Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH JERSEY INDUSTRIES INC | sji-20201104.htm |

Third Quarter 2020 Earnings Presentation November 5, 2020

Third Quarter 2020 Earnings Presentation Forward-Looking Statements & Non-GAAP Measures Forward-Looking Statements Non-GAAP Measures This presentation, including information incorporated by reference, contains forward-looking statements within the meaning of the U.S. Private Securities Management uses the non-GAAP financial measures of Economic Earnings and Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements regarding guidance, industry prospects or future Economic Earnings per share when evaluating its results of operations. These results of operations or financial position, expected sources of incremental margin, strategy, financing needs, future capital expenditures and the outcome or non-GAAP financial measures should not be considered as an alternative to effect of ongoing litigation, are forward-looking. This presentation uses words such as "anticipate," "believe," "expect," "estimate," "forecast," "goal," "intend," GAAP measures, such as net income, operating income, earnings per share "objective," "plan," "project," "seek," "strategy," "target," "will" and similar expressions to identify forward-looking statements. These forward-looking from continuing operations or any other GAAP measure of financial statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Forward- performance. We define Economic Earnings as: Income from continuing looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward- operations, (i) less the change in unrealized gains and plus the change in looking statements. These risks and uncertainties include, but are not limited to, general economic conditions on an international, national, state and local unrealized losses on non-utility derivative transactions; and (ii) less the impact level; weather conditions in SJI’s marketing areas; changes in commodity costs; changes in the availability of natural gas; “non-routine” or “extraordinary” of transactions, contractual arrangements or other events where management disruptions in SJI’s distribution system; regulatory, legislative and court decisions; competition; the availability and cost of capital; costs and effects of legal believes period to period comparisons of SJI's operations could be difficult or proceedings and environmental liabilities; the failure of customers, suppliers or business partners to fulfill their contractual obligations; changes in business potentially confusing. With respect to part (ii) of the definition of Economic strategies; and public health crises and epidemics or pandemics, such as a novel coronavirus (COVID-19). These risks and uncertainties, as well as other risks and Earnings, several items are excluded from Economic Earnings for the three and uncertainties that could cause our actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail nine months ended September 30, 2020 and 2019, consisting of the impact of under the heading “Item 1A. Risk Factors” in our Quarterly Reports, SJI’s and SJG's Annual Report on Form 10-K for the year ended December 31, 2019 and in pricing disputes with third parties, impairment charges recorded on solar any other SEC filings made by SJI or SJG during 2019 and 2020 and prior to the filing of this earnings release. Also refer to the additional risk factor described generating facilities, costs incurred and gains recognized related to the below: Our business could be materially and adversely affected by a public health crisis or the widespread outbreak of contagious disease, such as the recent acquisitions of EnerConnex and Annadale (fuel cell projects), costs to prepare outbreak of respiratory illness caused by a novel coronavirus (COVID-19), which has been declared a pandemic by the World Health Organization in March 2020. to exit the transaction service agreement (TSA), costs incurred and gains/losses The continued spread of COVID-19 across the world has led to disruption and volatility in the global capital markets, which increases the cost of capital and recognized on sales of solar, MTF/ACB, and ELK, costs incurred to cease adversely impacts access to capital. Additionally, our reliance on third-party suppliers, contractors, service providers, and commodity markets exposes us to operations at three landfill gas-to-energy-production facilities, severance and possibility of delay or interruption of our operations. For the duration of the outbreak of COVID-19, legislative and government action limits our ability to collect other employee separation costs, and a one-time tax adjustment resulting on overdue accounts, and prohibits us from shutting off services, which may cause a decrease in our cash flows or net income. These suspensions of shut downs from SJG's Stipulation of Settlement with the BPU. See (A)-(F) in the table of service for non-payment will go through at least March 15, 2021 based on an executive order issued by the Governor of New Jersey, in which water, gas and below. Economic Earnings is a significant financial measure used by our electricity providers are barred from cutting services to New Jersey residents. We have been executing our business continuity plans since the outbreak of management to indicate the amount and timing of income from continuing COVID-19 and are closely monitoring potential impacts due to COVID-19 pandemic responses at the state and federal level. As expected, we have incurred operations that we expect to earn after taking into account the impact of operating costs for emergency supplies, cleaning services, enabling technology and other specific needs during this crisis which have traditionally been derivative instruments on the related transactions, as well as the impact of recognized as prudent expenditures by our regulators. The effects of the pandemic also may have a material adverse impact on our ability to collect accounts contractual arrangements and other events that management believes make receivable as customers face higher liquidity and solvency risks, and also considering the inability to shut down services as noted above. Currently, the impact of period to period comparisons of SJI's operations difficult or potentially the pandemic to the collectability of our accounts receivable is an unknown and continues to be monitored, but such receivables have traditionally been confusing. Management uses Economic Earnings to manage its business and to included in rate recovery. Our infrastructure investment programs continue to move forward, and construction activity that was delayed in accordance with determine such items as incentive/compensation arrangements and allocation directives from the Governor of New Jersey have since continued; however, to the extent the pandemic worsens or a similar directive is put in place in the of resources. Specifically regarding derivatives, we believe that this financial future for a long period of time, our capital projects could be significantly impacted. It is impossible to predict the effect of the continued spread of the measure indicates to investors the profitability of the entire derivative-related coronavirus in the communities we service. Should the coronavirus continue to spread or not be contained, our business, financial condition and results of transaction and not just the portion that is subject to mark-to-market valuation operations could be materially impacted, including impairment of goodwill or access to capital markets, which in turn may have a negative effect on the market under GAAP. We believe that considering only the change in market value on price of our common stock. No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are the derivative side of the transaction can produce a false sense as to the cautioned not to place undue reliance on such statements, which speak only as of the date they are made. SJI and SJG undertake no obligation to revise or ultimate profitability of the total transaction as no change in value is reflected update any forward-looking statements, whether as result of new information, future events or otherwise, except as required by law. for the non-derivative portion of the transaction. 2

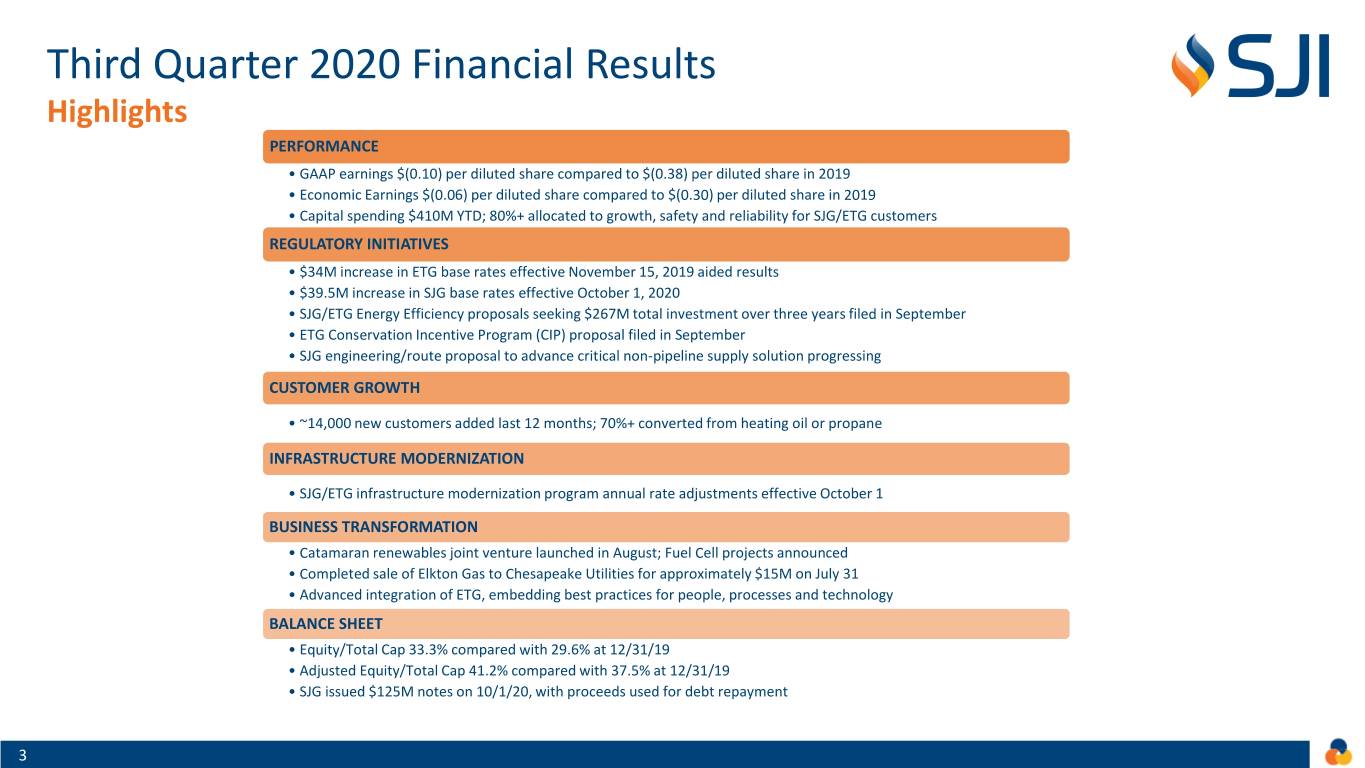

Third Quarter 2020 Financial Results Highlights PERFORMANCE • GAAP earnings $(0.10) per diluted share compared to $(0.38) per diluted share in 2019 • Economic Earnings $(0.06) per diluted share compared to $(0.30) per diluted share in 2019 • Capital spending $410M YTD; 80%+ allocated to growth, safety and reliability for SJG/ETG customers REGULATORY INITIATIVES • $34M increase in ETG base rates effective November 15, 2019 aided results • $39.5M increase in SJG base rates effective October 1, 2020 • SJG/ETG Energy Efficiency proposals seeking $267M total investment over three years filed in September • ETG Conservation Incentive Program (CIP) proposal filed in September • SJG engineering/route proposal to advance critical non-pipeline supply solution progressing CUSTOMER GROWTH • ~14,000 new customers added last 12 months; 70%+ converted from heating oil or propane INFRASTRUCTURE MODERNIZATION • SJG/ETG infrastructure modernization program annual rate adjustments effective October 1 BUSINESS TRANSFORMATION • Catamaran renewables joint venture launched in August; Fuel Cell projects announced • Completed sale of Elkton Gas to Chesapeake Utilities for approximately $15M on July 31 • Advanced integration of ETG, embedding best practices for people, processes and technology BALANCE SHEET • Equity/Total Cap 33.3% compared with 29.6% at 12/31/19 • Adjusted Equity/Total Cap 41.2% compared with 37.5% at 12/31/19 • SJG issued $125M notes on 10/1/20, with proceeds used for debt repayment 3

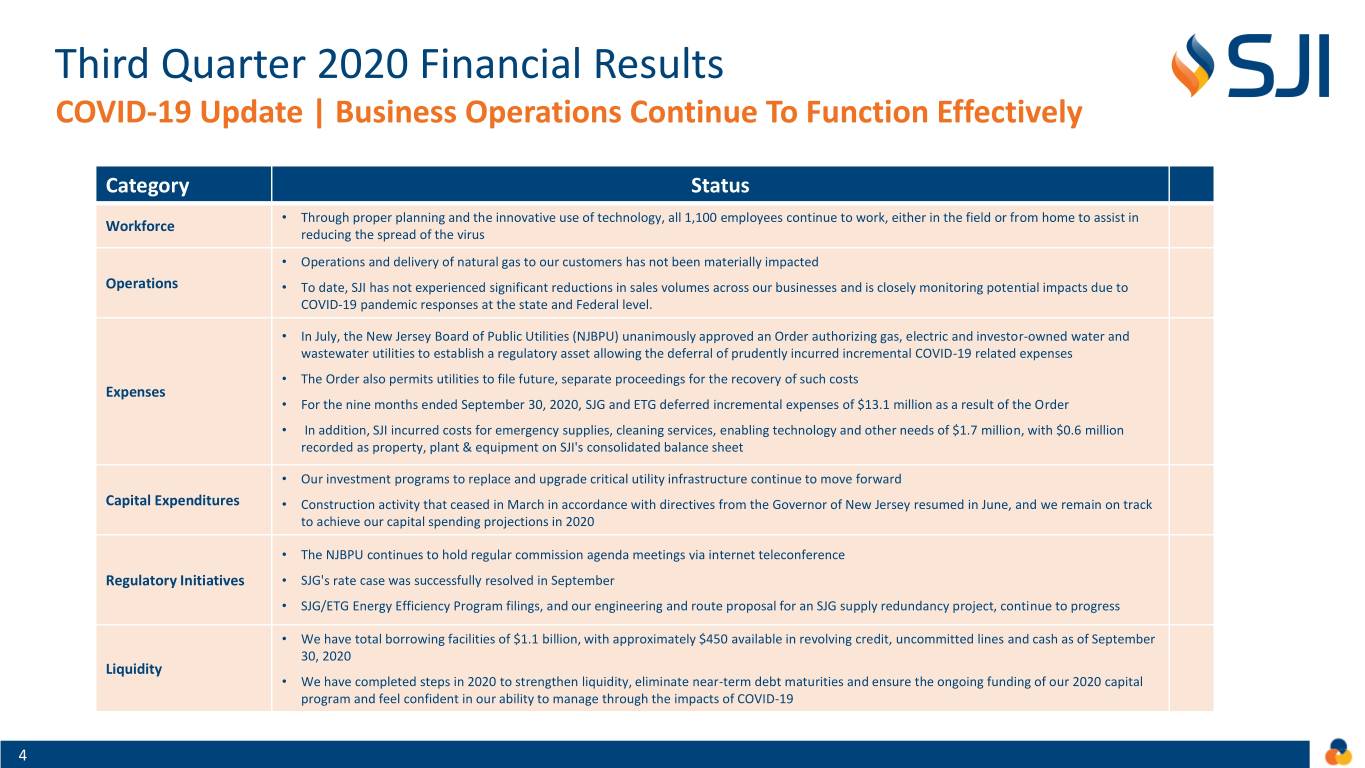

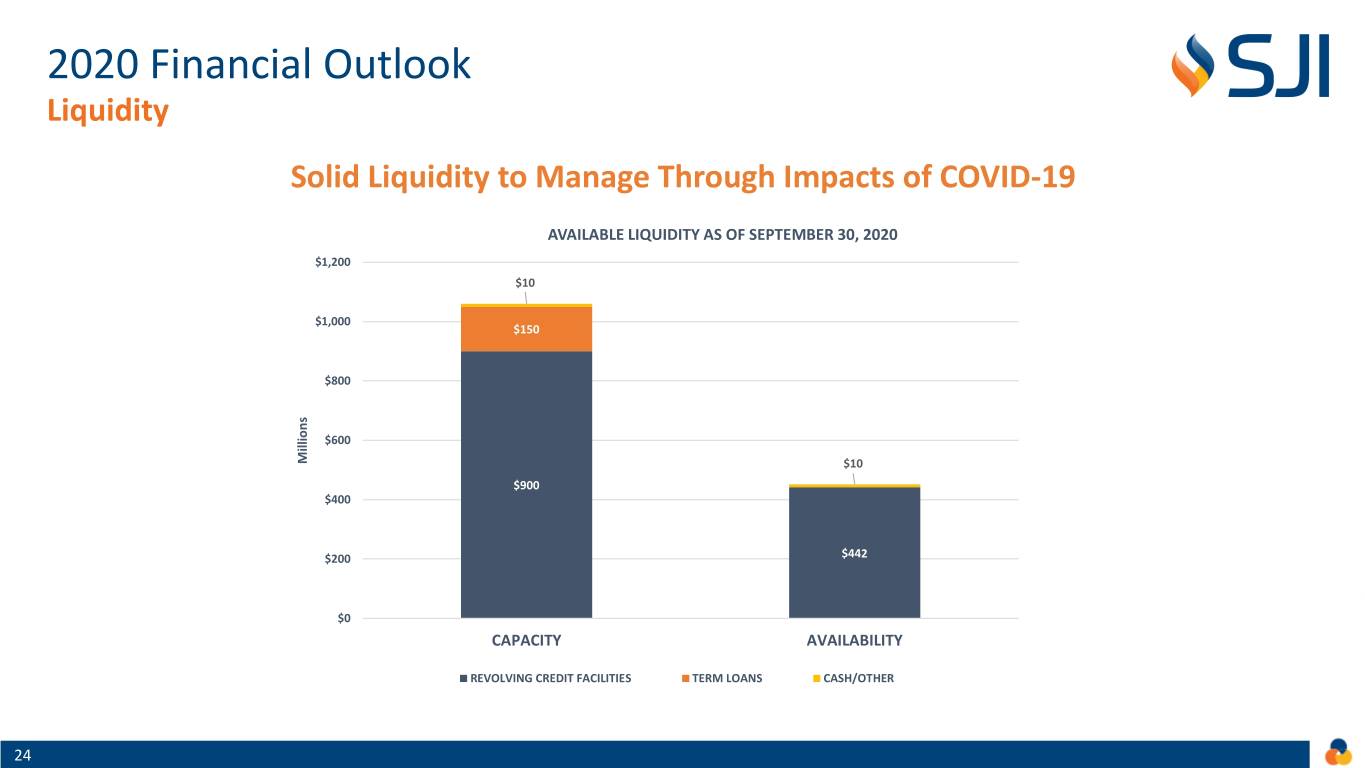

Third Quarter 2020 Financial Results COVID-19 Update | Business Operations Continue To Function Effectively Category Status • Through proper planning and the innovative use of technology, all 1,100 employees continue to work, either in the field or from home to assist in Workforce reducing the spread of the virus • Operations and delivery of natural gas to our customers has not been materially impacted Operations • To date, SJI has not experienced significant reductions in sales volumes across our businesses and is closely monitoring potential impacts due to COVID-19 pandemic responses at the state and Federal level. • In July, the New Jersey Board of Public Utilities (NJBPU) unanimously approved an Order authorizing gas, electric and investor-owned water and wastewater utilities to establish a regulatory asset allowing the deferral of prudently incurred incremental COVID-19 related expenses • The Order also permits utilities to file future, separate proceedings for the recovery of such costs Expenses • For the nine months ended September 30, 2020, SJG and ETG deferred incremental expenses of $13.1 million as a result of the Order • In addition, SJI incurred costs for emergency supplies, cleaning services, enabling technology and other needs of $1.7 million, with $0.6 million recorded as property, plant & equipment on SJI's consolidated balance sheet • Our investment programs to replace and upgrade critical utility infrastructure continue to move forward Capital Expenditures • Construction activity that ceased in March in accordance with directives from the Governor of New Jersey resumed in June, and we remain on track to achieve our capital spending projections in 2020 • The NJBPU continues to hold regular commission agenda meetings via internet teleconference Regulatory Initiatives • SJG's rate case was successfully resolved in September • SJG/ETG Energy Efficiency Program filings, and our engineering and route proposal for an SJG supply redundancy project, continue to progress • We have total borrowing facilities of $1.1 billion, with approximately $450 available in revolving credit, uncommitted lines and cash as of September 30, 2020 Liquidity • We have completed steps in 2020 to strengthen liquidity, eliminate near-term debt maturities and ensure the ongoing funding of our 2020 capital program and feel confident in our ability to manage through the impacts of COVID-19 4

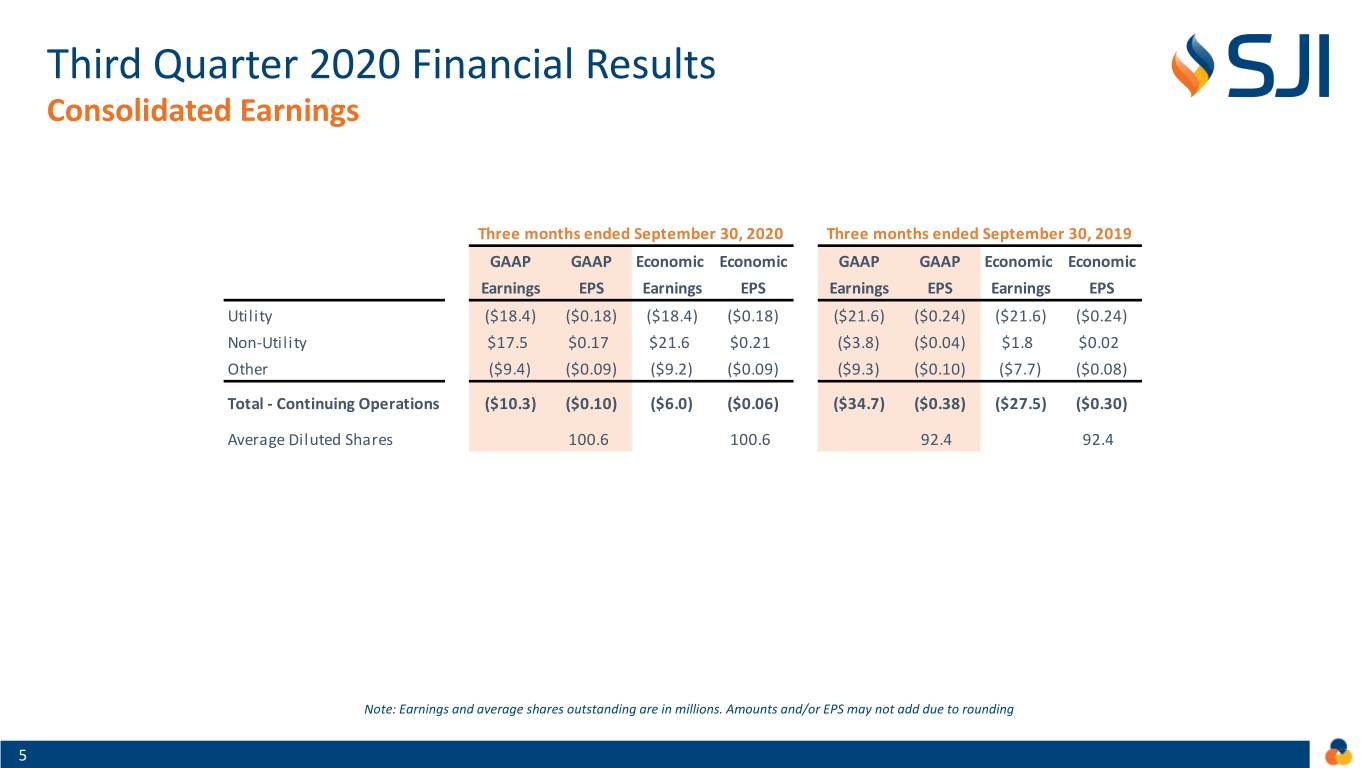

Third Quarter 2020 Financial Results Consolidated Earnings Three months ended September 30, 2020 Three months ended September 30, 2019 GAAP GAAP Economic Economic GAAP GAAP Economic Economic Earnings EPS Earnings EPS Earnings EPS Earnings EPS Utility ($18.4) ($0.18) ($18.4) ($0.18) ($21.6) ($0.24) ($21.6) ($0.24) Non-Utility $17.5 $0.17 $21.6 $0.21 ($3.8) ($0.04) $1.8 $0.02 Other ($9.4) ($0.09) ($9.2) ($0.09) ($9.3) ($0.10) ($7.7) ($0.08) Total - Continuing Operations ($10.3) ($0.10) ($6.0) ($0.06) ($34.7) ($0.38) ($27.5) ($0.30) Average Diluted Shares 100.6 100.6 92.4 92.4 Note: Earnings and average shares outstanding are in millions. Amounts and/or EPS may not add due to rounding 5

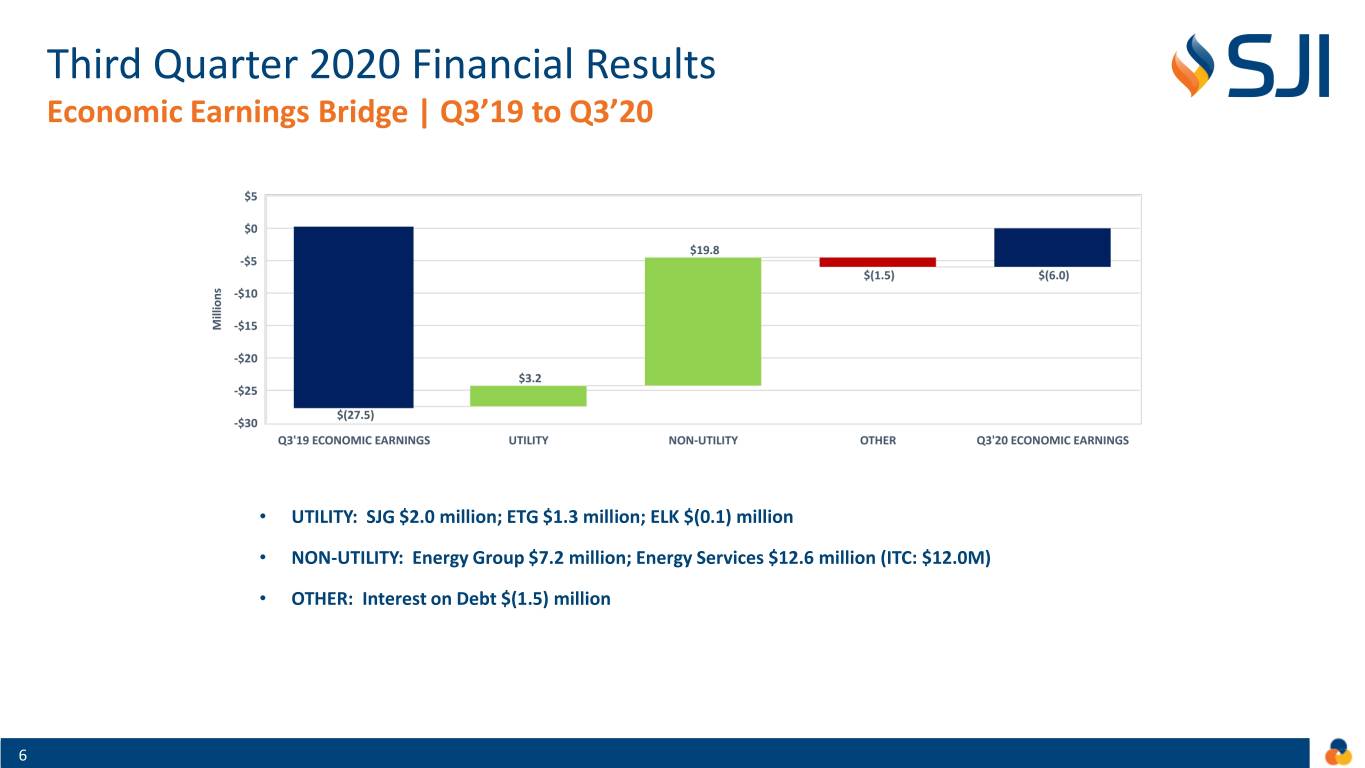

Third Quarter 2020 Financial Results Economic Earnings Bridge | Q3’19 to Q3’20 • UTILITY: SJG $2.0 million; ETG $1.3 million; ELK $(0.1) million • NON-UTILITY: Energy Group $7.2 million; Energy Services $12.6 million (ITC: $12.0M) • OTHER: Interest on Debt $(1.5) million 6

Nine Months 2020 Financial Results 7

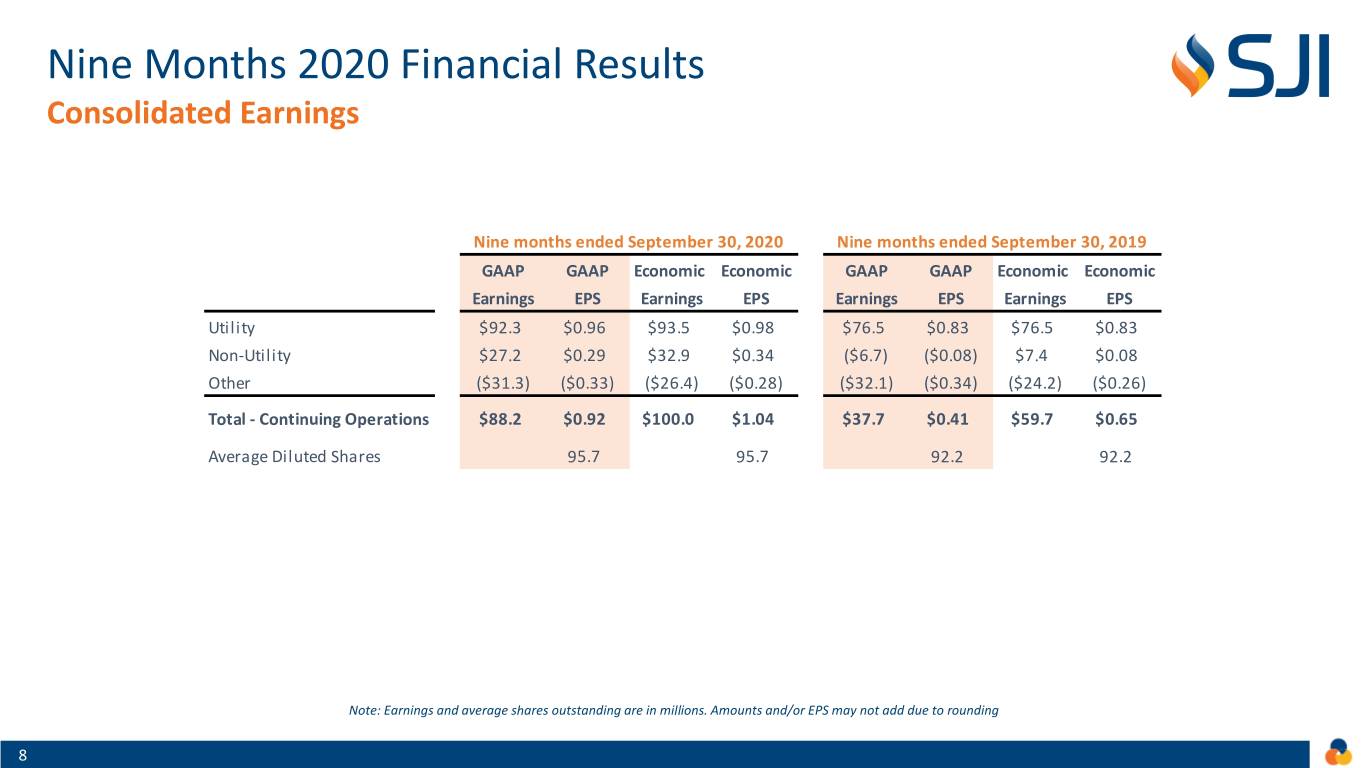

Nine Months 2020 Financial Results Consolidated Earnings Nine months ended September 30, 2020 Nine months ended September 30, 2019 GAAP GAAP Economic Economic GAAP GAAP Economic Economic Earnings EPS Earnings EPS Earnings EPS Earnings EPS Utility $92.3 $0.96 $93.5 $0.98 $76.5 $0.83 $76.5 $0.83 Non-Utility $27.2 $0.29 $32.9 $0.34 ($6.7) ($0.08) $7.4 $0.08 Other ($31.3) ($0.33) ($26.4) ($0.28) ($32.1) ($0.34) ($24.2) ($0.26) Total - Continuing Operations $88.2 $0.92 $100.0 $1.04 $37.7 $0.41 $59.7 $0.65 Average Diluted Shares 95.7 95.7 92.2 92.2 Note: Earnings and average shares outstanding are in millions. Amounts and/or EPS may not add due to rounding 8

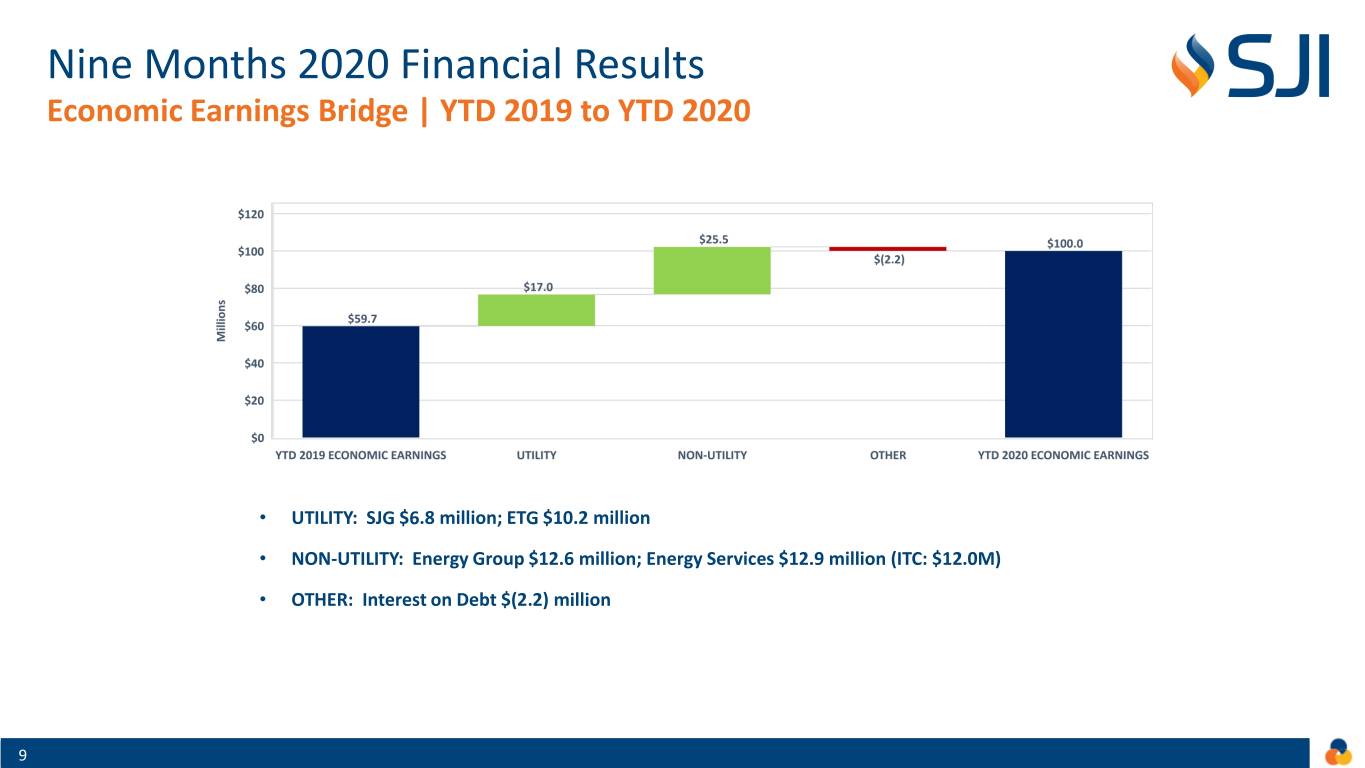

Nine Months 2020 Financial Results Economic Earnings Bridge | YTD 2019 to YTD 2020 • UTILITY: SJG $6.8 million; ETG $10.2 million • NON-UTILITY: Energy Group $12.6 million; Energy Services $12.9 million (ITC: $12.0M) • OTHER: Interest on Debt $(2.2) million 9

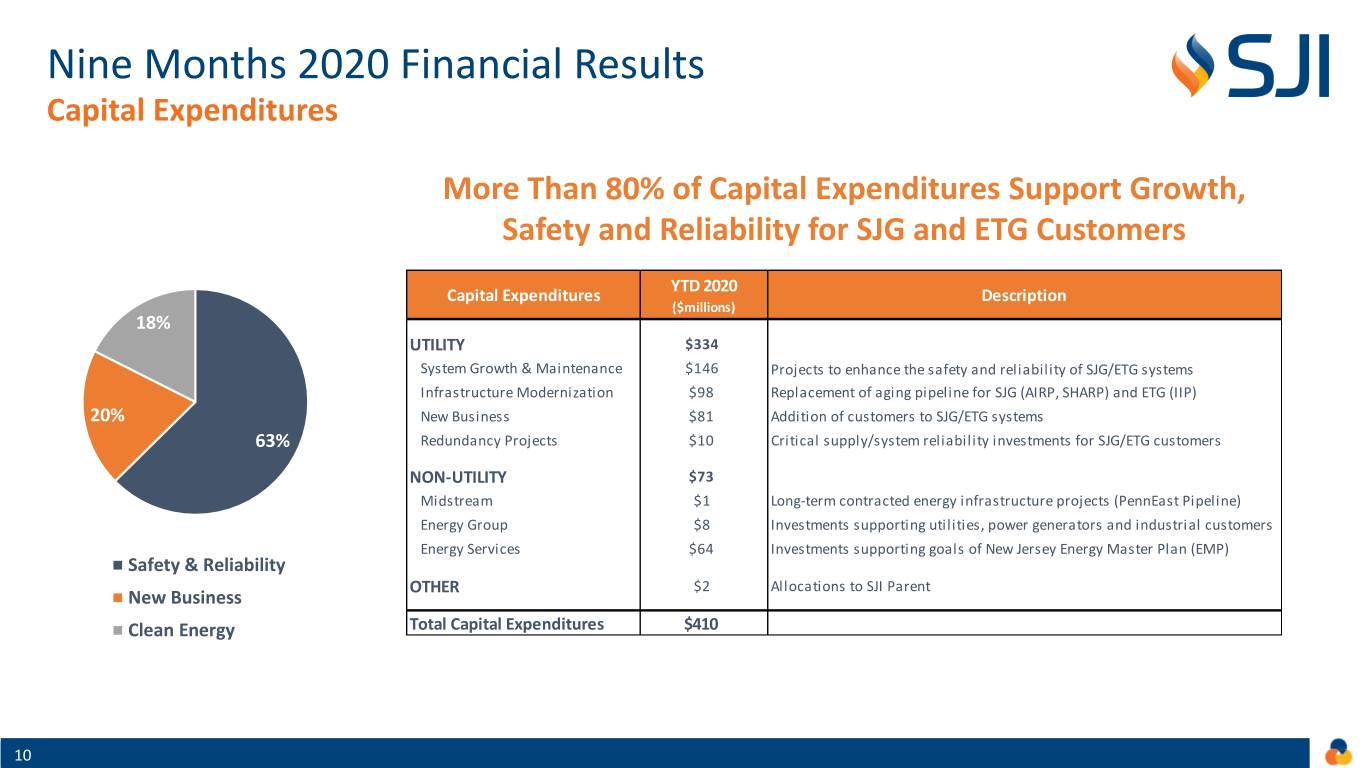

Nine Months 2020 Financial Results Capital Expenditures More Than 80% of Capital Expenditures Support Growth, Safety and Reliability for SJG and ETG Customers YTD 2020 Capital Expenditures Description ($millions) 18% UTILITY $334 System Growth & Maintenance $146 Projects to enhance the safety and reliability of SJG/ETG systems Infrastructure Modernization $98 Replacement of aging pipeline for SJG (AIRP, SHARP) and ETG (IIP) 20% New Business $81 Addition of customers to SJG/ETG systems 63% Redundancy Projects $10 Critical supply/system reliability investments for SJG/ETG customers NON-UTILITY $73 Midstream $1 Long-term contracted energy infrastructure projects (PennEast Pipeline) Energy Group $8 Investments supporting utilities, power generators and industrial customers Energy Services $64 Investments supporting goals of New Jersey Energy Master Plan (EMP) Safety & Reliability OTHER $2 Allocations to SJI Parent New Business Clean Energy Total Capital Expenditures $410 10

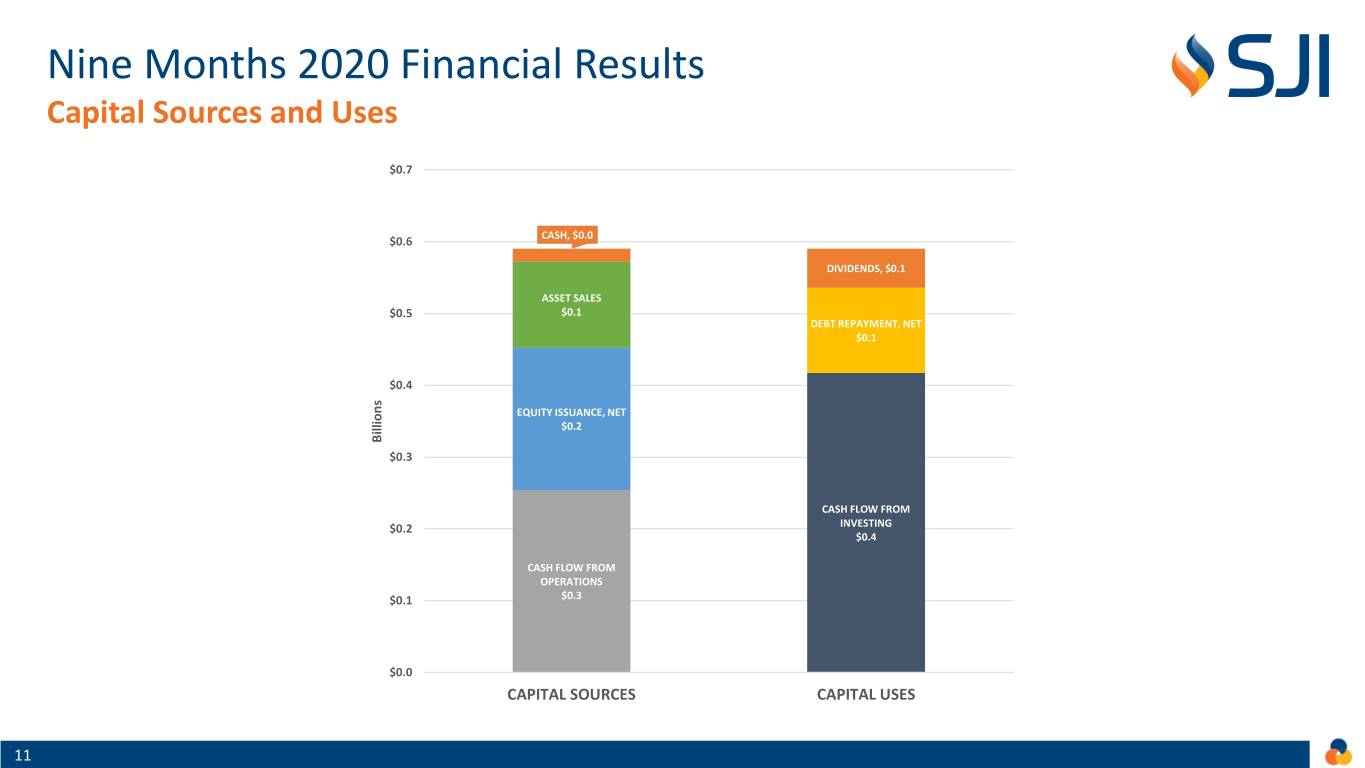

Nine Months 2020 Financial Results Capital Sources and Uses $0.7 $0.6 CASH, $0.0 DIVIDENDS, $0.1 ASSET SALES $0.5 $0.1 DEBT REPAYMENT, NET $0.1 $0.4 EQUITY ISSUANCE, NET $0.2 Billions $0.3 CASH FLOW FROM $0.2 INVESTING $0.4 CASH FLOW FROM OPERATIONS $0.1 $0.3 $0.0 CAPITAL SOURCES CAPITAL USES 11

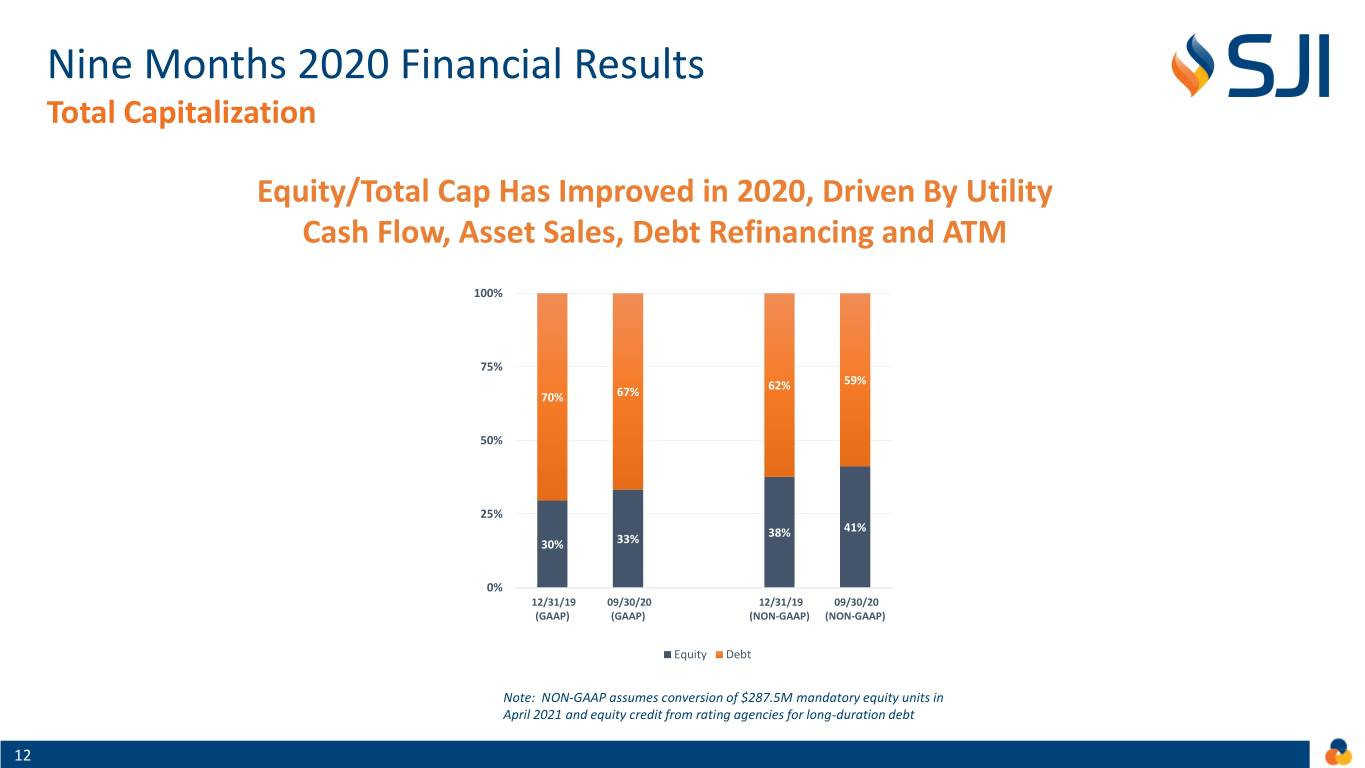

Nine Months 2020 Financial Results Total Capitalization Equity/Total Cap Has Improved in 2020, Driven By Utility Cash Flow, Asset Sales, Debt Refinancing and ATM 100% 75% 62% 59% 70% 67% 50% 25% 38% 41% 30% 33% 0% 12/31/19 09/30/20 12/31/19 09/30/20 (GAAP) (GAAP) (NON-GAAP) (NON-GAAP) Equity Debt Note: NON-GAAP assumes conversion of $287.5M mandatory equity units in April 2021 and equity credit from rating agencies for long-duration debt 12

Clean Energy and Utility Decarbonization 13

Clean Energy and Utility Decarbonization New Jersey Energy Master Plan ▪ The New Jersey Energy Master Plan (EMP) is intended to set forth a strategic vision for the production, distribution, consumption, and conservation of energy in the State of New Jersey ▪ The EMP is updated and revised periodically -- allows for improvements to reflect changes with technology, energy, and environmental developments and demands ▪ The updated EMP outlines Murphy administration’s goal of 100% clean energy by 2050 ▪ The updated EMP varies dramatically from the prior EMP in 2015 which was heavily supportive of natural gas as an abundant, clean and affordable commodity meriting aggressive expansion to homes and businesses in the state 14

Clean Energy and Utility Decarbonization Historic Track Record of Support ▪ REDUCING ENERGY CONSUMPTION/EMISSIONS ✓ Replacement of aging infrastructure, improving safety and reliability for customers and reducing greenhouse gas emissions (GHG); On track for expected reduction of 500 tons of carbon emissions at current replacement rate ✓ SJG Conservation Incentive Program (CIP) severed the tie between volumes and margins, encouraging reductions in consumption ▪ DEPLOYMENT OF RENEWABLE ENERGY ✓ Sizable investments in solar, combined heat-and-power (CHP), and landfill-to- electric generation ▪ MAXIMIZING ENERGY EFFICIENCY ✓ Energy Efficiency program (EE) designed to reduce consumption ▪ MODERNIZING VIA TECHNOLOGY ✓ Developed enterprise level environmental policy and management system 15

Clean Energy and Utility Decarbonization Future Investment Opportunities ▪ REDUCING ENERGY CONSUMPTION/EMISSIONS ✓ Extension and/or acceleration of replacement of aging infrastructure, improving safety and reliability for customers and reducing greenhouse gas emissions (GHG) • ETG: 5-10 years of bare-steel and cast-iron pipe remaining • SJG: sizable inventory of vintage plastic and coated-steel • Significant replacement need of vintage transmission infrastructure ✓ ETG Conservation Incentive Program (CIP) to encourage reduction in consumption ▪ DEPLOYMENT OF RENEWABLE ENERGY ✓ Executing plan to invest in clean energy infrastructure; targeting solar at SJI corporate facilities, landfills, fuel cells and other clean energy generation projects ✓ Evaluating Renewable Natural Gas (RNG) opportunities ▪ MAXIMIZING ENERGY EFFICIENCY ✓ Energy Efficiency proposals for SJG/ETG pending before NJBPU for increased investments and contemporaneous rate recovery at authorized ROE ▪ MODERNIZING VIA TECHNOLOGY ✓ Evaluating Smart Meters and other new technologies (Power to Gas; Hydrogen) 16

Clean Energy and Utility Decarbonization Renewables Joint Venture SJI remains committed to investments that lower consumption and the carbon content of natural gas in support of regional clean energy goals Overview ▪ In August, SJI formed Catamaran Renewables (Catamaran), a 50/50 joint venture between SJI subsidiary Marina Energy and renewable industry-leader Captona, to develop, own and operate renewable energy projects ▪ Collectively, Catamaran brings more than 1.3 GW of operational experience across all types of renewable energy and has financed more than $1 billion in renewable energy transactions Fuel Cell Project ▪ In August, announced the acquisition of two fuel cell projects in Staten Island, New York totaling 7.5 MW from NineDot Energy ▪ Projects have secured permits/interconnection rights; supported by long-term agreements with two creditworthy customers ▪ Marina owns 93% of projects and receives 93% of the ITC, cash flows and net income ▪ Projects qualify under New York’s Value of Distributed Energy Resources (VDER) program; 75% of project revenues are fixed ▪ Anticipated total return in excess of authorized utility return 2020 Goals ▪ Fuel Cell projects, combined with Solar investments earlier this year, satisfies SJI clean energy goals for 2020 17

2020 Financial Outlook 18

2020 Financial Outlook Remaining Priorities FINANCIAL PERFORMANCE • Ongoing Economic Earnings at upper end of $1.50 to $1.60 per diluted share; ~75% from utility operations, excluding interest costs • Capital spending ~$600M, with ~$500M for growth, safety and reliability for SJG/ETG customers REGULATORY INITIATIVES • Advance energy efficiency programs for SJG/ETG • Advance proposal for Conservation Incentive Program (CIP) for ETG • Advance proposal to extend SJG accelerated infrastructure replacement program (AIRP) CUSTOMER GROWTH • 10,000+ new customers, reflecting 1.5% annualized growth rate; 70%+ conversions from oil and propane INFRASTRUCTURE MODERNIZATION • Execute infrastructure modernization programs for SJG/ETG SUPPLY/SYSTEM REDUNDANCY • Advance critical non-pipeline supply solution for SJG CLEAN ENERGY INVESTMENTS • Execute clean energy investments that align with EMP and regional goals • Evaluate additional opportunities in support of NJ economic recovery and regional clean energy goals 19

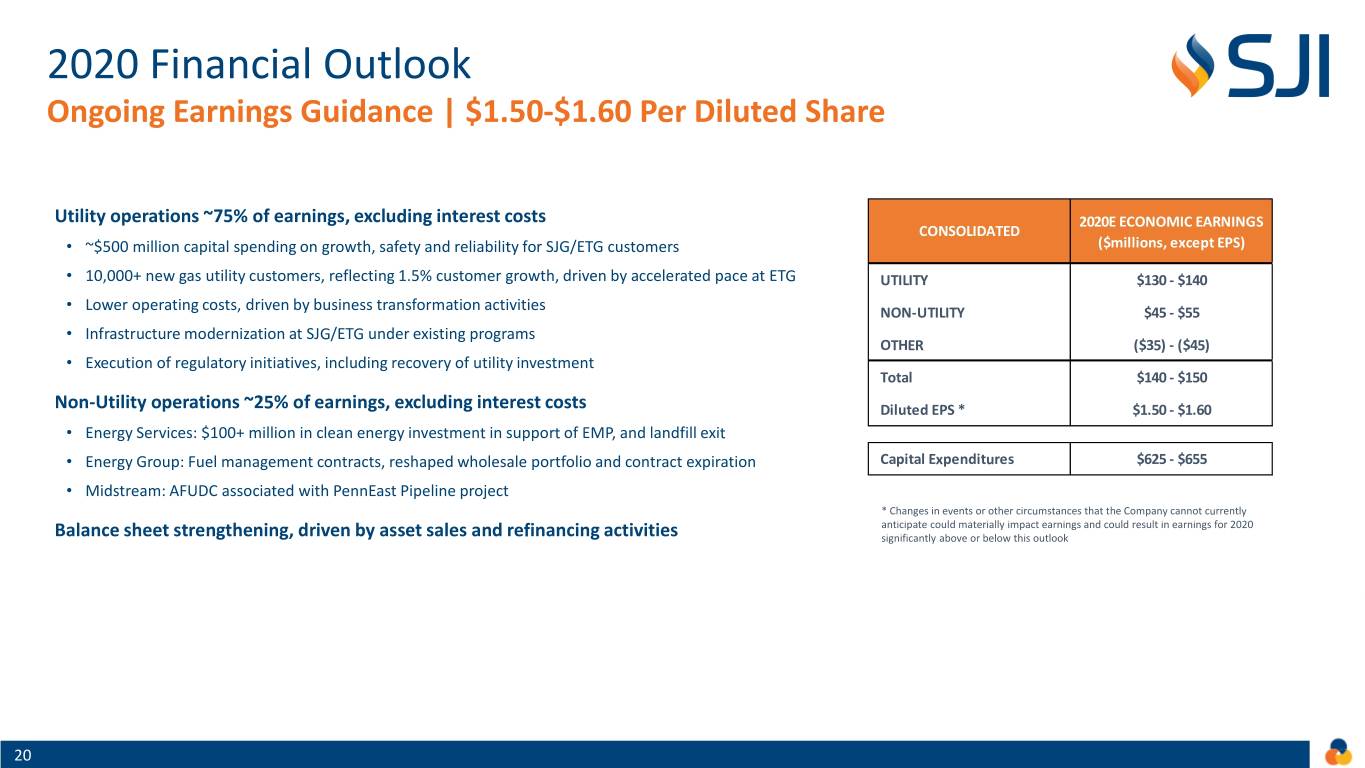

2020 Financial Outlook Ongoing Earnings Guidance | $1.50-$1.60 Per Diluted Share Utility operations ~75% of earnings, excluding interest costs 2020E ECONOMIC EARNINGS CONSOLIDATED • ~$500 million capital spending on growth, safety and reliability for SJG/ETG customers ($millions, except EPS) • 10,000+ new gas utility customers, reflecting 1.5% customer growth, driven by accelerated pace at ETG UTILITY $130 - $140 • Lower operating costs, driven by business transformation activities NON-UTILITY $45 - $55 • Infrastructure modernization at SJG/ETG under existing programs OTHER ($35) - ($45) • Execution of regulatory initiatives, including recovery of utility investment Total $140 - $150 Non-Utility operations ~25% of earnings, excluding interest costs Diluted EPS * $1.50 - $1.60 • Energy Services: $100+ million in clean energy investment in support of EMP, and landfill exit • Energy Group: Fuel management contracts, reshaped wholesale portfolio and contract expiration Capital Expenditures $625 - $655 • Midstream: AFUDC associated with PennEast Pipeline project * Changes in events or other circumstances that the Company cannot currently anticipate could materially impact earnings and could result in earnings for 2020 Balance sheet strengthening, driven by asset sales and refinancing activities significantly above or below this outlook 20

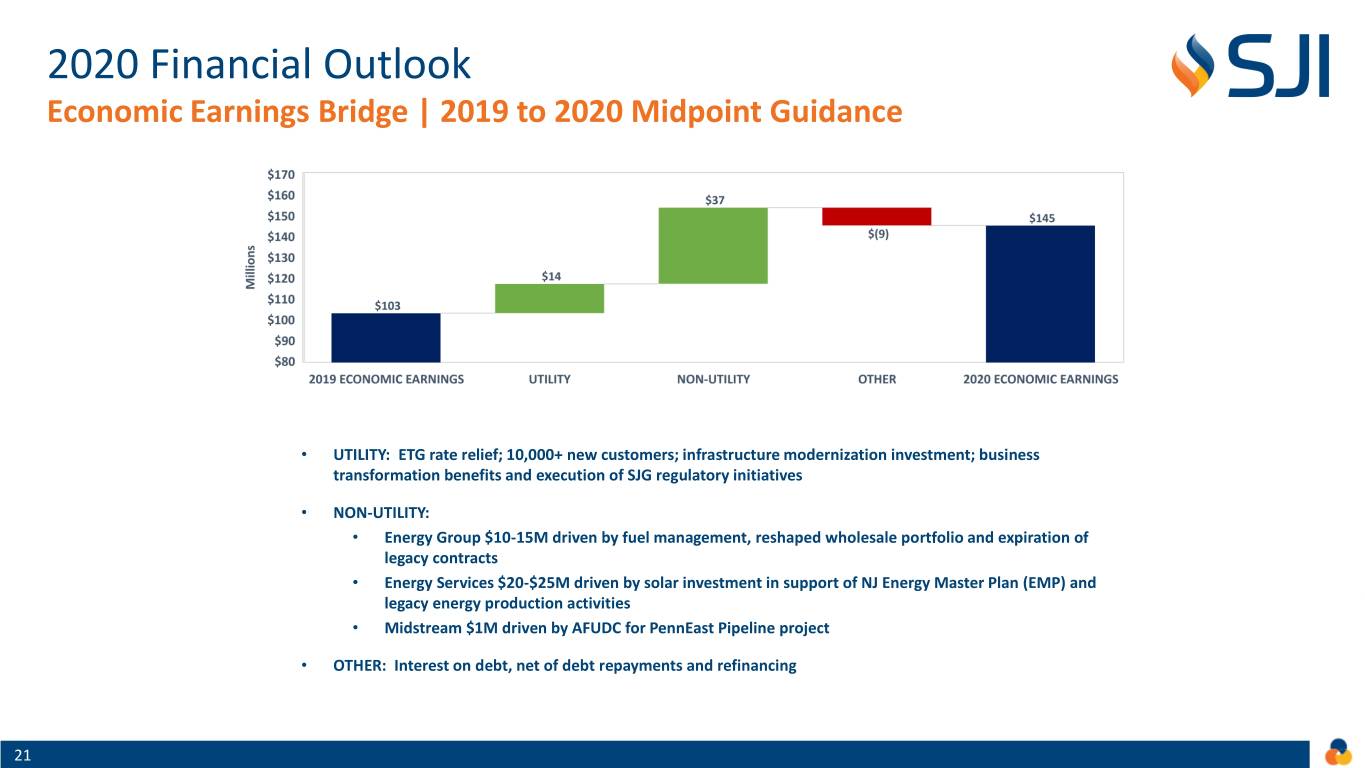

2020 Financial Outlook Economic Earnings Bridge | 2019 to 2020 Midpoint Guidance • UTILITY: ETG rate relief; 10,000+ new customers; infrastructure modernization investment; business transformation benefits and execution of SJG regulatory initiatives • NON-UTILITY: • Energy Group $10-15M driven by fuel management, reshaped wholesale portfolio and expiration of legacy contracts • Energy Services $20-$25M driven by solar investment in support of NJ Energy Master Plan (EMP) and legacy energy production activities • Midstream $1M driven by AFUDC for PennEast Pipeline project • OTHER: Interest on debt, net of debt repayments and refinancing 21

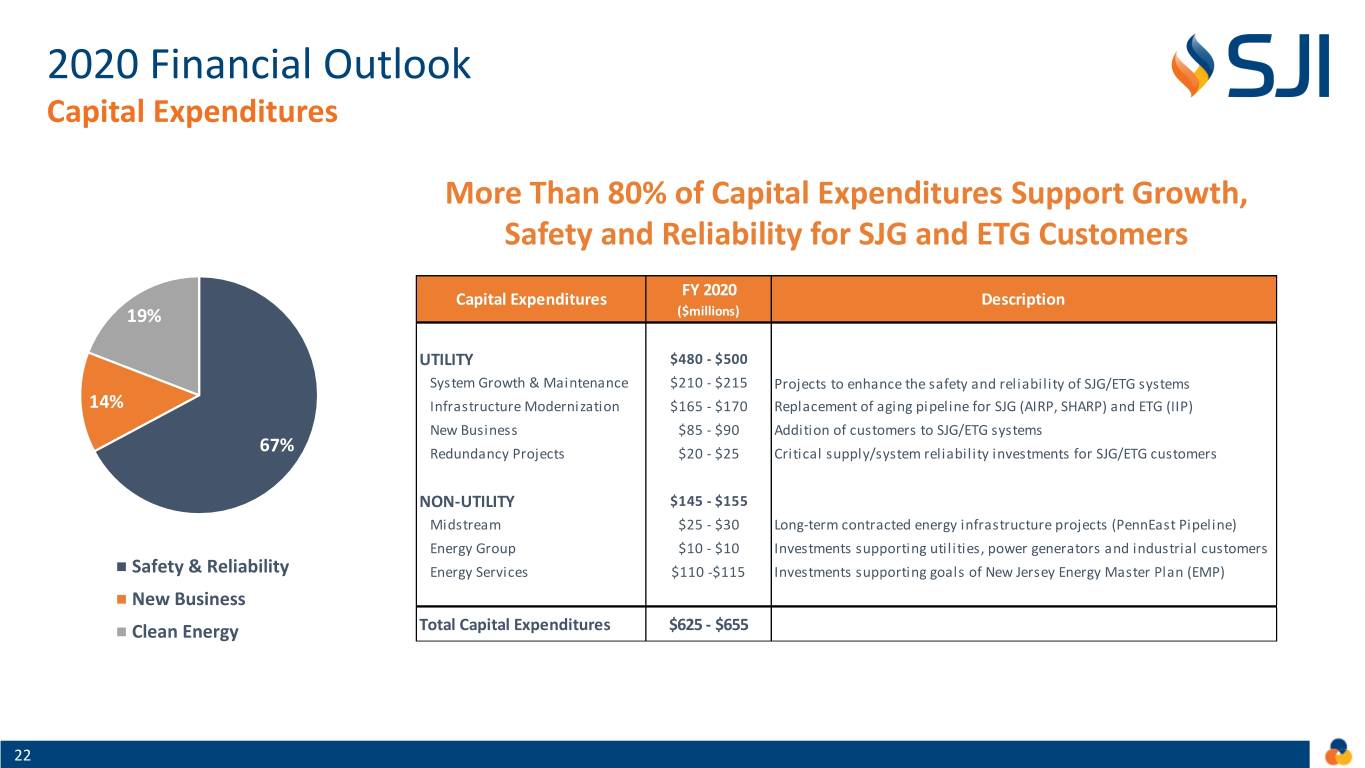

2020 Financial Outlook Capital Expenditures More Than 80% of Capital Expenditures Support Growth, Safety and Reliability for SJG and ETG Customers FY 2020 Capital Expenditures Description 19% ($millions) UTILITY $480 - $500 System Growth & Maintenance $210 - $215 Projects to enhance the safety and reliability of SJG/ETG systems 14% Infrastructure Modernization $165 - $170 Replacement of aging pipeline for SJG (AIRP, SHARP) and ETG (IIP) New Business $85 - $90 Addition of customers to SJG/ETG systems 67% Redundancy Projects $20 - $25 Critical supply/system reliability investments for SJG/ETG customers NON-UTILITY $145 - $155 Midstream $25 - $30 Long-term contracted energy infrastructure projects (PennEast Pipeline) Energy Group $10 - $10 Investments supporting utilities, power generators and industrial customers Safety & Reliability Energy Services $110 -$115 Investments supporting goals of New Jersey Energy Master Plan (EMP) New Business Clean Energy Total Capital Expenditures $625 - $655 22

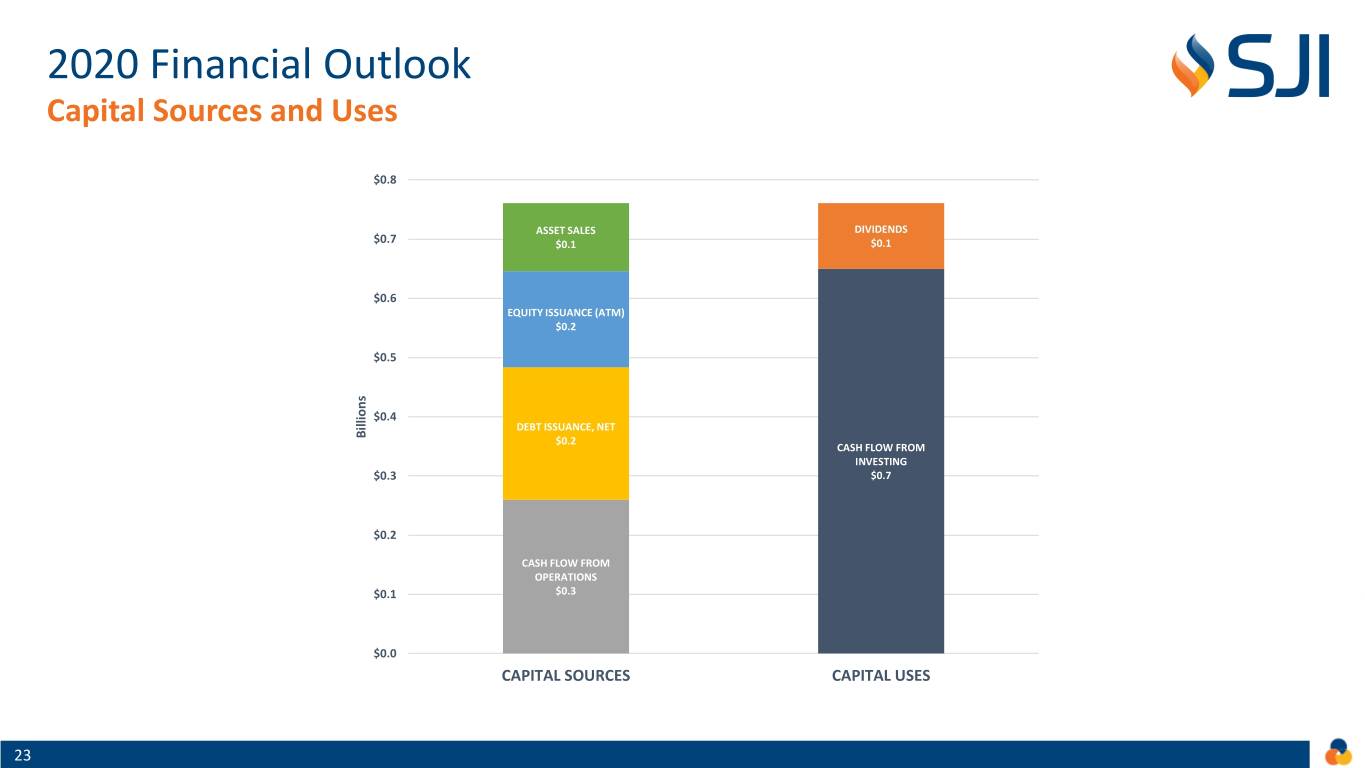

2020 Financial Outlook Capital Sources and Uses $0.8 ASSET SALES DIVIDENDS $0.7 $0.1 $0.1 $0.6 EQUITY ISSUANCE (ATM) $0.2 $0.5 $0.4 DEBT ISSUANCE, NET Billions $0.2 CASH FLOW FROM INVESTING $0.3 $0.7 $0.2 CASH FLOW FROM OPERATIONS $0.1 $0.3 $0.0 CAPITAL SOURCES CAPITAL USES 23

2020 Financial Outlook Liquidity Solid Liquidity to Manage Through Impacts of COVID-19 AVAILABLE LIQUIDITY AS OF SEPTEMBER 30, 2020 $1,200 $10 $1,000 $150 $800 $600 Millions $10 $900 $400 $200 $442 $0 CAPACITY AVAILABILITY REVOLVING CREDIT FACILITIES TERM LOANS CASH/OTHER 24

Appendix 25

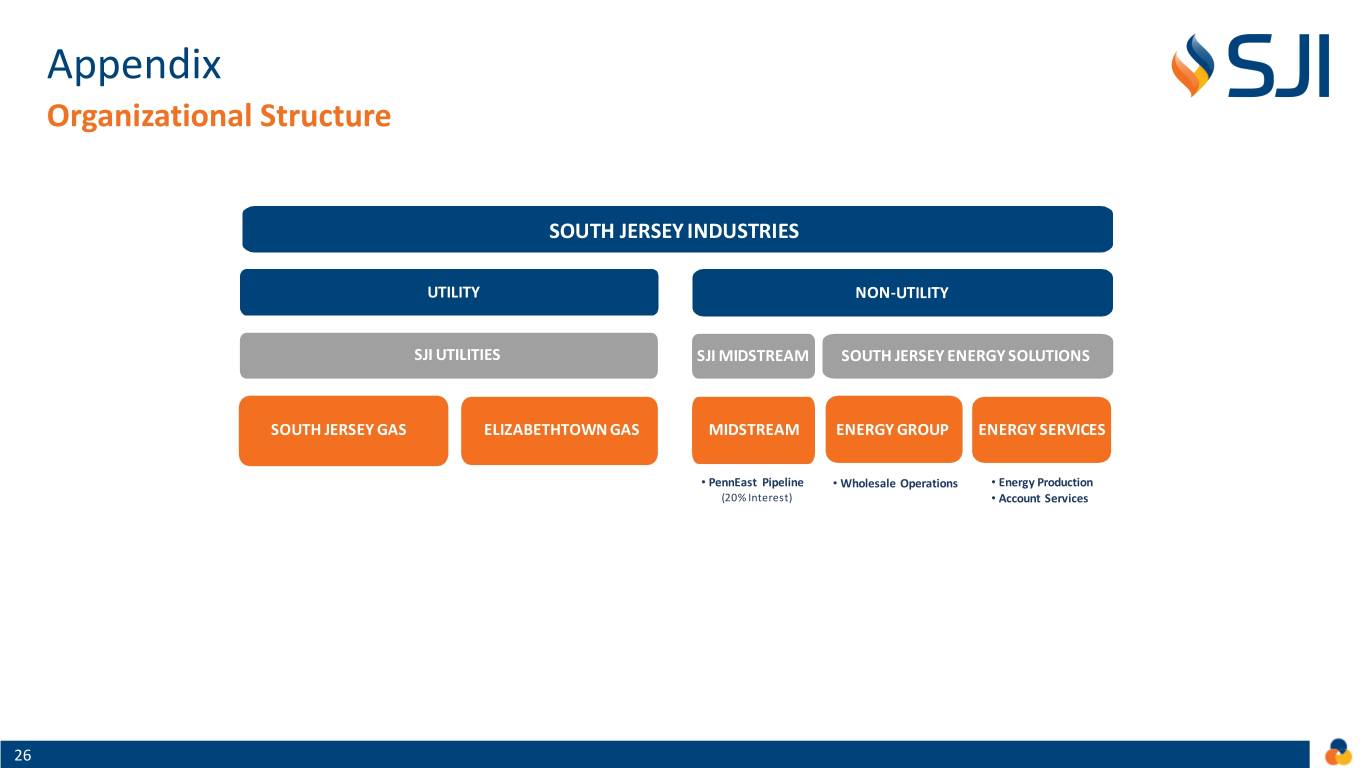

Appendix Organizational Structure SOUTH JERSEY INDUSTRIES UTILITY NON-UTILITY SJI UTILITIES SJI MIDSTREAM SOUTH JERSEY ENERGY SOLUTIONS SOUTH JERSEY GAS ELIZABETHTOWN GAS MIDSTREAM ENERGY GROUP ENERGY SERVICES • PennEast Pipeline • Wholesale Operations • Energy Production (20% Interest) • Account Services 26

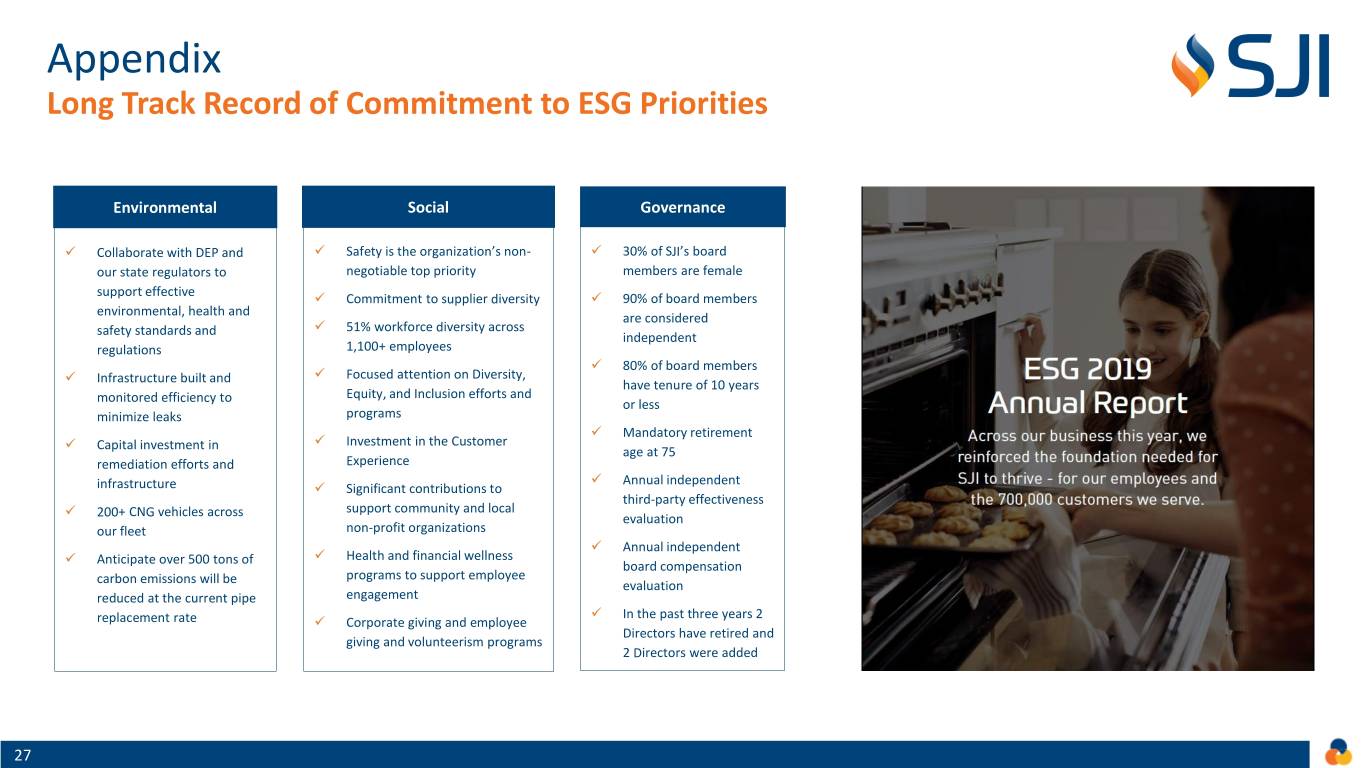

Appendix Long Track Record of Commitment to ESG Priorities Environmental Social Governance ✓ Collaborate with DEP and ✓ Safety is the organization’s non- ✓ 30% of SJI’s board our state regulators to negotiable top priority members are female support effective ✓ Commitment to supplier diversity ✓ 90% of board members environmental, health and are considered safety standards and ✓ 51% workforce diversity across independent regulations 1,100+ employees ✓ 80% of board members ✓ Infrastructure built and ✓ Focused attention on Diversity, have tenure of 10 years monitored efficiency to Equity, and Inclusion efforts and or less minimize leaks programs ✓ Mandatory retirement ✓ Capital investment in ✓ Investment in the Customer age at 75 remediation efforts and Experience ✓ Annual independent infrastructure ✓ Significant contributions to third-party effectiveness ✓ 200+ CNG vehicles across support community and local evaluation our fleet non-profit organizations ✓ Annual independent ✓ Anticipate over 500 tons of ✓ Health and financial wellness board compensation carbon emissions will be programs to support employee evaluation reduced at the current pipe engagement ✓ In the past three years 2 replacement rate ✓ Corporate giving and employee Directors have retired and giving and volunteerism programs 2 Directors were added 27

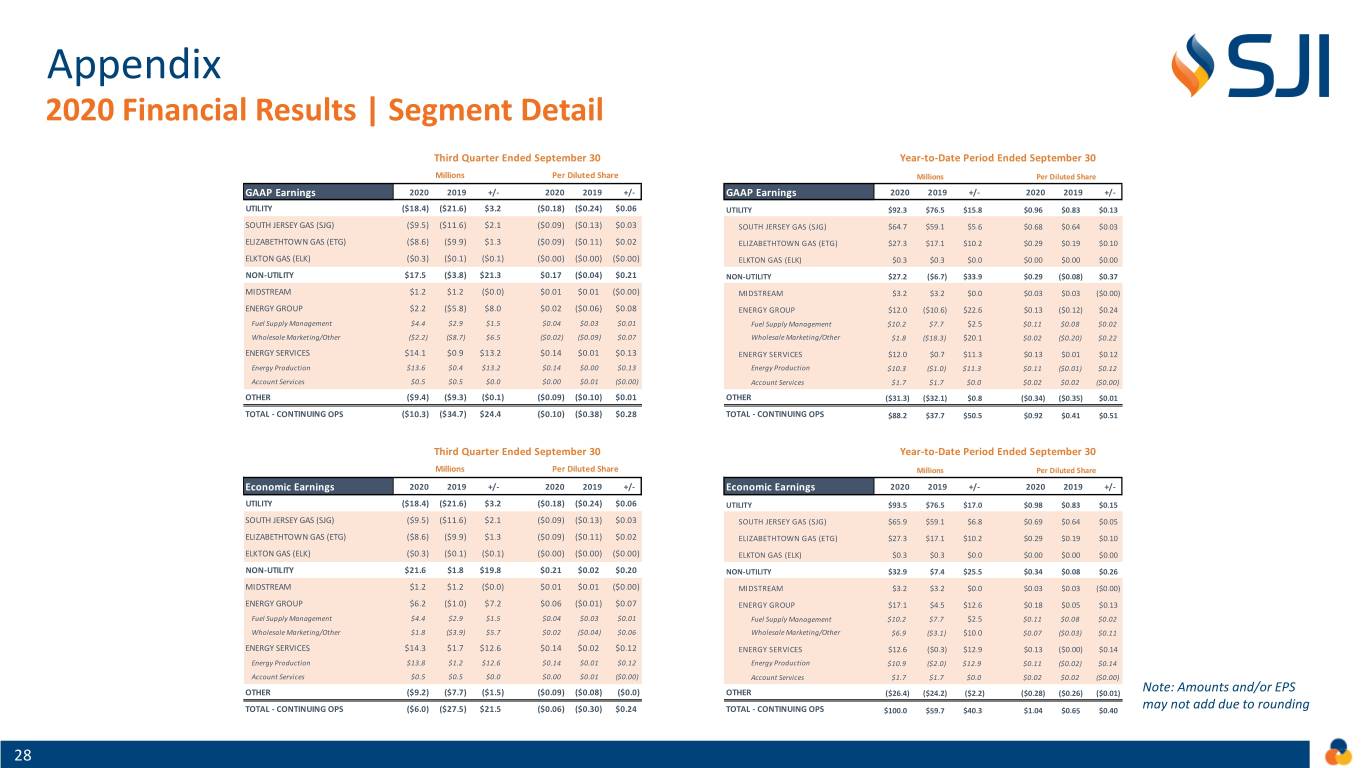

Appendix 2020 Financial Results | Segment Detail Third Quarter Ended September 30 Year-to-Date Period Ended September 30 Millions Per Diluted Share Millions Per Diluted Share GAAP Earnings 2020 2019 +/- 2020 2019 +/- GAAP Earnings 2020 2019 +/- 2020 2019 +/- UTILITY ($18.4) ($21.6) $3.2 ($0.18) ($0.24) $0.06 UTILITY $92.3 $76.5 $15.8 $0.96 $0.83 $0.13 SOUTH JERSEY GAS (SJG) ($9.5) ($11.6) $2.1 ($0.09) ($0.13) $0.03 SOUTH JERSEY GAS (SJG) $64.7 $59.1 $5.6 $0.68 $0.64 $0.03 ELIZABETHTOWN GAS (ETG) ($8.6) ($9.9) $1.3 ($0.09) ($0.11) $0.02 ELIZABETHTOWN GAS (ETG) $27.3 $17.1 $10.2 $0.29 $0.19 $0.10 ELKTON GAS (ELK) ($0.3) ($0.1) ($0.1) ($0.00) ($0.00) ($0.00) ELKTON GAS (ELK) $0.3 $0.3 $0.0 $0.00 $0.00 $0.00 NON-UTILITY $17.5 ($3.8) $21.3 $0.17 ($0.04) $0.21 NON-UTILITY $27.2 ($6.7) $33.9 $0.29 ($0.08) $0.37 MIDSTREAM $1.2 $1.2 ($0.0) $0.01 $0.01 ($0.00) MIDSTREAM $3.2 $3.2 $0.0 $0.03 $0.03 ($0.00) ENERGY GROUP $2.2 ($5.8) $8.0 $0.02 ($0.06) $0.08 ENERGY GROUP $12.0 ($10.6) $22.6 $0.13 ($0.12) $0.24 Fuel Supply Management $4.4 $2.9 $1.5 $0.04 $0.03 $0.01 Fuel Supply Management $10.2 $7.7 $2.5 $0.11 $0.08 $0.02 Wholesale Marketing/Other ($2.2) ($8.7) $6.5 ($0.02) ($0.09) $0.07 Wholesale Marketing/Other $1.8 ($18.3) $20.1 $0.02 ($0.20) $0.22 ENERGY SERVICES $14.1 $0.9 $13.2 $0.14 $0.01 $0.13 ENERGY SERVICES $12.0 $0.7 $11.3 $0.13 $0.01 $0.12 Energy Production $13.6 $0.4 $13.2 $0.14 $0.00 $0.13 Energy Production $10.3 ($1.0) $11.3 $0.11 ($0.01) $0.12 Account Services $0.5 $0.5 $0.0 $0.00 $0.01 ($0.00) Account Services $1.7 $1.7 $0.0 $0.02 $0.02 ($0.00) OTHER ($9.4) ($9.3) ($0.1) ($0.09) ($0.10) $0.01 OTHER ($31.3) ($32.1) $0.8 ($0.34) ($0.35) $0.01 TOTAL - CONTINUING OPS ($10.3) ($34.7) $24.4 ($0.10) ($0.38) $0.28 TOTAL - CONTINUING OPS $88.2 $37.7 $50.5 $0.92 $0.41 $0.51 Third Quarter Ended September 30 Year-to-Date Period Ended September 30 Millions Per Diluted Share Millions Per Diluted Share Economic Earnings 2020 2019 +/- 2020 2019 +/- Economic Earnings 2020 2019 +/- 2020 2019 +/- UTILITY ($18.4) ($21.6) $3.2 ($0.18) ($0.24) $0.06 UTILITY $93.5 $76.5 $17.0 $0.98 $0.83 $0.15 SOUTH JERSEY GAS (SJG) ($9.5) ($11.6) $2.1 ($0.09) ($0.13) $0.03 SOUTH JERSEY GAS (SJG) $65.9 $59.1 $6.8 $0.69 $0.64 $0.05 ELIZABETHTOWN GAS (ETG) ($8.6) ($9.9) $1.3 ($0.09) ($0.11) $0.02 ELIZABETHTOWN GAS (ETG) $27.3 $17.1 $10.2 $0.29 $0.19 $0.10 ELKTON GAS (ELK) ($0.3) ($0.1) ($0.1) ($0.00) ($0.00) ($0.00) ELKTON GAS (ELK) $0.3 $0.3 $0.0 $0.00 $0.00 $0.00 NON-UTILITY $21.6 $1.8 $19.8 $0.21 $0.02 $0.20 NON-UTILITY $32.9 $7.4 $25.5 $0.34 $0.08 $0.26 MIDSTREAM $1.2 $1.2 ($0.0) $0.01 $0.01 ($0.00) MIDSTREAM $3.2 $3.2 $0.0 $0.03 $0.03 ($0.00) ENERGY GROUP $6.2 ($1.0) $7.2 $0.06 ($0.01) $0.07 ENERGY GROUP $17.1 $4.5 $12.6 $0.18 $0.05 $0.13 Fuel Supply Management $4.4 $2.9 $1.5 $0.04 $0.03 $0.01 Fuel Supply Management $10.2 $7.7 $2.5 $0.11 $0.08 $0.02 Wholesale Marketing/Other $1.8 ($3.9) $5.7 $0.02 ($0.04) $0.06 Wholesale Marketing/Other $6.9 ($3.1) $10.0 $0.07 ($0.03) $0.11 ENERGY SERVICES $14.3 $1.7 $12.6 $0.14 $0.02 $0.12 ENERGY SERVICES $12.6 ($0.3) $12.9 $0.13 ($0.00) $0.14 Energy Production $13.8 $1.2 $12.6 $0.14 $0.01 $0.12 Energy Production $10.9 ($2.0) $12.9 $0.11 ($0.02) $0.14 Account Services $0.5 $0.5 $0.0 $0.00 $0.01 ($0.00) Account Services $1.7 $1.7 $0.0 $0.02 $0.02 ($0.00) OTHER ($9.2) ($7.7) ($1.5) ($0.09) ($0.08) ($0.0) OTHER ($26.4) ($24.2) ($2.2) ($0.28) ($0.26) ($0.01) Note: Amounts and/or EPS TOTAL - CONTINUING OPS ($6.0) ($27.5) $21.5 ($0.06) ($0.30) $0.24 TOTAL - CONTINUING OPS $100.0 $59.7 $40.3 $1.04 $0.65 $0.40 may not add due to rounding 28

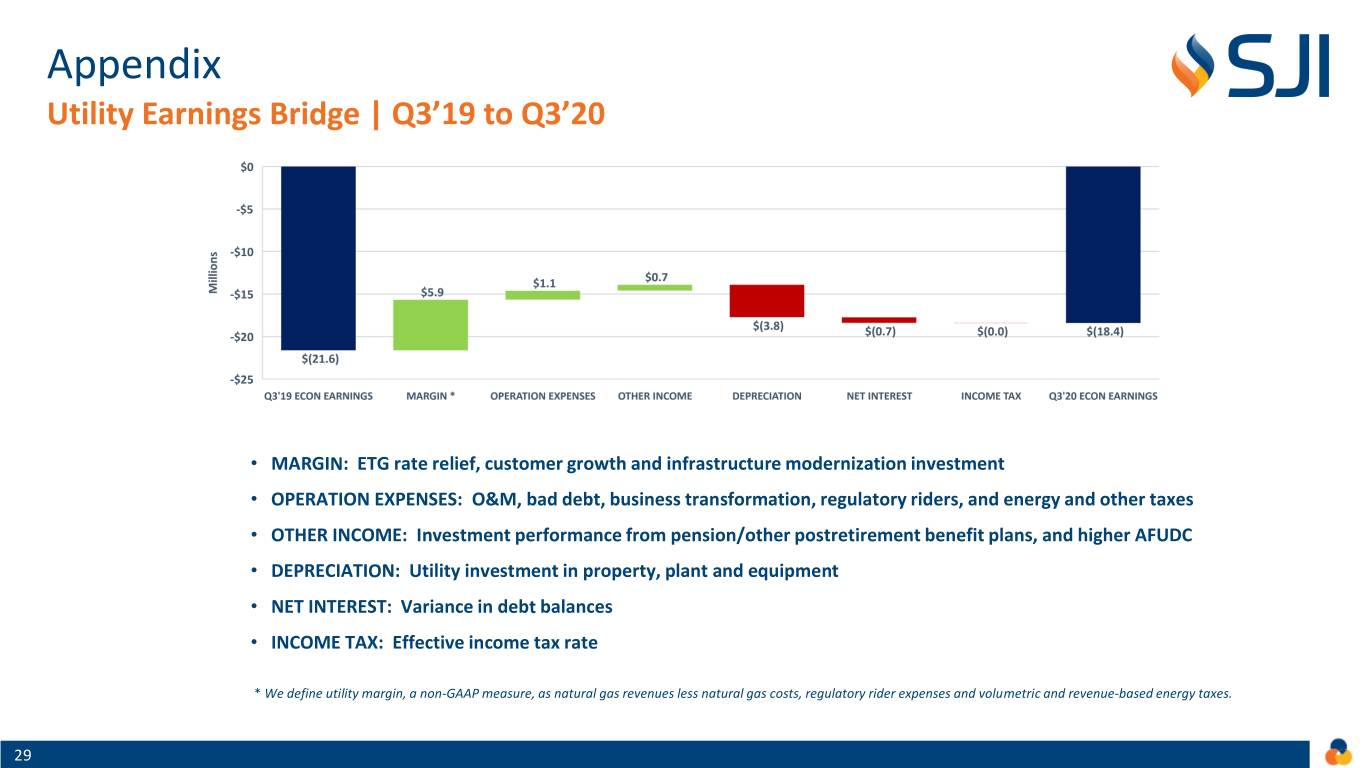

Appendix Utility Earnings Bridge | Q3’19 to Q3’20 • MARGIN: ETG rate relief, customer growth and infrastructure modernization investment • OPERATION EXPENSES: O&M, bad debt, business transformation, regulatory riders, and energy and other taxes • OTHER INCOME: Investment performance from pension/other postretirement benefit plans, and higher AFUDC • DEPRECIATION: Utility investment in property, plant and equipment • NET INTEREST: Variance in debt balances • INCOME TAX: Effective income tax rate * We define utility margin, a non-GAAP measure, as natural gas revenues less natural gas costs, regulatory rider expenses and volumetric and revenue-based energy taxes. 29

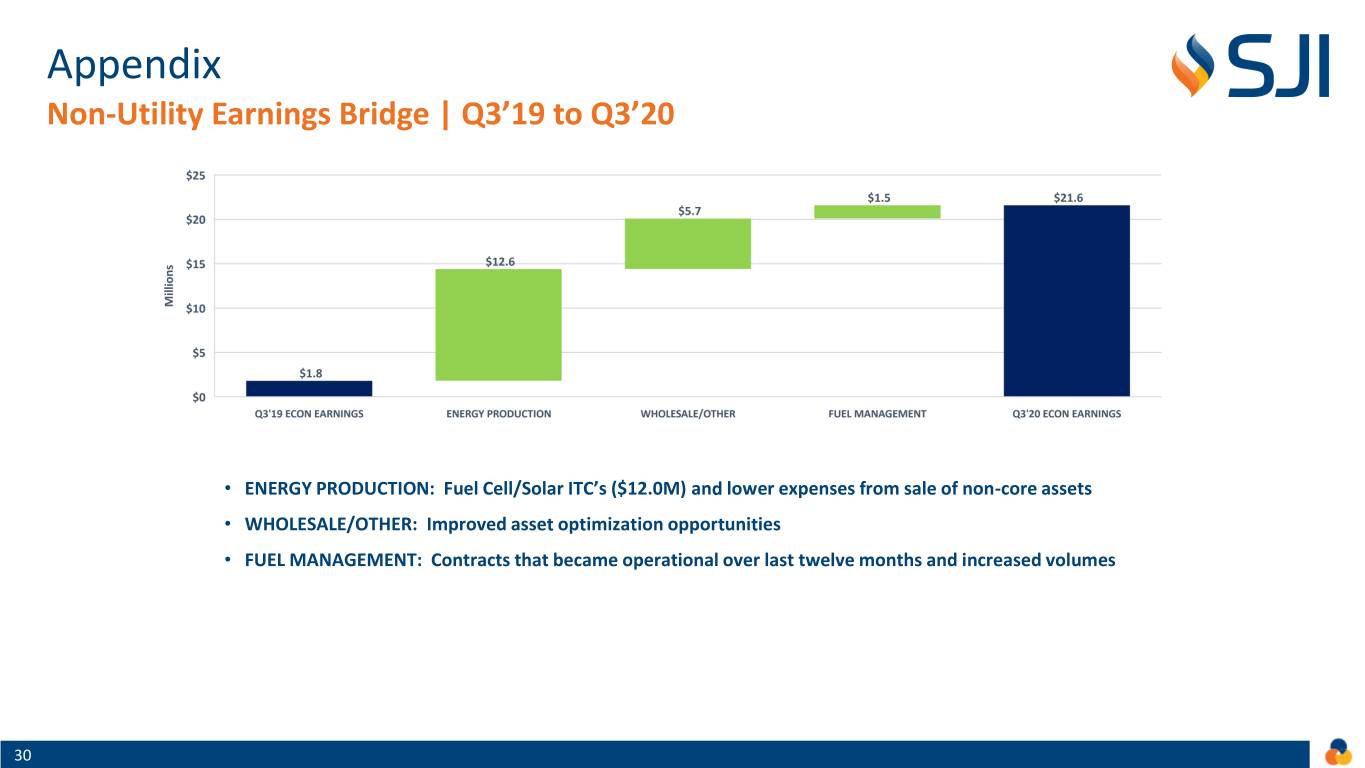

Appendix Non-Utility Earnings Bridge | Q3’19 to Q3’20 • ENERGY PRODUCTION: Fuel Cell/Solar ITC’s ($12.0M) and lower expenses from sale of non-core assets • WHOLESALE/OTHER: Improved asset optimization opportunities • FUEL MANAGEMENT: Contracts that became operational over last twelve months and increased volumes 30

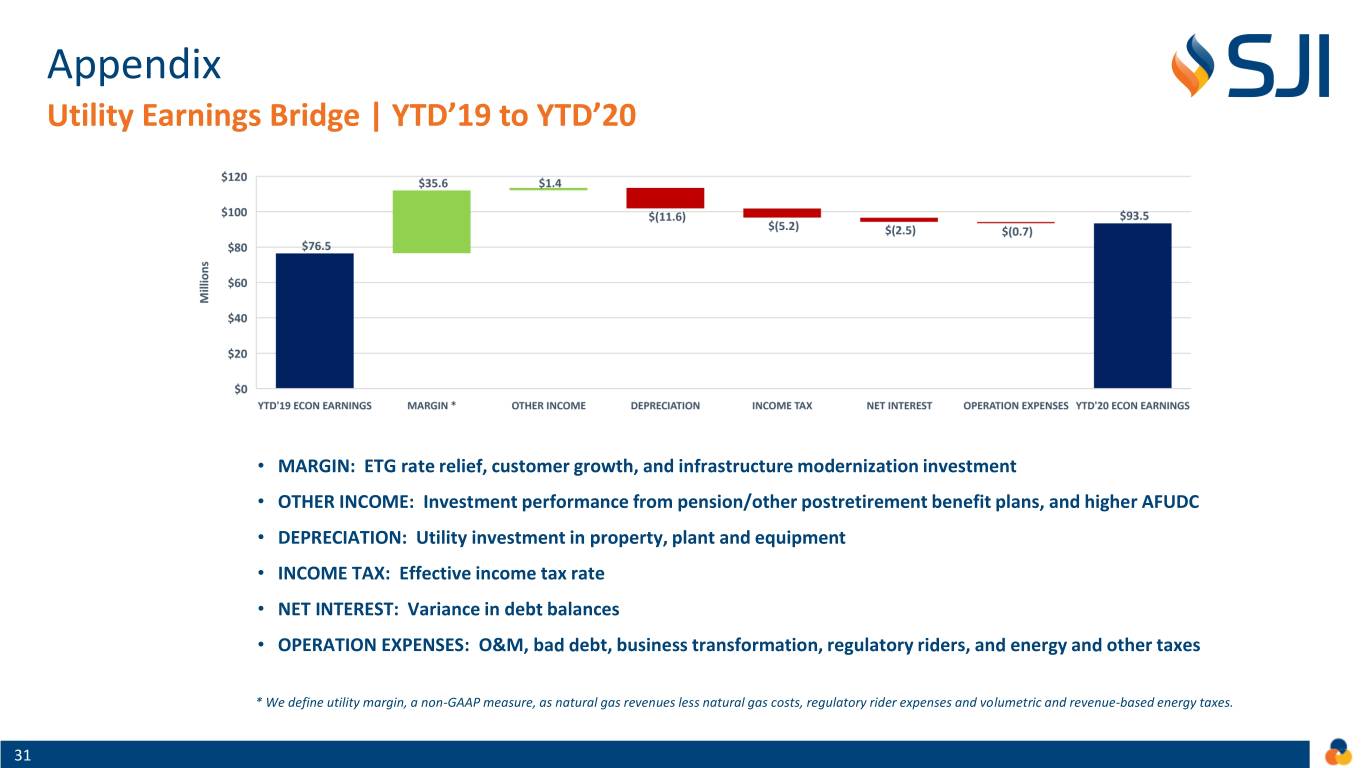

Appendix Utility Earnings Bridge | YTD’19 to YTD’20 • MARGIN: ETG rate relief, customer growth, and infrastructure modernization investment • OTHER INCOME: Investment performance from pension/other postretirement benefit plans, and higher AFUDC • DEPRECIATION: Utility investment in property, plant and equipment • INCOME TAX: Effective income tax rate • NET INTEREST: Variance in debt balances • OPERATION EXPENSES: O&M, bad debt, business transformation, regulatory riders, and energy and other taxes * We define utility margin, a non-GAAP measure, as natural gas revenues less natural gas costs, regulatory rider expenses and volumetric and revenue-based energy taxes. 31

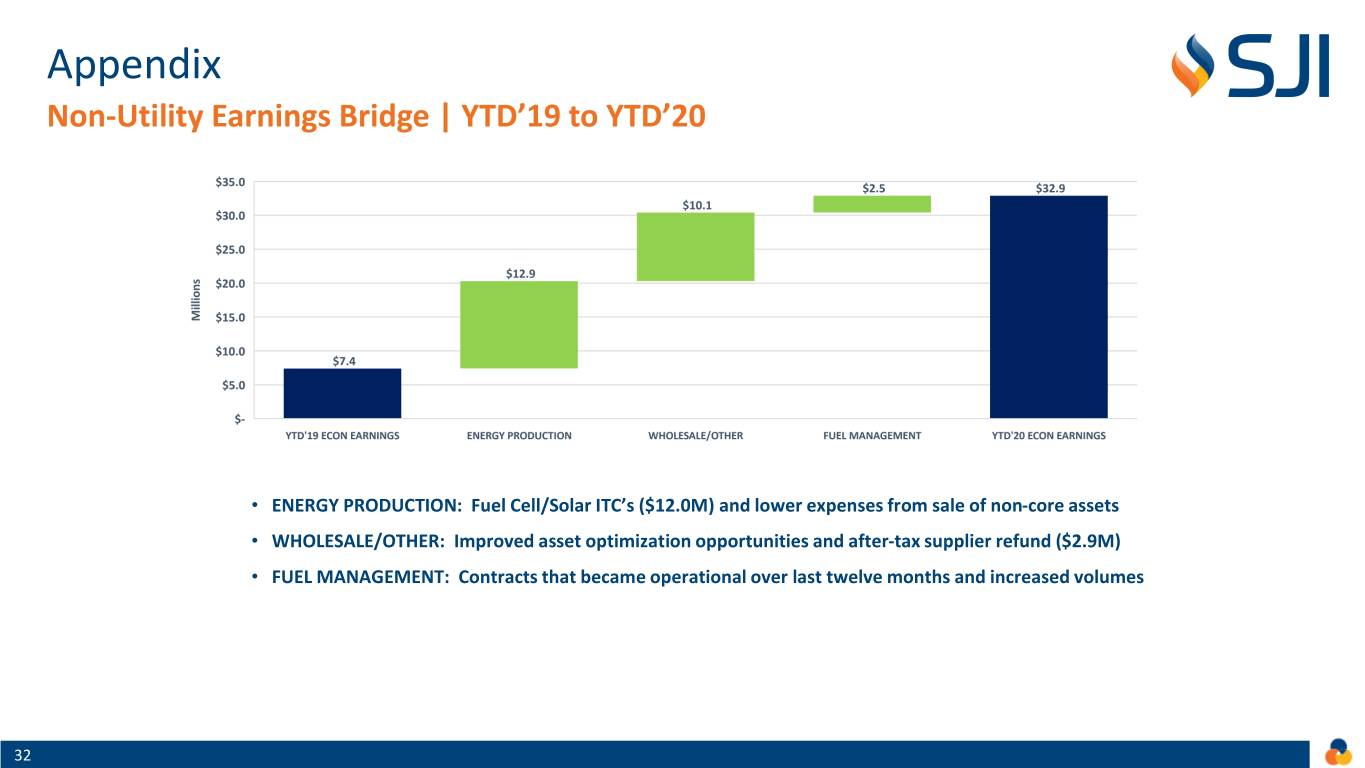

Appendix Non-Utility Earnings Bridge | YTD’19 to YTD’20 • ENERGY PRODUCTION: Fuel Cell/Solar ITC’s ($12.0M) and lower expenses from sale of non-core assets • WHOLESALE/OTHER: Improved asset optimization opportunities and after-tax supplier refund ($2.9M) • FUEL MANAGEMENT: Contracts that became operational over last twelve months and increased volumes 32

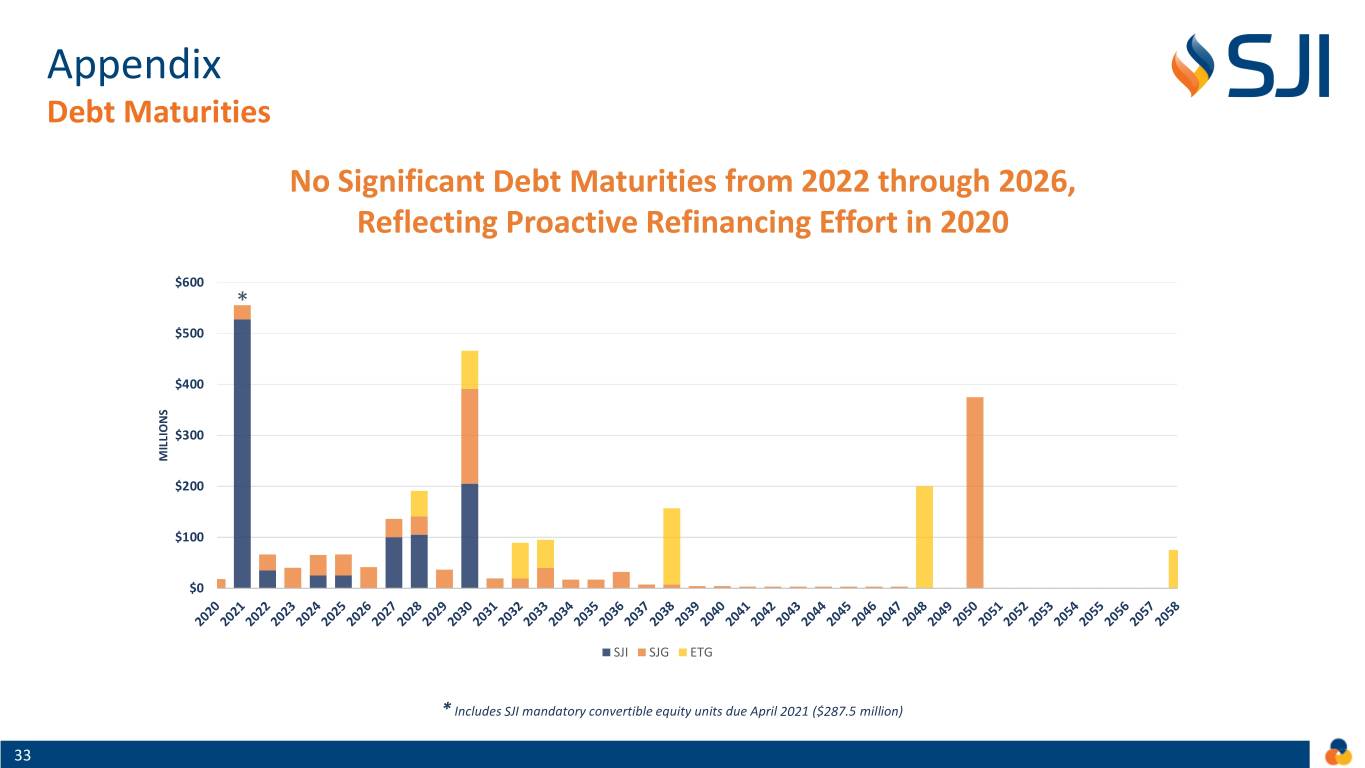

Appendix Debt Maturities No Significant Debt Maturities from 2022 through 2026, Reflecting Proactive Refinancing Effort in 2020 $600 * $500 $400 $300 MILLIONS $200 $100 $0 SJI SJG ETG * Includes SJI mandatory convertible equity units due April 2021 ($287.5 million) 33

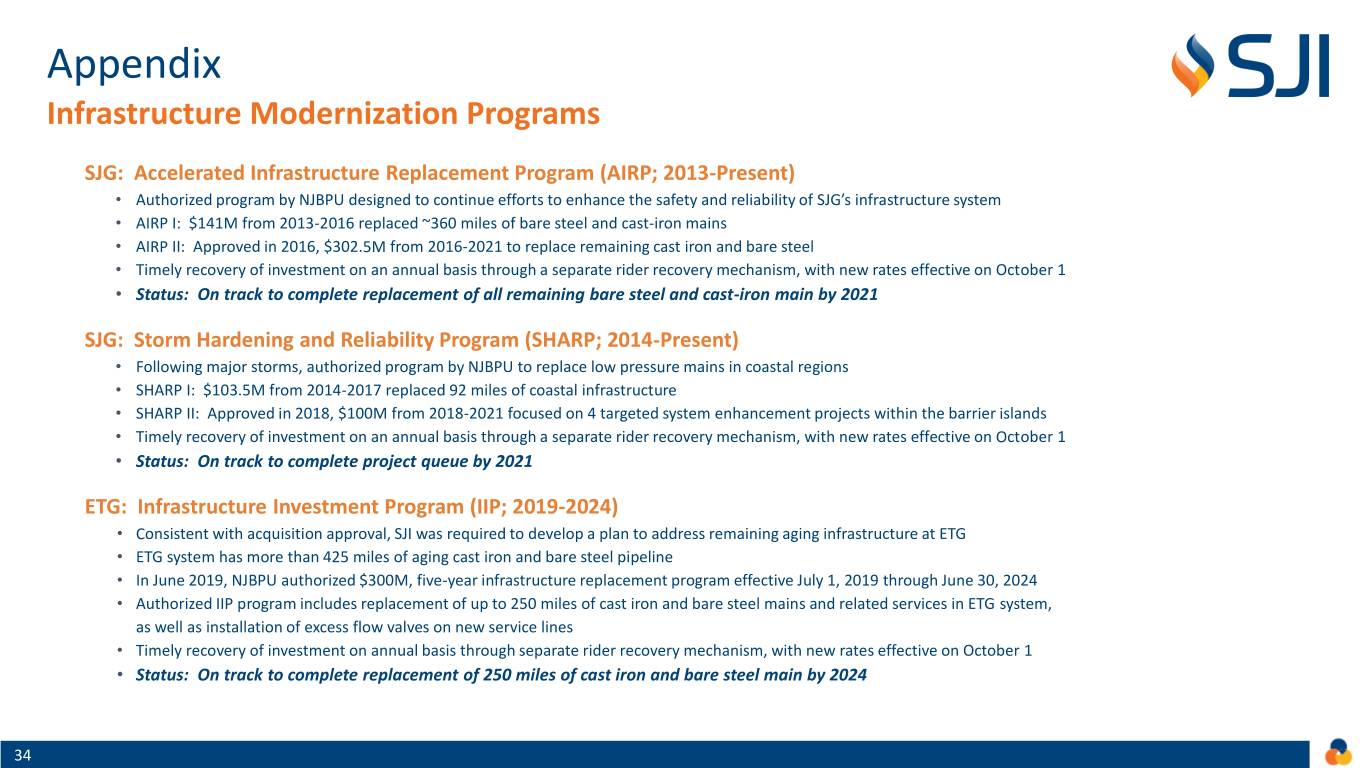

Appendix Infrastructure Modernization Programs SJG: Accelerated Infrastructure Replacement Program (AIRP; 2013-Present) • Authorized program by NJBPU designed to continue efforts to enhance the safety and reliability of SJG’s infrastructure system • AIRP I: $141M from 2013-2016 replaced ~360 miles of bare steel and cast-iron mains • AIRP II: Approved in 2016, $302.5M from 2016-2021 to replace remaining cast iron and bare steel • Timely recovery of investment on an annual basis through a separate rider recovery mechanism, with new rates effective on October 1 • Status: On track to complete replacement of all remaining bare steel and cast-iron main by 2021 SJG: Storm Hardening and Reliability Program (SHARP; 2014-Present) • Following major storms, authorized program by NJBPU to replace low pressure mains in coastal regions • SHARP I: $103.5M from 2014-2017 replaced 92 miles of coastal infrastructure • SHARP II: Approved in 2018, $100M from 2018-2021 focused on 4 targeted system enhancement projects within the barrier islands • Timely recovery of investment on an annual basis through a separate rider recovery mechanism, with new rates effective on October 1 • Status: On track to complete project queue by 2021 ETG: Infrastructure Investment Program (IIP; 2019-2024) • Consistent with acquisition approval, SJI was required to develop a plan to address remaining aging infrastructure at ETG • ETG system has more than 425 miles of aging cast iron and bare steel pipeline • In June 2019, NJBPU authorized $300M, five-year infrastructure replacement program effective July 1, 2019 through June 30, 2024 • Authorized IIP program includes replacement of up to 250 miles of cast iron and bare steel mains and related services in ETG system, as well as installation of excess flow valves on new service lines • Timely recovery of investment on annual basis through separate rider recovery mechanism, with new rates effective on October 1 • Status: On track to complete replacement of 250 miles of cast iron and bare steel main by 2024 34

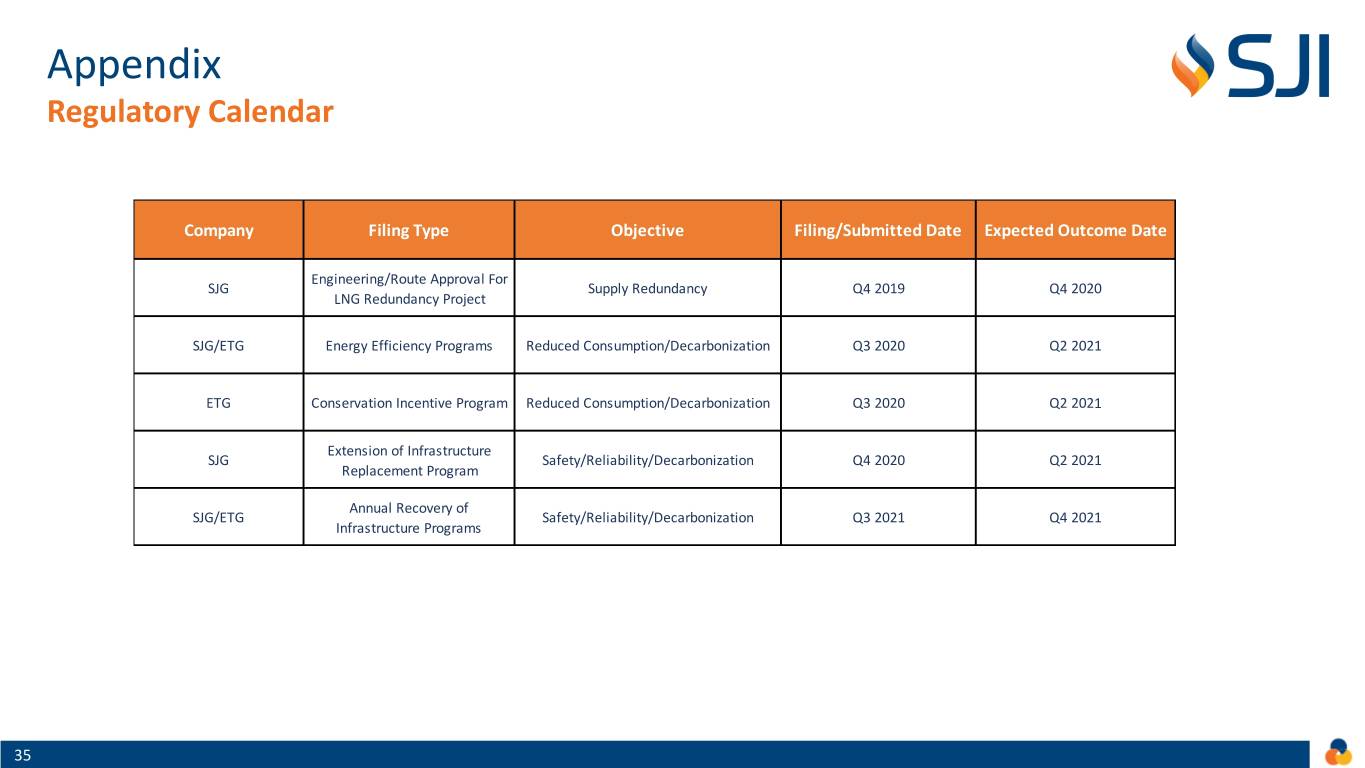

Appendix Regulatory Calendar Company Filing Type Objective Filing/Submitted Date Expected Outcome Date Engineering/Route Approval For SJG Supply Redundancy Q4 2019 Q4 2020 LNG Redundancy Project SJG/ETG Energy Efficiency Programs Reduced Consumption/Decarbonization Q3 2020 Q2 2021 ETG Conservation Incentive Program Reduced Consumption/Decarbonization Q3 2020 Q2 2021 Extension of Infrastructure SJG Safety/Reliability/Decarbonization Q4 2020 Q2 2021 Replacement Program Annual Recovery of SJG/ETG Safety/Reliability/Decarbonization Q3 2021 Q4 2021 Infrastructure Programs 35

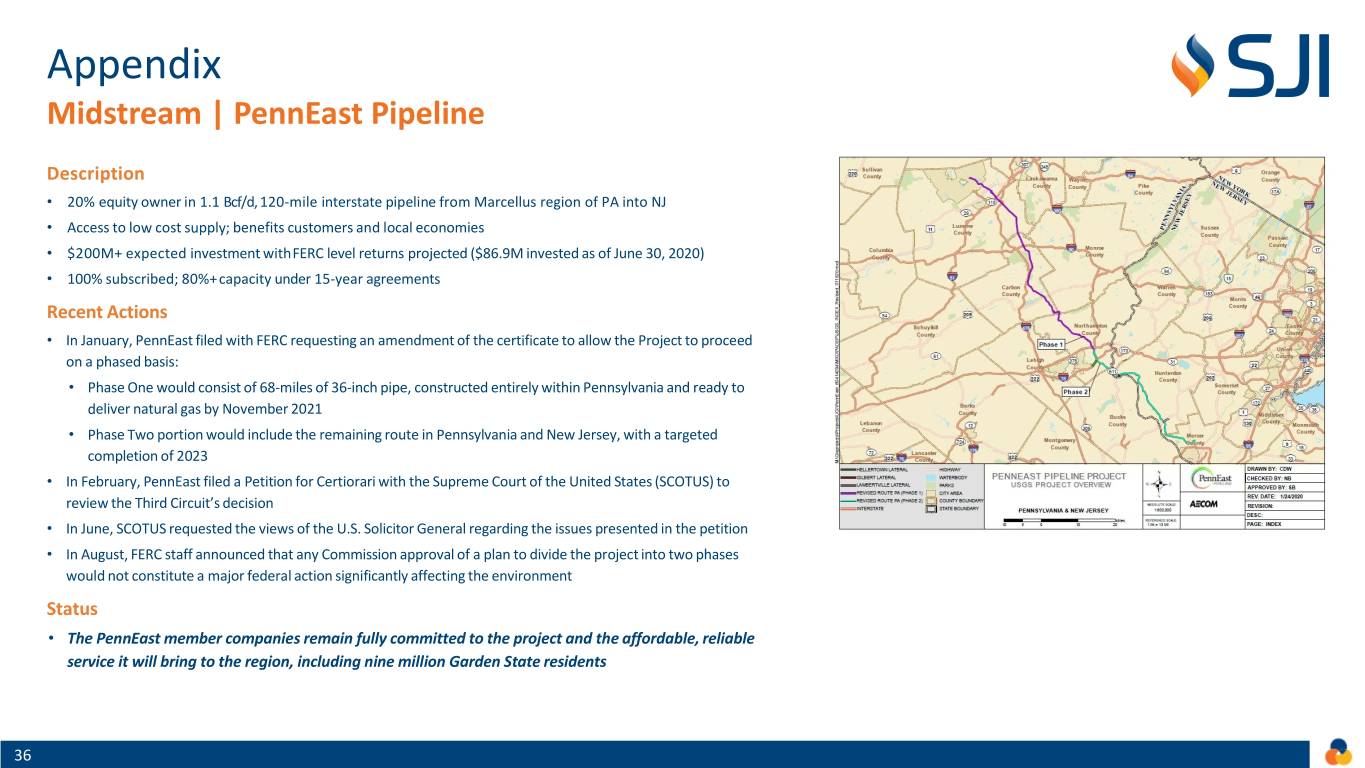

Appendix Midstream | PennEast Pipeline Description • 20% equity owner in 1.1 Bcf/d, 120-mile interstate pipeline from Marcellus region of PA into NJ • Access to low cost supply; benefits customers and local economies • $200M+ expected investment withFERC level returns projected ($86.9M invested as of June 30, 2020) • 100% subscribed; 80%+capacity under 15-year agreements Recent Actions • In January, PennEast filed with FERC requesting an amendment of the certificate to allow the Project to proceed on a phased basis: • Phase One would consist of 68-miles of 36-inch pipe, constructed entirely within Pennsylvania and ready to deliver natural gas by November 2021 • Phase Two portion would include the remaining route in Pennsylvania and New Jersey, with a targeted completion of 2023 • In February, PennEast filed a Petition for Certiorari with the Supreme Court of the United States (SCOTUS) to review the Third Circuit’s decision • In June, SCOTUS requested the views of the U.S. Solicitor General regarding the issues presented in the petition • In August, FERC staff announced that any Commission approval of a plan to divide the project into two phases would not constitute a major federal action significantly affecting the environment Status • The PennEast member companies remain fully committed to the project and the affordable, reliable service it will bring to the region, including nine million Garden State residents 36