Attached files

| file | filename |

|---|---|

| EX-10.3 - EX-10.3 - SAExploration Holdings, Inc. | d85997dex103.htm |

| EX-10.2 - EX-10.2 - SAExploration Holdings, Inc. | d85997dex102.htm |

| EX-10.1 - EX-10.1 - SAExploration Holdings, Inc. | d85997dex101.htm |

| 8-K - 8-K - SAExploration Holdings, Inc. | d85997d8k.htm |

Exhibit 10.4

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

| § | ||||

| In re: | § | Chapter 11 | ||

| § | ||||

| SAEXPLORATION HOLDINGS, INC., et al., | § | Case No. 20-34306 (MI) | ||

| § | ||||

| Debtors.1 | § | (Jointly Administered) | ||

| § |

THIRD AMENDED DISCLOSURE STATEMENT FOR THE

DEBTORS’ SECOND AMENDED CHAPTER 11 PLAN OF REORGANIZATION

| PORTER HEDGES LLP

John F. Higgins (TX 09597500) Eric M. English (TX 24062714) M. Shane Johnson (TX 24083263) Megan Young-John (TX 24088700) 1000 Main Street, 36th Floor Houston, Texas 77002

ATTORNEYS FOR THE DEBTORS

Dated: November 1, 2020

|

| THIS IS NOT A SOLICITATION OF AN ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL THIS DISCLOSURE STATEMENT HAS BEEN CONDITIONALLY APPROVED BY THE COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN CONDITIONALLY APPROVED BY THE COURT FOR PURPOSES OF SOLICITATION. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY SECURITIES. |

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: SAExploration Holdings, Inc. (7100), SAExploration Sub, Inc. (8859), SAExploration, Inc. (9022), SAExploration Seismic Services (US), LLC (5057), and NES, LLC. The Debtors’ mailing address is: 13645 N. Promenade Blvd., Stafford, TX 77477. |

THE DEBTORS ARE PROVIDING THE INFORMATION IN THIS DISCLOSURE STATEMENT TO HOLDERS OF CLAIMS FOR PURPOSES OF SOLICITING VOTES TO ACCEPT OR REJECT THE DEBTORS’ CHAPTER 11 PLAN OF REORGANIZATION ATTACHED HERETO AS EXHIBIT A. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY ENTITY FOR ANY OTHER PURPOSE. PRIOR TO DECIDING WHETHER AND HOW TO VOTE ON THE PLAN, EACH HOLDER ENTITLED TO VOTE SHOULD CAREFULLY CONSIDER ALL OF THE INFORMATION IN THIS DISCLOSURE STATEMENT, INCLUDING THE RISK FACTORS DESCRIBED IN ARTICLE VIII HEREIN.

THE PLAN IS SUPPORTED BY THE DEBTORS, CONSENTING CREDIT AGREEMENT LENDERS, CONSENTING TERM LOAN LENDERS, AND CONSENTING CONVERTIBLE NOTEHOLDERS PURSUANT TO THE RESTRUCTURING SUPPORT AGREEMENT, AND ALL SUCH PARTIES URGE HOLDERS OF CLAIMS WHOSE VOTES ARE BEING SOLICITED TO ACCEPT THE PLAN.

HOLDERS OF CLAIMS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, SECURITIES, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE VOTING ON THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS, AMONG OTHER THINGS, SUMMARIES OF THE PLAN, CERTAIN STATUTORY PROVISIONS, AND CERTAIN ANTICIPATED EVENTS IN THE DEBTORS’ CHAPTER 11 CASES. ALTHOUGH THE DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE, THESE SUMMARIES ARE QUALIFIED IN THEIR ENTIRETY TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF SUCH DOCUMENTS OR STATUTORY PROVISIONS OR EVERY DETAIL OF SUCH ANTICIPATED EVENTS. IN THE EVENT OF ANY INCONSISTENCY OR DISCREPANCY BETWEEN A DESCRIPTION IN THIS DISCLOSURE STATEMENT AND THE TERMS AND PROVISIONS OF THE PLAN OR ANY OTHER DOCUMENTS INCORPORATED HEREIN BY REFERENCE, THE PLAN OR SUCH OTHER DOCUMENTS WILL GOVERN FOR ALL PURPOSES. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY THE DEBTORS’ MANAGEMENT EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS DO NOT REPRESENT OR WARRANT THAT THE INFORMATION CONTAINED HEREIN OR ATTACHED HERETO IS WITHOUT ANY MATERIAL INACCURACY OR OMISSION.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(B) AND IS NOT NECESSARILY PREPARED IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER SIMILAR LAWS.

UPON CONFIRMATION OF THE PLAN, THE NEW EQUITY DESCRIBED IN THIS DISCLOSURE STATEMENT WILL BE ISSUED WITHOUT REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED, TOGETHER WITH THE RULES AND REGULATIONS PROMULGATED THEREUNDER (THE “SECURITIES ACT”), OR SIMILAR U.S. FEDERAL, STATE OR LOCAL LAWS TO PERSONS RESIDENT OR OTHERWISE LOCATED IN THE UNITED STATES IN RELIANCE ON THE EXEMPTION SET FORTH IN SECTION 1145 OF THE BANKRUPTCY CODE. THE DEBTORS WILL RELY ON SECTION 1145(a) OF THE BANKRUPTCY CODE TO EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND BLUE SKY LAWS THE OFFER, ISSUANCE, AND DISTRIBUTION OF NEW EQUITY UNDER THE PLAN.

THE NEW EQUITY UNDERLYING THE MANAGEMENT INCENTIVE PLAN, THE NEW EQUITY ISSUED PURSUANT TO THE RIGHTS OFFERING AND THE NEW EQUITY ISSUED PURSUANT TO THE FIRST LIEN EXIT FACILITY PUT OPTION PREMIUM WILL BE ISSUED PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT AND U.S. AND APPLICABLE STATE AND LOCAL SECURITIES LAWS AND THE LAWS OF FOREIGN JURISDICTIONS, AS APPLICABLE. TO THE EXTENT EXEMPTIONS FROM REGISTRATION UNDER SECTION 1145 OF THE BANKRUPTCY CODE DO NOT APPLY, THOSE SECURITIES MAY NOT BE OFFERED OR ISSUED TO PERSONS RESIDENT OR OTHERWISE LOCATED IN THE UNITED STATES EXCEPT PURSUANT TO (A) AN EFFECTIVE REGISTRATION STATEMENT OR (B) AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.

THIS DISCLOSURE STATEMENT WAS NOT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE AUTHORITY AND NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NEITHER THE SOLICITATION NOR THIS DISCLOSURE STATEMENT CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION, AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. THIS DISCLOSURE STATEMENT CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND THESE STATEMENTS, INCLUDING THOSE RELATING TO THE INTENT, BELIEFS, PLANS OR EXPECTATIONS OF THE DEBTORS ARE BASED UPON CURRENT EXPECTATIONS AND ARE SUBJECT TO A NUMBER OF RISKS, UNCERTAINTIES AND ASSUMPTIONS DESCRIBED HEREIN.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS (THE “COURT”).

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN. THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN OR THIS DISCLOSURE STATEMENT.

THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE, AND MAY NOT BE CONSTRUED AS, AN ADMISSION OF FACT, LIABILITY, STIPULATION, OR WAIVER. THE DEBTORS MAY SEEK TO INVESTIGATE, FILE, AND PROSECUTE CLAIMS AND MAY OBJECT TO CLAIMS AFTER THE CONFIRMATION OR EFFECTIVE DATE OF THE PLAN IRRESPECTIVE OF WHETHER THIS DISCLOSURE STATEMENT IDENTIFIES ANY SUCH CLAIMS OR OBJECTIONS TO CLAIMS.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE. ALL EXHIBITS TO THE DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

IF THE PLAN IS CONFIRMED BY THE COURT AND THE EFFECTIVE DATE OCCURS, ALL HOLDERS OF CLAIMS AND INTERESTS (INCLUDING THOSE HOLDERS OF CLAIMS WHO DO NOT SUBMIT BALLOTS (AS DEFINED BELOW) TO ACCEPT OR REJECT THE PLAN, OR WHO ARE NOT ENTITLED TO VOTE ON THE PLAN) WILL BE BOUND BY THE TERMS OF THE PLAN AND THE RESTRUCTURING TRANSACTION CONTEMPLATED THEREBY.

TABLE OF CONTENTS

| Page | ||||||||

| I. | INTRODUCTION |

1 | ||||||

| II. | OVERVIEW OF THE DEBTORS’ OPERATIONS |

6 | ||||||

| A. | The Debtors’ Business |

6 | ||||||

| B. | The Debtors’ History |

7 | ||||||

| C. | The Debtors’ Corporate Structure |

8 | ||||||

| D. | Directors and Officers |

9 | ||||||

| E. | The Debtors’ Capital Structure |

10 | ||||||

| F. | The Debtors’ Alaska Tax Credits |

13 | ||||||

| III. | KEY EVENTS LEADING TO CHAPTER 11 CASES |

14 | ||||||

| A. | Restructuring Negotiations |

16 | ||||||

| B. | The Restructuring Support Agreement |

16 | ||||||

| IV. | DEVELOPMENTS AND ANTICIPATED EVENTS DURING THE CHAPTER 11 CASES |

18 | ||||||

| A. | First Day Pleadings |

18 | ||||||

| B. | Other Administrative Motions and Retention Applications |

19 | ||||||

| C. | Claims Bar Date |

20 | ||||||

| D. | Assumption and Rejection of Executory Contracts and Unexpired Leases |

20 | ||||||

| E. | Legal Matters |

20 | ||||||

| V. | SUMMARY OF THE PLAN |

23 | ||||||

| A. | Administrative Claims, Professional Fee Claims, and Priority Claims |

23 | ||||||

| B. | Classification and Treatment of Claims and Interests |

25 | ||||||

| C. | Treatment of Claims and Interests |

26 | ||||||

| D. | Means for Implementation of the Plan |

32 | ||||||

| E. | Treatment of Executory Contracts and Unexpired Leases |

41 | ||||||

| F. | Provisions Governing Distributions |

43 | ||||||

| G. | Procedures for Resolving Contingent, Unliquidated, and Disputed Claims |

47 | ||||||

| H. | Settlement, Release, Injunction, and Related Provisions |

49 | ||||||

| I. | Conditions Precedent to Confirmation and Consummation of the Plan |

55 | ||||||

| J. | Modification, Revocation, or Withdrawal of the Plan |

57 | ||||||

| K. | Retention of Jurisdiction |

58 | ||||||

| L. | Miscellaneous Provisions |

60 | ||||||

| VI. | TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES LAWS |

63 | ||||||

| VII. | CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN |

66 | ||||||

| A. | Introduction |

66 | ||||||

| B. | Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors |

67 | ||||||

| C. | U.S. Federal Income Tax Consequences to Holders of Allowed Credit Agreement Claims |

70 | ||||||

| D. | Certain U.S. Federal Income Tax Consequences to U.S. Holders of Allowed Term Loans |

71 | ||||||

| E. | Certain Common U.S. Federal Income Tax Consequences to U.S. Holders of Claims |

72 | ||||||

| F. | Certain U.S. Federal Income Tax Consequences to Certain Non-U.S. Holders of Claims |

75 | ||||||

| G. | Compliance and Reporting |

80 | ||||||

| VIII. | CERTAIN RISK FACTORS TO BE CONSIDERED |

81 | ||||||

| A. | Certain Bankruptcy Law Considerations |

81 | ||||||

| B. | Additional Factors Affecting the Value of the Reorganized Debtors and Recoveries Under the Plan |

84 | ||||||

| C. | Risks Relating to the Debtors’ Business and Financial Condition |

85 | ||||||

| D. | Factors Relating to Securities to Be Issued Under the Plan |

88 | ||||||

| E. | Additional Factors |

89 | ||||||

| IX. | VOTING PROCEDURES AND REQUIREMENTS |

90 | ||||||

| A. | Parties Entitled to Vote |

90 | ||||||

| B. | Voting Procedures |

91 | ||||||

| C. | Voting Deadline |

91 | ||||||

| D. | Waivers of Defects and Irregularities |

93 | ||||||

| X. | CONFIRMATION OF THE PLAN |

94 | ||||||

| A. | Confirmation Hearing |

94 | ||||||

| B. | Objections to Confirmation |

94 | ||||||

| C. | Requirements for Confirmation of the Plan |

95 | ||||||

| D. | Best Interests Test/Liquidation Analysis |

96 | ||||||

| E. | Feasibility |

97 | ||||||

| F. | Acceptance by Impaired Classes |

98 | ||||||

| G. | Additional Requirements for Nonconsensual Confirmation |

98 | ||||||

| H. | Valuation of the Debtors |

99 | ||||||

| XI. | ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN |

99 | ||||||

| A. | Alternative Plan of Reorganization |

99 | ||||||

| B. | Sale Under Section 363 of the Bankruptcy Code |

99 | ||||||

| C. | Liquidation Under Chapter 7 or Applicable Non-Bankruptcy Law |

99 | ||||||

| XII. | CONCLUSION AND RECOMMENDATION |

100 | ||||||

ii

EXHIBITS

| EXHIBIT A | Plan of Reorganization | |

| EXHIBIT B | Restructuring Support Agreement | |

| EXHIBIT C | Liquidation Analysis | |

| EXHIBIT D | Financial Projections | |

| EXHIBIT E | Valuation Analysis | |

| EXHIBIT F | Rights Offering Procedures | |

iii

| I. | INTRODUCTION |

SAExploration Holdings, Inc. (“SAE Holdings”) and its debtor affiliates, as debtors and debtors in possession (collectively, the “Debtors”), submit this disclosure statement (the “Disclosure Statement”) pursuant to section 1125 of the Bankruptcy Code in connection with the solicitation of votes on the Debtors’ Second Amended Chapter 11 Plan of Reorganization, dated November 1, 2020 (the “Plan,” attached hereto as Exhibit A).2 The Plan constitutes a separate chapter 11 plan for SAE Holdings and each of the other Debtors. To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan governs.

The Debtors are commencing this solicitation after extensive discussions over the past several months among the Debtors and certain of their key creditor constituencies, including the holders of the fulcrum security, the Prepetition Convertible Noteholders. As a result of these negotiations, certain creditors holding approximately 95% of the Debtors’ Credit Agreement Claims, approximately 77% of the Debtors’ Term Loan Claims and approximately 95% of the Debtors’ Convertible Notes Claims entered into a restructuring support agreement (the “Restructuring Support Agreement”) with the Debtors, a copy of which is attached hereto as Exhibit B. Under the terms of the Restructuring Support Agreement, the Prepetition Credit Agreement Lenders, the Prepetition Term Loan Lenders and the Prepetition Convertible Noteholders who are, or later become, signatories to the Restructuring Support Agreement have agreed to a deleveraging transaction that would restructure the existing debt obligations of the Debtors in chapter 11 through the Plan (the “Restructuring”).

WHO IS ENTITLED TO VOTE: Under the Bankruptcy Code, only Holders of Claims or Interests in “impaired” Classes are entitled to vote on the Plan (unless, for reasons discussed in more detail below, such Holders are deemed to accept the Plan pursuant to section 1126(f) of the Bankruptcy Code or are deemed to reject the Plan pursuant to section 1126(g) of the Bankruptcy Code). Under section 1124 of the Bankruptcy Code, a Class of Claims or Interests is deemed to be “impaired” under the Plan unless (i) the Plan leaves unaltered the legal, equitable, and contractual rights to which such Claim or Interest entitles the Holder thereof or (ii) notwithstanding any legal right to an accelerated payment of such Claim or Interest, the Plan, among other things, cures all existing defaults (other than defaults resulting from the initiation of these Chapter 11 Cases) and reinstates the maturity of such Claim or Interest as it existed before the default.

The following table summarizes: (i) the treatment of Claims and Interests under the Plan, (ii) which Classes are Impaired by the Plan, (iii) which Classes are entitled to vote on the Plan, and (iv) the estimated recoveries for Holders of Claims and Interests. The table is qualified in its entirety by reference to the full text of the Plan. For a more detailed summary of the terms and provisions of the Plan, see Section V—Summary of the Plan below.

| 2 | Capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such terms in the Plan. |

| Class | Claim or Equity Interest |

Treatment | Impaired or Unimpaired |

Entitled to Vote |

Approx. % Recovery | |||||

| 1 | Other Priority Claims | In full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Other Priority Claim, each Holder thereof shall receive (i) payment in full, in Cash, of the unpaid portion of its Allowed Other Priority Claim or (ii) such other treatment as may otherwise be agreed to by such Holder, the Debtors, and the Requisite Creditors. | Unimpaired | No (Deemed to Accept) | 100% | |||||

| 2 | Other Secured Claims | Except to the extent that a Holder of an Allowed Other Secured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Other Secured Claim, each such Holder shall receive, at the Debtors’ election with the consent of the Requisite Creditors, either (i) Cash equal to the full Allowed amount of its Claim, (ii) Reinstatement of such Holder’s Allowed Other Secured Claim, or (iii) the return or abandonment of the collateral securing such Allowed Other Secured Claim to such Holder. | Unimpaired | No (Deemed to Accept) | 100% | |||||

| 3 | Secured Tax Claims | Except to the extent that a Holder of an Allowed Secured Tax Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Secured Tax Claim, each such Holder shall receive, at the Debtors’ election with the consent of the Requisite Creditors, either (i) Cash equal to the full Allowed amount of its Claim, (ii) Reinstatement of such Holder’s Allowed Secured Tax Claim, or (iii) the return or abandonment of the collateral securing such Allowed Secured Tax Claim to such Holder. | Unimpaired | No (Deemed to Accept) | 100% | |||||

| 4 | Credit Agreement Claims | Except to the extent that a Holder of an Allowed Credit Agreement Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Credit Agreement Claim, each such Holder shall receive (i) its Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims) of participation in the Second Lien Exit Facility in an amount equal to such Allowed Credit Agreement Claim; (ii) the right to purchase pursuant to the Rights Offering up to its Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims and the aggregate amount of Allowed Term Loan Claims) and (B) the New First Lien Exit Facility Equity; and (iii) the payment in full in Cash on the Effective Date of all Accrued Interest as of the Effective Date. | Impaired | Yes | 65% – 70% |

2

| Class | Claim or Equity Interest |

Treatment | Impaired or Unimpaired |

Entitled to Vote |

Approx. % Recovery | |||||

| 5 | Term Loan Claims | Except to the extent that a Holder of an Allowed Term Loan Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for its Allowed Term Loan Claim, each such Holder shall receive (i) its Pro Rata share (measured by reference to the aggregate amount of Allowed Term Loan Claims) of 100% of the New Equity under the Plan, subject to dilution by the (a) New First Lien Exit Facility Equity, (b) New Equity issued pursuant to the First Lien Exit Facility Put Option Premium, and (c) awards related to the New Equity issued under the Management Incentive Plan, and (ii) the right to purchase pursuant to the Rights Offering up to its Pro Rata share (measured by reference to the aggregate amount of Allowed Term Loan Claims and the aggregate amount of Allowed Credit Agreement Claims) of (A) the term loans under the First Lien Exit Facility and (B) the New First Lien Exit Facility Equity. | Impaired | Yes | 1.6% – 3.8% | |||||

| 6 | Convertible Notes Claims | Convertible Notes Claims shall be discharged, canceled, released, and extinguished as of the Effective Date, and shall be of no further force or effect, and Holders of Convertible Notes Claims shall not receive any distribution on account of such Convertible Notes Claims. | Impaired | No (Deemed to Reject) | 0% | |||||

| 7 | PPP Loan Claim | Except to the extent that a Holder of an Allowed PPP Loan Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of each Allowed PPP Loan Claim and in exchange for each Allowed PPP Loan Claim, the Allowed PPP Loan Claims shall be Reinstated as of the Effective Date. | Unimpaired | No | N/A | |||||

3

| Class | Claim or Equity Interest |

Treatment | Impaired or Unimpaired |

Entitled to Vote |

Approx. % Recovery | |||||

| 8 | General Unsecured Claims | General Unsecured Claims shall be discharged, canceled, released, and extinguished as of the Effective Date, and shall be of no further force or effect, and Holders of General Unsecured Claims shall not receive any distribution on account of such General Unsecured Claims. | Impaired | No (Deemed to Reject) | 0% | |||||

| 9 | Section 510(b) Claims3 |

Section 510(b) Claims, if any, shall be discharged, canceled, released, and extinguished as of the Effective Date, and shall be of no further force or effect, and Holders of Section 510(b) Claims shall not receive any distribution on account of such Section 510(b) Claims. | Impaired | No (Deemed to Reject) | 0% | |||||

| 10 | Intercompany Claims |

Intercompany Claims shall be Reinstated as of the Effective Date or, at the Reorganized Debtors’ option, shall be cancelled. No distribution shall be made on account of any Intercompany Claims other than in the ordinary course of business of the Reorganized Debtors, as applicable. For the avoidance of doubt, Intercompany Claims that are Reinstated as of the Effective Date, if any, shall be subordinate in all respects to the First Lien Exit Facility and the Second Lien Exit Facility. | Unimpaired / Impaired | No (Deemed to Either Accept or Reject) | N/A | |||||

| 3 | Class 9 (Section 510(b) Claims) includes the Class Action Claims (as defined below). |

4

| Class | Claim or Equity Interest |

Treatment | Impaired or Unimpaired |

Entitled to Vote |

Approx. % Recovery | |||||

| 11 | Intercompany Interests |

Intercompany Interests shall be Reinstated as of the Effective Date or, at the Reorganized Debtors’ option, shall be cancelled. No distribution shall be made on account of any Intercompany Interests. No distributions on account of Intercompany Interests are being made to the Holders of such Intercompany Interests. Instead, to the extent Intercompany Interests are Reinstated under the Plan, such Reinstatement is solely for the purposes of administrative convenience, for the ultimate benefit of the Holders of the New Equity, and in exchange for the Debtors’ and Reorganized Debtors’ agreement under the Plan to make certain distributions to the Holders of Allowed Claims. For the avoidance of doubt, to the extent Reinstated pursuant to the Plan, on and after the Effective Date, all Intercompany Interests shall continue to be owned by the Reorganized Debtor that corresponds to the Debtor that owned such Intercompany Interests prior to the Effective Date. |

Unimpaired / Impaired | No (Deemed to Either Accept or Reject) | N/A | |||||

| 12 | SAE Holdings Interests | On the Effective Date, or as soon thereafter as reasonably practicable, all SAE Holdings Interests will be extinguished and the Holders of SAE Holdings Interests shall not receive or retain any distribution, property, or other value on account of their SAE Holdings Interests. | Impaired | No (Deemed to Reject) | 0% | |||||

WHERE TO FIND ADDITIONAL INFORMATION: SAE Holdings currently files annual, quarterly and current reports, proxy statements, and other information with the SEC. Copies of any document filed with the SEC may be obtained by visiting the SEC website at http://www.sec.gov and performing a search under the “Company Filings” link. Information including, but not limited to, that in the following filings incorporated by reference is deemed to be part of this Disclosure Statement, except for any information superseded or modified by information contained expressly in this Disclosure Statement. You should not assume that the information in this Disclosure Statement is current as of any date other than the date on the first page of the Disclosure Statement. Any information SAE Holdings files under Section 13(a), 13(c), 14 or 15(d) of the Securities Act that updates information in the filings incorporated by reference will update and supersede that information:

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed on April 14, 2020 and amended on May 13, 2020; |

| • | Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2020, filed on August 14, 2020; |

| • | Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020, filed on May 13, 2020; and |

| • | Current Reports on Form 8-K and Form 8-K/A filed on September 22, 2020, September 16, 2020, September 15, 2020, August 28, 2020, July 28, 2020, June 30, 2020, June 17, 2020, May 29, 2020, May 5, 2020, May 1, 2020, April 29, 2020, April 22, 2020, April 14, 2020, April 6, 2020, April 3, 2020, April 3, 2020 (two filings), March 30, 2020, March 2, 2020, February 27, 2020, February 19, 2020, February 14, 2020, February 7, 2020, January 27, 2020, January 13, 2020 and January 2, 2020. |

DECIDING HOW TO VOTE ON THE PLAN: All Holders of Claims are encouraged to read this Disclosure Statement, its exhibits, and the Plan carefully and in their entirety before, if applicable, deciding to vote either to accept or to reject the Plan. This Disclosure Statement contains important information about the Plan, considerations pertinent to acceptance or rejection of the Plan and developments concerning the Chapter 11 Cases.

5

IN ORDER FOR YOUR VOTE TO BE COUNTED, YOUR VOTE MUST BE RECEIVED BY THE VOTING AGENT AT THE ADDRESS SET FORTH BELOW ON OR BEFORE THE VOTING DEADLINE OF 5:00 P.M., PREVAILING CENTRAL TIME, ON [DECEMBER 4], 2020, UNLESS EXTENDED BY THE DEBTORS.

EACH BALLOT ADVISES THAT CREDITORS WHO (A) VOTE TO ACCEPT THE PLAN OR (B) DO NOT VOTE OR VOTE TO REJECT THE PLAN AND DO NOT ELECT TO OPT OUT OF THE RELEASE PROVISIONS CONTAINED IN ARTICLE VIII OF THE PLAN SHALL BE DEEMED TO HAVE CONSENTED TO THE RELEASE, INJUNCTION, AND EXCULPATION PROVISIONS SET FORTH IN ARTICLE VIII OF THE PLAN AND UNCONDITIONALLY, IRREVOCABLY, AND FOREVER RELEASED AND DISCHARGED THE RELEASED PARTIES FROM ANY AND ALL CAUSES OF ACTION. CREDITORS WHO DO NOT GRANT THE RELEASES CONTAINED IN ARTICLE VIII OF THE PLAN WILL NOT RECEIVE THE BENEFIT OF THE RELEASES SET FORTH IN ARTICLE VIII OF THE PLAN.

ARTICLE IX OF THIS DISCLOSURE STATEMENT PROVIDES ADDITIONAL DETAILS AND IMPORTANT INFORMATION REGARDING VOTING PROCEDURES AND REQUIREMENTS. PLEASE READ ARTICLE IX OF THIS DISCLOSURE STATEMENT CAREFULLY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

| THE DEBTORS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE PLAN. THE DEBTORS AND THE CONSENTING CREDITORS BELIEVE THAT THE PLAN MAXIMIZES THE VALUE OF THE DEBTORS’ ESTATES AND REPRESENTS THE BEST AVAILABLE ALTERNATIVE FOR COMPLETING THE CHAPTER 11 CASES. |

| II. | OVERVIEW OF THE DEBTORS’ OPERATIONS |

| A. | The Debtors’ Business |

The Debtors are a full–service global provider of seismic data acquisition, logistical support and processing services to customers in the oil and natural gas industry. In addition to the acquisition of 2D, 3D, time–lapse 4D and multi–component seismic data on land, in transition zones between land and water, and offshore in depths reaching 3,000 meters, the Debtors offer a full–suite of logistical support and data processing services utilizing their proprietary, patent–protected software. The Debtors operate crews around the world that are currently supported by over 160,000 owned land channels of seismic data acquisition equipment and other leased equipment as needed to complete particular projects. Seismic data is used by the Debtors’ customers, including major integrated oil companies, national oil companies and independent oil and gas exploration and production companies, to identify and analyze drilling prospects and maximize successful drilling. While the results of the seismic surveys the Debtors conduct generally belong to their customers and are proprietary in nature, Alaskan Seismic Ventures, LLC (“ASV”), a related party variable interest entity, currently maintains a multiclient seismic data library of approximately 440 square kilometers in certain basins in Alaska which is available for future sale or license. Combined the Debtors and their non-debtor affiliates currently employ 132 full-time employees. The Debtors and their non-debtor affiliates also employ hourly and day-rate employees, but that number can fluctuate depending on: the time of year and the size and number of projects at the time.

The Debtors specialize in the acquisition of seismic data in logistically complex and challenging environments and delicate ecosystems, including jungle, mountain, arctic and subaquatic terrains. The

6

Debtors have extensive experience in deploying personnel and equipment in remote locations, while maintaining a strong quality, health, safety and environmental track record and building positive community relations in the locations where we operate. The Debtors employ highly specialized crews made up of personnel with the training and skills required to prepare for and execute each project and, over time, train and employ large numbers of people from the local communities where they conduct their surveys. The Debtors’ personnel are equipped with the technology necessary to meet the specific needs of the particular project and to manage the challenges presented by sensitive environments.

As of the Petition Date, the Debtors had approximately $65.3 million of backlog under contract, in addition to approximately $977.6 million of bids outstanding. Of the $65.3 million of backlog under contract, the Debtors expect $2.0 million to be completed in 2020. The Debtors’ backlog estimates represent those projects for which a customer has executed a contract or signed a binding letter of award, which can vary significantly from time to time, particularly if the backlog is made up of multi–year contracts with some of the Debtors’ more significant customers.

| B. | The Debtors’ History |

The Debtors’ business was started in 2006 in Peru as Exploración Sudamericana (South American Exploration), where their operations were focused until their expansion into Colombia in 2008. In 2010, the Debtors further expanded with the establishment of operations in Papua New Guinea and the opening of offices in Port Moresby, Papua New Guinea and Brisbane, Australia. In 2011, South American Exploration changed its name to SAExploration, incorporated in Delaware, and, in the same year, established seismic operations in North America with the acquisitions of Datum Exploration in Calgary, Canada and Northern Exploration Services in Anchorage, Alaska. In 2013, a business combination with a blank check company under the name Trio Merger Corp. was consummated in which SAE Holdings became a publicly listed company on the NASDAQ Capital Market.

The Debtors’ most recent material acquisitions and divestitures are highlighted below.

| 1. | Geokinetics Assets |

On July 2018, the Debtors acquired certain assets, including accounts receivable, equipment, certain contracts, certain tax assets, inventory, certain intellectual property, and other assets related to the Debtors’ geophysical services business specializing in acquiring and processing seismic data from Geokinetics, Inc. and certain of its subsidiaries in a transaction effected in Geokinetics’ bankruptcy proceedings (Case No. 18-33410 (DRJ), Bankr. S.D. Tex.) for aggregate cash consideration of $20 million.

| 2. | Australia Assets |

In November 2019, SAE Holdings and certain of its non-domestic subsidiaries sold substantially all of the assets associated with their business located in Australia to Terrex Pty Ltd. for (i) $6,000,000 (AUD) paid in cash on the closing date, (ii) $600,000 (AUD) payable no later than 30 business days after the closing date, and (iii) earn-out payments (the “Australia Earn-Out Amount”) based on the utilization of certain of the sold assets following the closing date in an amount of up to $3,000,000 (AUD). The Australia Earn-Out Amount will be paid over a two year period, capped at $1,500,000 (AUD) in each such year. Subject to certain conditions, the sellers will receive a minimum earn-out payment equal to $750,000 (AUD) in each earn-out year.

7

| 3. | Alaska Survey Data |

In January 2020, SAE Holdings, SAExploration, Inc. (“SAE Inc.”) and ASV sold seismic data and related assets for the Aklaq, Kuukpik and CRD Surveys to TGS-NOPEC Geophysical Company ASA (“TGS”) for $14.5 million at closing and earn-out payments of up to $5 million. In connection with the entry into the agreements with TGS to sell the seismic data, the sellers entered into an agreement pursuant to which ASV agreed that SAE Inc. will receive all of the proceeds paid or payable by TGS in consideration for the seismic data, which proceeds were credited by SAE Inc. towards outstanding amounts owed to it by ASV.

| 4. | The Debtors’ Business Operations |

The Debtors provide a full range of seismic data acquisition services, including in–field data processing and related logistics services. The Debtors currently provide their services on a proprietary basis to their customers and the seismic data acquired is owned by their customers once acquired, other than the multiclient seismic data library maintained by ASV. Their seismic data acquisition and logistics services include, (a) Program Design, Planning and Permitting, (b) Camp Services, (c) Survey and Drilling, (d) Recording, and (e) In-Field Data Processing.

The Debtors provide a full suite of onshore and offshore proprietary seismic data processing services. Seismic data are processed to produce an accurate image of the earth’s subsurface using proprietary computer software and internally developed technologies. Advanced signal processing of 2D, 3D, time–lapse 4D and multi–component seismic data acquired by the Debtors and other industry contractors, as well as reprocessing of previously acquired legacy data, provides clients with detailed subsurface information essential to reducing risk in their exploration and production activities.

ASV currently maintains a multiclient seismic data library of approximately 440 square kilometers of certain basins in Alaska which is available for future sale or license.

Due to the significant uncertainty in the outlook for oil and natural gas development as a result of the significant decline in oil prices since the beginning of 2020 due to the COVID–19 coronavirus pandemic and its impact on the worldwide economy and global demand for oil, the Debtors’ project visibility has continued to deteriorate as certain of their scheduled and anticipated projects have recently been cancelled or delayed and there is no assurance as to when they may be reinitiated or awarded, if at all. For example, on April 3, 2020, SAE Holdings was notified that its previously disclosed contracts for two joint 3D/4D Ocean Bottom Node Seismic Programs offshore West Africa have been terminated by the operator, and on June 11, 2020, SAE Holdings was notified that the second year of a three-year contract for onshore data acquisition services to be performed on the North Slope of Alaska was cancelled by the operator. The Debtors are unable to predict when market conditions may improve and worsening overall market conditions could result in additional reductions of backlog and bids outstanding.

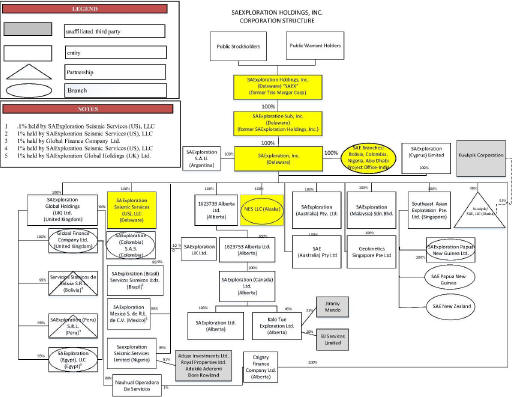

| C. | The Debtors’ Corporate Structure |

All of the Debtors other than SAE Holdings are direct or indirect subsidiaries of SAE Holdings. The following depicts the Debtors’ full corporate organization structure (the Debtors are highlighted in yellow):

8

SAExploration Holdings is the publicly traded parent holding company of the Debtors. SAExploration Sub, Inc. (“SAE Sub”) is 100% owned by SAE and is a holding company that owns 100% of SAE Inc. and was formerly SAExploration Holdings, Inc., which was the original entity that was acquired in 2013. SAE Inc. is the primary operating company of the Debtors. SAExploration Seismic Services (US), LLC (“Seismic Services”) is owned 100% by SAE Inc. and is the company that performs all land seismic acquisition services in the contiguous United States. NES, LLC (“NES”) is the entity that conducts the Debtors’ operations in Alaska. The non-Debtor entities are non-U.S. holding companies and operating entities.

In addition to the general operations and the separate entities owned by SAE Inc., SAE Inc. has four distinct “branches” within the SAE Inc. entity for its operations in Bolivia, Colombia, United Arab Emirates, and India (individually, as a “Branch” and collectively as, the “Branches”). The Branches are not separate legal entities, but the Debtors treat them as separate, in part, by maintaining separate bank accounts, identifying employees as employees of a certain Branch, and keeping separate books and records for each Branch, among other area.

| D. | Directors and Officers |

SAE Holdings’ current Board is composed of Michael Faust, L. Melvin Cooper, Gary Dalton, Alan Menkes and Jacob Mercer. With the exception of Mr. Faust, each member of the Board has been determined to be an independent director under NASDAQ standards.

9

SAE Holdings’ current executive management team is composed of Michael Faust—Chief Executive Officer and President; John Simmons—Vice President and Chief Financial Officer; Darin Silvernagle—Senior Vice President Marine; and David A. Rassin—Vice President, General Counsel, Secretary and Chief Compliance Officer.

The composition of the board of directors and identity of the officers of each Reorganized Debtor, as well as the nature of any compensation to be paid to any director or officer who is an Insider, will be disclosed in the Plan Supplement in accordance with section 1129(a)(5) of the Bankruptcy Code.

| E. | The Debtors’ Capital Structure |

| 1. | Prepetition Secured Indebtedness |

| (a) | Prepetition Credit Agreement |

SAE Inc. is the borrower under that certain Third Amended and Restated Credit and Security Agreement dated as of September 26, 2018 (as further amended, the “Prepetition Credit Agreement”) among SAE Holdings, SAE Sub, NES, Seismic Services, and SAExploration Acquisitions (U.S.), LLC, which was subsequently merged out of existence, as guarantors, Cantor Fitzgerald Securities as the administrative agent and the collateral agent, and the lenders party thereto. Borrowings under the Prepetition Credit Agreement are secured primarily by substantially all of the Debtors’ assets located in the United States, subject to certain exclusions. The Debtors may use borrowings under the Prepetition Credit Agreement for working capital purposes and general corporate purposes. The Prepetition Credit Agreement matures on August 1, 2021.

As of the Petition Date, $20.5 million in principal is outstanding under the Prepetition Credit Agreement and interest payments are due on the last day of each month. The interest rate for borrowings under the Prepetition Credit Agreement is 11.75% through and including August 2020 and 12.75% thereafter (the “Prepetition Credit Interest Rate”); however, pursuant to the Prepetition Credit Agreement and the ABL Forbearance Agreement (as defined below), while the Debtors are in default, the interest rate is two percentage points above the Prepetition Credit Interest Rate.

On April 13, 2020, the Debtors entered into a forbearance agreement with certain of the lenders of approximately 98% of the outstanding principal amount of the loans under the Prepetition Credit Agreement (the “ABL Forbearance Agreement”), pursuant to which the lenders agreed to refrain from exercising their rights and remedies under the Prepetition Credit Agreement with respect to certain existing defaults and other events of default that have occurred and are continuing. The ABL Forbearance Agreement was originally effective until the earlier to occur of (i) 5:00 p.m. (New York City time) on May 31, 2020 and (ii) the date the ABL Forbearance Agreement otherwise terminates in accordance with its terms. The May 31, 2020 deadline was ultimately extended to August 31, 2020. The ABL Forbearance Agreement terminated on the commencement of the Chapter 11 Cases.

As a result of existing events of default, the Debtors are unable to borrow additional amounts under the Prepetition Credit Agreement without the requisite approval of the lenders under the Prepetition Credit Agreement.

| (b) | Prepetition Term Loan |

On June 29, 2016, SAE Holdings entered into that certain Term Loan and Security Agreement (as amended or otherwise modified from time to time, the “Prepetition Term Loan Agreement”), among SAE Inc., SAE Sub, NES, and Seismic Services as guarantors, the lenders party thereto (the “Prepetition Term

10

Loan Lenders”) and Delaware Trust Company, as the collateral agent and as the administrative agent. Borrowings under the Prepetition Term Loan Agreement are secured primarily by substantially all of the collateral securing the obligations under the Prepetition Credit Agreement, subject to certain exclusions. Pursuant to the terms of the Prepetition Term Loan Agreement, the Debtors were able to draw upon $30 million at closing. The security interest in the collateral under the Prepetition Loan Agreement is junior to the security interest in the collateral securing the obligations under the Prepetition Credit Agreement, which priority is governed by the intercreditor agreements among the lenders.

As of the Petition Date, $29 million in principal is outstanding under the Prepetition Term Loan Agreement and interest payments are due on the last day of each month. Borrowings under the Prepetition Term Loan Agreement bear interest at a rate of 12.50% (the “Prepetition Term Loan Interest Rate”); however, pursuant to the Prepetition Term Loan Agreement and the Term Loan Forbearance Agreement (as defined below), while the Debtors are in default, the interest rate is two percentage points above the Prepetition Term Loan Interest Rate.

The Prepetition Term Loan Agreement matures in January 2021 and, to date, the Debtors have been unable to negotiate an extension of the maturity date with the Prepetition Term Loan Lenders. Absent the Restructuring, the Debtors would likely be unable to repay the Prepetition Term Loan when due in January 2021.

On April 13, 2020, the Debtors entered into a forbearance agreement with certain of the Prepetition Term Loan Lenders of approximately 82% of the outstanding principal amount of the term loans under the Prepetition Term Loan Agreement (the “Term Loan Forbearance Agreement”), pursuant to which the Prepetition Term Loan Lenders agreed to refrain from exercising their rights and remedies under the Prepetition Term Loan Agreement with respect to certain existing defaults and other events of default that have occurred and are continuing. The Term Loan Forbearance Agreement was originally effective until the earlier to occur of (i) 5:00 p.m. (New York City time) on May 31, 2020 and (ii) the date the Term Loan Forbearance Agreement otherwise terminates in accordance with its terms. The May 31, 2020 deadline was ultimately extended to August 31, 2020. The Term Loan Forbearance Agreement terminated on the commencement of the Chapter 11 Cases.

| (c) | Prepetition Convertible Notes |

On September 26, 2018, SAE Holdings issued $60 million in aggregate principal amount of 6.00% Senior Secured Convertible Notes due 2023 (the “Prepetition Convertible Notes”). The Prepetition Convertible Notes were issued under that certain Indenture dated as of September 26, 2018 (as amended, supplemented or otherwise modified from time to time, collectively the “Prepetition Indenture”), among SAE Holdings, as issuer, SAE Inc., SAE Sub, Seismic Services, NES and SAExploration Acquisitions (U.S.), LLC (which was subsequently merged out of existence), as guarantors, and Wilmington Savings Funds Society, FSB, as Trustee and Collateral Trustee thereunder. The Prepetition Convertible Notes are secured primarily by substantially all of the collateral securing the obligations under the Prepetition Credit Agreement, subject to certain exceptions. The security interest in the collateral under the Prepetition Indenture is junior to the security interest in the collateral securing the obligations under the Prepetition Credit Agreement and the Prepetition Term Loan Agreement.

As of the Petition Date, the outstanding principal on the Prepetition Convertible Notes was $60 million. Interest under the Prepetition Indenture is payable quarterly in arrears on March 15, June 15, September 15, and December 15 of each year. In 2018 and 2019, the Debtors recorded interest expense of $1.6 million and $6.2 million, respectively, related to the Prepetition Convertible Notes, of which $1.0 million and $2.6 million, respectively, related to contractual interest expense.

11

On April 13, 2020, the Debtors entered into a forbearance agreement with certain holders of approximately 98% of the outstanding principal amount of the Prepetition Convertible Notes (the “Notes Forbearance Agreement”), pursuant to which the holders of the Prepetition Convertible Notes agreed to refrain from exercising their rights and remedies under the Prepetition Indenture with respect to certain existing defaults and other events of default that have occurred and are continuing. The Notes Forbearance Agreement was originally effective until the earlier to occur of (i) 5:00 p.m. (New York City time) on May 31, 2020 and (ii) the date the Term Loan Forbearance Agreement otherwise terminates in accordance with its terms. The May 31, 2020 deadline was ultimately extended to August 31, 2020. The Notes Forbearance Agreement terminated on the commencement of the Chapter 11 cases.

| (d) | Equity Pledge |

Under the Prepetition Credit Agreement, Prepetition Term Loan Agreement, and the Prepetition Convertible Notes and subject to an intercreditor agreement, SAE pledged 65% of its equity interests in the following non-debtor affiliates: (a) SAExploration Mexico S. de R.L. de C.V.; (b) SAExploration (Australia) Pty. Ltd.; (c) SAExploration (Malaysia) Sdn. Bhd.; (d) Southeast Asian Exploration Pte. Ltd.; (e) Calgary Finance Company, Ltd.; (f) 1623739 Alberta Ltd.; (g) SAExploration (Brasil) Servicos Sismicos Ltda.; and (h) SAExploration Global Holdings (UK) Ltd. In addition, under the Prepetition Credit Agreement SAE Holdings pledged its 49% equity interest in the Kuukpik/SAExploration LLC joint venture.

| (e) | GTC Equipment Loan |

On November 18, 2019, SAE Inc. financed the purchase of a 30,000 single channel GCL system and certain related equipment from GTC, Inc. (“GTC”) pursuant to a secured promissory note payable to GTC in the original principal amount of $9,973,730 (the “GTC Equipment Loan”). The GTC Equipment Loan bears interest at a fixed rate equal to 7.0% per annum and matures on January 1, 2023. Principal and interest is due and payable in equal monthly payments of $307,959.83. As of the Petition Date, the outstanding principal balance of the GTC Equipment Loan is $8.2 million.

The GTC Equipment Loan is secured by a purchase money lien on and security interest in the 30,000 single channel GCL system and related equipment acquired by SAE Inc.

| 2. | Prepetition Unsecured Indebtedness |

| (a) | PPP Loan |

On May 11, 2020, SAE Inc. received an unsecured loan in the principal amount of approximately $6.8 million pursuant to the Paycheck Protection Program (the “PPP”) under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). The PPP loan matures in May 2022 and bears interest at a rate of 1.0% per annum. Principal and interest are payable monthly beginning seven months from the date of the PPP loan and may be prepaid at any time prior to maturity with no prepayment penalties.

Under the term of the CARES Act, PPP loan recipients can apply for and be granted forgiveness for all or a portion of the loan. Such forgiveness will be determined, subject to limitations, based on the use of loan proceeds for payment of payroll costs and any covered payments of mortgage interest, rent, and utilities. In the event the loan, or any portion thereof, is forgiven pursuant to the PPP, the amount forgiven is applied to outstanding principal. SAE Inc. intends to use the proceeds of the PPP Loan to maintain payroll and make lease, rent and utility payments. As of the Petition Date, approximately $6.8 million remains outstanding under the PPP loan and to the extent not forgiven, the PPP loan will be treated in Class 7 (PPP Loan Claims) under the Plan.

12

| (b) | Trade Creditors |

As of the Claims Bar Date, claimants had Filed unsecured claims in the total amount of approximately $2.2 million.

| 3. | Equity Ownership |

As of the Petition Date, SAE Holdings has 6,612,332 outstanding shares of common stock, par value $0.0001 per share. Since 2012, the common stock of SAE Holdings had been traded on the NASDAQ Capital Market (the “NASDAQ”). On June 15, 2020, the Debtors received written notice from the Listing Qualifications Department of the NASDAQ Stock Market that its staff had determined to suspend trading in the common stock of SAE Holdings at the opening of business on June 17, 2020 and to complete the delisting of the common stock of SAE Holdings by filing a Form 25-NSE with the SEC. The NASDAQ Stock Market reached its decision to delist SAE Holdings’ common stock from the NASDAQ pursuant to Listing Rule 5550(b)(1) because SAE Holdings had not complied with the minimum $2.5 million stockholders’ equity requirement for continued listing on the NASDAQ. Following the suspension of trading in SAE Holding’s common stock on the NASDAQ, the common stock of SAE Holdings began trading on electronic bulletin boards established for unlisted securities such as the OTC Bulletin Board or OTC Markets Pink Open Market.

As of the Petition Date, SAE Holdings had approximately 35.4 million warrants outstanding, which are potentially exercisable into approximately 2.3 million shares of common stock of SAE Holdings. The Prepetition Convertible Notes also currently have the right to convert to common stock of SAE Holdings.

| F. | The Debtors’ Alaska Tax Credits |

As of June 30, 2020, the Debtors had a $2.7 million tax credits receivable, net of an allowance of $27.7 million, related to the tax credits earned by ASV. The Debtors established the allowance due to the uncertainty of the future monetization of the tax credits and the potential for the Alaska Department of Revenue (the “DOR”) to disallow the tax credits as the Debtors’ management has determined that the costs submitted to the DOR by ASV did not reflect the affiliate status of ASV. The Debtors have classified this receivable as long–term because of the length of time the Debtors expect it will take to collect on it.

Falling oil prices have substantially reduced Alaska’s revenue from production taxes and other petroleum sources, resulting in appropriations to the oil and gas tax credit fund for purchase of tax credit certificates in the last several fiscal years at or below the amounts indicated by a statutory formula rather than amounts needed to pay for all the tax credit certificates in the queue for purchase. The Alaska budgets that passed in 2019 for fiscal year 2020, which ended June 30, 2020, and in 2020 for fiscal year 2021, which started July 1, 2020, had no appropriations to the oil and gas tax credit fund, but did include appropriations of an estimated $700 million for purchases of tax credit certificates through a bond program that would have authorized Alaska to issue bonds to finance the purchase of tax credit certificates. According to statements made by the DOR officials, that amount would have been enough to pay for the outstanding tax credit certificates awaiting purchase by the State of Alaska. However, the constitutionality of the legislation that set forth the bond program was challenged in Alaska state court, and on September 4, 2020 the Alaska Supreme Court ruled that the legislation violated the limitation placed on contracting debt under article IX, section 8 of the Alaska Constitution. Accordingly, the bond program would need to be approved by the people of Alaska either through a bond referendum or a constitutional amendment, and the Debtors do not believe that either is likely to happen, particularly in the current fiscal environment.

13

While the Debtors have continued to pursue other options to monetize the tax credit certificates, at this time the Debtors believe that the most likely path to monetize the tax credit certificates may be through appropriations to the oil and gas tax credit fund made by the Alaska Legislature as part of the budget process. However, there is great uncertainty as to if and when the Alaska Legislature will make such appropriations and how much those appropriations may be. Although the statute that governs purchase of tax credit certificates has a formula appropriation based on production tax revenues and oil prices, the funds remain subject to appropriation, the Alaska Legislature has not followed the formula for the last three years, and at least in recent years there has not been full consensus within the Legislature as to how the formula should be calculated. In addition, by statute, tax credit certificates submitted for purchase before 2017 will be purchased before tax credit certificates submitted for purchase in later years. The result is that approximately $290 million in tax credit certificates would need to be purchased before any payments will start being made on ASV’s tax credit certificates. Based on the DOR’s Spring 2020 Revenue Forecast, if the Alaska Legislature followed the DOR’s calculation, ASV would not receive any payments for a number of years — the annual formula appropriation would be in the range of $36-48 million for fiscal years 2021-2027, $61 million in fiscal year 2028 and $78 million in 2029. The next regular session of the Alaska Legislature will start in mid-January 2021.

In addition, the DOR is conducting an investigation with respect to the Debtors’ determination that ASV is a variable interest entity and related tax credit certificates. On October 27, 2020, the DOR filed a notice with the Court [Docket No. 263] notifying debtor, creditors, court, and others that the tax credits held by the Debtors in the Chapter 11 Cases may be valueless based on allegations of criminal fraud in obtaining the credits and that it is highly likely that the DOR will determine that the tax credits are valueless. The Debtors have been cooperating, and intend to continue to cooperate, with the DOR. The Debtors are currently unable to predict the eventual scope, duration or outcome with the DOR.

As a result of the above, the Debtors face several risks regarding the monetization of the tax credits, including uncertainty related to the DOR investigation, the appropriations to the oil and gas tax credit fund made by the Alaska Legislature and the timing of receipt of proceeds. While the Debtors believe that they will get paid some amount of the tax credits, they cannot predict when that will occur or how much, and accordingly the Liquidation Analysis attached hereto as Exhibit C and the Valuation Analysis attached hereto as Exhibit E do not attribute any value to the tax credits.

III. KEY EVENTS LEADING TO CHAPTER 11 CASES

From 2018 to 2020, the Debtors took the following actions, among others, to increase liquidity, reduce debt levels, and extend debt maturities:

| • | Consummated an exchange offer and consent solicitation pursuant to which the majority of the then outstanding amount of SAE Holding’s 10% Senior Secured Notes due 2019 and 10% Senior Notes due 2019 were exchanged for a combination of common stock, preferred stock and warrants, which reduced cash interest expense and the amount due at maturity; |

| • | Entered into the Prepetition Credit Agreement and issued the Prepetition Convertible Notes; |

| • | Sold the assets related to the Debtors’ Australia business for (i) $6,000,000 (AUD) paid in cash on the closing date, (ii) $600,000 (AUD) payable no later than 30 business days after the closing date, and (iii) earn-out payments based on the utilization of certain of the sold assets following the closing date in an amount of up to $3,000,000 (AUD), with a minimum earn-out payment of $750,000 (AUD) in each of the two earn-out years; |

| • | Sold the seismic data and related assets for the Aklaq, Kuukpik and CRD Surveys for $15 million and repaid $14.5 million of the amount due under the Prepetition Credit Agreement with the proceeds received from the sale of the seismic data; |

14

| • | Reduced full-time employees by 30% since year-end 2019; and |

| • | Applied for and received the approximately $6.8 million unsecured PPP Loan pursuant to the CARES Act. |

Although the Debtors generated net income and cash from operating activities in the first six months of 2020, they have reported recurring losses from operations and have not generated cash from operating activities for the six years ended December 31, 2019, and as of June 30, 2020, the Debtors had a stockholders’ deficit of $33.6 million. The Debtors anticipate negative cash flows from operating activities to begin to occur again in the second half of 2020 and continue for the foreseeable future due to, among other things, the significant uncertainty in the outlook for oil and natural gas development as a result of the significant decline in oil prices since the beginning of 2020 due to the COVID–19 coronavirus pandemic and its impact on the worldwide economy and global demand for oil. Due to these market conditions, certain of the Debtors’ scheduled or anticipated projects have been cancelled or delayed and there is no assurance as to when they may resume, if at all. For example, on April 3, 2020, SAE Holdings was notified that its previously disclosed contracts for two joint 3D/4D Ocean Bottom Node Seismic Programs offshore West Africa have been terminated by the operator, and on June 11, 2020, SAE Holdings was notified that the second year of a three-year contract for onshore data acquisition services to be performed on the North Slope of Alaska was cancelled by the operator.

As of the Petition Date, the Debtors had approximately $17.2 million of cash on hand and approximately $124.8 million aggregate principal amount of total debt (including finance leases) of which $115.3 million is classified as the current portion of long term debt. As of July 31, 2020, the Debtors’ assets total $68.1 million whereas the total current liabilities amount to $112 million.

Prior to the Petition Date, the Debtors were already in default under the Prepetition Credit Agreement, Prepetition Term Loan Agreement, and Prepetition Convertible Notes and had negotiated forbearance agreements with certain of the lenders under the Prepetition Credit Agreement and the Prepetition Term Loan Agreement, and certain of the holders of the Prepetition Convertible Notes. As a result of existing events of default occurring thereunder, the Debtors were unable to borrow additional amounts under the Prepetition Credit Agreement without the requisite approval of the lenders under the Prepetition Credit Agreement, which limited the Debtors’ ability to utilize the Prepetition Credit Agreement to fund continuing operations.

The Debtors’ Prepetition Term Loan Agreement matures in January 2021 and the Debtors were unable to negotiate an extension of the maturity date with the debt holders. As a result, the Debtors were unlikely to be able to repay the Prepetition Term Loan Agreement when due in January 2021.

As discussed above, SAE Holdings’ common stock was suspended from trading on the NASDAQ, which event constitutes a “fundamental change” under the terms of the Prepetition Indenture. Upon notice of such fundamental change to the holders of the Prepetition Convertible Notes, such holders would have the option to require SAE Holdings to repurchase for cash all of their Prepetition Convertible Notes at a repurchase price equal to 100% of the principal amount thereof, plus accrued and unpaid interest thereon to, but excluding, the repurchase date. On June 16, 2020, the Debtors and holders of 100% in aggregate face amount of the Prepetition Convertible Notes entered into a supplemental indenture to the Prepetition Indenture, which provided that a fundamental change resulting from the failure of SAE Holdings’ common stock to be listed or quoted on any of the NYSE American, The New York Stock Exchange, The NASDAQ Global Select Market, The NASDAQ Global Market, The NASDAQ Capital Market, the OTCQX Market or the OTCQB Market (or any of their respective successors) would not be deemed to have occurred as a result of such failure until the earlier of (i) August 31, 2020 or (ii) the termination date of the forbearance period set forth in the Notes Forbearance Agreement. The Debtors were unable to obtain a waiver of this fundamental change from the holders of the Prepetition Convertible Notes and, the Debtors did not expect that they would have sufficient funds to make any required repurchases of the Prepetition Convertible Notes.

15

Management, along with its legal and financial advisors, explored various strategic alternatives to address the Debtors’ capital structure. The Debtors also attempted to manage operating costs by actively reducing costs related to office leases, payroll, travel, and board fees and actively pursuing other cost-cutting measures, including costs related to office leases, maintaining servers, and travel, to maximize liquidity consistent with current industry market expectations. However, the Debtors were unable to negotiate an extension of the January 2021 maturity date of the Prepetition Term Loan Agreement or waivers of the events of default under the Prepetition Credit Agreement and the Prepetition Term Loan Agreement, and a cross default under the indenture governing the Prepetition Convertible Notes. As a result of such events of default, the Debtors were unable to borrow additional amounts under the Prepetition Credit Agreement without the requisite approval of the lenders under such credit facility. The Debtors were also unable to obtain additional financing.

Pursuant to the Plan negotiated with the Consenting Creditors, the Prepetition Credit Agreement Lenders will (i) exchange their debt for $20.5 million of the principal amount of the Second Lien Exit Facility, (ii) have the option to purchase pursuant to the Rights Offering up to their Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims and the aggregate amount of Allowed Term Loan Claims) of (a) the principal amount of the term loans under the First Lien Exit Facility and (b) the New First Lien Exit Facility Equity, and (iii) the payment in full in Cash on the Effective Date of all Accrued Interest as of the Effective Date. The Prepetition Term Loan Lenders will exchange their debt for 100% of the New Equity in New Parent, subject to dilution by the New First Lien Exit Facility Equity, the New Equity issued pursuant to the First Lien Exit Facility Put Option Premium and the awards related to New Equity issued under the Management Incentive Plan, and, the option to purchase their Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims and the aggregate amount of Allowed Term Loan Claims) of the principal amount of loans issued under the First Lien Exit Facility and the New First Lien Exit Facility Equity. If approved by this Court, the Debtors’ restructuring will significantly reduce the Debtors’ debt load and associated cash interest expense, and provide them with additional liquidity to fund the Debtors’ continued operations.

| A. | Restructuring Negotiations |

Given the uncertainty regarding the impact of the COVID-19 coronavirus pandemic and the Debtors’ unsustainable capital structure, the Board determined to retain Imperial Capital, LLC (“Imperial”) in April 2020 to analyze and evaluate various strategic alternatives to address its capital structure and to position the Debtors for future success.

| B. | The Restructuring Support Agreement |

After extensive good faith, arm’s-length negotiations, the Debtors, certain of the Prepetition Credit Agreement Lenders, Prepetition Term Loan Lenders, and Prepetition Convertible Noteholders were able to agree on the terms of a comprehensive restructuring transaction. The key terms of this transaction are embodied in the Plan attached as an exhibit to the Restructuring Support Agreement attached hereto as Exhibit B, which was signed on August 27, 2020, as amended on November 1, 2020 by the Debtors, Prepetition Credit Agreement Lenders holding approximately 95% of the face value of the Prepetition Credit Agreement Claims, certain Prepetition Term Loan Lenders holding approximately 77% of the face value of the Prepetition Term Loans, and Prepetition Convertible Noteholders holding approximately 95% of the face value of the Prepetition Convertible Notes.

16

The Debtors entered into the Restructuring Support Agreement only after a robust review process by the members of the Board. Based upon regular updates to the Board regarding the status of negotiations between the parties in the period leading up to the commencement of the Chapter 11 Cases, and upon rigorous review and negotiation of the Restructuring Support Agreement and the Plan by the Board, the Debtors determined that the terms of the Restructuring Support Agreement and the Plan represent the best transaction available and will maximize value to all stakeholders.

The Restructuring Support Agreement contemplates that certain restructuring transactions will be implemented in accordance with terms consistent with the Plan. The key elements of the Plan include:

| • | Prepetition Credit Agreement Lenders, Prepetition Term Loan Lenders and Prepetition Convertible Noteholders receive the New Equity, First Lien Exit Facility and Second Lien Exit Facility. The Prepetition Credit Agreement Lenders will exchange their debt for $20.5 million for (i) their Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims) of participation in the Second Lien Exit Facility in an amount equal to such Allowed Credit Agreement Claim; (ii) the right to purchase pursuant to the Rights Offering up to their Pro Rata share (measured by reference to the aggregate amount of Allowed Credit Agreement Claims and the aggregate amount of Allowed Term Loan Claims) of (A) the term loans under the First Lien Exit Facility and (B) the New First Lien Exit Facility Equity; and (iii) the payment in full in Cash on the Effective Date of all Accrued Interest as of the Effective Date. The Prepetition Term Loan Lenders will exchange their debt for (i) their Pro Rata share (measured by reference to the aggregate amount of Allowed Term Loan Claims) of 100% of the New Equity under the Plan, subject to dilution by the (a) New First Lien Exit Facility Equity, (b) New Equity issued pursuant to the First Lien Exit Facility Put Option Premium, and (c) awards related to the New Equity issued under the Management Incentive Plan, and (ii) the right to purchase pursuant to the Rights Offering up to their Pro Rata share (measured by reference to the aggregate amount of Allowed Term Loan Claims and the aggregate amount of Allowed Credit Agreement Claims) of (A) the term loans under the First Lien Exit Facility and (B) the New First Lien Exit Facility Equity. The Prepetition Convertible Noteholders Claims shall be discharged, canceled, and released, and extinguished as of the Effective Date and shall be of no further force or effect, and Holders of Convertible Notes Claims shall not receive any distribution on account of such Convertible Notes Claims. If approved by this Court, the Debtors’ restructuring will significantly reduce the Debtors’ debt load and associated cash interest expense, and provide them with additional liquidity to fund the Debtors’ continued operations. |

| • | Releases and Exculpation. The Plan includes mutual releases in favor of (a) the Debtors and certain of their related persons, professionals, and entities, and (b) the Consenting Creditors and their related persons, professionals, and entities. The Plan will also provide for the exculpation of the Debtors and certain of their related persons, professionals, and entities. |

The Restructuring Support Agreement includes the following key milestones that the Debtors have not met:

| (a) | if, by December 17, 2020, the Confirmation Order has not been entered by the Court; and |

| (b) | if, by December 31, 2020, the Effective Date shall not have occurred. |

17

It is important to note that the Debtors maintain a broad “fiduciary out” under the Restructuring Support Agreement. Specifically, Section 5(b)(ii) of the Restructuring Support Agreement provides that each Debtor may terminate its obligations thereunder if its board of directors (or board of managers, as applicable) determines that proceeding with the contemplated restructuring transactions “would be inconsistent with the exercise of its fiduciary duties.”

IV. DEVELOPMENTS AND ANTICIPATED EVENTS DURING THE CHAPTER 11 CASES

Under the Restructuring Support Agreement, the Debtors agreed to commence the Chapter 11 Cases no later than August 27, 2020 (the “Petition Date”).

| A. | First Day Pleadings |

On the Petition Date, along with their voluntary petitions for relief under chapter 11 of the Bankruptcy Code, the Debtors Filed several motions (the “First Day Pleadings”) designed to facilitate the administration of the Chapter 11 Cases and minimize disruption to the Debtors’ operations, by, among other things, easing the strain on the Debtors’ relationships with employees, vendors, insurers, and taxing authorities, among others, following the commencement of the Chapter 11 Cases. On August 28, 2020, the Debtors Filed the following First Day Pleadings:

| • | Debtors’ Emergency Motion for Joint Administration of These Chapter 11 Cases; |

| • | Debtors’ Notice of Designation as Complex Chapter 11 Bankruptcy Cases; |

| • | Debtors’ Emergency Motion to (I) Extend the Time to File Rule 2015.3 Financial Reports, (II) Authorize the Debtors to File a Consolidated List of Their 30 Largest Unsecured Creditors, (III) Waive the Requirement that Each Debtor File a List of Creditors, and (IV) Modifying the Requirement to File a List of Equity Security Holders, and (V) Granting Related Relief; |

| • | Debtors’ Emergency Application for Order Appointing Epiq Corporate Restructuring, LLC as Claims Noticing, Solicitation and Administrative Agent; |

| • | Debtors’ Emergency Motion for Interim and Final Orders Authorizing the Debtors to (I) Continue Operating Their Cash Management System, (II) Honor Certain Prepetition Obligations, (III) Maintain Existing Bank Accounts and Business Forms, and (IV) Granting Related Relief; |

| • | Debtors’ Emergency Motion for Entry of an Order (I) Authorizing Debtors to (A) Maintain Existing Insurance Policies and Pay All Insurance Obligations Thereunder, (B) Renew, Revise, Extend, Supplement, Change, or Enter into New Insurance Policies, (C) Maintain Existing Surety Bonds and Pay All Surety Bond Obligations thereunder, and (D) Renew, Revise, Extend, Supplement, Change, or Enter into New Surety Bonds, and (II) Directing Financial Institutions to Honor All Related Payment Requests; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection to the Prepetition Secured Parties, and (III) Modifying the Automatic Stay; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing the Payment of Claims of Critical Vendors, Foreign Vendors, 503(B)(9) Claimants, Statutory Lien Vendors and HSE Vendors, (II) Confirming Administrative Expense Priority of Outstanding Orders, and (III) Granting Related Relief; |

18

| • | Debtors’ Emergency Motion for an Order Authorizing (I) the Debtors to Pay Certain Prepetition Taxes and Related Obligations, and (II) Authorizing Financial Institutions to Receive, Process, Honor, and Pay All Checks Presented for Payment and to Honor all Funds Transfer Requests Related to Such Obligations; |

| • | Debtors’ Emergency Motion for Interim and Final Orders (I) Authorizing, but not Directing, the Debtors to Pay Prepetition Workforce Obligations; (II) Authorizing, but not Directing, the Debtors to Continue Certain Workforce Benefit Programs; and (III) Authorizing, but not Directing, Applicable Banks and Financial Institutions to Honor Prepetition Checks for Payment of the Prepetition Workforce Obligations; |

| • | Debtors’ Emergency Motion to (I) Approve Adequate Assurance of Payment to Utility Companies, (II) Establish Procedures to Resolve Objections by Utility Companies, and (III) Prohibit Utility Companies from Altering, Refusing, or Discontinuing Service; and |

| • | Debtors’ Emergency Motion for Entry of Interim and Final Orders Establishing Certain Notice and Hearing Procedures for Transfers of, and Declarations of Worthlessness with Respect to Certain Equity Interests of SAExploration Holdings, Inc. Nunc Pro Tunc to the Petition Date. |

| • | Debtors’ Emergency Motion for an Order (I) Authorizing the Debtors’ to Assume the Backstop Agreement and Obligations thereunder, and (II) Granting Related Relief. |

| • | Debtors’ Emergency Motion for Entry of an Order (I) Conditionally Approving Disclosure Statement, (II) Approving Procedures for Solicitation and Tabulation of Votes to Accept or Reject Plan, (III) Approving Notices; (IV) Approving Rights Offering Procedures; and (V) Granting Related Relief. |

The Court entered final orders on the First Day Pleadings on August 28, 2020, September 15, 2020, and September 17, 2020.

| B. | Other Administrative Motions and Retention Applications |

The Court has approved the retention of the following professionals to assist the Debtors in the Chapter 11 Cases:

| • | Porter Hedges LLP; |

| • | Imperial; and |

| • | Winter Harbor LLC. |

The Debtors also intend to File an application to employ Sidley Austin LLP under section 327(e) of the Bankruptcy Code to assist with matters related to the SEC.

19

| C. | Claims Bar Date |

The Court entered the Order (I) Setting Bar Dates for Filing Proofs of Claim, including Requests for Payment under Section 503(b)(9), (II) Establishing Amended Schedules Bar Date and Rejection Damages Bar Date, (III) Approving the Form of and Manner for Filing Proofs of Claim, including Section 503(b)(9) Requests, and (IV) Approving Notice of Bar Dates [Docket No. 166]. The order established procedures for Filing Proofs of Claim and set a Claims Bar Date of October 14, 2020 at 11:59 p.m. and is intended to streamline the claims process and eliminate the need for certain creditors to File Proofs of Claim.

| D. | Assumption and Rejection of Executory Contracts and Unexpired Leases |

Prior to the Petition Date and in the ordinary course of business, the Debtors entered into approximately 230 Executory Contracts and Unexpired Leases. The Debtors, with the assistance of their advisors, have reviewed and will continue to review the Executory Contracts and Unexpired Leases to identify contracts and leases to either assume or reject pursuant to sections 365 or 1123 of the Bankruptcy Code.

The Debtors will include information in the Plan Supplement regarding the assumption or rejection of their Executory Contracts and Unexpired Leases to be carried out as of the Effective Date, but may also elect to File additional discrete motions seeking to assume or reject various of the Debtors’ Executory Contracts and Unexpired Leases before such time.

| E. | Legal Matters |

| 1. | Litigation |