Attached files

| file | filename |

|---|---|

| 8-K - 8-K - METLIFE INC | met-20201104.htm |

| EX-99.2 - EX-99.2 - METLIFE INC | ex992qfsq320doc.htm |

| EX-99.1 - EX-99.1 - METLIFE INC | ex991earningsreleaseta.htm |

Exhibit 99.3 3Q20 Supplemental Slides1 John McCallion Chief Financial Officer 1 These slides highlight information in MetLife, Inc.'s earnings release, quarterly financial supplement and other prior public disclosures.

Table of contents Topic Page No. Net Income (Loss) to Adjusted Earnings 3 Actuarial Assumption Review 4 Adjusted Earnings ex. Total Notable Items by Segment 6 Variable Investment Income (VII) 7 Direct Expense Ratio 9 Cash & Capital 10 Appendix 11 2

Net income (loss) to adjusted earnings 3Q20 1 (post-tax) $ in millions $ Per Share Net Income (Loss) $633 $0.69 Less: Net Investment Gains (Losses) (16) (0.02) Net Derivative Gains (Losses)2 (459) (0.50) Investment Hedge Adjustments (181) (0.20) Actuarial Assumption Review2 (98) (0.11) Other2 (191) (0.21) Adjusted Earnings $1,578 $1.73 Less Notable Item: Actuarial Assumption Review (203) (0.22) Adjusted Earnings ex. Notable Item $1,781 $1.95 1 The per share data for each item is calculated on a standalone basis and may not sum to the total. 2 Net Derivative Gains (Losses) includes a $34 million post-tax gain associated with our Actuarial Assumption Review that is also included within the $98 million Actuarial Assumption Review line item. As a result, the Other line item reflects the removal of this gain being included within both categories. 3 See Appendix for non-GAAP financial information, definitions and/or reconciliations.

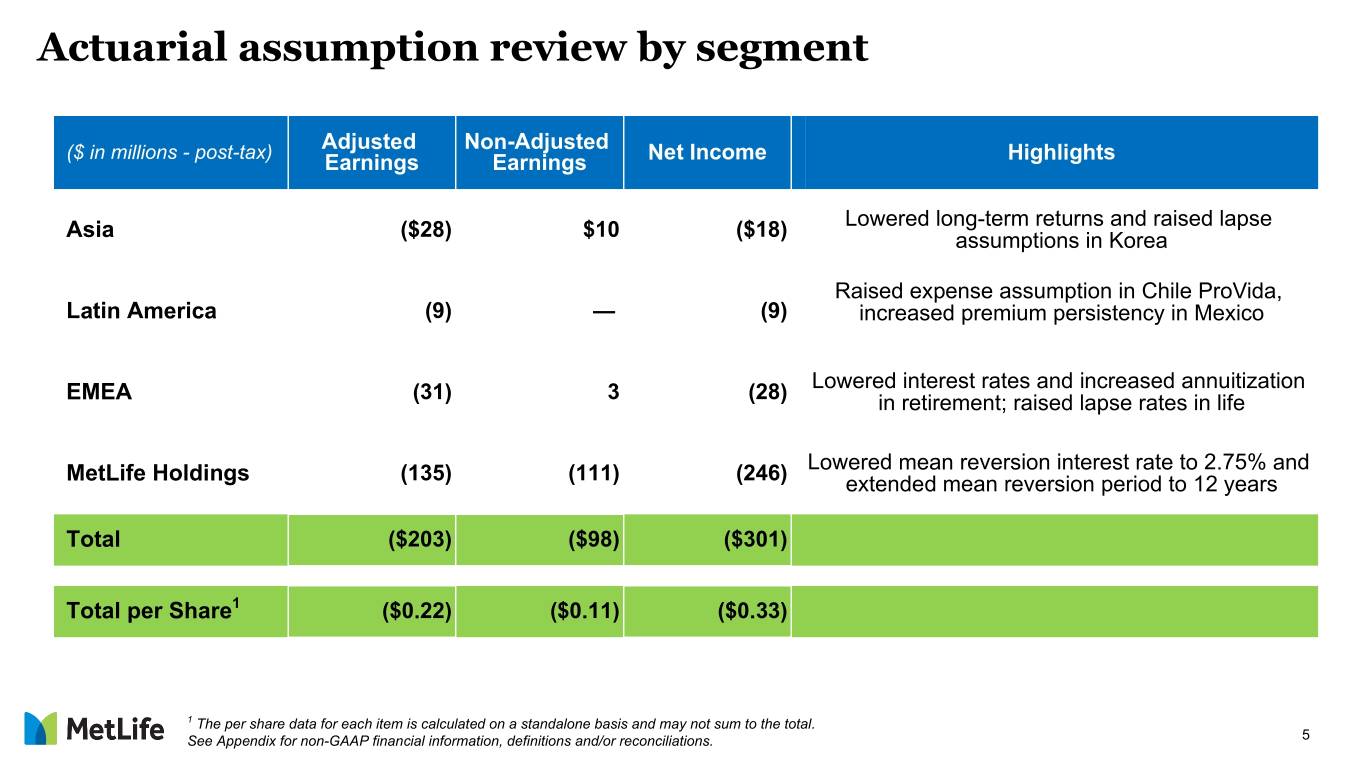

Assumption review reflects low interest rates for longer 3Q20 Actuarial Assumption Review Highlights $ in $ Per • Lowered U.S. mean reversion interest (post-tax) 1 millions Share rate from 3.75% to 2.75% Adjusted Earnings $(203) $(0.22) • Extended U.S. mean reversion Non-Adjusted Earnings (98) (0.11) period to 12 years Total Net Income Impact ($301) ($0.33) • Largest impact in MetLife Holdings 1 The per share data for each item is calculated on a standalone basis and may not sum to the total. See Appendix for non-GAAP financial information, definitions and/or reconciliations. 4

Actuarial assumption review by segment Adjusted Non-Adjusted ($ in millions - post-tax) Earnings Earnings Net Income Highlights Lowered long-term returns and raised lapse Asia ($28) $10 ($18) assumptions in Korea Raised expense assumption in Chile ProVida, Latin America (9) — (9) increased premium persistency in Mexico Lowered interest rates and increased annuitization EMEA (31) 3 (28) in retirement; raised lapse rates in life Lowered mean reversion interest rate to 2.75% and MetLife Holdings (135) (111) (246) extended mean reversion period to 12 years Total ($203) ($98) ($301) Total per Share1 ($0.22) ($0.11) ($0.33) 1 The per share data for each item is calculated on a standalone basis and may not sum to the total. See Appendix for non-GAAP financial information, definitions and/or reconciliations. 5

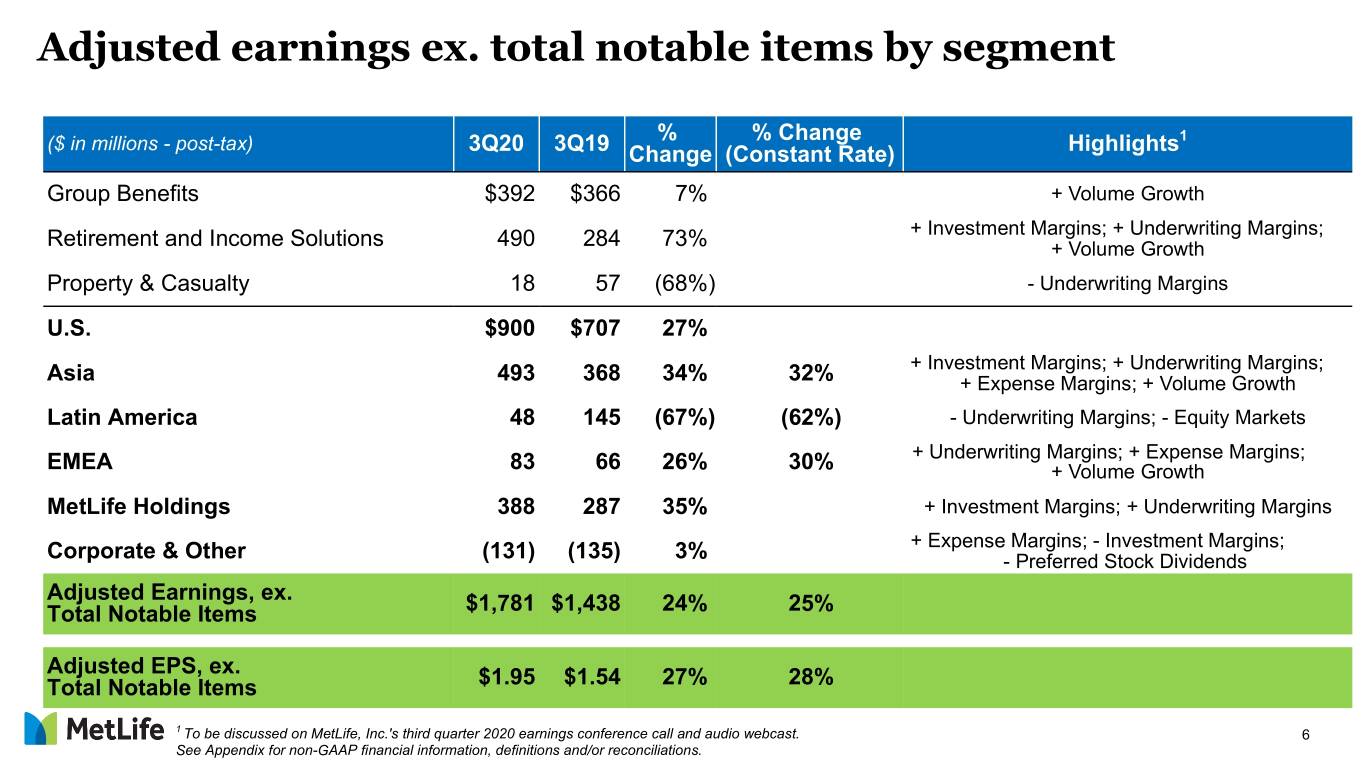

Adjusted earnings ex. total notable items by segment % % Change 1 ($ in millions - post-tax) 3Q20 3Q19 Change (Constant Rate) Highlights Group Benefits $392 $366 7% + Volume Growth + Investment Margins; + Underwriting Margins; Retirement and Income Solutions 490 284 73% + Volume Growth Property & Casualty 18 57 (68%) - Underwriting Margins U.S. $900 $707 27% + Investment Margins; + Underwriting Margins; Asia 493 368 34% 32% + Expense Margins; + Volume Growth Latin America 48 145 (67%) (62%) - Underwriting Margins; - Equity Markets + Underwriting Margins; + Expense Margins; EMEA 83 66 26% 30% + Volume Growth MetLife Holdings 388 287 35% + Investment Margins; + Underwriting Margins + Expense Margins; - Investment Margins; Corporate & Other (131) (135) 3% - Preferred Stock Dividends Adjusted Earnings, ex. Total Notable Items $1,781 $1,438 24% 25% Adjusted EPS, ex. Total Notable Items $1.95 $1.54 27% 28% 1 To be discussed on MetLife, Inc.'s third quarter 2020 earnings conference call and audio webcast. 6 See Appendix for non-GAAP financial information, definitions and/or reconciliations.

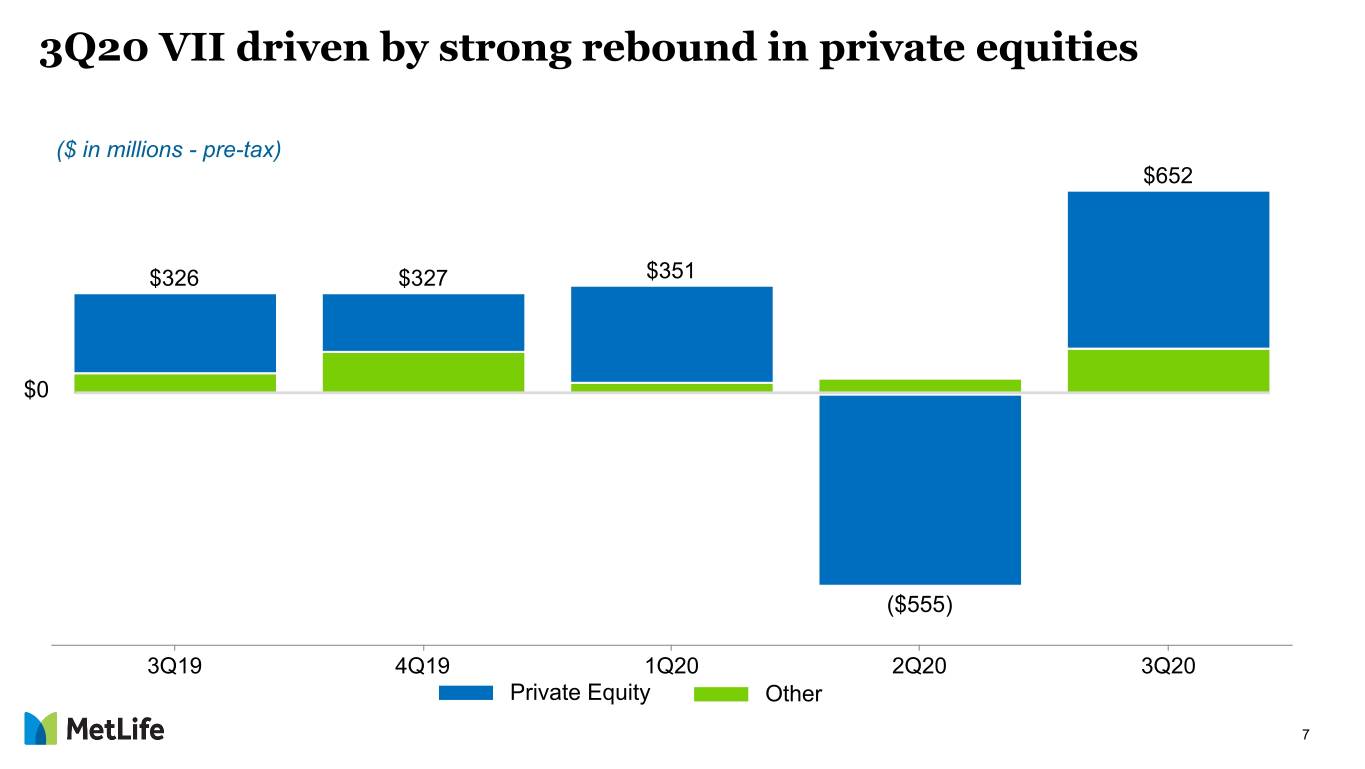

3Q20 VII driven by strong rebound in private equities ($ in millions - pre-tax) $652 $326 $327 $351 $0 ($555) 3Q19 4Q19 1Q20 2Q20 3Q20 Private Equity Other 7

3Q20 VII by segment ($ in millions - post-tax) 2Q20 3Q20 Group Benefits $3 $6 Retirement and Income Solutions (122) 164 Property & Casualty (9) 16 U.S. (128) 186 Asia (77) 148 Latin America (7) (3) EMEA — — MetLife Holdings (161) 172 Corporate & Other (65) 12 Total Variable Investment Income ($438) $515 8

Managing to ~12.3% direct expense ratio; 3Q20 ratio includes favorable items Direct Expense Ratio1 14.3% -170bps 13.3% 13.3% 12.9% 12.6% 12.4% 12.0% 11.4% 2015 2016 2017 2018 2019 1Q20 2Q20 3Q20 1 Direct expense ratio, excluding total notable items related to direct expenses and pension risk transfers (PRT). 9 See Appendix for non-GAAP financial information, definitions and/or reconciliations.

Cash & capital Holding Company Cash1 Capital $7.8B • Higher 3Q20 holding company cash driven by preferred stock issuance of $1 billion $6.6B • Share repurchases of $80 million in 3Q20 $5.3B • Expected total U.S. Statutory Adjusted Capital2 $4.2B $3.5B of ~$21 billion at Sept. 30, 2020, up 12% from year-end 2019 • Japan Solvency Margin ratio3 of 892% at June 30, 2020 3Q19 4Q19 1Q20 2Q20 3Q20 $3.0B to $4.0B Cash Buffer 1 At quarter-end. Includes cash and liquid assets. 2 Includes MetLife, Inc.'s principal U.S. insurance subsidiaries, excluding American Life Insurance Company. 3 Solvency ratio of MetLife's insurance subsidiary in Japan, which is calculated quarterly and does not reflect conditions and factors occurring after June 30, 2020. 10

Appendix

Cautionary Statement on Forward-Looking Statements The forward-looking statements in this presentation, such as “assumption,” "expect," "long-term," and “managing to" are based on assumptions and expectations that involve risks and uncertainties, including the “Risk Factors” MetLife, Inc. describes in its U.S. Securities and Exchange Commission filings. MetLife’s future results could differ, and it has no obligation to correct or update any of these statements. 12

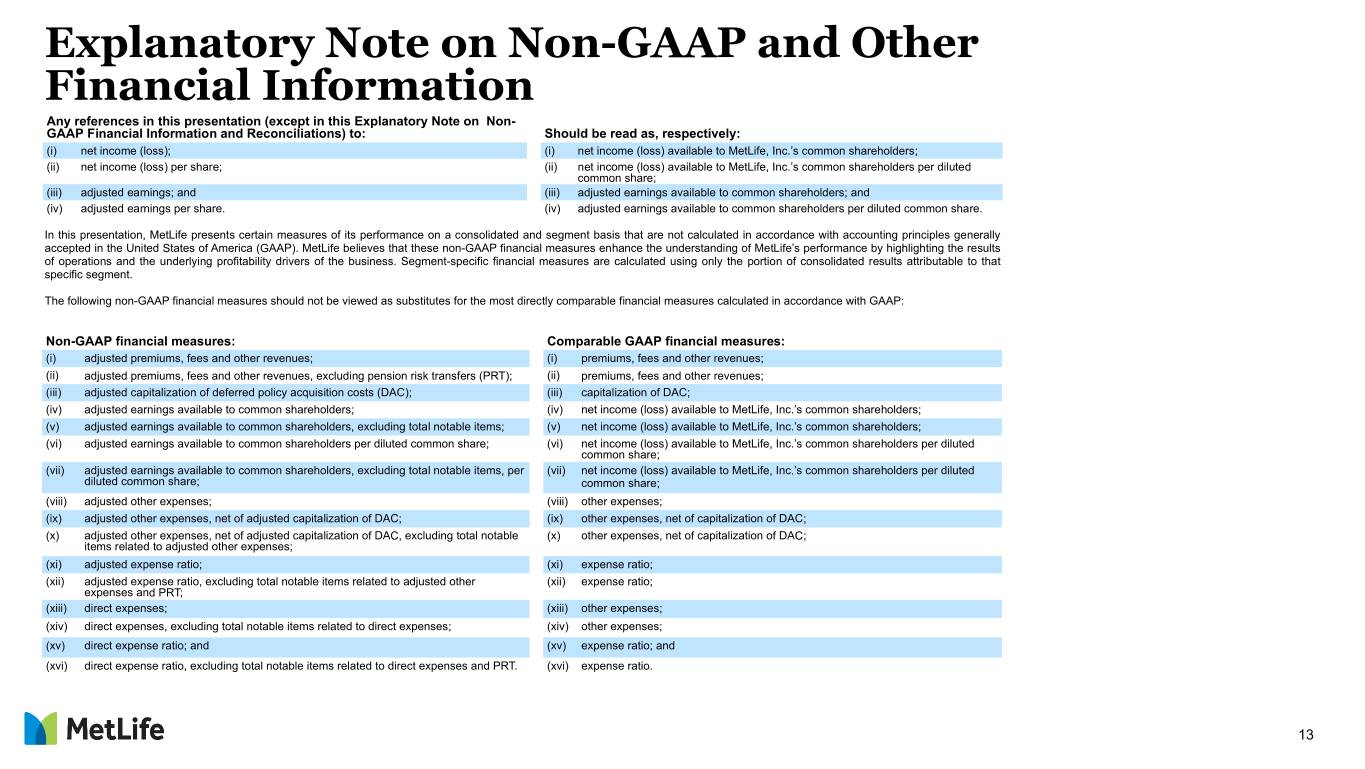

Explanatory Note on Non-GAAP and Other Financial Information Any references in this presentation (except in this Explanatory Note on Non- GAAP Financial Information and Reconciliations) to: Should be read as, respectively: (i) net income (loss); (i) net income (loss) available to MetLife, Inc.’s common shareholders; (ii) net income (loss) per share; (ii) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; (iii) adjusted earnings; and (iii) adjusted earnings available to common shareholders; and (iv) adjusted earnings per share. (iv) adjusted earnings available to common shareholders per diluted common share. In this presentation, MetLife presents certain measures of its performance on a consolidated and segment basis that are not calculated in accordance with accounting principles generally accepted in the United States of America (GAAP). MetLife believes that these non-GAAP financial measures enhance the understanding of MetLife’s performance by highlighting the results of operations and the underlying profitability drivers of the business. Segment-specific financial measures are calculated using only the portion of consolidated results attributable to that specific segment. The following non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP: Non-GAAP financial measures: Comparable GAAP financial measures: (i) adjusted premiums, fees and other revenues; (i) premiums, fees and other revenues; (ii) adjusted premiums, fees and other revenues, excluding pension risk transfers (PRT); (ii) premiums, fees and other revenues; (iii) adjusted capitalization of deferred policy acquisition costs (DAC); (iii) capitalization of DAC; (iv) adjusted earnings available to common shareholders; (iv) net income (loss) available to MetLife, Inc.’s common shareholders; (v) adjusted earnings available to common shareholders, excluding total notable items; (v) net income (loss) available to MetLife, Inc.’s common shareholders; (vi) adjusted earnings available to common shareholders per diluted common share; (vi) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; (vii) adjusted earnings available to common shareholders, excluding total notable items, per (vii) net income (loss) available to MetLife, Inc.’s common shareholders per diluted diluted common share; common share; (viii) adjusted other expenses; (viii) other expenses; (ix) adjusted other expenses, net of adjusted capitalization of DAC; (ix) other expenses, net of capitalization of DAC; (x) adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable (x) other expenses, net of capitalization of DAC; items related to adjusted other expenses; (xi) adjusted expense ratio; (xi) expense ratio; (xii) adjusted expense ratio, excluding total notable items related to adjusted other (xii) expense ratio; expenses and PRT; (xiii) direct expenses; (xiii) other expenses; (xiv) direct expenses, excluding total notable items related to direct expenses; (xiv) other expenses; (xv) direct expense ratio; and (xv) expense ratio; and (xvi) direct expense ratio, excluding total notable items related to direct expenses and PRT. (xvi) expense ratio. 13

Explanatory Note on Non-GAAP and Other Financial Information (Continued) Any of these financial measures shown on a constant currency basis reflect the impact of changes in foreign currency exchange rates and are calculated using the average foreign currency exchange rates for the most recent period and applied to the comparable prior period. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in this presentation and in this period’s quarterly financial supplement and earnings news release, which are available at www.metlife.com. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are not accessible on a forward-looking basis because we believe it is not possible without unreasonable effort to provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or outside the range and from period to period and may have a material impact on net income. MetLife’s definitions of non-GAAP and other financial measures discussed in this presentation may differ from those used by other companies: Adjusted earnings and related measures • adjusted earnings; • adjusted earnings available to common shareholders; • adjusted earnings available to common shareholders on a constant currency basis; • adjusted earnings available to common shareholders, excluding total notable items; • adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis; • adjusted earnings available to common shareholders per diluted common share; • adjusted earnings available to common shareholders on a constant currency basis per diluted common share; • adjusted earnings available to common shareholders, excluding total notable items per diluted common share; and • adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis per diluted common share. These measures are used by management to evaluate performance and allocate resources. Consistent with GAAP guidance for segment reporting, adjusted earnings and components of, or other financial measures based on, adjusted earnings are also MetLife’s GAAP measures of segment performance. Adjusted earnings and other financial measures based on adjusted earnings are also the measures by which MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans. Adjusted earnings and other financial measures based on adjusted earnings allow analysis of MetLife's performance relative to its business plan and facilitate comparisons to industry results. Adjusted earnings is defined as adjusted revenues less adjusted expenses, net of income tax. Adjusted loss is defined as negative adjusted earnings. Adjusted earnings available to common shareholders is defined as adjusted earnings less preferred stock dividends. Adjusted revenues and adjusted expenses These financial measures, along with the related adjusted premiums, fees and other revenues, focus on our primary businesses principally by excluding the impact of market volatility, which could distort trends, and revenues and costs related to non- core products and certain entities required to be consolidated under GAAP. Also, these measures exclude results of discontinued operations under GAAP and other businesses that have been or will be sold or exited by MetLife but do not meet the discontinued operations criteria under GAAP (Divested businesses). Divested businesses also include the net impact of transactions with exited businesses that have been eliminated in consolidation under GAAP and costs relating to businesses that have been or will be sold or exited by MetLife that do not meet the criteria to be included in results of discontinued operations under GAAP. In addition, for the year ended December 31, 2016, adjusted revenues and adjusted expenses exclude the financial impact of converting the Company’s Japan operations to calendar year-end reporting without retrospective application of this change to prior periods and is referred to as lag elimination. Adjusted revenues also excludes net investment gains (losses) (NIGL) and net derivative gains (losses) (NDGL). Adjusted expenses also excludes goodwill impairments. 14

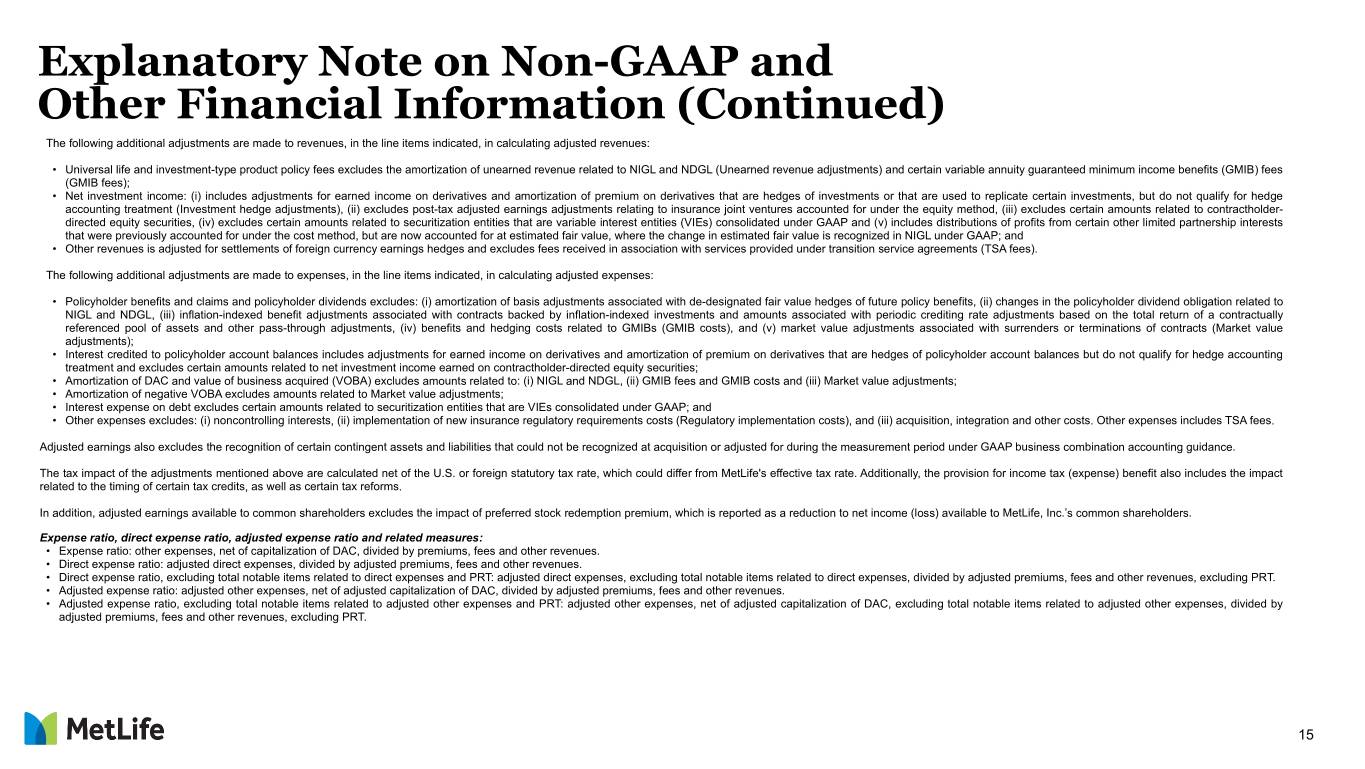

Explanatory Note on Non-GAAP and Other Financial Information (Continued) The following additional adjustments are made to revenues, in the line items indicated, in calculating adjusted revenues: • Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL (Unearned revenue adjustments) and certain variable annuity guaranteed minimum income benefits (GMIB) fees (GMIB fees); • Net investment income: (i) includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment (Investment hedge adjustments), (ii) excludes post-tax adjusted earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iii) excludes certain amounts related to contractholder- directed equity securities, (iv) excludes certain amounts related to securitization entities that are variable interest entities (VIEs) consolidated under GAAP and (v) includes distributions of profits from certain other limited partnership interests that were previously accounted for under the cost method, but are now accounted for at estimated fair value, where the change in estimated fair value is recognized in NIGL under GAAP; and • Other revenues is adjusted for settlements of foreign currency earnings hedges and excludes fees received in association with services provided under transition service agreements (TSA fees). The following additional adjustments are made to expenses, in the line items indicated, in calculating adjusted expenses: • Policyholder benefits and claims and policyholder dividends excludes: (i) amortization of basis adjustments associated with de-designated fair value hedges of future policy benefits, (ii) changes in the policyholder dividend obligation related to NIGL and NDGL, (iii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets and other pass-through adjustments, (iv) benefits and hedging costs related to GMIBs (GMIB costs), and (v) market value adjustments associated with surrenders or terminations of contracts (Market value adjustments); • Interest credited to policyholder account balances includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes certain amounts related to net investment income earned on contractholder-directed equity securities; • Amortization of DAC and value of business acquired (VOBA) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB fees and GMIB costs and (iii) Market value adjustments; • Amortization of negative VOBA excludes amounts related to Market value adjustments; • Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and • Other expenses excludes: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements costs (Regulatory implementation costs), and (iii) acquisition, integration and other costs. Other expenses includes TSA fees. Adjusted earnings also excludes the recognition of certain contingent assets and liabilities that could not be recognized at acquisition or adjusted for during the measurement period under GAAP business combination accounting guidance. The tax impact of the adjustments mentioned above are calculated net of the U.S. or foreign statutory tax rate, which could differ from MetLife's effective tax rate. Additionally, the provision for income tax (expense) benefit also includes the impact related to the timing of certain tax credits, as well as certain tax reforms. In addition, adjusted earnings available to common shareholders excludes the impact of preferred stock redemption premium, which is reported as a reduction to net income (loss) available to MetLife, Inc.’s common shareholders. Expense ratio, direct expense ratio, adjusted expense ratio and related measures: • Expense ratio: other expenses, net of capitalization of DAC, divided by premiums, fees and other revenues. • Direct expense ratio: adjusted direct expenses, divided by adjusted premiums, fees and other revenues. • Direct expense ratio, excluding total notable items related to direct expenses and PRT: adjusted direct expenses, excluding total notable items related to direct expenses, divided by adjusted premiums, fees and other revenues, excluding PRT. • Adjusted expense ratio: adjusted other expenses, net of adjusted capitalization of DAC, divided by adjusted premiums, fees and other revenues. • Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT: adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses, divided by adjusted premiums, fees and other revenues, excluding PRT. 15

Explanatory Note on Non-GAAP and Other Financial Information (Continued) Statistical sales information: • U.S.: ◦ Group Benefits: calculated using 10% of single premium deposits and 100% of annualized full-year premiums and fees from recurring premium policy sales of all products. ◦ Retirement and Income Solutions: calculated using 10% of single premium deposits and 100% of annualized full-year premiums and fees only from recurring premium policy sales of specialized benefit resources and corporate-owned life insurance. ◦ Property & Casualty: calculated based on first year direct written premium, net of cancellation and endorsement activity. • Latin America, Asia and EMEA: calculated using 10% of single-premium deposits (mainly from retirement products such as variable annuity, fixed annuity and pensions), 20% of single-premium deposits from credit insurance and 100% of annualized full-year premiums and fees from recurring-premium policy sales of all products (mainly from risk and protection products such as individual life, accident & health and group). Sales statistics do not correspond to revenues under GAAP, but are used as relevant measures of business activity. The following additional information is relevant to an understanding of MetLife’s performance results and outlook: • Volume growth, as discussed in the context of business growth, is the period over period percentage change in adjusted earnings available to common shareholders attributable to adjusted premiums, fees and other revenues and assets under management levels, applying a model in which certain margins and factors are held constant. The most significant of such items are underwriting margins, investment margins, changes in equity market performance, expense margins and the impact of changes in foreign currency exchange rates. • Notable items represent a positive (negative) impact to adjusted earnings available to common shareholders. Notable items reflect the unexpected impact of events that affect MetLife’s results, but that were unknown and that MetLife could not anticipate when it devised its business plan. Notable items also include certain items regardless of the extent anticipated in the business plan, to help investors have a better understanding of MetLife's results and to evaluate and forecast those results. 16

Reconciliation of Net Income (Loss) Available to MetLife, Inc.'s Common Shareholders to Adjusted Earnings Available to Common Shareholders 3Q20 3Q19 Earnings Per Earnings Per Weighted Weighted Average Average Common Common Share Share Diluted1 Diluted1 (In millions, except per share data) Net Income (loss) available to MetLife, Inc.'s common shareholders $ 633 $ 0.69 $ 2,152 $ 2.30 Adjustments from net income (loss) available to MetLife, Inc.'s common shareholders to adjusted earnings available to common shareholders: Less: Net investment gains (losses) (20) (0.02) 161 0.17 Less: Net derivative gains (losses) (581) (0.64) 1,254 1.34 Less: Other adjustments to net income (loss)2 (522) (0.57) (107) (0.11) Less: Provision for income tax (expense) benefit 195 0.21 (340) (0.36) Add: Net income (loss) attributable to noncontrolling interests 3 — 6 0.01 Add: Preferred stock redemption premium 14 0.02 — — Adjusted earnings available to common shareholders 1,578 1.73 1,190 1.27 Less: Total notable items (203) (0.22) (248) (0.26) Adjusted earnings available to common shareholders, excluding total notable items $ 1,781 $ 1.95 $ 1,438 $ 1.54 Adjusted earnings available to common shareholders on a constant currency basis $ 1,578 $ 1.73 $ 1,173 $ 1.25 Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis $ 1,781 $ 1.95 $ 1,421 $ 1.52 Weighted average common shares outstanding - diluted 913.7 936.4 1Adjusted earnings available to common shareholders, excluding total notable items, per diluted common share is calculated on a standalone basis and may not equal (i) adjusted earnings available to common shareholders per diluted common share, less (ii) total notable items per diluted common share. 17 2 Includes investment hedge adjustments.

Reconciliation to Adjusted Earnings Available to Common Shareholders, Excluding Total Notable Items 3Q20 Retirement and Group Income Property & Latin MetLife Corporate U.S.1 Benefits1 Solutions1 Casualty1 Asia America EMEA Holdings1 & Other1 (In millions) Adjusted earnings available to common shareholders $ 900 $ 392 $ 490 $ 18 $ 465 $ 39 $ 52 $ 253 $ (131) Less: Total notable items — — — — (28) (9) (31) (135) — Adjusted earnings available to common shareholders, excluding total notable items $ 900 $ 392 $ 490 $ 18 $ 493 $ 48 $ 83 $ 388 $ (131) Adjusted earnings available to common shareholders on a constant currency basis $ 465 $ 39 $ 52 Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis $ 493 $ 48 $ 83 3Q19 Retirement and Group Income Property & Latin MetLife Corporate U.S.1 Benefits1 Solutions1 Casualty1 Asia America EMEA Holdings1 & Other1 (In millions) Adjusted earnings available to common shareholders $ 707 $ 366 $ 284 $ 57 $ 349 $ 155 $ 53 $ 149 $ (223) Less: Total notable items — — — — (19) 10 (13) (138) (88) Adjusted earnings available to common shareholders, excluding total notable items $ 707 $ 366 $ 284 $ 57 $ 368 $ 145 $ 66 $ 287 $ (135) Adjusted earnings available to common shareholders on a constant currency basis $ 354 $ 135 $ 51 Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis $ 373 $ 125 $ 64 1Results on a constant currency basis are not included as constant currency impact is not significant. 18

Expense Detail and Ratios (In millions, except ratio data) 2015 2016 2017 2018 2019 Reconciliation of Capitalization of DAC to Adjusted Capitalization of DAC Capitalization of DAC $ (3,319) $ (3,152) $ (3,002) $ (3,254) $ (3,358) Less: Divested businesses and lag elimination1 120 (1) 34 (1) (20) Adjusted capitalization of DAC $ (3,439) $ (3,151) $ (3,036) $ (3,253) $ (3,338) Reconciliation of Other Expenses to Adjusted Other Expenses Other expenses $ 14,105 $ 13,295 $ 12,953 $ 12,927 $ 13,229 Less: Noncontrolling interests (13) (6) (12) (10) (15) Less: Regulatory implementation costs 2 1 — 11 18 Less: Acquisition, integration and other costs 28 64 65 24 44 Less: TSA fees — — — 305 246 Less: Divested businesses1 265 296 491 68 158 Adjusted other expenses $ 13,823 $ 12,940 $ 12,409 $ 12,529 $ 12,778 Other Detail and Ratios Other expenses $ 14,105 $ 13,295 $ 12,953 $ 12,927 $ 13,229 Capitalization of DAC (3,319) (3,152) (3,002) (3,254) (3,358) Other expenses, net of capitalization of DAC $ 10,786 $ 10,143 $ 9,951 $ 9,673 $ 9,871 Premiums, fees and other revenues $ 43,900 $ 44,370 $ 45,843 $ 51,222 $ 49,680 Expense ratio 24.6 % 22.9 % 21.7 % 18.9 % 19.9 % Direct expenses $ 6,444 $ 5,754 $ 6,006 $ 5,874 $ 5,977 Less: Total notable items related to direct expenses 362 79 296 214 338 Direct expenses, excluding total notable items related to direct expenses $ 6,082 $ 5,675 $ 5,710 $ 5,660 $ 5,639 Adjusted other expenses $ 13,823 $ 12,940 $ 12,409 $ 12,529 $ 12,778 Adjusted capitalization of DAC (3,439) (3,151) (3,036) (3,253) (3,338) Adjusted other expenses, net of adjusted capitalization of DAC $ 10,384 $ 9,789 $ 9,373 $ 9,276 $ 9,440 Less: Total notable items related to adjusted other expenses 362 507 377 214 338 Adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses $ 10,022 $ 9,282 $ 8,996 $ 9,062 $ 9,102 Adjusted premiums, fees and other revenues $ 44,329 $ 44,479 $ 46,200 $ 50,778 $ 49,144 Less: PRT 1,740 1,761 3,305 6,894 4,346 Adjusted premiums, fees and other revenues, excluding PRT $ 42,589 $ 42,718 $ 42,895 $ 43,884 $ 44,798 Direct expense ratio 14.5 % 12.9 % 13.0 % 11.6 % 12.2 % Direct expense ratio, excluding total notable items related to direct expenses and PRT 14.3 % 13.3 % 13.3 % 12.9 % 12.6 % Adjusted expense ratio 23.4 % 22.0 % 20.3 % 18.3 % 19.2 % Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT 23.5 % 21.7 % 21.0 % 20.6 % 20.3 % 1For the year ended December 31, 2016, Divested businesses and lag elimination includes adjustments related to the financial impact of converting MetLife’s 19 Japan operations to calendar year end reporting without retrospective application of this change to prior periods.

Expense Detail and Ratios (Continued) (In millions, except ratio data) 1Q20 2Q20 3Q20 Reconciliation of Capitalization of DAC to Adjusted Capitalization of DAC Capitalization of DAC $ (774) $ (671) $ (764) Less: Divested businesses (3) (2) — Adjusted capitalization of DAC $ (771) $ (669) $ (764) Reconciliation of Other Expenses to Adjusted Other Expenses Other expenses $ 3,047 $ 2,872 $ 2,954 Less: Noncontrolling interests (3) (7) (4) Less: Regulatory implementation costs 2 — 6 Less: Acquisition, integration and other costs 6 — 7 Less: TSA fees 42 39 39 Less: Divested businesses 19 23 7 Adjusted other expenses $ 2,981 $ 2,817 $ 2,899 Other Detail and Ratios Other expenses $ 3,047 $ 2,872 $ 2,954 Capitalization of DAC (774) (671) (764) Other expenses, net of capitalization of DAC $ 2,273 $ 2,201 $ 2,190 Premiums, fees and other revenues $ 11,336 $ 10,491 $ 11,887 Expense ratio 20.1 % 21.0 % 18.4 % Direct expenses $ 1,344 $ 1,287 $ 1,288 Less: Total notable items related to direct expenses — — — Direct expenses, excluding total notable items related to direct expenses $ 1,344 $ 1,287 $ 1,288 Adjusted other expenses $ 2,981 $ 2,817 $ 2,899 Adjusted capitalization of DAC (771) (669) (764) Adjusted other expenses, net of adjusted capitalization of DAC $ 2,210 $ 2,148 $ 2,135 Less: Total notable items related to adjusted other expenses — — — Adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses $ 2,210 $ 2,148 $ 2,135 Adjusted premiums, fees and other revenues $ 11,216 $ 10,401 $ 11,820 Less: PRT (9) (6) 487 Adjusted premiums, fees and other revenues, excluding PRT $ 11,225 $ 10,407 $ 11,333 Direct expense ratio 12.0 % 12.4 % 10.9 % Direct expense ratio, excluding total notable items related to direct expenses and PRT 12.0 % 12.4 % 11.4 % Adjusted expense ratio 19.7 % 20.7 % 18.1 % Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT 19.7 % 20.6 % 18.8 % 20

Premiums, Fees and Other Revenues (In millions) 2015 2016 2017 2018 2019 1Q20 2Q20 3Q20 Total Company - Premiums, Fees and Other Revenues Premiums, fees and other revenues $ 43,900 $ 44,370 $ 45,843 $ 51,222 $ 49,680 $ 11,336 $ 10,491 $ 11,887 Less: Unearned revenue adjustments 7 30 12 (7) 97 18 5 2 Less: GMIB fees 97 124 125 120 108 26 25 26 Less: Settlement of foreign currency earnings hedges (37) 4 22 19 9 — — — Less: TSA fees — — — 305 246 42 39 39 Less: Divested businesses and lag elimination1 (496) (267) (516) 7 76 34 21 — Adjusted premiums, fees and other revenues $ 44,329 $ 44,479 $ 46,200 $ 50,778 $ 49,144 $ 11,216 $ 10,401 $ 11,820 1For the year ended December 31, 2016, Divested businesses and lag elimination includes adjustments related to the financial impact of converting MetLife’s Japan operations to calendar year end reporting without retrospective application of this change to prior periods. 21

22