Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99.5 - GOLDRICH MINING CO | ex99-5.htm |

| EX-99 - EXHIBIT 99.4 - GOLDRICH MINING CO | ex99-4.htm |

| EX-99 - EXHIBIT 99.3 - GOLDRICH MINING CO | ex99-3.htm |

| EX-99 - EXHIBIT 99.2 - GOLDRICH MINING CO | ex99-2.htm |

| EX-99 - EXHIBIT 99.1 - GOLDRICH MINING CO | ex99-1.htm |

| EX-95 - EXHIBIT 95.1 - GOLDRICH MINING CO | ex95-1.htm |

| EX-32 - EXHIBIT 32.2 - GOLDRICH MINING CO | ex32-2.htm |

| EX-32 - EXHIBIT 32.1 - GOLDRICH MINING CO | ex32-1.htm |

| EX-31 - EXHIBIT 31.2 - GOLDRICH MINING CO | ex31-2.htm |

| EX-31 - EXHIBIT 31.1 - GOLDRICH MINING CO | ex31-1.htm |

| EX-21 - EXHIBIT 21 - GOLDRICH MINING CO | ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019 | ||

OR | ||

o |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-06412

Goldrich Mining Company

(Exact name of registrant as specified in its charter)

Alaska |

| 91-0742812 |

(State of other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

2607 Southeast Blvd., Suite B211 |

|

|

Spokane, Washington |

| 99223-4942 |

(Address of principal executive offices) |

| (Zip Code) |

(509) 535-7367

(Registrant’s Telephone Number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.10

(Tile of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o Nox

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and such files).

Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

| Accelerated filer | o |

Non-accelerated filer x |

| Smaller reporting company | x |

|

| Emerging Growth Company | o |

In an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o Nox

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $ 639,421 as of June 30, 2019

The number of shares of the Registrant’s Common Stock outstanding as of November 4, 2020 was 167,926,376.

Documents Incorporated by Reference: None

1

GOLDRICH MINING COMPANY

FORM 10-K

December 31, 2019

ITEM 1B. UNRESOLVED STAFF COMMENTS21

ITEM 4. MINE SAFETY DISCLOSURES40

ITEM 6. SELECTED FINANCIAL DATA43

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS43

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK48

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA49

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE78

ITEM 9A. CONTROLS AND PROCEDURES78

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE80

ITEM 11. EXECUTIVE COMPENSATION87

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE92

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES93

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES94

2

COVID-19

Subsequent to the close of the year ended on December 31, 2019, in March 2020, COVID-19 was declared a pandemic by the World Health Organization and the Centers for Disease Control and Prevention. Its rapid spread around the world and throughout the United States prompted many countries, including the United States, to institute restrictions on travel, public gatherings and certain business operations. These restrictions significantly disrupted economic activity in Goldrich’s business, as manifested in:

·the inability of Company management, geologic professionals and contractors to travel to the Company’s Alaska property to engage in any meaningful field work,

·restrictions placed on face-to-face meetings with staff, members of the Board of Directors and other direct stakeholders to smoothly conduct Company business, and

·a general slowdown in capital markets and investor activities in the Company’s industry as it conducted ongoing, and subdued capital-raising activities,

As of December 31, 2019, there was no disruption or impact to the Company’s financial statements. Since December 31, 2019, due to the arbitration proceedings (as described herein) and limited cash availability, the Company has been largely inactive at its Chandalar property. However, if the severity of the economic disruptions increase as the duration of the COVID-19 pandemic continues beyond the Company’s current inactive period, anticipated to end in the late winter/early spring of 2021, the negative financial impact due to limitation in conducting geologic field work and exploration activities could be significantly greater in future periods.

In addition, the economic disruptions caused by COVID-19 could also adversely impact the impairment risks for certain long-lived assets and equity method investments. Goldrich evaluated these impairment considerations and determined that no such impairments occurred as of December 31, 2019.

As of December 31, 2019, Goldrich’s available capital was approximately $1,300 and as of September 30, 2020 its available capital was approximately $18,000. Management believes the Company will need additional capital resources under new or existing credit facilities and operating agreements. To the extent that future access to the capital markets or the cost of funding is adversely affected by COVID-19, the Company may need to consider alternative sources of funding for operations and working capital, which may adversely impact future results of operations, financial condition, and cash flows.

In March 2020, President Trump signed into law legislation referred to as the "Coronavirus Aid, Relief, and Economic Security Act" (the CARES Act). The CARES Act includes tax relief provisions such as: (a) an Alternative Minimum Tax (AMT) Credit Refund, (b) a 5-year net operating losses (NOL) carryback from years 2018-2020 and (c) delayed payment of employer payroll taxes. As of December 31, 2019, Goldrich had approximately $42.8 million in NOL’s, which cannot be carried back to prior years to generate tax refunds, since no tax has been paid in those years by the Company.

The Company is taking steps to mitigate the potential risks to suppliers and employees posed by the spread of COVID-19. The Company has implemented work from home policies where appropriate. The Company will continue to monitor developments affecting both their workforce and contractors, and will take additional precautions that management determines are necessary in order to mitigate the impacts. There has been no material adverse impact to the Company’s business operations due to remote work. Despite efforts to manage these impacts to the Company, the ultimate impact of COVID-19 also depends on factors beyond management’s knowledge or control, including the duration and severity of this outbreak as well as third-party actions taken to contain its spread and mitigate its public health effects. Therefore, management cannot estimate the potential future impact to financial position, results of operations and cash flows, but the impacts could be material.

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include but are not limited to:

·estimates of mineralized material;

·our anticipated results and developments in future periods;

·statements regarding our exploration plans at our Chandalar property;

·statements regarding our plans to finance our operations;

·statements regarding future costs and expenditures;

·statements regarding our anticipated plan of operation; and

·other matters that may occur in the future.

These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might”, “should” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

·risks related to our ability to continue as a going concern being in doubt;

·risks related to our history of losses;

·risks related to our outstanding gold forward sales contracts and notes;

·risks related to need to raise additional capital to fund our exploration and, if warranted, development and production programs;

·risks related to our property not having any proven or probable reserves;

·risk related to our limited history of commercial production;

·risk related to operating a mine;

·risk related to accurately forecasting, extraction and production;

·risks related to our dependence on a single property – the Chandalar property;

·risks related to climate and location restricting our exploration and, if warranted, development and production activities;

·risks related to our mineralization estimates being based on limited drilling data;

·risks related to our exploration activities not being commercially successful;

·risks related to actual capital costs, production or economic return being different than projected;

·risk related to our joint venture arrangements;

·risks related to unfavorable outcomes of the joint venture arbitration proceedings;

·risks related to mineral exploration;

·risks related to increased costs;

·risks related to a shortage of equipment and supplies;

·risk related to fluctuations in gold prices;

·risks related to title to our properties being defective;

·risks related to title to our properties being subject to claims;

·risks related to estimates of mineralized material;

·risks related to government regulation;

·risks related to environmental laws and regulation;

·risks related to land reclamation requirements;

4

·risks related to future legislation regarding mining laws;

·risks related to future legislation regarding climate change;

·risks related to our lack of insurance coverage for all risks;

·risks related to competition in the mining industry;

·risks related to our dependence on key personnel;

·risks related to our executive offices not dedicating 100% of their time to our company;

·risks related to potential conflicts of interest with our directors and executive officers;

·risks related to market conditions;

·risks related to our disclosure controls and procedures; and

·risks related to our shares of common stock.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under “Item 1. Business,” “Item 1A. Risk Factors,” and “Item 7. Management’s Discussion and Analysis of Results of Operation” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

5

As used in herein, the terms “Goldrich,” the “Company,” “we,” “us,” and “our” refer to Goldrich Mining Company.

We are a minerals company in the business of acquiring and advancing mineral properties to the discovery point, where we believe maximum shareholder returns can be realized. Although we have conducted limited extraction of gold on one of our gold prospects, Goldrich is an exploration stage company as defined by the U.S. Securities and Exchange Commission (“SEC”) under its Industry Guide 7 (“SEC Industry Guide 7”), although over $50 million in revenue from gold has been produced from its claims since 2015.

Incorporated in 1959, Goldrich Mining Company (OTCBB trading symbol “GRMC”) has been a publicly traded company since October 9, 1970. Our executive offices are located at 2607 Southeast Blvd, Suite B211, Spokane, WA 99223, and our phone number there is (509) 535-7367. Our website address is www.goldrichmining.com. Information contained on our website is not part of this annual report.

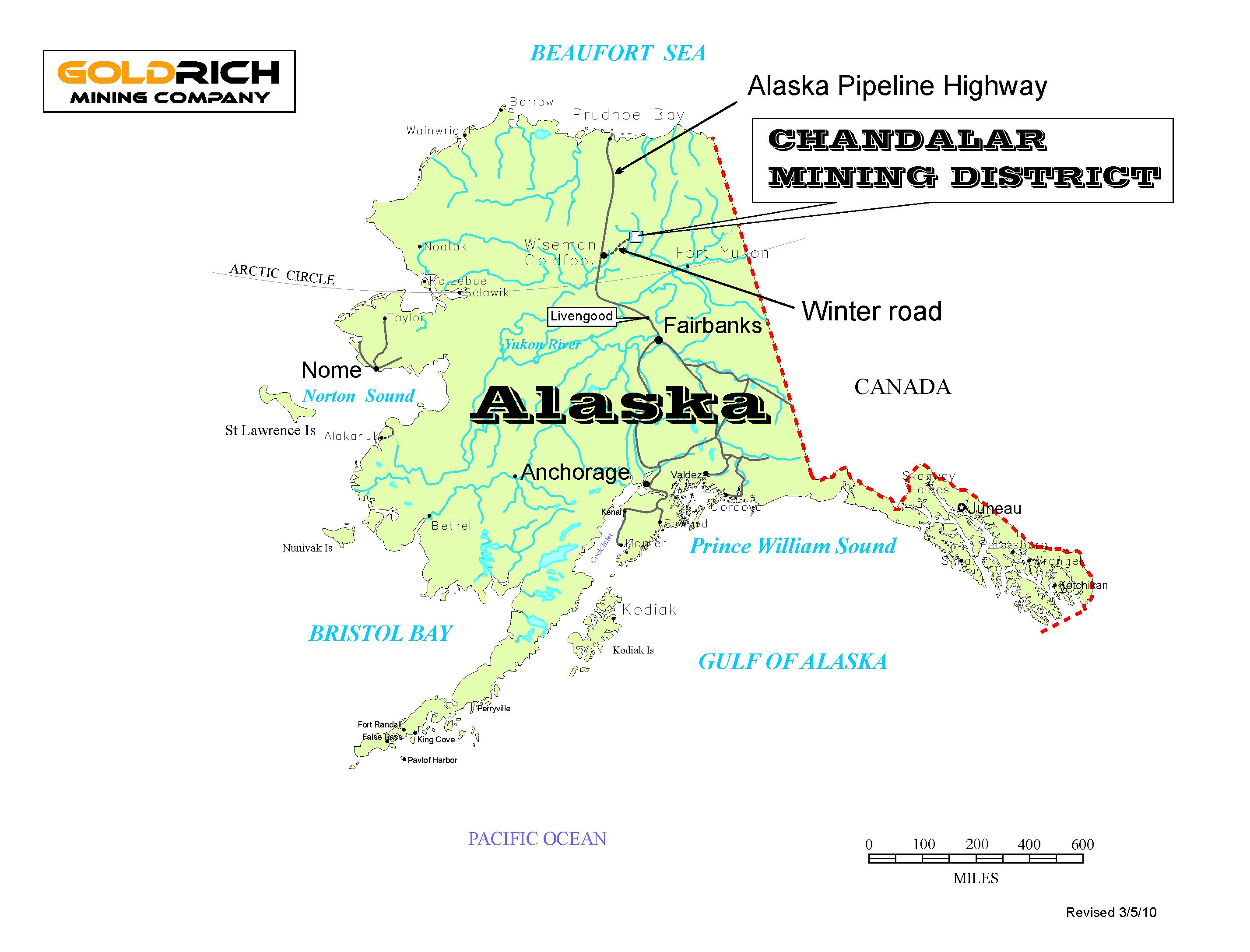

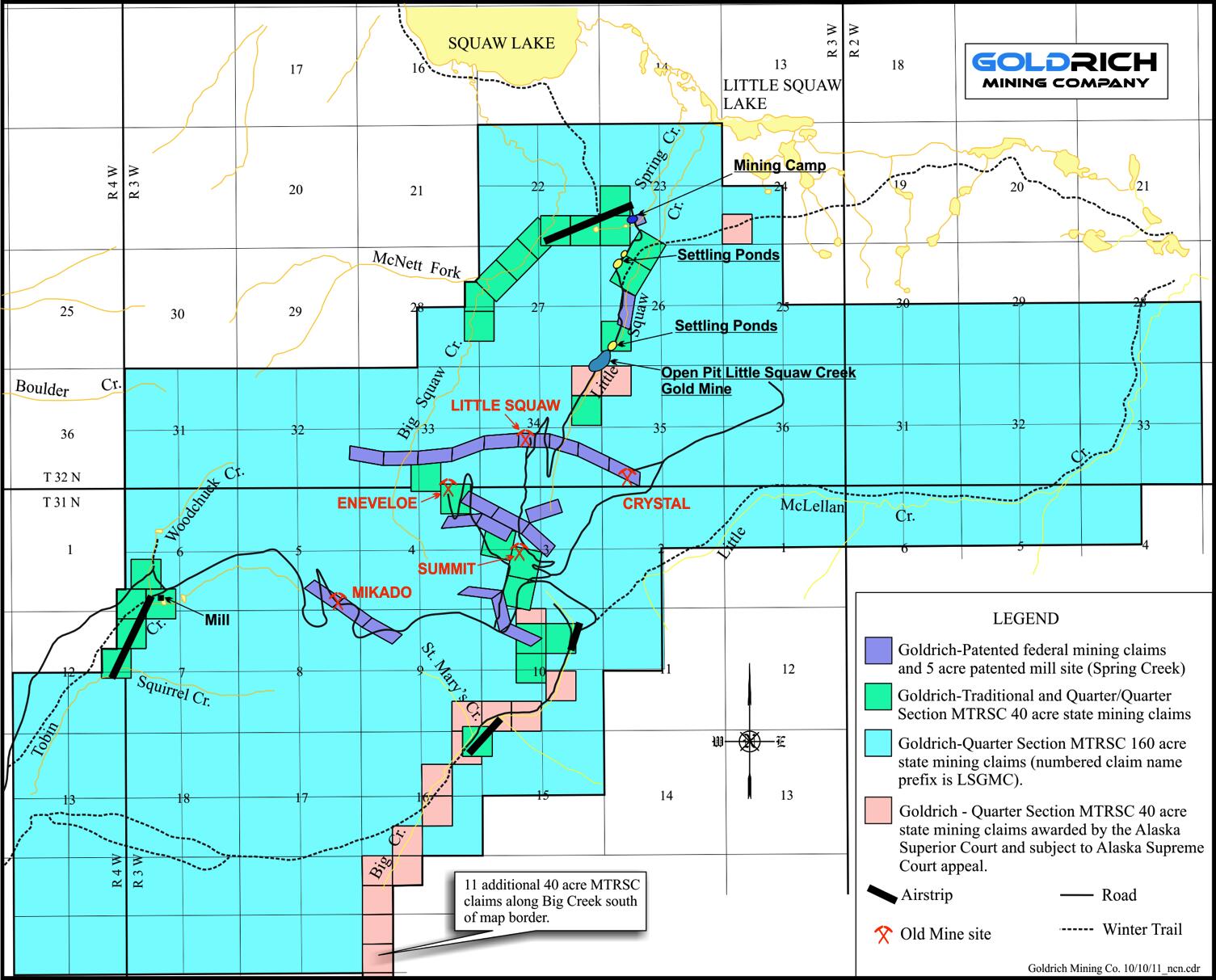

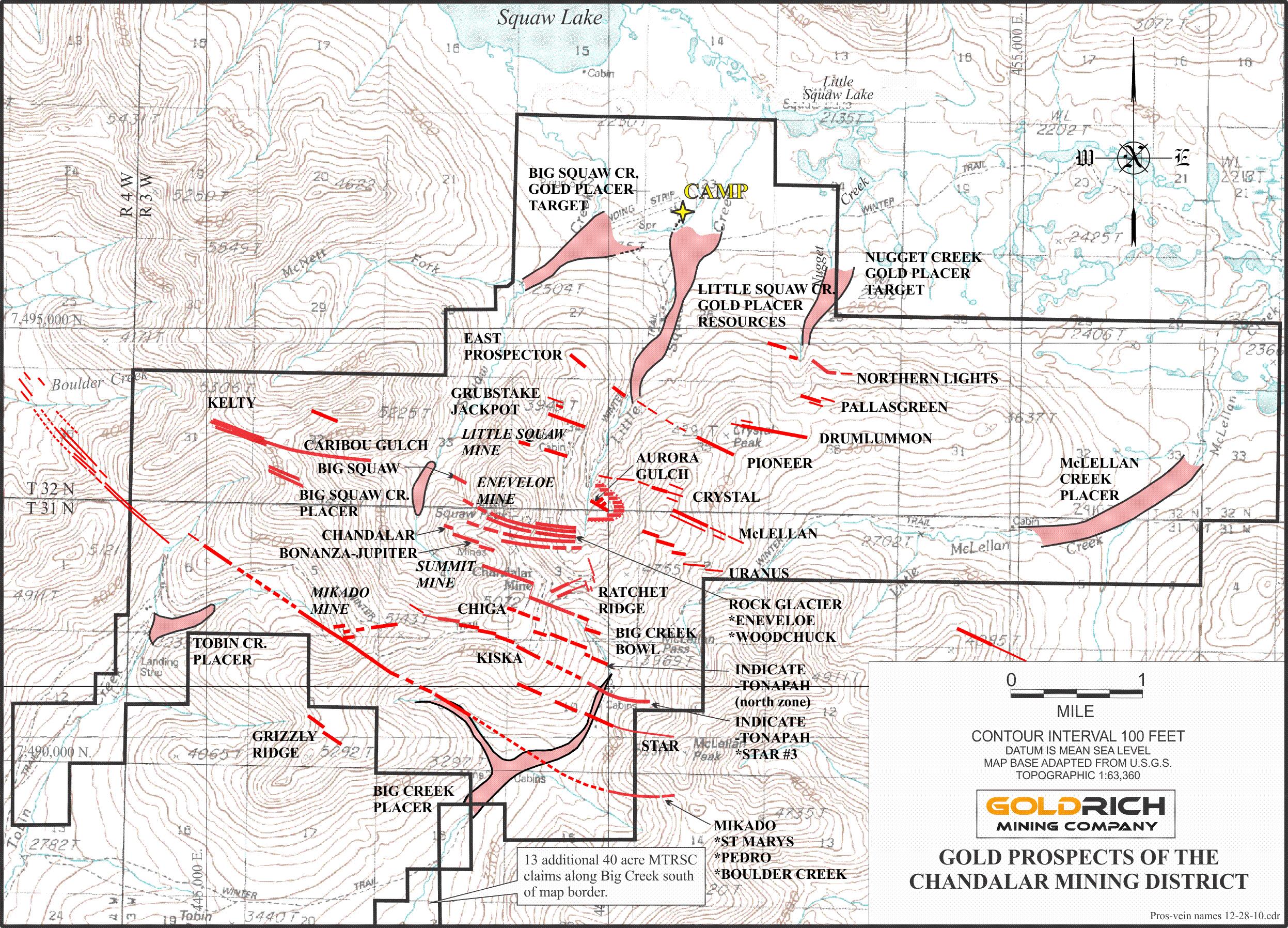

At this time, our major mineral exploration prospects are contained within our wholly-owned Chandalar property, located approximately 190 air miles north of Fairbanks, Alaska. The property is largely on land owned by the State of Alaska, which is one of the active and highly ranked mining jurisdictions in the world. Both patented federal mining claims and Alaska state mining claims provide exploration and mining rights to lode and placer mineral deposits. A more detailed description of our Chandalar property is set forth in “Item 2 – Properties” of this Annual Report.

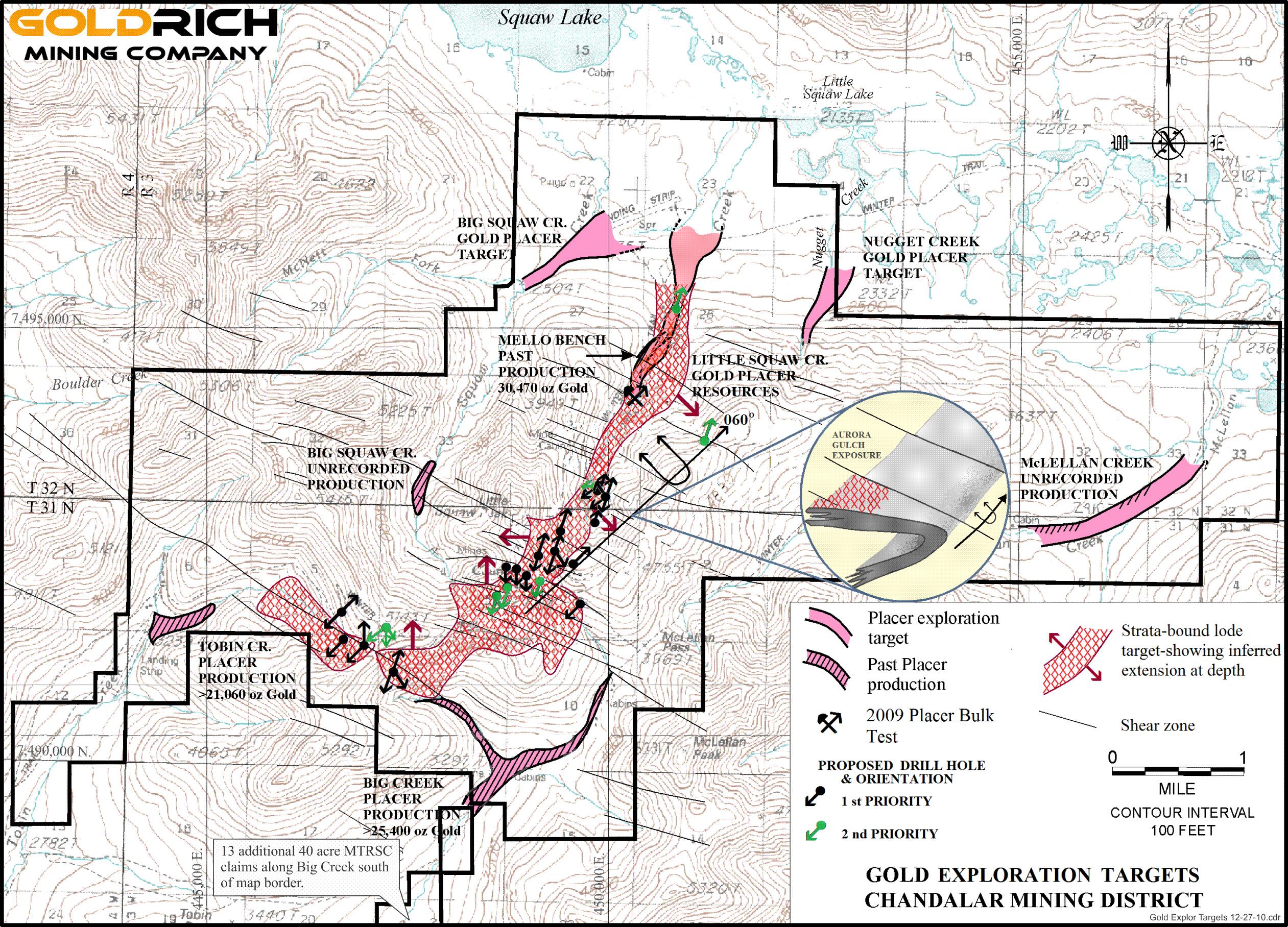

The Chandalar property contains both our Chandalar hard-rock (lode) gold project, our primary target, and the Chandalar alluvial gold mine. The area has a long prospecting and mining history dating to the discovery of placer gold deposits in 1905, soon followed by the discovery of more than 30 separate high-grade lode gold mineralization prospects. Over the next 80 years the lode gold mineralization occurrences were intermittently explored or mined by various small operators, but because of the district’s remote location the readily mineable alluvial gold deposits received the most attention.

Although there is a history of past lode and alluvial extraction on our Chandalar property, it currently does not contain any known proven or probable ore reserves as defined in SEC Industry Guide 7. The probability that ore reserves that meet SEC Industry Guide 7 guidelines will be discovered on an individual hard rock prospect at Chandalar cannot be determined at this time. We have however commissioned an independent engineering firm to complete a mining plan and initial assessment for the Company’s Chandalar placer mine, according to the new amendments adopted by the SEC to modernize the property disclosure requirements for mining registrants as codified in subpart 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended (“Subpart 1300”). The new disclosure requirements under Subpart 1300 will replace the SEC Industry Guide 7 and mining registrants are required to follow them beginning in fiscal years beginning on or after January 1, 2021. The new disclosure requirements under Subpart 1300 allow issuers to disclose inferred, indicated and measured resources as defined therein. Subject to the findings of Company’s currently commissioned initial assessment, we will decide if a preliminary feasibility study should also be prepared for the Chandalar placer mine. A preliminary feasibility study allows an issuer to disclose any proven or probable mineral reserves on a mineral property.

The ownership and management of Goldrich changed in 2003. Beginning in 2004, we ended a twenty-year hiatus of hard-rock exploration on the property and began employing modern exploration techniques. Our focus is two-fold:

(1) Continue exploration of our Chandalar property where we have discovered and identified drilling targets for a potentially large bulk tonnage hard-rock intrusion-related gold deposit.

(2) Continue gold extraction from the Chandalar placer gold deposit discovered on the property.

We have spent many millions of dollars in exploration and mining activities of our Chandalar property. Some of the

6

highlights include (see details of highlights in the Properties section below):

2012: As described below in Joint Venture Agreement, we signed an agreement with NyacAU to form a joint venture, Goldrich NyacAU Placer, LLC (“GNP”) for the purpose of mining the alluvial gold deposits within the bounds of our Chandalar property.

2013: Achievements included GNP’s mobilization of drilling equipment and plant setup, approval of permits to expand mining operations, significant infrastructure improvements and extraction of 680 ounces of fine gold.

2014: We conducted a property-wide airborne radiometric and magnetic survey to generate and further refine exploration targets for bulk-tonnage low-grade mineralization and possible deeper sources of intrusion-related mineralization. We also completed advanced petrographic studies of drill core samples from the Chandalar gold property. The new data refined the orogenic model that has historically guided exploration at Chandalar and redirected our future exploration for intrusion-related mineralization.

2015: We completed reclamation of mine waste road built in 2010 and received a confirmation of completion and satisfaction from the Army Corps of Engineers. GNP extracted approximately 3,600 ounces of fine gold.

2016: GNP extracted approximately 8,200 ounces of fine gold.

2017: We performed additional oxygen isotope studies to further confirm intrusion-related mineralization. In addition, GNP completed a sonic drill program and drilled 231 holes totaling 14,271 feet to further define the Chandalar placer deposit. GNP extracted approximately 12,300 ounces of fine gold.

2018: GNP extracted approximately 17,100 ounces of fine gold.

Although GNP extracted over 42,000 ounces of fine gold from 2013 to 2018, GNP failed to meet the minimum production requirements under the GNP Operating Agreement. Goldrich began arbitration proceedings against NyacAU and certain NyacAU related parties in 2017 (see Joint Venture Agreement and Arbitration below). GNP was dissolved in June 2019 and is in the process of liquidation. Except for equipment needed for reclamation, most of the heavy equipment and the wash plant were removed in March through mid-April 2019. There was no gold extracted in 2019. NyacAU is the holder of the mine permits and began reclamation of the mine in 2019. NyacAU is responsible for future reclamation costs. Goldrich hired an independent mining engineering firm in 2019 to formulate a mine plan and complete an initial assessment under Subpart 13000 to determine if Goldrich should pursue production at the placer mine. Any plan to continue future mining is contingent upon our success in raising sufficient capital to fund these activities or any portion of them (see Joint Venture Agreement below for details of the GNP joint venture, arbitration activities and the joint venture’s pending liquidation).

Concerning hard-rock exploration, although we are pleased with the progress that has been made, weak financial markets during the last several years have been an important factor affecting the level of our exploration activities. If the placer mine enters into commercial production (by Goldrich or a third-party operator), we look forward to potential internal cash flow and additional opportunities for financing that will give us a unique advantage for growth over other junior mining exploration companies; however, finances must be obtained before we can continue mining activities.

We also intend to list our shares on a recognized stock exchange in Canada in addition to maintaining our quotation on the OTCBB in the United States. We believe these factors will increase our access to financial markets and positively affect our ability to raise the funds necessary to add value to our property and increase shareholder value. Our main focus in the future will continue to be the exploration of the hard-rock targets of our Chandalar property as funds become available.

Competition

There is aggressive competition within the minerals industry to discover and acquire mineral properties considered to have commercial potential. We compete for the opportunity to participate in promising exploration projects with other entities. In addition, we compete with others in efforts to obtain financing to acquire and explore mineral properties,

7

acquire and utilize mineral exploration equipment and hire qualified mineral exploration personnel.

We may compete with other junior mining companies for mining claims in regions adjacent to our existing claims, or in other parts of the world should we dedicate resources to doing so in the future. These companies may be better capitalized than us and we may have difficulty in expanding our holdings through additional mining claims.

In competing for qualified mineral exploration personnel, we may be required to pay compensation or benefits relatively higher than those paid in the past, and the availability of qualified personnel may be limited in high-demand mining periods, such as have been experienced during the increased price of gold in recent years.

Employees

In October 2009, William Schara began employment as our President and Chief Executive Officer (“CEO”). We rely on consulting contracts for some of our management and administrative personnel needs, including for our Chief Financial Officer (“CFO”), Mr. Ted Sharp. The contract for Mr. Sharp expired on December 31, 2009, however, Mr. Sharp continues to provide services to the Company under the same terms provided in the contract. We employ individuals and contractors on a seasonal basis to conduct exploration, mining and other required company activities, mostly during the late spring through early fall months.

We currently have 2 full-time employees; our CEO and Controller. We had as many as 23 part-time employees and contractors during 2011, 5 part-time employees and contractors during 2012, and one employee at the mine site for logistics and other company activities during 2013, 2014, 2015, and 2017. In addition to the employees of Goldrich, GNP had as many as 10 employees during 2012, 46 employees during 2013, 10 employees during 2014, 67 employees during 2015, 50 employees during 2016, 63 employees during 2017, and 61 employees in 2018.

Seasons

We conduct exploration activities at Chandalar between late spring and early autumn. Access during that time is exclusively by airplane. All fuel is supplied to the campsite by air transport. Access during winter months is by ice road, snowmobile and ski-plane. All heavy supplies and equipment are brought in by trucking over the ice road from Coldfoot. Snow melt generally occurs toward the end of May, followed by an intensive, though short, 90-day growing season with 24 hours of daylight and daytime temperatures that range from 60° to 80° Fahrenheit. Freezing temperatures return in late August and freeze-up typically occurs by early October. Winter temperatures, particularly in the lower elevations, can drop to -50° F or colder for extended periods. Annual precipitation is 15 to 20 inches, coming mostly in late summer as rain and during the first half of the winter as snow. Winter snow accumulations are modest. The area is essentially an arctic desert.

Regulation

Our mineral exploration activities are subject to various federal, state, and local laws and regulations governing prospecting, exploration, production, labor standards, occupational health and mine safety, control of toxic substances, land use, water use, land claims of local people and other matters involving environmental protection and taxation. New rules and regulations may be enacted or existing rules and regulations may be applied in a manner that could limit or curtail exploration at our property. It is possible that future changes in these rules or regulations could have a significant impact on our business, causing those activities to be economically re-evaluated at that time.

Taxes Pertaining to Mining

Alaska’s tax and regulatory policy is widely viewed by the mining industry as offering the most favorable environment for establishing new mines in the United States. The mining taxation regimes in Alaska have been stable for many years. There is regular discussion of taxation issues in the legislatures but no changes have been proposed that would significantly alter their current state mining taxation structures. The economics of any potential mining operation on our properties would be particularly sensitive to changes in the State of Alaska's tax regimes. Amendments to current laws, regulations and permits governing our operations and the general activities of mining and exploration companies, or more stringent implementation thereof, could cause unanticipated increases in our exploration expenses, capital expenditures or future production costs, or could result in abandonment or delays in establishing operations at our

8

Chandalar property. Although management has no reason to believe that new mining taxation laws that could adversely impact our Chandalar property will materialize, such an event could and may happen in the future.

At present, Alaska has a 7% net profits mining license tax on all mineral production (AS 43.65), a 3% net profits royalty on minerals from state lands (AS 38.05.212) (where we hold unpatented state mining claims), and a graduated annual mining claim rental beginning at $1.03/acre. Alaska state corporate income tax is 9.4% if net profit is more than a set threshold amount. Alaska has an exploration incentive credit program (AS 27.30.010) whereby up to $20 million in approved accrued exploration credits can be deducted from the state mining license tax, the state corporate income tax, and the state mining royalty. All qualified new mining operations are exempt from the mining license tax for 3 1/2 years after production begins.

Environmental Regulations

Our Chandalar property contains an inactive small mining mill site on Tobin Creek with tailings impoundments, last used in 1983. The mill was capable of processing 100 tons of ore per day. A total of 11,884 tons were put through the mill, and into two small adjacent tailings impoundments. A December 19, 1990 letter from the Alaska Department of Environmental Conservation (the “Alaska DEC”) to the Alaska Division of Mining of the Department of Natural Resources (the “Alaska DNR”) states: “Our samples indicate the tailings impoundments meet Alaska DEC standards requirements and are acceptable for abandonment and reclamation.” The Alaska DNR conveyed acknowledgement of receipt of this report to us in a letter dated December 24, 1990. We subsequently reclaimed the tailings impoundments and expect that no further remedial action will be required. Vegetation has established itself on the tailings impoundments, thereby mitigating erosional forces.

In 1990, the Alaska DEC notified us that soil samples taken from a gravel pad adjacent to our Tobin Creek mill site contained elevated levels of mercury. In response to the notification, we engaged a professional mineral engineer to evaluate procedures for remediating contamination at the site. In 1994, the engineer evaluated the contamination and determined that it consists of approximately 160 cubic yards of earthen material that could be cleansed by processing it through a simple gravity washing plant. This plan was subsequently approved by the state. In 2000, the site was listed in the Alaska DEC’s contaminated sites database as a “medium” priority contaminated site. We are not aware of any changes in state environmental laws that would affect our state approved cleanup plan or impose a timetable for it to be done. During 2008, our employees took a suite of samples at the contamination site to update the readings taken in 1990 or prior. The results of this sampling reconfirmed the earlier findings, and also suggest that some attenuation of the mercury contamination has occurred. An independent technical consultant assessed those results and believes that proper procedures for sampling and testing were followed. During 2011, 2013 and 2014, we took additional samples that showed an overall reduction of mercury in the previously sampled area. However, one sample on the margin of the sampled area yielded high mercury content, and that may necessitate continued expansion of the area to be sampled in the future. The 2011, 2013 and 2014 sample results were submitted to the State for analysis and determination of what additional sampling the State may require on the area around the mill. In 2013, we received a letter request from the Alaska DEC to update our plan for remediating the contaminated site and in 2014, 2015, and 2016 continued communication with the Alaska DEC to determine what remediation is necessary. We have engaged an independent environmental engineering company to perform an evaluation of the remediation requirements based on locality, latitude, altitude, permafrost and other factors. During 2017, the environmental engineering company performed an eco-scoping study on the site. The Alaska DEC has notified us that further sampling will need to be performed in and around the streambed from the mine site to the stream’s confluence into Chandalar Lake. At December 31, 2019, we have an accrued liability of $100,000 in our financial statements for sampling and remediation costs.

During 2009 and 2010, we engaged in permitted open pit mining operations on Little Squaw Creek. The Small Mines permit restricts ground disturbance to a total maximum of ten acres and requires a specified reclamation plan for the disturbed area to be completed prior to additional acreage being disturbed. We joined the State of Alaska reclamation bond pool to assure the minimum legal reclamation requirements could be met. During the 2010 mining operations, we experienced a situation where it was not practical to concurrently mine and reclaim without wasting (or sacrificing) a significant portion of the mineralized material we intended to mine. During 2012, GNP completed certain corrective actions required by the ACE. In 2013, NyacAU, the managers of GNP, received a new permit to expand the mine site from 10 to approximately 350 acres. The new mining permit provided an increased area for stockpiling topsoil, a larger settling pond system with greater capacity to ensure water quality and availability, and room to allow concurrent mine

9

reclamation as the project advances. In addition, the permit also allowed for construction of a new airstrip. Processing plants used for the recovery of gold will use a recirculating closed-loop water system to minimize water usage and protect the environment.

Although NyacAU received a new permit to expand the mine, Goldrich was still required to remove a mine waste road built in 2010. Remediation activities were completed during 2015, and the Company received a confirmation of completion and satisfaction from the ACE on September 23, 2015.

The following sets forth certain risks and uncertainties that could have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock which may decline and investors may lose all or part of their investment. These risk factors should be considered along with the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause our actual results or financial condition to differ materially from those projected in forward-looking statements. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial also may impair our business operations. We cannot assure you that we will successfully address these risks or that other unknown risks exist that may affect our business.

Risks Related to Our Operations

Our ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2019, disclose a ‘going concern’ qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared under the assumption that we will continue as a going concern. We are an exploration stage company and we have incurred losses since our inception. We do not have sufficient cash to fund normal operations and meet debt obligations for the next 12 months without deferring payment on certain current liabilities and raising additional funds. During the year ended December 31, 2019, we raised $888,000 net cash from senior secured notes payable to third-party and related-party persons, as described elsewhere. We believe that the going concern condition cannot be removed with confidence until the Company has entered into a business climate where funding of its activities is more assured.

We currently have no historical recurring source of revenue and our ability to continue as a going concern is dependent on our ability to raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan. Our plans for the long-term return to and continuation as a going concern include financing our future operations through sales of our common stock and/or debt and the eventual profitable exploitation of our mining properties. Additionally, the current capital markets and general economic conditions in the United States are significant obstacles to raising the required funds. These factors raise substantial doubt about our ability to continue as a going concern.

GNP was dissolved in 2019 and is now in the process of liquidation. We are making our best efforts to raise sufficient capital to continue profitably operating the mine beginning in 2021. The current plant has been disassembled and it, as well as most of the equipment used by GNP, has been demobilized from the mine site. While we are working to replace the dissolved GNP operations with commensurate gold extraction by us or a qualified third-party operator, we cannot assure you we will have sufficient capital to implement our plan of operation, that we will be successful in beginning gold extraction operations in the future, the timing for any such operations or that the extraction results in future years will be similar to past results.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

10

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception, with the exception of the year ended December 31, 2015, and expect to continue to incur losses in the future. We had net income of $50,163 in the year ended 2015, but we incurred net losses during each of the following periods:

·$2,603,065 for the year ended December 31, 2019;

·$3,779,949 for the year ended December 31, 2018;

·$965,457 for the year ended December 31, 2017; and

·$733,298 for the year ended December 31, 2016;

We had an accumulated deficit of approximately $35.5 million as of December 31, 2019. We expect to continue to incur losses unless and until such time as the Chandalar Mine or one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

We may be unable to timely pay our obligations under our outstanding note payable in gold or our secured senior secured notes, which may result in us losing some of our rights to gold from Chandalar alluvial extraction operations and may adversely affect our assets, results of operations and future prospects.

At December 31, 2019, a portion of the Company’s notes payable in gold outstanding, with a net liability of $406,319, obligate the Company to deliver 266.788 ounces of fine gold on demand. To date, the gold notes have not been paid and the note holders have not demanded payment or delivery of gold. These notes are secured against our right to future distributions of gold extracted from subsequent gold mining operations. At December 31, 2019, we owed secured senior notes to related parties totaling $3,246,316 and outstanding notes payable to unrelated parties of $1,020,000, each with a maturity date of October 31, 2018, as amended on November 1, 2019 to be payable within 10 days of a demand notice of the holders. There has been no notice of default or demand issued by any holder. These notes are secured against all of the assets and property of each of Goldrich Mining Company and Goldrich Placer, LLC, whether real, personal or mixed, in which the holders of any Notes (or their Collateral Agent) hold a security interest at such time, including any property subject to liens or security interest granted by the Deed of Trust.

Under our gold forward sales contracts, each of the following constitutes an event of default: (a) our failure to perform or observe any term, covenant or agreement contained in the gold forward sales contract; (b) any warranty made by us in the gold forward sales contract shall prove to have been incorrect in a material respect when made; or (c) we shall declare bankruptcy. Upon the occurrence of an event of default, the holders of the gold forward sales contracts may designate a termination date for the contract and upon termination receive the delivery date index price (as determined in the gold forward sales contract) of any quantities of gold we were deficient in delivering payable in either (i) cash or (ii) an amount of our shares of common stock equal such value converted into shares at the greater of $0.15 per share or 75% of the current market price per share on the delivery date.

Under our senior secured notes, each of the following constitutes an event of default: (a) the Company fails to pay (i) any portion of the principal amount of any Note when due or (ii) any accrued and unpaid Interest when due and such failure continues for three (3) Business Days or (iii) any other amount that is due and payable under this Amended Agreement, any Note, or the Deed of Trust and such failure continues for ten (10) Business Days after demand for such payment is made by the Holder; (b) the Company fails to observe or perform any other obligation, covenant, or agreement applicable to the Company under this Amended Agreement as and when due and fails to cure such failure within 10 Business Days of notice of such failure by the holder to the Company; (c) the Company fails to observe or perform any covenant or agreement applicable under the Guaranty and fails to cure such failure within 10 Business Days of notice of such failure by the holder to the Company; (d)an insolvency or liquidation proceeding or assignment is commenced with respect to the Company or its subsidiary; or (e) any alleged creditor other than the holders seeks to collect any amount allegedly due and owing to said creditor at that time.

11

If we are unable to timely satisfy our obligations under the notes payable in gold or the secured senior notes, including timely payment of gold on demand or interest when due and payment of the principal amount on demand for the secured senior notes and we are not able to re-negotiate the terms of such agreements, the holders will have rights against us, including potentially seizing or selling our assets. The notes payable in gold are specifically secured against our right to future gold distributions from subsequent gold mining operations. The senior secured notes are secured against all our assets. Any failure to timely meet our obligations under these instruments may adversely affect our assets, results of operations and future prospects or cause us to declare bankruptcy.

We have entered into arbitration with our joint venture partner.

In 2017, we, our subsidiary and the joint venture, as claimants, filed an arbitration statement of claim before a three-member Arbitration Panel (“the Panel”), against our JV partner and its affiliates; NyacAU, LLC (“NyacAU”), BEAR Leasing, LLC, and Dr. J. Michael James, as respondents. In 2018, the respondents filed a counter-claim against the Company, its subsidiaries and certain members of our current and former management, the counterclaim respondents. During the year ended December 31, 2019, and in 2020 subsequent to the end of the reported period, the Panel has released various awards relating to the allegations of both parties. Some of which have been in favor of our positions some have been in favor of our JV partner and its affiliates. Under the terms of the Operating Agreement, both partners are required to abide by the rulings proceeding from the arbitration panel. The arbitration is ongoing and the various parties to the claims and counterclaims continue to disagree on several matters.

On May 25, 2019, the Panel issued an Interim Award, which requested input from the parties on a small number of discrete issues, all input to be supported by references to the arbitration record. On November 30, 2019, the Panel issued the Partial Final Award and concurrently the Second Interim Award RE Dissolution/Liquidation of GNP and Related Issues (“the Second Interim Award”). On September 4, 2020, the Arbitration Panel (the “Panel”) issued the Final Post Award Orders, wherein the Panel issued rulings on multiple material issues. A summary of each award is provided below in the Item 2: Properties section under Arbitration.

GNP is in liquidation.

NyacAU filed the formal Notice of Dissolution in May 2019 and received the certificate of dissolution in July with an effective date of June 3, 2019. GNP is now in the liquidation process (see Joint Venture Agreement and Arbitration below). The Panel ruled that NyacAU should continue as the liquidator. Except for equipment needed for reclamation, most the heavy equipment and the wash plant were removed on a winter trail in March through mid-April 2019. The Panel has jurisdiction over the liquidation process. The arbitration is ongoing and the various parties to the claims and counterclaims continue to disagree on several matters. The Panel may or may not rule in our favor.

We are required to raise additional capital to fund our exploration and, if warranted, development and production programs on the Chandalar property.

We are an exploration stage company and currently do not have sufficient capital to fully fund any long-term plan of operation at the Chandalar gold property. We will require additional financing in the future to fund exploration of and development and production on our properties, if warranted, to attain self-sufficient cash flows. We expect to obtain financing through various means including, but not limited to, private or public placement offerings of debt or our equity securities, the exercise of outstanding warrants, the sale of a production royalty, the sales of gold from future production, joint venture agreements with other mining companies, or a combination of the above. The level of additional financing required in the future will depend on the results of our exploration work and recommendations of our management and consultants. Failure to obtain sufficient financing may result in delaying or indefinite postponement of exploration or even a loss of some property interest. Additional capital or other types of financing may not be available if needed or, if available, may not be available on favorable terms or terms acceptable to us. Failure to raise such needed financing could result in us having to discontinue our mining and exploration business.

12

We have only a brief, recent history of gold extraction.

We have only a brief recent history of gold extraction from 2013-2018 and have carried on our business at a loss. As a result of dissolution of GNP, the current plant has been disassembled and it, as well as most of the equipment used by GNP, has been demobilized from the mine site. While we are working to replace the GNP operations with commensurate gold extraction by us or a qualified third-party operator, we cannot assure you that similar results will be accomplished in future years. At this time, due to the risks and uncertainties described in this section, we cannot assure you that extraction activities in the future will generate revenues, profits or cash flow to us.

Estimates of cash flows, extraction costs, profitability and other financial and extraction measurements are subject to the inherent risks related to accurately forecasting extraction.

Estimates of future extraction costs and potential extraction profitability are dependent on numerous factors, which could affect the success and profitability of extraction activities. These risks include volatile gold prices, engineering and construction errors, changes or shortages in equipment and labor availability and costs, variances in grade, natural disasters and other events outside our control. The occurrence of such events could make anticipated results differ from actual results and could negatively affect our financial position.

We depend largely on a single property - the Chandalar property.

Our major mineral property at this time is the Chandalar property. We are dependent upon making a gold deposit discovery at Chandalar for the furtherance of the Company at this time. Should we be able to make an economic find at Chandalar, we would then be solely dependent upon a single mining operation for our revenue and profits, if any.

Chandalar is located within the remote Arctic Circle region and exploration and, if warranted, development and production activities may be limited by climate and location.

While we have conducted test mining and minor gold mining extraction in recent years, our current focus remains on exploration of our Chandalar property. With our current infrastructure at Chandalar, the arctic climate limits exploration activities to a summer field season that generally starts in early May and lasts until freeze-up in mid-September. The remote location of the Chandalar property limits access and increases exploration expenses. Costs associated with such activities are estimated to be between 25% and 50% higher than costs associated with similar activities in the lower 48 states in the United States. Transportation and availability of qualified personnel is also limited because of the remote location. Higher costs associated with exploration activities and limitations for the annual periods in which we can carry on exploration activities will increase the costs and time associated with our planned activities and could negatively affect the value of our property and securities.

Our mineralized material estimate at Chandalar is based on a limited amount of drilling completed to date.

The internal report of Paul L. Martin on the mineralized material estimate and data analysis for the Chandalar Alluvial Gold Deposit on our Chandalar property is based on a limited amount of drilling completed during our 2007 drilling program. These estimates have a high degree of uncertainty. While we plan on conducting further drilling programs on the deposit, we cannot guarantee that the results of future drilling will return similar results or that our current estimate of mineralized materials will ever be established as proven and probable reserves as defined in SEC Industry Guide 7. Any mineralized material or gold resources that may be discovered at Chandalar through our drilling programs may be of insufficient quantities to justify commercial operations.

Our exploration activities may not result in commercially successful mining operations.

Our operations are focused on mineral exploration, which is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. The focus of our current exploration plans and activities is conducting mineral exploration and deposit definition drilling at Chandalar. The success of this gold exploration is determined in part by the following factors:

13

·identification of potential gold mineralization based on analysis;

·availability of government-granted exploration permits;

·the quality of our management and our geological and technical expertise; and

·capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to determine metallurgical processes to extract metal, and to establish commercial mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit at Chandalar would be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. Any mineralized material or gold resources that may be discovered at Chandalar may be of insufficient quantities to justify commercial operations.

Actual capital costs, operating costs, extraction and economic returns may differ significantly from those anticipated and there are no assurances that any future development activities will result in profitable mining operations.

We have limited operating history on which to base any estimates of future operating costs related to any future development of our properties. Capital and operating costs, extraction and economic returns, and other estimates contained in pre-feasibility or feasibility studies may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs for any future development activities will not be higher than anticipated or disclosed.

Mining and Exploration activities involve a high degree of risk.

Our operations on our properties will be subject to all the hazards and risks normally encountered in the mining of and exploration for deposits of gold. These hazards and risks include, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts, pit-wall failures, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and legal liability. Milling operations, if any, are subject to various hazards, including, without limitation, equipment failure and failure of retaining dams around tailings disposal areas, which may result in environmental pollution and legal liability.

The parameters that would be used at our properties in estimating possible mining and processing efficiencies would be based on the testing and experience our management has acquired in operations elsewhere. Various unforeseen conditions can occur that may materially affect estimates based on those parameters. In particular, past mining operations at Chandalar indicate that care must be taken to ensure that proper mineral grade control is employed and that proper steps are taken to ensure that the underground mining operations are executed as planned to avoid mine grade dilution, resulting in uneconomic material being fed to the mill. Other unforeseen and uncontrollable difficulties may occur in planned operations at our properties that could lead to failure of the operation.

If we decide to exploit our Chandalar property and build a large gold mining operation based on existing or additional deposits of gold mineralization that may be discovered and proven, we plan to process the resource using technology that has been demonstrated to be commercially effective at other geologically similar gold deposits elsewhere in the world. These techniques may not be as efficient or economical as we project, and we may never achieve profitability.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make extraction at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

14

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development and production operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of reaching production.

We may be adversely affected by a decrease in gold prices.

The value and price of our securities, our financial results, and our exploration activities may be significantly adversely affected by declines in the price of gold and other precious metals. Gold prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of gold producing countries throughout the world. The price for gold fluctuates in response to many factors beyond anyone’s ability to predict. The prices that would be used in making any economic assessment estimates of mineralized material on our properties would be disclosed and would probably differ from daily prices quoted in the news media. Percentage changes in the price of gold cannot be directly related to any estimated resource quantities at any of our properties, as they are affected by a number of additional factors. For example, a ten percent change in the price of gold may have little impact on any estimated quantities of commercially viable mineralized material at Chandalar and would affect only the resultant cash flow. Because any future mining at Chandalar would occur over a number of years, it may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons, including a belief that a low price of gold is temporary and/or that a greater expense would be incurred in temporarily or permanently closing a mine there. Mineralized material calculations and life-of-mine plans, if any, using significantly lower gold and precious metal prices could result in material write-downs of our investments in mining properties and increased reclamation and closure charges.

In addition to adversely affecting any of our mineralized material estimates and its financial aspects, declining metal prices may impact our operations by requiring a reassessment of the commercial feasibility of a particular project. Such a reassessment may be the result of a management decision related to a particular event, such as a cave-in of a mine tunnel or open pit wall. Even if any of our projects may ultimately be determined to be economically viable, the need to conduct such a reassessment may cause substantial delays in establishing operations or may interrupt on-going operations, if any, until the reassessment can be completed.

Title to our properties may be defective.

We hold certain interests in our Chandalar property in the form of State of Alaska unpatented mining claims. We hold no interest in any unpatented U.S. federal mining claims at Chandalar or elsewhere. Alaska state unpatented mining claims are unique property interests, in that they are subject to the paramount title of the State of Alaska, and rights of third parties to uses of the surface within their boundaries, and are generally considered to be subject to greater title risk than other real property interests. The rights to deposits of minerals lying within the boundaries of the unpatented state claims are subject to Alaska Statues 38.05.185 – 38.05.280, and are governed by Alaska Administrative Code 11 AAC 86.100 – 86.600. The validity of all State of Alaska unpatented mining claims is dependent upon inherent uncertainties and conditions. These uncertainties relate to matters such as:

·The existence and sufficiency of a discovery of valuable minerals;

·Proper posting and marking of boundaries in accordance state statutes;

·Making timely payments of annual rentals for the right to continue to hold the mining claims in accordance with state statutes;

·Whether sufficient annual assessment work has been timely and properly performed and recorded; and

·Possible conflicts with other claims not determinable from descriptions of records.

The validity of an unpatented mining claim also depends on: (1) the claim having been located on Alaska state land open to appropriation by mineral location, which is the act of physically going on the land and making a claim by putting corner stakes in the ground; (2) compliance with all applicable state statutes in terms of the contents of claim

15

location notices or certificates and the timely filing and recording of the same; (3) timely payment of annual claim rental fees; and (4) the timely filing and recording of proof of annual assessment work. In the absence of a discovery of valuable minerals, the ground covered by an unpatented mining claim is open to location by others unless the owner is in actual possession of and diligently working the claim. We are diligently working and are in actual possession of all of our mining claims comprising our Chandalar, Alaska property. The unpatented state mining claims we own or control there may be invalid, or the title to those claims may not be free from defects. In addition, the validity of our claims may be contested by the Alaska state government or challenged by third parties.

Title to our property may be subject to other claims.

There may be valid challenges to the title to properties we own or control that, if successful, could impair our exploration activities on them. Title to such properties may be challenged or impugned due to unknown prior unrecorded agreements or transfers or undetected defects in titles.

A major portion of our mineral rights on our flagship Chandalar property consists of “unpatented” lode mining claims created and maintained on deeded state lands in accordance with the laws governing Alaska state mining claims. We have no unpatented mining claims on federal land in the Chandalar mining district, but do have unpatented state mining claims. Unpatented mining claims are unique property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of complex federal and state laws and regulations. Also, unpatented mining claims are always subject to possible challenges by third parties or validity contests by the federal and state governments. In addition, there are few public records that definitively determine the issues of validity and ownership of unpatented state mining claims.

We have attempted to acquire and maintain satisfactory title to our Chandalar mining property, but we do not normally obtain title opinions on our properties in the ordinary course of business, with the attendant risk that title to some or all segments our properties, particularly title to the State of Alaska unpatented mining claims, may be defective. We do not carry title insurance on our patented mining claims.

Estimates of mineralized material are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our Chandalar property. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement a plan that may not lead to commercially viable operations in the future.

Government regulation may adversely affect our business and planned operations.

Our mineral exploration activities are subject to various laws governing prospecting, mining, development, production, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local residents and other matters in the United States. New rules and regulations may be enacted or existing rules and regulations may be applied in a manner that could limit or curtail exploration at our Chandalar property. The economics of any potential mining operation on our properties would be particularly sensitive to changes in the federal and State of Alaska's tax regimes.

The generally favorable State of Alaska tax regime could be reduced or eliminated. Such an event could materially hinder our ability to finance the future exploitation of any gold deposit we might prove-up at Chandalar, or elsewhere on State of Alaska lands. Amendments to current laws, regulations and permits governing our operations and the general activities of mining and exploration companies, or more stringent implementation thereof, could cause

16

unanticipated increases in our exploration expenses, capital expenditures or future extraction or production costs, or could result in abandonment or delays in establishing operations at our Chandalar property.

Our activities are subject to environmental laws and regulation that may materially adversely affect our future operations, in which case our operations could be suspended or terminated.

We are subject to a variety of federal, state and local statutes, rules and regulations in connection with our exploration activities. We are required to obtain various governmental permits to conduct exploration at and development of our property. Obtaining the necessary governmental permits is often a complex and time-consuming process involving numerous federal, state and local agencies. The duration and success of each permitting effort is contingent upon many variables not within our control. In the context of permitting, including the approval of reclamation plans, we must comply with known standards, existing laws, and regulations that may entail greater or lesser costs and delays depending on the nature of the activity to be permitted and the interpretation of the laws and regulations implemented by the permitting authority. The failure to obtain certain permits or the adoption of more stringent permitting requirements could have a material adverse effect on our business, plans of operation, and property in that we may not be able to proceed with our exploration programs. Compliance with statutory environmental quality requirements may require significant capital investments, significantly affect our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or local governments may be changed or become more stringent in the future, which could materially and adversely affect our proposed activities. As a result of these matters, our operations could be suspended or cease entirely.

Minerals exploration and mining are subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risk (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available to us (or to other companies in the minerals industry) at a reasonable price. To the extent that we become subject to environmental liabilities, the remediation of any such liabilities would reduce funds otherwise available to us and could have a material adverse effect on our financial condition. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

Federal legislation and regulations adopted and administered by the U.S. Environmental Protection Agency, Forest Service, Bureau of Land Management (“BLM”), Fish and Wildlife Service, Mine Safety and Health Administration, and other federal agencies, and legislation such as the Federal Clean Water Act, Clean Air Act, National Environmental Policy Act, Endangered Species Act, and Comprehensive Environmental Response, Compensation, and Liability Act, have a direct bearing on U.S. exploration and mining operations within the United States. These regulations will make the process for preparing and obtaining approval of a plan of operations much more time-consuming, expensive, and uncertain. Plans of operation will be required to include detailed baseline environmental information and address how detailed reclamation performance standards will be met. In addition, all activities for which plans of operation are required will be subject to review by the BLM, which must make a finding that the conditions, practices or activities do not cause substantial irreparable harm to significant scientific, cultural, or environmental resource values that cannot be effectively mitigated.

U.S. federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations. Although some mines continue to be approved in the United States, the process is increasingly cumbersome, time-consuming, and expensive, and the cost and uncertainty associated with the permitting process could have a material effect on exploring and mining our properties. Compliance with statutory environmental quality requirements described above may require significant capital investments, significantly affect our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or local governments may be changed or become more stringent in the future, which could materially and adversely affect our proposed activities. As a result of these matters, our operations could be suspended or cease entirely.

At this time, our Chandalar property does not include any federal lands and therefore we do not file plans of operations with the BLM. However, we are subject to obtaining watercourse diversion permits from the U.S. Army Corp of Engineers.

17

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

·control dispersion of potentially deleterious effluents; and

·reasonably re-establish pre-disturbance land forms and vegetation.

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Future legislation and administrative changes to the mining laws could prevent us from exploring and operating our properties.

New local, state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations. We are at this time unaware of any proposed Alaska state or U.S. federal laws and regulations that would have an adverse impact on the future of our Alaska mining properties.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

We do not insure against all risks.

Our insurance policies will not cover all the potential risks associated with our operations. We may also be unable to maintain insurance coverage to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurances against risks such as environmental pollution or other hazards as a result of exploration and production are not generally available to us or to other companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards for which we may not be insured against or for which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our financial condition and results of operations.

18

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration stage properties, or properties capable of producing precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our revenues, operations and financial condition and possible future revenues could be materially adversely affected by actions by our competitors. At our property at Chandalar, Alaska, we face no other competitors at this time.

We may experience cybersecurity threats.

We rely on secure and adequate operations of information technology systems in the conduct of our operations. Access to and security of the information technology systems are critical to our operations. Given that cyber risks cannot be fully mitigated and the evolving nature of these threats, we cannot assure that our information technology systems are fully protected from cybercrime or that the systems will not be inadvertently compromised, or without failures or defects. Potential disruptions to our information technology systems, including, without limitation, security breaches, power loss, theft, computer viruses, cyber-attacks, natural disasters, and noncompliance by third party service providers and inadequate levels of cybersecurity expertise and safeguards of third party information technology service providers, may adversely affect our operations as well as present significant costs and risks including, without limitation, loss or disclosure of confidential, proprietary, personal or sensitive information and third party data, material adverse effect on its financial performance, compliance with its contractual obligations, compliance with applicable laws, damaged reputation, remediation costs, potential litigation, regulatory enforcement proceedings and heightened regulatory scrutiny.

Newly adopted rules regarding mining property disclosure by companies reporting with the SEC may result in increased operating and legal costs.