Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HEALTHCARE TRUST OF AMERICA, INC. | q32020earningsrelease.htm |

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | hta-20201103.htm |

Exhibit 99.2

Table of Contents Company Overview Company Information 3 Recent Highlights 6 Financial Highlights 8 Company Snapshot 9 Financial Statements Condensed Consolidated Balance Sheets 10 Condensed Consolidated Statements of Operations 11 Condensed Consolidated Statements of Cash Flows 12 Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre 13 Debt Composition and Maturity Schedule 14 Capitalization and Covenants 15 Portfolio Information Same-Property Performance and NOI 16 Investment Activity 17 Development/Redevelopment Summary and Property Capital Expenditures 18 Key Markets/Top 75 MSA Concentration and Regional Portfolio Distribution 19 Portfolio Diversification by Type, Historical Campus Proximity and Ownership Interests 20 New and Renewal Leasing Activity, Historical Leased Rate and Tenant Lease Expirations 21 Tenant Profile, Tenant Specialty and Top MOB Tenants 22 Reporting Definitions 23 Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements about our plans, strategies, prospects and estimates regarding future medical office building market performance. Additionally, such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Forward- looking statements express expectations of future events. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial results, is included herein and in our filings with the SEC. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 2

Company Information Healthcare Trust of America, Inc. (NYSE: HTA) is the largest dedicated owner and operator of medical office buildings (“MOBs”) in the United States, comprising approximately 25.1 million square feet of gross leasable area (“GLA”), with $7.4 billion invested primarily in MOBs. HTA provides real estate infrastructure for the integrated delivery of healthcare services in highly-desirable locations. Investments are targeted to build critical mass in 20 to 25 leading gateway markets that generally have leading university and medical institutions, which translates to superior demographics, high-quality graduates, intellectual talent and job growth. The strategic markets HTA invests in support a strong, long-term demand for quality medical office space. HTA utilizes an integrated asset management platform consisting of on-site leasing, property management, engineering and building services, and development capabilities to create complete, state of the art facilities in each market. This drives efficiencies, strong tenant and health system relationships, and strategic partnerships that result in high levels of tenant retention, rental growth and long-term value creation. Headquartered in Scottsdale, Arizona, HTA has developed a national brand with dedicated relationships at the local level. Founded in 2006 and listed on the New York Stock Exchange in 2012, HTA has produced attractive returns for its stockholders that have outperformed the US REIT index. More information about HTA can be found on the Company’s Website (www.htareit.com), Facebook, LinkedIn, Instagram and Twitter. Senior Management Scott D. Peters I Chairman, Chief Executive Officer and President Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer Amanda L. Houghton I Executive Vice President - Asset Management David A. Gershenson I Chief Accounting Officer Caroline E. Chiodo I Senior Vice President - Acquisitions and Development Brock J. Cusano | Vice President - Operations Contact Information Corporate Headquarters Healthcare Trust of America, Inc. I NYSE: HTA 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 www.htareit.com Follow Us: Investor Relations Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 info@htareit.com Transfer Agent Computershare P.O. Box 505000 Louisville, KY 40233 888.801.0107 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 3

HTA: LARGEST DEDICATED OWNER OF MEDICAL OFFICES $7.4B ~25.1M SF 184% BBB/Baa2 GROSS INVESTMENTS LARGEST TOTAL SHAREHOLDER INVESTMENT GRADE ON-CAMPUS OWNER RETURNS BALANCE SHEET (Since December 2006) BEST IN CLASS PORTFOLIO FOCUSED IN 20-25 KEY MARKETS 10 MARKETS ~ 1M+ SF 17 MARKETS > 500K SF Full-Service Investment Grade Operating Platform Focus and Scale Diversification Balance Sheet Best-in-Class Fully 94% of Portfolio in 467 Buildings throughout BBB/Baa2 Integrated Operations Key Markets & 33 States Standard & Poor’s/Moody’s Management Top 75 MSAs Credit Rating Top Tenant < 4.2% of ABR Property Management Platform with Scale Creates: 5.7x Top Market < 9.8% of ABR Net Debt/ Leasing Local Expertise Adjusted EBITDAre Size & Diversification provides Facilities & Engineering Strong Relationships stability of cash flows $1.5B Liquidity Construction & Development Operational Benefits Access to Better Performing Markets 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 4

FINANCIAL PERFORMANCE: HISTORY OF VALUE CREATION Normalized FFO/Share Same Store Growth $0.45 4% $0.43 $0.42 $0.42 $0.42 $0.42 $0.42 $0.42 3.3% 2.6% $0.41 $0.41 $0.41 $0.41 $0.41 $0.41 3.2% 3% 3.1% 3.1% 3.1% HTA $0.40 $0.40 $0.40 $0.40 $0.40 3.0% Avg. 2.9% 2.9% 2.9% $0.4 2.8% $0.39 $0.39 2.7% 2.7% 2.7% 2.5% 2.6% 2.5%* 2.5%* 2.5% 2.5% 2.5% REIT MOB 2.3% Avg. 2% $0.35 1% 0.6% 0.5% $0.3 0% 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20* 3Q20* *The 2.5% same store growth excludes the impact of free rents associated with early renewals executed in 2Q20, during the COVID-19 pandemic. DELIVERING SHAREHOLDER VALUE 7.6% Annualized Average Total Returns Since First Distribution in 2006 to September 30, 2020 Top MOB Tenants Steady & Reliable Dividend » AdventHealth » Harbin Clinic $0.320 $0.32 » Ascension » HCA Healthcare $0.315 $0.310 » Atrium Health » Highmark-Allegheny Health Network $0.305 » Baylor Scott & White Health » Mercy Health $0.300 $0.3 $0.295 » Boston Medical Center » Steward Health Care » CommonSpirit Health » Tenet Healthcare Corporation » Community Health Network » Tufts Medical Center $0.28 » Community Health Systems » UNC Health Care 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 5

Company Overview Recent Highlights • Reported net loss attributable to common stockholders of $0.03 per diluted share, which included a $0.12 per share impact from debt extinguishment costs. • Reported FFO as defined by NAREIT of $0.31 per diluted share, which included a $0.12 per share impact from debt extinguishment costs. • Reported Normalized FFO of $0.43 per diluted share, a record level of earnings for HTA. • Reported Normalized FAD of $82.4 million, a record level for HTA. • Raised our quarterly dividend for the 7th consecutive year. • Signed 1.1 million square feet of leases in the quarter. Renewal releasing spreads were 7.4% on a cash basis, while same property tenant retention was 89%. • Cash rental collections within the period were equal to 102% of 3Q charges, including collections on prior period accounts receivable. For 3Q charges only, we collected or deferred 99% of 3Q rents. • Reported Same-Property Cash Net Operating Income (“NOI”) growth of 0.5% compared to Q3 2019. Our same-property cash NOI in the period was 2.5% excluding the impact of $2.4 million in free rent associated with the 500,000 SF of early renewals signed in Q2 2020, of which 82% were with health systems in our key markets. • Completed our initial development started by HTA. This 127,000 SF Class A medical office building (“MOB”) development in Raleigh, NC is anchored by WakeMed Health System and is currently 71% leased. • Raised $800 million of senior unsecured notes at a coupon of 2% per annum. Proceeds were used to repay approximately $600 million of existing debt. Combined with our outstanding forward equity of $277.5 million, we now have over $1.5 billion of available capital to deploy. Portfolio Performance • Our portfolio had a leased rate of 90.1% by gross leasable area (“GLA”) and an occupancy rate of 89.5% by GLA. HTA executed approximately 1.1 million square feet of leases, including 155 thousand square feet of new leases and 946 thousand square feet of renewals. Re-leasing spreads increased to 7.4% and tenant retention for the Same-Property portfolio was 89% by GLA for Q3 2020. • In Q3 2020, our total cash collections (including collections on prior period receivables) totaled 102% of our Q3 charges. For Q3 charges only, we collected or deferred 99% of our total monthly rents that are contractually due and owed, with cash collections totaling approximately 97% of monthly rents. Our October collections continue to be consistent with Q3. • In total, we have approved deferral plans that total approximately $11.0 million, of which approximately $3.7 million have been repaid through October 28, 2020. The remainder are expected to be repaid over the next 6 to 12 months. We have not approved any material deferrals in October. Investment Activity During the quarter, we completed and delivered a 127,000 SF, Class A MOB within the Raleigh metropolitan area in Cary, North Carolina which replaced approximately 45,000 SF of Class B MOBs on the site. The MOB is 71% leased, had incremental construction costs of approximately $44 million, and is projected to yield between 7.75% and 8.0% on construction costs upon full lease-up. Our remaining 3 developments in California, Florida, and Texas continue to progress, and we anticipate funding approximately $25 - $30 million in Q4 in connection with these developments which will be delivered between Q1 and Q3 2021. In Q3 we acquired an on-campus MOB in Salt Lake City, Utah for $11.1M, consisting of 47,000 square feet which is approximately 95% leased. We continue to see increased momentum in our acquisition pipeline and anticipate transacting on accretive investments in Q4 2020 and into 2021 utilizing capital already raised, subject to our application of our normal investment evaluation and diligence. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 6

Company Overview Recent Highlights Cont'd Capital Activity and Liquidity • On September 14, 2020, HTA priced $800 million of 2.00% senior unsecured notes due to mature in March 2031, which settled on September 28, 2020. The net proceeds were utilized to redeem $300 million of our outstanding 3.70% 2023 notes, pay down our revolver balance and pay off our remaining outstanding secured debt. The remaining proceeds will be utilized for general corporate purposes, including providing long-term financing to our pending or completed acquisitions and developments. • As of the end of the quarter, HTA had $277.5 million of equity to be settled on a forward basis with the issuance of approximately 9.4 million shares of common stock, subject to adjustment for costs to borrow under the terms of the applicable equity distribution agreements. • HTA ended Q3 2020 with total leverage of (i) 32.6%, measured as debt less cash and cash equivalents to total capitalization, and (ii) 5.7x net debt to Adjusted Earnings before Interest, Taxes, Depreciation and Amortization for real estate (“Adjusted EBITDAre”). Including the impact of the unsettled forward equity agreements, leverage would be 29.4% and 5.1x, respectively. • HTA ended Q3 with total liquidity of $1.5 billion, inclusive of $1.0 billion available on our unsecured revolving credit facility, $227.5 million of unsettled equity forward transactions and $227.1 million of cash and cash equivalents. HTA has no current debt due and no debt maturities until 2023. Dividend On September 22,2020, HTA’s Board of Directors announced a quarterly cash dividend of $0.320 per share of common stock and per Operating Partnership Unit, paid on October 9, 2020 to stockholders of record on October 2, 2020. This marks the 7th consecutive year of dividend increases to our shareholders. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 7

Company Overview Financial Highlights (unaudited and dollars in thousands, except per share data) Three Months Ended 3Q20 2Q20 1Q20 4Q19 3Q19 INCOME ITEMS Revenues $ 187,326 $ 178,845 $ 185,776 $ 176,313 $ 175,004 NOl (1)(2) 130,078 122,645 128,914 123,047 121,197 Adjusted EBITDAre, annualized (1)(3) 489,928 482,112 487,228 480,024 463,164 FFO (1)(3) 68,489 87,766 93,114 87,261 65,047 Normalized FFO (1)(3) 96,235 92,993 93,561 88,871 87,101 Normalized FAD (1)(3) 82,419 77,465 77,389 72,261 70,879 Net income attributable to common stockholders per diluted share $ (0.03) $ 0.06 $ 0.08 $ 0.04 $ (0.04) FFO per diluted share 0.31 0.40 0.42 0.41 0.31 Normalized FFO per diluted share 0.43 0.42 0.42 0.42 0.42 Same-Property Cash NOI growth (4) 0.5% 0.6% 2.7% 2.5% 2.5% Fixed charge coverage ratio (5) 4.82x 4.67x 4.63x 4.52x 4.46x As of 3Q20 2Q20 1Q20 4Q19 3Q19 ASSETS Gross real estate investments $ 7,636,402 $ 7,606,409 $ 7,571,447 $ 7,493,616 $ 7,143,223 Total assets 6,774,572 6,644,496 6,824,179 6,638,749 6,322,998 CAPITALIZATION Net debt (6) $ 2,799,396 $ 2,743,493 $ 2,743,208 $ 2,717,062 $ 2,652,943 Total capitalization (7) 8,573,996 8,633,134 8,134,436 9,387,352 8,853,151 Net debt/total capitalization (6) 32.6% 31.8% 33.7% 28.9% 30.0% (1) Refer to pages 23 and 24 for the reporting definitions of NOI, Adjusted EBITDAre, FFO, Normalized FFO and Normalized FAD. (2) Refer to page 16 for a reconciliation of GAAP Net Income to NOI. (3) Refer to page 13 for the reconciliations of GAAP Net Income Attributable to Common Stockholders to FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre. (4) Calculated as the increase in Same-Property Cash NOI for the quarter as compared to the same period in the previous year. (5) Calculated as Adjusted EBITDAre divided by interest expense and scheduled principal payments. (6) Refer to page 15 for components of net debt. (7) Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period, plus net debt. Refer to page 15 for details. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 8

Company Overview Company Snapshot (as of September 30, 2020) Investments in Real Estate (1) $ 7.4 Total portfolio GLA (2) 25.1 Leased rate (3) 90.1% Same-Property portfolio tenant retention rate (YTD) (4) 88% % of GLA managed internally 97% % of GLA on-campus/adjacent 67% % of invested dollars in key markets & top 75 MSAs (5) 94% Weighted average remaining lease term for all buildings (6) 5.5 Weighted average remaining lease term for single-tenant buildings (6) 7.5 Weighted average remaining lease term for multi-tenant buildings (6) 4.5 Credit ratings (Standard & Poor’s/Moody’s) BBB(Stable)/Baa2(Stable) Cash and cash equivalents (2) $ 227.1 Net debt/total capitalization 32.6% Weighted average interest rate per annum on portfolio debt (7) 2.89% Building Type Presence in Top MSAs (8) % of Portfolio (based on GLA) % of Portfolio (based on invested dollars) Medical Office Buildings Atlanta, GA Orange County/ Hartford/New 95% 4.6% Los Angeles, CA Haven, CT 4.4% 4.6% Indianapolis, IN Tampa, FL 3.8% 4.7% Raleigh, NC 3.7% Boston, MA 5.4% Phoenix, AZ 3.6% Houston, TX 6.1% Senior Care 1% Hospitals 4% Dallas, TX 11.6% Remaining Top All Other Markets MSAs 5.7% 41.8% (1) Amount presented in billions. Refer to page 23 for the reporting definition of Investments in Real Estate. (2) Amounts presented in millions. Total portfolio GLA excludes GLA for projects under development and includes 100% of the GLA of its unconsolidated joint venture. (3) Calculations are based on percentage of total GLA, excluding GLA for development properties. (4) Refer to page 24 for the reporting definition of Retention. (5) Refer to page 23 for the reporting definition of Metropolitan Statistical Area. (6) Amounts presented in years. (7) Includes the impact of cash flow hedges. (8) Refer to page 19 for a detailed table of HTA’ s Key Markets and Top 75 MSA Concentration. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 9

Financial Statements Condensed Consolidated Balance Sheets (unaudited and in thousands, except share and per share data) As of 3Q20 4Q19 ASSETS Real estate investments: Land $ 587,363 $ 584,546 Building and improvements 6,385,863 6,252,854 Lease intangibles 619,048 628,066 Construction in progress 44,128 28,150 7,636,402 7,493,616 Accumulated depreciation and amortization (1,642,827) (1,447,815) Real estate investments, net 5,993,575 6,045,801 Investment in unconsolidated joint venture 64,756 65,888 Cash and cash equivalents 227,138 32,713 Restricted cash 4,108 4,903 Receivables and other assets, net 239,641 237,024 Right-of-use assets - operating leases, net 234,846 239,867 Other intangibles, net 10,508 12,553 Total assets $ 6,774,572 $ 6,638,749 LIABILITIES AND EQUITY Liabilities: Debt $ 3,026,534 $ 2,749,775 Accounts payable and accrued liabilities 168,696 171,698 Derivative financial instruments - interest rate swaps 16,697 29 Security deposits, prepaid rent and other liabilities 56,263 49,174 Lease liabilities - operating leases 198,445 198,650 Intangible liabilities, net 33,586 38,779 Total liabilities 3,500,221 3,208,105 Commitments and contingencies Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 218,566,057 and 216,453,312 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively 2,186 2,165 Additional paid-in capital 4,914,767 4,854,042 Accumulated other comprehensive income (18,747) 4,546 Cumulative dividends in excess of earnings (1,685,813) (1,502,744) Total stockholders’ equity 3,212,393 3,358,009 Noncontrolling interests 61,958 72,635 Total equity 3,274,351 3,430,644 Total liabilities and equity $ 6,774,572 $ 6,638,749 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 10

Financial Statements Condensed Consolidated Statements of Operations (unaudited and in thousands, except per share data) Three Months Ended Nine Months Ended 3Q20 3Q19 3Q20 3Q19 Revenues: Rental income $ 187,258 $ 174,844 $ 551,459 $ 515,328 Interest and other operating income 68 160 488 399 Total revenues 187,326 175,004 551,947 515,727 Expenses: Rental 57,248 53,807 170,310 158,213 General and administrative 10,670 9,788 32,348 31,157 Transaction 125 522 297 858 Depreciation and amortization 75,892 73,820 228,484 211,730 Interest expense 23,136 24,625 71,285 72,601 Total expenses 167,071 162,562 502,724 474,559 Gain (loss) on sale of real estate, net — — 1,991 (37) Loss on extinguishment of debt, net (27,726) (21,646) (27,726) (21,646) Income from unconsolidated joint venture 422 422 1,223 1,456 Other income 117 205 290 781 Net (loss) income $ (6,932) $ (8,577) $ 25,001 $ 21,722 Net loss (income) attributable to noncontrolling interests 105 114 (438) (486) Net (loss) income attributable to common stockholders $ (6,827) $ (8,463) $ 24,563 $ 21,236 Earnings per common share - basic: Net (loss) income attributable to common stockholders $ (0.03) $ (0.04) $ 0.11 $ 0.10 Earnings per common share - diluted: Net (loss) income attributable to common stockholders $ (0.03) $ (0.04) $ 0.11 $ 0.10 Weighted average common shares outstanding: Basic 218,549 205,277 217,911 205,156 Diluted 218,549 205,277 221,521 209,026 Dividends declared per common share $ 0.320 $ 0.315 $ 0.950 $ 0.935 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 11

Financial Statements Condensed Consolidated Statements of Cash Flows (unaudited and in thousands) Nine Months Ended 3Q20 3Q19 Cash flows from operating activities: Net income $ 25,001 $ 21,722 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 211,843 203,392 Share-based compensation expense 7,135 7,828 Income from unconsolidated joint venture (1,223) (1,456) Distributions from unconsolidated joint venture 2,455 2,225 (Gain) loss on sale of real estate, net (1,991) 37 Loss on extinguishment of debt, net 27,726 21,646 Changes in operating assets and liabilities: Receivables and other assets, net 3,282 (2,148) Accounts payable and accrued liabilities (11,787) (19,783) Security deposits, prepaid rent and other liabilities 7,227 4,919 Net cash provided by operating activities 269,668 238,382 Cash flows from investing activities: Investments in real estate (52,553) (223,168) Development of real estate (49,479) (14,253) Proceeds from the sale of real estate 6,420 1,193 Capital expenditures (59,016) (59,533) Collection of real estate notes receivable 709 551 Advances on real estate notes receivable (6,000) — Net cash used in investing activities (159,919) (295,210) Cash flows from financing activities: Borrowings on unsecured revolving credit facility 1,329,862 365,000 Payments on unsecured revolving credit facility (1,429,862) (350,000) Proceeds from unsecured senior notes 793,568 906,927 Payments on unsecured senior notes (300,000) (700,000) Payments on secured mortgage loans (114,060) (96,765) Deferred financing costs (6,532) (6,954) Debt extinguishment costs (25,938) (18,383) Proceeds from issuance of common stock 50,020 51,804 Issuance of OP Units 1,378 — Repurchase and cancellation of common stock (5,094) (12,159) Dividends paid (205,880) (190,853) Distributions paid to noncontrolling interest of limited partners (3,581) (7,503) Net cash provided by (used in) financing activities 83,881 (58,886) Net change in cash, cash equivalents and restricted cash 193,630 (115,714) Cash, cash equivalents and restricted cash - beginning of period 37,616 133,530 Cash, cash equivalents and restricted cash - end of period $ 231,246 $ 17,816 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 12

Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDAre (unaudited and in thousands, except per share data) FFO, Normalized FFO and Normalized FAD Three Months Ended Nine Months Ended 3Q20 3Q19 3Q20 3Q19 Net (loss) income attributable to common stockholders $ (6,827) $ (8,463) $ 24,563 $ 21,236 Depreciation and amortization expense related to investments in real estate 74,848 73,042 225,354 209,814 (Gain) loss on sale of real estate, net — — (1,991) 37 Proportionate share of joint venture depreciation and amortization 468 468 1,443 1,390 FFO attributable to common stockholders $ 68,489 $ 65,047 $ 249,369 $ 232,477 Transaction expenses 125 522 297 858 Loss on extinguishment of debt, net 27,726 21,646 27,726 21,646 Noncontrolling (loss) income from OP units included in diluted shares (105) (114) 438 420 Other normalizing adjustments (1) — — 5,031 — Normalized FFO attributable to common stockholders $ 96,235 $ 87,101 $ 282,861 $ 255,401 Non-cash compensation expense 1,832 2,337 7,135 7,828 Straight-line rent adjustments, net (5,711) (2,539) (12,673) (8,261) Amortization of (below) and above market leases/leasehold interests and corporate assets, net 599 (612) 504 45 Deferred revenue - tenant improvement related and other — (1) — (4) Amortization of deferred financing costs and debt discount/premium, net 1,275 1,469 3,262 4,281 Recurring capital expenditures, tenant improvements and leasing commissions (11,811) (16,876) (43,744) (42,140) Normalized FAD attributable to common stockholders $ 82,419 $ 70,879 $ 237,345 $ 217,150 Net (loss) income attributable to common stockholders per diluted share $ (0.03) $ (0.04) $ 0.11 $ 0.10 FFO adjustments per diluted share, net 0.34 0.35 1.02 1.01 FFO attributable to common stockholders per diluted share $ 0.31 $ 0.31 $ 1.13 $ 1.11 Normalized FFO adjustments per diluted share, net 0.12 0.11 0.15 0.11 Normalized FFO attributable to common stockholders per diluted share $ 0.43 $ 0.42 $ 1.28 $ 1.22 Weighted average diluted common shares outstanding 222,101 209,072 221,521 209,026 Adjusted EBITDAre (2) Three Months Ended 3Q20 Net loss $ (6,932) Interest expense 23,136 Depreciation and amortization expense 75,892 Proportionate share of joint venture depreciation and amortization 468 EBITDAre $ 92,564 Transaction expenses 125 Loss on extinguisment of debt, net 27,726 Non-cash compensation expense 1,832 Pro forma impact of acquisitions 235 Adjusted EBITDAre $ 122,482 Adjusted EBITDAre, annualized $ 489,928 As of September 30, 2020: Debt $ 3,026,534 Less: cash and cash equivalents 227,138 Net Debt $ 2,799,396 Net Debt to Adjusted EBITDAre 5.7x (1) Other normalizing adjustments includes the following: Non-recurring bad debt of $4,672 thousand, incremental hazard pay to facilities employees of $314 thousand, and incremental personal protective equipment of $45 thousand for the nine months ended September 30, 2020. There were no other normalizing adjustments for the three months ended September 30, 2020 (2) Refer to page 23 for the reporting definitions of EBITDAre, as defined by NAREIT, and Adjusted EBITDAre. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 13

Financial Information Debt Composition and Maturity Schedule (as of September 30, 2020, dollars in thousands) Debt Composition Deferred Principal Financing (Discounts)/ Balance Costs, Net Premium, Net Total Stated Rate (1) Hedged Rate (2) Unsecured senior note due 2026 $ 600,000 $ (2,735) $ 6,443 $ 603,708 3.50% 3.50% Unsecured senior note due 2027 500,000 (2,860) (1,810) 495,330 3.75 3.75 Unsecured senior note due 2030 650,000 (5,096) (2,033) 642,871 3.10 3.10 Unsecured senior note due 2031 800,000 (6,506) (6,428) 787,066 2.00 2.00 Total unsecured senior notes $ 2,550,000 $ (17,197) $ (3,828) $ 2,528,975 Unsecured term loan due 2023 300,000 (1,127) — 298,873 1.29% 2.52% Unsecured term loan due 2024 200,000 (1,314) — 198,686 1.15 2.32 Total unsecured term loans $ 500,000 $ (2,441) $ — $ 497,559 Unsecured revolving credit facility (3) — — — — 1.19 1.19 Total debt $ 3,050,000 $ (19,638) $ (3,828) $ 3,026,534 2.69% 2.89% Maturity Schedule $800,000 $800,000 $700,000 $650,000 $600,000 $600,000 $500,000 $500,000 $400,000 $300,000 $300,000 $200,000 $200,000 $100,000 $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Period Ending Unsecured Senior Notes Unsecured Term Loans (1) The stated rate on the debt instrument as of the end of the period. (2) The effective rate incorporates any cash flow hedges that serve to fix variable rate debt, as of the end of the period. (3) $1.0 billion available as of September 30, 2020. Rate does not include the 20 basis point facility fee that is payable on the entire $1.0 billion revolving credit facility. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 14

Financial Information Capitalization and Covenants (as of September 30, 2020, dollars and shares in thousands, except stock price) Capitalization 3Q20 Unsecured revolving credit facility $ — Unsecured term loans 500,000 Equity Unsecured senior notes 2,550,000 67% Secured mortgage loans — Deferred financing costs, net (19,638) Discount, net (3,828) Total debt $ 3,026,534 Less: cash and cash equivalents 227,138 Net debt $ 2,799,396 Stock price (as of September 30, 2020) $ 26.00 Total diluted common shares outstanding 222,100 Unsecured Equity capitalization $ 5,774,600 Debt 33% Total capitalization $ 8,573,996 Total undepreciated assets $ 8,417,399 Gross book value of unencumbered assets $ 7,711,483 Total debt/undepreciated assets 36.0% Net debt/total capitalization 32.6% Available Capital: Unsecured Revolving Credit Facility $ 1,000,000 Outstanding Forward Equity 277,458 Cash and Cash Equivalents 227,138 Total Available Capital: $ 1,504,596 Covenants Bank Loans Required 3Q20 Senior Notes Required 3Q20 Total leverage ≤ 60% 38% Total leverage ≤ 60% 37% Secured leverage ≤ 30% 0% Secured leverage ≤ 40% 0% Fixed charge coverage ≥ 1.50x 4.82x Unencumbered leverage ≤ 60% 39% Unencumbered asset coverage ≥ 150% 268% Unencumbered coverage ≥ 1.75x 4.90x Interest coverage ≥ 1.50x 4.92x 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 15

Portfolio Information Same-Property Performance and NOI (as of September 30, 2020, unaudited and dollars and GLA in thousands) Same-Property Performance Three Months Ended Sequential Year-Over-Year 3Q20 2Q20 3Q19 $ Change % Change $ Change % Change Rental revenue $ 129,034 $ 128,584 $ 128,628 $ 450 0.3% $ 406 0.3% Tenant recoveries 38,869 36,767 38,108 2,102 5.7 761 2.0 Total rental income 167,903 165,351 166,736 2,552 1.5 1,167 0.7 Expenses 51,723 49,511 51,100 2,212 4.5 623 1.2 Same-Property Cash NOI $ 116,180 $ 115,840 $ 115,636 $ 340 0.3% $ 544 0.5% Rental Margin (1) 90.0% 90.1% 89.9% As of 3Q20 2Q20 3Q19 Number of buildings 417 417 417 GLA 22,581 22,582 22,565 Leased GLA, end of period 20,505 20,545 20,669 Leased %, end of period 90.8% 91.0% 91.6% Occupancy GLA, end of period 20,421 20,435 20,468 Occupancy %, end of period 90.4% 90.5% 90.7% NOI (2) Three Months Ended 3Q20 3Q19 Net (loss) income $ (6,932) $ (8,577) General and administrative expenses 10,670 9,788 Transaction expenses 125 522 Depreciation and amortization expense 75,892 73,820 Interest expense 23,136 24,625 (Gain) loss on extinguishment of debt, net 27,726 21,646 Income from unconsolidated joint venture (422) (422) Other income (117) (205) NOI $ 130,078 $ 121,197 NOI percentage growth 7.3% NOI $ 130,078 $ 121,197 Straight-line rent adjustments, net (5,711) (2,539) Amortization of (below) and above market leases/leasehold interests, net and other GAAP adjustments (113) (1,390) Notes receivable interest income (11) (23) Cash NOI $ 124,243 $ 117,245 Acquisitions not owned/operated for all periods presented and disposed properties Cash NOI (7,938) (928) Redevelopment Cash NOI 57 (536) Intended for sale Cash NOI (182) (145) Same-Property Cash NOI $ 116,180 $ 115,636 Same-Property Cash NOI percentage growth 0.5% (1) Rental margin presents Same-Property Cash NOI divided by Same-Property rental revenue. (2) Refer to pages 23 and 24 for the reporting definitions of NOI, Cash NOI and Same-Property Cash NOI. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 16

Portfolio Information Investment Activity (as of September 30, 2020, dollars and GLA in thousands) 2020 Property Acquisitions Date % Leased at Property Market Acquired Acquisition Purchase Price (1) GLA Piedmont Healthcare MOBs Charlotte, NC January 94% $ 16,600 92 Curtis Plaza Boise, ID February 98 6,883 26 Wylie Medical Plaza Dallas, TX February 83 18,000 49 Salt Lake Regional MOB Salt Lake City, UT July 95 11,135 47 Total $ 52,618 214 Annual Investments (1) (2) As of September 30, 2020, HTA has invested $7.4 billion primarily in MOBs, development properties and other healthcare assets comprising 25.1 million square feet of GLA. Annual Investments $2,800,000 $2,722,467 $2,450,000 $2,100,000 $1,750,000 $1,400,000 $1,050,000 $700,000 $802,148 $700,764 $542,976 $557,938 $350,000 $455,950 $439,530 $413,150 $397,826 $294,937 $271,510 $17,729 $52,618 $68,314 $0 $(82,885) $(35,685) $(39,483) $(85,150) $(4,900) $(7,550) $(308,550) $-350,000 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Acquisitions Dispositions (1) Excludes real estate note receivables and corporate assets. (2) Sale proceeds of $7.6M related to the disposition of some land parcels in 1Q20. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 17

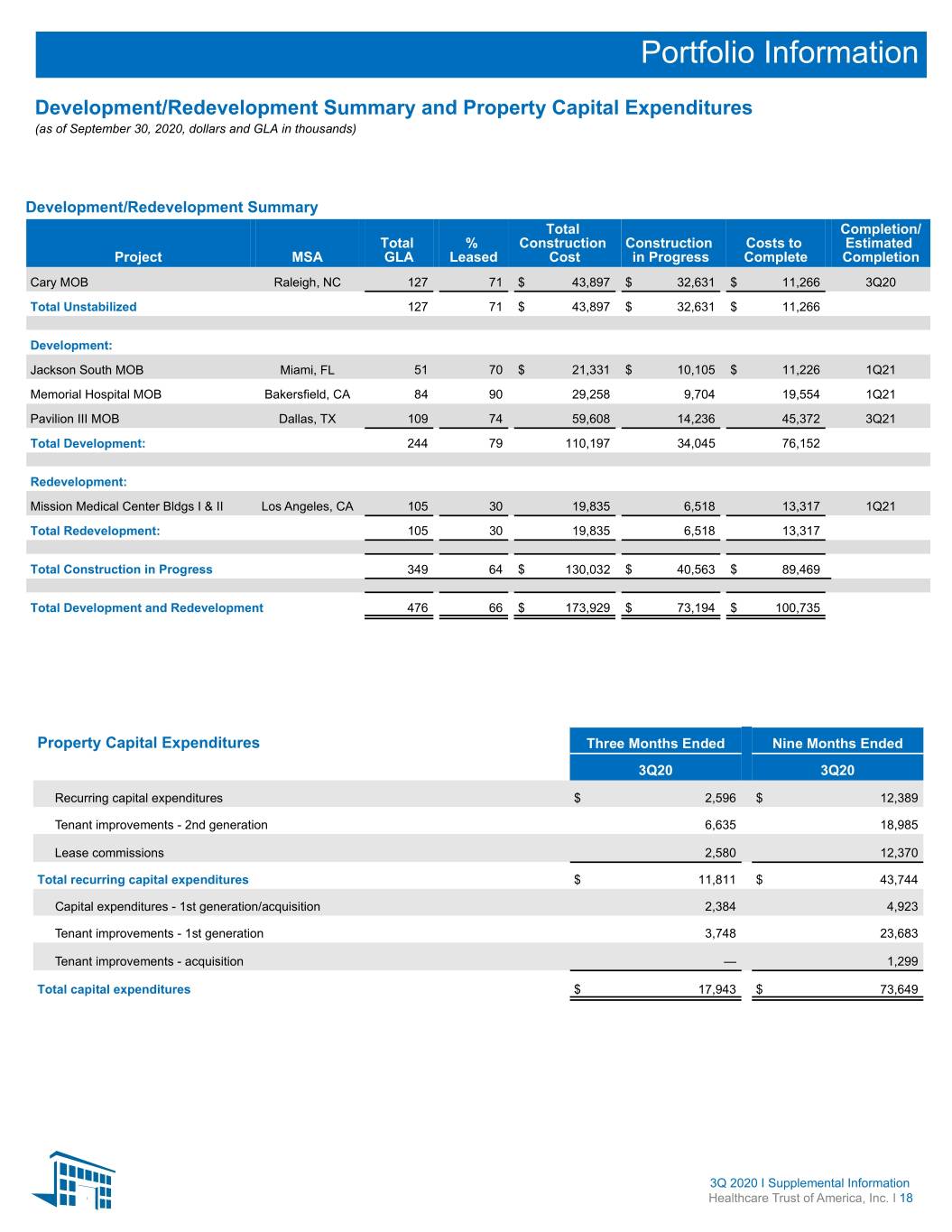

Portfolio Information Development/Redevelopment Summary and Property Capital Expenditures (as of September 30, 2020, dollars and GLA in thousands) Development/Redevelopment Summary Total Completion/ Total % Construction Construction Costs to Estimated Project MSA GLA Leased Cost in Progress Complete Completion Cary MOB Raleigh, NC 127 71 $ 43,897 $ 32,631 $ 11,266 3Q20 Total Unstabilized 127 71 $ 43,897 $ 32,631 $ 11,266 Development: Jackson South MOB Miami, FL 51 70 $ 21,331 $ 10,105 $ 11,226 1Q21 Memorial Hospital MOB Bakersfield, CA 84 90 29,258 9,704 19,554 1Q21 Pavilion III MOB Dallas, TX 109 74 59,608 14,236 45,372 3Q21 Total Development: 244 79 110,197 34,045 76,152 Redevelopment: Mission Medical Center Bldgs I & II Los Angeles, CA 105 30 19,835 6,518 13,317 1Q21 Total Redevelopment: 105 30 19,835 6,518 13,317 Total Construction in Progress 349 64 $ 130,032 $ 40,563 $ 89,469 Total Development and Redevelopment 476 66 $ 173,929 $ 73,194 $ 100,735 Property Capital Expenditures Three Months Ended Nine Months Ended 3Q20 3Q20 Recurring capital expenditures $ 2,596 $ 12,389 Tenant improvements - 2nd generation 6,635 18,985 Lease commissions 2,580 12,370 Total recurring capital expenditures $ 11,811 $ 43,744 Capital expenditures - 1st generation/acquisition 2,384 4,923 Tenant improvements - 1st generation 3,748 23,683 Tenant improvements - acquisition — 1,299 Total capital expenditures $ 17,943 $ 73,649 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 18

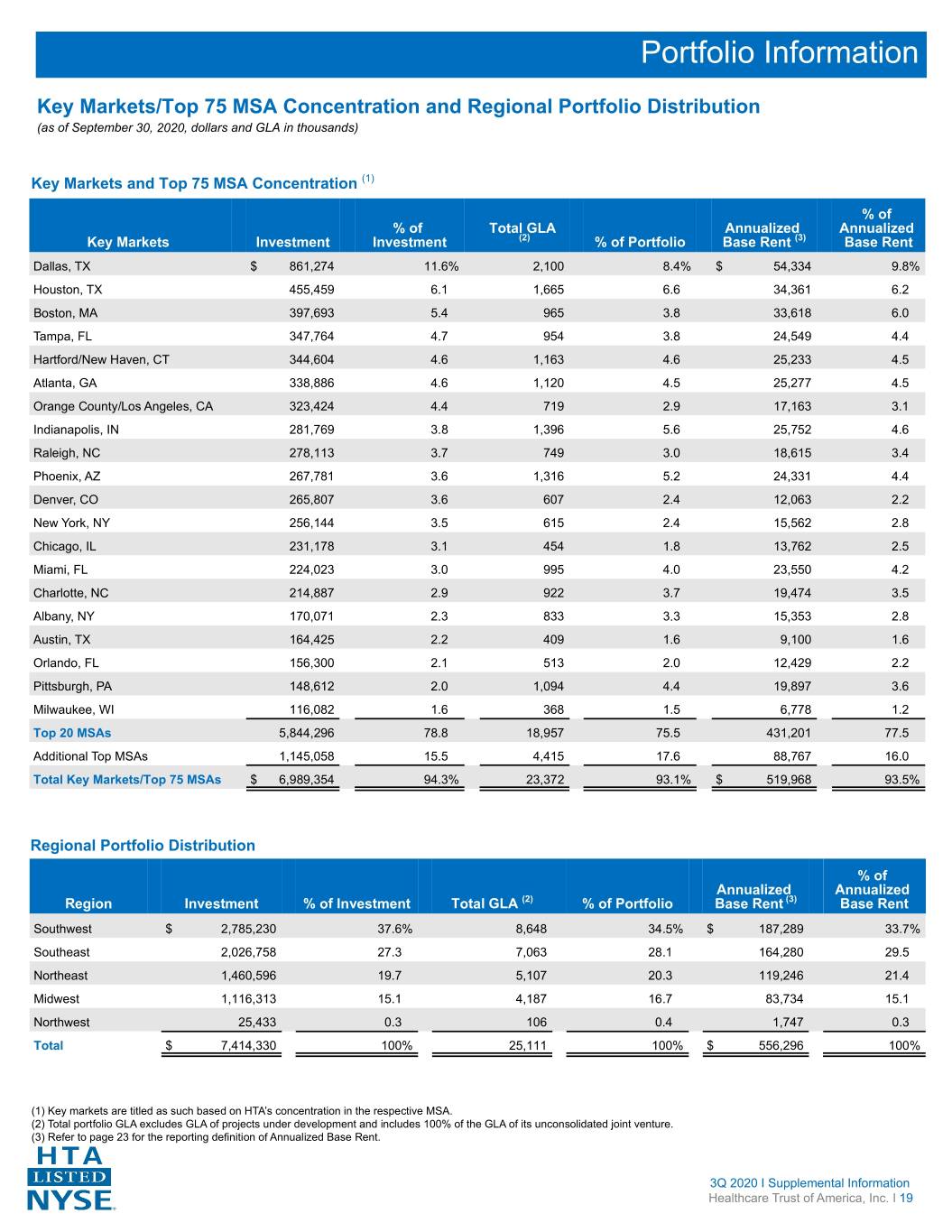

Portfolio Information Key Markets/Top 75 MSA Concentration and Regional Portfolio Distribution (as of September 30, 2020, dollars and GLA in thousands) Key Markets and Top 75 MSA Concentration (1) % of % of Total GLA Annualized Annualized Key Markets Investment Investment (2) % of Portfolio Base Rent (3) Base Rent Dallas, TX $ 861,274 11.6% 2,100 8.4% $ 54,334 9.8% Houston, TX 455,459 6.1 1,665 6.6 34,361 6.2 Boston, MA 397,693 5.4 965 3.8 33,618 6.0 Tampa, FL 347,764 4.7 954 3.8 24,549 4.4 Hartford/New Haven, CT 344,604 4.6 1,163 4.6 25,233 4.5 Atlanta, GA 338,886 4.6 1,120 4.5 25,277 4.5 Orange County/Los Angeles, CA 323,424 4.4 719 2.9 17,163 3.1 Indianapolis, IN 281,769 3.8 1,396 5.6 25,752 4.6 Raleigh, NC 278,113 3.7 749 3.0 18,615 3.4 Phoenix, AZ 267,781 3.6 1,316 5.2 24,331 4.4 Denver, CO 265,807 3.6 607 2.4 12,063 2.2 New York, NY 256,144 3.5 615 2.4 15,562 2.8 Chicago, IL 231,178 3.1 454 1.8 13,762 2.5 Miami, FL 224,023 3.0 995 4.0 23,550 4.2 Charlotte, NC 214,887 2.9 922 3.7 19,474 3.5 Albany, NY 170,071 2.3 833 3.3 15,353 2.8 Austin, TX 164,425 2.2 409 1.6 9,100 1.6 Orlando, FL 156,300 2.1 513 2.0 12,429 2.2 Pittsburgh, PA 148,612 2.0 1,094 4.4 19,897 3.6 Milwaukee, WI 116,082 1.6 368 1.5 6,778 1.2 Top 20 MSAs 5,844,296 78.8 18,957 75.5 431,201 77.5 Additional Top MSAs 1,145,058 15.5 4,415 17.6 88,767 16.0 Total Key Markets/Top 75 MSAs $ 6,989,354 94.3% 23,372 93.1% $ 519,968 93.5% Regional Portfolio Distribution % of Annualized Annualized Region Investment % of Investment Total GLA (2) % of Portfolio Base Rent (3) Base Rent Southwest $ 2,785,230 37.6% 8,648 34.5% $ 187,289 33.7% Southeast 2,026,758 27.3 7,063 28.1 164,280 29.5 Northeast 1,460,596 19.7 5,107 20.3 119,246 21.4 Midwest 1,116,313 15.1 4,187 16.7 83,734 15.1 Northwest 25,433 0.3 106 0.4 1,747 0.3 Total $ 7,414,330 100% 25,111 100% $ 556,296 100% (1) Key markets are titled as such based on HTA’s concentration in the respective MSA. (2) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (3) Refer to page 23 for the reporting definition of Annualized Base Rent. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 19

Portfolio Information Portfolio Diversification by Type, Historical Campus Proximity and Ownership Interests (as of September 30, 2020, dollars and GLA in thousands, except as otherwise noted) Portfolio Diversification by Type % of Number of Number of % of Total Annualized Annualized Buildings States GLA (1) GLA Base Rent (2) Base Rent Medical Office Buildings Single-tenant 118 21 6,262 24.9% $ 139,155 25.0% Multi-tenant 331 32 17,541 69.9 378,171 68.0 Other Healthcare Facilities Hospitals 15 7 954 3.8 33,325 6.0 Senior care 3 1 354 1.4 5,645 1.0 Total 467 33 25,111 100% $ 556,296 100% Net-Lease/Gross-Lease Net-lease 299 30 15,953 63.5% $ 363,174 65.3% Gross-lease 168 22 9,158 36.5 193,122 34.7 Total 467 33 25,111 100% $ 556,296 100% Historical Campus Proximity (3) As of 3Q20 2Q20 1Q20 4Q19 3Q19 Off-Campus Aligned 26% 27% 27% 28% 27% On-Campus 67 66 66 66 67 On-Campus/Aligned 93% 93% 93% 94% 94% Off-Campus/Non-Aligned 7 7 7 6 6 Total 100% 100% 100% 100% 100% Ownership Interests (4) % of As of (5) Number of Annualized Annualized Buildings GLA (3) Base Rent Base Rent 3Q20 2Q20 1Q20 4Q19 3Q19 Fee Simple 319 15,875 $ 351,899 63% 63% 63% 63% 63% 61% Customary Health System Restrictions 141 8,868 194,615 35 36 36 36 36 37 Economic with Limited Restrictions 6 333 9,393 2 1 1 1 1 2 Occupancy Health System Restrictions 1 35 389 — — — — — — Leasehold Interest Subtotal 148 9,236 204,397 37 37 37 37 37 39 Total 467 25,111 $ 556,296 100% 100% 100% 100% 100% 100% (1) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (2) Refer to page 23 for the reporting definition of Annualized Base Rent. (3) Percentages shown as percent of total GLA. Refer to page 24 for the reporting definitions of Off-campus/Non-Aligned and On-Campus/Aligned. (4) Refer to pages 23 and 24 for the reporting definitions of Customary Health System Restrictions, Economic with Limited Restrictions, and Occupancy Health System Restrictions. (5) Percentages shown as percent of total GLA. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 20

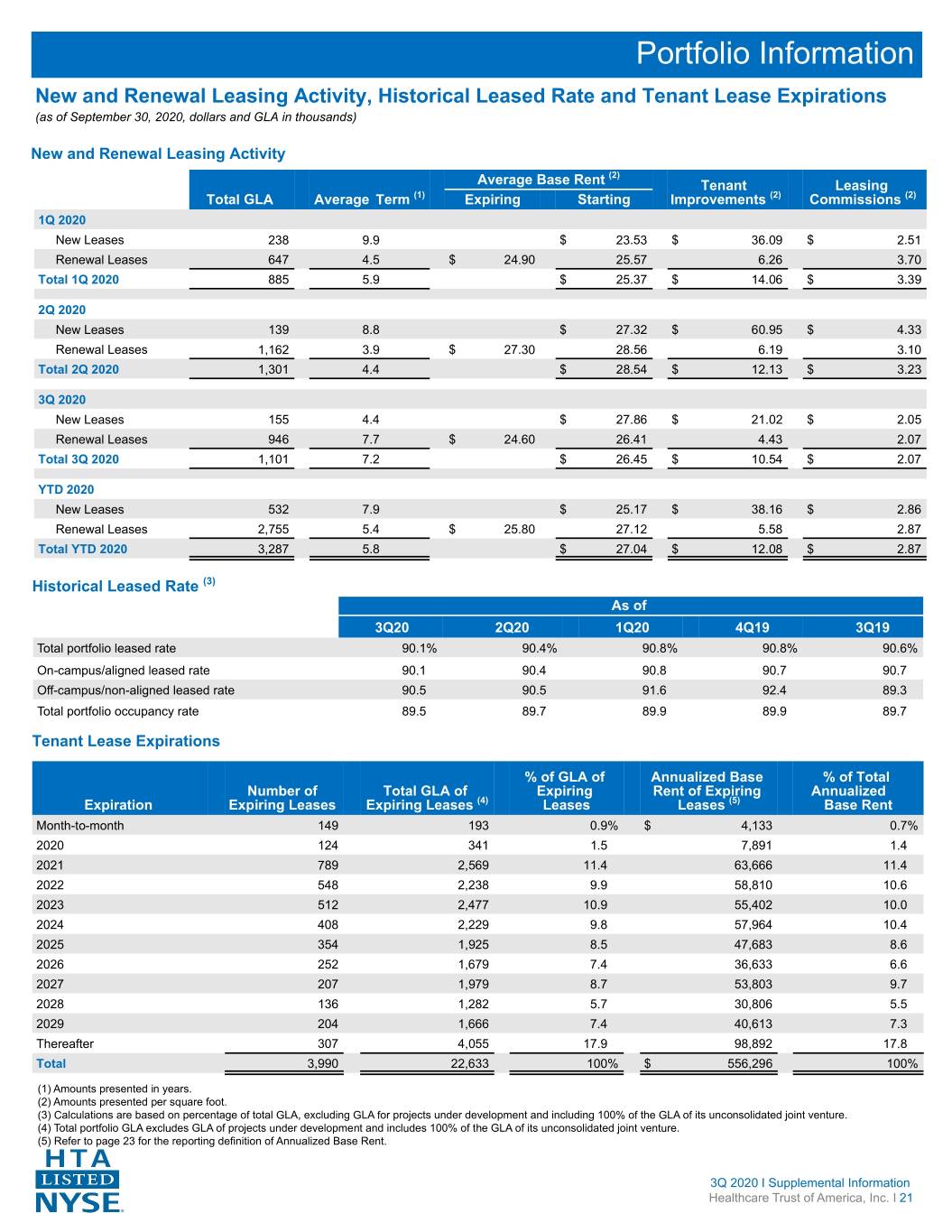

Portfolio Information New and Renewal Leasing Activity, Historical Leased Rate and Tenant Lease Expirations (as of September 30, 2020, dollars and GLA in thousands) New and Renewal Leasing Activity (2) Average Base Rent Tenant Leasing Total GLA Average Term (1) Expiring Starting Improvements (2) Commissions (2) 1Q 2020 New Leases 238 9.9 $ 23.53 $ 36.09 $ 2.51 Renewal Leases 647 4.5 $ 24.90 25.57 6.26 3.70 Total 1Q 2020 885 5.9 $ 25.37 $ 14.06 $ 3.39 2Q 2020 New Leases 139 8.8 $ 27.32 $ 60.95 $ 4.33 Renewal Leases 1,162 3.9 $ 27.30 28.56 6.19 3.10 Total 2Q 2020 1,301 4.4 $ 28.54 $ 12.13 $ 3.23 3Q 2020 New Leases 155 4.4 $ 27.86 $ 21.02 $ 2.05 Renewal Leases 946 7.7 $ 24.60 26.41 4.43 2.07 Total 3Q 2020 1,101 7.2 $ 26.45 $ 10.54 $ 2.07 YTD 2020 New Leases 532 7.9 $ 25.17 $ 38.16 $ 2.86 Renewal Leases 2,755 5.4 $ 25.80 27.12 5.58 2.87 Total YTD 2020 3,287 5.8 $ 27.04 $ 12.08 $ 2.87 Historical Leased Rate (3) As of 3Q20 2Q20 1Q20 4Q19 3Q19 Total portfolio leased rate 90.1% 90.4% 90.8% 90.8% 90.6% On-campus/aligned leased rate 90.1 90.4 90.8 90.7 90.7 Off-campus/non-aligned leased rate 90.5 90.5 91.6 92.4 89.3 Total portfolio occupancy rate 89.5 89.7 89.9 89.9 89.7 Tenant Lease Expirations % of GLA of Annualized Base % of Total Number of Total GLA of Expiring Rent of Expiring Annualized Expiration Expiring Leases Expiring Leases (4) Leases Leases (5) Base Rent Month-to-month 149 193 0.9% $ 4,133 0.7% 2020 124 341 1.5 7,891 1.4 2021 789 2,569 11.4 63,666 11.4 2022 548 2,238 9.9 58,810 10.6 2023 512 2,477 10.9 55,402 10.0 2024 408 2,229 9.8 57,964 10.4 2025 354 1,925 8.5 47,683 8.6 2026 252 1,679 7.4 36,633 6.6 2027 207 1,979 8.7 53,803 9.7 2028 136 1,282 5.7 30,806 5.5 2029 204 1,666 7.4 40,613 7.3 Thereafter 307 4,055 17.9 98,892 17.8 Total 3,990 22,633 100% $ 556,296 100% (1) Amounts presented in years. (2) Amounts presented per square foot. (3) Calculations are based on percentage of total GLA, excluding GLA for projects under development and including 100% of the GLA of its unconsolidated joint venture. (4) Total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. (5) Refer to page 23 for the reporting definition of Annualized Base Rent. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 21

Portfolio Information Tenant Profile, Tenant Specialty and Top MOB Tenants (as of September 30, 2020, dollars and GLA in thousands, except as otherwise noted) Tenant Profile Tenant Specialty (2) % of Specialty On-Campus Off-Campus Total Annualized Annualized (3) Tenant Classification Base Rent (1) Base Rent Primary Care 15.7% 20.6% 17.3% Credit Rated Tenancy Orthopedics/Sports Medicine 8.5% 9.9% 9.0% Health Systems/Universities $ 329,167 59% Leased % of % of Obstetrics/Gynecology 8.7 4.0 7.1 (3) (4) National/Large Regional Providers 80,287 15 Ratings GLA GLA ABR ABR Cardiology 6.2 2.8 5.0 Investment Grade 10,805 48% $ 260,452 47% Local Healthcare Providers/Other 146,842 26 Oncology 4.3 2.5 3.7 Total $ 556,296 100% Imaging/Diagnostics/Radiology 3.3 4.5 3.7 Other Credit Rated 2,789 12 77,954 15 Eye and Vision 3.0 3.8 3.3 Total Credit Rated 13,594 60% $ 338,406 62% General Surgery 2.6 2.5 2.6 Not Rated/Other 9,054 40 210,673 38 Credit Rated Tenancy Other Specialty 34.6 34.2 34.4 Specialty 71.2% 64.2% 68.8% Total 22,648 100% $ 549,079 100% Investment Grade $ 250,347 45% Ambulatory Surgery Center 4.9% 5.9% 5.3% Other Credit Rated 81,929 15 Education/Research 3.2 1.6 2.6 Total Credit Rated $ 332,276 60% Pharmacy 1.1 0.4 0.9 Not Rated/Other 224,020 40 Other 3.9 7.3 5.1 Total $ 556,296 100% Total 100% 100% 100% Top MOB Tenants (4) Weighted Average % of % of Remaining Credit Total Leased Leased Annualized Annualized Tenant Lease Term (5) Rating (6) GLA (7) GLA Base Rent (1) Base Rent Baylor Scott & White Health 6 Aa3 819 3.6% $ 22,859 4.1% HCA Healthcare 6 Ba1 742 3.3 20,937 3.8 Highmark-Allegheny Health Network 9 Baa1 927 4.1 17,382 3.1 Ascension 6 Aa2 481 2.1 11,405 2.0 Tufts Medical Center 7 Aa2 255 1.1 11,260 2.0 Steward Health Care 9 NR 380 1.7 10,375 1.9 Tenet Healthcare Corporation 5 B2 355 1.6 9,758 1.8 AdventHealth 5 Aa2 402 1.8 9,613 1.7 Community Health Systems 8 Caa3 418 1.8 8,382 1.5 Emblem Health 14 C+ 281 1.2 7,280 1.3 CommonSpirit Health 9 Baa1 339 1.5 7,212 1.3 Harbin Clinic 7 NR 316 1.4 7,006 1.3 Mercy Health 6 A1 270 1.2 6,961 1.2 Atrium Health 14 AA- 217 1.0 6,538 1.2 UnitedHealth Group/Optum 5 A3 283 1.2 6,259 1.1 Total 6,485 28.6% $ 163,227 29.3% (1) Refer to page 23 for the reporting definition of Annualized Base Rent. (2) Tenant Specialty includes the percentage of total GLA of multi-tenanted clinical MOBs. (3) Primary Care includes Pediatrics, Family and Internal Medicine. (4) Represents direct leases with top MOB health systems and their subsidiaries. Parent tenant credit rating used where direct tenant is not rated. (5) Amounts presented in years. (6) Credit ratings from S&P, Moody's or AM Best where appropriate. (7) Total leased and total portfolio GLA excludes GLA of projects under development and includes 100% of the GLA of its unconsolidated joint venture. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 22

Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“Adjusted EBITDAre”): Adjusted EBITDAre is presented on an assumed annualized basis. HTA defines Adjusted EBITDAre as EBITDAre (computed in accordance with NAREIT as defined below) plus: (i) transaction expenses; (ii) gain or loss on extinguishment of debt; (iii) non-cash compensation expense; (iv) pro forma impact of its acquisitions/dispositions; and (v) other normalizing adjustments. HTA considers Adjusted EBITDAre an important measure because it provides additional information to allow management, investors, and its current and potential creditors to evaluate and compare its core operating results and its ability to service debt. Annualized Base Rent or (“ABR”): Annualized base rent is calculated by multiplying contractual base rent for the end of the period by 12 (excluding the impact of abatements, concessions, and straight-line rent). Cash Net Operating Income (“Cash NOI”): Cash NOI is a non-GAAP financial measure which excludes from NOI: (i) straight-line rent adjustments; (ii) amortization of below and above market leases/leasehold interests and other GAAP adjustments; (iii) notes receivable interest income; and (iv) other normalizing adjustments. Contractual base rent, contractual rent increases, contractual rent concessions and changes in occupancy or lease rates upon commencement and expiration of leases are a primary driver of HTA’s revenue performance. HTA believes that Cash NOI, which removes the impact of straight-line rent adjustments, provides another measurement of the operating performance of its operating assets. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating performance of real estate investment trusts (“REITs”). However, HTA’s use of the term Cash NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of its financial performance. Cash NOI should be reviewed in connection with other GAAP measurements. Credit Ratings: Credit ratings of parent tenants and their subsidiaries. Customary Health System Restrictions: Ground leases with a health system ground lessor that include restrictions on tenants that may be considered competitive with the hospital, including provisions that tenants must have hospital privileges. Economic with Limited Restrictions: Ground leases that are primarily economic in nature and contain no material restrictions on tenancy. Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”): As defined by NAREIT, EBITDAre is computed as net income or loss (computed in accordance with GAAP) plus: (i) interest expense; (ii) income tax expense (not applicable to HTA); (iii) depreciation and amortization; (iv) impairment; (v) gain or loss on the sale of real estate; and (vi) the proportionate share of joint venture depreciation and amortization. Funds from Operations (“FFO”): HTA computes FFO in accordance with the current standards established by NAREIT. NAREIT defines FFO as net income or loss attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from sales of real estate property and impairment write-downs of depreciable assets, plus depreciation and amortization related to investments in real estate, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents this non-GAAP financial measure because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Historical cost accounting assumes that the value of real estate assets diminishes ratably over time. Since real estate values have historically risen or fallen based on market conditions, many industry investors have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Because FFO excludes depreciation and amortization unique to real estate, among other items, it provides a perspective not immediately apparent from net income or loss attributable to common stockholders. Gross Leasable Area (“GLA”): Gross leasable area in square feet. Investments in Real Estate: Based on acquisition price. Leased Rate: Leased rate represents the percentage of total GLA that is leased (excluding GLA for properties under development), including month-to-month leases and leases which have been executed, but which have not yet commenced, as of the date reported. Metropolitan Statistical Area (“MSA”): Is a geographical region with a relatively high population density at its core and close economic ties throughout the area. MSAs are defined by the Office of Management and Budget. Net Operating Income (“NOI”): NOI is a non-GAAP financial measure that is defined as net income or loss (computed in accordance with GAAP) before: (i) general and administrative expenses; (ii) transaction expenses; (iii) depreciation and amortization expense; (iv) impairment; (v) interest expense; (vi) gain or loss on sales of real estate; (vii) gain or loss on extinguishment of debt; (viii) income or loss from unconsolidated joint venture; and (ix) other income or expense. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the management of its properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance of REITs. However, HTA’s use of the term NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of HTA’s financial performance. NOI should be reviewed in connection with other GAAP measurements. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 23

Reporting Definitions - Continued Normalized Funds Available for Distribution (“Normalized FAD”): HTA computes Normalized FAD, which excludes from Normalized FFO: (i) non-cash compensation expense; (ii) straight-line rent adjustments; (iii) amortization of below and above market leases/leasehold interests and corporate assets; (iv) deferred revenue - tenant improvement related and other income; (v) amortization of deferred financing costs and debt premium/discount; and (vi) recurring capital expenditures, tenant improvements and leasing commissions. HTA believes this non-GAAP financial measure provides a meaningful supplemental measure of its operating performance. Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of its financial performance, nor is it indicative of cash available to fund cash needs. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (“Normalized FFO”): HTA computes Normalized FFO, which excludes from FFO: (i) transaction expenses; (ii) gain or loss on extinguishment of debt; (iii) noncontrolling income or loss from partnership units included in diluted shares; and (iv) other normalizing adjustments, which include items that are unusual and infrequent in nature. HTA presents this non-GAAP financial measure because it allows for the comparison of its operating performance to other REITs and between periods on a consistent basis. HTA’s methodology for calculating Normalized FFO may be different from the methods utilized by other REITs and, accordingly, may not be comparable to other REITs. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of its financial performance, nor is it indicative of cash available to fund cash needs. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy Health System Restrictions: Ground leases with customary health system restrictions whereby the restrictions cease if occupancy in the buildings/on-campus fall below stabilized occupancy, which is generally between 85% and 90%. Off-Campus/Non-Aligned: A building or portfolio that is not located on or adjacent to a healthcare or hospital campus or does not have full alignment with a recognized healthcare system. On-Campus/Aligned: On-campus refers to a property that is located on or adjacent to a healthcare or hospital campus. Aligned refers to a property that is not on a healthcare or hospital campus, but is anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements and Leasing Commissions: Represents amounts paid for: (i) recurring capital expenditures required to maintain and re-tenant its properties; (ii) second generation tenant improvements; and (iii) leasing commissions paid to secure new tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing agreements. Retention: Represents the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA of leases that renewed or expired during the period. Same-Property Cash Net Operating Income (“Same-Property Cash NOI”): To facilitate the comparison of Cash NOI between periods, HTA calculates comparable amounts for a subset of its owned and operational properties referred to as “Same-Property”. Same-Property Cash NOI excludes (i) properties which have not been owned and operated by HTA during the entire span of all periods presented and disposed properties, (ii) HTA’s share of unconsolidated joint ventures, (iii) development, redevelopment and land parcels, (iv) properties intended for disposition in the near term which have (a) been approved by the Board of Directors, (b) are actively marketed for sale, and (c) an offer has been received at prices HTA would transact and the sales process is ongoing, and (v) certain non-routine items. Same-Property Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of its financial performance. Same-Property Cash NOI should be reviewed in connection with other GAAP measurements. Tenant Recoveries: Tenant reimbursement revenue, which is comprised of additional amounts recoverable from tenants for real estate taxes, common area maintenance and other certain operating expenses are recognized as revenue on a gross basis in the period in which the related recoverable expenses are incurred. HTA accrues revenue corresponding to these expenses on a quarterly basis to adjust recorded amounts to its best estimate of the final annual amounts to be billed. Subsequent to year-end, on a calendar year basis, HTA performs reconciliations on a lease-by-lease basis and bill or credit each tenant for any differences between the estimated expenses HTA billed and the actual expenses that were incurred. 3Q 2020 I Supplemental Information Healthcare Trust of America, Inc. I 24