Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - REALTY INCOME CORP | realtyincomeex991q3202.htm |

| 8-K - 8-K - REALTY INCOME CORP | o-20201102.htm |

Exhibit 99.2 An S&P 500 SUPPLEMENTAL OPERATING company S&P 500 & FINANCIAL DATA Dividend Aristocrats® Q3 2020 index member

Table Of Contents Corporate Overview 3 COVID-19 Impact Summary of COVID-19 Impact 4 Rent Collections by Industry 6 Financial Summary Consolidated Statements Of Income 8 Funds From Operations (FFO) 9 Adjusted Funds From Operations (AFFO) 10 Consolidated Balance Sheets 11 Debt Summary 12 Debt Maturities 13 Capitalization & Financial Ratios 14 Adjusted EBITDAre & Coverage Ratios 15 Debt Covenants 16 Transaction Summary Investment Summary 17 Disposition Summary 18 Development Pipeline 19 Real Estate Portfolio Summary Tenant Diversification 20 Top 10 Industries 21 Industry Diversification 22 Geographic Diversification 24 Property Type Composition 26 Same Store Rental Revenue 27 Leasing Data Occupancy 29 Leasing Activity 30 Lease Expirations 31 Analyst Coverage 32 This Supplemental Operating & Financial Data should be read in connection with the company's third quarter 2020 earnings press release (included as Exhibit 99.1 of the company's Current Report on Form 8-K, filed on November 2, 2020) as certain disclosures, definitions, and reconciliations in such announcement have not been included in this Supplemental Operating & Financial Data. Q3 2020 Supplemental Operating & Financial Data 2

Corporate Overview Corporate Profile Senior Management Realty Income, The Monthly Dividend Company®, is an S&P 500 company Sumit Roy, President & Chief Executive Officer and member of the S&P 500 Dividend Aristocrats® index dedicated to Michael R. Pfeiffer, EVP, Chief Administrative Officer, General Counsel and providing stockholders with dependable monthly dividends that increase over Secretary time. For over 51 years, we have been acquiring and managing freestanding Neil M. Abraham, EVP, Chief Strategy Officer commercial real estate that generates rental revenue under long-term, net- Mark E. Hagan, EVP, Chief Investment Officer lease agreements, and supports our monthly dividend. Benjamin N. Fox, EVP, Asset Management & Real Estate Operations Portfolio Overview At September 30, 2020, we owned a diversified portfolio of 6,588 properties Credit Ratings located in 49 U.S. states, Puerto Rico and the United Kingdom (U.K.), with Senior Unsecured Outlook Commercial Paper approximately 108.5 million square feet of leasable space. Our properties are leased to approximately 600 different tenants doing business in 51 separate Moody’s A3 Stable P-2 industries. Approximately 85% of our total portfolio annualized contractual Standard & Poor’s A- Stable A-2 rental revenue(1) was generated from retail properties, 10% from industrial properties, and the remaining 5% from other property types. Our physical occupancy as of September 30, 2020 was 98.6%, with a weighted average Dividend Information as of October 2020 remaining lease term of approximately 9.0 years. Total portfolio annualized ▪ Current annualized dividend of 2.808 per share contractual rental revenue on our leases as of September 30, 2020 was $1.625 billion. ▪ Compound average annual dividend growth rate of approximately 4.5% ▪ 604 consecutive monthly dividends declared Common Stock ▪ 92 consecutive quarterly dividend increases Our Common Stock is traded on the New York Stock Exchange under the symbol "O“. Corporate Headquarters September 30, 2020 11995 El Camino Real Closing price $ 60.75 San Diego, California 92130 Shares and units outstanding 351,058,988 Phone: (858) 284-5000 Market value of common equity $ 21,326,833,000 Total market capitalization $ 29,774,664,000 London Office 42 Brook St. Transfer Agent London, United Kingdom W1K 5DB Computershare Phone: 020 3931 6856 Phone: (877) 218-2434 Website: www.realtyincome.com Website: www.computershare.com (1) We define total portfolio annualized contractual rental revenue as the monthly aggregate cash amount charged to tenants, inclusive of monthly base rent receivables, as of the balance sheet date, multiplied by 12, excluding percentage rent. We believe total portfolio annualized contractual revenue is a useful supplemental operating measure, as it excludes properties that were no longer owned at the balance sheet date and includes the annualized rent from properties acquired during the quarter. Total portfolio annualized contractual rental revenue has not been reduced to reflect reserves recorded as reductions to GAAP rental revenue in the periods presented. Q3 2020 Supplemental Operating & Financial Data 3

Summary of COVID-19 Impact The COVID-19 pandemic and the measures taken to limit the spread are negatively impacting the economy, including the industries in which some of our tenants operate. These impacts are likely to continue and may increase in severity as the duration of the pandemic lengthens. As a result, we continue to work diligently with our tenants affected by the pandemic to understand their business operations and financial liquidity in regard to their lease obligations to us. Our current guidance relating to our acquisition volume is approximately $2.0 billion for 2020. We continue to evaluate the impacts of the COVID-19 pandemic on our business as the situation continues to evolve. Percentages of Contractual Rent Collected by Month as of October 31, 2020 Month Ended Month Ended Month Ended Quarter Ended Month Ended July 31, 2020 August 31, 2020 September 30, 2020 September 30, 2020 October 31, 2020 Contractual rent collected(1) across total 91.8% 93.3% 94.1% 93.1% 92.9% portfolio Contractual rent collected(1) from top 20 90.0% 91.6% 91.8% 91.1% 89.9% tenants(2) Contractual rent collected(1) from investment 100.0% 100.0% 100.0% 100.0% 100.0% grade tenants(3) (1) Collection rates are calculated as the aggregate cash rent collected for the applicable period from the beginning of that applicable period through October 31, 2020, divided by the contractual cash rent charged for the applicable period. Cash rent collected is defined as amounts received including amounts in transit, where the tenant has confirmed payment is in process. Rent collection percentages are calculated based on contractual base rents (excluding percentage rents and tenant reimbursements). Charged amounts have not been adjusted for any COVID-19 related rent relief granted and include contractual base rents from any tenants in bankruptcy. Due to differences in applicable foreign currency conversion rates and rent conventions, the percentages above may differ from percentages calculated utilizing our total portfolio annualized contractual revenue. (2) We define top 20 tenants as our 20 largest tenants based on percentage of total portfolio annualized contractual rental revenue as of the most recent reported period. (3) We define investment grade tenants as tenants with a credit rating, and tenants that are subsidiaries or affiliates of companies with a credit rating, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch). COVID-19 Related Provisions for Impairment During 2020, we identified the impact of COVID-19 as an impairment triggering event for properties occupied by certain tenants experiencing difficulties meeting their lease obligations to us. After considering the impacts of COVID-19 on the key assumptions, we determined that the carrying values of 17 properties classified as held for investment for the three months ended September 30, 2020, and 25 properties classified as held for investment for the nine months ended September 30, 2020 were not recoverable. As a result, we recorded provisions for impairment of $81.6 million for the three months ended September 30, 2020, and $89.8 million for the nine months ended September 30, 2020, on these applicable properties impacted by the COVID-19 pandemic. Of the provisions for impairment recorded during the third quarter of 2020, a total of 12 assets occupied by certain of our tenants in the theater industry were impaired for $79.0 million. Q3 2020 Supplemental Operating & Financial Data 4

Summary of COVID-19 Impact (Cont'd) Theater Industry Update As of September 30, 2020, the theater industry represented 5.7% of annualized contractual rental revenue. Given the ongoing disruption to the industry due to the COVID-19 pandemic, we performed a property-level analysis on the collectability of rent for our 78 theater properties, including the gross receivables outstanding as of September 30, 2020, totaling $44.9 million. Our analysis involved the assignment of quartile rankings for each asset’s pre-pandemic EBITDAR relative to each operator’s overall footprint. Other criteria utilized included an analysis of the property’s pre- pandemic annual EBITDA generation before corporate overhead, and real estate fundamentals. As a result of this analysis, we determined that for 31 of the 78 theater properties it was no longer probable that we would collect substantially all of contractual rents due. As a conservative measure, we fully reserved for six additional theater properties for which we do not possess unit level financial information. Consequently, we reserved for 100% of the outstanding receivables for 37 theater properties and will account prospectively for these leases on a cash accounting basis. The aggregate reserve associated with outstanding receivables for these properties totaled $17.2 million, approximately $1.6 million of which was a reserve for straight-line rent receivables. The dilution for the third quarter of 2020 as a result of establishing these reserves for our theater portfolio is $0.05 per share to our net income and FFO and $0.04 per share to our AFFO. The monthly contractual rent associated with these properties totals approximately $2.8 million. Additionally, during the third quarter, we recorded provisions for impairment on 12 of the 37 theater properties for $79.0 million. Impairment charges are not included in Nareit-defined FFO or in our calculation of AFFO. (1) Unpaid Contractual Base Rent Summary (in millions) As of Percentage of September 30, 2020 Total Unpaid rent and rent deferred included in AFFO $ 62.9 70.4 % Reserves on contractual base rent (2) 26.1 29.2 Reduction of rental revenue from COVID-19 lease modifications and abatements (2) 0.4 0.4 Total Unpaid Rent $ 89.4 100 % (1) Contractual base rents exclude percentage rents and tenant reimbursements. (2) Reflects amounts for the nine months ended September 30, 2020. Q3 2020 Supplemental Operating & Financial Data 5

Rent Collections by Industry Percentage of Total Contractual Rent Due By Month (1) Percentage of Total Contractual Rent Collected By Month (1) October 2020 September 2020 August 2020 July 2020 October 2020 September 2020 August 2020 July 2020 U.S. Aerospace 0.6% 0.7% 0.7% 0.7% 0.6% 0.7% 0.7% 0.7% Apparel stores 1.3 1.3 1.3 1.4 1.3 1.3 1.3 1.4 Automotive collision services 1.1 1.2 1.2 1.1 1.1 1.2 1.2 1.1 Automotive parts 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 Automotive service 2.5 2.5 2.5 2.5 2.5 2.5 2.5 2.5 Automotive tire services 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 Beverages 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 Child care 2.1 2.1 2.1 2.2 2.1 2.1 2.1 1.9 Consumer electronics 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 Consumer goods 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 Convenience stores 12.1 12.3 12.4 12.2 12.0 12.2 12.3 12.2 Crafts and novelties 0.9 0.9 0.8 0.8 0.9 0.9 0.8 0.8 Diversified industrial 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 Dollar stores 7.8 7.8 7.9 7.9 7.8 7.8 7.8 7.9 Drug stores 8.4 8.5 8.6 8.6 8.4 8.5 8.6 8.6 Education 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.1 Electric utilities 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Entertainment 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.1 Equipment services 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 Financial services 1.9 1.9 1.9 1.9 1.9 1.9 1.9 1.9 Food processing 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 General merchandise 3.0 2.9 2.9 2.8 3.0 2.9 2.9 2.8 Government services 0.6 0.7 0.7 0.7 0.6 0.6 0.7 0.7 Grocery stores 5.0 5.1 5.0 5.1 5.0 5.1 5.0 5.1 Health and beauty 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 Health and fitness 7.0 7.2 7.2 7.2 5.8 5.4 6.0 6.1 (1) Collection rates are calculated as the aggregate cash rent collected for the applicable period from the beginning of that applicable period through October 31, 2020, divided by the contractual cash rent charged for the applicable period. Cash rent collected is defined as amounts received including amounts in transit, where the tenant has confirmed payment is in process. Rent collection percentages are calculated based on contractual base rents (excluding percentage rents and tenant reimbursements). Charged amounts have not been adjusted for any COVID-19 related rent relief granted and include contractual base rents from any tenants in bankruptcy. Due to differences in applicable foreign currency conversion rates and rent conventions, the industry percentages above may differ from industry percentages calculated utilizing our total portfolio annualized contractual revenue. Q3 2020 Supplemental Operating & Financial Data 6

Rent Collections by Industry (Cont'd) Percentage of Total Contractual Rent Due By Month (1) Percentage of Total Contractual Rent Collected By Month (1): October 2020 September 2020 August 2020 July 2020 October 2020 September 2020 August 2020 July 2020 U.S. (continued) Health care 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% 1.6% Home furnishings 0.7 0.8 0.8 0.8 0.6 0.7 0.7 0.7 Home improvement 3.0 2.9 2.9 2.9 3.0 2.9 2.9 2.9 Machinery 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Motor vehicle dealerships 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 Office supplies 0.2 0.2 0.2 0.2 0.1 0.2 0.1 0.1 Other manufacturing 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 Packaging 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 Paper 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Pet supplies and services 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 Restaurants - casual dining 3.0 3.0 3.0 3.1 2.7 2.8 2.8 2.8 Restaurants - quick service 5.6 5.7 5.7 5.8 5.6 5.6 5.0 5.0 Shoe stores 0.2 0.2 0.2 0.2 0.2 0.2 0.2 * Sporting goods 0.7 0.8 0.8 0.8 0.7 0.8 0.8 0.8 Telecommunications 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 Theaters 5.6 5.8 5.8 5.8 0.4 2.3 1.6 0.9 Transportation services 4.1 4.2 4.2 4.2 4.1 4.2 4.2 4.2 Wholesale clubs 2.5 2.4 2.4 2.4 2.5 2.4 2.4 2.4 Other 0.2 0.1 0.1 0.2 0.1 0.1 0.1 0.1 Total U.S. 95.3% 96.4% 96.5% 96.7% 88.2% 90.5% 89.8% 88.5% U.K. Grocery stores 3.7 3.2 3.3 3.2 3.7 3.2 3.3 3.2 Health care 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Home improvement 0.9 0.3 0.1 — 0.9 0.3 0.1 — Theaters * * * * — — — — Total U.K. 4.7% 3.6% 3.5% 3.3% 4.7% 3.6% 3.5% 3.3% Totals 100.0% 100.0% 100.0% 100.0% 92.9% 94.1% 93.3% 91.8% * Less than 0.1% (1) Collection rates are calculated as the aggregate cash rent collected for the applicable period from the beginning of that applicable period through October 31, 2020, divided by the contractual cash rent charged for the applicable period. Cash rent collected is defined as amounts received including amounts in transit, where the tenant has confirmed payment is in process. Rent collection percentages are calculated based on contractual base rents (excluding percentage rents and tenant reimbursements). Charged amounts have not been adjusted for any COVID-19 related rent relief granted and include contractual base rents from any tenants in bankruptcy. Due to differences in applicable foreign currency conversion rates and rent conventions, the industry percentages above may differ from industry percentages calculated utilizing total portfolio annualized contractual revenue. Q3 2020 Supplemental Operating & Financial Data 7

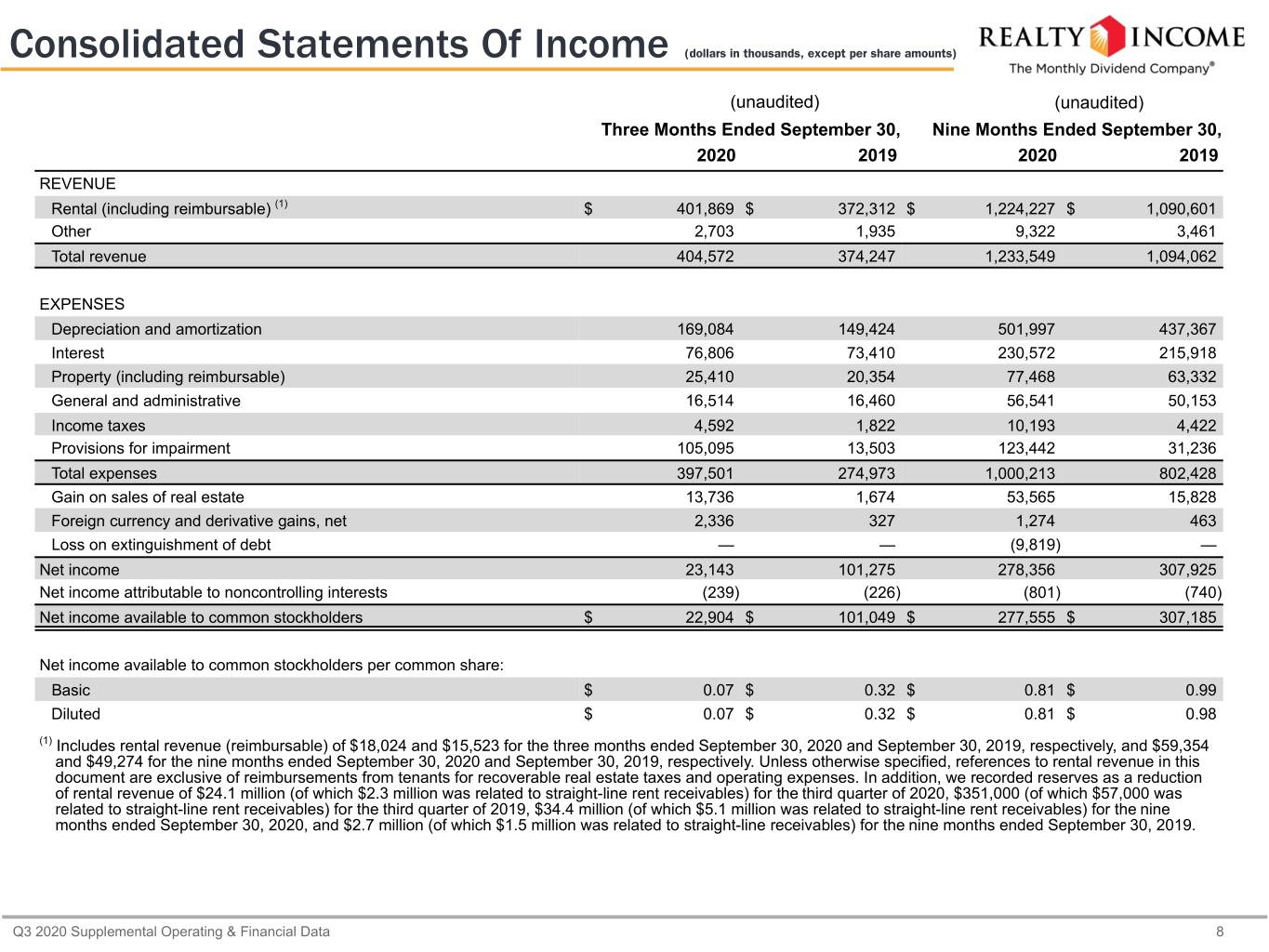

Consolidated Statements Of Income (dollars in thousands, except per share amounts) (unaudited) (unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 REVENUE Rental (including reimbursable) (1) $ 401,869 $ 372,312 $ 1,224,227 $ 1,090,601 Other 2,703 1,935 9,322 3,461 Total revenue 404,572 374,247 1,233,549 1,094,062 EXPENSES Depreciation and amortization 169,084 149,424 501,997 437,367 Interest 76,806 73,410 230,572 215,918 Property (including reimbursable) 25,410 20,354 77,468 63,332 General and administrative 16,514 16,460 56,541 50,153 Income taxes 4,592 1,822 10,193 4,422 Provisions for impairment 105,095 13,503 123,442 31,236 Total expenses 397,501 274,973 1,000,213 802,428 Gain on sales of real estate 13,736 1,674 53,565 15,828 Foreign currency and derivative gains, net 2,336 327 1,274 463 Loss on extinguishment of debt — — (9,819) — Net income 23,143 101,275 278,356 307,925 Net income attributable to noncontrolling interests (239) (226) (801) (740) Net income available to common stockholders $ 22,904 $ 101,049 $ 277,555 $ 307,185 Net income available to common stockholders per common share: Basic $ 0.07 $ 0.32 $ 0.81 $ 0.99 Diluted $ 0.07 $ 0.32 $ 0.81 $ 0.98 (1) Includes rental revenue (reimbursable) of $18,024 and $15,523 for the three months ended September 30, 2020 and September 30, 2019, respectively, and $59,354 and $49,274 for the nine months ended September 30, 2020 and September 30, 2019, respectively. Unless otherwise specified, references to rental revenue in this document are exclusive of reimbursements from tenants for recoverable real estate taxes and operating expenses. In addition, we recorded reserves as a reduction of rental revenue of $24.1 million (of which $2.3 million was related to straight-line rent receivables) for the third quarter of 2020, $351,000 (of which $57,000 was related to straight-line rent receivables) for the third quarter of 2019, $34.4 million (of which $5.1 million was related to straight-line rent receivables) for the nine months ended September 30, 2020, and $2.7 million (of which $1.5 million was related to straight-line receivables) for the nine months ended September 30, 2019. Q3 2020 Supplemental Operating & Financial Data 8

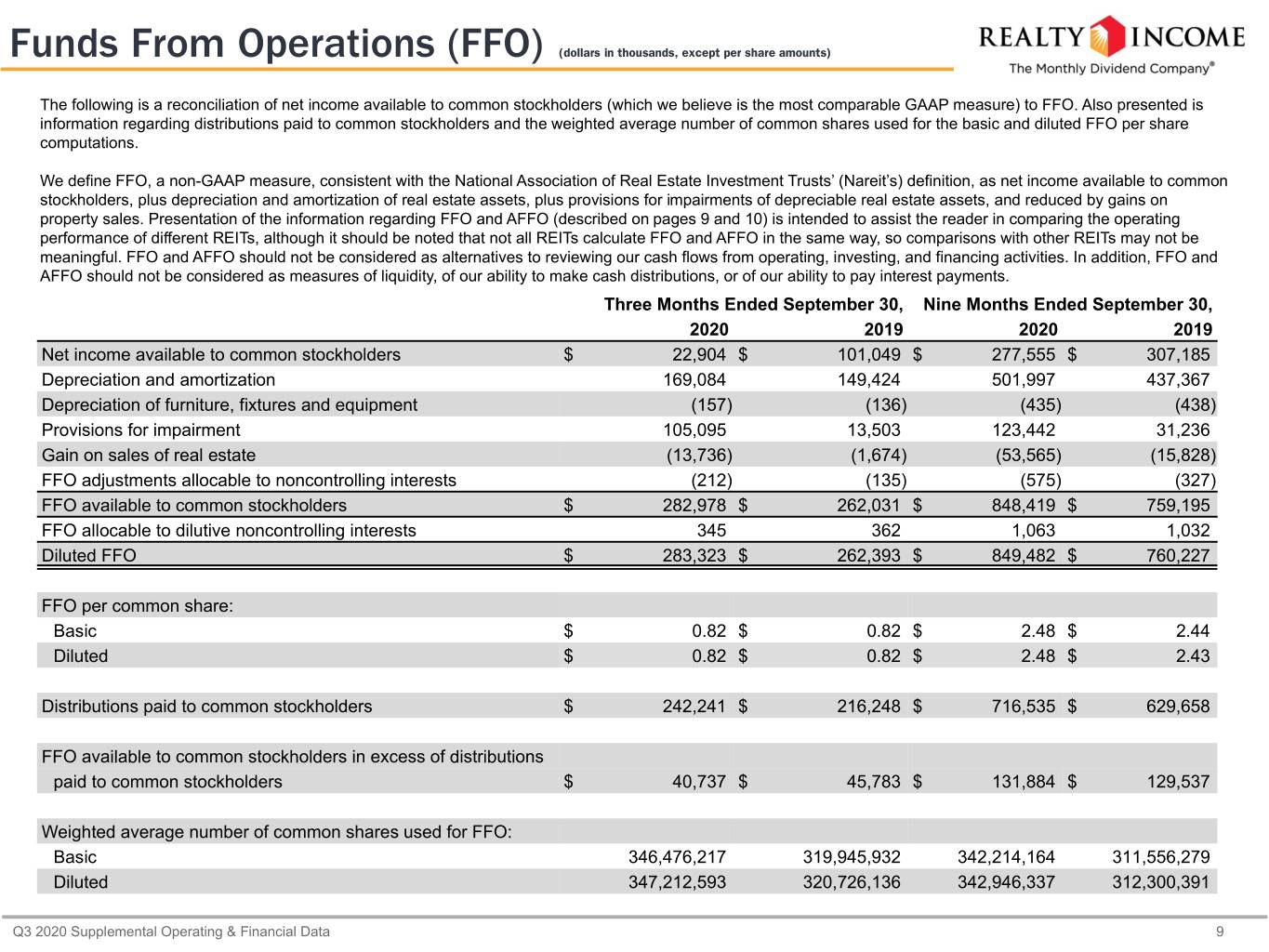

Funds From Operations (FFO) (dollars in thousands, except per share amounts) The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted FFO per share computations. We define FFO, a non-GAAP measure, consistent with the National Association of Real Estate Investment Trusts’ (Nareit’s) definition, as net income available to common stockholders, plus depreciation and amortization of real estate assets, plus provisions for impairments of depreciable real estate assets, and reduced by gains on property sales. Presentation of the information regarding FFO and AFFO (described on pages 9 and 10) is intended to assist the reader in comparing the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and AFFO in the same way, so comparisons with other REITs may not be meaningful. FFO and AFFO should not be considered as alternatives to reviewing our cash flows from operating, investing, and financing activities. In addition, FFO and AFFO should not be considered as measures of liquidity, of our ability to make cash distributions, or of our ability to pay interest payments. Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Net income available to common stockholders $ 22,904 $ 101,049 $ 277,555 $ 307,185 Depreciation and amortization 169,084 149,424 501,997 437,367 Depreciation of furniture, fixtures and equipment (157) (136) (435) (438) Provisions for impairment 105,095 13,503 123,442 31,236 Gain on sales of real estate (13,736) (1,674) (53,565) (15,828) FFO adjustments allocable to noncontrolling interests (212) (135) (575) (327) FFO available to common stockholders $ 282,978 $ 262,031 $ 848,419 $ 759,195 FFO allocable to dilutive noncontrolling interests 345 362 1,063 1,032 Diluted FFO $ 283,323 $ 262,393 $ 849,482 $ 760,227 FFO per common share: Basic $ 0.82 $ 0.82 $ 2.48 $ 2.44 Diluted $ 0.82 $ 0.82 $ 2.48 $ 2.43 Distributions paid to common stockholders $ 242,241 $ 216,248 $ 716,535 $ 629,658 FFO available to common stockholders in excess of distributions paid to common stockholders $ 40,737 $ 45,783 $ 131,884 $ 129,537 Weighted average number of common shares used for FFO: Basic 346,476,217 319,945,932 342,214,164 311,556,279 Diluted 347,212,593 320,726,136 342,946,337 312,300,391 Q3 2020 Supplemental Operating & Financial Data 9

Adjusted Funds From Operations (AFFO) (dollars in thousands, except per share amounts) The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO and AFFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted AFFO per share computations. We define AFFO as FFO adjusted for unique revenue and expense items, which the company believes are not as pertinent to the measurement of the company’s ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term "CAD" (for Cash Available for Distribution) or "FAD" (for Funds Available for Distribution). Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Net income available to common stockholders (1) $ 22,904 $ 101,049 $ 277,555 $ 307,185 Cumulative adjustments to calculate FFO (2) 260,074 160,982 570,864 452,010 FFO available to common stockholders 282,978 262,031 848,419 759,195 Executive severance charge — — 3,463 — Loss on extinguishment of debt — — 9,819 — Amortization of share-based compensation 3,020 3,187 11,644 10,478 Amortization of deferred financing costs 956 1,299 3,792 3,471 Amortization of net mortgage premiums (310) (354) (1,020) (1,061) Loss on interest rate swaps 1,123 694 3,115 2,058 Straight-line payments from cross-currency swaps 614 1,754 1,960 2,553 Leasing costs and commissions 98 (851) (1,013) (1,880) Recurring capital expenditures (105) (406) (126) (577) Straight-line rent (6,445) (7,642) (20,469) (19,735) Amortization of above and below-market leases, net 2,408 5,486 14,925 13,227 Other adjustments (1,828) 157 463 297 AFFO available to common stockholders $ 282,509 $ 265,355 $ 874,972 $ 768,026 AFFO allocable to dilutive noncontrolling interests 347 368 1,079 1,064 Diluted AFFO $ 282,856 $ 265,723 $ 876,051 $ 769,090 AFFO per common share: Basic $ 0.82 $ 0.83 $ 2.56 $ 2.47 Diluted $ 0.81 $ 0.83 $ 2.55 $ 2.46 Distributions paid to common stockholders $ 242,241 $ 216,248 $ 716,535 $ 629,658 AFFO available to common stockholders in excess of distributions paid to common stockholders $ 40,268 $ 49,107 $ 158,437 $ 138,368 Weighted average number of common shares used for AFFO: Basic 346,476,217 319,945,932 342,214,164 311,556,279 Diluted 347,212,593 320,726,136 342,946,337 312,300,391 (1) As of September 30, 2020, there was $26.5 million of uncollected rent deferred as a result of lease concessions we granted in response to the COVID-19 pandemic and recognized under the practical expedient provided by the Financial Accounting Standards Board (FASB) and $36.4 million of uncollected rent for which we have not granted a lease concession. The collection of the $62.9 million of unpaid rent is probable. Deferrals accounted for as modifications totaling $63,000 and $224,000 for the three and nine months ended September 30, 2020, respectively, have not been added back to AFFO. (2) See reconciling items for FFO presented under "Funds from Operations (FFO).” Q3 2020 Supplemental Operating & Financial Data 10

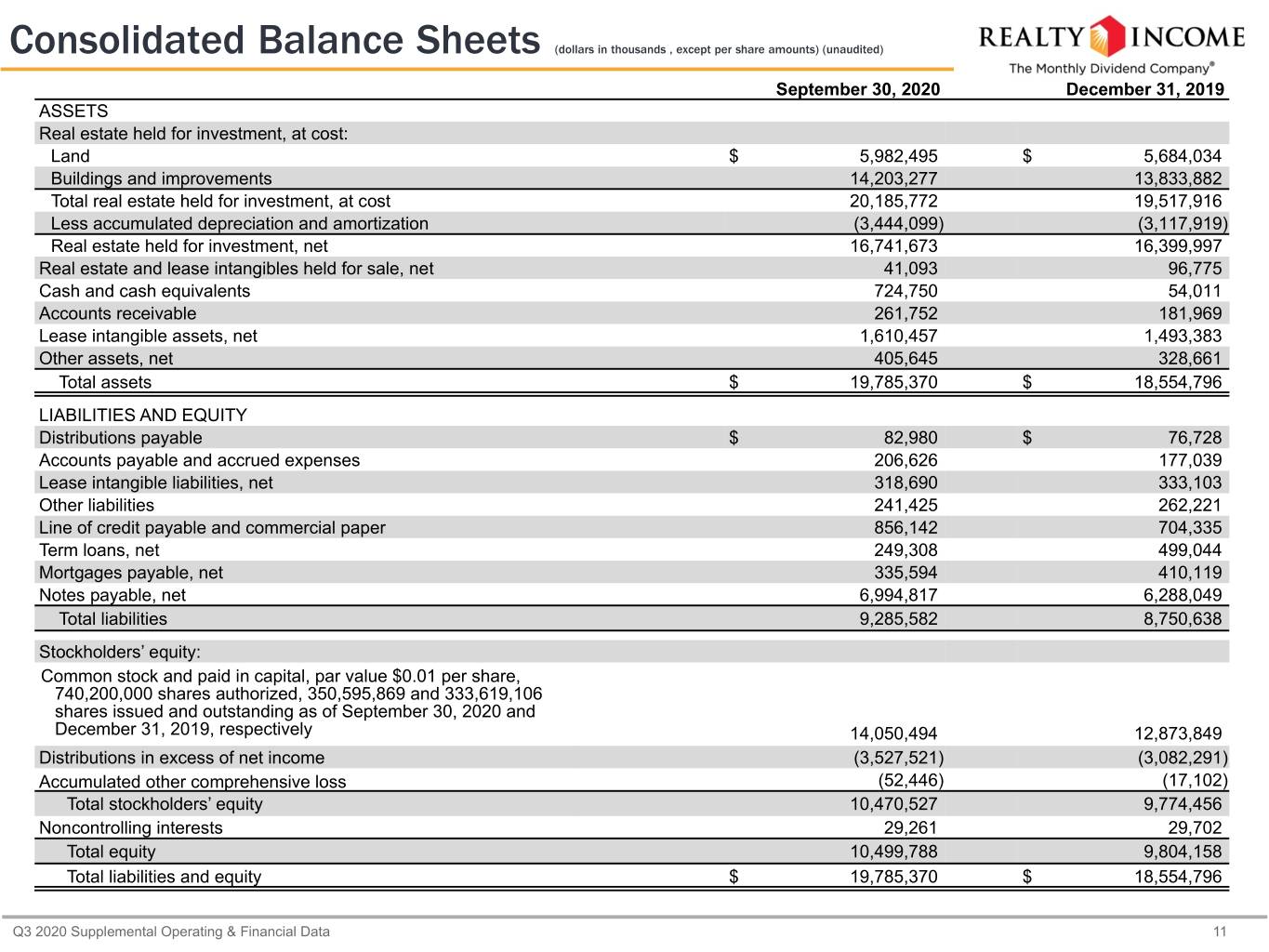

Consolidated Balance Sheets (dollars in thousands , except per share amounts) (unaudited) September 30, 2020 December 31, 2019 ASSETS Real estate held for investment, at cost: Land $ 5,982,495 $ 5,684,034 Buildings and improvements 14,203,277 13,833,882 Total real estate held for investment, at cost 20,185,772 19,517,916 Less accumulated depreciation and amortization (3,444,099) (3,117,919) Real estate held for investment, net 16,741,673 16,399,997 Real estate and lease intangibles held for sale, net 41,093 96,775 Cash and cash equivalents 724,750 54,011 Accounts receivable 261,752 181,969 Lease intangible assets, net 1,610,457 1,493,383 Other assets, net 405,645 328,661 Total assets $ 19,785,370 $ 18,554,796 LIABILITIES AND EQUITY Distributions payable $ 82,980 $ 76,728 Accounts payable and accrued expenses 206,626 177,039 Lease intangible liabilities, net 318,690 333,103 Other liabilities 241,425 262,221 Line of credit payable and commercial paper 856,142 704,335 Term loans, net 249,308 499,044 Mortgages payable, net 335,594 410,119 Notes payable, net 6,994,817 6,288,049 Total liabilities 9,285,582 8,750,638 Stockholders’ equity: Common stock and paid in capital, par value $0.01 per share, 740,200,000 shares authorized, 350,595,869 and 333,619,106 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively 14,050,494 12,873,849 Distributions in excess of net income (3,527,521) (3,082,291) Accumulated other comprehensive loss (52,446) (17,102) Total stockholders’ equity 10,470,527 9,774,456 Noncontrolling interests 29,261 29,702 Total equity 10,499,788 9,804,158 Total liabilities and equity $ 19,785,370 $ 18,554,796 Q3 2020 Supplemental Operating & Financial Data 11

Debt Summary (dollars in thousands) Maturity Date as of Principal Balance as of Interest Rate as of Weighted Average September 30, 2020 September 30, 2020 % of Debt September 30, 2020 Years until Maturity Credit Facility and Commercial Paper Credit Facility (1) March 24, 2023 $ 556,142 6.6 % 0.84 % Commercial Paper (2) October 1, 2020 $ 300,000 3.6 % 0.23 % (7) Carrying value 856,142 10.2 % 0.62 % 1.6 years Unsecured Term Loan Term Loan (3) March 24, 2024 $ 250,000 3.0 % 3.89 % 3.5 years Deferred financing costs (692) Carrying value 249,308 Senior Unsecured Notes and Bonds 3.250% Notes due 2022 October 15, 2022 950,000 11.2 % 3.25 % 4.650% Notes due 2023 August 1, 2023 750,000 8.9 % 4.65 % 3.875% Notes due 2024 July 15, 2024 350,000 4.1 % 3.88 % 3.875% Notes due 2025 April 15, 2025 500,000 5.9 % 3.88 % 4.125% Notes due 2026 October 15, 2026 650,000 7.7 % 4.13 % 3.000% Notes due 2027 January 15, 2027 600,000 7.1 % 3.00 % 3.650% Notes due 2028 January 15, 2028 550,000 6.5 % 3.65 % 3.250% Notes due 2029 June 15, 2029 500,000 5.9 % 3.25 % 3.250% Notes due 2031 January 15, 2031 950,000 11.2 % 3.25 % 2.730% Notes due 2034 (4) May 20, 2034 406,980 4.8 % 2.73 % 5.875% Bonds due 2035 March 15, 2035 250,000 3.0 % 5.88 % 4.650% Notes due 2047 March 15, 2047 550,000 6.5 % 4.65 % Principal amount 7,006,980 82.8 % 3.74 % (7) 8.2 years Unamortized net premiums and deferred financing costs (12,163) Carrying value 6,994,817 Mortgages Payable 22 mortgages on 72 properties October 2020 - June 2032 334,709 (5) 4.0 % 4.93 % (7) 2.9 years Unamortized net premiums and deferred financing costs 885 Carrying value 335,594 Total Debt $ 8,447,831 (6) 100.0 % 3.48 % (7) 7.2 years Fixed Rate $ 7,591,689 89.8 % Variable Rate $ 856,142 10.2 % (1) We have a $3.0 billion unsecured revolving credit facility bearing interest at LIBOR, plus 0.775% with an initial term that expires in March 2023. It includes, at our election, two six-month extension options, at a cost of 0.0625% of the facility commitment, or $1.875 million per option. The credit facility also has a $1.0 billion expansion option, which is subject to obtaining lender commitments. As of September 30, 2020, the outstanding balance was $556.1 million, entirely consisting of £430.5 million Sterling, leaving $2.4 billion available on the credit facility, excluding the $1.0 billion accordion feature. (2) Under the terms of the program, we may issue unsecured commercial paper notes up to a maximum aggregate amount outstanding of $1.0 billion. The company expects to use its $3.0 billion revolving credit facility as a liquidity backstop for the repayment of the notes issued under the commercial paper program. Upon settlement of a GBP/ USD currency exchange swap arrangement on October 1, 2020, we received $300.1 million upon our payment of £224.9 million, which was used to repay the outstanding borrowings under our commercial paper program. (3) Borrowings under the term loan have been swapped to fixed and bear interest at an effective rate of 3.89%. (4) Represents the principal balance (in U.S. dollars) of the Sterling-denominated private placement of £315.0 million, which approximates $407.0 million converted at the applicable exchange rate on September 30, 2020. (5) The mortgages payable are at fixed interest rates as of September 30, 2020. (6) Excludes non-cash unamortized net original issuance premiums recorded on the senior unsecured notes and bonds, non-cash unamortized net premiums recorded on the mortgages payable, and deferred financing costs on the term loans, notes and bonds, and mortgages payable. (7) The totals are calculated as the weighted average interest rate as of September 30, 2020 for each respective category. The credit facility consists entirely of Sterling-denominated borrowings of £430.5 million with a weighted average interest rate of 0.84% at September 30, 2020. Q3 2020 Supplemental Operating & Financial Data 12

Debt Maturities as of September 30, 2020 (dollars in millions) Debt Maturities Credit Facility and Year of Commercial Term Mortgages Senior Unsecured Weighted Average Maturity Paper (1) Loan Payable Notes and Bonds (2) Total Interest Rate(3) 2020 $ 300.0 $ — $ 10.5 $ — $ 310.5 5.07% 2021 — — 68.8 — 68.8 5.61% 2022 — — 111.8 950.0 1,061.8 3.43% 2023 556.1 — 20.6 750.0 1,326.7 4.64% 2024 — 250.0 112.2 350.0 712.2 3.97% Thereafter — — 10.8 4,957.0 4,967.8 3.69% Totals $ 856.1 $ 250.0 $ 334.7 $ 7,007.0 $ 8,447.8 (1) Borrowings of $300.0 million under the commercial paper program were due in October 2020, while borrowings of $556.1 million under the credit facility are assumed to be repaid at the expiration in March 2023. Upon settlement of a GBP/ USD currency exchange swap arrangement on October 1, 2020, we received $300.1 million upon our payment of £224.9 million, which was used to repay the outstanding borrowings under our commercial paper program. (2) In October 2020, we issued £400 million of 1.625% senior unsecured notes due December 2030. (3) Weighted average interest rate for 2020 excludes commercial paper and for 2023 excludes the credit facility. Mortgages Payable Maturities by Quarter Year of First Second Third Fourth Weighted Average Maturity Quarter Quarter Quarter Quarter Total Interest Rate 2020 $ — $ — $ — $ 10.5 $ 10.5 5.07% 2021 18.7 18.2 31.0 0.9 68.8 5.61% 2022 0.9 10.5 62.2 38.2 111.8 4.97% 2023 0.9 6.5 12.4 0.8 20.6 4.44% 2024 0.8 0.8 0.9 109.7 112.2 4.47% Thereafter — — — 10.8 10.8 5.64% Totals $ 21.3 $ 36.0 $ 106.5 $ 170.9 $ 334.7 Q3 2020 Supplemental Operating & Financial Data 13

Capitalization & Financial Ratios (dollars in thousands, except per share amounts) Capitalization as of September 30, 2020 Capital Structure as of September 30, 2020 Principal Debt Balance Credit Facility and Commercial Paper (1) $ 856,142 Unsecured Term Loan 250,000 Senior Unsecured Notes and Bonds (2) 7,006,980 Mortgages Payable 334,709 Total Debt $ 8,447,831 Equity Shares/Units Stock Price Market Value Common Stock (NYSE: "O") 350,595,869 $ 60.75 $ 21,298,699 Common Units 463,119 $ 60.75 $ 28,134 Total Equity $ 21,326,833 Total Market Capitalization (3) $ 29,774,664 Debt/Total Market Capitalization (3) 28.4 % (1) Upon settlement of a GBP/ USD currency exchange swap arrangement on October 1, 2020, we received $300.1 million upon our payment of £224.9 million, which was used to repay the outstanding borrowings under our commercial paper program. We expect to use our unsecured revolving credit facility as a liquidity backstop for the repayment of the notes issued under this program. (2) In October 2020, we issued £400 million of 1.625% senior unsecured notes due December 2030. (3) Our enterprise value was $29,049,914 (total market capitalization less cash on hand). The percentage for debt to enterprise value is materially consistent with that presented for total market capitalization. (4) Dividend Data Liquidity as of September 30, 2020 Year-over-Year Cash on Hand $ 724,750 YTD 2020 YTD 2019 Growth Rate Availability under Credit Facility 2,443,858 Common Dividend Paid per Share $ 2.092 $ 2.030 3.1 % $ 3,168,608 AFFO per Share (diluted) $ 2.55 $ 2.46 3.7 % (4) Liquidity calculation excludes availability under the $1.0 billion AFFO Payout Ratio 82.0 % 82.5 % commercial paper program. We expect to use our unsecured revolving credit facility as a liquidity backstop for the repayment of the notes issued under this program. Q3 2020 Supplemental Operating & Financial Data 14

Adjusted EBITDAre & Coverage Ratios (dollars in thousands) Reconciliation of Net Income to Adjusted EBITDAre (1) and Pro Forma Adjusted EBITDAre Three Months Ended Debt Service & Fixed Charge Coverage September 30, 2020 Net income (2) $ 23,143 Interest 76,806 Income taxes 4,592 Depreciation and amortization 169,084 Provisions for impairment 105,095 Gain on sales of real estate (13,736) Foreign currency and derivative gains, net (3) (2,336) Quarterly Adjusted EBITDAre (3) $ 362,648 Annualized Adjusted EBITDAre $ 1,450,592 Annualized Pro forma Adjustments (4) 24,586 Annualized Pro forma Adjusted EBITDAre (4) $ 1,475,178 Net Debt $ 7,711,111 Net Debt/Adjusted EBITDAre (5) 5.3 Net Debt/Pro forma Adjusted EBITDAre (5) 5.2 (1) The National Association of Real Estate Investment Trust (Nareit) came to the conclusion that a Nareit-defined EBITDA metric for real estate companies (i.e., EBITDA for real estate, or EBITDAre) would provide investors with a consistent measure to help make investment decisions among certain REITs. Our definition of “Adjusted EBITDAre” is generally consistent with the Nareit definition, other than our adjustment to remove foreign currency and derivative gains and losses (which is consistent with our previous calculations of "Adjusted EBITDAre"). We define Adjusted EBITDAre, a non-GAAP financial measure, for the most recent quarter, as earnings (net income) before (i) interest expense, including non-cash loss (gain) on swaps, (ii) income and franchise taxes, (iii) real estate depreciation and amortization, (iv) provisions for impairment, (v) gain on sales of real estate, and (vi) foreign currency and derivative gains and losses, net. Our Adjusted EBITDAre may not be comparable to Adjusted EBITDAre reported by other companies or as defined by Nareit, and other companies may interpret or define Adjusted EBITDAre differently than we do. Management believes Adjusted EBITDAre to be a meaningful measure of a REIT’s performance because it is widely followed by industry analysts, lenders and investors. Management also believes the use of an annualized quarterly Adjusted EBITDAre metric is meaningful because it represents the company’s current earnings run rate for the period presented. The ratio of our total debt to our annualized quarterly Adjusted EBITDAre is also used to determine vesting of performance share awards granted to our executive officers. Adjusted EBITDAre should be considered along with, but not as an alternative to net income as a measure of our operating performance. (2) Net income for the three months ended September 30, 2020 was negatively impacted by $24.1 million of rent reserves recorded as reductions of rental revenue, of which $2.3 million relates to straight-line rent. (3) Includes foreign currency gains and losses as a result of intercompany debt and certain remeasurement transactions. (4) The Annualized Pro Forma Adjustments consists of $25.2 million from properties we acquired or stabilized during the quarter and removes $614,000 of operating income from properties we disposed of during the quarter, assuming all transactions occurred at the beginning of the quarter. The pro forma adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes and bonds. We believe Annualized Pro Forma Adjusted EBITDAre is a useful non-GAAP supplemental measure, as it excludes properties that were no longer owned at the balance sheet date and includes the annualized rent from properties acquired during the quarter. See page 16 for further information regarding our debt covenants. (5) Our ratios of net debt-to-Adjusted EBITDAre and net debt-to-Pro Forma Adjusted EBITDAre, which are used by management as a measure of leverage, are calculated as net debt (which we define as total debt per the consolidated balance sheet, less cash and cash equivalents), divided by annualized quarterly Adjusted EBITDAre and annualized Pro Forma Adjusted EBITDAre, respectively. Q3 2020 Supplemental Operating & Financial Data 15

Debt Covenants As of September 30, 2020 The following is a summary of the key financial covenants for our senior unsecured notes and bonds, as defined and calculated per their terms. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show our ability to incur additional debt under the terms of our senior unsecured notes and bonds as well as to disclose our current compliance with such covenants, and are not measures of our liquidity or performance. Required Actuals Limitation on incurrence of total debt ≤ 60% of adjusted undepreciated assets 39.6 % Limitation on incurrence of secured debt ≤ 40% of adjusted undepreciated assets 1.6 % Debt service and fixed charge coverage (trailing 12 months) (1) ≥ 1.5x 5.2x Maintenance of total unencumbered assets ≥ 150% of unsecured debt 257.0 % (1) Our debt service coverage ratio is calculated on a pro forma basis for the preceding four-quarter period on the assumptions that: (i) the incurrence of any Debt (as defined in the covenants) incurred by us since the first day of such four-quarter period and the application of the proceeds therefrom (including to refinance other Debt since the first day of such four quarter period), (ii) the repayment or retirement of any of our Debt since the first day of such four-quarter period, and (iii) any acquisition or disposition by us of any asset or group since the first day of such four quarters had in each case occurred on October 1, 2019, and subject to certain additional adjustments. Such pro forma ratio has been prepared on the basis required by that debt service covenant, reflects various estimates and assumptions and is subject to other uncertainties, and therefore does not purport to reflect what our actual debt service coverage ratio would have been had transactions referred to in clauses (i), (ii) and (iii) of the preceding sentence occurred as of October 1, 2019, nor does it purport to reflect our debt service coverage ratio for any future period. Q3 2020 Supplemental Operating & Financial Data 16

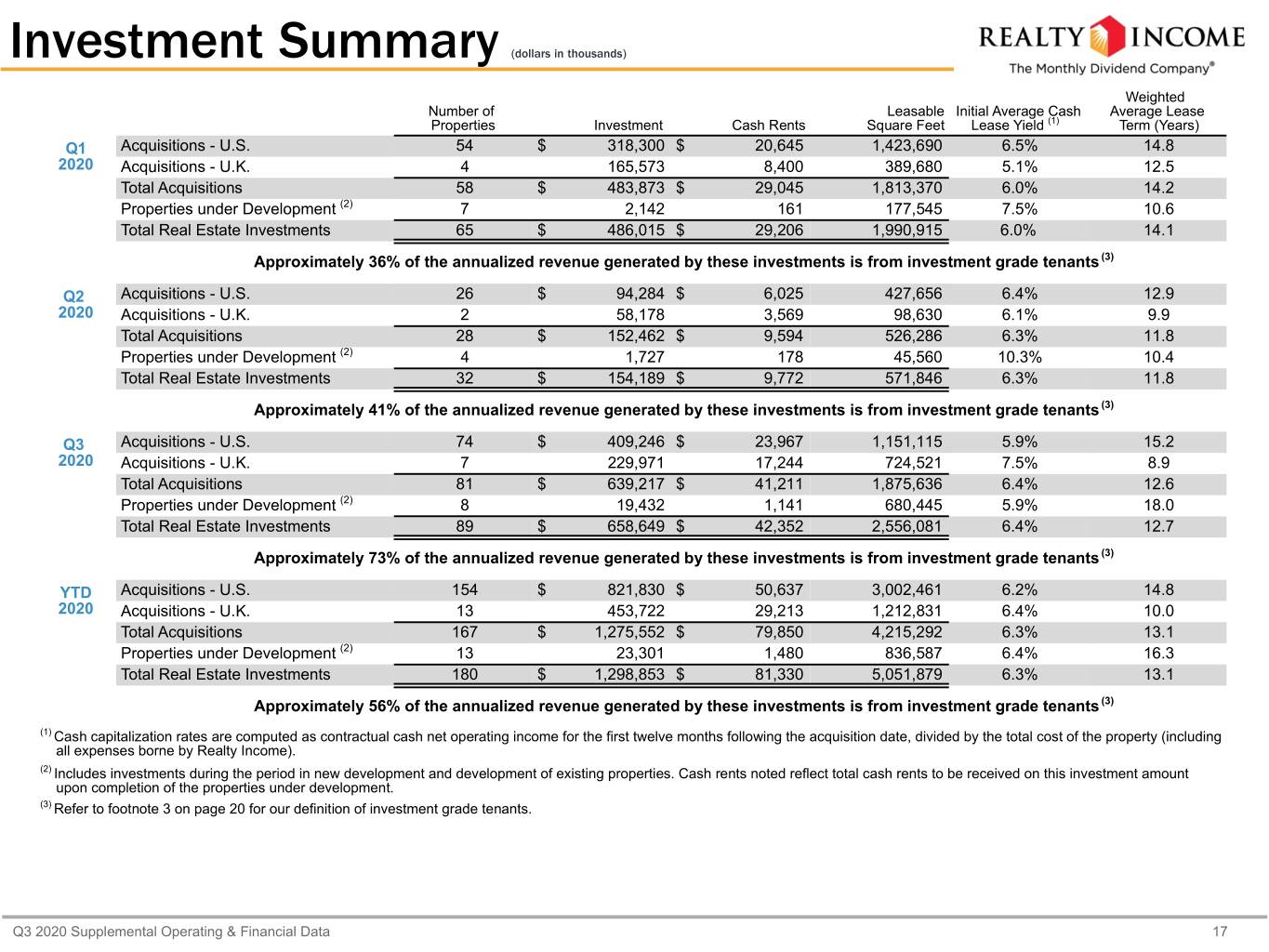

Investment Summary (dollars in thousands) Weighted Number of Leasable Initial Average Cash Average Lease Properties Investment Cash Rents Square Feet Lease Yield (1) Term (Years) Q1 Acquisitions - U.S. 54 $ 318,300 $ 20,645 1,423,690 6.5% 14.8 2020 Acquisitions - U.K. 4 165,573 8,400 389,680 5.1% 12.5 Total Acquisitions 58 $ 483,873 $ 29,045 1,813,370 6.0% 14.2 Properties under Development (2) 7 2,142 161 177,545 7.5% 10.6 Total Real Estate Investments 65 $ 486,015 $ 29,206 1,990,915 6.0% 14.1 Approximately 36% of the annualized revenue generated by these investments is from investment grade tenants (3) Q2 Acquisitions - U.S. 26 $ 94,284 $ 6,025 427,656 6.4% 12.9 2020 Acquisitions - U.K. 2 58,178 3,569 98,630 6.1% 9.9 Total Acquisitions 28 $ 152,462 $ 9,594 526,286 6.3% 11.8 Properties under Development (2) 4 1,727 178 45,560 10.3% 10.4 Total Real Estate Investments 32 $ 154,189 $ 9,772 571,846 6.3% 11.8 Approximately 41% of the annualized revenue generated by these investments is from investment grade tenants (3) Q3 Acquisitions - U.S. 74 $ 409,246 $ 23,967 1,151,115 5.9% 15.2 2020 Acquisitions - U.K. 7 229,971 17,244 724,521 7.5% 8.9 Total Acquisitions 81 $ 639,217 $ 41,211 1,875,636 6.4% 12.6 Properties under Development (2) 8 19,432 1,141 680,445 5.9% 18.0 Total Real Estate Investments 89 $ 658,649 $ 42,352 2,556,081 6.4% 12.7 Approximately 73% of the annualized revenue generated by these investments is from investment grade tenants (3) YTD Acquisitions - U.S. 154 $ 821,830 $ 50,637 3,002,461 6.2% 14.8 2020 Acquisitions - U.K. 13 453,722 29,213 1,212,831 6.4% 10.0 Total Acquisitions 167 $ 1,275,552 $ 79,850 4,215,292 6.3% 13.1 Properties under Development (2) 13 23,301 1,480 836,587 6.4% 16.3 Total Real Estate Investments 180 $ 1,298,853 $ 81,330 5,051,879 6.3% 13.1 Approximately 56% of the annualized revenue generated by these investments is from investment grade tenants (3) (1) Cash capitalization rates are computed as contractual cash net operating income for the first twelve months following the acquisition date, divided by the total cost of the property (including all expenses borne by Realty Income). (2) Includes investments during the period in new development and development of existing properties. Cash rents noted reflect total cash rents to be received on this investment amount upon completion of the properties under development. (3) Refer to footnote 3 on page 20 for our definition of investment grade tenants. Q3 2020 Supplemental Operating & Financial Data 17

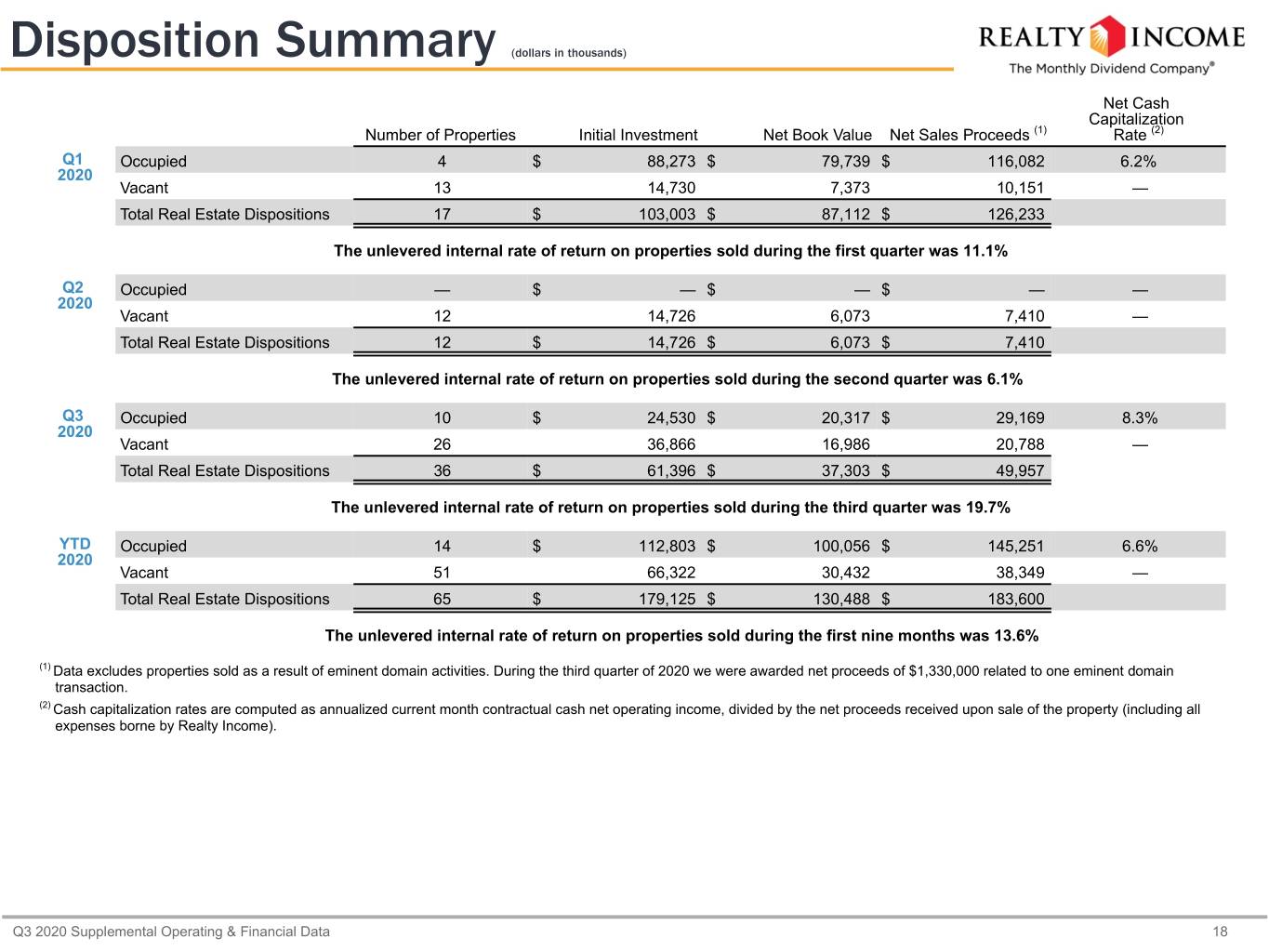

Disposition Summary (dollars in thousands) Net Cash Capitalization Number of Properties Initial Investment Net Book Value Net Sales Proceeds (1) Rate (2) Q1 Occupied 4 $ 88,273 $ 79,739 $ 116,082 6.2% 2020 Vacant 13 14,730 7,373 10,151 — Total Real Estate Dispositions 17 $ 103,003 $ 87,112 $ 126,233 The unlevered internal rate of return on properties sold during the first quarter was 11.1% Q2 Occupied — $ — $ — $ — — 2020 Vacant 12 14,726 6,073 7,410 — Total Real Estate Dispositions 12 $ 14,726 $ 6,073 $ 7,410 The unlevered internal rate of return on properties sold during the second quarter was 6.1% Q3 Occupied 10 $ 24,530 $ 20,317 $ 29,169 8.3% 2020 Vacant 26 36,866 16,986 20,788 — Total Real Estate Dispositions 36 $ 61,396 $ 37,303 $ 49,957 The unlevered internal rate of return on properties sold during the third quarter was 19.7% YTD Occupied 14 $ 112,803 $ 100,056 $ 145,251 6.6% 2020 Vacant 51 66,322 30,432 38,349 — Total Real Estate Dispositions 65 $ 179,125 $ 130,488 $ 183,600 The unlevered internal rate of return on properties sold during the first nine months was 13.6% (1) Data excludes properties sold as a result of eminent domain activities. During the third quarter of 2020 we were awarded net proceeds of $1,330,000 related to one eminent domain transaction. (2) Cash capitalization rates are computed as annualized current month contractual cash net operating income, divided by the net proceeds received upon sale of the property (including all expenses borne by Realty Income). Q3 2020 Supplemental Operating & Financial Data 18

Development Pipeline (dollars in thousands) As of September 30, 2020 Investment Estimated Remaining Retail Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) 1 $ 2,024 $ 2,653 $ 4,677 100 % Development of existing properties 5 7,120 4,876 11,996 80 % 6 $ 9,144 $ 7,529 $ 16,673 Investment Estimated Remaining Non-Retail Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) 2 $ 14,475 $ 88,606 $ 103,081 100 % Development of existing properties — — — — — % 2 $ 14,475 $ 88,606 $ 103,081 Investment Estimated Remaining Total Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) 3 $ 16,499 $ 91,259 $ 107,758 100 % Development of existing properties 5 7,120 4,876 11,996 80 % 8 $ 23,619 $ 96,135 $ 119,754 (1) Includes build-to-suit developments and forward take-out commitments on development properties with leases in place. (2) Estimated rental revenue commencement dates on properties under development are between October 2020 and August 2021. Q3 2020 Supplemental Operating & Financial Data 19

Tenant Diversification Top 20 Tenants (3) Our 20 largest tenants based on percentage of total portfolio annualized contractual rental Investment Grade Tenants : revenue at September 30, 2020 include the following: Number of Leases 3,532 Percentage of Percentage of Annualized Contractual Rental Revenue 49% Total Portfolio Annualized Investment Grade Number of Contractual Ratings Tenant Leases Rental Revenue (1) (S&P/Moody's/Fitch) Walgreens 248 5.8% BBB/Baa2/BBB- 7-Eleven 432 4.9% AA-/Baa1/- Dollar General 784 4.4% BBB/Baa2/- FedEx 41 3.8% BBB/Baa2/- Dollar Tree / Family Dollar 550 3.3% BBB-/Baa2/- LA Fitness 57 3.3% — Regal Cinemas (Cineworld) 42 2.8% — AMC Theaters 32 2.7% — Sainsbury's 17 2.6% — Walmart / Sam's Club 56 2.6% AA/Aa2/AA Lifetime Fitness 16 2.5% — Circle K (Couche-Tard) 278 1.8% BBB/Baa2/- BJ's Wholesale Clubs 15 1.7% — Treasury Wine Estates 17 1.6% — CVS Pharmacy 88 1.6% BBB/Baa2/- Super America (Marathon) 161 1.6% BBB/Baa2/BBB Kroger 22 1.5% BBB/Baa1/- Home Depot 22 1.4% A/A2/A GPM Investments / Fas Mart 203 1.4% — TBC Corp 159 1.2% BBB+/Baa1/- Total 3,240 52.6% (3) We define investment grade tenants as tenants with a credit rating, and (2) Weighted Average EBITDAR/Rent Ratio on Retail Properties 2.7x tenants that are subsidiaries or affiliates of companies with a credit Median EBITDAR/Rent Ratio on Retail Properties 2.5x (2) rating, of Baa3/BBB- or higher from one of the three major rating (1) agencies (Moody’s/S&P/Fitch). Refer to page 26 for investment grade Amounts for each tenant are calculated independently; therefore, the individual percentages may not composition by property type. sum to the total. (2) Based on an analysis of the most recently provided information from all retail tenants that provide such information. Outside of one convenience store tenant, the information is prior to the impact of the COVID-19 pandemic (March 2020). We do not independently verify the information we receive from our retail tenants. Q3 2020 Supplemental Operating & Financial Data 20

Top 10 Industries (1) Percentage of Total Portfolio Annualized Contractual Rental Revenue As of the Quarter Ended As of September 30, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 Convenience stores 12.1% 12.3 % 12.6 % 9.3 % 10.0 % 8.9 % Drug stores 8.4 8.8 9.4 10.2 10.8 10.8 Grocery stores 8.4 7.9 5.0 5.3 3.5 2.9 Dollar stores 7.8 7.9 7.3 7.5 8.0 8.8 Health and fitness 7.1 7.0 7.1 7.7 7.6 8.3 Theaters 5.7 6.1 5.3 5.7 4.6 5.0 Restaurants - quick service 5.6 5.8 6.3 5.2 4.8 4.5 Transportation services 4.1 4.3 5.0 5.4 5.7 5.4 Home improvement 3.9 2.9 2.8 2.9 2.5 2.4 General merchandise 3.0 2.5 2.1 2.3 1.9 1.6 (1) The presentation of Top 10 Industries combines annualized contractual rental revenue contribution from U.S. and U.K. properties. Q3 2020 Supplemental Operating & Financial Data 21

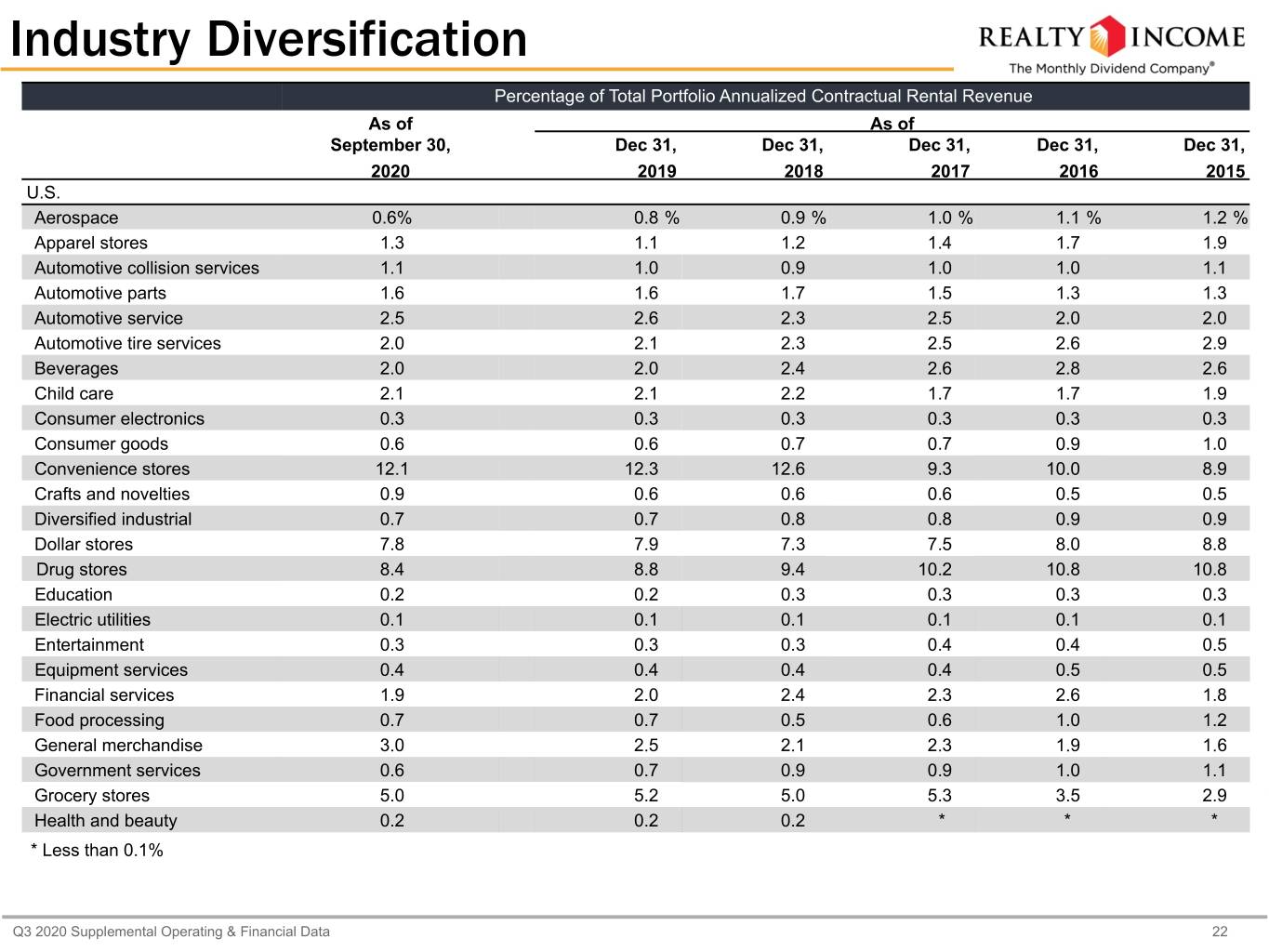

Industry Diversification Percentage of Total Portfolio Annualized Contractual Rental Revenue As of As of September 30, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 U.S. Aerospace 0.6% 0.8 % 0.9 % 1.0 % 1.1 % 1.2 % Apparel stores 1.3 1.1 1.2 1.4 1.7 1.9 Automotive collision services 1.1 1.0 0.9 1.0 1.0 1.1 Automotive parts 1.6 1.6 1.7 1.5 1.3 1.3 Automotive service 2.5 2.6 2.3 2.5 2.0 2.0 Automotive tire services 2.0 2.1 2.3 2.5 2.6 2.9 Beverages 2.0 2.0 2.4 2.6 2.8 2.6 Child care 2.1 2.1 2.2 1.7 1.7 1.9 Consumer electronics 0.3 0.3 0.3 0.3 0.3 0.3 Consumer goods 0.6 0.6 0.7 0.7 0.9 1.0 Convenience stores 12.1 12.3 12.6 9.3 10.0 8.9 Crafts and novelties 0.9 0.6 0.6 0.6 0.5 0.5 Diversified industrial 0.7 0.7 0.8 0.8 0.9 0.9 Dollar stores 7.8 7.9 7.3 7.5 8.0 8.8 Drug stores 8.4 8.8 9.4 10.2 10.8 10.8 Education 0.2 0.2 0.3 0.3 0.3 0.3 Electric utilities 0.1 0.1 0.1 0.1 0.1 0.1 Entertainment 0.3 0.3 0.3 0.4 0.4 0.5 Equipment services 0.4 0.4 0.4 0.4 0.5 0.5 Financial services 1.9 2.0 2.4 2.3 2.6 1.8 Food processing 0.7 0.7 0.5 0.6 1.0 1.2 General merchandise 3.0 2.5 2.1 2.3 1.9 1.6 Government services 0.6 0.7 0.9 0.9 1.0 1.1 Grocery stores 5.0 5.2 5.0 5.3 3.5 2.9 Health and beauty 0.2 0.2 0.2 * * * * Less than 0.1% Q3 2020 Supplemental Operating & Financial Data 22

Industry Diversification (Cont'd) Percentage of Total Portfolio Annualized Contractual Rental Revenue As of As of September 30, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 Health and fitness 7.1% 7.0 % 7.1 % 7.7 % 7.6 % 8.3 % Health care 1.6 1.6 1.6 1.4 1.5 1.6 Home furnishings 0.8 0.8 0.8 0.9 0.9 0.8 Home improvement 3.0 2.9 2.8 2.9 2.5 2.4 Machinery 0.1 0.1 0.1 0.1 0.1 0.1 Motor vehicle dealerships 1.6 1.6 1.8 2.0 2.0 1.6 Office supplies 0.2 0.2 0.2 0.2 0.3 0.3 Other manufacturing 0.6 0.6 0.7 0.8 0.8 0.8 Packaging 0.9 0.8 1.0 1.1 0.9 0.7 Paper 0.1 0.1 0.1 0.1 0.1 0.1 Pet supplies and services 0.7 0.7 0.5 0.6 0.6 0.7 Restaurants - casual dining 3.0 3.2 3.3 3.6 3.7 3.8 Restaurants - quick service 5.6 5.8 6.3 5.2 4.8 4.5 Shoe stores 0.2 0.2 0.5 0.6 0.6 0.7 Sporting goods 0.7 0.8 0.9 1.0 1.5 1.8 Telecommunications 0.5 0.5 0.6 0.6 0.7 0.7 Theaters 5.7 6.1 5.3 5.7 4.6 5.0 Transportation services 4.1 4.3 5.0 5.4 5.7 5.4 Wholesale clubs 2.5 2.5 2.9 3.1 3.4 3.7 Other 0.2 0.7 0.7 0.8 0.8 0.9 Total U.S. 95.6% 97.3 % 100 % 100 % 100 % 100 % U.K. Grocery stores 3.4 2.7 — — — — Health care 0.1 — — — — — Home improvement 0.9 — — — — — Theaters * * — — — — Total U.K. 4.4% 2.7 % — % — % — % — % Totals 100% 100 % 100 % 100 % 100 % 100 % * Less than 0.1% Q3 2020 Supplemental Operating & Financial Data 23

Geographic Diversification (dollars in thousands) Percentage of Total Portfolio Total Portfolio Approximate Annualized Contractual Annualized Number of Percent Leasable Rental Revenue as of Contractual Rental Location Properties Leased Square Feet September 30, 2020 Revenue Alabama 228 98 % 2,203,400 $ 31,777 2.0 % Alaska 3 100 274,600 2,100 0.1 Arizona 152 99 2,082,200 34,023 2.1 Arkansas 102 99 1,183,200 14,714 0.9 California 236 100 7,026,700 142,799 8.8 Colorado 99 97 1,578,100 23,698 1.5 Connecticut 21 90 1,378,200 13,688 0.8 Delaware 19 100 101,400 3,091 0.2 Florida 430 99 4,692,500 84,811 5.2 Georgia 297 99 4,601,800 59,124 3.6 Idaho 14 93 103,200 1,746 0.1 Illinois 299 98 6,507,400 92,463 5.7 Indiana 199 99 2,571,000 39,546 2.4 Iowa 46 100 2,527,800 18,304 1.1 Kansas 119 98 2,208,700 24,817 1.5 Kentucky 94 100 1,845,200 22,112 1.4 Louisiana 136 98 1,953,200 25,548 1.6 Maine 27 100 277,800 5,721 0.4 Maryland 38 100 1,494,000 25,570 1.6 Massachusetts 58 95 881,400 17,062 1.1 Michigan 234 100 2,706,200 39,411 2.4 Minnesota 172 99 2,326,800 44,106 2.7 Mississippi 188 98 2,031,000 23,131 1.4 Missouri 182 97 2,944,700 38,205 2.4 Q3 2020 Supplemental Operating & Financial Data 24

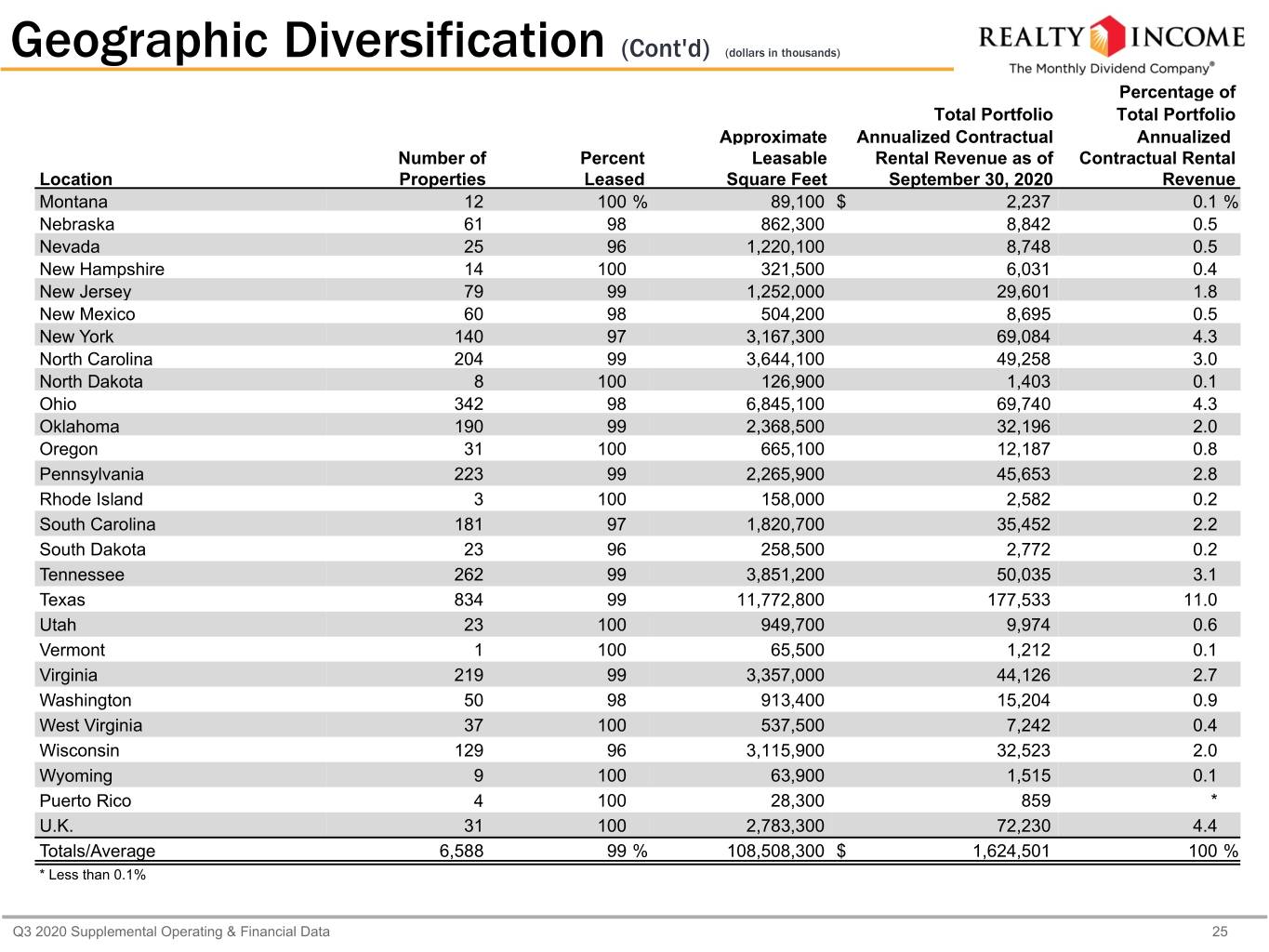

Geographic Diversification (Cont'd) (dollars in thousands) Percentage of Total Portfolio Total Portfolio Approximate Annualized Contractual Annualized Number of Percent Leasable Rental Revenue as of Contractual Rental Location Properties Leased Square Feet September 30, 2020 Revenue Montana 12 100 % 89,100 $ 2,237 0.1 % Nebraska 61 98 862,300 8,842 0.5 Nevada 25 96 1,220,100 8,748 0.5 New Hampshire 14 100 321,500 6,031 0.4 New Jersey 79 99 1,252,000 29,601 1.8 New Mexico 60 98 504,200 8,695 0.5 New York 140 97 3,167,300 69,084 4.3 North Carolina 204 99 3,644,100 49,258 3.0 North Dakota 8 100 126,900 1,403 0.1 Ohio 342 98 6,845,100 69,740 4.3 Oklahoma 190 99 2,368,500 32,196 2.0 Oregon 31 100 665,100 12,187 0.8 Pennsylvania 223 99 2,265,900 45,653 2.8 Rhode Island 3 100 158,000 2,582 0.2 South Carolina 181 97 1,820,700 35,452 2.2 South Dakota 23 96 258,500 2,772 0.2 Tennessee 262 99 3,851,200 50,035 3.1 Texas 834 99 11,772,800 177,533 11.0 Utah 23 100 949,700 9,974 0.6 Vermont 1 100 65,500 1,212 0.1 Virginia 219 99 3,357,000 44,126 2.7 Washington 50 98 913,400 15,204 0.9 West Virginia 37 100 537,500 7,242 0.4 Wisconsin 129 96 3,115,900 32,523 2.0 Wyoming 9 100 63,900 1,515 0.1 Puerto Rico 4 100 28,300 859 * U.K. 31 100 2,783,300 72,230 4.4 Totals/Average 6,588 99 % 108,508,300 $ 1,624,501 100 % * Less than 0.1% Q3 2020 Supplemental Operating & Financial Data 25

Property Type Composition (dollars in thousands) Total Portfolio Percentage of Total Annualized Portfolio Annualized Percentage of Contractual Rental Contractual Rental Annualized Revenue Approximate Leasable Revenue as of Revenue as of from Investment Grade Property Type Number of Properties Square Feet (1) September 30, 2020 September 30, 2020 Tenants (2) Retail 6,410 78,349,200 $ 1,374,093 84.6 % 44.7 % Industrial 120 26,798,900 169,418 10.4 80.0 Office 43 3,175,700 53,877 3.3 86.9 Agriculture 15 184,500 27,113 1.7 — Totals 6,588 108,508,300 $ 1,624,501 100 % 49.0 % (1) Includes leasable building square footage. Excludes 3,300 acres of leased land categorized as agriculture at September 30, 2020. (2) Refer to footnote 3 on page 20 for our definition of investment grade tenants. Q3 2020 Supplemental Operating & Financial Data 26

Same Store Rental Revenue (dollars in thousands) Third Quarter 2020 Top 3 Industries Contributing to the Change (1) Same Store Rental Revenue Quarter Ended Quarter Ended Net % Change Number of Properties 5,511 Industry September 30, 2020 September 30, 2019 Change by Industry Square Footage 86,200,209 Theaters - U.S. $ 3,322 $ 15,657 $ (12,335) (78.8) % Q3 2020 $ 302,986 Health and Fitness 19,454 22,332 (2,878) (12.9) % Q3 2019 $ 316,851 Drug Stores 30,519 30,111 408 1.4 % Decrease (in dollars) $ (13,865) Decrease (percent) (4.4) % Year-to-Date 2020 Top 3 Industries Contributing to the Change (1) Same Store Rental Revenue Nine Months Ended Nine Months Ended Net % Change Number of Properties 5,511 Industry September 30, 2020 September 30, 2019 Change by Industry Square Footage 86,200,209 Theaters - U.S. $ 34,716 $ 47,092 $ (12,376) (26.3) % YTD 2020 $ 937,218 Restaurants - Quick Service 57,688 60,141 (2,453) (4.1) % YTD 2019 $ 951,764 Health and Fitness 64,279 66,610 (2,331) (3.5) % Decrease (in dollars) $ (14,546) (1) Top 3 industry contributors are based on absolute value of net change year over year. Decrease (percent) (1.5) % Our calculation of same store rental revenue includes rent deferred for future payment as a result of lease concessions we granted in response to the COVID-19 pandemic and recognized under the practical expedient provided by the FASB. Same store rental income was negatively impacted by reserves recorded as reductions of rental revenue of $19.9 million for the three months ended September 30, 2020 compared to $241,000 for the three months ended September 30, 2019, and $26.5 million for the nine months ended September 30, 2020 compared to $1.2 million for the nine months ended September 30, 2019. Our calculation of same store rental revenue also includes uncollected rent for which we have not granted a lease concession. If these applicable amounts of rent deferrals and uncollected rent were excluded from our calculation of same store rental revenue, the decreases for the three and nine months ended September 30, 2020 relative to the comparable periods for 2019 would have been (4.6)% and (5.9)%, respectively. Same Store Pool Defined For purposes of determining the properties used to calculate our same store rental revenue pool, we include all properties that we owned for the entire year-to-date period, for both the current and prior year except for properties during the current or prior year that were: (i) vacant at any time, (ii) under development or redevelopment, or (iii) involved in eminent domain and rent was reduced. Rental revenue amounts presented in our same store rent calculation exclude straight-line rent, the amortization of above and below-market leases, and reimbursements from tenants for recoverable real estate taxes and operating expenses. Q3 2020 Supplemental Operating & Financial Data 27

Same Store Rental Revenue (Cont'd) (dollars in thousands) Same Store Rental Revenue by Property Type Third Quarter Quarter Ended Quarter Ended Net % Change by Property Type September 30, 2020 September 30, 2019 Change Property Type Retail $ 247,526 $ 261,797 $ (14,271) (5.5) % Industrial 36,442 36,318 124 0.3 % Office 13,344 13,132 212 1.6 % Agriculture 5,674 5,604 70 1.2 % Total $ 302,986 $ 316,851 $ (13,865) (4.4) % Year-to-Date Nine Months Ended Nine Months Ended Net % Change by Property Type September 30, 2020 September 30, 2019 Change Property Type Retail $ 771,085 $ 787,316 $ (16,231) (2.1) % Industrial 109,478 108,708 770 0.7 % Office 39,756 39,050 706 1.8 % Agriculture 16,899 16,690 209 1.3 % Total $ 937,218 $ 951,764 $ (14,546) (1.5) % Reconciliation of Same Store Rental Revenue to Rental Revenue (including reimbursable) Quarter Ended Nine Months Ended September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 Same store rental revenue $ 302,986 $ 316,851 $ 937,218 $ 951,764 Straight-line rent 6,529 7,481 20,702 19,211 Amortization of above and below-market leases (4,198) (6,568) (20,069) (15,071) Tenant reimbursements 18,024 15,523 59,354 49,274 Revenue from excluded properties (1) 78,528 39,025 227,022 85,423 Rental revenue (including reimbursable) $ 401,869 $ 372,312 $ 1,224,227 $ 1,090,601 (1) See Same Store Pool Defined on page 27. Q3 2020 Supplemental Operating & Financial Data 28

Occupancy By Property Change in Occupancy Occupied Properties 6,496 Vacant Properties at 6/30/2020 101 Total Properties 6,588 Occupancy 98.6 % Expiration Activity (1) + 98 Leasing Activity (2) - 80 By Square Footage Vacant Disposition Activity (3) - 27 Occupied Square Footage 106,443,343 Total Square Footage 108,508,312 Vacant Properties at 9/30/2020 92 Occupancy 98.1 % (1) Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the current quarter. (Economic Occupancy) By Rental Revenue (2) Includes 75 expirations that were re-leased to the same tenants without Quarterly Cash Rental Revenue $ 397,768,490 vacancy, two that were re-leased to new tenants without a period of vacancy, and three that were re-leased to new tenants after a period of vacancy. See Quarterly Cash Vacant Rental Revenue (1) $ 6,015,191 page 30 for additional detail on re-leasing activity. (3) Occupancy 98.5% Includes 25 properties that were vacant at the beginning of the quarter. (1) Based on contractual monthly rents received immediately preceding the date of vacancy. Occupancy by Number of Properties Q3 2020 Supplemental Operating & Financial Data 29

Leasing Activity (dollars in thousands) Re-leased to New Tenant Allocation Based on Number of Leases Re-leased to Without After a Period Re-leasing Q3 2020 Same Tenant Vacancy of Vacancy Totals Prior Cash Rents $ 11,856 $ 201 $ 371 $ 12,428 New Cash Rents* $ 11,705 $ 235 $ 388 $ 12,328 Recapture Rate 98.7 % 116.9 % 104.6 % 99.2 % Number of Leases 75 2 3 80 Average Months Vacant — — 10.2 0.4 Lease Incentives(1) $ — $ — $ — $ — *Percentage of Total Annualized Portfolio Rental Revenue: 0.8 % Re-leased to New Tenant Re-leased to Without After a Period Re-leasing Year-to-Date Same Tenant Vacancy of Vacancy Totals Prior Cash Rents $ 40,609 $ 3,499 $ 1,444 $ 45,552 New Cash Rents* $ 41,510 $ 2,681 $ 1,290 $ 45,481 Recapture Rate 102.2 % 76.6 % 89.3 % 99.8 % Number of Leases 225 5 8 238 Average Months Vacant — — 11.8 0.4 Lease Incentives(1) $ — $ — $ — $ — *Percentage of Total Annualized Portfolio Rental Revenue: 2.8 % (1) Lease incentives are defined as capital outlays made on behalf of a tenant that are specific to the tenant’s use and benefit, and are not capitalized as improvements to the property. Q3 2020 Supplemental Operating & Financial Data 30

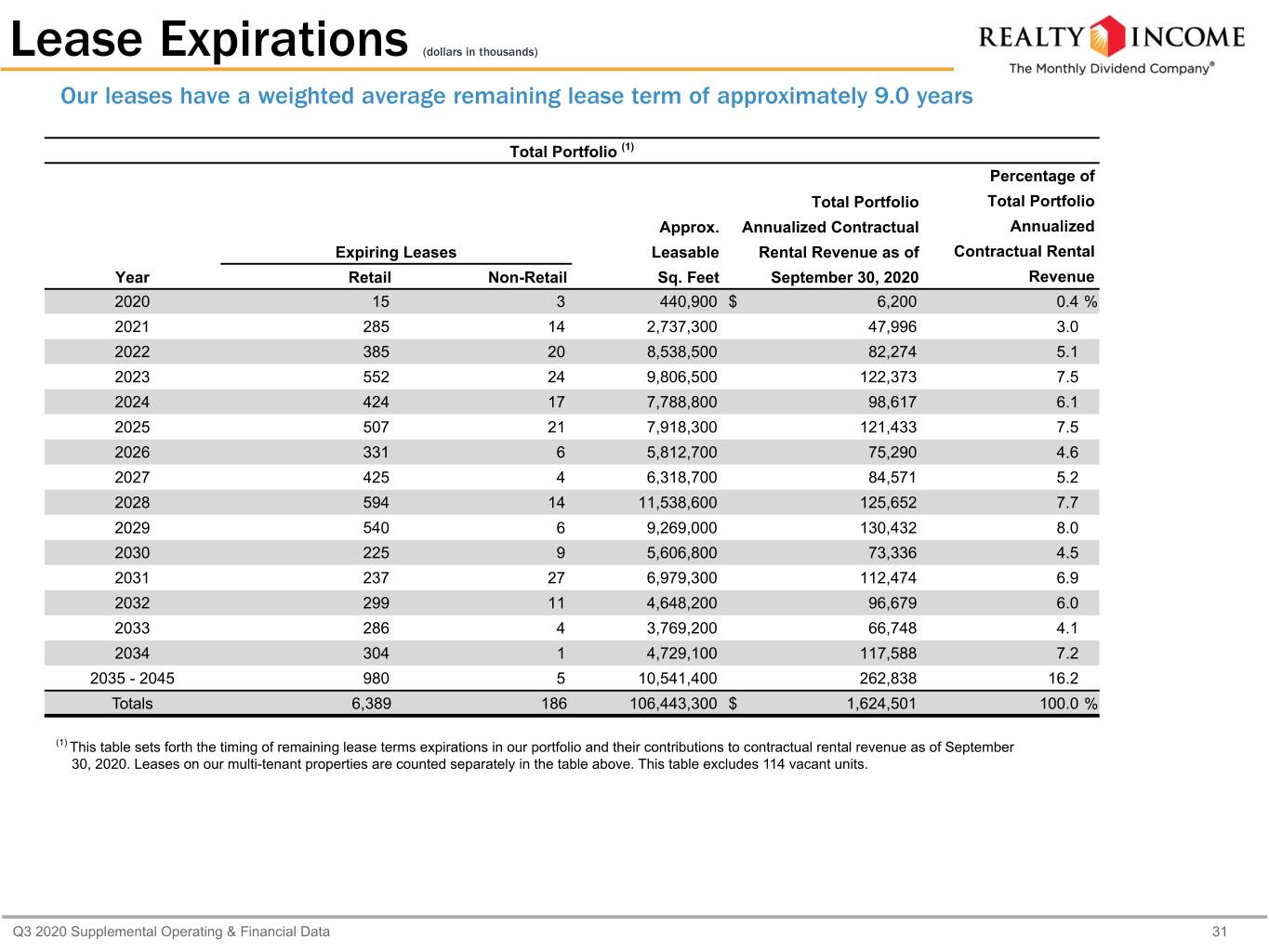

Lease Expirations (dollars in thousands) Our leases have a weighted average remaining lease term of approximately 9.0 years Total Portfolio (1) Percentage of Total Portfolio Total Portfolio Approx. Annualized Contractual Annualized Expiring Leases Leasable Rental Revenue as of Contractual Rental Year Retail Non-Retail Sq. Feet September 30, 2020 Revenue 2020 15 3 440,900 $ 6,200 0.4 % 2021 285 14 2,737,300 47,996 3.0 2022 385 20 8,538,500 82,274 5.1 2023 552 24 9,806,500 122,373 7.5 2024 424 17 7,788,800 98,617 6.1 2025 507 21 7,918,300 121,433 7.5 2026 331 6 5,812,700 75,290 4.6 2027 425 4 6,318,700 84,571 5.2 2028 594 14 11,538,600 125,652 7.7 2029 540 6 9,269,000 130,432 8.0 2030 225 9 5,606,800 73,336 4.5 2031 237 27 6,979,300 112,474 6.9 2032 299 11 4,648,200 96,679 6.0 2033 286 4 3,769,200 66,748 4.1 2034 304 1 4,729,100 117,588 7.2 2035 - 2045 980 5 10,541,400 262,838 16.2 Totals 6,389 186 106,443,300 $ 1,624,501 100.0 % (1) This table sets forth the timing of remaining lease terms expirations in our portfolio and their contributions to contractual rental revenue as of September 30, 2020. Leases on our multi-tenant properties are counted separately in the table above. This table excludes 114 vacant units. Q3 2020 Supplemental Operating & Financial Data 31

Analyst Coverage Equity Research Bank of America Merrill Lynch Joshua Dennerlein joshua.dennerlein@baml.com (646) 855-1681 Berenberg Nate Crossett nate.crossett@berenberg-us.com (646) 949-9030 BTIG Michael Gorman mgorman@btig.com (212) 738-6138 Capital One Chris Lucas christopher.lucas@capitalone.com (571) 633-8151 Citigroup Michael Bilerman michael.bilerman@citi.com (212) 816-1383 D.A. Davidson Barry Oxford boxford@dadco.com (212) 240-9871 Edward Jones James Shanahan jim.shanahan@edwardjones.com (314) 515-5292 Green Street Spenser Allaway sallaway@greenstreetadvisors.com (949) 640-8780 Janney Montgomery Scott Robert Stevenson robstevenson@janney.com (646) 840-3217 Jefferies Linda Tsai ltsai@jefferies.com (212) 778-8011 J.P. Morgan Anthony Paolone anthony.paolone@jpmorgan.com (212) 622-6682 Ladenburg Thalmann John Massocca jmassocca@ladenburg.com (212) 409-2543 Mizuho Haendel St. Juste haendel.st.juste@us.mizuho-sc.com (212) 205-7860 Morgan Stanley Vikram Malhotra vikram.malhotra@morganstanley.com (212) 761-7064 Raymond James RJ Milligan rjmilligan@raymondjames.com (727) 567-2585 Scotiabank Nicholas Yulico nicholas.yulico@scotiabank.com (212) 225-6904 Stifel Simon Yarmak yarmaks@stifel.com (443) 224-1345 UBS Brent Dilts brent.dilts@ubs.com (212) 713-1841 Wells Fargo Todd Stender todd.stender@wellsfargo.com (562) 637-1371 Realty Income is covered by the analysts at the firms listed above. This list may not be complete and is subject to change. Please note that any opinions, estimates or forecasts regarding Realty Income's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts of Realty Income or its management. Realty Income does not by its reference above or distribution imply, and expressly disclaims, any endorsement of or concurrence with any information, estimates, forecasts, opinions, conclusions or recommendations provided by analysts. Q3 2020 Supplemental Operating & Financial Data 32