Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - W. P. Carey Inc. | wpc2020q3supplementale.htm |

| 8-K - 8-K - W. P. Carey Inc. | wpc-20201030.htm |

| EX-99.1 - EX-99.1 - W. P. Carey Inc. | wpc2020q38-kerexh991.htm |

Exhibit 99.3 COVID-19 Update October 30, 2020 Investing for the long run®

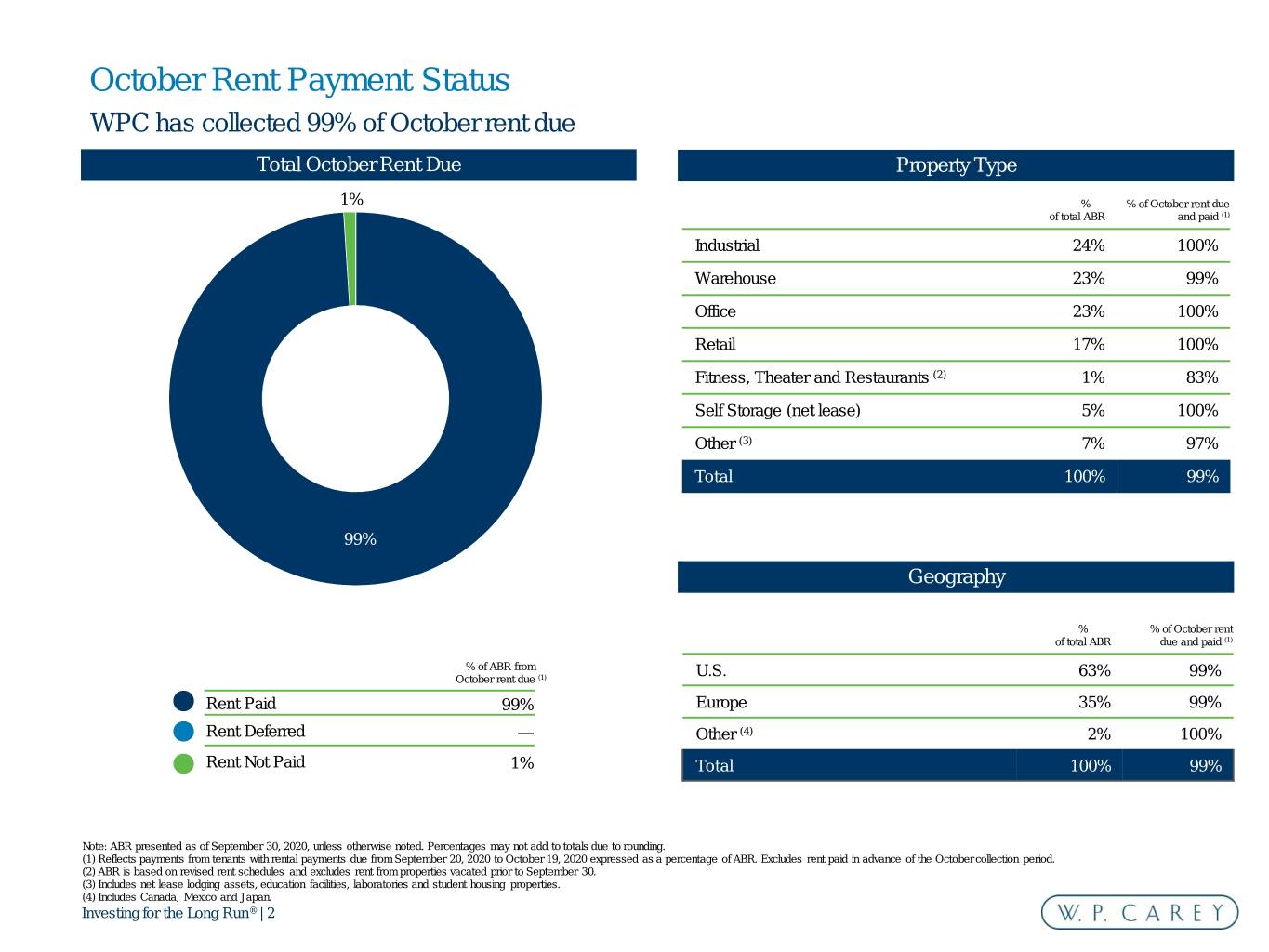

October Rent Payment Status WPC has collected 99% of October rent due Total October Rent Due Property Type 1% % % of October rent due of total ABR and paid (1) Industrial 24% 100% Warehouse 23% 99% Office 23% 100% Retail 17% 100% Fitness, Theater and Restaurants (2) 1% 83% Self Storage (net lease) 5% 100% Other (3) 7% 97% Total 100% 99% 99% Geography % % of October rent of total ABR due and paid (1) % of ABR from U.S. 63% 99% October rent due (1) Rent Paid 99% Europe 35% 99% Rent Deferred — Other (4) 2% 100% Rent Not Paid 1% Total 100% 99% Note: ABR presented as of September 30, 2020, unless otherwise noted. Percentages may not add to totals due to rounding. (1) Reflects payments from tenants with rental payments due from September 20, 2020 to October 19, 2020 expressed as a percentage of ABR. Excludes rent paid in advance of the October collection period. (2) ABR is based on revised rent schedules and excludes rent from properties vacated prior to September 30. (3) Includes net lease lodging assets, education facilities, laboratories and student housing properties. (4) Includes Canada, Mexico and Japan. Investing for the Long Run® | 2

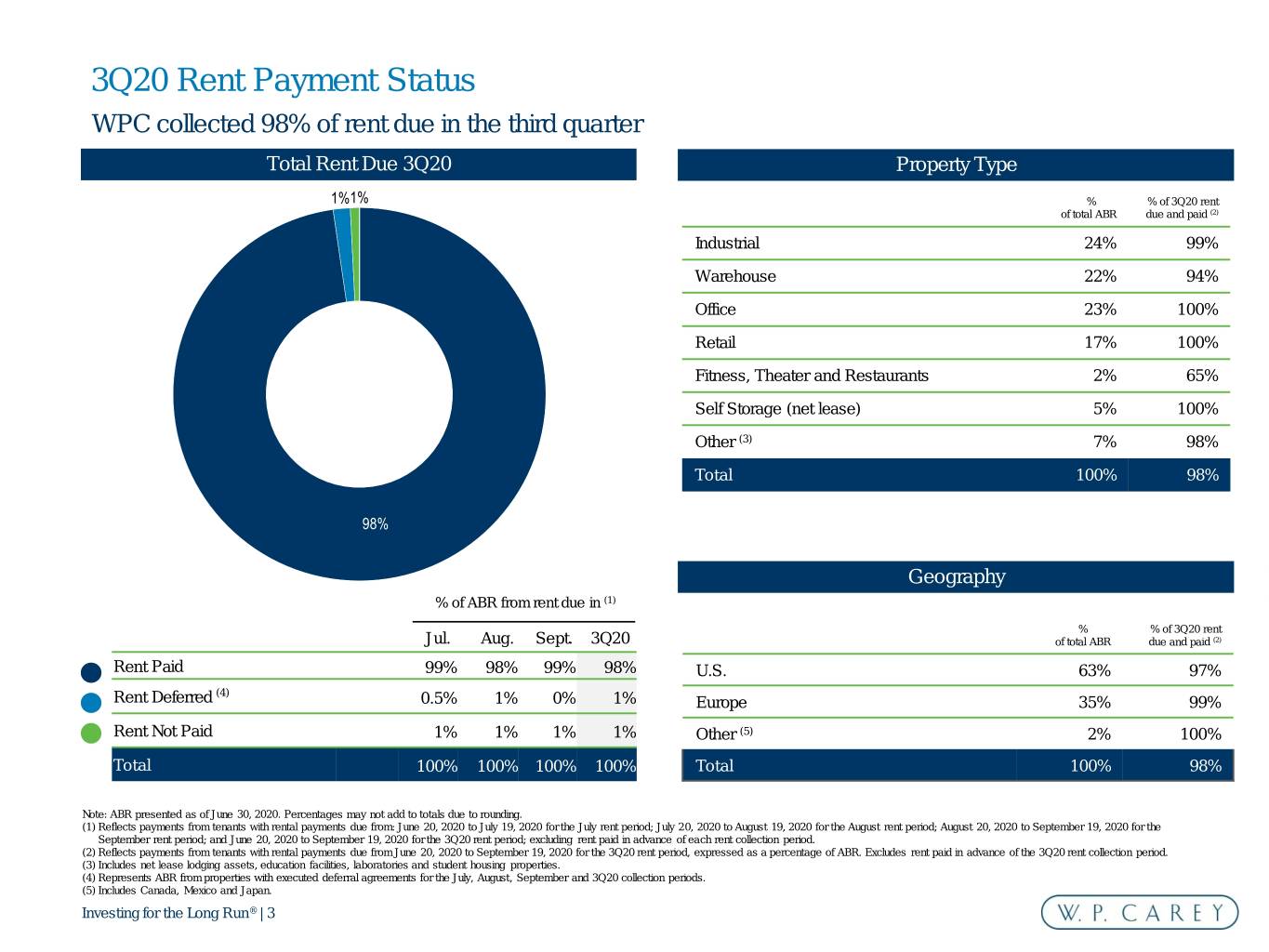

3Q20 Rent Payment Status WPC collected 98% of rent due in the third quarter Total Rent Due 3Q20 Property Type 1%1% % % of 3Q20 rent of total ABR due and paid (2) Industrial 24% 99% Warehouse 22% 94% Office 23% 100% Retail 17% 100% Fitness, Theater and Restaurants 2% 65% Self Storage (net lease) 5% 100% Other (3) 7% 98% Total 100% 98% 98% Geography % of ABR from rent due in (1) % % of 3Q20 rent Jul. Aug. Sept. 3Q20 of total ABR due and paid (2) Rent Paid 99% 98% 99% 98% U.S. 63% 97% (4) Rent Deferred 0.5% 1% 0% 1% Europe 35% 99% Rent Not Paid 1% 1% 1% 1% Other (5) 2% 100% Total 100% 100% 100% 100% Total 100% 98% Note: ABR presented as of June 30, 2020. Percentages may not add to totals due to rounding. (1) Reflects payments from tenants with rental payments due from: June 20, 2020 to July 19, 2020 for the July rent period; July 20, 2020 to August 19, 2020 for the August rent period; August 20, 2020 to September 19, 2020 for the September rent period; and June 20, 2020 to September 19, 2020 for the 3Q20 rent period; excluding rent paid in advance of each rent collection period. (2) Reflects payments from tenants with rental payments due from June 20, 2020 to September 19, 2020 for the 3Q20 rent period, expressed as a percentage of ABR. Excludes rent paid in advance of the 3Q20 rent collection period. (3) Includes net lease lodging assets, education facilities, laboratories and student housing properties. (4) Represents ABR from properties with executed deferral agreements for the July, August, September and 3Q20 collection periods. (5) Includes Canada, Mexico and Japan. Investing for the Long Run® | 3

Disclosures The following non-GAAP financial measures are used in this presentation: Pro Rata Metrics This presentation contains certain metrics prepared under the pro rata consolidation method. We refer to these metrics as pro rata metrics. We have a number of investments, usually with our affiliates, in which our economic ownership is less than 100%. Under the full consolidation method, we report 100% of the assets, liabilities, revenues and expenses of those investments that are deemed to be under our control or for which we are deemed to be the primary beneficiary, even if our ownership is less than 100%. Also, for all other jointly owned investments, which we do not control, we report our net investment and our net income or loss from that investment. Under the pro rata consolidation method, we present our proportionate share, based on our economic ownership of these jointly owned investments, of the assets, liabilities, revenues and expenses of those investments. Multiplying each of our jointly owned investments’ financial statement line items by our percentage ownership and adding or subtracting those amounts from our totals, as applicable, may not accurately depict the legal and economic implications of holding an ownership interest of less than 100% in our jointly owned investments. ABR ABR represents contractual minimum annualized base rent for our net-leased properties and reflects exchange rates as of September 30, 2020. If there is a rent abatement, we annualize the first monthly contractual base rent following the free rent period. ABR is not applicable to operating properties and is presented on a pro rata basis. Note: Given the significant uncertainty regarding the duration and severity of the impact of COVID-19, the Company is unable to predict the impact COVID-19 will have on its tenants’ continued ability to pay rent. Therefore, information provided regarding historical rent collections should not serve as an indication of expected future rent collections. Additional details regarding the Company’s update relating to COVID-19 can be found in a presentation furnished as Exhibit 99.3 of the Current Report on Form 8-K filed on October 30, 2020. All data presented herein is as of September 30, 2020 unless otherwise noted. Amounts may not sum to totals due to rounding. Past performance does not guarantee future results. Investing for the Long Run® | 4