Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | htz-20201029.htm |

Strictly Confidential Fleet Financing Facility Materials October 2020

Strictly Confidential Disclaimer This document is highly confidential, is subject to confidentiality agreement between the parties, and has been prepared by Hertz and is for information purposes only. By accepting this document, you hereby acknowledge that (a) the information contained herein and any oral statements made by the Companies’ (as hereinafter defined) representatives with respect to such information (the “Confidential Information") contains material non-public information relating to the Hertz corporation (“Hertz”), Hertz Global Holdings, Inc. (“HGH" or "Hertz Global”), the ultimate parent company of Hertz, and their affiliates (collectively, the “Companies"); and (b) the confidential information is provided as of the date of this presentation, and none of the parties disclosing such information has any duty to update such confidential information at any time. You also agree that you will comply with your obligations to the companies under the confidentiality agreements and that (a) you will not disclose, forward, release or distribute the confidential information to any third party other than those who have entered into a confidentiality agreement; (b) you will not rely on the confidential information; (c) under no circumstances will this confidential information constitute an offer to sell or a solicitation of an offer to invest in any transaction, purchase any securities or form the basis of any contract or commitment whatsoever and (d) you will not engage in any transaction involving any securities of the companies while in possession of any material non-public information as a result of your receipt of the confidential information until such material non-public information is made public. Further, you will be responsible and held liable for any breach of these provisions. The information contained herein may be superseded in its entirety by further updated materials which will be prepared by Hertz. The future performance of Hertz may differ significantly from the past performance of Hertz. The companies make no representation as to the accuracy or completeness of the information contained herein. The information provided may not reflect all information known to professionals in every business area of the companies. Certain data set forth herein has been provided by Hertz based on data obtained from third parties. Neither Hertz nor any of its affiliates have independently verified the accuracy of such data. This information is not intended to provide and should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own counsel, tax, accounting, regulatory and other advisors as to the legal, tax, accounting, regulatory, business, and financial issues relating to the confidential information. Information regarding the companies has been provided by the companies, and has not been independently verified by any other person or its affiliates. This information will be deemed to be superseded by any subsequent versions 2

Strictly Confidential New Financing Approach Lowers Securitization Risk • Financing the net capitalized cost is expected to fundamentally change the FMV profile of a vehicle over its life compared to HVF II’s gross capitalized cost approach • OEM incentive rebates are included as an asset within the ABS program and financed as a short term receivable equivalent to program turnback receivables • Starting vehicle net book value is gross purchase price less any incentive rebate Average FMV Score by Vehicle Age - 2017-2020 YTD 150.0% 140.0% • Starting NBV at the net purchase 130.0% price (as opposed to 120.0% gross purchase price in HVF II) 110.0% FMV Score FMV neutralizes 100.0% impact of first FMV mark 90.0% 80.0% 70.0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Vehicle Age in Months HVF II Pro Forma New Construct 100% 3

First Mark Historical 100.0% 105.0% 110.0% 70.0% 75.0% 80.0% 85.0% 90.0% 95.0% Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Count Nov-17 FMV Score of First MarkVehicles 2017 Dec-17 Jan-18 - Feb-18 Gross and Methodology Net Mar-18 HVF IIHVF Apr-18 May-18 Jun-18 Jul-18 Aug-18 Pro ConstructForma New Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 - Apr-19 2020 May-19 Jun-19 Jul-19 100% Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Strictly Confidential Mar-20 Apr-20 May-20 0 5,000 10,000 15,000 20,000 25,000 30,000 4

Strictly Confidential Hertz Effective Economic Depreciation Experience • Risk vehicle minimum depreciation rate of 1.67% of net capitalized cost is above historical average effective economic depreciation rates, which is expected to build FMV cushion over the vehicle’s life Effective Economic Depreciation Experience – Sold Risk Vehicles by MY Total Avg. Effective Total GAAP Disposition Economic Dep. Model Year Vehicle Type Vehicle Count Avg. Age Mths. Capitalized Cost Proceeds Rate 17 Risk 279,364 21.25 $5,504,540,983 $3,772,271,975 1.48% 18 Risk 216,886 18.85 4,628,024,010 3,469,674,566 1.33% 19 Risk 141,502 15.41 3,441,419,260 2,773,181,393 1.26% 20 Risk 35,075 7.45 958,772,967 945,352,689 0.19% Note: GAAP capitalized cost is the same or substantially the same as our “net” capitalized cost approach Actual vs. Pro Forma 3 Month MTM Test • Pro forma FMV results under new 125.0% construct significantly higher than actual HVF II experience, driven 120.0% by: • (i) 1.67% dep rate higher than 115.0% monthly FMV % change 110.0% • (ii) Size of incentive receivable relative to first mark impact 105.0% • 1.67% minimum dep rate does not apply if trailing 3-month FMV is 100.0% greater than [107%] 95.0% 90.0% Jul-18 Jul-17 Jul-19 Jul-20 Jan-18 Jan-17 Jan-19 Jan-20 Jun-18 Jun-17 Jun-19 Jun-20 Oct-17 Oct-18 Oct-19 Feb-18 Apr-18 Feb-17 Apr-17 Feb-19 Apr-19 Feb-20 Apr-20 Sep-18 Sep-17 Sep-19 Dec-17 Dec-18 Dec-19 Aug-18 Aug-17 Aug-19 Aug-20 Nov-17 Nov-18 Nov-19 Mar-18 Mar-17 Mar-19 Mar-20 May-18 May-19 May-20 May-17 5 Actual 3 Month Test Pro Forma 3 Month Test 107%

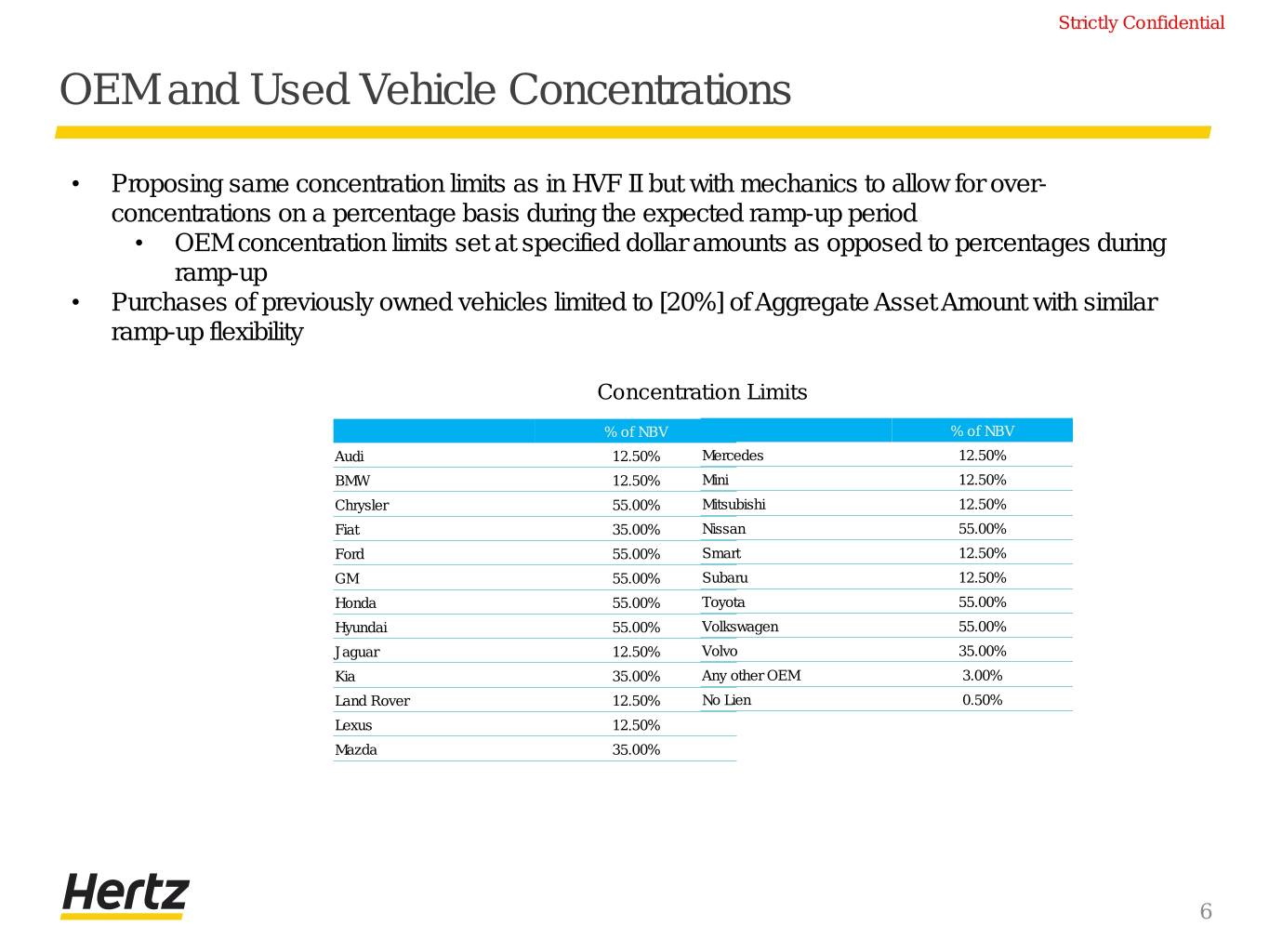

Strictly Confidential OEM and Used Vehicle Concentrations • Proposing same concentration limits as in HVF II but with mechanics to allow for over- concentrations on a percentage basis during the expected ramp-up period • OEM concentration limits set at specified dollar amounts as opposed to percentages during ramp-up • Purchases of previously owned vehicles limited to [20%] of Aggregate Asset Amount with similar ramp-up flexibility Concentration Limits % of NBV % of NBV Audi 12.50% Mercedes 12.50% BMW 12.50% Mini 12.50% Chrysler 55.00% Mitsubishi 12.50% Fiat 35.00% Nissan 55.00% Ford 55.00% Smart 12.50% GM 55.00% Subaru 12.50% Honda 55.00% Toyota 55.00% Hyundai 55.00% Volkswagen 55.00% Jaguar 12.50% Volvo 35.00% Kia 35.00% Any other OEM 3.00% Land Rover 12.50% No Lien 0.50% Lexus 12.50% Mazda 35.00% 6

Strictly Confidential Historical Average Incentive Receivable Balances by OEM • Seeking to lower/eliminate “off of invoice” incentives with each OEM to minimize incentive receivable balance going forward ($ in millions) 269 235 233 206 193 179 170 163 153 156 155 133 130 120 115 118 110 98 94 89 91 78 80 81 69 64 63 67 64 64 67 59 57 55 52 46 43 41 32 21 15 Jul-18 Jul-17 Jul-19 Jan-18 Jan-20 Jan-17 Jan-19 Jun-18 Jun-17 Jun-19 Oct-17 Oct-19 Oct-18 Feb-19 Feb-17 Feb-18 Feb-20 Sep-18 Sep-17 Sep-19 Dec-18 Dec-17 Dec-19 Apr-18 Apr-20 Apr-17 Apr-19 Mar-17 Mar-20 Mar-18 Mar-19 Aug-17 Aug-19 Aug-18 Nov-17 Nov-18 Nov-19 May-17 May-19 May-18 May-20 7