Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Stagwell Inc | a8-kexhibit991mdcax202.htm |

| 8-K - 8-K - Stagwell Inc | mdca-20201029.htm |

Management Presentation Third Quarter 2020 Results October 29, 2020

FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation contains forward-looking statements. Statements in this presentation that are not historical facts, including without limitation the information under the heading "Financial Outlook" and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined below. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients, including as a result of the novel coronavirus pandemic (“COVID-19”); • the effects of the outbreak of COVID-19, including the measures to reduce its spread, and the impact on the economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties; • developments involving the proposal by Stagwell Media LP to enter into a business combination with the Company (the “Potential Transaction”), including the impact of the announcement of the formation of the special committee, the reaching of an agreement in principle on certain aspects of a Potential Transaction, and the continuing discussion and review of a Potential Transaction on the Company’s business, whether any Potential Transaction will occur, and/or the ability to implement any Potential Transaction or other transaction; • the Company’s ability to attract new clients and retain existing clients; • reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • the Company’s ability to retain and attract key employees; • the Company’s ability to achieve the full amount of its stated cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; and • foreign currency fluctuations. Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in the Company’s 2019 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 5, 2020 and accessible on the SEC’s website at www.sec.gov., under the caption “Risk Factors,” and in the Company’s other SEC filings. 2

SUMMARY • Organic Revenue decline of 16.4% in the third quarter and 14.1% YTD driven by lower spending by clients in connection with the COVID-19 pandemic • Sequential revenue growth of 9.1% from the second quarter of 2020. • Adjusted EBITDA Margin for the third quarter of 2020 was 19.1% vs. 14.3% in prior year, an increase of 480 basis points • Adjusted EBITDA Margin for the first nine months of 2020 was 14.9% vs. 11.3% in prior year, an increase of 360 basis points • Net new business wins of $31.9 million in the third quarter and $60.8 million in the nine months ended September 30, 2020 Note: See appendix for definitions of Non-GAAP Financial Measures 3

----- THIRDDRAFT QUARTER ----- 2020 FINANCIAL HIGHLIGHTS • Revenue of $283.4 million versus $342.9 million in the prior year period • Organic revenue decreased by 16.4% versus the prior year period. Organic revenue was unfavorably impacted by 121 basis points from billable pass through costs • Sequential revenue growth of 9.1% from the second quarter of 2020. • Adjusted EBITDA of $54.1 million versus $49.2 million in the prior year period, an increase of 9.9% • Sequential Adjusted EBITDA growth of 49.5% from the second quarter of 2020, increasing from $36.2 million to $54.1 million. • Adjusted EBITDA Margin of 19.1% vs. 14.3% in prior year, an increase of 480 basis points • Covenant EBITDA (LTM) of $199.3 million for the third quarter of 2020 versus $175.5 million as of September 30, 2019, an increase of 13.6% • Net new business wins of $31.9 million Note: See appendix for definitions of Non-GAAP Financial Measures 4

----- DRAFTNINE MONTHS ----- 2020 FINANCIAL HIGHLIGHTS • Revenue of $870.8 million versus $1,033.8 million in the prior year period • Organic revenue decreased by 14.1% versus the prior year period. Organic revenue was unfavorably impacted by 198 basis points from billable pass through costs • Adjusted EBITDA of $129.8 million versus $117.1 million in the prior year period, an increase of 10.8% • Adjusted EBITDA Margin of 14.9% vs. 11.3% in prior year, an increase of 360 basis points • Excluding Kingsdale and Sloane, Adjusted EBITDA increased 15.2% in the first nine months of 2020 compared with the prior year period. • Net new business wins of $60.8 million Note: See appendix for definitions of Non-GAAP Financial Measures 5

CONSOLIDATED REVENUE AND EARNINGS (US$ in millions, except percentages) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 % Change 2020 2019 % Change Revenue: $ 283.4 $ 342.9 (17.3) % $ 870.8 $ 1,033.8 (15.8) % Operating Expenses: Cost of services sold 172.5 222.4 (22.4) % 560.9 700.4 (19.9) % Office and general expenses 72.5 79.7 (9.0) % 205.1 234.1 (12.4) % Depreciation and amortization 9.3 9.4 (0.4) % 27.4 28.9 (5.0) % Impairment and other losses 0.2 1.9 (91.8) % 19.2 1.9 NM % Operating income 28.9 29.4 (1.8) % 58.3 68.5 (14.9) % Interest expense and finance charges, net (15.3) (16.1) (46.8) (49.3) Foreign exchange gain (loss) 2.2 (4.0) (7.3) 4.4 Other, net 0.5 (0.4) 22.7 (4.6) Income tax expense 1.5 3.5 7.0 6.3 Equity in earnings (losses) of non-consolidated affiliates — 0.1 (0.8) 0.4 Net income 14.8 5.5 19.1 13.2 Net income attributable to the noncontrolling interest (10.7) (7.3) (14.6) (10.7) Accretion on and net income allocated to convertible preference shares (3.7) (3.3) (10.5) (8.9) Net income (loss) attributable to MDC Partners Inc. common shareholders $ 0.4 $ (5.1) $ (6.0) $ (6.5) Note: See appendix for definitions of Non-GAAP Financial Measures Note: Actuals may not foot due to rounding 6

REVENUE SUMMARY (US$ in millions, except percentages) Three Months Ended Nine Months Ended Revenue $ % Change Revenue $ % Change September 30, 2019 $ 342.9 $ 1,033.8 Organic revenue (56.3) (16.4) % (145.3) (14.1) % Non-GAAP acquisitions (dispositions), net (4.1) (1.2) % (13.9) (1.3) % Foreign exchange impact 0.9 0.3 % (3.8) (0.4) % Total Change (59.5) (17.3) % (163.0) (15.8) % September 30, 2020 $ 283.4 $ 870.8 Organic revenue declined 16.4% in the third quarter of 2020 versus the prior year period. Note: Actuals may not foot due to rounding 7

REVENUE BY GEOGRAPHY AND SEGMENT (1) (US$ in millions, except percentages) 2019 2020 Q3 Q4 Q1 Q2 Q3 Organic Organic Organic Organic Organic Total Total Revenue Total Total Revenue Total Total Revenue Total Total Revenue Total Total Revenue Growth Growth Growth Growth Growth Revenue Growth (Decline) Revenue Growth (Decline) Revenue Growth (Decline) Revenue Growth (Decline) Revenue Growth (Decline) United States $ 271.7 (8.4) % (8.5) % $ 296.7 (2.7) % (2.6) % $ 264.6 0.6 % 1.3 % $ 210.3 (26.1) % (24.7) % $ 228.3 (16.0) % (14.5) % Canada 25.9 (19.4) % (7.0) % 32.2 (0.5) % 12.6 % 18.3 18.4 % (1.7) % 16.6 (32.4) % (28.9) % 20.3 (21.6) % (20.9) % North America 297.6 (9.5) % (8.3) % 328.9 (2.5) % (1.2) % 282.9 0.9 % 1.1 % 227.0 (26.6) % (25.0) % 248.6 (16.5) % (15.0) % Other 45.3 (3.8) % (1.5) % 53.0 (5.9) % (3.6) % 44.9 3.5 % 7.6 % 32.7 (38.1) % (34.2) % 34.9 (23.1) % (25.4) % Total $ 342.9 (8.8) % (7.5) % $ 382.0 (3.0) % (1.5) % $ 327.7 (0.3) % 2.0 % $ 259.7 (28.3) % (26.4) % $ 283.4 (17.3) % (16.4) % Integrated Networks - Group A $ 99.3 (2.0) % (1.4) % $ 115.8 3.4 % 3.5 % $ 90.6 22.9 % 23.4 % $ 82.7 (19.9) % (19.2) % $ 87.1 (12.3) % (12.7) % Integrated Networks - Group B 129.1 (11.3) % (10.8) % 136.1 (3.5) % (3.1) % 117.7 (11.6) % (11.0) % 93.4 (30.0) % (29.0) % 112.2 (13.1) % (12.8) % Media & Data Network 36.2 (21.0) % (20.6) % 42.5 (12.5) % (12.6) % 41.1 (5.0) % (4.5) % 28.6 (27.6) % (26.7) % 33.6 (7.3) % (7.3) % All Other 78.3 (5.8) % (1.9) % 87.5 (4.8) % 0.8 % 78.4 (0.4) % 7.3 % 55.0 (36.1) % (30.7) % 50.6 (35.4) % (31.2) % Total $ 342.9 (8.8) % (7.5) % $ 382.0 (3.0) % (1.5) % $ 327.7 (0.3) % 2.0 % $ 259.7 (28.3) % (26.4) % $ 283.4 (17.3) % (16.4) % 1 Effective in the first quarter of 2020, the Company reorganized its management structure resulting in the aggregation of certain Partner Firms into integrated groups (“Networks”). In connection with our discussions with the SEC, the Company has changed the prior presentation for the Networks. Beginning in the second quarter of 2020, the Company separated the Networks into two reportable segments: Integrated Networks - Group A and Integrated Networks - Group B. Prior periods presented have been recast to reflect the change in reportable segments. Note: Actuals may not foot due to rounding 8

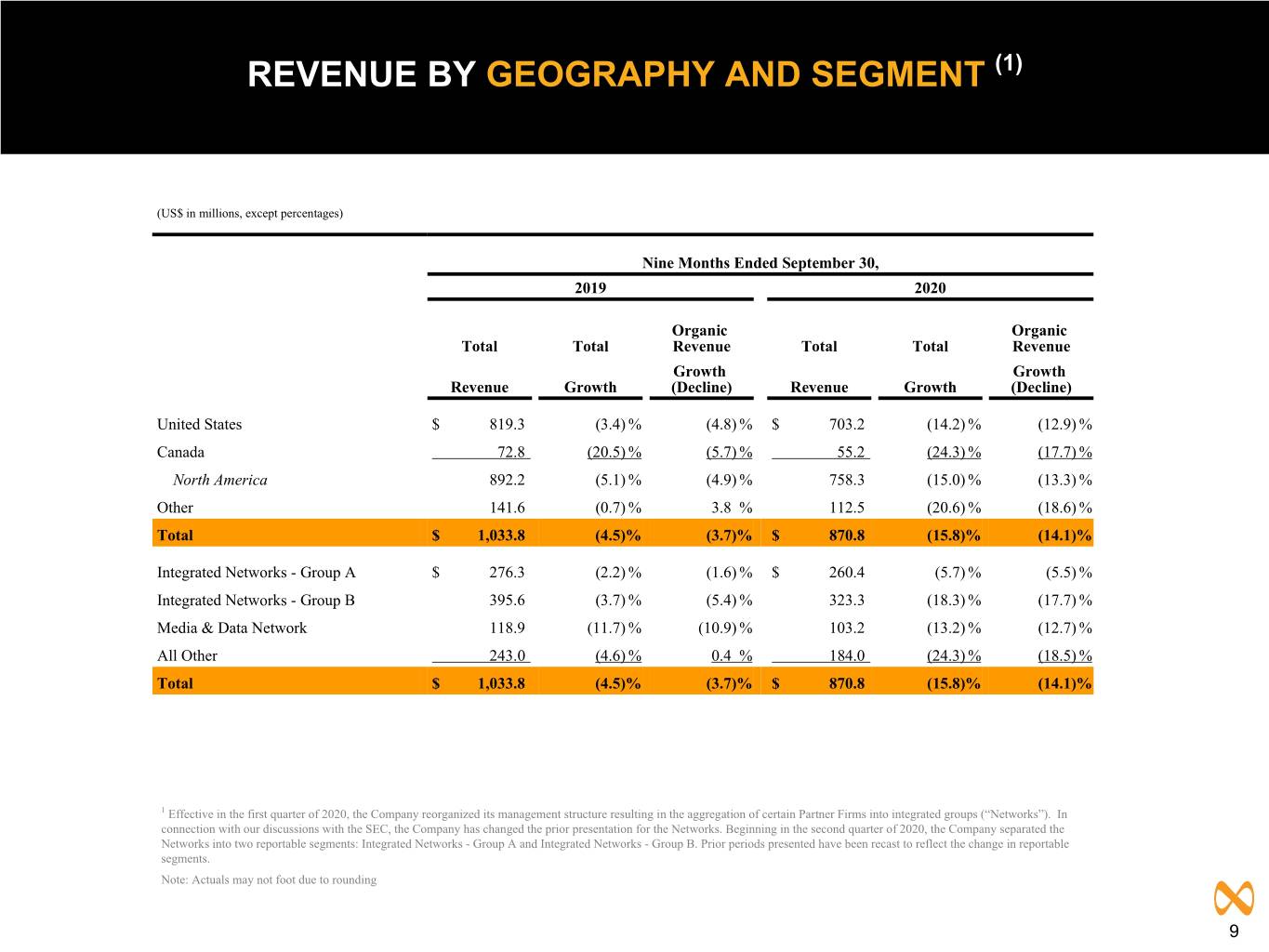

REVENUE BY GEOGRAPHY AND SEGMENT (1) (US$ in millions, except percentages) Nine Months Ended September 30, 2019 2020 Organic Organic Total Total Revenue Total Total Revenue Growth Growth Revenue Growth (Decline) Revenue Growth (Decline) United States $ 819.3 (3.4) % (4.8) % $ 703.2 (14.2) % (12.9) % Canada 72.8 (20.5) % (5.7) % 55.2 (24.3) % (17.7) % North America 892.2 (5.1) % (4.9) % 758.3 (15.0) % (13.3) % Other 141.6 (0.7) % 3.8 % 112.5 (20.6) % (18.6) % Total $ 1,033.8 (4.5) % (3.7) % $ 870.8 (15.8) % (14.1) % Integrated Networks - Group A $ 276.3 (2.2) % (1.6) % $ 260.4 (5.7) % (5.5) % Integrated Networks - Group B 395.6 (3.7) % (5.4) % 323.3 (18.3) % (17.7) % Media & Data Network 118.9 (11.7) % (10.9) % 103.2 (13.2) % (12.7) % All Other 243.0 (4.6) % 0.4 % 184.0 (24.3) % (18.5) % Total $ 1,033.8 (4.5) % (3.7) % $ 870.8 (15.8) % (14.1) % 1 Effective in the first quarter of 2020, the Company reorganized its management structure resulting in the aggregation of certain Partner Firms into integrated groups (“Networks”). In connection with our discussions with the SEC, the Company has changed the prior presentation for the Networks. Beginning in the second quarter of 2020, the Company separated the Networks into two reportable segments: Integrated Networks - Group A and Integrated Networks - Group B. Prior periods presented have been recast to reflect the change in reportable segments. Note: Actuals may not foot due to rounding 9

REVENUE BY CLIENT INDUSTRY Q3 2020 Mix Year-over-Year Growth by Category Automotive 5% Transportation and Q3 2020 QTD Q3 2020 YTD Travel/Lodging 3% Technology 15% Other 9% 0% to 10% Retail, Healthcare Healthcare Consumer Products, Food and Beverage, Retail, Automotive, Technology, Food & Beverage 17% Technology, Automotive Transportation and Travel/ Financials 8% Consumer Products, Below 0% Lodging, Financials, Communications, Financials, Communications, Food and Transportation and Travel/ Beverage, Other Lodging, Other Communications 7% Healthcare 9% Retail 14% Consumer Products 13% Top 10 clients decreased to 22.8% of revenue versus 23.2% a year ago (largest <4.4%) 10

ADJUSTED EBITDA (1) (US$ in millions, except percentages) % Change 2019 2020 Q3 2020 vs. Q3 2019 Q3 Q4 Q1 Q2 Q3 Integrated Networks - Group A 24.0 31.7 16.3 17.2 21.0 (12.5) % Integrated Networks - Group B 22.0 19.5 17.1 16.4 29.6 34.5 % Media & Data Network 1.4 5.4 1.8 0.9 3.0 NM % All Other 9.2 10.7 9.9 6.9 7.1 (22.8) % Corporate (7.3) (10.1) (5.6) (5.2) (6.7) (8.2) % Adjusted EBITDA (2) $ 49.2 $ 57.0 $ 39.6 $ 36.2 $ 54.1 9.9 % Adjusted EBITDA margin 14.3 % 14.9 % 12.1 % 13.9 % 19.1 % 1 Effective in the first quarter of 2020, the Company reorganized its management structure resulting in the aggregation of certain Partner Firms into integrated groups (“Networks”). In connection with our discussions with the SEC, the Company has changed the prior presentation for the Networks. Beginning in the second quarter of 2020, the Company separated the Networks into two reportable segments: Integrated Networks - Group A and Integrated Networks - Group B. Prior periods presented have been recast to reflect the change in reportable segments. 2Adjusted EBITDA is a non-GAAP financial measure. See appendix for the definition. Note: Actuals may not foot due to rounding. 11

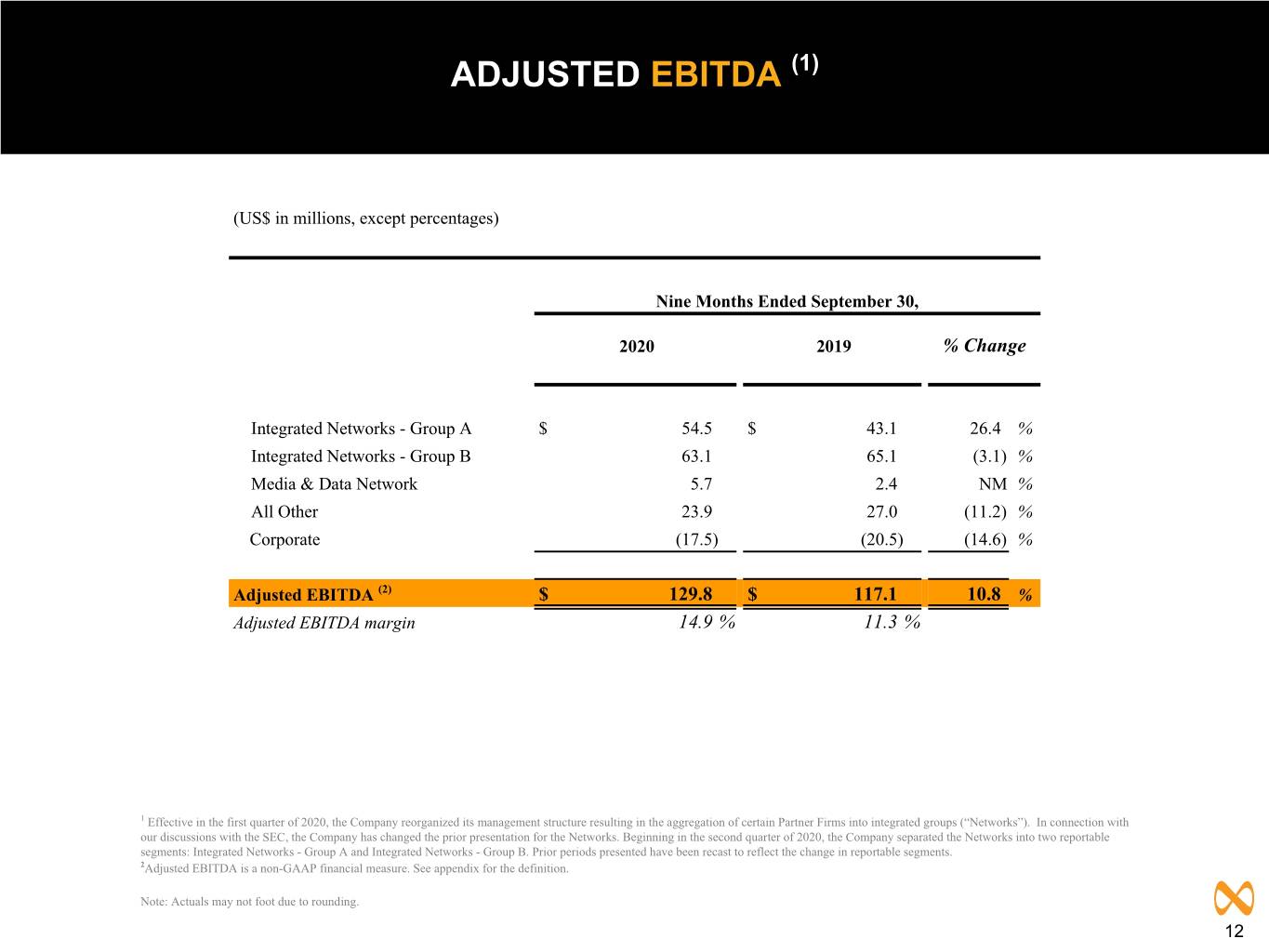

ADJUSTED EBITDA (1) (US$ in millions, except percentages) Nine Months Ended September 30, 2020 2019 % Change Integrated Networks - Group A $ 54.5 $ 43.1 26.4 % Integrated Networks - Group B 63.1 65.1 (3.1) % Media & Data Network 5.7 2.4 NM % All Other 23.9 27.0 (11.2) % Corporate (17.5) (20.5) (14.6) % Adjusted EBITDA (2) $ 129.8 $ 117.1 10.8 % Adjusted EBITDA margin 14.9 % 11.3 % 1 Effective in the first quarter of 2020, the Company reorganized its management structure resulting in the aggregation of certain Partner Firms into integrated groups (“Networks”). In connection with our discussions with the SEC, the Company has changed the prior presentation for the Networks. Beginning in the second quarter of 2020, the Company separated the Networks into two reportable segments: Integrated Networks - Group A and Integrated Networks - Group B. Prior periods presented have been recast to reflect the change in reportable segments. 2Adjusted EBITDA is a non-GAAP financial measure. See appendix for the definition. Note: Actuals may not foot due to rounding. 12

COVENANT EBITDA Covenant EBITDA 2019 2020 (LTM) (1) Q2-2020- Q3-2020 - (US$ in millions) Q3 Q4 Q1 Q2 Q3 LTM LTM Net income (loss) attributable to MDC Partners Inc. common shareholders $ (5.1) $ (10.5) $ (2.4) $ (4.1) $ 0.4 $ (22.1) $ (16.7) Adjustments to reconcile to operating income: Accretion on and net income allocated to convertible preference shares 3.3 3.4 3.4 3.5 3.7 13.6 14.0 Net income attributable to the noncontrolling interests 7.3 5.4 0.8 3.1 10.7 16.6 20.0 Equity in losses (earnings) of non-consolidated affiliates (0.1) — — 0.8 — 0.7 0.8 Income tax expense (benefit) 3.5 4.2 13.5 (7.9) 1.5 13.3 11.3 Interest expense and finance charges, net 16.1 15.7 15.6 15.9 15.3 63.3 62.5 Foreign exchange loss (gain) 4.0 (4.3) 14.8 (5.3) (2.2) 9.0 2.9 Other, net 0.4 (2.2) (16.3) (5.9) (0.5) (23.9) (24.9) Operating income $ 29.4 $ 11.7 $ 29.3 $ 0.1 $ 28.9 $ 70.5 $ 70.0 Adjustments to reconcile to Adjusted EBITDA: Depreciation and amortization $ 9.4 $ 9.5 $ 9.2 $ 8.9 $ 9.3 $ 36.9 $ 36.9 Impairment and other losses 1.9 5.9 0.2 18.8 0.2 26.8 25.0 Stock-based compensation 6.0 18.4 3.1 1.0 6.5 28.5 29.0 Deferred acquisition consideration adjustments 1.9 9.0 (4.6) 2.3 2.8 8.7 9.5 Distributions from non-consolidated affiliates (0.2) 2.2 — 1.1 0.2 3.1 3.5 Other items, net (2) 0.7 0.3 2.4 3.9 6.2 7.4 12.9 Adjusted EBITDA $ 49.2 $ 57.0 $ 39.6 $ 36.2 $ 54.1 $ 182.0 $ 186.8 Adjustments to reconcile to Covenant EBITDA: Proforma dispositions (3) $ (1.0) $ (1.3) $ (0.1) $ — $ — $ (2.4) $ (1.4) Severance due to eliminated positions 2.0 3.2 2.1 5.2 2.3 12.5 12.9 Other adjustments, net (4) 0.2 0.4 0.4 0.2 0.1 1.2 1.0 $ 50.4 $ 59.3 $ 41.9 $ 41.6 $ 56.5 $ 193.3 $ 199.3 (1) Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, permitted dispositions and other adjustments, as defined in the Company's Credit Agreement. Covenant EBITDA is calculated as the aggregate of operating results for the rolling last twelve months (LTM). Each quarter is presented to provide the information utilized to calculate Covenant EBITDA. Historical Covenant EBITDA may be re-casted in the current period for any proforma adjustments related to acquisitions and/or dispositions in the current period. See "Non-GAAP Financial Measures" herein. (2) Other items, net includes items such as severance expense, other restructuring expenses and costs associated with the Company's strategic review process. (3) Represents Kingsdale and Sloane EBITDA for the respective period. (4) Other adjustments, net primarily includes one-time professional fees and costs associated with real estate consolidation. 13 Note: Actuals may not foot due to rounding.

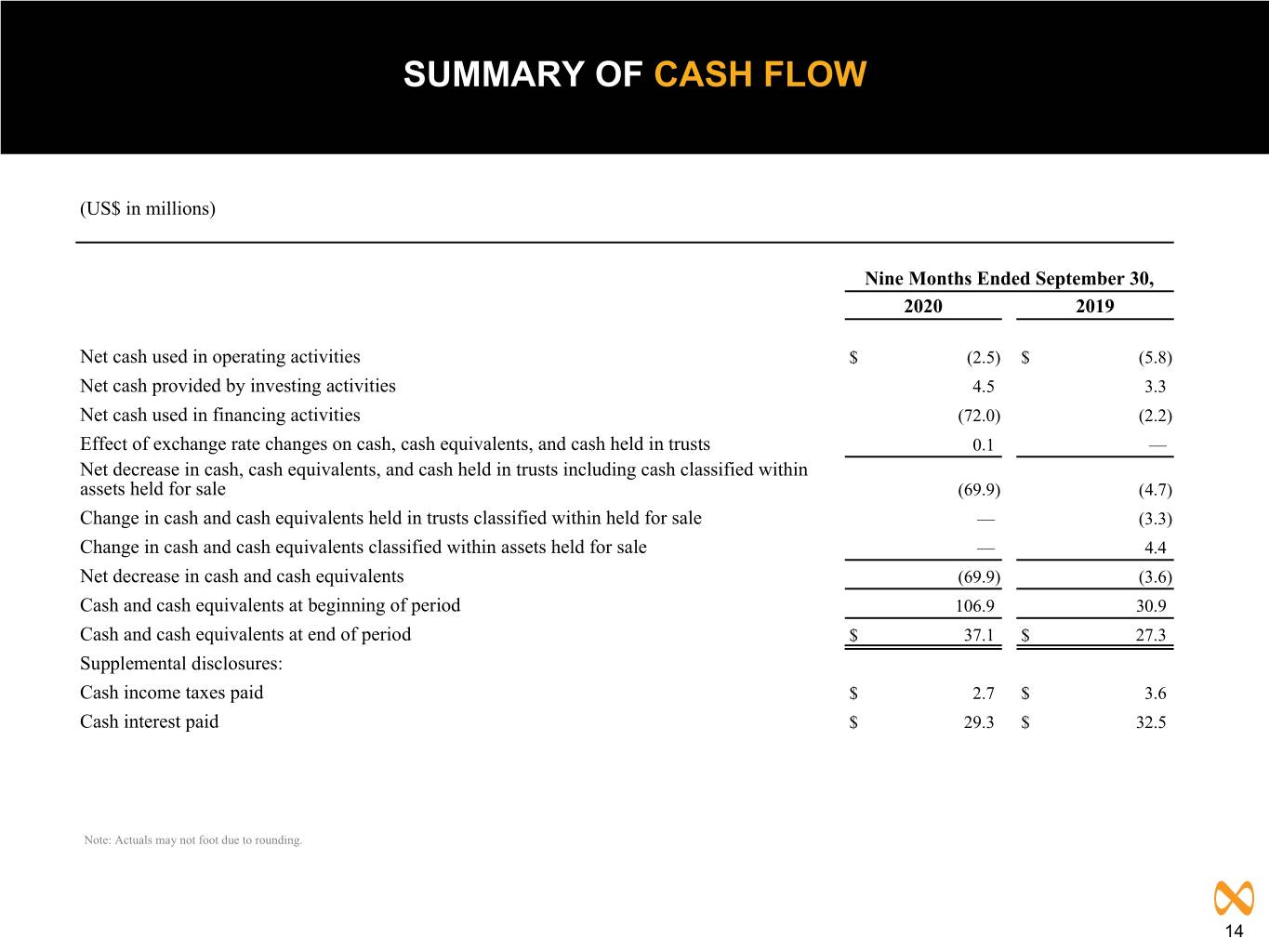

SUMMARY OF CASH FLOW (US$ in millions) Nine Months Ended September 30, 2020 2019 Net cash used in operating activities $ (2.5) $ (5.8) Net cash provided by investing activities 4.5 3.3 Net cash used in financing activities (72.0) (2.2) Effect of exchange rate changes on cash, cash equivalents, and cash held in trusts 0.1 — Net decrease in cash, cash equivalents, and cash held in trusts including cash classified within assets held for sale (69.9) (4.7) Change in cash and cash equivalents held in trusts classified within held for sale — (3.3) Change in cash and cash equivalents classified within assets held for sale — 4.4 Net decrease in cash and cash equivalents (69.9) (3.6) Cash and cash equivalents at beginning of period 106.9 30.9 Cash and cash equivalents at end of period $ 37.1 $ 27.3 Supplemental disclosures: Cash income taxes paid $ 2.7 $ 3.6 Cash interest paid $ 29.3 $ 32.5 Note: Actuals may not foot due to rounding. 14

2020 FINANCIAL OUTLOOK • Given the uncertainties in the global business environment arising from the COVID-19 pandemic, the Company is not providing a 2020 outlook for Revenue and Covenant EBITDA at this time. 15

APPENDIX 16

REVENUE TRENDING SCHEDULE (US$ in thousands, except percentages) 2019 2020 Q1 Q2 Q3 Q4 YTD Q1 Q2 Q3 YTD Revenue United States $ 263,017 $ 284,659 $ 271,671 $ 296,698 $ 1,116,045 $ 264,561 $ 210,342 $ 228,256 $ 703,158 Canada 22,378 24,564 25,895 32,230 105,067 18,256 16,609 20,299 55,164 North America 285,395 309,223 297,566 328,928 1,221,112 282,817 226,951 248,555 758,322 Other 43,396 52,907 45,341 53,047 194,691 44,925 32,727 34,868 112,521 Total $ 328,791 $ 362,130 $ 342,907 $ 381,975 $ 1,415,803 $ 327,742 $ 259,678 $ 283,423 $ 870,843 % of Revenue United States 80.0 % 78.6 % 79.2 % 77.7 % 78.8 % 80.7 % 81.0 % 80.5 % 80.8 % Canada 6.8 % 6.8 % 7.6 % 8.4 % 7.4 % 5.6 % 6.4 % 7.2 % 6.3 % North America 86.8 % 85.4 % 86.8 % 86.1 % 86.2 % 86.3 % 87.4 % 87.7 % 87.1 % Other 13.2 % 14.6 % 13.2 % 13.9 % 13.8 % 13.7 % 12.6 % 12.3 % 12.9 % Total 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % Total Growth % United States 2.5 % (3.6) % (8.4) % (2.7) % (3.2) % 0.6 % (26.1) % (16.0) % (14.2) % Canada (15.2) % (25.8) % (19.4) % (0.5) % (15.3) % (18.4) % (32.4) % (21.6) % (24.3) % North America 0.9 % (5.8) % (9.5) % (2.5) % (4.4) % (0.9) % (26.6) % (16.5) % (15.0) % Other (1.5) % 3.0 % (3.8) % (5.9) % (2.2) % 3.5 % (38.1) % (23.1) % (20.6) % Total 0.6 % (4.6) % (8.8) % (3.0) % (4.1) % (0.3) % (28.3) % (17.3) % (15.8) % Organic Revenue Growth (Decline) % United States (1.7) % (3.8) % (8.5) % (2.6) % (4.2) % 1.3 % (24.7) % (14.5) % (12.9) % Canada (3.8) % (5.6) % (7.0) % 12.6 % (0.9) % (1.7) % (28.9) % (20.9) % (17.7) % North America (1.9) % (3.9) % (8.3) % (1.2) % (3.9) % 1.1 % (25.0) % (15.0) % (13.3) % Other 5.4 % 7.3 % (1.5) % (3.6) % 1.7 % 7.6 % (34.2) % (25.4) % (18.6) % Total (0.9) % (2.4) % (7.5) % (1.5) % (3.1) % 2.0 % (26.4) % (16.4) % (14.1) % Growth % from Foreign Exchange United States 0.0 % 0.0 % 0.0 % (0.0) % (0.0) % 0.0 % (0.0) % 0.0 % 0.0 % Canada (4.7) % (3.4) % (1.1) % 1.0 % (1.9) % (0.1) % (3.4) % (0.7) % (1.4) % North America (0.4) % (0.3) % (0.1) % 0.1 % (0.2) % — % (0.3) % (0.1) % (0.1) % Other (8.8) % (5.9) % (4.3) % (2.4) % (5.2) % (4.1) % (3.9) % 2.3 % (2.0) % Total (1.6) % (1.1) % (0.6) % (0.3) % (0.9) % (0.5) % (0.8) % 0.3 % (0.4) % Growth % from Acquisitions (Dispositions), net United States 4.2 % 0.2 % 0.1 % (0.1) % 1.0 % (0.8) % (1.4) % (1.5) % (1.2) % Canada (6.6) % (16.8) % (11.3) % (14.1) % (12.5) % (16.6) % 0.0 % 0.0 % (5.1) % North America 3.2 % (1.5) % (1.0) % (1.4) % (0.3) % (2.0) % (1.3) % (1.4) % (1.6) % Other 1.9 % 1.6 % 1.9 % 0.0 % 1.3 % 0.0 % 0.0 % 0.0 % 0.0 % Total 3.0 % (1.1) % (0.6) % (1.2) % (0.1) % (1.7) % (1.1) % (1.2) % (1.3) % Note: See appendix for definitions of Non-GAAP Financial Measures Note: Actuals may not foot due to rounding 17

ADJUSTED EBITDA TRENDING SCHEDULE (US$ in thousands) 2019 2020 Q1 Q2 Q3 Q4 YTD Q1 Q2 Q3 YTD PARTNER FIRMS Revenue $ 328,791 $ 362,130 $ 342,907 $ 381,975 $ 1,415,803 $ 327,742 $ 259,678 $ 283,423 $ 870,843 Operating income 20,504 40,073 38,532 26,899 126,008 37,667 11,921 43,651 93,239 Depreciation and amortization 8,621 10,442 9,176 9,222 37,461 8,974 8,663 9,133 26,770 Impairment and other losses — — 1,944 5,028 6,972 161 17,710 159 18,030 Stock-based compensation 4,545 2,442 5,193 16,980 29,160 2,928 763 5,038 8,729 Deferred acquisition consideration adjustments (7,643) 2,073 1,943 9,030 5,403 (4,600) 2,312 2,803 515 Distributions from non-consolidated affiliates — — (250) (250) — — — — Adjusted EBITDA (1) $ 26,027 $ 55,030 $ 56,538 $ 67,159 $ 204,754 $ 45,130 $ 41,369 $ 60,784 $ 147,283 CORPORATE GROUP Revenue $ — $ — $ — $ — $ — $ — $ — $ — $ — Operating loss (4,823) (16,631) (9,111) (15,203) (45,768) (8,338) (11,823) (14,762) (34,923) Depreciation and amortization 217 221 192 238 868 232 236 199 667 Impairment and other losses — — — 847 847 — 1,129 — 1,129 Stock-based compensation (1,573) 1,192 833 1,428 1,880 142 276 1,421 1,839 Distributions from non-consolidated affiliates — 31 48 2,219 2,298 (14) 1,079 208 1,273 Other items, net 1,626 6,594 705 349 9,274 2,416 3,895 6,208 12,519 Adjusted EBITDA (1) $ (4,553) $ (8,593) $ (7,333) $ (10,122) $ (30,601) $ (5,562) $ (5,208) $ (6,726) $ (17,496) TOTAL Revenue $ 328,791 $ 362,130 $ 342,907 $ 381,975 $ 1,415,803 $ 327,742 $ 259,678 $ 283,423 $ 870,843 Operating income 15,681 23,442 29,421 11,696 80,240 29,329 98 28,889 58,316 Depreciation and amortization 8,838 10,663 9,368 9,460 38,329 9,206 8,899 9,332 27,437 Impairment and other losses — — 1,944 5,875 7,819 161 18,839 159 19,159 Stock-based compensation 2,972 3,634 6,026 18,408 31,040 3,070 1,039 6,459 10,568 Deferred acquisition consideration adjustments (7,643) 2,073 1,943 9,030 5,403 (4,600) 2,312 2,803 515 Distributions from non-consolidated affiliates — 31 (202) 2,219 2,048 (14) 1,079 208 1,273 Other items, net 1,626 6,594 705 349 9,274 2,416 3,895 6,208 12,519 Adjusted EBITDA (1) $ 21,474 $ 46,437 $ 49,205 $ 57,037 $ 174,153 $ 39,568 $ 36,161 $ 54,058 $ 129,787 (1 )Adjusted EBITDA is a non-GAAP financial measure. See appendix for the definition. Note: Actuals may not foot due to rounding 18

RECONCILIATIONS (US$ in thousands) 2019 2020 Q1 Q2 Q3 Q4 YTD Q1 Q2 Q3 YTD NON-GAAP ACQUISITIONS (DISPOSITIONS), NET GAAP revenue from current year acquisitions $ — $ 698 $ 1,347 $ 1,396 $ 3,441 $ — $ — $ — $ — GAAP revenue from prior year acquisitions (1) 15,685 1,519 1,109 291 18,604 — — — — Foreign exchange impact — — 470 (246) 224 (248) — — (248) Contribution to organic revenue (2) (4,008) (440) (2,185) (1,694) (8,327) (411) — — (411) Prior year revenue from dispositions (3) (1,825) (5,995) (3,178) (4,505) (15,503) (5,024) (4,106) (4,076) (13,206) Non-GAAP acquisitions (dispositions), net $ 9,852 $ (4,218) $ (2,437) $ (4,758) $ (1,561) $ (5,683) $ (4,106) $ (4,076) $ (13,865) OTHER ITEMS, NET Severance and other restructuring expenses $ — $ 6,703 $ 705 $ — $ 7,408 $ 1,334 $ 2,969 $ 3,270 $ 7,573 Strategic review process costs 1,626 (109) — 349 1,866 1,082 926 2,938 4,946 Total other items, net $ 1,626 $ 6,594 $ 705 $ 349 $ 9,274 $ 2,416 $ 3,895 $ 6,208 $ 12,519 CASH INTEREST, NET & OTHER Cash interest paid $ (1,629) $ (30,014) $ (882) $ (29,698) $ (62,223) $ (145) $ (28,591) $ (575) $ (29,311) Bond interest accrual adjustment (14,625) 14,625 (14,625) 14,625 — (14,625) 13,894 (14,035) (14,766) Adjusted cash interest paid (16,254) (15,389) (15,507) (15,073) (62,223) (14,770) (14,697) (14,610) (44,077) Interest income 149 138 165 162 614 114 190 114 418 Total cash interest, net & other $ (16,105) $ (15,251) $ (15,342) $ (14,911) $ (61,609) $ (14,656) $ (14,507) $ (14,496) $ (43,659) CAPITAL EXPENDITURES, NET Capital expenditures $ (3,606) $ (4,317) $ (5,863) $ (4,810) $ (18,596) $ (1,546) $ (2,144) $ (24,187) $ (27,877) MISCELLANEOUS OTHER DISCLOSURES Net income attributable to the noncontrolling interests $ 429 $ 3,043 $ 7,265 $ 5,419 $ 16,156 $ 791 $ 3,101 $ 10,728 $ 14,620 Cash taxes $ 1,677 $ 1,817 $ 137 $ (1,335) $ 2,296 $ 849 $ 1,717 $ 134 $ 2,700 (1) GAAP revenue from prior year acquisitions for 2020 and 2019 relates to acquisitions which occurred in 2019 and 2018, respectively. (2) Contributions to organic revenue represents the change in revenue, measured on a constant currency basis, relative to the comparable pre-acquisition period for acquired businesses that is included in the Company's organic revenue growth (decline) calculation. (3) Prior year revenue from dispositions reflects the incremental impact on revenue for the comparable period after the Company's disposition of such disposed business, plus revenue from each business disposed of by the Company in the previous year through the twelve month anniversary of the disposition. Note: Actuals may not foot due to rounding. 19

AVAILABLE LIQUIDITY1 (US$ in millions) September 30, 2020 December 31, 2019 Commitment Under Facility $ 211.5 $ 250.0 Drawn — — Undrawn Letters of Credit 18.6 4.8 Undrawn Commitments Under Facility (1) $ 192.9 $ 245.2 Total Cash & Cash Equivalents 37.1 106.9 Liquidity $ 230.0 $ 352.1 1 Subject to available borrowings under the Credit Facility. Note: Actuals may not foot due to rounding 20

CURRENT CREDIT PICTURE $211.5 million Credit Facility Covenants (1) Current Debt Maturity Profile (5) (US$ in millions) September 30, 2020 Covenants Total Senior Leverage I. Ratio 0.02 Maximum per covenant 2.00 II. Total Leverage Ratio 4.38 Maximum per covenant 6.25 III. Fixed Charges Ratio 3.03 Minimum per covenant 1.00 IV. Covenant EBITDA (2) $199.3 Minimum per covenant $120.0 Debt Calculation Total Senior Leverage, net (3) $3.5 Net Debt (4) $873.8 1 These ratios and measures are not based on generally accepted accounting principles and are not presented as alternatives measures of operating performance or liquidity. Some of these ratios and measures include, among other things, pro forma adjustments for acquisitions, one-time charges, and other items, as defined in the Credit Agreement. They are presented here to demonstrate compliance with the covenants in the Credit Agreement, as non-compliance with such covenants could have a material adverse effect on the Company. 2 Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, and other items, as defined in the Credit Agreement. 3 Total Senior Leverage is a measure that includes borrowings under the Credit Agreement, outstanding letters of credit, less cash held in depository accounts, as defined in the Credit Agreement 4 Net Debt is a measure that includes borrowings under the Credit Agreement, the Senior Notes, other outstanding debt and letters of credit, less cash held in depository accounts, as defined in the Credit Agreement. Net Debt does not include Deferred Acquisition Consideration with the exception of certain fixed components ($0.3 million as of September 30, 2020), and it does not include minority interest. 5 Based on borrowings as of June 30, 2020. Excludes letters of credit, and Deferred Acquisition Consideration. Note: Actuals may not foot due to rounding 21

DEFINITION OF NON-GAAP FINANCIAL MEASURES In addition to its reported results, MDC Partners has included in its earnings release and supplemental management presentation certain financial results that the Securities and Exchange Commission defines as "non-GAAP financial measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following: Organic Revenue: Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms which the Company has held throughout each of the comparable periods presented, and (b) “non- GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisitions as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such dispositions as if they had been disposed of during the equivalent period in the prior year. Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. Adjusted EBITDA: Adjusted EBITDA is a non-GAAP financial measure that represents Net income (loss) attributable to MDC Partners Inc. common shareholders plus or minus adjustments to operating income (loss) plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, distributions from non-consolidated affiliates, and other items, net which includes items such as severance expense and other restructuring expenses, including costs for leases that will either be terminated or sublet in connection with the centralization of our New York real estate portfolio. Covenant EBITDA: Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, permitted dispositions and other items, as defined in the Credit Agreement. We believe that the presentation of Covenant EBITDA is useful to investors as it eliminates the effect of certain non-cash and other items not necessarily indicative of a company’s underlying operating performance. In addition, the presentation of Covenant EBITDA provides additional information to investors about the calculation of, and compliance with, certain financial covenants in the Credit Agreement. Included in the Company’s earnings release and supplemental management presentation are tables reconciling MDC Partners’ reported results to arrive at certain of these non-GAAP financial measures. Note: A reconciliation of non-GAAP to US GAAP reported results has been provided by the Company in the tables included herein. 22

MDC Partners One World Trade Center, Floor 65 New York, NY 10007 646-429-1800 www.mdc-partners.com