Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Emmaus Life Sciences, Inc. | ea129108-8k_emmanuslife.htm |

Exhibit 99.1

Hope Delivered : Changing Lives Today The first treatment approved by the FDA for Sickle Cell Disease in nearly 20 years Informational Meeting of Stockholders September 17, 2020

Safe Harbor Statement This presentation by Emmaus Life Sciences, Inc . (“Emmaus” or the “Company”) contains forward - looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 , as amended, including statements regarding operating trends and the research, development and commercialization of pharmaceutical products . Such forward - looking statements are based on current expectations and are subject to numerous assumptions, risks and uncertainties which change over time, including factors that could delay, divert or change any of them, and could cause actual outcomes and results to differ materially from current expectations . Some of these important risks and uncertainties, including uncertainties related to the Company’s working capital and ability to carry on its existing operations and obtain needed financing and other factors are previously described in the Company’s reports filed with the Securities and Exchange Commission . Emmaus is providing this information as of the date of this publication or the dates stated within this publication and does not undertake any obligation to update any forward - looking statements as a result of new information, future events or otherwise . 2

Stockholders Informational Meeting AGENDA: • Sales Updates • Operational Updates • Product Expansion & Pipeline • Ube Plant • COVID - 19 Impact on Business • Financial Position • Audit Status (10 - K and 10 - Q filings) and Common Stock Trading Update • Q & A Session 3 Emmaus Life Sciences Commercial - stage biopharmaceutical company focused on growing sales of Endari® and developing innovative treatments and therapies, including those in the rare and orphan disease categories • Endari® - prescription grade L - glutamine powder (PGLG) for sickle cell disease (SCD) x FDA approval in 2017 x Sales began in 2018 x Strong growth in 2019 • Platform provides for expanded applications of PGLG (diverticulosis and diabetes) and a series of potential additional product candidates to facilitate long term growth

Emmaus and its FDA - Approved Product, Endari®: Addressing an Unmet Medical Need; Positioned for Sustainable Growth 4 Sales Overview : • Effective January 1 , 2020 , switched from using a contract sales organization (CSO) to our own direct sales force • Emmaus currently has 20 employees in its sales and marketing departments • Nationwide network of pharmacies in 44 states, Puerto Rico and Washington D . C . • Expanding network of GPOs and PBMs • Supporting sickle cell advocacy locally and nationally • WAC price per patient averages $ 32 , 000 per year – net approximately $ 24 , 000 • Payers cover majority of patients : Medicaid, Medicare, Commercial • Initiated Patient Adherence Programs Endari® vs Competition: • Endari® approved in July 2017 to treat SCD in adult and pediatric patients 5 years and older is well positioned with two successful years on the market x Broad Indication x No Black Box Warning x No Warnings and Precautions on Label x Lower Incidence of Acute Chest Syndrome • Oxbryta (voxelotor) approved in November 2019 for the treatment of SCD in adults and pediatric patients 12 years and older • Adakveo (crizanlizumab) approved in November 2019 for adults and pediatric patients 16 years and older with SCD • Endari WAC price increased from $ 1 , 110 to $ 1 , 154 per box as of 1 / 1 / 2020 and is still priced considerably lower than Oxbryta and Adakveo

Sales Growth Driven by Strong Clinical Data 5 As published in The New England Journal of Medicine , July 2018 (48 - week Phase 3 clinical trial of Endari® compared to placebo) x 25% reduction in frequency of SCD crises ; p=0.005 (median 3 vs. median 4) x 33% reduction in frequency of hospitalization ; p=0.005 (median 2 vs. median 3) x 41% reduction in hospital days ; p=0.02 (median 6.5 days vs. median 11 days) x 56% delay in the onset of first sickle cell crises; p=0.02 (median 84 days vs. 54 days) x 63% fewer cases of acute chest syndrome ; p=0.003 (13 of 152 patients [8.6%] had at least 1 case of ACS compared with 18 of 78 in the placebo group [23.1%]) x Safety profile similar to placebo with no serious adverse events . The most common adverse reactions (incidence > 10 % ) in clinical studies were constipation, nausea, headache, abdominal pain, cough, pain in extremity, back pain and chest pain . $15.1 $23.0 0 5 10 15 20 25 2018 Actual Q1-Q3 2019 Annualized $ in Millions 2018 Actual and Q1 - Q3 2019 Annualized Net Revenue Non - Endari sales of less than $500k in 2018 and 2019 Annualized Statistics for Endari® x 44% reduction in frequency of SCD crises; p=0.022 (median 2.4 vs. median 4.3) x 36% reduction in hospital days; p=0.042 (median 8.5 vs. median 13.2)

Emmaus Unit Sales - Boxes Shipped in U.S. 6 5,347 5,626 6,295 6,804 7,456 4,864 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2019-Q1 2019-Q2 2019-Q3 2019-Q4 2020-Q1 2020-Q2 Boxes Sold by Emmaus Directly to Distributors and Specialty Pharmacies Average quarterly growth of 8.4% in 2019 (Q1 - Q4) Q1 - 2020 up 39% over Q1 - 2019 COVID - 19 pandemic begins March 2020 impacting Q2 - 2020 sales to Distributors and Specialty Pharmacies Q2 - 2020 down 14% compared to Q2 - 2019 As of 9/14/2020 Emmaus has sold 5,785 boxes in Q3 - 2020 with two weeks left in Q3 - 2020

Distributor Unit Sales (Sell - Through) – U.S. 7 5,361 5,667 6,083 5,823 5,673 6,085 4,800 5,000 5,200 5,400 5,600 5,800 6,000 6,200 2019-Q1 2019-Q2 2019-Q3 2019-Q4 2020-Q1 2020-Q2 Boxes Sold by Distributors and Specialty Pharmacies to Retail Pharmacies and Specialty Pharmacy Patients Despite COVID - 19 pandemic (begins March 2020), demand at the retail pharmacy and patient level remained strong in Q2 - 2020 As of 9/14 /2020 sell - through was 4,413 boxes in Q3 - 2020 with two weeks left in Q3 - 2020. Q3 - 2019 included some large retail pharmacy purchases from distributors

Emmaus Unit Sales - Outside U.S. 8 268 193 131 125 234 102 0 50 100 150 200 250 300 2019-Q1 2019-Q2 2019-Q3 2019-Q4 2020-Q1 2020-Q2 Early Access Boxes Sold Outside U.S. Early Access Program (EAP) operational in France Scientific Advice Working Party (SAWP) and Committee for Medicinal Products for Human Use (CHMP) advice received regarding path to European Medicines Agency (EMA) approval Establishing direct business in the Middle East and North Africa (MENA) region - Dubai office opened in July 2020 Over 225,000 SCD patients (100,000 potentially treatable) in the MENA region Submitted Marketing Authorization for Endari® to the Saudi Food and Drug Authority (SFDA) in August 2020 (previously granted priority review designation) Israeli Ministry of Health approval of Endari® in June 2020

Operational Updates 9 Operational Updates Transitioned from a contract sales organization (CSO) to internal sales department effective January 1 , 2020 Emmaus currently has 50 full - time employees as follows : Selling & Marketing : 20 General & Administrative : 20 Research & Development : 10 COVID - 19 impact : (i) temporarily slowed progress of our diverticulosis clinical trial at one of the sites but patient enrollment has now resumed (ii) business operations have run effectively and efficiently without any interruption

Operating Expenses - Profile for 2018 and 2019 10 11% 9% 31% 30% 84% 56% 29% 16% 0% 20% 40% 60% 80% 100% 120% 140% 160% 180% 2018 2019 Operating Expenses Profile for 2018 and 2019 (as a % of Net Revenue) R&D Selling G&A Non-Cash Achieved operating profit in Q 4 - 2019 and Q 1 - 2020 as net revenue exceed operating expenses Working towards continuous profit at the operating income line 2019 includes one - time, non - recurring merger related costs in Q 3 Non - cash relates to amortization of stock options previously granted Note : Net Revenue is determined and reported by adjusting gross sales for shipments in transit, fees, discounts, rebates, other variable consideration, and adjustments to prior period estimates of variable consideration in accordance with ASC 606

11 Diverticulosis – (i) preliminary pilot trial results are very promising, (ii) pilot study ongoing and preparing for Phase 3 trial, (iii) pursuing licensing deal through Partner International, and (iv) large potential patient population Other : Diabetes, Cell Sheets (CAOMECS), Sickle Cell Trait, COVID - 19 , Ointment for treating Skin Ulcerations in SCD (exclusive patent license from NIH) Product Expansion & Pipeline Commercial launch of Endari® in MENA region 2020/21 Anticipated Xyndari (named filed with the EMA) for: x Europe 2021/22 x LATAM 2021/22

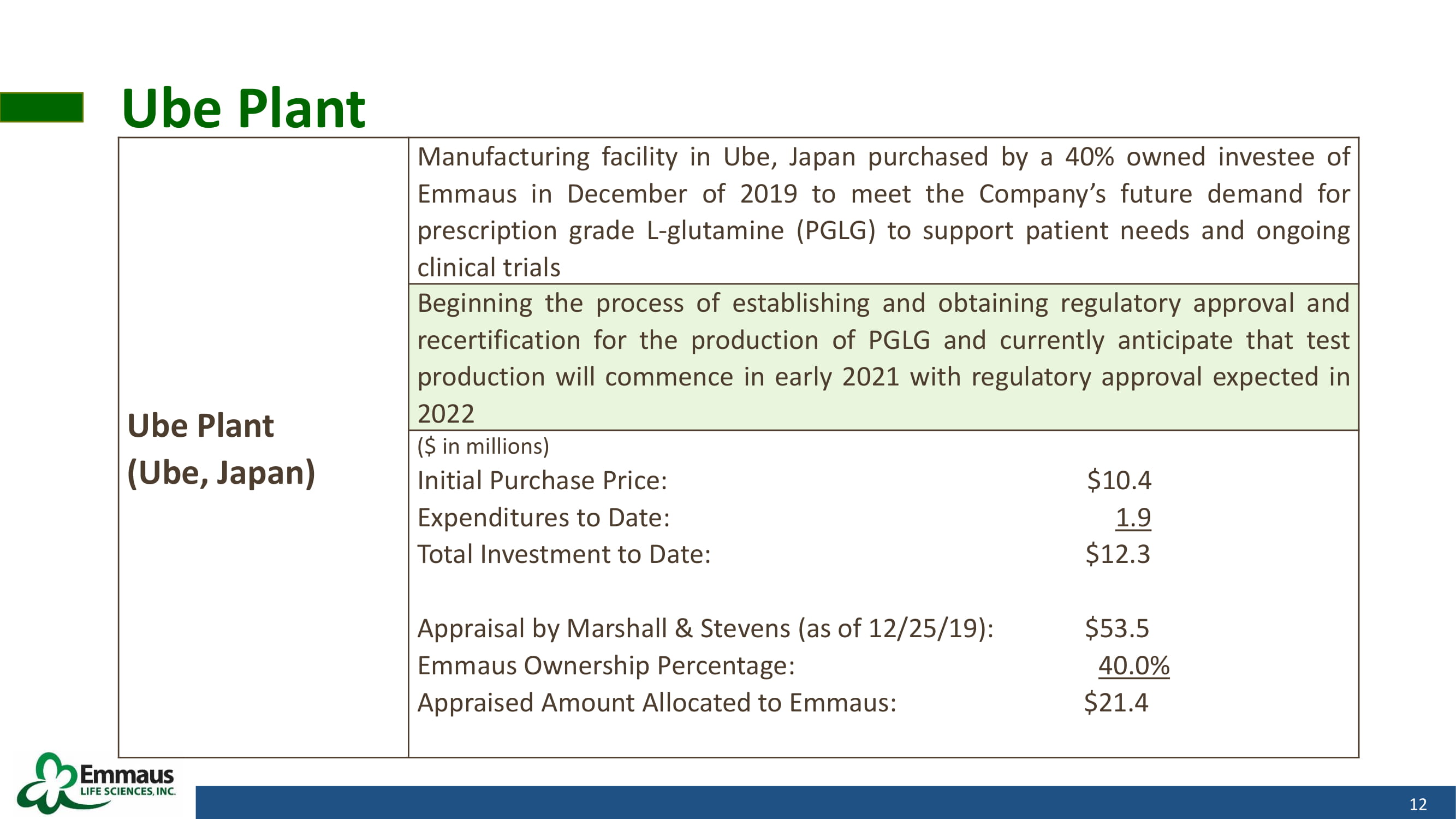

Ube Plant 12 Ube Plant (Ube, Japan) Manufacturing facility in Ube, Japan purchased by a 40 % owned investee of Emmaus in December of 2019 to meet the Company’s future demand for prescription grade L - glutamine (PGLG) to support patient needs and ongoing clinical trials Beginning the process of establishing and obtaining regulatory approval and recertification for the production of PGLG and currently anticipate that test production will commence in early 2021 with regulatory approval expected in 2022 ( $ in millions) Initial Purchase Price : $ 10 . 4 Expenditures to Date : 1 . 9 Total Investment to Date : $ 12 . 3 Appraisal by Marshall & Stevens (as of 12 / 25 / 19 ) : $ 53 . 5 Emmaus Ownership Percentage : 40 . 0 % Appraised Amount Allocated to Emmaus : $ 21 . 4

COVID - 19 Impact on Business 13 COVID - 19 Impact on Business Sales – some challenges faced by salesforce in calling on their customers, distributors taking a cautious view in terms of inventory levels (i . e . lowering days sales ratios), other factors Distributor Unit Sales to retail pharmacy and Specialty Pharmacy Unit Sales to patients continued to trend upward during Q 2 - 2020 despite the COVID - 19 pandemic that began March 2020 Operations – have been able to run the business effectively without any interruption Supply Chain - no interruption, PGLG/Endari® levels are sufficient to support sales as well as clinical trials Clinical trials – patient enrollment at one of the three Emmaus trial sites was temporarily suspended but patient enrollment has resumed Researching the benefit of PGLG/Endari® on countering adverse effects of COVID - 19 and/or assisting patients in their recovery

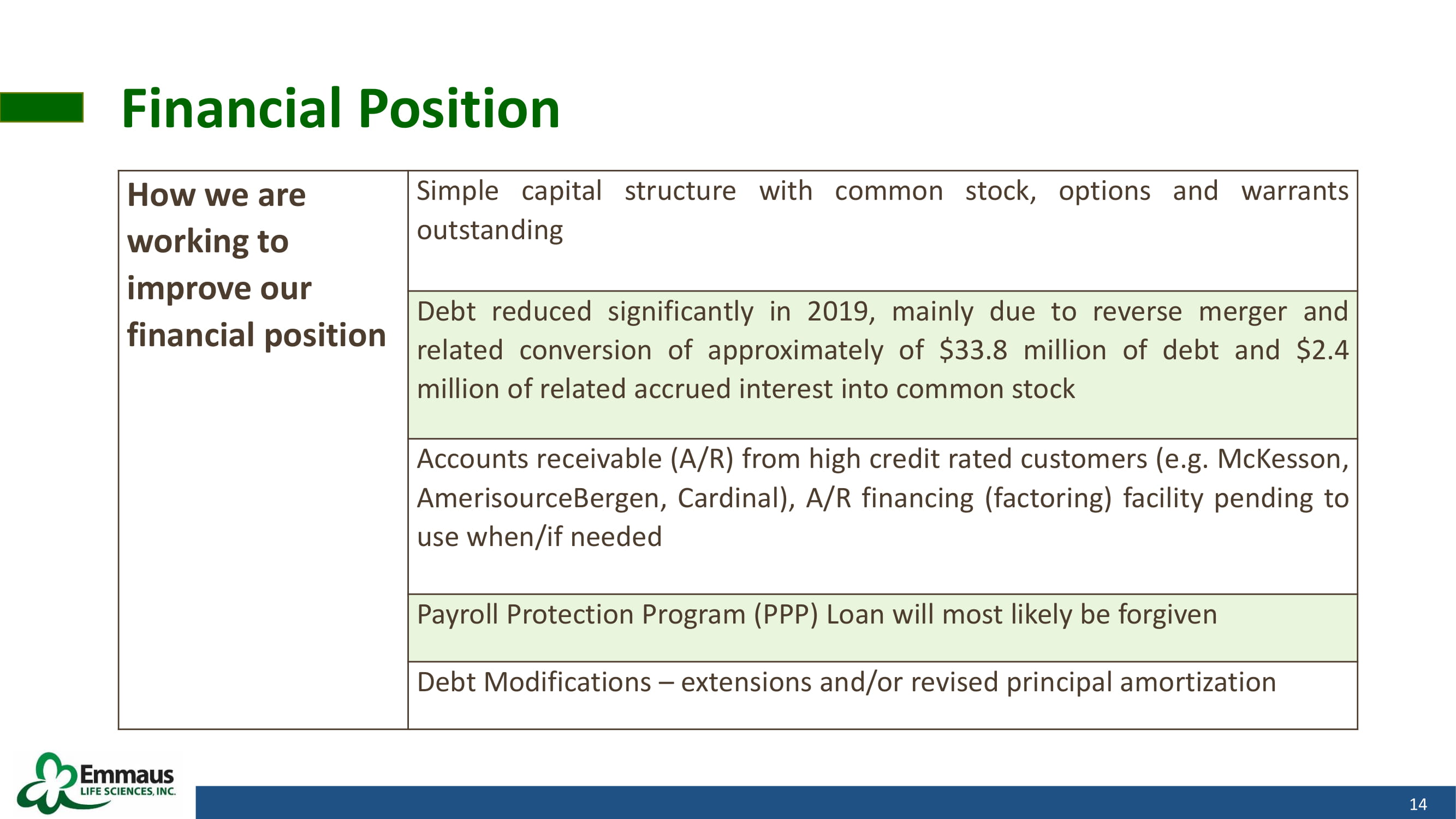

Financial Position 14 How we are working to improve our financial position Simple capital structure with common stock, options and warrants outstanding Debt reduced significantly in 2019 , mainly due to reverse merger and related conversion of approximately of $ 33 . 8 million of debt and $ 2 . 4 million of related accrued interest into common stock Accounts receivable (A/R) from high credit rated customers (e . g . McKesson, AmerisourceBergen, Cardinal), A/R financing (factoring) facility pending to use when/if needed Payroll Protection Program (PPP) Loan will most likely be forgiven Debt Modifications – extensions and/or revised principal amortization

Audit Status & Common Stock Trading Update 15 Audit Status Delay in 2019 audit primarily attributable to predecessor auditor and current auditor not being able to reach agreement on path forward to complete the 2019 audit and adjustments to the 2018 financials Based on the above, the Audit Committee has agreed with management’s recommendation to engage a new auditor to audit both our 2019 and 2018 financials and review our 2020 10 - Qs Goal for filing 2019 10 - K and 2020 10 - Qs (Q 1 , Q 2 and Q 3 ) is mid - to - late November 2020 Common Stock Trading Update Recently relegated to the OTC Pink tier due to delay in filing of 10 - K and 10 - Qs We will be back on the OTCQB tier once we are current with our SEC reports for 2019 and 2020 Plan is to up - list to NASDAQ or NYSE American as soon as possible after reinstatement to OTCQB Ticker (OTCPK) : EMMA Shares Outstanding : 48 , 987 , 189 30 - Day Average Volume : 20 , 571 shares Recent Price ( 9 / 14 / 2020 ) : $ 1 . 17 52 - Week High : $ 3 . 48 52 - Week Low : $ 0 . 85 Market Capitalization : $ 57 , 315 , 011 Enterprise Valuation : $ 74 , 842 , 501

Thank you and we now welcome your questions

Appendix 17

Emmaus Unit Sales (boxes shipped) - Q1 and Q2 2020 18 Q1 and Q2 2020 Summary Management Commentary Quarterly Emmaus Unit Sales are impacted by distributor inventory levels as well as the timing of bulk orders (i . e . , large - volume purchases) placed periodically by Emmaus’ distributors, which could reduce Emmaus Unit Sales in subsequent quarters in which no similar bulk orders occur A historically high level of bulk orders during Q 1 - 2020 adversely impacted Emmaus Unit Sales in Q 2 - 2020 Distributor inventories, at new highs in Q 1 - 2020 , as of July 31 , 2020 are now 32 % lower compared to March 31 , 2020 The factors above could continue and possibly impact Q 3 and Q 4 - 2020 as the COVID - 19 pandemic continues (potentially impacting doctor and pharmacy availability) and distributors/wholesalers may decide to carry lower than normal inventory levels (days sales ratios) Boxes sold by Emmaus to its Distributor and Specialty Pharmacy customers (Emmaus Unit Sales) declined from 7 , 456 in Q 1 - 2020 to 4 , 864 in Q 2 - 2020 However, Distributor Unit Sales growth remained strong in Q 2 - 2020 and increased 7 % over Q 1 - 2020 in the U . S . market ( 6 , 085 boxes vs . 5 , 673 boxes)