Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRICO BANCSHARES / | tcbk-20201026.htm |

Investor Presentation Third Quarter 2020 October 2020 Richard P. Smith – President & Chief Executive Officer John S. Fleshood – EVP & Chief Operating Officer Peter G. Wiese – EVP & Chief Financial Officer

SAFE HARBOR STATEMENT The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There can be no assurance that future developments affecting us will be the same as those anticipated by management. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the impact of changes in financial services policies, laws and regulations; technological changes; weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on economic and business environments in which the Company operates; the continuing adverse impact on the U.S. economy, including the markets in which we operate, due to the COVID-19 global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products; the costs or effects of mergers, acquisitions or dispositions we may make; the future operating or financial performance of the Company, including our outlook for future growth, changes in the level of our nonperforming assets and charge- offs; the appropriateness of the allowance for credit losses including the timing and effects of the implementation of the current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting standards and practices; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; our ability to attract deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; our noninterest expense and the efficiency ratio; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; the challenges of integrating and retaining key employees; the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber- attacks and the cost to defend against such attacks; the effect of a fall in stock market prices on our brokerage and wealth management businesses; and our ability to manage the risks involved in the foregoing. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2019, which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. 2 October 2020

AGENDA • Most Recent Quarter Recap • Company Overview • Lending Overview • Deposit Overview • Financials 3 October 2020

MOST RECENT QUARTER HIGHLIGHTS Pre-tax pre-provision return on average assets and average equity was 1.72% and 14.11%, Consistent Profitability respectively and 1.78% and 13.84%, respectively for the three- and nine-month respective periods ended September 30, 2020. Focus on expense management strategies were made to benefit forward-looking results. Net interest margin was 3.72% for Q3 2020 versus 4.10% for Q2 2020 and 4.44% in Q3 2019. Net Interest Margin Non-interest-bearing deposits were 39.7% of total deposits. Non-interest-bearing deposit growth contributed to more than $400 million of excess balance sheet liquidity impacted net interest margin by 23 basis points in the quarter. Nonperforming assets to total assets of 0.34% 0.31%, and 0.31% at Q3 2020 Q2 2020, and Q3 2019, respectively is considered low and consistently outperforms peer rates. Credit Quality The ratio of loan loss reserves to total loans of 1.81% at Q3 2020 continued to build from 1.66% and 1.32% at Q2 and Q1 2020, respectively. Net recoveries for the three and nine months ended September 30, 2020 were $187,000 and $308,000, respectively. Experienced and Proven Well managed through past credit cycles. Team Prudent and proactive risk management focus is complementary to strong asset quality. Track record of well executed and accretive acquisitions. Diverse Deposit Base Cost of total deposits was 0.09% in Q3 2020 versus 0.12% in Q2 2020 and 0.23% in Q3 2019. We remain well capitalized across all regulatory capital ratios. Capital and Liquidity Recent stress tests performed by management do not support the need to access capital markets. Strength Quarterly dividends have been sustained while the share repurchase program has been paused. 4 October 2020

COMPANY OVERVIEW 5 October 2020

COMPANY OVERVIEW Nasdaq: TCBK Headquarters: Chico, California Stock Price*: $24.49 Market Capitalization: $729 Million Asset Size: $7.4 Billion Deposits: $6.3 Billion Loans: $4.8 Billion Bank Branches: 75 ATMs: 97 Market Area: TriCo currently serves 29 counties throughout Northern and Central California. These counties represent over 30% of California’s population. * As of close of business September 30, 2020 6 October 2020

EXECUTIVE TEAM Rick Smith John Fleshood Peter Wiese President & CEO EVP Chief Operating Officer EVP Chief Financial Officer TriCo since 1993 TriCo since 2016 TriCo since 2018 Greg Gehlmann Craig Carney Dan Bailey Judi Giem SVP General Counsel EVP Chief Credit Officer EVP Chief Banking Officer SVP Chief HR Officer TriCo since 2017 TriCo since 1996 TriCo since 2007 TriCo since 2020 7 October 2020

POSITIVE EARNINGS TRACK RECORD * Impact of the Tax Cut and Jobs Act results in adjusted quarterly diluted EPS of $0.45. 8 October 2020

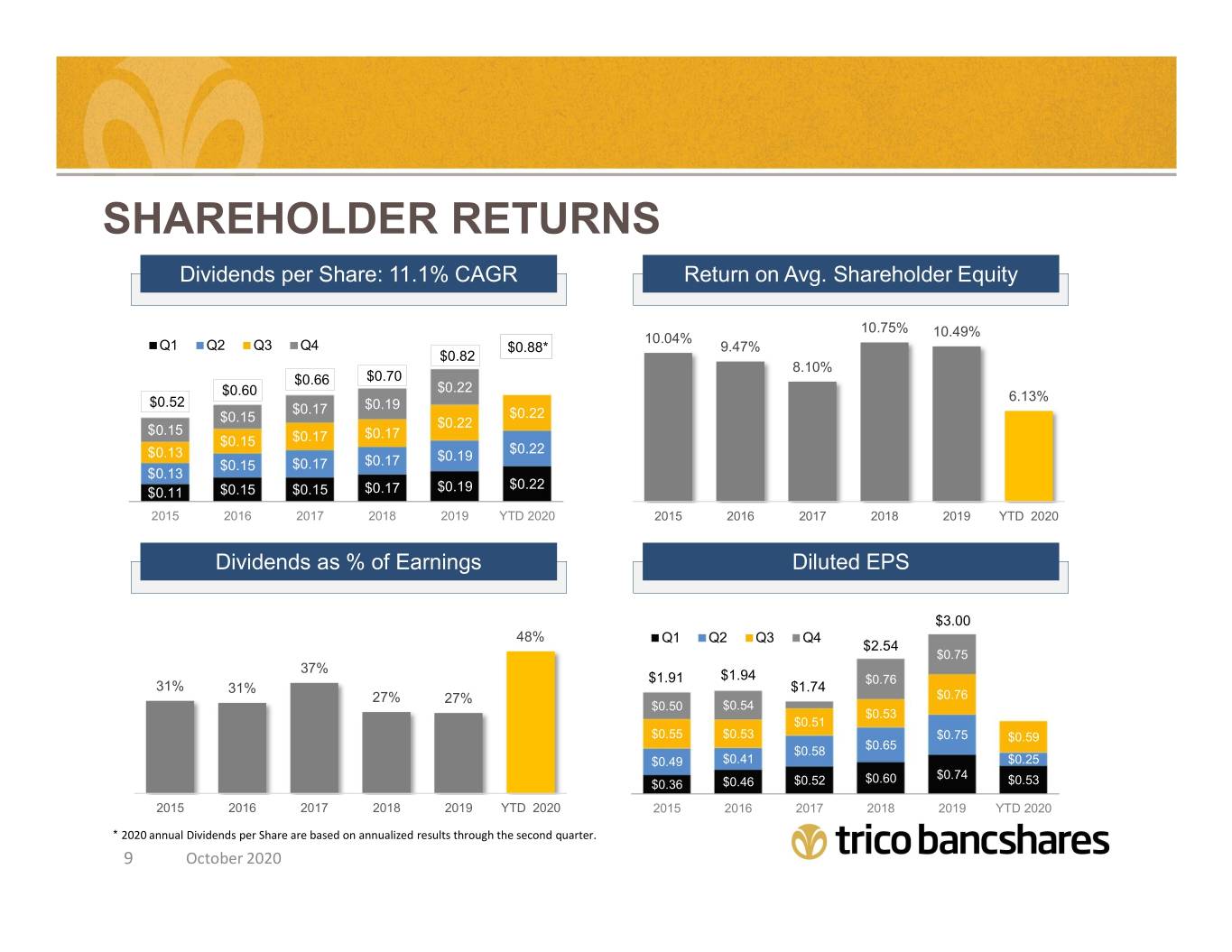

SHAREHOLDER RETURNS Dividends per Share: 11.1% CAGR Return on Avg. Shareholder Equity 10.75% 10.04% 10.49% Q1 Q2 Q3 Q4 $0.88* 9.47% $0.82 8.10% $0.66 $0.70 $0.22 $0.60 6.13% $0.52 $0.19 $0.17 $0.22 $0.15 $0.22 $0.15 $0.17 $0.15 $0.17 $0.22 $0.13 $0.19 $0.15 $0.17 $0.17 $0.13 $0.22 $0.11 $0.15 $0.15 $0.17 $0.19 2015 2016 2017 2018 2019 YTD 2020 2015 2016 2017 2018 2019 YTD 2020 Dividends as % of Earnings Diluted EPS $3.00 48% Q1 Q2 Q3 Q4 $2.54 $0.75 37% $1.91 $1.94 $0.76 31% 31% $1.74 27% 27% $0.76 $0.50 $0.54 $0.53 $0.51 $0.55 $0.53 $0.75 $0.59 $0.58 $0.65 $0.49 $0.41 $0.25 $0.74 $0.36 $0.46 $0.52 $0.60 $0.53 2015 2016 2017 2018 2019 YTD 2020 2015 2016 2017 2018 2019 YTD 2020 * 2020 annual Dividends per Share are based on annualized results through the second quarter. 9 October 2020

CONSISTENT ORGANIC GROWTH & DISCIPLINED ACQUIRER Dollars in millions. Total Assets for periods ending 2005 – Q3 2020. 10 October 2020

“MONDAY MORNING EXECUTIVE TOPICS” • Fiscal Policy Changes and the Effectiveness of Economic Stimulus Measures…if any • Opportunities - Identification of New Markets, Along with Talent and Customer Acquisition Strategy Execution • Digital Banking - Service and the Customer Experience with Fewer Branches • Monitoring Credit Risks as Well as the Needs of Our Borrowers • Process Redesign and Leveraging Technologies for Greater Efficiency and Cost Reductions • Duration of a Low Rate Environment – Maximizing Margin and Growing Earning Assets • Impacts of a Mobile Workforce on Culture • Building and Growing the Bank of the Future 11 October 2020

LOANS & CREDIT QUALITY 12 October 2020

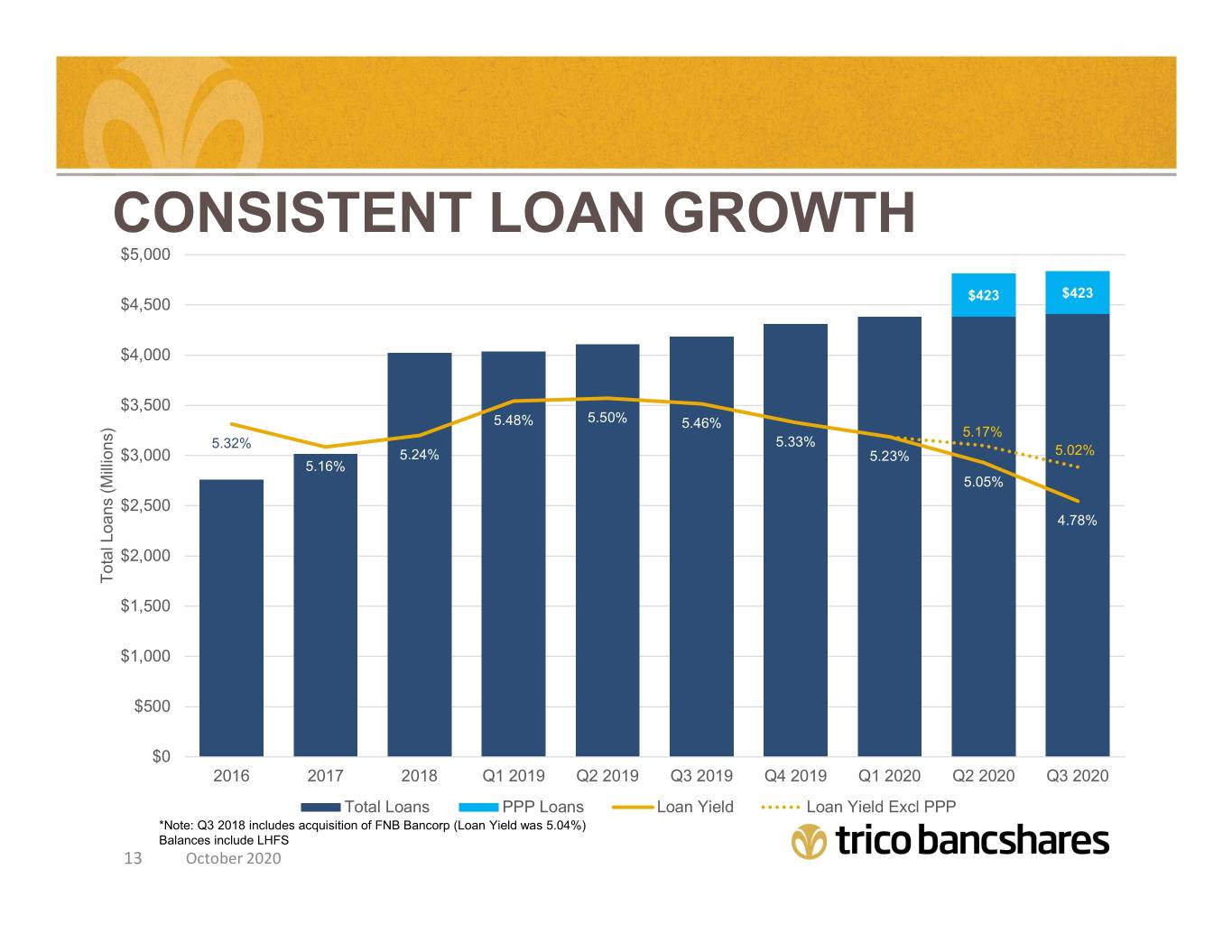

CONSISTENT LOAN GROWTH $5,000 $423 $423 $4,500 6.00% $4,000 $3,500 5.48% 5.50% 5.46% 5.17% 5.32% 5.33% $3,000 5.24% 5.23% 5.02% 5.16% 5.00% 5.05% $2,500 4.78% $2,000 Total Loans (Millions) Loans Total $1,500 4.00% $1,000 $500 $0 3.00% 2016 2017 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Total Loans PPP Loans Loan Yield Loan Yield Excl PPP *Note: Q3 2018 includes acquisition of FNB Bancorp (Loan Yield was 5.04%) Balances include LHFS 13 October 2020

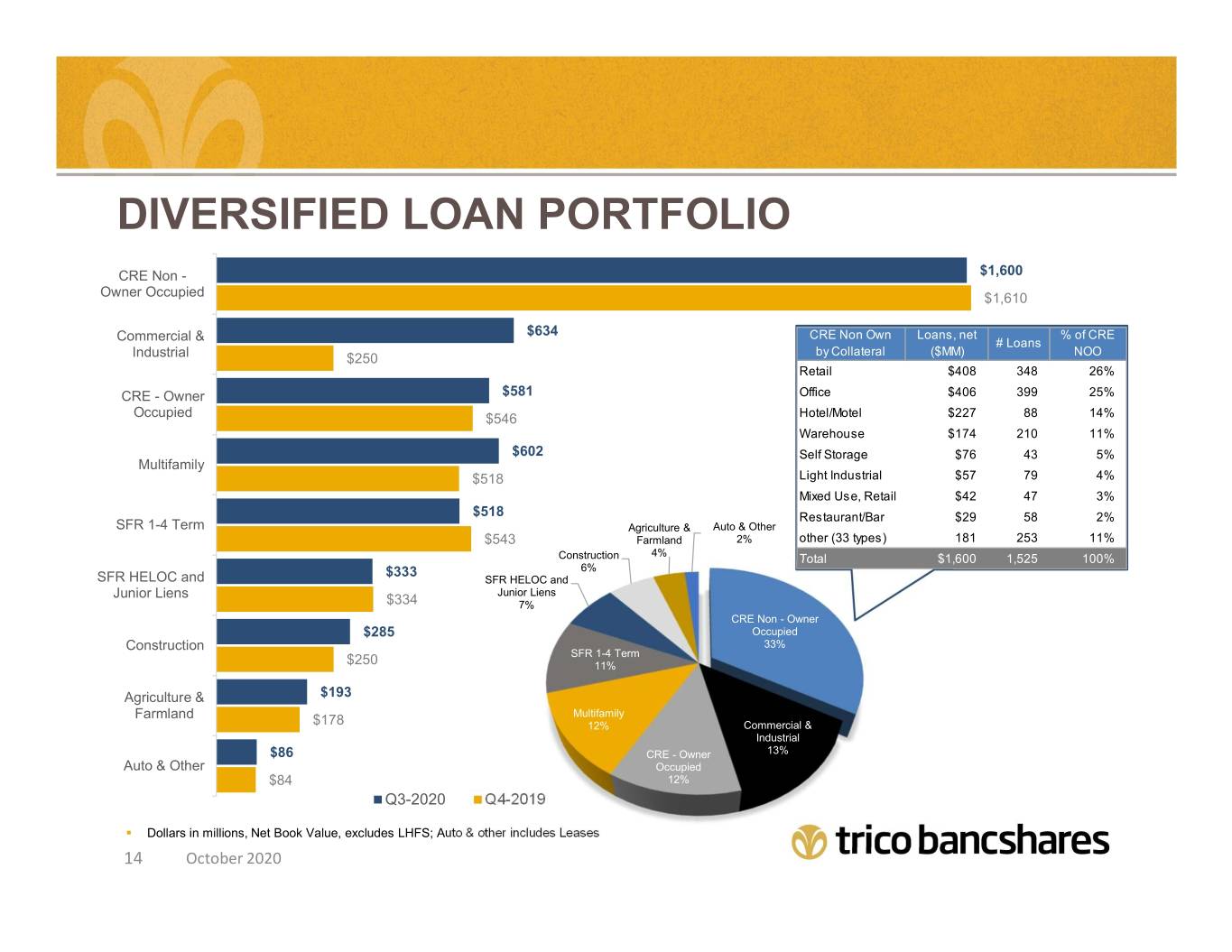

DIVERSIFIED LOAN PORTFOLIO CRE Non - $1,600 Owner Occupied $1,610 $634 CRE Non Own Loans, net % of CRE Commercial & # Loans by Collateral ($MM) NOO Industrial $250 Retail $408 348 26% CRE - Owner $581 Office $406 399 25% Occupied $546 Hotel/Motel $227 88 14% Warehouse $174 210 11% $602 Self Storage $76 43 5% Multifamily $518 Light Industrial $57 79 4% Mixed Use, Retail $42 47 3% $518 Restaurant/Bar $29 58 2% SFR 1-4 Term Agriculture & Auto & Other $543 Farmland 2% other (33 types) 181 253 11% Construction 4% Total $1,600 1,525 100% $333 6% SFR HELOC and SFR HELOC and Junior Liens Junior Liens $334 7% CRE Non - Owner $285 Occupied Construction 33% SFR 1-4 Term $250 11% Agriculture & $193 Farmland Multifamily $178 12% Commercial & Industrial $86 CRE - Owner 13% Auto & Other Occupied $84 12% Q3-2020 Q4-2019 . Dollars in millions, Net Book Value, excludes LHFS; Auto & other includes Leases 14 October 2020

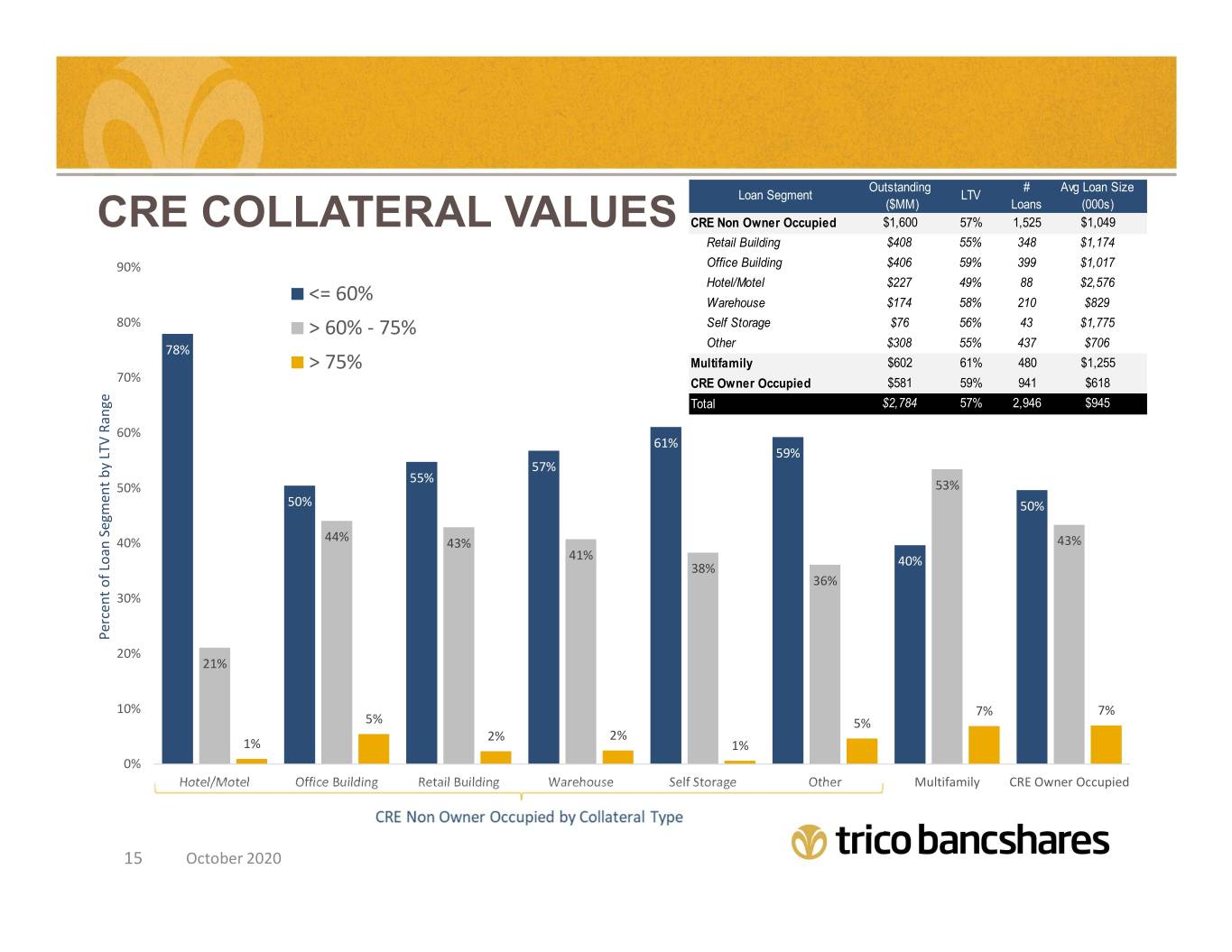

Outstanding # Avg Loan Size Loan Segment LTV ($MM) Loans (000s) CRE COLLATERAL VALUES CRE Non Owner Occupied $1,600 57% 1,525 $1,049 Retail Building $408 55% 348 $1,174 90% Office Building $406 59% 399 $1,017 Hotel/Motel $227 49% 88 $2,576 <= 60% Warehouse $174 58% 210 $829 80% > 60% - 75% Self Storage $76 56% 43 $1,775 Other $308 55% 437 $706 78% > 75% Multifamily $602 61% 480 $1,255 70% CRE Owner Occupied $581 59% 941 $618 Total $2,784 57% 2,946 $945 60% 61% 59% 57% 55% 50% 53% 50% 50% 40% 44% 43% 43% 41% 40% 38% 36% 30% Percent of Loan Segment LTV byRange 20% 21% 10% 7% 7% 5% 5% 2% 2% 1% 1% 0% Hotel/Motel Office Building Retail Building Warehouse Self Storage Other Multifamily CRE Owner Occupied 15 October 2020

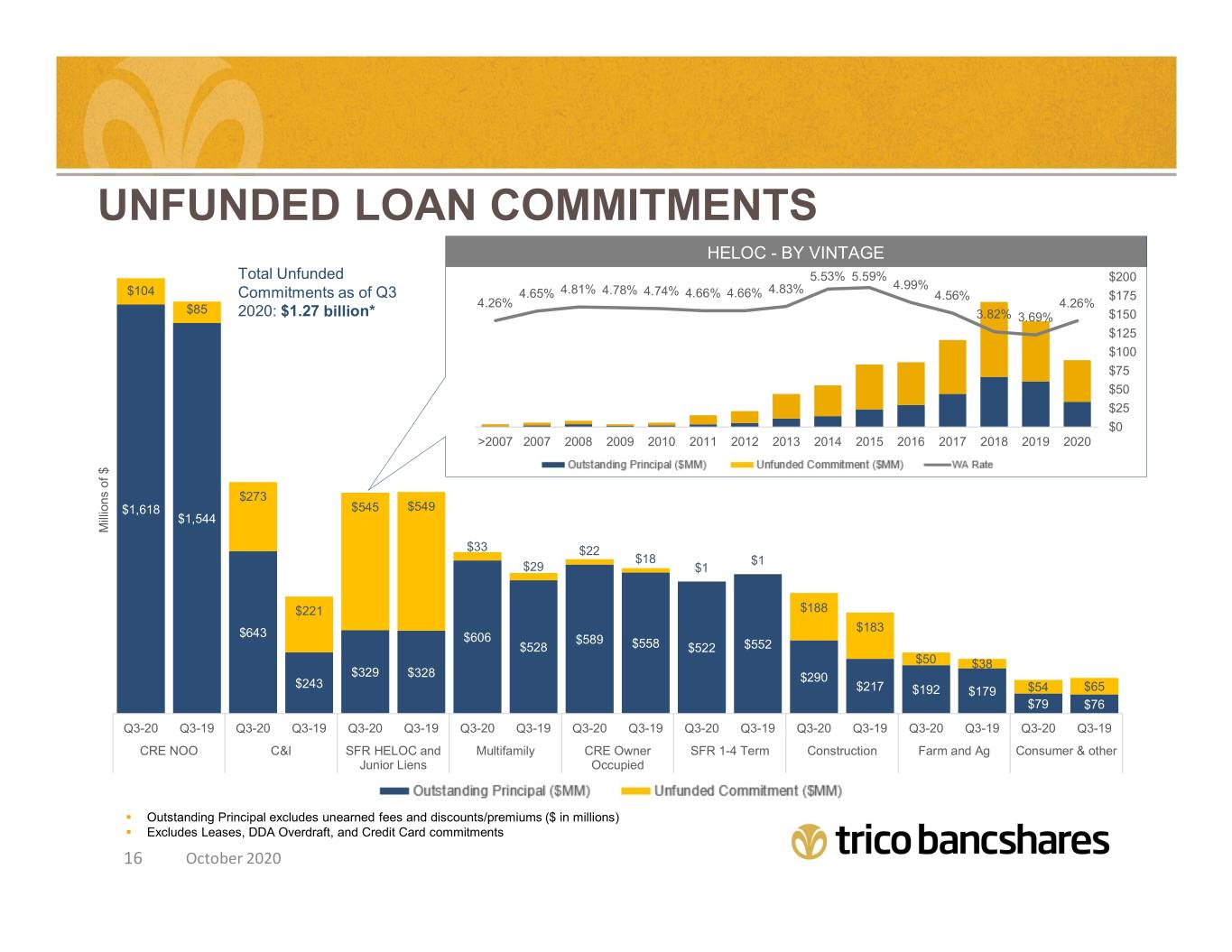

UNFUNDED LOAN COMMITMENTS HELOC - BY VINTAGE Total Unfunded 6.00% 5.53% 5.59% $200 4.81% 4.83% 4.99% $104 Commitments as of Q3 4.65% 4.78% 4.74% 4.66% 4.66% 4.56% $175 5.00% 4.26% $85 4.26% 2020: $1.27 billion* 3.82% 3.69% $150 4.00% $125 3.00% $100 2.00% $75 $50 1.00% $25 0.00% $0 >2007 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 $273 $1,618 $545 $549 $1,544 Millions of $ of Millions $33 $22 $18 $1 $29 $1 $221 $188 $643 $183 $606 $589 $528 $558 $522 $552 $50 $38 $329 $328 $243 $290 $217 $192 $179 $54 $65 $79 $76 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 Q3-20 Q3-19 CRE NOO C&I SFR HELOC and Multifamily CRE Owner SFR 1-4 Term Construction Farm and Ag Consumer & other Junior Liens Occupied . Outstanding Principal excludes unearned fees and discounts/premiums ($ in millions) . Excludes Leases, DDA Overdraft, and Credit Card commitments 16 October 2020

C&I balance and utilization peaked in the months leading C&I UTILIZATION up to the pandemic taking hold in the US and prior to the CARES Act and launch of the PPP loan program. $600 60% 52.4% 52.5% 52.2% 52.7% 50.9% 50.5% 49.3% 49.4% $500 48.4% 50% 44.0% 44.1% 43.3% 42.9% $400 40% $300 30% 245 235 Millions of $ of Millions 221 220 222 254 254 242 243 254 262 271 243 244 242 247 248 246 265 275 273 $200 228 20% 208 214 210 205 $100 10% $0 0% Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Outstanding Principal ($MM) Unfunded Commitment ($MM) Utlization . Outstanding Principal excludes unearned fees and discounts/premiums ($ millions) 17 October 2020

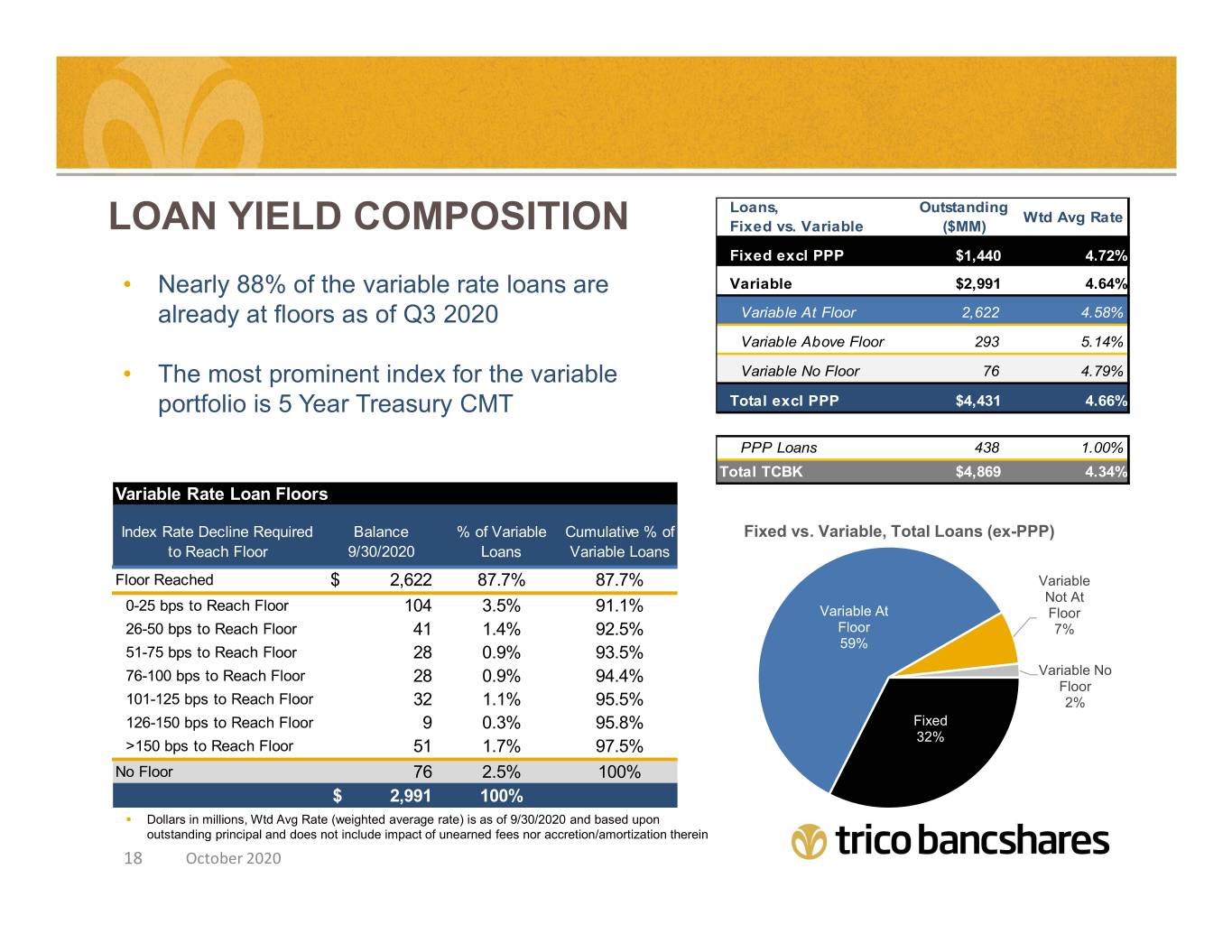

Loans, Outstanding Wtd Avg Rate LOAN YIELD COMPOSITION Fixed vs. Variable ($MM) Fixed excl PPP $1,440 4.72% • Nearly 88% of the variable rate loans are Variable $2,991 4.64% already at floors as of Q3 2020 Variable At Floor 2,622 4.58% Variable Above Floor 293 5.14% • The most prominent index for the variable Variable No Floor 76 4.79% portfolio is 5 Year Treasury CMT Total excl PPP $4,431 4.66% PPP Loans 438 1.00% Total TCBK $4,869 4.34% Variable Rate Loan Floors Index Rate Decline Required Balance % of Variable Cumulative % of Fixed vs. Variable, Total Loans (ex-PPP) to Reach Floor 9/30/2020 Loans Variable Loans Floor Reached $ 2,622 87.7% 87.7% Variable Not At 0-25 bps to Reach Floor 104 3.5% 91.1% Variable At Floor 26-50 bps to Reach Floor 41 1.4% 92.5% Floor 7% 59% 51-75 bps to Reach Floor 28 0.9% 93.5% 76-100 bps to Reach Floor 28 0.9% 94.4% Variable No Floor 101-125 bps to Reach Floor 32 1.1% 95.5% 2% 126-150 bps to Reach Floor 9 0.3% 95.8% Fixed 32% >150 bps to Reach Floor 51 1.7% 97.5% No Floor 76 2.5% 100% $ 2,991 100% . Dollars in millions, Wtd Avg Rate (weighted average rate) is as of 9/30/2020 and based upon outstanding principal and does not include impact of unearned fees nor accretion/amortization therein 18 October 2020

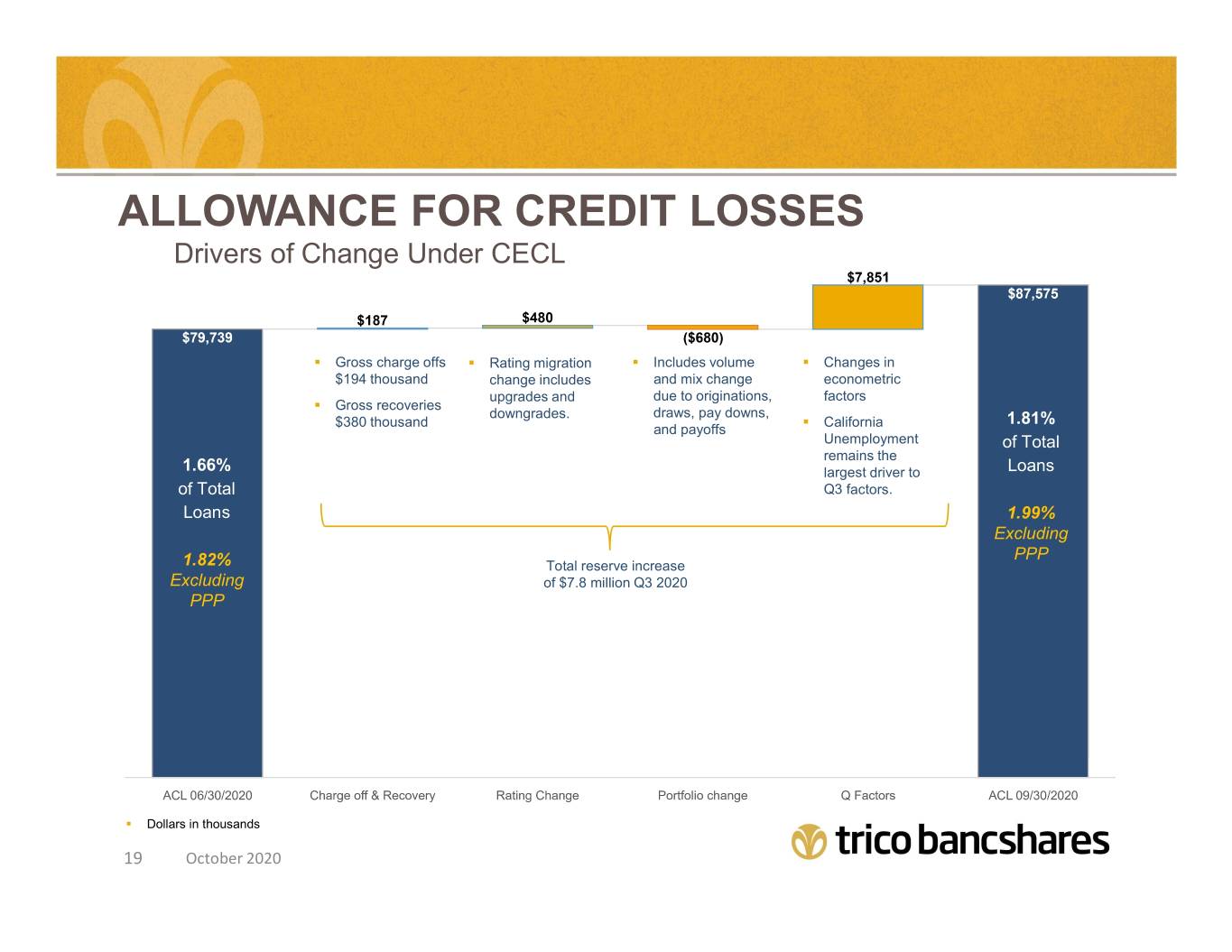

ALLOWANCE FOR CREDIT LOSSES Drivers of Change Under CECL . Gross charge offs . Rating migration . Includes volume . Changes in $194 thousand change includes and mix change econometric upgrades and due to originations, factors . Gross recoveries downgrades. draws, pay downs, $380 thousand . California 1.81% and payoffs Unemployment of Total remains the 1.66% largest driver to Loans of Total Q3 factors. Loans 1.99% Excluding PPP 1.82% Total reserve increase Excluding of $7.8 million Q3 2020 PPP . Dollars in thousands 19 October 2020

ALLOWANCE FOR CREDIT LOSSES Allocation of Allowance by Segment January 1, 2020 ($ Thousands) CECL Adoption June 30, 2020 September 30, 2020 % of Credit % of Credit % of Credit % of Credit Allowance for Credit Losses Amount Amount Amount excluding Outstanding Outstanding Outstanding PPP Loans Commercial real estate: CRE non-owner occupied$ 12,649 0.79%$ 26,091 1.63%$ 28,847 1.80% 1.80% CRE owner occupied 4,308 0.79% 8,710 1.50% 9,625 1.66% 1.66% Multifamily 5,633 1.09% 8,581 1.49% 10,032 1.67% 1.67% Farmland 1,253 0.86% 1,468 0.97% 1,790 1.17% 1.17% Total commercial real estate loans $ 23,843 0.85%$ 44,850 1.54%$ 50,293 1.71% 1.71% Consumer: SFR 1-4 1st DT$ 4,981 0.97%$ 8,015 1.56%$ 8,937 1.72% 1.72% SFR HELOCs and junior liens 10,821 2.98% 12,108 3.38% 11,676 3.51% 3.51% Other 2,566 3.15% 3,042 3.77% 3,394 4.18% 4.18% Total consumer loans $ 18,368 1.92%$ 23,165 2.43%$ 24,007 2.57% 2.57% Commercial and industrial$ 2,906 1.16%$ 4,018 0.63%$ 4,534 0.72% 2.18% Construction 4,321 1.73% 6,775 2.43% 7,640 2.68% 2.68% Agriculture production 82 0.25% 919 2.59% 1,093 2.69% 2.69% Leases 9 0.70% 12 0.68% 7 0.19% 0.19% Allowance for Loan and Lease Losses$ 49,529 1.15%$ 79,739 1.66%$ 87,575 1.81% 1.99% Reserve for Unfunded Loan Commitments 2,775 3,000 3,000 Allowance for Credit Losses$ 52,304 1.21%$ 82,739 1.72%$ 90,575 1.88% 2.06% Discounts on Acquired Loans 33,033 30,446 28,570 Total ACL Plus Discounts$ 85,337 1.98%$ 113,185 2.36%$ 119,145 2.47% 2.71% . Dollars in thousands 20 October 2020

RISK GRADE MIGRATION 0.8% 0.9% 0.9% 1.0% Special Mention (NBV) 1.0% 1.4% 1.3% 3.1% 5.0% 4.8% Q4-2019 Q3-2020 Diff Pool % (mln) # Loans % (mln) # Loans (mln) # Loans 13.9% 13.7% CRE Ow ner Occupied 0.8% $4.6 16 2.3% $13.3 18 $8.7 2 CRE NOO 0.8% $12.2 12 4.1% $65.3 33 $53.1 21 Multifamily 0.5% $2.6 2 7.4% $44.8 10 $42.2 8 SFR 1-4 Term 1.1% $5.9 51 0.9% $5.1 47 -$0.8 -4 HELOC 1.3% $4.2 85 1.7% $5.2 92 $1.1 7 C&I 1.6% $3.8 60 0.2% $1.3 35 -$2.5 -25 Farm and Ag 3.2% $5.6 6 4.9% $9.3 8 $3.7 2 Consumer & other 0.9% $0.7 184 1.0% $0.8 173 $0.1 -11 Construction 1.8% $4.5 2 0.7% $2.1 3 -$2.4 1 Grand Total 1.0% $44.2 418 3.1% $147.3 419 $103.1 1 93.2% 92.9% Substandard/Doubtful/Loss (NBV) 83.9% 82.2% Q4-2019 Q3-2020 Diff Pool % (mln) # Loans % (mln) # Loans (mln) # Loans CRE Ow ner Occupied 1.0% $5.7 16 1.4% $8.3 18 $2.6 2 CRE NOO 0.3% $4.8 15 0.4% $7.2 17 $2.4 2 Multifamily 0.4% $2.0 2 0.0% $0.0 0 -$2.0 -2 SFR 1-4 Term 1.6% $8.5 81 2.3% $12.4 103 $3.9 22 % of Loan Portfolio Outstanding, by Risk Grade Riskby Outstanding, Portfolio ofLoan % HELOC 1.1% $3.8 65 1.7% $5.3 83 $1.5 18 C&I 1.7% $4.2 80 0.6% $3.7 64 -$0.5 -16 Farm and Ag 3.0% $5.3 18 3.5% $6.7 20 $1.4 2 Consumer & other 0.2% $0.1 29 0.8% $0.6 38 $0.5 9 Construction 0.1% $0.2 2 1.6% $4.7 4 $4.4 2 Grand Total 0.8% $34.7 306 1.0% $48.7 347 $14.0 41 Q4-2019 Q1-2020 Q2-2020 Q3-2020 Pass Watch Special Mention Substandard . Zero balance in Doubtful and Loss 21 October 2020

Non-Performing Assets as a % of Total Assets TCBK Peers ASSET QUALITY 0.77% 0.77% 0.73% 0.70% 0.70% 0.64% 0.61% 0.58% 0.59% 0.57% 0.54% 0.53% 0.53% 0.54% 0.53% 0.47% NPAs have remained below peers 0.45% 0.45% while loss coverage has expanded, 0.35% 0.32% 0.31% 0.33% with CECL transition and allowance 0.30% 0.28% 0.30% build up resulting in a coverage ratio nearly 2X that of peers. 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 395% COVERAGE RATIO 385% 343% Allowance as a % of Non-Performing Loans TCBK Peers 193% 174% 180% 159% 134% 126% 125% 124% 118% 120% 202% 157% 156% 156% 145% 139% 137% 134% 131% 129% 129% 125% 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 . Peer group consists of 99 closest peers in terms of asset size, range $4.1-8.8 Billion source: BankRegData.com . NPA and NPL ratios displayed are net of guarantees 22 October 2020

DEPOSITS 23 October 2020

DEPOSITS: STRENGTH IN FUNDING Liability Mix 9/30/2020 Net Loans to Core Deposits * Borrowings & TCBK Peers Subordinated Other 120 Time Debt, 1.5% liabilities, 100 Deposits, 2.0% 80 6.2% 60 81.6 81.6 80.7 80.6 79.1 78.1 76.9 76.9 76.8 76.4 76.3 75.9 75.5 40 20 - Non Interest- 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 bearing Demand Deposits, 38.5% Non Interest-bearing Deposits as % of Total Deposits Interest-bearing Demand & TCBK Peers 40 Savings Deposits, 51.9% 39.8 30 39.7 34.9 34.1 34.1 33.6 33.6 33.6 33.3 33.3 32.8 32.7 32.4 20 10 Total Deposits = $6.34 billion 0 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 96.8% of Total Liabilities Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 . Peer group consists of 99 closest peers in terms of asset size, range $4.1-8.8 Billion; source: BankRegData.com . Net Loans includes LHFS and Allowance for Credit Loss; Core Deposits = Total Deposits less CDs > 250k 24 October 2020

DEPOSITS: STRENGTH IN COST OF FUNDS $6,248 $6,341 $5,366 $5,430 $5,342 $5,295 $5,367 $5,403 Q2 2020 includes $2,487 $2,518 $413 million Wtd.Avg. $1,761 $1,762 $1,780 $1,777 $1,833 $1,883 increase QvQ $4,009 Rate - 1.23% directly attributed $1,368 to PPP borrowers 2018 includes $3,174 $3,223 $3,121 $3,067 $3,094 $3,101 $3,363 $3,446 FNB acquisition $2,336 Wtd.Avg. Rate - 0.05% $305 $432 $446 $441 $451 $441 $419 $399 $376 2017 2018 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 FY FY QTD QTD QTD QTD QTD QTD QTD Cost of Deposits 2017 2018 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Noninterest-Bearing Demand - - - - - - - - - Int-Bearing Demand & Savings 0.10% 0.14% 0.18% 0.20% 0.19% 0.19% 0.16% 0.09% 0.06% Time Deposits 0.48% 0.86% 1.18% 1.28% 1.39% 1.27% 1.23% 1.09% 0.91% Total Deposits 0.10% 0.15% 0.20% 0.22% 0.23% 0.22% 0.19% 0.12% 0.09% Interest-bearing Deposits 0.15% 0.23% 0.30% 0.33% 0.34% 0.33% 0.29% 0.20% 0.15% . Regulated bank level deposits 25 October 2020

FINANCIALS 26 October 2020

CONSISTENT OPERATING METRICS Net Interest Margin (FTE) Efficiency Ratio 4.47% 4.32% 68.7% 4.23% 4.22% 4.30% 65.1% 65.4% 4.04% 63.7% 59.7% 59.6% 2015 2016 2017 2018 2019 YTD 2020 2015 2016 2017 2018 2019 YTD 2020 PPNR as % of Average Assets ROAA 1.43% 1.94% 1.24% 1.79% 1.70% 1.73% 1.78% 1.11% 1.60% 1.02% 0.89% 0.79% 2015 2016 2017 2018 2019 YTD 2020 2015 2016 2017 2018 2019 YTD 2020 27 October 2020

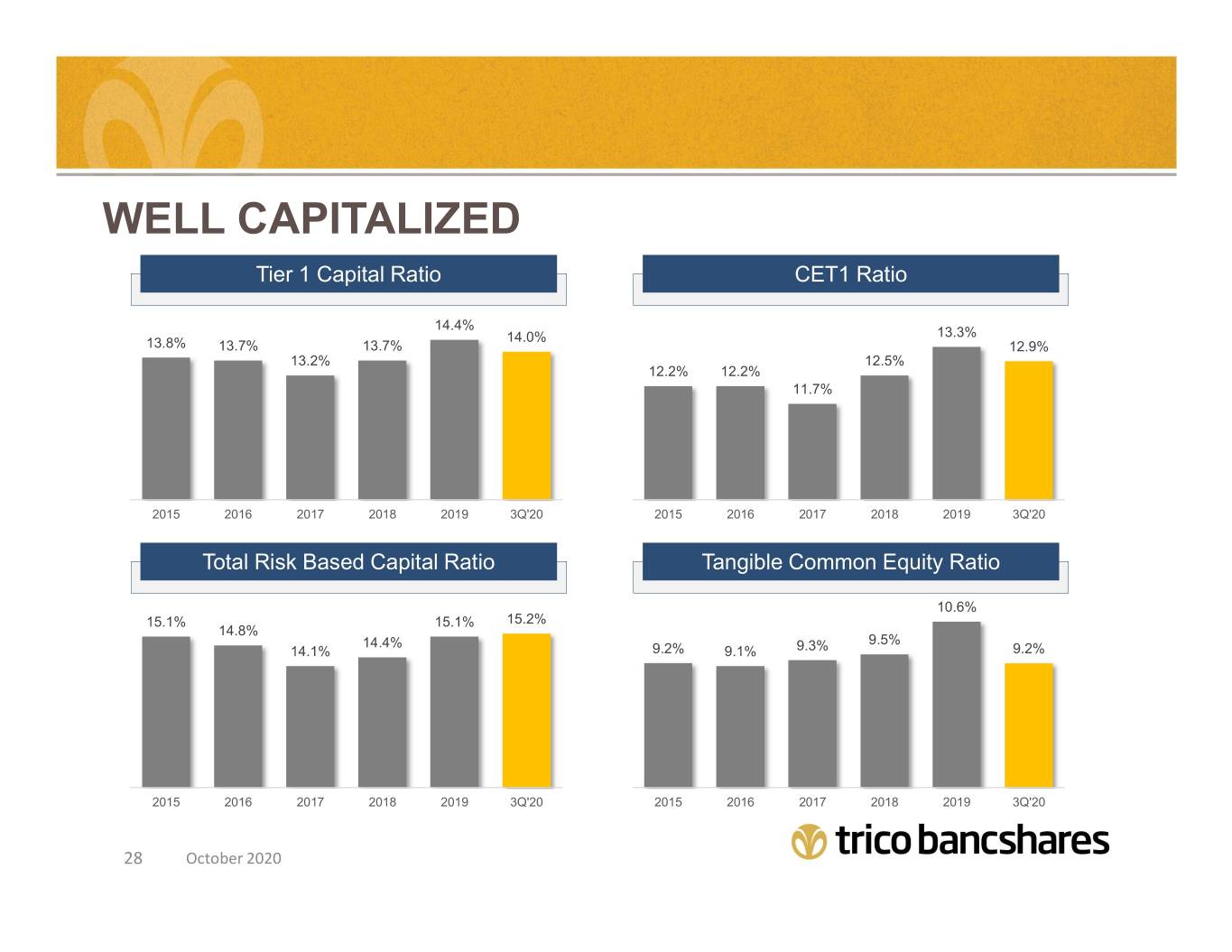

WELL CAPITALIZED Tier 1 Capital Ratio CET1 Ratio 14.4% 14.0% 13.3% 13.8% 13.7% 13.7% 12.9% 13.2% 12.5% 12.2% 12.2% 11.7% 2015 2016 2017 2018 2019 3Q'20 2015 2016 2017 2018 2019 3Q'20 Total Risk Based Capital Ratio Tangible Common Equity Ratio 10.6% 15.1% 15.1% 15.2% 14.8% 14.4% 9.5% 14.1% 9.2% 9.1% 9.3% 9.2% 2015 2016 2017 2018 2019 3Q'20 2015 2016 2017 2018 2019 3Q'20 28 October 2020

29 AugustOctober 2020 2020