Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Silvergate Capital Corp | ex991q32020earningsrel.htm |

| 8-K - 8-K - Silvergate Capital Corp | si8-k10262020earningsr.htm |

Exhibit 99.2 Silvergate Capital Corporation 3Q20 Earnings Presentation October 26, 2020

1 5 0 Forward Looking Statements #010500 This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such 41 as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates 42 and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are 44 subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary #292A2C language included in the Company’s periodic and current reports filed with the U.S. Securities and Exchange Commission. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward- looking statements. The Company’s past results are not necessarily indicative of future performance. Further, given its ongoing and 221 dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on 228 future developments, which are highly uncertain, including when the coronavirus can be controlled and abated and when and how the economy may be reopened. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, 231 #DDE4E7 we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, #919498 liquidity, and results of operations: the demand for our products and services may decline, making it difficult to grow assets and income; if the economy is unable to fully reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; our allowance for loan losses may increase if borrowers 146 experience financial difficulties, which will adversely affect our net income; the net worth and liquidity of loan guarantors may decline, 183 impairing their ability to honor commitments to us; as the result of the decline in the Federal Reserve Board’s target federal funds rate to 188 near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; our cyber security risks are increased as the result of an increase in the number of #92B7BC employees working remotely; and FDIC premiums may increase if the agency experiences additional resolution costs. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For the most current, accurate information, please refer to the investor 0 relations section of the Company's website at https://ir.silvergatebank.com. 175 220 Silvergate #00AFDC “Silvergate Bank” and its logos and other trademarks referred to and included in this presentation belong to us. Solely for convenience, we refer to our trademarks in this presentation without the ® or the ™ or symbols, but such references are not intended to indicate that we will not fully assert under applicable law our trademark rights. Other service marks, trademarks and trade names referred to in this 0 presentation, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks. In this presentation, we refer to Silvergate Capital Corporation as “Silvergate” or the “Company” and 107 to Silvergate Bank as the “Bank”. 183 #006BB7 2

1 5 0 3Q20 Highlights #010500 Digital Currency Platform Loan Portfolio & Credit • Record number of 3Q20 Silvergate Exchange Network • Loan portfolio balance up 26% from prior quarter and up 41 (SEN) transactions of 68,361 and SEN volumes of $36.7 40% from September 30, 2019, driven by recent 42 billion, up 70% and 64%, respectively, versus 2Q20 residential mortgage refinance activity resulting in $283 44 million growth in mortgage warehouse balance from June • SEN transfers volumes since inception surpass $100 30, 2020 #292A2C billion during 3Q20 • Conservative credit culture evidenced by relatively low • Digital currency fee income of $3.3 million, up 36% as loan-to-value (LTV), with a 53% LTV in commercial and compared to 2Q20 and up 106% compared to 3Q19 221 multi-family real estate loans, and 55% LTV in 1-4 family loans 228 • SEN Leverage pilot completed with approved lines of 231 credit totaling $35.5 million versus $22.5 million in 2Q20 • As of September 30, 2020, the proportion of loans which #DDE4E7 continued under various forms of COVID-19 related #919498 • Digital currency deposits grew by $586 million to $2.1 modification was 4.4% of total gross HFI loans billion as of September 30, 2020 compared to $1.5 billion outstanding compared to 15.5% at June 30, 2020 as of June 30, 2020 146 183 3Q20 Financial Highlights Other 188 • Net income of $7.1 million as compared to $5.5 million for • Net income of $7.1 million in 3Q20 included a $0.5 million #92B7BC 2Q20 benefit to income taxes, which arose upon filing prior year tax returns including the benefit of R&D tax credits. • Diluted EPS of $0.37 per share compared to $0.29 per Net income of $5.5 million in 2Q20 included a $2.6 million share for 2Q20 0 pre-tax gain on sale of securities and a $1.2 million pre- tax accelerated premium expense related to calling • Book value per share of $15.18 compared to $14.36 for 175 brokered CDs 220 2Q20 • Total assets increased 12% from prior quarter to $2.6 #00AFDC • NIM was 3.19% compared to 3.14% for 2Q20 billion, driven by record levels of digital currency deposits • Total risk-based capital ratio of 24.68% and Tier 1 and mortgage warehouse loans leverage ratio of 10.36% as of September 30, 2020 0 • Silvergate continued to operate with uninterrupted 107 banking access for customers with approximately 95% of 183 the Company’s employees working remotely #006BB7 3

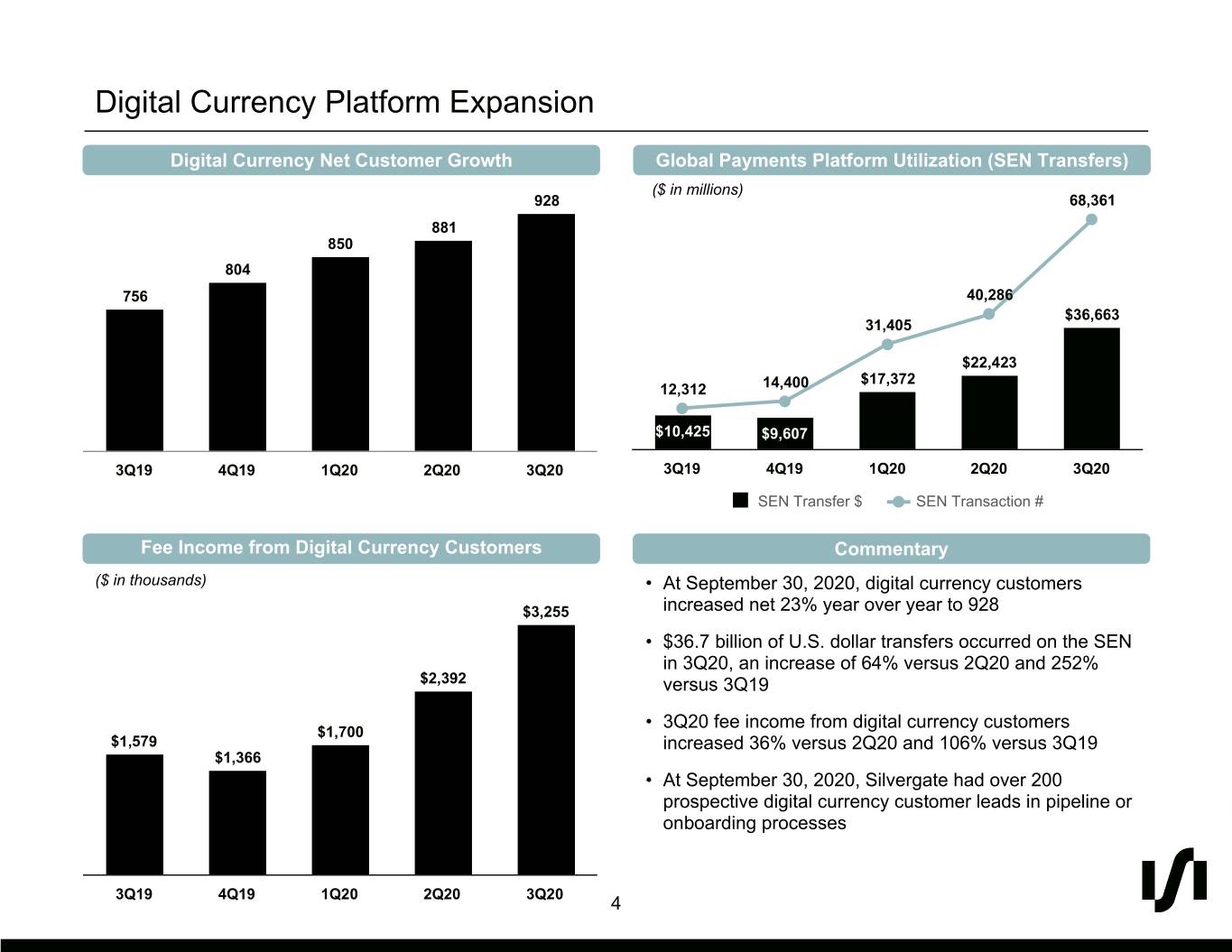

1 5 0 Digital Currency Platform Expansion #010500 Digital Currency Net Customer Growth Global Payments Platform Utilization (SEN Transfers) ($ in millions) 928 68,361 41 881 42 850 44 804 #292A2C 756 40,286 $36,663 31,405 221 $22,423 $17,372 228 12,312 14,400 231 #DDE4E7 $10,425 $9,607 #919498 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 SEN Transfer $ SEN Transaction # 146 183 Fee Income from Digital Currency Customers Commentary 188 ($ in thousands) • At September 30, 2020, digital currency customers #92B7BC $3,255 increased net 23% year over year to 928 • $36.7 billion of U.S. dollar transfers occurred on the SEN in 3Q20, an increase of 64% versus 2Q20 and 252% 0 $2,392 versus 3Q19 175 • 3Q20 fee income from digital currency customers 220 $1,700 $1,579 increased 36% versus 2Q20 and 106% versus 3Q19 #00AFDC $1,366 • At September 30, 2020, Silvergate had over 200 prospective digital currency customer leads in pipeline or 0 onboarding processes 107 183 3Q19 4Q19 1Q20 2Q20 3Q20 #006BB7 4

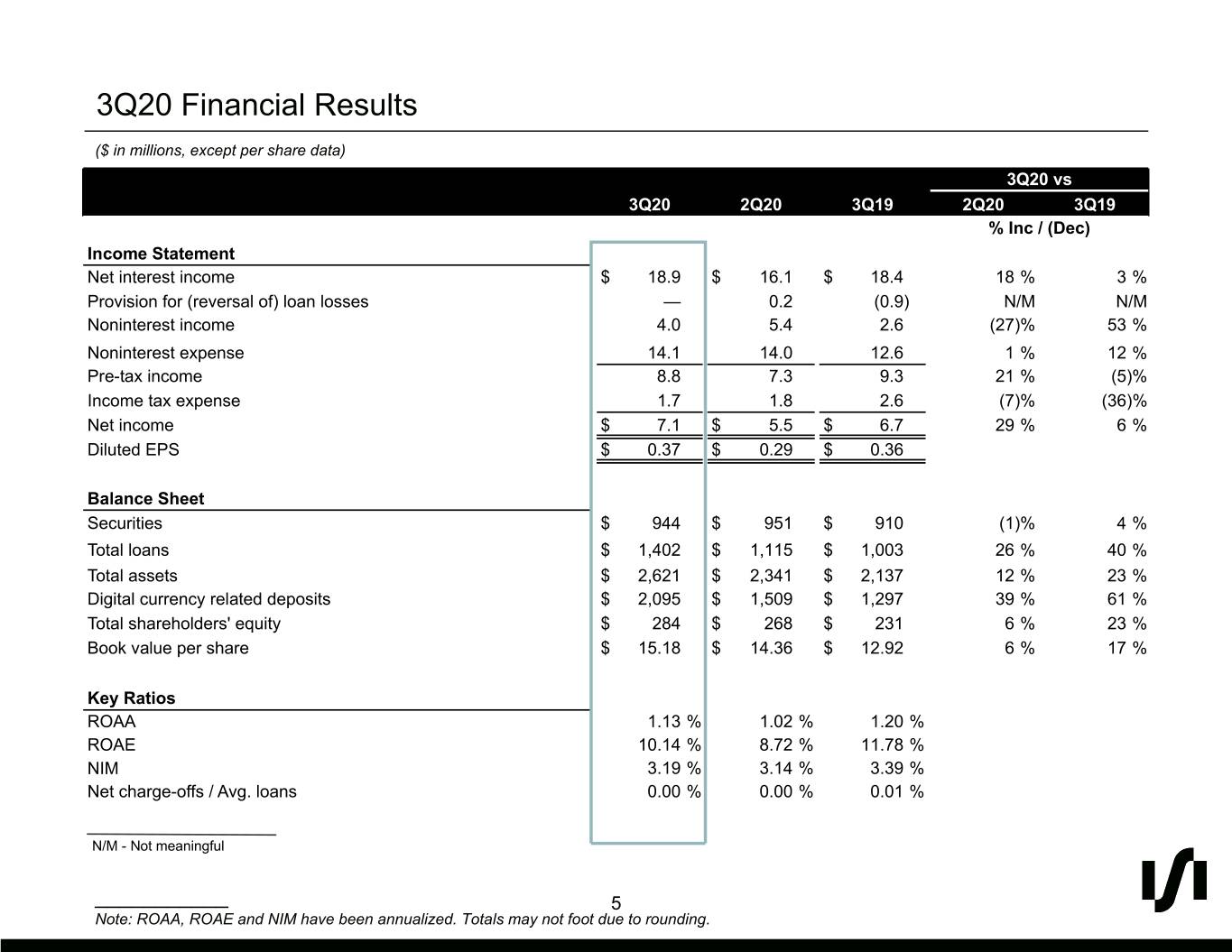

1 5 0 3Q20 Financial Results #010500 ($ in millions, except per share data) 3Q20 vs 41 3Q20 2Q20 3Q19 2Q20 3Q19 42 % Inc / (Dec) 44 Income Statement Net interest income $ 18.9 $ 16.1 $ 18.4 18 % 3 % #292A2C Provision for (reversal of) loan losses — 0.2 (0.9) N/M N/M Noninterest income 4.0 5.4 2.6 (27) % 53 % Noninterest expense 14.1 14.0 12.6 1 % 12 % 221 Pre-tax income 8.8 7.3 9.3 21 % (5) % 228 Income tax expense 1.7 1.8 2.6 (7) % (36) % 231 #DDE4E7 Net income $ 7.1 $ 5.5 $ 6.7 29 % 6 % #919498 Diluted EPS $ 0.37 $ 0.29 $ 0.36 Balance Sheet 146 Securities $ 944 $ 951 $ 910 (1) % 4 % 183 Total loans $ 1,402 $ 1,115 $ 1,003 26 % 40 % 188 Total assets $ 2,621 $ 2,341 $ 2,137 12 % 23 % #92B7BC Digital currency related deposits $ 2,095 $ 1,509 $ 1,297 39 % 61 % Total shareholders' equity $ 284 $ 268 $ 231 6 % 23 % Book value per share $ 15.18 $ 14.36 $ 12.92 6 % 17 % 0 175 Key Ratios 220 ROAA 1.13 % 1.02 % 1.20 % ROAE 10.14 % 8.72 % 11.78 % #00AFDC NIM 3.19 % 3.14 % 3.39 % Net charge-offs / Avg. loans 0.00 % 0.00 % 0.01 % 0 107 N/M - Not meaningful 183 ___________ #006BB7 5 Note: ROAA, ROAE and NIM have been annualized. Totals may not foot due to rounding.

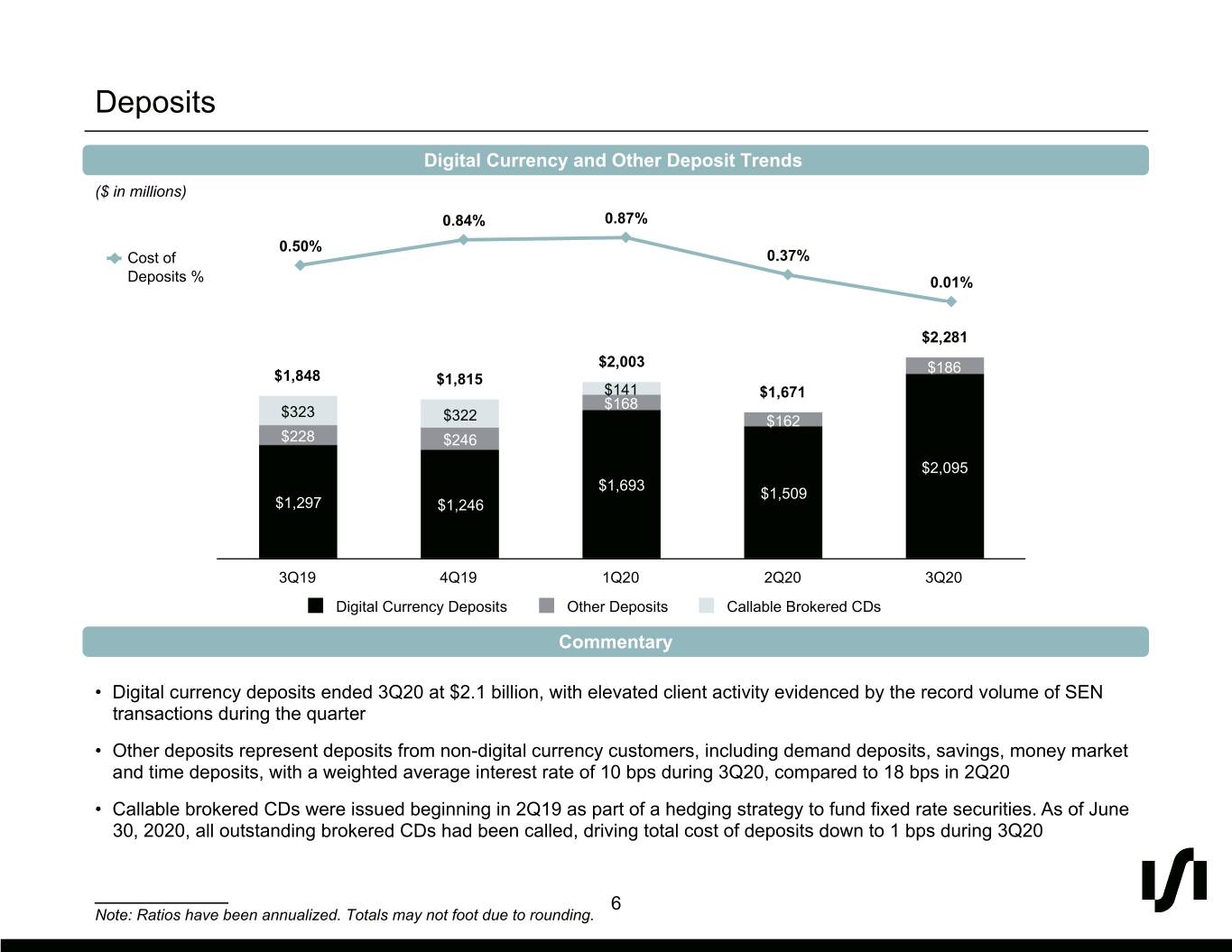

1 5 0 Deposits #010500 Digital Currency and Other Deposit Trends ($ in millions) 41 0.84% 0.87% 42 0.50% 44 Cost of 0.37% Deposits % 0.01% #292A2C $2,281 221 $2,003 $186 $1,848 $1,815 228 $141 $1,671 $168 $323 231 $322 $162 #DDE4E7 $228 #919498 $246 $2,095 $1,693 $1,509 $1,297 $1,246 146 183 188 3Q19 4Q19 1Q20 2Q20 3Q20 #92B7BC Digital Currency Deposits Other Deposits Callable Brokered CDs Commentary 0 175 • Digital currency deposits ended 3Q20 at $2.1 billion, with elevated client activity evidenced by the record volume of SEN transactions during the quarter 220 #00AFDC • Other deposits represent deposits from non-digital currency customers, including demand deposits, savings, money market and time deposits, with a weighted average interest rate of 10 bps during 3Q20, compared to 18 bps in 2Q20 • Callable brokered CDs were issued beginning in 2Q19 as part of a hedging strategy to fund fixed rate securities. As of June 0 30, 2020, all outstanding brokered CDs had been called, driving total cost of deposits down to 1 bps during 3Q20 107 183 ___________ 6 #006BB7 Note: Ratios have been annualized. Totals may not foot due to rounding.

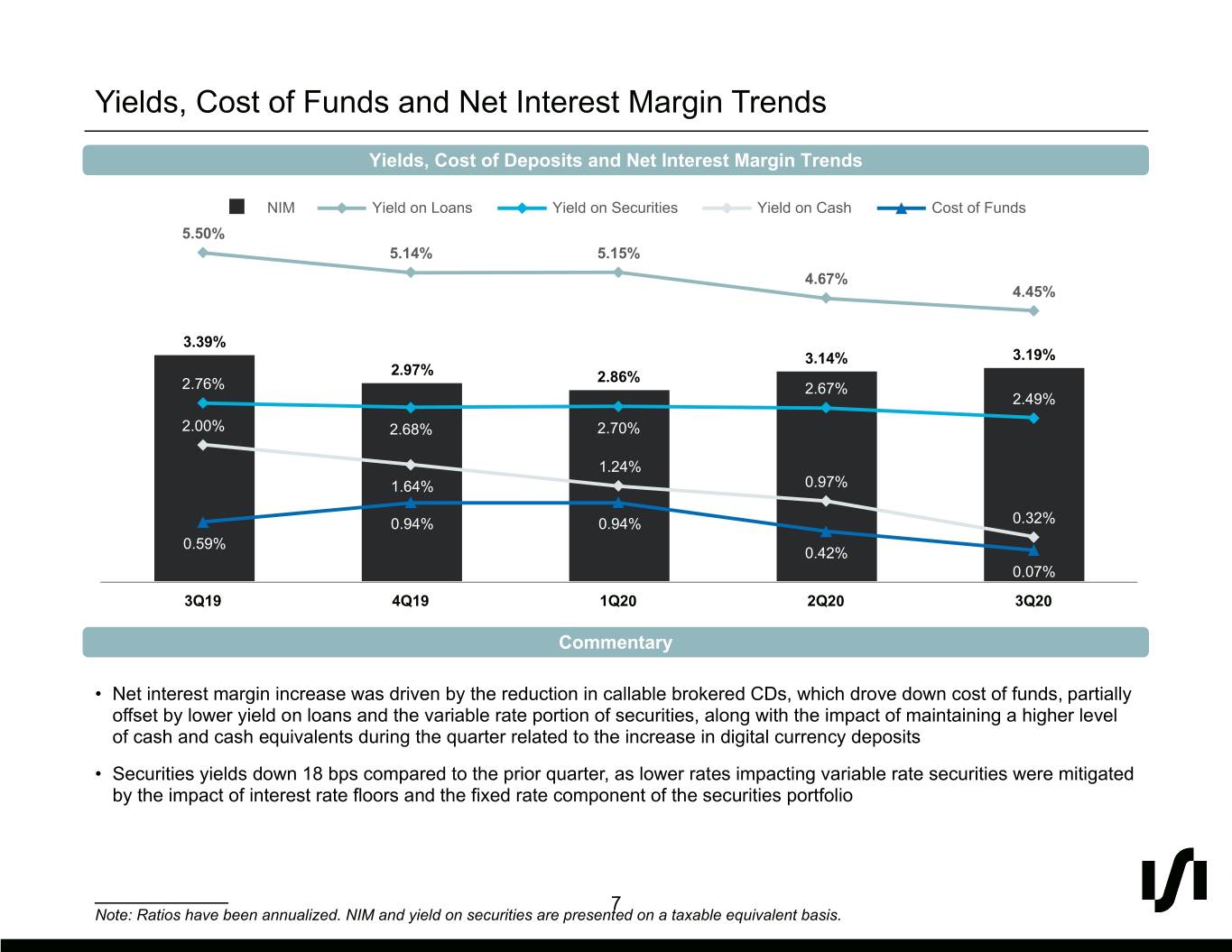

1 5 0 Yields, Cost of Funds and Net Interest Margin Trends #010500 Yields, Cost of Deposits and Net Interest Margin Trends 41 NIM Yield on Loans Yield on Securities Yield on Cash Cost of Funds 42 5.50% 44 5.14% 5.15% 4.67% #292A2C 4.45% 3.39% 3.14% 3.19% 221 2.97% 2.86% 2.76% 2.67% 228 2.49% 231 #DDE4E7 2.00% 2.68% 2.70% #919498 1.24% 1.64% 0.97% 146 0.94% 0.94% 0.32% 0.59% 183 0.42% 188 0.07% #92B7BC 3Q19 4Q19 1Q20 2Q20 3Q20 Commentary 0 175 • Net interest margin increase was driven by the reduction in callable brokered CDs, which drove down cost of funds, partially 220 offset by lower yield on loans and the variable rate portion of securities, along with the impact of maintaining a higher level of cash and cash equivalents during the quarter related to the increase in digital currency deposits #00AFDC • Securities yields down 18 bps compared to the prior quarter, as lower rates impacting variable rate securities were mitigated by the impact of interest rate floors and the fixed rate component of the securities portfolio 0 107 183 ___________ 7 #006BB7 Note: Ratios have been annualized. NIM and yield on securities are presented on a taxable equivalent basis.

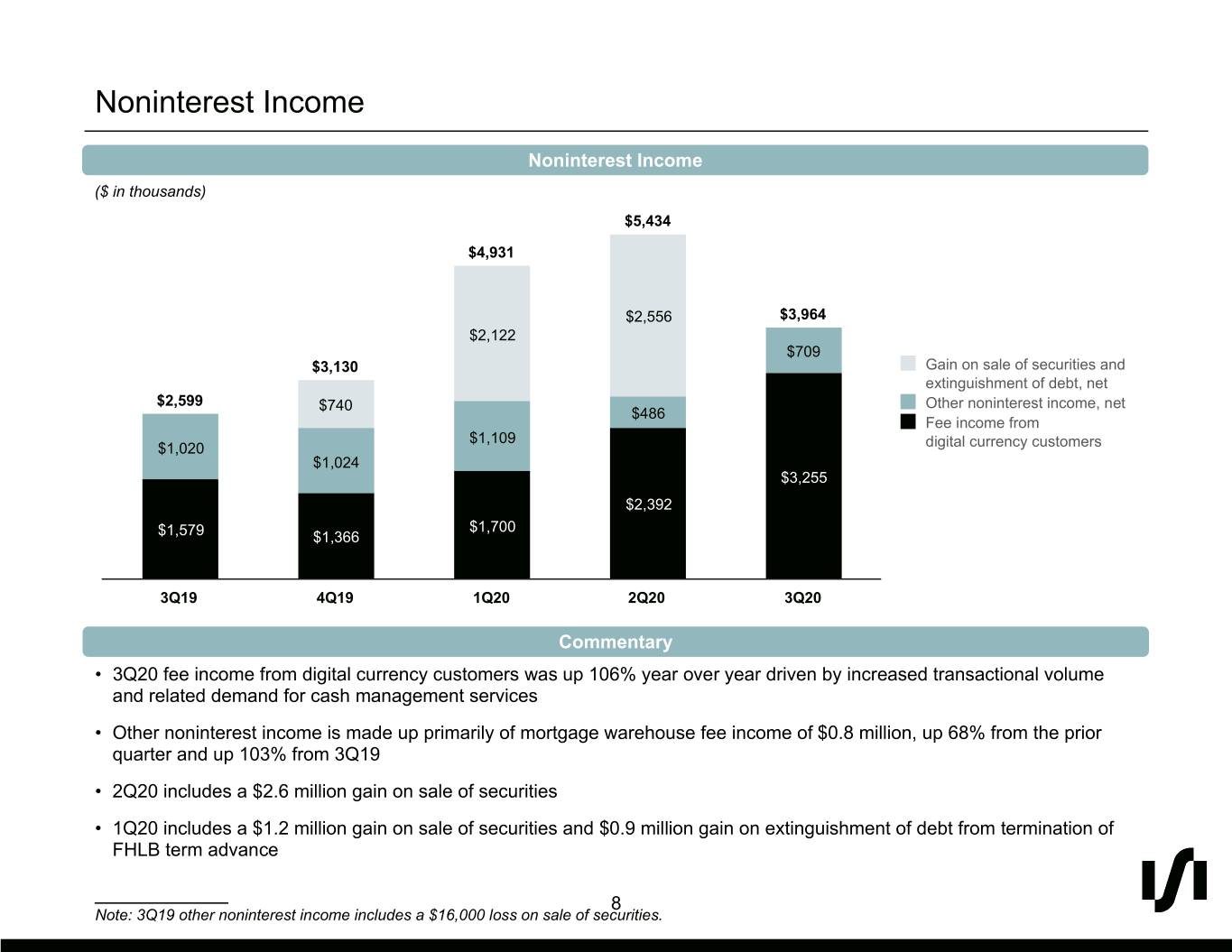

1 5 0 Noninterest Income #010500 Noninterest Income ($ in thousands) 41 $5,434 42 44 $4,931 #292A2C $2,556 $3,964 $2,122 $709 221 $3,130 Gain on sale of securities and 228 extinguishment of debt, net $2,599 $740 Other noninterest income, net $486 231 Fee income from #DDE4E7 $1,109 #919498 $1,020 digital currency customers $1,024 $3,255 $2,392 146 $1,579 $1,700 183 $1,366 188 #92B7BC 3Q19 4Q19 1Q20 2Q20 3Q20 Commentary 0 • 3Q20 fee income from digital currency customers was up 106% year over year driven by increased transactional volume 175 and related demand for cash management services 220 • Other noninterest income is made up primarily of mortgage warehouse fee income of $0.8 million, up 68% from the prior #00AFDC quarter and up 103% from 3Q19 • 2Q20 includes a $2.6 million gain on sale of securities 0 • 1Q20 includes a $1.2 million gain on sale of securities and $0.9 million gain on extinguishment of debt from termination of 107 FHLB term advance 183 ___________ 8 #006BB7 Note: 3Q19 other noninterest income includes a $16,000 loss on sale of securities.

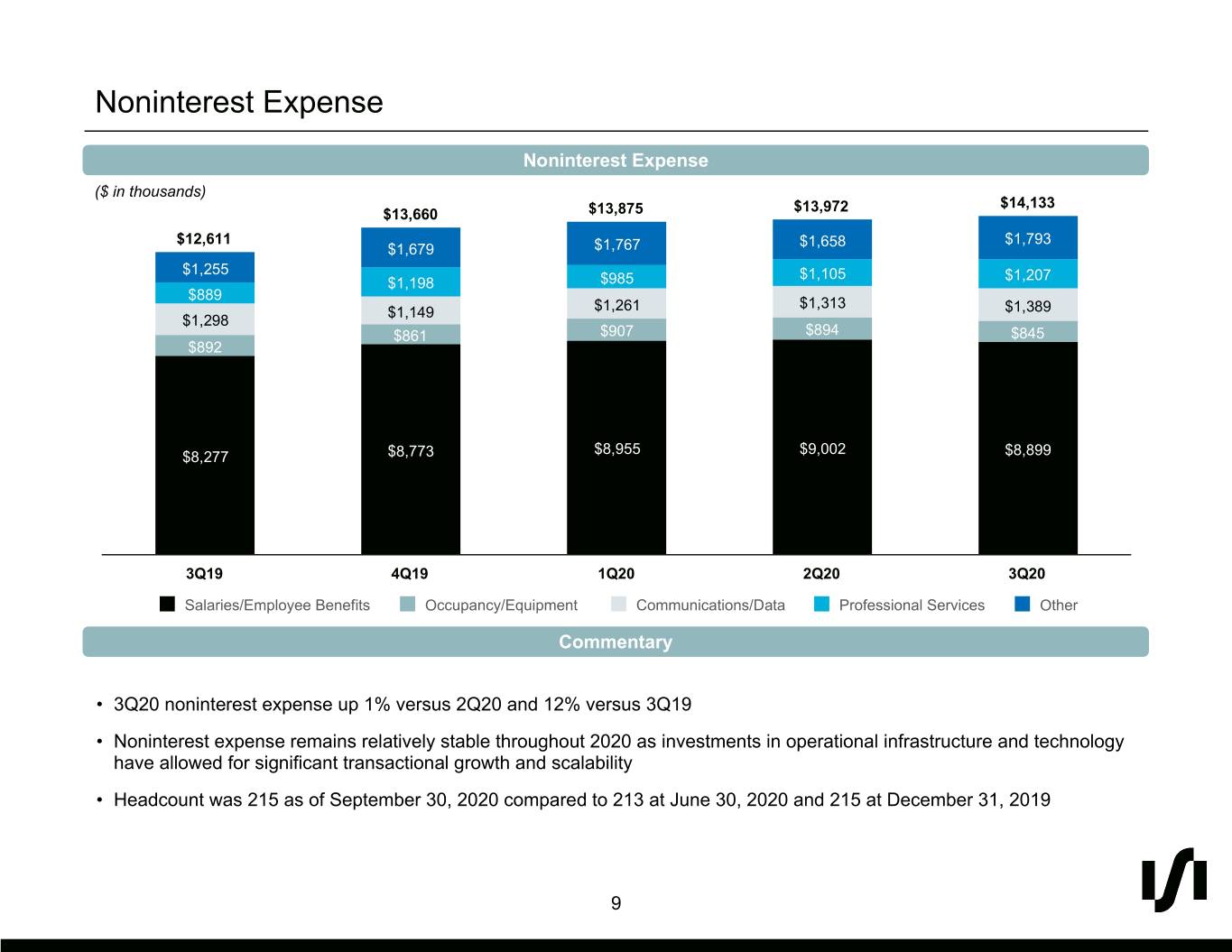

1 5 0 Noninterest Expense #010500 Noninterest Expense ($ in thousands) $13,972 $14,133 41 $13,660 $13,875 42 $12,611 $1,658 $1,793 $1,679 $1,767 44 $1,255 $1,105 $1,207 $1,198 $985 #292A2C $889 $1,313 $1,149 $1,261 $1,389 $1,298 $861 $907 $894 $845 $892 221 228 231 #DDE4E7 #919498 $8,955 $9,002 $8,277 $8,773 $8,899 146 183 188 3Q19 4Q19 1Q20 2Q20 3Q20 #92B7BC Salaries/Employee Benefits Occupancy/Equipment Communications/Data Professional Services Other Commentary 0 175 • 3Q20 noninterest expense up 1% versus 2Q20 and 12% versus 3Q19 220 • Noninterest expense remains relatively stable throughout 2020 as investments in operational infrastructure and technology #00AFDC have allowed for significant transactional growth and scalability • Headcount was 215 as of September 30, 2020 compared to 213 at June 30, 2020 and 215 at December 31, 2019 0 107 183 #006BB7 9

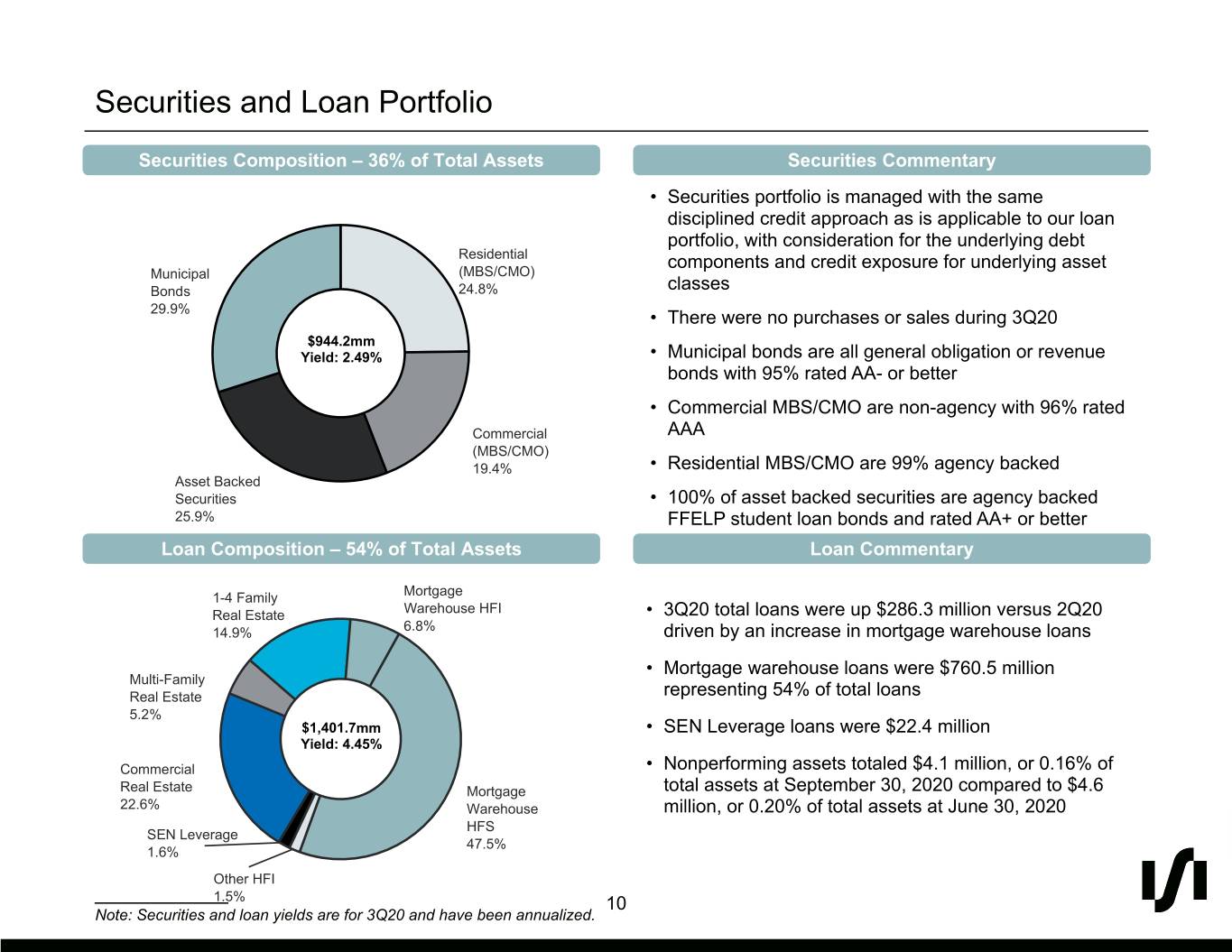

1 5 0 Securities and Loan Portfolio #010500 Securities Composition – 36% of Total Assets Securities Commentary • Securities portfolio is managed with the same 41 disciplined credit approach as is applicable to our loan 42 portfolio, with consideration for the underlying debt Residential components and credit exposure for underlying asset 44 Municipal (MBS/CMO) classes #292A2C Bonds 24.8% 29.9% • There were no purchases or sales during 3Q20 $944.2mm Yield: 2.49% • Municipal bonds are all general obligation or revenue 221 bonds with 95% rated AA- or better 228 231 • Commercial MBS/CMO are non-agency with 96% rated #DDE4E7 Commercial AAA #919498 (MBS/CMO) 19.4% • Residential MBS/CMO are 99% agency backed Asset Backed Securities • 100% of asset backed securities are agency backed 146 25.9% FFELP student loan bonds and rated AA+ or better 183 Loan Composition – 54% of Total Assets Loan Commentary 188 Mortgage #92B7BC 1-4 Family Real Estate Warehouse HFI • 3Q20 total loans were up $286.3 million versus 2Q20 14.9% 6.8% driven by an increase in mortgage warehouse loans • Mortgage warehouse loans were $760.5 million 0 Multi-Family representing 54% of total loans 175 Real Estate 5.2% 220 $1,401.7mm • SEN Leverage loans were $22.4 million Yield: 4.45% #00AFDC Commercial • Nonperforming assets totaled $4.1 million, or 0.16% of Real Estate Mortgage total assets at September 30, 2020 compared to $4.6 22.6% Warehouse million, or 0.20% of total assets at June 30, 2020 HFS 0 SEN Leverage 47.5% 107 1.6% 183 Other HFI ___________ 1.5% 10 #006BB7 Note: Securities and loan yields are for 3Q20 and have been annualized.

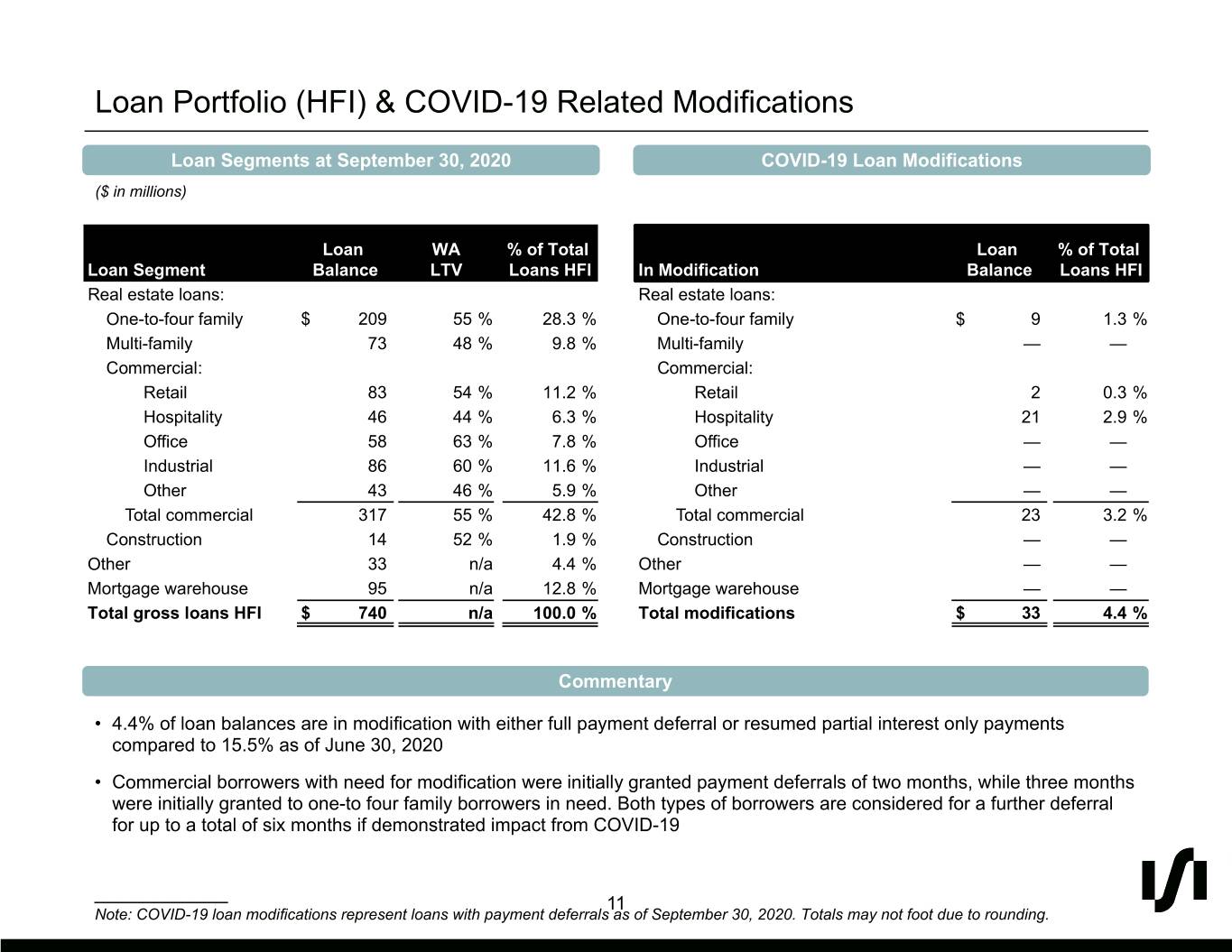

1 5 0 Loan Portfolio (HFI) & COVID-19 Related Modifications #010500 Loan Segments at September 30, 2020 COVID-19 Loan Modifications ($ in millions) 41 42 Loan WA % of Total Loan % of Total 44 Loan Segment Balance LTV Loans HFI In Modification Balance Loans HFI #292A2C Real estate loans: Real estate loans: One-to-four family $ 209 55 % 28.3 % One-to-four family $ 9 1.3 % Multi-family 73 48 % 9.8 % Multi-family — — 221 Commercial: Commercial: 228 Retail 83 54 % 11.2 % Retail 2 0.3 % 231 Hospitality 46 44 % 6.3 % Hospitality 21 2.9 % #DDE4E7 #919498 Office 58 63 % 7.8 % Office — — Industrial 86 60 % 11.6 % Industrial — — Other 43 46 % 5.9 % Other — — 146 Total commercial 317 55 % 42.8 % Total commercial 23 3.2 % 183 Construction 14 52 % 1.9 % Construction — — 188 Other 33 n/a 4.4 % Other — — Mortgage warehouse 95 n/a 12.8 % Mortgage warehouse — — #92B7BC Total gross loans HFI $ 740 n/a 100.0 % Total modifications $ 33 4.4 % 0 Commentary 175 220 • 4.4% of loan balances are in modification with either full payment deferral or resumed partial interest only payments compared to 15.5% as of June 30, 2020 #00AFDC • Commercial borrowers with need for modification were initially granted payment deferrals of two months, while three months were initially granted to one-to four family borrowers in need. Both types of borrowers are considered for a further deferral 0 for up to a total of six months if demonstrated impact from COVID-19 107 183 ___________ 11 #006BB7 Note: COVID-19 loan modifications represent loans with payment deferrals as of September 30, 2020. Totals may not foot due to rounding.

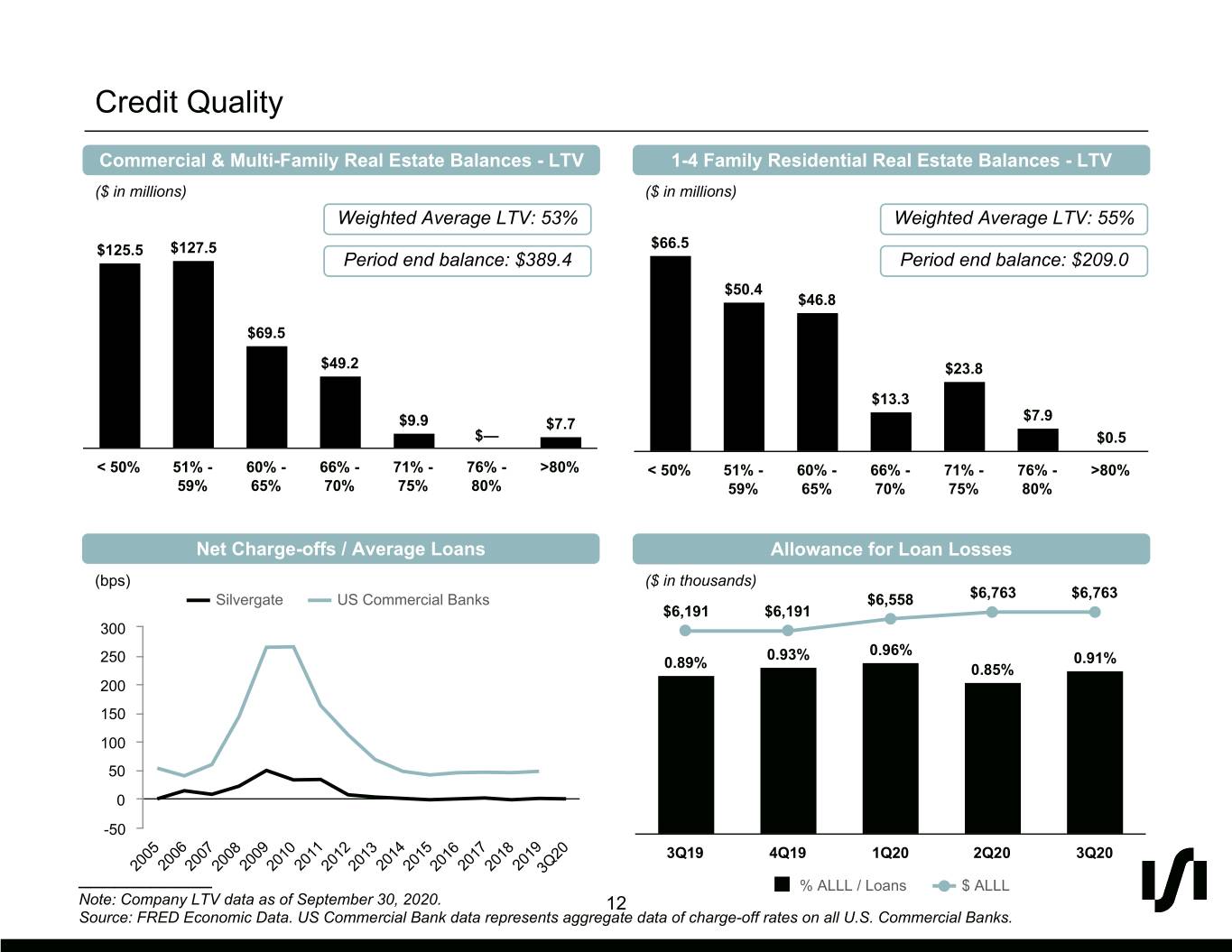

1 5 0 Credit Quality #010500 Commercial & Multi-Family Real Estate Balances - LTV 1-4 Family Residential Real Estate Balances - LTV ($ in millions) ($ in millions) 41 Weighted Average LTV: 53% Weighted Average LTV: 55% 42 $125.5 $127.5 $66.5 44 Period end balance: $389.4 Period end balance: $209.0 $50.4 #292A2C $46.8 $69.5 221 $49.2 $23.8 228 $13.3 $7.9 231 $9.9 $7.7 #DDE4E7 $— $0.5 #919498 < 50% 51% - 60% - 66% - 71% - 76% - >80% < 50% 51% - 60% - 66% - 71% - 76% - >80% 59% 65% 70% 75% 80% 59% 65% 70% 75% 80% 146 183 Net Charge-offs / Average Loans Allowance for Loan Losses 188 (bps) ($ in thousands) $6,763 $6,763 #92B7BC Silvergate US Commercial Banks $6,558 $6,191 $6,191 300 0.96% 250 0.93% 0.91% 0.89% 0.85% 0 200 175 150 220 100 #00AFDC 50 0 0 -50 107 3Q19 4Q19 1Q20 2Q20 3Q20 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 20193Q20 183 ___________ % ALLL / Loans $ ALLL Note: Company LTV data as of September 30, 2020. #006BB7 12 Source: FRED Economic Data. US Commercial Bank data represents aggregate data of charge-off rates on all U.S. Commercial Banks.

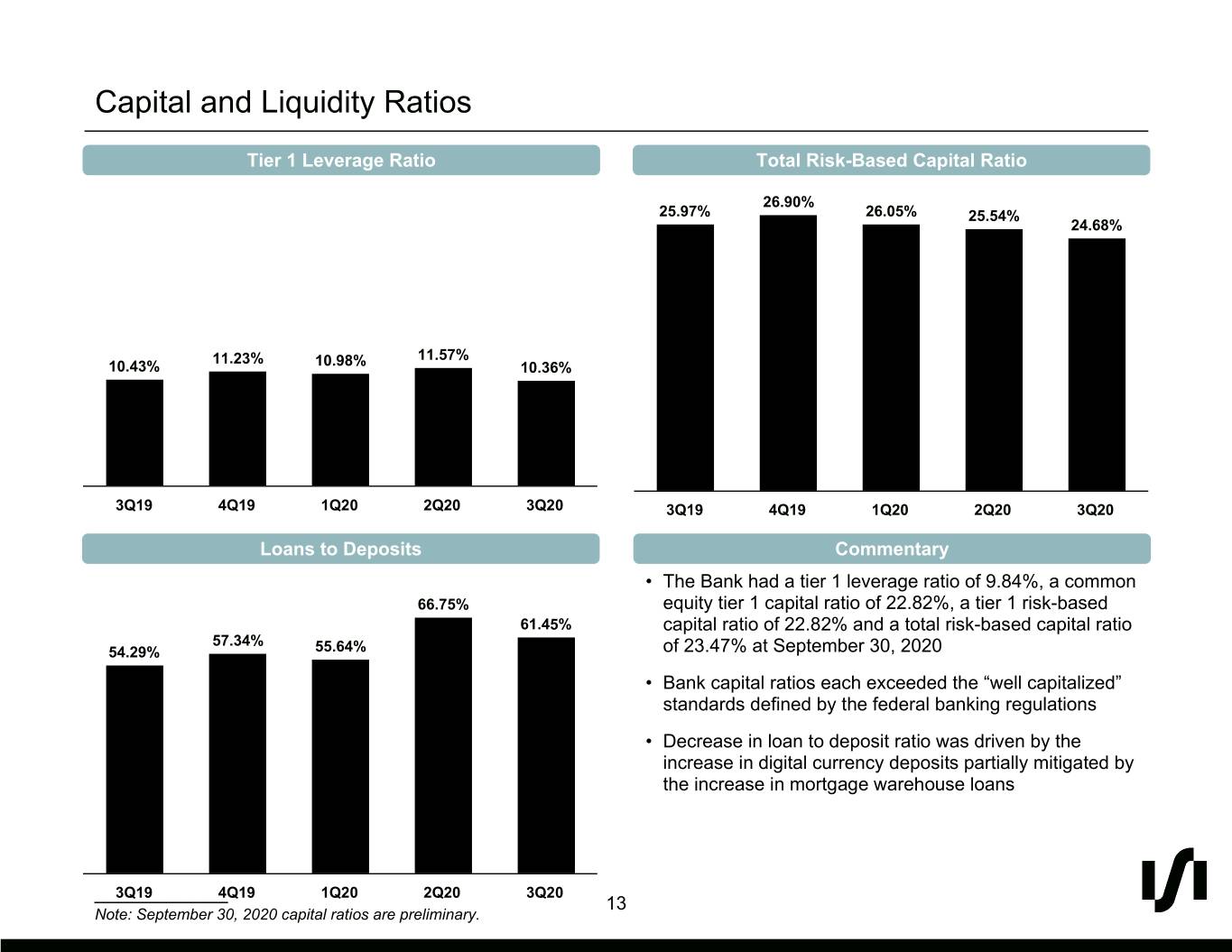

1 5 0 Capital and Liquidity Ratios #010500 Tier 1 Leverage Ratio Total Risk-Based Capital Ratio 26.90% 41 25.97% 26.05% 25.54% 24.68% 42 44 #292A2C 11.23% 11.57% 221 10.43% 10.98% 10.36% 228 231 #DDE4E7 #919498 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 146 183 Loans to Deposits Commentary 188 • The Bank had a tier 1 leverage ratio of 9.84%, a common #92B7BC 66.75% equity tier 1 capital ratio of 22.82%, a tier 1 risk-based 61.45% capital ratio of 22.82% and a total risk-based capital ratio 57.34% 54.29% 55.64% of 23.47% at September 30, 2020 0 • Bank capital ratios each exceeded the “well capitalized” 175 standards defined by the federal banking regulations 220 • Decrease in loan to deposit ratio was driven by the #00AFDC increase in digital currency deposits partially mitigated by the increase in mortgage warehouse loans 0 107 183 ___________3Q19 4Q19 1Q20 2Q20 3Q20 13 #006BB7 Note: September 30, 2020 capital ratios are preliminary.

Appendix

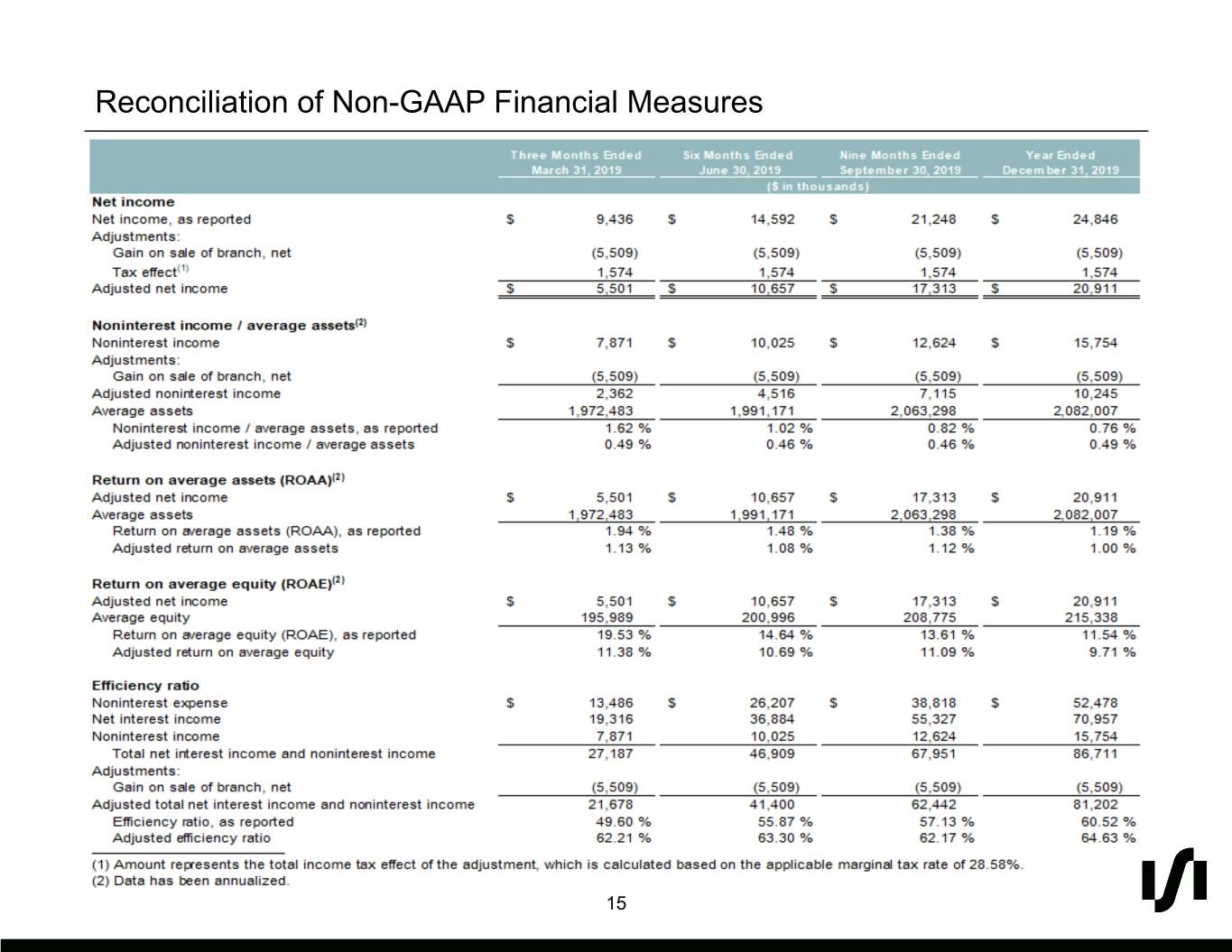

1 5 0 Reconciliation of Non-GAAP Financial Measures #010500 41 42 44 #292A2C 221 228 231 #DDE4E7 #919498 146 183 188 #92B7BC 0 175 220 #00AFDC 0 107 183 #006BB7 15