SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2018

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 000-55755

WALL STREET ACQUISITIONS CORP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

| 30-0965482 |

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

One Gateway Center, 26th Fl, Newark, New Jersey 07102

![]()

(Address of principal executive offices)

(973) 277-4239

(Registrant’s telephone number, including area code)

![]()

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicated by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).Yes ¨ No x

Check whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

1

Large Accelerated Filer ¨ |

| Accelerated Filer ¨ |

Non-accelerated Filer x |

| Smaller Reporting Company x |

|

| Emerging Growth Company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Check whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes X No x

As of September 30, 2018 there were 20,000,000 shares of common stock, par value $0.0001, issued and outstanding.

UNAUDITED CONDENSED FINANCIAL STATEMENTS

Unaudited Condensed Financial Statements3-6

Notes to Unaudited Condensed Financial Statements 7-12

2

WALL STREET ACQUISITIONS CORPORATION | |||

UNAUDITED CONDENSED BALANCE SHEET | |||

|

|

|

|

|

| AS OF SEPTEMBER 30, 2018 | AS OF DECEMBER 31, 2017 |

ASSETS | |||

Current Assets |

|

|

|

Cash & Cash Equivalents |

| $ - | $ - |

|

|

|

|

Total Assets |

| $ - | $ - |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS DEFICIT | |||

Current Liabilities |

|

|

|

Accrued Expense |

| $ 9,339 | $ 1,207 |

Due to related party |

| $ 1,207 | - |

|

|

|

|

Total Current Liabilities |

| 10,546 | 1,207 |

|

|

|

|

|

|

|

|

STOCKHOLDERS DEFICIT |

|

|

|

|

|

|

|

Preferred Stock $0.0001 par value, |

|

|

|

20,000,000 share authorized, non outstanding |

|

|

|

Common Stock, 0.0001 par value, |

|

|

|

100,000,000 authorized 20,000,000 |

|

|

|

issued and outstanding |

| 2,000 | 2,000 |

Additional Paid In Capital |

| (1,439) | (1,439) |

Accumulated Deficit |

| (11,107) | (1,768) |

|

|

|

|

Total Stockholder's Deficit |

| (10,546) | (1,207) |

|

|

|

|

Total Liabilities & Stockholders’ Deficit |

| $ - | $ - |

|

|

|

|

The accompanying notes are an integral part of these financial statements. | |||

WALL STREET ACQUISITIONS, CORPORATION |

| ||||||

UNAUDITED STATEMENT OF OPERATIONS |

| ||||||

|

|

|

| THREE MONTHS ENDED | NINE MONTHS ENDED | ||

|

|

|

| SEPTEMBER 30, 2018 | SEPTEMBER 30, 2017 | SEPTEMBER 30, 2018 | SEPTEMBER 30, 2017 |

Revenues | $ |

|

| - | - | - | - |

|

|

|

|

|

|

|

|

Cost of Revenue | $ |

|

| - | - | - | - |

|

|

|

|

|

|

|

|

Gross Profit |

|

|

| - | - | - | - |

|

|

|

|

|

|

|

|

Operating Expenses |

|

| 1,113 | 1,096 | 9,339 | 1,415 | |

|

|

|

|

|

|

|

|

Loss Before Income Taxes |

|

| (1,113) | (1,096) | (9,339) | (1,415) | |

|

|

|

|

|

|

|

|

Income Tax Expense |

|

|

| - | - | 0 | 0 |

|

|

|

|

|

|

|

|

Net Loss | $ |

|

| (1,113) | (1,096) | (9,339) | (1,415) |

|

|

|

|

|

|

|

|

Loss per Share- Basic & Diluted |

| (0.00006) | (0.00005) | (0.00047) | (0.00007) | ||

|

|

|

|

|

|

|

|

Weighted Average Shares- |

|

|

|

|

|

| |

Basic and Diluted |

|

|

| 20,000,000 | 20,000,000 | 20,000,000 | 20,000,000 |

3

WALL STREET ACQUISITIONS CORPORATION | ||||||||||

STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT | ||||||||||

FOR THE PERIOD FROM INCEPTION (DECEMBER 2, 2016) TO SEPTEMBER 30, 2018 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK |

| ADDITIONAL PAID |

| ACCUMULATED |

| TOTAL STOCKHOLERS | ||

|

| SHARES |

| AMOUNT |

| IN CAPITAL |

| DEFICIT |

| DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 2, 2016 (Inception) |

| - | $ | - | $ | - | $ | - | $ | - |

|

|

|

|

|

|

|

|

|

|

|

Issuance of Common Stock |

| 20,000,000 |

| 2,000 |

| (2,000) |

| - |

| - |

|

|

|

|

|

|

|

|

|

|

|

Capital Contribution |

| - |

| - |

| 202 |

| - |

| 202 |

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

| - |

| - |

| - |

| (202) |

| (202) |

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2016 | 20,000,000 |

| 2,000 |

| (1,798) |

| (202) |

| - | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2017 | 20,000,000 |

| 2,000 |

| (1,798) |

| (202) |

| - | |

|

|

|

|

|

|

|

|

|

|

|

Issuance of Common Stock |

| - |

| - |

| - |

| - |

| - |

|

|

|

|

|

|

|

|

|

|

|

Capital Contribution |

| - |

| - |

| 359 |

| - |

| 359 |

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

| - |

| - |

| - |

| (1,566) |

| (1,566) |

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2017 | 20,000,000 |

| 2,000 |

| (1,439) |

| (1,768) |

| (1,207) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2018 | 20,000,000 |

| 2,000 |

| (1,439) |

| (1,768) |

| (1,207) | |

|

|

|

|

|

|

|

|

|

|

|

Issuance of Common Stock |

| - |

| - |

| - |

| - |

| - |

|

|

|

|

|

|

|

|

|

|

|

Capital Contribution |

| - |

| - |

| - |

| - |

| - |

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

| - |

| - |

| - |

| (9,339) |

| (9,339) |

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2018 | 20,000,000 |

| 2,000 |

| (1,439) |

| (11,107) |

| (10,546) | |

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements | ||||||||||

4

WALL STREET ACQUISITIONS CORPORATION | ||

UNAUDITED CONDENSED STATEMENT OF CASH FLOWS | ||

| Nine months ended | |

| 'SEPTEMBER | SEPTEMBER |

|

|

|

Net Loss | $ (9,339) | $ (1,415) |

|

|

|

Adjustments to reconcile net loss to net cash |

|

|

used in operating activities: |

|

|

|

|

|

Change in Accrued liabilities | 8,132 | 1,056 |

Change in Due to related party | 1,207 | - |

|

|

|

Net Cash provided by (used in) operating activities | $ - | $ (359) |

|

|

|

Cash Flows from Investing Activities | $ - | $ - |

|

|

|

Cash Flows from Financing Activities | $ - | $ - |

|

|

|

Expenses paid for by stockholders and contributed as capital | $ - | $ 359 |

|

|

|

Cash and cash equivalents, beginning of period | $ - | $ - |

|

|

|

Cash and Cash equivalents, end of period | $ - | $ - |

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES |

|

|

Interest Paid | $ - | $ - |

Taxes Paid | $ - | $ - |

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements |

| |

5

WALL STREET ACQUISITIONS, CORPORATION

NOTES TO FINANCIAL STATEMENTS

Note 1.NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

NATURE OF OPERATIONS

Wall Street Acquisitions, Corporation (“Wall Street Acquisitions” or the “Company”) was incorporated on December 2, 2016 under the laws of the State of Delaware to engage in lawful corporate undertaking, including, but limited to, selected mergers and acquisitions. The Company has been in the developmental stage since its inception and its operations to date have been limited to issuing shares to its original shareholders. The Company will attempt to locate and negotiate with a business entity for the combination of that target company with the Company. The combination will normally take the form of a merger, stock-for-stock exchange or stocks for assets exchange.

BASIS OF PRESENTATION

The summary of significant accounting policies presented below is designed to assist in understanding the Company’s financial statements. These accounting policies conform to accounting principles generally accepted in the United States of America. (“GAAP”) in all material respects and have been consistently applied in preparing the accompanying financial statements.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosures of contingent assets and liabilities as at the date of the financial statements and reported amount of revenues and expenses during the reported periods. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash on hand and on deposit with banking institutions as well as all highly liquid short-term investments with original maturities of 90 days or less. The Company did not have cash equivalents as of September 30, 2018.

REVENUE RECOGNITION

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable. Revenue generally is recognized net of allowances for returns and any taxes collected from customers and subsequently remitted to governmental authorities.

PROPERTY, PLANT AND EQUIPMENT

Property and equipment is stated at cost and depreciated using the straight-line method over the shorter of the estimated useful life of the asset or the lease term. The estimated useful lives of our property and equipment are generally as follows: computer software developed or acquired for internal use, three to 10 years; computer equipment, two to three years; buildings and improvements, five to 15 years; leasehold improvements, two to 10 years; and furniture and equipment, one to five years.

6

CONCENTRATION OF RISK

Financial instruments that potentially subject the Company to concentration of credit risk consist primarily of cash. The Company did not have cash balances in excess of the Federal Deposit Insurance Corporation limit as of September 30, 2018.

INCOME TAXES

Under ASC 740, “Income Taxes,” deferred tax assets and liabilities are recognized for future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Valuation allowances are provided when it is more likely than not that some or all of the deferred tax assets will not be realized.

LOSS PER COMMON SHARE

Basic loss per common share excludes dilution and is computed by dividing by the weighted average number of common shares outstanding during the period. Diluted loss per common share reflects the potential dilution that could occur if the securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that is then shared in the loss of the entity. As of September 30, 2018, there are no outstanding dilutive securities.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company follows the guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. Additionally, the Company adopted guidance for fair value measurements related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1 inputs are quoted (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for asset or liability, either directly or indirectly.

Level 3 inputs are observable input for asset or liability. The carrying amount of financial assets such as cash approximate their fair values because of short maturity of these assets.

RECENT PRONOUNCEMENTS

In November 2015, the Financial Accounting Standards Board (FASB) issued ASU 2015-17, “Balance Sheet Classification of Deferred Taxes” (ASU 2015-17), which changes how deferred taxes are classified on the balance sheet and is effective for financial statements issued for annual periods beginning after December 15, 2016, with early adoption permitted. ASU 2015-17 requires all deferred tax assets and liabilities to be classified as non-current. The Company does not expect the adoption of this standard to have a significant effect on its financial statements.

7

In January 2016, the FASB issued ASU 2016-01, “Recognition and Measurement of Financial Assets and Financial Liabilities” (ASU 2016-01), which requires equity investments that are not accounted for under the equity method of accounting to be measured at fair value with changes recognized in net income and updates certain presentation and disclosure requirements. ASU 2016-01 is effective beginning after December 15, 2017. The adoption of this guidance is not expected to have a material impact on the Company’s results of operations, financial position or disclosures.

In February 2016, the FASB issued ASU No. 2016-02, “Leases,” which requires lessees to recognize right-of-use assets and lease liabilities, for all leases, with the exception of short-term leases, at the commencement date of each lease. This ASU requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight-line basis over the term of the lease. This ASU is effective for annual periods beginning after December 15, 2018 and interim periods within those annual periods. Early adoption is permitted. The amendments of this update should be applied using a modified retrospective approach, which requires lessees and lessors to recognize and measure leases at the beginning of the earliest period presented. The adoption of this guidance is not expected to have a material impact on the Company’s results of operations, financial position or disclosures.

In March 2016, the FASB issued ASU 2016-09, “Improvements to Employee Share-Based Payment Accounting.” The guidance simplifies accounting for share-based payments, most notably by requiring all excess tax benefits and tax deficiencies to be recorded as income tax benefits or expense in the income statement and by allowing entities to recognize forfeitures of awards when they occur. This new guidance is effective for annual reporting periods beginning after December 15, 2016 and may be adopted prospectively or retroactively. The Company does not expect the adoption of this standard to have a significant effect on its financial statements.

In May 2016, the FASB issued ASU 2016-12, “Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients” (“ASU 2016-12”), which amends the guidance in the new revenue standard on collectability, noncash consideration, presentation of sales tax, and transition. The amendments are intended to address implementation issues and provide additional practical expedients to reduce the cost and complexity of applying the new revenue standard. The new guidance is effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods, which will be our interim period beginning January 1, 2018. Early adoption is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods with that reporting period. The Company does not expect the adoption of this standard to have a significant effect on its financial statements.

In August 2016, the FASB issued ASU 2016-15, regarding ASC Topic 230 “Statement of Cash Flows.” This update addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. The new guidance is effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Early adoption is permitted. The Company does not expect the adoption of this standard to have a significant effect on its financial statements.

In August 2018, the FASB issued ASU 2018-14, regarding ASC Topic 820 “Fair Value Measurement”. Effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The amendments on changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively for only the most recent interim or annual period presented in the initial fiscal year of adoption. All other amendments should be applied retrospectively to all periods presented upon their effective date. Early adoption is permitted. The Company will evaluate the impact of this standard on its financial statements.

There were no other new accounting pronouncements during the period ended September 30, 2018 that we believe would have a material impact on our financial position or results of operations.

8

NOTE 2 GOING CONCERN

The Company has not yet generated any revenue since inception to date and has sustained operating losses during the period ended September 30, 2018.

The Company had working capital of ($ 10,546) and an accumulated deficit of $11,107 as of September 30, 2018. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flow from operations to meet its obligations and/or obtaining additional financing from its members or other sources as may be required. The accompanying financial statements have been prepared assuming that the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to do so. The Company will attempt to raise capital to mitigate the risk, but there is substantial doubt raised by these factors regarding the Company’s ability to satisfy its liquidity needs for 12 months from the issuance of the financial statements. The Company has no commitments from any third party for the purchase of its equity.

The financial statements do not include adjustments to reflect the possible future effects of on the recoverability and classification of assets or amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

NOTE 3 STOCKHOLDERS’ EQUITY

As of September 30, 2018, the Company has 20,000,000 founders common stock held by two directors and officers for no consideration. The Company is authorized to issue 100,000,000 shares of common stock and 20,000,000 shares of preferred stock. As of September 30, 2018, 20,000,000 shares of the common stock and no preferred stock were issued and outstanding. The Company recorded a discount on the common stock equal to the par value of shares issued.

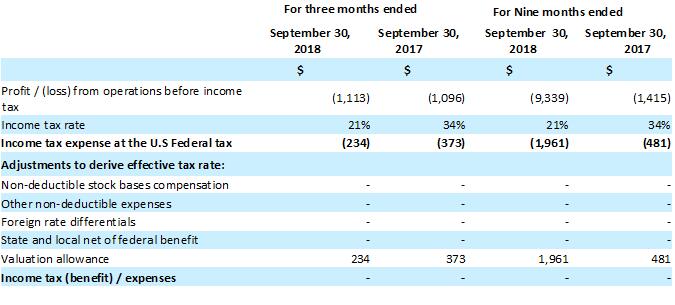

NOTE 4 INCOME TAXES

Reconciliation of the income tax expense / (benefit) computed at the U.S. Federal income tax rate to the Company’s reported income tax expense / (benefit) for the period ended September 30, 2018 and September 30, 2017 is as follows:

The ultimate realization of deferred tax assets depends primarily on the Company’s ability to generate sufficient timely future income of the appropriate character in the appropriate taxing jurisdiction.

At September 30, 2018 Company has no unrecognized tax benefits.

9

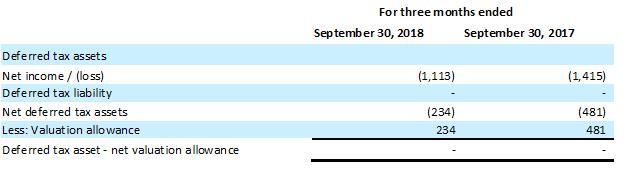

The significant components of deferred tax assets and liabilities are as follows:

On an annual basis, the Company has a net operating loss carryover of approximately $11,107 available to offset future income for income tax reporting purposes which will expire in various years through 2037, if not previously utilized. However, the Company’s ability to use the carryover net operating loss may be substantially limited or eliminated pursuant to Internal Revenue Code Section 382. As of September 30, 2018, there were no deferred taxes due to the uncertainty of the realization of net operating loss or carry forward prior to expiration.

The Company’s policy regarding income tax interest and penalties is to expense those items as general and administrative expense but to identify them for tax purposes. During the period January 1, 2017 to September 30, 2018, there was no income tax, or related interest and penalty items in the income statement, or liabilities on the balance sheet. The Company files income tax returns in the U.S. federal jurisdiction and Delaware state jurisdiction. We are not currently involved in any income tax examinations.

Impact of the Tax Cuts and Jobs Act

The tax cuts and Jobs Act (the “Tax Reform Act”) was enacted on December 22, 2017 and provides for significant changes to U.S. tax law. Among other provisions, the Tax Reform Act reduces the U.S. corporate income tax rate to 21%, effective in 2018. The Tax Reform Act also provides for a transition to a new territorial system of taxation and generally requires companies to include certain untaxed foreign earnings of non-U.S. subsidiaries into taxable income in 2017 (“Transition Tax”). Additionally, the Securities Exchange Commission staff has issued SAB 118, which allows the Company to record provisional amounts during a measurement period not to extend beyond one year of the enactment date. On December 22, 2017, Staff Accounting Bulletin No. 118 (“SAB 118”) was issued to address the application of U.S. GAAP in situations when a registrant does not have the necessary information available, prepared, or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the Act. Because the Company is still in the process of analyzing certain provisions of the Tax Act, the Company has determined that the adjustment to its deferred taxes and the Transition Tax are provisional amounts as permitted under SAB 118.

NOTE 5 RELATED PARTY TRANSACTIONS

The stockholders of the Company contributed $1,439 towards the operating expenses of the Company from inception to December 31, 2017. This amount has been recorded in additional paid in capital as their capital contribution to the Company. Further, as at September 30, 2018, an amount of $1,207 is payable to Franklin Ogele which was incurred by him on behalf of the Company. This will be reimbursed in due course.

10

NOTE 6 SUBSEQUENT EVENTS

Management has evaluated subsequent events, in accordance with FASB ASC Topic 855, “Subsequent Events”, through October 21, 2020, the date which the financial statements were available to be issued and there are no material subsequent events to report other than those described below:

On September 06, 2019 Franklin Ogele, acquired at $0.0001 par value, 1,000,000 shares of common stock of the Company from Chima E. Chima. As a result of the transaction, Franklin Ogele became the holder of all the issued and outstanding 20,000,000 shares of common stock of the Company.

On September 17, 2019 WSAC pursuant to certain Share Purchase and Merger Agreement, (the “Purchase and Merger Agreement”), acquired all the issued and outstanding shares of WSA Gold & Minerals, Inc., a Texas corporation (“WSA Gold”) and owner of certain mining properties, in a stock-for-stock exchange transaction and effected a merger with the Company, pursuant to which the Company is the surviving entity. Under the Purchase and Merger Agreement, WSAC shall issue Jimmy Ramirez 113,333,333 in exchange for 200,000 shares of WSA common stock and shall issue to Franklin Ogele 20,000,000 shares of common stock. This will result in 85% or 113,333,333 shares held by Jimmy Ramirez and 15% or 20,000,000 shares held by Franklin Ogele for a total of 133,333,333 issued and outstanding shares.

As a result of the transaction, on September 17, 2019 Franklin Ogele stepped down as President/CEO and Member of the Board of Directors of the Company effective September 17, 2019. Chima E. Chima also stepped down as Vice President, Secretary and Member of the Board of Directors of the Company effective September 17, 2019. Mr. Jimmy Ramirez was elected Member of the Board of Directors and appointed as President and CEO of the Company. Franklin Ogele was elected Member of the Board of Directors and appointed as Vice President and Secretary of the Company.

ITEM 2.MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Wall Street Acquisitions, Corporation was incorporated on December 2, 2016 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. Wall Street Acquisitions, Corporation ("WSAC" or the "Company") is a blank check company and qualifies as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act which became law in April 2012.

Since inception WSAC's operations to date of the period covered by this report have been limited to issuing shares of common stock to its original shareholders and filing a registration statement on Form 10 on February 24, 2017 with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 as amended to register its class of common stock.

WSAC has no operations nor does it currently engage in any business activities generating revenues. WSAC's principal business objective is to achieve a business combination with a target company.

A combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. In most instances, the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended.

No assurances can be given that WSAC will be successful in locating or negotiating with any target company.

The most likely target companies are those seeking the perceived benefits of a reporting corporation. Such perceived benefits may include facilitating or improving the terms on which additional equity financing may be sought, providing liquidity for incentive stock options or similar benefits to key employees, increasing the opportunity to use securities for acquisitions, providing liquidity for shareholders and other factors. Business opportunities may be available in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities difficult and complex.

The search for a target company will not be restricted to any specific kind of business entities but may acquire a venture which is in its preliminary or development stage, which is already in operation, or in essentially any stage of its business

11

life. It is impossible to predict at this time the status of any business in which the Company may become engaged, whether such business may need to seek additional capital, may desire to have its shares publicly traded, or may seek other perceived advantages which the Company may offer.

In implementing a structure for a particular business acquisition, the Company may become a party to a merger, consolidation, reorganization, joint venture, licensing agreement or other arrangement with another corporation or entity. On the consummation of a transaction, it is likely that the present management and shareholders of the Company will no longer be in control of the Company. In addition, it is likely that the officer and director of the Company will, as part of the terms of the business combination, resign and be replaced by one or more new officers and directors.

As of September 30, 2018, WSAC had not generated revenues and had no income or cash flows from operations since inception. During the period, WSAC had sustained net loss of $1,113 and had an accumulated deficit of $11,107.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of WSAC as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for the combination of that target company with WSAC.

Management will pay all expenses incurred by WSAC until a change in control is affected.

The president of WSAC is the president, director and shareholder of WSR LLC. WSR LLC assists companies in becoming public reporting companies and with introductions to the financial community.

ITEM 3. Quantitative and Qualitative Disclosures about Market Risk.

Information not required to be filed by Smaller reporting companies.

ITEM 4. Controls and Procedures.

Disclosures and Procedures

Pursuant to Rules adopted by the Securities and Exchange Commission, the Company carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures pursuant to Exchange Act Rules. This evaluation was done as of the end of the period covered by this report under the supervision and with the participation of the Company's principal executive officer (who is also the principal financial officer).

Based upon that evaluation, he believes that the Company's disclosure controls and procedures are effective in gathering, analyzing and disclosing information needed to ensure that the information required to be disclosed by the Company in its periodic reports is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Act is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

This Quarterly Report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this Quarterly Report.

12

Changes in Internal Controls

There was no change in the Company's internal control over financial reporting that was identified in connection with such evaluation that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

PART II -- OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

There are no legal proceedings against the Company and the Company is unaware of such proceedings contemplated against it.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the past years, the Company has issued 20,000,000 common shares pursuant to Section 4(2) of the Securities Act of 1933 at par as follows:

On September 30, 2018, the Company issued the following shares of its common stock:

Name Number of Shares

Franklin Ogele 19,000,000

Chima E. Chima 1,000,000

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

Not applicable.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

ITEM 5. OTHER INFORMATION

(a) Not applicable.

(b) Item 407(c) (3) of Regulation S-K:

During the quarter covered by this Report, there have not been any material changes to the procedures by which security holders may recommend nominees to the Board of Directors.

ITEM 6. EXHIBITS

(a) Exhibits

31. Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

32. Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

13

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

WALL STREET ACQUISITIONS, CORPORATION

By: /s/ Franklin Ogele, Esq.

President, Chief Financial Officer

Dated: October 21, 2020

14