Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WSFS FINANCIAL CORP | exhibit991earningsrele.htm |

| 8-K - 8-K - WSFS FINANCIAL CORP | wsfs-20201022.htm |

Exhibit 99.2 WSFS Financial Corporation 3Q 2020 Earnings Supplement1 October 22, 2020 1 3Q 2020 Earnings Release Supplement is for the purpose and use in conjunction with our Earnings Release furnished as Exhibit 99.1 to our Form 8-K on October 22, 2020 1

Forward Looking Statements & Non-GAAP Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including the uncertain effects of the COVID-19 pandemic and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail the Company's Form 10-K for the year ended December 31, 2019, Form 10-Q for the quarter ended March 31, 2020, Form 10-Q for the quarter ended June 30, 2020, and and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core earnings per share (“EPS”), core pre-provision net revenue (“PPNR”), PPNR, core PPNR to average assets ratio, PPNR to average assets ratio, core return on assets (“ROA”), core return on tangible common equity (“ROTCE”), ROTCE, core fee income and core fee income as a percentage of total core net revenue. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. 2

Table of Contents Financial Highlights Page 4 Loan & Deposit Growth Page 5 Core Fee Income Trends Page 6 Credit Risk Management CECL Page 7 Loan Modifications Page 8 Selected Portfolios Page 9 NIM Trends & Outlook Page 10 Core PPNR Trends & Outlook Page 11 Capital Position Page 12 Appendix: Reconciliation of Non-GAAP Financial Information Page 13 3

3Q 2020 Financial Highlights Solid operating performance with PPNR1 at 1.98% of average assets reflecting diversified business model Significant ACL reserve, strong capital levels, and the approved resumption of share repurchases in 4Q 2020 3Q 2020 • Core PPNR1 of $68.0 million increased $4.4 million, or 7%, from 2Q 2020 reflecting positive core operating leverage $ in millions (except per share amounts) Core • Core fee income1 increased $5.3 million, or 13%, compared to 2Q 2020, despite a $3.2 million negative EPS1 $1.00 impact due to Durbin Amendment (effective July 2020). Solid growth across several areas, including PPNR1 $68.0 mortgage, trust services, non-interchange related core banking fees, and Cash Connect® 1 PPNR % 1.98% • Modest provision expense of $2.7 million while maintaining a strong allowance for credit losses (“ACL”) ROA1 1.48% coverage ratio of 2.74% excluding Paycheck Protection Program (“PPP”) loans and 3.22% including estimated credit mark on acquired loans. Short-term loan deferrals reduced to 3% of total portfolio at October 15, 2020 ROTCE1 16.47% NIM 3.66% • Loans grew $95.5 million, or 5% on an annualized basis during the quarter and $254 million, or 4% year-over- year, excluding PPP loans, ACL, and purposeful run-off portfolios Fee Income/Total Revenue1,2 28.8% Customer funding levels remain elevated and increased $364 million, or 13% on an annualized basis, during Efficiency Ratio1 57.1% • the quarter and $1.9 billion, or 20%, compared to 3Q 2019 primarily due to PPP loans and the current ACL Coverage Ratio (ex. PPP) 2.74% economic environment Loan to Deposit Ratio 83% • Board approved the resumption of share repurchases in 4Q 2020 under current authorization of 15% of Common Equity Tier 1 Capital 13.24% outstanding shares and a $0.12 quarterly cash dividend to be paid in November 2020 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 4 2 Tax-equivalent

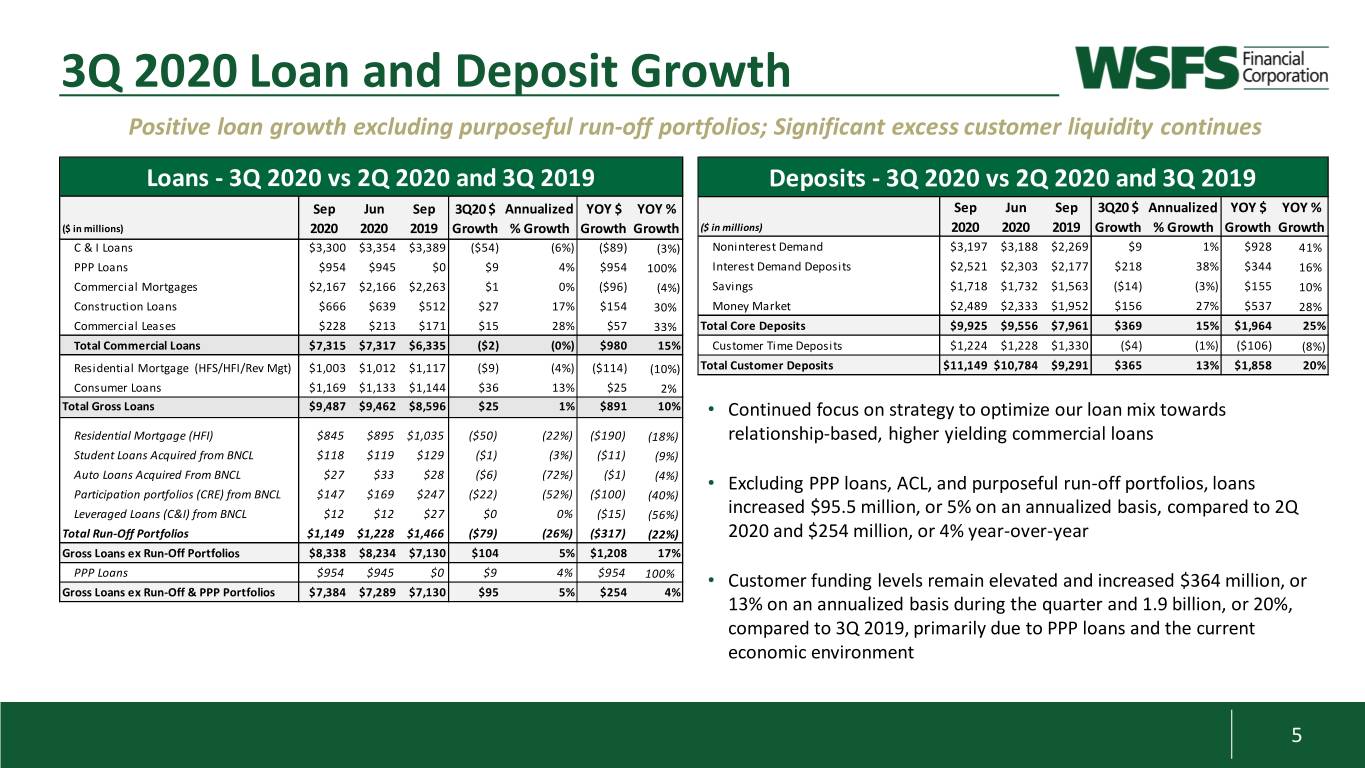

3Q 2020 Loan and Deposit Growth Positive loan growth excluding purposeful run-off portfolios; Significant excess customer liquidity continues Loans - 3Q 2020 vs 2Q 2020 and 3Q 2019 Deposits - 3Q 2020 vs 2Q 2020 and 3Q 2019 Sep Jun Sep 3Q20 $ Annualized YOY $ YOY % Sep Jun Sep 3Q20 $ Annualized YOY $ YOY % ($ in millions) 2020 2020 2019 Growth % Growth Growth Growth ($ in millions) 2020 2020 2019 Growth % Growth Growth Growth C & I Loans $3,300 $3,354 $3,389 ($54) (6%) ($89) (3%) Noninterest Demand $3,197 $3,188 $2,269 $9 1% $928 41% PPP Loans $954 $945 $0 $9 4% $954 100% Interest Demand Deposits $2,521 $2,303 $2,177 $218 38% $344 16% Commercial Mortgages $2,167 $2,166 $2,263 $1 0% ($96) (4%) Savings $1,718 $1,732 $1,563 ($14) (3%) $155 10% Construction Loans $666 $639 $512 $27 17% $154 30% Money Market $2,489 $2,333 $1,952 $156 27% $537 28% Commercial Leases $228 $213 $171 $15 28% $57 33% Total Core Deposits $9,925 $9,556 $7,961 $369 15% $1,964 25% Total Commercial Loans $7,315 $7,317 $6,335 ($2) (0%) $980 15% Customer Time Deposits $1,224 $1,228 $1,330 ($4) (1%) ($106) (8%) Residential Mortgage (HFS/HFI/Rev Mgt) $1,003 $1,012 $1,117 ($9) (4%) ($114) (10%) Total Customer Deposits $11,149 $10,784 $9,291 $365 13% $1,858 20% Consumer Loans $1,169 $1,133 $1,144 $36 13% $25 2% Total Gross Loans $9,487 $9,462 $8,596 $25 1% $891 10% • Continued focus on strategy to optimize our loan mix towards Residential Mortgage (HFI) $845 $895 $1,035 ($50) (22%) ($190) (18%) relationship-based, higher yielding commercial loans Student Loans Acquired from BNCL $118 $119 $129 ($1) (3%) ($11) (9%) Auto Loans Acquired From BNCL $27 $33 $28 ($6) (72%) ($1) (4%) • Excluding PPP loans, ACL, and purposeful run-off portfolios, loans Participation portfolios (CRE) from BNCL $147 $169 $247 ($22) (52%) ($100) (40%) Leveraged Loans (C&I) from BNCL $12 $12 $27 $0 0% ($15) (56%) increased $95.5 million, or 5% on an annualized basis, compared to 2Q Total Run-Off Portfolios $1,149 $1,228 $1,466 ($79) (26%) ($317) (22%) 2020 and $254 million, or 4% year-over-year Gross Loans ex Run-Off Portfolios $8,338 $8,234 $7,130 $104 5% $1,208 17% PPP Loans $954 $945 $0 $9 4% $954 100% • Customer funding levels remain elevated and increased $364 million, or Gross Loans ex Run-Off & PPP Portfolios $7,384 $7,289 $7,130 $95 5% $254 4% 13% on an annualized basis during the quarter and 1.9 billion, or 20%, compared to 3Q 2019, primarily due to PPP loans and the current economic environment 5

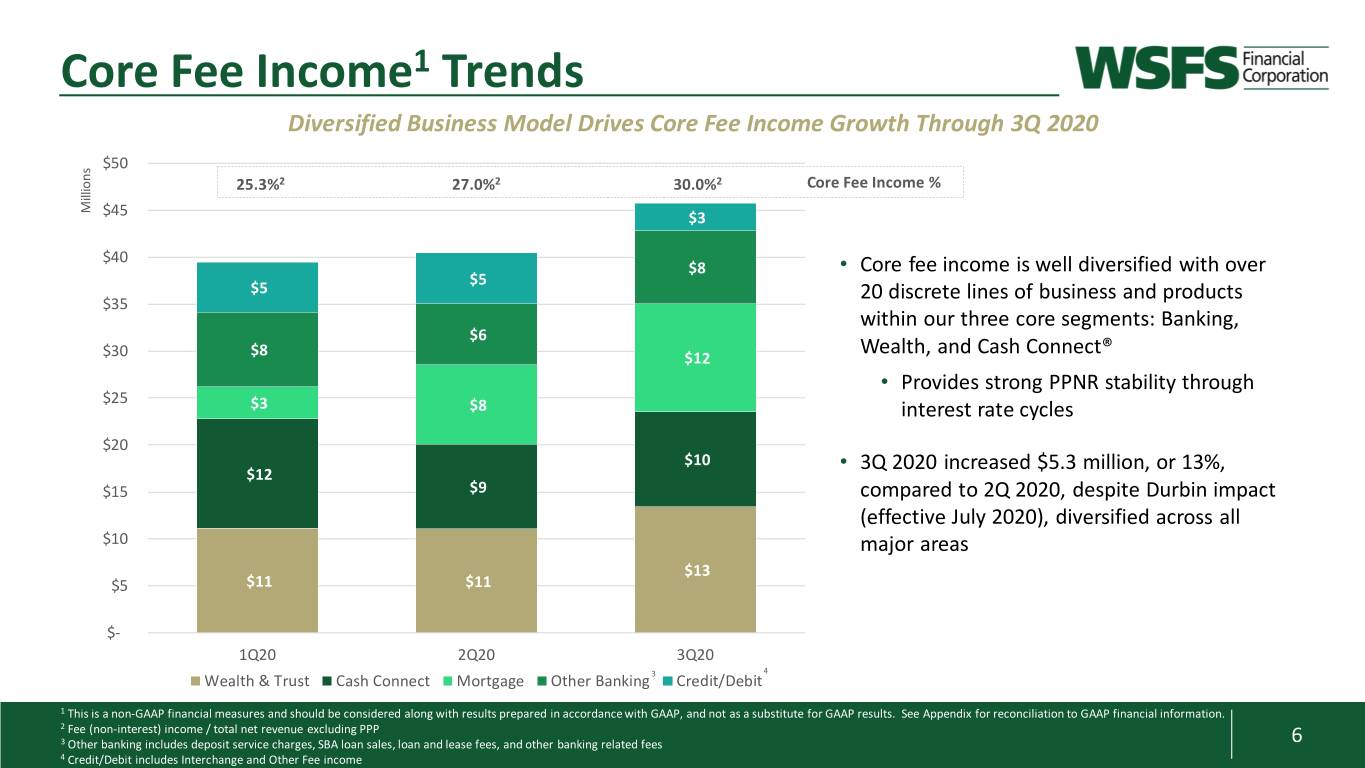

Core Fee Income1 Trends Diversified Business Model Drives Core Fee Income Growth Through 3Q 2020 $50 25.3%2 27.0%2 30.0%2 Core Fee Income % Millions $45 $3 $40 $8 • Core fee income is well diversified with over $5 $5 20 discrete lines of business and products $35 within our three core segments: Banking, $6 Wealth, and Cash Connect® $30 $8 $12 • Provides strong PPNR stability through $25 $3 $8 interest rate cycles $20 $10 • 3Q 2020 increased $5.3 million, or 13%, $12 $15 $9 compared to 2Q 2020, despite Durbin impact (effective July 2020), diversified across all $10 major areas $13 $5 $11 $11 $- 1Q20 2Q20 3Q20 4 Wealth & Trust Cash Connect Mortgage Other Banking 3 Credit/Debit 1 This is a non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Fee (non-interest) income / total net revenue excluding PPP 3 Other banking includes deposit service charges, SBA loan sales, loan and lease fees, and other banking related fees 6 4 Credit/Debit includes Interchange and Other Fee income

Credit Risk Management - CECL 2 F/Y GDP forecast of (3.7%) in 2020 and 3.7% in 2021 Considerations & Components for 3Q 2020 ACL Y/E Unemployment forecast of 8.8% in 2020 and 6.6% in 20212 GDP Growth by Quarter Unemployment by Quarter • Coverage ratio of 2.74% excluding PPP loans and 3.22% including 35% 15% estimated remaining credit mark on the acquired loan portfolio 25% 13% • Modest reserve build of $0.5 million in 3Q 2020 driven by: 15% 11% 5% • Portfolio migration largely consistent with expectations; -5% 9% remaining targeted portfolio reviews completed in 3Q 2020 -15% 7% • Core loan growth offset by intentional portfolio run-off and net -25% charge offs 5% -35% • No significant economic forecast changes -45% 3% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Components of 3Q 2020 ACL Economic 2Q Forecast 3Q Forecast 2Q Forecast 3Q Forecast $300 Forecast Impact (in millions) ACL by Segment $250 $232 $233 January 1, 2020 March 31, 2020 June 30, 2020 September 30, 2020 $200 -$2 $3 ($ millions) $ % $ % $ % $ % C&I1 $40.3 1.99% $62.3 2.96% $133.1 6.81% $137.8 7.24% $150 Construction1 $4.6 0.78% $5.2 0.82% $10.1 1.59% $10.2 1.54% $100 CRE Investor $9.1 0.41% $26.6 1.19% $38.4 1.77% $34.3 1.58% Owner Occupied $3.2 0.24% $9.4 0.72% $9.0 0.67% $10.4 0.77% $50 Leases $2.0 0.77% $3.6 1.34% $11.1 5.20% $10.7 4.70% Mortgage $8.9 0.90% $11.6 1.22% $9.2 1.03% $8.4 1.00% $0 HELOC & HEIL $9.4 1.27% $12.6 1.69% $10.8 1.43% $11.2 1.41% 6/30/2020 NCO Net Growth/Other 9/30/2020 Installment - Other $3.8 3.82% $4.4 5.17% $6.9 6.58% $5.6 5.55% Other $1.9 0.33% $3.4 0.81% $3.6 0.90% $4.1 1.04% 2.73% 2.74% TOTAL $83.2 0.96% $139.1 1.60% $232.2 2.73% $232.7 2.74% Coverage Ratio (ex PPP) 1 Hotel loan balances are included in the C&I and Construction segments 2 Source: Oxford Economics as of September 2020 7

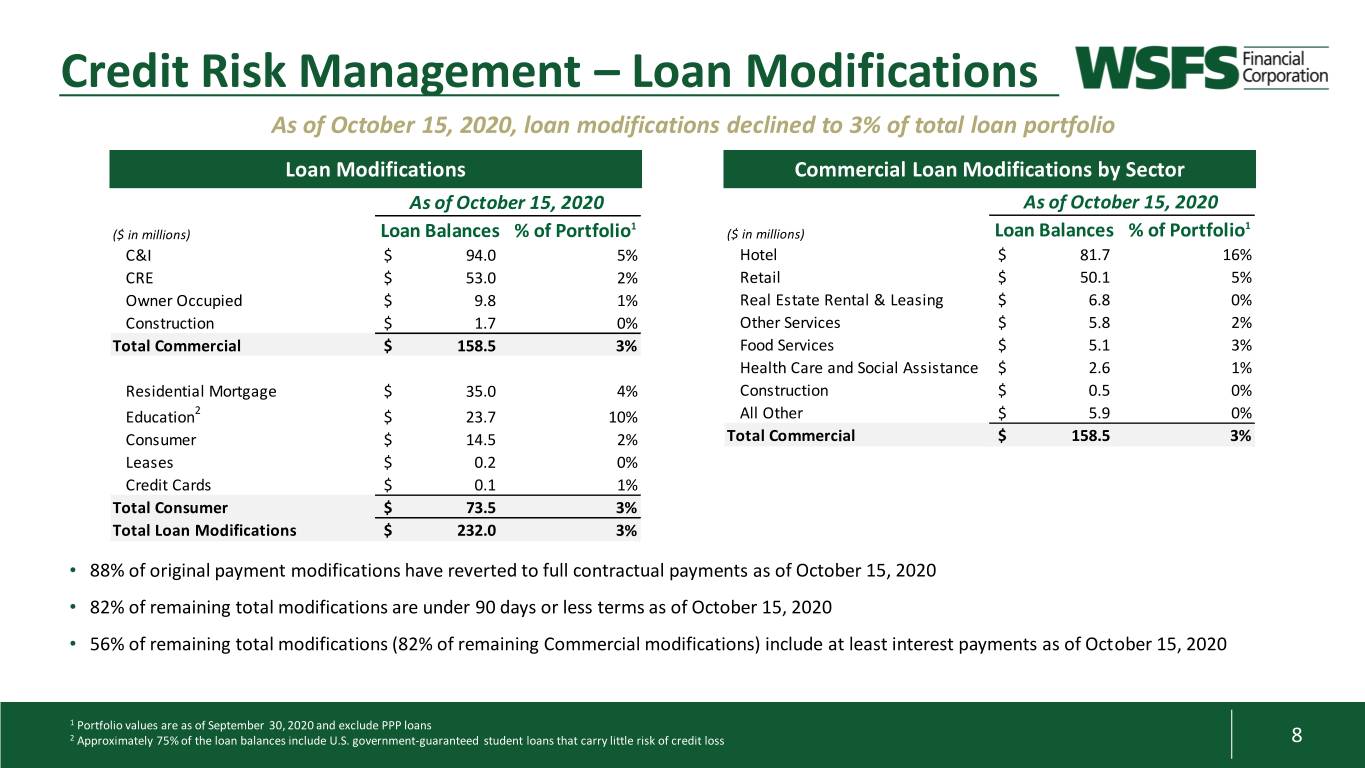

Credit Risk Management – Loan Modifications As of October 15, 2020, loan modifications declined to 3% of total loan portfolio Loan Modifications Commercial Loan Modifications by Sector As of October 15, 2020 As of October 15, 2020 1 1 ($ in millions) Loan Balances % of Portfolio ($ in millions) Loan Balances % of Portfolio C&I $ 94.0 5% Hotel $ 81.7 16% CRE $ 53.0 2% Retail $ 50.1 5% Owner Occupied $ 9.8 1% Real Estate Rental & Leasing $ 6.8 0% Construction $ 1.7 0% Other Services $ 5.8 2% Total Commercial $ 158.5 3% Food Services $ 5.1 3% Health Care and Social Assistance $ 2.6 1% Residential Mortgage $ 35.0 4% Construction $ 0.5 0% Education2 $ 23.7 3 10% All Other $ 5.9 0% Consumer $ 14.5 2% Total Commercial $ 158.5 3% Leases $ 0.2 0% Credit Cards $ 0.1 1% Total Consumer $ 73.5 3% Total Loan Modifications $ 232.0 3% • 88% of original payment modifications have reverted to full contractual payments as of October 15, 2020 • 82% of remaining total modifications are under 90 days or less terms as of October 15, 2020 • 56% of remaining total modifications (82% of remaining Commercial modifications) include at least interest payments as of October 15, 2020 1 Portfolio values are as of September 30, 2020 and exclude PPP loans 2 Approximately 75% of the loan balances include U.S. government-guaranteed student loans that carry little risk of credit loss 8

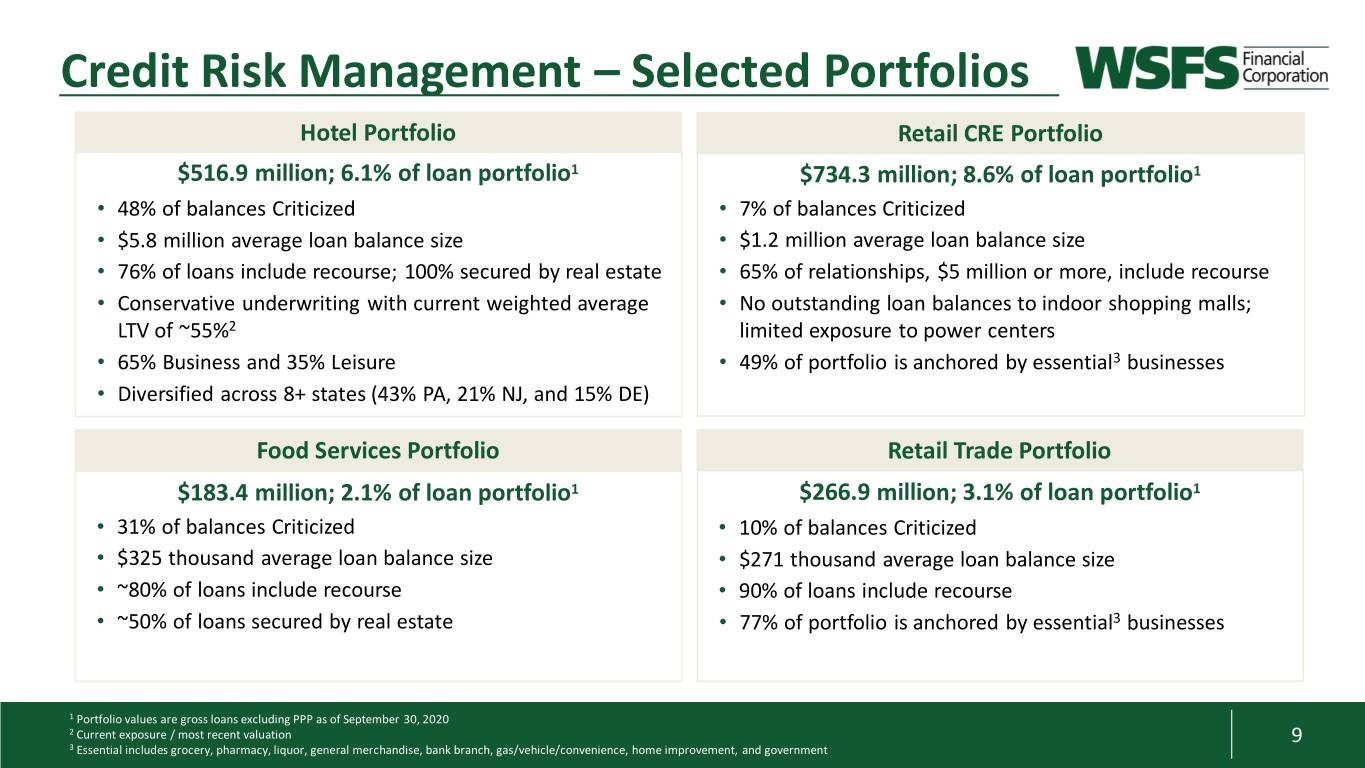

Credit Risk Management – Selected Portfolios Hotel Portfolio Retail CRE Portfolio $516.9 million; 6.1% of loan portfolio1 $734.3 million; 8.6% of loan portfolio1 • 48% of balances Criticized • 7% of balances Criticized • $5.8 million average loan balance size • $1.2 million average loan balance size • 76% of loans include recourse; 100% secured by real estate • 65% of relationships, $5 million or more, include recourse • Conservative underwriting with current weighted average • No outstanding loan balances to indoor shopping malls; LTV of ~55%2 limited exposure to power centers • 65% Business and 35% Leisure • 49% of portfolio is anchored by essential3 businesses • Diversified across 8+ states (43% PA, 21% NJ, and 15% DE) 3 Food Services Portfolio Retail Trade Portfolio $183.4 million; 2.1% of loan portfolio1 $266.9 million; 3.1% of loan portfolio1 • 31% of balances Criticized • 10% of balances Criticized • $325 thousand average loan balance size • $271 thousand average loan balance size • ~80% of loans include recourse • 90% of loans include recourse • ~50% of loans secured by real estate • 77% of portfolio is anchored by essential3 businesses 1 Portfolio values are gross loans excluding PPP as of September 30, 2020 2 Current exposure / most recent valuation 9 3 Essential includes grocery, pharmacy, liquor, general merchandise, bank branch, gas/vehicle/convenience, home improvement, and government

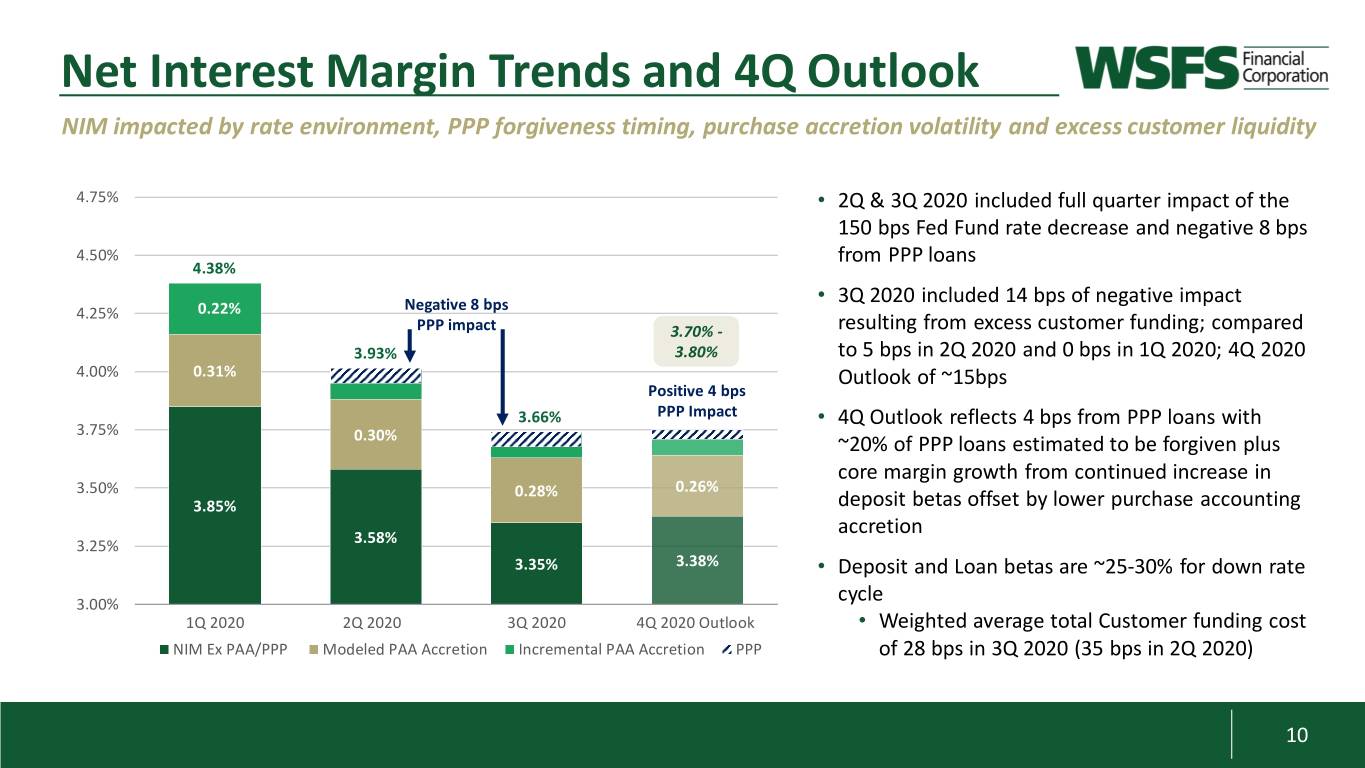

Net Interest Margin Trends and 4Q Outlook NIM impacted by rate environment, PPP forgiveness timing, purchase accretion volatility and excess customer liquidity 4.75% • 2Q & 3Q 2020 included full quarter impact of the 150 bps Fed Fund rate decrease and negative 8 bps 4.50% from PPP loans 4.38% 0. • 3Q 2020 included 14 bps of negative impact 4.25% 0.22% Negative 8 bps PPP impact 3.70% - resulting from excess customer funding; compared 3.93% 3.80% to 5 bps in 2Q 2020 and 0 bps in 1Q 2020; 4Q 2020 4.00% 0.31% Outlook of ~15bps Positive 4 bps 3.66% PPP Impact • 4Q Outlook reflects 4 bps from PPP loans with 3.75% 0.30% ~20% of PPP loans estimated to be forgiven plus core margin growth from continued increase in 3.50% 0.28% 0.26% 3.85% deposit betas offset by lower purchase accounting accretion 3.25% 3.58% 3.35% 3.38% • Deposit and Loan betas are ~25-30% for down rate 3.00% cycle 1Q 2020 2Q 2020 3Q 2020 4Q 2020 Outlook • Weighted average total Customer funding cost NIM Ex PAA/PPP Modeled PAA Accretion Incremental PAA Accretion PPP of 28 bps in 3Q 2020 (35 bps in 2Q 2020) 10

Core PPNR1 Trends and 4Q 2020 Outlook Solid Core PPNR Results Despite Challenging Rate Environment $140 2.50% 2.36% • 4Q 2020 Outlook assumes continued gradual Millions 2.36% $120 1.96% 1.98% reopening of the economy, and PPP net income 1.80% - 2.05% 2.00% growth from ~20% of PPP loans forgiven during 1.98% 1.94% $100 the quarter 1.72% - 1.87% 1.50% $80 • Excluding PPP loans, core PPNR and core PPNR as $5.9 1 $3.0 $7 - $10 a percentage of average assets are expected to $60 decline in 4Q 2020 due primarily to the following: 1.00% • Lower seasonal mortgage revenue and $40 expected decline in refinancing volume $71.5 $60.5 $62.0 $55 - $60 0.50% • Lower incremental purchase loan accretion $20 • Modest increase in expenses due to franchise investments $- 0.00% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1 1 1 PPNR - Core (ex PPP) PPP PPNR % Assets (ex PPP) PPNR % Assets 1 These are non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 11

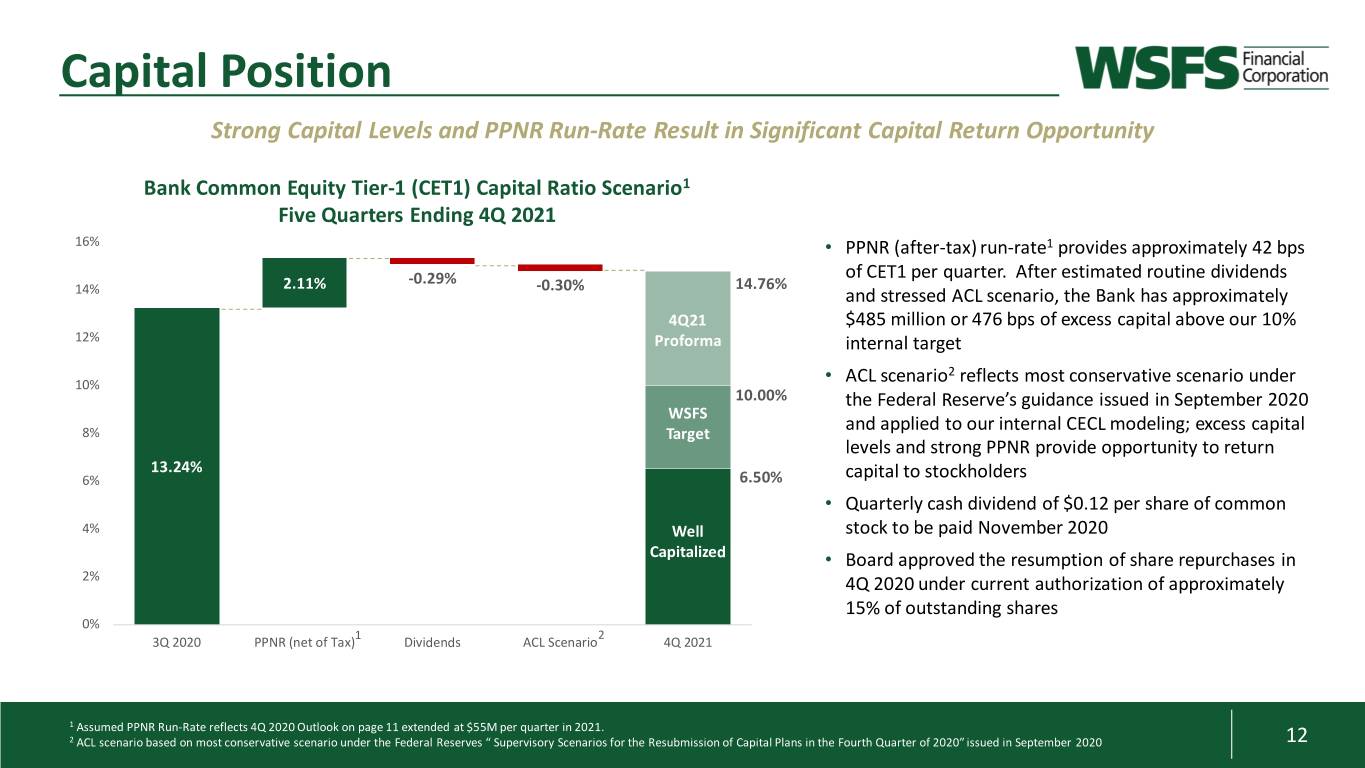

Capital Position Strong Capital Levels and PPNR Run-Rate Result in Significant Capital Return Opportunity1 Bank Common Equity Tier-1 (CET1) Capital Ratio Scenario1 Five Quarters Ending 4Q 2021 16% • PPNR (after-tax) run-rate1 provides approximately 42 bps of CET1 per quarter. After estimated routine dividends 2.11% -0.29% -0.30% 14.76% 14% and stressed ACL scenario, the Bank has approximately 4Q21 $485 million or 476 bps of excess capital above our 10% 12% Proforma internal target 2 10% • ACL scenario reflects most conservative scenario under 10.00% the Federal Reserve’s guidance issued in September 2020 WSFS and applied to our internal CECL modeling; excess capital 8% Target levels and strong PPNR provide opportunity to return 13.24% 6% 6.50% capital to stockholders • Quarterly cash dividend of $0.12 per share of common 4% Well stock to be paid November 2020 Capitalized • Board approved the resumption of share repurchases in 2% 4Q 2020 under current authorization of approximately 15% of outstanding shares 0% 1 2 3Q 2020 PPNR (net of Tax) Dividends ACL Scenario 4Q 2021 1 Assumed PPNR Run-Rate reflects 4Q 2020 Outlook on page 11 extended at $55M per quarter in 2021. 2 ACL scenario based on most conservative scenario under the Federal Reserves “ Supervisory Scenarios for the Resubmission of Capital Plans in the Fourth Quarter of 2020” issued in September 2020 12

Appendix: Non-GAAP Financial Information 13

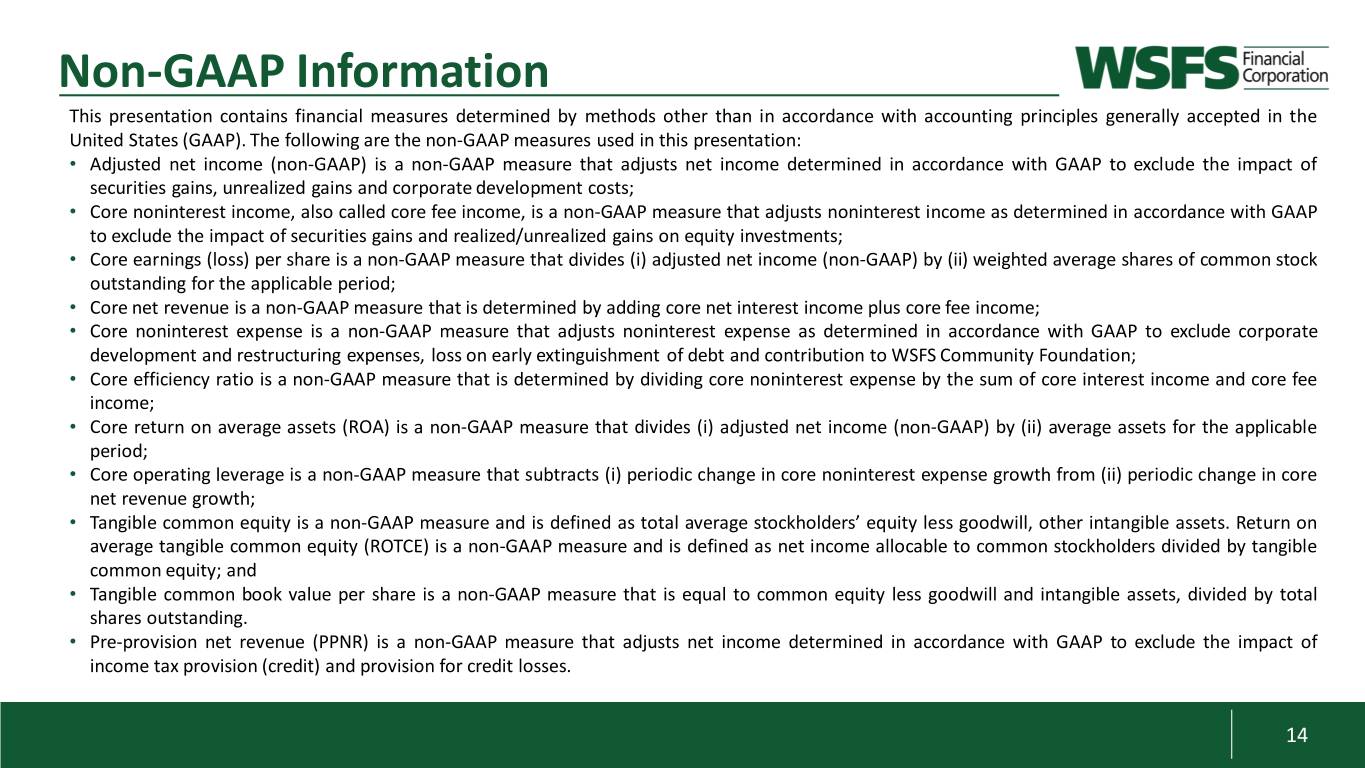

Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). The following are the non-GAAP measures used in this presentation: • Adjusted net income (non-GAAP) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains, unrealized gains and corporate development costs; • Core noninterest income, also called core fee income, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of securities gains and realized/unrealized gains on equity investments; • Core earnings (loss) per share is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) by (ii) weighted average shares of common stock outstanding for the applicable period; • Core net revenue is a non-GAAP measure that is determined by adding core net interest income plus core fee income; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude corporate development and restructuring expenses, loss on early extinguishment of debt and contribution to WSFS Community Foundation; • Core efficiency ratio is a non-GAAP measure that is determined by dividing core noninterest expense by the sum of core interest income and core fee income; • Core return on average assets (ROA) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) by (ii) average assets for the applicable period; • Core operating leverage is a non-GAAP measure that subtracts (i) periodic change in core noninterest expense growth from (ii) periodic change in core net revenue growth; • Tangible common equity is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other intangible assets. Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; and • Tangible common book value per share is a non-GAAP measure that is equal to common equity less goodwill and intangible assets, divided by total shares outstanding. • Pre-provision net revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of income tax provision (credit) and provision for credit losses. 14

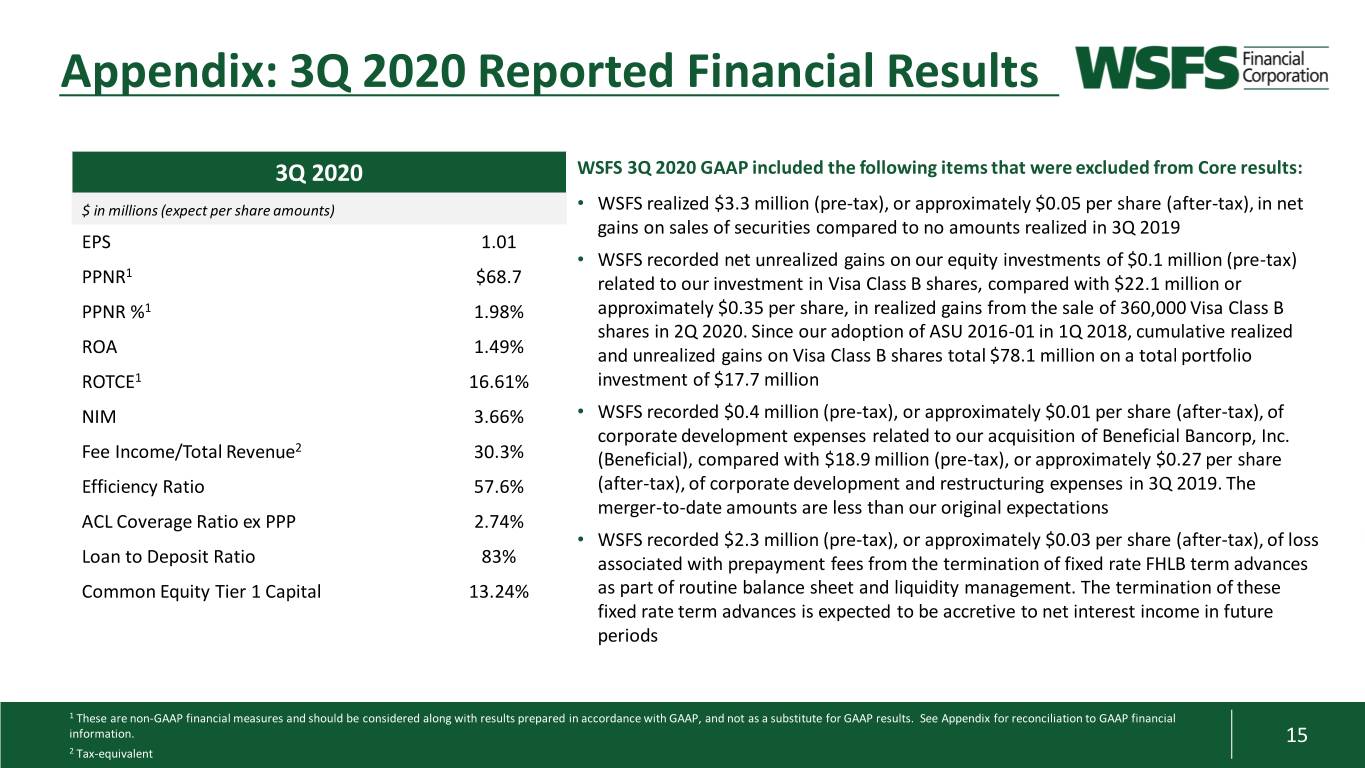

Appendix: 3Q 2020 Reported Financial Results 3Q 2020 WSFS 3Q 2020 GAAP included the following items that were excluded from Core results: $ in millions (expect per share amounts) • WSFS realized $3.3 million (pre-tax), or approximately $0.05 per share (after-tax), in net gains on sales of securities compared to no amounts realized in 3Q 2019 EPS 1.01 • WSFS recorded net unrealized gains on our equity investments of $0.1 million (pre-tax) 1 PPNR $68.7 related to our investment in Visa Class B shares, compared with $22.1 million or PPNR %1 1.98% approximately $0.35 per share, in realized gains from the sale of 360,000 Visa Class B shares in 2Q 2020. Since our adoption of ASU 2016-01 in 1Q 2018, cumulative realized ROA 1.49% and unrealized gains on Visa Class B shares total $78.1 million on a total portfolio ROTCE1 16.61% investment of $17.7 million NIM 3.66% • WSFS recorded $0.4 million (pre-tax), or approximately $0.01 per share (after-tax), of corporate development expenses related to our acquisition of Beneficial Bancorp, Inc. 2 Fee Income/Total Revenue 30.3% (Beneficial), compared with $18.9 million (pre-tax), or approximately $0.27 per share Efficiency Ratio 57.6% (after-tax), of corporate development and restructuring expenses in 3Q 2019. The merger-to-date amounts are less than our original expectations ACL Coverage Ratio ex PPP 2.74% • WSFS recorded $2.3 million (pre-tax), or approximately $0.03 per share (after-tax), of loss Loan to Deposit Ratio 83% associated with prepayment fees from the termination of fixed rate FHLB term advances Common Equity Tier 1 Capital 13.24% as part of routine balance sheet and liquidity management. The termination of these fixed rate term advances is expected to be accretive to net interest income in future periods 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 15 2 Tax-equivalent

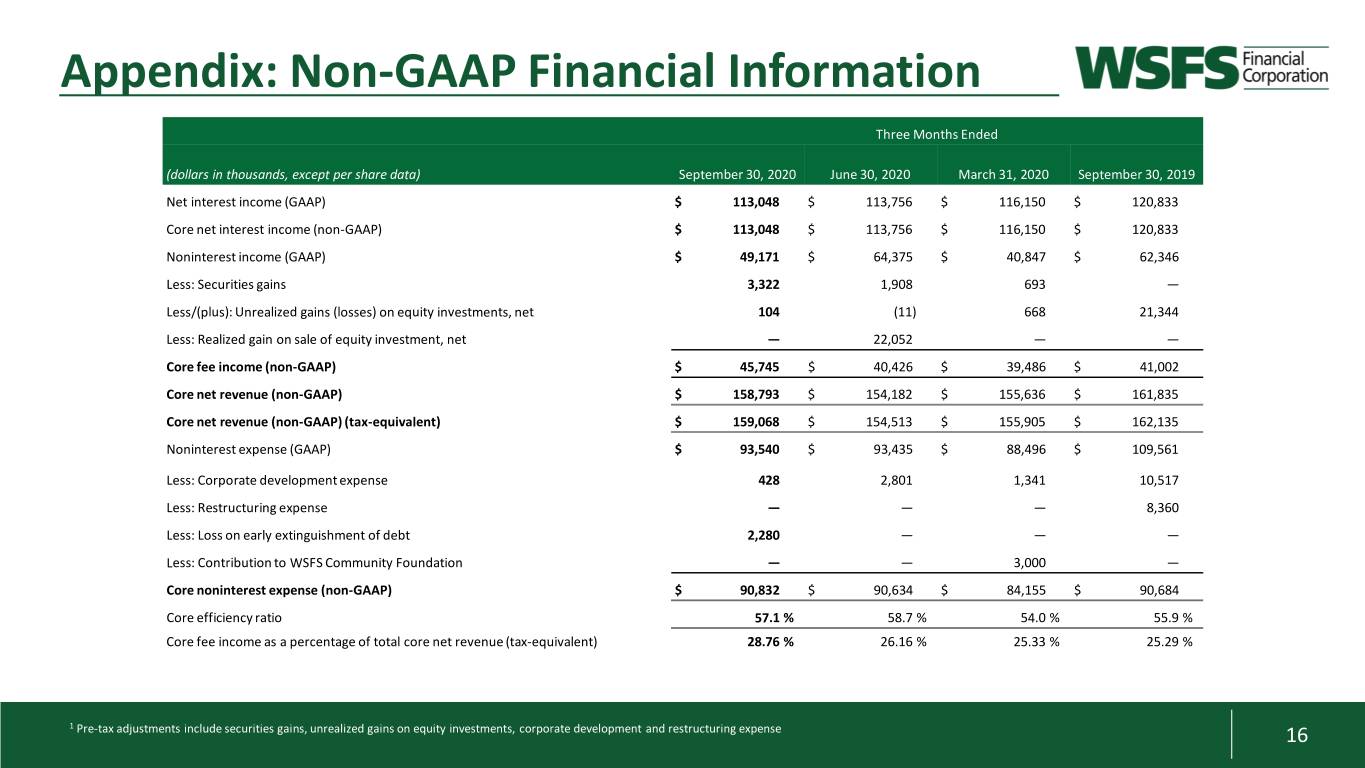

Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands, except per share data) September 30, 2020 June 30, 2020 March 31, 2020 September 30, 2019 Net interest income (GAAP) $ 113,048 $ 113,756 $ 116,150 $ 120,833 Core net interest income (non-GAAP) $ 113,048 $ 113,756 $ 116,150 $ 120,833 Noninterest income (GAAP) $ 49,171 $ 64,375 $ 40,847 $ 62,346 Less: Securities gains 3,322 1,908 693 — Less/(plus): Unrealized gains (losses) on equity investments, net 104 (11) 668 21,344 Less: Realized gain on sale of equity investment, net — 22,052 — — Core fee income (non-GAAP) $ 45,745 $ 40,426 $ 39,486 $ 41,002 Core net revenue (non-GAAP) $ 158,793 $ 154,182 $ 155,636 $ 161,835 Core net revenue (non-GAAP) (tax-equivalent) $ 159,068 $ 154,513 $ 155,905 $ 162,135 Noninterest expense (GAAP) $ 93,540 $ 93,435 $ 88,496 $ 109,561 Less: Corporate developmentexpense 428 2,801 1,341 10,517 Less: Restructuring expense — — — 8,360 Less: Loss on early extinguishment of debt 2,280 — — — Less: Contribution to WSFS Community Foundation — — 3,000 — Core noninterest expense (non-GAAP) $ 90,832 $ 90,634 $ 84,155 $ 90,684 Core efficiency ratio 57.1 % 58.7 % 54.0 % 55.9 % Core fee income as a percentage of total core net revenue (tax-equivalent) 28.76 % 26.16 % 25.33 % 25.29 % 1 Pre-tax adjustments include securities gains, unrealized gains on equity investments, corporate development and restructuring expense 16

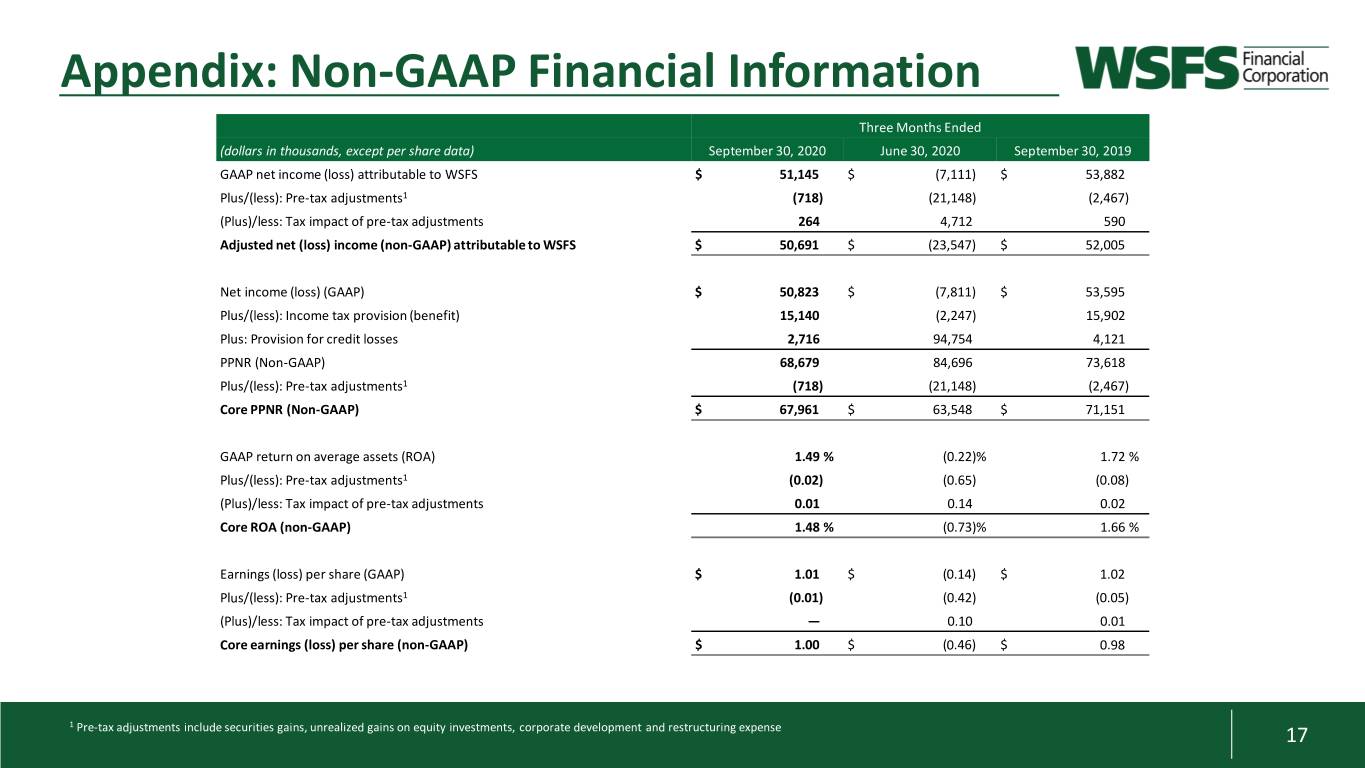

Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands, except per share data) September 30, 2020 June 30, 2020 September 30, 2019 GAAP net income (loss) attributable to WSFS $ 51,145 $ (7,111) $ 53,882 Plus/(less): Pre-tax adjustments1 (718) (21,148) (2,467) (Plus)/less: Tax impact of pre-tax adjustments 264 4,712 590 Adjusted net (loss) income (non-GAAP) attributable to WSFS $ 50,691 $ (23,547) $ 52,005 Net income (loss) (GAAP) $ 50,823 $ (7,811) $ 53,595 Plus/(less): Income tax provision (benefit) 15,140 (2,247) 15,902 Plus: Provision for credit losses 2,716 94,754 4,121 PPNR (Non-GAAP) 68,679 84,696 73,618 Plus/(less): Pre-tax adjustments1 (718) (21,148) (2,467) Core PPNR (Non-GAAP) $ 67,961 $ 63,548 $ 71,151 GAAP return on average assets (ROA) 1.49 % (0.22)% 1.72 % Plus/(less): Pre-tax adjustments1 (0.02) (0.65) (0.08) (Plus)/less: Tax impact of pre-tax adjustments 0.01 0.14 0.02 Core ROA (non-GAAP) 1.48 % (0.73)% 1.66 % Earnings (loss) per share (GAAP) $ 1.01 $ (0.14) $ 1.02 Plus/(less): Pre-tax adjustments1 (0.01) (0.42) (0.05) (Plus)/less: Tax impact of pre-tax adjustments — 0.10 0.01 Core earnings (loss) per share (non-GAAP) $ 1.00 $ (0.46) $ 0.98 1 Pre-tax adjustments include securities gains, unrealized gains on equity investments, corporate development and restructuring expense 17

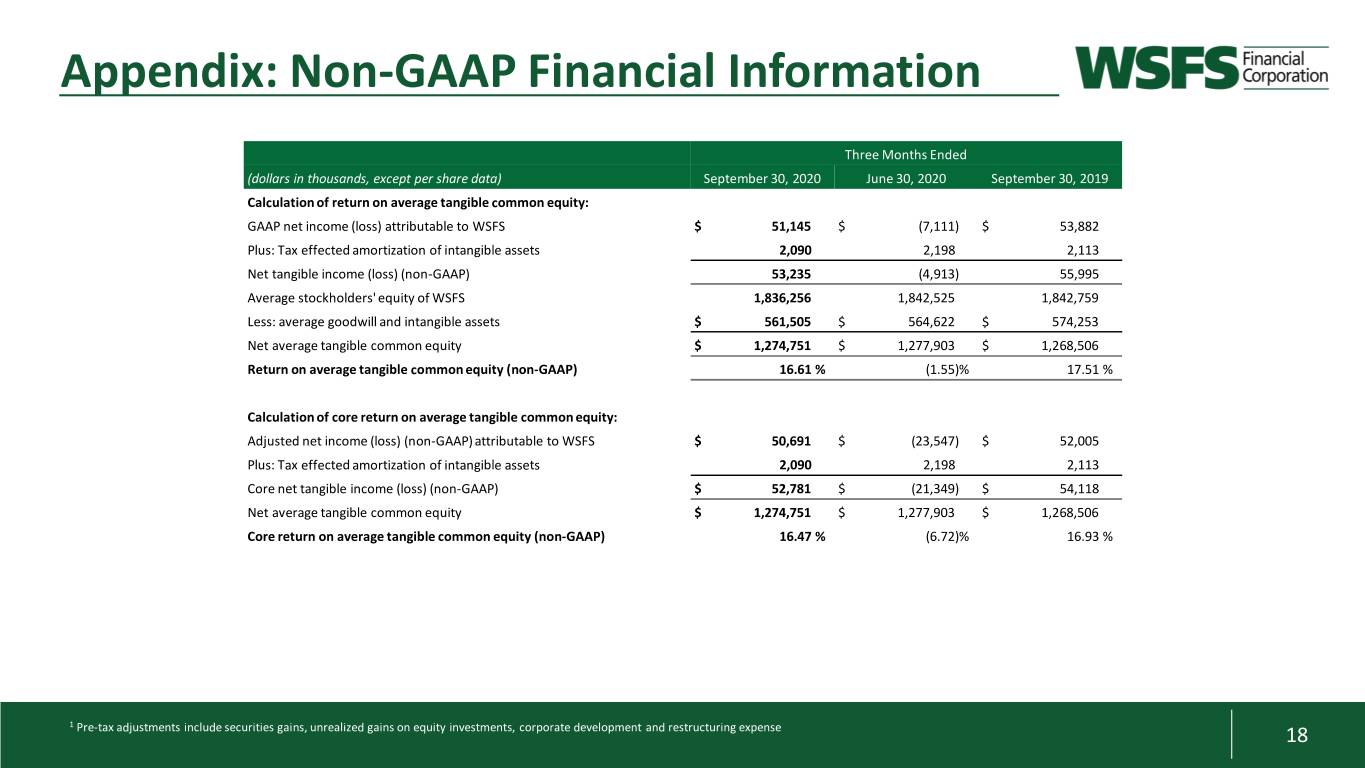

Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands, except per share data) September 30, 2020 June 30, 2020 September 30, 2019 Calculation of return on average tangible common equity: GAAP net income (loss) attributable to WSFS $ 51,145 $ (7,111) $ 53,882 Plus: Tax effected amortization of intangible assets 2,090 2,198 2,113 Net tangible income (loss) (non-GAAP) 53,235 (4,913) 55,995 Average stockholders' equity of WSFS 1,836,256 1,842,525 1,842,759 Less: average goodwill and intangible assets $ 561,505 $ 564,622 $ 574,253 Net average tangible common equity $ 1,274,751 $ 1,277,903 $ 1,268,506 Return on average tangible common equity (non-GAAP) 16.61 % (1.55)% 17.51 % Calculation of core return on average tangible common equity: Adjusted net income (loss) (non-GAAP) attributable to WSFS $ 50,691 $ (23,547) $ 52,005 Plus: Tax effected amortization of intangible assets 2,090 2,198 2,113 Core net tangible income (loss) (non-GAAP) $ 52,781 $ (21,349) $ 54,118 Net average tangible common equity $ 1,274,751 $ 1,277,903 $ 1,268,506 Core return on average tangible common equity (non-GAAP) 16.47 % (6.72)% 16.93 % 1 Pre-tax adjustments include securities gains, unrealized gains on equity investments, corporate development and restructuring expense 18

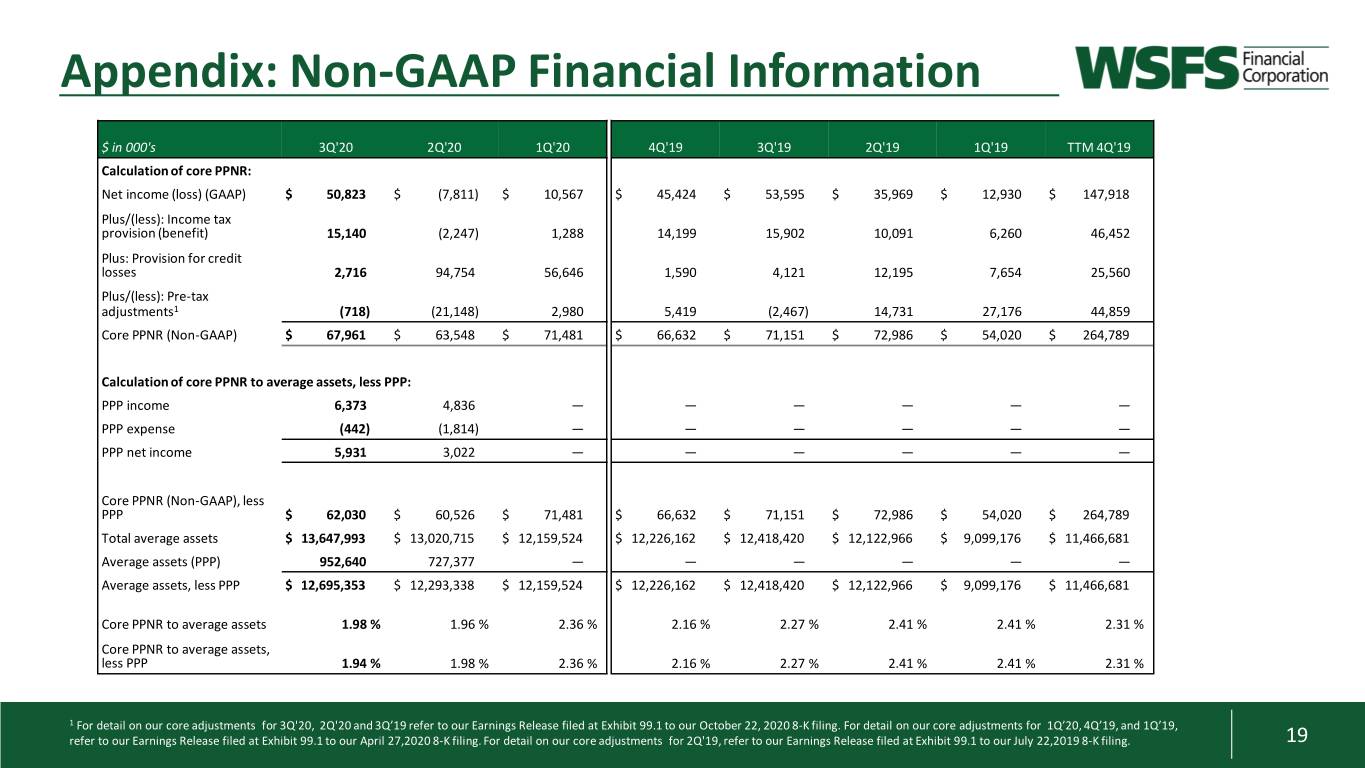

Appendix: Non-GAAP Financial Information $ in 000's 3Q'20 2Q'20 1Q'20 4Q'19 3Q'19 2Q'19 1Q'19 TTM 4Q'19 Calculation of core PPNR: Net income (loss) (GAAP) $ 50,823 $ (7,811) $ 10,567 $ 45,424 $ 53,595 $ 35,969 $ 12,930 $ 147,918 Plus/(less): Income tax provision (benefit) 15,140 (2,247) 1,288 14,199 15,902 10,091 6,260 46,452 Plus: Provision for credit losses 2,716 94,754 56,646 1,590 4,121 12,195 7,654 25,560 Plus/(less): Pre-tax adjustments1 (718) (21,148) 2,980 5,419 (2,467) 14,731 27,176 44,859 Core PPNR (Non-GAAP) $ 67,961 $ 63,548 $ 71,481 $ 66,632 $ 71,151 $ 72,986 $ 54,020 $ 264,789 Calculation of core PPNR to average assets, less PPP: PPP income 6,373 4,836 — — — — — — PPP expense (442) (1,814) — — — — — — PPP net income 5,931 3,022 — — — — — — Core PPNR (Non-GAAP), less PPP $ 62,030 $ 60,526 $ 71,481 $ 66,632 $ 71,151 $ 72,986 $ 54,020 $ 264,789 Total average assets $ 13,647,993 $ 13,020,715 $ 12,159,524 $ 12,226,162 $ 12,418,420 $ 12,122,966 $ 9,099,176 $ 11,466,681 Average assets (PPP) 952,640 727,377 — — — — — — Average assets, less PPP $ 12,695,353 $ 12,293,338 $ 12,159,524 $ 12,226,162 $ 12,418,420 $ 12,122,966 $ 9,099,176 $ 11,466,681 Core PPNR to average assets 1.98 % 1.96 % 2.36 % 2.16 % 2.27 % 2.41 % 2.41 % 2.31 % Core PPNR to average assets, less PPP 1.94 % 1.98 % 2.36 % 2.16 % 2.27 % 2.41 % 2.41 % 2.31 % 1 For detail on our core adjustments for 3Q'20, 2Q'20 and 3Q’19 refer to our Earnings Release filed at Exhibit 99.1 to our October 22, 2020 8-K filing. For detail on our core adjustments for 1Q’20, 4Q’19, and 1Q’19, refer to our Earnings Release filed at Exhibit 99.1 to our April 27,2020 8-K filing. For detail on our core adjustments for 2Q'19, refer to our Earnings Release filed at Exhibit 99.1 to our July 22,2019 8-K filing. 19

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso Chairman, President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 20