Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CONOCOPHILLIPS | tm2033409d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - CONOCOPHILLIPS | tm2033409d1_ex2-1.htm |

| 8-K - FORM 8-K - CONOCOPHILLIPS | tm2033409-1_8k.htm |

Exhibit 99.2

Conoco. ..P.... .hllh. psI c ·o·MN c H oConocoPhillips & Concho ResourcesTransaction Announcement,- ..-------·--- .... ....., ... , ... ... ... ... .. .. ,' .......... ........ ... ... #' .. .. .. ... " ... ... .. ' ...... ' ... ......... ....OCTOBER 19, 2020; .......·-... ' ......... .............. ... .., .. Ill ... ' ........' ... .... .. - ·····..' ...Ill...' ...... ""... .........# '.. ' "' " ..' ... '.. '..... ' ............... - "-... ... ...... ...... ... ....... ' • .. .. .. " Ill ... .. ... ...

Cautionary StatementCAUTIONARY STATEMENT FOR THE PURPOSES OFTJ-IE "SAFE HARBOR" PROVISIONS OFTJ-IE PRNATE SECURmES LmGATION REFORM ACT OF 1995 This commumcation relates to a proposed business combination transaction between ConocoPhillips ("ConocoPhillips") and Concho Resources Inc. reoncho•). Forward-looking statements relate to future events and anticipated results of operations, business strategies, the antiopated benefits ofthe proposed transactron, the anticipated 1mpact of the proposed transaction on the combined company's business and future frnancial and operating results, the expected amount and timing of synergies from the proposed transaction, and the antidpated closing date for the proposed transaction and other aspects of our operations or operating results. Words and phrases such as "anticipate,." Mestimate," "believe,• '"'budget,"' "continue," "could," "intend,"" "may," "plan.'' "'potential/' "predict," ''seek":should," "wd1,• "would," ·expect" "objective;• "projection," "forecast/' "goal," •·guidance," •outlook," "effort," "target" and other similar words can be used to identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking.Where, in any forward-looking statement, the company expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith and believed to be reasonable at the bme such forward-looking statement IS made.However, these statements are not guarantees of future performance and involve certain risks, uncertainties and other factors beyond our controL Therefore, actual outcomes and results may differ materially from what is expressed or forecast in the forward-looking statements.The followtng 1mp<Jrtant factors and uncertainties, among others, could cause actual results or events to differ materially from those described 1n these forward-looking statements: the tmpact of public health criSes, such as pandemics (including coronavirus (COVID-19)) and epidemics and any related company or government policies and actions to protect the health and safety of individuals or government polities or actions to maintain the functionmg of national or global economies and markets; global and regional changes 1n the demand, supply, pnces, differentials or other market conditions affecting oil and gas and the resulting act1ons in response to such changes, including changes resulting from the Imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; changes in commodity pnces; changes in expected levels of oil and gas reserves or production;operating hazards, drilling risks. unsuccessful exploratory activities; unexpected cost increases or techmcal difficulties in constructing, maintaining, or modifying company facilities; legislative and regulatory initiatives addressing global climate change or other environmental concerns; investment in and development of competing or alternative energy sources; disruptions or mterruptions impacting the transportation for oil and gas production; mternational monetary cond1t1ons and exchange rate fluctuations;changes in mternational trade relationships, including the imposition of trade restrictions or tariffs on any materials or products (such as aluminum and steel} used in the operation of ConocoPhillips' business; ConocoPhillips' ability to collect payments when due under ConocoPhillips'settlement agreement with POVSA; ConocoPhillips' ability to collect payments from the government of Venezuela as ordered by the ICSID;ConocoPhillips' ability to liquidate the common stock issued to ConocoPhillips by Cenovus Energy Inc. at pnces we deem acceptable, or at all; ConocoPhillips' ability to complete ConocoPhillips' other announced dispositions or acquisitions on the timeline currently anticipated, if at all, the p<Jssibility that regulatory approvals for ConocoPhillips' other announced dispositions or acquisitions will not be received on a timely basis, if at all, or that such approvals may require modification to the terms of such announced dispositions, acquisitions or CooocoPhillips' remaining business, business disruptions during or following ConocoPhillips' other announced dispositions or acquisitions, including the diversion of management time and attention; the ability to deploy net proceeds from such disposttions in the manner and timeframe we currently antiCipate, if at all; potential liability for remed1al actions under existing or future environmental regulations and adverse results in litigation matters, including the potential for litigation related to the proposed transaction; limited access to capital or significantly higher cost of caprtal related to illiquidity or uncertainty in the domestic or international financial markets; general domestic and International economic and polit1cal conditions; changes in fiscal reg1me or tax, environmental and other laws applicable to the combined company's business; disruptions resulting from extraordinary weather e11ents, dvil unrest, war, terrorism or a cyber attack;ConocoPhillips' ability to successfully integrate Concho's businesses and technologies; the risk that the expected benefits and synergies of the proposed transaction may not be fully achieved in a timely manner, or at all; the risk that ConocoPhillips or Concho will be unable to retain and hire key personnel; the fiSk associated with ConocoPhitlips' and Concho's ability to obtam the approvals of the1r respective stockholders required to consummate the proposed transaction and the timing of the dosing of the proposed transaction, including the risk that the conditions to the transaction are not satisfled on a timely basis or at all or the failure of the transactwn to dose for any other reason or to close on the antocipated terms, mdud1ng the antidpated tax treatment;the nsk that any regulatory approval, consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; unantidpated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transact1on; uncertainty as to the long-term value of ConocoPhill1ps'common stock;and the diversion of management time on transaction-related matters.These risks,as well as other risks related to the proposed transaction, will be included in the registration statement on Form s-4 and joint proxy statement/prospectus that will be filed with the Securities and Exchange Commission (the "SEC") in connection with the proposed transaction.While the ltst of factors presented here is, and the list of factors to be presented in the regiStration statement on Form S-4 are, considered representative, no such list should be cons1dered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please referto CooocoPhillips'and Concho's respective periodic rep<Jrts and other filings with the SEC, Including the risk factors contarned in ConocoPhillips' and Concho's most recent Quarterly Reports on Form 10.0 and Annual Reports on form 1Q-K. forward-looking statements represent management's current expectations and are inherently uncertain and are made only as of the date hereof. Except as required by law, neither ConocoPhillips nor Concho undertakesor assumes any obligation to update any forward-looking statements, whether as a result of new information or to reflect subsequent events or circumstances or othei'W\Se_

Cautionary StatementNo Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.Additional Information about the Merger and Where to Find It In connection with the proposed transaction, ConocoPhillips intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of ConocoPhillips and Concho and that also constitutes a prospectus of ConocoPhillips. Each of ConocoPhllllps and Concho may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that ConocoPhillips or Concho may file with the SEC. The definitive joint proxy statement/prospectus (if and when available) will be mailed to stockholders of ConocoPhillips and Concho. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about ConocoPhillips, Concho and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by ConocoPhillips will be available free of charge on ConocoPhillips' website at http://www.conocophillips.com or by contacting ConocoPhillips' Investor Relations Department by email at investor.relations@conocophillips.com or by phone at 281-293-5000. Copies of the documents filed with the SEC by Concho will be available free of charge on Concho's investor relations website at https:ljir.concho.com/investors/.Participants in the Solicitation ConocoPhillips, Concho and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of ConocoPhillips, including a description of their direct or indirect Interests, by security holdings or otherwise, is set forth in ConocoPhillips' proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 30, 2020, and ConocoPhillips' Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 18, 2020, as well as in Forms 8-K filed by ConocoPhillips with the SEC on May 20, 2020 and September 8, 2020, respectively. Information about the directors and executive officers of Concho, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Concho's proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2020, and Concho's Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 19, 2020. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from ConocoPhillips or Concho using the sources indicated above.¥ I · 3

Cautionary StatementUse of Non-GAAP Financial InformationThis presentation may include non-GAAP financial measures, which help facilitate comparison of company operating performance across periods and with peer companies. Any non-GAAP measures related to historical periods included herein will be accompanied by a reconciliation to the nearest corresponding GAAP measure in the Appendix at the end of this presentation. For forward-looking non-GAAP measures we are unable to provide a reconciliation to the most comparable GAAP financial measures because the information needed to reconcile these measures is dependent upon future events, many of which are outside of management's control as described on the previous slides. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with our accounting policies for future periods is extremely difficult and requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort.Cautionary Note to U.S. InvestorsThe SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. We may use the term "resource" in this presentation that the SEC's guidelines prohibit us from including in filings with the SEC, and any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include "potential" reserves and/or other estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC's latest reserve reporting guidelines. U.S.investors are urged to consider closely the oil and gas disclosures in our Form 10-K and other reports and filings with the SEC. Copies are available from the SEC and from the ConocoPhillips website.¥ I · 4

The Transaction Premise- A New Era of Energy LeadershipThis is not just another industry deal it-'s an affirmation of our joint commitment to lead a structural change for our vital industry sector. RYAN LANCETIM LEACHThis transaction ushers in a new era ofenergy leadership with a compelling. leading E&P company that can deliver superior returns through cycles.....,- I · s

Transaction OverviewTRANSACTION ECONOMICSTransaction Enterprise Value $13 billionAll-Stock;fixed exchange ratio of 1.46 shares of ConocoPhillips for each Concho sharePro forma equity ownership 79% ConocoPhillips and 21% ConchoAll-in acquisition cost of supply <$50/BBLLEADERSHIP & GOVERNANCEChairman & CEO Ryan LanceEVP and President Lower 481 joining Board of DirectorsTim LeachEnhancing Our Competitive Position in MidlandTRANSACTION CONDITIONS & TIMINGKey Filings and ApprovalsHart-Scott-Rodino andJoint Proxy Statement Form S-4ConocoPhillips & Concho ResourcesRequires Shareholder VoteAnticipated Close102021¥ I · 6

Combination Creates Leading Company with Scale & Relevance$ r·o_J •••IDIDCJc:::JQSHARED BEST-IN- SIGNIFICANT IMMEDIATELY TOP-TIER, ELEVATED VIS ION CLASS, AND ACCRETIVE RESILIENT COMMITMENT FOR LOW COST SUSTAINABLE TO KEY BALANCE TO ESG DELIVERING OF SUPPLY COST AND CONSENSUS SHEET EXCELLENCE SUPERIOR PORTFOLIO CAPITAL METRICS AND RETURNS REDUCTIONS ENHANCES THROUGH DIVIDEND CYCLES COVERAGEALIGN EO VISION BEST IN CLASS,LOW CoS SUSTAINABLE SAVINGS ACCilETIVE METRICS BALANCE SHEET STRENGlll ESG COMMITMENT ¥ I · 1

Shared Vision to Deliver Superior Returns Through CyclesSTRATEGY ALIGNED TO BUSINESS REALITIESFOUNDATIONAL PRINCIPLESCLEAR PRIORITIESPRICE UNCERTAINTY Low breakeven price Financial strengthCAPITAL INTENSITY Diverse,low cost of supply portfolio Optimized capital investmentsMATURITYStrong free cash flow generation Focus on returns on/of capitalESG FOCUSParis-aligned climate frameworkESG-integrated planningfree cash flow,rerum on capital employed and cash from operations (CFO) are non-GAAP measures defined in the AppenanL ----------------CASH FLOW EXPANSIONolBALANCE SHEET STRENGTHPEER-LEADING DISTRIBUTIONSESG EXCELLENCEPRIORITY 1 Sustain production and pay dividendPRIORITY 2 Annual dividend growthPRIORITY 3 'A' rated balance sheetPRIORITY 4 >30% of CFO shareholder payoutPRIORITY 5 Disciplined investment for CFO expansionALIGNED VISION BEST IN CLASS, LOW CoSSUSTA I NABLE SAVINGS ACCilETIVE METR I CS BALANCE SHEET STRENGlllESG COMMITMENT¥ I · s

Best-in-Class, Global, Low Cost of Supply Portfolio23 BILLION BBL RESOURCE WITH AN AVERAGE CoS <$30/BBL WTITOTAL RESOURCE1 - COMBINED COMPANY PRO FORMA6'}o ASIA PACIFIC19%6 o57%,-....NORWAYEUROPE fl.SIACANADALOWER 48Atlantic OceanMIDDLE EASTCHINA ('IBYA PacificALASKAPRODUCTION2 COMBINED COMPANY PRO FORMA 1,502 MBOEDAFRICAQATAROceanMALAYSIA4% E:MENA' 17% ASIA PACIFIC 4% C ANADA 15% ALASKASO LITH AMERICAINDONESIAUSTRALIASO% LOWER 481.Estimated resource as of year-end 2020 2. 2019 combinedcompany production exdudes Ubya and dosed asset dispositions 3.Europe,Middle East and North Afri caALIGNED VIS ON BEST IN CLASS,LOW CoSSUSTAINABLE SAVINGS ACCilETIVE METRICSBALANCE SHEET STRENGlllESG COMMITMENT....,- I · 9

Competitive Advantage from Scale,Diversification & Low Capital IntensitylQ 2020 TOTAL PROOUCTION1 INDEPENDENT E&Ps - NET MBOEDMEGATREND2 TOP 10 E&Ps- NET MBOED• UNCONVENTIONAL • CONV E NTIONAl • LNGOIL SANDS • HEAVY OIL1,800 y1,6001,4001,2001,0008006004002000PRO FORMA COMPANY +-"o" NCHO0 500 1,000 1,500<12% AVERAGE BASE DECLINE FOR A DECADE31.102020 reported total company production for independent E.&.Pi induding Antero Resources,. ApaCabo.1Oil & Gas,Can.adran N.atural Resources, Cenovus fna'gy,dtesape;_ake Ene.rgy, Concho A:esourres, ConoroPbiDips, ContinentaJ Resources, EQT COrporation, Devon Ene.rgv, Hess Corporation, INPEX corporation, Marathon Oil, Nobfe Energy, ocDde.ntaJ Peuoleurn, OMV.Pioneer, Rime AesourcRepsoJ.. Southwestern Energy and sunc:or En-e.Source:WoodMac. 2- aa:sed oo \\"oodMac resource thEmE::Sa;gregate..d to Convemionaf, Unconvennon.aJ,LNG and Oil Sands/Heavy oM. Showing the top 10E&P producers in terms of M.fiOEO in 1Q 2020 mdudiAntero Re:sourC£3.Ca.nadi:in N.aturaJ Resources,eonocof'hiJIJp:s+Ooncho,EOG ResourcesfQT COrpJration,JN..PEX Corporation, Occidental Petroleum, OVintiv, Rep.sol and suru::or Energy.3.3..yr compound annual dedine r.l1e.AliGNED VIS 0'. BEST IN CLASS,LOW CoS "'"' A jC<: SHEET STRE'.G H ESG ;:Qt. , T 1E T

"Core-of-the-Core" Times FourEAGLE FORD I "" 200,000 NET ACRES""-BAKKEN I ""620,000 NET ACR ESLOW HIGH SINGLE WELL COST OF SUPPLY1'Source:En\l'erus & Conocol'hillipsAliGNED VIS 0'. BEST IN CLASS, LOW CoSSUSTAINABLE SAVINGS ACCilETIVE METRICSBALANCE SHEET STRENGlll ESG COMMITMENT ....,- I · u

Pacing Development for Value-OptimizationU.S. UNCONVENTOI 2019NET MBODNAL OIL PRODUCTION 1CAPITAL ALLOCATION APPROACH REFLECTS VALUE-OPTIMIZATION PACE500450400PRO FORMA COMPANY100% >95%MAX NPVPACE350300250200150100500Soun:e:Wood MacEAGL£ FORD MIDLAND> 0... z X <t ::::E u. 0 ';/.75%<$40/BBL CoS THRESHOLDPLATEAU RATE/RIG COUNTz n ;:lO s: m z )> r- n 0 VIL Top U.S. 11nconventional producers in 2019 net MBOD induding Apache, BP,Chesapeake Energy, Chevron+ Noble, Cimarex Energy, Concha Resouroes, ConocoPhillips,Continental Resources,Devon+ WPX,Olamondb;Kk Energy Inc, lOO Resources, ElotonMobil, HessCorporation, Mamhon Oil,Ocddentlll PetrOleu m, <Mntiv,!'arsley Energy, POC Energy,Pioneer Natural Resouroes,Shell,Whiting PetrOleum Corporation.AliGNED VIS 0'. BEST IN CLASS, LOW CoS ACCilETIVE METRICSBALANCE SHEET STRENGlll ESG COMMITMENT ....,- 1 · 12

Premier Permian Unconventional Position0 CONOCOPHILLIPS AND CONCHO0 ... • •.•.• "t-'..i1-Balanced portfolio across • 0 Delaware and Midland basinsE L AWARE BASIN= ..".. .. D ·ddf:t' ' o·, " \ ":I 0 Do"· ' ,0 ,IIa c9 cCompetitive,low cost of supply and low GHG-intensity resource \D r;, ..Extending disciplined0 . ."!r ., .,..,·· . ,.investment philosophy across a larger platformALIGN EO V I SIONBEST IN CLASS, LOW CoSSUSTA I NABLE SAVINGS ACCilETIVE METR I CSBALANCE SHEET STRENGlll ESG COMMITMENT ....,- I · 13

Significant and Sustainable Cost and Capital Savings$250 MM/YR$150MM/YR $500 MM/YRPLAN TO ACHIEVE FULL SAVINGS BY 2022DIRECT COSTSOfficers,board and corporate costsEXPLORATIONRefocused exploration program (Capital, G&A and G&G)1. Pre-Tax$100 MM/YRDIRECT COSTSEXPLORATIONCORPORATE & EXPECTED REGIONAL NET CASH FLOW COSTS IMPROVEMENTlCORPORATE AND REGIONAL COSTS Restructure I streamline corporate center Business units support cost reductionsAliGN EO VISION BEST IN CLASS, LOW CoS SUSTA I NAB L E SAVINGS ACCilETIVE METRICSBALANCE SHEET STRENGlllESG COMMITMENT ¥ I · 14

Value Creation from Scale, Execution Excellence & Shared Learnings.rf•-".MARGIN IMPROVEMENTSCrude oil transport flexibilityTop 5 natural gas marketer by volume within U.S. (>8 BCFD)DEVELOPMENT STRATEGYLeveraging Concho expertise to accelerate Permian learningSharing technologies across North American unconventional assetsSUPPLY CHAIN BENEFITSLogistics optimizationEconomy of scale provides opportunities across assetsALIGN EO VISIONACCilETIVE METRICSBALANCE SHEET STRENGlll

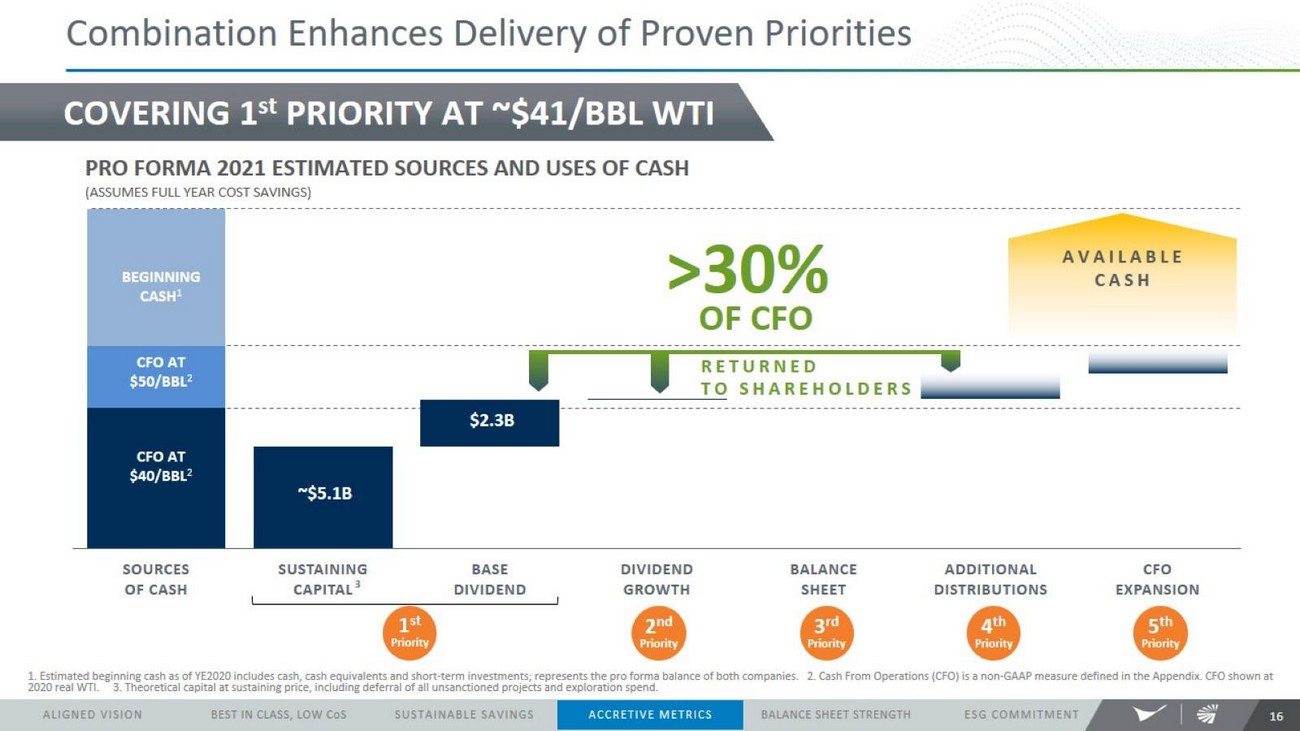

Combination Enhances Delivery of Proven PrioritiesCOVERING 1st PRIORITY AT "'$41/BBL WTIPRO FORMA 2021ESTIMATED SOURCES AND USES OF CASH (ASSUMES FUllYEAR COST SAVINGS) ---------------------------------------------------------------------------------------------------- -------------------------------------------------->30% OFCFOAVAILABLE CASH- - - - TO-SHAREHOLDERS •---------------------------------------------------------------------------------------------------- ------------------------------------------ RETURNED$2.38SOURCES SUSTAINING BASE DIVIDEND BALANCE ADDITIONAL CFO OF CA SH CAPITAL3 DIVIDEND GROWTH SHEET DISTRIBUTIONS EXPANSION 8 8 1. Estimated beginnrng cash as of YE2020 includes cash, cash equrvalents and short-term inve5tments; represents the pro forma balance of both companies. 2. Cash From Operations (CfO) is a non-GAAP measure defined in rhe AppendiX.. CFO shown at 2020 real WTI. 3.Theoretical capital at sustaining price, including deferral of aU unsanctioned projects and exploration spend. ALIGNED Vlll Ot, BEST IN CLASS, tOW CoS SUSTA1NABLE SA IG!> ACCRETIVE METRICS 81\lANCE SHEET STRENGTH ESG COMMITMENT ....,- I · 16

Transaction Immediately Accretive to Key Consensus MetricsSTRONGER FREE CASH FLOW GENERATIONAbsolute free cash flow improvementFree cash flow yield improvementPRESERVES STRONG BALANCE SHEETMaintains top-tier balance sheetPlan performs against low-price scenariosIMPROVED RETURN ON CAPITALAccretive to ROCEAccretive to earnings per shareCOMPETITIVE RETURN OF CAPITALExpanded free cash flow coverage of dividendContinued commitment to return >30% CFOBased on consensus mean estimates as or Oct.16, 2020per Bloomberg;Assumes100% of cost and capita!savings realizedin 2021;Excludes restructuring costs;Share price as of Oct.13, 2020. Absolute freecash flow improvement 1s based on estimated free cash flow for ConocoPhilliJl'S standalone as compared to est1ma1ed free cash llow of the combined company after close of the transaction. Free cash flow return on capitalemployed,net debt and cash from operations (CfO) are non-<;AAP measures defined 1n the AppendixALIGNED VISION BEST IN CLASS, tOW CoSSi.JHAINABLE SAVINGSACCRETIVE METRICS 81\tANCE SHEET STRENGTH ESG COMMITMENT ¥ I · 11

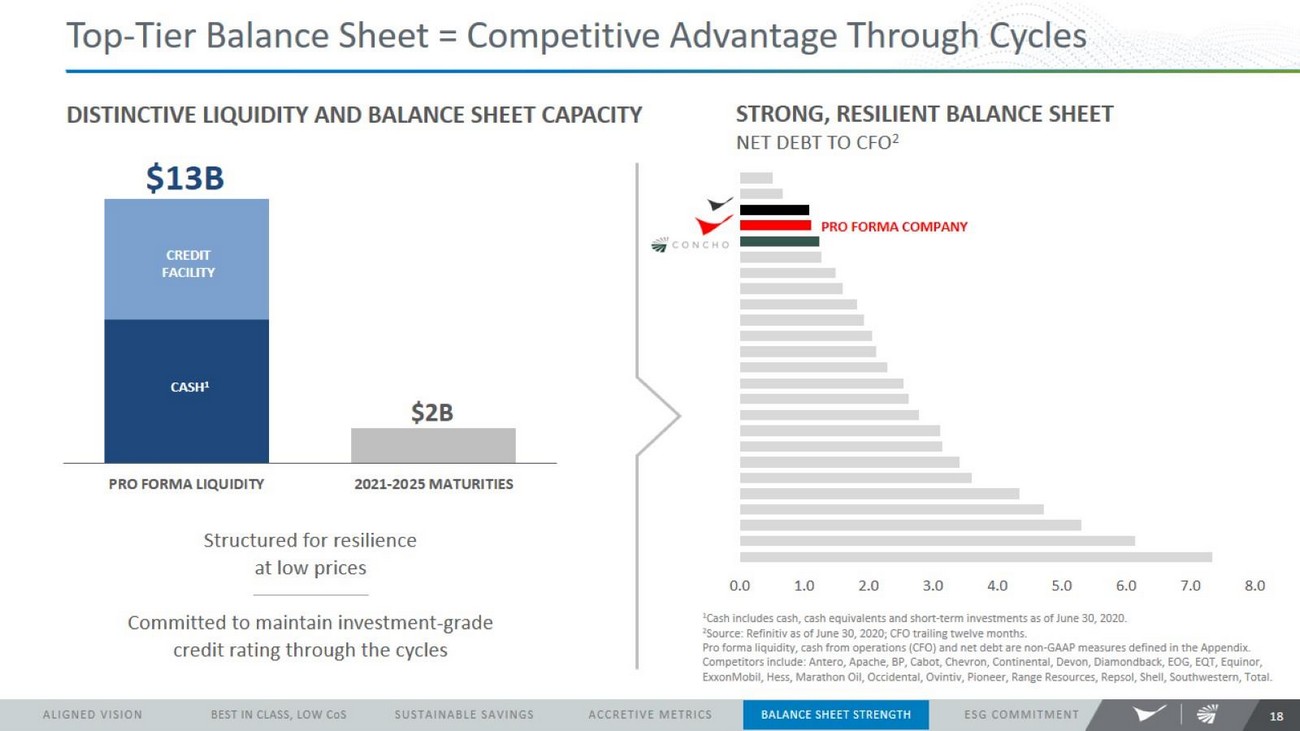

Top-Tier Balance Sheet Competitive Advantage Through CyclesDISTINCTIVE LIQUIDITY AND BALANCE SHEET CAPACITY$138STRONG, RESILIENT BALANCE SHEET NET DEBT TO CF02-------..,PRO FORMA LIQUIDITY 2021-2025 MATURITIESStructured for resilience at low pricesCommitted to maintain investment-grade credit rating through the cycles0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0'Cash indudes cash,cash equivalents and short-term investments as of June 30,2020. 1Source. Refinitiv as of June 30,2020; CFO trailing twelve months. Pro forma liquidity, cash from operations (CFO) and net debt are nan-GAAP measures definedin the Appendix. Competitors include:Amero,Apache,BP,cabot,Chevron,Continental,Devon,Oiamondbadc,EOG,EQT,Equinor, ExxonMobil,Hess,MarathonOil,Occidental,Ovintiv,Pioneer,Range Resources,Repsol,Shell Southwestern,Tota•lALIGNED VISION BES- IN CLASS tOW CoS SUSTAINABLE SAVINGSACCilETIVE METR ICS BALANCE SHEET STRENGTHESG COMMITMENT....,- 1 · 18

Performance With Purpose- Elevating Our Commitment to ESG ExcellenceCOMBINING STRONG SUSTAINABILITY TRACK RECORDS.. ,;ENVIRONMENTAL• Paris-aligned climate risk strategy• Operational emissions intensity reductions• Targeting 35-45%1 by 2030• Ambition for net-zero by 2050• Advocacy for end-use emissions reductions• Joining World Bank Flaring Initiative• Leadership in water stewardshipSOCIAL• Highly aligned values-based cultures• Transaction combines two world-class workforces• Driving and measuring diversity and inclusion• Commitment to our communitiesGOVERNANCE• Diverse and engaged boards• Alignment of compensation with returns and ESG performance• Committed to timely and transparent disclosure• Proactive stakeholder engagementCOMMITTED TO STAKEHOLDER ENGAGEMENT'From 2016 basehne.ALIGN EO VISIONBEST IN CLASS,LOW CoS SUSTAINABLE SAVINGS ACCilETIVE METRICSBALANCE SHEET STRENGlllESG COMMITMENT1111."."."... I '"' 19

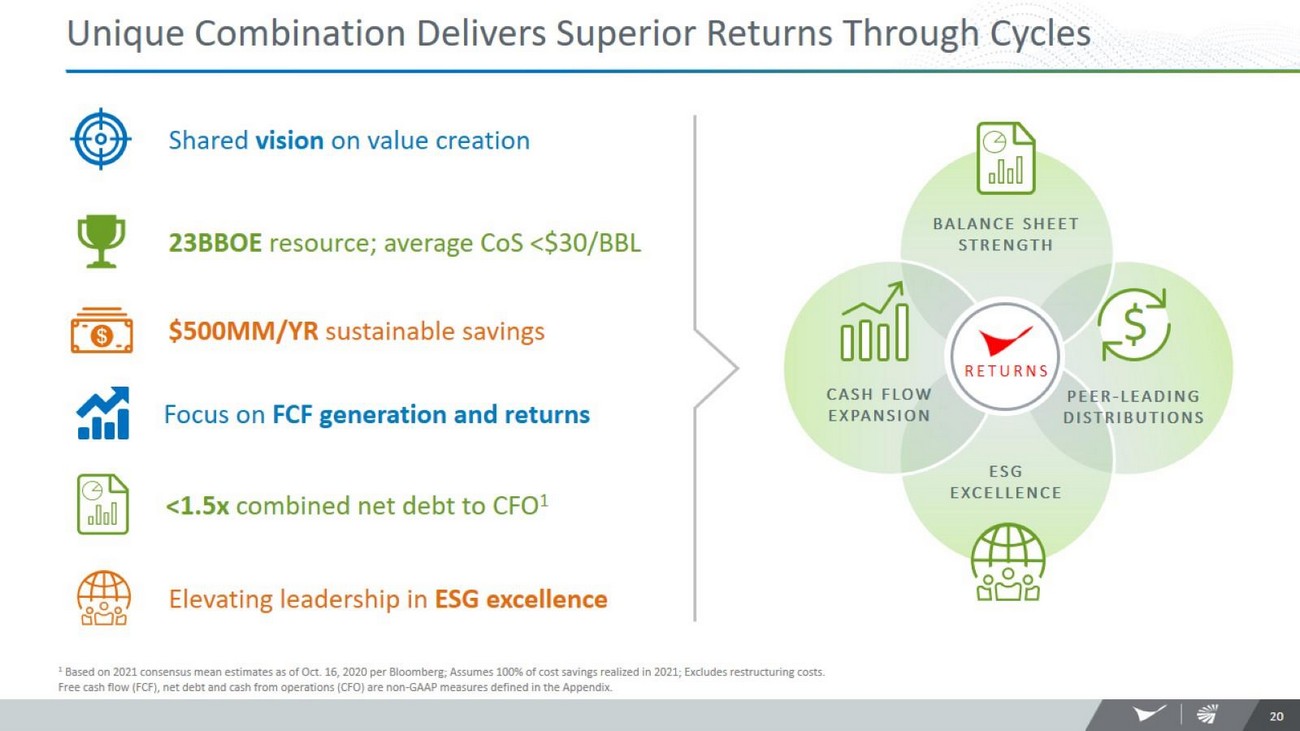

Unique Combination Delivers Superior Returns Through Cycles$ Shared vision on va lue creation23BBOE resource; average CoS <$30/BBL[·o_J $SOOMM/YR sustainable savingsBALANCE SHEET STRENGTH••• IGoOouFocus on FCF generation and returns<l.Sx combined net debt to CFOlCASH FLOW EXPANSIONESGPEER - LEADING DISTRIBUTIONSEXCELLENCEoc:JaElevating leadership in ESG excellence1Based on 2021consensus mean estimates as of Oa.16,2020 per Bloomberg;Assumes 100%of cost savings realized in 2021;Exdudes restruauring costs. free cash flow (FCf), net debt and cash from operations (CFO) are non-<JAAP measure-s defined in the Appendix.¥ I · 20

ConocriP'hillipsAppendix----- ..... . - - .- .. .. RECONCILIATIONS- ..- .... 'AND DEFINITIONS... • •

Non-GAAP ReconciliationsUse of Non-GAAP FinancialInformation-This presentation includes non-GAAP financial measures,which help facilitate comparison of company operating performance across periods and with peer companies. Any non-GAAP measures related to historicalperiods included herein will be accompanied by a reconciliation to the nearest corresponding GAAP measure. For forward-looking non-GAAP measures we are unable to provide a reconciliation to the most comparable GAAP financial measures because the information needed to reconcile these measures is dependent on future events,many of which are outside management's control as described above.Additionally,estimating such GAAP measures and providing a meaningful reconciliation consistent with our accounting policies for future periods is extremely difficult and requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions.RECONCILIATION OF PRO FORMA LIQUIDITY $MILLIONSFor the Quarter Ended 6/30/2020ConocoPhillips Concho Pro Forma Adjustments!Pro Fom1a Combined Companycash and cash equivalents 2,907 320 3,227Short-Term Investments 3,985 3,985Revolver 6,000 2,000 (2,000) 6,000Total Uquidity 12,892 2,320 (2,000) 13,2121 Pro Fomw Ad justments assumes termination of Concho's revolving credit facility upon close of the transaction.

Definitions I AppendixNON-GAAP TERMSCash from operations (CFO): Cash provided by operating activities excluding the impact from operating working capital. Estimated CFO assumes no operating working capital changes, and therefore CFO equals cash provided by operating activities. Free cash flow (FCF): Cash from operations in excess of capital expenditures and investments. Free cash flow is not a measure of cash available for discretionary expenditures since the company has certa i n non-discretionary obligations such as debt service that are not deducted from the measure. Liquidity:Liquidity includes cash, cash equivalents, short-term investments and available borrowing capacity under the company's revolving credit facility. Net Debt: Total balance sheet debt net of cash, cash equivalents and short-term investments. Return on capital employed (ROCE): Measure of the profitability of average capital employed in the business. Calculated as a ratio, the numerator of which is net income plus after-tax interest expense and excluding after-tax interest income, and the denominator of which is average total equity plus average total debt adjusted for average cash, cash equivalents, restricted cash and short-term investments. Net income is adjusted for non-operational or special item impacts.OTHER TERMS Cost of supply:Cost of supply is the WTI equivalent price that generates a 10 percent after-tax return on a point-forward and fully burdened basis. Fully burdened includes capital infrastructure, foreign exchange, price-related inflation, G&A and carbon tax {if currently assessed). If no carbon tax exists for the asset, it is not included in this metric. All barrels of resource are discounted at 10 percent. Enterprise Value: Concho's enterprise value included in this presentation is calculated based on the sum of net debt as of June 30, 2020 and anticipated shares to be issued assuming the fixed conversion ratio, measured at ConocoPhillips' closing share price on October 16, 2020. Free cash flow yield: Free cash flow divided by market capitalization. Market capitalization is valued using common shares outstanding and recent stock price. Resources:Based on the Petroleum Resources Management System, a system developed by industry that classifies recoverable hydrocarbons into commercial and sub-commercial to reflect their status at the time of reporting. Proved, probable and possibl e reserves are classified as commercial, while remaining resources are categorized as sub-commercial or contingent. The company's resource estimate includes volumes associated with both commercial and contingent categories.The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. U.S. investors are urged to consider closely the oil and gas discl osures in our Form 10-K and other reports and filings with the SEC.Returns of capital: Total of dividends and share repurchases. Also referred to as distri butions.¥ I · 23