Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - GOLDMAN SACHS GROUP INC | d38229dex992.htm |

| 8-K - 8-K - GOLDMAN SACHS GROUP INC | d38229d8k.htm |

Exhibit 99.1

|

Third Quarter 2020

Earnings Results

Media Relations: Jake Siewert 212-902-5400 Investor Relations: Heather Kennedy Miner 212-902-0300

|

||

|

The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282

|

Third Quarter 2020 Earnings Results

Goldman Sachs Reports Third Quarter Earnings Per Common Share of $9.68

|

“Our ability to serve clients who are navigating a very uncertain environment drove strong performance across the franchise, building off a strong first half of the year. As our clients begin to emerge from the tough economy brought on by the pandemic, we are well positioned to help them recover and grow, particularly given market share gains we’ve achieved this year.” |

|

- David M. Solomon, Chairman and Chief Executive Officer

|

Financial Summary

|

|

|

|||||||

|

Net Revenues

|

Net Earnings

|

EPS

| ||||||

|

3Q $10.78 billion

3Q YTD $32.82 billion

|

3Q $3.62 billion

3Q YTD $5.20 billion

|

3Q $9.68

3Q YTD $13.34

| ||||||

|

Annualized ROE1

|

Annualized ROTE1

|

Book Value Per Share

| ||||||

|

3Q 17.5%

3Q YTD 8.0%

|

3Q 18.6%

3Q YTD 8.5%

|

3Q $229.49

YTD Growth 5.0%

| ||||||

NEW YORK, October 14, 2020 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $10.78 billion and net earnings of $3.62 billion for the third quarter ended September 30, 2020. Net revenues were $32.82 billion and net earnings were $5.20 billion for the first nine months of 2020.

Diluted earnings per common share (EPS) was $9.68 for the third quarter of 2020 compared with $4.79 for the third quarter of 2019 and $0.53 for the second quarter of 2020, and was $13.34 for the first nine months of 2020 compared with $16.32 for the first nine months of 2019.

Annualized return on average common shareholders’ equity (ROE)1 was 17.5% for the third quarter of 2020 and 8.0% for the first nine months of 2020. Annualized return on average tangible common shareholders’ equity (ROTE)1 was 18.6% for the third quarter of 2020 and 8.5% for the first nine months of 2020.

During the first nine months of 2020, the firm recorded net provisions for litigation and regulatory proceedings of $3.15 billion, which reduced diluted EPS by $8.77 and reduced annualized ROE by 5.1 percentage points.

1

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

Highlights

| ◾ |

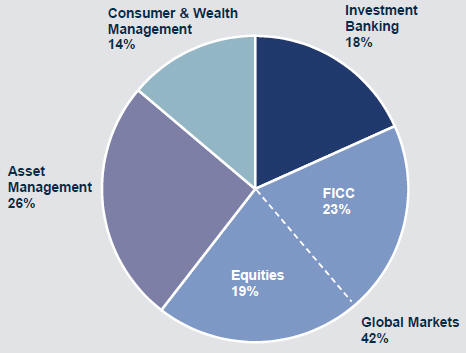

The firm’s quarterly results reflected strong net revenues of $10.78 billion, record quarterly diluted EPS of $9.68 and annualized ROE1 of 17.5%, the highest quarterly ROE since 2010. |

| ◾ |

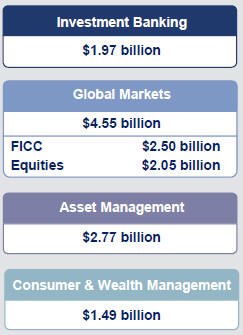

Investment Banking generated quarterly net revenues of $1.97 billion, including the second highest quarterly net revenues in Equity underwriting. The firm ranked #1 in worldwide announced and completed mergers and acquisitions, worldwide equity and equity-related offerings, common stock offerings and initial public offerings for the year-to-date.2 |

| ◾ |

Global Markets generated quarterly net revenues of $4.55 billion, reflecting continued strength in Fixed Income, Currency and Commodities (FICC) and Equities. |

| ◾ |

Asset Management generated quarterly net revenues of $2.77 billion, reflecting strong performance in Equity investments. |

| ◾ |

Consumer & Wealth Management generated quarterly net revenues of $1.49 billion, reflecting record net revenues in Consumer banking and continued strength in Wealth management. |

| ◾ |

The firm maintained a highly liquid balance sheet. In addition, the Standardized common equity tier 1 capital ratio3 increased 120 basis points during the quarter to 14.5%4. |

Quarterly Net Revenue Mix by Segment

|

|

|

2

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

|

Net Revenues

|

|

|

| Net revenues were $10.78 billion for the third quarter of 2020, 30% higher than the third quarter of 2019 and 19% lower than the second quarter of 2020. The increase compared with the third quarter of 2019 reflected higher net revenues across all segments, including significant increases in Asset Management and Global Markets. |

|

Net Revenues

| ||

|

$10.78 billion

| ||||

|

The operating environment continued to recover during the third quarter of 2020 from the impact of the COVID-19 pandemic earlier in the year as global economic activity significantly rebounded following a sharp decrease in the second quarter, market volatility declined modestly, and monetary and fiscal policy remained accommodative. As a result, global equity prices increased and credit spreads tightened compared with the end of the second quarter of 2020. |

|

|

|

Investment Banking |

|

|

| Net revenues in Investment Banking were $1.97 billion for the third quarter of 2020, 7% higher than the third quarter of 2019 and 26% lower compared with a strong second quarter of 2020. The increase compared with the third quarter of 2019 reflected significantly higher net revenues in Underwriting, partially offset by significantly lower net revenues in Corporate lending and Financial advisory.

The increase in Underwriting net revenues was due to significantly higher net revenues in Equity underwriting, primarily reflecting a significant increase in industry-wide initial public offerings, and higher net revenues in Debt underwriting, driven by asset-backed and investment-grade activity. The decrease in Corporate lending net revenues primarily reflected lower results for relationship lending activities, including the impact of changes in credit spreads on hedges. The decrease in Financial advisory net revenues reflected a decrease in industry-wide completed mergers and acquisitions transactions.

The firm’s investment banking transaction backlog3 increased significantly compared with the end of the second quarter of 2020, but was slightly lower compared with the end of 2019. |

Investment Banking

| |||||

|

$1.97 billion

| ||||||

|

|

Financial Advisory |

$507 million | ||||

| Underwriting |

$1.43 billion | |||||

|

Corporate Lending

|

$35 million

| |||||

|

|

Global Markets |

|

| Net revenues in Global Markets were $4.55 billion for the third quarter of 2020, 29% higher than the third quarter of 2019 and 37% lower than the second quarter of 2020.

Net revenues in FICC were $2.50 billion, 49% higher than the third quarter of 2019, due to significantly higher net revenues in FICC intermediation, reflecting significantly higher net revenues in interest rate products, mortgages, commodities and credit products, while net revenues in currencies were essentially unchanged. Net revenues in FICC financing were lower, reflecting lower net revenues in structured credit financing and repurchase agreements.

Net revenues in Equities were $2.05 billion, 10% higher than the third quarter of 2019, due to significantly higher net revenues in Equities intermediation, reflecting significantly higher net revenues in derivatives, partially offset by lower net revenues in cash products. In addition, net revenues in Equities financing were significantly lower, due to higher net funding costs, including the impact of lower yields on the firm’s global core liquid assets. |

Global Markets

| |||||

|

$4.55 billion

| ||||||

|

FICC Intermediation |

$2.17 billion | |||||

| FICC Financing |

$332 million | |||||

| FICC |

$2.50 billion | |||||

| Equities Intermediation |

$1.47 billion | |||||

| Equities Financing |

$585 million | |||||

|

Equities |

$2.05 billion

| |||||

|

|

||||||

3

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

|

|

Asset Management |

|

| Net revenues in Asset Management were $2.77 billion for the third quarter of 2020, 71% higher than the third quarter of 2019 and 32% higher than the second quarter of 2020. The increase compared with the third quarter of 2019 reflected significantly higher net revenues in Equity investments and Lending and debt investments, and higher Management and other fees from the firm’s institutional and third-party distribution asset management clients. Incentive fees were essentially unchanged.

The increase in Equity investments net revenues reflected net gains from investments in public equities in the third quarter of 2020 compared with net losses in the third quarter of 2019. This increase was partially offset by significantly lower net gains from investments in private equities. The increase in Lending and debt investments net revenues was due to higher net gains, reflecting tighter corporate credit spreads during the quarter. The increase in Management and other fees reflected the impact of higher average assets under supervision, partially offset by a lower average effective management fee due to shifts in the mix of client assets and strategies. |

Asset Management

| |||||

|

$2.77 billion

| ||||||

| Management and Other Fees |

$ 728 million | |||||

|

Incentive Fees |

$28 million | |||||

|

Equity Investments |

$1.42 billion | |||||

| Lending and Debt Investments

|

$589 million

| |||||

|

|

Consumer & Wealth Management |

|

| Net revenues in Consumer & Wealth Management were $1.49 billion for the third quarter of 2020, 13% higher than the third quarter of 2019 and 10% higher than the second quarter of 2020.

Net revenues in Wealth management were $1.17 billion, 6% higher than the third quarter of 2019, due to higher Management and other fees, primarily reflecting the impact of higher average assets under supervision and higher transaction volumes, partially offset by a lower average effective management fee due to shifts in the mix of client assets and strategies. Incentive fees were lower, while net revenues in Private banking and lending were essentially unchanged.

Net revenues in Consumer banking were $326 million, 50% higher than the third quarter of 2019, primarily reflecting higher credit card loan balances. |

Consumer & Wealth Management

| |||||

|

$1.49 billion

| ||||||

|

Wealth Management |

$ 1.17 billion | |||||

|

Consumer Banking

|

$326 million

| |||||

Provision for Credit Losses

| Provision for credit losses was $278 million for the third quarter of 2020, compared with $291 million for the third quarter of 2019 and $1.59 billion for the second quarter of 2020. The decrease compared with the third quarter of 2019 primarily reflected reserve reductions from paydowns on corporate lines of credit and consumer installment loans, partially offset by reserve increases from individual impairments related to wholesale loans and growth in credit card loans.

The firm’s allowance for credit losses was $4.33 billion as of September 30, 2020. |

Provision for Credit Losses

| |||

|

$278 million

| ||||

4

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

Operating Expenses

| Operating expenses were $5.95 billion for the third quarter of 2020, 6% higher than the third quarter of 2019 and 43% lower than the second quarter of 2020. The firm’s efficiency ratio3 for the first nine months of 2020 was 69.6%, compared with 66.2% for the first nine months of 2019. |

|

Operating Expenses

| ||

|

$5.95 billion

| ||||

|

The increase in operating expenses compared with the third quarter of 2019 was due to higher compensation and benefits expenses (reflecting significantly higher net revenues), partially offset by slightly lower non-compensation expenses. Within non- compensation expenses, travel and entertainment expenses (included in market development expenses), professional fees, occupancy-related expenses, and net provisions for litigation and regulatory proceedings were lower, partially offset by higher technology expenses and brokerage, clearing, exchange and distribution fees.

Net provisions for litigation and regulatory proceedings for the third quarter of 2020 were $6 million compared with $47 million for the third quarter of 2019.

Headcount increased 5% compared with the end of the second quarter of 2020, primarily reflecting the timing of campus hires.

|

YTD Efficiency Ratio

| |||

|

69.6%

| ||||

Provision for Taxes

| The effective income tax rate for the first nine months of 2020 decreased to 27.6% from 39.9% for the first half of 2020, primarily due to a decrease in the impact of non- deductible litigation in the first nine months of 2020 compared with the first half of 2020. |

YTD Effective Tax Rate

| |||

|

27.6%

| ||||

Other Matters

| ◾ On October 13, 2020, the Board of Directors of The Goldman Sachs Group, Inc. declared a dividend of $1.25 per common share to be paid on December 30, 2020 to common shareholders of record on December 2, 2020.

◾ During the quarter, the firm returned $448 million of capital in common stock dividends.3

◾ Global core liquid assets3 averaged $302 billion4 for the third quarter of 2020, compared with an average of $290 billion for the second quarter of 2020. |

Declared Quarterly Dividend Per Common Share

| |||

|

$1.25

| ||||

|

Common Stock Dividends

| ||||

|

$448 million

| ||||

|

Average GCLA

| ||||

|

$302 billion

|

5

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

|

|

Cautionary Note Regarding Forward-Looking Statements |

|

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity indicated in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity, see “Risk Factors” in Part II, Item 1A of the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 and in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2019.

Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements.

Statements about the firm’s investment banking transaction backlog also may constitute forward-looking statements. Such statements are subject to the risk that transactions may be modified or not completed at all and associated net revenues may not be realized or may be materially less than those currently expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak of hostilities, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. For information about other important factors that could adversely affect the firm’s investment banking transactions, see “Risk Factors” in Part II, Item 1A of the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 and in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2019.

Statements about the effects of the COVID-19 pandemic on the firm’s business, results, financial position and liquidity may constitute forward-looking statements and are subject to the risk that the actual impact may differ, possibly materially, from what is currently expected.

|

|

Conference Call |

|

A conference call to discuss the firm’s financial results, outlook and related matters will be held at 9:30 am (ET). The call will be open to the public. Members of the public who would like to listen to the conference call should dial 1-888-281-7154 (in the U.S.) or 1-706-679-5627 (outside the U.S.). The number should be dialed at least 10 minutes prior to the start of the conference call. The conference call will also be accessible as an audio webcast through the Investor Relations section of the firm’s website, www.goldmansachs.com/investor-relations. There is no charge to access the call. For those unable to listen to the live broadcast, a replay will be available on the firm’s website or by dialing 1-855-859-2056 (in the U.S.) or 1-404-537-3406 (outside the U.S.) passcode number 64774224 beginning approximately three hours after the event. Please direct any questions regarding obtaining access to the conference call to Goldman Sachs Investor Relations, via e-mail, at gs-investor-relations@gs.com.

6

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

||||||||||||||||||||

|

INVESTMENT BANKING

|

||||||||||||||||||||||||

|

Financial advisory |

$ 507 | $ 686 | $ 697 | (26) % | (27) % | |||||||||||||||||||

| Equity underwriting |

856 | 1,057 | 366 | (19) | 134 | |||||||||||||||||||

|

Debt underwriting

|

|

571

|

|

|

990

|

|

|

524

|

|

|

(42)

|

|

|

9

|

| |||||||||

|

Underwriting |

1,427 | 2,047 | 890 | (30) | 60 | |||||||||||||||||||

| Corporate lending |

35 | (76) | 254 | N.M. | (86) | |||||||||||||||||||

|

Net revenues

|

|

1,969

|

|

|

2,657

|

|

|

1,841

|

|

|

(26)

|

|

|

7

|

| |||||||||

|

GLOBAL MARKETS

|

||||||||||||||||||||||||

|

FICC intermediation |

2,170 | 3,786 | 1,315 | (43) | 65 | |||||||||||||||||||

|

FICC financing |

332 | 449 | 364 | (26) | (9) | |||||||||||||||||||

|

FICC

|

|

2,502

|

|

|

4,235

|

|

|

1,679

|

|

|

(41)

|

|

|

49

|

| |||||||||

|

Equities intermediation |

1,466 | 2,199 | 1,080 | (33) | 36 | |||||||||||||||||||

|

Equities financing

|

|

585

|

|

|

742

|

|

|

784

|

|

|

(21)

|

|

|

(25)

|

| |||||||||

|

Equities

|

|

2,051

|

|

|

2,941

|

|

|

1,864

|

|

|

(30)

|

|

|

10

|

| |||||||||

|

Net revenues

|

|

4,553

|

|

|

7,176

|

|

|

3,543

|

|

|

(37)

|

|

|

29

|

| |||||||||

|

ASSET MANAGEMENT

|

||||||||||||||||||||||||

|

Management and other fees |

728 | 684 | 660 | 6 | 10 | |||||||||||||||||||

|

Incentive fees |

28 | 34 | 24 | (18) | 17 | |||||||||||||||||||

|

Equity investments |

1,423 | 924 | 596 | 54 | 139 | |||||||||||||||||||

|

Lending and debt investments

|

|

589

|

|

|

459

|

|

|

341

|

|

|

28

|

|

|

73

|

| |||||||||

|

Net revenues

|

|

2,768

|

|

|

2,101

|

|

|

1,621

|

|

|

32

|

|

|

71

|

| |||||||||

|

CONSUMER & WEALTH MANAGEMENT

|

||||||||||||||||||||||||

|

Management and other fees |

957 | 938 | 881 | 2 | 9 | |||||||||||||||||||

|

Incentive fees |

7 | 10 | 21 | (30) | (67) | |||||||||||||||||||

|

Private banking and lending

|

|

201

|

|

|

155

|

|

|

199

|

|

|

30

|

|

|

1

|

| |||||||||

|

Wealth management

|

|

1,165

|

|

|

1,103

|

|

|

1,101

|

|

|

6

|

|

|

6

|

| |||||||||

|

Consumer banking

|

|

326

|

|

|

258

|

|

|

217

|

|

|

26

|

|

|

50

|

| |||||||||

|

Net revenues

|

|

1,491

|

|

|

1,361

|

|

|

1,318

|

|

|

10

|

|

|

13

|

| |||||||||

|

Total net revenues

|

|

$ 10,781

|

|

|

$ 13,295

|

|

|

$ 8,323

|

|

|

(19)

|

|

|

30

|

| |||||||||

|

Geographic Net Revenues (unaudited)3 |

|

|||||||||||||||||||||||

| $ in millions

|

||||||||||||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

||||||||||||||||||||||

|

Americas |

$ 6,873 | $ 8,289 | $ 4,941 | |||||||||||||||||||||

|

EMEA |

2,470 | 3,453 | 2,329 | |||||||||||||||||||||

|

Asia

|

|

1,438

|

|

|

1,553

|

|

|

1,053

|

|

|||||||||||||||

|

Total net revenues

|

|

$ 10,781

|

|

|

$ 13,295

|

|

|

$ 8,323

|

|

|||||||||||||||

| Americas |

64% | 62% | 59% | |||||||||||||||||||||

|

EMEA |

23% | 26% | 28% | |||||||||||||||||||||

|

Asia

|

|

13%

|

|

|

12%

|

|

|

13%

|

|

|||||||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

|

100%

|

|

|||||||||||||||

7

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| NINE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||

| SEPTEMBER 30, 2020 |

SEPTEMBER 30, 2019 |

SEPTEMBER 30, 2019 |

||||||||||||||||

|

INVESTMENT BANKING

|

||||||||||||||||||

|

Financial advisory |

$ 1,974 | $ 2,342 | (16) % | |||||||||||||||

| Equity underwriting |

2,291 | 1,104 | 108 | |||||||||||||||

|

Debt underwriting

|

|

2,144

|

|

|

1,520

|

|

|

41

|

|

|||||||||

|

Underwriting |

4,435 | 2,624 | 69 | |||||||||||||||

| Corporate lending |

|

401

|

|

|

569

|

|

|

(30)

|

|

|||||||||

|

Net revenues

|

|

6,810

|

|

|

5,535

|

|

|

23

|

|

|||||||||

|

GLOBAL MARKETS

|

||||||||||||||||||

| FICC intermediation |

8,493 | 4,627 | 84 | |||||||||||||||

| FICC financing |

|

1,213

|

|

|

992

|

|

|

22

|

|

|||||||||

|

FICC

|

9,706 | 5,619 | 73 | |||||||||||||||

| Equities intermediation |

5,193 | 3,395 | 53 | |||||||||||||||

|

Equities financing

|

|

1,993

|

|

|

2,285

|

|

|

(13)

|

|

|||||||||

| Equities |

7,186 | 5,680 | 27 | |||||||||||||||

|

Net revenues

|

|

16,892

|

|

|

11,299

|

|

|

49

|

|

|||||||||

|

ASSET MANAGEMENT

|

||||||||||||||||||

|

Management and other fees |

2,052 | 1,934 | 6 | |||||||||||||||

|

Incentive fees |

216 | 85 | 154 | |||||||||||||||

|

Equity investments |

2,325 | 2,900 | (20) | |||||||||||||||

|

Lending and debt investments

|

|

180

|

|

|

1,043

|

|

|

(83)

|

|

|||||||||

|

Net revenues

|

|

4,773

|

|

|

5,962

|

|

|

(20)

|

|

|||||||||

|

CONSUMER & WEALTH MANAGEMENT

|

||||||||||||||||||

|

Management and other fees |

2,854 | 2,508 | 14 | |||||||||||||||

|

Incentive fees |

86 | 62 | 39 | |||||||||||||||

|

Private banking and lending

|

|

538

|

|

|

589

|

|

|

(9)

|

|

|||||||||

|

Wealth management |

3,478 | 3,159 | 10 | |||||||||||||||

| Consumer banking |

|

866

|

|

|

636

|

|

|

36

|

|

|||||||||

|

Net revenues

|

|

4,344

|

|

|

3,795

|

|

|

14

|

|

|||||||||

|

Total net revenues

|

|

$ 32,819

|

|

|

$ 26,591

|

|

|

23

|

|

|||||||||

|

Geographic Net Revenues (unaudited)3 $ in millions

|

|

|||||||||||||||||

| NINE MONTHS ENDED | ||||||||||||||||||

| SEPTEMBER 30, 2020 |

SEPTEMBER 30, 2019 |

|||||||||||||||||

| Americas |

$ 20,333 | $ 15,838 | ||||||||||||||||

|

EMEA |

8,031 | 7,477 | ||||||||||||||||

|

Asia

|

|

4,455

|

|

|

3,276

|

|

||||||||||||

|

Total net revenues

|

|

$ 32,819

|

|

|

$ 26,591

|

|

||||||||||||

| Americas |

62% | 60% | ||||||||||||||||

|

EMEA |

24% | 28% | ||||||||||||||||

|

Asia

|

|

14%

|

|

|

12%

|

|

||||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

||||||||||||

8

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)

In millions, except per share amounts and headcount

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

||||||||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||||||||||

|

Investment banking

|

|

$ 1,934 |

|

|

$ 2,733 |

|

|

$ 1,587 |

|

|

(29) % |

|

|

22 % |

|

|||||||||||||

| Investment management

|

1,689 | 1,635 | 1,562 | 3 | 8 | |||||||||||||||||||||||

| Commissions and fees

|

804 | 875 | 748 | (8) | 7 | |||||||||||||||||||||||

| Market making

|

3,327 | 5,787 | 2,476 | (43) | 34 | |||||||||||||||||||||||

| Other principal transactions

|

|

1,943

|

|

|

1,321

|

|

|

942

|

|

|

47

|

|

|

106

|

|

|||||||||||||

|

Total non-interest revenues

|

|

9,697

|

|

|

12,351

|

|

|

7,315

|

|

|

(21)

|

|

|

33

|

|

|||||||||||||

| Interest income

|

2,932 | 3,034 | 5,459 | (3) | (46) | |||||||||||||||||||||||

| Interest expense

|

|

1,848

|

|

|

2,090

|

|

|

4,451

|

|

|

(12)

|

|

|

(58)

|

|

|||||||||||||

|

Net interest income

|

|

1,084

|

|

|

944

|

|

|

1,008

|

|

|

15

|

|

|

8

|

|

|||||||||||||

|

Total net revenues

|

|

10,781

|

|

|

13,295

|

|

|

8,323

|

|

|

(19)

|

|

|

30

|

|

|||||||||||||

|

Provision for credit losses

|

|

278

|

|

|

1,590

|

|

|

291

|

|

|

(83)

|

|

|

(4)

|

|

|||||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||||||||||||

|

Compensation and benefits

|

|

3,117 |

|

|

4,478 |

|

|

2,731 |

|

|

(30) |

|

|

14 |

|

|||||||||||||

| Brokerage, clearing, exchange and distribution fees

|

911 | 945 | 853 | (4) | 7 | |||||||||||||||||||||||

| Market development

|

70 | 89 | 169 | (21) | (59) | |||||||||||||||||||||||

| Communications and technology

|

340 | 345 | 283 | (1) | 20 | |||||||||||||||||||||||

| Depreciation and amortization

|

468 | 499 | 473 | (6) | (1) | |||||||||||||||||||||||

| Occupancy

|

235 | 233 | 252 | 1 | (7) | |||||||||||||||||||||||

| Professional fees

|

298 | 311 | 350 | (4) | (15) | |||||||||||||||||||||||

| Other expenses

|

|

515

|

|

|

3,514

|

|

|

505

|

|

|

(85)

|

|

|

2

|

|

|||||||||||||

|

Total operating expenses

|

|

5,954

|

|

|

10,414

|

|

|

5,616

|

|

|

(43)

|

|

|

6

|

|

|||||||||||||

| Pre-tax earnings

|

4,549 | 1,291 | 2,416 | N.M. | 88 | |||||||||||||||||||||||

| Provision for taxes

|

|

932

|

|

|

918

|

|

|

539

|

|

|

2

|

|

|

73

|

|

|||||||||||||

|

Net earnings

|

|

3,617

|

|

|

373

|

|

|

1,877

|

|

|

N.M.

|

|

|

93

|

|

|||||||||||||

|

Preferred stock dividends

|

|

134

|

|

|

176

|

|

|

84

|

|

|

(24)

|

|

|

60

|

|

|||||||||||||

|

Net earnings applicable to common shareholders

|

|

$ 3,483

|

|

|

$ 197

|

|

|

$ 1,793

|

|

|

N.M.

|

|

|

94

|

|

|||||||||||||

|

EARNINGS PER COMMON SHARE

|

||||||||||||||||||||||||||||

|

Basic3

|

|

$ 9.77 |

|

|

$ 0.53 |

|

|

$ 4.83 |

|

|

N.M. % |

|

|

102 % |

|

|||||||||||||

| Diluted |

$ 9.68 | $ 0.53 | $ 4.79 | N.M. | 102 | |||||||||||||||||||||||

|

AVERAGE COMMON SHARES

|

||||||||||||||||||||||||||||

|

Basic

|

|

355.9 |

|

|

355.7 |

|

|

370.0 |

|

|

– |

|

|

(4) |

|

|||||||||||||

| Diluted |

359.9 | 355.7 | 374.3 | 1 | (4) | |||||||||||||||||||||||

|

SELECTED DATA AT PERIOD-END

|

||||||||||||||||||||||||||||

|

Common shareholders’ equity

|

|

$ 81,697

|

|

|

$ 78,826

|

|

|

$ 80,809

|

|

|

4

|

|

|

1

|

|

|||||||||||||

| Basic shares3

|

|

356.0

|

|

|

355.8

|

|

|

369.3

|

|

|

–

|

|

|

(4)

|

|

|||||||||||||

| Book value per common share |

$ 229.49 | $ 221.55 | $ 218.82 | 4 | 5 | |||||||||||||||||||||||

| Headcount

|

|

40,900

|

|

|

39,100

|

|

|

37,800

|

|

|

5

|

|

|

8

|

|

|||||||||||||

9

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)

In millions, except per share amounts

| NINE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||

| SEPTEMBER 30, 2020 |

SEPTEMBER 30, 2019 |

SEPTEMBER 30, 2019 |

||||||||||||||||

|

REVENUES

|

||||||||||||||||||

|

Investment banking |

$ 6,409 | $ 4,966 | 29 % | |||||||||||||||

|

Investment management |

5,092 | 4,518 | 13 | |||||||||||||||

|

Commissions and fees |

2,699 | 2,301 | 17 | |||||||||||||||

|

Market making |

12,796 | 7,678 | 67 | |||||||||||||||

|

Other principal transactions |

2,482 | 3,831 | (35) | |||||||||||||||

|

Total non-interest revenues

|

|

29,478

|

|

|

23,294

|

|

|

27

|

|

|||||||||

|

Interest income |

10,716 | 16,816 | (36) | |||||||||||||||

|

Interest expense |

7,375 | 13,519 | (45) | |||||||||||||||

|

Net interest income

|

|

3,341

|

|

|

3,297

|

|

|

1

|

|

|||||||||

|

Total net revenues

|

|

32,819

|

|

|

26,591

|

|

|

23

|

|

|||||||||

|

Provision for credit losses

|

|

2,805

|

|

|

729

|

|

|

N.M.

|

|

|||||||||

|

OPERATING EXPENSES |

||||||||||||||||||

|

Compensation and benefits |

10,830 | 9,307 | 16 | |||||||||||||||

|

Brokerage, clearing, exchange and distribution fees |

2,831 | 2,438 | 16 | |||||||||||||||

|

Market development |

312 | 539 | (42) | |||||||||||||||

|

Communications and technology |

1,006 | 859 | 17 | |||||||||||||||

|

Depreciation and amortization |

1,404 | 1,240 | 13 | |||||||||||||||

|

Occupancy |

706 | 711 | (1) | |||||||||||||||

|

Professional fees |

956 | 950 | 1 | |||||||||||||||

|

Other expenses |

4,781 | 1,556 | N.M. | |||||||||||||||

|

Total operating expenses

|

|

22,826

|

|

|

17,600

|

|

|

30

|

|

|||||||||

| Pre-tax earnings |

7,188 | 8,262 | (13) | |||||||||||||||

|

Provision for taxes |

1,985 | 1,713 | 16 | |||||||||||||||

|

Net earnings

|

|

5,203

|

|

|

6,549

|

|

|

(21)

|

|

|||||||||

|

Preferred stock dividends |

400 | 376 | 6 | |||||||||||||||

|

Net earnings applicable to common shareholders

|

|

$ 4,803

|

|

|

$ 6,173

|

|

|

(22)

|

|

|||||||||

|

EARNINGS PER COMMON SHARE |

||||||||||||||||||

|

Basic3 |

$ 13.41 | $ 16.43 | (18) % | |||||||||||||||

|

Diluted |

$ 13.34 | $ 16.32 | (18) | |||||||||||||||

|

AVERAGE COMMON SHARES |

||||||||||||||||||

|

Basic |

356.5 | 374.7 | (5) | |||||||||||||||

|

Diluted

|

|

360.0

|

|

|

378.2

|

|

|

(5)

|

|

|||||||||

10

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (unaudited)4

$ in billions

| AS OF | ||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

|||||||||||||||

|

ASSETS

|

||||||||||||||||

|

Cash and cash equivalents |

$ 153 | $ 133 | ||||||||||||||

|

Collateralized agreements |

229 | 274 | ||||||||||||||

|

Customer and other receivables |

111 | 106 | ||||||||||||||

|

Trading assets |

408 | 397 | ||||||||||||||

|

Investments |

81 | 77 | ||||||||||||||

|

Loans |

112 | 117 | ||||||||||||||

|

Other assets

|

|

38

|

|

|

38

|

|

||||||||||

|

Total assets

|

|

$ 1,132

|

|

|

$ 1,142

|

|

||||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||||||||||

|

Deposits |

$ 261 | $ 269 | ||||||||||||||

|

Collateralized financings |

144 | 131 | ||||||||||||||

|

Customer and other payables |

187 | 199 | ||||||||||||||

|

Trading liabilities |

162 | 162 | ||||||||||||||

|

Unsecured short-term borrowings |

48 | 44 | ||||||||||||||

|

Unsecured long-term borrowings |

214 | 223 | ||||||||||||||

|

Other liabilities

|

|

23

|

|

|

24

|

|

||||||||||

|

Total liabilities

|

|

1,039

|

|

|

1,052

|

|

||||||||||

|

Shareholders’ equity

|

|

93

|

|

|

90

|

|

||||||||||

|

Total liabilities and shareholders’ equity

|

|

$ 1,132

|

|

|

$ 1,142

|

|

||||||||||

|

Capital Ratios and Supplementary Leverage Ratio (unaudited)3,4 $ in billions

|

|

|||||||||||||||

| AS OF | ||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

|||||||||||||||

|

Common equity tier 1 capital |

$ 77.8 | $ 74.7 | ||||||||||||||

|

STANDARDIZED CAPITAL RULES

|

||||||||||||||||

|

Risk-weighted assets |

$ 535 | $ 563 | ||||||||||||||

|

Common equity tier 1 capital ratio |

14.5% | 13.3% | ||||||||||||||

|

ADVANCED CAPITAL RULES

|

||||||||||||||||

|

Risk-weighted assets |

$ 600 | $ 628 | ||||||||||||||

|

Common equity tier 1 capital ratio |

13.0% | 11.9% | ||||||||||||||

|

SUPPLEMENTARY LEVERAGE RATIO

|

||||||||||||||||

| Supplementary leverage ratio |

6.8% | 6.6% | ||||||||||||||

|

Average Daily VaR (unaudited)3,4 $ in millions

|

|

|||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

|||||||||||||||

|

RISK CATEGORIES

|

||||||||||||||||

|

Interest rates |

$ 72 | $ 98 | ||||||||||||||

|

Equity prices |

55 | 74 | ||||||||||||||

|

Currency rates |

22 | 39 | ||||||||||||||

|

Commodity prices |

26 | 24 | ||||||||||||||

|

Diversification effect

|

|

(84)

|

|

|

(113)

|

|

||||||||||

|

Total

|

|

$ 91

|

|

|

$ 122

|

|

||||||||||

11

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Assets Under Supervision (unaudited)3,4

$ in billions

| AS OF | ||||||||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

||||||||||||||||||||

|

SEGMENT

|

||||||||||||||||||||||

|

Asset Management |

$ 1,461 | $ 1,499 | $ 1,232 | |||||||||||||||||||

|

Consumer & Wealth Management

|

|

575

|

|

|

558

|

|

|

530

|

|

|||||||||||||

|

Total AUS

|

|

$ 2,036

|

|

|

$ 2,057

|

|

|

$ 1,762

|

|

|||||||||||||

|

ASSET CLASS

|

||||||||||||||||||||||

| Alternative investments |

$ 182 | $ 179 | $ 182 | |||||||||||||||||||

|

Equity |

421 | 394 | 392 | |||||||||||||||||||

|

Fixed income

|

|

856

|

|

|

817

|

|

|

784

|

|

|||||||||||||

|

Total long-term AUS

|

|

1,459

|

|

|

1,390

|

|

|

1,358

|

|

|||||||||||||

|

Liquidity products

|

|

577

|

|

|

667

|

|

|

404

|

|

|||||||||||||

|

Total AUS

|

|

$ 2,036

|

|

|

$ 2,057

|

|

|

$ 1,762

|

|

|||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||

| SEPTEMBER 30, 2020 |

JUNE 30, 2020 |

SEPTEMBER 30, 2019 |

||||||||||||||||||||

|

ASSET MANAGEMENT |

||||||||||||||||||||||

|

Beginning balance |

$ 1,499 | $ 1,309 | $ 1,171 | |||||||||||||||||||

|

Net inflows / (outflows): |

||||||||||||||||||||||

|

Alternative investments |

(3) | (2) | (1) | |||||||||||||||||||

|

Equity |

(5) | 3 | 26 | |||||||||||||||||||

|

Fixed income |

|

22

|

|

|

6

|

|

|

11

|

|

|||||||||||||

|

Total long-term AUS net inflows / (outflows) |

|

14

|

|

|

7

|

|

|

36

|

|

|||||||||||||

|

Liquidity products

|

|

(86)

|

|

|

121

|

|

|

12

|

|

|||||||||||||

|

Total AUS net inflows / (outflows)

|

|

(72)

|

|

|

128

|

|

|

48

|

5

|

|||||||||||||

|

Net market appreciation / (depreciation) |

|

34

|

|

|

62

|

|

|

13

|

|

|||||||||||||

|

Ending balance

|

|

$ 1,461

|

|

|

$ 1,499

|

|

|

$ 1,232

|

|

|||||||||||||

|

CONSUMER & WEALTH MANAGEMENT |

||||||||||||||||||||||

|

Beginning balance |

$ 558 | $ 509 | $ 489 | |||||||||||||||||||

|

Net inflows / (outflows): |

||||||||||||||||||||||

|

Alternative investments |

2 | – | 9 | |||||||||||||||||||

|

Equity |

– | (1) | 15 | |||||||||||||||||||

|

Fixed income |

|

2

|

|

|

–

|

|

|

9

|

|

|||||||||||||

|

Total long-term AUS net inflows / (outflows)

|

|

4

|

|

|

(1)

|

|

|

33

|

|

|||||||||||||

|

Liquidity products |

|

(4)

|

|

|

12

|

|

|

5

|

|

|||||||||||||

|

Total AUS net inflows / (outflows)

|

|

–

|

|

|

11

|

|

|

38

|

5

|

|||||||||||||

|

Net market appreciation / (depreciation) |

|

17

|

|

|

38

|

|

|

3

|

|

|||||||||||||

|

Ending balance

|

|

$

575

|

|

|

$

558

|

|

|

$

530

|

|

|||||||||||||

|

FIRMWIDE |

||||||||||||||||||||||

|

Beginning balance |

$ 2,057 | $ 1,818 | $ 1,660 | |||||||||||||||||||

|

Net inflows / (outflows): |

||||||||||||||||||||||

|

Alternative investments |

(1) | (2) | 8 | |||||||||||||||||||

|

Equity |

(5) | 2 | 41 | |||||||||||||||||||

|

Fixed income |

|

24

|

|

|

6 |

|

|

20

|

|

|||||||||||||

|

Total long-term AUS net inflows / (outflows)

|

|

18

|

|

|

6

|

|

|

69

|

|

|||||||||||||

|

Liquidity products |

|

(90)

|

|

|

133

|

|

|

17

|

|

|||||||||||||

|

Total AUS net inflows / (outflows)

|

|

(72)

|

|

|

139

|

|

|

86

|

5

|

|||||||||||||

|

Net market appreciation / (depreciation)

|

|

51

|

|

|

100

|

|

|

16

|

|

|||||||||||||

|

Ending balance

|

|

$ 2,036

|

|

|

$ 2,057

|

|

|

$ 1,762

|

|

|||||||||||||

12

Goldman Sachs Reports

Third Quarter 2020 Earnings Results

|

Footnotes |

|

|

| 1. | Annualized ROE is calculated by dividing annualized net earnings applicable to common shareholders by average monthly common shareholders’ equity. Annualized ROTE is calculated by dividing annualized net earnings applicable to common shareholders by average monthly tangible common shareholders’ equity (tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets). Management believes that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally, and that tangible common shareholders’ equity is meaningful because it is a measure that the firm and investors use to assess capital adequacy. ROTE and tangible common shareholders’ equity are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. |

The table below presents a reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity:

| AVERAGE FOR THE | ||||||||||||

| Unaudited, $ in millions | THREE MONTHS ENDED SEPTEMBER 30, 2020 |

NINE MONTHS ENDED SEPTEMBER 30, 2020 |

||||||||||

|

Total shareholders’ equity

|

|

$ 91,004

|

|

|

$ 91,068

|

|

||||||

| Preferred stock

|

|

(11,203)

|

|

|

(11,203)

|

|

||||||

|

Common shareholders’ equity

|

|

79,801

|

|

|

79,865

|

|

||||||

|

Goodwill and identifiable intangible assets

|

|

(4,835)

|

|

|

(4,825)

|

|

||||||

|

Tangible common shareholders’ equity

|

|

$ 74,966

|

|

|

$ 75,040

|

|

||||||

| 2. | Dealogic – January 1, 2020 through September 30, 2020. |

| 3. | For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2020: (i) investment banking transaction backlog – see “Results of Operations – Investment Banking” (ii) assets under supervision – see “Results of Operations – Assets Under Supervision” (iii) efficiency ratio – see “Results of Operations – Operating Expenses” (iv) share repurchase program – see “Equity Capital Management and Regulatory Capital – Equity Capital Management” (v) global core liquid assets – see “Risk Management – Liquidity Risk Management” (vi) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” and (vii) VaR – see “Risk Management – Market Risk Management.” |

For information about the following items, see the referenced sections in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2020: (i) risk-based capital ratios and the supplementary leverage ratio – see Note 20 “Regulation and Capital Adequacy” (ii) geographic net revenues – see Note 25 “Business Segments” and (iii) unvested share-based awards that have non-forfeitable rights to dividends or dividend equivalents in calculating basic EPS – see Note 21 “Earnings Per Common Share.”

| 4. | Represents a preliminary estimate for the third quarter of 2020 and may be revised in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2020. |

| 5. | Net inflows in assets under supervision for the third quarter of 2019 included $58 billion of total inflows (substantially all in equity and fixed income assets) in connection with the acquisitions of both Standard & Poor’s Investment Advisory Services (SPIAS) and GS Personal Financial Management. SPIAS was included in the Asset Management segment and GS Personal Financial Management was included in the Consumer & Wealth Management segment. |

13