Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EATON VANCE CORP | d820339dex991.htm |

| EX-3.2 - EX-3.2 - EATON VANCE CORP | d820339dex32.htm |

| EX-3.1 - EX-3.1 - EATON VANCE CORP | d820339dex31.htm |

| EX-2.1 - EX-2.1 - EATON VANCE CORP | d820339dex21.htm |

| 8-K - 8-K - EATON VANCE CORP | d820339d8k.htm |

Advancing Our Strategic Transformation: Leading Asset Manager Positioned for Growth Morgan Stanley Acquisition of Eaton Vance October 8, 2020 Exhibit 99.2

Notice Important Information about the Transaction and Where to Find It In connection with the proposed transaction between Morgan Stanley and Eaton Vance Corp. (“Eaton Vance”), Morgan Stanley and Eaton Vance will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a Morgan Stanley registration statement on Form S-4 that will include a prospectus of Morgan Stanley. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF MORGAN STANLEY AND EATON VANCE ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement (when it becomes available), as well as other filings containing information about Morgan Stanley or Eaton Vance, without charge at the SEC’s Internet website (http://www.sec.gov) or by contacting the investor relations department of Morgan Stanley or Eaton Vance at the following: Morgan Stanley Eaton Vance 1585 BroadwayTwo International Place New York, NY 10036Boston, MA 02110 Media Relations: 212-761-2448Media Relations: 617-672-8940 mediainquiries@morganstanley.com rtice@eatonvance.com Investor Relations: 1-212-762-8131Investor Relations: 617-672-6744 investorrelations@morganstanley.com esenay@eatonvance.com No Offer or Solicitation This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Notice Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining required regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period, (ii) the ability of Morgan Stanley and Eaton Vance to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed transaction that could be instituted against Morgan Stanley, Eaton Vance or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and Eaton Vance’s business, including current plans and operations, (v) the ability of Morgan Stanley or Eaton Vance to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the acquisition that could affect Morgan Stanley’s and/or Eaton Vance’s financial performance, (x) certain restrictions during the pendency of the acquisition that may impact Morgan Stanley’s or Eaton Vance’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Morgan Stanley’s or Eaton Vance’s management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K, (xv) those risks described in Item 1A of Eaton Vance’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K and (xvi) those risks that will be described in the registration statement on Form S-4 available from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, will be more fully discussed in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed acquisition. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or Eaton Vance’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Morgan Stanley nor Eaton Vance assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Strategic Rationale Advances Morgan Stanley’s Strategic Transformation with Three World-Class Businesses of Scale 1 Right Time and Right Partner: Combining Two Strong Performing Managers 2 Delivers Long-Term Financial Benefits with Low Execution Risk 7 Creates a Leading Asset Manager with High Quality Complementary Platforms in Key Secular Growth Areas 3 Adds Customization and Sustainability Franchises Positioned for Growth 4 Enhances Client Reach by Combining Leading U.S. Wealth and International Distribution Franchises 6 Delivers Quality Scale and Fills Gaps in Value-Add Fixed Income Business 5

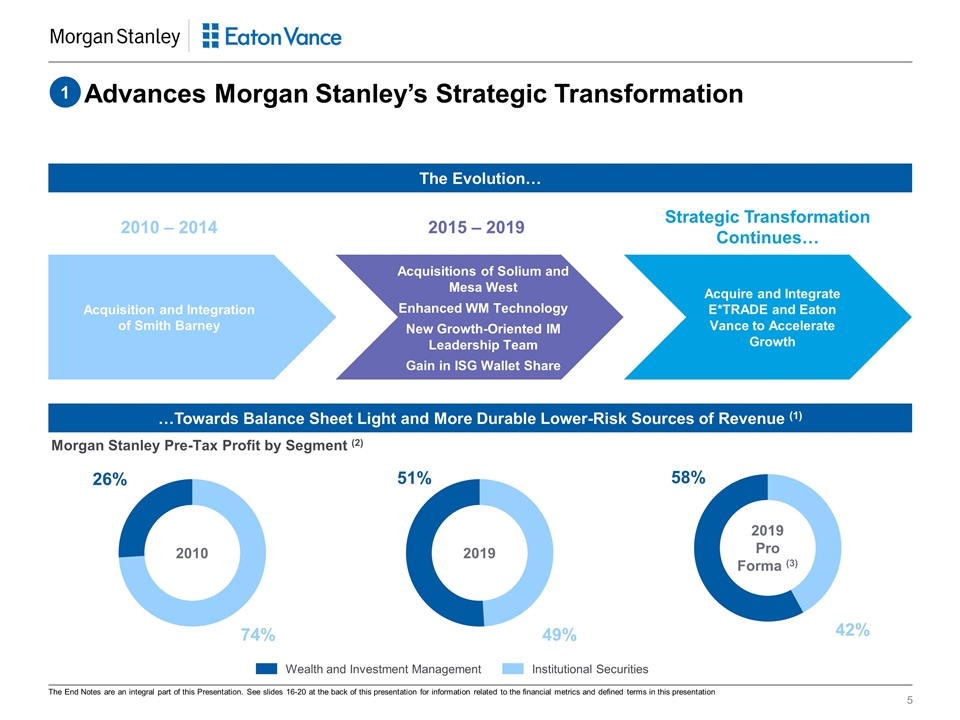

Advances Morgan Stanley’s Strategic Transformation 1 2010 – 2014 2015 – 2019 Institutional Securities Wealth and Investment Management 26% 74% 2010 51% 49% 2019 The Evolution… …Towards Balance Sheet Light and More Durable Lower-Risk Sources of Revenue (1) Acquire and Integrate E*TRADE and Eaton Vance to Accelerate Growth Acquisition and Integration of Smith Barney The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation Strategic Transformation Continues… Morgan Stanley Pre-Tax Profit by Segment (2) 58% 42% 2019 Pro Forma (3) Acquisitions of Solium and Mesa West Enhanced WM Technology New Growth-Oriented IM Leadership Team Gain in ISG Wallet Share

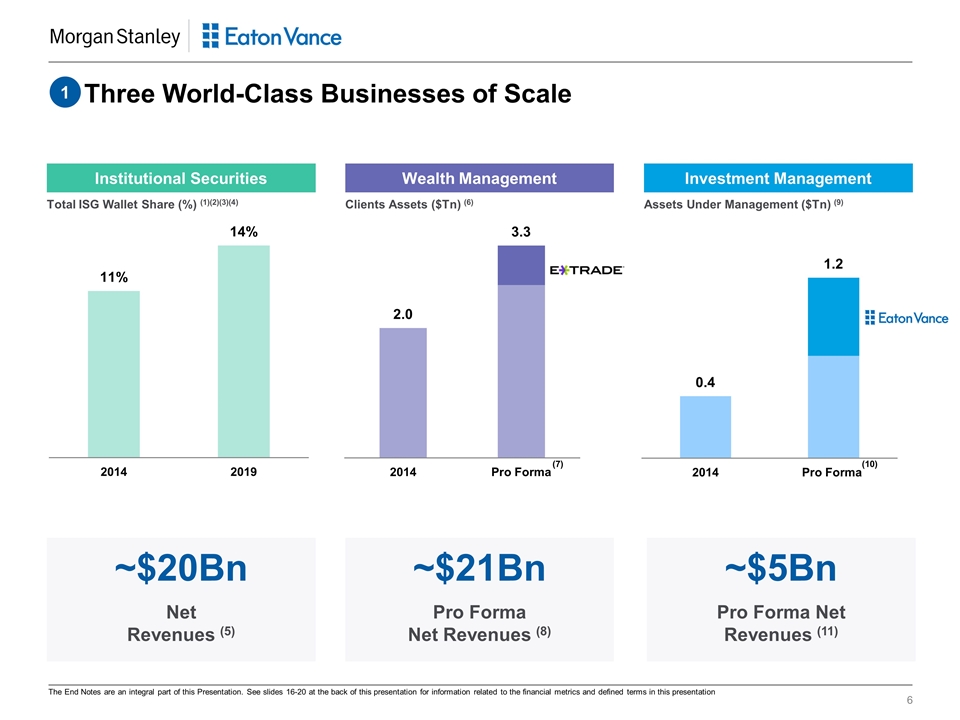

Three World-Class Businesses of Scale 1 Institutional Securities Wealth Management Investment Management Total ISG Wallet Share (%) (1)(2)(3)(4) Clients Assets ($Tn) (6) Assets Under Management ($Tn) (9) (7) (10) ~$20Bn Net Revenues (5) ~$21Bn Pro Forma Net Revenues (8) ~$5Bn Pro Forma Net Revenues (11) The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

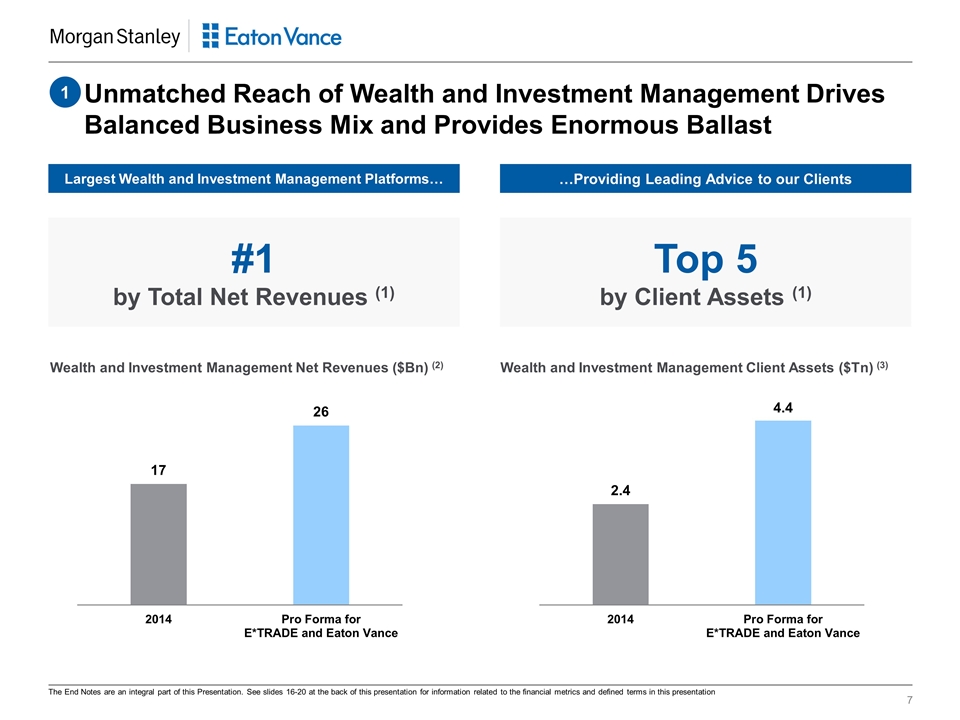

Unmatched Reach of Wealth and Investment Management Drives Balanced Business Mix and Provides Enormous Ballast #1 by Total Net Revenues (1) Top 5 by Client Assets (1) Largest Wealth and Investment Management Platforms… Wealth and Investment Management Net Revenues ($Bn) (2) Wealth and Investment Management Client Assets ($Tn) (3) 1 …Providing Leading Advice to our Clients The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

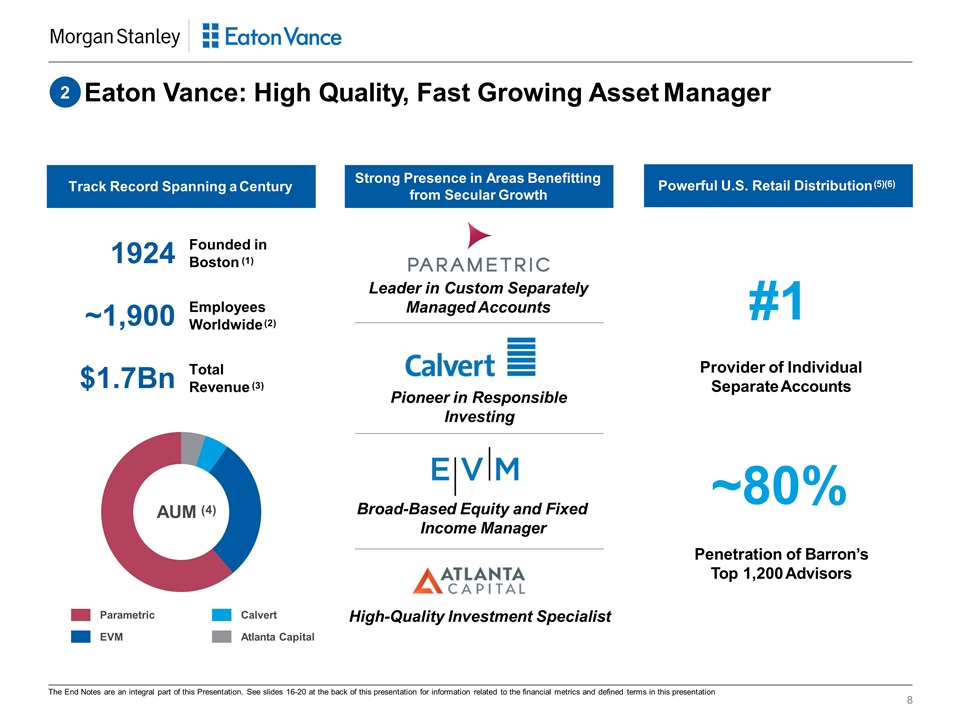

Eaton Vance: High Quality, Fast Growing Asset Manager Pioneer in Responsible Investing Leader in Custom Separately Managed Accounts Broad-Based Equity and Fixed Income Manager Strong Presence in Areas Benefitting from Secular Growth Powerful U.S. Retail Distribution (5)(6) High-Quality Investment Specialist ~80% Penetration of Barron’s Top 1,200 Advisors #1 Provider of Individual Separate Accounts Track Record Spanning a Century 1924 Founded in Boston (1) ~1,900 Employees Worldwide (2) $1.7Bn Total Revenue (3) Parametric EVM Calvert Atlanta Capital AUM (4) 2 The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

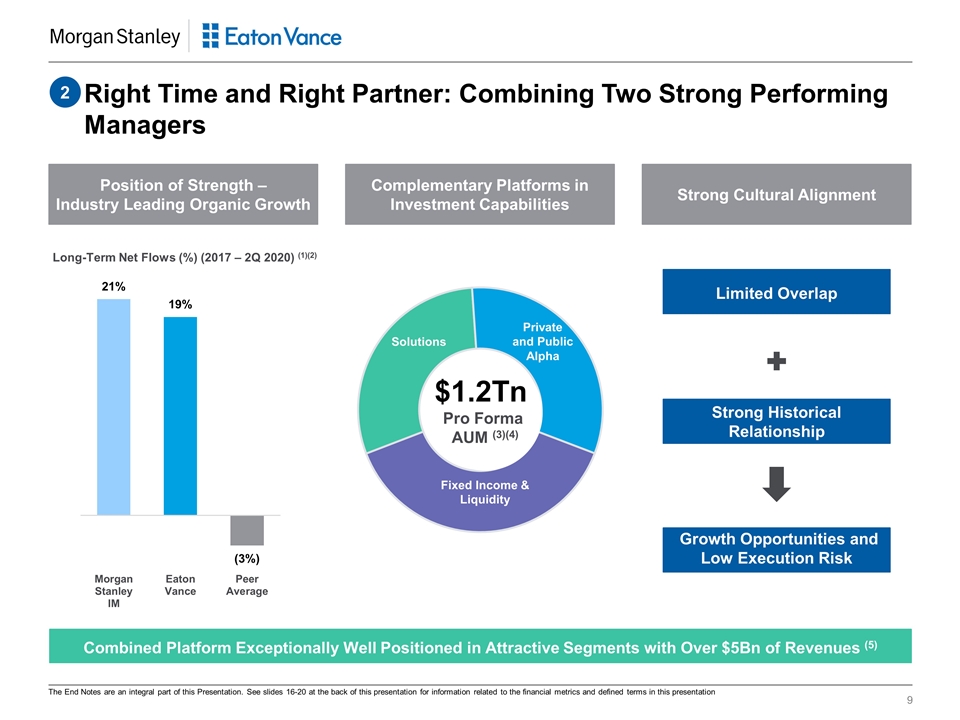

$1.2Tn Pro Forma AUM (3)(4) Private and Public Alpha Solutions Fixed Income & Liquidity Right Time and Right Partner: Combining Two Strong Performing Managers 2 Complementary Platforms in Investment Capabilities Long-Term Net Flows (%) (2017 – 2Q 2020) (1)(2) Position of Strength – Industry Leading Organic Growth Strong Cultural Alignment Combined Platform Exceptionally Well Positioned in Attractive Segments with Over $5Bn of Revenues (5) Limited Overlap Strong Historical Relationship Growth Opportunities and Low Execution Risk The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

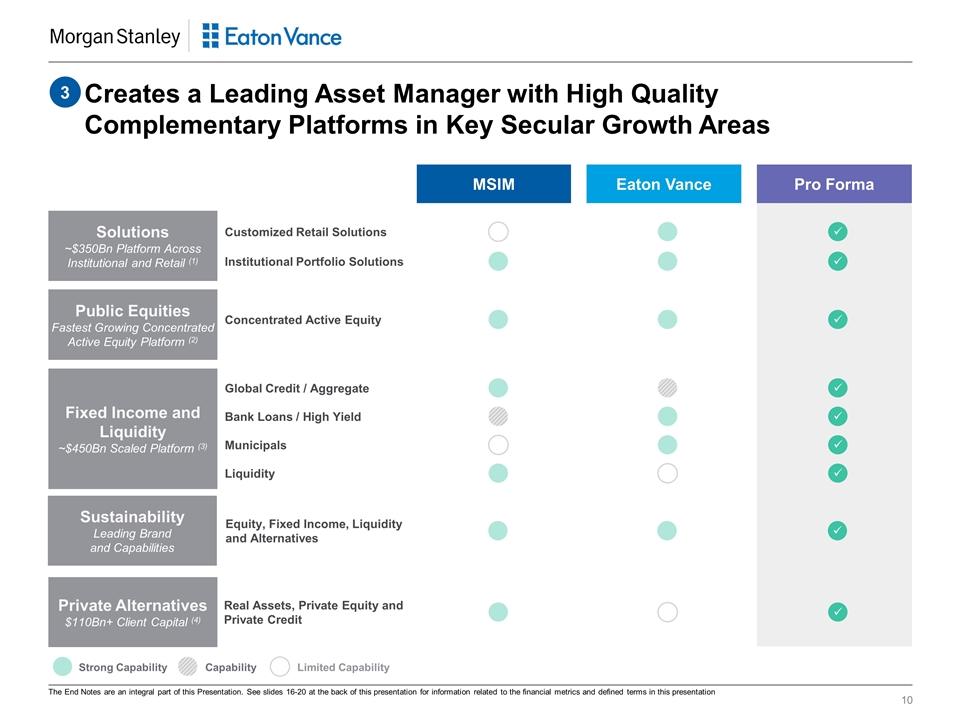

Strong Capability Capability Eaton Vance MSIM Pro Forma Limited Capability Creates a Leading Asset Manager with High Quality Complementary Platforms in Key Secular Growth Areas Concentrated Active Equity ü Public Equities Fastest Growing Concentrated Active Equity Platform (2) Real Assets, Private Equity and Private Credit ü Private Alternatives $110Bn+ Client Capital (4) 3 Institutional Portfolio Solutions ü Customized Retail Solutions ü Solutions ~$350Bn Platform Across Institutional and Retail (1) Global Credit / Aggregate ü Bank Loans / High Yield ü Municipals ü Liquidity ü Fixed Income and Liquidity ~$450Bn Scaled Platform (3) Equity, Fixed Income, Liquidity and Alternatives ü Sustainability Leading Brand and Capabilities The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

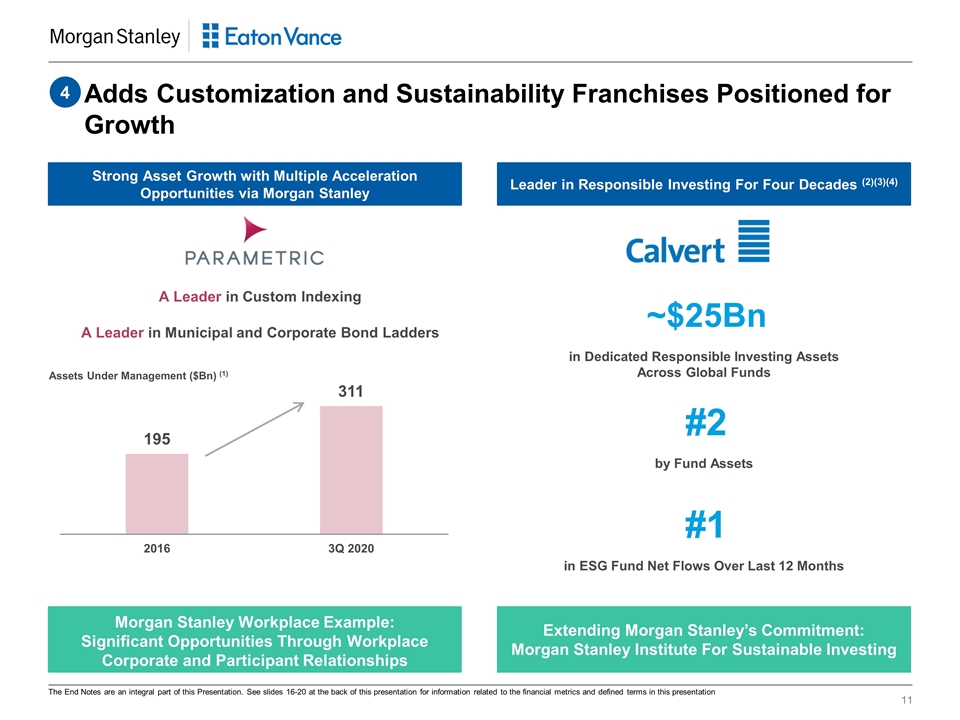

Morgan Stanley Workplace Example: Significant Opportunities Through Workplace Corporate and Participant Relationships Adds Customization and Sustainability Franchises Positioned for Growth Strong Asset Growth with Multiple Acceleration Opportunities via Morgan Stanley 4 Leader in Responsible Investing For Four Decades (2)(3)(4) Assets Under Management ($Bn) (1) A Leader in Custom Indexing A Leader in Municipal and Corporate Bond Ladders ~$25Bn in Dedicated Responsible Investing Assets Across Global Funds #2 by Fund Assets #1 in ESG Fund Net Flows Over Last 12 Months Extending Morgan Stanley’s Commitment: Morgan Stanley Institute For Sustainable Investing The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

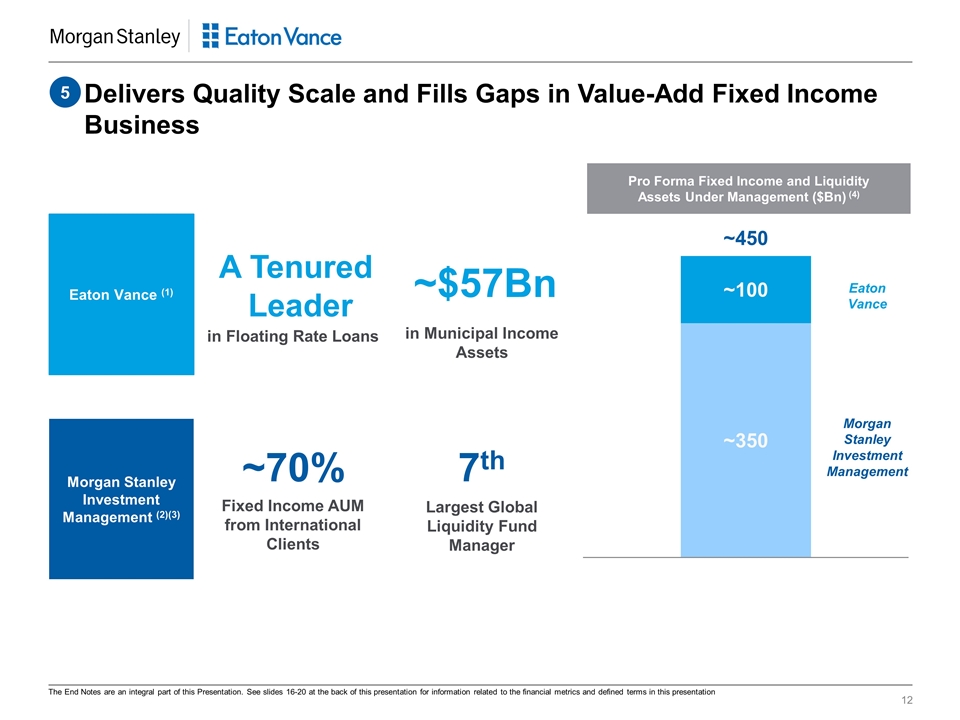

Delivers Quality Scale and Fills Gaps in Value-Add Fixed Income Business 5 ~$57Bn in Municipal Income Assets 7th Largest Global Liquidity Fund Manager Eaton Vance (1) Morgan Stanley Investment Management (2)(3) Pro Forma Fixed Income and Liquidity Assets Under Management ($Bn) (4) Eaton Vance Morgan Stanley Investment Management A Tenured Leader in Floating Rate Loans ~70% Fixed Income AUM from International Clients The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

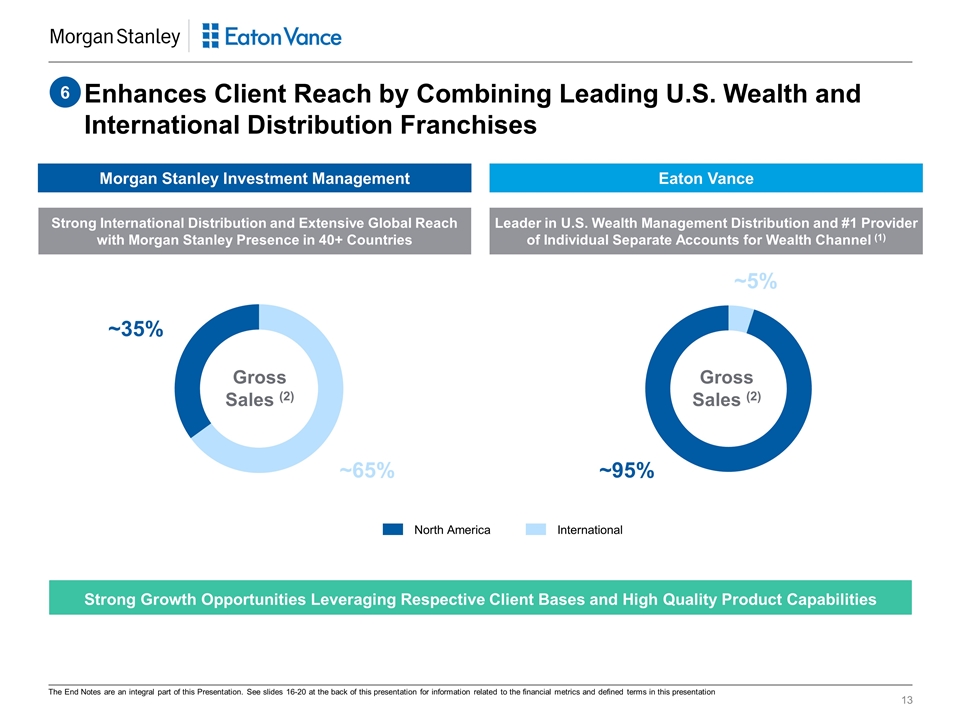

Enhances Client Reach by Combining Leading U.S. Wealth and International Distribution Franchises 6 ~65% ~35% Gross Sales (2) ~95% ~5% North America International Morgan Stanley Investment Management Eaton Vance Strong International Distribution and Extensive Global Reach with Morgan Stanley Presence in 40+ Countries Leader in U.S. Wealth Management Distribution and #1 Provider of Individual Separate Accounts for Wealth Channel (1) Gross Sales (2) Strong Growth Opportunities Leveraging Respective Client Bases and High Quality Product Capabilities The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

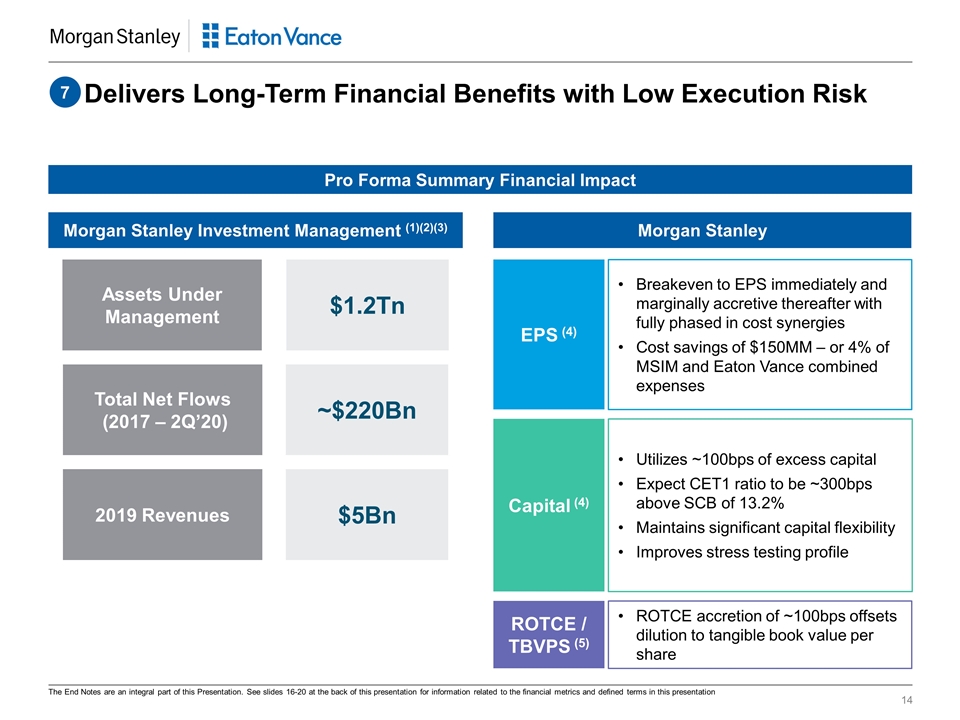

Delivers Long-Term Financial Benefits with Low Execution Risk 7 ROTCE / TBVPS (5) ROTCE accretion of ~100bps offsets dilution to tangible book value per share EPS (4) Breakeven to EPS immediately and marginally accretive thereafter with fully phased in cost synergies Cost savings of $150MM – or 4% of MSIM and Eaton Vance combined expenses Capital (4) Utilizes ~100bps of excess capital Expect CET1 ratio to be ~300bps above SCB of 13.2% Maintains significant capital flexibility Improves stress testing profile Morgan Stanley Investment Management (1)(2)(3) Morgan Stanley Pro Forma Summary Financial Impact ~$220Bn Total Net Flows (2017 – 2Q’20) $1.2Tn Assets Under Management $5Bn 2019 Revenues The End Notes are an integral part of this Presentation. See slides 16-20 at the back of this presentation for information related to the financial metrics and defined terms in this presentation

Strategic Rationale Advances Morgan Stanley’s Strategic Transformation with Three World-Class Businesses of Scale 1 Right Time and Right Partner: Combining Two Strong Performing Managers 2 Delivers Long-Term Financial Benefits with Low Execution Risk 7 Creates a Leading Asset Manager with High Quality Complementary Platforms in Key Secular Growth Areas 3 Adds Customization and Sustainability Franchises Positioned for Growth 4 Enhances Client Reach by Combining Leading U.S. Wealth and International Distribution Franchises 6 Delivers Quality Scale and Fills Gaps in Value-Add Fixed Income Business 5

These notes refer to the financial metrics and/or defined term presented on Slide 5 Balance Sheet Light, as it relates to the Morgan Stanley’s Wealth Management segment, refers to a lower Risk Weighted Assets (‘RWAs’) intensity. Durable sources of revenues represent revenues associated with fee-based pricing arrangements, financing and lending that are generally less susceptible to significant fluctuation as a result of market volatility when compared to other Firm revenues, and are comprised of: Asset Management revenues in the Wealth and Investment Management segments; revenues from Financing and Secured Lending activities in the ISG and Wealth Management (‘WM’) segments; and revenues from Investment Banking Advisory services. Pre-Tax Profit represents Income from continuing operations before income taxes. Pre-Tax Profit for 2010 excludes the negative impact of DVA of approximately $873 million. DVA represents the change in fair value resulting from fluctuations in our debt credit spreads and other credit factors related to borrowings and other liabilities carried under the fair value option. The full amount of the Net revenues DVA adjustment was recorded in the Institutional Securities segment. Pre-Tax Profit, excluding DVA is a non-GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. E*TRADE’s Pre-Tax Profit based on E*TRADE’s Annual Report on Form 10-K for the year ended December 31, 2019 (‘E*TRADE’s 2019 Form 10-K’). Eaton Vance’s Pre-Tax Profit based on Eaton Vance’s Annual Report on Form 10-K for the year ended October 31, 2019 (‘Eaton Vance’s 2019 Form 10-K’). Figures represent the latest available full fiscal year financials. Pro Forma Pre-Tax Profit represents the addition of Morgan Stanley’s, E*TRADE’s and Eaton Vance’s pre-tax profit. Pro Forma Pre-Tax Profit by Segment does not include estimated cost and funding synergies and post-closing restructuring / integration costs associated with the transaction and does not factor in any potential attrition of assets or revenues post closing due to limited anticipated disruption to the existing business models. Figures represent the latest available full fiscal year financials. These notes refer to the financial metrics and/or defined term presented on Slide 6 Wallet represents aggregated reported net revenues of Morgan Stanley and the following peers: Goldman Sachs, JP Morgan, Bank of America, Citigroup, UBS, Deutsche Bank, Credit Suisse, and Barclays. Morgan Stanley’s ISG wallet share represents total ISG segment net revenues. Peer wallet includes revenues that represent Advisory, Equity Underwriting, Debt Underwriting, Equity Sales & Trading and Fixed Income Sales & Trading, where applicable. Morgan Stanley’s 2014 Wallet Share is calculated as the percentage of Morgan Stanley’s net revenues, excluding DVA to the Wallet. Peer data reflects revenues from applicable business lines and 2014 has been adjusted for DVA, where it is reported and where applicable. European peer results were translated to USD using average exchange rates for the appropriate period; sourced from Bloomberg. In determining 2014 Wallet Share, Equity Sales & Trading net revenues, exclude the positive impact from DVA of $232 million. Equity Sales & Trading Net Revenues, excluding DVA is a non-GAAP financial measure the Firm considers useful for analysts, investors and other stakeholders to allow better comparability of period to period operating performance. In determining 2014 Wallet Share, Institutional Securities Sales & Trading net revenues, exclude the positive impact from DVA of $651 million. Institutional Securities Sales & Trading Net Revenues, excluding DVA is a non-GAAP financial measure the Firm considers useful for analysts, investors and other stakeholders to allow better comparability of period to period operating performance. Net Revenues includes Morgan Stanley’s Institutional Securities Net Revenues based on the Firm’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (‘2019 Form 10-K’). Client Assets represents Morgan Stanley Wealth Management client assets based on the Firm’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 (‘2020 2Q Form 10-Q’). Pro Forma Client Assets represents the addition of Morgan Stanley’s and E*TRADE’s Client Assets. E*TRADE’s Client Assets based on E*TRADE’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 (‘E*TRADE’s 2020 2Q Form 10-Q’) and represents total customer assets, excluding corporate services unvested holdings. Figures represent the latest available fiscal quarter financials. Pro Forma Net Revenues represents the addition of Morgan Stanley’s Wealth Management Revenues and E*TRADE’s Net Revenues. E*TRADE’s Net Revenues are based on E*TRADE’s 2019 Form 10-K and represents Total Net Revenues. End Notes

These notes refer to the financial metrics and/or defined term presented on Slide 6 Assets Under Management (AUM) represents Morgan Stanley’s Investment Management AUM on the Firm’s 2020 2Q Form 10-Q. Pro Forma Assets Under Management represents the addition of Morgan Stanley’s Investment Management and Eaton Vance’s assets under management. Eaton Vance’s Assets Under Management based on Eaton Vance’s Quarterly Report on Form 10-Q for the quarter ended July 31, 2020 (‘Eaton Vance’s 2020 3Q Form 10-Q’). Figures represent the latest available fiscal quarter financials. Pro Forma Net Revenues represents the addition of Morgan Stanley’s Investment Management Net Revenues and Eaton Vance’s Net Revenues. Figures represent the latest available full fiscal year financials. Eaton Vance’s Net Revenues represent total revenue and total non-operating income based on Eaton Vance’s 2019 Form 10-K. These notes refer to the financial metrics and/or defined term presented on Slide 7 Rankings: Net Revenues ranking based on fiscal 2019 combined Investment Management & Wealth Management net revenues. Rankings based on internal analysis of Total Net Revenues with data aggregated from public data for Bank of America, BlackRock, Charles Schwab, Credit Suisse, Fidelity, Goldman Sachs, JP Morgan, UBS and Wells Fargo. Morgan Stanley position in the rankings based on metrics pro forma for E*TRADE and Eaton Vance. Client Asset ranking based on the most recent fiscal quarter for combined Investment Management and Wealth Management client assets and assets under management. Rankings based on internal analysis of combined Investment and Wealth management client assets and assets under management with data aggregated from public filings for Allianz, Bank of America, BlackRock, Charles Schwab, Fidelity, JP Morgan, State Street, UBS and Vanguard. Rankings exclude assets under custody and assets under administration. Morgan Stanley’s position in the rankings based on metrics pro forma for E*TRADE and Eaton Vance. Morgan Stanley’s Wealth Management and Investment Management Net Revenues represent the aggregation of both segments net revenues and excludes intersegment activity. Morgan Stanley net revenues are based on the Firm’s Annual report on form 10K for the year ended December 31, 2019 and December 31, 2014. E*TRADE’s Net Revenues are based on E*TRADE’s 2019 Form 10-K and represents Total Net Revenue. Eaton Vance’s Net Revenues based on Eaton Vance’s 2019 Form 10-K. Pro Forma Net Revenues represents the addition of Morgan Stanley’s, E*TRADE’s and Eaton Vance’s Net Revenues, Figures represent the latest available full fiscal year financials. Client Assets represents Wealth Management client assets and Investment Management assets under management based on the Firm’s 2020 2Q Form 10-Q. E*TRADE’s Client Assets based on E*TRADE’s 2020 2Q Form 10-Q and represents total customer assets, excluding corporate services unvested holdings. Eaton Vance’s Client Assets based on Eaton Vance’s 2020 3Q Form 10-Q and represents total assets under management. Pro Forma Client Assets represents the addition of Morgan Stanley’s Client Assets, E*TRADE’s Clients Assets and Eaton Vance’s Client Assets. Figures represent the latest available fiscal quarter financials. These notes refer to the financial metrics and/or defined term presented on Slide 8 Refers to the creation of the first mutual fund, Massachusetts Investors Trust, a predecessor firm of Vance, Sanders & Company, which ultimately became Eaton Vance. Represents full-time and part-time employees of Eaton Vance’s wholly- and majority-owned subsidiaries based on Eaton Vance’s 2019 Form 10-K. Total Revenue based on Eaton Vance’s 2019 Form 10-K. Assets Under Management based on Eaton Vance’s 2020 3Q Form 10-Q. Figures represent the latest available fiscal quarter financials. End Notes

These notes refer to the financial metrics and/or defined term presented on Slide 8 Provider of Individual Separate Accounts Ranking based on Cerulli Lodestar’s Separate Managed Account Industry Manager Leaderboard as of June 30, 2020. Penetration represents a measure of advisors included in the Barron’s top 1,200 advisors rankings that have made an investment in Eaton Vance strategies over a 24-month period. These notes refer to the financial metrics and/or defined term presented on Slide 9 Organic Growth represents cumulative long-term net flows over 14 quarters from calendar 1Q 2017 to 2Q 2020 as a percentage of beginning Assets Under Management for 2017 (as of calendar 4Q 2016) for Morgan Stanley and Peers. For Eaton Vance, this represents cumulative long-term net flows over 14 fiscal quarters from fiscal 2Q 2017 to 3Q 2020 as a percentage of beginning Assets Under Management as of fiscal 1Q 2017. Peer Average includes AllianceBernstein, BlackRock (Active Only), DWS (Active Only), Franklin Templeton, Goldman Sachs Asset Management, Invesco (Active Only), Janus Henderson Group, JP Morgan Asset Management, Legg Mason, Schroders, Standard Life Aberdeen and T. Rowe Price. These represent Morgan Stanley Investment Management and Eaton Vance’s peers based on similarity of business models and Assets Under Management. In addition, all notable acquisitions have been removed from net flows and entire Standard Life Aberdeen business is assumed to be long-term flows. Pro Forma Assets Under Management represents the addition of Morgan Stanley’s Investment Management AUM based on the Firm’s 2020 2Q Form 10-Q and Eaton Vance’s AUM based on Eaton Vance’s 2020 3Q Form 10-Q. For Morgan Stanley “Private and Public Alpha” includes public equity strategies reported under the "Equity" category and real assets, private equity, private credit and private equity fund of funds reported under the "Alternative/Other" category as of June 30, 2020 in the Firm’s 2020 2Q Form 10-Q. For Eaton Vance “Private and Public Alpha” includes strategies reported under the "Equity" category and the "Alternative" category as of July 31, 2020 in Eaton Vance’s 2020 3Q Form 10-Q. For Morgan Stanley “Solutions” includes multi-asset portfolio strategies and hedge fund of funds reported under the "Alternative/Other" category as of June 30, 2020 in the Firm’s 2020 2Q Form 10-Q. For Eaton Vance “Solutions” includes strategies reported under the “Parametric custom portfolios” and “Parametric overlay services” categories as of July 31, 2020 in Eaton Vance’s 2020 3Q Form 10-Q. For Morgan Stanley “Fixed Income & Liquidity” includes strategies reported under the "Fixed income" and "Liquidity" categories as of June 30, 2020 the Firm’s 2020 2Q Form 10-Q. For Eaton Vance “Fixed Income & Liquidity” includes strategies reported under the "Fixed income" and "Floating-rate income" categories as of July 31, 2020 in Eaton Vance’s 2020 3Q Form 10-Q. Pro Forma Net Revenues represents the addition of Morgan Stanley’s Investment Management Net Revenues and Eaton Vance’s Net Revenues. Figures represent the latest available full fiscal year financials. Eaton Vance’s Net Revenues represent total revenue and total non-operating income based on Eaton Vance’s 2019 Form 10-K. These notes refer to the financial metrics and/or defined term presented on Slide 10 Platform Across Institutional and Retail represents the addition of Morgan Stanley’s and Eaton Vance’s “Solutions” AUM. For Morgan Stanley “Solutions” includes multi-asset portfolio strategies and hedge fund of funds reported under the "Alternative/Other" category as of June 30, 2020 in the Firm’s 2020 2Q Form 10-Q. For Eaton Vance “Solutions” includes strategies reported under the “Parametric custom portfolios” and “Parametric overlay services” categories as of July 31, 2020 in Eaton Vance’s 2020 3Q Form 10-Q. Figures represent the latest available fiscal quarter financials. Fastest Growing Concentrated Equity Platform based on growth representing cumulative active equity net flows over 14 quarters from calendar 1Q 2017 to 2Q 2020 as a percentage of beginning Assets Under Management for 2017 (as of calendar 4Q 2016) for Morgan Stanley and Peers. For Eaton Vance, this represents cumulative active equity net flows over 14 fiscal quarters from fiscal 2Q 2017 to 3Q 2020 as a percentage of beginning Assets Under Management as of fiscal 1Q 2017. Peers are based on U.S. publicly traded Asset Managers with Active Equity AUM greater than $100Bn as of June 30, 2020: Affiliated Managers Group, AllianceBernstein, Artisan Partners, BlackRock (active equities flows), BrightSphere, Franklin Resources, Invesco (active equities flows), Janus Henderson, Legg Mason, T. Rowe Price, or as of July 31, 2020: Eaton Vance. Brightsphere changed their asset class categorizations in 3Q 2019, therefore figures used in comparison reflect "Quantitative and Solutions" and "Liquid Alpha", which are substantially all equity. End Notes

These notes refer to the financial metrics and/or defined term presented on Slide 10 Fixed Income and Liquidity Scaled Platform for Morgan Stanley includes strategies reported under the "Fixed income" and "Liquidity" categories as of June 30, 2020 in the Firm’s 2020 2Q Form 10-Q. For Eaton Vance includes strategies reported under the "Fixed income" and "Floating-rate income" categories as of July 31, 2020 in Eaton Vance’s 2020 3Q Form 10-Q. Figures represent the latest available fiscal quarter financials. Private Alternatives Client Capital includes client assets under management, unfunded commitments, co-investments and leverage across private credit, private equity, private real assets and alternatives fund of funds as of June 30, 2020. These notes refer to the financial metrics and/or defined term presented on Slide 11 Parametric’s Assets Under Management based on Eaton Vance’s Annual Report on Form 10-K for the year ended October 31, 2016 (‘Eaton Vance’s 2016 Form 10-K’) which have been recast to reflect the shift of Eaton Vance’s systematically managed fixed income strategies from Eaton Vance Management to Parametric effective in the first quarter of fiscal 2020 and Eaton Vance’s 2020 3Q Form 10-Q. Dedicated Responsible Investing Assets Across Global Funds represent Calvert’s Assets Under Management based on Eaton Vance’s 2020 3Q Form 10-Q. Figures represent the latest available fiscal quarter financials. Fund Assets Ranking represents Calvert’s ranking by AUM in U.S. domiciled sustainable mutual funds, sourced from Morningstar, as of September 30, 2020. Figures represent the latest available metrics. Fund Net Flows Ranking represents Calvert’s ranking by Last Twelve Months (LTM) net flows in U.S. domiciled sustainable mutual funds, sourced from Morningstar, as of September 30, 2020. Figures represent the latest available metrics. These notes refer to the financial metrics and/or defined term presented on Slide 12 Municipal Income Assets represent total municipal bond AUM, including EVM managed assets and Parametric managed assets, as of July 31, 2020. Figures represent the latest available metrics. Fixed Income AUM from International Clients represents Morgan Stanley’s Fixed Income AUM by region of sale including EMEA, Asia and Latin America, excluding North America, as of June 30, 2020. Liquidity Fund Manager Ranking based on Global Total Money Market Funds assets under management as of June 30, 2020 from iMoneyNet. Fixed Income and Liquidity Assets Under Management for Morgan Stanley includes assets under management reported under the "Fixed income" and "Liquidity" categories as of June 30, 2020 in the Firm’s 2020 2Q Form 10-Q. Eaton Vance’s Fixed Income and Liquidity Assets Under Management based on Eaton Vance’s 2020 3Q Form 10-Q and represents assets under management for the “Fixed income” and “Floating-rate income” categories. Figures represent the latest available fiscal quarter financials. Pro Forma Fixed Income and Liquidity Assets Under Management represents the addition of Morgan Stanley’s and Eaton Vance’s Fixed Income and Liquidity Assets Under Management. End Notes

These notes refer to the financial metrics and/or defined term presented on Slide 13 Provider of Individual Separate Accounts Ranking based on Cerulli Lodestar’s Separate Managed Account Industry Manager Leaderboard as of June 30, 2020. Gross Sales represents gross sales from long-term asset classes for the period from January 1 through June 30, 2020 for Morgan Stanley and 9 month fiscal year-to-date period starting on October 31, 2019 and ending July 31, 2020 for Eaton Vance. These notes refer to the financial metrics and/or defined term presented on Slide 14 Assets Under Management represents the addition of Morgan Stanley’s Investment Management AUM based on the Firm’s 2020 2Q Form 10-Q and Eaton Vance’s AUM based on Eaton Vance’s 2020 3Q Form 10-Q. Total Net Flows represents the addition of Morgan Stanley’s Investment Management and Eaton Vance’s cumulative Total Net Flows. Figures represent 14 quarters of cumulative total net flows from 1Q 2017 to 2Q 2020 for Morgan Stanley and cumulative total net flows over 14 fiscal quarters from 2Q 2017 to 3Q 2020 for Eaton Vance. Figures represent the latest available financials. 2019 Revenues represents addition of Morgan Stanley’s Investment Management Net Revenues based on the Firm’s 2019 Form 10-K and Eaton Vance’s 2019 Form 10-K. Figures represent the latest available full fiscal year financials. EPS and CET1 impacts are Morgan Stanley estimates. For EPS, estimated cost synergies are phased in over three years from the closing date of the transaction. The calculation of ROTCE uses pro forma net income applicable to Morgan Stanley less preferred dividends as a percentage of pro forma average tangible common equity (‘TCE’). Tangible Book Value per Common Share (‘TBVPS’) equals pro forma TCE divided by period end common shares outstanding, as adjusted for the transaction. Pro forma ROTCE and Tangible Book Value per Share are non-GAAP financial measures that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. End Notes

Advancing Our Strategic Transformation: Leading Asset Manager Positioned for Growth Morgan Stanley Acquisition of Eaton Vance October 8, 2020