Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BridgeBio Pharma, Inc. | d84765dex991.htm |

| 8-K - 8-K - BridgeBio Pharma, Inc. | d84765d8k.htm |

BridgeBio to acquire remaining minority interest in Eidos Therapeutics October 5, 2020 Exhibit 99.2

Forward-Looking Statements and Disclaimer This Presentation contains statements relating to the proposed transaction involving BridgeBio Pharma, Inc. (the “Company”) and Eidos Therapeutics, Inc. (“Eidos”) that are not statements of historical fact. Such statements are considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding the Company’s research and clinical development plans, expected manufacturing capabilities, strategy, regulatory matters, market size and opportunity, future financial position, future revenue, projected costs, prospects, plans, objectives of management, and the Company’s ability to complete certain milestones. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “will,” “may,” “goal,” “potential,” “should,” “could,” “aim,” “estimate,” “predict,” “continue” and similar expressions or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, though not all forward-looking statements necessarily contain these identifying words. These forward-looking statements are neither forecasts, promises nor guarantees, and are based on the beliefs of the Company’s management as well as assumptions made by and information currently available to the Company. Such statements reflect the current views of the Company with respect to future events and are subject to known and unknown risks, including business, regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about the Company, including, without limitation, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the risk that the Company’s and/or Eidos’ stockholders may not approve the proposed transaction, inability to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived, uncertainty as to the timing of completion of the proposed transaction, potential adverse effects or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement or completion of the proposed transaction, potential litigation relating to the proposed transaction that could be instituted against the Company, Eidos or their respective directors and officers, including the effects of any outcomes related thereto, possible disruptions from the proposed transaction that could harm the Company’s or Eidos’ business, including current plans and operations, unexpected costs, charges or expenses resulting from the proposed transaction, uncertainty of the expected financial performance of each of the Company and Eidos following completion of the proposed transaction, including the possibility that the expected synergies and value creation from the proposed transaction will not be realized or will not be realized within the expected time period, the ability of the Company and/or Eidos to implement their respective business strategies, inability to retain and hire key personnel, risks inherent in developing therapeutic products, the success, cost, and timing of the Company’s product candidate development activities and ongoing and planned preclinical studies and clinical trials, trends in the industry, the legal and regulatory framework for the industry, the Company’s ability to obtain and maintain regulatory approval for its product candidates, the Company’s ability to commercialize its product candidates, future agreements with third parties in connection with the development or commercialization of the Company’s product candidates, the size and growth potential of the market for the Company’s product candidates, the accuracy of the Company’s estimates regarding expenses, future revenue, future expenditures and needs for and ability to obtain additional financing, the Company’s ability to obtain and maintain intellectual property protection for its product candidates, potential adverse impacts due to the global COVID-19 pandemic such as delays in clinical trials, preclinical work, overall operations, regulatory review, manufacturing and supply chain interruptions, adverse effects on healthcare systems and disruption of the global economy, and those risks and uncertainties described under the heading “Risk Factors” in the Company’s most recent Quarterly Report on Form 10-Q and Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) and in subsequent filings made by the Company with the SEC, which are available on the SEC’s website at www.sec.gov. In light of these risks and uncertainties, many of which are beyond the Company’s control, the events or circumstances referred to in the forward-looking statements, expressly or implicitly, may not occur. The actual results may vary from the anticipated results and the variations may be material. You are cautioned not to place undue reliance on these forward-looking statements, which speak the Company’s current beliefs and expectations only as of the date this Presentation is given. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this Presentation in the event of new information, future developments or otherwise. You should, therefore, not rely on these forward-looking statements as representing our views of any date subsequent to the date of this press release. No representation is made as to the safety or effectiveness of these product candidates for the therapeutic use for which such product candidates are being studied. Certain information contained in this Presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this Presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its own internal research is reliable, such research has not been verified by any independent source. The Company is the owner of various trademarks, trade names and service marks. Certain other trademarks, trade names and service marks appearing in this Presentation are the property of third parties. Solely for convenience, the trademarks and trade names in this Presentation are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Additional Information and Where to Find It This Presentation is being made in respect of the proposed transaction involving the Company and Eidos, which will be submitted to the Company’s and Eidos’ stockholders for their consideration. The Company intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of the Company and Eidos, and each party will file other documents regarding the proposed transaction with the SEC. Any definitive proxy statement(s) / prospectus(es) (if and when available) will also be sent to the stockholders of the Company and Eidos, when seeking any required stockholder approval. This Presentation is not intended to be, and is not, a substitute for such filings or for any other document that the Company or Eidos may file with the SEC in connection with the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT(S) AND PROXY STATEMENT(S) / PROSPECTUS(ES), WHEN THEY BECOME AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The documents filed or furnished by the Company and Eidos with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by the Company may be obtained free of charge from the Company at www.investor.bridgebio.com, under the tab “Financials & Filings,” and the documents filed by Eidos may be obtained free of charge from Eidos at www.eidostx.com, under the tab “Investors.” Alternatively, these documents, when available, can be obtained free of charge from the Company upon written request to the Company at 421 Kipling Street, Palo Alto, CA 94301, Attn: Grace Rauh, or by calling 917-232-5478, or from Eidos upon written request to Eidos at 101 Montgomery Street, Suite 2000, San Francisco, CA 94104, Attn: John Grimaldi, Burns McClellan, or by calling 212-213-0006. Participants in the Solicitation The Company, Eidos and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders of Eidos in connection with the proposed transaction under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of directors and executive officers of the Company in the Company’s proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 22, 2020, as well as its other filings with the SEC. Investors may obtain information regarding the names, affiliations and interests of Eidos’ directors and executive officers in Eidos’ proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 24, 2020, as well as its other filings with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the registration statement, joint proxy statement / prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction (if and when they become available). You may obtain free copies of these documents at the SEC’s website at www.sec.gov. Copies of documents filed with the SEC by the Company and Eidos will also be available free of charge from the Company or Eidos, as applicable, using the contact information above. No Offer or Solicitation This material is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any proxy, vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be deemed to be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Transaction overview BridgeBio Pharma (BridgeBio) to acquire all outstanding shares of Eidos Therapeutics (Eidos) not held by BridgeBio Subject to the terms and conditions of the agreement, Eidos stockholders will have the option to elect to receive either (i) 1.8500x shares of BridgeBio common stock or (ii) $73.26 in cash for each Eidos share, with the cash consideration subject to proration Total cash consideration will not exceed $175M and will be funded from cash available on balance sheet with potential for incremental financing to be raised by BridgeBio Both options represent approximately a 41% premium to the unaffected Eidos closing price on October 2, 20201 and a 55% premium to the 30-Day VWAP2 Unanimously approved by the Board of BridgeBio and a Special Committee of the independent directors of Eidos Expected closing in the first quarter of 2021, subject to Eidos and BridgeBio stockholder approvals, and other customary closing conditions 1 Last trading day before BridgeBio proposal was publicly disclosed ($51.92 closing price as of 10/02/20) 2 30-Day VWAP of $47.21 as of the unaffected Eidos closing price on 10/02/20

BridgeBio fully and formally welcomes Eidos back into its vibrant ecosystem of innovation This agreement removes all barriers and allows us to fully unlock the potential of acoramidis for patients and investors Best owner hypothesis in orphan and RGD drugs = the passionate operators that connect science to medicine to commercial seamlessly to best serve both patients and investors Acoramidis / Eidos Team within BridgeBio = best owners = no barriers to: Pursuing full development landscape – primary prevention, sub-population analyses by stage or genetics Marrying current efforts with additional precision cardiovascular and renal genetic opportunities (across modalities) to keep community engaged, building on learnings, and recruit the very best talent Starting serious commercial development – including market ‘growth’ activities around dx, research, and education. Market access discussions Pursuing lifecycle management – once daily dosing Deploying capital to maximize value of asset

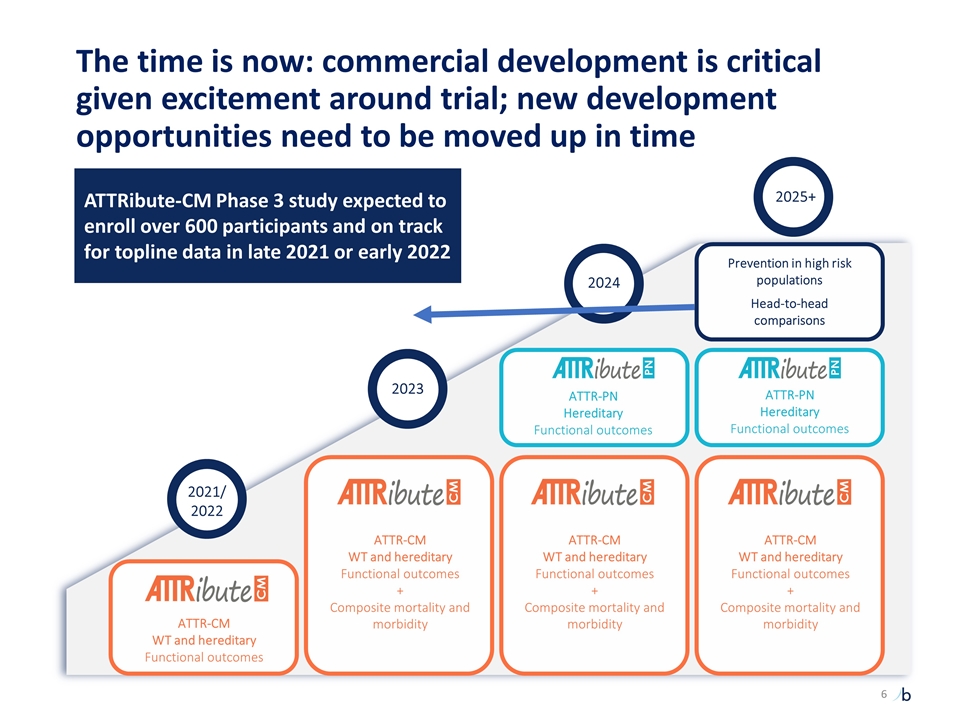

The time is now: commercial development is critical given excitement around trial; new development opportunities need to be moved up in time ATTR-CM WT and hereditary Functional outcomes ATTR-CM WT and hereditary Functional outcomes + Composite mortality and morbidity ATTR-CM WT and hereditary Functional outcomes + Composite mortality and morbidity ATTR-PN Hereditary Functional outcomes Prevention in high risk populations Head-to-head comparisons ATTR-PN Hereditary Functional outcomes ATTR-CM WT and hereditary Functional outcomes + Composite mortality and morbidity 2021/ 2022 2023 2024 2025+ ATTRibute-CM Phase 3 study expected to enroll over 600 participants and on track for topline data in late 2021 or early 2022

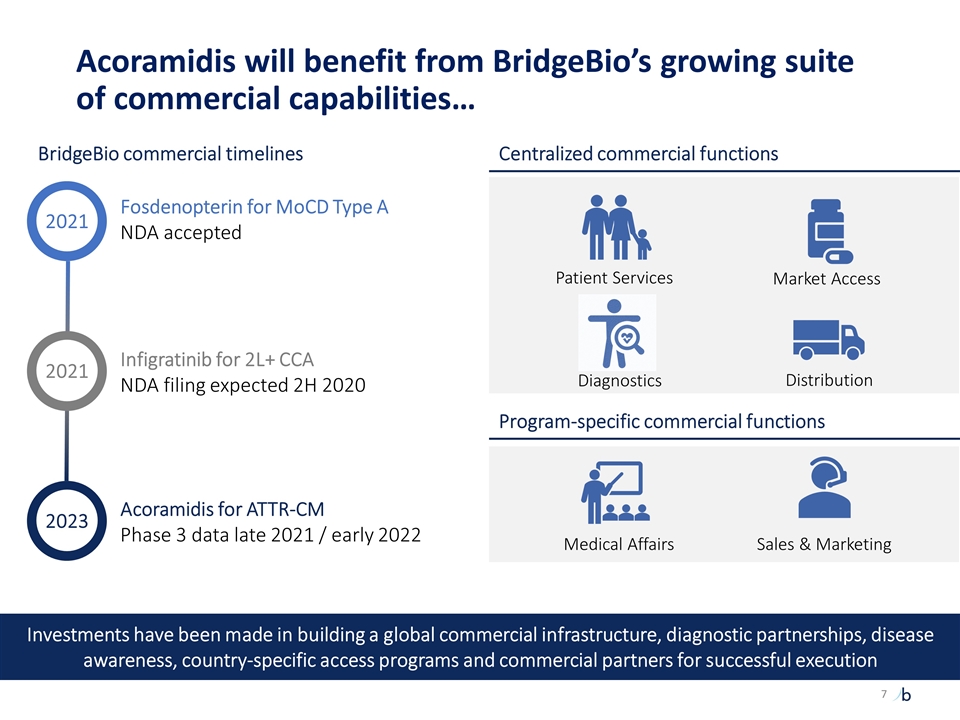

Acoramidis will benefit from BridgeBio’s growing suite of commercial capabilities… Centralized commercial functions BridgeBio commercial timelines Fosdenopterin for MoCD Type A NDA accepted Infigratinib for 2L+ CCA NDA filing expected 2H 2020 Acoramidis for ATTR-CM Phase 3 data late 2021 / early 2022 Program-specific commercial functions Market Access Patient Services Medical Affairs Sales & Marketing Distribution 2021 2021 2023 Investments have been made in building a global commercial infrastructure, diagnostic partnerships, disease awareness, country-specific access programs and commercial partners for successful execution Diagnostics

…and a set of advisors and R&D leaders Selected R&D leaders Selected Clinical Advisors Charles Homcy, MD Chairman, Pharmaceuticals Richard Scheller, PhD Chairman, R&D Robert Harrington, MD Michael Gibson, MD Michael Kitt, MD Ethan Weiss, MD Dan Gretler, MD Senior leadership will guide ongoing and planned studies of acoramidis and broader cardio-renal diseases at BridgeBio

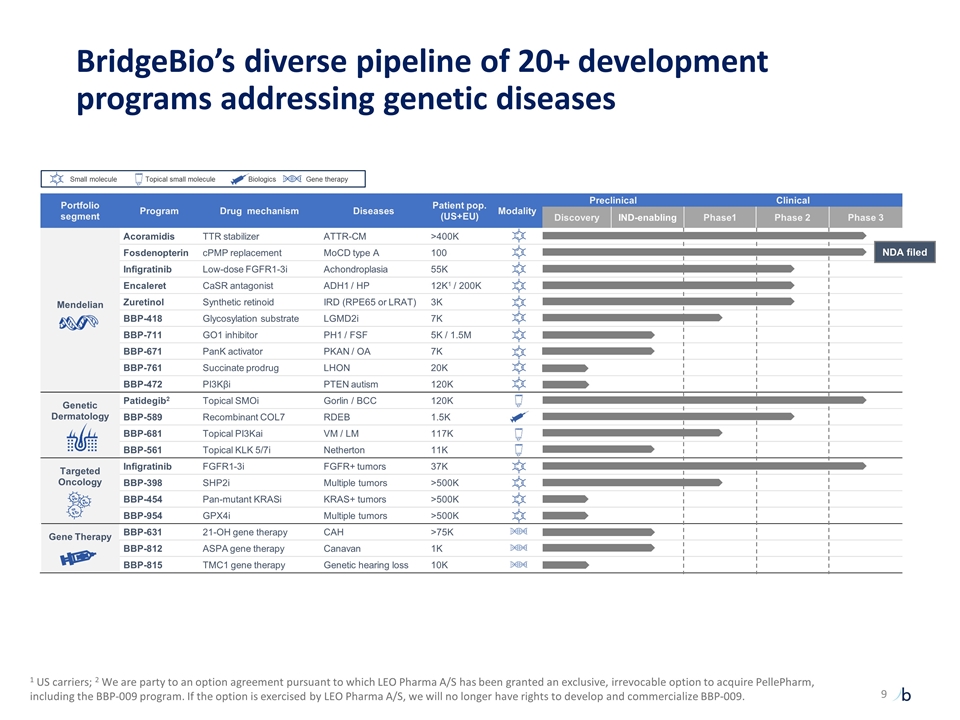

Portfolio segment Program Drug mechanism Diseases Patient pop. (US+EU) Modality Preclinical Clinical Discovery IND-enabling Phase1 Phase 2 Phase 3 Mendelian Acoramidis TTR stabilizer ATTR-CM >400K Fosdenopterin cPMP replacement MoCD type A 100 Infigratinib Low-dose FGFR1-3i Achondroplasia 55K Encaleret CaSR antagonist ADH1 / HP 12K1 / 200K Zuretinol Synthetic retinoid IRD (RPE65 or LRAT) 3K BBP-418 Glycosylation substrate LGMD2i 7K BBP-711 GO1 inhibitor PH1 / FSF 5K / 1.5M BBP-671 PanK activator PKAN / OA 7K BBP-761 Succinate prodrug LHON 20K BBP-472 PI3Kβi PTEN autism 120K Genetic Dermatology Patidegib2 Topical SMOi Gorlin / BCC 120K BBP-589 Recombinant COL7 RDEB 1.5K BBP-681 Topical PI3Kai VM / LM 117K BBP-561 Topical KLK 5/7i Netherton 11K Targeted Oncology Infigratinib FGFR1-3i FGFR+ tumors 37K BBP-398 SHP2i Multiple tumors >500K BBP-454 Pan-mutant KRASi KRAS+ tumors >500K BBP-954 GPX4i Multiple tumors >500K Gene Therapy BBP-631 21-OH gene therapy CAH >75K BBP-812 ASPA gene therapy Canavan 1K BBP-815 TMC1 gene therapy Genetic hearing loss 10K BridgeBio’s diverse pipeline of 20+ development programs addressing genetic diseases NDA filed Small molecule Biologics Gene therapy Topical small molecule 1 US carriers; 2 We are party to an option agreement pursuant to which LEO Pharma A/S has been granted an exclusive, irrevocable option to acquire PellePharm, including the BBP-009 program. If the option is exercised by LEO Pharma A/S, we will no longer have rights to develop and commercialize BBP-009.

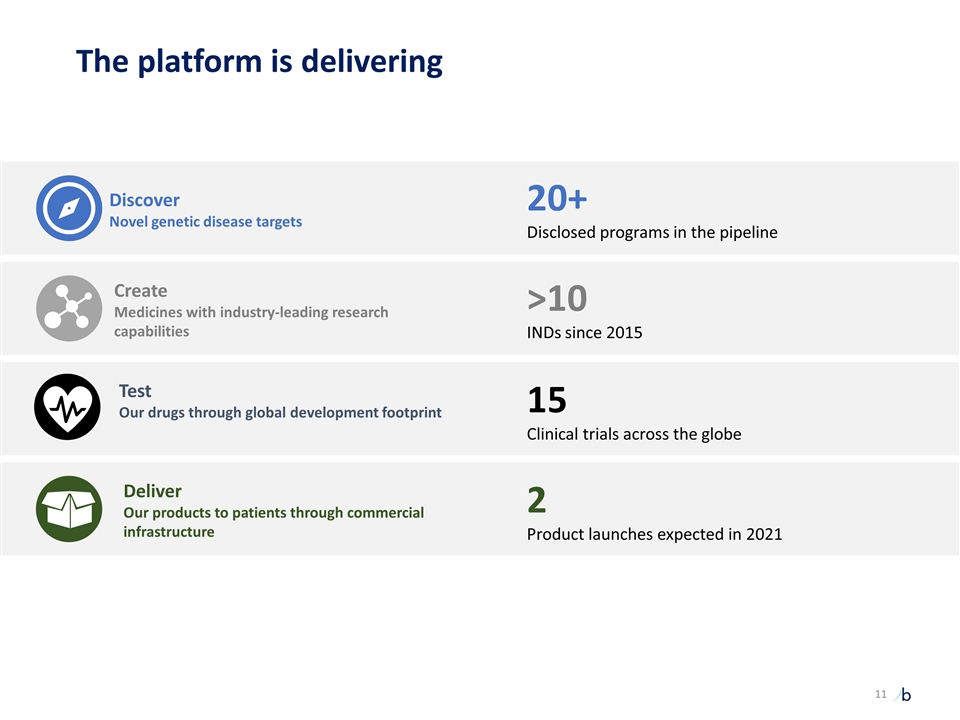

Well described diseases than can be targeted at their source Tailored therapeutic technologies to create first or best-in-class medicines Broad clinical development capabilities across therapeutic areas and geographies Building the capabilities to deliver genetic medicines to patients globally Discover Novel genetic disease targets Create Medicines with industry-leading research capabilities Test Our drugs through global development footprint Deliver Our products to patients through commercial infrastructure BridgeBio drug engineering basics: our platform

Discover Novel genetic disease targets Create Medicines with industry-leading research capabilities Deliver Our products to patients through commercial infrastructure Test Our drugs through global development footprint 20+ Disclosed programs in the pipeline >10 INDs since 2015 15 Clinical trials across the globe 2 Product launches expected in 2021 The platform is delivering

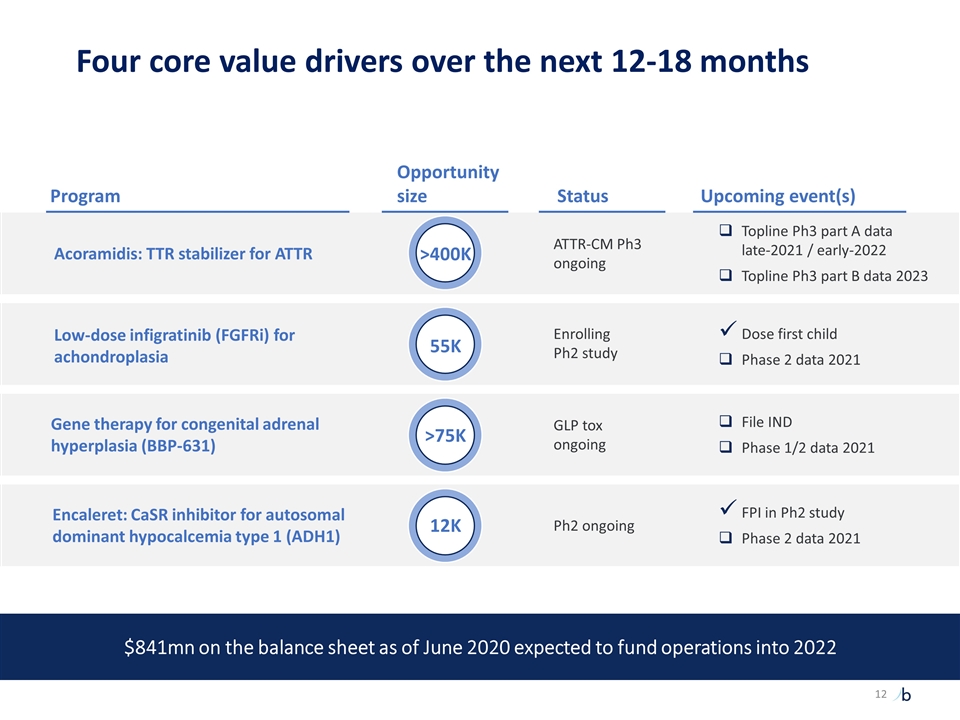

Low-dose infigratinib (FGFRi) for achondroplasia Enrolling Ph2 study Dose first child Phase 2 data 2021 ATTR-CM Ph3 ongoing GLP tox ongoing File IND Phase 1/2 data 2021 Ph2 ongoing FPI in Ph2 study Phase 2 data 2021 Acoramidis: TTR stabilizer for ATTR Gene therapy for congenital adrenal hyperplasia (BBP-631) Encaleret: CaSR inhibitor for autosomal dominant hypocalcemia type 1 (ADH1) Program Status Upcoming event(s) Opportunity size >400K 55K >75K 12K Topline Ph3 part A data late-2021 / early-2022 Topline Ph3 part B data 2023 Four core value drivers over the next 12-18 months $841mn on the balance sheet as of June 2020 expected to fund operations into 2022