Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MidWestOne Financial Group, Inc. | mofg-20200918.htm |

Investor Presentation Update September 18, 2020

Forward-Looking Statements Cautionary Note Regarding Forward-Looking Statements This investor presentation contains certain “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. We and our representatives may, from time to time, make written or oral statements that are “forward-looking” and provide information other than historical information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These factors include, among other things, the factors listed below. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of our management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “should,” “could,” “would,” “plans,” “goals,” “intend,” “project,” “estimate,” “forecast,” “may” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, these statements. Readers are cautioned not to place undue reliance on any such forward- looking statements, which speak only as of the date made. Additionally, we undertake no obligation to update any statement in light of new information or future events, except as required under federal securities law. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors that could have an impact on our ability to achieve operating results, growth plan goals and future prospects include, but are not limited to, the following: (1) effects of the COVID-19 pandemic, including its potential effects on the economic environment, our customers and our operations, as well as any changes to federal, state, or local government laws, regulations, or orders in connection with the pandemic; (2) government intervention in the U.S. financial system in response to the COVID-19 pandemic, including the effects of recent legislative, tax, accounting and regulatory actions and reforms including the Coronavirus Aid, Relief, and Economic Security Act; (3) the impact of the COVID-19 pandemic on our financial results, including possible lost revenue and increased expenses (including the cost of capital), as well as possible goodwill impairment charges; (4) credit quality deterioration or pronounced and sustained reduction in real estate market values causing an increase in the allowance for credit losses, an increase in the credit loss expense, and a reduction in net earnings; (5) the effects of interest rates, including on our net income and the value of our securities portfolio; (6) changes in the economic environment, competition, or other factors that may affect our ability to acquire loans or influence the anticipated growth rate of loans and deposits and the quality of the loan portfolio and loan and deposit pricing; (7) fluctuations in the value of our investment securities; (8) governmental monetary and fiscal policies; (9) changes in benchmark interest rates used to price loans and deposits, including the expected elimination of LIBOR; (10) legislative and regulatory changes, including changes in banking, securities, trade, and tax laws and regulations and their application by our regulators; (11) the ability to attract and retain key executives and employees experienced in banking and financial services; (12) the sufficiency of the allowance for credit losses to absorb the amount of actual losses inherent in our existing loan portfolio; (13) our ability to adapt successfully to technological changes to compete effectively in the marketplace; (14) credit risks and risks from concentrations (by geographic area and by industry) within our loan portfolio; (15) the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, financial technology companies, and other financial institutions operating in our markets or elsewhere or providing similar services; (16) the failure of assumptions underlying the establishment of allowances for credit losses and estimation of values of collateral and various financial assets and liabilities; (17) the risks of mergers, including, without limitation, the related time and costs of implementing such transactions, integrating operations as part of these transactions and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions; (18) volatility of rate-sensitive deposits; (19) operational risks, including data processing system failures or fraud; (20) asset/liability matching risks and liquidity risks; (21) the costs, effects and outcomes of existing or future litigation; (22) changes in general economic, political, or industry conditions, nationally, internationally or in the communities in which we conduct business; (23) changes in accounting policies and practices, as may be adopted by state and federal regulatory agencies and the Financial Accounting Standards Board, such as the implementation of CECL; (24) war or terrorist activities, widespread disease or pandemic, or other adverse external events, which may cause deterioration in the economy or cause instability in credit markets; (25) the effects of cyber-attacks; (26) the imposition of tariffs or other domestic or international governmental policies impacting the value of the agricultural or other products of our borrowers; and (27) other risk factors detailed from time to time in Securities and Exchange Commission filings made by the Company. 2

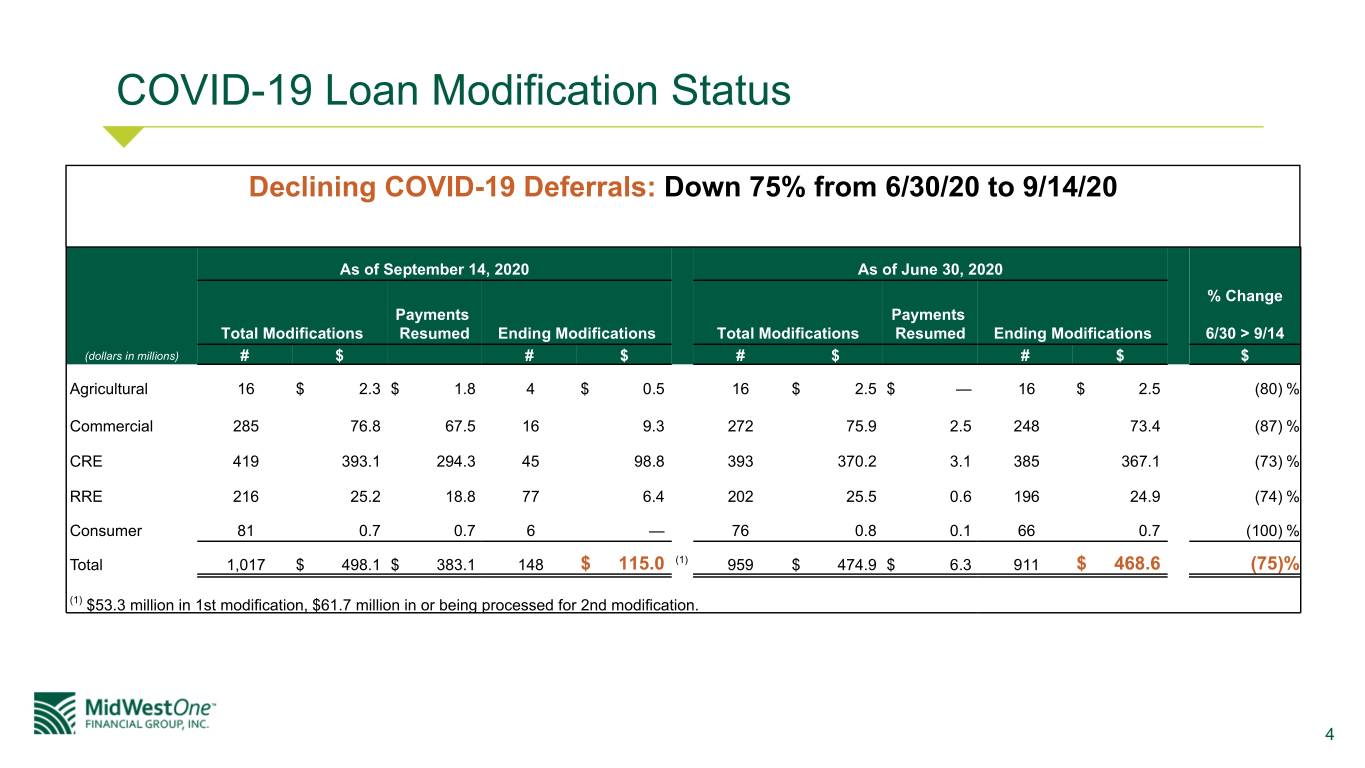

Investor Presentation Update We are providing an update to the COVID-19 loan modification program information. This update provides current and potential investors a more recent depiction of the status of the Company's COVID-19 loan modification program. Specifically, the update included herein reflects COVID-19 related loan payment modification status as of September 14, 2020 compared to the same information as of June 30, 2020. 3

COVID-19 Loan Modification Status Declining COVID-19 Deferrals: Down 75% from 6/30/20 to 9/14/20 As of September 14, 2020 As of June 30, 2020 % Change Payments Payments Total Modifications Resumed Ending Modifications Total Modifications Resumed Ending Modifications 6/30 > 9/14 (dollars in millions) # $ # $ # $ # $ $ Agricultural 16 $ 2.3 $ 1.8 4 $ 0.5 16 $ 2.5 $ — 16 $ 2.5 (80) % Commercial 285 76.8 67.5 16 9.3 272 75.9 2.5 248 73.4 (87) % CRE 419 393.1 294.3 45 98.8 393 370.2 3.1 385 367.1 (73) % RRE 216 25.2 18.8 77 6.4 202 25.5 0.6 196 24.9 (74) % Consumer 81 0.7 0.7 6 — 76 0.8 0.1 66 0.7 (100) % Total 1,017 $ 498.1 $ 383.1 148 $ 115.0 (1) 959 $ 474.9 $ 6.3 911 $ 468.6 (75) % (1) $53.3 million in 1st modification, $61.7 million in or being processed for 2nd modification. 4