Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT-23.2 - HYCROFT MINING HOLDING CORP | hymc-20200814xex23d2.htm |

| EX-23.1 - EXHIBIT-23.1 - HYCROFT MINING HOLDING CORP | hymc-20200814xex23d1.htm |

| EX-4.4 - EXHIBIT-4.4 - HYCROFT MINING HOLDING CORP | hymc-20200814xex4d4.htm |

| EX-1.1 - EXHIBIT-1.1 - HYCROFT MINING HOLDING CORP | hymc-20200814xex1d1.htm |

As filed with the Securities and Exchange Commission on September 16, 2020

Registration No. 333-248516

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

HYCROFT MINING HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

Delaware |

| 1040 |

| 82-2657796 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

8181 E. Tufts Ave., Suite 510

Denver, Colorado 80237

(303) 253-3267

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Diane R. Garrett

President and Chief Executive Officer

Hycroft Mining Holding Corporation

8181 E. Tufts Ave., Suite 510

Denver, Colorado 80237

(303) 524-1947

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Neal, Gerber & Eisenberg LLP

2 N. LaSalle Street, Suite 1700

Chicago, IL 60602

Attention: David S. Stone, Esq.

Tel: (312) 269-8000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ⌧

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ⌧ |

Non-accelerated filer ◻ | Smaller reporting company ☒ |

| Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee |

Units, consisting of: (i) shares of Class A common stock, par value $0.0001 per share, and (ii) warrants to purchase Class A common stock, par value $0.0001 per share (3) | $74,750,000 | $9,702.55 |

Class A common stock, par value $0.0001 per share (4) | $74,750,000 | $9,702.55 |

Total | $149,500,000 | $19,405.10(5) |

| (1) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

(2) | Includes Units issuable upon exercise of the underwriters’ option to purchase additional Units. |

(3) | No separate fee is required pursuant to Rule 457(i) under the Act. |

(4) | Issuable from time to time upon due exercise of the warrants comprising the Units. |

(5) | Of this amount, $9,702.55 was previously paid with the original filing of this registration statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 16, 2020

Preliminary Prospectus

$65,000,000

HYCROFT MINING HOLDING CORPORATION

Units, each consisting of One Share of Class A Common Stock and

[●] Warrants to Purchase One Share of Class A Common Stock

We are offering [●] units, with each unit consisting of one share of our Class A common stock, par value $0.0001 per share (“Common Stock”), and [●] warrants to purchase one share of our Common Stock (together with the shares of Common Stock issuable upon exercise of such warrants, the “Units”). Warrants included in the Units have an exercise price of $[●] per whole share (the “Warrants”).

The Units will not be issued or certificated. The shares of Common Stock and the Warrants are immediately separable and will be issued separately, but will be purchased together in this offering. The Warrants will be exercisable on the date of issuance and will expire on the [●] year anniversary of the date of issuance.

Our Common Stock, public warrants and Seller warrants (as defined herein) are listed on the Nasdaq Capital Market under the symbols “HYMC,” “HYMCW ” and “HYMCZ,” respectively. On September 15, 2020, the closing price of our Common Stock was 12.39 per share, the closing price of our public warrants was $2.34 and the closing price of our Seller warrants was $0.28 per share.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Common Stock and Warrants involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

| Per Share |

| Total | ||

Public offering price | | $ | | | $ | |

Underwriting discounts and commissions (1) | | $ | | | $ | |

Proceeds, before expenses, to us | | $ | | | $ | |

| (1) | We have also agreed to reimburse certain expenses of the underwriters. See “Underwriting” beginning on page 105 of this prospectus for additional information regarding underwriting compensation. |

We have granted the underwriters an option to purchase up to an additional [●] Units from us at the public offering price, less the underwriting discounts and commissions, within 30 days of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the Units to investors on or about September [●], 2020, subject to customary closing conditions.

BMO Capital Markets | Stifel | Canaccord Genuity |

The date of this prospectus is September [●], 2020

TABLE OF CONTENTS

ii | |

ii | |

ii | |

1 | |

3 | |

7 | |

8 | |

25 | |

25 | |

26 | |

27 | |

42 | |

56 | |

Market Price of and Dividends on Common Stock and Related Stockholder Matters | 57 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 57 |

76 | |

80 | |

90 | |

Security Ownership of Certain Beneficial Owners and Management | 94 |

96 | |

101 | |

105 | |

111 | |

111 | |

111 | |

112 | |

F-1 |

We are responsible for the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus and we take no responsibility for any other information that others may give you. We are offering to sell, and seeking offers to buy, the Units only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Units. Our business, operating results or financial condition may have changed since such date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On May 29, 2020, the entity formerly known as Mudrick Capital Acquisition Corporation (the “Company”), consummated the transactions contemplated by the Purchase Agreement, dated as of January 13, 2020, by and among the Company, MUDS Acquisition Sub, Inc. (“Acquisition Sub”) and Hycroft Mining Corporation, a Delaware corporation (the “Seller”), as amended by that certain Amendment to Purchase Agreement, dated as of February 26, 2020 (as amended, the “Purchase Agreement”). Pursuant to the Purchase Agreement, Acquisition Sub acquired all of the issued and outstanding equity interests of the direct subsidiaries of Seller and substantially all of the other assets and assumed substantially all of the liabilities of Seller, a U.S.-based gold and silver producer operating the Hycroft Mine located in the mining region of northern Nevada. In connection with the completion of the business combination transaction contemplated by the Purchase Agreement (the “Recapitalization Transaction”), the Company changed its name from Mudrick Capital Acquisition Corporation to Hycroft Mining Holding Corporation. The above description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by the full text of the Purchase Agreement, which is included as Exhibit 2.1 and Exhibit 2.2 to the registration statement of which this prospectus forms a part. Common terms and their meaning are set forth below under the heading “Selected Definitions.”

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain market, ranking and industry data included in this prospectus, including the size of certain markets and our size or position and the positions of our competitors within these markets, including its products and services relative to its competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate, which, in each case, we believe are reliable.

We are responsible for all of the disclosure in this prospectus and while we believe the data from these sources to be accurate and complete, we have not independently verified data from these sources or obtained third-party verification of market share data and this information may not be reliable. In addition, these sources may use different definitions of the relevant markets. Data regarding our industry is intended to provide general guidance, but is inherently imprecise.

Assumptions and estimates of our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk factors—Risks Related to Our Business.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

Unless stated in this prospectus or the context otherwise requires, references to:

“1.25 Lien Exchange” means the exchange by the 1.25 Lien Noteholders of the outstanding 1.25 Lien Notes for the Subordinated Notes.

“1.25 Lien Exchange Agreement” means that certain Note Exchange Agreement, dated as of January 13, 2020, by and among Seller and certain investment funds affiliated with or managed by Mudrick Capital, Whitebox, Highbridge, Aristeia and Wolverine, as amended, pursuant to which the 1.25 Lien Exchange occurred immediately prior to the consummation of the Recapitalization Transaction.

“1.25 Lien Notes” means the notes issued pursuant to the Note Purchase Agreements, dated as of February 22, 2019, May 21, 2019, June 27, 2019, August 6, 2019, August 29, 2019, September 25, 2019, October 16, 2019, November 21, 2019, December 17, 2019, January 17, 2020, February 7, 2020, March 12, 2020, April 16, 2020 and May 7, 2020 between Seller, the guarantors and the purchasers named therein and WBox 2015-5 Ltd., as collateral agent.

“1.25 Lien Noteholders” means the holders of the 1.25 Lien Notes and, subsequent to the 1.25 Lien Exchange, the holders of the Subordinated Notes.

“1.5 Lien Notes” means the notes issued pursuant to the Note Purchase Agreements, dated as of May 3, 2016, July 29, 2016, September 22, 2016, November 30, 2016, February 2, 2017, April 12, 2017, June 30, 2017, July 14, 2017, December 20, 2017,

ii

March 8, 2018, May 10, 2018, July 10, 2018, August 22, 2018, November 1, 2018, and December 19, 2018 between Seller, the guarantors and the purchasers named therein and WBox 2015-5 Ltd., as collateral agent.

“1.5 Lien Noteholders” means certain investment funds affiliated with Mudrick Capital, Whitebox, Highbridge, Aristeia and Wolverine that hold the 1.5 Lien Notes.

“Amended and Restated Registration Rights Agreement” means that certain Amended and Restated Registration Rights Agreement entered into at the closing of the Recapitalization Transaction, by and among the Company and the restricted stockholders.

“Acquisition Sub” means MUDS Acquisition Sub, Inc., a Delaware corporation and an indirect, wholly owned subsidiary of the Company now known as Autar Gold Corporation.

“Aristeia” means Aristeia Capital, LLC.

“Board” means the board of directors of Hycroft Mining Holding Corporation.

“business day” means a day, other than Saturday, Sunday or such other day on which commercial banks in New York, New York are authorized or required by applicable laws to close.

“Cantor” means Cantor Fitzgerald & Co.

“Common Stock” means the Class A common stock, par value $0.0001 per share, of the Company.

“conversion” means the conversion of the Second Lien Notes into shares of Seller common stock, pursuant to the terms of the Second Lien Conversion Agreement.

“DGCL” means the General Corporation Law of the State of Delaware.

“debt and warrant assumption” means the assignment by Seller and the assumption by the Company of (x) $80,000,000 in aggregate principal amount of Subordinated Notes, (y) the Sprott Credit Agreement and (z) Seller’s liabilities and obligations under the Seller Warrant Agreement.

“effective time” means 9:00 a.m. New York time on May 29, 2020.

“employee benefit plan” means any material “employee benefit plan” within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended.

“Excess Noteholders” means the holders of the Excess Notes.

“Excess Notes” means the $48,459,232 in aggregate principal amount of Subordinated Notes exchanged pursuant to the Exchange Agreement.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange Agreement” means that certain Exchange Agreement, dated as of January 13, 2020, by and among Seller, Acquisition Sub, the 1.5 Lien Noteholders and the 1.25 Lien Noteholders, as amended.

“First Lien Credit Agreement” means the first lien term loan credit agreement between Seller and The Bank of Nova Scotia, as administrative agent, and other lenders.

“First Lien Notes” means the notes under the First Lien Credit Agreement.

“forward purchase” means the issuance to sponsor of shares of Common Stock pursuant to the terms of the Forward Purchase Contract.

“Forward Purchase Contract” means the Forward Purchase Contract, dated January 24, 2018, by and between the Company and sponsor, pursuant to which sponsor purchased 3,125,000 shares of Common Stock and 2,500,000 forward purchase warrants exercisable at $11.50 per share, for gross proceeds of $25,000,000, concurrently with the consummation of the Recapitalization Transaction.

“forward purchase warrants” means the warrants to purchase one share of Common Stock at a price of $11.50 per share issued to the sponsor upon consummation of the Recapitalization Transaction pursuant to the Forward Purchase Contract.

“founder shares” means shares of Class B common stock, par value $0.0001 per share, of the Company initially purchased by sponsor which were redeemed or converted into shares of Common Stock upon the consummation of the Recapitalization Transaction.

“GAAP” means generally accepted accounting principles in the United States.

“Highbridge” means Highbridge Capital Management, LLC.

iii

“HRD” means Hycroft Resources & Development, LLC, a Delaware limited liability company and an indirect, wholly owned subsidiary of the Company.

“Hycroft,” “Company,” “we,” “our,” or “us,” means Hycroft Mining Holding Corporation, a Delaware corporation.

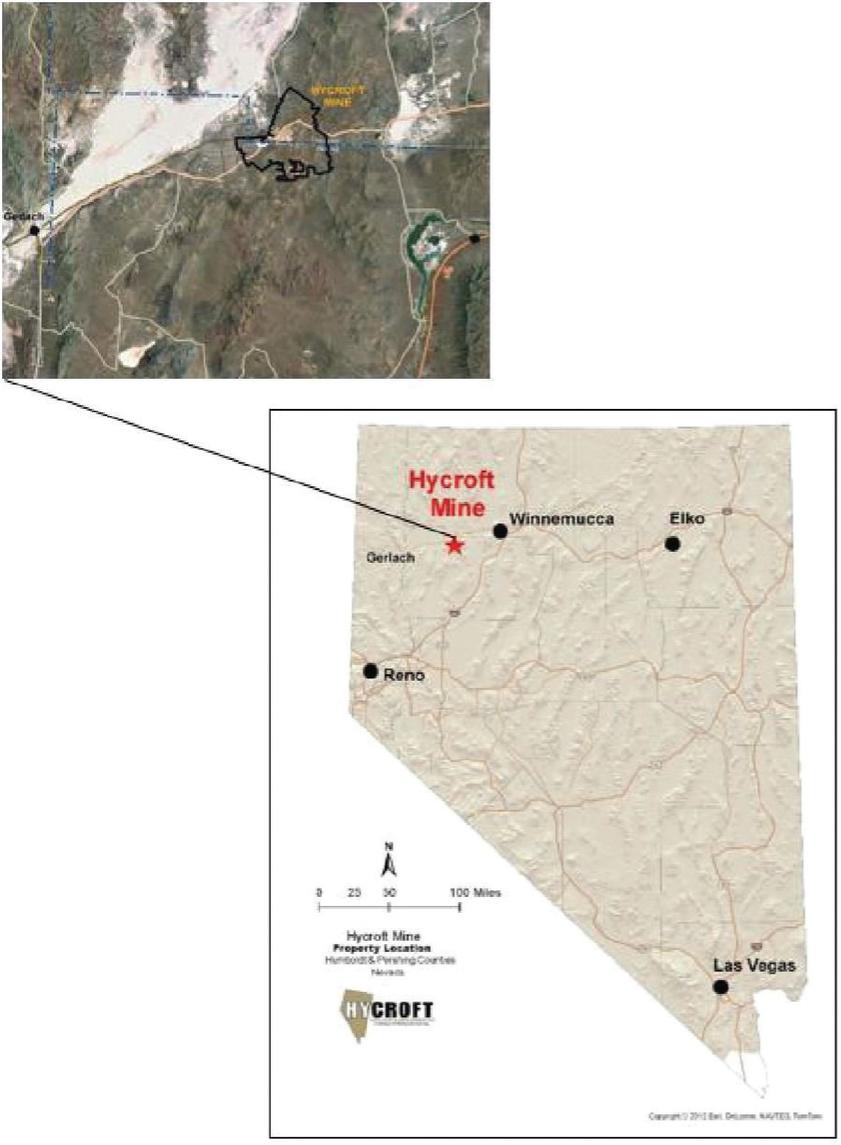

“Hycroft Mine” means the Hycroft Open Pit Mine, located in Winnemucca, Nevada that produces gold and silver using a heap leach mining process.

“Hycroft Technical Report” means that certain Technical Report Summary, Heap Leaching Feasibility Study prepared for Seller with an effective date of July 31, 2019 by M3 Engineering and Technology Corporation and other qualified persons, prepared in accordance with the requirements of the Modernization of Property Disclosures for Mining Registrants set forth in subpart 1300 of Regulation S-K.

“Incentive Plan” means the HYMC 2020 Performance and Incentive Pay Plan.

“initial stockholders” means holders of founder shares prior to the IPO.

“Initial Subscribers” means investment funds affiliated with or managed by Mudrick Capital, Whitebox, Highbridge, Aristeia and Wolverine (together with any permitted assigns under the Subscription/Backstop Agreements).

“IPO” means the Company’s initial public offering, consummated on February 12, 2018, through the sale of 20,800,000 public units (including 800,000 units sold pursuant to the underwriters’ partial exercise of their overallotment option) at $10.00 per unit.

“JOBS Act” means the Jumpstart our Business Startups Act of 2012.

“Lender” means Sprott Private Resource Lending II (Collector), LP.

“Mudrick Capital” means Mudrick Capital Management, L.P., a Delaware limited partnership, an affiliate of sponsor.

“Nasdaq” means The Nasdaq Stock Market LLC.

“New Mining Rules” means the Modernization of Property Disclosures for Mining Registrants final rule promulgated by the SEC.

“New Warrant Agreement” means that certain warrant agreement, dated as of September [●], 2020, by and between the Company and Continental Stock Transfer & Trust Company, as initial warrant agent.

“Note exchange” means the exchange of the 1.5 Lien Notes and the Excess Notes, if any, for shares of Common Stock valued at $10.00 per share pursuant to the terms of the Exchange Agreement.

“Parent Sponsor Letter Agreement” means that certain letter agreement, dated as of January 13, 2020, by and between the Company and sponsor, as amended from time to time.

“PIPE warrants” means the warrants to purchase one share of Common Stock at a price of $11.50 per share issued to the Initial Subscribers in the private investment.

“private investment” means the equity financing through a private placement of equity securities in the Company pursuant to Section 4(a)(2) of the Securities Act, for gross proceeds to the Company in an aggregate amount of approximately $76.0 million funded in accordance with the terms of the Subscription/Backstop Agreements.

“private placement warrants” means the warrants issued to sponsor and Cantor in a private placement simultaneously with the closing of the IPO.

“public shares” means shares of Common Stock sold as part of the units in the IPO.

“public units” means one share of Common Stock and one redeemable public warrant of the Company, whereby each public warrant entitles the holder thereof to purchase one share of Common Stock at an exercise price of $11.50 per share of Common Stock, sold in the IPO.

“public warrants” means the warrants included in the units issued in the IPO, where one warrant entitles the holder thereof to purchase one share of Common Stock at an exercise price of $11.50 per share of Common Stock in accordance with the terms of the Warrant Agreement.

“Purchase Agreement” means that certain Purchase Agreement, dated January 13, 2020, as amended on February 26, 2020, by and among the Company, Acquisition Sub and Seller.

“Recapitalization Transaction” means the transactions contemplated by the Purchase Agreement, the Exchange Agreement and the Second Lien Conversion Agreement consummated on May 29, 2020.

iv

“representatives” means a Person’s officers, directors, employees, accountants, consultants, agents, legal counsel, and other representatives.

“restricted stockholders” means, collectively, sponsor, Cantor, certain directors and officers of the Company (as set forth in the Amended and Restated Registration Rights Agreement), the 1.5 Lien Noteholders, certain stockholders of Seller that receive Common Stock in the Recapitalization Transaction, the Initial Subscribers pursuant to the private investment, and Lender.

“SEC” means the United States Securities and Exchange Commission.

“Second Amended and Restated Charter” means the Second Amended and Restated Certificate of Incorporation of the Company filed with the Delaware Secretary of State on May 29, 2020.

“Second Lien Conversion Agreement” means that certain Note Conversion and Consent Agreement by and among Seller and the Second Lien Noteholders, dated January 13, 2020.

“Second Lien Notes” means the notes issued pursuant to (a) that certain Note Purchase Agreement, dated as of October 22, 2015, by and among Seller, certain of its affiliates and the purchasers named therein and (b) that certain Note Purchase Agreement, dated as of December 2, 2015, by and among Seller, certain of Seller’s subsidiaries and the purchasers named therein, in each case, entered into pursuant to the 15% Senior Secured Convertible Notes Due 2020 Indenture, dated as of October 22, 2015, by and among Seller, the guarantors (as defined therein) and Wilmington Trust, National Association, as trustee and collateral agent as of January 6, 2016 and March 24, 2016.

“Second Lien Noteholders” means certain funds affiliated with Mudrick Capital, Whitebox, Highbridge, Aristeia and Wolverine and two additional noteholders.

“Securities Act” means the Securities Act of 1933, as amended.

“Seller” means Hycroft Mining Corporation, a Delaware corporation.

“Seller common stock” means Seller’s common stock, par value $0.001 per share.

“Seller warrants” means a warrant to purchase shares of Common Stock issued pursuant to the Seller Warrant Agreement following the assumption of the Seller Warrant Agreement by the Company pursuant to the Purchase Agreement and effective as of the consummation of the Recapitalization Transaction.

“Seller Warrant Agreement” means that certain warrant agreement, dated as of October 22, 2015, by and between Seller and Computershare Inc., a Delaware corporation, and its wholly owned subsidiary Computershare Trust Company, N.A., a federally chartered trust company, collectively as initial warrant agent; such warrant agreement was assumed by the Company pursuant to the Purchase Agreement and Continental Stock Transfer & Trust Company, LLC is the successor warrant agent.

“sponsor” means Mudrick Capital Acquisition Holdings LLC, a Delaware limited liability company, which is 100% owned by investment funds and separate accounts managed by Mudrick Capital.

“Sprott Credit Agreement” means that certain amended and restated credit agreement, dated as of May 29, 2020, between Hycroft Mining Holding Corporation, as borrower, MUDS Acquisition Sub, Inc., MUDS Holdco, Inc., Hycroft Resources & Development, LLC, a Delaware limited liability company, and Allied VGH LLC, a Delaware limited liability company, as guarantors, Sprott Private Resource Lending II (Collector), LP, as lender, and Sprott Resource Lending Corp., as arranger.

“Sprott Royalty Agreement” means that certain royalty agreement between the Company, Hycroft Resources & Development, LLC, a Delaware limited liability company and Sprott Private Resource Lending II (Co), Inc.

“Subordinated Notes” means the $80.0 million in aggregate principal amount of 10% payment in-kind subordinated notes issued pursuant to the 1.25 Lien Exchange Agreement and assigned to, and assumed by, the Company in connection with the Recapitalization Transaction.

“Subscription/Backstop Agreements” means those certain Subscription/Backstop Agreements, dated as of January 13, 2020, by and among the Company and the Initial Subscribers, as amended on May 28, 2020.

“Treasury Regulations” means the regulations promulgated by the U.S. Department of the Treasury pursuant to and in respect of provisions of the U.S. Tax Code.

“trust account” means the trust account of the Company that held the proceeds from the IPO.

“Unit” means each unit offered hereby, consisting of one share of our Common Stock and [●] Warrants to purchase one share of our Common Stock, together with the shares of Common Stock issuable upon due exercise of such Warrants.

v

“U.S. Holder” means a beneficial owner of the Company’s securities who or that is, for U.S. federal income tax purposes, (i) an individual who is a citizen or resident of the United States, (ii) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) organized in or under the laws of the United States, any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income tax regardless of its source, or (iv) a trust, if (a) a court within the United States is able to exercise primary supervision over the administration of the trust or one or more U.S. persons (as defined in the U.S. Tax Code) have authority to control all substantial decisions of the trust or (b) it has a valid election in effect under Treasury Regulations to be treated as a U.S. person.

“U.S. Tax Code” means the Internal Revenue Code of 1986, as amended.

“Warrant Agreement” means the Warrant Agreement, dated February 7, 2018, by and between Mudrick Capital Acquisition Corporation and Continental Stock Transfer & Trust Company, LLC.

“Warrants” means the warrants to purchase one share of Common Stock at an exercise price of $[•] per whole share, included in the Units offered hereby, and issued pursuant to the New Warrant Agreement.

“Whitebox” means Whitebox Advisors, LLC.

“Wolverine” means Wolverine Asset Management, LLC.

vi

CAUTIONARY NOTES REGARDING FORWARD-LOOKING STATEMENTS

We make “forward-looking statements” in the “Summary,” “Risk Factors,” “Description of Business,” “Description of Property,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and elsewhere throughout this prospectus. All statements, other than statements of historical facts, included in this prospectus and in press releases and public statements by our officers or representatives, that address activities, events or developments that our management expects or anticipates will or may occur in the future, are forward-looking statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths and expansion and growth of our business.

The words “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe” “target”, “budget”, “may”, “schedule” and similar words or expressions identify forward-looking statements. Forward-looking statements in this prospectus may include, for example, statements about:

| ● | Use of proceeds from this offering; |

| ● | Industry-related risks including: |

| o | Fluctuations in the price of gold and silver; |

| o | Uncertainties concerning estimates of reserves and mineralized material; |

| o | Uncertainties relating to the novel coronavirus (“COVID-19”) pandemic; |

| o | The intense competition within the mining industry and state of Nevada; |

| o | The inherently hazardous nature of mining activities, including environmental risks; |

| o | Our insurance may not be adequate to cover all risks associated with our business, or cover the replacement costs of our assets; |

| o | Potential effects on our operations of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements; |

| o | Cost of compliance with current and future government regulations; |

| o | Uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities; |

| o | Potential challenges to title in our mineral properties; |

| o | Risks associated with proposed legislation in Nevada that could significantly increase the costs or taxation of our operations; and |

| o | Changes to the climate and regulations and pending legislation regarding climate change. |

| ● | Business-related risks including: |

| o | Risks related to our liquidity and going concern considerations; |

| o | Risks related to the heap leaching process at the Hycroft Mine and estimates of production; |

| o | Our ability to achieve our estimated production and sales rates and stay within our estimated operating and production costs and capital expenditure projections; |

| o | Risks related to our limited experience with a largely untested process of oxidizing and heap leaching sulfide ores; |

| o | The decline of our gold and silver production; |

| o | Risks related to our reliance on one mine with a new process; |

| o | Uncertainties and risks related to our reliance on contractors and consultants; |

| o | Uncertainties related to our ability to replace and expand our ore reserves; |

| o | The costs related to our land reclamation requirements; |

| o | Availability and cost of equipment, supplies, energy, or commodities; |

| o | The commercial success of, and risks relating to, our development activities; |

| o | Risks related to slope stability; |

| o | Our ability to raise capital on favorable terms or at all; |

| o | Risks related to our substantial indebtedness, including cross acceleration and our ability to generate sufficient cash to service our indebtedness; |

| o | Uncertainties resulting from the possible incurrence of operating and net losses in the future; |

| o | Risks related to disruption of our business due to the historical chapter 11 proceedings; |

| o | The loss of key personnel or our failure to attract and retain personnel; |

| o | Risks related to technology systems and security breaches; |

| o | Risks related to current and future legal proceedings; |

| o | Our current intention or future decisions whether or not to use streaming or forward-sale arrangements; |

| o | Risks associated with possible future joint ventures; and |

| o | Risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval. |

| ● | Risks related to our securities, including |

| o | Volatility in the price of our Common Stock; |

| o | Risks related to a lack of liquidity in the trading of our Common Stock and the Warrants; |

| o | Potential declines in the value of our Common Stock and the Warrants due to substantial future sales of our common stock and/or warrants; |

| o | Dilution of your investment; |

| o | We do not intend to pay cash dividends; and |

| o | Anti–takeover provisions could make a third party acquisition of us difficult. |

These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on current expectations. Although our management believes that its expectations are based on reasonable assumptions, we can give no assurance that these expectations will prove correct. Please see “Risk Factors” below for more information about these and other risks. Potential investors are cautioned against attributing undue certainty to forward-looking statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in the statements. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

2

This summary highlights information contained elsewhere in this prospectus. It does not contain all the information that you may consider important in making your investment decision. Therefore, you should read the entire prospectus carefully, including, in particular, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our and Seller’s consolidated financial statements and related notes.

As used in this prospectus, unless the context otherwise requires or indicates, references to “Hycroft,” “Company,” “we,” “our,” and “us,” refer to Hycroft Mining Holding Corporation and its subsidiaries. “Seller” refers to Hycroft Mining Corporation.

Overview

We are a U.S.-based gold producer that is focused on operating and developing our wholly owned Hycroft Mine in a safe, environmentally responsible, and cost-effective manner. Gold and silver sales represent 100% of our operating revenues and the market prices of gold and silver significantly impact our financial position, operating results and cash flows. The Hycroft Mine is located in the state of Nevada.

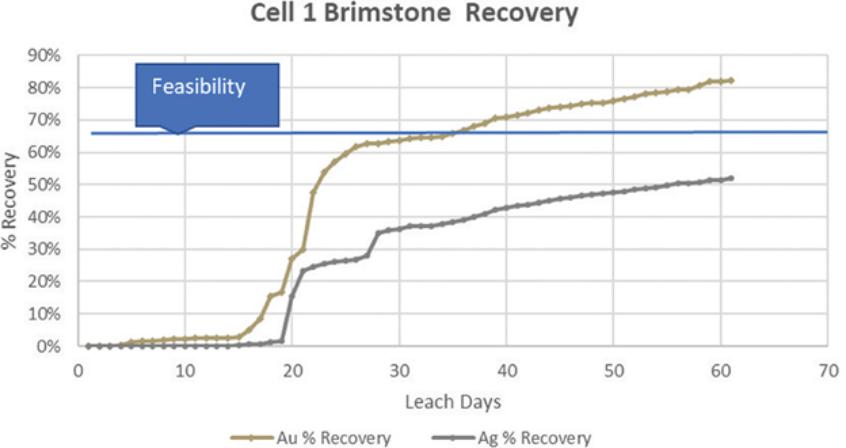

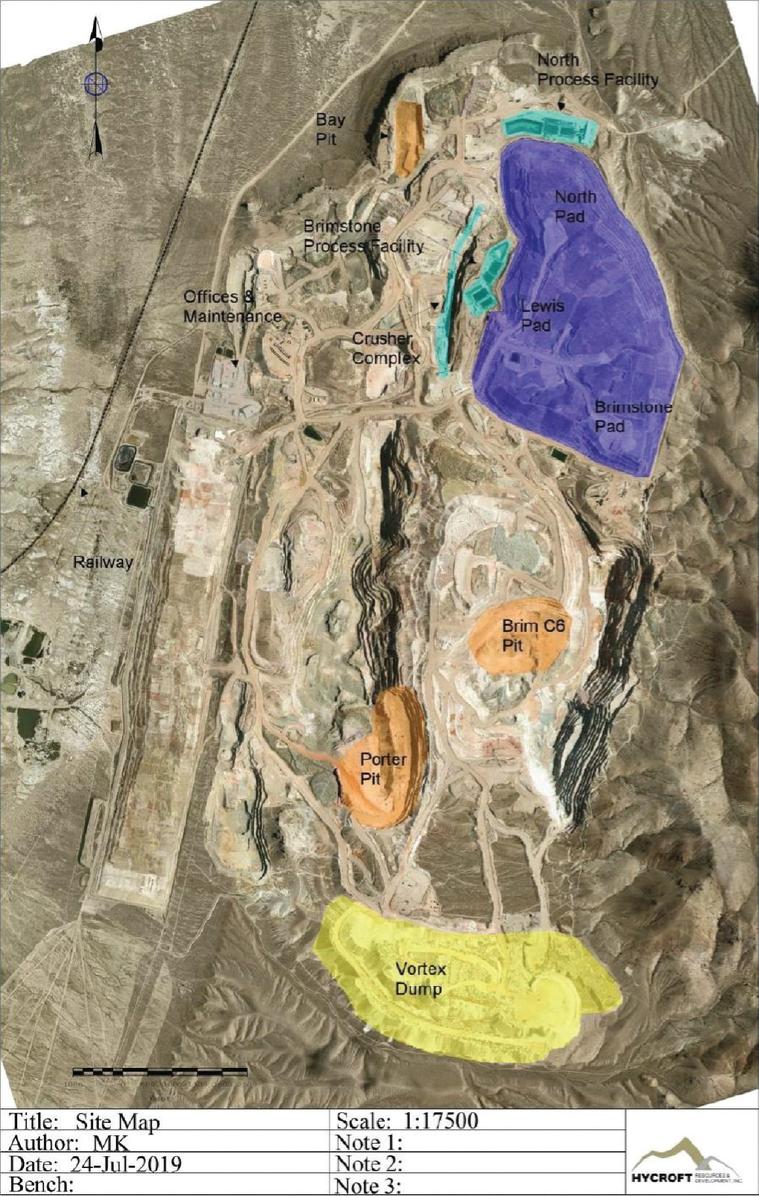

During the second quarter of 2019, we restarted open pit mining operations at the Hycroft Mine, and, during the third quarter of 2019, produced and sold gold and silver which we have continued to do on an approximate weekly basis since restarting. As part of the 2019 restart of mining operations, existing equipment was re-commissioned, including haul trucks, shovels and a loader, upgrades were made to the crushing system and new leach pad space was added to the existing leach pads. During the first half of 2020, we continued to increase our operations by mining more tons, procuring additional mobile equipment rentals, and increasing our total headcount. During the first six months of 2020 the Hycroft Mine produced 12,342 ounces of gold and 73,717 ounces of silver and sold 10,797 ounces of gold and 70,703 ounces of silver.

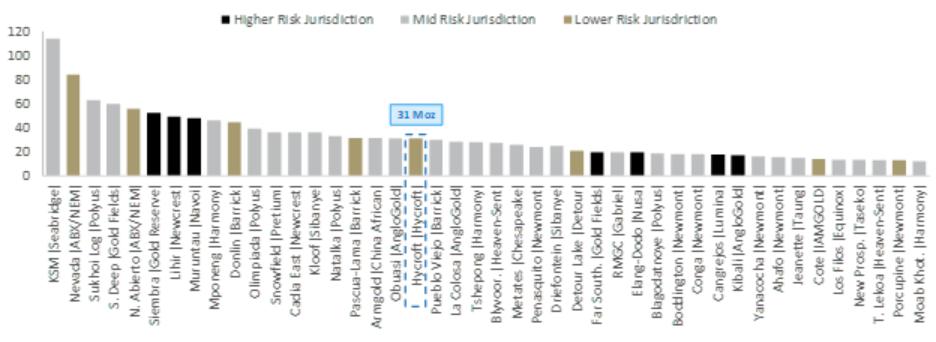

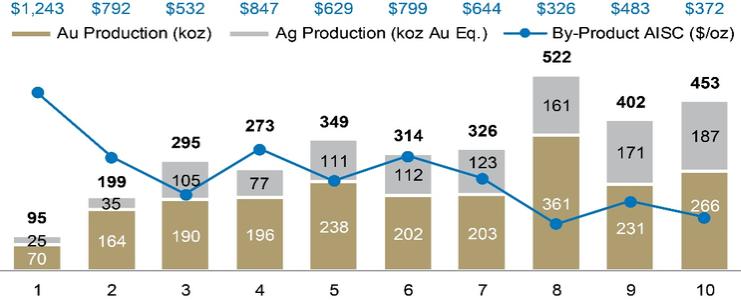

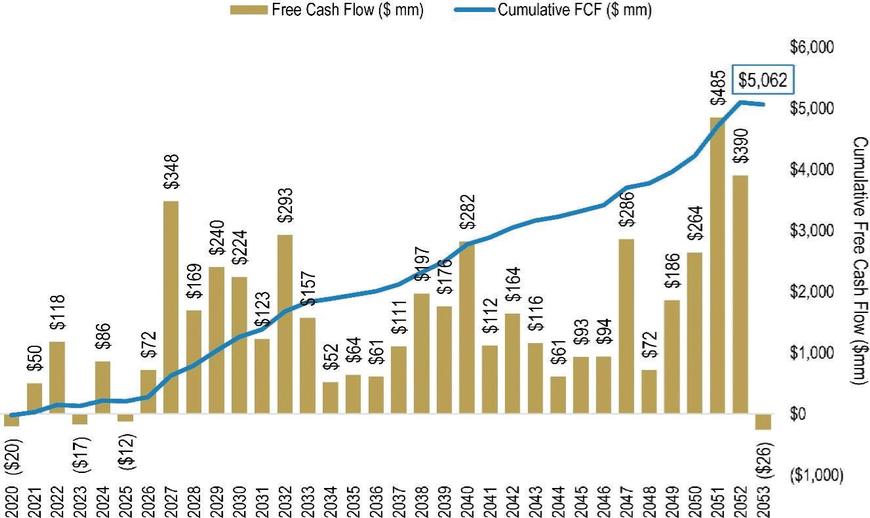

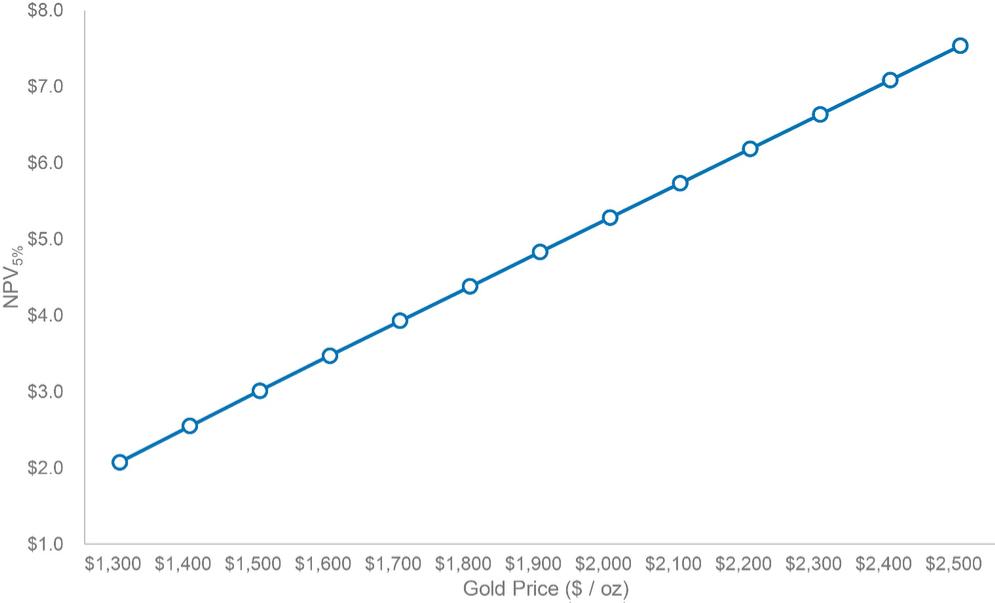

As of June 30, 2019, based on the Hycroft Technical Report, the Hycroft Mine had proven and probable mineral reserves of 12.0 million ounces of gold and 481.4 million ounces of silver, which are contained in oxide, transition and sulfide ores. The Hycroft Mine ranks among one of the 20 largest gold deposits in the world, and the second largest in the United States, based on resource sizes. Pursuant to the current 34-year life of mine plan in the Hycroft Technical Report, once fully operational, mining will range from approximately 85 – 100 million tons per year. As set forth in the Hycroft Technical Report, during the initial five-year ramp-up we expect mining will be performed by a contract mining company or we will primarily use a short-term equipment rental fleet using customary truck and shovel open pit mining methods. After the initial ramp-up, we expect to self-perform mining with our own equipment fleet.

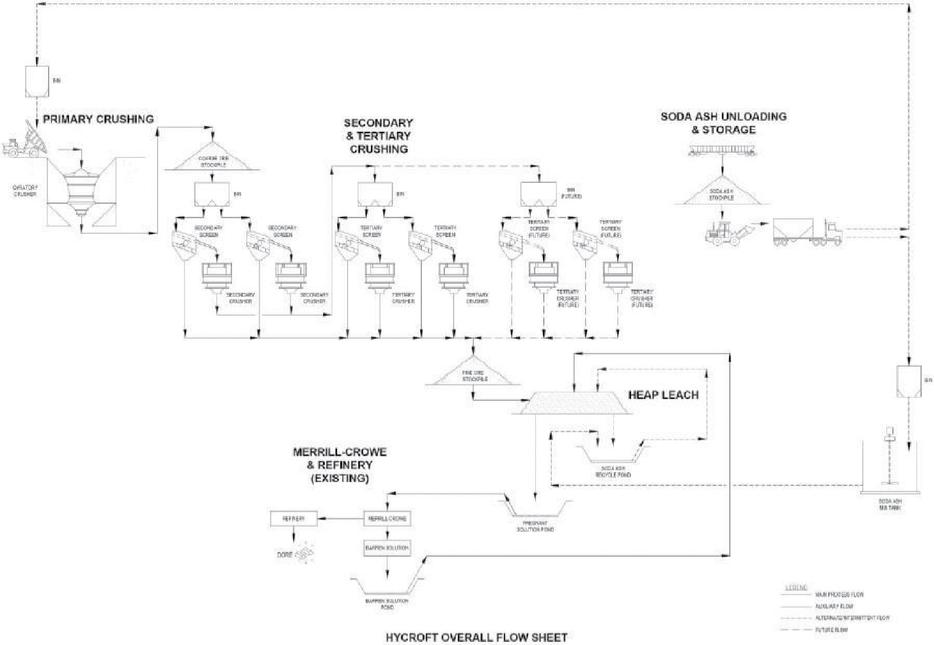

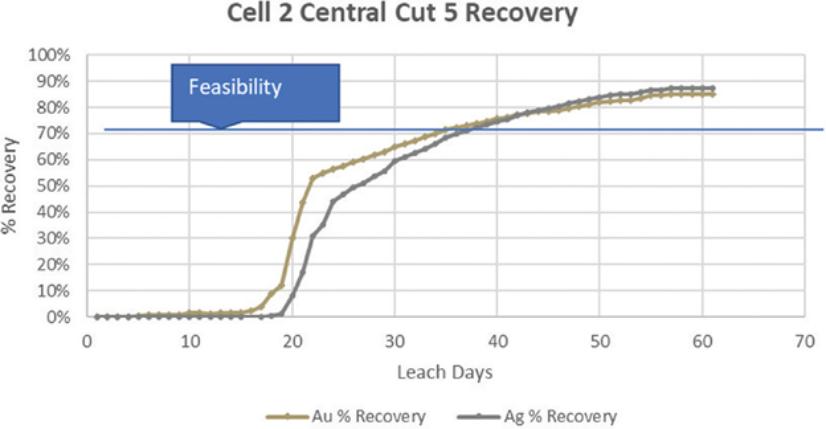

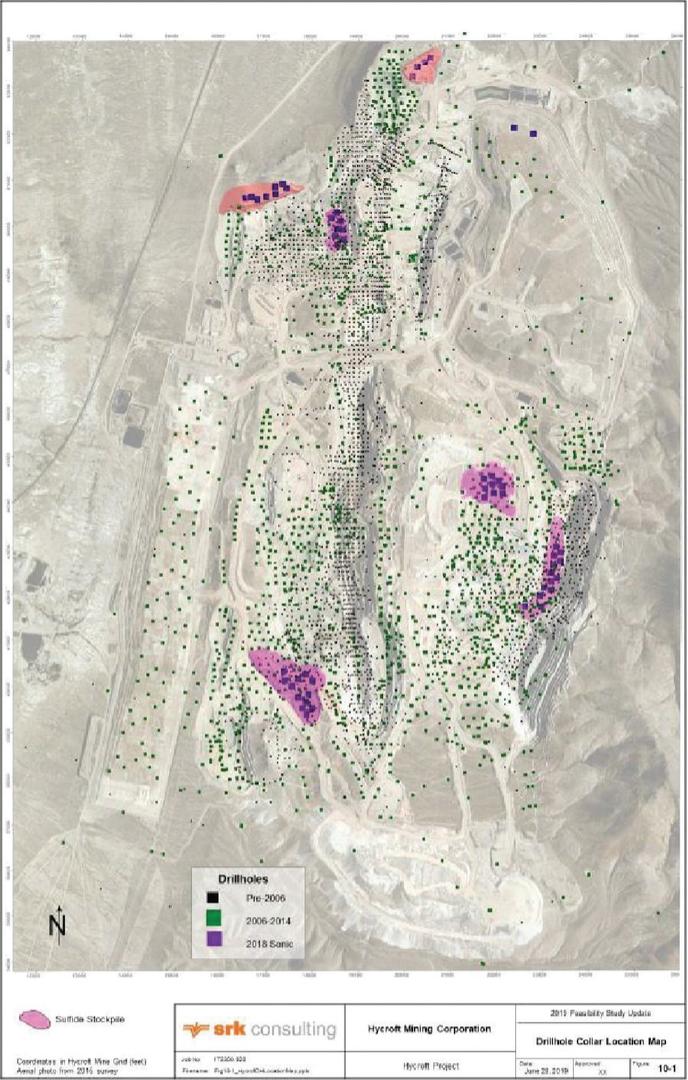

Effective July 31, 2019, M3 Engineering and Technology Corporation (“M3 Engineering”), in conjunction with SRK Consulting (U.S.), Inc. (“SRK”) and Seller, completed the Hycroft Technical Report Summary, Heap Leaching Feasibility Study prepared for Seller with an effective date of July 1, 2019, and prepared in accordance with the requirements of the Modernization of Property Disclosures for Mining Registrants set forth in subpart 1300 of Regulation S-K, for a two-stage, heap oxidation and subsequent leaching of transition and sulfide ores.

Our sole mining property is located in Nevada. We currently have one operating property, which is the Hycroft Mine as discussed herein.

Recent Developments

On May 29, 2020, we completed the Recapitalization Transaction described below in the Section entitled “Description of Business.”

On July 1, 2020, Randy Buffington, our former Chairman, President, and CEO departed the Company. Mr. Buffington is assisting us during this transition period and has entered into a consulting agreement for 24 months, through July 1, 2022. See Note 22 — Subsequent Events to the Notes to Unaudited Consolidated Financial Statements and “Executive Compensation — Transition Agreements with Randy Buffington.”

On August 31, 2020, the Company announced that it will appoint Diane R. Garrett, Ph.D, as the Company’s President and Chief Executive Officer and as a director, effective as of September 8, 2020. For more information about Dr. Garrett’s biography and compensation arrangements, see “Management” and “Executive Compensation — Compensation Arrangements with Diane R. Garrett,” respectively.

On September 8, 2020, the Company entered into a Transition and Succession Agreement and a Consulting Agreement with Stephen M. Jones, pursuant to which he resigned as the Company’s interim President and Chief Executive Officer and agreed to

3

remain as a non-executive employee through November 30, 2020 and to provide consulting services for an additional six months thereafter. For more information, see “Executive Compensation — Transition Agreements with Stephen M. Jones.”

Risk Factors

An investment in our securities involves substantial risk. The occurrence of one or more of the events or circumstances described in the section entitled “Risk Factors,” alone or in combination with other events or circumstances, may have a material adverse effect on our business, cash flows, financial condition and results of operations. Important factors and risks that could cause actual results to differ materially from those in the forward-looking statements include, among others:

Industry-related risks including:

| ● | Fluctuations in the price of gold and silver; |

| ● | Uncertainties concerning estimates of reserves and mineralized material; |

| ● | Uncertainties relating to the ongoing COVID-19 pandemic; |

| ● | The intense competition within the mining industry and state of Nevada; |

| ● | The inherently hazardous nature of mining activities, including environmental risks; |

| ● | Our insurance may not be adequate to cover all risks associated with our business, or cover the replacement costs of our assets; |

| ● | Potential effects on our operations of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements; |

| ● | Cost of compliance with current and future government regulations; |

| ● | Uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities; |

| ● | Potential challenges to title in our mineral properties; |

| ● | Risks associated with proposed legislation in Nevada that could significantly increase the costs or taxation of our operations; and |

| ● | Changes to the climate and regulations and pending legislation regarding climate change. |

Business-related risks including:

| ● | Risks related to our liquidity and going concern considerations; |

| ● | Risks related to the heap leaching process at the Hycroft Mine and estimates of production; |

| ● | Our ability to achieve our estimated production and sales rates and stay within our estimated operating and production costs and capital expenditure projections; |

| ● | Risks related to our limited experience with a largely untested process of oxidizing and heap leaching sulfide ores; |

| ● | The decline of our gold and silver production; |

| ● | Risks related to our reliance on one mine with a new process; |

| ● | Uncertainties and risks related to our reliance on contractors and consultants; |

| ● | Uncertainties related to our ability to replace and expand our ore reserves; |

| ● | The costs related to our land reclamation requirements; |

| ● | Availability and cost of equipment, supplies, energy or commodities; |

| ● | The commercial success of, and risks relating to, our development activities; |

| ● | Risks related to slope stability; |

| ● | Our ability to raise capital on favorable terms or at all; |

4

| ● | Risks related to our substantial indebtedness, including cross acceleration and our ability to generate sufficient cash to service our indebtedness; |

| ● | Uncertainties resulting from the possible incurrence of operating and net losses in the future; |

| ● | Risks related to disruption of our business due to the historical chapter 11 proceedings; |

| ● | The loss of key personnel or our failure to attract and retain personnel; |

| ● | Risks related to technology systems and security breaches; |

| ● | Risks related to current and future legal proceedings; |

| ● | Our current intention or future decisions whether or not to use streaming or forward-sale arrangements; |

| ● | Risks associated with possible future joint ventures; and |

| ● | Risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval. |

Risks related to our securities and this offering, including:

| ● | Volatility in the price of our Common Stock; |

| ● | Risks related to a lack of liquidity in the trading of our Common Stock and the Warrants; |

| ● | Potential declines in the value of our Common Stock and the Warrants due to substantial future sales of our Common Stock and/or warrants; |

| ● | Dilution of your investment; |

| ● | We do not intend to pay cash dividends; and |

| ● | Anti-takeover provisions could make a third party acquisition of us difficult. |

You should carefully review and consider the risk factors set forth under the section entitled “Risk Factors” beginning on page 8 of this prospectus.

Implications of Being An Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the “JOBS Act.” An emerging growth company may take advantage of specified reduced requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| ● | we may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations; |

| ● | we are exempt from the requirement to obtain an attestation report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| ● | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| ● | we are not required to give our stockholders non-binding votes on executive compensation or "golden parachute" arrangements. |

5

We may take advantage of these provisions for up to five full fiscal years or such earlier time that we are no longer an emerging growth company. We may choose to take advantage of some but not all of these reduced burdens. We would cease to be an emerging growth company if we have $1.07 billion or more in annual revenues, have more than $700 million in market value of our shares of common stock held by non-affiliates, or issue more than $1 billion of non-convertible debt over a three-year period. The Company has elected not to opt out of the extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of the Company’s financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

Corporate Information

We were incorporated on August 28, 2017 as a Delaware corporation under the name “Mudrick Capital Acquisition Corporation” and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. On May 29, 2020, in connection with the consummation of the Recapitalization Transaction, we changed our name to “Hycroft Mining Holding Corporation.”

Our principal executive offices are located at 8181 E. Tufts Ave., Suite 510, Denver, Colorado, and our telephone number is (303) 253-3267. Our website is www.hycroftmining.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this prospectus.

6

The following summary contains general information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus.

Units offered by us |

| [●] Units. Each Unit consists of one share of Common Stock and [●] Warrants to purchase one share of our Common Stock (together with the shares of Common Stock issuable upon exercise of such Warrants). |

Underwriters’ option to purchase additional Units | | We have granted the underwriters a 30-day option to purchase up to an additional [●] Units from us at the public offering price, less underwriting discounts and commissions, to cover over-allotments, if any. |

Description of Warrants | | The Warrants will be exercisable on the date of issuance at an exercise price of $[●] per share of Common Stock and will expire on the [●] year anniversary of the original issuance date. This prospectus also relates to the shares of Common Stock issuable upon due exercise of the Warrants. The exercise price of the Warrants and the number of shares into which the Warrants may be exercised are subject to adjustment in certain circumstances. See the section of this prospectus entitled “Description of Securities – Description of Warrants Included in the Units” for more information. |

Common stock to be outstanding immediately after this offering | | [●] shares (or [●] shares if the underwriters exercise their option to purchase additional Units in full). |

Use of proceeds | | We estimate that the net proceeds from the sale of Units in this offering will be approximately $[●] million (or approximately $[●] million if the underwriters’ option to purchase additional Units in this offering is exercised in full), based upon an assumed public offering price of $[●] per share, which was the closing sale price of our Common Stock on the Nasdaq Capital Market on September [●], 2020, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to fund working capital expenditures as we seek to continue to ramp up operations at the Hycroft Mine and to construct a new leach pad and associated infrastructure. See the section of this prospectus entitled “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

Risk factors | | See the section of this prospectus entitled “Risk Factors” beginning on page 8 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Common Stock and Warrants. |

Except as otherwise indicated, the information in this prospectus reflects or assumes the following:

7

Investing in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the other information set forth in the registration statement of which this prospectus forms a part, including our and Seller’s financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to invest in our Common Stock and Warrants. If any of the events or developments described below occur, our business, financial condition, or results of operations could be materially or adversely affected. As a result, the market price of our Common Stock could decline, and investors could lose all or part of their investment. The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Notes Regarding Forward-Looking Statements” above.

Risks Related To Our Industry

The market prices of gold and silver are volatile. A decline in gold and silver prices could result in decreased revenues, decreased net income, increased losses and decreased cash inflows, which would negatively affect our business.

Gold and silver are commodities. Their prices fluctuate and are affected by many factors beyond our control, including interest rates, expectations regarding inflation, speculation, currency values, central bank activities, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors. The prices of gold and silver, as quoted by The London Bullion Market Association on September 15, 2020, December 31, 2019 and December 31, 2018, were $1,949, $1,515 and $1,279 per ounce for gold, respectively, and $27.55, $18.05 and $15.46 per ounce for silver, respectively. The prices of gold and silver may decline in the future. A substantial or extended decline in gold or silver prices would adversely impact our financial position, revenues, net income and cash flows, particularly in light of our current strategy of not engaging in hedging transactions with respect to gold or silver. In addition, sustained lower gold or silver prices may:

| ● | reduce revenue potential due to cessation of the mining of deposits, or portions of deposits, that have become uneconomic at the then-prevailing gold or silver price; |

| ● | reduce or eliminate the profit, if any, that we currently expect from mining operations; |

| ● | halt, delay, modify, or cancel plans for the mining of oxide and sulfide ores or the development of new and existing projects; |

| ● | make it more difficult for us to satisfy and/or service our debt obligations; |

| ● | reduce existing reserves by removing ores from reserves that can no longer be economically processed at prevailing prices; and |

| ● | cause us to recognize an impairment to the carrying values of mineral properties and long-lived assets. |

Reserve and other mineralized material calculations are estimates only, and are subject to uncertainty due to factors including metal prices, inherent variability of the ore and recoverability of metal in the mining process.

The calculation of mineral reserves, mineral resources and grades are estimates and depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources, and corresponding grades. Until mineral reserves and mineral resources are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral reserves and mineral resources may vary depending on metal prices, which largely determine whether mineral reserves and other mineralized materials are classified as ore (economic to mine) or waste (uneconomic to mine). A decline in metal prices may result in previously reported mineral reserves (ore) becoming uneconomic to mine (waste). Current reserve estimates were calculated using a $1,200 per ounce gold price and $16.50 per ounce silver price. A material decline in the current price of gold or silver could require a reduction in our reserve estimates. Any material change in the quantity of mineral reserves, mineral resources, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, we can provide no assurance that gold and silver recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

8

Our activities may be adversely affected by the ongoing COVID-19 pandemic, whether those effects are local, nationwide or global. Matters outside our control may prevent us from executing on our mining operations, limit travel of Company representatives, adversely affect the health and welfare of Company personnel or prevent important vendors and contractors from performing normal and contracted activities, including mining operations.

Our business could be adversely impacted by the effects of the ongoing COVID-19 pandemic. In March 2020, the World Health Organization declared the outbreak of COVID-19 as a pandemic, which continues to spread throughout the United States. Efforts implemented by local and national governments, as well as businesses, including temporary closures, are expected to have adverse impacts on local, national and the global economies. The extent to which the COVID-19 pandemic impacts our business, including our operations and the market for our securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time. Uncertainties include the duration, severity and scope of the outbreak and the actions taken to contain or treat the COVID-19 outbreak. In particular, the continued spread of COVID-19 could materially and adversely impact our business including without limitation, employee health, limitations on travel, the availability of industry experts and personnel, restrictions to planned drill programs, assaying, and other factors that will depend on future developments beyond our control that may have a material and adverse effect on its business, financial condition and results of operations. There can be no assurance that our personnel will not be impacted by such disease and we may ultimately see our workforce productivity reduced or incur increased medical and related costs as a result of these health risks. In addition, a significant outbreak of COVID-19 could result in a widespread global health crisis that could adversely affect global economies and financial markets resulting in an economic downturn that could have an adverse effect on the demand for precious metals and our future prospects.

Moreover, the actual and threatened spread of the COVID-19 pandemic globally has had a material adverse effect on the global economy, could continue to negatively impact stock markets, including the trading price of our shares, could adversely impact our ability to raise capital, could cause continued interest rate volatility and movements that could make obtaining financing or refinancing our debt obligations more challenging or more expensive and could result in any operations affected by COVID-19 becoming subject to quarantine. Any of these developments, and others, could have a material adverse effect on our business and results of operations.

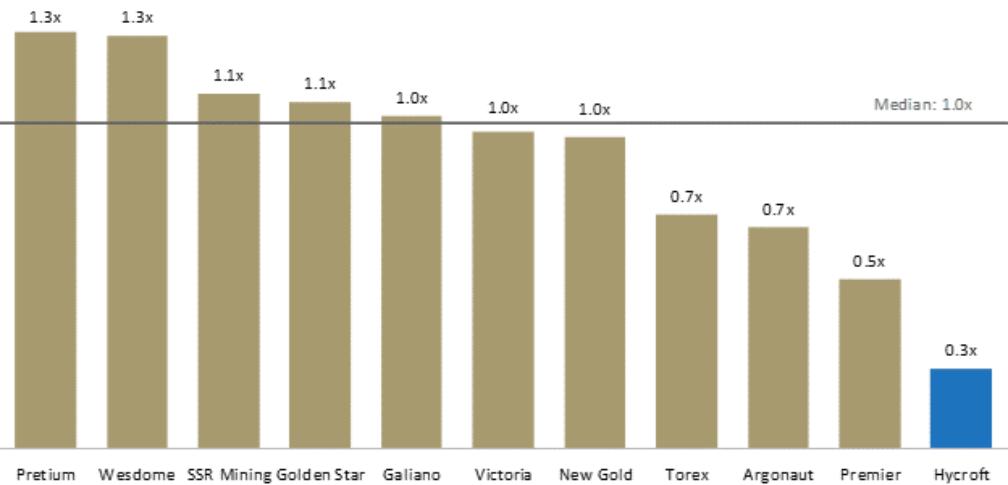

We face intense competition in the mining industry.

The mining industry is intensely competitive. As a result of this competition, some of which is with large established mining companies with substantial mining capabilities and with greater financial and technical resources than ours, we compete with other mining companies in the recruitment and retention of qualified managerial and technical employees and in acquiring attractive mining claims. If we are unable to successfully attract and retain qualified employees, our development programs and/or our operations may be slowed down or suspended, which may adversely impact our development, financial condition and results of operations.

Mining development and processing operations pose inherent risks and costs that may negatively impact our business.

Mining development and processing operations involve many hazards and uncertainties, including, among others:

| ● | metallurgical or other processing problems; |

| ● | ground or slope failures; |

| ● | industrial accidents; |

| ● | unusual and unexpected rock formations or water conditions; |

| ● | environmental contamination or leakage; |

| ● | flooding and periodic interruptions due to inclement or hazardous weather conditions or other acts of nature; |

| ● | fires; |

| ● | seismic activity; |

| ● | organized labor disputes or work slow-downs; |

| ● | mechanical equipment failure and facility performance problems; and |

| ● | the availability of critical materials, equipment and skilled labor. |

These occurrences could result in damage to, or destruction of, our properties or production facilities, personal injury or death, environmental damage, delays in mining or processing, increased production costs, asset write downs, monetary losses and legal liability, any of which could have an adverse effect on our results of operations and financial condition and adversely affect our projected development and production estimates.

9

Our insurance may not cover all of the risks associated with our business.

The mining business is subject to risks and hazards, including, but not limited to, construction risks, environmental hazards, industrial accidents, the encountering of unusual or unexpected geological formations, slide-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, reduced production and delays in mining, asset write-downs, monetary losses and possible legal liability. Insurance fully covering many of these risks is not generally available to us and if it is, we may elect not to obtain it because of the high premium costs or commercial impracticality. We do not currently carry business interruption insurance and have no plans to obtain such insurance in the future. Any liabilities incurred for these risks and hazards could be significant and could adversely affect our results of operation, cash flows and financial condition.

Environmental regulations could require us to make significant expenditures or expose us to potential liability.

To the extent we become subject to environmental liabilities, the payment of such liabilities or the costs that we may incur, including costs to remedy environmental pollution, would reduce funds otherwise available to us and could have a material adverse effect on our financial condition, results of operations, and liquidity. If we are unable to fully remedy an environmental violation or release of hazardous substances, we might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy or corrective action. The environmental standards that may ultimately be imposed at a mine site can vary and may impact the cost of remediation. Actual remedial costs may exceed the financial accruals that have been made for such remediation. The potential exposure may be significant and could have a material adverse effect on our financial condition and results of operations.

Moreover, governmental authorities and private parties may bring lawsuits based upon damage to property or natural resources and injury to persons resulting from the environmental, health and safety impacts of our past and current operations, which could lead to the imposition of substantial fines, remediation costs, penalties, injunctive relief and other civil and criminal sanctions. Substantial costs and liabilities, including those required to restore the environment after the closure of mines, are inherent in our operations. We cannot provide any assurance that any such law, regulation, enforcement or private claim will not have a negative effect on our business, financial condition or results of operations.

Our operations are subject to extensive environmental regulations, which could result in the incurrence of operational delays, penalties and costs.

All phases of our operations are subject to extensive federal and state environmental regulation, including those enacted under the following laws:

| ● | Comprehensive Environmental Response, Compensation, and Liability Act; |

| ● | The Resource Conservation and Recovery Act; |

| ● | The Clean Air Act; |

| ● | The National Environmental Policy Act; |

| ● | The Clean Water Act; and |

| ● | The Safe Drinking Water Act. |

Additional regulatory authorities also have jurisdiction over some of our operations and mining projects including the Environmental Protection Agency, the Nevada Division of Environmental Protection, the U.S. Fish and Wildlife Service, the U.S. Bureau of Land Management (the “BLM”), and the Nevada Department of Wildlife.

These environmental regulations require us to obtain various operating permits, approvals and licenses and also impose standards and controls relating to development and production activities. For instance, we are required to hold a Nevada Reclamation Permit with respect to the Hycroft Mine. This permit mandates concurrent and post-mining reclamation of mines and requires the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Changes to the amount required to be posted for reclamation bonds for our operations at the Hycroft Mine could materially affect our financial position, results of operations, cash flows and liquidity. Also, the U.S. Fish and Wildlife Service may designate critical habitat and suitable habitat areas it believes are necessary for survival of a threatened or endangered species. A critical habitat or suitable habitat designation could result in further material restrictions to land use and may materially delay or prohibit land access for our development. For example, we had to obtain certain permits associated with mining in the area of an eagle habitat. Failure to obtain such required permits or failure to comply with federal and state regulations could also result in delays in beginning or expanding operations, incurring additional costs for investigation or

10

cleanup of hazardous substances, payment of penalties for non-compliance or discharge of pollutants, and post-mining closure, reclamation and bonding, all of which could have an adverse impact on our financial performance, results of operations and liquidity.

Compliance with current and future government regulations may cause us to incur significant costs.

Our operations are subject to extensive federal and state legislation governing matters such as mine safety, occupational health, labor standards, prospecting, exploration, production, exports, toxic and hazardous substances, explosives, management of natural resources, land use, water use, air emissions, waste disposal, environmental review and taxes. Compliance with this and other legislation could require us to make significant financial outlays. The enactment of new legislation or more stringent enforcement of current legislation may increase costs, which could have a negative effect on our financial position, results of operations, and liquidity. We cannot provide any assurances that we will be able to adapt to these regulatory developments on a timely or cost-effective basis. Violations of these laws, regulations and other regulatory requirements could lead to substantial fines, penalties or other sanctions, including possible shut-down of the Hycroft Mine or future operations, as applicable.

Changes in environmental regulations could adversely affect our cost of operations or result in operational delays.

The regulatory environment in which we operate is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. New environmental laws and regulations or changes in existing environmental laws and regulations could have a negative effect on exploration activities, operations, production levels and methods of production.

We cannot provide any assurance that future changes in environmental laws and regulations will not adversely affect our current operations or future projects. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or surety requirements.

Our operations are subject to numerous governmental permits that are difficult to obtain and we may not be able to obtain or renew all of the permits we require, or such permits may not be timely obtained or renewed.

In the ordinary course of business we are required to obtain and renew governmental permits for our operations, including in connection with our plans for heap leaching our transition and sulfide ores at the Hycroft Mine. We will also need additional governmental permits to accomplish our long-term plans to mine sulfide ores, including without limitation, permits to allow construction of additional leach pad space. Obtaining or renewing the necessary governmental permits is a complex and time-consuming process involving costly undertakings by us. The duration and success of our efforts to obtain and renew permits are contingent upon many variables not within our control, including the interpretation of applicable requirements implemented by the permitting authority and intervention by third parties in any required environmental review. We may not be able to obtain or renew permits that are necessary to our operations on a timely basis or at all, and the cost to obtain or renew permits may exceed our estimates. Failure to comply with the terms of our permits may result in injunctions, fines, suspension or revocation of permits and other penalties. We can provide no assurance that we have been, or will at all times, be in full compliance with all of the terms of our permits or that we have all required permits. The costs and delays associated with compliance with these permits and with the permitting process could alter the mine plan, delay or stop us from proceeding with the operation or development of the Hycroft Mine or increase the costs of development or production, any or all of which may materially adversely affect our business, results of operations, financial condition and liquidity.

There are uncertainties as to title matters in the mining industry. Any defects in such title could cause us to lose our rights in mineral properties and jeopardize our business operations.

Our mineral properties consist of private mineral rights, leases covering private lands, leases of patented mining claims and unpatented mining claims. Areas of the Hycroft Mine are unpatented mining claims located on lands administered by the BLM, Nevada State office to which we have only possessory title. Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper location and posting and marking of boundaries, and possible conflicts with other claims not determinable from descriptions of record. We believe a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, and this uncertainty is inherent in the mining industry.

The present status of our unpatented mining claims located on public lands allows us the right to mine and remove valuable minerals, such as precious and base metals, from the claims conditioned upon applicable environmental reviews and permitting programs. We also are generally allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the land remains with the United States. We remain at risk that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements. Prior to

11

1994, a mining claim locator who was able to prove the discovery of valuable, locatable minerals on a mining claim, and to meet all other applicable federal and state requirements and procedures pertaining to the location and maintenance of federal unpatented mining claims, had the right to prosecute a patent application to secure fee title to the mining claim from the Federal government. The right to pursue a patent, however, has been subject to a moratorium since October 1994, through federal legislation restricting the BLM from accepting any new mineral patent applications. If we do not obtain fee title to our unpatented mining claims, we can provide no assurance that we will be able to obtain compensation in connection with the forfeiture of such claims.

There may be challenges to title to the mineral properties in which we hold a material interest. If there are title defects with respect to any properties, we might be required to compensate other persons or perhaps reduce our interest in the affected property. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing production and development programs.

Legislation has been proposed periodically that could, if enacted, significantly affect the cost of our operations on our unpatented mining claims or the amount of Net Proceeds of Mineral Tax we pay to the State of Nevada.

Members of the U.S. Congress have periodically introduced bills which would supplant or alter the provisions of the Mining Law of 1872. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Such proposed legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. A majority of our mining claims are unpatented claims. Although we cannot predict what legislated royalties might be, the enactment of these proposed bills could adversely affect the potential for development of our unpatented mining claims and the economics of our existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance and results of operations.

We pay Net Proceeds of Mineral Tax (“NPT”), to the State of Nevada on up to 5% of net proceeds generated from the Hycroft Mine. Net proceeds are calculated as the excess of gross yield over direct costs. Gross yield is determined as the value received when minerals are sold, exchanged for anything of value or removed from the state. Direct costs generally include the costs to develop, extract, produce, transport and refine minerals. From time to time Nevada legislators introduce bills which aim to increase the amount of NPT that mining companies operating in the state pay. Recently a resolution was introduced in each of the Assembly and Senate of the state of Nevada to repeal the NPT and replace it with a tax on gross revenue. If legislation is passed that increases the NPT we pay to the state of Nevada or if the NPT is replaced with a tax on gross revenue, our business, results of operations, and cash flows could be negatively impacted.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such regulations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation.

Climate change could have an adverse impact on our cost of operations.

The potential physical impacts of climate change on our operations are highly uncertain and would be particular to the area in which we operate. These climate changes may include changes in rainfall and storm patterns and intensities, water shortages and changing temperatures. These changes in climate could adversely affect our mining operations, including by affecting the moisture levels and pH of ore on our leach pads, increase the cost of production at the Hycroft Mine and adversely affect the financial performance of our operations.

12

Risks Related to Our Business

Due to uncertainty surrounding our ability to achieve sales, production, cost and other operating targets, as well as our ability to raise sufficient additional working capital in this offering to fund construction of a leach pad, substantial doubt exists as to our ability to continue as a going concern. Our plans to alleviate the substantial doubt about our ability to continue as a going concern may not be successful, and we may be forced to limit our business activities or be unable to continue as a going concern, which would have a material adverse effect on our results of operations and financial condition.

The consolidated financial statements as of and for the periods ended June 30, 2020 included in this prospectus have been prepared on a “going concern” basis, which contemplates the presumed continuation of the Company even though events and conditions exist that, when considered individually or in the aggregate, raise substantial doubt about our ability to continue as a going concern because it is probable that, without sufficient additional capital injections, we will be unable to meet our obligations as they become due within one year after the date that such financial statements were issued.

For the six months ended June 30, 2020, we incurred a net loss of $84.4 million and the cash used in operating activities was $57.6 million. As of June 30, 2020, we had available cash on hand of $47.3 million, working capital of $68.0 million, total liabilities of $195.4 million, and an accumulated deficit of $468.8 million. Although we recently completed the Recapitalization Transaction, using our internal forecasts and cash flow projection models, we now project, without the net proceeds from this offering, there is insufficient cash to meet our future obligations as they become due or ramp up the Hycroft Mine’s operations from current levels or to levels which are contemplated by the Hycroft Technical Report.