Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITY HOLDING CO | a8-kpspres.htm |

City Holding Company Sandler O’Neill DC Investor Conference September 18, 2020

Forward looking statements • This presentation contains certain forward-looking statements that are included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such information involves risks and uncertainties that could result in the Company's actual results differing from those projected in the forward-looking statements. Factors that could cause actual results to differ from those discussed in such forward-looking statements include, but are not limited to those set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 under “ITEM 1A Risk Factors” and the following: (1) general economic conditions, especially in the communities and markets in which we conduct our business; (2) the uncertainties on the Company’s business, results of operations and financial condition, caused by the COVID-19 pandemic, which will depend on several factors, including the scope and duration of the pandemic, its continued influence on financial markets, the effectiveness of the Company’s work from home arrangements and staffing levels in operational facilities, the impact of market participants on which the Company relies and actions taken by governmental authorities and other third parties in response to the pandemic; (3) credit risk, including risk that negative credit quality trends may lead to a deterioration of asset quality, risk that our allowance for loan losses may not be sufficient to absorb actual losses in our loan portfolio, and risk from concentrations in our loan portfolio; (4) changes in the real estate market, including the value of collateral securing portions of our loan portfolio; (5) changes in the interest rate environment; (6) operational risk, including cybersecurity risk and risk of fraud, data processing system failures, and network breaches; (7) changes in technology and increased competition, including competition from non-bank financial institutions; (8) changes in consumer preferences, spending and borrowing habits, demand for our products and services, and customers’ performance and creditworthiness; (9) difficulty growing loan and deposit balances; (10) our ability to effectively execute our business plan, including with respect to future acquisitions; (11) changes in regulations, laws, taxes, government policies, monetary policies and accounting policies affecting bank holding companies and their subsidiaries; (12) deterioration in the financial condition of the U.S. banking system may impact the valuations of investments the Company has made in the securities of other financial institutions; (13) regulatory enforcement actions and adverse legal actions; (14) difficulty attracting and retaining key employees; (15) other economic, competitive, technological, operational, governmental, regulatory, and market factors affecting our operations. Forward-looking statements made herein reflect management's expectations as of the date such statements are made. Such information is provided to assist stockholders and potential investors in understanding current and anticipated financial operations of the Company and is included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made. 2

City was very proud to recently announce that for the 3rd consecutive year, we were awarded the highest ranking in customer satisfaction in the North Central District by JD Power (IN, OH, KY, MI, WV). 2018 2019 2020 3

Presenters: Skip Hageboeck CEO & President John DeRito EVP Commercial Banking Tim Whittaker Chief Credit Officer 4

Snapshot • Total Assets $5.5 billion • Branches 94 • FTE 913 • Market Cap $1.0 billion • Markets: Stable, Slow growing, & less competitive • Business Lines: Retail, Commercial, Investment Management • Asset Quality: Demonstrated strong track record • Performance: Long record as a high performer • Growth: Succeeding in slow-growth markets & expanding into new markets 5

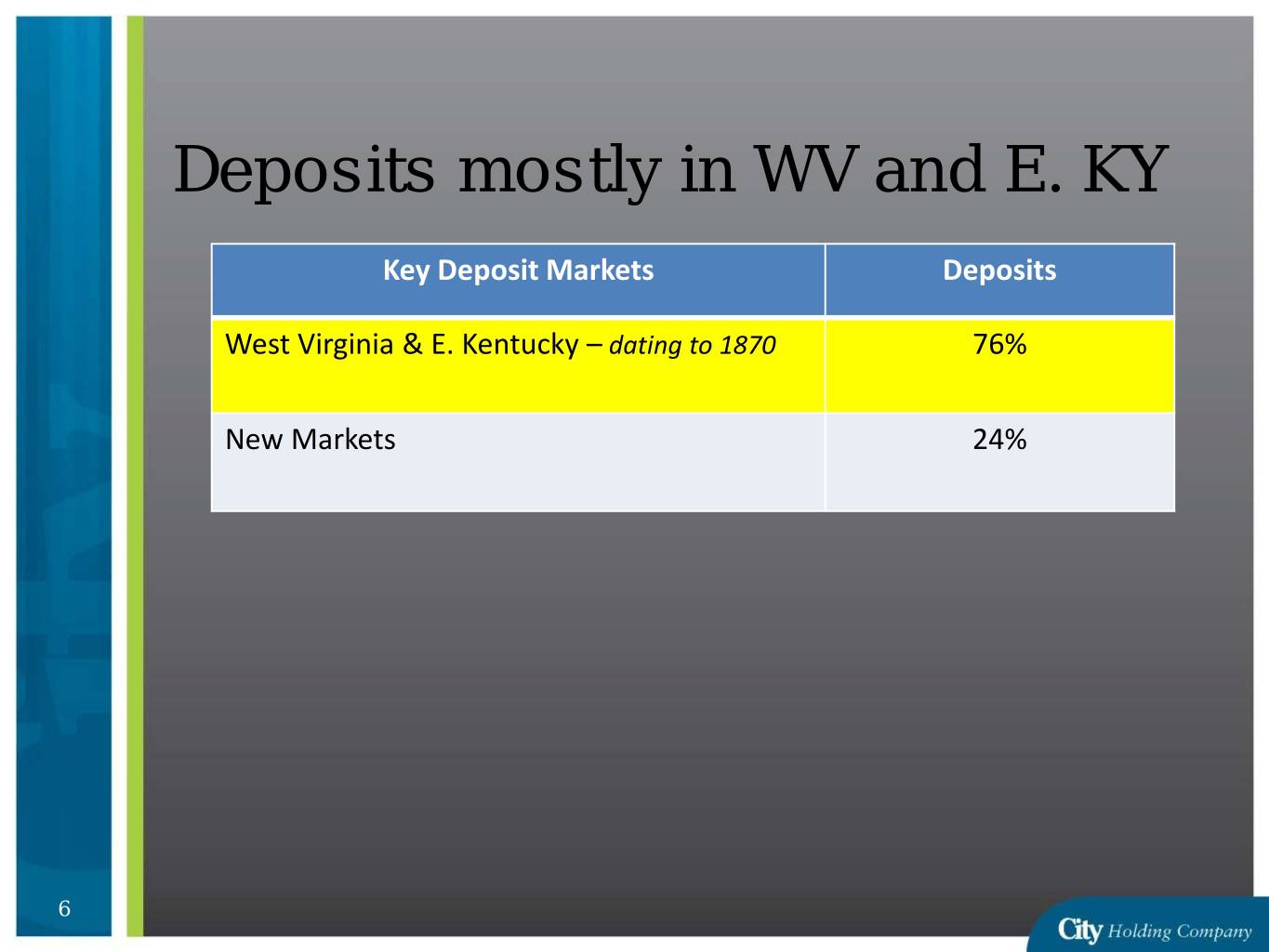

Deposits mostly in WV and E. KY Key Deposit Markets Deposits West Virginia & E. Kentucky – dating to 1870 76% New Markets 24% 6

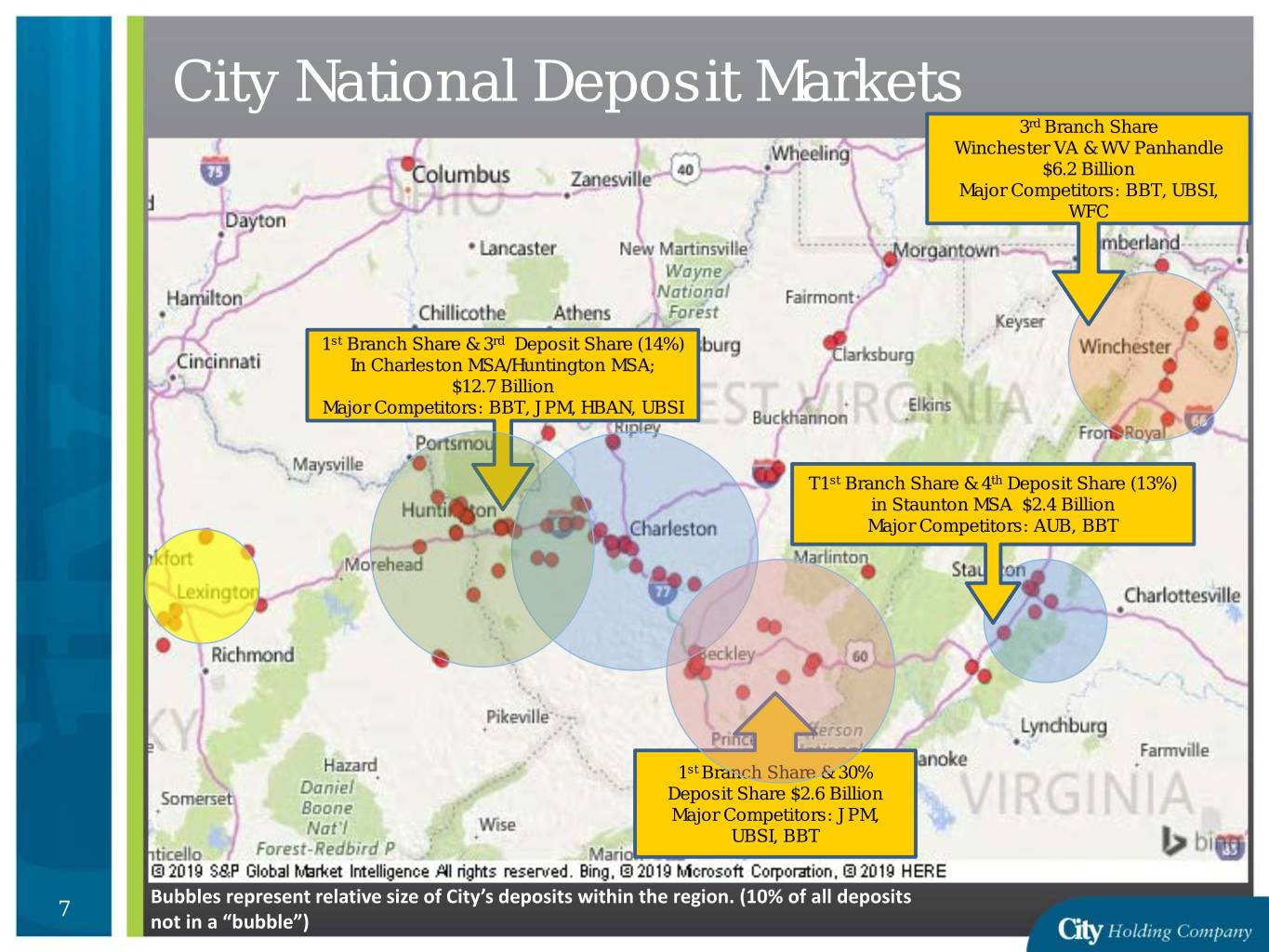

City National Deposit Markets 3rd Branch Share Winchester VA & WV Panhandle $6.2 Billion Major Competitors: BBT, UBSI, WFC 1st Branch Share & 3rd Deposit Share (14%) In Charleston MSA/Huntington MSA; $12.7 Billion Major Competitors: BBT, JPM, HBAN, UBSI T1st Branch Share & 4th Deposit Share (13%) in Staunton MSA $2.4 Billion Major Competitors: AUB, BBT 1st Branch Share & 30% Deposit Share $2.6 Billion Major Competitors: JPM, UBSI, BBT Bubbles represent relative size of City’s deposits within the region. (10% of all deposits 7 not in a “bubble”)

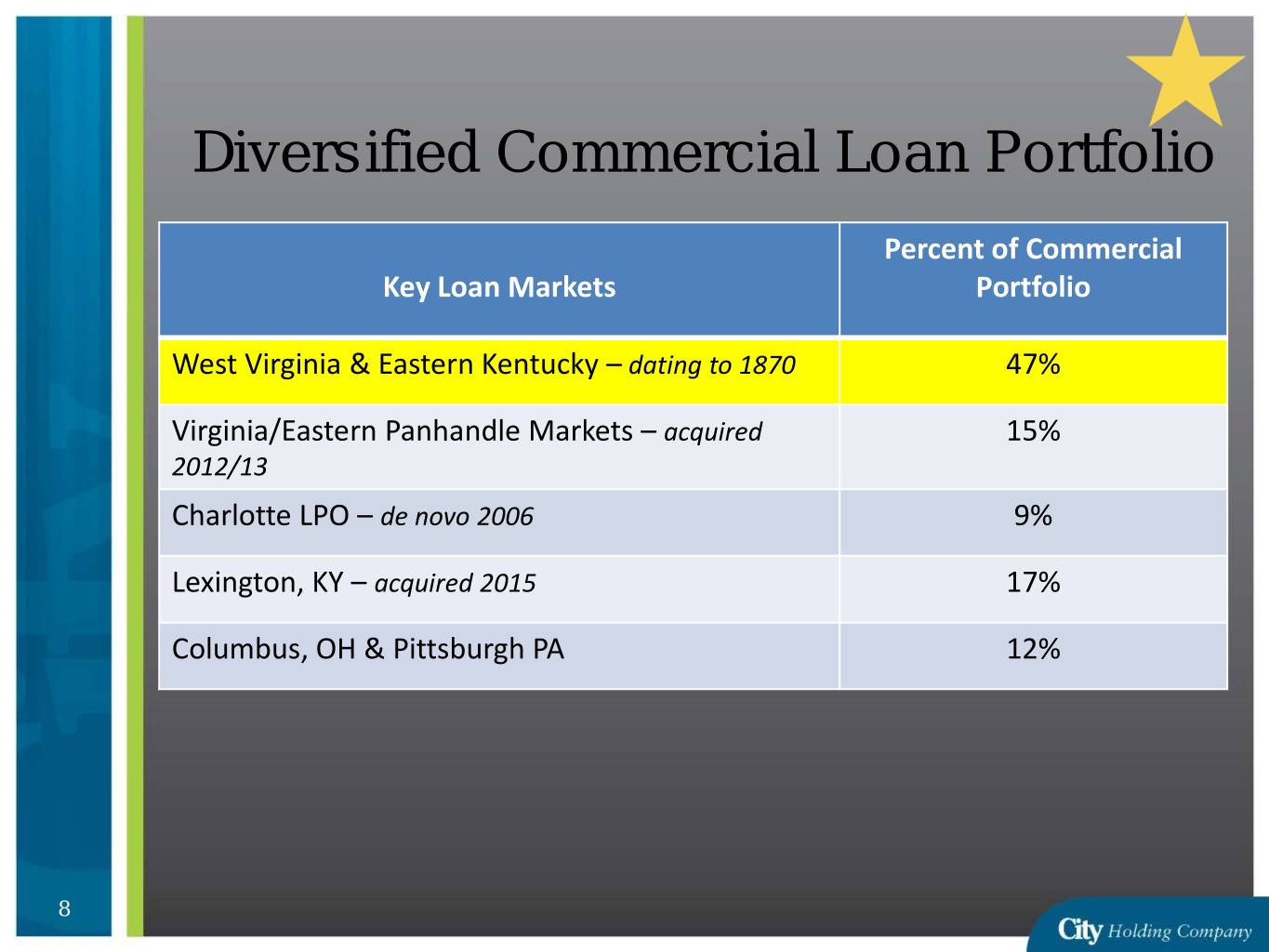

Diversified Commercial Loan Portfolio Percent of Commercial Key Loan Markets Portfolio West Virginia & Eastern Kentucky – dating to 1870 47% Virginia/Eastern Panhandle Markets – acquired 15% 2012/13 Charlotte LPO – de novo 2006 9% Lexington, KY – acquired 2015 17% Columbus, OH & Pittsburgh PA 12% 8

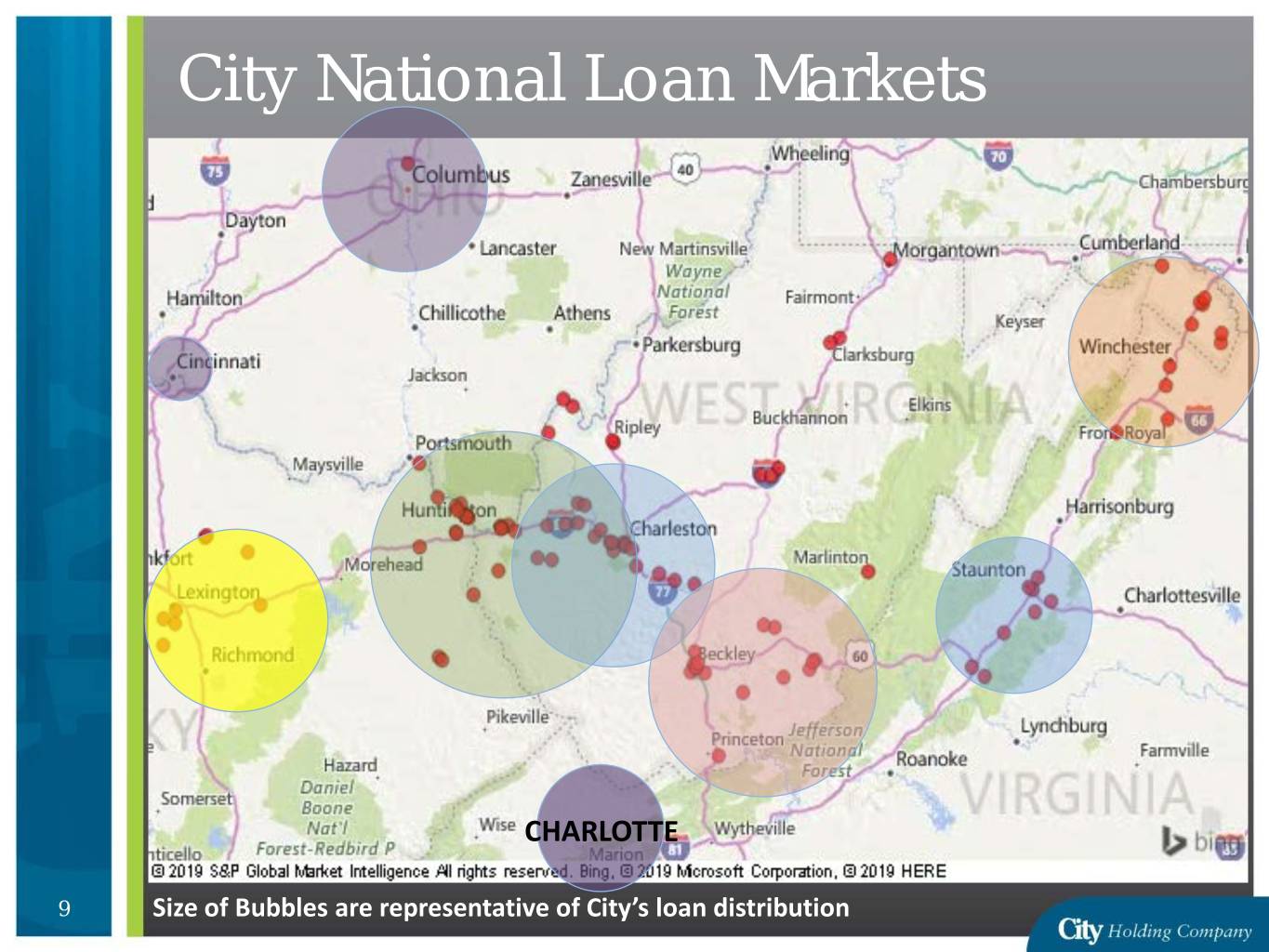

City National Loan Markets CHARLOTTE 9 Size of Bubbles are representative of City’s loan distribution

Market Position City’s biggest markets have strong distribution, large share, and high profitability Deposits Deposit Branch Branch Market Population ($mm) Share Branches Share Rank Charleston/Huntington /Ashland MSA 611,000 $1,729 14% 36 20% 1 Beckley/Lewisburg WV 162,000 783 30% 16 25% 1 Winchester/ Martinsburg 397,000 424 7% 11 10% 3 Valley Region 160,000 270 11% 8 15% 1 (tie) Lexington KY Region 430,000 259 3% 7 4% 9 Note: Green highlight indicates market expansion as a result of acquisitions. Data: S&P Global MI – regions modified slightly to fit City’s branch distribution 10

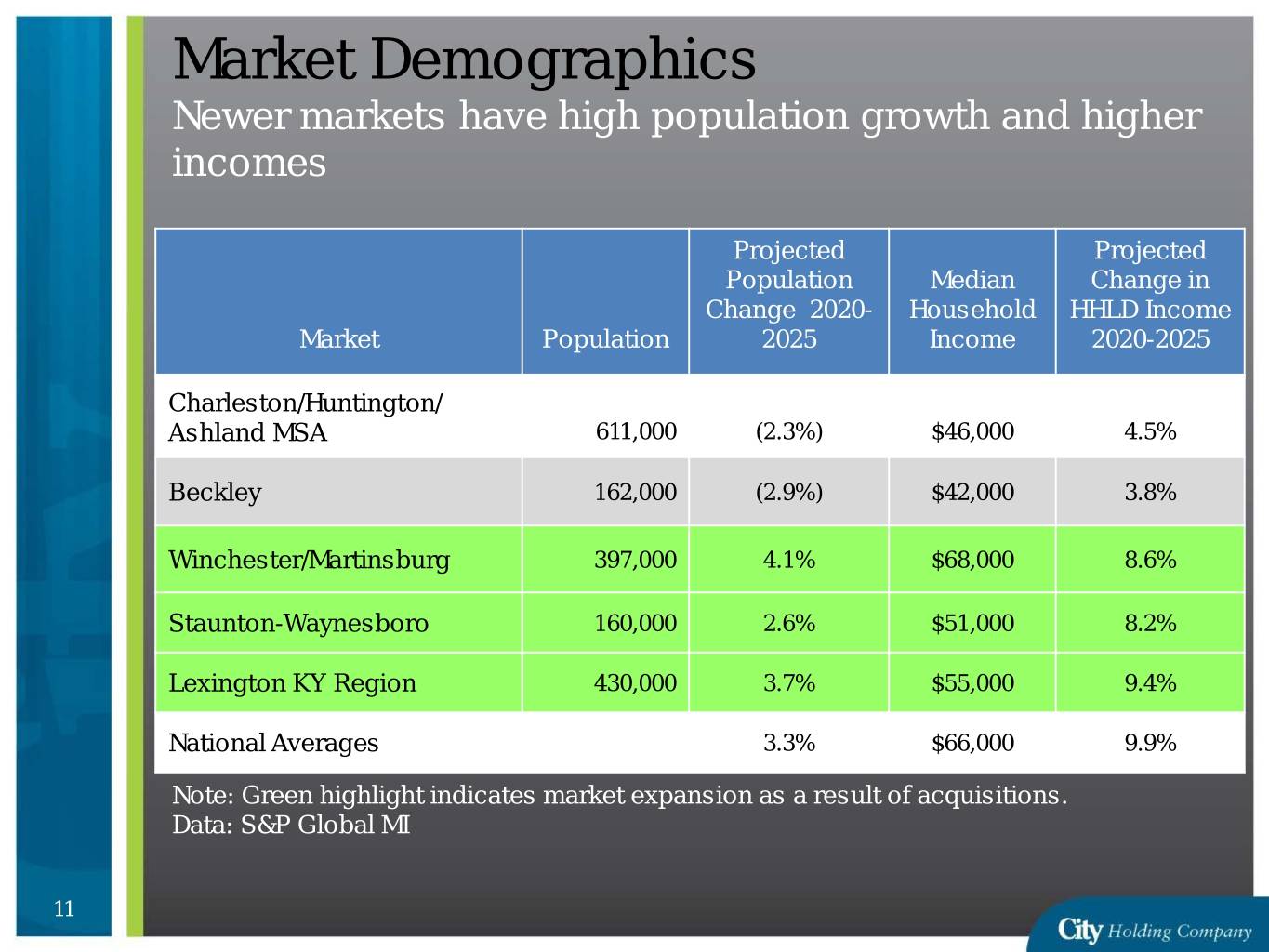

Market Demographics Newer markets have high population growth and higher incomes Projected Projected Population Median Change in Change 2020- Household HHLD Income Market Population 2025 Income 2020-2025 Charleston/Huntington/ Ashland MSA 611,000 (2.3%) $46,000 4.5% Beckley 162,000 (2.9%) $42,000 3.8% Winchester/Martinsburg 397,000 4.1% $68,000 8.6% Staunton-Waynesboro 160,000 2.6% $51,000 8.2% Lexington KY Region 430,000 3.7% $55,000 9.4% National Averages 3.3% $66,000 9.9% Note: Green highlight indicates market expansion as a result of acquisitions. Data: S&P Global MI 11

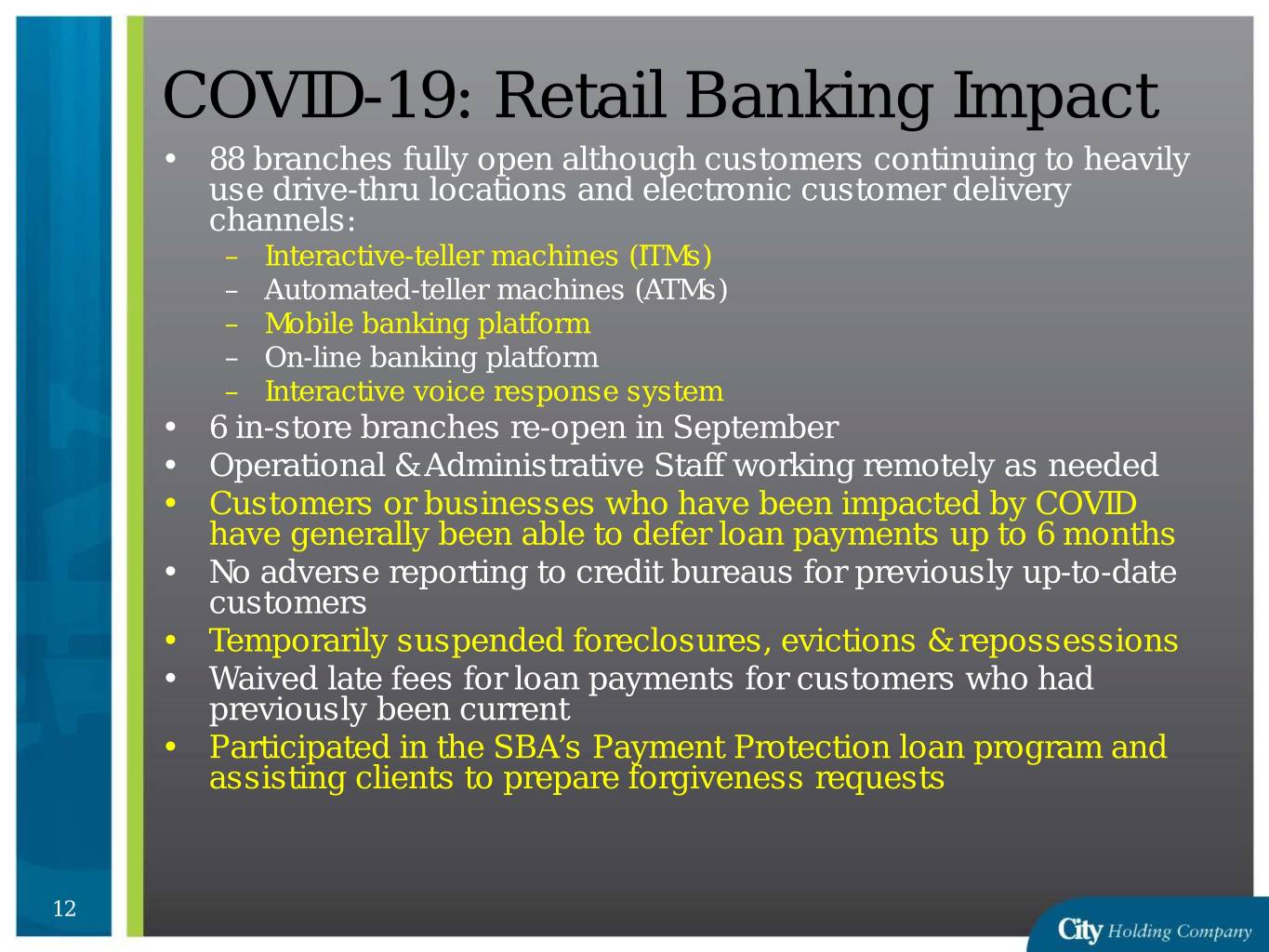

COVID-19: Retail Banking Impact • 88 branches fully open although customers continuing to heavily use drive-thru locations and electronic customer delivery channels: – Interactive-teller machines (ITMs) – Automated-teller machines (ATMs) – Mobile banking platform – On-line banking platform – Interactive voice response system • 6 in-store branches re-open in September • Operational & Administrative Staff working remotely as needed • Customers or businesses who have been impacted by COVID have generally been able to defer loan payments up to 6 months • No adverse reporting to credit bureaus for previously up-to-date customers • Temporarily suspended foreclosures, evictions & repossessions • Waived late fees for loan payments for customers who had previously been current • Participated in the SBA’s Payment Protection loan program and assisting clients to prepare forgiveness requests 12

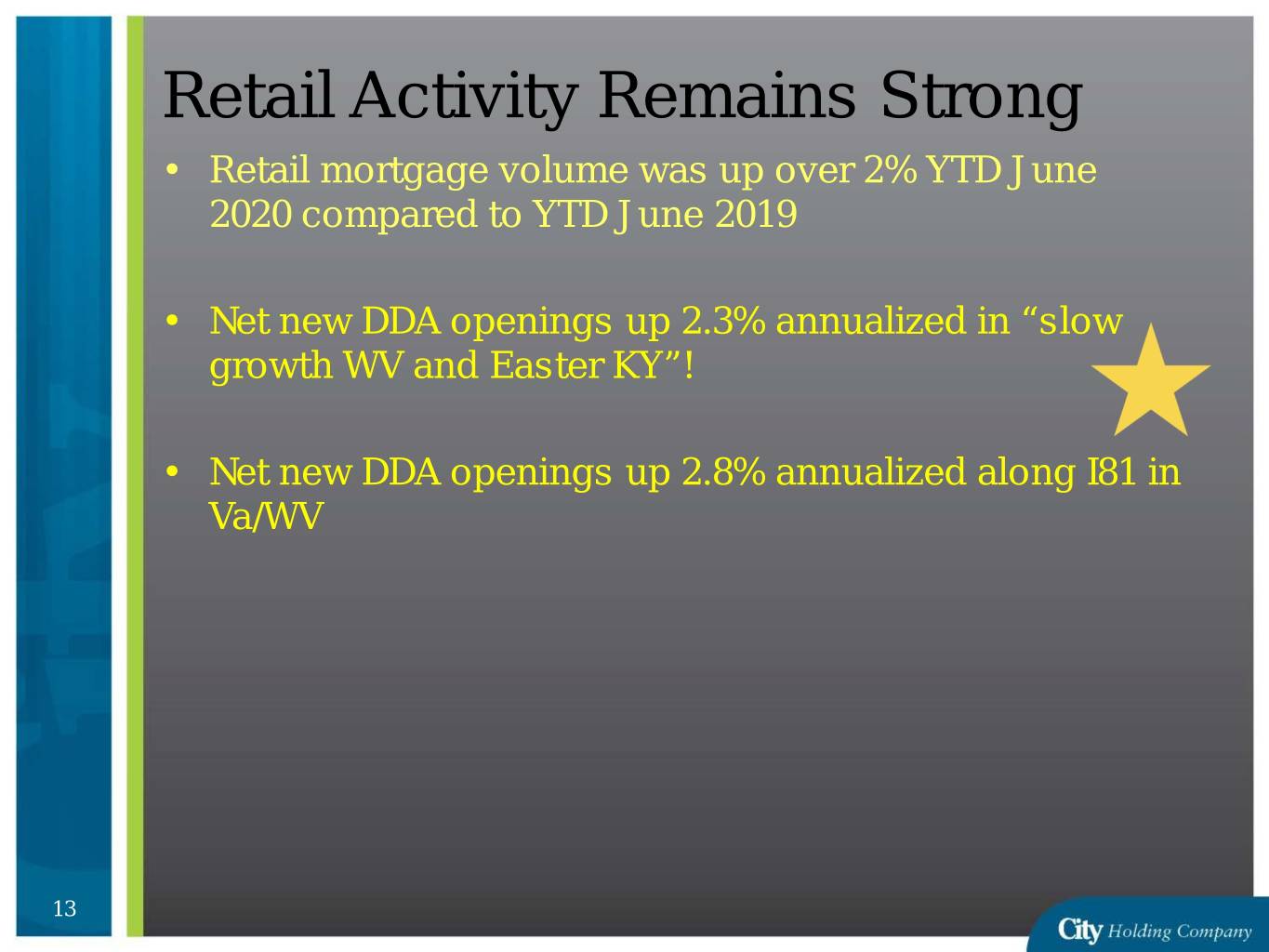

Retail Activity Remains Strong • Retail mortgage volume was up over 2% YTD June 2020 compared to YTD June 2019 • Net new DDA openings up 2.3% annualized in “slow growth WV and Easter KY”! • Net new DDA openings up 2.8% annualized along I81 in Va/WV 13

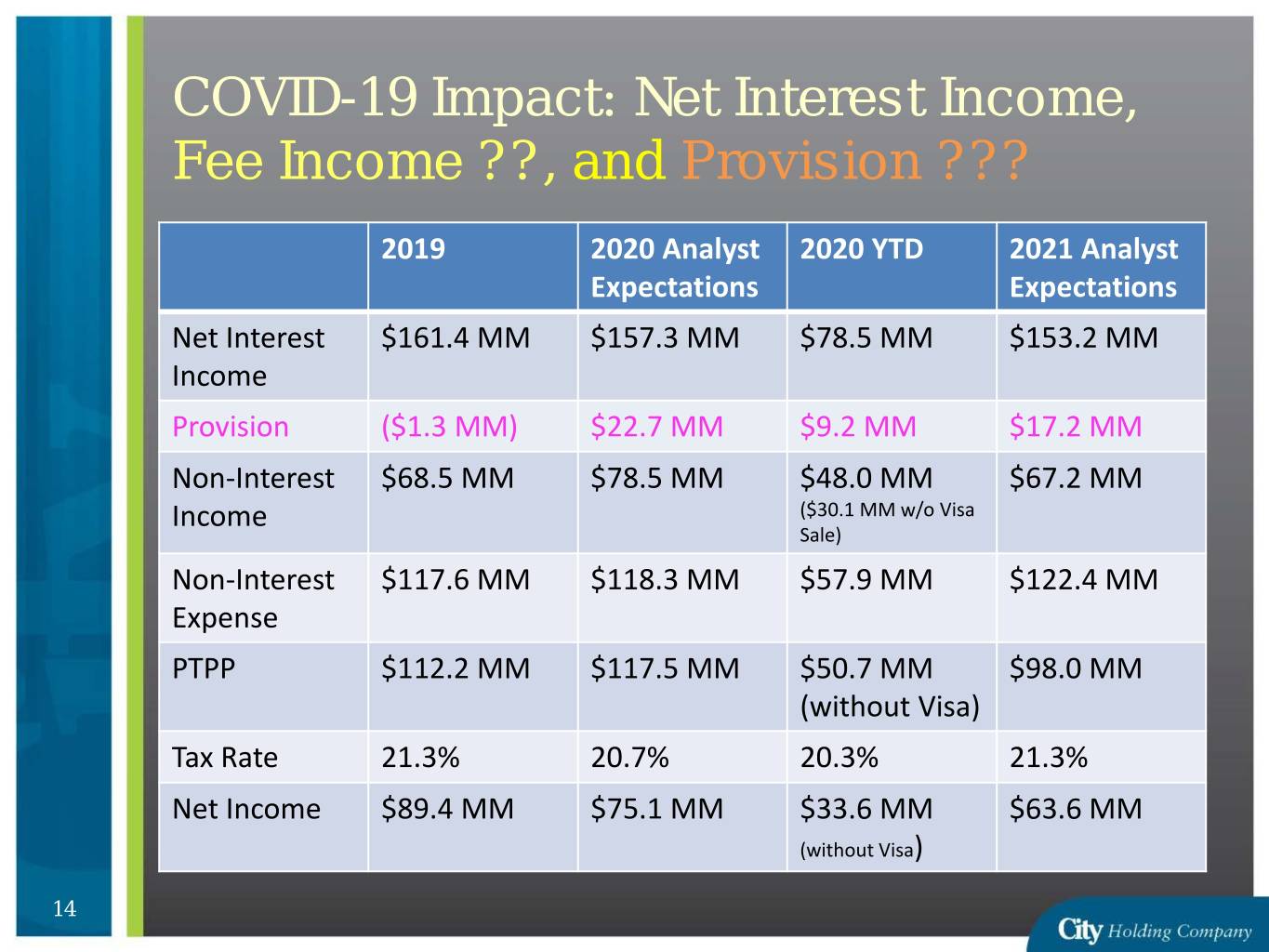

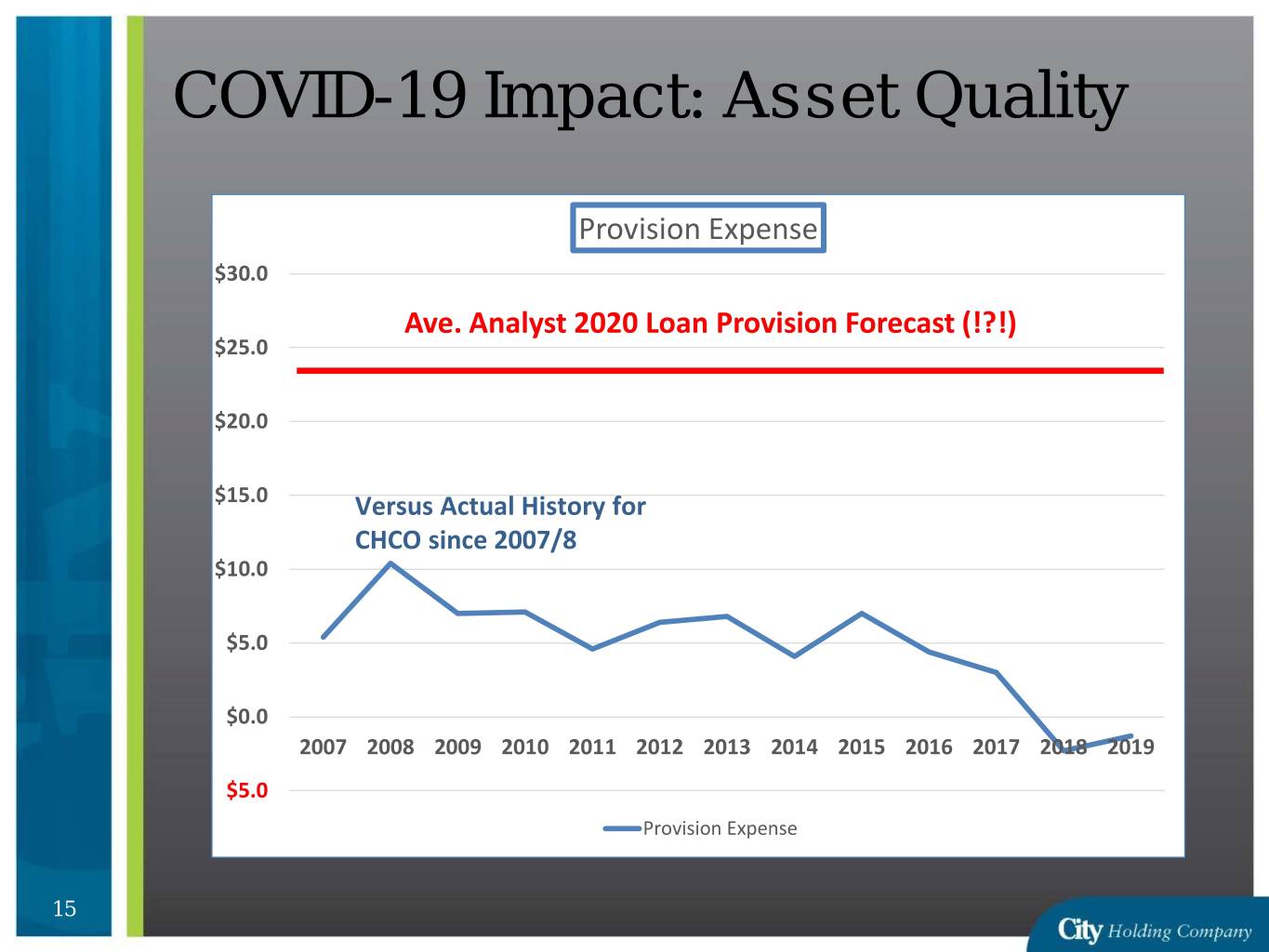

COVID-19 Impact: Net Interest Income, Fee Income ??, and Provision ??? 2019 2020 Analyst 2020 YTD 2021 Analyst Expectations Expectations Net Interest $161.4 MM $157.3 MM $78.5 MM $153.2 MM Income Provision ($1.3 MM) $22.7 MM $9.2 MM $17.2 MM Non-Interest $68.5 MM $78.5 MM $48.0 MM $67.2 MM Income ($30.1 MM w/o Visa Sale) Non-Interest $117.6 MM $118.3 MM $57.9 MM $122.4 MM Expense PTPP $112.2 MM $117.5 MM $50.7 MM $98.0 MM (without Visa) Tax Rate 21.3% 20.7% 20.3% 21.3% Net Income $89.4 MM $75.1 MM $33.6 MM $63.6 MM (without Visa) 14

COVID-19 Impact: Asset Quality Provision Expense $30.0 Ave. Analyst 2020 Loan Provision Forecast (!?!) $25.0 $20.0 $15.0 Versus Actual History for CHCO since 2007/8 $10.0 $5.0 $0.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 $5.0 Provision Expense 15

Charge-offs During Last Recession (w/o DDA Charge-offs) 3.00% 2.75% 2.50% 2.25% 2.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% 2005 2006 2007 2008 2009 2010 2011 CHCO w/o NSF's Industry Source: FDIC, All Insured Depository Institutions 16

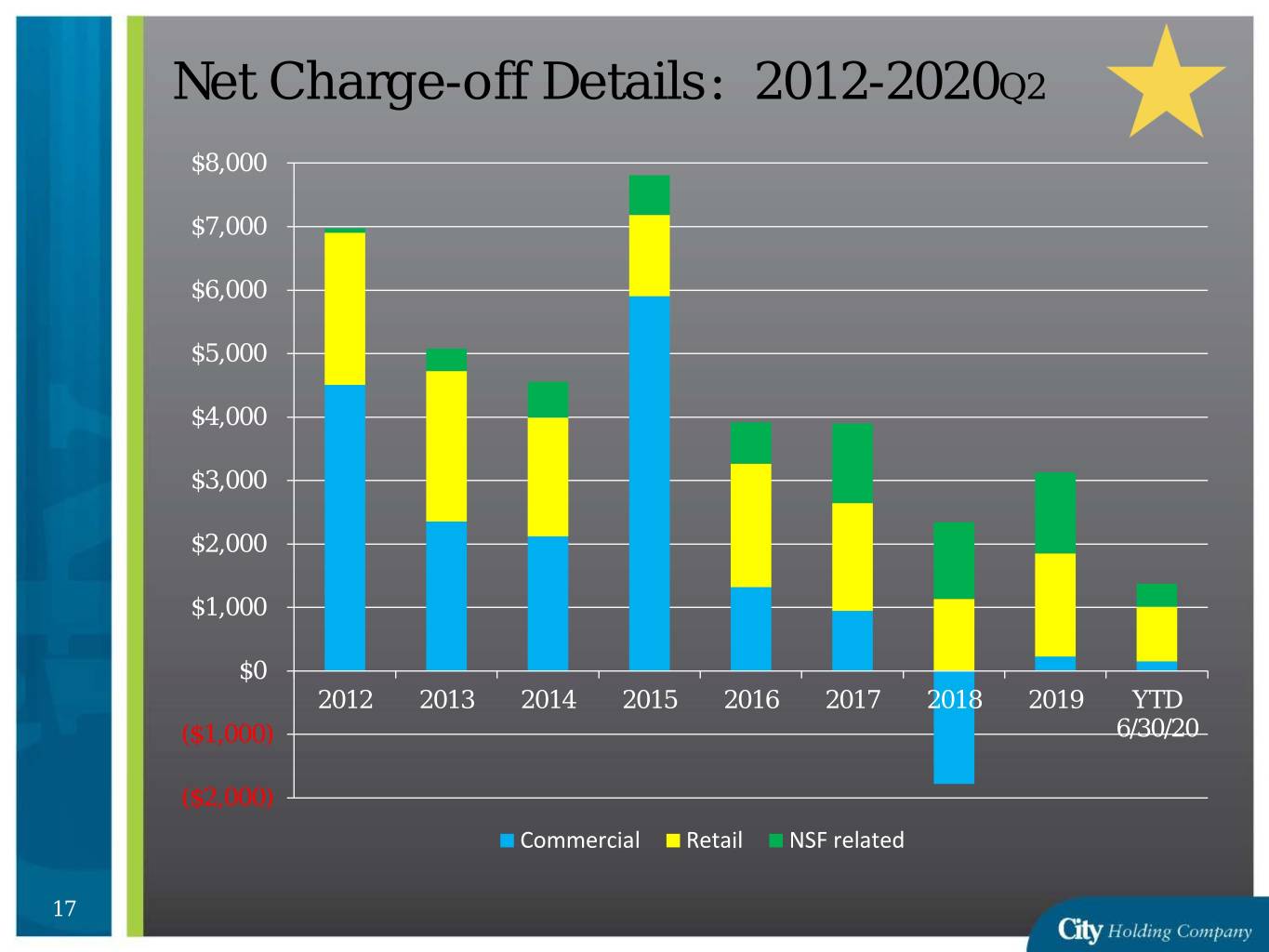

Net Charge-off Details: 2012-2020Q2 $8,000 $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0 2012 2013 2014 2015 2016 2017 2018 2019 YTD ($1,000) 6/30/20 ($2,000) Commercial Retail NSF related 17

Exposure to Commercial Sectors Most Impacted by COVID-19 As of 08/31/2020 All-Time % of Total Current Average Average $ in millions Pass Criticized Total COVID-19 Loans Deferments DSC LTV Deferments Nonresidential $463.7 $7.0 $470.7 12.9% $48.4 $17.2 1.34x 66% Properties Single/Multi-Family $333.2 $15.5 $348.7 9.5% $23.3 $2.1 1.70x 64% Housing Hotels & Motels $260.5 $36.1 $296.6 8.1% $274.6 $194.4 1.81x 63% Skilled Nursing Care $84.3 $0 $84.3 2.3% $27.8 $0 1.66x 80% Facilities/Assisted Living Restaurants $22.7 $1.3 $24.0 0.7% $10.6 $0 2.85x 60% Entertainment $9.0 $10.0 $19.0 0.5% $19.0 $13.9 2.06x 59% Establishments • ~35% of Nonresidential Properties are Retail oriented w/1.36 DSC • ~75% of Restaurants are fast food properties • DSC are as of 2019 18

COVID-19 Hotel Impacts - LTV Avg. Years to 85% Current LTV # of Loans $ Outstanding (Millions) Avg. 2019 DSC LTV 80% to 85% 4 $43.2 1.16 1.95 74.5% to 79.9% 7 $66.3 2.73 1.52 69% to 74.4% 5 $27.9 4.36 1.51 Up to 69% 25 $159.1 16.19 1.75 • The table above reflects the number of loans, outstanding balance, and average years to 85% LTV categorized by currently appraised LTV. • Years to 85% LTV includes the balance, any SWAP breakage fees, and any line of credit. • Continued deferral of interest payments is assumed for the analysis. 19

Hotel Exposure 23.4% Location Map 34.2% 23.2% WV KY 4.6% 14.6% OH VA Other 20

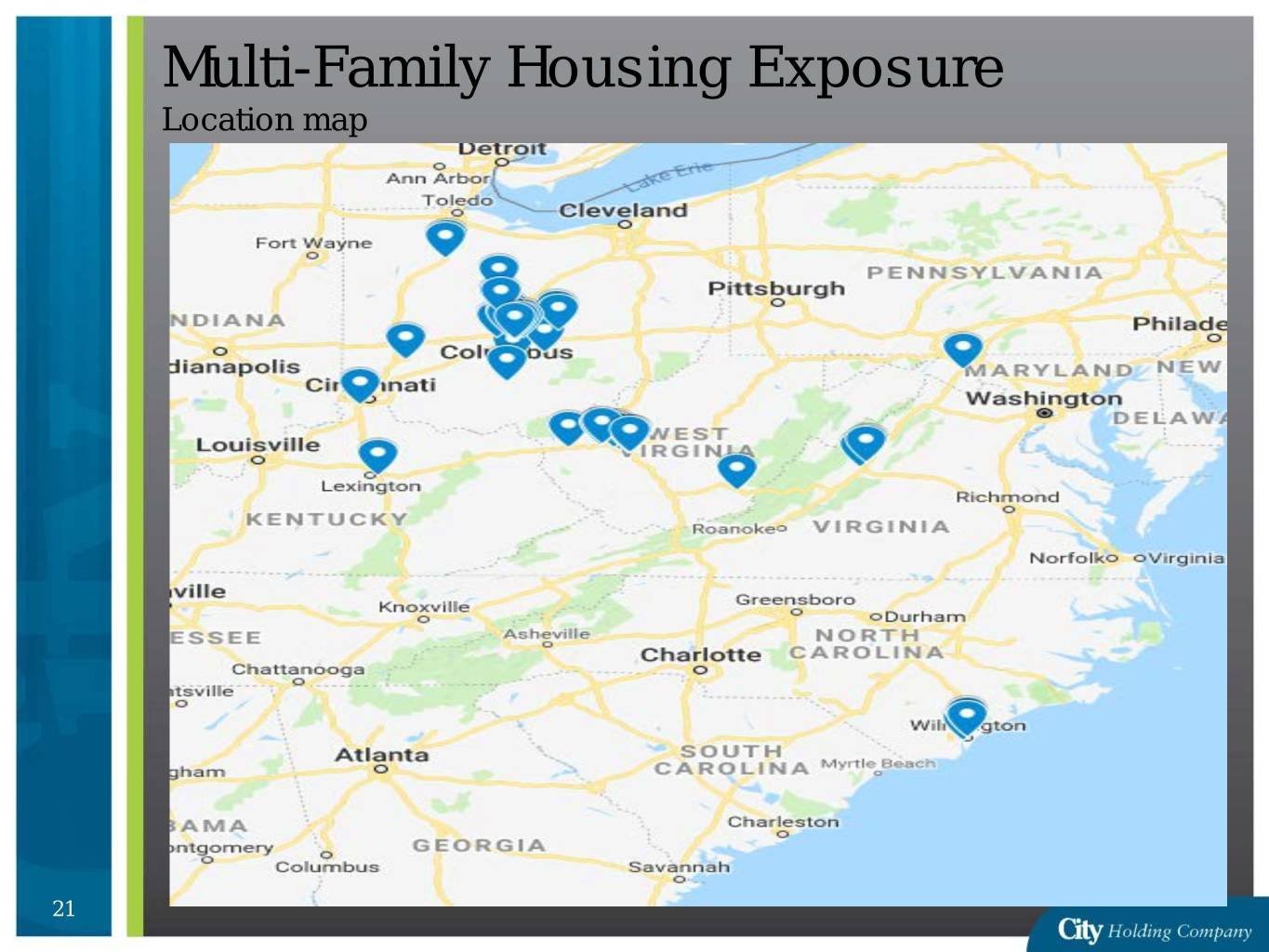

Multi-Family Housing Exposure Location map 21

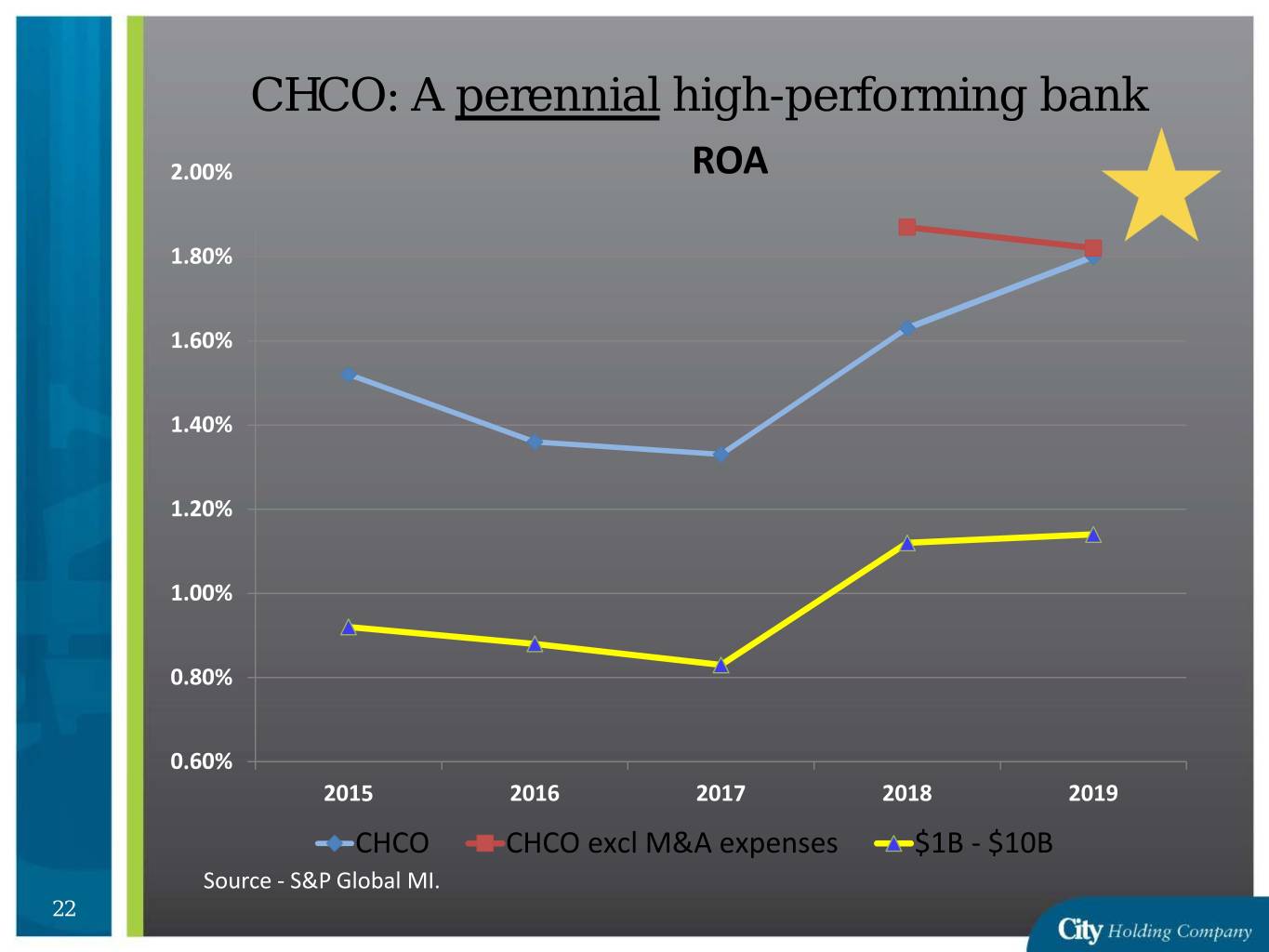

CHCO: A perennial high-performing bank 2.00% ROA 1.80% 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 2015 2016 2017 2018 2019 CHCO CHCO excl M&A expenses $1B - $10B Source - S&P Global MI. 22

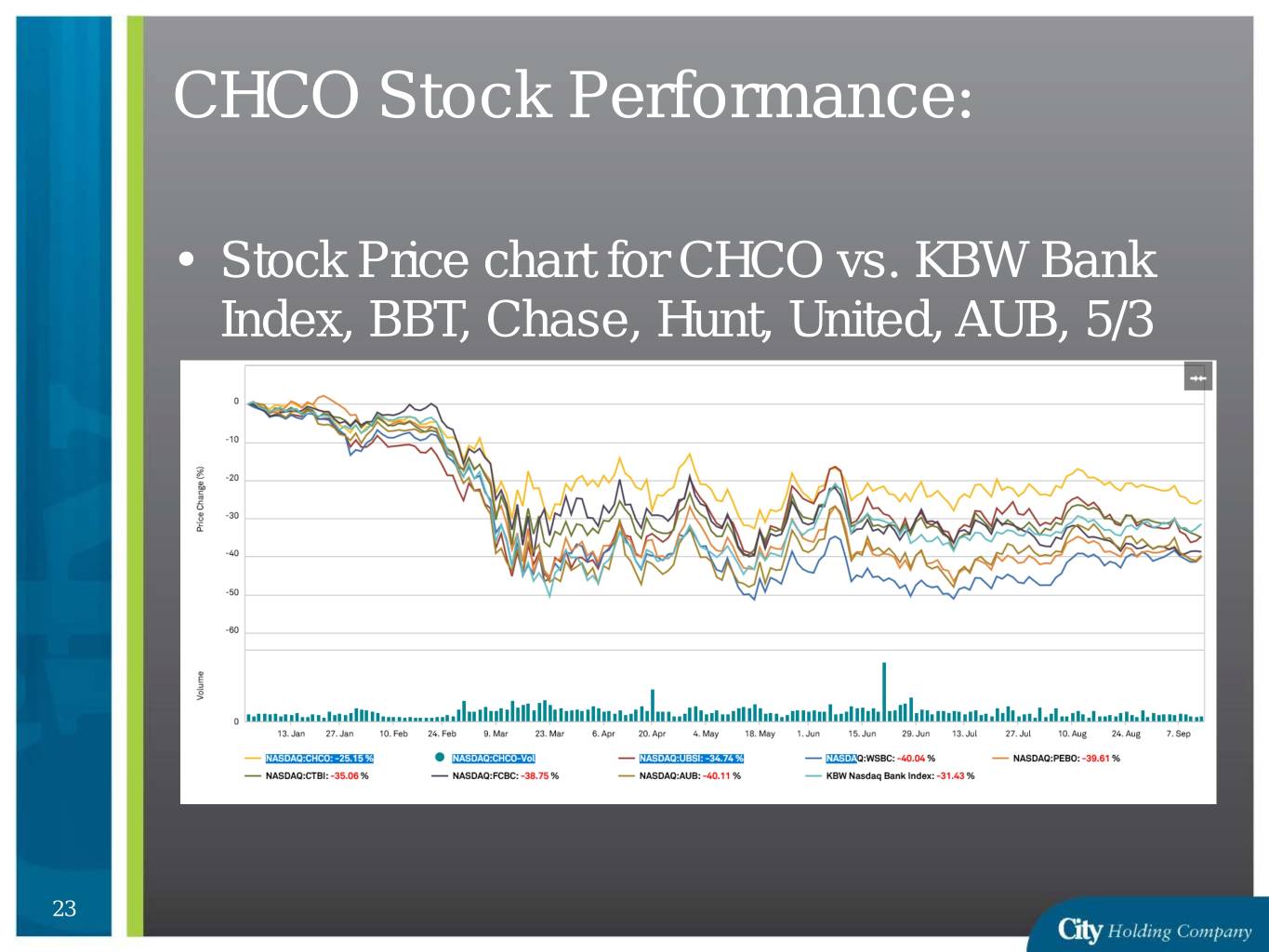

CHCO Stock Performance: • Stock Price chart for CHCO vs. KBW Bank Index, BBT, Chase, Hunt, United, AUB, 5/3 Since 1/1/2020 – CHCO (yellow) has outperformed AUB, UBSI, WSBC, PEBO, CTBI, FCBC 23

Why is CHCO Highly Valued? • Proven Conservative Lender • Strong Retail Franchise • Acquisitions are Accretive and Strategic • Profits are Strong and Stable – In low interest rate environments, fee income and efficiency matter: City is exceptional at both 24

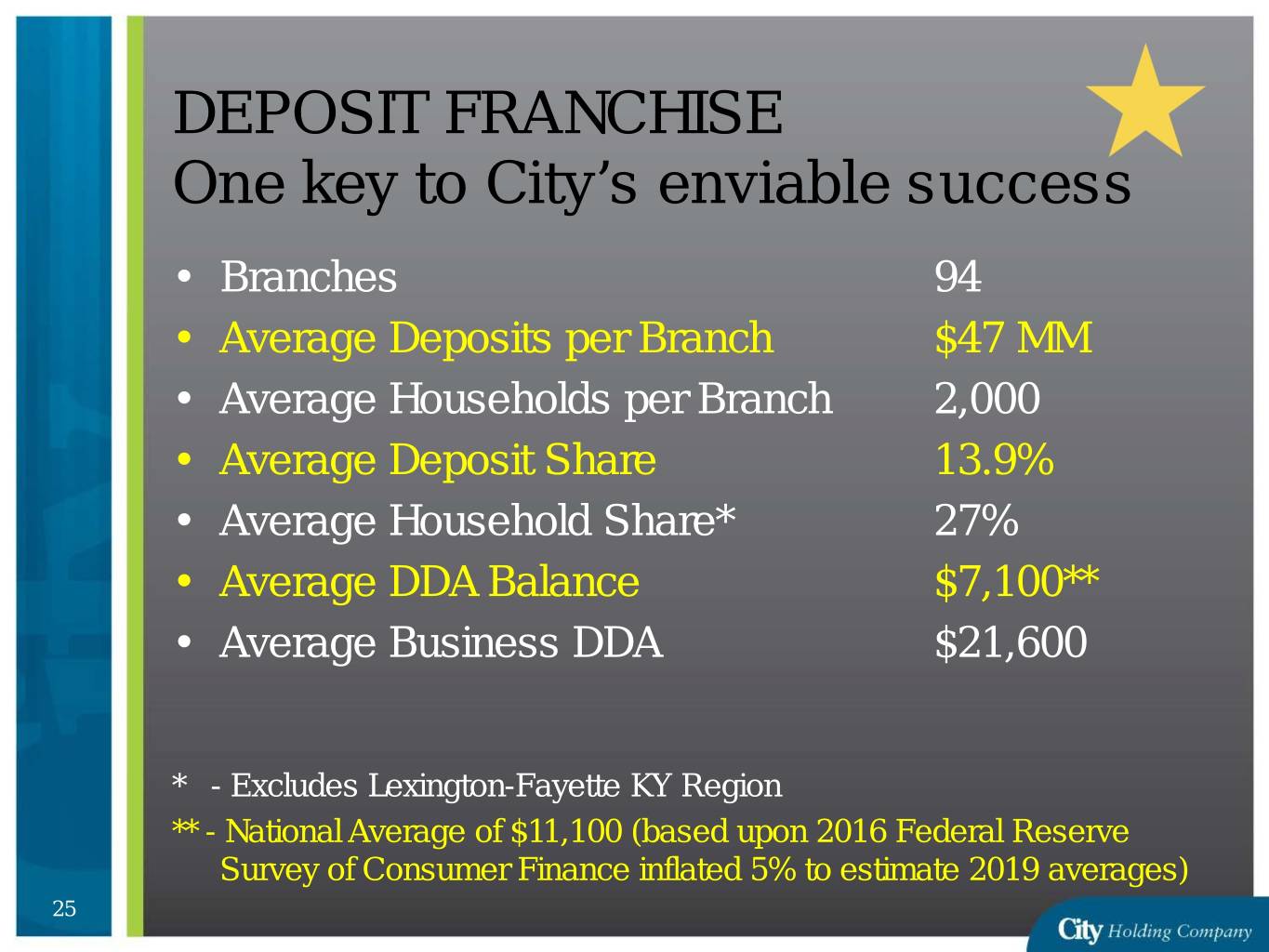

DEPOSIT FRANCHISE One key to City’s enviable success • Branches 94 • Average Deposits per Branch $47 MM • Average Households per Branch 2,000 • Average Deposit Share 13.9% • Average Household Share* 27% • Average DDA Balance $7,100** • Average Business DDA $21,600 * - Excludes Lexington-Fayette KY Region ** - National Average of $11,100 (based upon 2016 Federal Reserve Survey of Consumer Finance inflated 5% to estimate 2019 averages) 25

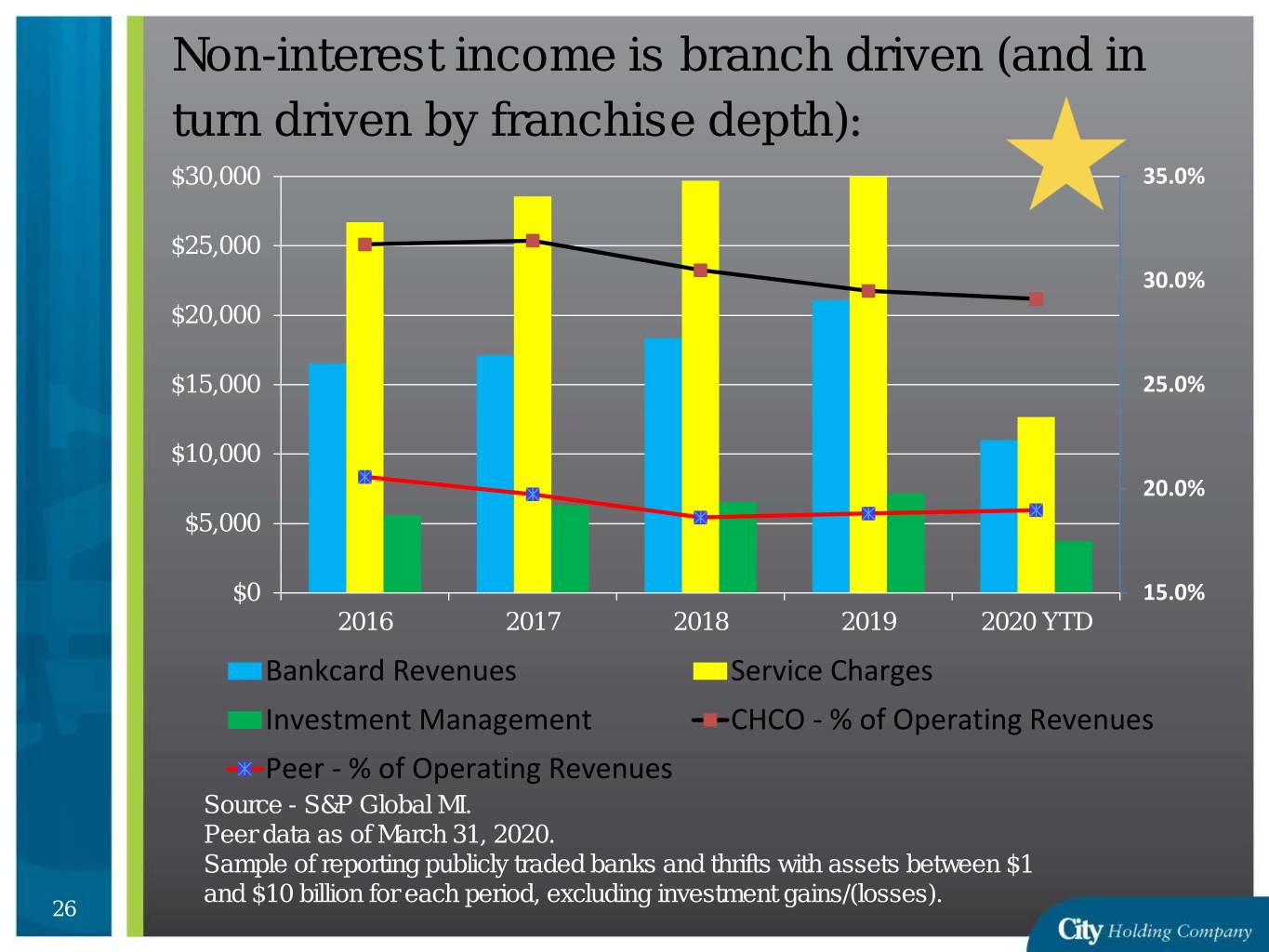

Non-interest income is branch driven (and in turn driven by franchise depth): $30,000 35.0% $25,000 30.0% $20,000 $15,000 25.0% $10,000 20.0% $5,000 $0 15.0% 2016 2017 2018 2019 2020 YTD Bankcard Revenues Service Charges Investment Management CHCO - % of Operating Revenues Peer - % of Operating Revenues Source - S&P Global MI. Peer data as of March 31, 2020. Sample of reporting publicly traded banks and thrifts with assets between $1 and $10 billion for each period, excluding investment gains/(losses). 26

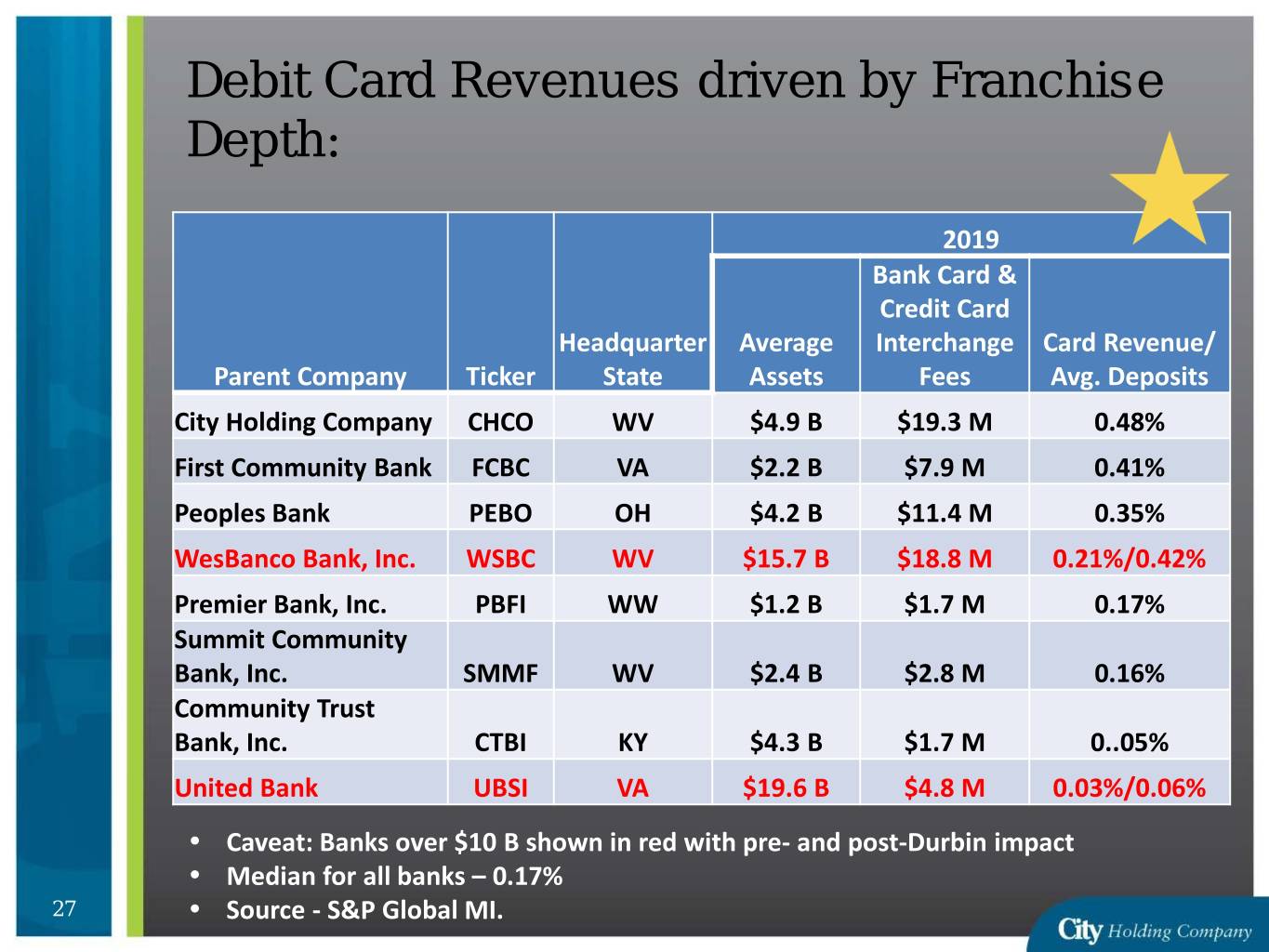

Debit Card Revenues driven by Franchise Depth: 2019 Bank Card & Credit Card Headquarter Average Interchange Card Revenue/ Parent Company Ticker State Assets Fees Avg. Deposits City Holding Company CHCO WV $4.9 B $19.3 M 0.48% First Community Bank FCBC VA $2.2 B $7.9 M 0.41% Peoples Bank PEBO OH $4.2 B $11.4 M 0.35% WesBanco Bank, Inc. WSBC WV $15.7 B $18.8 M 0.21%/0.42% Premier Bank, Inc. PBFI WW $1.2 B $1.7 M 0.17% Summit Community Bank, Inc. SMMF WV $2.4 B $2.8 M 0.16% Community Trust Bank, Inc. CTBI KY $4.3 B $1.7 M 0..05% United Bank UBSI VA $19.6 B $4.8 M 0.03%/0.06% • Caveat: Banks over $10 B shown in red with pre- and post-Durbin impact • Median for all banks – 0.17% 27 • Source - S&P Global MI.

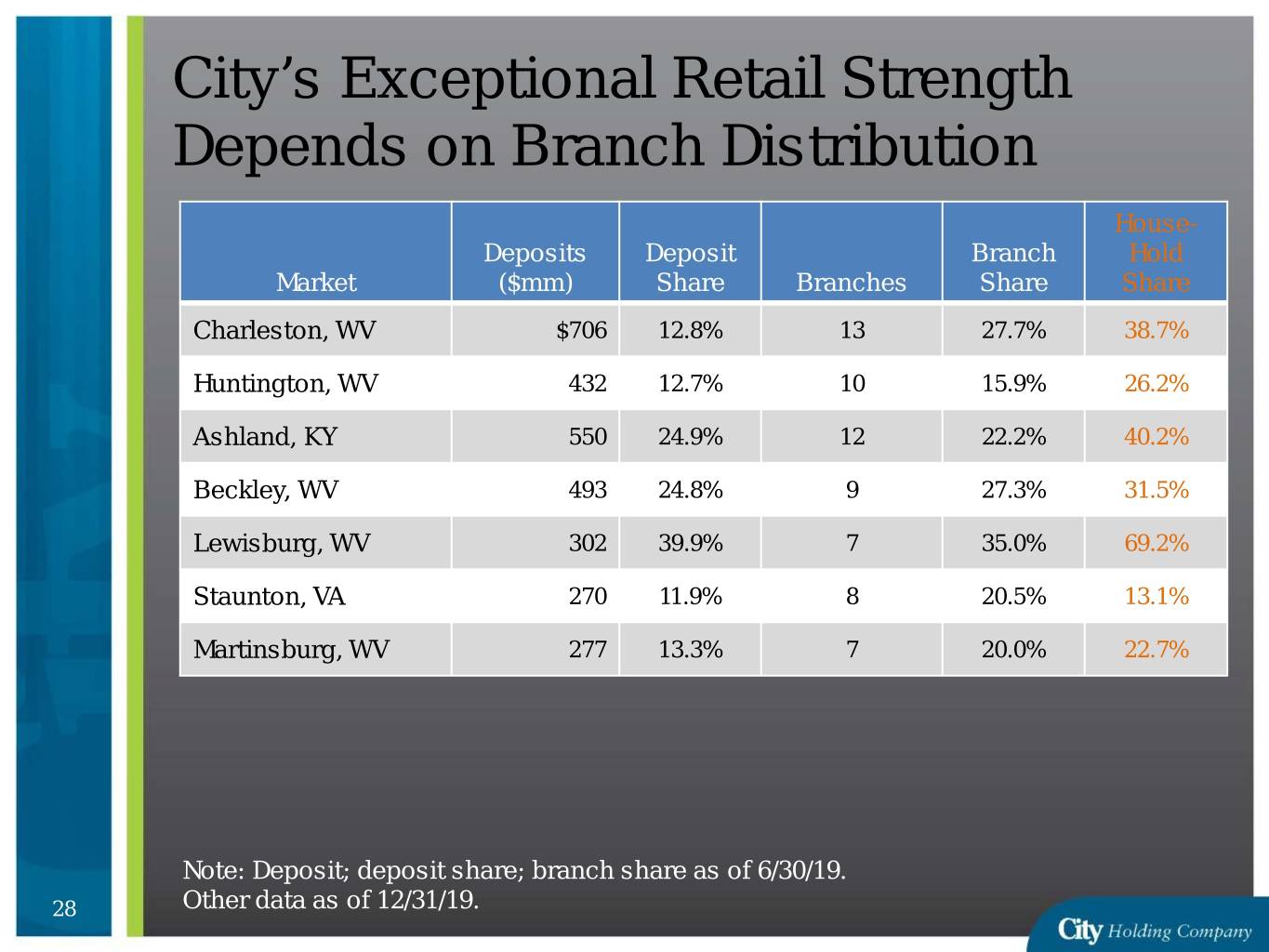

City’s Exceptional Retail Strength Depends on Branch Distribution House- Deposits Deposit Branch Hold Market ($mm) Share Branches Share Share Charleston, WV $706 12.8% 13 27.7% 38.7% Huntington, WV 432 12.7% 10 15.9% 26.2% Ashland, KY 550 24.9% 12 22.2% 40.2% Beckley, WV 493 24.8% 9 27.3% 31.5% Lewisburg, WV 302 39.9% 7 35.0% 69.2% Staunton, VA 270 11.9% 8 20.5% 13.1% Martinsburg, WV 277 13.3% 7 20.0% 22.7% Note: Deposit; deposit share; branch share as of 6/30/19. 28 Other data as of 12/31/19.

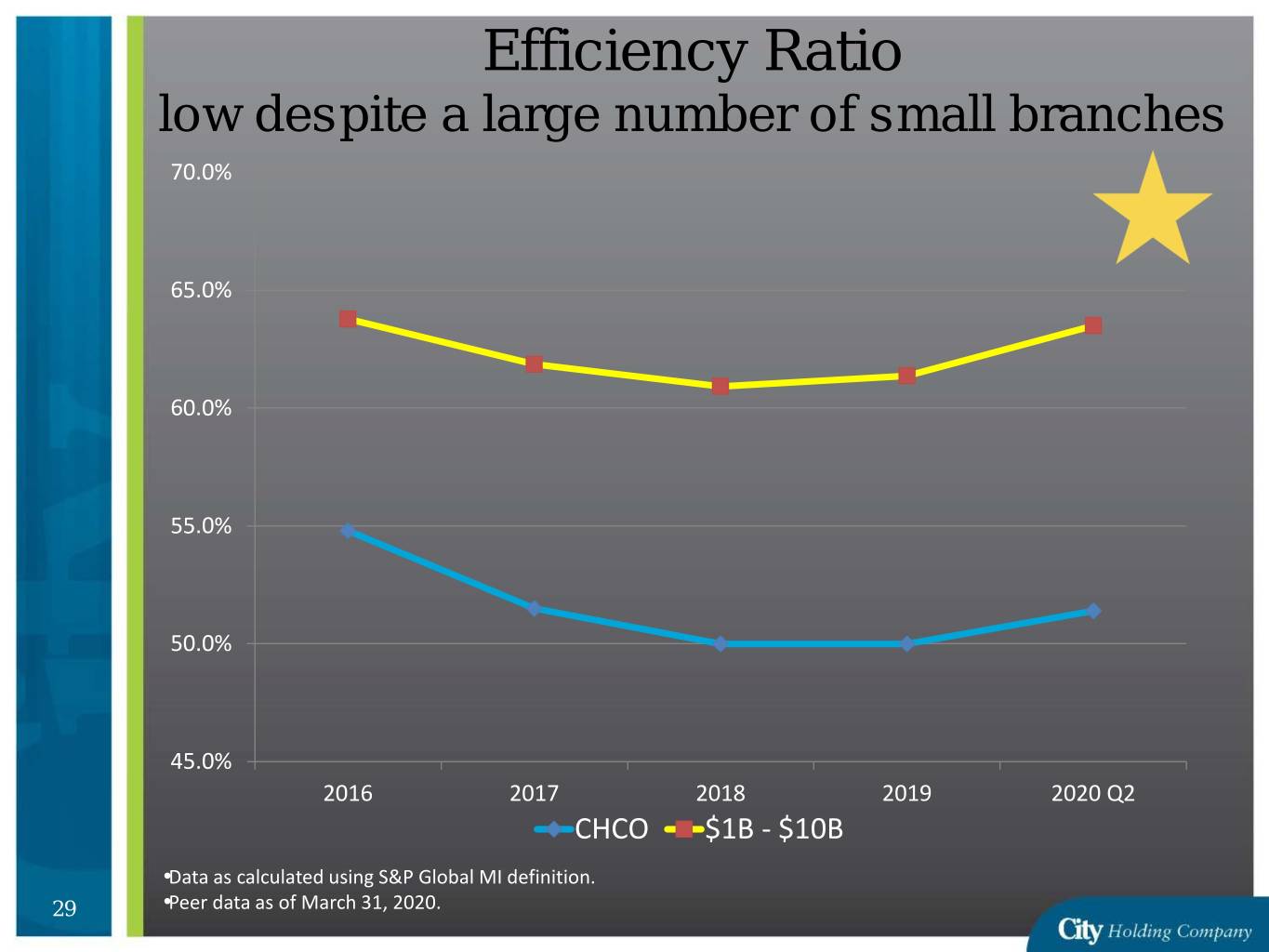

Efficiency Ratio low despite a large number of small branches 70.0% 65.0% 60.0% 55.0% 50.0% 45.0% 2016 2017 2018 2019 2020 Q2 CHCO $1B - $10B •Data as calculated using S&P Global MI definition. 29 •Peer data as of March 31, 2020.

Capital Management: A Long-term Core Competency • CHCO generates more capital than average • Allows CHCO to steadily increase TCE while balancing shareholder value: – History of increasing cash dividends – Active share repurchase program – Cash acquisition ? 30

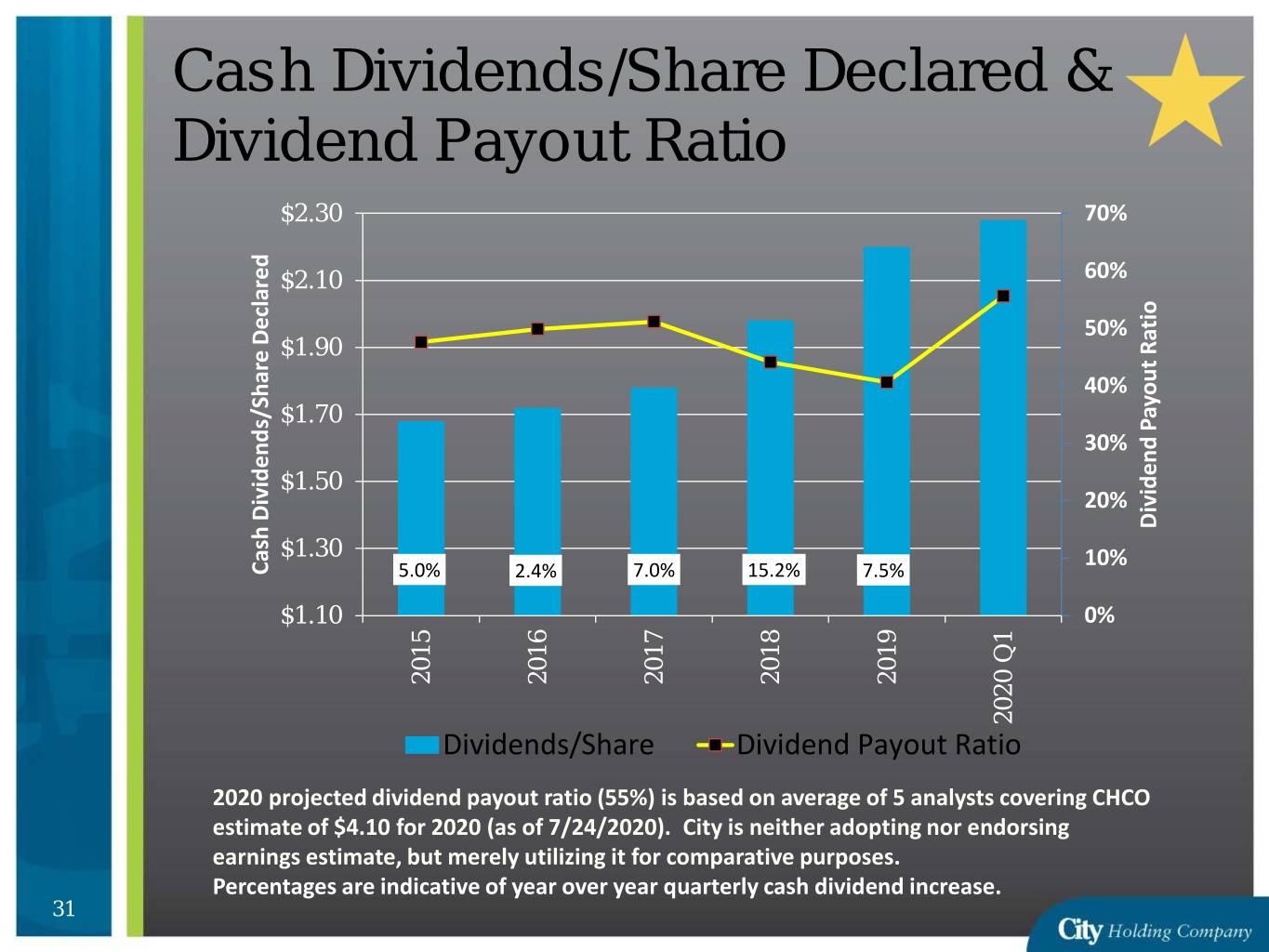

Cash Dividends/Share Declared & Dividend Payout Ratio $2.30 70% $2.10 60% 50% $1.90 40% $1.70 30% $1.50 20% Dividend Payout Ratio Payout Dividend $1.30 10% Cash Dividends/Share Declared Cash Dividends/Share 5.0% 2.4% 7.0% 15.2% 7.5% $1.10 0% 2015 2016 2017 2018 2019 2020Q1 Dividends/Share Dividend Payout Ratio 2020 projected dividend payout ratio (55%) is based on average of 5 analysts covering CHCO estimate of $4.10 for 2020 (as of 7/24/2020). City is neither adopting nor endorsing earnings estimate, but merely utilizing it for comparative purposes. Percentages are indicative of year over year quarterly cash dividend increase. 31

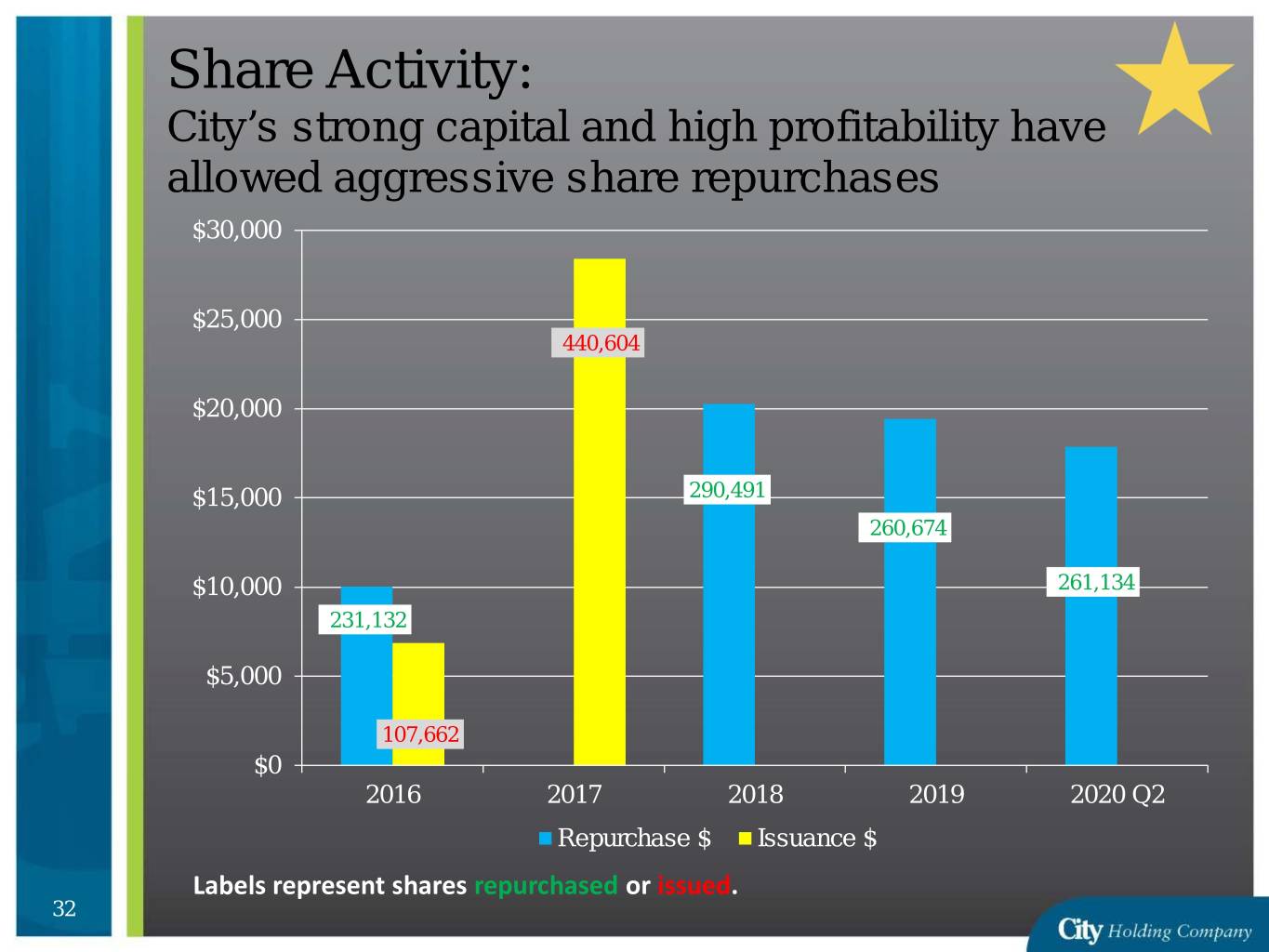

Share Activity: City’s strong capital and high profitability have allowed aggressive share repurchases $30,000 $25,000 440,604 $20,000 $15,000 290,491 260,674 $10,000 261,134 231,132 $5,000 107,662 $0 2016 2017 2018 2019 2020 Q2 Repurchase $ Issuance $ Labels represent shares repurchased or issued. 32

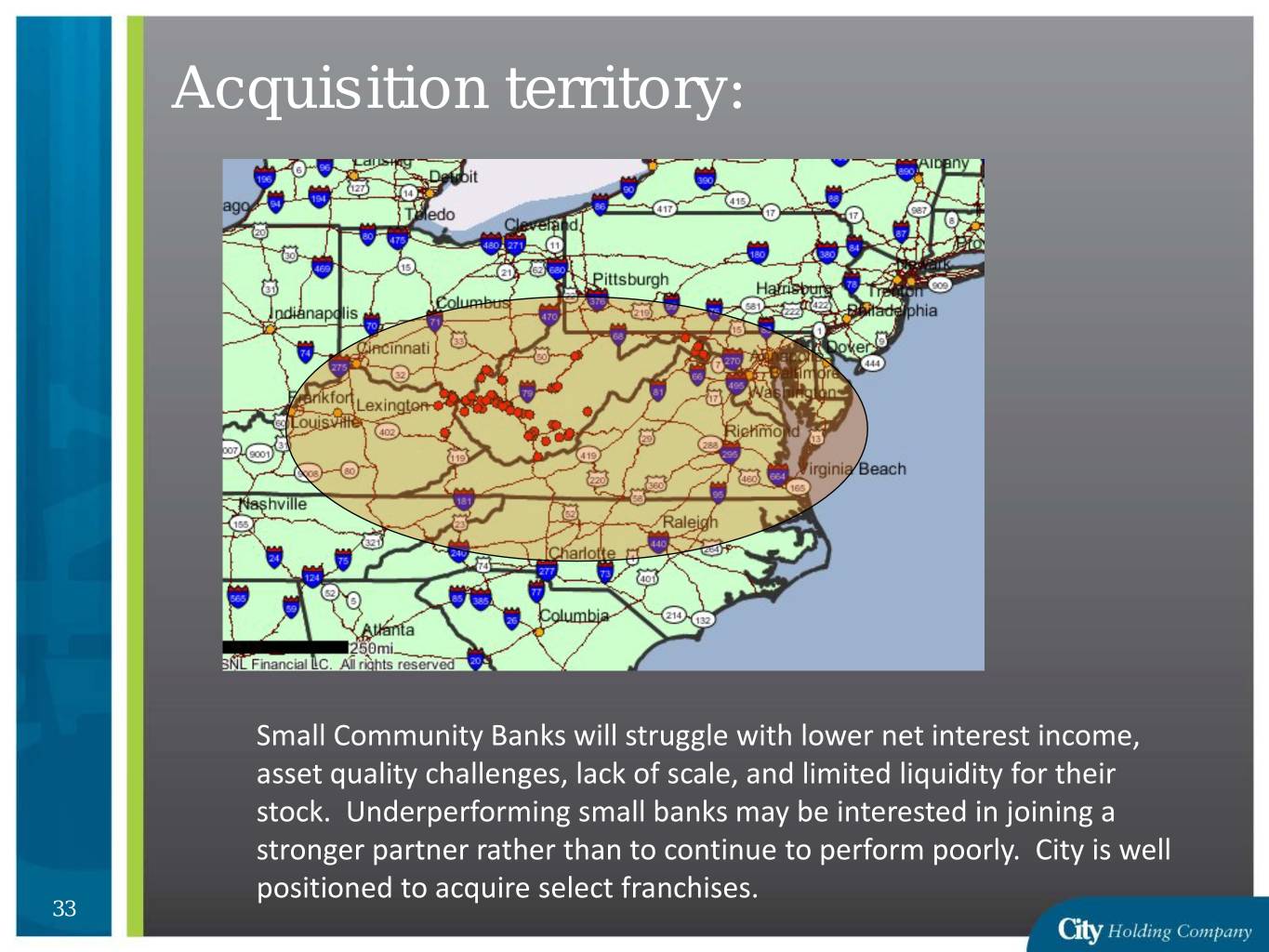

Acquisition territory: Small Community Banks will struggle with lower net interest income, asset quality challenges, lack of scale, and limited liquidity for their stock. Underperforming small banks may be interested in joining a stronger partner rather than to continue to perform poorly. City is well positioned to acquire select franchises. 33

Bottom Line: CHCO is a Simple Model Incredible Core Banking Franchise Well Managed (Expenses, Asset Quality, Etc.) Disciplined Growth Strategy focused on shareholders, customers and community service Highly Profitable Allows Strong Dividends & Accretive Share Repurchases 34

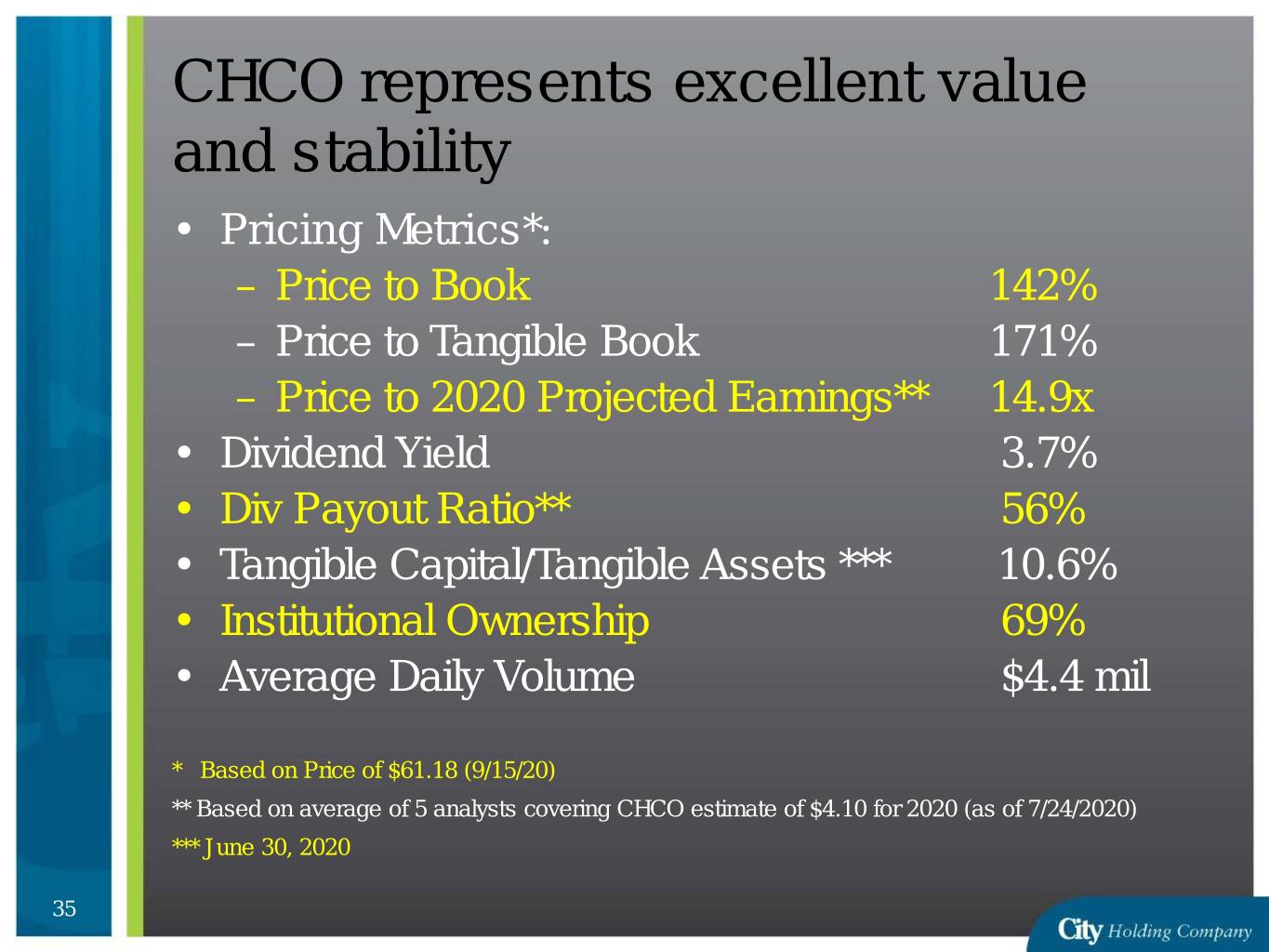

CHCO represents excellent value and stability • Pricing Metrics*: – Price to Book 142% – Price to Tangible Book 171% – Price to 2020 Projected Earnings** 14.9x • Dividend Yield 3.7% • Div Payout Ratio** 56% • Tangible Capital/Tangible Assets *** 10.6% • Institutional Ownership 69% • Average Daily Volume $4.4 mil * Based on Price of $61.18 (9/15/20) ** Based on average of 5 analysts covering CHCO estimate of $4.10 for 2020 (as of 7/24/2020) *** June 30, 2020 35