Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EQT Corp | tm2030415-1_8k.htm |

Exhibit 99.1

|

Supplemental Investor Presentation Barclays CEO Energy-Power Conference September 9, 2020 9/8/202 0 11 Exhibit 99.1 |

|

Cautionary Statements This presentation supplements EQT Corporation’s Investor Presentation dated July 27, 2020 (the “Original IR Presentation”). This presentation contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Statements that do not relate strictly to historical or current facts are forward-looking. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include the expectations of plans, strategies, objectives and growth and anticipated financial and operational performance of EQT Corporation and its subsidiaries (collectively, the Company), including guidance regarding the Company’s strategy to develop its reserves; drilling plans and programs; projected natural gas prices; the impact of commodity prices on the Company's business; projected reductions in expenses, capital costs and well costs, the projected timing of achieving such reductions and the Company's ability to achieve such reductions; the projected strategic benefits associated with the execution of the Company’s consolidated gas gathering and compression agreement with Equitrans Midstream Corporation; monetization transactions, including asset sales, joint ventures or other transactions involving the Company's assets, the timing of such monetization transactions, if at all, the projected proceeds from such monetization transactions and the Company's planned use of such proceeds; the amount and timing of any redemptions, repayments or repurchases of the Company's common stock, outstanding debt securities or other debt instruments; the Company’s ability to reduce its debt and the timing of such reductions, if any; projected free cash flow, net debt, liquidity and financing requirements, including funding sources and availability; the Company's ability to maintain or improve its credit ratings, leverage levels and financial profile; and the Company’s hedging strategy. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The Company has based these forward-looking statements on current expectations and assumptions about future events, taking into account all information currently available to the Company. While the Company considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond the Company’s control. The risks and uncertainties that may affect the operations, performance and results of the Company’s business and forward-looking statements include, but are not limited to, volatility of commodity prices; the costs and results of drilling and operations; access to and cost of capital; uncertainties about estimates of reserves, identification of drilling locations and the ability to add proved reserves in the future; the assumptions underlying production forecasts; the quality of technical data; the Company’s ability to appropriately allocate capital and resources among its strategic opportunities; inherent hazards and risks normally incidental to drilling for, producing, transporting and storing natural gas, NGLs and oil; cyber security risks; availability and cost of drilling rigs, completion services, equipment, supplies, personnel, oilfield services and water required to execute the Company's exploration and development plans; the ability to obtain environmental and other permits and the timing thereof; government regulation or action; environmental and weather risks, including the possible impacts of climate change; uncertainties related to the severity, magnitude and duration of the COVID-19 pandemic; and disruptions to the Company’s business due to acquisitions and other significant transactions. These and other risks are described under Item 1A, “Risk Factors,” and elsewhere in EQT’s Annual Report on Form 10-K for the year ended December 31, 2019, as updated by Part II, Item 1A, “Risk Factors” in EQT’s subsequently filed Quarterly Reports on Form 10-Q and other documents the Company files from time to time with the Securities and Exchange Commission. In addition, the Company may be subject to currently unforeseen risks that may have a materially adverse impact on it. Any forward-looking statement speaks only as of the date on which such statement is made and the Company does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. This presentation also refers to free cash flow, adjusted EBITDA and net debt calculations and ratios. These non-GAAP financial measures are not alternatives to GAAP measures and should not be considered in isolation or as an alternative for analysis of the Company’s results as reported under GAAP. For additional disclosures regarding these non-GAAP measures, including definitions of these terms and reconciliations to the most directly comparable GAAP measures, as applicable, please refer to the appendix of this presentation. 2 |

|

Business Update – 2H 2020 • Current well cost trends validating sustainability of 2Q 2020 performance Robust basis hedge position provides protection from in-basin price weakness • • Strategically executing volume curtailments to enhance NAV • Curtailed ~570 Mmcf per day gross / ~425 Mmcf per day net production on September 1, 2020 Further reducing net debt • • Received remaining $202 million tax refund in July 2020 Expecting free cash flow(1) of approximately $130 million(2) for 2H 2020 • • Constructive conversations ongoing regarding MVP capacity sell-down • Heightened focus on ESG • Revamped ESG Report to be published in 4Q 2020 3 1. 2. Non-GAAP measure. See appendix for definition. Midpoint of full-year 2020 guidance, minus 6/30/20 year-to-date actual free cash flow. |

|

Business Update – 2021 • Improving commodity fundamentals enhances 2021 financial outlook • Systematically adding hedges to lock-in value • Expecting 2021 free cash flow to be greater than 2020 Targeting total debt of $3.5 - $3.7 billion by year-end 2021 • Expecting leverage at or below 2.0x total debt / adjusted EBITDA(1) • • Additional optionality exists to enhance and/or accelerate deleveraging • Aggressively pursuing path back to an Investment Grade Balance Sheet • Current financial metrics sit well above current credit rating • Each ratings upgrade improves liquidity and reduces interest expense Evaluating potential shareholder return scenarios • • Once target leverage ratios and ratings upgrades are achieved 4 1. Non-GAAP measure. See appendix for definition. |

|

Aggressively Pursuing Improved Credit Ratings Addressing concerns raised by the agencies • Key concerns of rating agencies that led to negative ratings actions in the first half of 2020: • • Low commodity prices impacting profitability, cash flows, and leverage metrics Significant debt maturity profile over next two years • Measures EQT has taken to address agency concerns: Issued $1.75 billion of Notes and $500 million of Convertible Notes, dramatically reducing near-term maturities Sold non-strategic producing assets for $125 million Renegotiated gathering rates with ETRN, improving cost structure Reduced net debt(1) by ~ $0.7 billion from December 31, 2019 to June 30, 2020 • • • • • Agencies are beginning to recognize progress • • Fitch – upgrade to Positive Outlook (from Negative) S&P – upgrade to Stable Outlook (from Negative) Natural gas prices have risen significantly • • • • Enhanced EQT’s deleveraging efforts Opportunistically hedging to lock-in price upside Agency price decks are now disconnected from the market by $0.50-$0.70 in 2021 • Debt spreads have substantially tightened • • Investors are taking notice Expect ratings agencies to follow suit 5 1. Non-GAAP measure. See appendix for definition. |

|

Appendix 6 6 |

|

Non-GAAP Financial Measure Adjusted EBITDA and Free Cash Flow Adjusted EBITDA Adjusted EBITDA is defined as net income (loss), excluding interest expense, income tax (benefit) expense, depreciation and depletion, amortization of intangible assets, impairments, transaction, proxy and reorganization costs, the revenue impact of changes in the fair value of derivative instruments prior to settlement and certain other items that impact comparability between periods. Adjusted EBITDA is a non-GAAP supplemental financial measure used by the Company’s management to evaluate period-over-period earnings trends. The Company’s management believes that this measure provides useful information to external users of the Company's consolidated financial statements, such as industry analysts, lenders and ratings agencies. Management uses adjusted EBITDA to evaluate earnings trends because the measure reflects only the impact of settled derivative contracts; thus, the measure excludes the often-volatile revenue impact of changes in the fair value of derivative instruments prior to settlement. The measure also excludes other items that affect the comparability of results or that are not indicative of trends in the ongoing business. Adjusted EBITDA should not be considered as an alternative to net income (loss) presented in accordance with GAAP. The Company has not provided projected net income (loss) or a reconciliation of projected adjusted EBITDA to projected net income (loss), the most comparable financial measure calculated in accordance with GAAP. Net income (loss) includes the impact of depreciation and depletion expense, income tax expense, the revenue impact of changes in the projected fair value of derivative instruments prior to settlement and certain other items that impact comparability between periods and the tax effect of such items, which may be significant and difficult to project with a reasonable degree of accuracy. Therefore, projected net income (loss), and a reconciliation of projected adjusted EBITDA to projected net income (loss), are not available without unreasonable effort. Free Cash Flow Free cash flow is defined as net cash provided by operating activities, less changes in other assets and liabilities, less accrual-based capital expenditures. Free cash flow is a non-GAAP supplemental financial measure used by the Company's management to assess liquidity, including the Company's ability to generate cash flow in excess of its capital requirements and return cash to shareholders. The Company’s management believes that this measure provides useful information to external users of the Company's consolidated financial statements, such as industry analysts, lenders and ratings agencies. Free cash flow should not be considered as an alternative to net cash provided by operating activities or any other measure of liquidity presented in accordance with GAAP. The Company has not provided projected net cash provided by operating activities or a reconciliation of projected free cash flow to projected net cash provided by operating activities, the most comparable financial measure calculated in accordance with GAAP. The Company is unable to project net cash provided by operating activities for any future period because this metric includes the impact of changes in operating assets and liabilities related to the timing of cash receipts and disbursements that may not relate to the period in which the operating activities occurred. The Company is unable to project these timing differences with any reasonable degree of accuracy without unreasonable efforts such as predicting the timing of its payments and its customers’ payments, with accuracy to a specific day, months in advance. Furthermore, the Company does not provide guidance with respect to its average realized price, among other items, that impact reconciling items between net cash provided by operating activities and free cash flow, as applicable. Natural gas prices are volatile and out of the Company’s control, and the timing of transactions and the income tax effects of future transactions and other items are difficult to accurately predict. Therefore, the Company is unable to provide projected net cash provided by operating activities, or the related reconciliation of projected free cash flow to projected net cash provided by operating activities, without unreasonable effort. 7 |

|

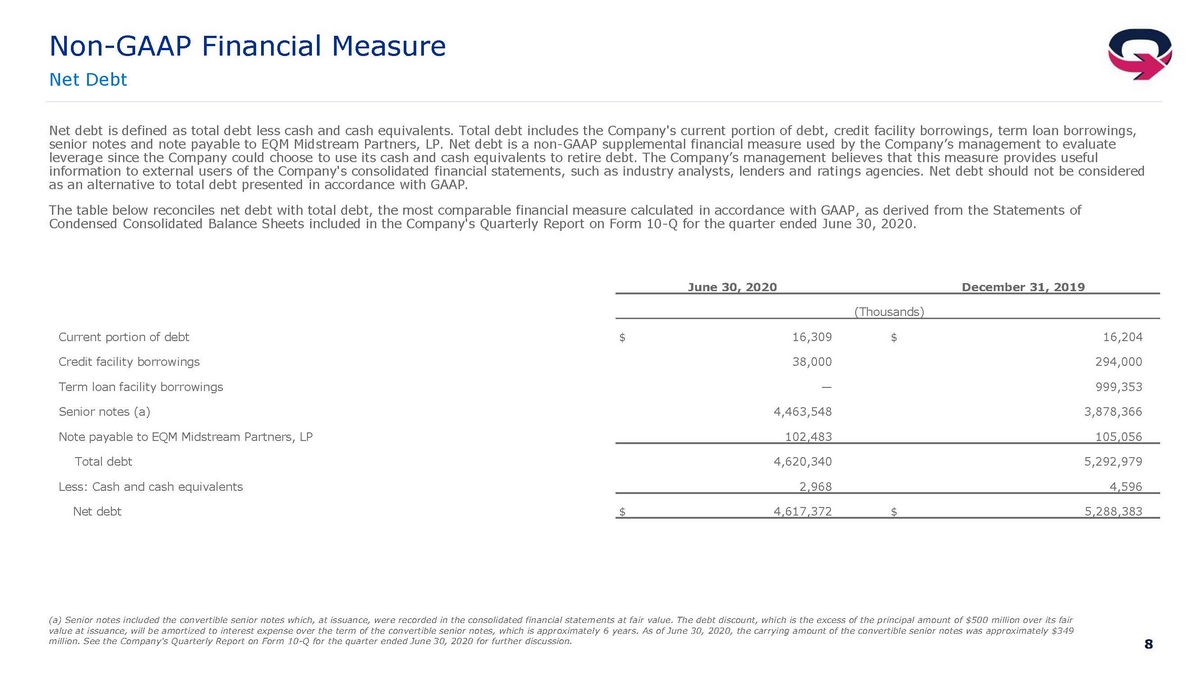

Non-GAAP Financial Measure Net Debt Net debt is defined as total debt less cash and cash equivalents. Total debt includes the Company's current portion of debt, credit facility borrowings, term loan borrowings, senior notes and note payable to EQM Midstream Partners, LP. Net debt is a non-GAAP supplemental financial measure used by the Company’s management to evaluate leverage since the Company could choose to use its cash and cash equivalents to retire debt. The Company’s management believes that this measure provides useful information to external users of the Company's consolidated financial statements, such as industry analysts, lenders and ratings agencies. Net debt should not be considered as an alternative to total debt presented in accordance with GAAP. The table below reconciles net debt with total debt, the most comparable financial measure calculated in accordance with GAAP, as derived from the Statements of Condensed Consolidated Balance Sheets included in the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2020. June 30, 2020 December 31, 2019 (Thousands) Current portion of debt $ 16,309 $ 16,204 Credit facility borrowings 38,000 294,000 Term loan facility borrowings — 999,353 Senior notes (a) 4,463,548 3,878,366 Note payable to EQM Midstream Partners, LP 102,483 105,056 Total debt 4,620,340 5,292,979 Less: Cash and cash equivalents 2,968 4,596 Net debt $ 4,617,372 $ 5,288,383 (a) Senior notes included the convertible senior notes which, at issuance, were recorded in the consolidated financial statements at fair value. The debt discount, which is the excess of the principal amount of $500 million over its fair value at issuance, will be amortized to interest expense over the term of the convertible senior notes, which is approximately 6 years. As of June 30, 2020, the carrying amount of the convertible senior notes was approximately $349 million. See the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 for further discussion. 8 |