Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STAAR SURGICAL CO | staa-8k_20200902.htm |

STAAR Surgical Company Investor presentation September 2020 Exhibit 99.1

Forward Looking Statements All statements in this presentation that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections, plans, strategies, and objectives of management for 2020 or prospects for achieving such plans, expectations for sales, revenue, or earnings, the expected impact of the COVID-19 pandemic and related public health measures (including but not limited to its impact on sales, operations or clinical trials globally), product safety or effectiveness, the status of our pipeline of ICL products with regulators, including our EVO family of lenses in the U.S., and any statements of assumptions underlying any of the foregoing, including those relating to our product pipeline and market expansion activities. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to the COVID-19 pandemic and related public health measures, as well as the factors set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended July 3, 2020, and Annual Report on Form 10-K for the year ended January 3, 2020 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. The Visian ICL with CentraFLOW, now known as EVO Visian ICL, is not yet approved for sale in the United States.

The Future of Refractive Surgery is Lens-Based... The Time for STAAR is Now Large and Growing Total Addressable Market (TAM) Strong Financial Performance includes Expanding Margins and Cash Generation Proprietary Lens Technology and Business Model is Driving Industry-Leading Growth

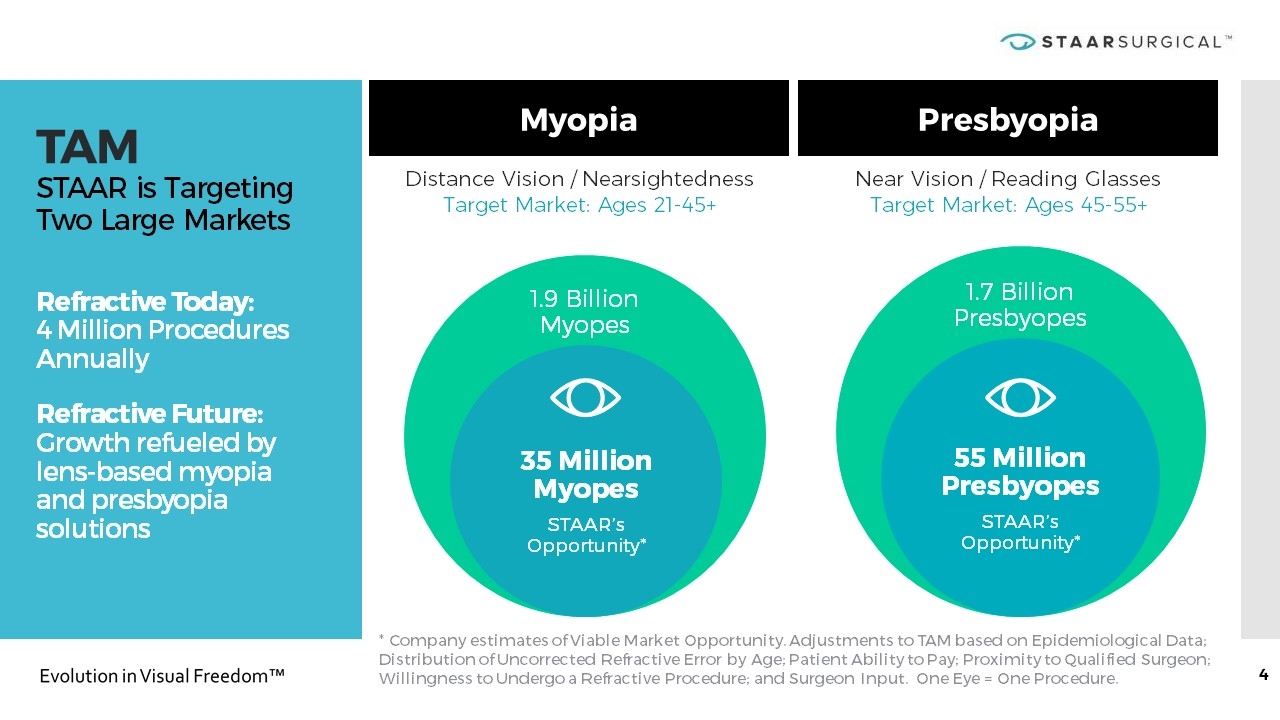

TAM STAAR is Targeting Two Large Markets Refractive Today: 4 Million Procedures Annually Refractive Future: Growth refueled by lens-based myopia and presbyopia solutions Myopia Presbyopia * Company estimates of Viable Market Opportunity. Adjustments to TAM based on Epidemiological Data; Distribution of Uncorrected Refractive Error by Age; Patient Ability to Pay; Proximity to Qualified Surgeon; Willingness to Undergo a Refractive Procedure; and Surgeon Input. One Eye = One Procedure. Distance Vision / Nearsightedness Target Market: Ages 21-45+ Near Vision / Reading Glasses Target Market: Ages 45-55+ 1.7 Billion Presbyopes 55 Million Presbyopes STAAR’s Opportunity* 1.9 Billion Myopes 35 Million Myopes STAAR’s Opportunity*

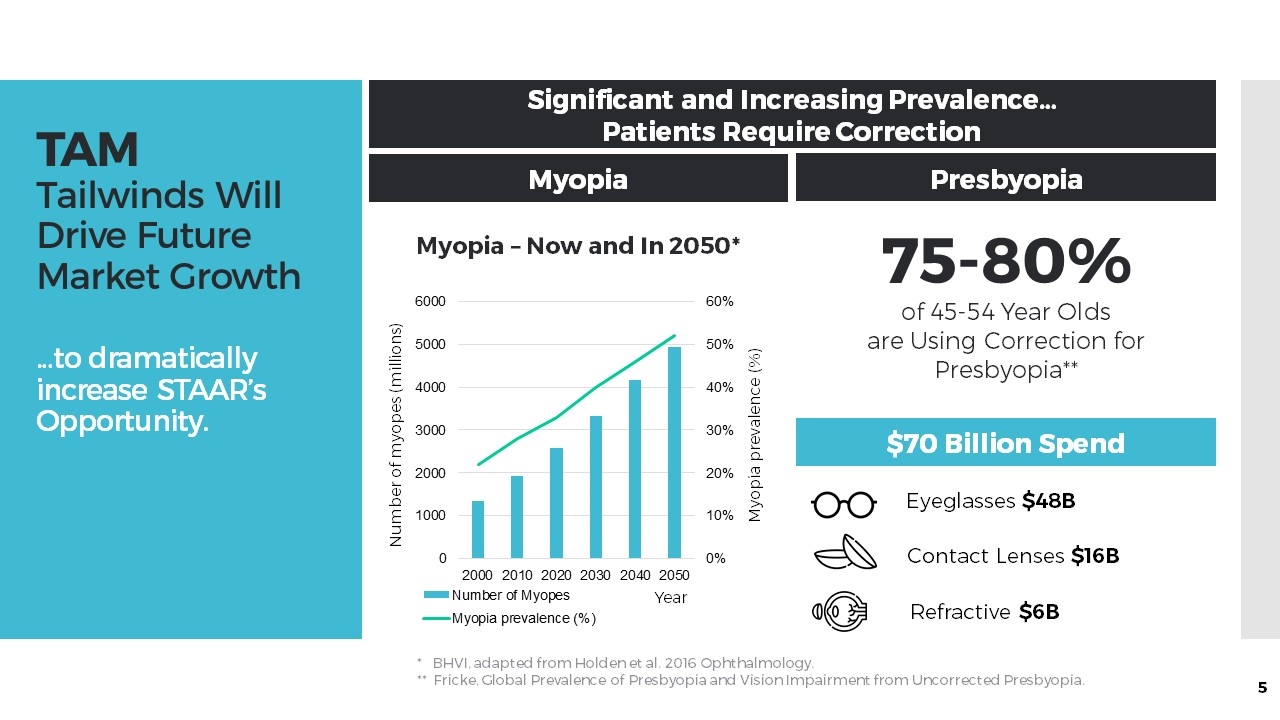

TAM Tailwinds Will Drive Future Market Growth …to dramatically increase STAAR’s Opportunity. Significant and Increasing Prevalence… Patients Require Correction Myopia Presbyopia 75-80% of 45-54 Year Olds are Using Correction for Presbyopia** $70 Billion Spend * BHVI, adapted from Holden et al. 2016 Ophthalmology. ** Fricke, Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia. Eyeglasses $48B Contact Lenses $16B Refractive $6B Number of myopes (millions) Myopia – Now and In 2050* Myopia prevalence (%) Year

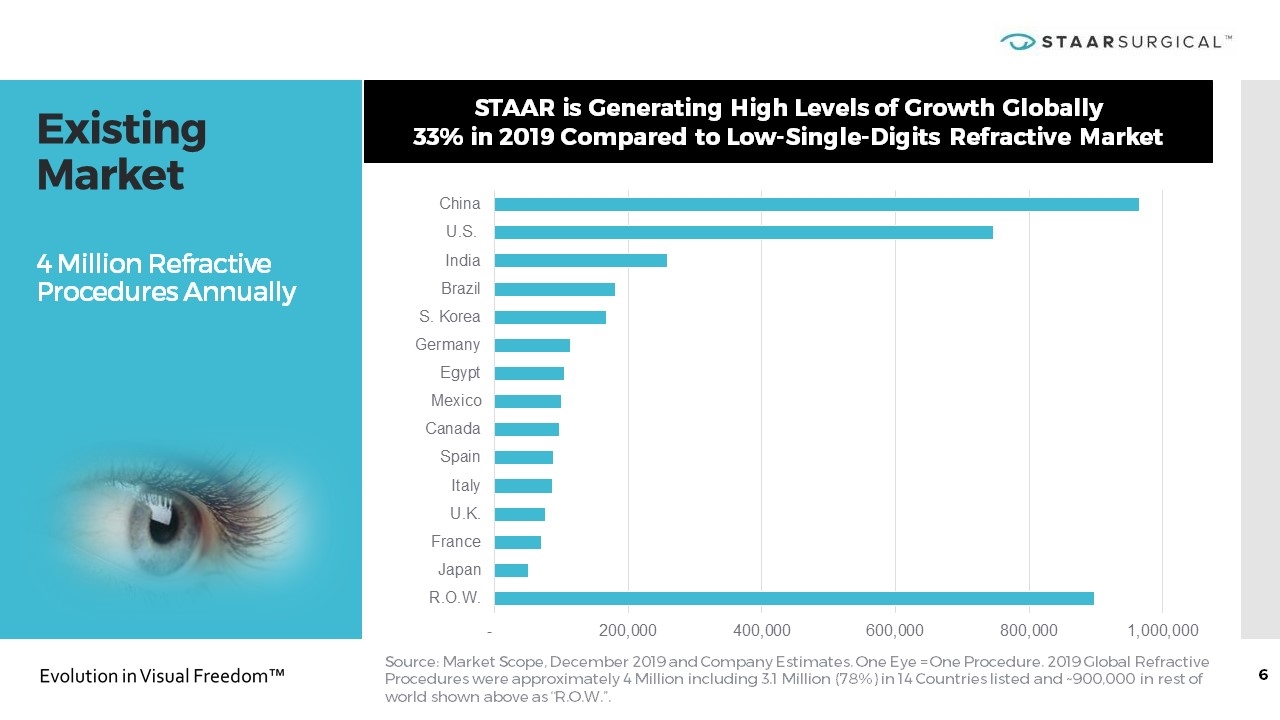

Existing Market 4 Million Refractive Procedures Annually Source: Market Scope, December 2019 and Company Estimates. One Eye = One Procedure. 2019 Global Refractive Procedures were approximately 4 Million including 3.1 Million (78%) in 14 Countries listed and ~900,000 in rest of world shown above as “R.O.W.”. STAAR is Generating High Levels of Growth Globally 33% in 2019 Compared to Low-Single-Digits Refractive Market

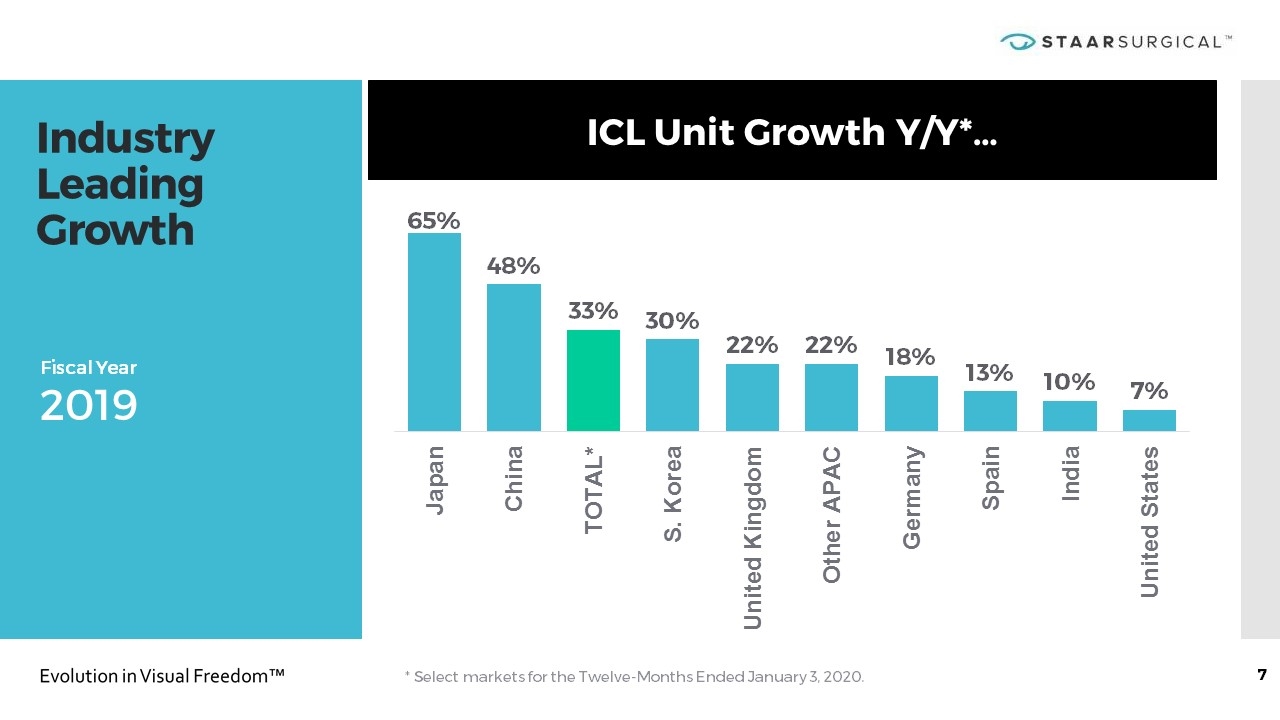

Industry Leading Growth ICL Unit Growth Y/Y*… Fiscal Year 2019 * Select markets for the Twelve-Months Ended January 3, 2020.

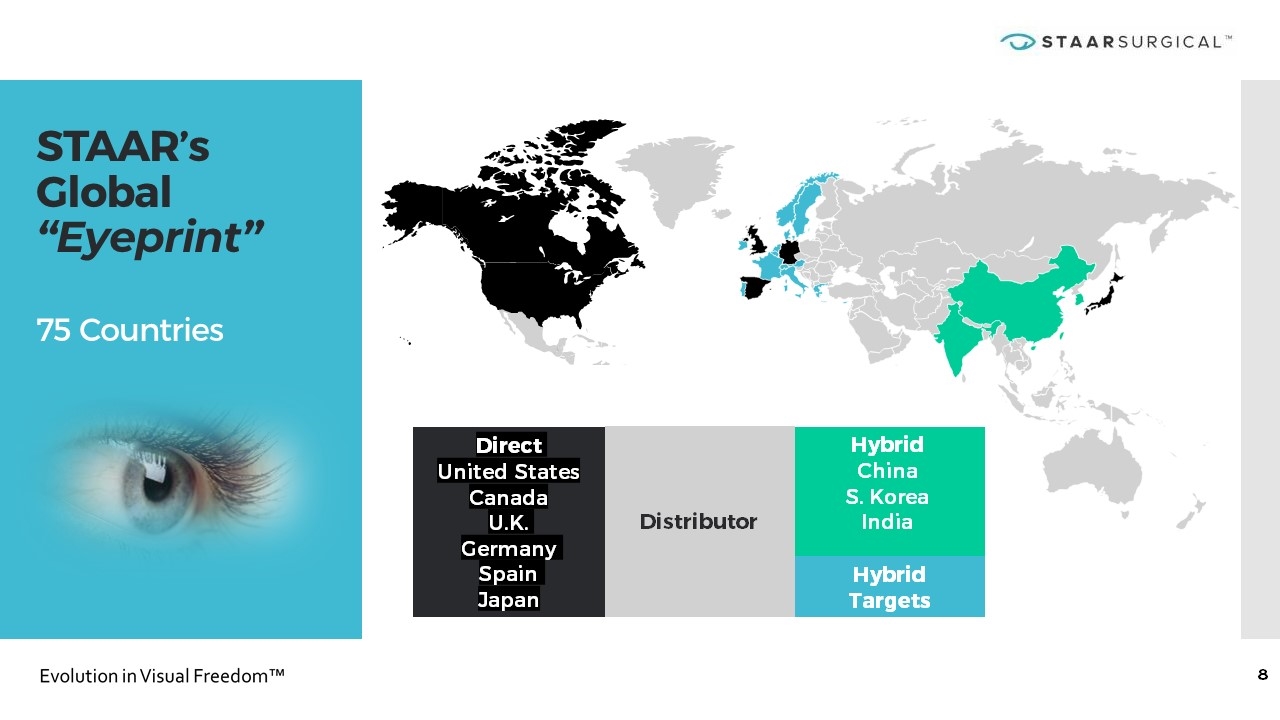

STAAR’s Global “Eyeprint” 75 Countries Hybrid China S. Korea India Direct United States Canada U.K. Germany Spain Japan Distributor Hybrid Targets

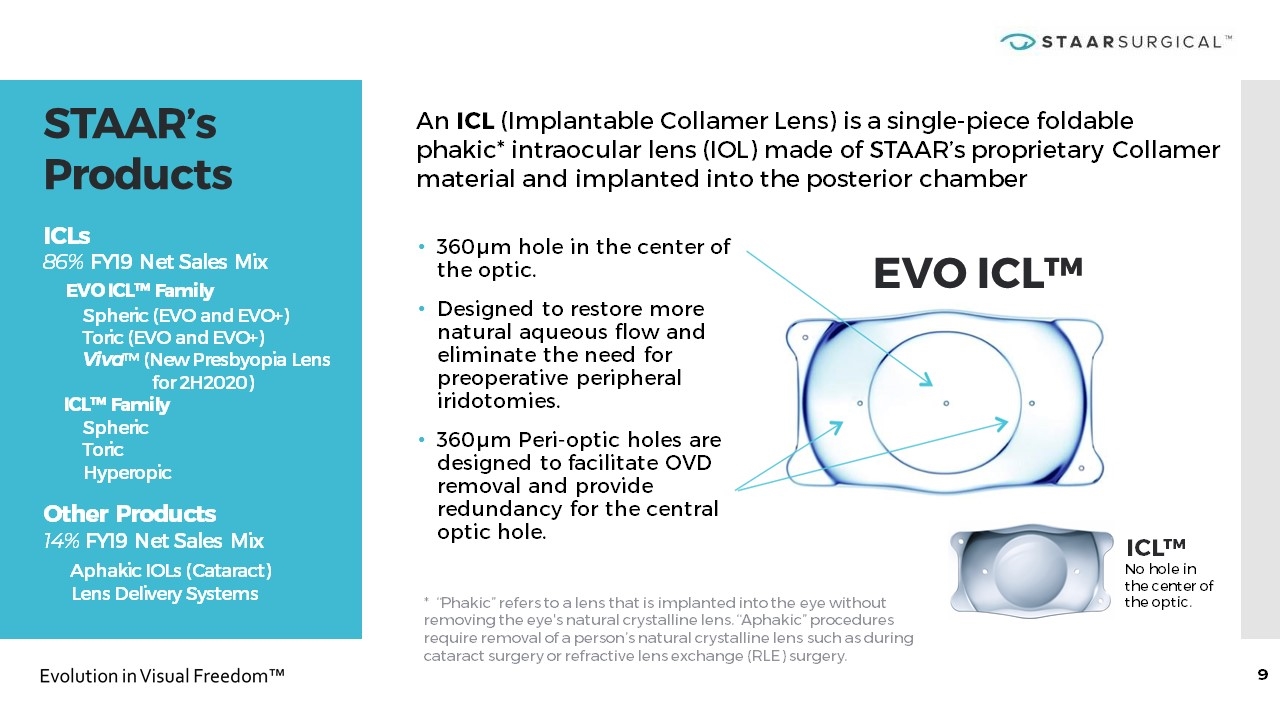

STAAR’s Products x ICLs 86% FY19 Net Sales Mix EVO ICL™ Family Spheric (EVO and EVO+) Toric (EVO and EVO+) Viva™ (New Presbyopia Lens for 2H2020) ICL™ Family Spheric Toric Hyperopic x Other Products 14% FY19 Net Sales Mix Aphakic IOLs (Cataract) Lens Delivery Systems An ICL (Implantable Collamer Lens) is a single-piece foldable phakic* intraocular lens (IOL) made of STAAR’s proprietary Collamer material and implanted into the posterior chamber 360µm hole in the center of the optic. Designed to restore more natural aqueous flow and eliminate the need for preoperative peripheral iridotomies. 360µm Peri-optic holes are designed to facilitate OVD removal and provide redundancy for the central optic hole. EVO ICL™ ICL™ * “Phakic” refers to a lens that is implanted into the eye without removing the eye's natural crystalline lens. “Aphakic” procedures require removal of a person’s natural crystalline lens such as during cataract surgery or refractive lens exchange (RLE) surgery. No hole in the center of the optic.

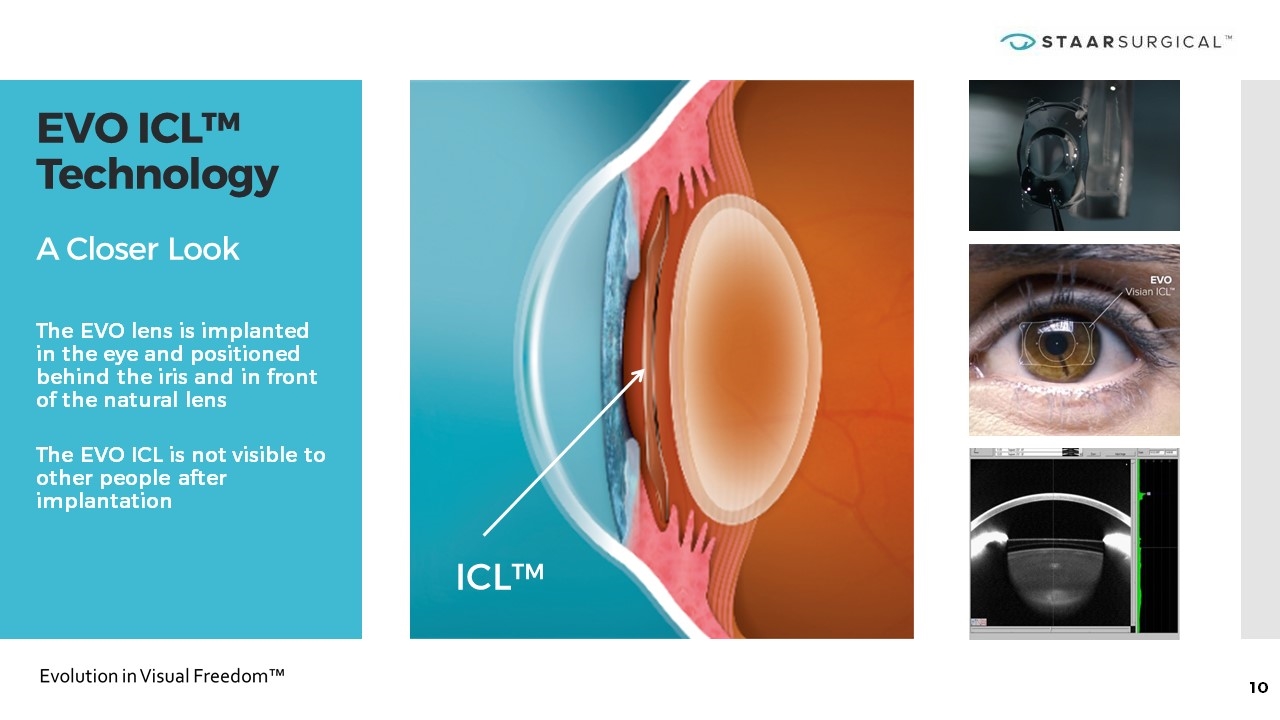

EVO ICL™ Technology A Closer Look The EVO lens is implanted in the eye and positioned behind the iris and in front of the natural lens The EVO ICL is not visible to other people after implantation ICL™

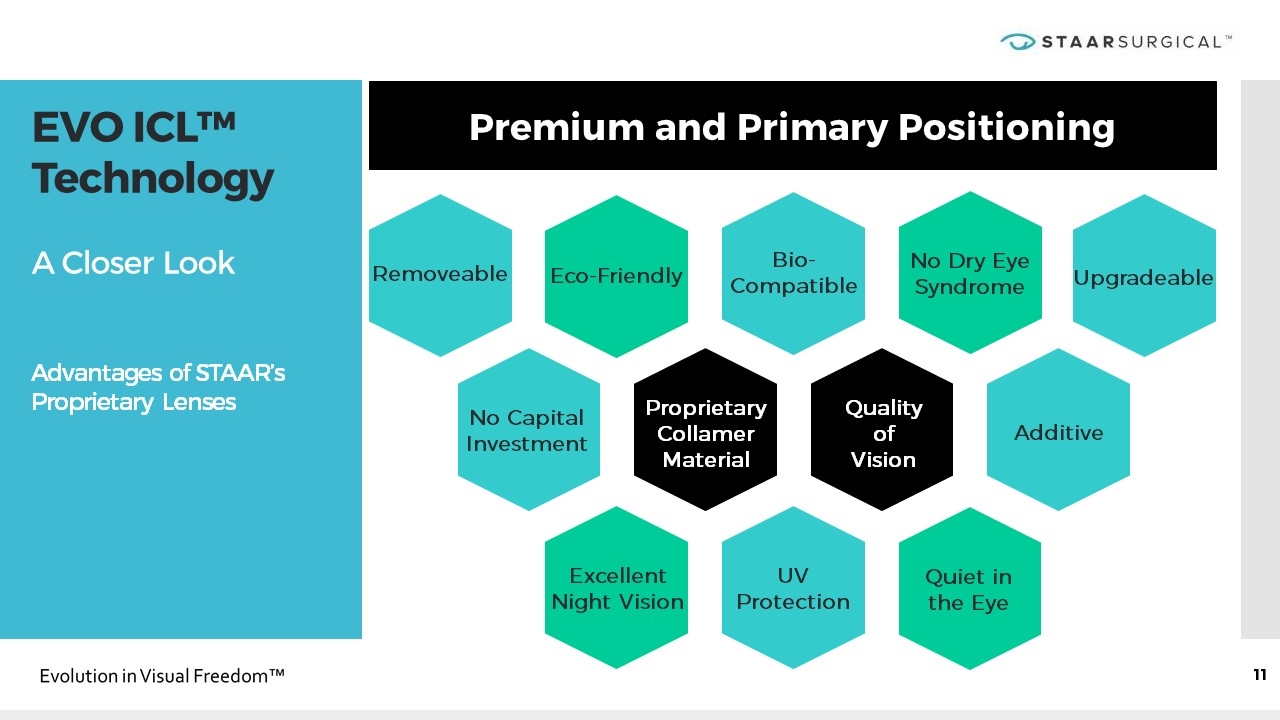

Premium and Primary Positioning EVO ICL™ Technology x x A Closer Look Advantages of STAAR’s Proprietary Lenses Proprietary Collamer Material Quality of Vision Removeable Eco-Friendly Bio-Compatible No Dry Eye Syndrome Upgradeable No Capital Investment Excellent Night Vision Quiet in the Eye Additive UV Protection

99.4% of Patients Would Elect STAAR’s EVO Implantable Collamer® Lens Again* Over 1 Million ICLs Implanted Globally * EVO ICL Patient Registry data on file.

What’s Going On in Active Markets Globally…

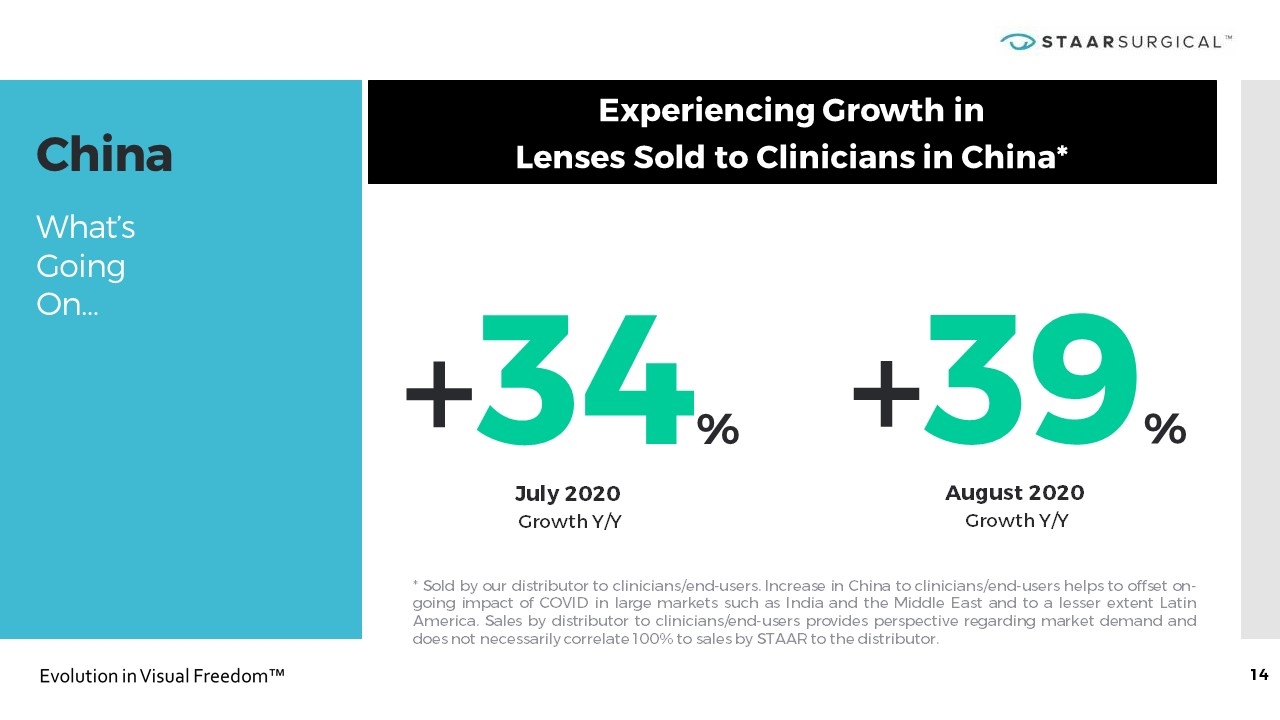

China What’s Going On… * Sold by our distributor to clinicians/end-users. Increase in China to clinicians/end-users helps to offset on-going impact of COVID in large markets such as India and the Middle East and to a lesser extent Latin America. Sales by distributor to clinicians/end-users provides perspective regarding market demand and does not necessarily correlate 100% to sales by STAAR to the distributor. Experiencing Growth in Lenses Sold to Clinicians in China* +39% August 2020 Growth Y/Y +34% July 2020 Growth Y/Y

United States What’s Going On… Successful launch of Toric ICL, which was approved in September 2018 Increased surgeon engagement with Inaugural Surgeons Council Meeting in August 2019 Signed dozens of Strategic Agreements with potential future EVO luminary sites Introducing high quality and effective Consumer Marketing to raise ICL awareness Commenced U.S. EVO ICL Clinical Trial in January 2020 with first implant and full enrollment in the trial anticipated in the September 2020 timeframe Supporting surgeon partners, practices and patients with Refractive Restart STRATEGIC IMPERATIVE Approval & Commercialization of EVO ICL™ in the U.S. (Expected 2H21) Removes surgeon barrier to ICL utilization, e.g. less complexity (no preoperative peripheral iridotomies), fewer visits for patient and more efficiency for surgeon More fully opens the #2 market in the world, where the Company currently has approximately 1% market share with an earlier lens technology, to STAAR’s ‘game-changing’ EVO family of lenses Laying Groundwork for STAAR’s Success in Second Largest Market Globally Consumer Marketing: St. Louis Billboard

Impactful Digital Consumer Marketing, Influencer Campaigns and Surgeon Support are Driving ICL Unit Growth S. Korea What’s Going On… 24 / 365 Influencer Campaign Son Na-eun, Apink K-Pop Square Billboard Seoul Gangnam Station Billboard

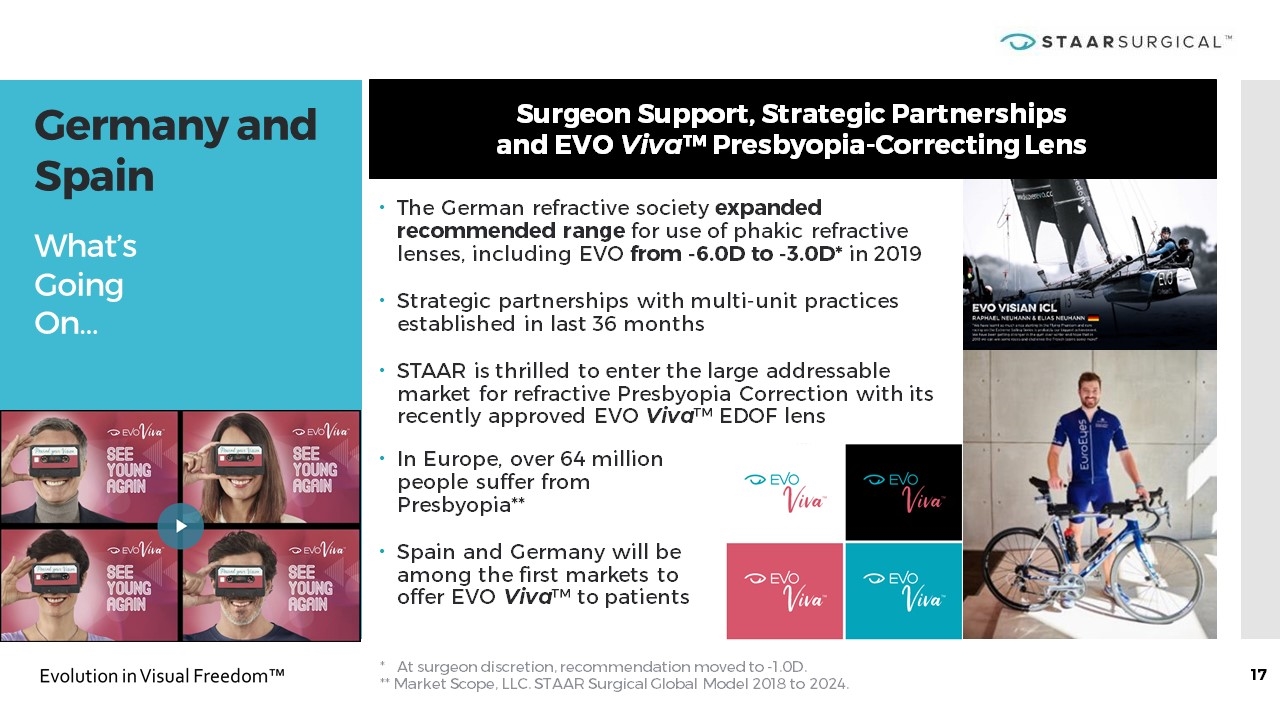

The German refractive society expanded recommended range for use of phakic refractive lenses, including EVO from -6.0D to -3.0D* in 2019 Strategic partnerships with multi-unit practices established in last 36 months STAAR is thrilled to enter the large addressable market for refractive Presbyopia Correction with its recently approved EVO Viva™ EDOF lens Germany and Spain What’s Going On… Surgeon Support, Strategic Partnerships and EVO Viva™ Presbyopia-Correcting Lens * At surgeon discretion, recommendation moved to -1.0D. ** Market Scope, LLC. STAAR Surgical Global Model 2018 to 2024. In Europe, over 64 million people suffer from Presbyopia** Spain and Germany will be among the first markets to offer EVO Viva™ to patients

2Q Earnings Review Key Takeaways August 5, 2020 Welcomed new Chief Financial Officer and two new Board Members 2Q results demonstrated STAAR’s ability to perform well in the midst of prolonged COVID-19 related shutdown of elective surgeries in most markets Net Sales of $35.2 Million Down 11% Y/Y Gross Margin at 69.4% vs. 75.4% Year Ago Net Loss of ($0.03)/share vs. Net Income of $0.08/share Year Ago $116.3 Million of Cash and Cash Equivalents at July 3, 2020 Outlook Expect 20% sequential Net Sales growth from 2Q20 to 3Q20; expect 4Q20 Net Sales to be similar to 3Q20 Expect to complete U.S. EVO clinical trial enrollment in September timeframe Expect to launch EVO Viva™ EDOF lens through a phased roll-out beginning in 3Q20

STAAR’s Proven Track Record of Operating and Financial Execution…

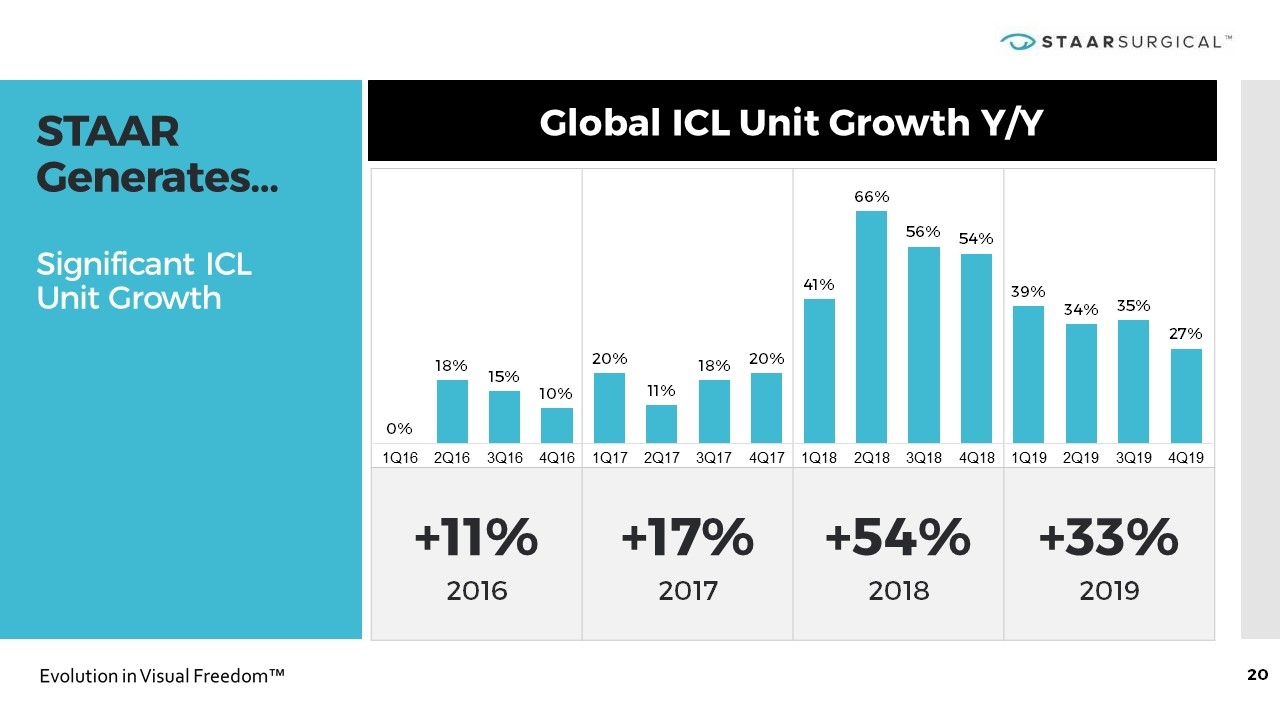

+11% 2016 +17% 2017 +54% 2018 +33% 2019 STAAR Generates… Significant ICL Unit Growth Global ICL Unit Growth Y/Y

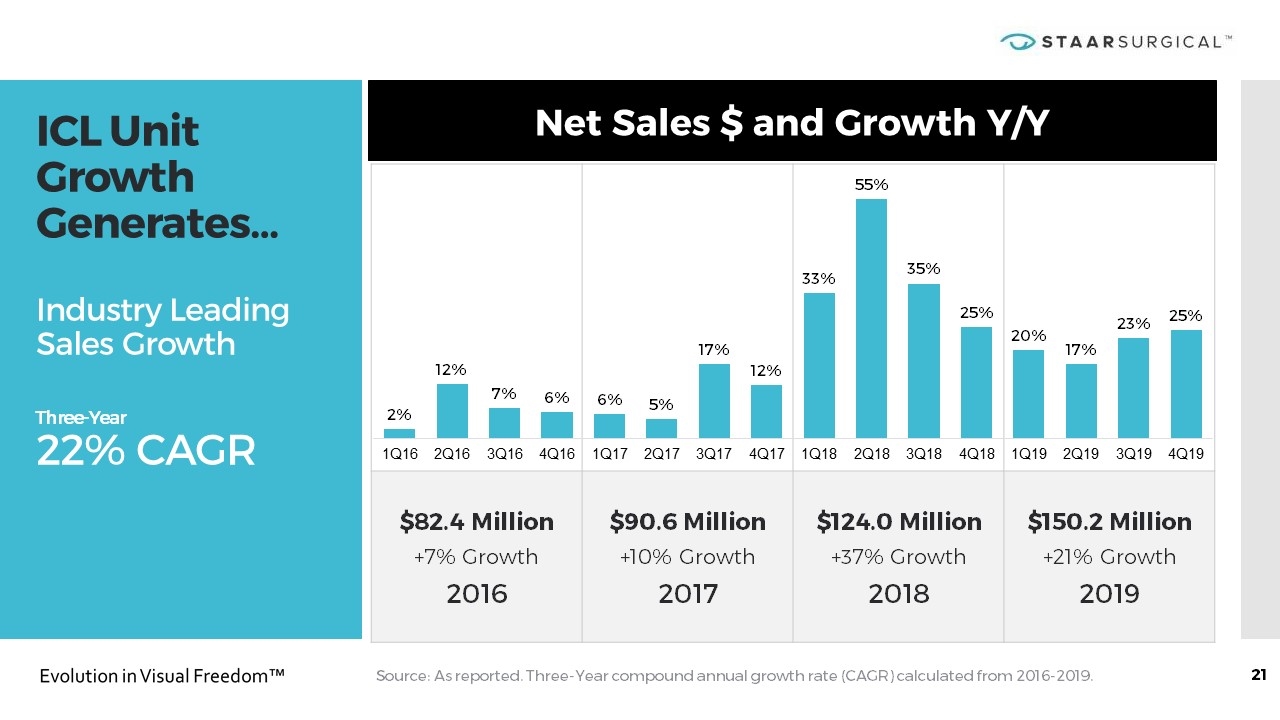

$82.4 Million +7% Growth 2016 $90.6 Million +10% Growth 2017 $124.0 Million +37% Growth 2018 $150.2 Million +21% Growth 2019 ICL Unit Growth Generates… Industry Leading Sales Growth Three-Year 22% CAGR Net Sales $ and Growth Y/Y Source: As reported. Three-Year compound annual growth rate (CAGR) calculated from 2016-2019.

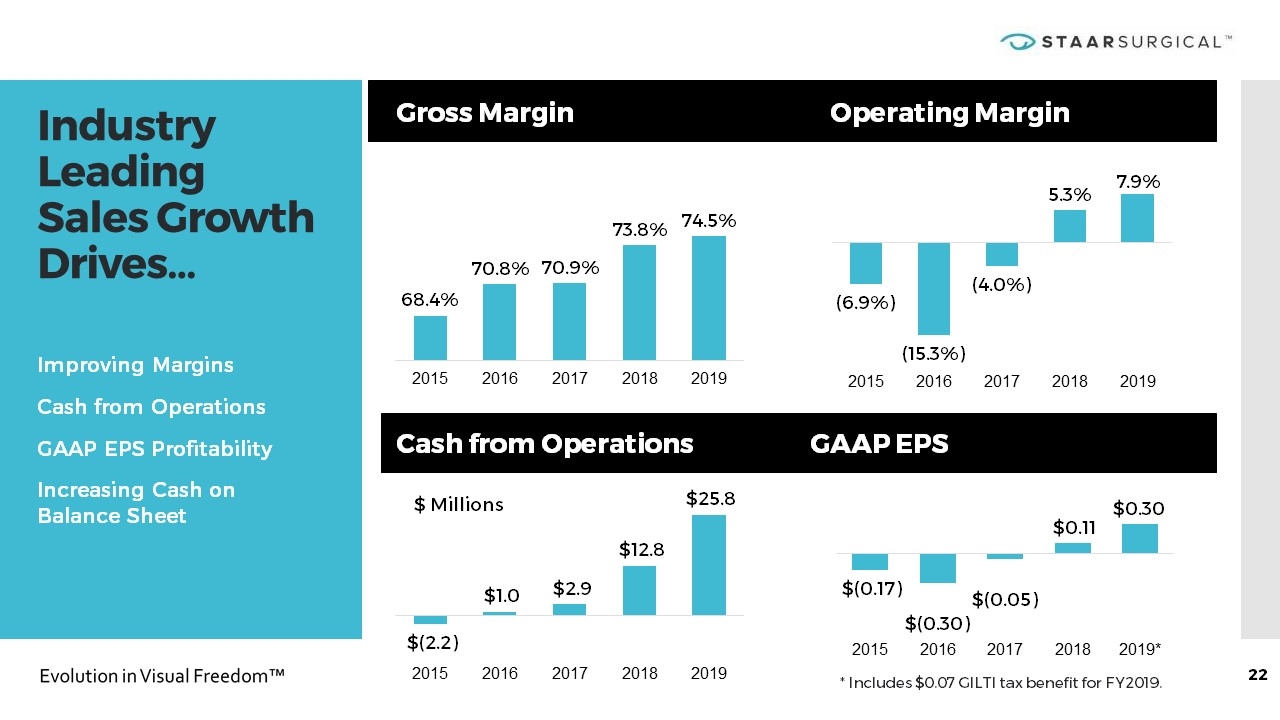

Industry Leading Sales Growth Drives… Gross Margin Operating Margin Cash from Operations GAAP EPS * Includes $0.07 GILTI tax benefit for FY2019. Improving Margins Cash from Operations GAAP EPS Profitability Increasing Cash on Balance Sheet

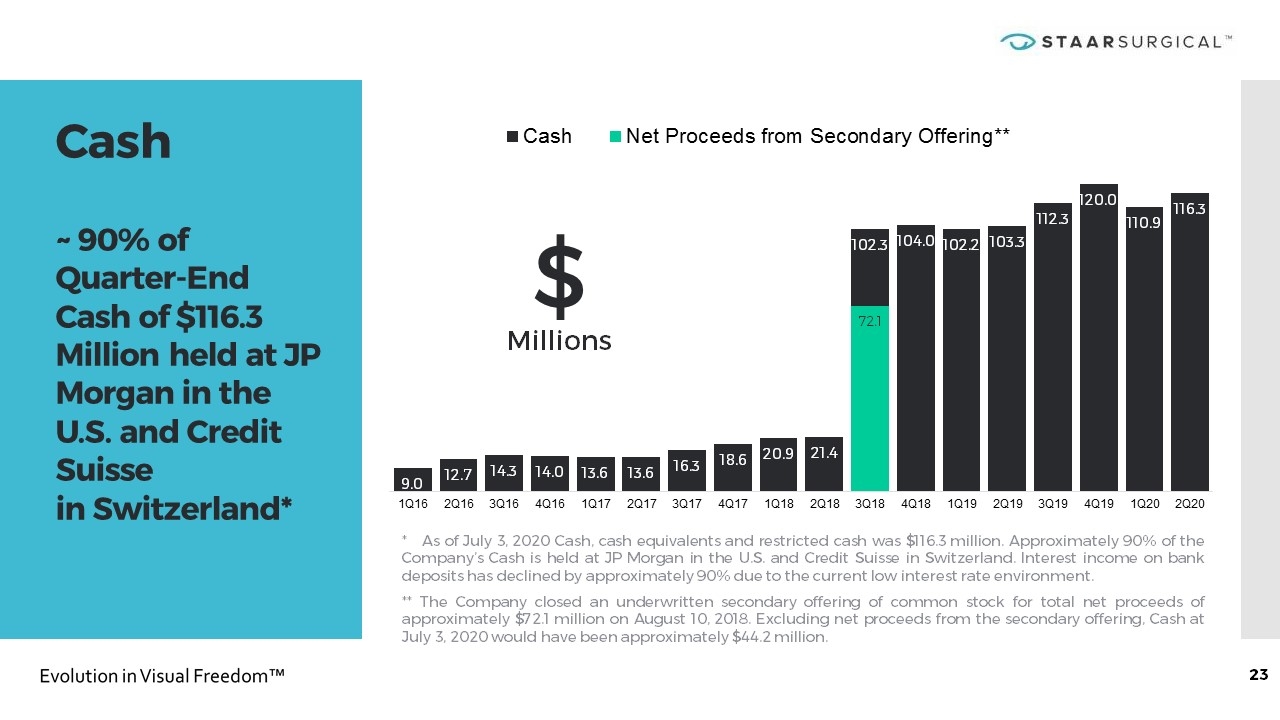

Cash ~ 90% of Quarter-End Cash of $116.3 Million held at JP Morgan in the U.S. and Credit Suisse in Switzerland* * As of July 3, 2020 Cash, cash equivalents and restricted cash was $116.3 million. Approximately 90% of the Company’s Cash is held at JP Morgan in the U.S. and Credit Suisse in Switzerland. Interest income on bank deposits has declined by approximately 90% due to the current low interest rate environment. ** The Company closed an underwritten secondary offering of common stock for total net proceeds of approximately $72.1 million on August 10, 2018. Excluding net proceeds from the secondary offering, Cash at July 3, 2020 would have been approximately $44.2 million. $ Millions

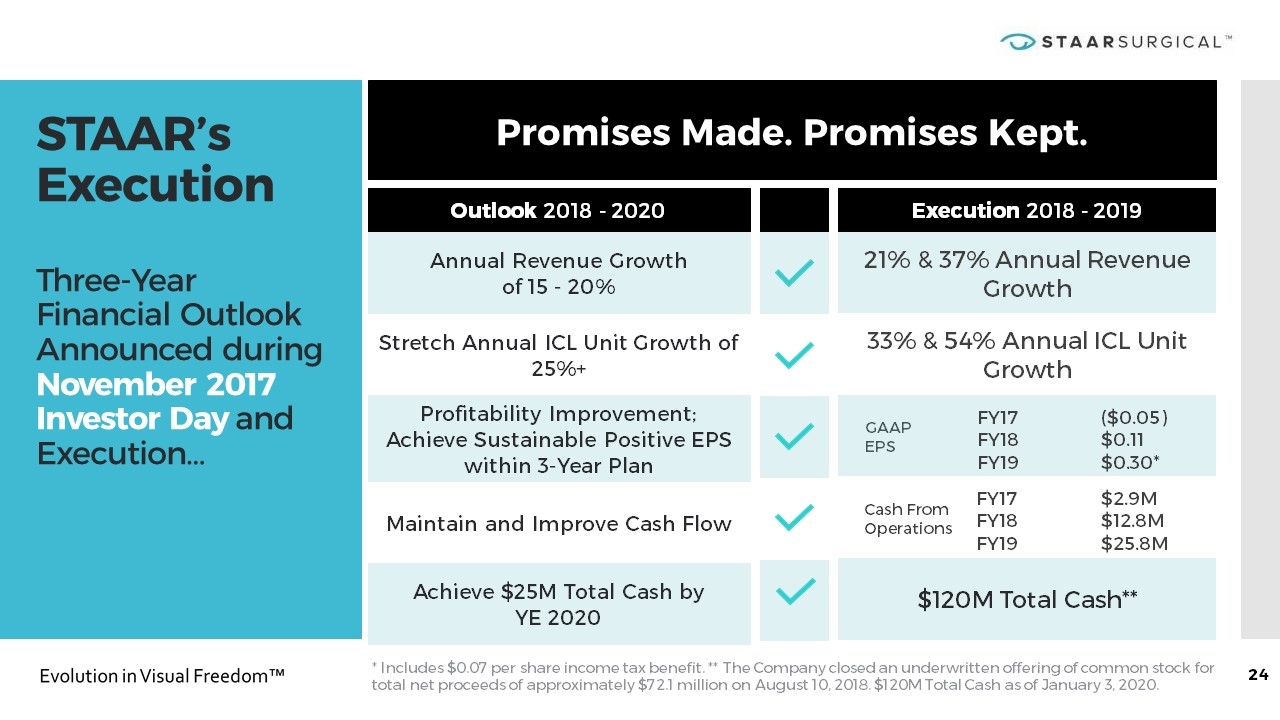

STAAR’s Execution Three-Year Financial Outlook Announced during November 2017 Investor Day and Execution… Promises Made. Promises Kept. GAAP EPS Outlook 2018 - 2020 Annual Revenue Growth of 15 - 20% Stretch Annual ICL Unit Growth of 25%+ Profitability Improvement; Achieve Sustainable Positive EPS within 3-Year Plan Maintain and Improve Cash Flow Achieve $25M Total Cash by YE 2020 Execution 2018 - 2019 21% & 37% Annual Revenue Growth 33% & 54% Annual ICL Unit Growth $120M Total Cash** FY17 FY18 FY19 ($0.05) $0.11 $0.30* Cash From Operations FY17 FY18 FY19 $2.9M $12.8M $25.8M * Includes $0.07 per share income tax benefit. ** The Company closed an underwritten offering of common stock for total net proceeds of approximately $72.1 million on August 10, 2018. $120M Total Cash as of January 3, 2020.

The Future of Refractive Surgery is Lens-Based. The Time for STAAR is Now! We welcome you to visit STAAR’s investor website for clinical papers, examples of global consumer marketing and much more at investors.staar.com www.staar.com www.discoverevo.com