Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARCH RESOURCES, INC. | tm2030015d1_8k.htm |

Exhibit 99.1

Our evolution into a sustainable, metallurgical-focused coal company S E P T E M B E R2 ,2 0 2 0 Deck Slone SVP, Strategy

Our evolution into a sustainable, metallurgical-focused coal company S E P T E M B E R2 ,2 0 2 0 Deck Slone SVP, Strategy

Forward-Looking Information This presentation contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from the COVID-19 pandemic, including its adverse effects on businesses, economies, and financial markets worldwide; from changes in the demand for our coal by the global electric generation and steel industries; from our ability to access the capital markets on acceptable terms and conditions; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from competition within our industry and with producers of competing energy sources; from our ability to successfully acquire or develop coal reserves; from operational, geological, permit, labor and weather-related factors; from the Tax Cuts and Jobs Act and other tax reforms; from the effects of foreign and domestic trade policies, actions or disputes; from fluctuations in the amount of cash we generate from operations, which could impact, among other things, our ability to resume paying dividends or repurchase shares; from our ability to successfully integrate the operations that we acquire; from our ability to complete the joint venture transaction with Peabody Energy Corporation (“Peabody”) in a timely manner, including obtaining regulatory approvals and satisfying other closing conditions; from our ability to achieve expected synergies from the joint venture; from our ability to generate significant revenue to make payments required by, and to comply with restrictions related to, our tax-exempt bonds; from our ability to successfully integrate the operations of certain mines in the joint venture; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a more detailed description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA. These non-GAAP financial measures are not measures of financial performance in accordance with generally accepted accounting principles and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under generally accepted accounting principles. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. A reconciliation of these financial measures to the most comparable measures presented in accordance with generally accepted accounting principles has been included at the end of this presentation.

Forward-Looking Information This presentation contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from the COVID-19 pandemic, including its adverse effects on businesses, economies, and financial markets worldwide; from changes in the demand for our coal by the global electric generation and steel industries; from our ability to access the capital markets on acceptable terms and conditions; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from competition within our industry and with producers of competing energy sources; from our ability to successfully acquire or develop coal reserves; from operational, geological, permit, labor and weather-related factors; from the Tax Cuts and Jobs Act and other tax reforms; from the effects of foreign and domestic trade policies, actions or disputes; from fluctuations in the amount of cash we generate from operations, which could impact, among other things, our ability to resume paying dividends or repurchase shares; from our ability to successfully integrate the operations that we acquire; from our ability to complete the joint venture transaction with Peabody Energy Corporation (“Peabody”) in a timely manner, including obtaining regulatory approvals and satisfying other closing conditions; from our ability to achieve expected synergies from the joint venture; from our ability to generate significant revenue to make payments required by, and to comply with restrictions related to, our tax-exempt bonds; from our ability to successfully integrate the operations of certain mines in the joint venture; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a more detailed description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA. These non-GAAP financial measures are not measures of financial performance in accordance with generally accepted accounting principles and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under generally accepted accounting principles. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. A reconciliation of these financial measures to the most comparable measures presented in accordance with generally accepted accounting principles has been included at the end of this presentation.

Arch Resources in brief Arch is a large and growing U.S. producer of high-quality metallurgical coals, and the leading global supplier of premium, High-Vol A coking coal xWe operate large, modern coking coal mines at the low end of the U.S. cost curve xOur product slate is dominated by High-Vol A coals that typically earn a market premium xOur Leer South growth project will solidify our position as the leading global supplier of High-Vol A coking coal xWe have exceptional, long-lived reserves that provide significant and valuable optionality for long-term growth Arch continues to shift its focus away from – and shrink – its legacy thermal coal platform xWe are pursuing completion of a joint venture for our mines in the Powder River Basin and Colorado, and are evaluating options for our other thermal assets as well xIn the meantime, these mines are geared towards free cash generation and value optimization in a declining market environment Arch has deep expertise in mining, marketing and logistics — and, critically, in mine safety and environmental stewardship – and levers those competencies in both steel and power markets Arch has one of the industry’s strongest balance sheets and the potential to generate high levels of free cash in a wide range of market conditions – a position that will be further enhanced by the commencement of longwall mining at Leer South

Arch Resources in brief Arch is a large and growing U.S. producer of high-quality metallurgical coals, and the leading global supplier of premium, High-Vol A coking coal xWe operate large, modern coking coal mines at the low end of the U.S. cost curve xOur product slate is dominated by High-Vol A coals that typically earn a market premium xOur Leer South growth project will solidify our position as the leading global supplier of High-Vol A coking coal xWe have exceptional, long-lived reserves that provide significant and valuable optionality for long-term growth Arch continues to shift its focus away from – and shrink – its legacy thermal coal platform xWe are pursuing completion of a joint venture for our mines in the Powder River Basin and Colorado, and are evaluating options for our other thermal assets as well xIn the meantime, these mines are geared towards free cash generation and value optimization in a declining market environment Arch has deep expertise in mining, marketing and logistics — and, critically, in mine safety and environmental stewardship – and levers those competencies in both steel and power markets Arch has one of the industry’s strongest balance sheets and the potential to generate high levels of free cash in a wide range of market conditions – a position that will be further enhanced by the commencement of longwall mining at Leer South

Our ESG commitment is well-aligned with our shareholder value creation strategy We are executing a fundamental strategic shift – towards global steel and metallurgical markets and away from domestic power and thermal markets x Transitioning to become a producer of lower-volume, higher-value metallurgical coal for steel markets x New steel will be essential to the construction of a new, low-carbon economy With this shift, Arch’s direct and indirect carbon emissions have declined significantly, and we are pursuing further reductions Our ESG profile has undergone a transformation x Today, Arch’s ESG profile is similar to that of many other major commodities – particularly iron ore, with which it is inextricably bound in the global marketplace

Our ESG commitment is well-aligned with our shareholder value creation strategy We are executing a fundamental strategic shift – towards global steel and metallurgical markets and away from domestic power and thermal markets x Transitioning to become a producer of lower-volume, higher-value metallurgical coal for steel markets x New steel will be essential to the construction of a new, low-carbon economy With this shift, Arch’s direct and indirect carbon emissions have declined significantly, and we are pursuing further reductions Our ESG profile has undergone a transformation x Today, Arch’s ESG profile is similar to that of many other major commodities – particularly iron ore, with which it is inextricably bound in the global marketplace

While the pursuit of a low-carbon steel solution is underway, high-quality metallurgical coal will be essential to new steel production for decades Steelmaking contributes an estimated 7% - 9% of the world’s CO2e emissions In July 2020, the European Commission launched a new hydrogen strategy for the steel industry x Ultimate goal is carbon neutrality by 2050 The goal is to use hydrogen for the reduction process in order to reduce CO2 emissions x Arcelor, Voestalpine, SSAB, ThyssenKrupp, Salzgitter and Tata have all joined the pursuit The most advanced initiative is arguably HYBRIT x Goal is to have a small-scale demonstration project up and running sometime in 2026 Most major steel producers are targeting 2045-2050 for producing carbon-neutral steel at commercial scale Arch expects there to be a need for high-quality coking coal through that timeframe Source: European Commission, SSAB, Company Filings, Public Information, Internal

While the pursuit of a low-carbon steel solution is underway, high-quality metallurgical coal will be essential to new steel production for decades Steelmaking contributes an estimated 7% - 9% of the world’s CO2e emissions In July 2020, the European Commission launched a new hydrogen strategy for the steel industry x Ultimate goal is carbon neutrality by 2050 The goal is to use hydrogen for the reduction process in order to reduce CO2 emissions x Arcelor, Voestalpine, SSAB, ThyssenKrupp, Salzgitter and Tata have all joined the pursuit The most advanced initiative is arguably HYBRIT x Goal is to have a small-scale demonstration project up and running sometime in 2026 Most major steel producers are targeting 2045-2050 for producing carbon-neutral steel at commercial scale Arch expects there to be a need for high-quality coking coal through that timeframe Source: European Commission, SSAB, Company Filings, Public Information, Internal

Arch is pursuing a joint venture that – if consummated – would nearly complete its strategic shift In June 2019, Arch and Peabody announced plans to form a JV with their thermal assets in Wyoming and Colorado xThe goal is to increase the competitiveness of these assets versus other fuels and renewables, establish a stable supply platform in a declining marketplace, and optimize the remaining value of these assets for stakeholders xThe parties are awaiting a ruling from the U.S. District Court as to whether the combination can proceed If consummated, Arch will become a minority equity holder xPeabody will become the operator of the JV and will manage day-to-day activities, including marketing xThe long-term liabilities associated with these thermal assets will shift to the JV over time Arch will be the recipient of cash distributions as the remaining value of these legacy assets is harvested xWe will use these distributions to continue the buildout of the metallurgical portfolio, to augment our financial position and de-lever the balance sheet, and – ultimately – to help fund the resumption of our successful capital return program Arch will sharpen its organizational concentration and structure still further, to an almost singular focus on steel and metallurgical markets xThis streamlining process will position Arch for long-term sustainability and profitability xIn 2020, Arch has reduced corporate and thermal segment staffing by approximately 250 positions – through voluntary separation programs and normal attrition – and by a total of 25 percent since 2019

Arch is pursuing a joint venture that – if consummated – would nearly complete its strategic shift In June 2019, Arch and Peabody announced plans to form a JV with their thermal assets in Wyoming and Colorado xThe goal is to increase the competitiveness of these assets versus other fuels and renewables, establish a stable supply platform in a declining marketplace, and optimize the remaining value of these assets for stakeholders xThe parties are awaiting a ruling from the U.S. District Court as to whether the combination can proceed If consummated, Arch will become a minority equity holder xPeabody will become the operator of the JV and will manage day-to-day activities, including marketing xThe long-term liabilities associated with these thermal assets will shift to the JV over time Arch will be the recipient of cash distributions as the remaining value of these legacy assets is harvested xWe will use these distributions to continue the buildout of the metallurgical portfolio, to augment our financial position and de-lever the balance sheet, and – ultimately – to help fund the resumption of our successful capital return program Arch will sharpen its organizational concentration and structure still further, to an almost singular focus on steel and metallurgical markets xThis streamlining process will position Arch for long-term sustainability and profitability xIn 2020, Arch has reduced corporate and thermal segment staffing by approximately 250 positions – through voluntary separation programs and normal attrition – and by a total of 25 percent since 2019

Arch’s metallurgical products are essential to the production of new steel, which — in turn — is essential to the construction of a new economy Iron ore and metallurgical coal are essential companions in the production of new steel Global steel demand is projected to continue its upward trajectory, spurred by economic development in Asia and ongoing urbanization around the globe New steel is essential to the construction of a new, low-carbon economy xSuch steel is required for mass transit systems, wind turbines and electric vehicles, among other things Metallurgical coal will be needed for the production of new steel through at least mid-century, according to most forecasts

Arch’s metallurgical products are essential to the production of new steel, which — in turn — is essential to the construction of a new economy Iron ore and metallurgical coal are essential companions in the production of new steel Global steel demand is projected to continue its upward trajectory, spurred by economic development in Asia and ongoing urbanization around the globe New steel is essential to the construction of a new, low-carbon economy xSuch steel is required for mass transit systems, wind turbines and electric vehicles, among other things Metallurgical coal will be needed for the production of new steel through at least mid-century, according to most forecasts

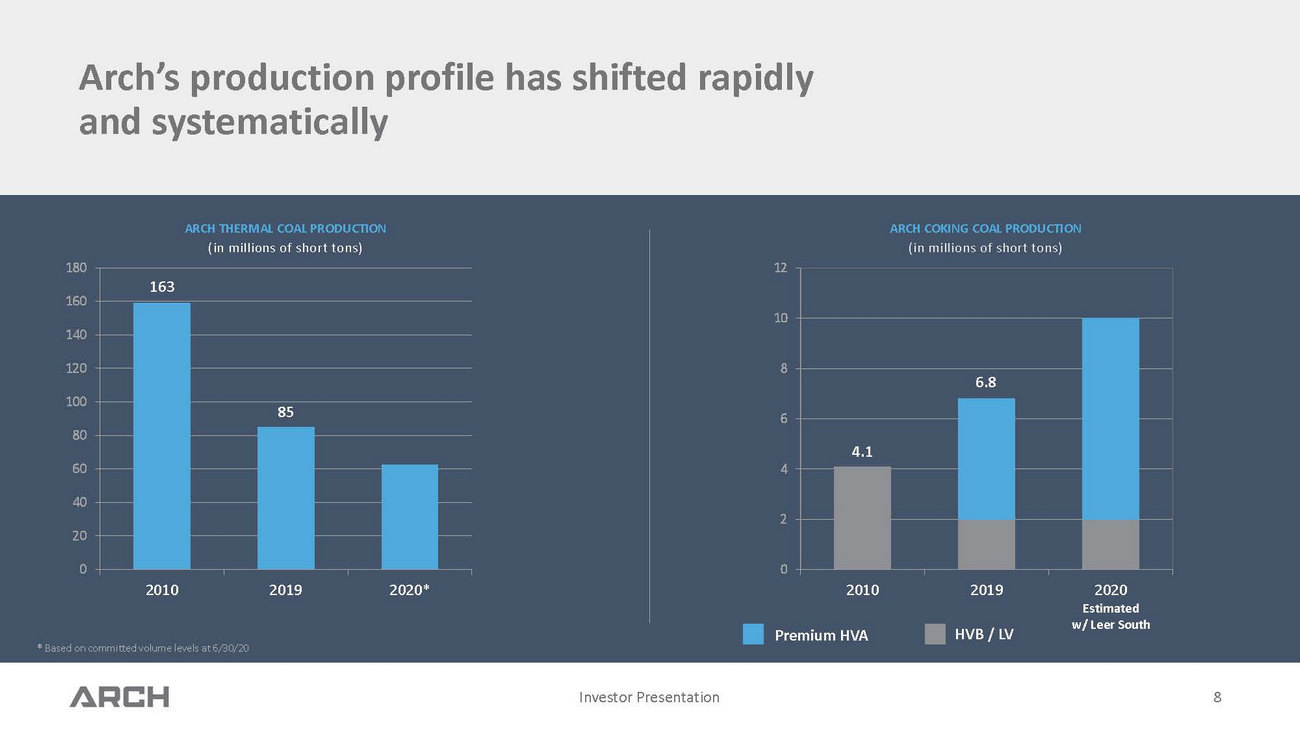

Arch’s production profile has shifted rapidly and systematically 180 160 140 163 ARCH THERMAL COAL PRODUCTION (in millions of short tons) ARCH COKING COAL PRODUCTION (in millions of short tons) 12 10 120 100 85 80 60 8 6 4.1 4 6.8 40 2 20 0 201020192020* 0 201020192020 Estimated w/ Leer South * Based on committed volume levels at 6/30/20 Premium HVAHVB / LV

Arch’s production profile has shifted rapidly and systematically 180 160 140 163 ARCH THERMAL COAL PRODUCTION (in millions of short tons) ARCH COKING COAL PRODUCTION (in millions of short tons) 12 10 120 100 85 80 60 8 6 4.1 4 6.8 40 2 20 0 201020192020* 0 201020192020 Estimated w/ Leer South * Based on committed volume levels at 6/30/20 Premium HVAHVB / LV

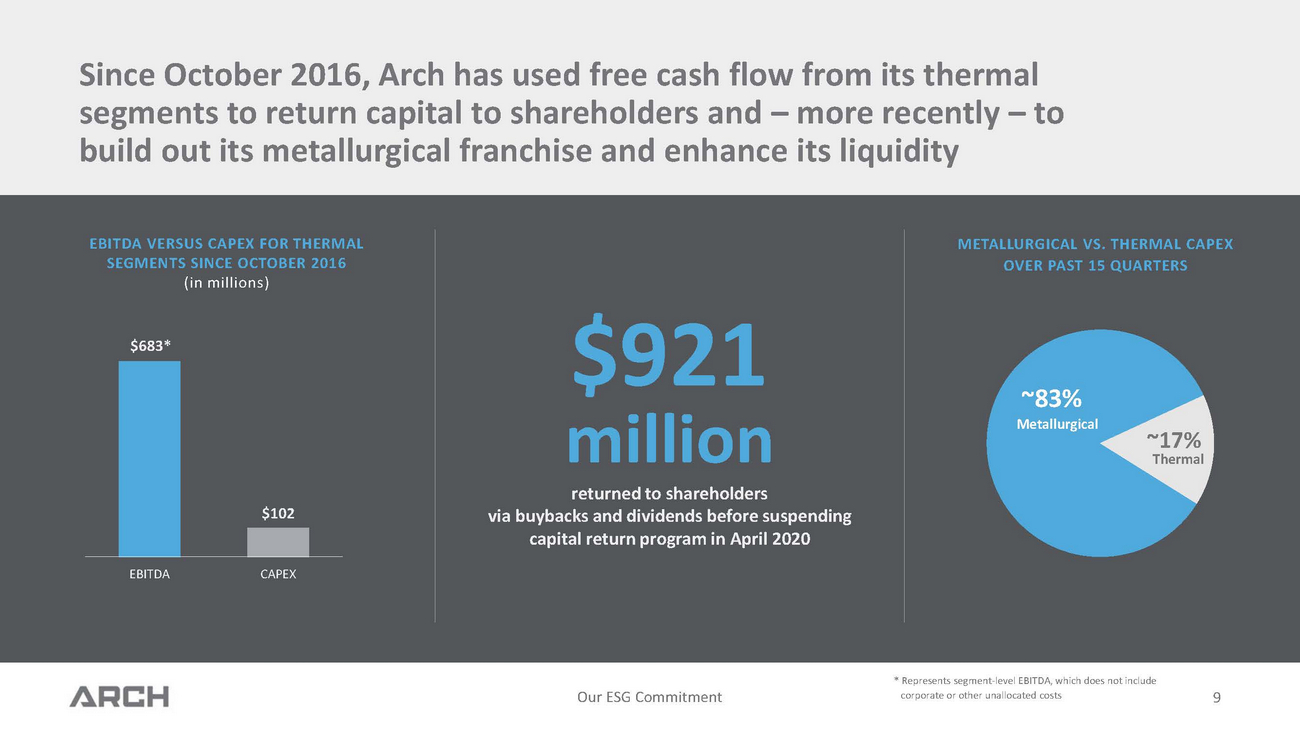

Since October 2016, Arch has used free cash flow from its thermal segments to return capital to shareholders and – more recently – to build out its metallurgical franchise and enhance its liquidity EBITDA VERSUS CAPEX FOR THERMAL SEGMENTS SINCE OCTOBER 2016 (in millions) $683* $921 $102 METALLURGICAL VS. THERMAL CAPEX OVER PAST 15 QUARTERS ~83% Metallurgical Thermal ~17% returned to shareholders via buybacks and dividends before suspending capital return program in April 2020 EBITDACAPEX

Since October 2016, Arch has used free cash flow from its thermal segments to return capital to shareholders and – more recently – to build out its metallurgical franchise and enhance its liquidity EBITDA VERSUS CAPEX FOR THERMAL SEGMENTS SINCE OCTOBER 2016 (in millions) $683* $921 $102 METALLURGICAL VS. THERMAL CAPEX OVER PAST 15 QUARTERS ~83% Metallurgical Thermal ~17% returned to shareholders via buybacks and dividends before suspending capital return program in April 2020 EBITDACAPEX

Leer SouthLeer South will be nearly identical to Arch’s world-class Leer mine LeerLeer South Mine life Mining technique Seam Seam thickness Average panel length Annual met output Product quality 20 Years Longwall Lower Kittanning ~ 74 inches ~ 6,700 feet Up to 4 million tons High-Vol A 20 Years Longwall Lower Kittanning ~ 65 inches ~ 9,000 feet Up to 4 million tons High-Vol A Tygart Valley Reserve Block Leer South Leer Projected cash cost Export facilities Sub-$50 Baltimore / DTA Low-$50s Baltimore / DTA Note: Excluding the reserves in the mine plans for Leer and Leer South, Arch will still have ~ 150 million tons of undeveloped reserves in the Tygart Valley reserve block. Our ESG Commitment10

Leer SouthLeer South will be nearly identical to Arch’s world-class Leer mine LeerLeer South Mine life Mining technique Seam Seam thickness Average panel length Annual met output Product quality 20 Years Longwall Lower Kittanning ~ 74 inches ~ 6,700 feet Up to 4 million tons High-Vol A 20 Years Longwall Lower Kittanning ~ 65 inches ~ 9,000 feet Up to 4 million tons High-Vol A Tygart Valley Reserve Block Leer South Leer Projected cash cost Export facilities Sub-$50 Baltimore / DTA Low-$50s Baltimore / DTA Note: Excluding the reserves in the mine plans for Leer and Leer South, Arch will still have ~ 150 million tons of undeveloped reserves in the Tygart Valley reserve block. Our ESG Commitment10

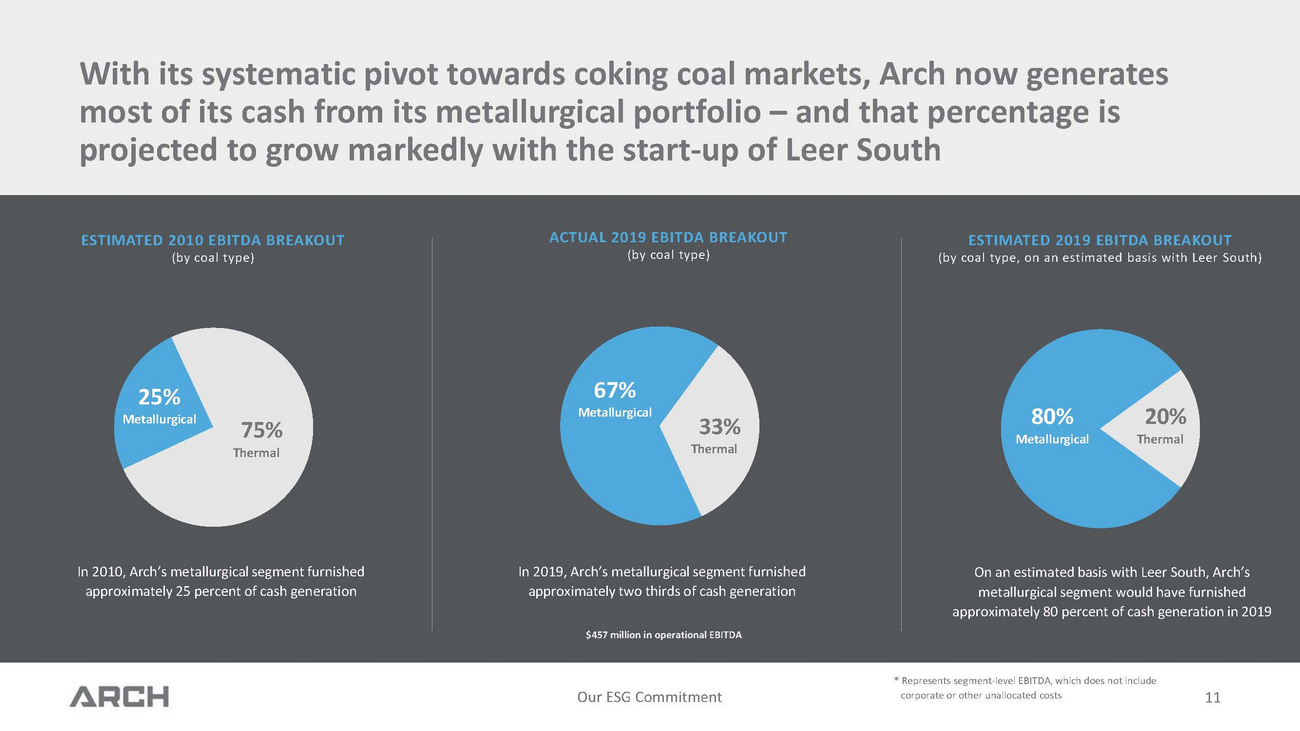

With its systematic pivot towards coking coal markets, Arch now generates most of its cash from its metallurgical portfolio – and that percentage is projected to grow markedly with the start-up of Leer South ESTIMATED 2010 EBITDA BREAKOUT (by coal type) ACTUAL 2019 EBITDA BREAKOUT (by coal type) ESTIMATED 2019 EBITDA BREAKOUT (by coal type, on an estimated basis with Leer South) 25% Metallurgical 75% Thermal 67% Metallurgical 33% Thermal 80% Metallurgical 20% Thermal In 2010, Arch’s metallurgical segment furnished approximately 25 percent of cash generation In 2019, Arch’s metallurgical segment furnished approximately two thirds of cash generation $457 million in operational EBITDA On an estimated basis with Leer South, Arch’s metallurgical segment would have furnished approximately 80 percent of cash generation in 2019 Our ESG Commitment * Represents segment-level EBITDA, which does not include corporate or other unallocated costs11

With its systematic pivot towards coking coal markets, Arch now generates most of its cash from its metallurgical portfolio – and that percentage is projected to grow markedly with the start-up of Leer South ESTIMATED 2010 EBITDA BREAKOUT (by coal type) ACTUAL 2019 EBITDA BREAKOUT (by coal type) ESTIMATED 2019 EBITDA BREAKOUT (by coal type, on an estimated basis with Leer South) 25% Metallurgical 75% Thermal 67% Metallurgical 33% Thermal 80% Metallurgical 20% Thermal In 2010, Arch’s metallurgical segment furnished approximately 25 percent of cash generation In 2019, Arch’s metallurgical segment furnished approximately two thirds of cash generation $457 million in operational EBITDA On an estimated basis with Leer South, Arch’s metallurgical segment would have furnished approximately 80 percent of cash generation in 2019 Our ESG Commitment * Represents segment-level EBITDA, which does not include corporate or other unallocated costs11

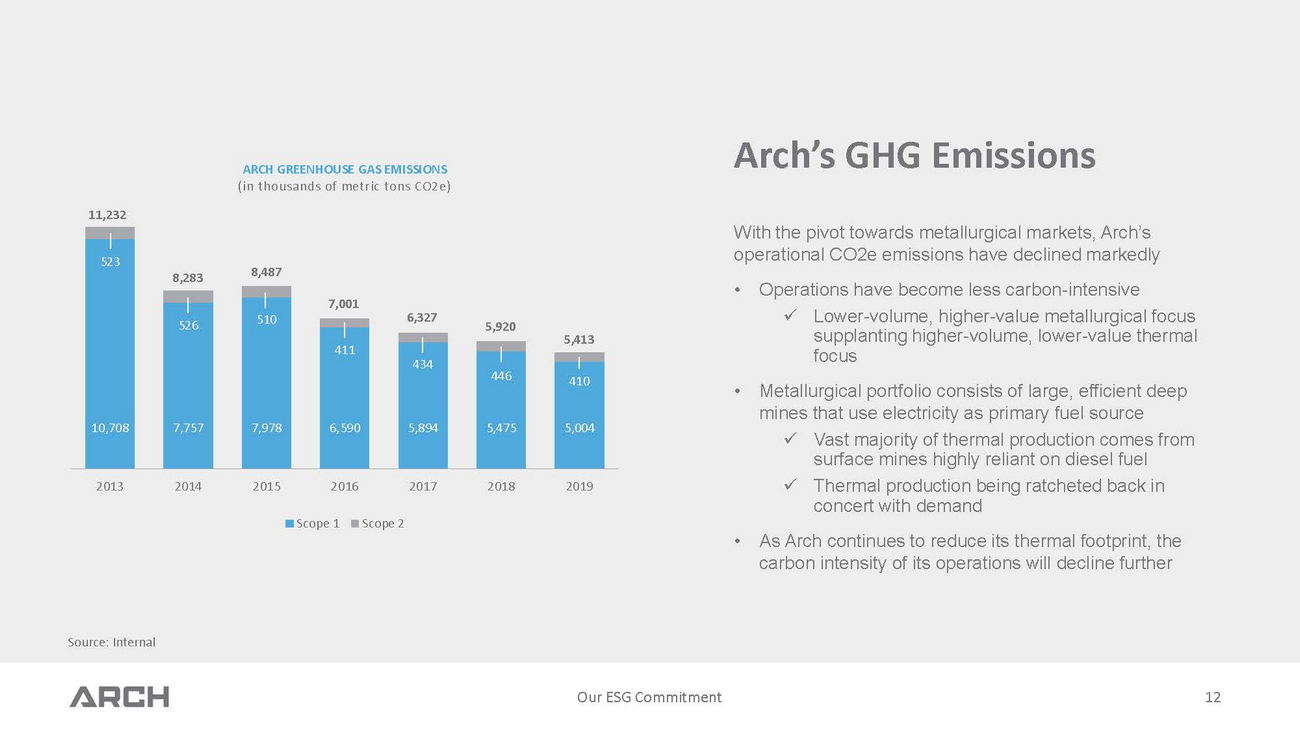

ARCH GREENHOUSE GAS EMISSIONS (in thousands of metric tons CO2e) Arch’s GHG Emissions 11,232 523 8,283 8,487 7,001 With the pivot towards metallurgical markets, Arch’s operational CO2e emissions have declined markedly •Operations have become less carbon-intensive 526510 411 6,327 434 5,920 5,413 xLower-volume, higher-value metallurgical focus supplanting higher-volume, lower-value thermal focus 446410 10,7087,7577,9786,5905,8945,4755,004 2013201420152016201720182019 Scope 1Scope 2 •Metallurgical portfolio consists of large, efficient deep mines that use electricity as primary fuel source xVast majority of thermal production comes from surface mines highly reliant on diesel fuel xThermal production being ratcheted back in concert with demand •As Arch continues to reduce its thermal footprint, the carbon intensity of its operations will decline further Source: Internal

ARCH GREENHOUSE GAS EMISSIONS (in thousands of metric tons CO2e) Arch’s GHG Emissions 11,232 523 8,283 8,487 7,001 With the pivot towards metallurgical markets, Arch’s operational CO2e emissions have declined markedly •Operations have become less carbon-intensive 526510 411 6,327 434 5,920 5,413 xLower-volume, higher-value metallurgical focus supplanting higher-volume, lower-value thermal focus 446410 10,7087,7577,9786,5905,8945,4755,004 2013201420152016201720182019 Scope 1Scope 2 •Metallurgical portfolio consists of large, efficient deep mines that use electricity as primary fuel source xVast majority of thermal production comes from surface mines highly reliant on diesel fuel xThermal production being ratcheted back in concert with demand •As Arch continues to reduce its thermal footprint, the carbon intensity of its operations will decline further Source: Internal

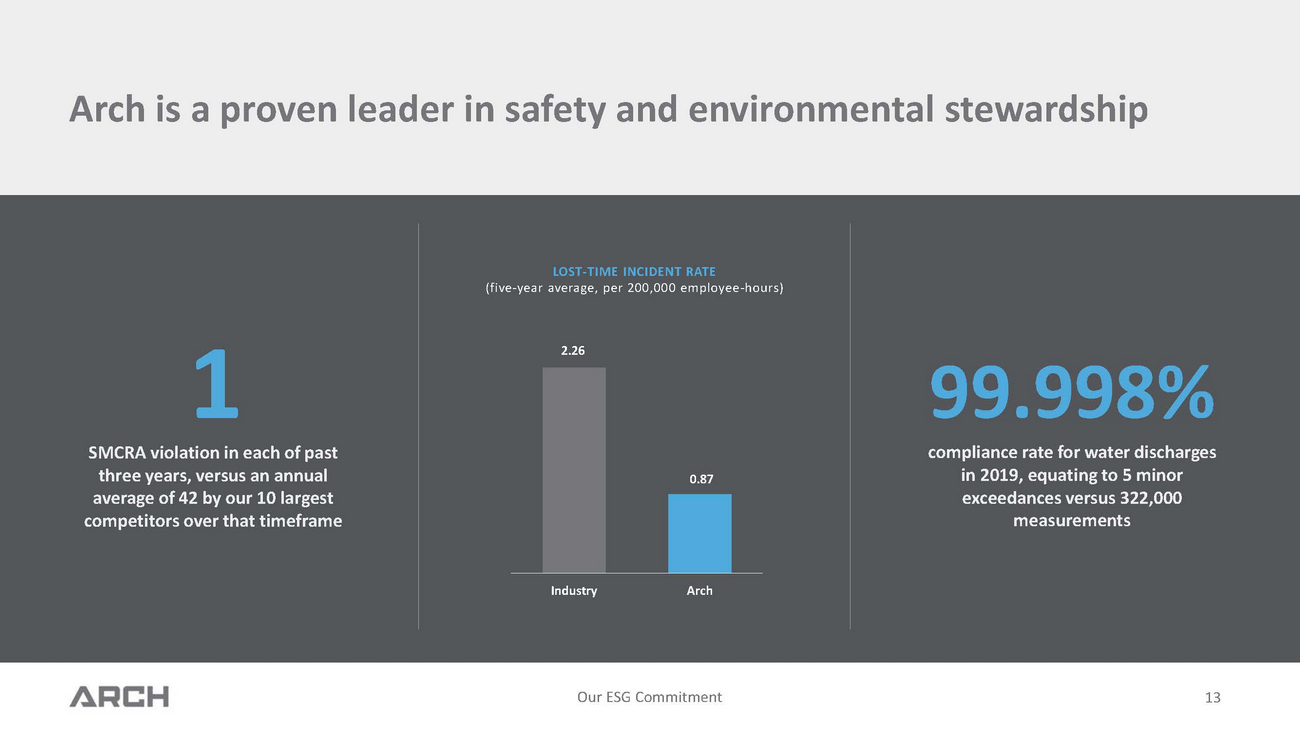

Arch is a proven leader in safety and environmental stewardship LOST-TIME INCIDENT RATE (five-year average, per 200,000 employee -hours) 12.26 SMCRA violation in each of past 99.998% compliance rate for water discharges three years, versus an annual average of 42 by our 10 largest competitors over that timeframe 0.87 IndustryArch in 2019, equating to 5 minor exceedances versus 322,000 measurements

Arch is a proven leader in safety and environmental stewardship LOST-TIME INCIDENT RATE (five-year average, per 200,000 employee -hours) 12.26 SMCRA violation in each of past 99.998% compliance rate for water discharges three years, versus an annual average of 42 by our 10 largest competitors over that timeframe 0.87 IndustryArch in 2019, equating to 5 minor exceedances versus 322,000 measurements

Arch is driving forward with its transformation into a sustainable metallurgical coal company, while maintaining its focus on industry leadership across key ESG metrics We are sharply focused on completing our transformation into a sustainable, ESG-driven producer of high-quality coking coal for the production of primary steel x We have a large base of premium, long-lived reserves and continue to build out and strengthen our highly cost-competitive operations We consider safety, environmental stewardship, community engagement, employee respect and strong corporate governance practices to be hallmarks of Arch’s corporate culture Arch has a proven record of disciplined and sustained continuous improvement processes across key metrics, and will apply that skillset to facilitate further advances We are markedly expanding our ESG-related outreach and communications efforts x In May, we changed the company name to reflect our structural shift towards steel markets x At the same time, we launched a new website with far more robust ESG disclosures We are in the process of reaching out to ESG-focused shareholder groups and ratings entities to ensure that this shift is understood and appreciated x During this outreach, we will be listening as much as we will be talking

Arch is driving forward with its transformation into a sustainable metallurgical coal company, while maintaining its focus on industry leadership across key ESG metrics We are sharply focused on completing our transformation into a sustainable, ESG-driven producer of high-quality coking coal for the production of primary steel x We have a large base of premium, long-lived reserves and continue to build out and strengthen our highly cost-competitive operations We consider safety, environmental stewardship, community engagement, employee respect and strong corporate governance practices to be hallmarks of Arch’s corporate culture Arch has a proven record of disciplined and sustained continuous improvement processes across key metrics, and will apply that skillset to facilitate further advances We are markedly expanding our ESG-related outreach and communications efforts x In May, we changed the company name to reflect our structural shift towards steel markets x At the same time, we launched a new website with far more robust ESG disclosures We are in the process of reaching out to ESG-focused shareholder groups and ratings entities to ensure that this shift is understood and appreciated x During this outreach, we will be listening as much as we will be talking

Our evolution into a sustainable, metallurgical-focused coal company S E P T E M B E R2 ,2 0 2 0 Deck Slone SVP, Strategy

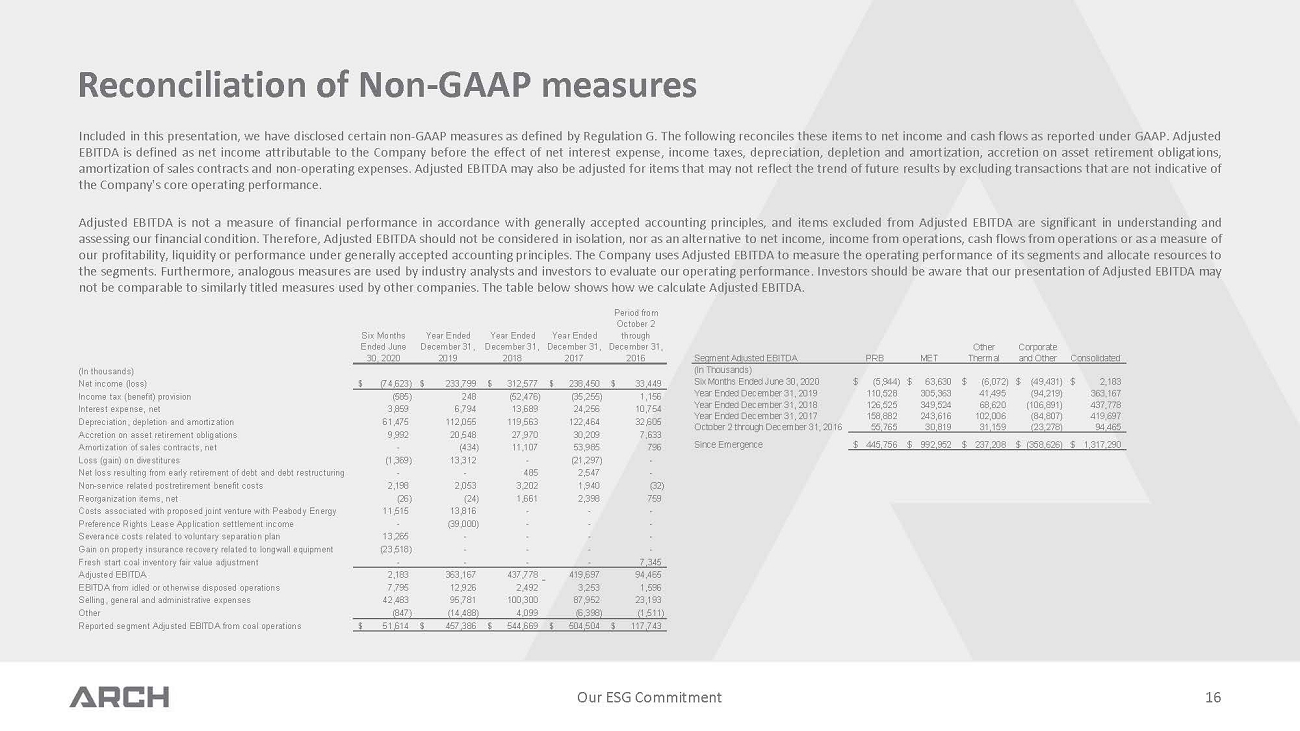

Reconciliation of Non-GAAP measures Included in this presentation, we have disclosed certain non-GAAP measures as defined by Regulation G. The following reconciles these items to net income and cash flows as reported under GAAP. Adjusted EBITDA is defined as net income attributable to the Company before the effect of net interest expense, income taxes, depreciation, depletion and amortization, accretion on asset retirement obligations, amortization of sales contracts and non-operating expenses. Adjusted EBITDA may also be adjusted for items that may not reflect the trend of future results by excluding transactions that are not indicative of the Company's core operating performance. Adjusted EBITDA is not a measure of financial performance in accordance with generally accepted accounting principles, and items excluded from Adjusted EBITDA are significant in understanding and assessing our financial condition. Therefore, Adjusted EBITDA should not be considered in isolation, nor as an alternative to net income, income from operations, cash flows from operations or as a measure of our profitability, liquidity or performance under generally accepted accounting principles. The Company uses Adjusted EBITDA to measure the operating performance of its segments and allocate resources to the segments. Furthermore, analogous measures are used by industry analysts and investors to evaluate our operating performance. Investors should be aware that our presentation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The table below shows how we calculate Adjusted EBITDA. Six Months Ended June Year Ended December 31, Year Ended December 31, Year Ended December 31, Period from October 2 through December 31, Other Corporate (In thousands) 30, 2020 2019 2018 2017 2016 Segment Adjusted EBITDA PRB MET Thermal and Other Consolidated (In Thousands) Net income (loss) $(74,623) $ 233,799 $ 312,577 $ 238,450 $ 33,449 Six Months Ended June 30, 2020 $(5,944) $ 63,630 $ (6,072) $ (49,431) $ 2,183 Income tax (benefit) provision(585)248(52,476)(35,255)1,156 Year Ended December 31, 2019110,528305,36341,495(94,219)363,167 Our ESG Commitment16