Attached files

| file | filename |

|---|---|

| S-1 - REGISTRATION STATEMENT ON FORM S-1 - JFrog Ltd | d841831ds1.htm |

| EX-23.1 - EX-23.1 - JFrog Ltd | d841831dex231.htm |

| EX-21.1 - EX-21.1 - JFrog Ltd | d841831dex211.htm |

| EX-10.17 - EX-10.17 - JFrog Ltd | d841831dex1017.htm |

| EX-10.16 - EX-10.16 - JFrog Ltd | d841831dex1016.htm |

| EX-10.15 - EX-10.15 - JFrog Ltd | d841831dex1015.htm |

| EX-10.14 - EX-10.14 - JFrog Ltd | d841831dex1014.htm |

| EX-10.13 - EX-10.13 - JFrog Ltd | d841831dex1013.htm |

| EX-10.12 - EX-10.12 - JFrog Ltd | d841831dex1012.htm |

| EX-10.11 - EX-10.11 - JFrog Ltd | d841831dex1011.htm |

| EX-10.10 - EX-10.10 - JFrog Ltd | d841831dex1010.htm |

| EX-10.9 - EX-10.9 - JFrog Ltd | d841831dex109.htm |

| EX-10.8 - EX-10.8 - JFrog Ltd | d841831dex108.htm |

| EX-10.7 - EX-10.7 - JFrog Ltd | d841831dex107.htm |

| EX-10.6 - EX-10.6 - JFrog Ltd | d841831dex106.htm |

| EX-10.5 - EX-10.5 - JFrog Ltd | d841831dex105.htm |

| EX-10.2 - EX-10.2 - JFrog Ltd | d841831dex102.htm |

| EX-10.1 - EX-10.1 - JFrog Ltd | d841831dex101.htm |

Exhibit 3.1

THE COMPANIES LAW, 5759- 1999

A PRIVATE COMPANY LIMITED BY SHARES

NINTH AMENDED AND RESTATED

ARTICLES OF ASSOCIATION

OF

JFROG LTD.

DULY ADOPTED BY THE SHAREHOLDERS

ON MARCH 31, 2020

THE COMPANIES LAW, 5759-1999

A PRIVATE COMPANY LIMITED BY SHARES

NINTH AMENDED AND RESTATED

ARTICLES OF ASSOCIATION

OF

JFROG LTD.

GENERAL

| 1. | These Articles evidence that: |

| 1.1. | The name of the Company is “JFrog Ltd.” |

| 1.2. | The purpose of the Company is to operate in accordance with business considerations to generate profits; provided however, that the Company may donate reasonable amounts to worthy causes, as the Board may determine in its discretion, even if such donations are not within the framework of business considerations. |

| 1.3. | The object of the Company is to engage in any lawful activity or business. |

| 1.4. | The liability of each Shareholder is limited to the unpaid portion of the par value of each share held by such Shareholder. |

| 1.5. | These Articles entirely amend, restate, supersede and replace those eighth Amended and Restated Articles of Association of the Company as adopted by the Shareholders on September 17, 2018, and any other prior Articles of Association of the Company. |

INTERPRETATION; GENERAL

| 2. | In these Articles, unless the context otherwise requires: |

| 2.1. | “Affiliate” means with respect to (i) any Person, any other Person, directly or indirectly, through one or more intermediary Persons, Controlling, Controlled by, or under common Control with such Person; (ii) any Preferred Shareholder (as defined below), any entity which Controls, is Controlled by or is under common Control with, such Preferred Shareholder or if the Preferred Shareholder is a partnership its partners and/or affiliated partnerships managed by the same manager or management company or managing partner or managed by an entity which controls, is controlled by, or is under common control with, such manager, management company or managing general partner. |

| 2.2. | “Articles” means these Ninth Amended and Restated Articles of Association of the Company, as shall be in force from time to time. |

| 2.3. | “As Converted Basis” means the number of Ordinary Shares into which the Preferred Shares are convertible, at the Conversion Price (as defined below) applicable to such Preferred Shares at the time of the relevant calculation. |

| 2.4. | “Battery” means Battery Ventures X, L.P. and Battery Investment Partners X, LLC. and any of its Affiliates. |

| 2.5. | “Board” means the Company’s board of directors designated or elected in accordance with these Articles. |

| 2.6. | “Bonus Shares” means shares issued by the Company for no consideration to Shareholders entitled to receive them. |

| 2.7. | “Business Day” means a day on which commercial banks are open for business in Israel. |

| 2.8. | “Companies Law” means the Companies Law, 5759-1999 as shall be in effect from time to time and all the regulations promulgated under it. |

| 2.9. | “Companies Ordinance” means the applicable Sections of the Companies Ordinance [New Version], 5743-1983 that remain in effect. |

| 2.10. | “Company” means JFrog Ltd. |

| 2.11. | “Control” or “control” means direct or indirect ownership of more than 50% of the issued and outstanding equity and voting power of an entity, or possession of the right and power to direct the policy and management of such entity. |

| 2.12. | “Director” or “Directors” means a member or members of the Board who have been designated or appointed in accordance with the provisions of these Articles. |

| 2.13. | “Dividend” means any asset transferred by the Company to a Shareholder in respect of such Shareholder’s shares, whether in cash or in any other way, including a transfer without valuable consideration, but excluding Bonus Shares. |

| 2.14. | “EMC” means EMC Ireland Holdings and any of its Affiliates. |

| 2.15. | “Exempted Securities” means: (i) securities issued or issuable to employees, directors, officers, consultants and service providers of the Company or any Affiliate thereof pursuant to an option plan approved by the Board; (ii) Ordinary Shares issued by way of Dividend; (iii) securities issued or issuable to the public in an IPO, (iv) securities issued or issuable in connection with any Recapitalization Event; (v) Ordinary Shares issued or issuable upon the conversion of the Preferred Shares and by virtue thereof; (vi) securities issued or issuable to a strategic partner approved as such by the Board, including at least one Board member appointed by the Preferred Shareholders, provided that all such securities issued pursuant to such transactions, in the aggregate, do not exceed 3% of the Company’s then issued share capital on an As Converted Basis; (vii) securities issued to parties providing the Company with equipment leases, real property leases, loans, credit lines or guarantees of indebtedness, customers, suppliers or OEM’s; provided that: (a) the issuance of the Company’s securities is not the primary purpose of such transaction; (b) such issuance of securities is approved by the Board, including at least one Board member appointed by the Preferred Shareholders; and (c) the securities issued pursuant to such transactions do not exceed, in the aggregate, 3% of the Company’s then issued share capital; (viii) securities issued or issuable as consideration for an acquisition of another corporation by the Company; provided that such acquisition or transaction has been approved by the Board including at least one Board member appointed by the Preferred Shareholders; (ix) securities issued or issuable pursuant to that certain Series D Preferred Share Purchase Agreement, dated September 17, 2018, and (x) securities issued or issuable which the Preferred Shares Majority resolve will be deemed included within the definition of “Exempted Securities”. |

| 2.16. | “Founders” means Shlomi Ben-Haim, Frederic Simon and Yoav Landman. |

| 2.17. | “Fully Diluted Basis” means all issued and outstanding share capital of the Company, all securities issuable upon the conversion of any existing convertible securities or loans, the exercise of all outstanding warrants, options, options reserved in the Company’s share option pool (whether allocated or unallocated, vested or unvested), and issuance of securities pursuant to any anti-dilution rights of existing shareholders (if any). |

| 2.18. | “Gemini” means (i) Gemini Israel V L.P., (ii) Gemini Partners Investors V L.P., (iii) and any of Gemini’s Affiliates. |

| 2.19. | “General Meeting” means an annual or special general meeting of the Shareholders. |

| 2.20. | “Geodesic” means Geodesic Capital Fund I, L.P., Geodesic Capital Fund I-S, L.P., and any of Geodesic’s Affiliates. |

| 2.21. | “Insight” means Insight Venture Partners X, L.P., a Cayman Islands exempted limited partnership, Insight Venture Partners (Cayman) X, L.P., a Cayman Islands limited partnership, Insight Venture Partners (Delaware) X, L.P., a Delaware limited partnership, Insight Venture Partners X (Co-Investors), L.P., a Cayman Islands exempted limited partnership, and any of their respective Affiliates. |

| 2.22. | “IPO” means the offering of the Company’s shares to the public in a bona fide underwriting pursuant to a registration statement under the U.S. Securities Act of 1933, as amended, or similar securities laws of another jurisdiction. |

| 2.23. | “Law” means the Companies Law, the Companies Ordinance and any other law that shall be in effect from time to time with respect to companies and that shall apply to the Company. |

| 2.24. | “M&A Event” means any of the following events, whether effectuated through a transaction or a series of transactions: (i) a consolidation, merger, reorganization, plan of exchange or any other similar transaction of the Company with or into any other entity or person, other than a wholly-owned subsidiary of the Company; (ii) any Person acquiring, directly or indirectly, more than 50% of the Company’s issued and outstanding shares (other than in the event such shares are acquired as part of a transaction the primary reason of which are newly issued shares of the Company); (iii) sale, transfer or other disposition of all or substantially all the Company’s assets, or a transfer or grant of an exclusive license to all or substantially all of the Company’s intellectual property; and (iv) any transaction resulting in substantially all of the Company’s shares being exchanged for securities of any other entity; provided that in case of (i) and (iv) above, in any event other than in a transaction in which the persons that beneficially owned, directly or indirectly, more than 50% of the voting rights of the Company immediately prior to such transaction, beneficially own, immediately following such transaction, directly or indirectly, more than 50% of the voting rights of the surviving or transferee entity or the right to appoint or elect at least fifty percent (50%) or more of the members of the Board of Directors. |

| 2.25. | “Majority Preferred A Shareholders” means the holders of a majority of the issued and outstanding Preferred A Shares (on an As Converted Basis), voting together as a single class. |

| 2.26. | “Majority Preferred B Shareholders” means the holders of a majority of the issued and outstanding Preferred B Shares (on an As Converted Basis), voting together as a single class. |

| 2.27. | “New Securities” means Ordinary Shares, Preferred Shares, options, warrants or rights to purchase shares of the Company or other securities exercisable or exchangeable for or convertible into shares of the Company, in each case issued after the date hereof, other than Exempted Securities. |

| 2.28. | “Office” means the registered office of the Company. |

| 2.29. | “Office Holders” as defined in the Companies Law. |

| 2.30. | “Ordinary Shares” means ordinary shares of the Company par value NIS 0.01 each. |

| 2.31. | “Original Issue Date” means with respect to each Preferred Share, the date on which such Preferred Share was first issued. |

| 2.32. | “Original Issue Price” means, reflecting the issuance of Bonus Shares issued by the Company on July 31, 2018, with respect to each Preferred A Share – $US 0.1716 subject to appropriate adjustment in the event of any share dividend, bonus shares, share split, combination or other similar recapitalization, with respect to the Preferred A Shares, with respect to each Preferred A-1 Share US$0.2946, subject to appropriate adjustment in the event of any share dividend, bonus shares, share split, combination or other similar recapitalization with respect to the Preferred A-1 Shares, with respect to each Preferred B Share US$0.8558, subject to appropriate adjustment in the event of any share dividend, bonus shares, share split, combination or other similar recapitalization, with respect to the Preferred B Shares, with respect to each Preferred C Share US$ 2.3922, subject to appropriate adjustment in the event of any share dividend, bonus shares, share split, combination or other similar recapitalization with respect to the Preferred C Shares, and with respect to each Preferred D Share US$ 11.81836, subject to appropriate adjustment in the event of any share dividend, bonus shares, share split, combination or other similar recapitalization with respect to the Preferred D Shares. |

| 2.33. | “Permitted Transferee” means an individual, a partnership, a trust, the beneficiary of a trust, a legal entity, in each case which receives Securities pursuant to one of the following permitted transfers: (a) the transfer of all or any of the Securities held by a shareholder of the Company to: (i) an Affiliate; or (ii) in the case of a corporate body, to its shareholders; (b) the transfer by a shareholder who is an individual pursuant to laws of descent or to his spouse, children, or grandchildren or to trusts for the benefit of the aforementioned (and the transfer back to the beneficiaries) or charitable trusts (c) the transfer by ScaleVP, Sapphire, Qumra Capital, Vintage, Battery, Gemini, Insight, Spark, Geodesic, EMC or VMware to (i) any secondary fund that specializes in purchasing all or partial of the portfolios of investee company investments of an existing venture firm or (ii) any entity which purchases from such shareholders all or part of such shareholders’ shares in the Company as part of a larger sale of such shareholder’s portfolios and (iii) each entity consisting of or Affiliated with ScaleVP, |

| Sapphire, Qumra Capital, Vintage, Battery, Gemini, Insight, Spark, Geodesic, EMC or VMware shall be deemed a Permitted Transferee of each other and, for the avoidance of doubt, for the purposes hereof, EMC and VMware shall be deemed Permitted Transferees of each other at all times; (d) the Transfer of shares by any Founder to the other Founder pursuant to that certain Share Option Agreement by and between Shlomi Ben Haim, Yoav Landman and Frederic Simon dated February 1, 2010, as amended on May 2012; and (e) the Transfer of shares pursuant to that certain Secondary Purchase Agreement, dated September 17, 2018. |

| 2.34. | “Person” means an individual, corporation, partnership, joint venture, trust, and any other corporate entity and any unincorporated corporation or organization. |

| 2.35. | “Preferred C Director” as defined in Article 70.1 below. |

| 2.36. | “Preferred D Director” as defined in Article 70.2 below. |

| 2.37. | “Preferred Shares” means the Preferred A Shares, the Preferred A-1 Shares, the Preferred B Shares, the Preferred C Shares, and Preferred D Shares (as applicable). |

| 2.38. | “Preferred A Share” means Preferred A Shares of the Company par value NIS 0.01 each. |

| 2.39. | “Preferred A-1 Share” means Preferred A-1 Shares of the Company par value NIS 0.01 each. |

| 2.40. | “Preferred B Share” means Preferred B Shares of the Company par value NIS 0.01 each. |

| 2.41. | “Preferred C Share” means Preferred C Shares of the Company par value NIS 0.01 each. |

| 2.42. | “Preferred D Share” means Preferred D Shares of the Company par value NIS 0.01 each. |

| 2.43. | “Preferred A Shareholder” means a holder of Preferred A Shares. |

| 2.44. | “Preferred A-1 Shareholder” means a holder of Preferred A-1 Shares. |

| 2.45. | “Preferred B Shareholder” means a holder of Preferred B Shares. |

| 2.46. | “Preferred C Shareholder” means a holder of Preferred C Shares. |

| 2.47. | “Preferred D Shareholder” means a holder of Preferred D Shares. |

| 2.48. | “Preferred Shareholder” means a holder of Preferred Shares. |

| 2.49. | “Preferred Shares Majority” – means the holders of a majority of the voting power of the then issued and outstanding Preferred Shares voting together as a single class (calculated on an As Converted Basis). |

| 2.50. | “QIPO” means an IPO which results in (i) gross proceeds to the Company of not less than US$ 50,000,000 and (ii) the Company’s shares being listed on the New York Stock Exchange or the NASDAQ Stock Market. |

| 2.51. | “Qumra Capital” means Qumra Capital and any of its Affiliates. |

| 2.52. | “Realization Event” means any of the following events: (i) liquidation, dissolution, bankruptcy, winding up or reorganization of the Company, either voluntary or non-voluntary; and (ii) M&A Event. |

| 2.53. | “Recapitalization Event” means any event of share combination or subdivision, stock splits, stock Dividends, distribution of Bonus Shares or any other reclassification, reorganization or recapitalization of the Company’s share capital and the like, where the shareholders retain their proportionate holdings in the Company. |

| 2.54. | “Register” means the Register of Shareholders that is to be kept pursuant to Section 127 of the Companies Law, as updated from time to time. |

| 2.55. | “Related Person” means any director, officer or shareholder of a Person (other than employees who are shareholders solely by reason of a stock option or similar incentive plans), and any family member or Affiliate of such Person or of any of the above. |

| 2.56. | “Requisite Preferred C Shareholders” means the holders of at least sixty percent (60%) of the issued and outstanding Preferred C Shares (on an As Converted Basis), voting together as a single class. |

| 2.57. | Requisite Preferred D Shareholders” means the holders of at least sixty percent (60%) of the issued and outstanding Preferred D Shares (on an As Converted Basis), voting together as a single class. |

| 2.58. | “Sapphire” means Sapphire Ventures Fund II, L.P. and any of its Affiliates. |

| 2.59. | “ScaleVP” means Scale Venture Partners IV, L.P. and any of its Affiliates. |

| 2.60. | “Securities” mean shares, options, warrants or other securities which may be exercised or converted into shares of the Company. |

| 2.61. | “Shareholder” means a shareholder of the Company. |

| 2.62. | “Spark” means Spark Capital Growth Fund II, L.P., Spark Capital Growth Founders’ Fund II, L.P., and any of their Affiliates. |

| 2.63. | “Transfer” means any sale, transfer, assignment, hypothecation, pledge, mortgage or other disposition, or grant of a security interest in or other disposal of all or any portion of a security, or any interest or rights in a security in consideration for cash as gift, or otherwise. “Transferred” means the accomplishment of a Transfer, and “Transferee” means the recipient of a Transfer. |

| 2.64. | “Vintage” means Vintage Investment Partners VI (Cayman), L.P., Vintage Investment Partners VI (Israel), L.P., Vintage Investment Partners VIII (Cayman), L.P., Vintage Investment Partners VIII (Israel), L.P., and any of their Affiliates. |

| 2.65. | “VMware” means VMware International Marketing Limited and any of its Affiliates. |

| 3. | The specific provisions of these Articles shall supersede the provisions of the Law to the extent permitted under the Law. In these Articles, all terms used herein and not otherwise defined herein shall have the meanings defined in the Law, as in effect on the day on which these Articles become binding on the Company; words and expressions importing the singular shall include the plural and vice versa; words and expressions importing the masculine gender shall include the feminine gender. Headings to Articles herein are for convenience only, and shall not affect the meaning or interpretation of any provision hereof. |

LIMITATIONS

| 4. | The following limitations shall apply to the Company: |

| 4.1. | The right to transfer shares is restricted in the manner hereinafter provided; |

| 4.2. | The number of Shareholders at any time (exclusive of employees or former employees of the Company who have been Shareholders during their employment and remain Shareholders after termination of their employment with the Company) shall not exceed 50; provided, however, that if two or more individuals hold a share or shares of the Company jointly, they shall be deemed to be one Shareholder for purposes of these Articles; |

| 4.3. | An offer to the public to subscribe for shares or debentures of the Company is prohibited. |

CAPITAL

| 5. | Authorized Share Capital |

The authorized share capital of the Company is NIS 1,533,780 divided into 153,378,000 shares as follows: (A) 101,314,353 Ordinary Shares of nominal value of NIS 0.01 each, (B) 1,252,945 Preferred A Shares of nominal value of NIS 0.01 each; (C) 11,880,520 Preferred A-1 Shares of nominal value of NIS 0.01 each; (D) 7,712,440 Preferred B Shares of nominal value of NIS 0.01 each; (E) 21,517,470 Preferred C Shares of nominal value of NIS 0.01 each; and (E) 9,700,272 Preferred D Shares of nominal value of NIS 0.01 each.

The Company may alter its share capital in accordance with the Companies Law and these Articles.

Subject to the Companies Law, these Articles, Article 91 and Article 91A, the Company may issue any shares having preferred rights, deferred rights or other special rights, or limited rights in relation to voting, dividend, return of capital, participation in surplus assets or otherwise as the Company shall determine from time to time. For the avoidance of doubt, the creation (or authorization of the creation of), increase or decrease of the authorized, or issue (or authorize the issuance) of any New Securities, including, without limitation, New Securities with any preference or priority as to dividends or assets superior to or on a parity with that of existing securities, shall not in and of itself be deemed to impair or have any adverse effect on any of the rights or obligations of the then existing securities.

| 6. | The Ordinary Shares |

The Ordinary Shares shall rank pari passu among them and shall entitle their holders:

| 6.1. | to receive notices of, and to attend, General Meetings where each Ordinary Share shall have one vote for all purposes; |

| 6.2. | subject to the rights and privileges of the Preferred Shares, to share equally among them, on a per share basis, Bonus Shares or Dividends as may be declared by the Board and approved by the Shareholders, if required, out of funds legally available therefor; and |

| 6.3. | subject to the rights and privileges of the Preferred Shares, upon a Realization Event – to participate in the distribution of the assets of the Company legally available for distribution to Shareholders after payment of all debts and other liabilities of the Company (in each case, proportionally to the number of Ordinary Shares outstanding and the amounts paid by Shareholders on account of their Shares, if not paid in full, before calls for payment were made). |

| 7. | The Preferred Shares |

The Preferred Shares confer on the holders thereof all rights accruing to holders of Ordinary Shares in the Company, and, in addition the following rights:

| 7.1. | Liquidation and Distribution Preference. |

In the event of a Realization Event, then all the assets or proceeds available for distribution to the Shareholders (excluding any escrow amount, contingent payments, or milestone or earn-out payments, or any other amount not obtained or received at closing, other than amounts placed in escrow solely in order to secure indemnification obligations for breach of representation and warranties, covenants and liabilities (collectively, the “Contingent Consideration Mechanism”)) (a “Distribution Event”) (the “Distributable Proceeds”) shall be distributed among the Shareholders according to the following order of preference:

| 7.1.1. | The holders of Preferred Shares shall be entitled to receive, from the funds legally available for distribution (in cash, cash equivalent or otherwise), on a pro rata and pari passu basis among themselves, prior and in preference to any other securities of the Company, for each Preferred Share held by them—an amount equal to the Original Issue Price less any Distributable Proceeds of any kind previously paid in preference on such Preferred Share including by way of distribution of any Dividends (collectively, the “Preferred Preference Amount”). In the event that the Distributable Proceeds shall be insufficient for the distribution of the Preferred Preference Amount in full to all of the holders of Preferred Shares for all of the Preferred Shares, all of the Distributable Proceeds shall be distributed among the holders of Preferred Shares on a pro rata and pari passu basis. |

| 7.1.2. | After payment in full of the Preferred Preference Amount, the remaining Distributable Proceeds available for distribution, if any, shall be distributed pro-rata and pari passu among all the holders of Ordinary Shares (on a non-converted basis), provided however, that if a conversion of a Preferred Share into Ordinary Share immediately prior to the applicable distribution of the Distributable Proceeds to the holder of such Preferred Share pursuant to Article 7.1.1 would result in the holder of such Preferred Share receiving in respect of such converted Preferred Share a greater payment than the Preferred Preference Amount applicable to such Preferred Share, then the holder of such Preferred Share shall be entitled to participate in such distribution together with the holders of the Ordinary Shares, on a pro-rata, as converted basis, without the need to actually convert such Preferred Share (and in such event, shall not be entitled to the Preferred Preference Amount with respect to such Preferred Share). |

| 7.1.3. | Allocation of Contingent Payments. In the event of a Distribution Event, if any portion of the consideration payable to the Shareholders is payable to the Shareholders subject to Contingent Consideration Mechanism, then the distribution of all Distributable Proceeds derived from such Distribution Event shall be as follows, and the agreement relating to the Distribution Event (e.g. a merger, share purchase or similar agreement) shall provide that (a) the portion of such consideration that is not subject to any Contingent Consideration Mechanism (the “Initial Consideration”) shall be distributed among the Shareholders in accordance with Article 7.1 as if the Initial Consideration was the only consideration payable in connection with such Distribution Event and (b) any additional consideration which becomes payable to the Shareholders pursuant to the Contingent Consideration Mechanism shall be allocated among the Shareholders in accordance with this Article 7.1 after taking into account the previous payment of the Initial Consideration as part of the same transaction in order to achieve the allocation which would have been made had such additional consideration been paid in its entirety at the closing of such Distribution Event. |

| 7.1.4. | Notwithstanding anything to the contrary in these Articles (including Article 7.1A), the proceeds of any Realization Event or Distribution Event, shall be allocated and distributed among the Shareholders in accordance with Article 7.1, whether by Dividend or otherwise, such that at the closing of the transaction at which the Company is deemed for purposes of this Article 7.1 to be wound up, the holders of the Preferred Shares shall be paid in cash, securities or a combination thereof, an amount equal to the amount per share which would be payable to the holders of Preferred Shares, respectively, pursuant to Article 7.1, if all consideration being received by the Company and the holders of the Company’s shares in connection with such transaction were being distributed in a liquidation of the Company. |

| 7.1A | Dividends. |

The Company shall not declare, pay or set aside any Dividends on shares of any other class or series of share capital unless (in addition to the obtaining of any consents required elsewhere in the Articles) the holders of the Preferred Shares then outstanding shall simultaneously receive, a dividend on each outstanding Preferred Share, on As Converted Basis, in each case calculated on the record date for determination of holders entitled to receive such dividend.

| 7.2. | Conversion. |

The Preferred Shareholders shall have conversion rights as follows (the “Conversion Rights”):

| 7.2.1. | Right to Convert. |

| (i) | Each Preferred Share shall be convertible, at the option of the holder of such share, at any time after the respective Original Issue Date of such share, into such number of fully paid and non-assessable Ordinary Shares of the Company as is determined by dividing the applicable Original Issue Price for such share by the Conversion Price (as defined below) applicable for such share at the time in effect for such share. |

| (ii) | Each Preferred Share shall automatically be converted into such number of fully paid and non-assessable Ordinary Shares as is determined by dividing the applicable Original Issue Price for such share by the Conversion Price applicable for such share at the time in effect for such share, immediately: (a) upon the consummation of a QIPO; or (b) at the election by vote or written consent of the holders of at least 60% of the voting power of the then issued and outstanding Preferred Shares voting together as a single class (calculated on an As Converted Basis); or (c) in connection with a Financing Recapitalization Event, at the election by vote or written consent of the Preferred Shares Majority. “Financing Recapitalization Event” means any event of share combination or subdivision, share split, share dividend, bonus shares or any other reclassification, reorganization or recapitalization of all (or less than all, in the context of different treatment as a result of participation (or lack thereof) in a pay-to-play or similar transaction; provided that the affected shareholders were first given the opportunity to participate in such pay-to-play or similar transaction on substantially the same terms as the unaffected shareholders) the Company’s share capital and the like which is done as part of (i) an equity financing of not less than $25,000,000; and (ii) which financing is approved by the Board of Directors. Notwithstanding anything herein to the contrary, other than pursuant to Sub-Article 7.2.1(ii)(a) above, the Preferred D Shares shall not be automatically converted into Ordinary Shares without the prior written consent of a majority of the Preferred D Shareholders, provided, that with respect to a conversion pursuant to Sub-Article 7.2.1(ii)(c) or in connection with a Realization Event, such consent of the Preferred D Shareholders should be required only to the extent that the holders of the Preferred D Shares would be adversely affected as a result thereof in a manner different than the holders of the Preferred Shares (other than the Preferred D Shares), it being understood that to the extent that the holders of Preferred C Shares are also economically adversely affected as a result (with respect to the Preferred C Shares) of such a conversion, such conversion shall be deemed to result in the Preferred D Shareholders being adversely affected as a result thereof in the same manner as the holders of the Preferred Shares (other than the Preferred D Shares). |

| 7.2.2. | Mechanics of Conversion. |

Before any Preferred Shareholder shall be entitled to convert any Preferred Share into Ordinary Shares, such Shareholder shall give written notice by registered mail, postage prepaid, to the Company of the election to convert the same. The Company shall, as soon as practicable thereafter, issue and deliver to such Shareholder a certificate or certificates for the number of

Ordinary Shares to which such Preferred Shareholder shall be entitled as aforesaid. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the Preferred Shares to be converted, and the Person or Persons entitled to receive the Ordinary Shares issuable upon such conversion shall be treated for all purposes as the record holder of such Ordinary Shares as of such date. In the case of conversion pursuant to Article 7.2.1 (ii), such conversion shall be deemed to have been made immediately prior to the close of business on the date of the occurrence of any of the events listed in Article 7.2.1(ii) and subject to the actual occurrence of such event, and the Person or Persons entitled to receive the Ordinary Shares issuable upon such conversion shall be treated for all purposes as the record holder of such Ordinary Shares as of such date; provided that the event does actually occur.

| (i) | The initial Conversion Price for the Preferred Shares shall be the Original Purchase Price for each such share (subject to any adjustments under this Article 7.2.2, the “Conversion Price”). If the Company subdivides or combines its Ordinary Shares, the Conversion Price shall be proportionately reduced, in case of subdivision of shares, as at the effective date of such subdivision, or shall be proportionately increased, in the case of combination of shares, as the effective date of such combination. |

| (ii) | Broad Based Weighted Average Adjustment: |

(A) Until an IPO, upon each issuance (or deemed issuance, as described below) by the Company of any New Securities at a price per share less than the applicable Conversion Price then in effect with respect to a Preferred Share, the Conversion Price then in effect with respect to such share will be reduced to a price equal to a fraction (i) the numerator of which is the sum of (A) the total number of Ordinary Shares outstanding prior to the issuance of such New Securities (calculated on an As Converted Basis and on a Fully-Diluted Basis) multiplied by the applicable Conversion Price of such Preferred Share, as the case may be, in effect prior to the issuance of such New Securities plus (B) the total amount of the consideration received and/or to be received by the Company for such New Securities and (ii) the denominator of which is the sum of the total number of Ordinary Shares outstanding immediately prior to the issuance of such New Securities (calculated on an As Converted Basis and on a Fully-Diluted Basis) plus the number of such New Securities issued (i.e., a “broad based weighted average” adjustment).

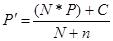

The formula can be expressed algebraically as follows:

where:

P = Conversion Price of the applicable Preferred Share prior to the dilutive issuance.

P’ = New Conversion Price of the applicable Preferred Share after the dilutive issuance.

N = Total number of Ordinary Shares (calculated on an As Converted Basis and on a Fully-Diluted Basis) outstanding immediately prior to the dilutive issuance of New Securities.

n = Number of New Securities issued in the dilutive issuance.

C = Total amount of consideration received by the Company for the New Securities issued in the dilutive issuance.

(B) No adjustments of a Conversion Price shall be made in an amount less than one Agura (NIS 0.01) per share. No adjustment of a Conversion Price shall be made if it has the effect of increasing the Conversion Price beyond the applicable Conversion Price in effect for such series of Preferred Shares immediately prior to such adjustment.

(C) The consideration for the issuance of New Securities shall be deemed to be the amount of cash received therefore after giving effect to any discounts or commissions paid or incurred by the Company for any underwriting or otherwise in connection with the issuance and sale thereof, and shall not include consideration other than cash.

(D) In the case of the issuance of options to purchase or rights to subscribe for Ordinary Shares, or securities, which by their terms are convertible into or exchangeable for Ordinary Shares or options to purchase or rights to subscribe for such convertible or exchangeable securities, other than options to purchase Ordinary Shares granted to the Company’s employees, directors, consultants or officers pursuant to a share incentive plan approved by the Board, the aggregate maximum number of Ordinary Shares deliverable upon exercise (assuming the satisfaction of any conditions to exercisability, including without limitation, the passage of time, but without taking into account potential anti-dilution adjustments) of such options to purchase or rights to subscribe for Ordinary Shares, or upon the exchange or conversion of such security, shall be deemed to have been issued at the time of the issuance of such options, rights or securities, at a consideration equal to the consideration (determined in the manner provided herein), received by the Company upon the issuance of such options, rights or securities plus any additional consideration payable to the Company pursuant to the term of such options, rights or securities (without taking into account potential anti-dilution adjustments) for the Ordinary Shares covered thereby; provided, however, that if any options as to which an adjustment to the Conversion Price has been made pursuant to this Article 7.2 (i)(D) expire without having been exercised, then the Conversion Price shall be readjusted as if such options had not been issued (without any effect, however, on adjustments to the Conversion Price as a result of other events described in this Article 7.2).

(E) For the purpose of the calculations hereof, the consideration for any New Securities shall be taken into account at the U.S. Dollar equivalent thereof, on the day such New Securities are issued or deemed to be issued pursuant hereto.

| (iii) | If the Company at any time pays a dividend, with respect to its Ordinary Shares only, payable in New Securities of Ordinary Shares or other securities or rights convertible into, or entitling the holder thereof to receive directly or indirectly, additional Ordinary Shares, without any comparable payment or distribution to the holders of Preferred Shares (hereinafter referred to as “Ordinary Shares Equivalents”), then the Conversion Price shall be adjusted as at the date of such payment to that price determined by multiplying the applicable Conversion Price in effect immediately prior to such payment by a fraction, the numerator of which shall be the total number of Ordinary Shares outstanding and those issuable with respect to Ordinary Shares |

| Equivalents prior to the payment of such dividend, and the denominator of which shall be the total number of shares of Ordinary Shares outstanding and those issuable with respect to such Ordinary Shares Equivalents immediately after the payment of such dividend (plus, in the event that the Company paid cash for fractional shares, the number of additional shares which would have been outstanding had the Company issued fractional shares in connection with such dividend). |

| (iv) | In the event the Company declares a distribution payable in securities of other persons, evidences of indebtedness issued by the Company or other persons, assets (excluding cash dividends) or options or rights not referred to in this Article 7.2, then, in each such case, the holders of the Preferred Shares shall be entitled to receive such distribution, in respect of their holdings on an as-converted basis as of the record date for such distribution. |

| (v) | If at any time or from time to time there shall be a Recapitalization Event (other than a subdivision, combination or merger or sale of assets transaction provided for elsewhere in this Article 7.2), provision shall be made so that the Preferred Shareholders shall thereafter be entitled to receive upon conversion of the Preferred Shares the number of Ordinary Shares or other securities or property of the Company or otherwise, to which a holder of Ordinary Shares deliverable upon conversion of the Preferred Shares would have been entitled immediately prior to such Recapitalization Event. In any such case, appropriate adjustment shall be made in the application of the provisions of this Article 7.2 with respect to the rights of the Preferred Shareholders after the recapitalization to the end that the provisions of this Article 7.2 (including adjustment of the Conversion Price then in effect and the number of shares issuable upon conversion of the Preferred Shares) shall be applicable after that event as nearly equivalent as may be practicable. |

| (vi) | No fractional shares shall be issued upon conversion of the Preferred Shares, and the aggregate number of Ordinary Shares to be issued shall be rounded down to the nearest whole share. |

| (vii) | Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this Article 7.2 the Company, at its expense, shall promptly compute such adjustment or readjustment in accordance with the terms hereof and prepare and furnish to each holder of Preferred Shares a certificate setting forth each adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Company shall furnish or cause to be furnished to such holder a table setting forth (A) such adjustment or readjustment, (B) the Conversion Price at the time in effect, and (C) the number of shares of Ordinary Shares and the amount, if any, of other property which at the time would be received upon the conversion of a Preferred Share. |

| (viii) | In the event of any taking by the Company of a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend (including a cash dividend) or other distribution, any right to subscribe for, purchase or otherwise acquire any shares of any class or any other securities or property, or to receive any other right, the Company shall notify each holder of Preferred Shares, at least fourteen (14) days prior to the date specified therein, of the date on which any such record is to be taken for the purpose of such dividend, distribution or right, and the amount and character of such dividend, distribution or right. |

| (ix) | The Company shall at all times reserve and keep available out of its authorized but unissued Ordinary Shares, solely for the purpose of effecting the conversion of the Preferred Shares, such number of its Ordinary Shares as shall from time to time be sufficient to effect the conversion of all outstanding Preferred Shares; and if at any time the number of authorized but unissued Ordinary Shares shall not be sufficient to effect the conversion of all then outstanding Preferred Shares, then in addition to such other remedies as shall be available to the holders of such Preferred Shares the Company will take such corporate action as may be necessary to increase its authorized but unissued Ordinary Shares to such number of shares as shall be sufficient for such purposes. |

| (x) | The Company shall pay any and all issue and other taxes (other than income or capital gain taxes) that may be payable in respect of any issue or delivery of Ordinary Shares on conversion of Preferred Shares pursuant hereto. For clarification purposes, the Company shall not be obligated to pay any transfer taxes resulting from any transfer of securities requested by any holder in connection with any such conversion. |

| 7.3. | Voting Rights |

| (i) | Except as specifically provided otherwise in these Articles, to the fullest extent permitted by law, the Preferred D Shares, the Preferred C Shares, the Preferred B Shares, the Preferred A-1 Shares and the Preferred A Shares shall vote together as one class. |

| (ii) | Except as specifically provided otherwise in these Articles, to the fullest extent permitted by law, the Preferred Shares shall vote together with the other shares of the Company, and not as a separate class or as separate classes, in all Shareholders meetings, except as required herein or by law, with each Preferred Share having votes in such number as if then converted into Ordinary Shares on an As Converted Basis. |

SHARES; PRE-EMPTIVE RIGHTS

| 8. | Subject to the provisions of these Articles, the unissued shares of the Company shall be at the disposal of the Board who may offer, allot, grant options over or otherwise dispose of shares to such Persons, at such times and upon such terms and conditions as the Company may by resolution of Board determine. |

| 9. | Subject to the provisions of these Articles, the Company may issue shares having the same rights as the existing shares, or having preferred or deferred rights, or rights of redemption, or restricted rights, or any other special right in respect of dividend distributions, voting, appointment or dismissal of directors, return of share capital, distribution of Company’s property, or otherwise, all as determined by the Company from time to time. |

| 10. | Subject to the provisions of the Companies Law and these Articles, the Company may issue redeemable shares and redeem them. |

| 11. | Until the consummation of an IPO, each Shareholder (including his or its Permitted Transferees), (i) as long as it holds, together with its Permitted Transferees, at least three and a half percent (3.5%) of the issued and outstanding share capital of the Company on an As Converted Basis and on a Fully Diluted Basis, OR (ii) (A) as long as it holds, together with its Permitted Transferees, at least two percent (2%) of the issued and outstanding share capital of the Company on an As Converted Basis and on a Fully Diluted Basis, AND (B) which has participated in primary investments in the Company in an aggregate amount of at least US$ 17,000,000 (the “Eligible Shareholder”), will have a preemptive right under the following terms: |

| 11.1. | If the Company proposes to issue New Securities, it shall give each Eligible Shareholder a written notice thereof (the “Rights Notice”) of its intention to do so, describing the New Securities, the price and the general terms upon which the Company proposes to issue them. Each Eligible Shareholder shall have fourteen (14) days from delivery of the Rights Notice to agree to purchase all or any part of its Pro-Rata Share (as defined below) of such New Securities, which will enable it to maintain its shareholding percentage ownership of the issued and outstanding share capital of the Company for the price and upon the general terms specified in the Rights Notice, by giving written notice to the Company setting forth the quantity of New Securities which the Eligible Shareholder wishes to purchase. There shall not be over allotment rights. |

For the purpose of this Article 11, the term “Pro Rata Share” means the ratio of the number of the Ordinary Shares held by each Eligible Shareholder as of the date of the Rights Notice, on an As Converted Basis, to the sum of the total Ordinary Shares of the Company, on an As Converted Basis, outstanding immediately prior to the issuance of the New Securities.

| 11.2. | If the Eligible Shareholders did not exercise in full their Pre-Emptive Right within the period specified in Article 11.1 above, then the Company shall have one hundred and twenty (120) days after delivery of the Rights Notice to sell the New Securities not purchased by Eligible Shareholders at a price and upon general terms no more favorable to the purchasers thereof than specified in the Rights Notice. If the Company has not sold such New Securities within said one hundred and twenty (120) day period, the Company shall not thereafter issue or sell any New Securities without first offering such securities to the Eligible Shareholders in the manner provided above. |

| 11.3. | No Preemptive Right under Companies Law. The right of first offer or preemptive right under Section 290 of the Companies Law shall not apply herein and shall not be in force and effect. |

| 12. | Subject to the provisions of these Articles (including, without limitation, Article 11), the Company may issue from time to time options, warrants, other rights to subscribe for instruments convertible into, or exchangeable for shares of the Company, the terms and conditions of which shall be determined by the Board in accordance with these Articles. |

| 13. | The Company shall not be bound to recognize any equitable, contingent, future or partial interest in any share or any other right whatsoever in any share other than an absolute right to the entirety thereof in the registered holder. |

| 14. | If two or more Persons are registered as joint holders of a share: |

| 14.1. | They shall be jointly and severally liable for any calls or any other liability with respect to such share. However, with respect to voting, powers of attorney and furnishing of notices, the one registered first in the Register shall be deemed to be the sole owner of the share unless all the registered joint holders notify the Company in writing to treat another one of them as the sole owner of the share. |

| 14.2. | Each one of them shall be permitted to give receipts binding all the joint holders for Dividends or other moneys or property received from the Company in connection with the share and the Company shall be permitted to pay all the dividend or other moneys or property due with respect to the share to one or more of the joint holders, as it shall choose. |

| 15. | Share certificates shall bear the signatures of one (1) director, or of any other person or persons authorized thereto by the Board. Each Shareholder shall be entitled to one numbered certificate for all the shares of any series registered in his or its name, and if the Board so approves, to several certificates, each for one or more of such shares. Each certificate shall specify the serial numbers of the shares represented thereby. A share certificate registered in the names of two or more persons shall be delivered to the person first named in the Register. If a share certificate is defaced, lost or destroyed, it may be replaced, upon payment of such fee, and upon the furnishing of such evidence of ownership and such indemnity, as the Board may deem fit. |

LIEN

| 16. | The Company shall have a lien and first pledge on every share that was not paid up in full, in respect of money due to the Company on calls for payment or payable at fixed times, whether or not presently payable, or the fulfillment and performance of the obligations and commitments to which the Company is entitled in respect of the share. The lien on a share shall also apply to Dividends and other distributions payable on it. The Board may exempt any share, in full or in part, temporarily or permanently, from the provisions of this Article 16. |

| 17. | The Company may sell any share on which it has a lien in any manner the Board sees fit, but such share shall not be sold before the date of payment of the amount in respect of which the lien exists, or the date of fulfillment and performance of the obligations and commitments in consideration of which the lien exists, has arrived, and until fourteen (14) days have passed after written notice has been given to the registered holder at that time of the share, or to whoever is entitled to it upon the registered owner’s death or bankruptcy, demanding payment of the amount against which the lien exists, or the fulfillment and performance of the obligations and commitments in consideration of which the lien exists, and such payment or fulfillment and performance have not been made. |

| 18. | The net proceeds of the sale shall be applied in payment of the amount due to the Company or the fulfillment and performance of the obligations and commitments as aforesaid in the preceding Article 17, and the remainder, if any, shall be paid to whoever is entitled to the share on the day of the sale, subject to a lien on amounts the date of payment of which has not yet arrived, similar to the lien on the share before its sale. |

| 19. | After the execution of a sale of pledged shares as aforesaid, the Board shall be permitted to sign or to appoint someone to sign a deed of transfer of the sold shares and to register the purchaser’s name in the Register as the owner of the shares so sold, and it shall not be the obligation of the buyer to supervise the application of the purchase price nor will his right in the shares be affected by any fault or error in the procedure of sale. The sole remedy of one who has been aggrieved by the sale shall be in damages only and against the Company exclusively. |

CALLS FOR PAYMENT

| 20. | With respect to shares not fully paid for according to their terms of issuance, a Shareholder, whether he is the sole holder of shares or holds the shares together with another Person, shall not be entitled to receive Dividends nor to any other right a Shareholder has unless he has paid all the calls by the Company which shall have been made from time to time. |

| 21. | The Board may make calls for payment from Shareholders of the amount not yet paid up on their shares as the Board shall see fit, provided that the Company gives the Shareholders prior notice of at least fourteen (14) days on every call and that the date for payment set forth in such notice be not less than one month after the last call for payment. Each Shareholder shall pay the amount called to the Company on the date and at the place prescribed in the Company’s notice. |

| 22. | The joint holders of a share shall be jointly and severally liable to pay the calls for payment on such share in full. |

| 23. | If the amount called is not paid by the prescribed date, the Person from whom it is due shall be liable to pay such index linkage differentials and interest as the Board shall determine, from the date on which payment was prescribed until the day on which it is paid, but the Board may forego the payment of such linkage differentials or interest, in whole or in part. |

| 24. | Any amount that, according to the conditions of issuance of a share, must be paid at the time of issuance or at a fixed date, whether on account of the par value of the share or premium, shall be deemed for the purposes of these Articles to be a call for payment that was duly made. In the event of non-payment of such amount all the provisions of these Articles shall apply in respect of such amount as if a proper call for its payment has been made and an appropriate notice thereof given. |

| 25. | At the time of issuance of shares the Board may make arrangements that differentiate between Shareholders, in respect of the amounts of calls for payment, their dates of payment or the rate of interest. |

| 26. | The Board may, if it thinks fit, accept from any Shareholder for his shares any amount of money the payment of which has not yet been called and paid, and to pay him (i) interest for that advance until the day on which payment of that amount would have been due had he not paid it in advance, at a rate agreed between the Company and such Shareholder, and (ii) any Dividends that may be paid for that part of the shares for which the Shareholder has paid in advance. |

FORFEITURE OF SHARES

| 27. | If a Shareholder fails to pay any call or installment of a call on the day appointed for payment thereof, the Board may, at any time thereafter during such time as any part of such call or installment remains unpaid, serve a notice on him requiring payment of so much of the call or installment as is unpaid, together with any interest which may have accrued and any expenses that were incurred as a result of such non-payment. |

| 28. | The notice shall specify a date not less than seven (7) days from the date of the notice, on or before which the payment of the call or installment or part thereof is to be made together with interest and any expenses incurred as a result of such non-payment. The notice shall also state the place where the payment is to be made and that in the event of non-payment at or before the time appointed, the share in respect of which the call was made will be liable to forfeiture. |

| 29. | If the requirements of any such notice as aforesaid are not complied with, any share in respect of which the notice has been given may at any time thereafter, before the payment required by the notice has been made, be forfeited by a resolution of the Board to that effect. The forfeiture shall apply to those Dividends that were declared but not yet distributed with respect to the forfeited shares. |

| 30. | A share so forfeited shall be deemed to be the property of the Company and can be sold or otherwise disposed of, on such terms and in such manner as the Board thinks fit. At any time before a sale or disposition the forfeiture may be canceled on such terms as the Board thinks fit. |

| 31. | A Person whose shares have been forfeited shall cease to be a Shareholder in respect of the forfeited shares, but shall notwithstanding remain liable to pay to the Company all moneys which, at the date of forfeiture, were presently payable by him to the Company in respect of the shares, but his liability shall cease if and when the Company receives payment in full of the nominal amount of the shares. |

| 32. | The forfeiture of a share shall cause, at the time of forfeiture, the cancellation of all rights in the Company and of any claim or demand against the Company with respect to that share, and of other rights and obligations between the share owner and the Company accompanying the share, except for those rights and obligations which these Articles exclude from such a cancellation or which the Law imposes upon former Shareholders. |

| 33. | The Person to whom the share is sold or disposed of shall be registered as the holder of the share and shall not be bound to see to the application of the purchase money, if any, nor shall his title to the share be affected by any irregularity or invalidity in the proceedings in reference to the forfeiture, sale or disposal of the share. |

| 34. | The provisions of these Articles as to forfeiture shall apply in the case of non-payment of any sum which, by the terms of issue of a share, becomes payable at a fixed time, whether on account of the par value of the share or by way of premium, as if the same had been payable by virtue of a call duly made and notified. |

TRANSFER OF SHARES—GENERAL

| 35. | Any transfer or sale of the Company’s shares shall be in compliance with the provisions of Article 45 below. |

| 36. | Any transfer or sale of the Company’s shares shall be conditioned upon an undertaking in writing by the transferee to assume and be bound by all obligations of the transferor under any instrument and agreement involving the transferor and the Company and applicable to such transferred shares, signed by the transferee, which will be delivered to the Company prior to and as a condition to such transfer. |

| 37. | No transfer or sale of shares shall be registered unless the Company receives a deed of transfer or other proper instrument of transfer (in form and substance satisfactory to the Board or the corporate secretary of the Company), together with the share certificate(s) and such other evidence of title as the Board or the corporate secretary of the Company may reasonably require. Until the transferee has been registered in the Register in respect of the shares so transferred, the Company may continue to regard the transferor as the owner thereof. |

| 38. | Upon the death of a Shareholder, the Company shall recognize the custodian or administrator of the estate or executor of the will, and in the absence of such, the lawful heirs of the Shareholder, as the only holders of the right for the shares of the deceased Shareholder, after receipt of evidence to the entitlement thereto, as determined by the Board. |

| 39. | The Company may recognize the receiver or liquidator of any corporate Shareholder in liquidation or dissolution, or the receiver or trustee in bankruptcy of any Shareholder, as being entitled to the shares registered in the name of such Shareholder, after receipt of evidence to the entitlement thereto, as determined by the Board. |

| 40. | A person acquiring a right in shares as a result of being a custodian, administrator of the estate, executor of a will or the heir of a Shareholder, or a receiver, liquidator or a trustee in a bankruptcy of a Shareholder or according to another provision of Law, is entitled, after providing evidence of his right to the satisfaction of the Board, to be registered as the Shareholder or to transfer such shares to another person, subject to the provisions of this Article 40. |

| 41. | Upon the death of a Shareholder, the remaining partners, in the event that the deceased was a partner in a share, or the administrators or executors or heirs of the deceased, in the event the deceased was the sole holder of the share or was the only one of the joint holders of the share to remain alive, shall be recognized by the Company as the sole holders of any title to the shares of the deceased. However, nothing aforesaid shall release the estate of a joint holder of a share from any obligation to the Company with respect to the share that he held in partnership. |

| 42. | Any Person becoming entitled to a share as a consequence of the death or bankruptcy or liquidation of a Shareholder shall, upon such evidence being produced as may from time to time be required by the Board, have the right either to be registered as a Shareholder in respect of the share, or, instead of being registered himself, to transfer such share to another Person, in either instance subject to the Board’s power hereunder to refuse or delay registration as they would have been entitled to do if the deceased or the bankrupt had transferred his share before his death or before his bankruptcy, and subject to all other provisions hereof relating to transfers of shares. |

| 43. | A Person becoming entitled to a share because of the death of a Shareholder shall be entitled to receive, and to give receipts for, Dividends or other payments paid or distributions made, with respect to the share, but shall not be entitled to receive notices with respect to General Meetings or to participate or vote therein with respect to that share, or to use any other right of a Shareholder, until he has been registered as a Shareholder with respect to that share. |

FOUNDERS’ NO SALE

| 44. | Notwithstanding anything to the contrary in these Articles, the Founders shall not make any Transfer of all or any of the shares of the Company held by the Founders, of any class or series, as of the date of these Articles, and any shares issued upon exercise of any options, or issuable upon exercise of any option, unless the Preferred Shares Majority have given their written consent for any such Transfer, except with respect to a Transfer by such Founder to any of his Permitted Transferees or Transfer by such Founder of up to fifteen percent (15%) of the shares held by him as of May 17, 2012 (the “Permitted Amount”), provided that any such Transfer, shall be subject to the right of first refusal set forth in Article 45 below, and further provided, that such Permitted Amount shall be in addition to Ordinary Shares sold under that certain Secondary Share Purchase Agreement, dated June 12, 2014, under that certain Secondary Share Purchase Agreement, dated January 5, 2016, under that certain Secondary Share Transfer Agreement, dated January 11, 2017, and under that certain Secondary Share Purchase Agreement, dated September 17, 2018. These limitations as set forth in this Article 44 shall expire upon an IPO or, with respect to each Founder—upon termination of his employment by the Company (otherwise than for Cause) or removal from the Board (expect if such removal is a result of the Founder voluntarily resigning from the Board, his death or “Disability” or upon termination of the Founder for “Good Reason”. “Disability” means the physical or mental |

| illness or injury as a result of which Founder remains unable to perform his duties for a period of three (3) successive months. Disability and termination therefore shall occur upon the end of such 3-month period, without need for any advance notice on the part of the Company or Founder, other than any advance notice mandated according to applicable law. “Good Reason” means the occurrence, whether or not after a Realization Event, of any of the events or conditions described below: (i) a change in the Founder’s status, title, position or responsibilities (including reporting responsibilities) which represents a material adverse change from his status, title, position or responsibilities as in effect immediately prior to such change; the assignment to the Founder of any duties or responsibilities which are inconsistent with his status, title, position or responsibilities as in effect immediately prior to such change; or any removal of the Founder from any of such offices or positions (except in those cases where a change is either at the request of the Founder, in connection with a general corporate restructuring of officer responsibilities, or a result of the promotion of the Founder); (ii) the failure by the Company to provide the Founder with benefits, in the aggregate, at least equal (in terms of benefit levels) to those provided for under each employee benefit plan, program and practice in which the Founder was participating at any time prior to such failure (except in connection with a general reduction of salary and benefits to all employees); or (iii) any material breach by the Company of any provision of this Agreement which is not cured within thirty (30) days after the receipt of written notice by the Company of a description of the breach. “Cause” means: (i) the Founder’s breach of trust or fiduciary duties, including but not limited to theft, embezzlement, self-dealing, or breach of the provisions of the confidentiality, proprietary and invention assignment agreement, or his obligation to not to compete pursuant to his employment agreement; (ii) any willful failure to perform or failure to perform competently any of the Founder’s fundamental functions or duties hereunder (including violation of the Company’s policies or procedures), or other breach of his employment agreement, which, if capable of cure, was not cured within seven (7) days of receipt by the Founder of written notice thereof; (iii) an event in which the Founder deliberately or gross negligently causes harm to the Company’s business affairs or reputation; (iv) conviction of, or entry of any plea of guilty or nolo contendere by the Founder of any felony or other lesser crime that would require removal from his or her position at the Company (e.g., any alcohol or drug related misdemeanor); (v) willful misconduct; or (vi) any other cause justifying termination or dismissal without severance payment under applicable law. |

RIGHT OF FIRST REFUSAL; CO SALE

| 45. | Without derogating from the provisions of these Articles, each Eligible Shareholder (the “ROFR Offeree”) shall have a right of first refusal with respect to any Transfer by any holder of Shares in the Company, except with respect to a Transfer by such holder to its Permitted Transferees, as follows: |

| (a) | Any holder of Shares proposing to transfer all or any of his Shares (the “Offeror”) to a Person who is not a Permitted Transferee of such Offeror, shall first send to the Company a written notice detailing the number of Shares intended to be transferred or sold (the “Offered Shares”), the price and the other terms of the Transfer (the “Offer”) after which the Company shall deliver in a timely manner (but in any event within no more than seven (7) days) to the ROFR Offeree(s) a written notice describing the Offer. The Offeree(s) shall have a right to purchase such number of the Offered Shares as it may elect (subject to the provisions of |

| Article 45(b)) by sending the Offeror a written notice (“Notice of Reply”) within a period of 15 (fifteen) days after receipt of Offerors’ notice (the “Offer Period”), and under the terms of the Offer. Each of the ROFR Offerees may accept such Offer as aforesaid in respect of all or part of the Offered Shares (collectively, the “Accepting Offerees”). If a ROFR Offeree does not respond in the abovementioned manner within the Offer Period, such ROFR Offeree shall be regarded as having given a notice of refusal to purchase the Offered Shares or any part thereof. |

| (b) | In the event that the Accepting Offerees, in the aggregate, are in respect of all of, or more than, the Offered Shares, then the ROFR Offerees shall acquire the Offered Shares, on the terms aforementioned, in proportion to their respective holdings among themselves, (calculated on an As Converted Basis), provided that no Accepting Offeree shall be entitled or be forced to acquire under the provisions of this Article 45 more than the number of Offered Shares initially accepted by such Accepting Offeree, and upon the allocation to him/her/it of the full number of Offered Shares so accepted, such Accepting Offeree shall be disregarded in any subsequent computations and allocations hereunder. Any Offered Shares remaining after the computation of such respective entitlements shall be re-allocated among the remaining Accepting Offerees (other than those to be disregarded as aforesaid), in the same manner, until one hundred percent (100%) of the Offered Shares have been allocated as aforesaid. |

In such case the Accepting Offerees shall execute an agreement for the sale and purchase of all the Offered Shares at the price and conditions specified in the Offer, and the Offeror shall transfer all the Offered Shares to the Accepting Offeree(s) within 15 days after the expiration of the Offer Period, against the payment of the price, or, if the Offer states other times for delivery and/or other payment terms, in accordance with the conditions of the Offer.

| (c) | In the event that the Acceptances, in the aggregate, are in respect of less than the full number of Offered Shares, then the Accepting Offerees shall not be entitled to acquire the Offered Shares, and the Offeror, at the expiration of the aforementioned fifteen (15) day period, shall be entitled to transfer all (but not less than all) of the Offered Shares to the proposed transferee(s) identified in the Offer, provided, however, that in no event shall the Offeror transfer any of the Offered Shares to any transferee other than such Accepting Offerees or such proposed transferee(s) or transfer the same on terms more favorable to the buyer(s) than those stated in the Offer, and provided further that any of the Offered Shares not transferred within one hundred and twenty (120) days after the expiration of such fifteen (15) day period, shall again be subject to the provisions of this Article 45. |

| (d) | This Article 45 shall also apply to the sale of Shares by a receiver, liquidator, trustee in bankruptcy, administrator of an estate, executor of a will, etc. |

| 45A. | Until an IPO, unless the right of first refusal set forth in Article 45 is exercised in full by the Eligible Shareholders, and in lieu thereof, each Eligible Shareholder shall have the right, during the Offer Period, to participate in sale of Offered Shares by any Offeror and be entitled, upon written notice to the Offeror (the “Participation Notice”) within the Offer Period, to sell to the third party |

| purchaser up to such number of shares of the Company owned by such Eligible Shareholder determined by multiplying the total number of Offered Shares by a fraction the numerator of which is the number of shares of the Company held by such Eligible Shareholder (on an As Converted Basis) and the denominator of which is the aggregate shares of the Company held by all issued and outstanding shares of the Company’s share capital (calculated on As Converted Basis). The Participation Notice shall indicate the number of shares that such Eligible Shareholder wishes to transfer to the third party purchaser. If such Eligible Shareholder exercises such right within the Offer Period, the number of Offered Shares that an Offeror may sell pursuant to an Offer shall be correspondingly reduced. The sale of the Offeror shall be conditioned upon the undertaking by the purchaser to purchase from the Eligible Shareholder the number of shares indicated by such Eligible Shareholder in the Participation Notice. |

| 45B. | Notwithstanding any provisions of these Article 45 and Article 45B Transfers of shares: (i) effected pursuant to the bring-along mechanism as provided under Article 46 below; (ii) to Permitted Transferees, are exempt from all restrictions on transfer specified in Article 45 and Article 45B; provided, however, that with respect to Permitted Transferee, such transfer shall be so exempted only if as a condition precedent thereto such Permitted Transferee undertake in writing towards the Company and the Shareholders to be bound by all of the undertakings and obligations hereunder; and in the case of a transfer to a wholly owned company, provided, further, that such Permitted Transferee shall remain a Permitted Transferee of the transferor at all times it holds shares in the Company. |

STANDSTILL

| 45C. | Any other provision of these Articles to the contrary notwithstanding, except in connection with a Realization Event, and unless otherwise approved by the Board at its sole and absolute discretion (the “Board Approval”), (A) any Shareholder and any Affiliate or Permitted Transferee thereof, shall not be entitled to Transfer onto its name and to its holding and ownership any Securities from the Company or any holder of such securities (e.g. any Shareholder, option holder, warrant holder etc.), if as a result of such Transfer such Shareholder shall hold, together with its Affiliates or Permitted Transferees (beneficially or of record) (i) twenty percent (20%) or more of the Company’s share capital or the voting power represented thereby, or (ii) fifty percent (50%) or more of the shares of any class of shares of the Company or the voting power represented thereby; (B) each of the Company’s Shareholders shall not Transfer to another Shareholder any Affiliate or Permitted Transferee thereof, any Securities held by such shareholder, if as a result of such Transfer such Shareholder shall hold, together with its Affiliates or Permitted Transferees (beneficially or of record) (i) twenty percent (20%) or more of the Company’s share capital or the voting power represented thereby, or (ii) fifty percent (50%) or more of the shares of any class of shares of the Company or the voting power represented thereby; and (C) the Company shall not issue or sell to a Shareholder or any Affiliate or Permitted Transferee thereof, any Securities of the Company, if as a result of such issuance or sale such Shareholder shall hold, together with its Affiliates or Permitted Transferees (beneficially or of record) (i) twenty percent (20%) or more of the Company’s share capital or the voting power represented thereby, or (ii) fifty percent (50%) or more of the shares of any class of shares of the Company or the voting power represented thereby. Such Board Approval (if and to the extent granted) shall specify the terms and conditions pursuant to which a Shareholder may be allowed to Transfer, purchase or otherwise be issued Securities onto his name. For the avoidance of doubt, such Board Approval shall be required for any additional proposed Transfer of Securities to a Shareholder, even if such Shareholder received a Board Approval with respect to the prior Transfer. |

BRING ALONG

| 46. | Subject to Article 91.3, if prior to an IPO, (i) the Preferred Shares Majority; (ii) the Board; and (iii) the holders of at least sixty-six percent (66%) of the Company’s issued and outstanding share capital (on an As Converted Basis) (collectively, the “Sale Requisite Majority”) approve an M&A Event in writing, specifying that this Article 46 shall apply to such transaction (the “Sale Transaction”), then the other shareholders of the Company (such other shareholders, collectively, the “Remaining Holders”) shall be required to participate in such sale on the same terms and conditions; provided however, that: |

| 46.1. | At every meeting of the Shareholders of the Company called with respect to any of the following, and at every adjournment or postponement thereof, and on every action or approval by written consent of the shareholders of the Company with respect to any of the following, the Remaining Holders shall vote all shares of the Company that such Remaining Holders then hold or for which such Remaining Holders otherwise then have voting power for (collectively, for the purposes of this Article 46, the “Shares”): (A) in favor of approval of the Sale Transaction and any matter that could reasonably be expected to facilitate the Sale Transaction, and (B) against any proposal for any recapitalization, merger, sale of assets or other business combination (other than the Sale Transaction) between the Company and any person or entity or any other action or agreement that would result in a breach of any covenant, representation or warranty or any other obligation or agreement of the Company under the definitive agreement(s) related to the Sale Transaction or which could result in any of the conditions to the Company’s obligations under such agreement(s) not being fulfilled; |

| 46.2. | If the Sale Transaction is structured as (A) a merger or consolidation, each Remaining Holder shall waive any dissenting minority or similar rights in connection with such merger or consolidation, or (B) a sale of shares, each Remaining Holder shall agree to sell all of the Shares and rights to acquire shares of the Company held by such Remaining Holder on the terms and conditions approved by the Sale Requisite Majority; and |

| 46.3. | Each Remaining Holder shall take all necessary actions in connection with the consummation of the Sale Transaction as requested by the Company or the Sale Requisite Majority and shall, if requested by the Sale Requisite Majority, execute and deliver any agreements prepared in connection with such Sale Transaction which agreements are executed by the Sale Requisite Majority, including without limitation, executing any purchase agreements, indemnity agreements, escrow agreements or related documents (in each case, subject to the terms and limitations set forth in this Article 46), as such Sale Requisite Majority and the Purchaser execute that are reasonably required in order to carry out the terms and provisions of this Article 46 and provided that no Shareholder shall be required to undertake or be obligated to terms and conditions which do not similarly apply to all selling Shareholders. |