Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Helix Technologies, Inc. | ea125597-8k_helixtechnolog.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 17, 2020 - Helix Technologies, Inc. | ea125597ex99-1_helixtechno.htm |

Exhibit 99.2

critical infrastructure services for the legal cannabis industry The premier provider of

This presentation may contain “Forward Looking Statements" within the meaning of Section 27A of the Securities Act of 1933, a s a mended, and Section 21E of the Securities Exchange Act of 1934. "Forward - looking statements" describe future expectations, plans, results, o r strategies and are generally preceded by words such as "may," "future,” "plan" or "planned,” "will" or "should,” "expected,” "anticipates,” "dra ft, ” "eventually" or "projected.” You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumst anc es, events, or results to differ materially from those projected in the forward - looking statements, including the risk that actual results may differ m aterially from those projected in the forward - looking statements as a result of various factors, risks that we may not realize the anticipated benefi ts of acquisitions we may make or plan to make, and other risks identified in the Company’s 10 - K for the fiscal year ended December 31, 2019 and other filings made by the Company with the Securities and Exchange Commission. Forward Looking Statements 2

Executive Leadership 3 Zachary L Venegas Executive Chairman & CEO Scott Ogur , CFA CFO Garvis W Toler III President of Data Services Key Career Accomplishments Proven team with a demonstrated track record in venture capital companies, specializing in frontier markets and global M&A. Zachary Venegas and Scott Ogur founded Helix Technologies and within five years have: • Executed a successful, non - dilutive, reverse merger • Uplisted to the OTCQB • Completed multiple successful acquisitions • Built quarterly revenue to $4.8MM • Achieved positive EBITDA and Cash Flow From Operations • Became an industry leader in: • Seed to sale tracking & dispensary point of sale (U.S.) • Government traceability technology • Licensed wholesale technology • Security services The addition of Mr. Toler brings critical data and capital markets experience to the executive leadership team.

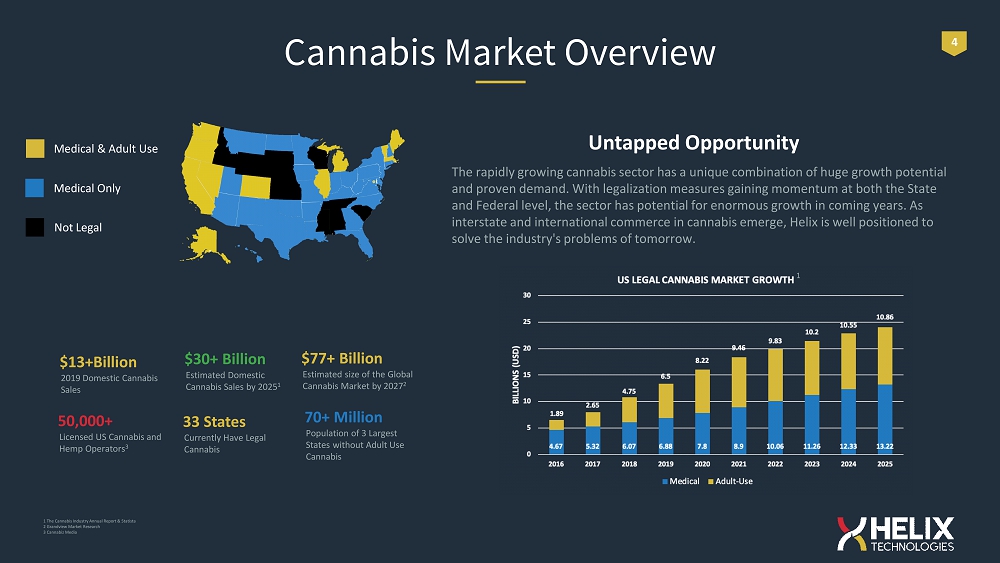

Cannabis Market Overview $77+ Billion Estimated size of the Global Cannabis Market by 2027 2 $30+ Billion Estimated Domestic Cannabis Sales by 2025 1 33 States Currently Have Legal Cannabis 70+ Million Population of 3 Largest States without Adult Use Cannabis $13+Billion 2019 Domestic Cannabis Sales 50,000+ Licensed US Cannabis and Hemp Operators 3 The rapidly growing cannabis sector has a unique combination of huge growth potential and proven demand. With legalization measures gaining momentum at both the State and Federal level, the sector has potential for enormous growth in coming years. As interstate and international commerce in cannabis emerge, Helix is well positioned to solve the industry's problems of tomorrow. Untapped Opportunity Medical & Adult Use Medical Only Not Legal 4 1 The Cannabis Industry Annual Report & Statista 2 Grandview Market Research 3 Cannabiz Media 1 KF8

Traceability Cole Memorandum (still de facto position of the Federal Govt) dictates that states take action to avoid diversion to the black market Consumer Safety Recent “vape crisis” has highlighted the need and desire for transparency in the supply vertical Tax Compliance “All Cash” nature of the business has raised concerns about States collecting the correct amount of tax revenue Future Challenges As interstate and international commerce become commonplace, new, unique problems will arise such as cross border tax compliance Cannabis Specific Problems 5

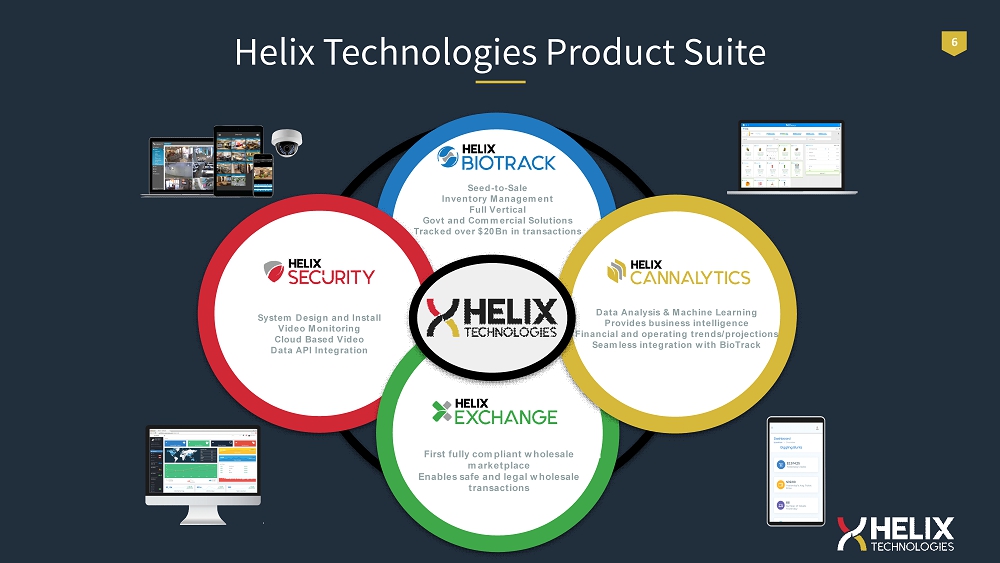

Seed - to - Sale Inventory Management Full Vertical Govt and Commercial Solutions Tracked over $20Bn in transactions System Design and Install Video Monitoring Cloud Based Video Data API Integration First fully compliant wholesale marketplace Enables safe and legal wholesale transactions Data Analysis & Machine Learning Provides business intelligence Financial and operating trends/projections Seamless integration with BioTrack Helix Technologies Product Suite 6

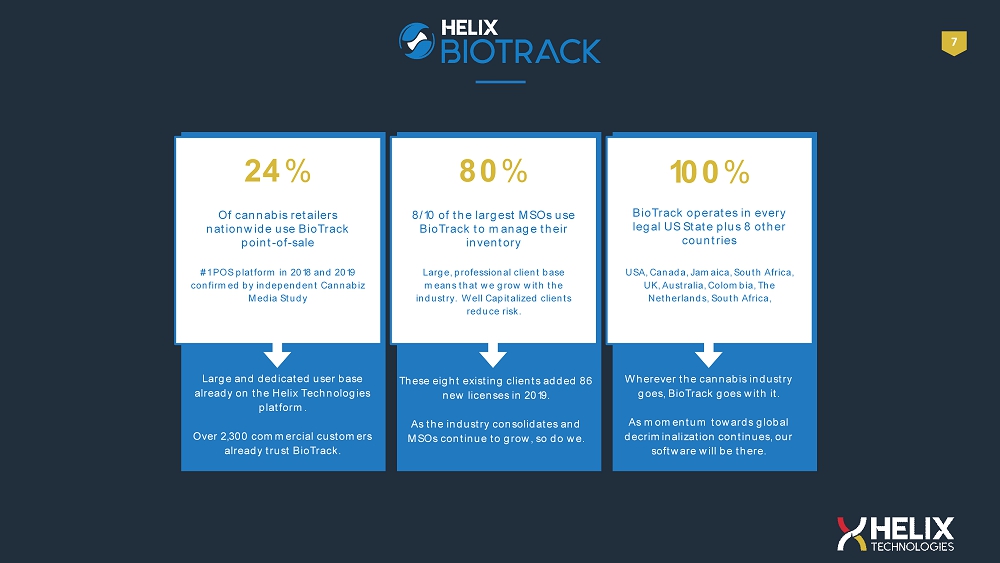

Of cannabis retailers nationwide use BioTrack point - of - sale #1 POS platform in 2018 and 2019 confirmed by independent Cannabiz Media Study 24 % Large and dedicated user base already on the Helix Technologies platform. Over 2,300 commercial customers already trust BioTrack. 8/10 of the largest MSOs use BioTrack to manage their inventory Large, professional client base means that we grow with the industry. Well Capitalized clients reduce risk. 80 % These eight existing clients added 86 new licenses in 2019. As the industry consolidates and MSOs continue to grow, so do we. BioTrack operates in every legal US State plus 8 other countries USA, Canada, Jamaica, South Africa, UK, Australia, Colombia, The Netherlands, South Africa, 100 % Wherever the cannabis industry goes, BioTrack goes with it. As momentum towards global decriminalization continues, our software will be there. 7

Seed to Sale Landscape Driving Industry Change Data Security As the market matures, cyber security measures are taking center stage Consolidation Helix is positioned to grow as large operators command more market share Market Growth Only 11 States and 1 Country have full recreational cannabis As the industry continues to mature, the larger, well capitalized operators will continue to drive consolidation through M&A and driving smaller firms out of business. Helix will benefit from this trend as our large Multi - State Operator (MSO) clients continue to expand. While the cannabis market has seen rapid growth in recent years there is still massive growth potential in domestic and international markets. 70+ million people live in 3 of the largest states without adult use cannabis. With several high - profile security breaches in recent memory we expect continued prioritization of confidentiality and data security with respect to patient and customer information. Helix Technologies maintains a sterling track record and best in class security practices. Integrations Third party platforms are becoming increasingly popular With the industry's biggest footprint, a rapidly growing list of integrators, and restful API architecture, Helix is well positioned to increase stickiness and margins through integration partners. 9

Government Customers Contracts with 9 state or Governmental Agencies, working directly with regulatory cannabis programs for each As one of the largest and most experienced providers of Government Traceability systems, Helix has a wealth of industry knowl edg e and insights that we apply to all of our business lines. Best in class integration with our commercial software also drives market share in State s w here we are contracted to provide Seed to Sale Traceability. With our spotless data security and uptime record, as well as industry first innovations such as electronic patient registrie s a nd hemp tacking, we have earned the trust of our Government clients to help them expand their programs. New Mexico Trace & Patient Registry Illinois Medical & Adult Opiate Pilot New York Medical & PMP Reporting North Dakota Trace & Patient Registry Delaware Trace, Hemp, & Patient Registry Hawaii Medical Puerto Rico Medical Tourism Reciprocity New Hampshire Patient Registry Arkansas Trace & Patient Registry 9

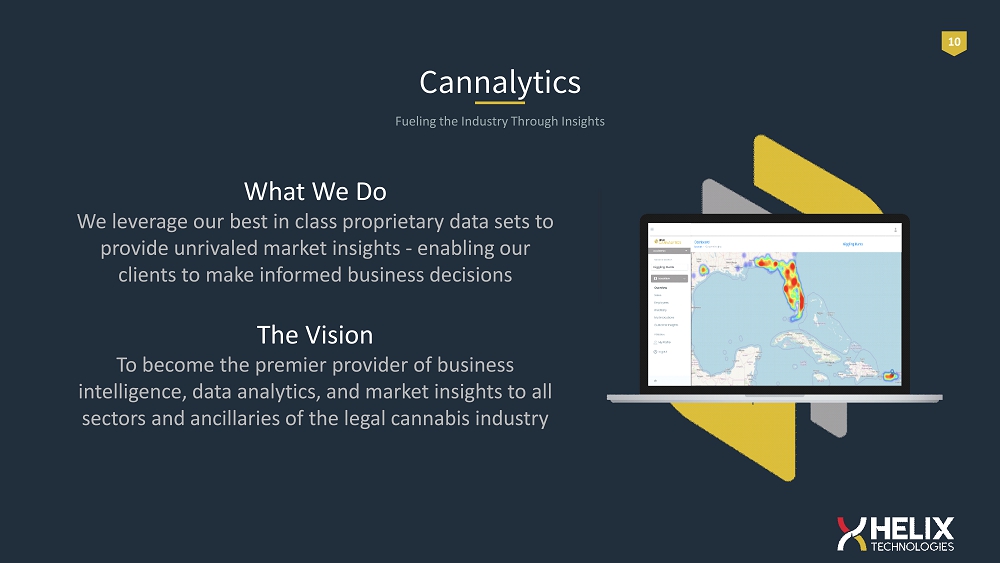

10 Cannalytics What We Do We leverage our best in class proprietary data sets to provide unrivaled market insights - enabling our clients to make informed business decisions The Vision To become the premier provider of business intelligence, data analytics, and market insights to all sectors and ancillaries of the legal cannabis industry Fueling the Industry Through Insights

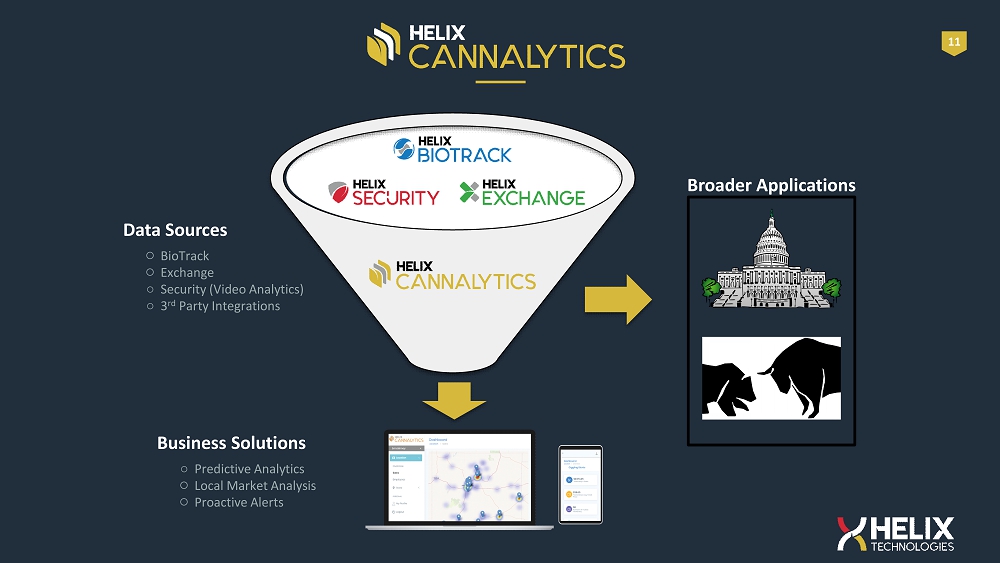

Broader Applications Data Sources ○ BioTrack ○ Exchange ○ Security (Video Analytics) ○ 3 rd Party Integrations Business Solutions ○ Predictive Analytics ○ Local Market Analysis ○ Proactive Alerts 11

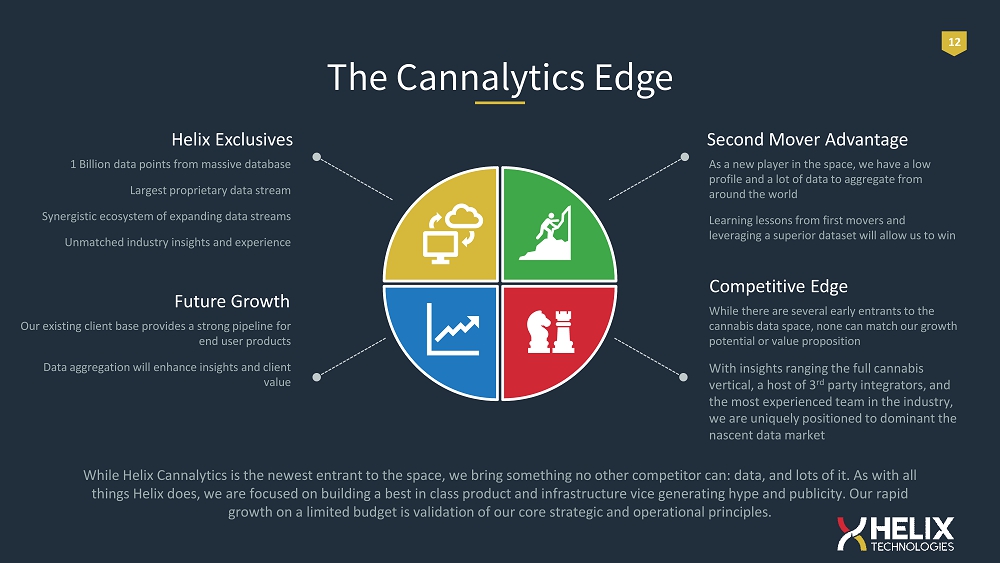

12 The Cannalytics Edge Helix Exclusives 1 Billion data points from massive database Largest proprietary data stream Synergistic ecosystem of expanding data streams Unmatched industry insights and experience Future Growth Our existing client base provides a strong pipeline for end user products Data aggregation will enhance insights and client value Seco nd Mover Advantage As a new player in the space, we have a low profile and a lot of data to aggregate from around the world Learning lessons from first movers and leveraging a superior dataset will allow us to win Competitive Edge While there are several early entrants to the cannabis data space, none can match our growth potential or value proposition With insights ranging the full cannabis vertical, a host of 3 rd party integrators, and the most experienced team in the industry, we are uniquely positioned to dominant the nascent data market While Helix Cannalytics is the newest entrant to the space, we bring something no other competitor can: data, and lots of it. As with all things Helix does, we are focused on building a best in class product and infrastructure vice generating hype and publicity. Our rapid growth on a limited budget is validation of our core strategic and operational principles.

“Only fully compliant cannabis exchange” Transactions happen in real time creating an efficient market that automatically handles reporting and compliance requirements for every jurisdiction ○ BioTrack integration enables end - to - end compliant reporting ○ Transparent marketplace prevents diversion and black - market transactions and enables regulators to easily audit platform Exclusive DAMA Financial payment solution ○ Fully compliant banking solution ensures only licensed, legitimate businesses can transact ○ Thorough onboarding process screens out illegitimate actors ○ 50 state solution for federally legal hemp businesses Captures valuable wholesale transaction data ○ B2B transactions represent the most valuable and least available data in the industry ○ Future opportunities include import / export trading facilitating cross boarder transactions 13

Security system design and installation business fueled by growing legal markets and strict regulatory requirements ○ Engage clients by assisting with the license application ○ Specify cloud video in applications to generate MRR from newly licensed business ○ Cross - sell virtual guarding as a less expensive (higher margin) alternative to guards Virtual Guarding ○ Protects business from internal and external threats ○ Proven to decrease law enforcement response time ○ Lowers liability for clients compared to armed personnel on site ○ Clients from Massachusetts to California Integration with BioTrack Software ○ Software integration agreements in place with leading VMS vendors ○ Enables Helix Technologies to offers video verified compliance audits 14

While guarding provided meaningful revenue, the gross margins and operating margins were low, liability was high, and the bus ine ss was difficult to scale. By divesting the guarding operation, we are now able to dedicate ourselves 100% to driving shareholder and client value through accelerated software development and sales. Our guarding clients and employees will be well served by a security focused firm. Guarding Divestiture The 80/20 Principle in Action, Leveraging our Network to Drive Results We are a Technology Company. While physical guarding was our “foot in the door” of the cannabis industry, we have evolved, and physical security is no longer in line with our vision or mission. Focusing on technology will allow us to improve margins, accelerate growth, and bring the newest, most innovative products to bear for the cannabis industry. We are proud of the outstanding guarding business we built, but it is time to move forward. 15 GU [2]1 CP1

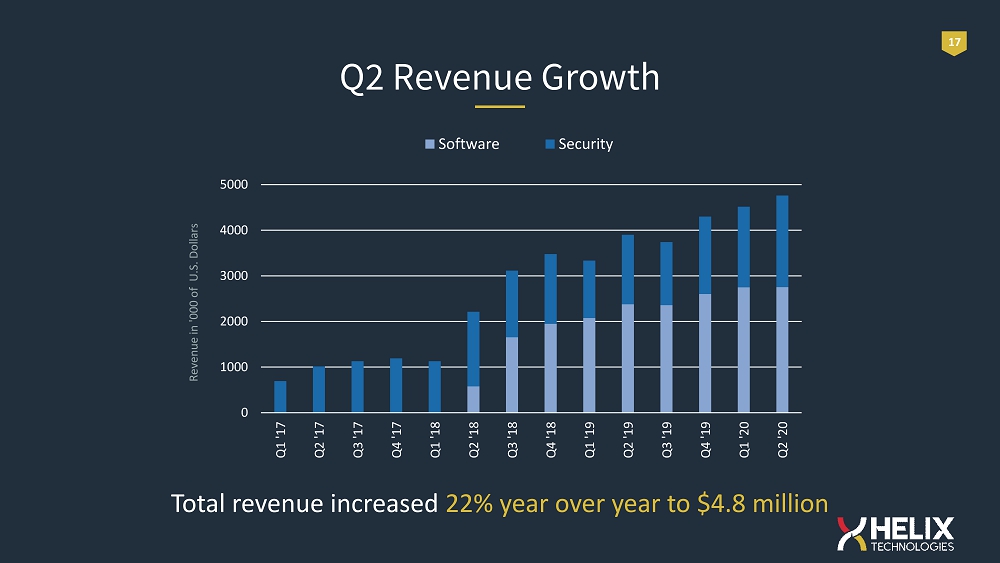

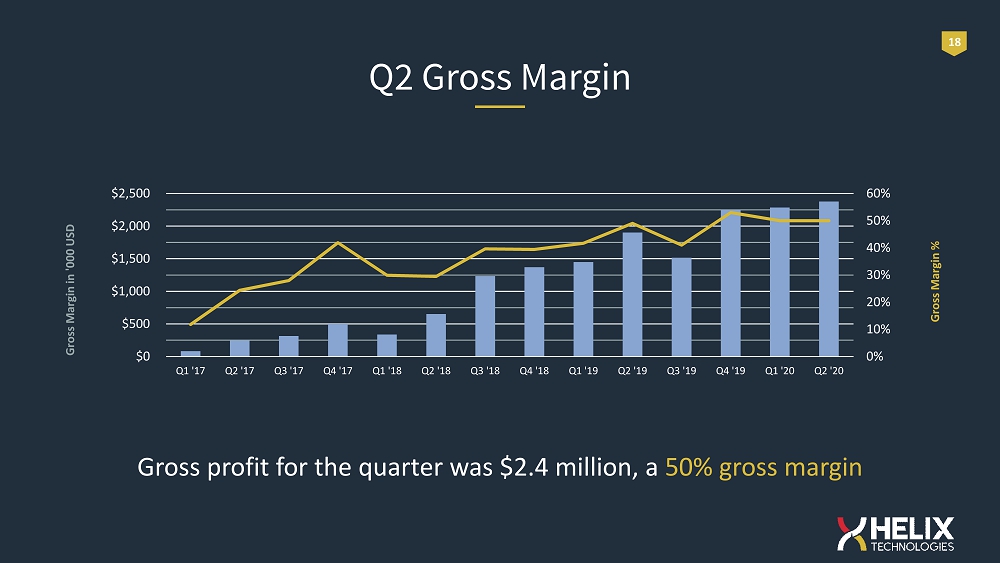

● Grew first half revenue to a record $9.3mm ● Achieved positive cash flow from operations of $446k in Q2, a 162% increase over Q2 2019 ● Surpassed 200 Cannalytics clients ● Grew the Helix Ecosystem by adding new integration partners ● Improved software gross margin to 74% ● Software Adjusted EBITDA of $1.6mm for first half 2020 Q2 Operational Highlights 16 CS13 CP15

Total revenue increased 22% year over year to $4.8 million Q2 Revenue Growth 17 0 1000 2000 3000 4000 5000 Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Revenue in '000 of U.S. Dollars Software Security

Gross profit for the quarter was $2.4 million, a 50% gross margin 0% 10% 20% 30% 40% 50% 60% $0 $500 $1,000 $1,500 $2,000 $2,500 Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Gross Margin % Gross Margin in '000 USD Q2 Gross Margin 18

Q2 Cash Flows from Operations 19 Achieved Positive Cash Flows From Operations of $446k Cash From Operations in ‘000 USD

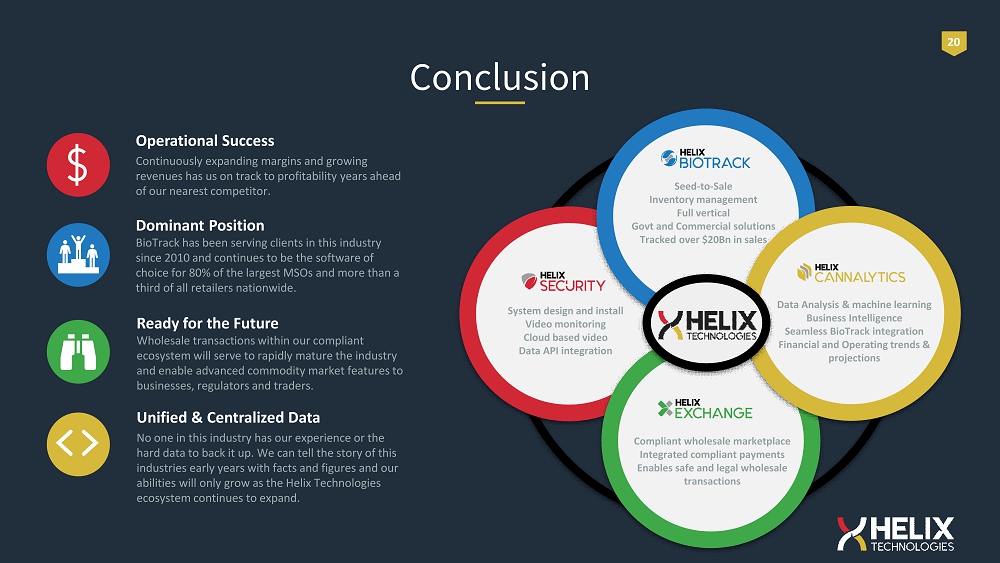

Conclusion Operational Success Continuously expanding margins and growing revenues has us on track to profitability years ahead of our nearest competitor. Dominant Position BioTrack has been serving clients in this industry since 2010 and continues to be the software of choice for 80% of the largest MSOs and more than a third of all retailers nationwide. Unified & Centralized Data No one in this industry has our experience or the hard data to back it up. We can tell the story of this industries early years with facts and figures and our abilities will only grow as the Helix Technologies ecosystem continues to expand. Ready for the Future Wholesale transactions within our compliant ecosystem will serve to rapidly mature the industry and enable advanced commodity market features to businesses, regulators and traders. 20 System design and install Video monitoring Cloud based video Data API integration Seed - to - Sale Inventory management Full vertical Govt and Commercial solutions Tracked over $20Bn in sales Compliant wholesale marketplace Integrated compliant payments Enables safe and legal wholesale transactions Data Analysis & machine learning Business Intelligence Seamless BioTrack integration Financial and Operating trends & projections

Thank you for investing! Helix Technologies, Inc. 5300 DTC Parkway, Suite 300 Greenwood Village, CO 80111