Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Telenav, Inc. | tnavex991fy20q4earning.htm |

| 8-K - 8-K - Telenav, Inc. | tnav63020208-k.htm |

Telenav | Transforming Life on the Go Telenav, Inc. (NASDAQ: TNAV) Fourth Quarter and Fiscal 2020 Conference Call August 12, 2020 Q4 2020

Forward Looking Statements This supplemental investor presentation contains forward-looking statements that are based on the Company management’s belief and assumptions and on information currently available to its management. Actual events or results may differ materially from those described in this document due to a number of risks and uncertainties. These potential risks and uncertainties include, among others: These potential risks and uncertainties include, among others: the impact of the COVID-19 on business activity, including but not limited to the shutdown of manufacturing operations by Ford, GM and other automobile manufacturer customers; consumer demand for new vehicles and the Company’s operations; when Ford, GM and other automobile manufacturer partners will resume full production and the impact the continued period of reduced volume of new vehicles being produced will have our revenue and operating results; the ensuing economic recession; the Company’s ability to achieve future revenue currently estimated under customer engagements; the Company's ability to develop and implement products for Ford, GM and Toyota and to support Ford, GM and Toyota and their customers; the impact of Ford’s announcement regarding the elimination of various sedans in North America over the near term; the impact of tariffs on sales of automobiles in the United States and other markets; the Company’s success in extending its contracts for current and new generation of products with its existing automobile manufacturers and tier ones, particularly Ford; the impact of Ford’s announcement regarding Garmin and the possibility that Ford and other OEMs may transition additional business to other platforms and provides, such as Google Automotive Services; GM’s announcement regarding Google Automotive Services; the Company’s ability to achieve additional design wins and the delivery dates of automobiles including the Company’s products; adoption by vehicle purchasers of Scout GPS Link; the Company’s ability to remediate its material weaknesses in its internal control over financial reporting and disclosures, and timely demonstrate such mitigation, including as it may relate to the Company’s recognition of revenue; the Company’s dependence on a limited number of automobile manufacturers and tier ones for a substantial portion of its revenue, such as Ford and GM; reductions in demand for automobiles in general and specifically for Ford and GM vehicles; potential impacts of automobile manufacturers and tier ones, in particular Ford and GM, including competitive capabilities in their vehicles, such as Apple CarPlay and Android Auto; the Company’s continued reporting of losses and operating expenses in excess of expectations the timing of new product releases and vehicle production by the Company’s automotive customers, including inventory procurement and fulfillment; possible warranty claims, and the impact on consumer perception of its brand; the Company’s ability to perform under its initiatives with Amazon and Microsoft, and benefit from those initiatives; the potential that the Company may not be able to realize its deferred tax assets and may have to take a reserve against them;. The Company discusses these risks in greater detail in “Risk Factors” and elsewhere in its Form 10-K for the fiscal year ended June 30, 2019 and other filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date made. You should review the company’s SEC filings carefully and with the understanding that actual future results may be materially different from what the Company expects.

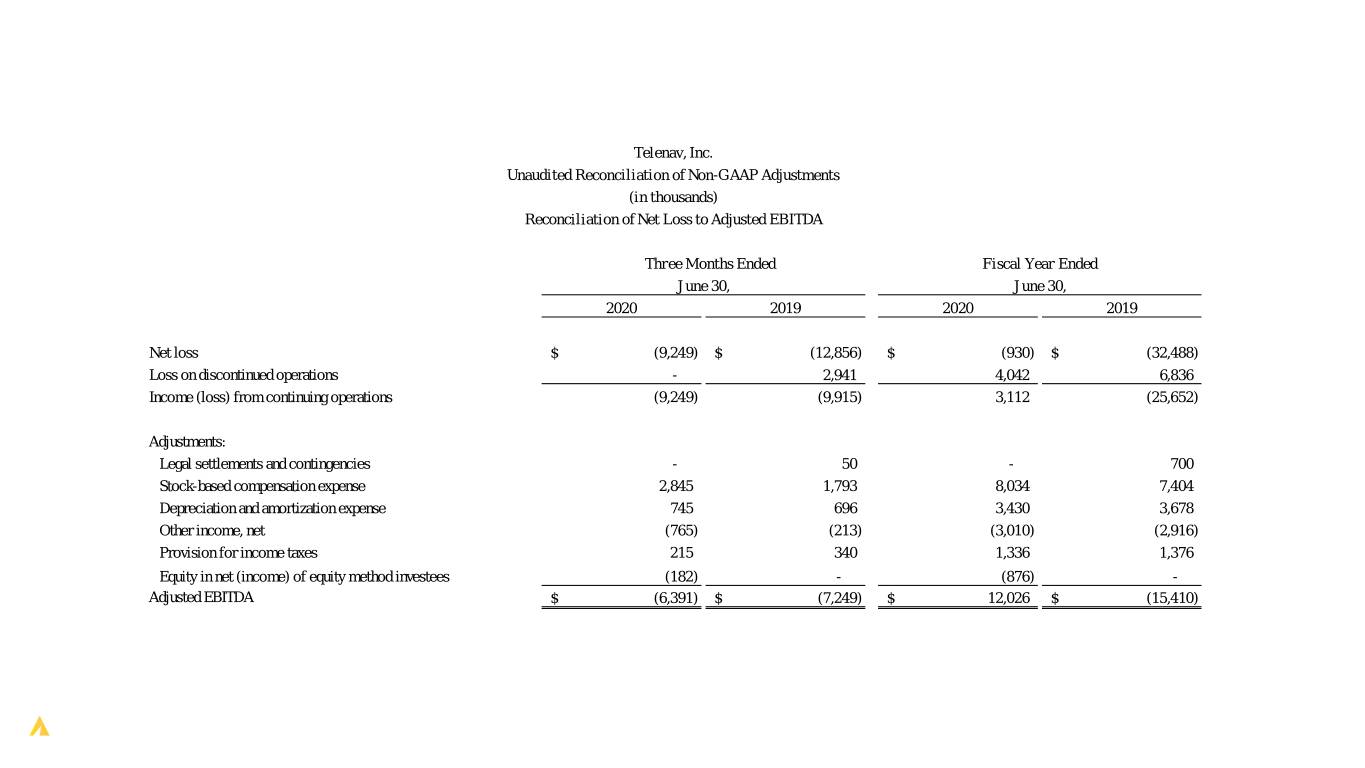

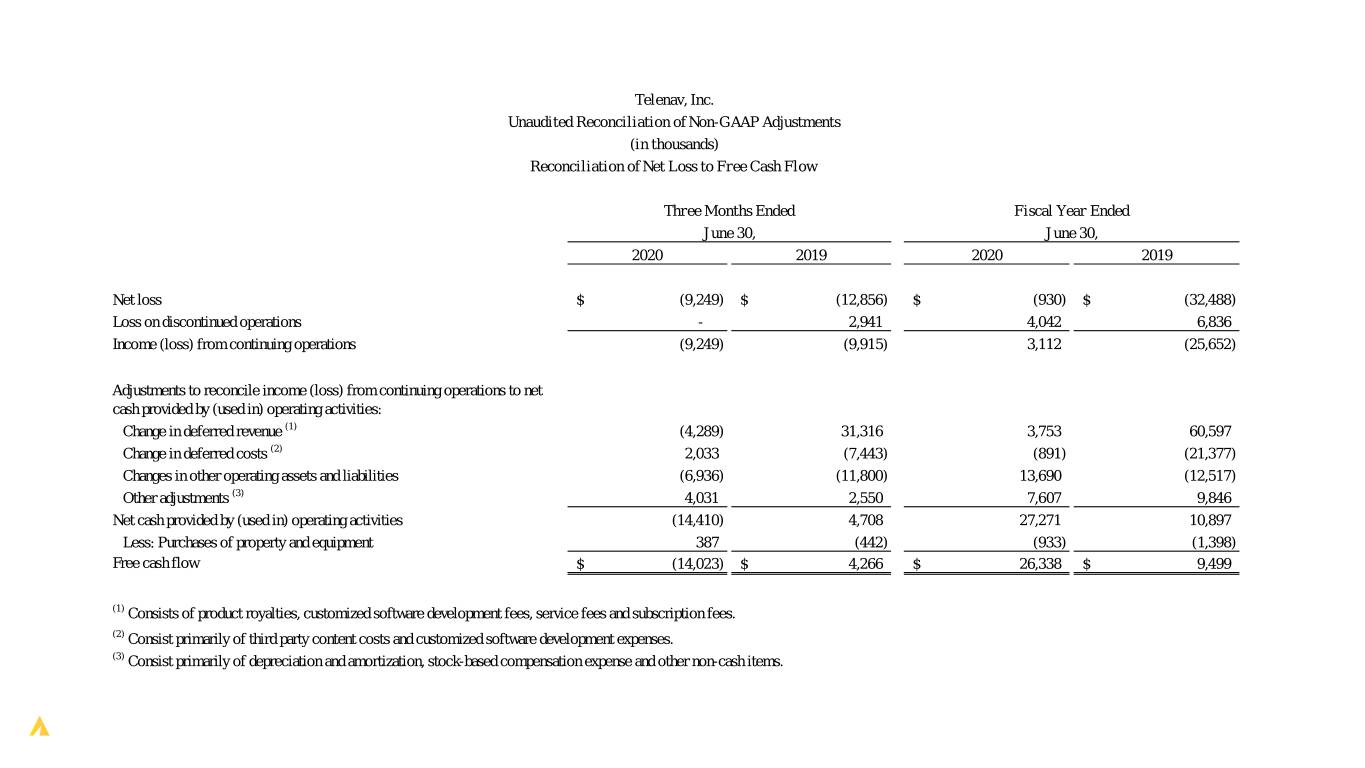

Use of Non-GAAP Financial Measures Telenav prepares its financial statements in accordance with generally accepted accounting principles for the United States, or GAAP. The non-GAAP financial measures such as billings, change in deferred revenue, change in deferred costs, adjusted EBITDA, and free cash flow included in this supplemental investor presentation are different from those otherwise presented under GAAP. Telenav has provided these measures in addition to GAAP financial results because management believes these non-GAAP measures help provide a consistent basis for comparison between periods that are not influenced by certain items and, therefore, are helpful in understanding Telenav’s underlying operating results. These non-GAAP measures are some of the primary measures Telenav’s management uses for planning and forecasting. These measures are not in accordance with, or an alternative to, GAAP and these non-GAAP measures may not be comparable to information provided by other companies. To reconcile the historical GAAP results to non-GAAP financial metrics, please refer to the reconciliations in the financial tables included in this supplemental investor presentation. Billings equal GAAP revenue recognized plus the change in deferred revenue from the beginning to the end of the applicable period. In connection with its presentation of the change in deferred revenue, Telenav has provided a similar presentation of the change in the related deferred costs. Such deferred costs primarily include costs associated with third party content and certain development costs associated with its customized software solutions whereby customized engineering fees are earned. As the company enters into more hybrid and brought-in navigation programs, deferred revenue and deferred costs become larger components of its operating results, so Telenav believes these metrics are useful in evaluating cash flows. Telenav considers billings to be a useful metric for management and investors because billings drive revenue and deferred revenue, which is an important indicator of its business. There are a number of limitations related to the use of billings versus revenue calculated in accordance with GAAP. First, billings include amounts that have not yet been recognized as revenue and may require additional services to be provided over contracted service periods. For example, billings related to certain brought-in solutions cannot be fully recognized as revenue in a given period due to requirements for ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs. Second, we may calculate billings in a manner that is different from peer companies that report similar financial measures, making comparisons between companies more difficult. Accordingly, when Telenav uses this measure, it attempts to compensate for these limitations by providing specific information regarding billings and how they relate to revenue calculated in accordance with GAAP. Adjusted EBITDA measures GAAP net income/loss adjusted for discontinued operations and excluding the impact of stock-based compensation expense, depreciation and amortization, other income (expense) net, provision (benefit) for income taxes, and other applicable items such as legal settlements and contingencies. Stock-based compensation expense relates to equity incentive awards granted to its employees, directors, and consultants. Legal settlements and contingencies represent settlements, offers made to settle, or loss accruals relating to litigation or other disputes in which Telenav is a party or the indemnitor of a party. Adjusted EBITDA, while generally a measure of profitability, can also represent a loss. Adjusted EBITDA is a key measure Telenav uses to understand and evaluate its core operating performance and trends, to prepare and approve its annual budget and to develop short- and long-term operational plans. In particular, Telenav believes that the exclusion of the expenses eliminated when calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of Telenav’s core business. Accordingly, Telenav believes that adjusted EBITDA generally may provide useful information to investors and others in understanding and evaluating its operating results in the same manner as Telenav does. Free cash flow is a non-GAAP financial measure Telenav defines as net cash provided by (used in) operating activities, less purchases of property and equipment. Telenav considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash (used in) generated by its business after purchases of property and equipment.

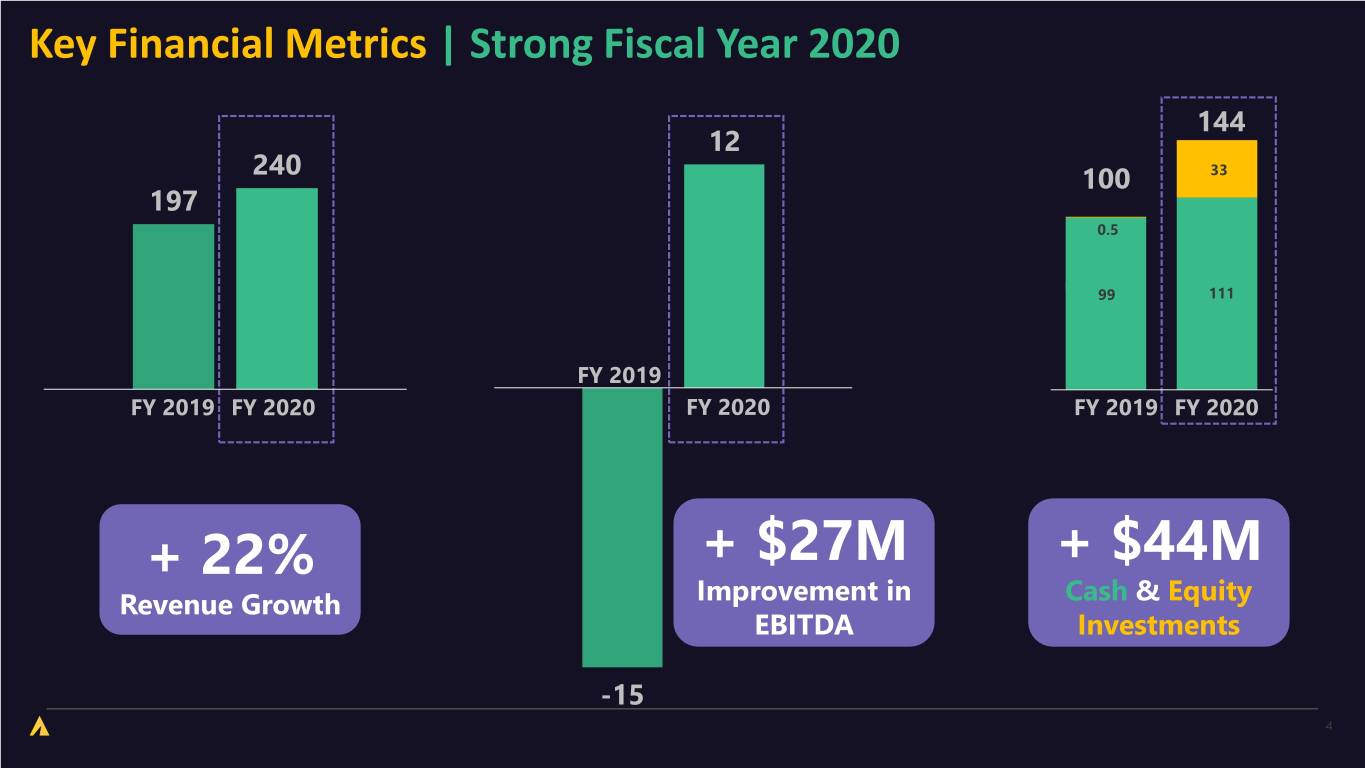

Key Financial Metrics | Strong Fiscal Year 2020 144 12 240 100 33 197 0.5 99 111 FY 2019 FY 2019 FY 2020 FY 2020 FY 2019 FY 2020 + 22% + $27M + $44M Revenue Growth Improvement in Cash & Equity EBITDA Investments -15 4

Evolving Landscape I Our Response Improving Pandemic Team OEM Outlook Response & Resilience & from Q4 Cost Efficiency Will to Win

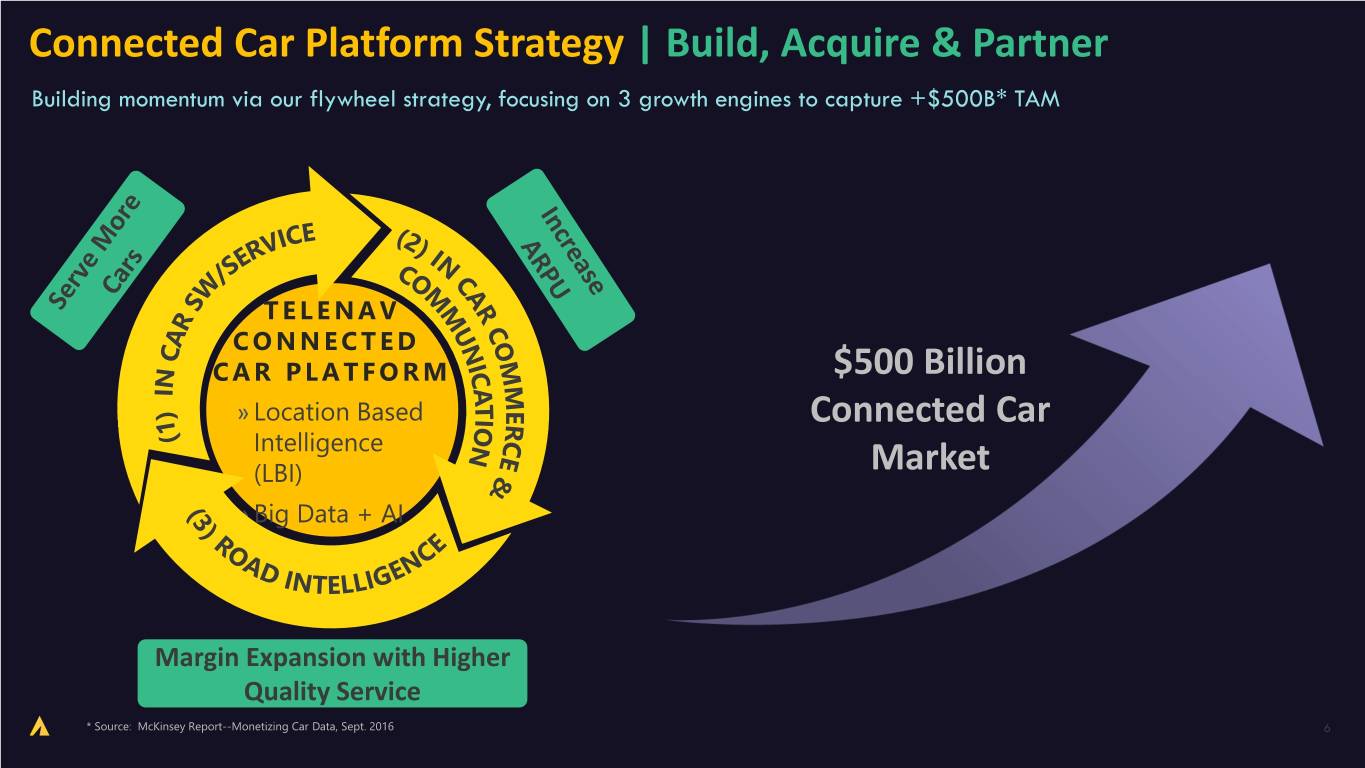

Connected Car Platform Strategy | Build, Acquire & Partner Building momentum via our flywheel strategy, focusing on 3 growth engines to capture +$500B* TAM TELENAV C O N N E C T E D CAR PLATFORM $500 Billion » Location Based Connected Car Intelligence (LBI) Market » Big Data + AI Margin Expansion with Higher Quality Service * Source: McKinsey Report--Monetizing Car Data, Sept. 2016 6

In-Car Software and Service » Ford launched SYNC4 - F-150, Bronco » Won two new Chinese OEM awards ❯ SAIC - Largest OEM in China ❯ Xpeng Motors – Leading EV OEM » VIVID platform advancement & beta testing » Investment in video platform company for fleets TELENAV C O N N E C T E D CAR PLATFORM » Location Based Intelligence (LBI) » Big Data + AI7

In-Car Commerce and Communication » Continued to develop ICC; launch with Japanese OEM expected in 2H FY21 » Increased investment in Motion Auto Insurance ❯ rapid increase in market coverage ❯ continues to scale at an accelerated pace » InMarket Media continues to grows at double digit % TELENAV C O N N E C T E D CAR PLATFORM » Location Based Intelligence (LBI) » Big Data + AI 8

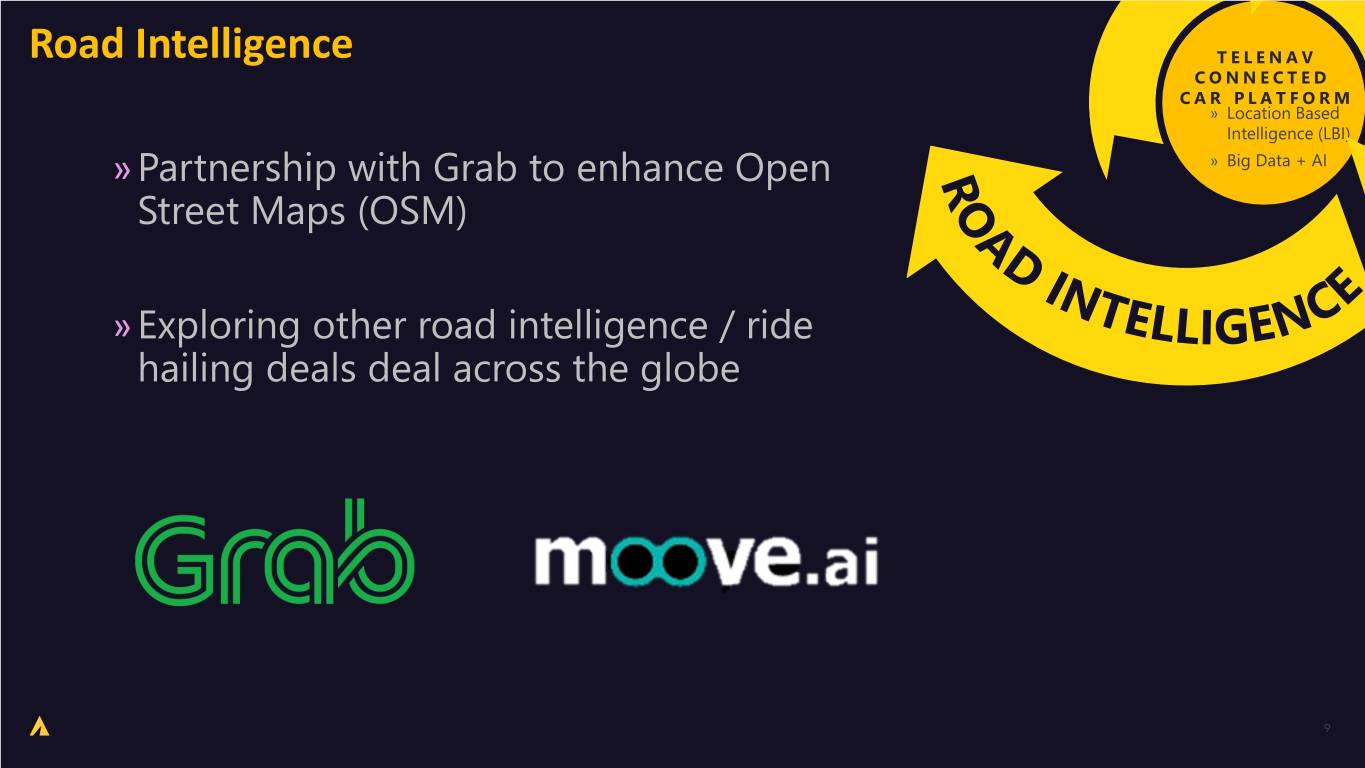

Road Intelligence TELENAV C O N N E C T E D CAR PLATFORM » Location Based Intelligence (LBI) » Partnership with Grab to enhance Open » Big Data + AI Street Maps (OSM) » Exploring other road intelligence / ride hailing deals deal across the globe 9

2021 Focus Areas »Drive flywheel momentum with: ❯ Organic initiatives TELENAV ❯ Inorganic opportunities C O N N E C T E D CAR PLATFORM » Location Based Intelligence »Strive for operational excellence (LBI) & continue the journey » Big Data + AI »Build great culture 10

Q4 and FY20 Financial Overview

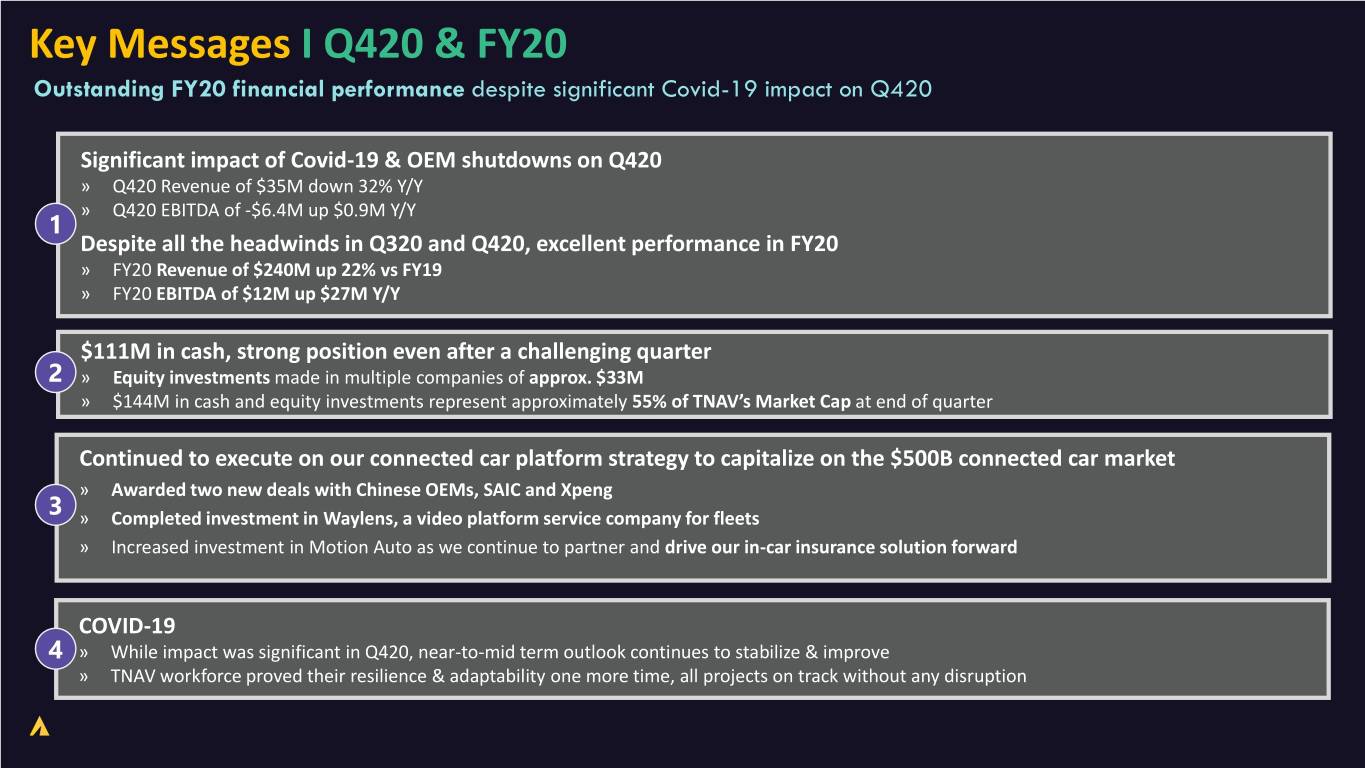

Key Messages I Q420 & FY20 Outstanding FY20 financial performance despite significant Covid-19 impact on Q420 Significant impact of Covid-19 & OEM shutdowns on Q420 » Q420 Revenue of $35M down 32% Y/Y » Q420 EBITDA of -$6.4M up $0.9M Y/Y 1 Despite all the headwinds in Q320 and Q420, excellent performance in FY20 » FY20 Revenue of $240M up 22% vs FY19 » FY20 EBITDA of $12M up $27M Y/Y $111M in cash, strong position even after a challenging quarter 2 » Equity investments made in multiple companies of approx. $33M » $144M in cash and equity investments represent approximately 55% of TNAV’s Market Cap at end of quarter Continued to execute on our connected car platform strategy to capitalize on the $500B connected car market » Awarded two new deals with Chinese OEMs, SAIC and Xpeng 3 » Completed investment in Waylens, a video platform service company for fleets » Increased investment in Motion Auto as we continue to partner and drive our in-car insurance solution forward COVID-19 4 » While impact was significant in Q420, near-to-mid term outlook continues to stabilize & improve » TNAV workforce proved their resilience & adaptability one more time, all projects on track without any disruption

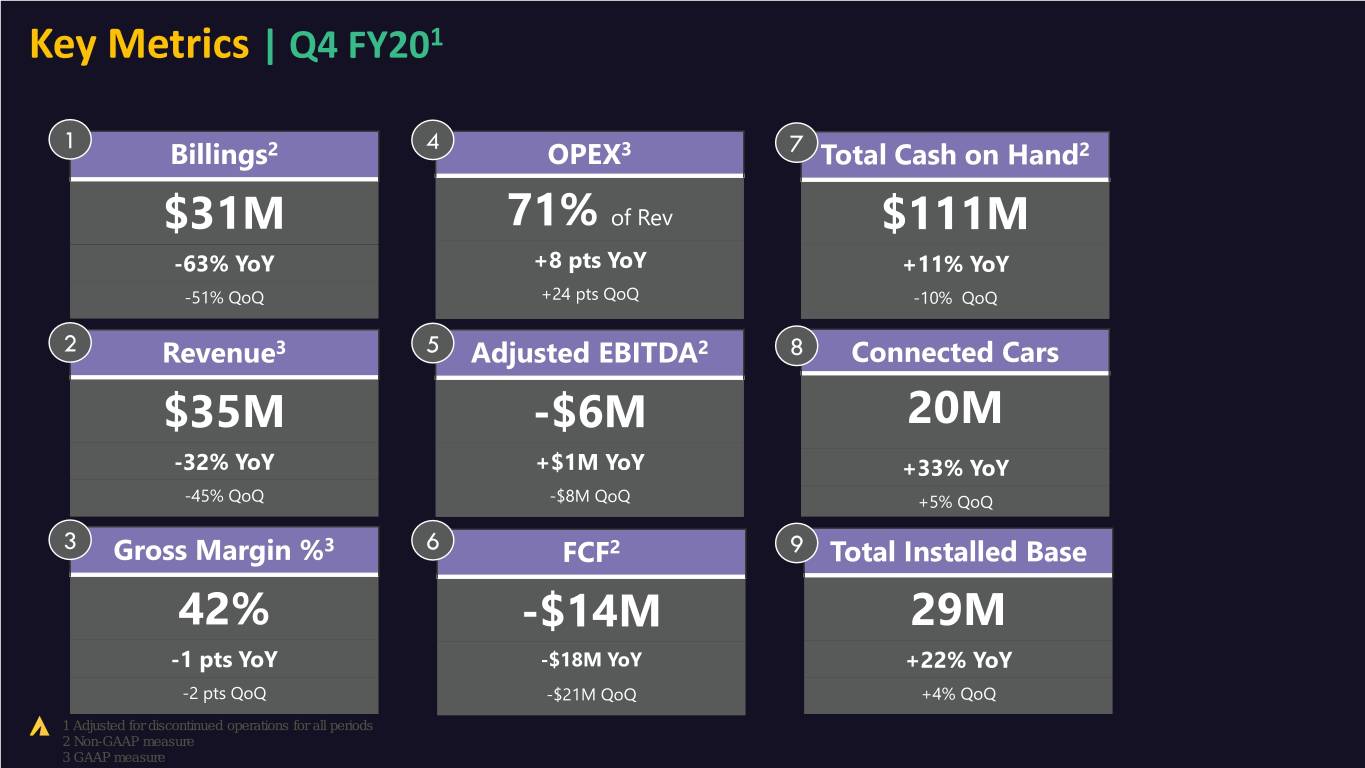

Key Metrics | Q4 FY201 1 4 Billings2 OPEX3 7 Total Cash on Hand2 $31M 71% of Rev $111M -63% YoY +8 pts YoY +11% YoY -51% QoQ +24 pts QoQ -10% QoQ 2 Revenue3 5 Adjusted EBITDA2 8 Connected Cars $35M -$6M 20M -32% YoY +$1M YoY +33% YoY -45% QoQ -$8M QoQ +5% QoQ 3 Gross Margin %3 6 FCF2 9 Total Installed Base 42% -$14M 29M -1 pts YoY -$18M YoY +22% YoY -2 pts QoQ -$21M QoQ +4% QoQ 1 Adjusted for discontinued operations for all periods 2 Non-GAAP measure 3 GAAP measure

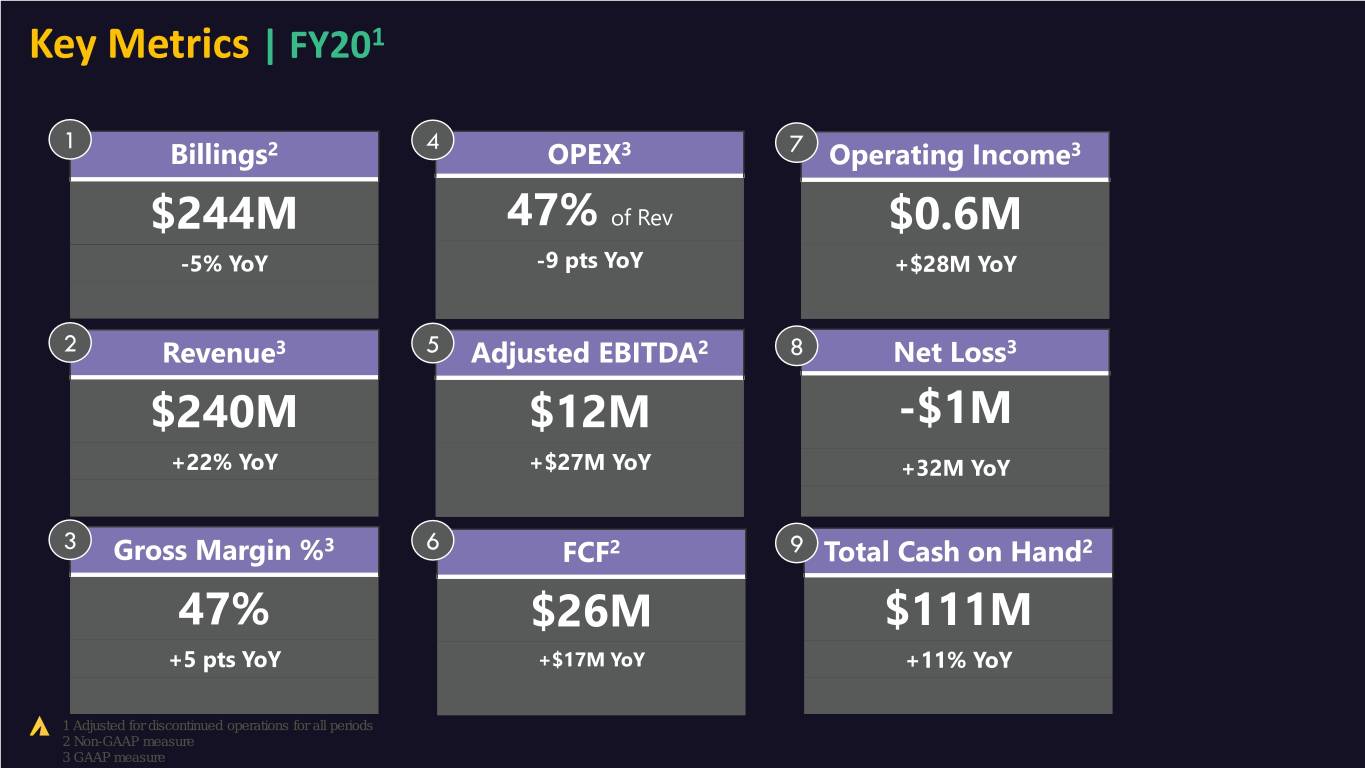

Key Metrics | FY201 1 4 Billings2 OPEX3 7 Operating Income3 $244M 47% of Rev $0.6M -5% YoY -9 pts YoY +$28M YoY 2 Revenue3 5 Adjusted EBITDA2 8 Net Loss3 $240M $12M -$1M +22% YoY +$27M YoY +32M YoY 3 Gross Margin %3 6 FCF2 9 Total Cash on Hand2 47% $26M $111M +5 pts YoY +$17M YoY +11% YoY 1 Adjusted for discontinued operations for all periods 2 Non-GAAP measure 3 GAAP measure

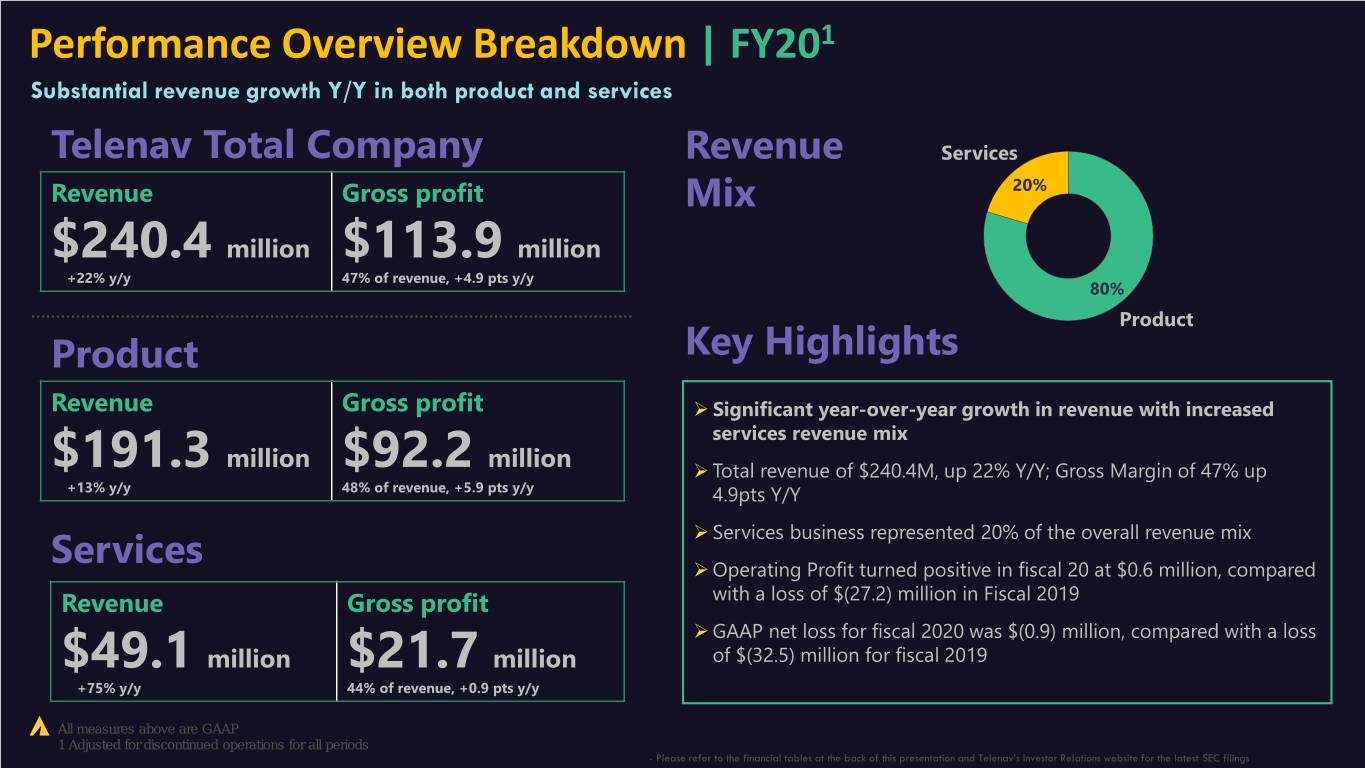

Performance Overview Breakdown | FY201 Substantial revenue growth Y/Y in both product and services Telenav Total Company Revenue Services Revenue Gross profit Mix 20% $240.4 million $113.9 million +22% y/y 47% of revenue, +4.9 pts y/y 80% Product Product Key Highlights Revenue Gross profit ➢ Significant year-over-year growth in revenue with increased services revenue mix $191.3 million $92.2 million ➢ Total revenue of $240.4M, up 22% Y/Y; Gross Margin of 47% up +13% y/y 48% of revenue, +5.9 pts y/y 4.9pts Y/Y ➢ Services business represented 20% of the overall revenue mix Services ➢ Operating Profit turned positive in fiscal 20 at $0.6 million, compared Revenue Gross profit with a loss of $(27.2) million in Fiscal 2019 ➢ GAAP net loss for fiscal 2020 was $(0.9) million, compared with a loss $49.1 million $21.7 million of $(32.5) million for fiscal 2019 +75% y/y 44% of revenue, +0.9 pts y/y All measures above are GAAP 1 Adjusted for discontinued operations for all periods - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings

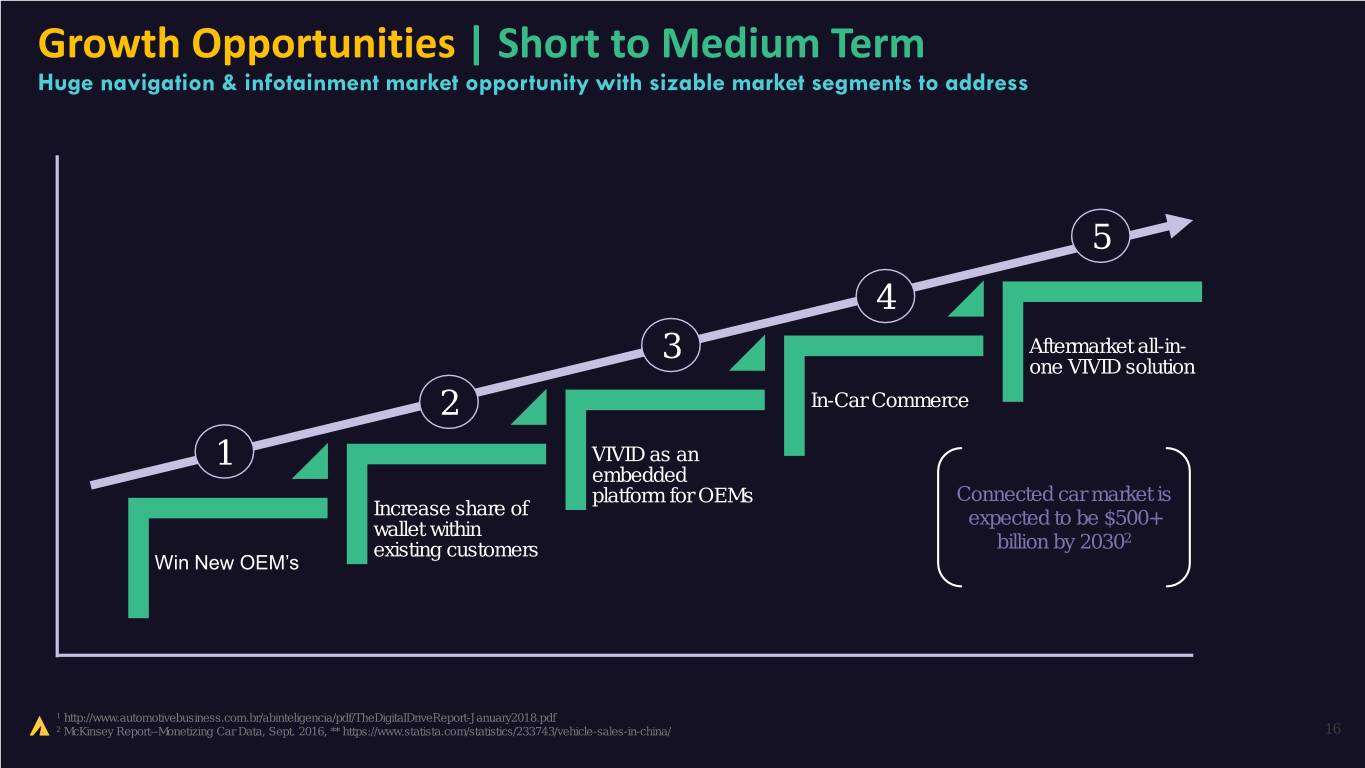

Growth Opportunities | Short to Medium Term Huge navigation & infotainment market opportunity with sizable market segments to address 5 4 3 Aftermarket all-in- one VIVID solution 2 In-Car Commerce 1 VIVID as an embedded platform for OEMs Connected car market is Increase share of expected to be $500+ wallet within 2 existing customers billion by 2030 Win New OEM’s 1 http://www.automotivebusiness.com.br/abinteligencia/pdf/TheDigitalDriveReport-January2018.pdf 2 McKinsey Report--Monetizing Car Data, Sept. 2016, ** https://www.statista.com/statistics/233743/vehicle-sales-in-china/ 16

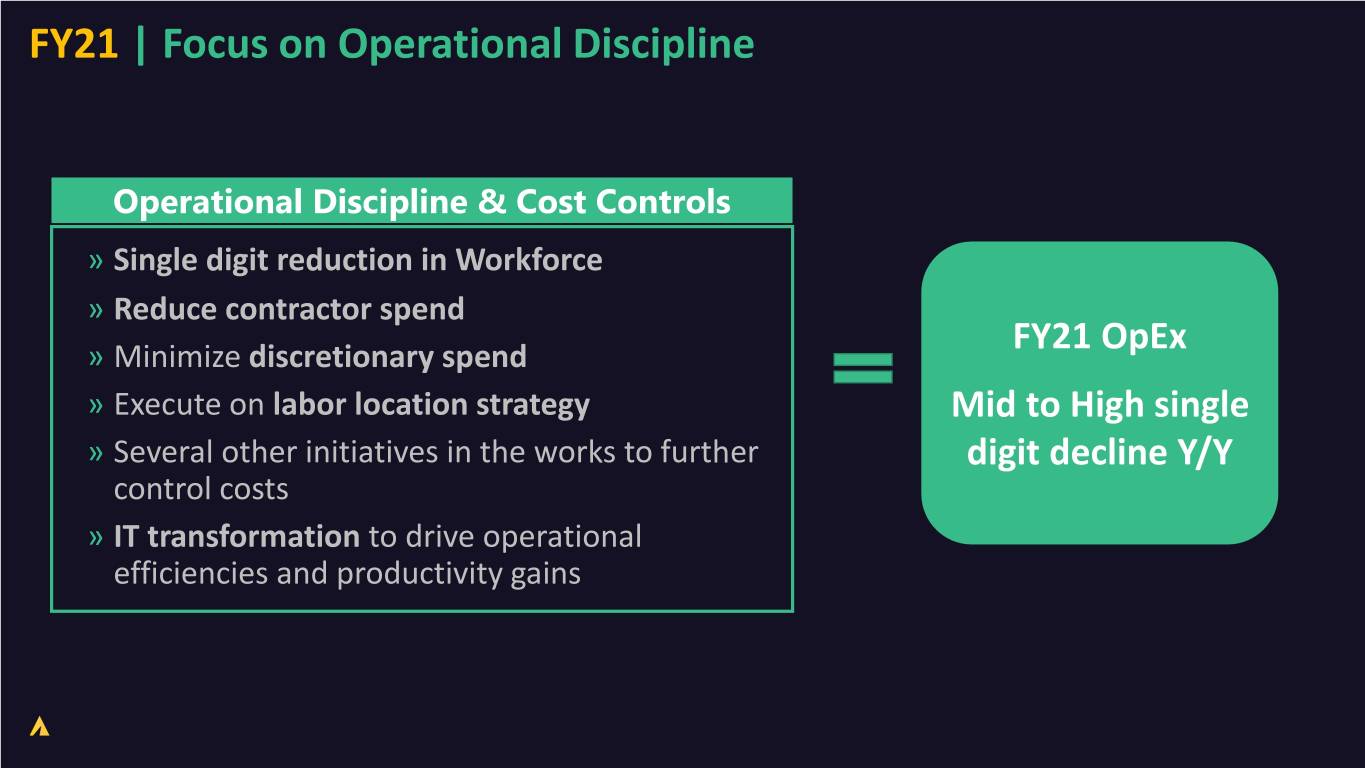

FY21 | Focus on Operational Discipline Operational Discipline & Cost Controls » Single digit reduction in Workforce » Reduce contractor spend FY21 OpEx » Minimize discretionary spend » Execute on labor location strategy Mid to High single » Several other initiatives in the works to further digit decline Y/Y control costs » IT transformation to drive operational efficiencies and productivity gains

Q1 FY21 Outlook

Q1 FY21 Outlook Guidance (as of August 12, 2020) (dollars in millions) Revenue $57.0 to $59.0 Gross margin % 43% to 45% Operating expenses $27.0 to $29.0 Net income $(3.0) to $(1.0) Adjusted EBITDA* $0.0 to $2.0 - All measures above are GAAP except where denoted by a * (Non-GAAP)

Q4 Appendix and FY20 Financial Tables

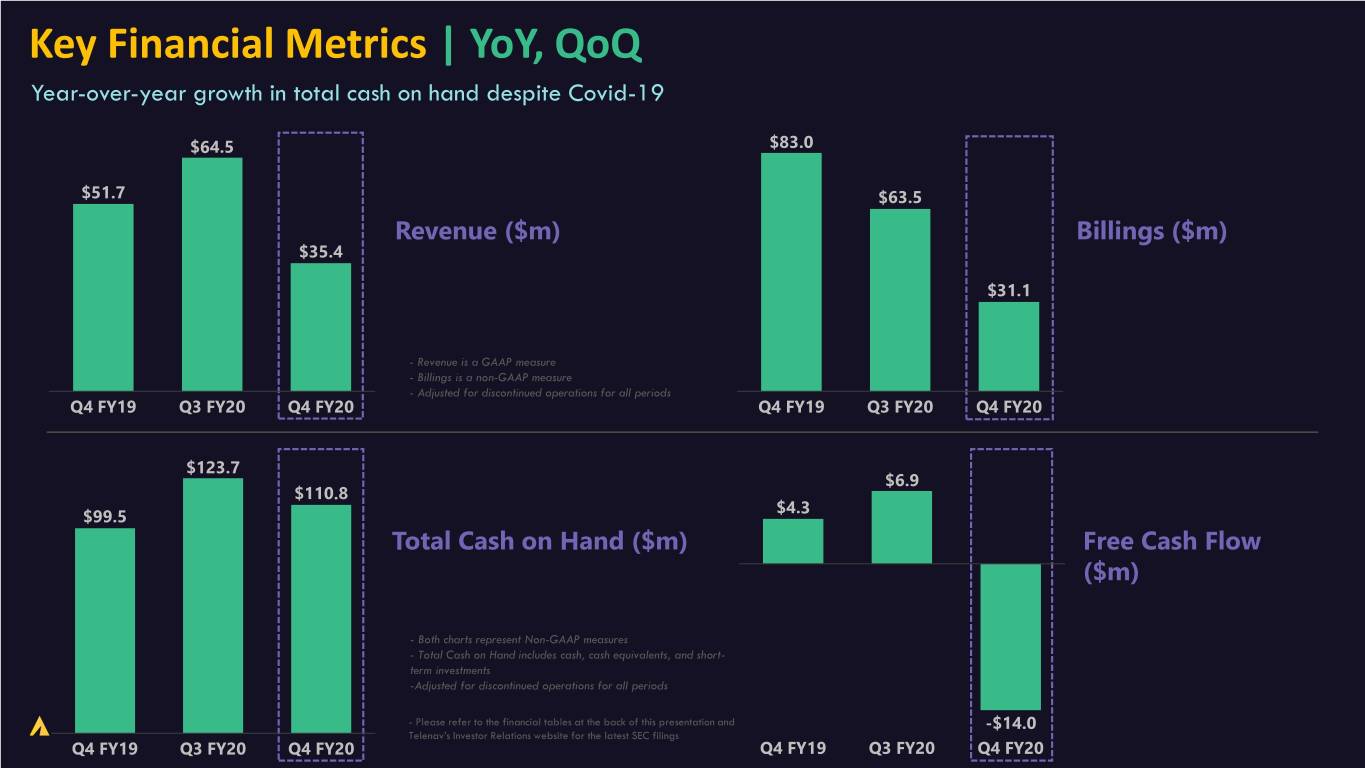

Key Financial Metrics | YoY, QoQ Year-over-year growth in total cash on hand despite Covid-19 $64.5 $83.0 $51.7 $63.5 Revenue ($m) Billings ($m) $35.4 $31.1 - Revenue is a GAAP measure - -RevenueBillings is a GAAPnon-GAAP measure measure - -BillingsAdjusted is a for non discontinued-GAAP measure operations for all periods Q4 FY19 Q3 FY20 Q4 FY20 - Adjusted for discontinued operations for all periods Q4 FY19 Q3 FY20 Q4 FY20 $123.7 $6.9 $110.8 $4.3 $99.5 Total Cash on Hand ($m) Free Cash Flow ($m) - Both charts represent Non-GAAP measures - Both- Total charts Cash represent on Hand Non includes-GAAP cash, measures cash equivalents, and short- - Totalterm Cashinvestments on Hand includes cash, cash equivalents, and short- term-Adjusted investments for discontinued operations for all periods -Adjusted for discontinued operations for all periods - Please refer to the financial tables at the back of this presentation and -$14.0 - PleaseTelenav’s refer Investor to the financialRelations tables website at forthe theback latest of this SEC presentation filings and Q4 FY19 Q3 FY20 Q4 FY20 Telenav’s Investor Relations website for the latest SEC filings Q4 FY19 Q3 FY20 Q4 FY20

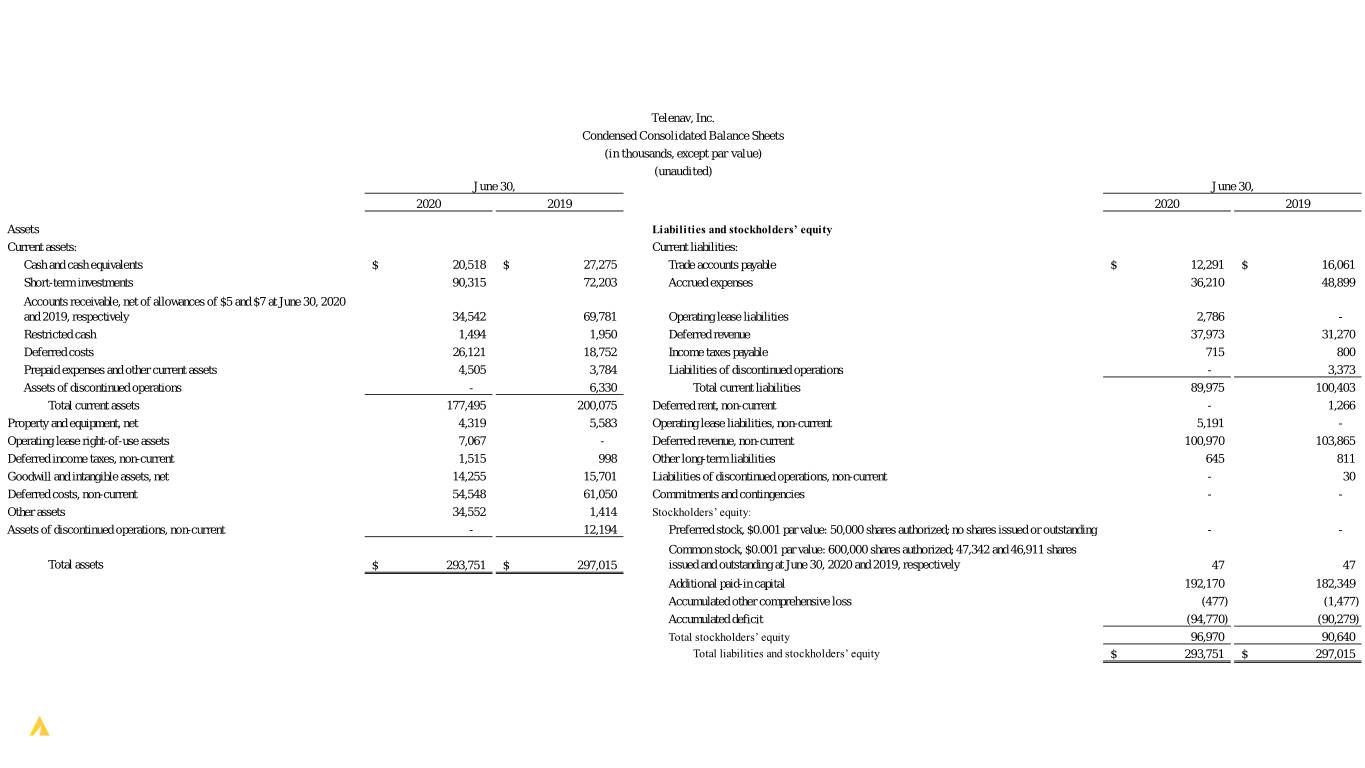

Telenav, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (unaudited) June 30, June 30, 2020 2019 2020 2019 Assets Liabilities and stockholders’ equity Current assets: Current liabilities: Cash and cash equivalents $ 20,518 $ 27,275 Trade accounts payable $ 12,291 $ 16,061 Short-term investments 90,315 72,203 Accrued expenses 36,210 48,899 Accounts receivable, net of allowances of $5 and $7 at June 30, 2020 and 2019, respectively 34,542 69,781 Operating lease liabilities 2,786 - Restricted cash 1,494 1,950 Deferred revenue 37,973 31,270 Deferred costs 26,121 18,752 Income taxes payable 715 800 Prepaid expenses and other current assets 4,505 3,784 Liabilities of discontinued operations - 3,373 Assets of discontinued operations - 6,330 Total current liabilities 89,975 100,403 Total current assets 177,495 200,075 Deferred rent, non-current - 1,266 Property and equipment, net 4,319 5,583 Operating lease liabilities, non-current 5,191 - Operating lease right-of-use assets 7,067 - Deferred revenue, non-current 100,970 103,865 Deferred income taxes, non-current 1,515 998 Other long-term liabilities 645 811 Goodwill and intangible assets, net 14,255 15,701 Liabilities of discontinued operations, non-current - 30 Deferred costs, non-current 54,548 61,050 Commitments and contingencies - - Other assets 34,552 1,414 Stockholders’ equity: Assets of discontinued operations, non-current - 12,194 Preferred stock, $0.001 par value: 50,000 shares authorized; no shares issued or outstanding - - Common stock, $0.001 par value: 600,000 shares authorized; 47,342 and 46,911 shares Total assets $ 293,751 $ 297,015 issued and outstanding at June 30, 2020 and 2019, respectively 47 47 Additional paid-in capital 192,170 182,349 Accumulated other comprehensive loss (477) (1,477) Accumulated deficit (94,770) (90,279) Total stockholders’ equity 96,970 90,640 Total liabilities and stockholders’ equity $ 293,751 $ 297,015

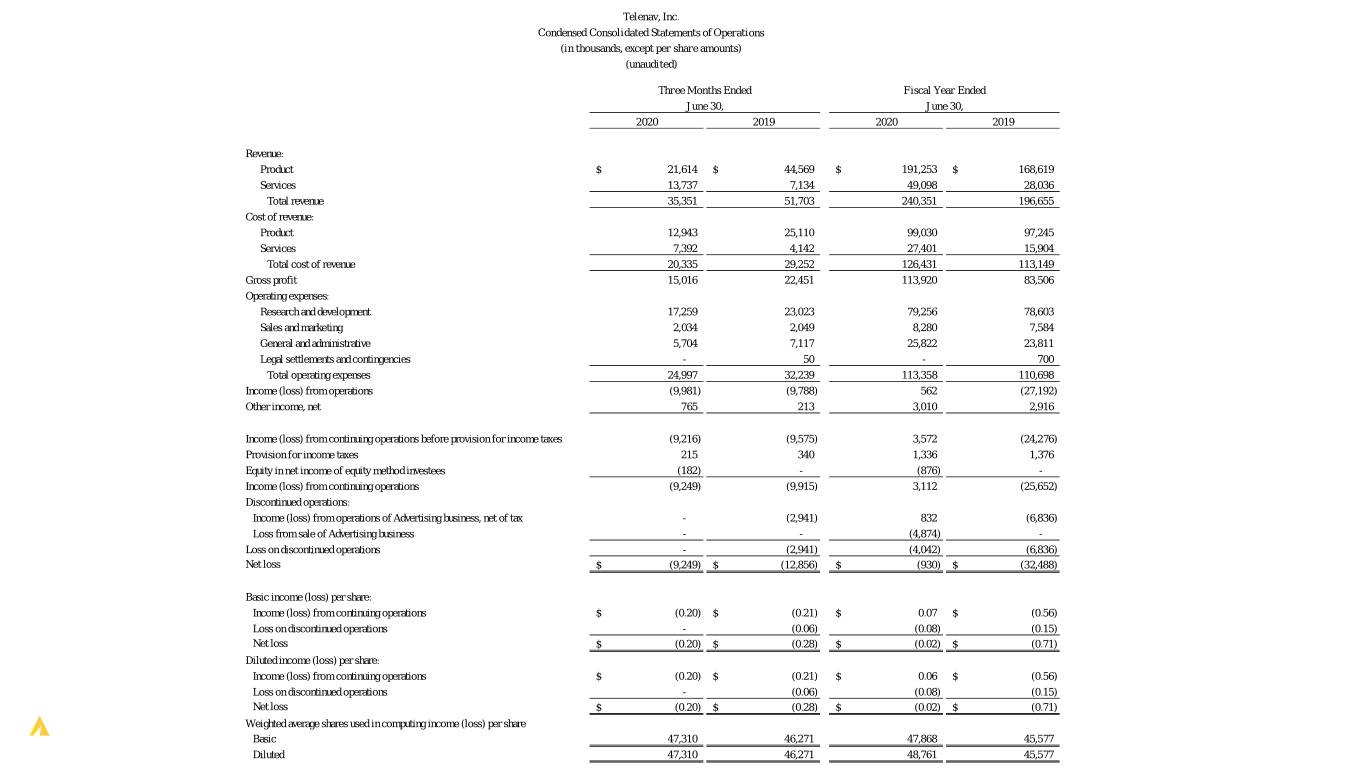

Telenav, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share amounts) (unaudited) Three Months Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Revenue: Product $ 21,614 $ 44,569 $ 191,253 $ 168,619 Services 13,737 7,134 49,098 28,036 Total revenue 35,351 51,703 240,351 196,655 Cost of revenue: Product 12,943 25,110 99,030 97,245 Services 7,392 4,142 27,401 15,904 Total cost of revenue 20,335 29,252 126,431 113,149 Gross profit 15,016 22,451 113,920 83,506 Operating expenses: Research and development 17,259 23,023 79,256 78,603 Sales and marketing 2,034 2,049 8,280 7,584 General and administrative 5,704 7,117 25,822 23,811 Legal settlements and contingencies - 50 - 700 Total operating expenses 24,997 32,239 113,358 110,698 Income (loss) from operations (9,981) (9,788) 562 (27,192) Other income, net 765 213 3,010 2,916 Income (loss) from continuing operations before provision for income taxes (9,216) (9,575) 3,572 (24,276) Provision for income taxes 215 340 1,336 1,376 Equity in net income of equity method investees (182) - (876) - Income (loss) from continuing operations (9,249) (9,915) 3,112 (25,652) Discontinued operations: Income (loss) from operations of Advertising business, net of tax - (2,941) 832 (6,836) Loss from sale of Advertising business - - (4,874) - Loss on discontinued operations - (2,941) (4,042) (6,836) Net loss $ (9,249) $ (12,856) $ (930) $ (32,488) Basic income (loss) per share: Income (loss) from continuing operations $ (0.20) $ (0.21) $ 0.07 $ (0.56) Loss on discontinued operations - (0.06) (0.08) (0.15) Net loss $ (0.20) $ (0.28) $ (0.02) $ (0.71) Diluted income (loss) per share: Income (loss) from continuing operations $ (0.20) $ (0.21) $ 0.06 $ (0.56) Loss on discontinued operations - (0.06) (0.08) (0.15) Net loss $ (0.20) $ (0.28) $ (0.02) $ (0.71) Weighted average shares used in computing income (loss) per share Basic 47,310 46,271 47,868 45,577 Diluted 47,310 46,271 48,761 45,577

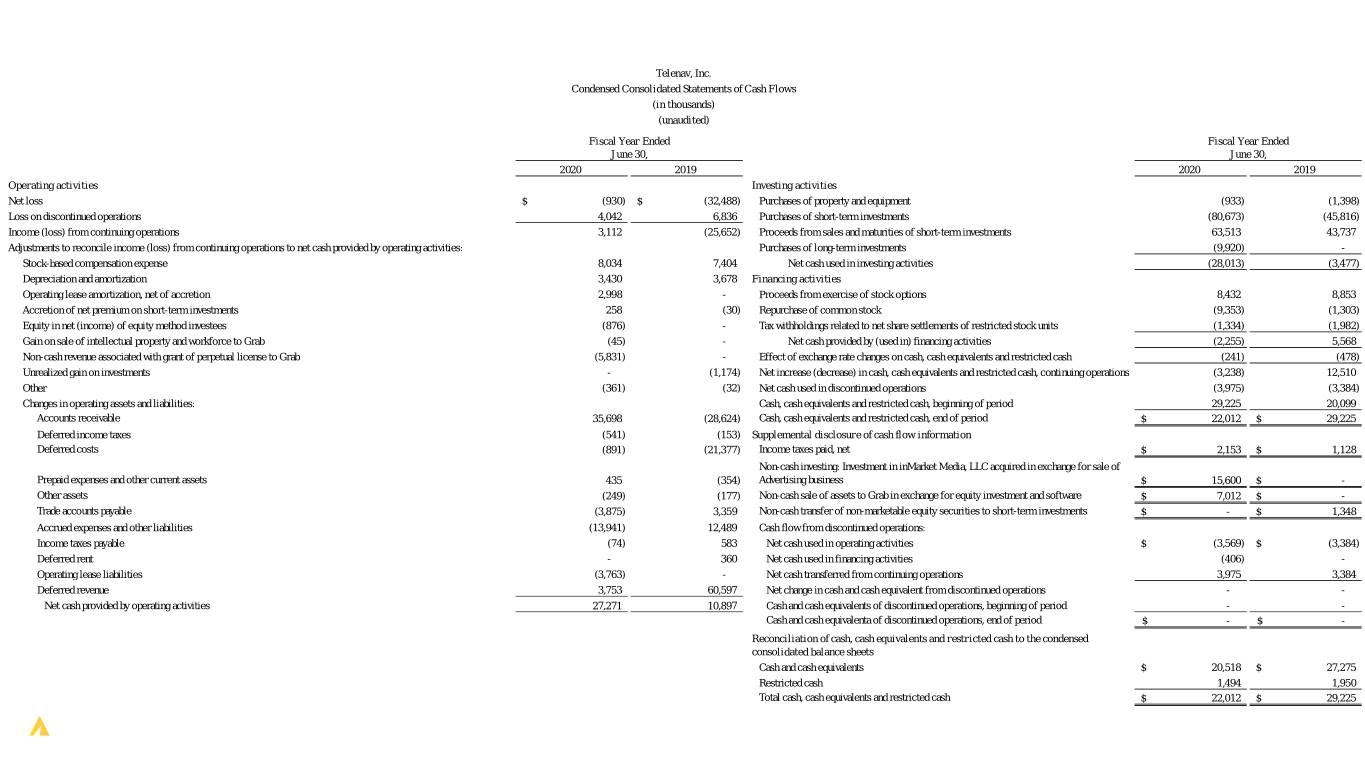

Telenav, Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Fiscal Year Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Operating activities Investing activities Net loss $ (930) $ (32,488) Purchases of property and equipment (933) (1,398) Loss on discontinued operations 4,042 6,836 Purchases of short-term investments (80,673) (45,816) Income (loss) from continuing operations 3,112 (25,652) Proceeds from sales and maturities of short-term investments 63,513 43,737 Adjustments to reconcile income (loss) from continuing operations to net cash provided by operating activities: Purchases of long-term investments (9,920) - Stock-based compensation expense 8,034 7,404 Net cash used in investing activities (28,013) (3,477) Depreciation and amortization 3,430 3,678 Financing activities Operating lease amortization, net of accretion 2,998 - Proceeds from exercise of stock options 8,432 8,853 Accretion of net premium on short-term investments 258 (30) Repurchase of common stock (9,353) (1,303) Equity in net (income) of equity method investees (876) - Tax withholdings related to net share settlements of restricted stock units (1,334) (1,982) Gain on sale of intellectual property and workforce to Grab (45) - Net cash provided by (used in) financing activities (2,255) 5,568 Non-cash revenue associated with grant of perpetual license to Grab (5,831) - Effect of exchange rate changes on cash, cash equivalents and restricted cash (241) (478) Unrealized gain on investments - (1,174) Net increase (decrease) in cash, cash equivalents and restricted cash, continuing operations (3,238) 12,510 Other (361) (32) Net cash used in discontinued operations (3,975) (3,384) Changes in operating assets and liabilities: Cash, cash equivalents and restricted cash, beginning of period 29,225 20,099 Accounts receivable 35,698 (28,624) Cash, cash equivalents and restricted cash, end of period $ 22,012 $ 29,225 Deferred income taxes (541) (153) Supplemental disclosure of cash flow information Deferred costs (891) (21,377) Income taxes paid, net $ 2,153 $ 1,128 Non-cash investing: Investment in inMarket Media, LLC acquired in exchange for sale of Prepaid expenses and other current assets 435 (354) Advertising business $ 15,600 $ - Other assets (249) (177) Non-cash sale of assets to Grab in exchange for equity investment and software $ 7,012 $ - Trade accounts payable (3,875) 3,359 Non-cash transfer of non-marketable equity securities to short-term investments $ - $ 1,348 Accrued expenses and other liabilities (13,941) 12,489 Cash flow from discontinued operations: Income taxes payable (74) 583 Net cash used in operating activities $ (3,569) $ (3,384) Deferred rent - 360 Net cash used in financing activities (406) - Operating lease liabilities (3,763) - Net cash transferred from continuing operations 3,975 3,384 Deferred revenue 3,753 60,597 Net change in cash and cash equivalent from discontinued operations - - Net cash provided by operating activities 27,271 10,897 Cash and cash equivalents of discontinued operations, beginning of period - - Cash and cash equivalenta of discontinued operations, end of period $ - $ - Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets Cash and cash equivalents $ 20,518 $ 27,275 Restricted cash 1,494 1,950 Total cash, cash equivalents and restricted cash $ 22,012 $ 29,225

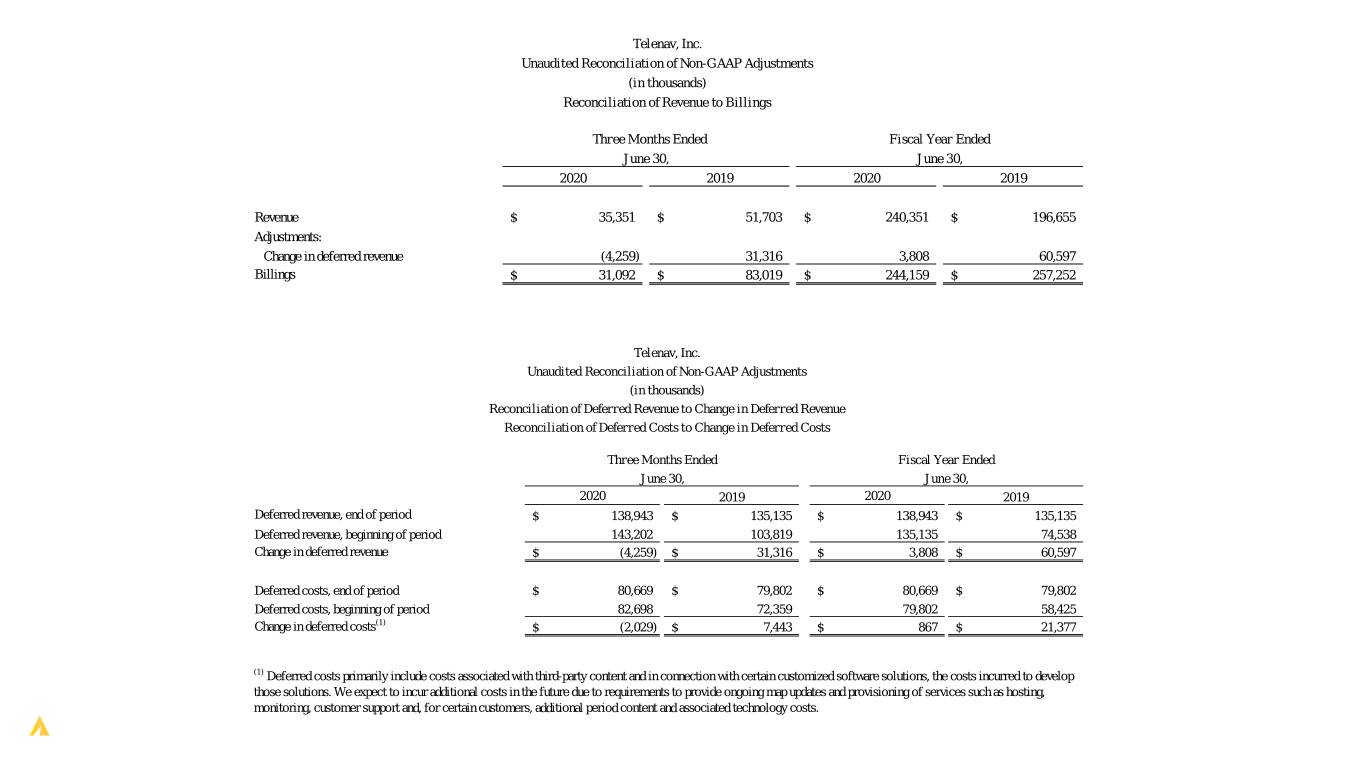

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Revenue to Billings Three Months Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Revenue $ 35,351 $ 51,703 $ 240,351 $ 196,655 Adjustments: Change in deferred revenue (4,259) 31,316 3,808 60,597 Billings $ 31,092 $ 83,019 $ 244,159 $ 257,252 Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Deferred Revenue to Change in Deferred Revenue Reconciliation of Deferred Costs to Change in Deferred Costs Three Months Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Deferred revenue, end of period $ 138,943 $ 135,135 $ 138,943 $ 135,135 Deferred revenue, beginning of period 143,202 103,819 135,135 74,538 Change in deferred revenue $ (4,259) $ 31,316 $ 3,808 $ 60,597 Deferred costs, end of period $ 80,669 $ 79,802 $ 80,669 $ 79,802 Deferred costs, beginning of period 82,698 72,359 79,802 58,425 Change in deferred costs(1) $ (2,029) $ 7,443 $ 867 $ 21,377 (1) Deferred costs primarily include costs associated with third-party content and in connection with certain customized software solutions, the costs incurred to develop those solutions. We expect to incur additional costs in the future due to requirements to provide ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs.

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Loss to Adjusted EBITDA Three Months Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Net loss $ (9,249) $ (12,856) $ (930) $ (32,488) Loss on discontinued operations - 2,941 4,042 6,836 Income (loss) from continuing operations (9,249) (9,915) 3,112 (25,652) Adjustments: Legal settlements and contingencies - 50 - 700 Stock-based compensation expense 2,845 1,793 8,034 7,404 Depreciation and amortization expense 745 696 3,430 3,678 Other income, net (765) (213) (3,010) (2,916) Provision for income taxes 215 340 1,336 1,376 Equity in net (income) of equity method investees (182) - (876) - Adjusted EBITDA $ (6,391) $ (7,249) $ 12,026 $ (15,410)

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Loss to Free Cash Flow Three Months Ended Fiscal Year Ended June 30, June 30, 2020 2019 2020 2019 Net loss $ (9,249) $ (12,856) $ (930) $ (32,488) Loss on discontinued operations - 2,941 4,042 6,836 Income (loss) from continuing operations (9,249) (9,915) 3,112 (25,652) Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used in) operating activities: Change in deferred revenue (1) (4,289) 31,316 3,753 60,597 Change in deferred costs (2) 2,033 (7,443) (891) (21,377) Changes in other operating assets and liabilities (6,936) (11,800) 13,690 (12,517) Other adjustments (3) 4,031 2,550 7,607 9,846 Net cash provided by (used in) operating activities (14,410) 4,708 27,271 10,897 Less: Purchases of property and equipment 387 (442) (933) (1,398) Free cash flow $ (14,023) $ 4,266 $ 26,338 $ 9,499 (1) Consists of product royalties, customized software development fees, service fees and subscription fees. (2) Consist primarily of third party content costs and customized software development expenses. (3) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash items.