Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR DECK - Benefitfocus, Inc. | bnft-8k_20200812.htm |

Benefitfocus Investor Presentation Q2 2020 Exhibit 99.1

Safe Harbor Except for historical information, all of the statements, expectations, and assumptions contained in this presentation are forward-looking statements. Actual results might differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include: volatility and uncertainty in the global economy and financial markets in light of the evolving COVID-19 pandemic; our continuing losses and need to achieve GAAP profitability; fluctuations in our financial results; our ability to maintain our culture, retain and motivate qualified personnel; the immature and volatile market for our products and services; risks related to changing healthcare and other applicable regulations; risks associated with acquisitions; cyber-security risks; the need to innovate and provide useful products and services; our ability to compete effectively; privacy, security and other risks associated with our business; and the other risk factors set forth from time to time in our SEC filings, copies of which are available free of charge within the Investor Relations section of the Benefitfocus website at http://investor.benefitfocus.com/sec-filings or upon request from our Investor Relations Department. Benefitfocus assumes no obligation and does not intend to update these forward-looking statements, except as required by law. Non-GAAP Financial Measures The Company uses certain non-GAAP financial measures in this presentation, including non-GAAP gross profit, adjusted EBITDA and Free Cash Flow. Generally, a non-GAAP financial measure is a numerical measure of a Company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP gross profit excludes stock-based compensation expenses, amortization of acquisition-related intangible assets, transaction and acquisition-related costs expensed, if any, restructuring charges, if any, and costs not core to our business, if any. We define adjusted EBITDA as net loss before net interest, taxes, and depreciation and amortization expense, adjusted to eliminate stock-based compensation expense, expense related to the impairment of goodwill and intangible assets, transaction and acquisition-related costs expensed, restructuring charges and costs not core to our business. We define Free Cash Flow as cash used in operating activities less capital expenditures, adjusted to eliminate restructuring charges. Please note that other companies might define their non-GAAP financial measures differently than we do. Management presents these non-GAAP financial measures in this presentation because it considers them to be important supplemental measures of performance. Management uses these non-GAAP financial measures for planning purposes, including analysis of the Company's performance against prior periods, the preparation of operating budgets and to determine appropriate levels of operating and capital investments. Management believes that these non-GAAP financial measures provide additional insight for analysts and investors in evaluating the Company's financial and operational performance. Management also intends to provide these non-GAAP financial measures as part of the Company’s future earnings discussions and, therefore, their inclusion should provide consistency in the Company’s financial reporting. Non-GAAP financial measures have limitations as an analytical tool. Investors are encouraged to review the reconciliation of the non-GAAP measures to their most directly comparable GAAP measures provided in this presentation, including in the accompanying tables.

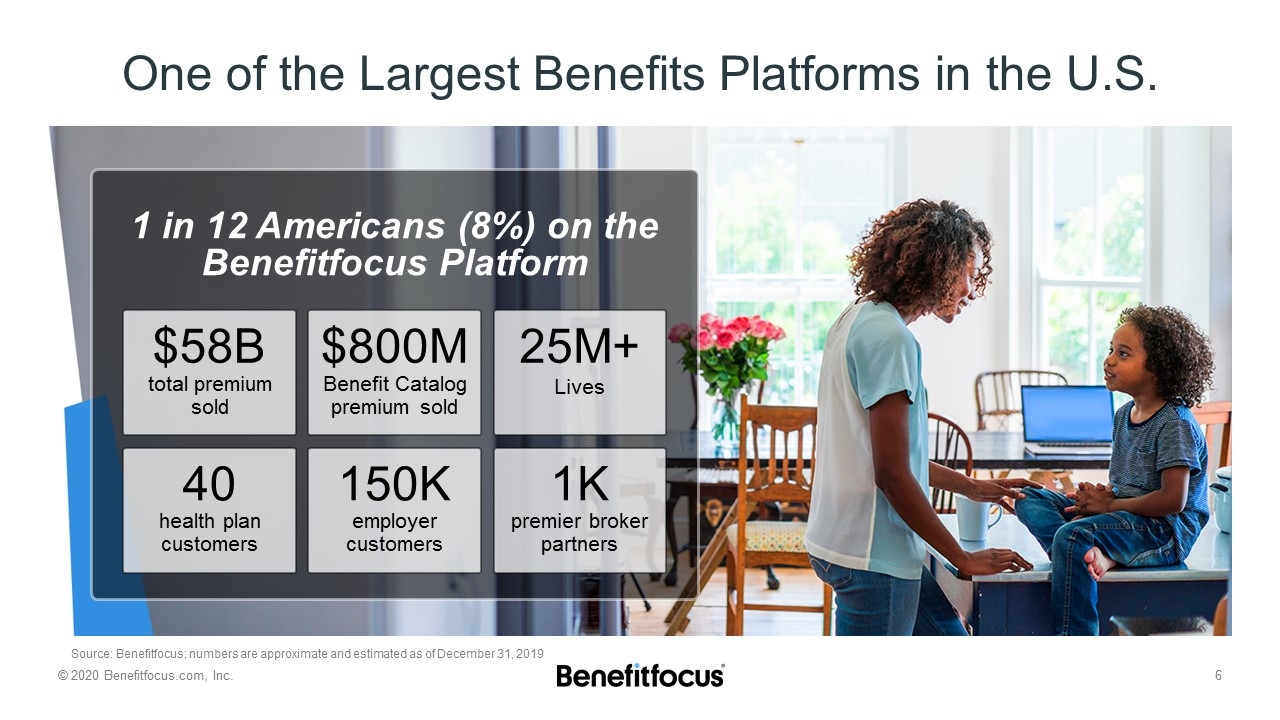

Benefitfocus is one of the largest benefits platforms in the U.S. uniting Consumers, Employers and Health Plans with benefits. Our mission is to improve lives with benefits.

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

One of the Largest Benefits Platforms in the U.S. 1 in 12 Americans (8%) on the Benefitfocus Platform $58B total premium sold 40 health plan customers $800M Benefit Catalog premium sold 150K employer customers 25M+ Lives 1K premier broker partners Source: Benefitfocus; numbers are approximate and estimated as of December 31, 2019

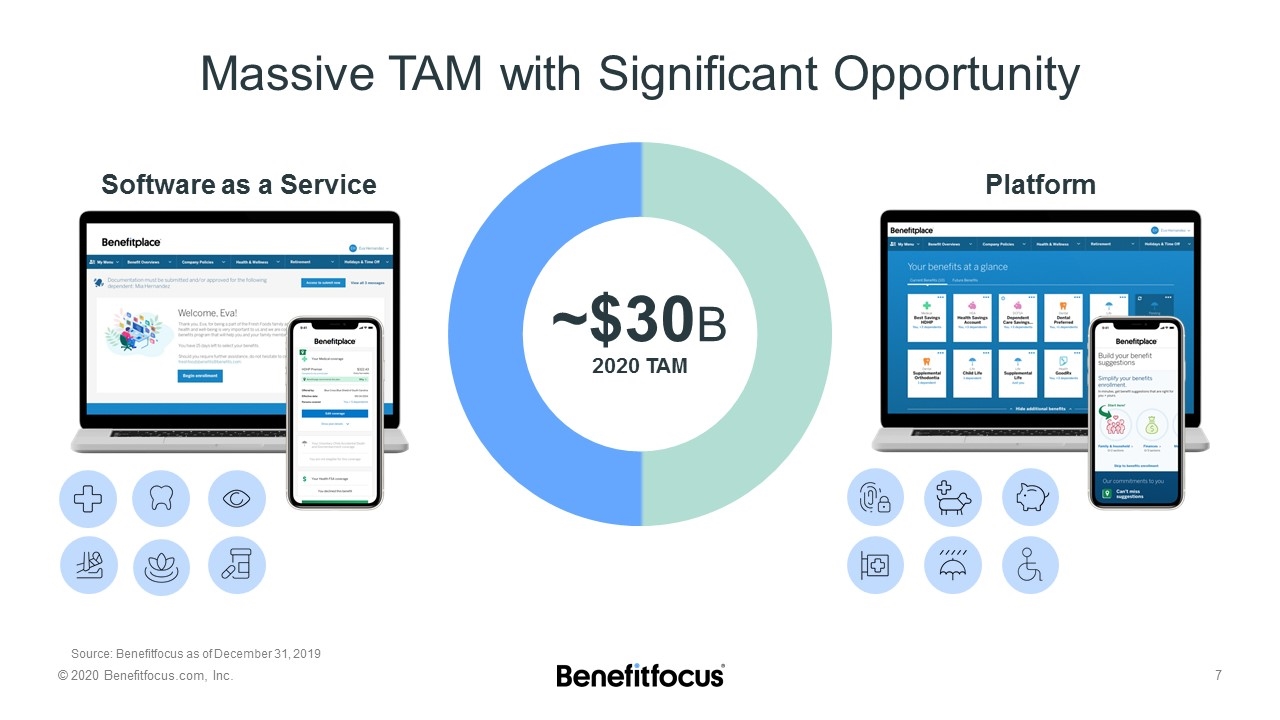

Massive TAM with Significant Opportunity ~$30B 2020 TAM Software as a Service Platform Source: Benefitfocus as of December 31, 2019

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

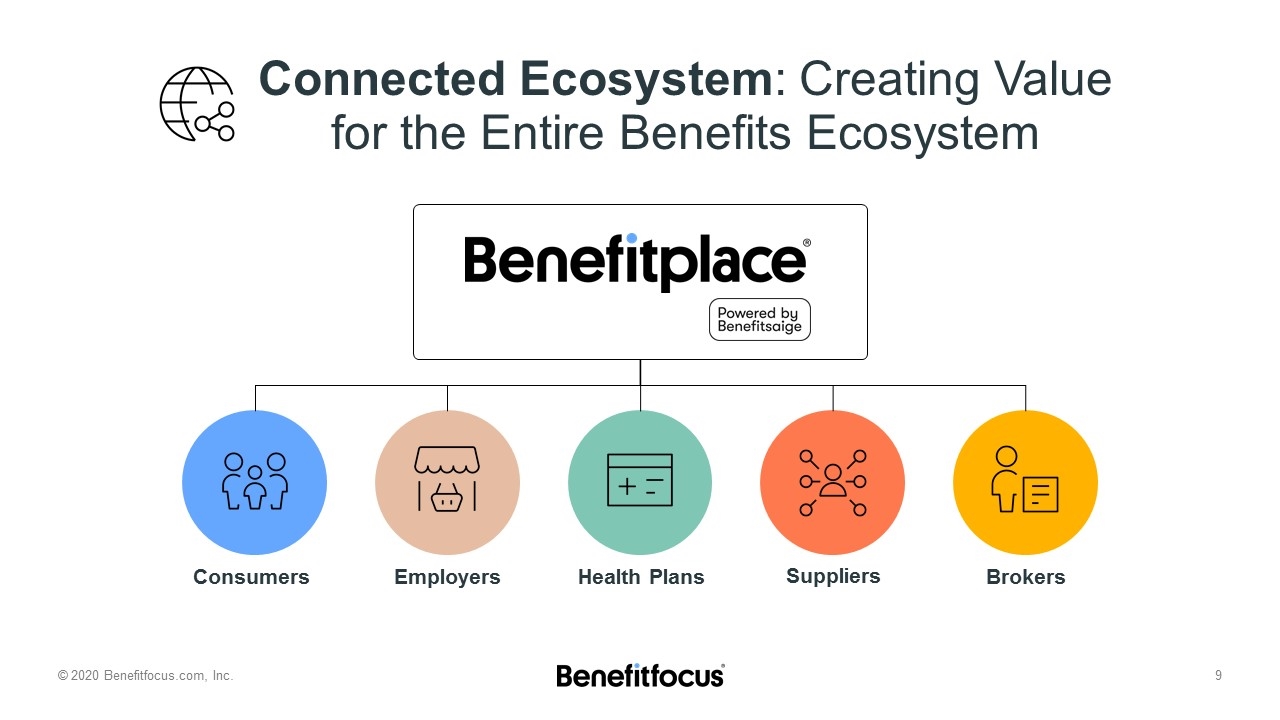

Connected Ecosystem: Creating Value for the Entire Benefits Ecosystem Employers Consumers Health Plans Brokers Suppliers

Our Value Proposition Health Plans Lower operational costs, higher member satisfaction and digital transformation Employers Lower health care costs, reduced complexity and higher employee retention Consumer Valuable, affordable and personalized benefits

Vast & unique data assets AI-powered platform Industry leading products Competitive Differentiation

Industry Leading Products: Comprehensive and Curated Marketplace of Suppliers Benefit Catalog Robust portfolio of trusted health, wealth, property and lifestyle benefits integrated into our enrollment experience.

AI-powered Platform: Benefitsaige is the AI that Delivers Insights across our Ecosystem Personalized Benefits Consumers connect to the benefits their families need. Population Health Insights Employers control healthcare costs and optimize benefit strategy. Operational Scale Health Plans gain operational scale with a connected, digital ecosystem

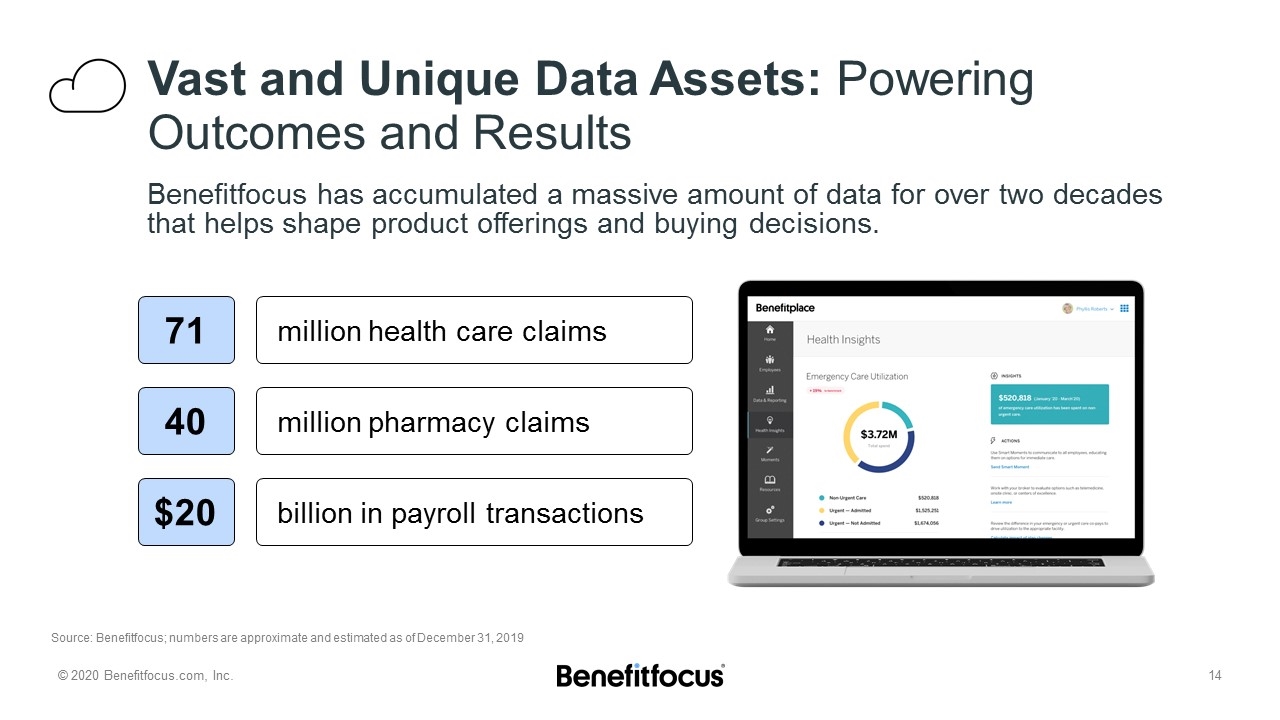

Vast and Unique Data Assets: Powering Outcomes and Results million health care claims million pharmacy claims billion in payroll transactions 71 40 $20 Benefitfocus has accumulated a massive amount of data for over two decades that helps shape product offerings and buying decisions. Source: Benefitfocus; numbers are approximate and estimated as of December 31, 2019

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

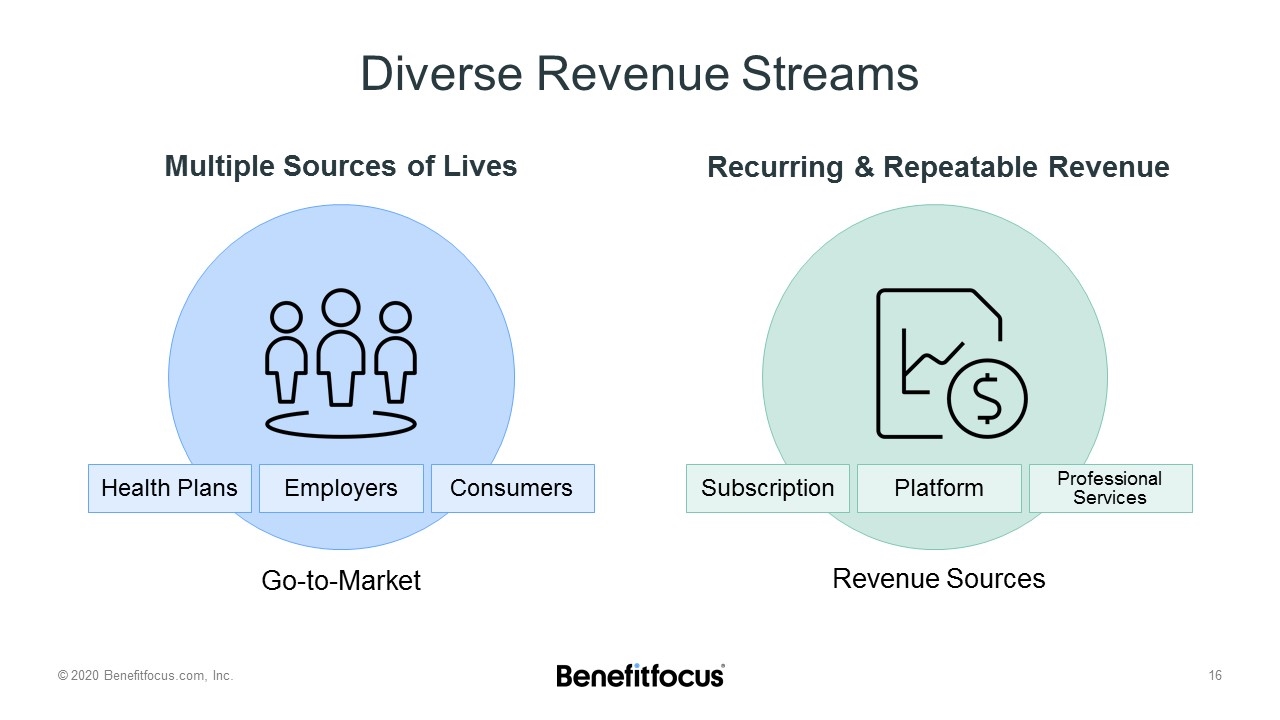

Diverse Revenue Streams Multiple Sources of Lives Recurring & Repeatable Revenue Go-to-Market Revenue Sources Health Plans Employers Consumers Subscription Platform Professional Services

Proactively Managing Impact of COVID-19 Well-positioned to Successfully Navigate Challenging Conditions Decisive cost management actions; Focused on highly profitable revenue Accelerating innovating and automation to address emerging Ecosystem needs Improving margins, adjusted EBITDA and Free Cash Flow

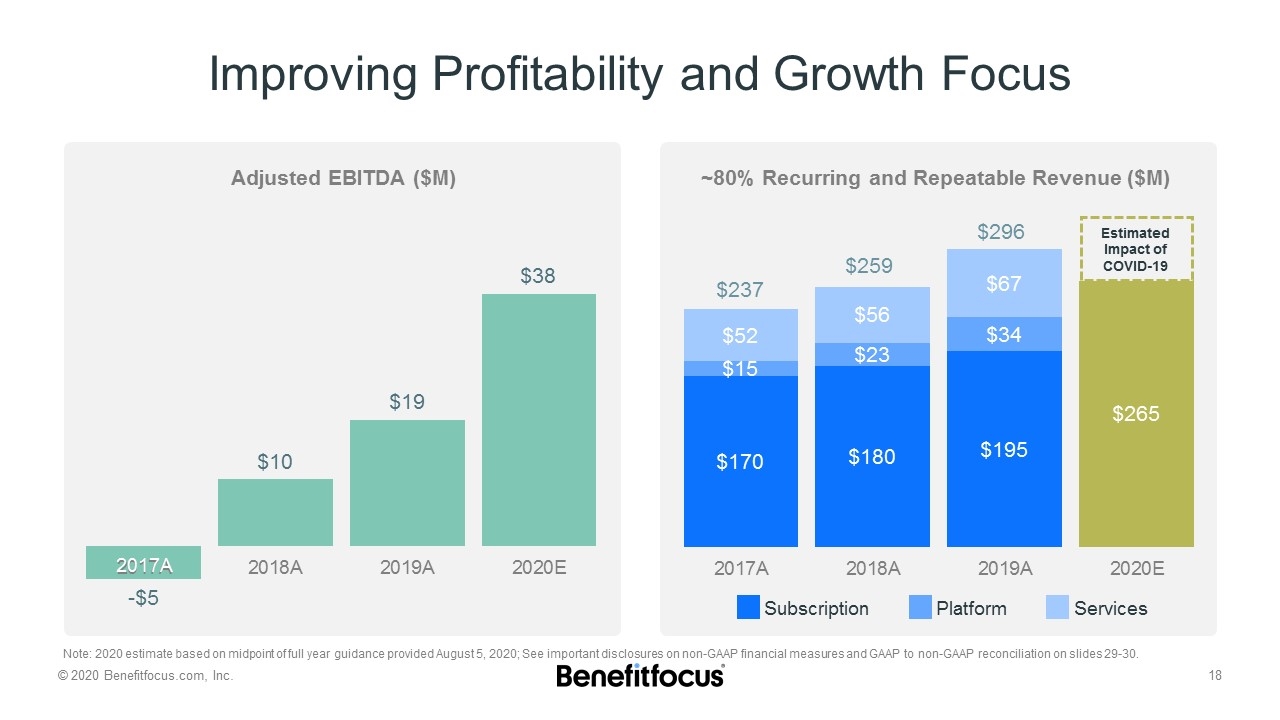

Adjusted EBITDA ($M) Improving Profitability and Growth Focus ~80% Recurring and Repeatable Revenue ($M) Subscription Platform Services Estimated Impact of COVID-19 2017A Note: 2020 estimate based on midpoint of full year guidance provided August 5, 2020; See important disclosures on non-GAAP financial measures and GAAP to non-GAAP reconciliation on slides 29-30. $237 $259 $296

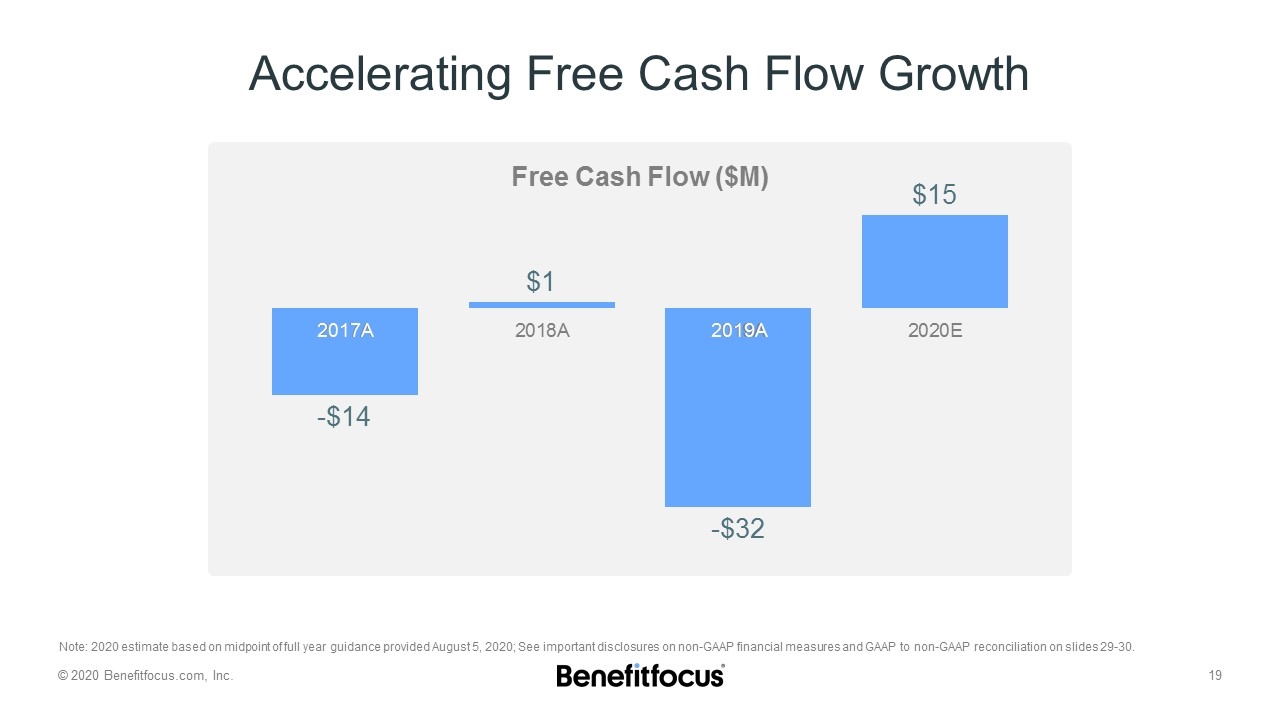

Accelerating Free Cash Flow Growth Free Cash Flow ($M) 2017A 2019A Note: 2020 estimate based on midpoint of full year guidance provided August 5, 2020; See important disclosures on non-GAAP financial measures and GAAP to non-GAAP reconciliation on slides 29-30.

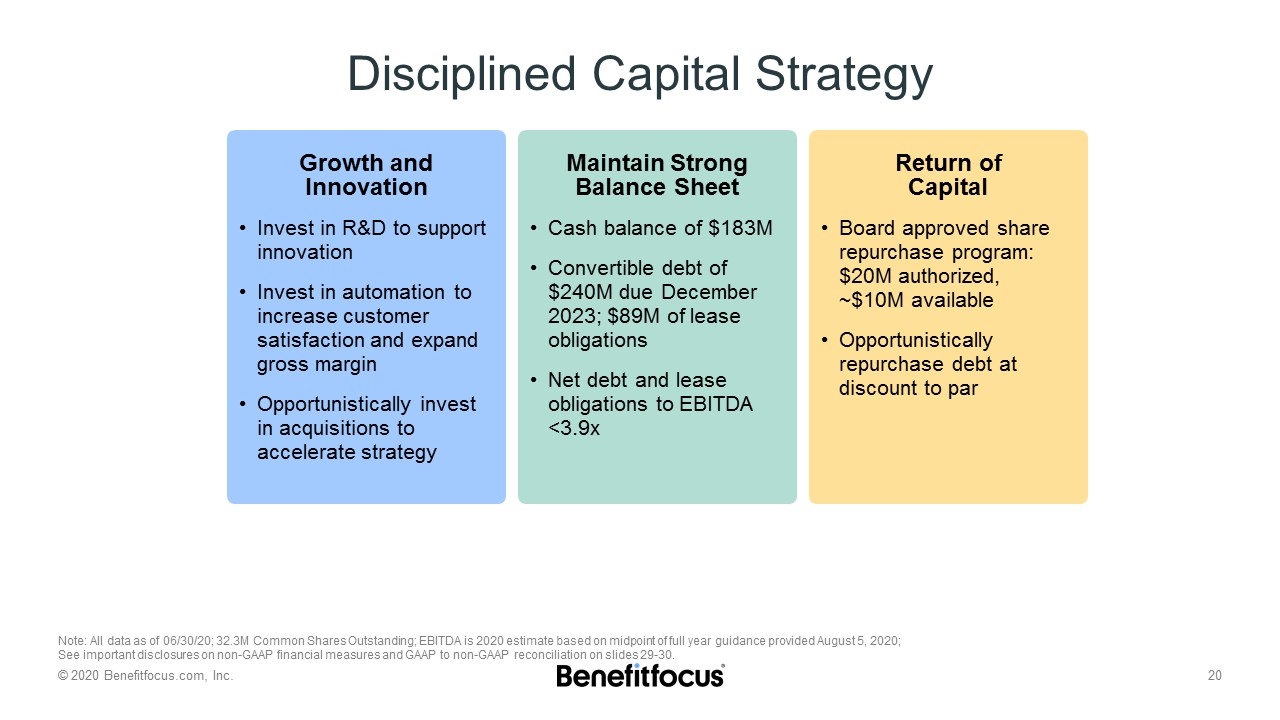

Disciplined Capital Strategy Growth and Innovation Invest in R&D to support innovation Invest in automation to increase customer satisfaction and expand gross margin Opportunistically invest in acquisitions to accelerate strategy Return of Capital Board approved share repurchase program: $20M authorized, ~$10M available Opportunistically repurchase debt at discount to par Maintain Strong Balance Sheet Cash balance of $183M Convertible debt of $240M due December 2023; $89M of lease obligations Net debt and lease obligations to EBITDA <3.9x Note: All data as of 06/30/20; 32.3M Common Shares Outstanding; EBITDA is 2020 estimate based on midpoint of full year guidance provided August 5, 2020; See important disclosures on non-GAAP financial measures and GAAP to non-GAAP reconciliation on slides 29-30.

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

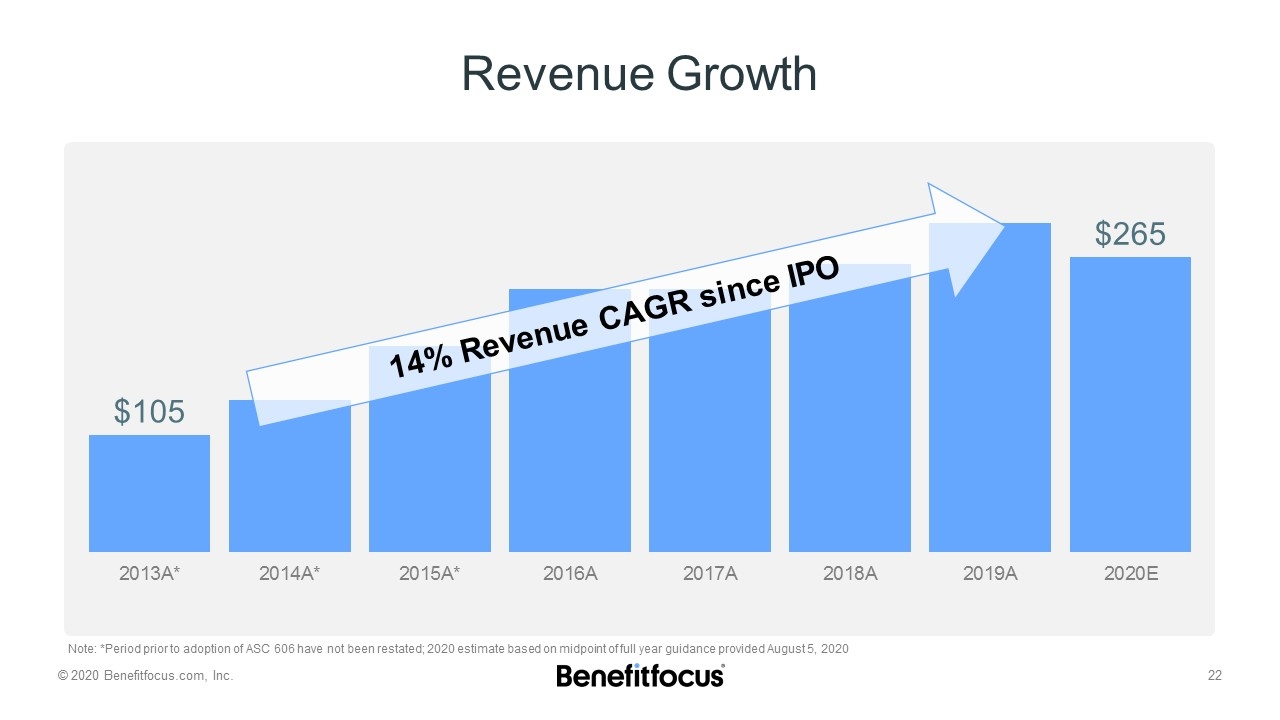

Revenue Growth Note: *Period prior to adoption of ASC 606 have not been restated; 2020 estimate based on midpoint of full year guidance provided August 5, 2020 14% Revenue CAGR since IPO

Accelerate Strategic Investment of Capital customer loyalty via automation Improve Platform and operating scale Expand value enhancing acquisitions Target

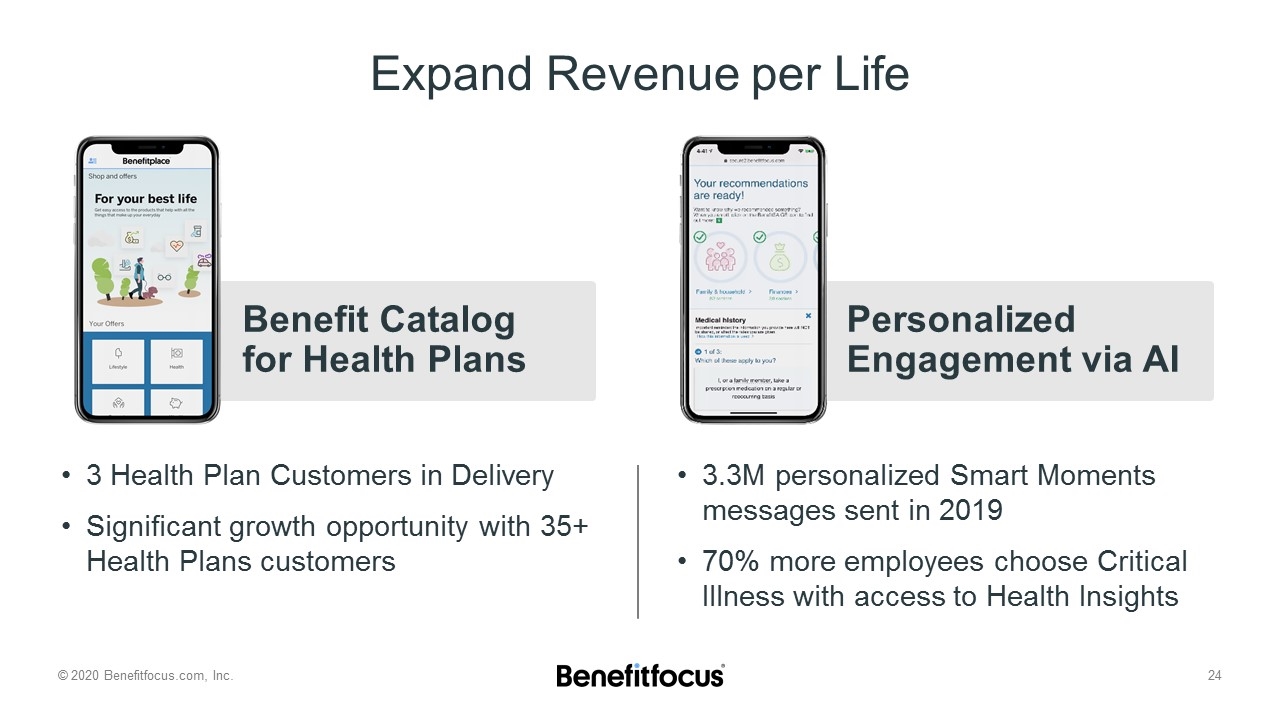

Expand Revenue per Life 3 Health Plan Customers in Delivery Significant growth opportunity with 35+ Health Plans customers 3.3M personalized Smart Moments messages sent in 2019 70% more employees choose Critical Illness with access to Health Insights Benefit Catalog for Health Plans Personalized Engagement via AI

Accelerate Lives Growth Health Plans Operational Efficiency with Quote-to-Pay solution 4 strategic Health Plan deals in last 12 months Employers Differentiation via healthcare costs savings Health Insights powering smart decisions

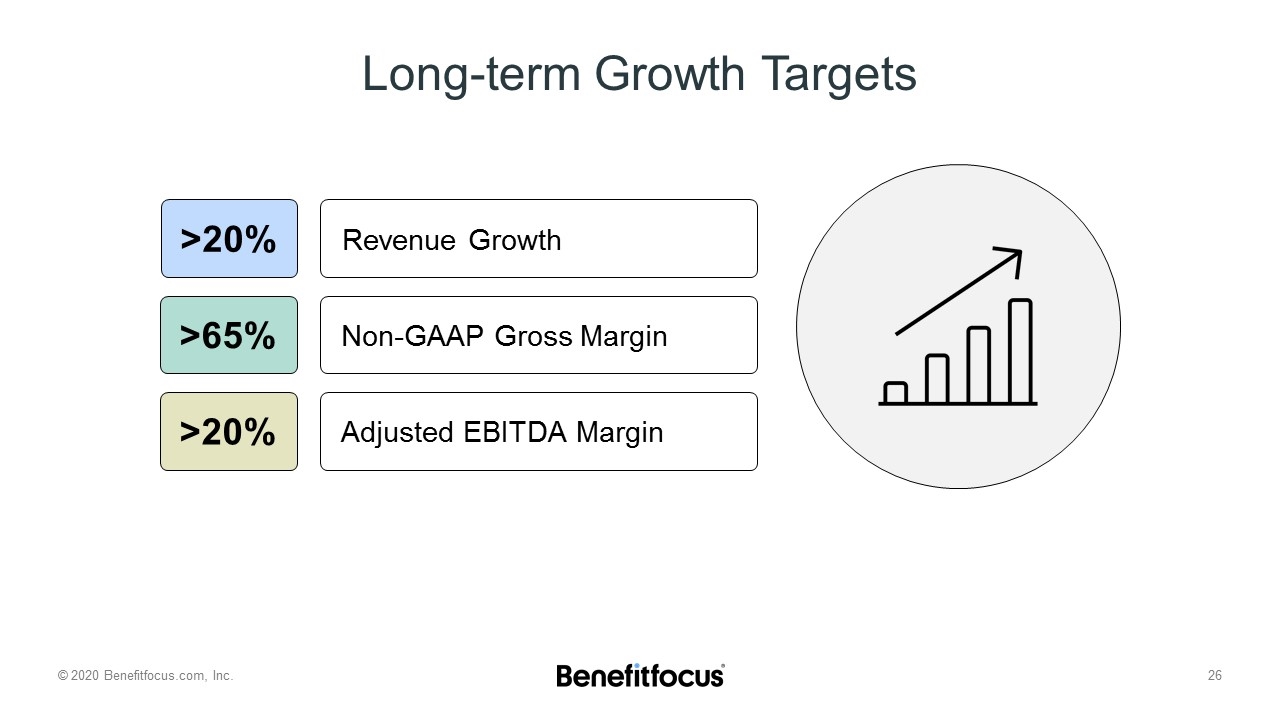

Long-term Growth Targets Revenue Growth Non-GAAP Gross Margin Adjusted EBITDA Margin >20% >65% >20%

Investment Highlights One of the largest benefits platforms in the U.S. and massive, growing market Highly differentiated from competition by providing value to entire Benefits ecosystem Diversified recurring revenue, improving operating leverage and disciplined capital strategy Executing long-term, high-value growth strategy

GAAP to non-GAAP Reconciliation

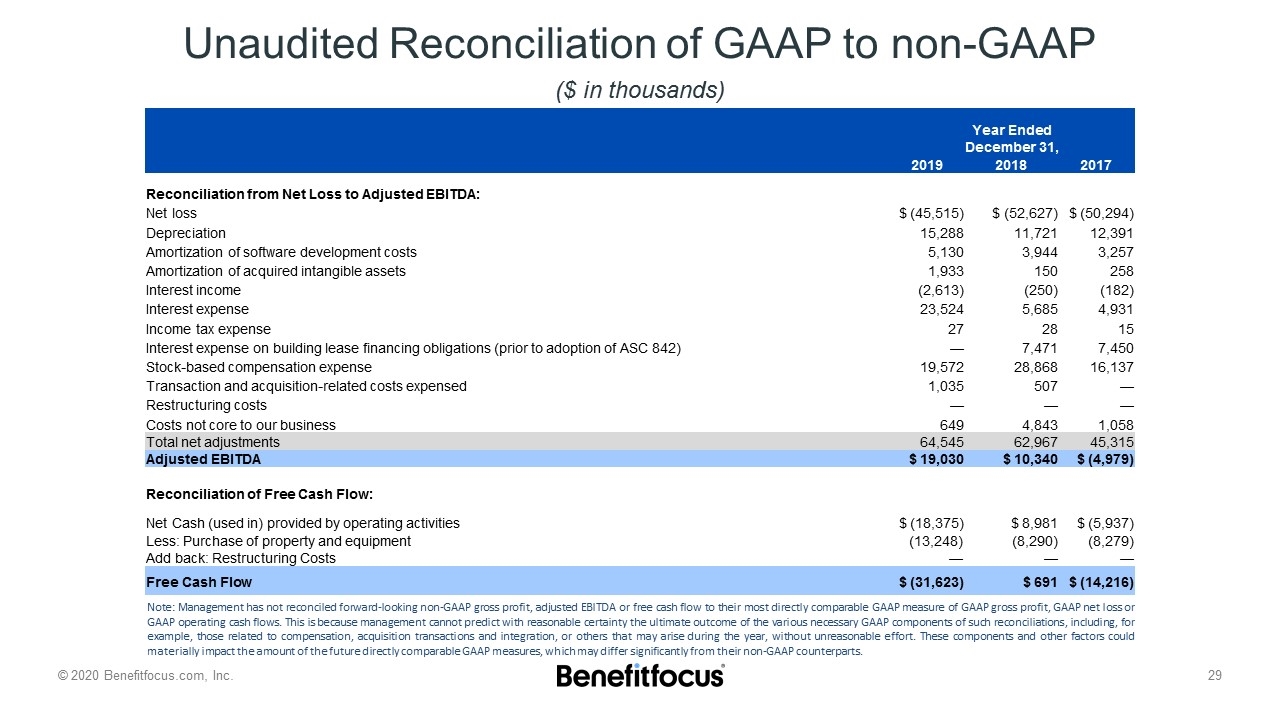

Unaudited Reconciliation of GAAP to non-GAAP ($ in thousands) Year Ended December 31, 2019 2018 2017 Reconciliation from Net Loss to Adjusted EBITDA: Net loss $ (45,515) $ (52,627) $ (50,294) Depreciation 15,288 11,721 12,391 Amortization of software development costs 5,130 3,944 3,257 Amortization of acquired intangible assets 1,933 150 258 Interest income (2,613) (250) (182) Interest expense 23,524 5,685 4,931 Income tax expense 27 28 15 Interest expense on building lease financing obligations (prior to adoption of ASC 842) — 7,471 7,450 Stock-based compensation expense 19,572 28,868 16,137 Transaction and acquisition-related costs expensed 1,035 507 — Restructuring costs — — — Costs not core to our business 649 4,843 1,058 Total net adjustments 64,545 62,967 45,315 Adjusted EBITDA $ 19,030 $ 10,340 $ (4,979) Reconciliation of Free Cash Flow: Net Cash (used in) provided by operating activities $ (18,375) $ 8,981 $ (5,937) Less: Purchase of property and equipment (13,248) (8,290) (8,279) Add back: Restructuring Costs — — — Free Cash Flow $ (31,623) $ 691 $ (14,216) Note: Management has not reconciled forward-looking non-GAAP gross profit, adjusted EBITDA or free cash flow to their most directly comparable GAAP measure of GAAP gross profit, GAAP net loss or GAAP operating cash flows. This is because management cannot predict with reasonable certainty the ultimate outcome of the various necessary GAAP components of such reconciliations, including, for example, those related to compensation, acquisition transactions and integration, or others that may arise during the year, without unreasonable effort. These components and other factors could materially impact the amount of the future directly comparable GAAP measures, which may differ significantly from their non-GAAP counterparts.

Benefitfocus Investor Presentation August 2020