Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Premier, Inc. | d59221dex993.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d59221dex991.htm |

| EX-10.1 - EX-10.1 - Premier, Inc. | d59221dex101.htm |

| EX-2.1 - EX-2.1 - Premier, Inc. | d59221dex21.htm |

| 8-K - FORM 8-K - Premier, Inc. | d59221d8k.htm |

Premier, Inc. Business and Financial Update August 11, 2020 Exhibit 99.2

Forward-looking statements and non-GAAP financial measures Forward-looking statements – Statements made in this presentation that are not statements of historical or current facts, such as those related to the expected near- and long-term tax benefits, net administrative fee visibility, enhanced financial and balance sheet flexibility, the expected financial impacts from the amendment of the GPO agreements, and the expected growth rate for consolidated net revenue, adjusted EBITDA and adjusted earnings per share beginning in fiscal 2022, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of Premier’s Form 10-K for the year ended June 30, 2019, Form 10-Q for the quarter ended March 31, 2020 and Current Report on Form 8-K filed August 11, 2020, as filed or to be filed shortly with the SEC and also made available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Our Positioning Executing on strategy to provide differentiated value to healthcare providers through technology-enabled, end-to-end supply chain and enterprise analytics and performance improvement solutions to help drive improved health outcomes and reduce costs Continue to build and maintain unique, long-term relationships with health system members that are aligned with our strategy Generate strong free cash flow and maintain flexible balance sheet to support balanced approach to capital deployment priorities Well-positioned to further penetrate supply chain and enterprise analytics markets, drive long-term growth and deliver value to our stakeholders

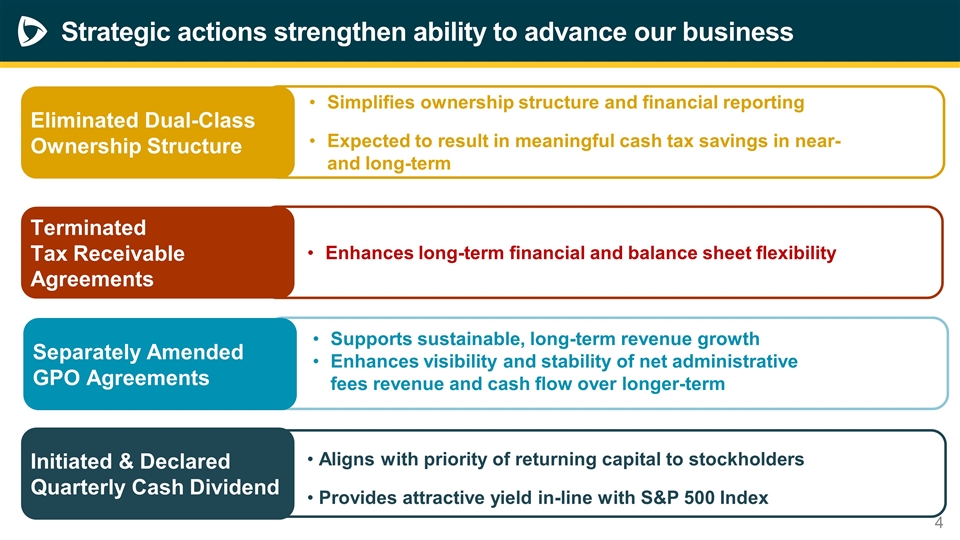

Strategic actions strengthen ability to advance our business Supports sustainable, long-term revenue growth Enhances visibility and stability of net administrative fees revenue and cash flow over longer-term Separately Amended GPO Agreements Simplifies ownership structure and financial reporting Expected to result in meaningful cash tax savings in near- and long-term Eliminated Dual-Class Ownership Structure Enhances long-term financial and balance sheet flexibility Terminated Tax Receivable Agreements Aligns with priority of returning capital to stockholders Provides attractive yield in-line with S&P 500 Index Initiated & Declared Quarterly Cash Dividend

Terminating Tax Receivable Agreement (TRA) with member-owners by accelerating payment obligations at a discounted value totaling $474M Less than $11M payable in first quarter fiscal 2021 and remaining $463M to be paid in 18 equal quarterly installments beginning in 3Q21 and ending in 4Q25 Elimination of dual-class structure and termination of Tax Receivable Agreement obligations Member-owners representing more than 99% of member-owner gross administrative fees agreed to equity restructuring Elimination of dual-class structure expected to result in future cash tax savings Termination of TRA expected to enhance financial and balance sheet flexibility Exchange of remaining Class B units for Class A shares expected to result in $300M to $350M in future cash tax savings Including historical quarterly Class B unit exchanges, expected to result in total of $780M to $830M in future cash tax savings Simplified income tax reporting results in remeasurement of deferred tax assets Expected to result in one-time deferred tax benefit of $100M to $120M which we currently expect will result in negative effective tax rate for fiscal 2021 100% of operating income now attributable to Premier, Inc. Cash taxes expected to be $20M to $35M lower in fiscal 2021 compared with fiscal 2020

Enhances visibility and stability of net administrative fees revenue Aggregate fee share across all members participating in Premier GPO programs in high-40% to low-50% range moving forward Amended and extended group purchasing agreements support sustainable, long-term revenue growth Generally, agreement durations of 5, 6 or 7 years and elimination of “termination for convenience” clauses contained in prior agreements (1) For the twelve months ended June 30, 2020. Separately, have amended group purchasing agreements with vast majority of member-owners Represents 96% of total gross member-owner administrative fees revenue (1)

Beginning in fiscal 2022, Premier: Expects net administrative fees revenue to resume historical low-to-mid, single-digit growth Targeting multi-year, mid-to-high single-digit compound annual growth rate in consolidated net revenue, adjusted EBITDA and adjusted EPS Financial effects of amended Group Purchasing Agreements and long-term growth target Significantly increases stability and transparency of future revenue growth and successfully addresses risk and uncertainty related to member-owner GPO renewals For fiscal 2021, expected reduction of: $100M to $110M to net administrative fees revenue and adjusted EBITDA $0.60 to $0.66 to adjusted EPS

Reflects confidence in strength, stability and prospects of company Returning capital to stockholders with common stock dividend Board of Directors initiated and declared quarterly cash dividend of $0.19 per share, or $0.76 on annualized basis Payable on Sept. 15, 2020 to stockholders of record as of Sept. 1, 2020 Underscores long-standing priority of returning capital to stockholders while maintaining ample liquidity to fund investments for further growth of business Testament to strength and flexibility of balance sheet; consistent, strong free cash flow generation; and sustainability of business

PINC: A Compelling Value Proposition Executing on strategy to provide differentiated value to healthcare providers through technology-enabled, end-to-end supply chain and enterprise analytics and performance improvement solutions to help drive improved health outcomes and reduce costs Maintain unique, long-term relationships with health system members that are aligned with our strategy Generate strong free cash flow and maintain a flexible balance sheet to support balanced approach to capital deployment priorities Reinvestment in organic growth Disciplined acquisitions and investments to support strategic goals Returning capital to shareholders through a quarterly cash dividend payment Well-positioned to further penetrate supply chain and enterprise analytics markets and drive long-term growth and maintain market leadership position