Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Funko, Inc. | ex-9918620.htm |

| 8-K - 8-K - Funko, Inc. | fnko-20200806.htm |

August 6, 2020 Second Quarter 2020 Earnings

2 CautionaryHOLLYWOOD Notes UPDATE This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, industry dynamics, our mission, growth opportunities, business strategy and plans and our objectives for future operations, including expanding into new product categories, broadening our retailer network and increasing international sales, the underlying trends in our business, the anticipated impact of COVID-19 on our business, and our expected liquidity are forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this presentation are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including without limitation our ability to execute our business strategy; risks related to the impact of COVID- 19 on our business, financial results and financial condition; our ability to maintain and realize the full value of our license agreements; the ongoing level of popularity of our products with consumers; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; our ability to compete effectively; fluctuations in our gross margin; our dependence on content development and creation by third parties; our ability to manage our inventories; our ability to develop and introduce products in a timely and cost-effective manner; increases in tariffs, trade restrictions or taxes; risks related to Brexit; counterfeit product risks; risks relating to intellectual property; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third- party manufacturing; risks associated with our international operations; risks related to the recent coronavirus outbreak; changes in effective tax rates; foreign currency exchange rate exposure; economic downturns; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; reputational risk resulting from our e-commerce business and social media presence; risks relating to our indebtedness and our ability to secure additional financing; the potential for our electronic data or the electronic data of our customers to be compromised, risks relating to our organizational structure; risks associated with our internal control over financial reporting; and the important factors discussed under the caption “Risk Factors” in our Form 10-Q for the quarter ended June 30, 2020 and our other filings with the Securities and Exchange Commission. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date hereof, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this presentation with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward- looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this presentation, and except as otherwise required by law, we do not plan to publicly update or revise any forward-looking statements contained in this presentation, whether as a result of any new information, future events or otherwise. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us.

3 IS BUILT ON THE PRINCIPLE THAT EVERYONE IS A FAN OF SOMETHING… FUNKO 2020

4 … and Funko Has Something for Every Fan Movies TV Music Sports Anime Games Note: Represents a sampling of our current portfolio offerings as of June 2020. FUNKO 2020

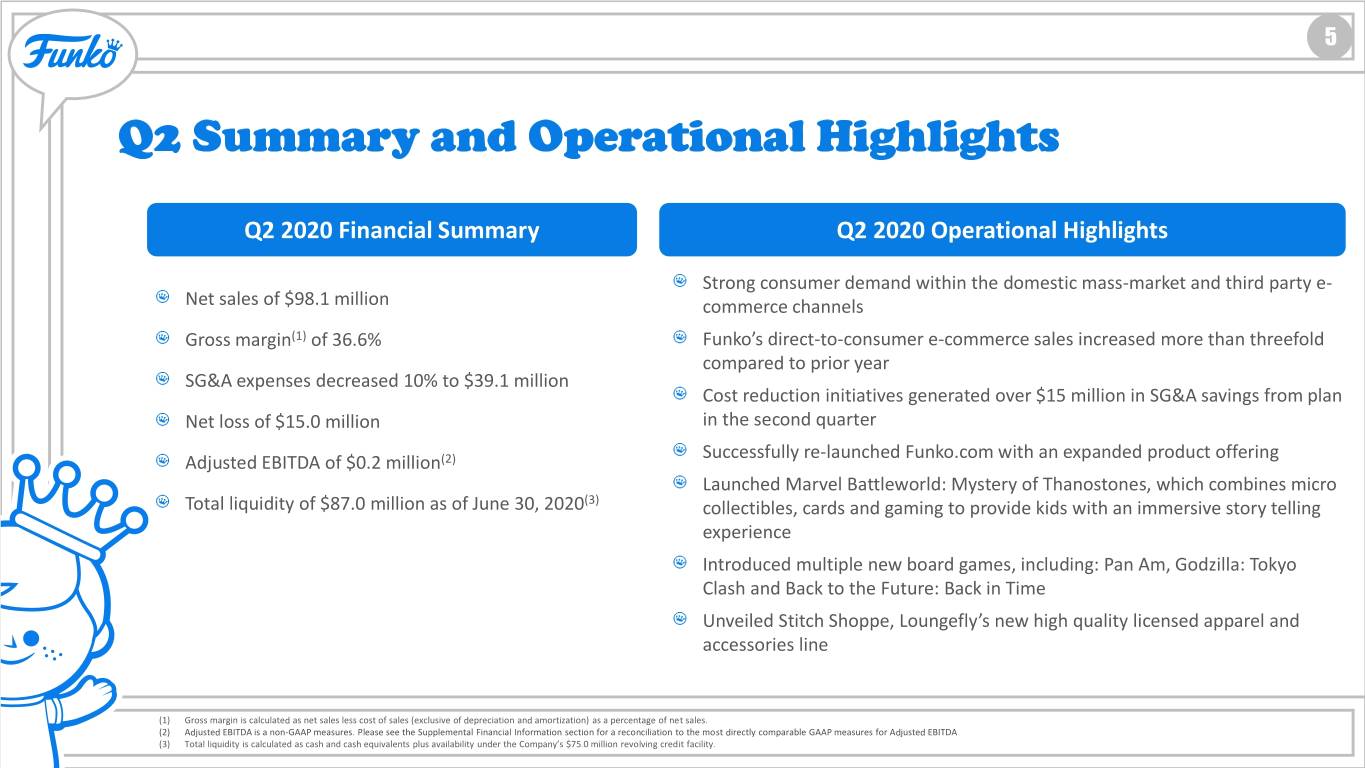

5 Q2HOLLYWOOD Summary and UPDATE Operational Highlights Q2 2020 Financial Summary Q2 2020 Operational Highlights Strong consumer demand within the domestic mass-market and third party e- Net sales of $98.1 million commerce channels Gross margin(1) of 36.6% Funko’s direct-to-consumer e-commerce sales increased more than threefold compared to prior year SG&A expenses decreased 10% to $39.1 million Cost reduction initiatives generated over $15 million in SG&A savings from plan Net loss of $15.0 million in the second quarter Successfully re-launched Funko.com with an expanded product offering Adjusted EBITDA of $0.2 million(2) Launched Marvel Battleworld: Mystery of Thanostones, which combines micro Total liquidity of $87.0 million as of June 30, 2020(3) collectibles, cards and gaming to provide kids with an immersive story telling experience Introduced multiple new board games, including: Pan Am, Godzilla: Tokyo Clash and Back to the Future: Back in Time Unveiled Stitch Shoppe, Loungefly’s new high quality licensed apparel and accessories line (1) Gross margin is calculated as net sales less cost of sales (exclusive of depreciation and amortization) as a percentage of net sales. (2) Adjusted EBITDA is a non-GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the most directly comparable GAAP measures for Adjusted EBITDA (3) Total liquidity is calculated as cash and cash equivalents plus availability under the Company’s $75.0 million revolving credit facility.

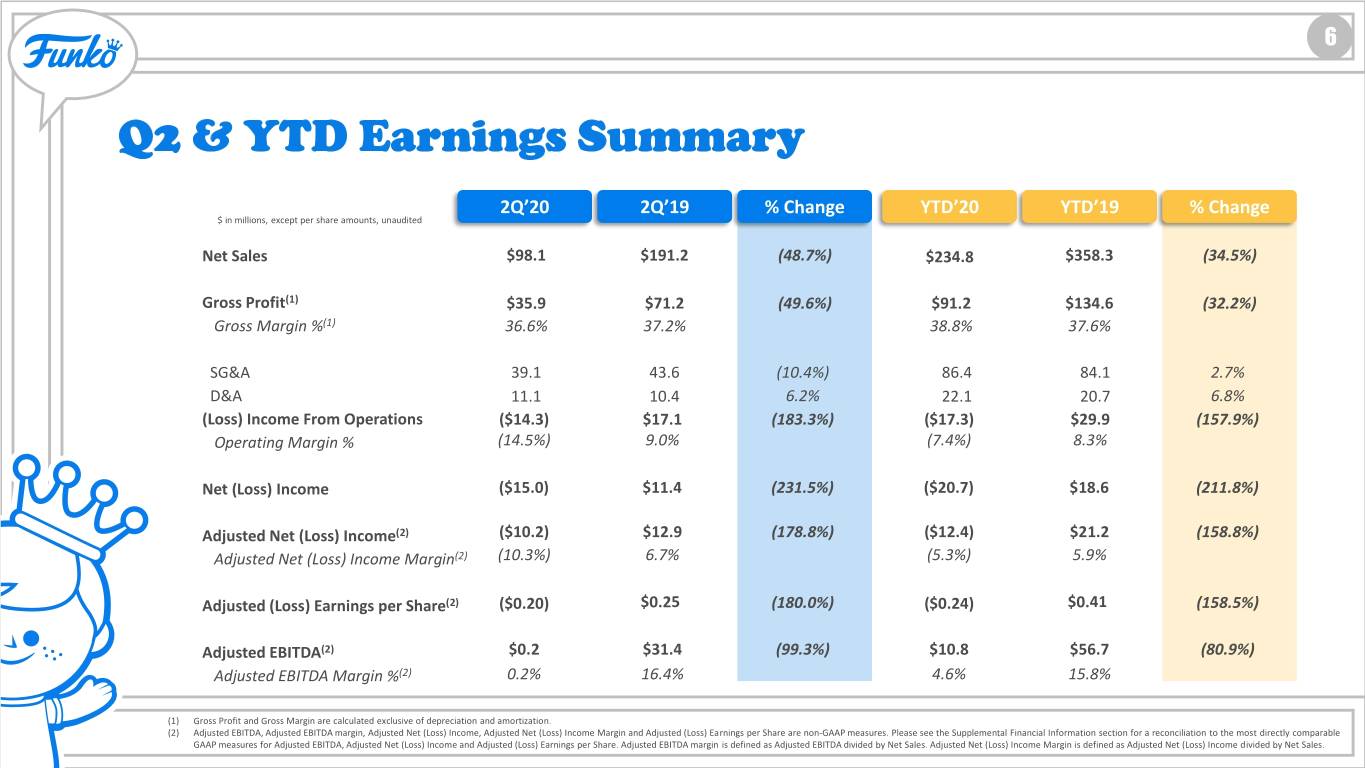

6 Q2HOLLYWOOD & YTD Earnings UPDATE Summary 2Q’20 2Q’19 % Change YTD’20 YTD’19 % Change $ in millions, except per share amounts, unaudited Net Sales $98.1 $191.2 (48.7%) $234.8 $358.3 (34.5%) Gross Profit(1) $35.9 $71.2 (49.6%) $91.2 $134.6 (32.2%) Gross Margin %(1) 36.6% 37.2% 38.8% 37.6% SG&A 39.1 43.6 (10.4%) 86.4 84.1 2.7% D&A 11.1 10.4 6.2% 22.1 20.7 6.8% (Loss) Income From Operations ($14.3) $17.1 (183.3%) ($17.3) $29.9 (157.9%) Operating Margin % (14.5%) 9.0% (7.4%) 8.3% Net (Loss) Income ($15.0) $11.4 (231.5%) ($20.7) $18.6 (211.8%) Adjusted Net (Loss) Income(2) ($10.2) $12.9 (178.8%) ($12.4) $21.2 (158.8%) Adjusted Net (Loss) Income Margin(2) (10.3%) 6.7% (5.3%) 5.9% Adjusted (Loss) Earnings per Share(2) ($0.20) $0.25 (180.0%) ($0.24) $0.41 (158.5%) Adjusted EBITDA(2) $0.2 $31.4 (99.3%) $10.8 $56.7 (80.9%) Adjusted EBITDA Margin %(2) 0.2% 16.4% 4.6% 15.8% (1) Gross Profit and Gross Margin are calculated exclusive of depreciation and amortization. (2) Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net (Loss) Income, Adjusted Net (Loss) Income Margin and Adjusted (Loss) Earnings per Share are non-GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the most directly comparable GAAP measures for Adjusted EBITDA, Adjusted Net (Loss) Income and Adjusted (Loss) Earnings per Share. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Net Sales. Adjusted Net (Loss) Income Margin is defined as Adjusted Net (Loss) Income divided by Net Sales.

7 RecentlyHOLLYWOOD Launched UPDATE Products Continuing to innovate and expand our product offering by creating new ways for fans to connect with their fandoms Marvel Battleworld: Mystery of Thanostones Launched multiple new game offerings in the Stitch Shoppe is Loungefly’s new high quality targets a younger demographic and combines quarter, including: Pan Am, Godzilla: Tokyo licensed apparel and accessory line in which each micro collectibles, cards and gaming Clash and Back to the Future: Back in Time piece is a limited edition and comes with an exclusive pin for an added layer of collectability

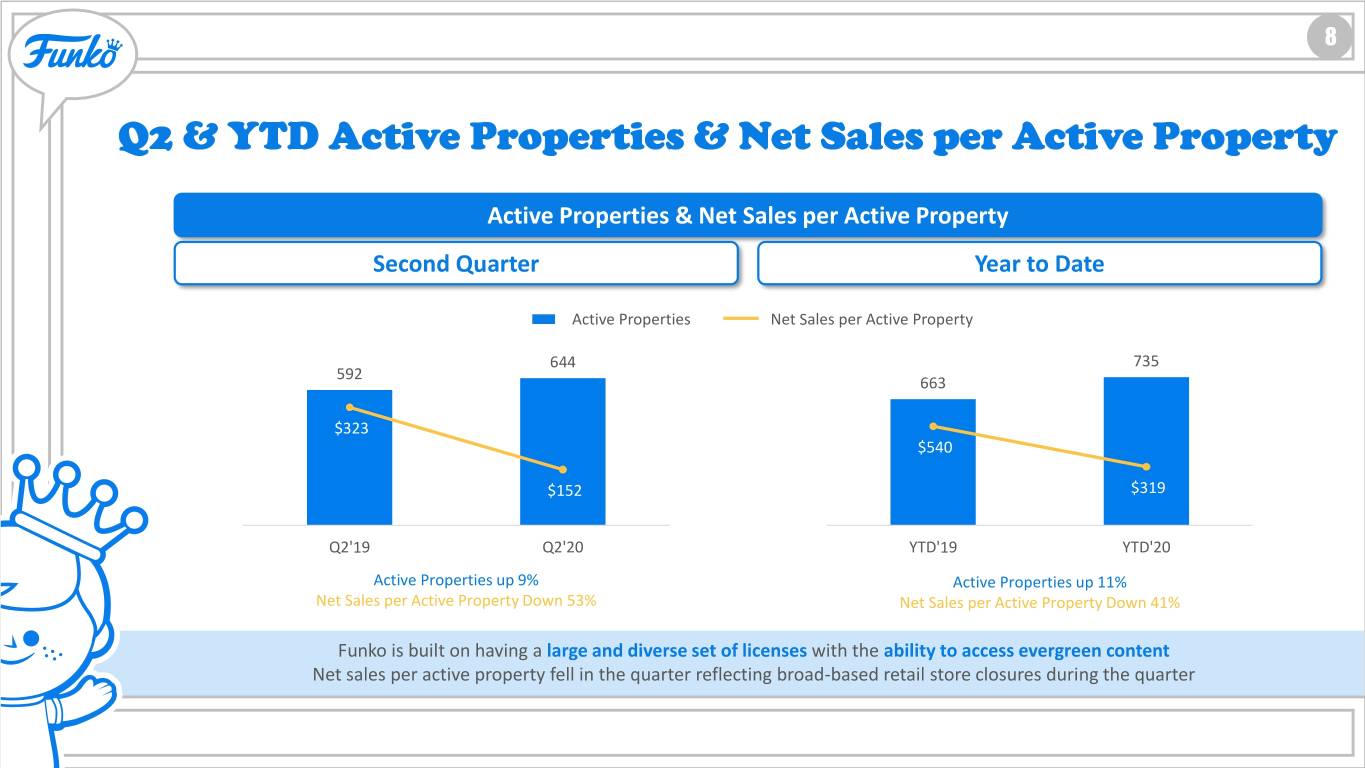

8 HOLLYWOODQ2 & YTD Active UPDATE Properties & Net Sales per Active Property Active Properties & Net Sales per Active Property Second Quarter Year to Date Active Properties Net Sales per Active Property 800 $500 850 $1,000 $450 $900 700 644 735 750 592 $400 $800 600 663 $350 $700 650 500 $300 $600 400 $323 $250 550 $500 $200 $540 $400 300 450 $150 $300 200 $100 $200 $152 350 $319 100 $50 $100 0 $- 250 $- Q2'19 Q2'20 YTD'19 YTD'20 Active Properties up 9% Active Properties up 11% Net Sales per Active Property Down 53% Net Sales per Active Property Down 41% Funko is built on having a large and diverse set of licenses with the ability to access evergreen content Net sales per active property fell in the quarter reflecting broad-based retail store closures during the quarter

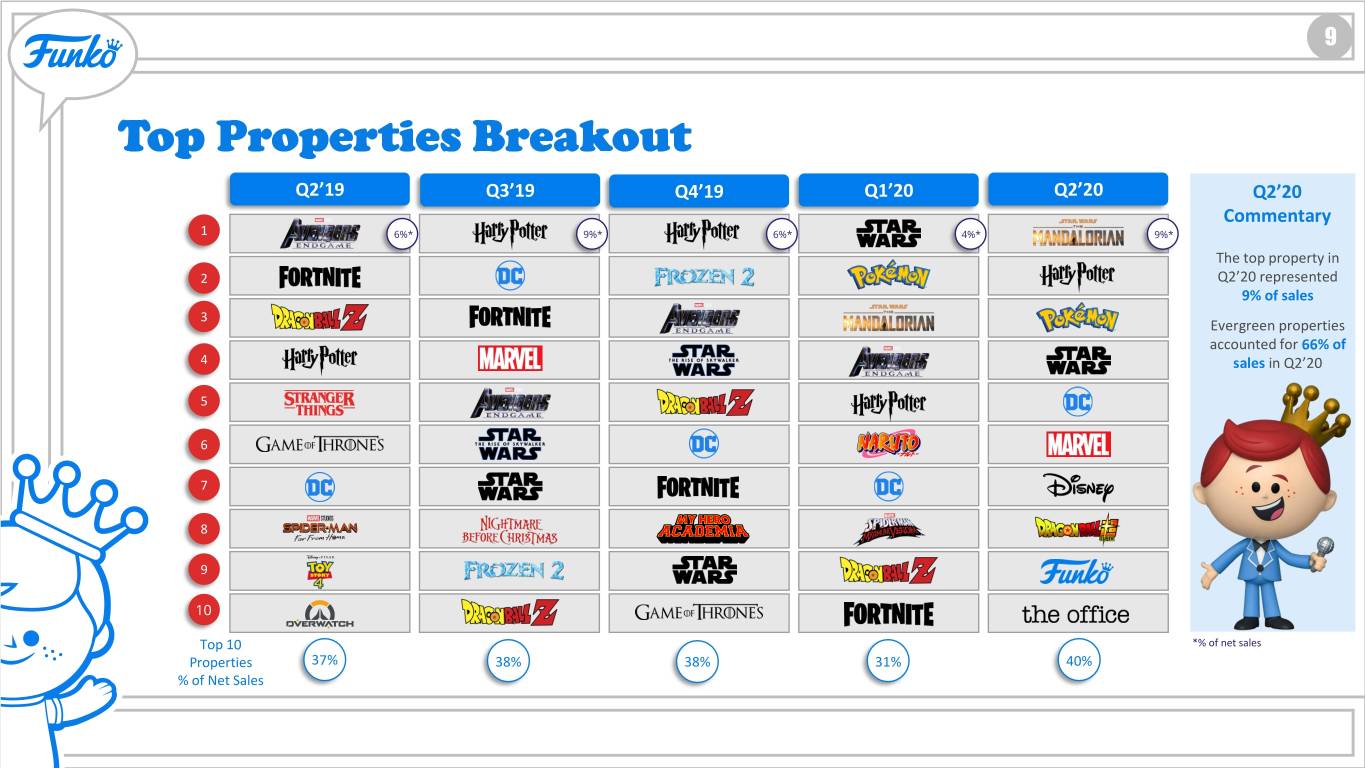

9 TopHOLLYWOOD Properties UPDATE Breakout Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 Q2’20 Commentary 1 6%* 9%* 6%* 4%* 9%* The top property in 2 Q2’20 represented 9% of sales 3 Evergreen properties accounted for 66% of 4 sales in Q2’20 5 6 7 8 9 10 Top 10 *% of net sales Properties 37% 38% 38% 31% 40% % of Net Sales

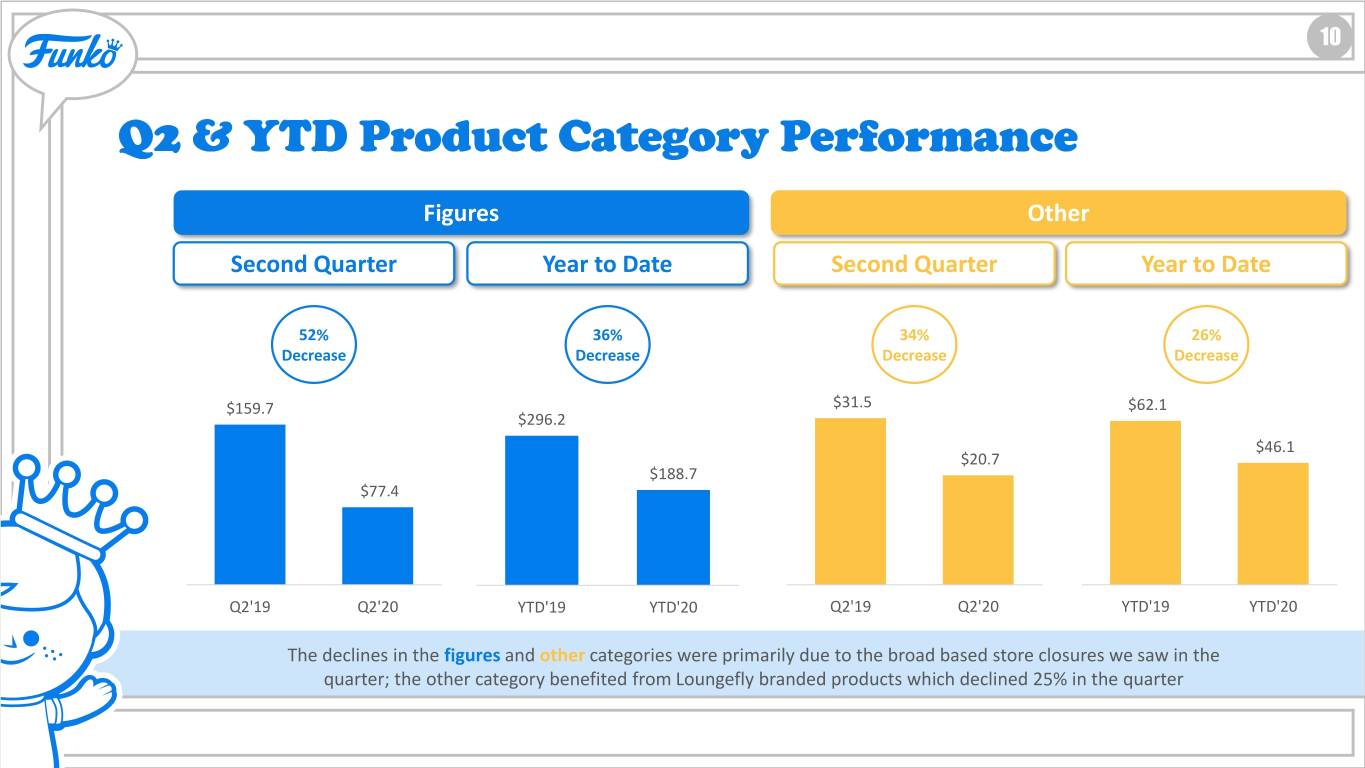

10 Q2HOLLYWOOD & YTD Product UPDATE Category Performance Figures Other Second Quarter Year to Date Second Quarter Year to Date 52% 36% 34% 26% Decrease Decrease Decrease Decrease $159.7 $31.5 $62.1 $296.2 $46.1 $20.7 $188.7 $77.4 Q2'19 Q2'20 YTD'19 YTD'20 Q2'19 Q2'20 YTD'19 YTD'20 The declines in the figures and other categories were primarily due to the broad based store closures we saw in the quarter; the other category benefited from Loungefly branded products which declined 25% in the quarter

11 SomethingHOLLYWOOD for UPDATE Everyone Fans can find their something as the world of Funko continues to expand with new product categories FIGURES OTHER 79% of 21% of Sales* Sales* *% of net sales for Q2’ 20

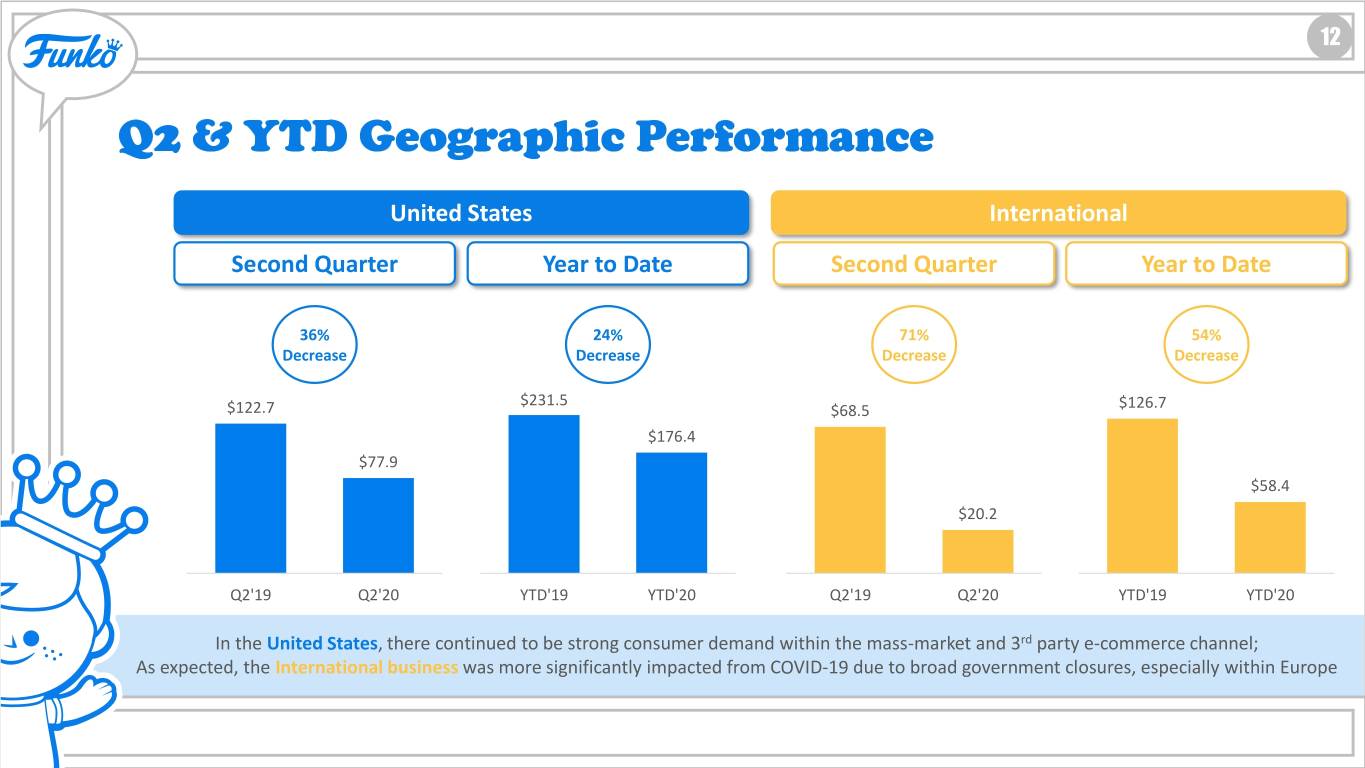

12 Q2HOLLYWOOD & YTD Geographic UPDATE Performance United States International Second Quarter Year to Date Second Quarter Year to Date 36% 24% 71% 54% Decrease Decrease Decrease Decrease $231.5 $122.7 $68.5 $126.7 $176.4 $77.9 $58.4 $20.2 Q2'19 Q2'20 YTD'19 YTD'20 Q2'19 Q2'20 YTD'19 YTD'20 In the United States, there continued to be strong consumer demand within the mass-market and 3rd party e-commerce channel; As expected, the International business was more significantly impacted from COVID-19 due to broad government closures, especially within Europe

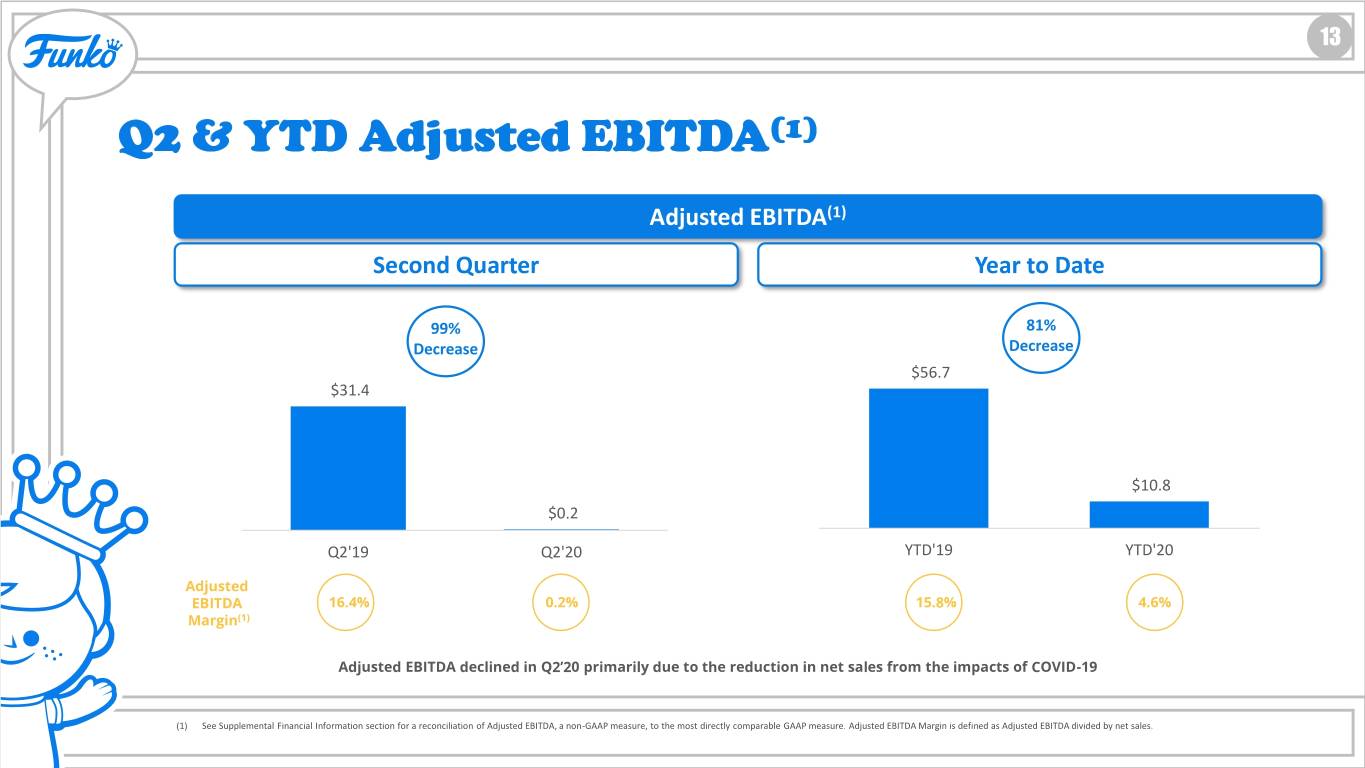

13 Q2HOLLYWOOD & YTD Adjusted UPDATE EBITDA(1) Adjusted EBITDA(1) Second Quarter Year to Date 99% 81% Decrease Decrease $56.7 $31.4 $10.8 $0.2 Q2'19 Q2'20 YTD'19 YTD'20 Adjusted EBITDA 16.4% 0.2% 15.8% 4.6%6.6% Margin(1) Adjusted EBITDA declined in Q2’20 primarily due to the reduction in net sales from the impacts of COVID-19 (1) See Supplemental Financial Information section for a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most directly comparable GAAP measure. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales.

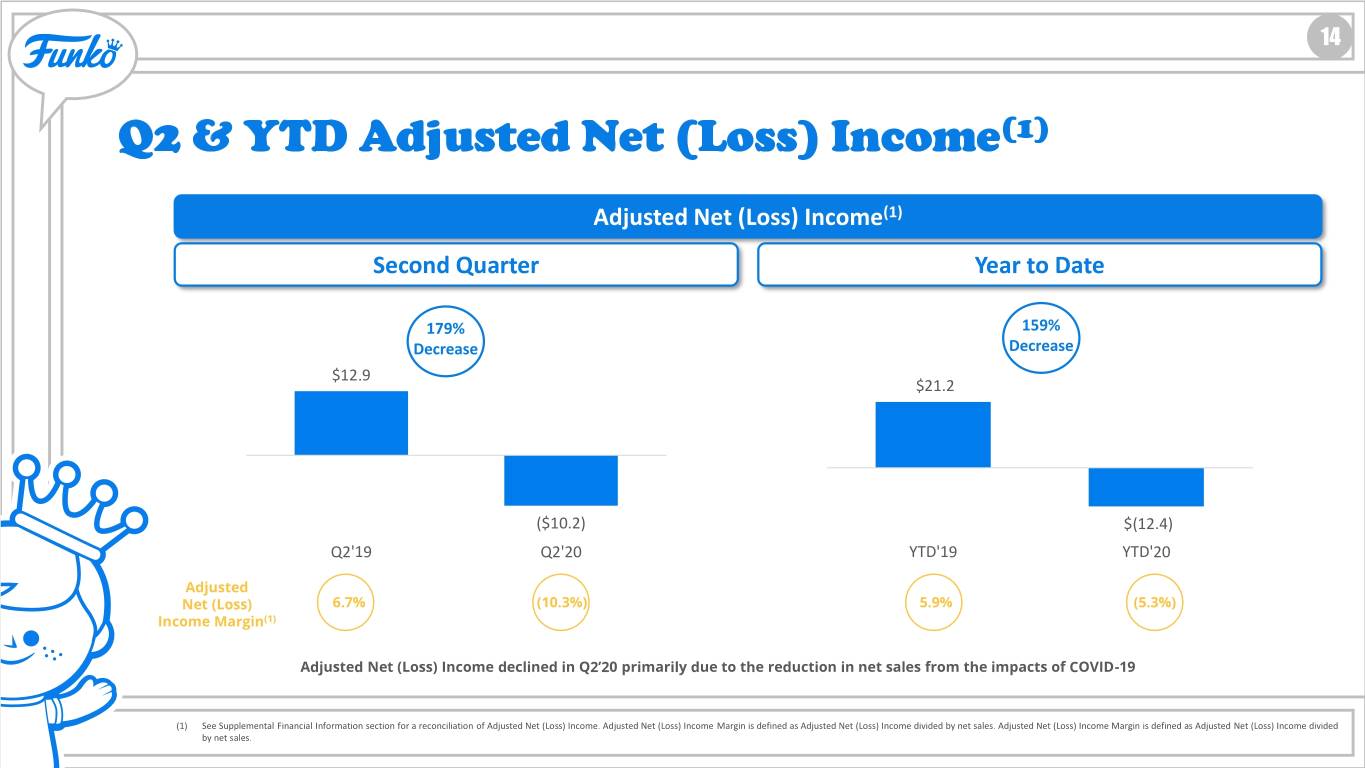

14 Q2HOLLYWOOD & YTD Adjusted UPDATE Net (Loss) Income(1) Adjusted Net (Loss) Income(1) Second Quarter Year to Date 179% 159% Decrease Decrease $12.9 $21.2 ($10.2) $(12.4) Q2'19 Q2'20 YTD'19 YTD'20 Adjusted Net (Loss) 6.7% (10.3%) 5.9% (5.3%)6.6% Income Margin(1) Adjusted Net (Loss) Income declined in Q2’20 primarily due to the reduction in net sales from the impacts of COVID-19 (1) See Supplemental Financial Information section for a reconciliation of Adjusted Net (Loss) Income. Adjusted Net (Loss) Income Margin is defined as Adjusted Net (Loss) Income divided by net sales. Adjusted Net (Loss) Income Margin is defined as Adjusted Net (Loss) Income divided by net sales.

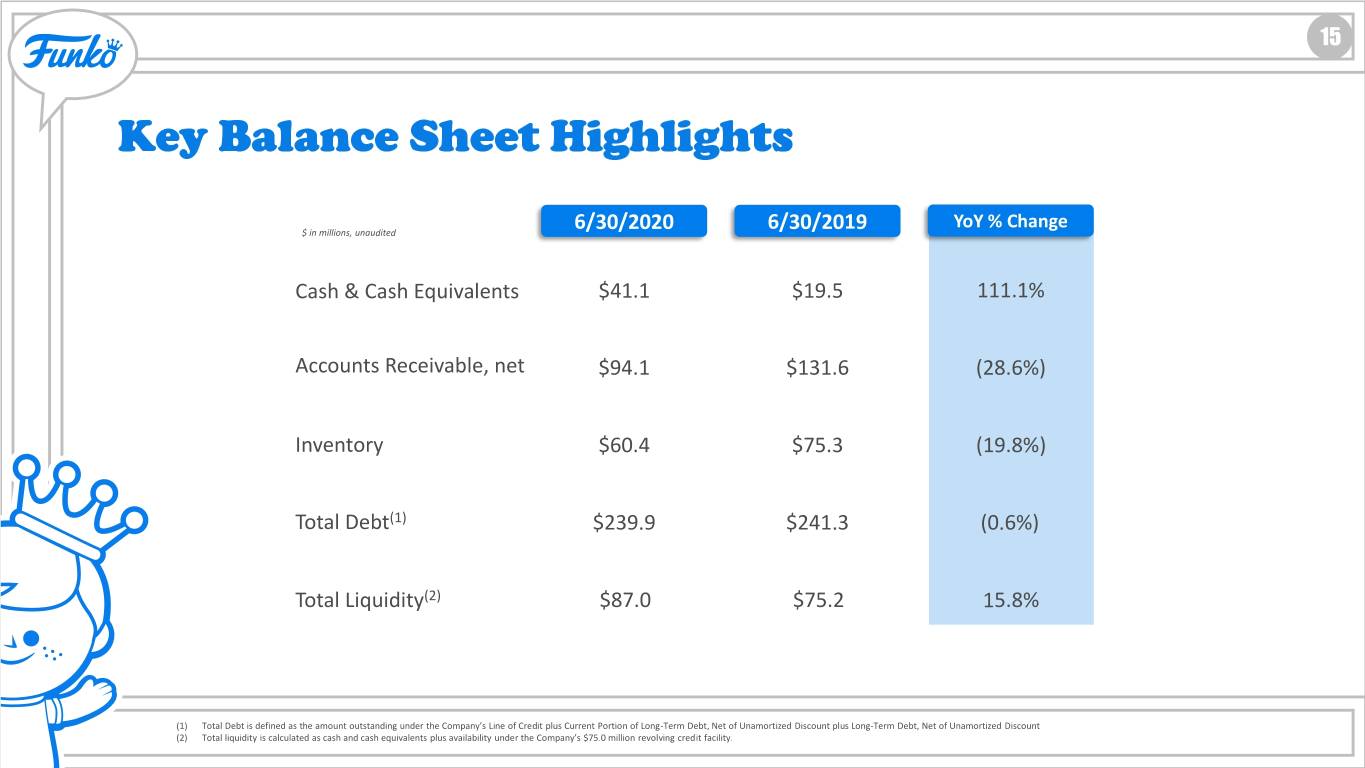

15 KeyHOLLYWOOD Balance Sheet UPDATE Highlights YoY % Change $ in millions, unaudited 6/30/2020 6/30/2019 Cash & Cash Equivalents $41.1 $19.5 111.1% Accounts Receivable, net $94.1 $131.6 (28.6%) Inventory $60.4 $75.3 (19.8%) Total Debt(1) $239.9 $241.3 (0.6%) Total Liquidity(2) $87.0 $75.2 15.8% (1) Total Debt is defined as the amount outstanding under the Company’s Line of Credit plus Current Portion of Long-Term Debt, Net of Unamortized Discount plus Long-Term Debt, Net of Unamortized Discount (2) Total liquidity is calculated as cash and cash equivalents plus availability under the Company’s $75.0 million revolving credit facility.

Supplemental Financial Information

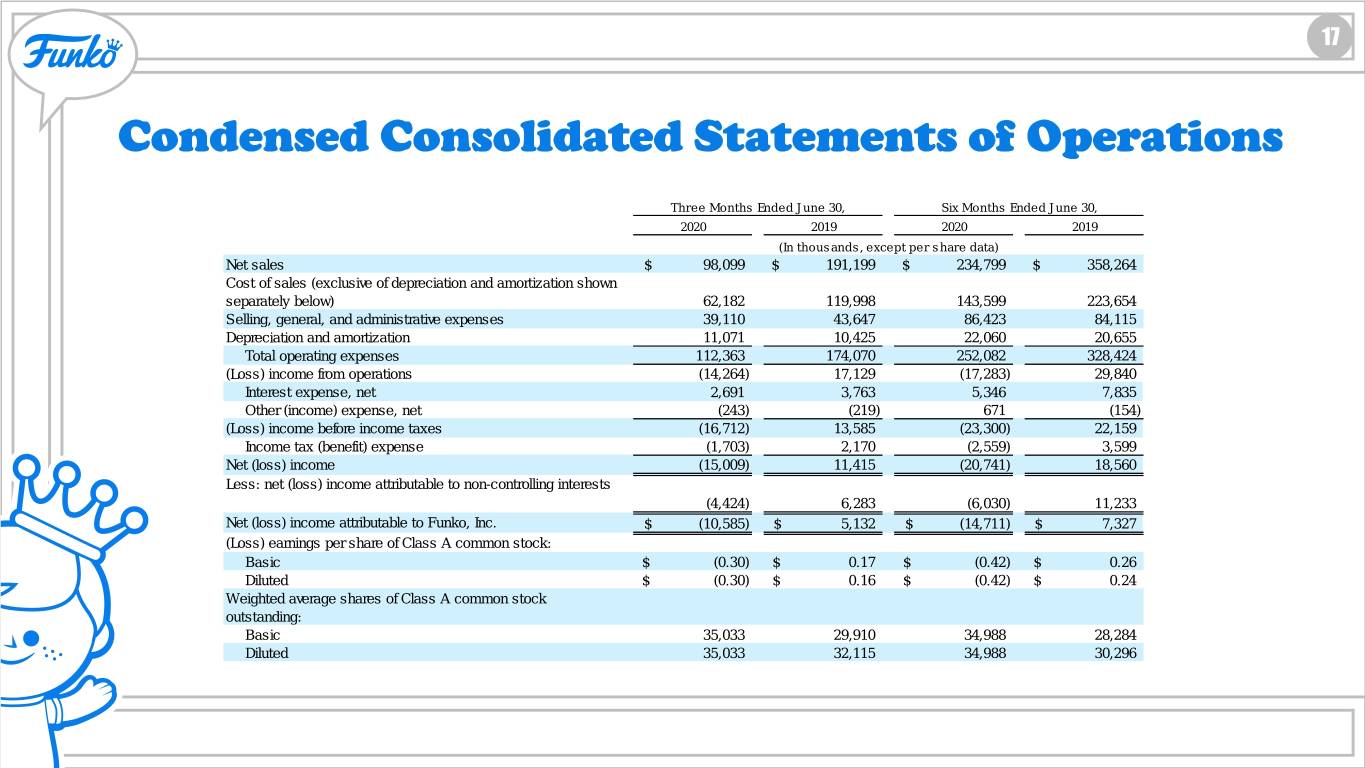

17 CondensedHOLLYWOOD Consolidated UPDATE Statements of Operations Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 (In thousands, except per share data) Net sales $ 98,099 $ 191,199 $ 234,799 $ 358,264 Cost of sales (exclusive of depreciation and amortization shown separately below) 62,182 119,998 143,599 223,654 Selling, general, and administrative expenses 39,110 43,647 86,423 84,115 Depreciation and amortization 11,071 10,425 22,060 20,655 Total operating expenses 112,363 174,070 252,082 328,424 (Loss) income from operations (14,264) 17,129 (17,283) 29,840 Interest expense, net 2,691 3,763 5,346 7,835 Other (income) expense, net (243) (219) 671 (154) (Loss) income before income taxes (16,712) 13,585 (23,300) 22,159 Income tax (benefit) expense (1,703) 2,170 (2,559) 3,599 Net (loss) income (15,009) 11,415 (20,741) 18,560 Less: net (loss) income attributable to non-controlling interests (4,424) 6,283 (6,030) 11,233 Net (loss) income attributable to Funko, Inc. $ (10,585) $ 5,132 $ (14,711) $ 7,327 (Loss) earnings per share of Class A common stock: Basic $ (0.30) $ 0.17 $ (0.42) $ 0.26 Diluted $ (0.30) $ 0.16 $ (0.42) $ 0.24 Weighted average shares of Class A common stock outstanding: Basic 35,033 29,910 34,988 28,284 Diluted 35,033 32,115 34,988 30,296

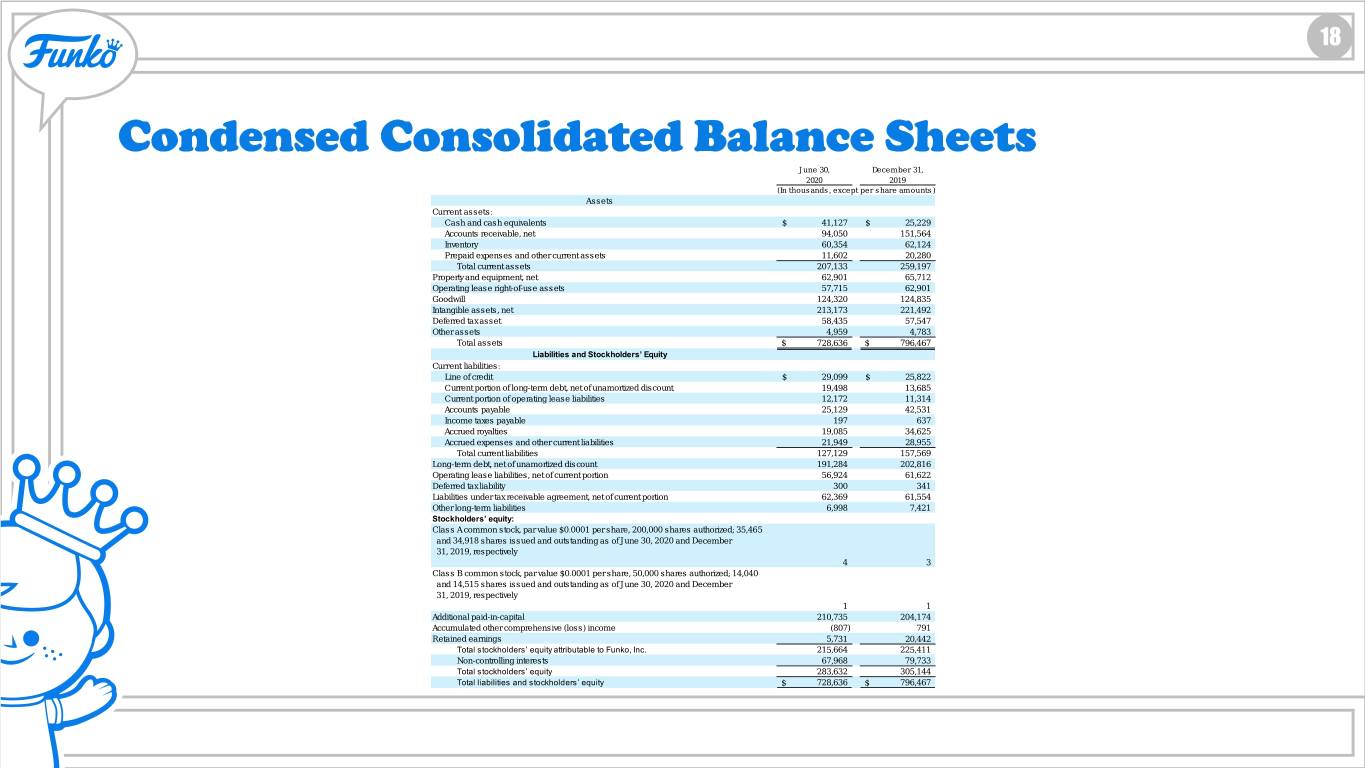

18 CondensedHOLLYWOOD Consolidated UPDATE Balance Sheets June 30, December 31, 2020 2019 (In thousands, except per share amounts) Assets Current assets: Cash and cash equivalents $ 41,127 $ 25,229 Accounts receivable, net 94,050 151,564 Inventory 60,354 62,124 Prepaid expenses and other current assets 11,602 20,280 Total current assets 207,133 259,197 Property and equipment, net 62,901 65,712 Operating lease right-of-use assets 57,715 62,901 Goodwill 124,320 124,835 Intangible assets, net 213,173 221,492 Deferred tax asset 58,435 57,547 Other assets 4,959 4,783 Total assets $ 728,636 $ 796,467 Liabilities and Stockholders’ Equity Current liabilities: Line of credit $ 29,099 $ 25,822 Current portion of long-term debt, net of unamortized discount 19,498 13,685 Current portion of operating lease liabilities 12,172 11,314 Accounts payable 25,129 42,531 Income taxes payable 197 637 Accrued royalties 19,085 34,625 Accrued expenses and other current liabilities 21,949 28,955 Total current liabilities 127,129 157,569 Long-term debt, net of unamortized discount 191,284 202,816 Operating lease liabilities, net of current portion 56,924 61,622 Deferred tax liability 300 341 Liabilities under tax receivable agreement, net of current portion 62,369 61,554 Other long-term liabilities 6,998 7,421 Stockholders’ equity: Class A common stock, par value $0.0001 per share, 200,000 shares authorized; 35,465 and 34,918 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively 4 3 Class B common stock, par value $0.0001 per share, 50,000 shares authorized; 14,040 and 14,515 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively 1 1 Additional paid-in-capital 210,735 204,174 Accumulated other comprehensive (loss) income (807) 791 Retained earnings 5,731 20,442 Total stockholders’ equity attributable to Funko, Inc. 215,664 225,411 Non-controlling interests 67,968 79,733 Total stockholders’ equity 283,632 305,144 Total liabilities and stockholders’ equity $ 728,636 $ 796,467

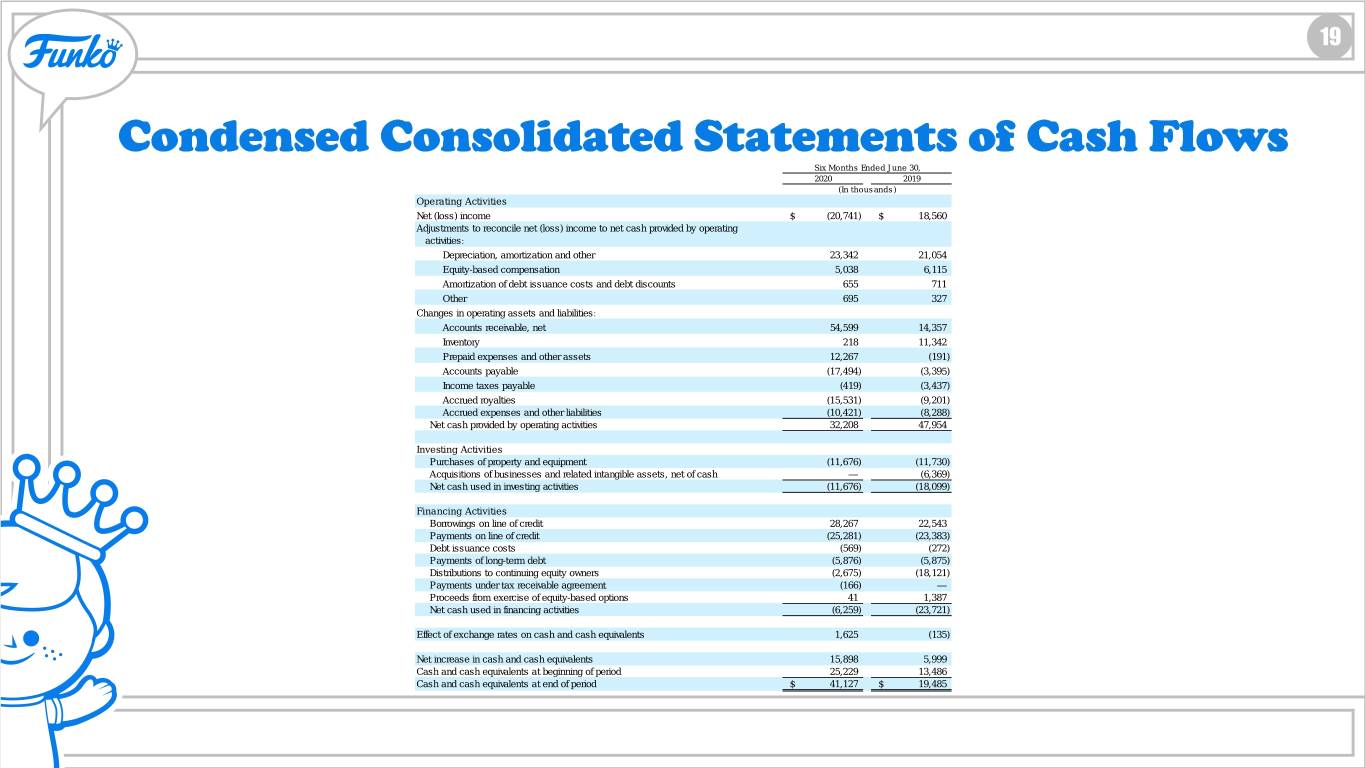

19 CondensedHOLLYWOOD Consolidated UPDATE Statements of Cash Flows Six Months Ended June 30, 2020 2019 (In thousands) Operating Activities Net (loss) income $ (20,741) $ 18,560 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation, amortization and other 23,342 21,054 Equity-based compensation 5,038 6,115 Amortization of debt issuance costs and debt discounts 655 711 Other 695 327 Changes in operating assets and liabilities: Accounts receivable, net 54,599 14,357 Inventory 218 11,342 Prepaid expenses and other assets 12,267 (191) Accounts payable (17,494) (3,395) Income taxes payable (419) (3,437) Accrued royalties (15,531) (9,201) Accrued expenses and other liabilities (10,421) (8,288) Net cash provided by operating activities 32,208 47,954 Investing Activities Purchases of property and equipment (11,676) (11,730) Acquisitions of businesses and related intangible assets, net of cash — (6,369) Net cash used in investing activities (11,676) (18,099) Financing Activities Borrowings on line of credit 28,267 22,543 Payments on line of credit (25,281) (23,383) Debt issuance costs (569) (272) Payments of long-term debt (5,876) (5,875) Distributions to continuing equity owners (2,675) (18,121) Payments under tax receivable agreement (166) — Proceeds from exercise of equity-based options 41 1,387 Net cash used in financing activities (6,259) (23,721) Effect of exchange rates on cash and cash equivalents 1,625 (135) Net increase in cash and cash equivalents 15,898 5,999 Cash and cash equivalents at beginning of period 25,229 13,486 Cash and cash equivalents at end of period $ 41,127 $ 19,485

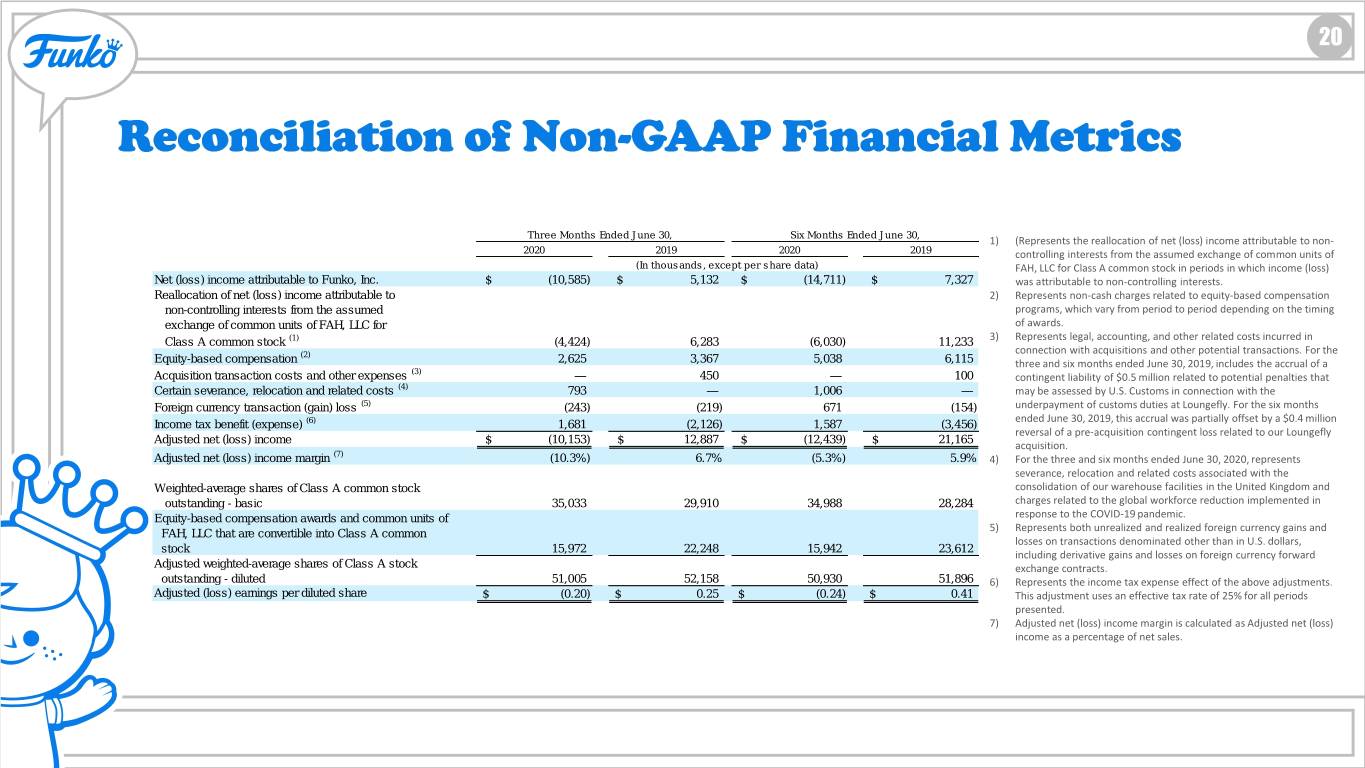

20 ReconciliationHOLLYWOOD UPDATE of Non-GAAP Financial Metrics Three Months Ended June 30, Six Months Ended June 30, 1) (Represents the reallocation of net (loss) income attributable to non- 2020 2019 2020 2019 controlling interests from the assumed exchange of common units of (In thousands, except per share data) FAH, LLC for Class A common stock in periods in which income (loss) Net (loss) income attributable to Funko, Inc. $ (10,585) $ 5,132 $ (14,711) $ 7,327 was attributable to non-controlling interests. Reallocation of net (loss) income attributable to 2) Represents non-cash charges related to equity-based compensation non-controlling interests from the assumed programs, which vary from period to period depending on the timing exchange of common units of FAH, LLC for of awards. Class A common stock (1) (4,424) 6,283 (6,030) 11,233 3) Represents legal, accounting, and other related costs incurred in (2) connection with acquisitions and other potential transactions. For the Equity-based compensation 2,625 3,367 5,038 6,115 three and six months ended June 30, 2019, includes the accrual of a (3) Acquisition transaction costs and other expenses — 450 — 100 contingent liability of $0.5 million related to potential penalties that Certain severance, relocation and related costs (4) 793 — 1,006 — may be assessed by U.S. Customs in connection with the Foreign currency transaction (gain) loss (5) (243) (219) 671 (154) underpayment of customs duties at Loungefly. For the six months (6) ended June 30, 2019, this accrual was partially offset by a $0.4 million Income tax benefit (expense) 1,681 (2,126) 1,587 (3,456) reversal of a pre-acquisition contingent loss related to our Loungefly Adjusted net (loss) income $ (10,153) $ 12,887 $ (12,439) $ 21,165 acquisition. Adjusted net (loss) income margin (7) (10.3%) 6.7% (5.3%) 5.9% 4) For the three and six months ended June 30, 2020, represents severance, relocation and related costs associated with the Weighted-average shares of Class A common stock consolidation of our warehouse facilities in the United Kingdom and outstanding - basic 35,033 29,910 34,988 28,284 charges related to the global workforce reduction implemented in Equity-based compensation awards and common units of response to the COVID-19 pandemic. FAH, LLC that are convertible into Class A common 5) Represents both unrealized and realized foreign currency gains and losses on transactions denominated other than in U.S. dollars, stock 15,972 22,248 15,942 23,612 including derivative gains and losses on foreign currency forward Adjusted weighted-average shares of Class A stock exchange contracts. outstanding - diluted 51,005 52,158 50,930 51,896 6) Represents the income tax expense effect of the above adjustments. Adjusted (loss) earnings per diluted share $ (0.20) $ 0.25 $ (0.24) $ 0.41 This adjustment uses an effective tax rate of 25% for all periods presented. 7) Adjusted net (loss) income margin is calculated as Adjusted net (loss) income as a percentage of net sales.

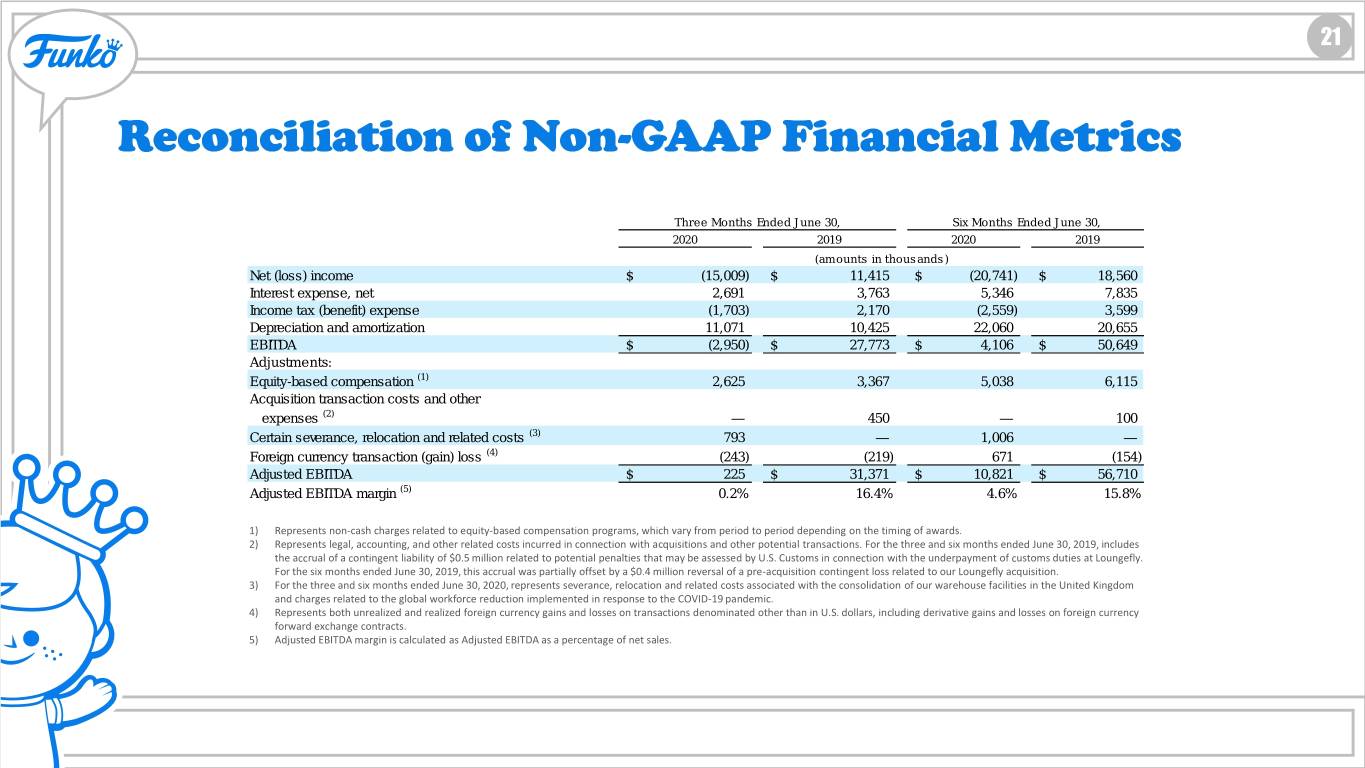

21 ReconciliationHOLLYWOOD UPDATE of Non-GAAP Financial Metrics Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 (amounts in thousands) Net (loss) income $ (15,009) $ 11,415 $ (20,741) $ 18,560 Interest expense, net 2,691 3,763 5,346 7,835 Income tax (benefit) expense (1,703) 2,170 (2,559) 3,599 Depreciation and amortization 11,071 10,425 22,060 20,655 EBITDA $ (2,950) $ 27,773 $ 4,106 $ 50,649 Adjustments: Equity-based compensation (1) 2,625 3,367 5,038 6,115 Acquisition transaction costs and other expenses (2) — 450 — 100 Certain severance, relocation and related costs (3) 793 — 1,006 — Foreign currency transaction (gain) loss (4) (243) (219) 671 (154) Adjusted EBITDA $ 225 $ 31,371 $ 10,821 $ 56,710 Adjusted EBITDA margin (5) 0.2% 16.4% 4.6% 15.8% 1) Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on the timing of awards. 2) Represents legal, accounting, and other related costs incurred in connection with acquisitions and other potential transactions. For the three and six months ended June 30, 2019, includes the accrual of a contingent liability of $0.5 million related to potential penalties that may be assessed by U.S. Customs in connection with the underpayment of customs duties at Loungefly. For the six months ended June 30, 2019, this accrual was partially offset by a $0.4 million reversal of a pre-acquisition contingent loss related to our Loungefly acquisition. 3) For the three and six months ended June 30, 2020, represents severance, relocation and related costs associated with the consolidation of our warehouse facilities in the United Kingdom and charges related to the global workforce reduction implemented in response to the COVID-19 pandemic. 4) Represents both unrealized and realized foreign currency gains and losses on transactions denominated other than in U.S. dollars, including derivative gains and losses on foreign currency forward exchange contracts. 5) Adjusted EBITDA margin is calculated as Adjusted EBITDA as a percentage of net sales.