Attached files

| file | filename |

|---|---|

| EX-23.1 - OPINION OF CENTURION ZD CPA & CO. - 4DMed, Ltd. | ex23-1.htm |

| EX-5.1 - LEGAL OPINION AND CONSENT OF LANE & ASSOCIATES, P.A. - 4DMed, Ltd. | ex5-1.htm |

| EX-3.2 - BYLAWS - 4DMed, Ltd. | ex3-2.htm |

| EX-3.1 - CERTIFICATE OF INCORPORATION - 4DMed, Ltd. | ex3-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| 4DMED, LTD. |

| (Name of registrant as specified in its charter) |

| Nevada | 8099 | 82-2523472 | ||

| (State

or jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

| 11/F Capital Centre, |

| 151 Gloucester Road, Wanchai, |

| Hong Kong |

| (852) 93841733 |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

| Resident Agency National |

| 4650 Wedekind Road, #2 |

| Sparks, Nevada 89431 |

| (775) 882-7549 |

| With a copy to: |

| Lane & Associates, P.A. |

| c/o Paul Camp Lane |

| 5401 S. Kirkman Road |

| Suite 310 |

| Orlando, FL 32819 |

| (407) 316-0343 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Approximate date of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | x |

| Emerging growth company | x | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. x

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Security(1) ($) | Proposed Maximum Aggregate Offering Price(1) ($) | Amount of Registration Fee ($) | ||||||||||||

| Selling Shareholders | 400,000 | $ | 1.00 | $ | 400,000 | $ | 51.92 | |||||||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457 of the Securities Act of 1933. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

1

The information in this prospectus is not complete and may be amended. The Registrant may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED ___________, 2019

PRELIMINARY PROSPECTUS

4DMED,

LTD.

400,000 SHARES OF COMMON STOCK

OFFERING PRICE $1.00 PER SHARE

This prospectus relates to the offering (the Offering”) of 400,000 shares of our common stock by our Selling Shareholders at a fixed offering price of $1.00 per share until our shares are quoted on the Over-the-Counter Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses incurred in this Offering (other than transfer taxes), and the Selling Shareholders will receive all of the net proceeds from this Offering.

AN INVESTMENT IN OUR SECURITIES IS SPECULATIVE. INVESTORS SHOULD BE ABLE TO AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 6 BEFORE INVESTING IN OUR COMMON STOCK.

Prior to this Offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $1.00 per share in relation to this Offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Bulletin Board. We may never be approved for trading on any exchange. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this Prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

The Company is an emerging growth company under the Jumpstart Our Business Startups Act.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is _______, 2020

2

TABLE OF CONTENTS

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

3

This Prospectus and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section beginning on page 6 of this Prospectus and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section beginning on page 28 of this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on page 6, and the consolidated financial statements, before making an investment decision.

Corporate Background and Business Overview

4DMed, Ltd. (“4DMed”, the “Company” “we” or “us”) is a development stage company. We were incorporated under the laws of the state of Nevada on November, 2016. We are a medical software and medical device development company that intends to design, patent, and market a medical virtual reality operating system with integrated, customary haptic and position sensing interfaces for the health care education research, software and medical device markets.

Our Hong Kong business office is located at 11/F, Capital Centre, 151 Gloucester Road, Wanchai, Hong Kong. This office is provided to us by our Chief Executive Officer, President and Director, Yuen May Cheung, at no cost to our Company. Our telephone number is (852) 93841733.

We have one (1) executive officer, Yuen May Cheung, our Chief Executive Officer and President, Chief Financial Officer and Secretary. Our two (2) Directors are Yuen May Cheung and Hau Tin Cheung.

We are a development stage company that has generated no revenues and has had limited operations to date. At June 30, 2020, the Company had not yet recorded any revenues, has working capital of $132,969 and has an accumulated deficit of $3,676,041. As of June 30, 2020, we had $4,319,153 in current assets and current liabilities of $35,581. Through June 30, 2020, we have issued an aggregate of 25,250,703 shares of our common stock since our inception. We issued 21,000,000 shares of our common stock to one (1) founding shareholder for services. We issued a total of 4,250,703 shares to 188 separate accredited foreign shareholders from July 20, 2017 through August 5, 2020, pursuant to private placements of our common stock exempt from registration under Regulation S of the Securities Act of 1933, for total proceeds of approximately $7,508,324.26. Since our inception we have not made any significant purchase or sale of assets, nor have we been involved in any mergers, acquisitions or consolidations.

Due to the uncertainty of our ability to meet our current operating and capital expenses, our independent auditors have included a going concern opinion in their report on our audited financial statements for the period December 31, 2019. The notes to our financial statements contain additional disclosure describing the circumstances leading to the issuance of a going concern opinion by our auditors.

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue in our last fiscal year, we are defined as an “emerging growth company” under the Jumpstart Our Business Startups (“JOBS”) Act. We will retain “emerging growth company” status until the earliest of:

| ● | The last day of the fiscal year during which our annual revenues are equal to or exceed $1 billion; |

| ● | The last day of the fiscal year following the fifth anniversary of our first sale of common stock pursuant to a registration statement filed under the Securities Act of 1933, as amended, which we refer to in this document as the Securities Act; |

| ● | The date on which we have issued more than $1 billion in nonconvertible debt in a previous three-year period; or |

| ● | The date on which we qualify as a large accelerated filer under Rule 12b-2 adopted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (i.e., an issuer with a public float of $700 million that has been filing reports with the U.S. Securities and Exchange Commission (“SEC”) under the Exchange Act for at least 12 months). |

4

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to SEC reporting companies. For so long as we remain an emerging growth company we will not be required to:

| ● | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Wall Street Reform and Consumer Protection Act of 2002; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation matters to stockholder non-binding advisory votes; |

| ● | submit for stockholder approval golden parachute payments not previously approved; |

| ● | disclose certain executive compensation related items, as we will be subject to the scaled disclosure requirements of a smaller reporting company with respect to executive compensation disclosure; and |

| ● | present more than two years of audited financial statements and two years of selected financial data in this registration statement and future filings, instead of the customary three years for audited financial statements and five years for selected financial data. |

We have not elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of The JOBS Act.

Because the worldwide market value of our common stock held by non-affiliates, or public float, is below $75 million, we are also a “smaller reporting company” as defined under the Exchange Act. Some of the foregoing reduced disclosure and other requirements are also available to us because we are a smaller reporting company and may continue to be available to us even after we are no longer an emerging growth company under the JOBS Act but remain a smaller reporting company under the Exchange Act. As a smaller reporting company we are not required to:

| ● | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; and |

| ● | present more than two years of audited financial statements in our registration statements and annual reports on Form 10-K and present any selected financial data in such registration statements and annual reports. |

Summary of the Offering

| Shares of common stock being offered by the Registrant: | 400,000 shares (the “Maximum Offering”) of the Selling Shareholder’s common stock. | |

| Offering price: | $1.00 per share of common stock. | |

| Number of shares outstanding before the Offering: | As of August 5, 2020, we had 25,250,703 shares of our common stock issued and outstanding, and no issued and outstanding convertible securities. | |

| Number of shares outstanding after the Offering | 25,250,703 if all of the shares being offered are sold | |

| Market for the common stock: | There is no public market for our common stock. After the effective date of the registration statement of which this prospectus is a part, we intend to seek a market maker to file an application on our behalf to have our common stock quoted on the Over-the-Counter Bulletin Board. We may never be approved for trading on any exchange. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that a trading market for our stock will develop be sustained if developed | |

| Use of Proceeds: | No proceeds to the Company. | |

| Risk Factors: | See the “Risk Factors” beginning on page 6 and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. | |

| Dividend Policy: | We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. |

5

Summary Financial Data

The following summary financial information for the period from January 1, 2019, through June 30, 2020, includes statement of expenses and balance sheet data from our audited financial statements. The information contained in this table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and the financial statements and accompanying notes included in this prospectus.

Statement of Operations

| Period from January 1, 2019 To December 31, 2019 | Six Months Ended June 30, 2020 (Unaudited) | |||||||

| Revenues | $ | 0 | 0 | |||||

| Total expenses | $ | (2,336,135 | ) | $ | (799,080 | ) | ||

| Net loss | $ | (2,336,135 | ) | $ | (799,080 | ) | ||

Balance Sheet Data

| June 30, 2020 (Unaudited) | ||||

| Total assets | $ | 4,319,153 | ||

| Total liabilities | $ | 35,581 | ||

| Total liabilities and stockholders’ equity (deficit) | $ | 4,319.153 | ||

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and other information in this prospectus before deciding to invest in our Company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth could be seriously harmed. As a result, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Relating to Our Business

There is uncertainty regarding our ability to continue as a going concern, indicating the possibility that we may be required to curtail or discontinue our operations in the future. If we discontinue our operations, you may lose all of your investment.

We have incurred a net loss of ($799,080) for the six months ended June 30, 2020, and an accumulated deficit of $2,876,961 as of June 30, 2020, and have completed only the preliminary stages of our business plan. We anticipate incurring additional losses before realizing any revenues and will depend on additional financing in order to meet our continuing obligations and ultimately, to attain profitability. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue our business. If we are unable to obtain additional financing from outside sources and eventually produce enough revenues, we may be forced to sell our assets, or curtail or discontinue our operations. If this happens, you could lose all or part of your investment.

We are in an early stage of development. If we are not able to develop our business as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your investment.

We were incorporated on November 2, 2016. We are in an early stage of development and have not earned any revenues to date. Our business prospects are difficult to predict because of our limited operating history, early stage of development, and unproven business strategy. For the six month period ending June 30, 2020, we have incurred accumulated net losses of ($799,080). We expect to continue to incur operating losses for the foreseeable future, and such losses may be substantial. Given our history of operating losses, we cannot assure you that we will be able to achieve or maintain operating profitability on an annual or quarterly basis or at all. If we are unable to execute our business plan as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your investment.

6

We expect to suffer losses in the immediate future that may cause us to curtail or discontinue our operations.

We expect to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the development of our business operations, generally. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will almost certainly fail.

We have limited sales and marketing experience, which increases the risk that our business will fail.

Our officers, who will be responsible for marketing, have only nominal sales and marketing experience. There can be no assurance that our efforts will be successful. Further, if our initial efforts to create a market are not successful, there can be no assurance that we will be able to attract and retain qualified individuals with marketing and sales expertise to attract customer. Our future success will depend, among other factors, upon whether our products and services can be sold at a profitable price and the extent to which consumers acquire, adopt, and continue to use them.

We may not be able to execute our business plan or stay in business without additional funding.

Our ability to generate future operating revenues depends in part on whether we can obtain the financing necessary to implement our business plan. We will likely require additional financing through the issuance of debt and/or equity in order to establish profitable operations, and such financing may not be forthcoming. As widely reported, the global and domestic financial markets have been extremely volatile in recent months. If such conditions and constraints continue or if there is no investor appetite to finance our specific business, we may not be able to acquire additional financing through credit markets or equity markets. Even if additional financing is available, it may not be available on terms favorable to us. At this time, we have not identified or secured sources of additional financing. Our failure to secure additional financing when it becomes required will have an adverse effect on our ability to remain in business.

If our estimates related to future expenditures are erroneous or inaccurate, our business will fail and you could lose your entire investment.

Our success is dependent in part upon the accuracy of our management’s estimates of our future cost expenditures for legal and accounting services (including those we expect to incur as a publicly reporting company), for research and development, construction, marketing, and for administrative expenses over the next twelve (12) months. If such estimates are erroneous or inaccurate, or if we encounter unforeseen costs, we may not be able to carry out our business plan, which could result in the failure of our business and the loss of your entire investment.

Our auditor has raised substantial doubts about our ability to continue as a going concern and if we are unable to continue our business, our shares may have little or no value.

Our ability to become a profitable operating company is dependent upon our ability to generate revenues and/or obtain financing adequate to fulfill its research and market introduction activities, and achieving a level of revenues adequate to support our cost structure has raised substantial doubts about our ability to continue as a going concern. We plan to attempt to raise additional equity capital by selling shares, if necessary, through one or more private placement or public offerings. However, the doubts raised, relating to our ability to continue as a going concern, may make our shares an unattractive investment for potential investors. These factors, among others, may make it difficult to raise any additional capital.

We are a small company with limited resources relative to our competitors and we may not be able to compete effectively.

Our competitors have longer operating histories, greater resources and name recognition, and a larger base of customers than we have. As a result, these competitors will have greater credibility with our potential customers. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion, and sale of their services than we may be able to devote to our services. Therefore, we may not be able to compete effectively and our business may fail.

7

The loss of the services of any of our officers or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services.

The development of our business will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officer, Yuen May Cheung, our Chief Executive Officer, President, and Chief Financial Officer, who is developing our business, and on our ability to identify and retain competent consultants and employees with the skills required to execute our business objectives. The loss of the services of any of our officers or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services, which could adversely affect our financial results and impair our growth.

Our Chief Executive Officer and Chief Financial Officer has conflicts of interest in that she has other time commitments that will prevent her from devoting full-time to our operations, which may affect our operations.

Because our Chief Executive Officer and Chief Financial Officer, Yuen May Cheung, only devote approximately fifty percent (50%) of her full working time to operation and management of us, the implementation of our business plans may be impeded. Ms. Cheung has limited time in which to devote to our operations, which may slow our operations and may reduce our financial results and as a result, we may not be able to continue with our operations. Additionally, if Ms. Cheung became unable to handle her daily duties of the Chief Executive Officer and Chief Financial Officer on her own, we may not be able to hire additional qualified personnel to replace her in a timely manner. If this event should occur, we may not be able to reach profitability, which might result in the loss of some or all of your investment in our common stock.

We are subject to financing and interest rate exposure risks.

Our future success depends on our ability to access capital markets and obtain financing on reasonable terms. Our ability to access financial markets and obtain financing on commercially reasonable terms in the future is dependent on a number of factors, many of which we cannot control, including changes in:

| ● | our credit rating; |

| ● | interest rates; |

| ● | the structured and commercial financial markets; |

| ● | market perceptions of us and the oil and natural gas exploration and production industry; and |

| ● | tax burdens due to new tax laws. |

Any amounts due under our credit facility will bear interest at a variable rate. Any increases in our interest rates, or our inability to access the debt or equity markets on reasonable terms, could have an adverse impact on our financial condition, results of operations and growth prospects.

Risks Relating to Our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop or be sustained after this Offering. After the effective date of the registration statement of which this prospectus is a part, we intend to identify a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the Over-the-Counter Bulletin Board. We must satisfy certain criteria in order for our application to be accepted. We may never be approved for trading on any exchange. We do not currently have a market maker willing to participate in this application process, and even if we identify a market maker, there can be no assurance as to whether we will meet the requisite criteria or that our application will be accepted. Our common stock may never be quoted on the Over-the-Counter Bulletin Board or a public market for our common stock may not materialize if it becomes quoted.

If our securities are not eligible for initial or continued quotation on the Over-the-Counter Bulletin Board or if a public trading market does not develop, purchasers of the common stock in this Offering may have difficulty selling or be unable to sell their securities should they desire to do so, rendering their shares effectively worthless and resulting in a complete loss of their investment.

If we do not file a Registration Statement on Form 8-A to become a mandatory reporting company under Section 12(g) of the Securities Exchange Act of 1934, we will continue as a reporting company and will not be subject to the proxy statement requirements, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity, all of which could reduce the value of your investment and the amount of publicly available information about us.

As a result of this Offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities and Exchange Commission once this registration statement is declared effective. Once this registration statement is declared effective, we intend voluntarily to file a registration statement on Form 8-A which will subject us to all of the reporting requirements of the 1934 Act. This will require us to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity. We are not required under Section 12(g) or otherwise to become a mandatory 1934 Act filer unless we have more than 500 shareholders and total assets of more than $10 million on March 31, 2020. If we do not file a registration statement on Form 8-A, we will continue as a reporting company and will not be subject to the proxy statement requirements of the 1934 Act, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity.

8

Because we will be subject to “penny stock” rules once our shares are quoted on the Over-the-Counter Bulletin Board, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges). The penny stock rules require a broker-dealer to deliver to its customers a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market prior to carrying out a transaction in a penny stock not otherwise exempt from the rules,. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules. If a trading market does develop for our common stock, these regulations will likely be applicable, and investors in our common stock may find it difficult to sell their shares.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may also limit your ability to buy and sell our stock, which could depress our share price.

FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares, depressing our share price.

State securities laws may limit secondary trading, which may restrict the states in which you can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold pursuant to this Offering, you may not be able to resell the shares in a certain state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder’s ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder’s risk of losing some or all of his investment.

Our Company has a concentration of stock ownership and control, which may have the effect of delaying, preventing, or deterring a change of control.

Our common stock ownership is highly concentrated. Through ownership of shares of our common stock, three shareholders, Yuen May Cheung, who is also our Chief Executive Officer, Chief Financial Officer and Director, beneficially owns approximately 83.2% of our total outstanding shares of common stock before this Offering. As a result of the concentrated ownership of the stock, Ms. Cheung, who owns 21,000,000 shares of our common stock, acting alone, will be able to control all matters requiring stockholder approval, including the election of directors and approval of mergers and other significant corporate transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our Company. It could also deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of our common stock. Moreover, such concentration of our common stock in Ms. Cheung could create potential or actual conflicts of interests detrimental to our stockholders and have a negative impact on our ability to maintain effective internal controls.

9

If quoted, the price of our common stock may be volatile, which may substantially increase the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Even if our shares are quoted for trading on the Over-the-Counter Bulletin Board following this Offering and a public market develops for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

| ● | variations in quarterly operating results; |

| ● | our announcements of significant contracts and achievement of milestones; |

| ● | our relationships with other companies or capital commitments; |

| ● | additions or departures of key personnel; |

| ● | sales of common stock or termination of stock transfer restrictions; |

| ● | changes in financial estimates by securities analysts, if any; and |

| ● | fluctuations in stock market price and volume. |

Your inability to sell your shares during a decline in the price of our stock may increase losses that you may suffer as a result of your investment.

The stock market has experienced extreme price and volume fluctuations and if we face a class action suit due to the volatility of the price of our common stock, regardless of the outcome, such litigation may have an adverse impact on our financial condition and business operations.

The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management’s attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

Because we do not intend to pay any dividends on our common stock; holders of our common stock must rely on stock appreciation for any return on their investment.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Accordingly, holders of our common stock will have to rely on capital appreciation, if any, to earn a return on their investment in our common stock.

Any future additional issuances of our common stock may result in immediate dilution to existing shareholders.

We are authorized to issue up to 75,000,000 shares of common stock, of which 25,250,703 shares are issued and outstanding as of the date of this prospectus. Our Board of Directors has the authority, without the consent of any of our stockholders, to cause us to issue additional shares of common stock, and to determine the rights, preferences and privileges attached to such shares. The sale of our common stock pursuant to this prospectus, and any future additional issuances of our common stock will result in immediate dilution to our existing shareholders’ interests, which may have a dilutive impact on our existing shareholders, and could negatively affect the value of your shares.

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements; others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges and NASDAQ, are those that address the board of Directors independence, audit committee oversight, and the adoption of a code of ethics. While our Board of Directors has adopted a Code of Ethics and Business Conduct, we have not yet adopted any of these corporate governance measures, and since our securities are not listed on a national securities exchange or NASDAQ, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, shareholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officers and recommendations for director nominees, may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

10

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements and information relating to our business that are based on our beliefs, on assumptions made by us, or upon information currently available to us. These statements reflect our current views and assumptions with respect to future events and are subject to risks and uncertainties. Forward-looking statements are often identified by words like: “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled Risk Factors beginning on page 6, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the Management’s Discussion and Analysis of Financial Condition and Results of Operation section beginning on page 28 and the section entitled “Description of Our Business” beginning on page 12, and as well as those discussed elsewhere in this prospectus. Other factors include, among others: general economic and business conditions; industry capacity; industry trends; competition; changes in business strategy or development plans; project performance; availability, terms, and deployment of capital; and availability of qualified personnel.

These forward-looking statements speak only as of the date of this prospectus. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we expressly disclaim any obligation or undertaking to disseminate any update or revisions of any of the forward-looking statements to reflect any change in our expectations with regard thereto or to conform these statements to actual results.

The Company will receive no proceeds from this offering by the selling shareholders.

As this is a selling shareholders offering there is no dilution in the price of the stock as a result of this registration.

DETERMINATION OF THE OFFERING PRICE

There is no established public market for our shares of common stock. The offering price of $1.00 per share was determined by us arbitrarily. We believe that this price reflects the appropriate price that a potential investor would be willing to invest in our Company at this initial stage of our development. This price bears no relationship whatsoever to our business plan, the price paid for our shares by our founders, our assets, earnings, book value or any other criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities, which is likely to fluctuate.

See “Plan of Distribution” for additional information.

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain any earnings to develop and market our services. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

Market Information

There is no established public market for our common stock.

After the effective date of the registration statement of which this prospectus is a part, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority, Inc., or FINRA, to have our common stock quoted on the Over-the-Counter Bulletin Board. We will have to satisfy certain criteria in order for our application to be accepted. We do not currently have a market maker who is willing to participate in this application process, and even if we identify a market maker, there can be no assurance as to whether we will meet the requisite criteria or that our application will be accepted. Our common stock may never be quoted on the Over-the-Counter Bulletin Board, or, even if quoted, a public market may not materialize. There can be no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained.

We have issued 25,250,703 shares of our common stock since our inception on November 2, 2016. There are no outstanding options, warrants, or other securities that are convertible into shares of common stock.

Holders

There were 189 holders of record of our common stock as of August 5, 2020.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any compensation plan under which equity securities are authorized for issuance.

11

Overview

Company Summary

4DMed, Ltd. (“4DMed”, the “Company” “we” or “us”) is a development stage company. We were incorporated under the laws of the state of Nevada on November, 2016. We are a medical software and medical device development company that intends to design, patent, and market a medical virtual reality operating system with integrated, customary haptic and position sensing interfaces for the health care education research, software and medical device markets.

We are a development stage company that has generated no revenues and has had limited operations to date. At June 30, 2020, the Company had not yet recorded any revenues, has working capital of $132,969 and has an accumulated deficit of $3,676,041. As of June 30, 2020, we had $4,319,153 in current assets and current liabilities of $35,581. Through June 30, 2020, we have issued an aggregate of 25,250,703 shares of our common stock since our inception. We issued 21,000,000 shares of our common stock to one (1) founding shareholder for services. We issued a total of 4,250,703 shares to 188 separate accredited foreign shareholders from July 20, 2017 through August 5, 2020, pursuant to private placements of our common stock exempt from registration under Regulation S of the Securities Act of 1933, for total proceeds of approximately $7,508,324.26. Since our inception we have not made any significant purchase or sale of assets, nor have we been involved in any mergers, acquisitions or consolidations.

Business Overview

Company Mission, Vision and Values

4DMED’s mission is to create a medical Virtual Reality (VR) operating system that will provide top-notch training for medical practitioners and learning institutions, and also make the provision of medical services, including surgeries, more available and affordable.

4DMED’s vision is the placement of at least one of its VR operating systems in every hospital and medical clinic in which surgeries are performed, and every medical school throughout the world.

4DMED’s values are seen by the company to be critical to success. They are the strong foundation of the company, define who the company is, and set it apart from all competitors. They underlie the company’s vision of the future. These values include:

| ● | Product Quality |

| 4DMED acts with utmost responsibility, always seeking to meet or exceed expectations. |

| ● | Teamwork |

| 4DMED acts as a team with all of its partners, committed to each other, and bound by trust and loyalty. |

| ● | Integrity |

| 4DMED treats all of its partners, and all other stakeholders with dignity and respect and honesty. Ethical behavior, and integrity are fundamental characteristics of its business conduct. |

12

Implementaton of Business Plan

We intend to implement our business plan through four (4) divisions with our Company. These divisions are. MedVR, MedXR, MedSLS and MedAI.

MedVR

The MedVR mission is to educate, motivate, and activate people to achieve the best possible health program for their environment and it will be responsible for developing the educational component of 4DMED activities. We are currently developing two training programs:

One is surgeon training to be given by senior, experienced trainers, the other creates medical simulation (“SIM”) environments for training nurses or other junior trainees. In designing the 4DMED Simulator, the Company employs both the “far” and “close” approaches - to make it easier for training in hospitals or universities. MedVR is also building a complete anatomy library to support the VR program, with assistance from educational and clinical organizations around the globe.

MedXR

MedXR will develop the treatment component of 4DMED activities. These will include virtual environments to clinically treat severe mental and behavioral health problems including…drug and alcohol abuse, schizophrenia, post-traumatic stress disorder, mood disorders, mild cognitive impairment, autism spectrum disorder, ADHD and others. MedXR creates experiences that activate cognitive, emotional and physiological responses with the goal of improving health. These VR experiences empower individuals and lower the barriers to good health with personalized content and treatment, by creating emotional regulation skills and stress resilience techniques. MedXR has built a breakthrough, comprehensive platform for activating healthy behaviors and improving health outcomes. The platform enables clinical organizations to extend their brand into new virtual patient care experiences.

MedSLS

MedSLS will create the hardware units for 4DMED. One of the first such products is the 4DMED Simulator which is being developed in concert with a Swiss company. Trainees remain engaged and learn more quickly with the progressively more complex cases offered by the VR program with the double screens that are a feature of the simulator…a first. Double screens can help the trainers to get familiar with the surgery room and to working with the assistants. With simulator, techniques complete procedures can be practiced again and again at increasing levels of difficulty, with thousands of new challenges, scenarios and complications to make each experience unique. Each exercise is digitally recorded with detailed metrics, statistics and video debriefing, providing both immediate and long-term skill development feedback.

MedSLS is also working with a development company in Florida on a VR glove with which the trainer can feel more reality in the VR exercise. The user…hospital or university…will have more choice and the trainers can ‘feel their hands’ during the VR application.

MedAI

MedAI will be responsible for the surgical element of 4DMED activities. 4DMED software development kit (SDK) is the Company’s own proprietary product used to develop all of its surgical operations. Users can also use this proprietary SDK to create their own applications, or other VR teaching applications together with support from the MedVR library program.

Streaming interactive, cloud-based VR experiences over upcoming high-speed 5G mobile networks may be possible with a combination of a low latency encoder and optimized client decoding. This will help to achieve VR experiences that deliver presence without simulation sickness. 5G refers to the fifth generation of mobile networks. Currently, many countries have adopted 4G as the standard for high-speed mobile data, allowing users to browse the web, stream media, and make video calls almost effortlessly. The next generation, 5G, will bring improvements to all of these areas.

Corporate Strategy

Virtual simulation technology has come a long way since the Sensorama Simulator was first introduced in 1962. Over the past few decades, VR and simulation technology have become intertwined and implemented in various industries…in particular healthcare. Surgery simulators have been invaluable for physician training, and hospitals have paid …and will continue to pay…large sums of money for this specialized equipment.

With visual simulation combined with force-feedback technology, the surgeon can experience both visual and physical feedback when practicing a procedure. Companies developing cutting-edge simulators for the system. It is unlikely that current HMD technology will be able to replace these sophisticated simulators, but the cost should come down with new sensor and display technologies now available.

13

Beyond surgery, VR is a cost-effective, safe and engaging method for clinical education and training of healthcare professionals, such as nurses, physicians, surgeons, counsellors, dentists, paramedics and even patients. Practitioners can receive training on procedures, techniques, equipment and patient interactions in a far more immersive and realistic environment than using traditional videos and paperwork.

Training in VR allows physicians a risk-free environment in which to practice life-saving procedures, particularly ones that are not commonly performed.

Based on the need to enhance rapid market penetration along with the distribution and adaptation of new medical technology 4DMED is working to build up strategic associations with medical schools, medical software developers, and medical device manufacturers. In view of its solid comprehension of the present market, 4DMED has already created integral arrangements, some which use patent pending innovation which are set in place to serve as income producing answers to existing market needs.

All of this will help 4DMED achieve its main goal to become the industry leader for developing, marketing, and licensing medical VR technology.

The basic 4DMED strategy is embodied in our 4DMED.net program. 4DMED.net is a joint venture with universities and hospitals around the world with a focus on developing program content. The components of the 4DMED strategy are:

Content

4DMED.net is a joint venture with universities and hospitals to develop content. The joint venturers include hospitals in Asia such as Shanghai Hospital, Shanghai, China; Hungary University, Budapest, Hungary.

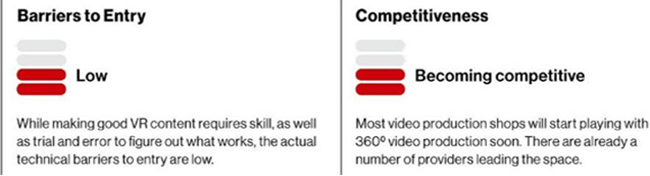

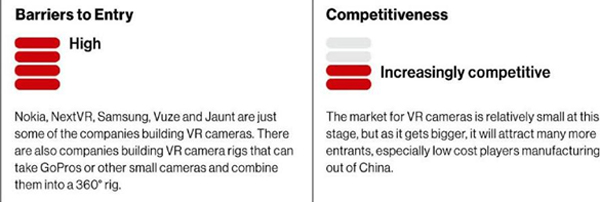

Cameras

VR cameras are differentiating themselves in a few ways — some are stereoscopic, and some don’t have top and bottom cameras or only cover 1800. Some can live stream, while others just record to disc. One new and interesting technology is volumetric capture, where multiple cameras are arranged facing inward to capture video within an area as opposed to 360-degree cameras that capture video from one point facing outward. The market is currently small but growing. There will be professional, prosumer, and consumer camera rigs, but like the action camera market, there will be a couple of primary players for each target customer, along with a number of cheaper knockoffs or highly specialized cameras. The market will likely only sustain a handful of manufacturers. 4DMED.net is currently evaluating potential partners for developing our cameras.

14

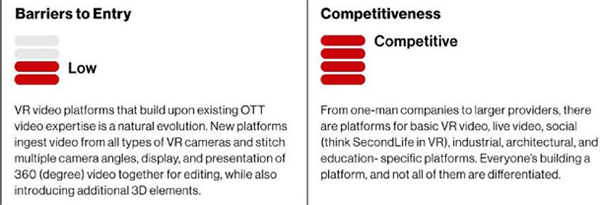

Platforms

Platforms are the “glue” of VR. The companies that will succeed in this space are those that can build innovative and differentiated value added features, along with a delivery mechanism.

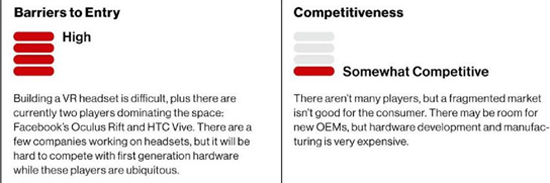

VR Headsets

At this point the VR Headset component is in a bit of turmoil with participating manufacturers not fully decided on how they are going to approach the market. New features might give some headset manufacturers an edge (for example FOVE is supposed to include eye tracking), but a good headset manufacturer needs plenty of funding in order to solve problems with the current headset devices. Oculus and HTC are already likely planning version 2 of their headsets and, like the camera market, the dedicated headset market will only sustain a limited number of manufacturers, unless they’re niche products like medical applications. The next round of VR headsets is likely to include higher resolutions, better head tracking, and better interaction between physical and virtual environments (e.g. better controllers) – all of which will have high costs for the first players in this space. In addition, mobile phone manufacturers will build ever more powerful devices, with higher-resolution displays, that will be used to power VR headsets. While dedicated headsets are likely to provide a higher-end experience, every mobile phone user will potentially have a VR-capable device. 4DMED has recognized this potential dilemma and is focused on overcoming it through careful adherence to its values, its strategy and its keys to success.

The Market

The VR/AR healthcare market has been valued at approximately US$748.3 Million in 2017 and is anticipated to enjoy healthy growth over the forecast period 2019-2026. The market is conservatively estimated to reach a value US$6.91 Billion by 2026, according to a March 2019 publication by Reports and Data. This can be mainly associated with the increasing demand for innovative diagnostic techniques, the presence of many more neurological disorders, and increasing disease awareness. The market is driven mainly by applications in surgical simulation, diagnostic imaging, patient care management, rehabilitation and health management. The advancements being made in the field of information technology such as computers of all types, internet connectivity and mobile applications, are also a significant factor stimulating market demand.

15

Because of the constant technological advancement of related products, prevalence of neurological & psychological disorders, and presence of a sophisticated healthcare infrastructure, the North America region accounts for the largest market share of 44.21% in 2018. It is expected to retain the dominant position in 2026 but because of accelerating growth in other regions, its overall market penetration will likely decrease.

| ● | The overall market is projected to grow at a compound annual growth rate (CAGR) of 16.2% in terms of value and reach US$6.91 billion by 2026. |

| ● | The software component is expected to grow at a CAGR of 15.4% during the forecast period. |

| ● | The hardware component is expected to grow at a CAGR of 14.8% during the forecast period. |

| ● | Fully immersive VR is projected to grow at a CAGR of 16.6% during the forecast period. Different medical training institutes have combined fully immersive VR, with medical data and highly advanced medical simulation technologies, to enable modern medical education and training globally. The adaptability offered by the institutions assist as a practical teaching tool today and will continue to do in the future. This will serve as an excellent vehicle for promoting the development to the next level of medical practice. |

| ● | The patient care management component is estimated to grow at a CAGR of 16.6 % during the forecast period and is expected to lead the market for VR in the healthcare segment. The use of VR/AR in therapies and rehabilitation, including brain injury, stroke, and physical therapy among others, will be a significant addition to the healthcare market. |

The main market participants are:

| ● | individuals (retail customers) accounting for more than 90 percent of sales, and |

| ● | local businesses (corporate customers) which, in terms of purchase orders, typically make larger orders for their employees and business needs. |

VR technology is beneficial for not just doctors but also for patients; this technology offers great convenience to patients by enabling them to visit physicians virtually. This has also driven the growth of healthcare VR. According to March 2019 Reports and Data research, VR is ahead of AR because of the advanced offerings of VR technology. VR allows a person to experience their presence inside a different world and interact with it in real time, whereas AR builds a visual world around but does not facilitate any interaction with this world.

There are a lot of factors contributing to the growth of the healthcare VR/AR market including new start-ups that are inclined towards capitalizing on highly prevalent technology. With a positive growth approach of the global market these start-ups are widening their scope of VR/AR applications by using this technology in new applications, thereby providing new functionalities in their products. As these start-ups continue to increase, new products will keep getting developed, increasing the market numbers significantly. The easy availability of VR/AR products, and the need to gain competitive advantage, mean that a growing number of companies has, or will, lower the prices of products, making them affordable for healthcare providers.

VR/AR services are likely to witness higher demand compared to hardware and software and are expected to account for more than 42% share of the total revenue by the end of 2026. Applications of healthcare VR/AR in the medical training segment will reportedly remain the highest, followed by the surgery planning segment. They are anticipated to present the most lucrative opportunities in coming years. Hospitals and clinics are foreseen to retain the top end-user position with more than 40% value share estimated by the end of 2026, followed by medical research organizations.

Competition

There are many worldwide competitors for 4DMED in the VR arena. The following brief summaries of some of the larger, more well-known companies focuses only on their activities in the healthcare industry. The list identifies a number of potential partners that 4DMED can work with to pursue its goals.

Phillips Healthcare (Netherlands)

Koninklijke Philips N.V. (KPNV) was founded in 1891 and is headquartered in Amsterdam, the Netherlands. KPNV operates as a health technology company worldwide. It operates through Diagnosis & Treatment, Connected Care & Health Informatics, and Personal Health segments. The company offers mother, child-care, and oral healthcare products; male grooming and beauty products; food preparation and home care products; and sleep and respiratory care. It provides diagnostic X-ray, integrated clinical, magnetic resonance imaging, computed tomography, and molecular imaging solutions. The company also offers interventional X-ray systems, and imaging and therapy devices for treatment of coronary artery and peripheral vascular disease; imaging products focus on diagnosis, treatment planning, and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications; and proprietary software to enable diagnostics and intervention. Further, it provides patient monitoring solutions; patient analytics, precision diagnosis, and clinical decision support systems; therapeutic care products; patient monitoring and therapeutic care consumables; and customer services. Additionally, the company offers healthcare information technology, clinical, and visualization and quantification informatics solutions for radiology, cardiology, and oncology departments; universal data management solutions, picture archiving and communication systems, and integrated electronic medical record systems; clinical and hospital IT platforms; technology-enabled monitoring and intervention, actionable program, cloud-based, and population health management software solutions. It also provides digital frameworks that connect consumers, patients, and healthcare providers in a cloud-based connected health ecosystem of devices, apps, and tools.

16

CAE Healthcare (Canada)

CAE Healthcare is committed to improving clinical education and patient safety through simulation-based training solutions. With a mission to Improve clinical competency and performance, we develop evidence-based curriculum and innovative learning technologies for healthcare education.

Firsthand Technology (USA)

Firsthand has helped pioneer VR as a digital therapeutic for pain and rehab, mental health, and promoting healthy lifestyles. The company believes that VR has an Firsthand enormous potential to improve health and wellness.

EON Reality (USA)

EON Reality is the world leader in Virtual and Augmented Reality based knowledge transfer for industry and education. EON believes that knowledge is a human right, and its goal is to make knowledge available, affordable, and accessible for every human on the planet. To do this, it is creating the next generation of Virtual and Augmented Reality tools to increase the world’s knowledge transfer capabilities.

GE Healthcare (USA)

GE Healthcare expertise in medical imaging and information technologies, medical diagnostics, patient monitoring systems, performance improvement, drug discovery, and biopharmaceutical manufacturing technologies is helping clinicians around the world re-imagine new ways to predict, diagnose, inform and treat disease, so their patients can live their lives to the fullest.

Intuitive Surgical Inc. (USA)

Intuitive was founded in 1995 to create innovative, robotic-assisted systems that help empower doctors and hospitals to make surgery less invasive than an open approach. Since da Vinci® became one of the first robotic-assisted systems cleared by the FDA for general laparoscopic surgery, it’s taken robotic-assisted surgery from “science fiction” to reality. Working with doctors and hospitals, Intuitive is continuing to develop new, minimally invasive surgical platforms and future diagnostic tools, including VR, to help solve complex healthcare challenges around the world.

Medtronic plc (USA)

Medtronic plc is the world’s largest medical device company that generates the majority of its sales and profits from the U.S. healthcare system. The company is a leading innovator of healthcare VR.

Mimic Technologies Inc. (USA)

Mimic has a proven programmatic approach that leverages “best-in-class” simulation, cloud-based data collection, advanced analytics that enable objective decisions on privileging and credentialing and the latest VR techniques. By facilitating training outside of the operating room, Mimic enables a rapid climb up the learning curve without wasting valuable OR time. Surgical quality and efficiency are emphasized, while training costs and risk are minimized.

Siemens Healthineers (Germany)

Siemens is a leading global healthcare company, which is continually refining and expanding its healthcare offerings, from medical imaging and laboratory diagnostics, to consulting, healthcare IT, and VR development – as well as further technologies for therapeutic and molecular diagnostics. It is very successful and has an abundance of capital to undertake its operations and research.

17

Surgical Science AB (Sweden)

TeamSim® is a dynamic platform for inter-professional education development taking surgery simulation into the real-world. Using the validated VR training system LapSim® as base, the TeamSim® package is the element that lifts a team training to new levels and immerse into realistic surgery scenarios While innovations in laparoscopic surgical simulators have made an incredible impact on individualized training, there has been a gap between the experience of a single professional standing at the simulator and stepping into a collaborative OR staffed with multiple team members. TeamSim® erases that gap by giving the whole OR team the opportunity to practice and refine their communication and non-technical skills without any patient risk.

Virtual Realities (USA)

Virtual Realities is a leading world distributor of 3D peripheral products and output devices, software, and systems, primarily for the educational and healthcare industries. Its primary goal is to deliver integrated turnkey solution with professional VR applications.

Virtually Better Inc. (USA)

Virtually Better has over 20 years’ experience developing VR to treat mental health disorders. Its corporate motto is “Virtual Reality for a Healthier You” and it focuses on the VR environment almost exclusively.

Vital Images Inc. (USA)

Vital, a Canon Group company, has a legacy of leadership in healthcare imaging using smart algorithms and VR techniques spanning 30 years. As the premier provider of an enterprise imaging (EI) solution focused on interoperability, Vital transforms and seamlessly connects disparate PACS and other data into an efficient, perceptive and interoperable EI solution. Through modular and scalable enterprise message orchestration, enterprise visualization and enterprise analytics solutions, Vital’s Vitrea® Enterprise Imaging solution makes data accessible across the entire enterprise anytime, anywhere, and in any standardized form.

Vuzix Corporation (USA)

Vuzix is a leading supplier of Smart-Glasses and AR technologies and products for the consumer and healthcare markets. The Company’s products include personal display and wearable computing devices that offer users a portable high-quality viewing experience, provide solutions for mobility, wearable displays and both VR and AR. Vuzix holds 66 patents and 43 additional patents pending and numerous IP licenses in the near-eye display field.

WorldViz LLC (USA)

WorldViz makes virtual reality hardware and software for professionals, ranging from comprehensive development platforms to drag-and-drop VR creation and collaboration tools. It has 17 years of building a VR knowledge base, creation VR projection systems. WorldViz is an industry-leading provider of VR solutions for non-entertainment applications, primarily in the healthcare industry. It has patent pending VR products used widely in that industry.

zSpace Inc. (USA)

zSpace provides an immersive learning platform for medical training, allowing students to examine virtual living body structures with accurate anatomical representation, plan procedures and present findings.

The foregoing is not intended to be an exhaustive list of 4DMED’s competitors in the VR healthcare market. Nor is it intended to focus on their history in the market, their financial strength or their respective position in the market.

What it is intended to do is illustrate that there are many participants in the industry who provide products or services that are complimentary to 4DMED’s activities and may be able to be relied upon as a provider to help 4DMED achieve its goals. This is consistent with the 4DMED strategy of using external partners as much as possible.

18

SWAT Analysis

SWOT is the acronym for “Strengths, Weaknesses, Opportunities, Threats”. The analysis is a framework used to evaluate a company’s competitive position and to develop strategic planning. SWOT analysis assesses internal and external factors, as well as current and future potential.

The SWOT analysis for 4DMED looks like:

| Strengths | Weaknesses | ||

| ● | relationship with medical and educational facilities | ● | small – lack of financial resources |

| ● | working with top end providers of products and services | ● | no profile in VR industry |

| ● | understand VR technology | ● | no well-established base |

| ● | understand VR market | ||

| ● | small and focused | ||

| ● | addressing all healthcare VR components | ||

| Opportunities | Threats | ||

| ● | rapidly changing industry initiatives | ● | large, financially secure competition |

| ● | collaboration with industry participants | ● | many participants in a “hot” industry |

| ● | increasing demand for VR | ● | economic/political change |

| ● | increased pressure for healthcare provider cost reductions | ● | lack of public funding for purchasers |

| ● | pressure to reduce healthcare costs | ||

4DMED is admittedly small and has no strong profile in the VR industry yet compared to companies that are more stablished and better funded. But we are also participating in an industry that appears to have an insatiable demand for VR products and processes where there are opportunities for meaningful collaboration with well-established industry participants.

Healthcare VR is largely paid for from the public purse in most environments and there are always pressures to reduce costs, coupled with ongoing economic and political changes. Public funding is not always available, and expenditures get delayed.

Property and Facilities

We do not own or lease any real property or facilities. Our Hong Kong business office is located at 11/F, Capital Centre, 151 Gloucester Road, Wanchai, Hong Kong. This office is provided to us by our Chief Executive Officer, President and Director, Yuen May Cheung, at no cost to our Company.

Dependence on One or a Few Major Customers

We do not anticipate dependence on one or a few major customers for at least the next twelve (12) months or the foreseeable future.

Environmental Regulations

Environmental regulations have had no materially adverse effect on our operations to date, but no assurance can be given that environmental regulations will not, in the future, result in a curtailment of service or otherwise have a materially adverse effect on our business, financial condition or results of operation. Public interest in the protection of the environment has increased dramatically in recent years. The trend of more expansive and stricter environmental legislation and regulations could continue. To the extent that laws are enacted or other governmental action is taken that imposes environmental protection requirements that result in increased costs, our business and prospects could be adversely affected.

Patents, Trademarks and Licenses

We currently do not have any patents or trademarks; and we are not party to any license, franchise, concession, or royalty agreements or any labor contracts.

Legal Proceedings

As of the date of this prospectus, we know of no material pending legal proceedings to which we are a party or of which any of our property is the subject. There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Employees

Our only employee is our one (1) executive officer.

19

The name, age and position of each of our directors and executive officers are as follows:

| Name | Age | Position | ||

| Yuen May Cheung | 54 | CEO, President, CFO, Secretary and Director | ||

| Hau Tin Cheung | 52 | Director |

Yuen May Cheung, Age 54, Chief Executive Officer, President, Chief Financial Officer, Secretary and Director

Ms. Cheung, is our founder and our Chief Executive Officer, President, Chief Financial Officer, Secretary and Director and has served in in such capacities since our inception in November of 2016. Ms. Cheung currently devotes 50% of her working time to the management and operations of our Company. Ms. Cheung was the co-founder of GuangNing ChangRong Bamboo & Wood Handicraft Products Co. Ltd, a factory and manufacturer, served as Director and owned by Ms. Cheung, since 2007, Ms. Cheung served as Director of Zhong Cui Investments Ltd., a marketing company, owned by Ms. Cheung since 2006. Ms. Cheung also serves as President and sole Director of AIFam, Ltd. Ms. Cheung provides hands-on leadership, strategic direction and operations management with a focus on business development, exceptional quality management and fiscal accountability. Ms. Cheung attended Centennial College in Toronto, Canada from 1989-1991 where she received a Certificate of Accounting, and she also attended Chui Hai College in Hong Kong from 1984-1988 where she received a degree in Business Management. Ms. Cheung has served as an officer and director of AIFarm. Ltd., a company formerly required to file reports with the Securities and Exchange Commission.

Hau Tin Cheung, Age 52, Director

Prior to 4DMed Ltd, Mr. Cheung was involved for over 20 years as a private investor, business man, and merchant banker, managing and coordinating the financing of tens of millions of dollars of transaction proceeds, in numerous domestic and overseas business opportunities, across diverse sectors of industries including; natural gas, oil, mining, pharmaceuticals and technology. Mr. Cheung attended Centennial College in Toronto, Canada where he received a Certificate of Finance Management in 1990. Mr. Cheung does not, and has not served as an officer or director of any other company required to file reports with the Securities and Exchange Commission.

Board Composition