Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - EXP World Holdings, Inc. | expi-20200630xex31d2.htm |

| 10-Q - 10-Q - EXP World Holdings, Inc. | expi-20200630x10q.htm |

| EX-32.2 - EX-32.2 - EXP World Holdings, Inc. | expi-20200630xex32d2.htm |

| EX-32.1 - EX-32.1 - EXP World Holdings, Inc. | expi-20200630xex32d1.htm |

| EX-31.1 - EX-31.1 - EXP World Holdings, Inc. | expi-20200630xex31d1.htm |

Exhibit 10.1

Independent Contractor Agreement

This Independent Contractor Agreement is entered into by and between:

Name of Licensee: |

| |

| | (List entity name only if license is held in the name of an entity approved by the applicable state real estate commission. Must include entity designation if listing an entity name. DBAs not accepted.) |

| | |

Address: | | |

City: | | |

State: | | |

ZIP code: | | |

(the “Independent Contractor” or “Contractor” or “You”), and eXp Realty, LLC, a Washington limited liability company; or eXp Realty of California, Inc., a Washington corporation; or eXp Realty of Connecticut, LLC, a Connecticut limited liability company; or eXp Realty North, LLC, a North Dakota limited liability company, or eXp Realty Associates, LLC, a Georgia limited liability company, whichever is the applicable entity licensed as Contractor’s applicable jurisdiction, all with their corporate office located at 2219 Rimland Dr., Suite 301, Bellingham, WA 98226 (hereinafter referred to as "eXp Realty" or "Company"). eXp Realty/Company and Contractor/Independent Contractor are each referred to individually herein as a "Party" and collectively as the "Parties".

Whereas Contractor is duly licensed with each of the state(s) listed below to do business as a real estate licensee and whereas Contractor wishes to affiliate and place his or her license with the Company and the Company desires to allow Contractor to affiliate with it on the terms and conditions set forth herein.

Primary/Domicile State: | | License No.: | |

Additional States Contractor is licensed in & License No.’s (if applicable): | | ||

| |||

Now, therefore, the Parties agree as follows:

STATEMENT OF AGENCY

Effective as of the date of this Independent Contractor Agreement (“Agreement” or “ICA”), Company shall retain Contractor as an "Independent Contractor" as defined under Section 3508 of the Internal Revenue Code with the title of "Real Estate Salesperson" or other such equivalent title as the state recognizes (i.e., real estate licensee, broker, qualifying broker, principal broker, associate broker, etc.) exclusively for the Company. This Agreement does not constitute a hiring by either party, and neither party shall be liable for any obligation incurred by the other, except as provided hereunder.

Contractor shall be free to devote to his or her real estate service business such portion of his or her time, energy, effort and skill, as Contractor sees fit and to establish his or her own endeavors. Contractor shall not be required to keep definite office hours, attend sales meetings or adhere to sales quotas. Contractor shall not have mandatory duties except those specifically set out in this Agreement. Nothing contained in this Agreement shall be regarded as creating any relationship (employer/employee, joint venture, partnership, shareholder) between the parties, other than the independent contractor relationship as set forth herein. Contractor understands this is an “at will” agreement.

Contractor understands that Company is legally accountable for the activities of the Contractor.

1

Contractor further agrees that they will follow all local, state, and federal laws regarding business permits and licenses that may be required to carry out their business.

A. Workers’ Compensation Insurance Coverage. Contractor is an Independent Contractor. To the maximum extent permitted and required by law, Contractor shall acquire on his or her own behalf, as a self-employed person, such workers’ compensation insurance coverage as he or she deems appropriate, but no less than is required by law, and consistent with his or her status as an independent contractor and the mutual intent of the Company and the Contractor not to create an employer/employee relationship. Contractor hereby agrees not to claim or assert, or to support any third-party assertion of, the existence of an employee/employer relationship. Any specific state exceptions and requirements shall be covered in a state-specific addendum. Contractor shall name the Company, its affiliates and subsidiaries as additional insureds on any workers’ compensation policy that Contractor obtains on his or her own behalf and shall also obtain a waiver of subrogation endorsement from the workers’ compensation insurer in favor of the Company, its affiliates and subsidiaries. Contractor shall, uponwritten request, provide evidence of the above insurance requirements for any policy of workers’ compensation insurance he or she obtains on his or her own behalf.

B. Taxation. Independent Contractor understands that Independent Contractor is entering into this Agreement as an Independent Contractor and not as an employee. Company will have no responsibility to withhold or pay any income or other taxes on Independent Contractor’s compensation or to provide any insurance, retirement or other employee benefits to Independent Contractor. Independent Contractor will not be treated as an employee with respect to services rendered by Independent Contractor pursuant to the Agreement for federal/state/local tax purposes.

TERMINATION

This Agreement shall be deemed terminated (i) upon the occurrence of expiration, suspension, revocation or termination of Contractor’s real estate license for any cause or reason whatsoever, (ii) upon written notice, with or without cause, from either party to the other party of the intent to terminate this Agreement for breach of any provision hereof, and (iii) upon written notice from either party to the other party of the intent, with or without cause, to terminate this Agreement.

Upon termination of this Agreement, for any reason, Contractor agrees to cease use of any and all sales materials or similar items that bear the name, logos, registered trademarks or inscription of Company, in any manner whatsoever.

Upon termination of this Agreement, for any reason, Company will release those listings without an existing contract of sale, provided the account of Contractor is paid in full, and the property owner wishes the listing released. After Contractor’s association with Company terminates, Company will continue to pay Contractor’s commission less any fees or other monies owed (e.g., commission advances, garnishments or required withholdings, past due balances owed to Company, etc.) on Transactions (as defined in Addendum A, below) in a pending status as of termination date, upon successful close of escrow, in accordance with the terms set forth on Addendum A of this Agreement. Company shall be deemed released from all claims for commissions not yet earned under the law by Contractor.

Upon termination of this Agreement, for any reason, Contractor is aware that such termination could result in a significant financial loss, including but not limited to, pending transactions, revenue share, and stock awards. Contractor agrees that, on such an occasion, Company may not have any adequate remedies at law and understands and agrees that Company may seek any and all available equitable remedies, in addition to or instead of any and all available legal remedies. See relevant sections relating to transactions upon termination, revenue share guidelines and stock awards in the eXp Realty U.S. Policies and Procedures Manual.

2

DUTIES OF CONTRACTOR

Contractor shall act as an independent real estate sales professional in carrying out the customary activities of a licensed real estate agent, including, but not limited to:

A. Maintain an active real estate license with eXp Realty as required in every state that Contractor engagesin activities requiring a real estate license.

B. Maintain a funding source on file for auto withdrawal of fees and any amounts due to Company.

C. List all properties for sale under the eXp Realty brokerage brand.

D. Promptly upload all listing contracts, purchase contracts, leases, referrals and any other transaction documentation into the transaction management system within two business days of execution date.

E. Represent buyers and sellers in the sale of real property.

F. Represent landlords and tenants in the leasing of property.

G. Such other services pertaining to the real estate business of the Company.

H. Adhere to the rules of conduct as laid out by each applicable State(s)’ Department of Licensing, MLS Rules, Federal and State Fair Housing, National Association of REALTORSⓇ Code of Ethics and the Association of REALTORS to which the Contractor belongs.

I. Abide by all Company policies and procedures, including the Unauthorized Real Estate Activities section of the Policies and Procedures manual.

J. Notify the Company in writing and each applicable State(s)’ Department of Licensing, as required, within10 calendar days of a criminal conviction, an adverse judgment, or disciplinary action against the Contractor.

K. Contractor must notify their Designated Managing Broker and/or Managing Broker in writing prior to removing their license from Company and terminating this agreement. All fees shall continue to be billed and charged to Contractor’s funding source(s) until such notice is received.

L. Contractor shall not be affiliated with a competing firm. For purposes hereof, “Affiliate with a competitor of the Company” shall mean that the Contractor or Contractor’s spouse or partner is an individual proprietor, partner, majority stockholder, officer, employee, director, consultant, agent, joint venturer, investor, lender, or in any other capacity, alone or in association with others, owning, managing, operating, controlling or participating in the ownership, management, operation or control of, or working for or permitting the use of his or her name by, a residential real estate brokerage other than eXp Realty.

Contractor agrees that any and all real estate listings, or any interest therein, and all other real estate related service contracts approved by the Company, including, but not limited to, those pertaining to the purchase, sale, rental or lease of real estate, or any interest therein or services in relation thereto, any of which Contractor is required under applicable law to hold and maintain a real estate license in order to perform the service or have an interest in, shall be taken in the name of the Company and its Designated Managing Broker in the state, as required under applicable state law and regulation. Contractor shall ensure that all fees, commissions or other compensation earned by Contractor, and for which Contractor must be a licensed real estate professional in order to receive such commission or compensation, in connection with the sale, lease or rental of real estate and any interest therein or service in relation thereto are made payable to the Company.

Contractor understands that the Designated Managing Broker and Managing Broker(s) (hereinafter collectively referred to as “Broker”) will rely on the accuracy, completeness and competence of Independent Contractor's services performed under this Agreement in fulfilling the Broker's contractual commitments to the public. Contractor shall strive at all times to perform in a manner that will increase the goodwill, reputation and business of Broker, and Contractor shall do nothing which would serve to disturb, discredit or devalue Broker or Broker's goodwill, reputation and/or business.

ANNIVERSARY DATE AND GOOD STANDING

Contractor’s join date (“Join Date”) shall be the date on which the Contractor completes the onboarding process and

3

transfers his or her license to eXp Realty. The anniversary date (“Anniversary Date”) for Contractor will be ◻ ◻ the first day of the calendar month following Contractor’s Join Date with the Company.

To be considered a Contractor in Good Standing, Contractor must be current on all financial obligations, including all fees and/or amounts owed to the Company. In addition, all required licenses, local, state and national dues and subscriptions which are required to conduct real estate business in Contractor’s state(s) must be current and in effect.

COMMISSIONS ON TRANSACTIONS (See Addendum A: Fee Schedule)

Should transactions be subject to any state or local taxes, the 80/20 commission split will be calculated after the Company portion of the tax is deducted.

AGENCY RELATIONSHIPS

Contractor acknowledges that all agency relationships entered into for any real estate transactions exist solely between the Company and the client. The Contractor owes a duty of reasonable care to all parties in the transaction. During the period of this Agreement, Contractor shall diligently represent eXp Realty with all reasonable skill and care expected of a licensed real estate professional.

REALTOR AFFILIATION

Contractor shall maintain an active membership in a local association or board of REALTORS affiliated with the National Association of REALTORS as determined by Company. Contractor agrees to be a dues paying member of, and abide by the REALTOR Code of Ethics and Standards of Practice of the National Association of REALTORS as well as the statutes and rules of the state within which they are licensed and any requirements of the multiple listing service if Contractor is a member. For any REALTOR boards that require the brokerage to pay the fees upfront, the Contractor shall reimburse the company within 10 days of invoice for the same.

EXPAND MENTORING PROGRAM

Contractors who have not yet completed and closed a minimum of three residential real estate sales transactions within the previous 12-month period in each state he or she is licensed in prior to joining eXp Realty shall be automatically enrolled in the eXpand Mentoring Program. If this requirement is applicable, the eXpand Mentoring Program Agreement will be attached and will apply.

REVENUE SHARE PLAN

The Company’s Sustainable Revenue Share Plan exists to provide a financial incentive to the real estate licensees with the Company (“eXp Agents”) who have helped grow company sales through the agent ranks of eXp Realty. The Sustainable Revenue Share Plan guidelines are defined in the attached Addendum B and shall be executed and acknowledged by Contractor concurrently with this ICA.

SPONSOR IN REVENUE SHARE PLAN

Selecting a sponsor is an important decision and should be based on who has been most influential in your decision to join eXp Realty. Sponsor selection is part of this legally binding Agreement.

A sponsor's sole requirement to qualify as a sponsor is selection by the joining agent as having been the most influential person in his or her decision to join eXp Realty. Sponsors are encouraged to support joining agents throughout the joining process and beyond, but are not required by eXp Realty to do so. If the selected sponsor has made representations or promises above and beyond referring a joining agent to eXp Realty, it is the sole responsibility of the joining agent to confirm the sponsor's ability and intent to deliver all additional support promised. eXp Realty is not responsible for enforcing agreements between agents made outside of this ICA.

4

If an agent removes his or her license from eXp Realty, terminates this ICA, and rejoins eXp Realty within 180 days from the date the agent’s license disassociated from eXp Realty, the previously named sponsor will continue to be named as that agent’s sponsor. However, after 180 days from the date agent’s license was disassociated from eXp Realty, the agent is free to rejoin eXp Realty and select a different sponsor.

If there is no individual who most influenced you to join eXp Realty, or you prefer not to select a sponsor for any reason, eXp Realty may be selected as the sponsor and will hold that position going forward.

THE FOLLOWING IS A SIGNIFICANT DECISION WHICH IS IRREVOCABLE. PLEASE PAUSE TO CONSIDER CAREFULLY WHO THE MOST INFLUENTIAL INDIVIDUAL IN YOUR DECISION TO JOIN EXP REALTY WAS. CHANGES IN SPONSORSHIP WILL NOT BE MADE.

IF THERE ARE ANY UNANSWERED QUESTIONS ABOUT SPONSORSHIP, STOP NOW AND RETURN TO THE ICA ONCE THE SELECTION OF SPONSORSHIP IS FULLY UNDERSTOOD.

Contractor was most influenced to join eXp Realty by and selects this individual to be his or her eXp Realty sponsor. Contractor is aware the sponsor has no binding authority for Company and this ICA overrides any and all verbal or written representations made by the sponsor. Upon execution of this ICA, and pursuant to the terms and conditions herein, sponsor selection shall be permanent and may notchange.

CONTRACTOR EXPENSES TO CONDUCT INDEPENDENT BUSINESS

Contractor is responsible for all expenses related to being a real estate licensee unless otherwise provided in this Agreement. In no way limiting the generality of the foregoing, Contractor shall be responsible for the following expenses: REALTOR dues, MLS dues, cell phone expenses, business cards, signs, sign-posts, advertising, personal branding, continuing education, licensing, printing, copying, faxing, digital camera, computer(s), printer/scanner/fax, high-speed Internet, automobile expenses, auto insurance, individual E&O insurance for a real estate agent where so required by state law, local, state, federal and municipality taxes of any kind, and any and all government, regulatory or agency licensure, compliance, or other fees and expenses.

AUTOMOBILE INSURANCE

Company does not maintain commercial automobile insurance coverage that extends coverage to Contractor or any other independent contractor of Company. For the duration of this ICA, Contractor shall maintain automobile insurance coverage with minimum liability limits of $100,000 per occurrence, $300,000 aggregate, and a minimum limit of $100,000 in property damage coverage. If available by the insurer, Contractor shall cause the insurance policy to name Company as an additional insured. In any event, such insurance shall be primary and noncontributory to any insurance available to Company and Company’s insurance shall be in excess thereto. In no event shall the limits of such insurance be considered as limiting the liability of Contractor under this Agreement and in no event shall the above insurance limits be any indication that such insurance limits are adequate insurance coverage for Contractor.

POLICIES AND PROCEDURES

Contractor acknowledges Contractor has read, asked any questions of his or her Broker or eXp Realty management, and fully understands the eXp Realty U.S. Policies and Procedures Manual, which is incorporated into the ICA by this reference and which can be found at http://policies.exprealty.com. Contractor agrees to fully review any amendments and/or additions to the Company’s Policies and Procedures, ICA or any Addenda thereto.

Contractor agrees to abide by the Company’s Policies and Procedures. In the event of any direct conflict between any of the Company’s Policies and Procedures and the terms and provisions of the ICA, the terms and provisions of the ICA shall control.

5

By signing this Agreement, Contractor acknowledges having read the Company’s Policies and Procedures and certifies Contractor’s compliance therewith effective as of the date of this Agreement.

NON-DISCLOSURE OF TRADE SECRETS

Contractor recognizes and acknowledges that much of the information that will be furnished to him/her concerning the Company’s customers, listings, holdings, investments, transactions, company-generated leads and other confidential matters constitutes valuable, special and unique assets and are trade secrets of the Company.

Accordingly, Contractor will not, during or after the term of his or her affiliation with the Company, disclose any such information or any part thereof to any person, firm, corporation, association or other entity for any reason or purpose whatsoever without the express written consent of the Company.

TRADEMARK USAGE

eXp Realty, eXp and the associated logo graphics and color placement used (or designed and intended for use) by Company, are trademarks of the Company. In order to maintain the strength of the Company’s brands, the Company must maintain strict guidelines as to how its trademarks are used. Contractor agrees not to use eXp Realty, eXp, eXp World Technologies, VirBELA, eXp World Holdings, or any other Company trademark, in any manner (including in or with, any font, style or design) that is not expressly permitted by the Company in writing in Company’s Policies and Procedures, or that is otherwise determined by Company, at Company’s sole discretion, to be prejudicial to the goodwill associated with the Company’s trademarks, or to weaken Company’s ability to enforce its trademark rights. Contractor shall not use Company’s trademarks (including eXp Realty or eXp) in any domain name, email address, online account ID, Twitter ID, or Facebook Group, or in any other social or business media context that would conflict with the Company’s Policies and Procedures.

COMPLIANCE WITH LAW AND GOOD BUSINESS PRACTICES

Contractor shall abide by all applicable laws, ordinances and regulations, including, without limitation, local, state and federal laws and regulations relating to real estate licensing, real estate transactions, real estate service businesses, telemarketing, marketing, intellectual property rights, etc. Contractor shall also abide by the rules of ethical conduct established by the National Association of REALTORS®. Contractor’s advertising and promotion must be completely factual and ethical. In all dealings, Contractor shall adhere to the highest standards of professionalism, ethics and integrity.

CONTENT LICENSE AND MODEL RELEASE PROVIDED BY CONTRACTOR

Unless otherwise expressly agreed upon in writing between eXp Realty and Contractor, to the extent Contractor provides to eXp Realty or any of its affiliates or licensees (collectively, “eXp Licensees”), any photographs, images or content of any type created or otherwise owned by Contractor (collectively, “Contractor Content”) including, without limitation, by uploading such Contractor Content via any online network operated by an eXp Licensee, Contactor retains ownership to such Contractor Content but Contractor hereby grants eXp Licensees a royalty-free, irrevocable, world-wide, perpetual, non-exclusive license to publicly display, distribute, reproduce and create derivative works of the Contractor Content, in whole or in part, in any media, including on any eXp Licensee website, for any purpose, including advertising and promotion of eXp Licensee services and/or products.

Contractor warrants and represents that Contractor Content provided by Contractor to eXp Licensees does not violate the intellectual property of others. eXp Licensees will not be required to pay any additional consideration or seek any additional approval in connection with using the Contractor Content provided by Contractor, and eXp Licensees retain exclusive and sole discretion as to whether to use such Contractor Content or reject or remove such Contractor Content from any online systems operated by any of the eXp Licensees.

Moreover, to the extent the Contractor provides to any eXp Licensees, or otherwise consents to allow eXp Licensees to receive, any photographs of Contractor as a model, Contractor hereby provides eXp Licensees with the irrevocable

6

right to use Contractor’s name (or any fictional name), likeness, picture, portrait, or photograph in all forms and in all media and in all manner, without any restriction as to changes or alterations (including but not limited to composite or distorted representations or derivative works made in any medium) for advertising, trade, promotion, exhibition, or any other lawful purposes, and Contractor waives any right to inspect or approve such photograph(s) or finished version(s) incorporating such photograph(s), including any written materials or other content that may be created and appear in connection therewith.

Contractor hereby waives all moral rights as to such photographs and releases and agrees to hold harmless eXp Licensees, and their assigns, licensees, successors in interest, agents, employees and representatives from any liability by virtue of any blurring, distortion, alteration, or use in composite form whether intentional or otherwise, that may occur or be produced in the taking of the photographs, or in any processing thereof.

AGREEMENTS, COMPLIANCE FORMS, INSURANCE FORMS

Contractor will submit any documents necessary for the Company to keep Contractor in compliance with all local, state and federal laws as well as Company Policies and Procedures. The Company will share all materials with Contractor that the Company has relating to the Contractor's independent contractor relationship with the Company in an agent file.

The Company reserves the right to assess penalties, financial and otherwise, in accordance with the Company Policies and Procedures, against Contractors who fail or refuse to provide completed documentation as required by the Company or by any state, federal or local law in order to achieve and maintain compliance.

ERRORS & OMISSIONS COVERAGE

Company carries comprehensive errors and omissions (“E&O”) insurance coverage in each state in which the Company conducts business. This coverage provides varying degrees of protection against claims arising out of professional services. Even though the Company’s E&O coverage may typically cover such claims, Contractor agrees to defend, indemnify and hold Company harmless against any and all claims that may arise in connection with Contractor practicing real estate. In the event a Contractor receives notice of a lawsuit, a demand letter, a threat of a lawsuit, or a complaint before the Department of Real Estate or any REALTOR Association, Contractor shall notify the Broker immediately. Contractor agrees to actively cooperate and assist the Company, Broker and/or the insurance company in defending such claim or complaint until it is resolved.

Currently, the deductible on Company’s E&O policy is $25,000 (twenty-five thousand dollars) in most states, but is subject to a potential change at each renewal term. Where the deductible differs from the Company’s E&O policy deductible amount, a state-specific addendum will be executed with contractors of that state. Contractor shall be responsible for and shall reimburse Company up to $2,500 (two thousand five hundred dollars) incurred in the defense or resolution of any claim made against the Contractor and/or Company as a result of Contractor’s actions or inactions, regardless of whether or not the claim is eligible for insurance coverage. Even where Contractor does not believe the claim or cause of action has merit and/or does not believe any money should be expended in the defense or resolution of the matter, Contractor agrees in advance, by signing this Agreement, that he or she will reimburse Company up to $2,500 expended in defense or resolution of the matter within 30 days of receipt of a request for reimbursement from Company. Contractor may elect to have all or any portion of the reimbursable amount withheld from any commissions and/or revenue share payments due Contractor in lieu of making payment directly to Company. However, if Contractor does not reimburse the Company directly within the 30 day period then Company shall deduct the full amount due from any and all commissions and revenue share payments due Contractor until Company has been fully reimbursed.

Contractor acknowledges that if it is determined that Contractor acted fraudulently, grossly or recklessly negligent, or willfully, Contractor shall be responsible for the full amount of the damages and costs recovered against Company,

7

along with all costs of defense. This language in no way limits the liability of Contractor to Company.

INDEMNIFICATION AND HOLD HARMLESS

Contractor hereby agrees to indemnify and hold harmless the Company, its owners, officers, affiliates, subsidiaries, agents or representatives from any and all claims which may arise out of, in the course of, or relate in any way to the Contractor’s performance of his or her duties hereunder. Additionally, Contractor acknowledges that if Contractor is subject to any non-compete agreement or covenant from a previous brokerage that Contractor will not violate that covenant or agreement or put the Company at risk of liability by violating it. Contractor shall indemnify, defend and hold Company harmless for any action or failure to act by Contractor, including, without limitation, any unauthorized representations and any failure to fulfill any of Contractor's responsibilities or obligations set forth herein.

LEADS UPON DEPARTURE

It is Company’s policy that upon departure from the Company a Contractor who is remaining in the real estate brokerage business (“Departing Agent”), Company shall maintain and preserve the Departing Agent’s database of leads (“Leads”) in any of the company provided consumer relationship management applications) Contractor’s accounts for a period of 30 days (“Preservation Period”) measured from the date on which the Contractor formally exits the organization with Agent Services and Administration (“Exit Date”).

If the Departing Agent would like to obtain a list of their Leads, then the Leads can be exported upon written request to eXp Realty’s Technology and Technical Support at support@exprealty.com (an “Export Request”) provided the Export Request is received within the Preservation Period.

If Departing Agent does not provide an Export Request as set forth herein during the Preservation Period, then the Departing Agent’s Leads are subject to forfeiture and deletion after the Preservation Period expires.

COVENANT OF COOPERATION

In the event of any dispute, complaint, claim, or allegation concerning or involving Contractor, either directly or indirectly, Contractor agrees to cooperate fully and in good faith by providing documents, testimony and any other items or information that may be needed to respond to and defend a complaint, claim, or allegation. This covenant shall survive termination of this Agreement, whether voluntary and involuntary, and is without time limitations in its obligation. Contractor’s breach of this provision shall constitute a material breach of this Agreement and Company shall be entitled to recover reasonable legal fees and costs expended or incurred as a result of Contractor’s noncooperation.

EMERGENCY CONTACT INFORMATION AND CHANGE OF ADDRESS NOTIFICATIONS

Contractor agrees to provide emergency contact information in case eXp Realty needs to get hold of someone on Contractor’s behalf. Contractor agrees to update this information along with keeping current any personal information, including a change of address within 10 days of any change. Please provide the current information below:

Emergency Contact: | |

Relationship to Contractor: | |

Phone Number: | |

Email: | |

WRITTEN CONTRACT AS CONSTITUTING ENTIRE AGREEMENT

This Agreement, along with any and all addenda, exhibits, attachments and Company’s Policies and Procedures identified in this Agreement, constitute the entire Agreement between the parties and are hereby expressly and specifically incorporated herein by reference in their entirety as if fully set forth in this Agreement. There are no verbal understandings or other agreements of any nature with respect to the subject matter hereof except those contained in

8

this Agreement as set forth herein.

CONTRACT REVISIONS/MODIFICATIONS

Certain portions of this Agreement may be modified from time to time by the Company in its sole discretion. Company will provide a minimum of seven days’ notice of any material revision for review by Contractor by sending an email communication to the email address on file in Company’s Enterprise system (www.expenterprise.com) (“Enterprise”). For material changes, after the seven-day review period has elapsed, unless Contractor has notified the Company in writing that Contractor objects to the revisions, Contractor is deemed to have accepted all revisions. The Company strives to update the Policies and Procedures manuals bi-annually in May and November, as needed, but may be updated at any time necessary. Contractor will receive timely communications from Company regarding any such Policy & Procedures update. However, it is the Contractor’s responsibility to remain informed of and familiar with the most current version of the Company’s Policies and Procedures at all times.

If Contractor fails to provide an email address in Company’s Enterprise system, or fails to provide Company with notice of changes to Contractor’s email address, to the extent Company is required to provide notice of amendment by email, Company’s notice of amendment will nonetheless be effective upon the date Company attempts to send the amendment to Contactor at an email address that is the last known email address to Company of Contractor.

It is the Contractor’s responsibility to remain informed at all times of his or her responsibilities and obligations under the most current version of the Company’s ICA.

NOTICE

Delivery of all notices and documentation shall be in writing and deemed delivered and received when: (i) sent via electronic mail to the email address on file in Company’s eXp Enterprise system; or (ii) sent by mail to Contractor’s address on file. Company’s address for physical delivery of notices and documentation sent by Contractor is eXp Realty, ATTN: Legal Department, 2219 Rimland Dr., Suite 301, Bellingham, WA 98226.

BINDING EFFECT

This Agreement shall be binding upon and inure to the benefit of the respective heirs, successors and assigns of the parties hereto.

GOVERNING LAW

This Agreement and the rights of the parties hereunder shall be governed by and construed in accordance with the laws of the state in which the Contractor is licensed as a real estate agent and if Contractor is licensed in multiple states, then the laws of the state in which the Contractor is both domiciled and licensed.

MANDATORY BINDING ARBITRATION AND DISPUTE RESOLUTION

A. Mediation in Advance of Arbitration

1. The parties agree that any and all disputes, claims or controversies arising out of or relating to this Agreement shall be submitted to JAMS, a private alternative dispute resolution provider, or its successor, for mediation, and if the matter is not resolved through mediation, then it shall be submitted to JAMS, or its successor, for final and binding arbitration pursuant to the clause set forth in subparagraph A.5below.

2. Either party may commence mediation by providing to JAMS and the other party a written request for mediation, setting forth the subject of the dispute and the relief requested.

3. The parties will cooperate with JAMS and with one another in selecting a mediator from the JAMS panel of neutrals and in scheduling the mediation proceedings. The parties agree that they will participate in the mediation in good faith and that they will share equally in its costs.

4. All offers, promises, conduct and statements, whether oral or written, made in the course of the mediation by any of the parties, their agents, employees, experts and attorneys, and by the mediator or any JAMS

9

employees, are confidential, privileged and inadmissible for any purpose, including impeachment, in any arbitration or other proceeding involving the parties, provided that evidence that is otherwise admissible or discoverable shall not be rendered inadmissible or non-discoverable as a result of its use in themediation.

5. Either party may initiate arbitration with respect to the matters submitted to mediation by filing a written demand for arbitration at any time following the initial mediation session or at any time following 45 days from the date of filing the written request for mediation, whichever occurs first (“Earliest Initiation Date”). The mediation may continue after the commencement of arbitration if the parties so desire.

6. At no time prior to the Earliest Initiation Date shall either side initiate an arbitration or litigation related to this Agreement except to pursue a provisional remedy that is authorized by law or by JAMS rules or by agreement of the parties. However, this limitation is inapplicable to a party if the other party refuses to comply with the requirements of paragraph 3 above.

7. All applicable statutes of limitation and defenses based upon the passage of time shall be tolled until 15 days after the Earliest Initiation Date. The parties will take such action, if any, required to effectuate suchtolling.

B. Binding Final Arbitration; Appeal. The parties to this Agreement agree that any dispute, claim or controversy arising out of or relating to this Agreement or the breach, termination, enforcement, interpretation or validity thereof, including the determination of the scope or applicability of this agreement to arbitrate, not resolved pursuant to paragraphs A, 1 through 7 above, shall be determined by arbitration in the state that issued the Contractor’s real estate license, and if Contractor is licensed in more than one state then the state in which the transaction that is the subject of the dispute closed in, or if there is no applicable transaction, the state in which the agent was domiciled at the time the dispute arose, before three arbitrator(s). The arbitration shall be administered by JAMS pursuant to and in accordance with the expedited procedures in those rules or pursuant to JAMS’ Streamlined Arbitration Rules & Procedures and which can be found at www.jamsadr.com. Judgment on the award may be entered in any court having jurisdiction. This clause shall not preclude parties from seeking provisional remedies in aid of arbitration from a court of appropriate jurisdiction. Of the three arbitrators, the Chair must previously have served as Chair or sole arbitrator in at least 10 arbitrations where an award was rendered following a hearing on the merits and one of the wing arbitrators must be an expert in the area of residential real estate brokerage transactions.

The aggrieved party must file and give written notice of any claim to the other party no later than the expiration of the statute of limitations (filing deadline) that the law imposes for the claim. Otherwise, the claim shall be null and void and deemed waived. The arbitrators shall apply the substantive law (and the law of remedies, if applicable) of the applicable state, or federal law, or both, as applicable to the claim(s) asserted. In the event of a dispute, the arbitrators shall decide which substantive laws shall apply. The arbitrators are authorized to award any remedy allowed by applicable law. The arbitrators shall issue a written and signed statement of the basis of their decision, including findings of fact and conclusions of law. EACH PARTY, THEREFORE, ACKNOWLEDGES THAT IT IS WAIVING ANY RIGHT TO A TRIAL BY JURY.

This Agreement and the rights of the parties hereunder shall be governed by and construed in accordance with the laws of the State in which the Contractor is licensed as a real estate agent and if Contractor is licensed in multiple states, then the laws of the state in which the transaction that was the basis of the dispute was located, or if there is no applicable transaction, the state in which the Contractor is domiciled at the time the dispute arose.

Notwithstanding the provision in the preceding sentence with respect to applicable substantive law, any arbitration conducted pursuant to the terms of this Agreement shall be governed by the Federal Arbitration Act (9 U.S.C., Secs. 1-16).

The parties adopt and agree to implement the JAMS Optional Arbitration Appeal Procedure (as it exists on the effective date of this Agreement) with respect to any final award in an arbitration arising out of or related to this Agreement.

10

C. Damages and Limitation of Liability. In any arbitration arising out of or related to this Agreement, the arbitrator(s) are not empowered to award punitive or exemplary damages, except where permitted by statute, and the parties waive any right to recover any such damages. In any arbitration arising out of or related to this Agreement, the arbitrator(s) may not award any incidental, indirect or consequential damages, includingdamages for lost profits.

D. Class Action Waiver

1. Company and Contractor agree that any and all claims pursued against each other will be on an individual basis, and not on behalf of or as a part of any purported class, collective, representative, or consolidated action. Both Company and Contractor waive their right to comment, become a party to or remain aparticipant in any group, representative, class collective or hybrid class collective or group action in any court, arbitration proceeding, or any other forum, against the other. The parties agree that any claim by or against Company or Contractor shall be heard in arbitration without joinder of parties or consolidation of such claim with any other person or entity’s claim, except as otherwise agreed to in writing by Company and Contractor. This class action waiver shall supersede any contrary agreements, statements or rules in the JAMS rules.

2. The waiver of class action claims and proceedings is an essential and material term of this arbitration agreement in this section, and the parties agree that if it is determined that the waiver in this section is prohibited or invalid in its entirety in a case in which a class action, representative action or similar allegations have been made, then the remainder of this section shall also be void. If however, some, but not all, of the waivers are found to be unenforceable for any reason in a case in which class action, representative action or similar allegations have been made, the Contractor’s individual claims shall be decided in arbitration. Any class action, representative action or similar action as to which the class action waiver in the paragraph is found to be unenforceable shall be decided in court and not in arbitration.

E. Fees and Costs to Prevailing Party. In any arbitration arising out of or related to this Agreement, the arbitrator(s) shall award to the prevailing party, if any, the costs and attorneys’ fees reasonably incurred by the prevailing party in connection with the arbitration. If the arbitrator(s) determine a party to be the prevailing party under circumstances where the prevailing party won on some but not all of the claims and counterclaims, the arbitrator(s) may award the prevailing party an appropriate percentage of the costs and attorneys’ fees reasonably incurred by the prevailing party in connection with the arbitration.

F. Confidentiality. The parties shall maintain the confidential nature of the arbitration proceeding and the Award, including the Hearing, except as may be necessary to prepare for or conduct the arbitration hearing on the merits, or except as may be necessary in connection with a court application for a preliminary remedy, a judicial challenge to an award or its enforcement, or unless otherwise required by law or judicial decision.

ATTORNEYS FEES

In the event of any legal or equitable action, including any appeals, which may arise hereunder between or among the parties hereto, the prevailing party shall be entitled to recover reasonable attorneys fees and costs. Attorneys fees shall also include hourly charges for paralegals, law clerks and other staff members operating under the supervision of an attorney.

SEVERABILITY

The invalidity or unenforceability of any portion of this Agreement shall not affect the remaining provisions and portions thereof.

HEADINGS

The paragraph headings contained herein are for convenience of reference only and are not to be used in the construction or interpretation hereof.

11

INTERPRETATION

Any ambiguities in this Agreement will not be strictly construed against the drafter of the language concerned, but will be resolved by applying the most reasonable interpretation under the circumstances, giving full consideration to the intentions of the parties at the time of contracting. Unless the context requires otherwise, all references to the singular include the plural and the plural the singular, and words importing any gender include the other genders and gender neutrality.

CONTRACTOR UNDERSTANDS ARBITRATION & WAIVER AGREEMENTS

Contractor represents and acknowledges that he or she understands the meaning and effect of the arbitration waiver and agreements in this Agreement and has been provided a reasonable time and opportunity to consult with his or her own legal counsel regarding the same.

This agreement is effective as of the date of the Contractor’s signature and shall remain in effect until its termination according to the TERMINATION section of this Agreement.

IN WITNESS WHEREOF, the parties have caused this Agreement to be duly executed as follows:

Contractor |

| |

| |

| | Name | | |

| | | | |

| | | | |

| | Signature | | Date |

| | | | |

| | | | |

| | | | |

Company | | | | |

| | Name | | |

| | | | |

| | | | |

| | Signature | | Date |

12

Addendum A: Current Fee & Commission Schedule

Sign-Up Fee: $149, includes first month’s Cloud Brokerage Fee.

Cloud Brokerage Fee: $85 per month, includes access to all platforms.

Payment/Funding Source: Both a primary and a secondary/backup electronic funds transfer funding source, one of which must be an Automatic Clearing House (ACH) source, for payment of any and all recurring and non-recurring fees and amounts due from Contractor under this ICA must be on file and kept current. Unused portions of any fees previously paid will not be credited/prorated. Unpaid fees, charges, repayments, and any other amounts Contractor owes to Company can and will be deducted directly from any and all of Contractor’s pending and future earnings that would otherwise be payable to Contractor by eXp Realty.

Broker Review Fee: $25 per Transaction. All Transactions (defined below) will include a Broker Review Fee taken as a charge against the Contractor Dollar Amount (defined below) and shall be deducted from all closings, excluding all referrals, Broker Price Opinions (“BPO’s”), and leasing/rental commissions under $1,000 Gross Commission Income (defined below) to Company.

Risk Management Fee: $40 per Transaction. All Transactions will include a Risk Management Fee taken as a charge against the Contractor Dollar Amount and shall be deducted from all closings, excluding all referrals, BPO’s, and leasing/rental commissions under $1,000 Gross Commission Income to Company. The annual per eXp Agent cap on payment of Risk Management Fees for non-commercial Transactions is $500. Commercial Transactions do not have a Risk Management Fee cap.

All fees are non-refundable. Sales tax laws and regulations for each state determine if a fee is subject to sales tax. If applicable, sales tax is applied as a separate line item on Contractor’s statement.

COMMISSIONS ON TRANSACTIONS

Contractor shall be entitled to a commission on sales, rental/lease transactions, broker price opinions (“BPOs”) and referrals (collectively “Transactions”) as follows: income retained by the Company after referrals and concessions, but prior to commission split (“Gross Commission Income”), shall be split at the rate of 80% to Contractor (“Contractor Dollar Amount”) and 20% to Company (“Company Dollar”) on all Transactions closed by the Contractor.

Should any Transaction be subject to any state or local taxes, the 80/20 commission split will be calculated after the tax is deducted.

Personal Transactions: A Personal Transaction is any Transaction for which Contractor has an ownership interest in the subject property, whether through Contractor’s own name, a spouse’s name, or a business entity or revocable trust that is owned and/or controlled by Contractor and/or Contractor’s spouse.

• Personal Transactions will carry a $250 Transaction Fee, plus Broker Review and Risk Management Fees. For eXp Agents in the Mentor Program, please see the Mentor Program Agreement for rules and fees involved in a Personal Transaction.

• Personal Transaction commissions are not included in Revenue Share Plan calculations.

• Contractor may exempt up to three Personal Transactions per anniversary year.

• Contractor must be in Good Standing with the Company (current on fees and/or amounts owed, etc.).

• Contractor’s name, Contractor and/or Contractor’s Spouse’s business or trust name, or Contractor’sspouse’s name must be on the title.

13

COMPANY CAP

The first day of the calendar month following the Join Date shall be known annually as the “Anniversary Date.” If the Company Dollar reaches $16,000 since the last Anniversary Date, the Contractor will be in a “Capped Status” until the next Anniversary Date. When Contractor is in a Capped Status, the Company will no longer retain 20% of the commission received by the Company from Contractor’s Transactions. Instead, the Company will assess a “Capped Status Transaction Fee” of $250 per Transaction, up to $5,000 per anniversary year, at which point the Capped Status Transaction Fee is reduced to $75 per Transaction for the remainder of Contractor’s anniversary year. Because the Capped Status Transaction Fee is "per Transaction" and not "per agent," Capped Status Transaction Fee are always split between agents on a transaction equal to the percentage of commission each agent earns. Revenue Share (see Addendum B) will not be paid out on Transactions consummated by Contractors in a Capped Status. Capped Status Transaction Fees will be in addition to all other deductions and fees authorized by this Agreement.

Similar to the Minimum Company Dollar Rule outlined below, Contractor shall pay the lesser of either the applicable Capped Status Transaction Fee ($250 or $75), or 20% of at least a 3% commission. This applies to both sides of a Transaction closed by an eXp Agent/Contractor in a Capped Status, both listing and buying, unless the eXp/Contractor Agent is in a Single Agent Dual Agency transaction. In Single Agent Dual Agency, the eXp Agent/Contractor is charged one Capped Status Transaction Fee per sale, not per side.

As stated above, Capped Status Transaction Fees are assessed on a per Transaction basis. In the case of multiple eXp Agents on a Transaction side, the appropriate transaction fee shall be split out in accordance with the percentages used in the applicable Disbursement Agreement.

Example : If Contractor A and Contractor B, both in a Capped Status, both represented the buyer in a sale and Contractor A received 60% of the commission and Contractor B received 40% of the commission, Contractor A would pay $150 (60% of the $250) of the Capped Status Transaction Fee and Contractor B would pay $100 (40% of the $250) of the Capped Status Transaction Fee.

In the example above, the $250 Capped Status Transaction Fee would be reduced to $75 once Contractor has paid a total of $5,000 in Capped Status Transaction Fees as described above. Each Contractor will pay the percentage of their respective Capped Status Transaction Fee amount, if any, if the Contractors have different applicable Capped Status Transaction Fee amounts.

MINIMUM COMPANY DOLLAR RULE

Company Dollar on listing-side sale commissions below 3% of the closed selling price will be subject to a minimum of $500 or the regular 20% split based on 3% of the closed selling price, whichever is lower.

Example A: 2% listing commission on $100,000 sale = $2,000. 20% = $400.

Minimum: 3% listing commission on $100,000 sale = $3,000. 20% = $600 Take the lower of $600 or

$500. Company Dollar = $500, Agent gets $1,500.

Example B: 2% listing commission on $60,000 sale = $1,200. 20% = $240.

Minimum: 3% listing commission on $60,000 sale = $1,800. 20% = $360 Take the lower of $360 or

$500. Company Dollar = $360, Agent gets $840.

NOTE: The Minimum Company Dollar Rule applies to listing transactions only, because the Contractor does not always have the opportunity to set or control the commission received on other transaction types. We DO NOT mandate any fees or percentages that a Contractor must charge to his or her clients.

14

Exempt: REO/HUD Listings and Short Sales - All REO/HUD and Short Sale Listings with a defined non-negotiable listing commission rate are exempt from the Minimum Company Dollar Rule and will be paid out according to the Contractor’s regular payment plan, per this Addendum A of the ICA.

Exempt: All Other Commission Types - The Minimum Company Dollar Rule only applies to listing-side sales commissions. Buyer-side commissions, residential leasing/rental commissions, referral commissions, fees for BPO’s, and any other fees received are not subject to the Minimum Company Dollar Rule.

RETAINER FEES

All fees, deposits, or monetary amounts requested from a client or potential client by Contractor which are designed to retain the professional real estate services of Contractor (“Retainer Fee”) shall be paid directly to the Company and be subject to any applicable splits.

LATE FEES

All payments billed to the agent from the Company for recurring payments, monthly Cloud Brokerage Fees, programs opted in, and any other fees billed or back-billed for reimbursement per written agreements and policies are due within 10 days from the date of billing.

Any billing that is more than 30 days past due will be assessed a minimum of $25 interest per month or the maximum amount allowed under state law.

If a Contractor’s account reaches 90 days past due/delinquent, the Company may terminate this Agreement pursuant to the Termination clause and any/all pending commission payments and/or revenue share payments shall be forfeited to the company

Contractor agrees to pay Company in full any past due fees upon demand. Company retains the right to deduct from payment of commissions, revenue share, funding source on file, or any other means necessary, any past due amounts of any kind, overpayments of commissions or revenue share and/or late fees assessed. Any unpaid balances shall be subject to collections and/or formal legal proceedings. Additionally, if Contractor has elected to participate in the 2015 Agent Equity Program as described in Addendum C, Contractor’s participation will be temporarily suspended until Company has been paid in full.

The Company reserves the right to adjust this fee schedule.

Contractor |

| |

| |

| | Name | | |

| | | | |

| | | | |

| | Signature | | Date |

15

Addendum B: Sustainable Revenue Share Plan

eXp Realty has a Sustainable Revenue Share Plan (“Revenue Share Plan”) that all eXp Agents are automatically enrolled in which aims to pay out approximately 50% of Company Dollar to eXp Agents who help the Company’s sales grow by attracting fellow agents to join its ranks. As explained in Addendum A, Company Dollar is the percentage of GCI, usually 20%, that the Company retains from commission earned on a Transaction.

DEFINITIONS

Adjusted Gross Commission Income: Adjusted Gross Commission Income (AGCI) is the GCI adjusted by a factor to achieve 50% of the Company Dollar in the overall monthly Revenue Share Plan.

Tier: The hierarchy of eXp Agents that are sponsored in succession beginning with the Contractor and each group of eXp Agents thereafter, as follows:

| ● | Contractor. |

| ● | Tier 1: the group of eXp Agents sponsored by the Contractor. |

| ● | Tier 2: the group of eXp Agents sponsored by Tier 1 eXp Agents. |

| ● | Tier 3: the group of eXp Agents sponsored by Tier 2 eXp Agents. |

| ● | Tier 4: the group of eXp Agents sponsored by Tier 3 eXp Agents. |

| ● | Tier 5: the group of eXp Agents sponsored by Tier 4 eXp Agents. |

| ● | Tier 6: the group of eXp Agents sponsored by Tier 5 eXp Agents. |

| ● | Tier 7: the group of eXp Agents sponsored by Tier 6 eXp Agents. |

Revenue Share Group: A Contractor’s Revenue Share Group consists of the eXp Agents he or she personally sponsors to join the sales ranks of the Company and those eXp Agents sponsored thereafter as a result of Contractor’s original sponsorship(s).

Qualifying Sale Transaction: A Qualifying Sale Transaction is a Transaction that earns Company Dollar of at least $200 and is not a Personal Transaction.

For Qualifying Sale Transactions that are the purchase or sale of real property (each a “Sale”) where one eXp Agent represents a Seller or Buyer, the Sale will be counted as a full credit Sale to the eXp Agent. For Qualifying Sale Transactions that are the purchase or sale of real property where multiple eXp Agents are involved in the representation of the same principal party, each side of the Sale will be counted to each eXp Agent in an amount that is proportionate to the distribution of the total Contractor Dollar Amount.

By way of illustration, if eXp Agent “A” receives 50% of the total Contractor Dollar Amount on a Sale, then the Sale will be counted as a one-half credit Sale for each of the eXp Agents involved and four of such Transactions would be needed to achieve two full credit Sales (within the prior rolling six full months to be classified as an FLQA).

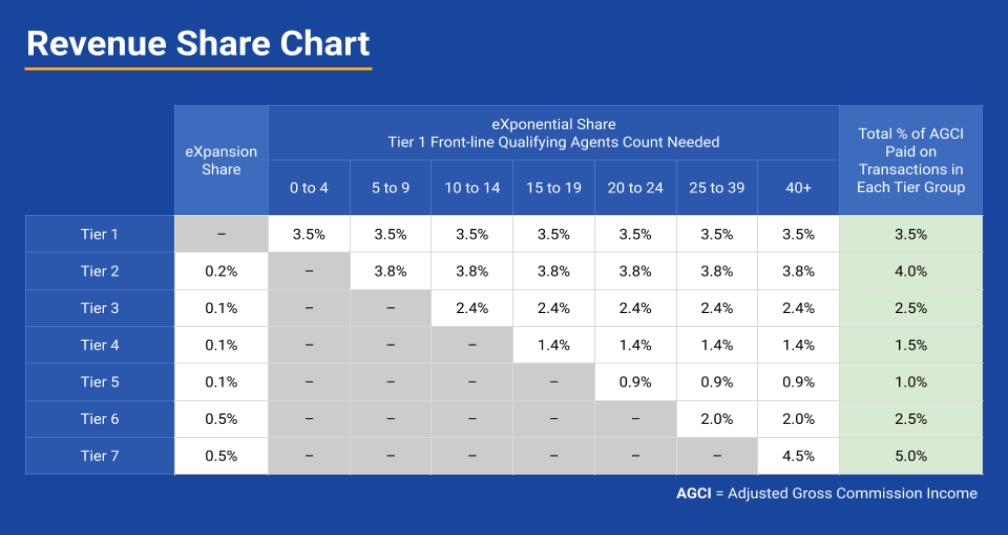

eXpansion Share: eXpansion Share is revenue share generated from AGCI received from Qualifying Sale Transactions closed by a Contractor’s Revenue Share Group, and that is paid out to the Contractor in an amount that is based on the Tier group of the eXp Agent(s) who closed the Transaction(s). See the REVENUE SHARE PLAN CHART (“Revenue Share Chart”) below for a breakdown of the amount of eXpansion Share paid for each Tier group.

eXponential Share: eXponential Share is revenue share generated from AGCI received from Qualifying Sale Transactions closed by a Contractor’s Revenue Share Group, and that is paid out to the Contractor in an amount that is based on the Tier group of the eXp Agent(s) who closed the Transaction(s). In order to unlock eXponential Share

16

earning potential beyond Tier 1, the Contractor must have the minimum number of Front-Line Qualifying Active agents (as defined below). See the REVENUE SHARE PLAN CHART (“Revenue Share Chart”) below for a breakdown of the amount of eXponential Share paid for each Tier.

Front-Line Qualifying Active (FLQA): A Front-Line Qualifying Active agent is a licensed agent who has been personally sponsored into eXp Realty and that has been active and productive with the Company during the prior rolling six- month period by closing: 1) a minimum of two full credit Sales, or the equivalent; or 2) $5,000 in Gross Commission Income. All FLQA agents are Tier 1 eXp Agents that have been directly sponsored by the Contractor; however, not all Tier 1 eXp Agents sponsored by Contractor are FLQA Agents.

Revenue Share Eligible: For a Contractor to remain eligible to collect revenue share (also referred to as “Revenue Share Eligibility”), the Contractor must meet the following requirements:

1. Be in Good Standing;

2. Be current on any of the fees due such as Cloud Brokerage Fee, etc., and not be past due on other outstanding invoices with the Company; and

3. Be current in all association fees, MLS dues and/or mandatory market-based fees, if applicable.

Revenue Share Grace Period: The Revenue Share Grace Period (also referred to as the “Grace Period”) is a one hundred eighty (180) day period that begins with the day following the date that an eXp Agent satisfies the Revenue Share Grace Period Productivity Requirement, during which time the eXp Agent will be classified as an FLQA agent for his or her sponsor.

Revenue Share Grace Period Productivity Requirement: A new eXp Agent satisfies the Revenue Share Grace Period Productivity Requirement (also referred to as the “Productivity Requirement”) when he/she closes either 1) one full credit Sale, or 2) $5,000 in Gross Commission Income.

Vested: Subject to certain qualifications and conditions, a Contractor that is Vested in the Revenue Share Plan continues to receive benefits payable thereunder.

Affiliate with a competitor of Company: For purposes hereof, “affiliates with a competitor of the Company” shall mean that the Contractor or Contractor’s spouse or partner is an individual proprietor, partner, stockholder, officer, employee, director, consultant, agent, joint venturer, investor, lender, or in any other capacity, alone or in association with others, owning, managing, operating, controlling or participating in the ownership, management, operation or control of, or working for or permitting the use of his or her name by, a residential real estate brokerage other than eXp Realty.

Straw Agent: Straw Agents are agents who are not engaged in the business of selling real estate or engaged in the process of attracting other productive agents to join the Company and help grow company sales.

[This Space Intentionally Left Blank.]

17

REVENUE SHARE EXPLAINED

The Revenue Share Plan is paid out as a percentage of AGCI which is the GCI adjusted by a factor and calculated each month in an effort to achieve and pay out 50% of Company Dollar in the overall monthly Revenue Share Plan in the form of revenue share. Actual payouts on individual Transactions can be higher or lower than the 50% payout target depending on how many FLQAs are counted on each Tier.

As a Contractor encourages fellow active and productive agents to join the ranks of the Company and the Contractor is named as the sponsor of those new eXp Agents, the Contractor will begin earning the standard Tier 1 3.5% of AGCI revenue share amount on the Qualifying Sale Transactions of the Contractor’s Tier 1 group of eXp Agents. As the Contractor’s Tier 1 group of eXp Agents (Contractor’s direct sponsored agents) become sponsors themselves of more new eXp Agents, each new eXp Agent added to the Contractor’s Revenue Share Group can potentially expand and unlock the Contractor’s ability to earn more revenue share in two different ways: 1) eXpansion Share; and 2) eXponential Share.

Illustration: Contractor directly sponsors 15 new eXp Agents (Tier 1 group), who in turn sponsor 25 more new eXp Agents (Tier 2), who in turn sponsor 40 more new eXp Agents (Tier 3), who in turn sponsor 30 more new eXp Agents (Tier 4). Of the Tier 1 group of eXp Agents, 10 are classified as FLQA which unlocks Tiers 2 & 3 of eXponential Share for the Contractor. Contractor will now earn:

1. 3.5% of AGCI in eXponential Share on all Qualifying Sale Transactions of the 15 Tier 1 group of eXp Agents; and

2. 0.2% in eXpansion Share + 3.8% in eXponential Share, for a total of 4% of AGCI on all Qualifying Sale Transactions of the 25 Tier 2 group of eXp Agents; and

3. 0.1% in eXpansion Share + 2.4% in eXponential Share, for a total of 2.5% of AGCI on all Qualifying Sale Transactions of the 40 Tier 3 group of eXp Agents; and

4. 0.1% of AGCI in eXpansion Share on all Qualifying Sale Transactions of the 30 Tier 4 group of eXp Agents.

18

For all Company Dollar earned from Qualifying Sale Transactions of each of the eXp Agents in Contractor’s Tier groups, the Contractor will receive revenue share from each of those Qualifying Sale Transactions as long as the eXp Agent that closed the Transaction is not in a Capped Status. This is because there is no Company Dollar from which to pay out revenue share that is retained from the Transactions of an agent who is in a Capped Status.

The Revenue Share Plan pays out a percentage of AGCI per Qualifying Sale Transaction of the Contractor’s Revenue Share Group and pays in the calendar month following the closing of the Qualifying Sale Transactions by the Contractor’s Revenue Share Group.

When an eXp Agent who is not Vested leaves the Company, the position that the departing agent held within other sponsors’ Revenue Share Groups immediately becomes a Company position. The revenue share structure does not compress or roll up.

The Revenue Share Grace Period is available only for new eXp Agents who have Join Dates of March 1, 2020 or later. For eXp Agents with a Join Date that falls on or in between September 3, 2019 through February 29, 2020, will continue to be classified as an FLQA agent for their sponsor for the first one hundred and eighty (180) days from their respective Join Date, after which the FLQA qualification requirements will apply

The Revenue Share Plan is funded entirely by the percentage of the Gross Commission Income that the Company retains on closed Transactions. Therefore, no revenue share dollars are paid out on any Transaction where the Contractor who consummated the Transaction was in Capped Status, as that term is defined in the ICA, or where no Company Dollar is earned.

Qualifications To Receive Revenue Share

In order to be qualified to receive revenue share under both the eXpansion Share and the eXponential Share Contractor must be Revenue Share Eligible on the date when a Qualifying Sale Transaction closes, and Contractor’s license must be active and affiliated with eXp Realty in every state that Contractor engages in activities requiring a real estate license.

Manipulating Revenue Share Plan Prohibited

Contractor agrees that he or she will not attempt to manipulate the Revenue Share Plan by engaging in the practice of sponsoring Straw Agents. Additionally, Contractor shall not add any agent(s)’s name to transaction documentation who was not a true party to the Transaction solely for the purpose of artificially qualifying that eXp Agent as an FLQA. The Company shall have the right and sole discretion to determine who is considered a Straw Agent, and further reserves the right to terminate Contractors who are, in the sole discretion of the Company, determined to be Straw Agents and which would reduce the number of Front-Line Active Agents and/or Front-Line Qualifying Active Agents that an eXp Agent has directly caused to join Company.

The Company will also notify Contractor that it has released the licenses of the eXp Agent(s) that it believes are Straw Agents and review the recruiting practices of Contractor with Contractor.

If, after reviewing the recruiting practices with Contractor, Contractor continues to engage in, or appears to be engaged in, the practice of manipulating the Revenue Share Plan, Contractor may be restricted from sponsoring agents and/or released from the Company.

Revenue Share Vesting Policy

To qualify for revenue share vesting, Contractor must satisfy the following conditions: 1) hold a current real estate license and be authorized to receive commissions; 2) be affiliated with the Company as a Contractor/real estate agent for not less than 36 consecutive months; and 3) and meet all requirements under the Revenue Share Eligible definition

19

above for not less than 36 consecutive months.

Subject to meeting the qualification requirements above, the Contractor shall be considered Vested in the Revenue Share Plan’s eXpansion Share and will continue to receive the benefits provided under the eXpansion Share even after Contractor disassociates from the Company. The Contractor's Vesting in the Revenue Share Plan’s eXponential Share shall continue, as long as Contractor’s real estate license is actively associated with a brokerage that is an affiliate of the Company and the Contractor does not Affiliate with a competitor of the Company.

Vested agents that are retired need to qualify in the jurisdiction they are domiciled in order to receive revenue share. In many states, revenue share is considered a distribution of real estate commission in which case one would need an active real estate license to continue to receive revenue share payments.

Incapacitation Or Death of an eXp Agent

In the event that Contractor is unable to carry out his or her work as a real estate agent and unable to engage in the process of attracting and supporting other productive agents into the Company due to Contractor’s permanent incapacity or death, Contractor shall automatically be considered Vested in the Revenue Share Plan regardless of whether Contractor has met the second and third requirements to qualify for revenue share vesting as explained above. Any heir, legal representative or guardian of Contractor who is legally authorized to act on Contractor's behalf or Contractor's estate's behalf, may be substituted as the agent of record for Contractor in the Company Revenue Share Plan. For a plan of substitution to be approved, the proposed substitute must meet the following conditions, in the order in which they are listed: 1) be approved by the Company and the Company's Broker for the state where the substituting contractor will be licensed; 2) submit a written legal opinion from a duly licensed attorney in substitute’s state of licensing that states that the plan of substitution contemplated complies with all applicable local, state and federal laws, rules and regulations; and 3) complete all application and onboarding steps to properly join Company as a duly licensed real estate agent within 12 months of the date of permanent incapacitation or death of Contractor. If the plan of substitution is approved and the substitute properly joins Company, the terms and conditions of the Revenue Share Vesting Policy shall then apply to the approved substitute.

Company is not required to approve a plan of substitution for a Contractor who was not in Good Standing with Company prior to the Contractor's permanent incapacitation or death.

The stated revenue share payout structure may be modified to allow the Company to better compete, attract and retain agents as well as to maintain a base level of profitability. Should a change to this Addendum B be made, Contractor shall be notified in accordance with contract revisions/modification section of the ICA.

The terms and conditions of this policy, or to the eXp Sustainable Revenue Share Plan, are subject to modification as determined by the Executive Management of the Company and/or the Board of Directors of eXp World Holdings, Inc. An explanation about revenue sharing calculations as well as other aspects of the Revenue Share Plan can be obtained by visiting the Company’s Accounting Team in eXp World. The Company’s long-term goal is to payout 50% of Company Dollar through the Sustainable Revenue Share System. Any modification to the Revenue Share model does not require future signatures from a recipient in order for a recipient to continue to receive revenue share under any new terms.

Contractor |

| |

| |

| | Name | | |

| | | | |

| | | | |

| | Signature | | Date |

**In acknowledgment of certain contributions made to the Company’s growth and infrastructure, the Company reserves the right to designate

20

certain managing brokers, executives and key personnel as being in Good Standing with the Company notwithstanding any discrepancies that may exist from time to time between their own personal production and the criteria set forth in the ICA. In addition, such personnel may be deemed to be in Good Standing even though no monthly Cloud Brokerage Fee is assessed against such personnel.

21

Addendum C: 2015 Agent Equity Program Participation Election Form

eXp World Holdings, Inc. (“EXPI”) previously adopted the 2015 Equity Incentive Plan, as adopted on March 12, 2015 and amended August 28, 2017 (the “Plan”). Pursuant to the Plan, EXPI created the 2015 Agent Equity Program (the “Program”) to be administered at the board’s discretion, and may issue shares of EXPI’s common stock to the Company’s agents and brokers who elect to participate (“Participant(s)”) as payment of five percent (5%) of the commission compensation earned by a Participant.

Eligibility: All agents and brokers in Good Standing with the Company are eligible to participate in the Program.

Issuance of Shares As Payment of Commission: By submitting this Form of Election, Participant authorizes the Company to set aside five percent (5%) of Participant’s net Contractor Dollar Amount (after splits, fees, and any other required withholdings) (“Shares for Payment”) on Transactions which close in Participant’s name, commencing with Transactions closing on or after Participant’s Join Date.

Price of Issued Shares: All Shares for Payment on Transactions that close and the commission payment is received by Company by 5:00 PM Pacific Time on December 31, 2019, the price for shares issued under the Program shall be at a twenty percent (20%) discount to the fair market value of EXPI’s common stock, as determined by the closing market price of EXPI’s common stock on the last trading day of the month. Effective January 1, 2020, the price for shares issued under the Program shall be at a ten percent (10%) discount to the fair market value of EXPI’s common stock, as determined by the closing market price of EXPI’s common stock on the last trading day of the month.

Issuance Date: Shares under the Program shall be issued on the last trading day of the month during which the closing on the sales of any properties from which a Shares for Payment has been authorized results in an accumulated Shares for Payment of not less than $250 USD (each a “Issue Date”).

Custody of Shares: All shares issued under the Program shall initially be placed and held in an account created in Participant’s name with Solium Financial Services LLC.

Associated Costs: Ownership of shares issued under the Program may come with associated costs imposed by third parties, including but not limited to, fees that may be imposed by a stockbroker, financial services broker of Participant’s choosing, or others.

Cancellation of Participation: Any Participant may cancel his or her participation in the Program by providing email notification of cancellation (“Cancellation Notice”) not less than thirty (30) calendar days prior to the next scheduled Issue Date. In order to be effective, Cancellation Notices must be sent to stock@exprealty.com.

Modification or Termination: The Program is subject to modification or termination at the discretion of the Company’s Board of Directors.

Acknowledgments: Participant understands that participation in this Program is subject to the terms and conditions contained in the Independent Contractor Agreement, in this Agent Equity Program Participation Election Form, in the Program itself, and in the Plan. Participant has read and fully understands both the Program and the Plan. By participating in the Plan, Participant agrees to be bound by the terms and conditions of the ICA, the Program and the Plan. By acceptance of this opportunity to receive shares, Participant consents to the electronic delivery of all related documents, including the Program, the Plan, any account statements and Plan prospectuses, as applicable, and all other documents that EXPI is required to deliver to its security holders (including, without limitation, annual reports and proxy statements) or other communications or information related to an investment in EXPI’s stock. Electronic delivery

22

may include the delivery of a link to a Company intranet or the internet site of a third party, the delivery of the document via email or such other delivery determined at EXPI’s discretion.

By signing this enrollment form, Participant certifies that he or she is of legal age in the state or country of his or her residence.

Participant, by signing this enrollment form, certifies that: Participant is not subject to backup withholding because

(a) Participant is exempt from backup withholding, or (b) Participant has been notified by the Internal Revenue Service (IRS) that Participant is not subject to backup withholding, or (c) the IRS has notified Participant that Participant is no longer subject to backup withholding.

Participant, by signing this enrollment form, certifies that: Participant is receiving the shares solely for Participant’s own account, and not for the benefit of any other person. Participant is being issued the shares solely for investment purposes and not with a view to distribution or resale, nor with the intention of selling, transferring or otherwise disposing of all or any part thereof for any particular price, or at any particular time, or upon the happening of any particular event or circumstance, except selling, transferring, or disposing of the shares, in full compliance with all applicable provisions of the Securities Act, the rules and regulations promulgated by the Securities and Exchange Commission thereunder, and applicable state securities laws.

Participant confirms that she or he has had the opportunity to ask questions of, and receive answers from, EXPI or any authorized person acting on its behalf concerning EXPI and its business, and to obtain any additional information, to the extent possessed by EXPI (or to the extent it could have been acquired by EXPI without unreasonable effort or expense) necessary to verify the accuracy of the information received by Participant.

Participant has carefully considered and has discussed (or accepts the responsibility to discuss) with its own legal, tax, accounting and financial advisors, to the extent the Participant has deemed necessary, the suitability of this investment and the transactions contemplated by this Agreement for the Participant’s particular federal, state, provincial, local and foreign tax and financial situation and has independently determined that this investment and the transactions contemplated by this Agreement are a suitable investment for the Participant. Participant understands that it (and not EXPI) shall be responsible for Participant’s own tax liability that may arise as a result of the receipt of the shares or the transactions contemplated by this Agreement.

Participant understands that participation in this Program does not change the at will nature of Participant’s independent contractor consulting relationship with the Company.

NO AGENT, BROKER OR ELIGIBLE INDIVIDUAL SHALL BE DEEMED A PARTICIPANT UNLESS AND UNTIL SUBMITTING THIS COMPLETED FORM OF ELECTION.