Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MidWestOne Financial Group, Inc. | financialresults2020q2.htm |

| 8-K - 8-K - MidWestOne Financial Group, Inc. | mofg-20200730.htm |

COVID-19 RESPONSE AND SUPPLEMENTAL FINANCIAL INFORMATION SECOND QUARTER 2020 June 30, 2020

COVID-19 Response 2

Providing Support During COVID-19 Pandemic Supporting our Employees: Supporting our Customers: Supporting our Communities: Focus on Safety: Paycheck Protection Program • In addition to the more than 200 organizations • Provided customer relief through participation in MidWestOne supports through its annual • Implemented social distancing throughout our the Paycheck Protection Program ("PPP") and charitable giving, MidWestOne is donating an locations providing subsidies for certain loan payments additional $150,000 to organizations supporting those most impacted by COVID-19. • Servicing customers through a combination of • 2,534 applications have been processed and digital banking channels, drive-thru banking approved, representing $345 million in client • MidWestOne has focused on supporting local locations, and customer service phone lines funding since we've begun to participate in the businesses, including through employee PPP recognition lunches from local businesses for • Significant expansion of work from home on-site employees capabilities • As of June 30, 2020, $2.0 million PPP loans outstanding are in the Agricultural segment, with • Partnered with other local banks in the Iowa City • Increased cleaning services the remaining $325.6 million in the Commercial area in the Holding our Own program. This segment program encourages the community to shop • Business travel restrictions local, with a goal of motivating over $1M of local Loan Payment Deferral Program spending. As part of this Holding our Own • Enhanced guidelines for returning to work program, for every $150 spent at participating • Implemented a loan payment deferral program businesses, customers will receive $20 in gift cards and $5 will be donated to a local program Employee Assistance: that supports and administers minority-owned business grants • Pandemic pay benefits for employees impacted by COVID-19 • Accommodations for employees with pre-existing health conditions 3

Loan Portfolio 4

Diversified Loan Portfolio Loan Portfolio Mix June 30, 2020 Consumer, 2% One-to-four family Loan Performance junior liens, 4% 5.20% $4,000 5.10% One-to-four family Commercial and first liens, 10% Industrial, 30% 4.98% 5.00% $3,000 4.80% $2,000 4.60% $1,000 4.51% Agricultural, 4% CRE-Other, 32% $3,183 $3,436 $3,634 Construction & 4.40% $— Development, 6% 2Q.2019 1Q.2020 2Q.2020 Farmland, 5% Average Loans Yield on Loans, tax equivalent* Multifamily, 7% Average loans reported are in millions of dollars. *Non-GAAP Measure. See the "Earnings Release" Non-GAAP Measures section. 5

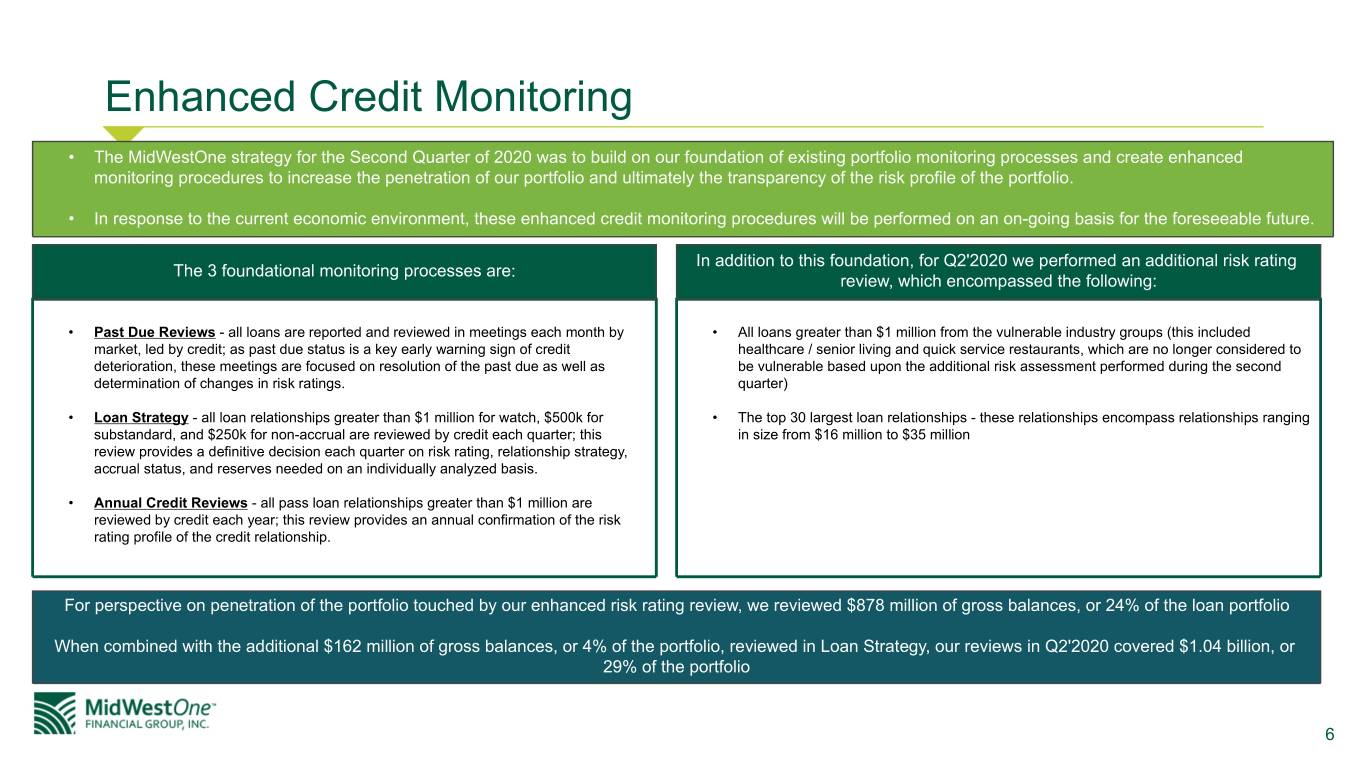

Enhanced Credit Monitoring • The MidWestOne strategy for the Second Quarter of 2020 was to build on our foundation of existing portfolio monitoring processes and create enhanced monitoring procedures to increase the penetration of our portfolio and ultimately the transparency of the risk profile of the portfolio. • In response to the current economic environment, these enhanced credit monitoring procedures will be performed on an on-going basis for the foreseeable future. In addition to this foundation, for Q2'2020 we performed an additional risk rating The 3 foundational monitoring processes are: review, which encompassed the following: • Past Due Reviews - all loans are reported and reviewed in meetings each month by • All loans greater than $1 million from the vulnerable industry groups (this included market, led by credit; as past due status is a key early warning sign of credit healthcare / senior living and quick service restaurants, which are no longer considered to deterioration, these meetings are focused on resolution of the past due as well as be vulnerable based upon the additional risk assessment performed during the second determination of changes in risk ratings. quarter) • Loan Strategy - all loan relationships greater than $1 million for watch, $500k for • The top 30 largest loan relationships - these relationships encompass relationships ranging substandard, and $250k for non-accrual are reviewed by credit each quarter; this in size from $16 million to $35 million review provides a definitive decision each quarter on risk rating, relationship strategy, accrual status, and reserves needed on an individually analyzed basis. • Annual Credit Reviews - all pass loan relationships greater than $1 million are reviewed by credit each year; this review provides an annual confirmation of the risk rating profile of the credit relationship. For perspective on penetration of the portfolio touched by our enhanced risk rating review, we reviewed $878 million of gross balances, or 24% of the loan portfolio When combined with the additional $162 million of gross balances, or 4% of the portfolio, reviewed in Loan Strategy, our reviews in Q2'2020 covered $1.04 billion, or 29% of the portfolio 6

Exposure in Vulnerable Industries Loan Portfolio Vulnerable Industries Vulnerable Industries Nonessential Retail $107.9 21% 14% Restaurants $60.7 12% Hotel $122.6 24% CRE - Retail $208.4 40% 86% Arts, Entertainment & Gaming $21.6 4% $— $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 $200.0 $225.0 $ of Portfolio All Other Loans $ in millions, Loan balances as of 6/30/20 7

Exposure in Vulnerable Industries Non-essential Retail Portfolio Characteristics - Non-essential Retail Loan Balance Outstanding (000s) $ 107,878 By Geography Number of Loans 568 Average Loan Size (000s) $ 190 Other, —% Average Note Term (months) 39 Colorado, 17% Loan-to-Value (Average) 69 % SBA PPP Loans - Number 155 SBA PPP Loans - Dollars (000s) $ 17,057 Wisconsin, 13% Iowa, 49% Portfolio Fundamentals • Predominately local auto and equipment retailers which have established positions in the community and strong brand affiliations • Most auto and equipment retailers have reduced accessibility to their sales Minnesota, 17% showrooms during the COVID-19 pandemic but maintained service Florida, 3% department levels at full-service • Most auto and equipment retailers have experienced severely reduced sales during the COVID-19 pandemic and recent sales rebounds have been constrained by inventory availability • Most relationships have guaranties from owner-operators 8

Exposure in Vulnerable Industries Restaurants Portfolio Characteristics - Restaurants Loan Balance Outstanding (000s) $ 60,668 By Geography Number of Loans 387 Average Loan Size (000s) $ 157 Other, 1% Average Note Term (months) 43 Colorado, 4% Loan-to-Value (Average) 63 % Wisconsin, 14% SBA PPP Loans - Number 164 SBA PPP Loans - Dollars (000s) $ 15,260 Iowa, 47% Portfolio Fundamentals Minnesota, 22% • Represents the Bank's full-service restaurant customers, primarily non- franchise, local operators in casual dining • Guaranties from owner-operators are required in most relationships • Most restaurants during the COVID-19 pandemic have been allowed to Florida, 13% provide takeout and delivery services. More recently, these businesses have re-opened but are experiencing reduced business volume • Quick service restaurant exposures were removed from the vulnerable restaurant industry exposures at June 30, 2020 based upon our experience with these customers and their financial performance during the COVID-19 pandemic 9

Exposure in Vulnerable Industries Hotel Portfolio Characteristics - Hotel Loan Balance Outstanding (000s) $ 122,623 By Geography Number of Loans 90 Average Loan Size (000s) $ 1,362 Average Note Term (months) 58 Other, 6% Loan-to-Value (Average) 64 % Colorado, 1% SBA PPP Loans - Number 26 Wisconsin, 4% SBA PPP Loans - Dollars (000s) $ 2,173 Minnesota, 24% Portfolio Fundamentals Iowa, 49% • Lending focus is on experienced, local developers within the Bank's trade areas. Approximately 80% of properties have major flags while the remainder is comprised of gaming industry related boutique hotels in the Dubuque, IA market. • Flagged hotels are primarily core travel hotels that are positioned close to major highways in the Bank's key metropolitan markets with no convention center exposure Florida, 17% • Conservative underwriting standards include a maximum LTV of 75% • Guaranties from owner-operators are regularly required. Non-recourse lending is not a material exposure. • Occupancy was severely reduced during the COVID-19 pandemic (generally to less than 10%). Most operators have recently seen improving occupancy trends with some reporting 40% in July 2020. Hotels associated with Dubuque's gaming industry have recently been experiencing weekend occupancy rates comparable to pre- pandemic levels. 10

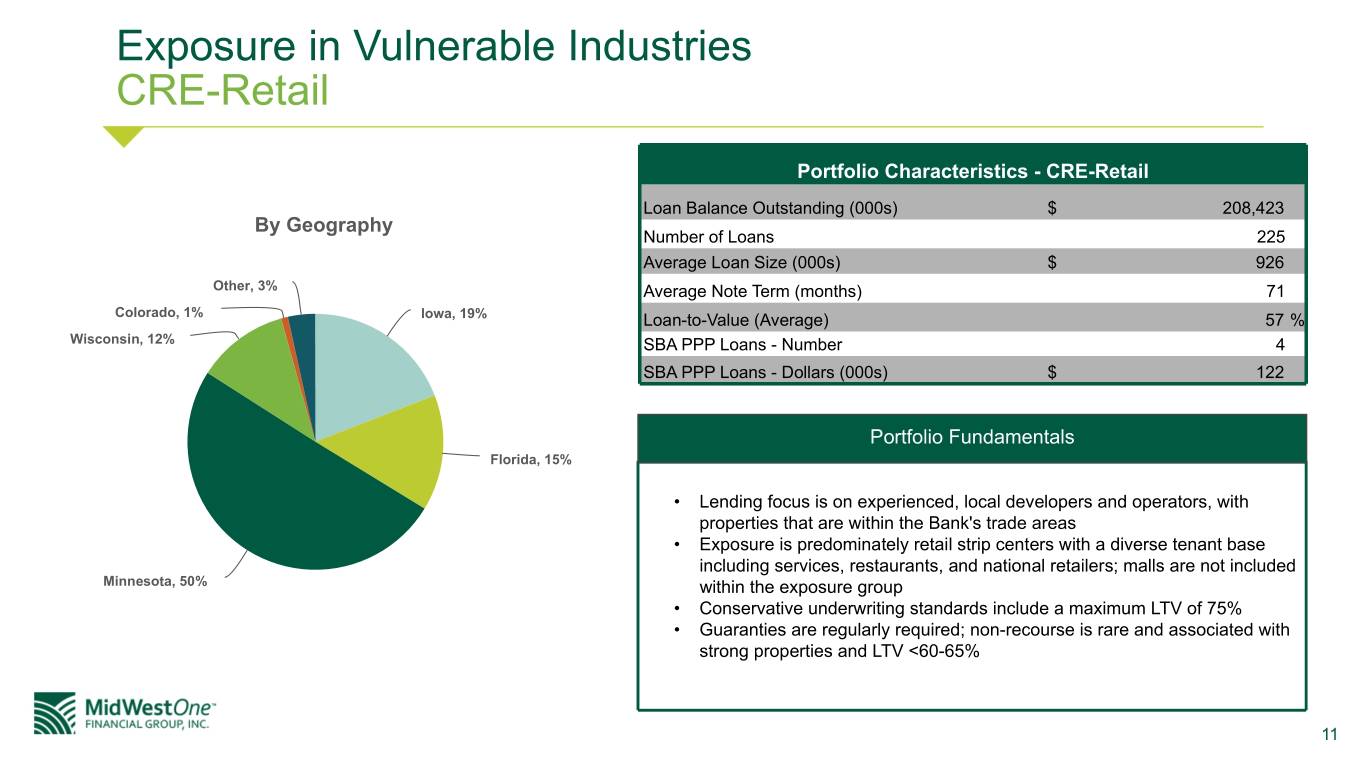

Exposure in Vulnerable Industries CRE-Retail Portfolio Characteristics - CRE-Retail Loan Balance Outstanding (000s) $ 208,423 By Geography Number of Loans 225 Average Loan Size (000s) $ 926 Other, 3% Average Note Term (months) 71 Colorado, 1% Iowa, 19% Loan-to-Value (Average) 57 % Wisconsin, 12% SBA PPP Loans - Number 4 SBA PPP Loans - Dollars (000s) $ 122 Portfolio Fundamentals Florida, 15% • Lending focus is on experienced, local developers and operators, with properties that are within the Bank's trade areas • Exposure is predominately retail strip centers with a diverse tenant base including services, restaurants, and national retailers; malls are not included Minnesota, 50% within the exposure group • Conservative underwriting standards include a maximum LTV of 75% • Guaranties are regularly required; non-recourse is rare and associated with strong properties and LTV <60-65% 11

Exposure in Vulnerable Industries Arts, Entertainment & Gaming Portfolio Characteristics - Arts, Entertainment & Gaming Loan Balance Outstanding (000s) $ 21,550 By Geography Number of Loans 165 Average Loan Size (000s) $ 131 Other, 6% Average Note Term (months) 53 Colorado, 1% Loan-to-Value (Average) 51 % Wisconsin, 12% SBA PPP Loans - Number 65 SBA PPP Loans - Dollars (000s) $ 2,884 Portfolio Fundamentals Iowa, 57% Minnesota, 23% • Small overall exposure relative to the portfolio; not a key focus of the Bank's lending efforts • Largest concentration of exposure is gaming operations in our Dubuque, IA market (in the Mississippi River Entertainment district) Florida, —% • While completely shutdown during the initial COVID-19 risk mitigation orders in Iowa, the facilities have since re-opened, with strict risk mitigation guidelines, and are experiencing a solid rebound in business volume 12

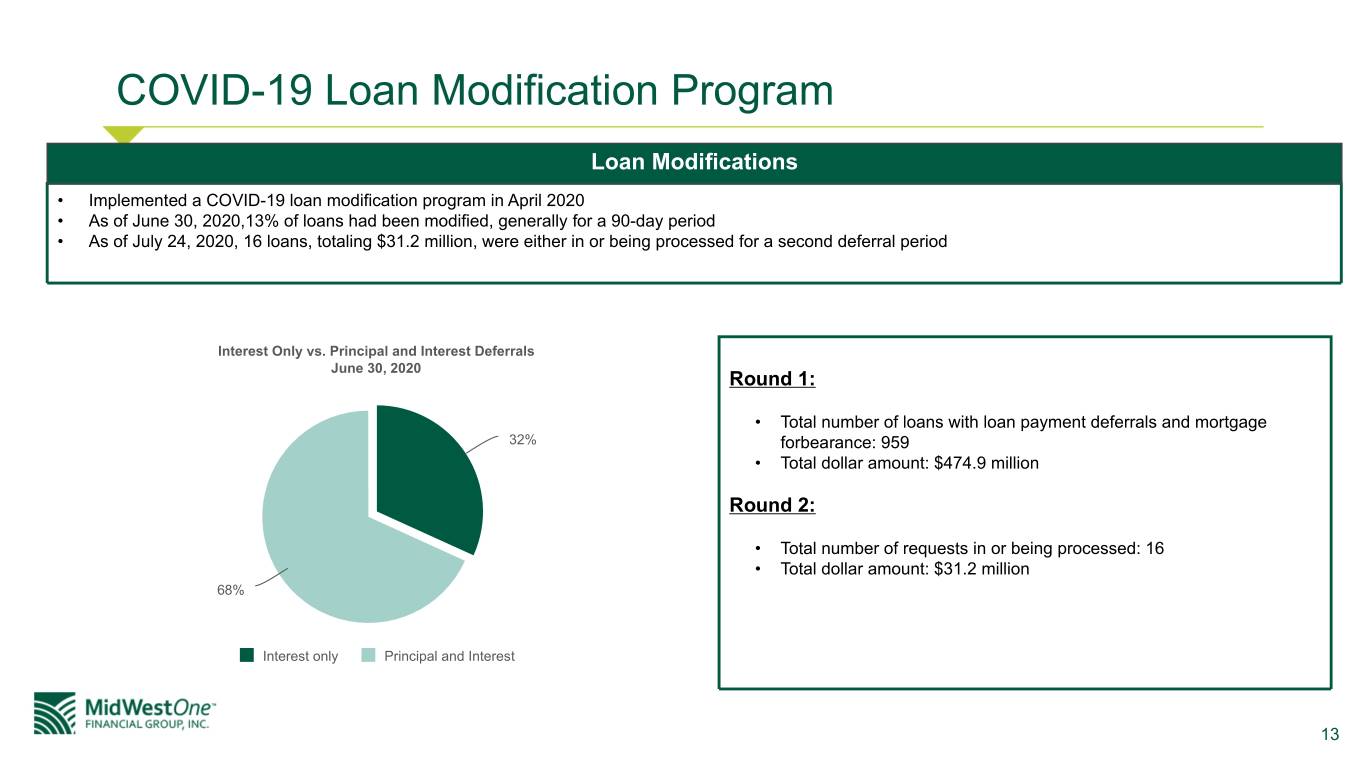

COVID-19 Loan Modification Program Loan Modifications • Implemented a COVID-19 loan modification program in April 2020 • As of June 30, 2020,13% of loans had been modified, generally for a 90-day period • As of July 24, 2020, 16 loans, totaling $31.2 million, were either in or being processed for a second deferral period Interest Only vs. Principal and Interest Deferrals June 30, 2020 Round 1: • Total number of loans with loan payment deferrals and mortgage 32% forbearance: 959 • Total dollar amount: $474.9 million Round 2: • Total number of requests in or being processed: 16 • Total dollar amount: $31.2 million 68% Interest only Principal and Interest 13

COVID-19 Loan Modification Program Accomodation, Food Service $98.6 20.8% Construction $26.8 5.6% Health Care $12.4 2.6% Manufacturing $22.7 4.8% Other Services $19.8 4.2% Real Estate $213.1 44.9% Retail $20.0 4.2% 13.0% Other $61.5 $— $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 $220.0 $240.0 $ in Millions Deferral data as of June 30, 2020 14

CECL and Allowance for Credit Losses 15

Change in ACL and Model Assumptions Methodology Assumptions Drivers of the Change in ACL: • Increases in Midwest unemployment Discounted Cash Flow Method • Decreases in CRE index, national home price index and US GDP • Moderate increases in the national retail sales and US rental vacancy • Discounted cash flow method utilized to estimate expected credit losses for agricultural, commercial and industrial, commercial real estate, residential real estate, and consumer loan segments Allowance for Credit Losses $ in Thousands • Credit loss drivers determined by regression analysis between Company and peer historical loan loss data and multiple macroeconomic variables $60,000 $6,324 • Macroeconomic variables include Midwest unemployment, national retail $236 sales, CRE index, US rental vacancy rate, US GDP, and national home price $(2,103) index $40,000 • Reasonable and supportable forecast period of 4 quarters, with reversion back to a historical loss rates over 4 quarters on a straight-line basis $55,644 $51,187 • Adjustments to the ACL are made based upon qualitative factors, which include company, market industry or business specific data, changes in $20,000 underlying loan composition of specific portfolios, trends relating to credit quality, delinquency, non-performing and adversely rated loans, and reasonable and supportable forecasts of economic conditions $— 3/31/20 Charge-offs Recoveries Credit loss 6/30/20 expense related to loans 16

CECL Modeling Disclosure ACL by Loan Type Allowance for Credit Losses - by Loan Type December 31, 2019 January 1, 2020 March 31, 2020 June 30, 2020 ALLL Balance % of Loans ACL Balance % of Loans ACL Balance % of Loans ACL Balance % of Loans (dollars in thousands) Commercial real estate $ 13,804 0.40 % $ 15,104 0.44 % $ 23,137 0.68 % $ 28,221 0.78 % Commercial and industrial 8,394 0.24 % 11,122 0.32 % 19,310 0.56 % 18,709 0.52 % Agricultural 3,748 0.11 % 1,191 0.03 % 1,146 0.03 % 1,408 0.04 % Residential real estate 2,685 0.08 % 4,735 0.14 % 6,425 0.19 % 6,074 0.17 % Consumer 448 0.01 % 911 0.03 % 1,169 0.03 % 1,232 0.03 % Allowance for credit losses $ 29,079 $ 33,063 $ 51,187 $ 55,644 Liability for off-balance sheet credit exposures $ — $ 3,433 $ 5,844 $ 4,205 17

Credit Quality Nonperforming Assets Composition June 30, 2020 dollars in thousands 6/30/2020 3/31/2020 6/30/2019 Nonaccrual loans held for investment $ 41,303 $ 43,973 $ 30,875 Allowance for credit losses Consumer, 0% 90 days+ past due $ 55,644 $ 51,187 $ 28,691 & still accruing Residential real interest, 7% Credit loss expense related to loans (for the quarter) estate, 6% $ 6,324 $ 19,322 $ 696 Foreclosed Net charge-offs (for the quarter) assets, net, 2% $ 1,867 $ 1,198 $ 1,657 Agricultural, 7% Net charge-offs to average loans held for investment (for the quarter, annualized) 0.21 % 0.14 % 0.21 % ACL to loans held for investment, net of unearned income 1.55 % 1.49 % 0.81 % Commercial and industrial, 22% ACL to loans held for investment, net of unearned income (adjusted)(1) 1.70 % 1.49 % 0.81 % ACL to nonaccrual loans held for investment, net of unearned Commercial real income 134.72 % 116.41 % 92.93 % estate, 55% Nonaccrual loans held for investment to loans held for investment, net of unearned income 1.15 % 1.28 % 0.87 % (1) Loans held for investment, net of unearned income was adjusted for the total amount of PPP loans. Non-GAAP Measure. See the separate Non-GAAP Measures section in the "Earnings Release" for a reconciliation to the most directly comparable GAAP Non-accrual loans broken out separately by segment measure. 18

Digital and Branch Banking Trends 19

Digital and Branch Banking Trends QTD Totals for Digital and Branch Channels 1,610,251 (Q1'20 vs. Q2'20) 1,445,744 1,454,607 1,328,553 • Mobile logins increased 11% • Online/Desktop logins increased 9% • Branch/Teller Transactions decreased 14% • Mobile Deposits increased 19% 559,370 481,913 32,462 38,538 Q1'20 Q2'20 Mobile Logins Online/Dekstop Logins Branch/Teller Transactions # of Mobile Deposits 20