Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PATRICK INDUSTRIES INC | patk2020-q2991.htm |

| 8-K - 8-K - PATRICK INDUSTRIES INC | patk2020-q2earnings8k.htm |

Q2 2020 EARNINGS PRESENTATION July 30, 2020

FORWARD-LOOKING STATEMENTS This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward- looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. Q2 2020 Earnings Presentation

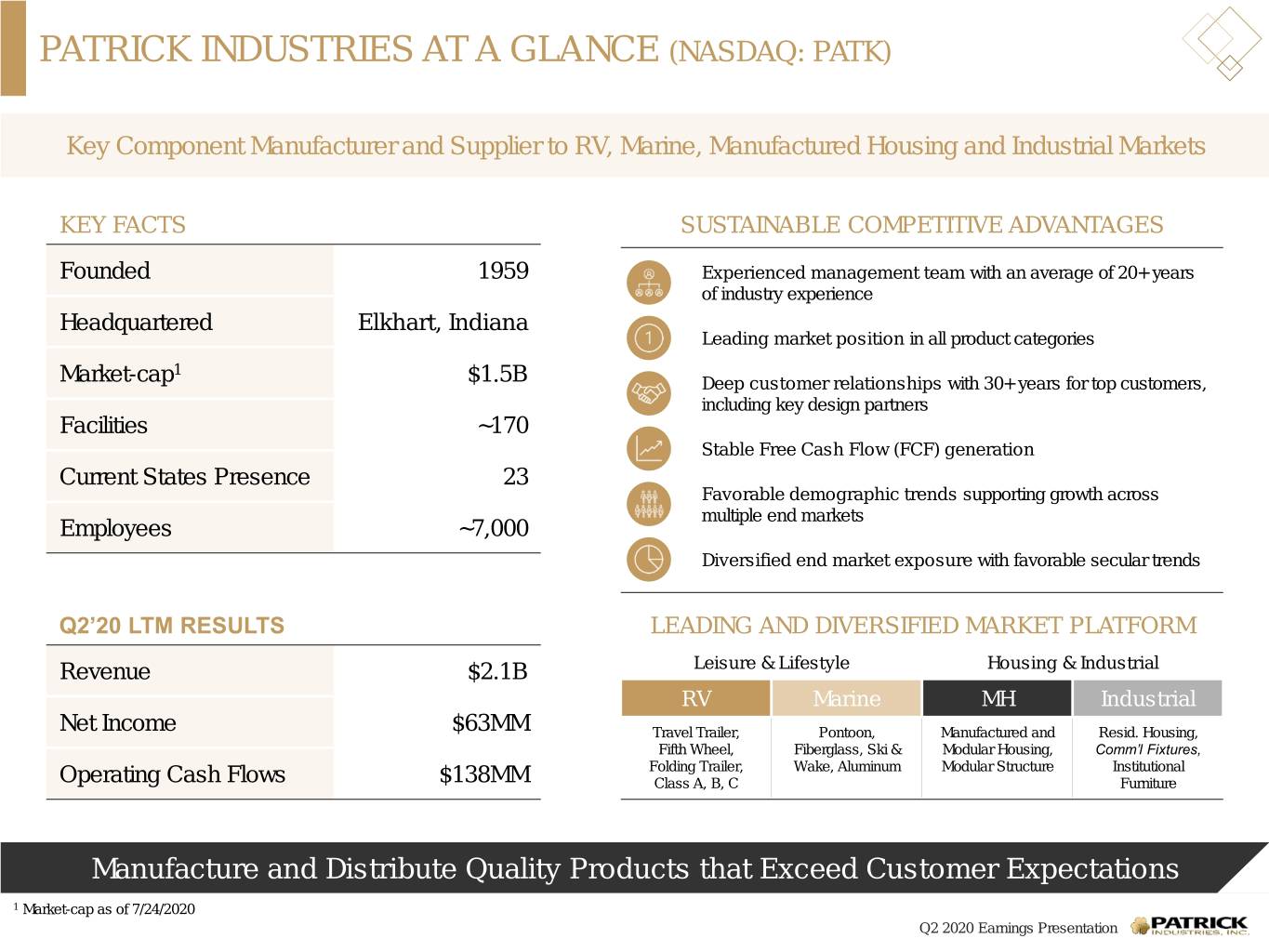

PATRICK INDUSTRIES AT A GLANCE (NASDAQ: PATK) Key Component Manufacturer and Supplier to RV, Marine, Manufactured Housing and Industrial Markets KEY FACTS SUSTAINABLE COMPETITIVE ADVANTAGES Founded 1959 Experienced management team with an average of 20+ years of industry experience Headquartered Elkhart, Indiana Leading market position in all product categories 1 Market-cap $1.5B Deep customer relationships with 30+ years for top customers, including key design partners Facilities ~170 Stable Free Cash Flow (FCF) generation Current States Presence 23 Favorable demographic trends supporting growth across multiple end markets Employees ~7,000 Diversified end market exposure with favorable secular trends Q2’20 LTM RESULTS LEADING AND DIVERSIFIED MARKET PLATFORM Revenue $2.1B Leisure & Lifestyle Housing & Industrial RV Marine MH Industrial Net Income $63MM Travel Trailer, Pontoon, Manufactured and Resid. Housing, Fifth Wheel, Fiberglass, Ski & Modular Housing, Comm’l Fixtures, Folding Trailer, Wake, Aluminum Modular Structure Institutional Operating Cash Flows $138MM Class A, B, C Furniture Manufacture and Distribute Quality Products that Exceed Customer Expectations 1 Market-cap as of 7/24/2020 Q2 2020 Earnings Presentation

KEY MESSAGES Prioritization of team members safety, commitment to maintaining a 1 safe work environment while continuing to serve our customers Well-prepared for strong resurgence in our end markets as a result 2 of increased consumer demand 3 Quick response to initial COVID-19 and flexible business model led to strong operational and financial performance in the quarter Strong balance sheet and ample liquidity to support strategic growth 4 investments and disciplined capital allocation Positioned for Success Now and in the Future Q2 2020 Earnings Presentation

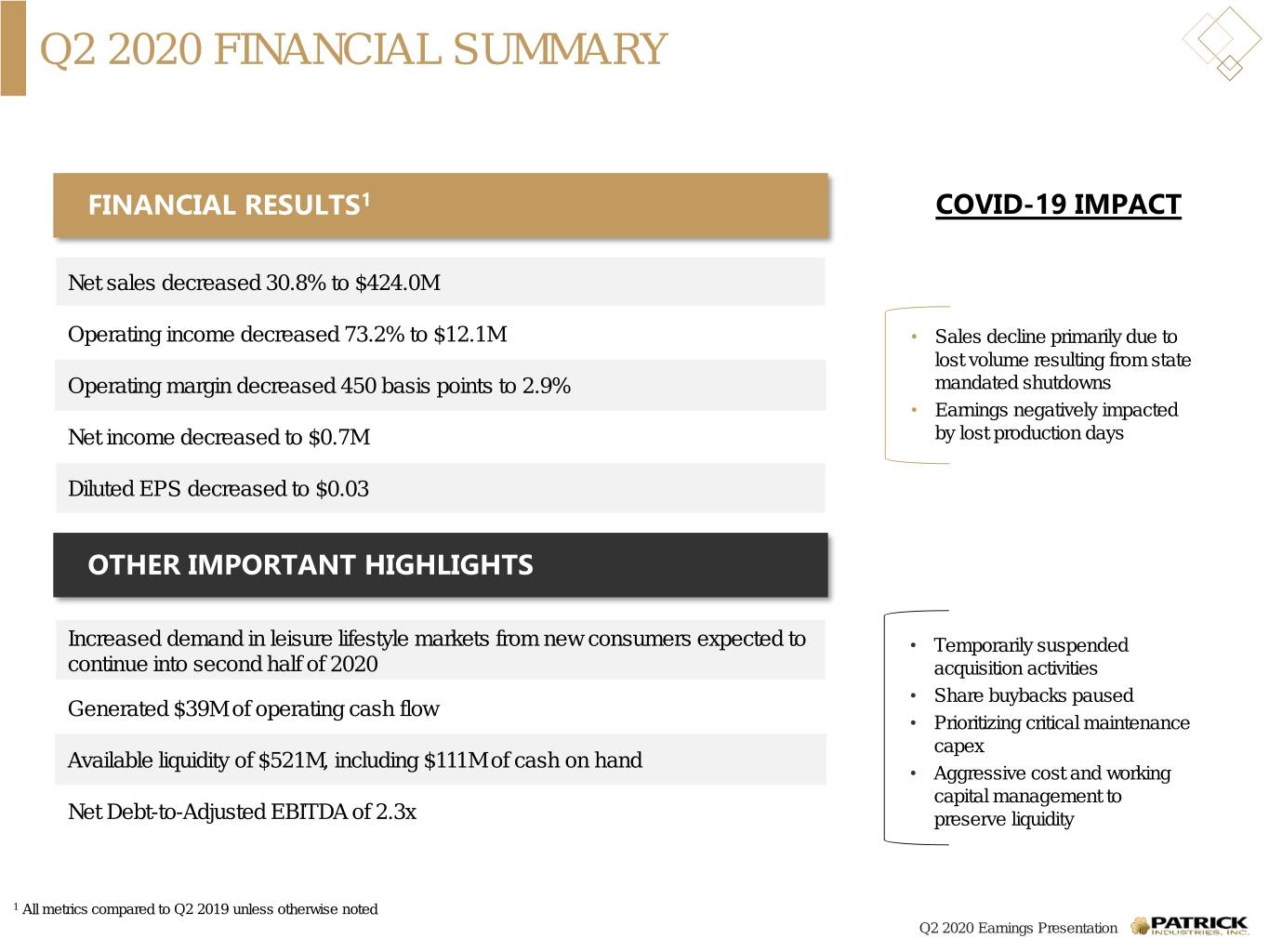

Q2 2020 FINANCIAL SUMMARY FINANCIAL RESULTS1 COVID-19 IMPACT Net sales decreased 30.8% to $424.0M Operating income decreased 73.2% to $12.1M • Sales decline primarily due to lost volume resulting from state Operating margin decreased 450 basis points to 2.9% mandated shutdowns • Earnings negatively impacted Net income decreased to $0.7M by lost production days Diluted EPS decreased to $0.03 OTHER IMPORTANT HIGHLIGHTS Increased demand in leisure lifestyle markets from new consumers expected to • Temporarily suspended continue into second half of 2020 acquisition activities • Share buybacks paused Generated $39M of operating cash flow • Prioritizing critical maintenance capex Available liquidity of $521M, including $111M of cash on hand • Aggressive cost and working capital management to Net Debt-to-Adjusted EBITDA of 2.3x preserve liquidity 1 All metrics compared to Q2 2019 unless otherwise noted Q2 2020 Earnings Presentation

MARKET SECTOR TRENDS RV MARINE MH INDUSTRIAL Wholesale . Apr – May: (56%) . Apr – May: (52%) . Apr – May: (20%) . Apr – May: (24%) Shipments . Q2: (35%) . Q2: (39%) . Q2: (17%) . Q2: (17%) Retail . Apr – May: (28%) . Apr – May: (20%) . Apr – May: (15%) Shipments1 . Q2: (15% - 20%) . Q2: (5% - 10%) . Q2: (13%) - . Strong retail demand . Dealer demand . Demographic trends . Tight inventories and outpacing production; continues to grow as support strong demand low interest rates expect historically low retail gains momentum patterns for quality, . Increased demand at dealer inventory levels affordable homes Industry . Expect completion of big box retail as Trends . Increased savings from inventory de-stocking to . Tailwinds from first- homeowners look to shutdown plus stimulus be completed for 2021 time home buyers and remodel payments creating new model year older generation first-time buyers downsizing COVID-19 . Lifestyle and . Lifestyle and . Demographics, low . Low inventories and Impact adaptation changes adaptation changes inventories and price low interest rates points 1 Company estimates Q2 2020 Earnings Presentation

OPERATIONS & SHORT-TERM OUTLOOK We remain disciplined with a flexible business model that enables us to shift production across like-product We remain disciplinedfacilities with and a flexible provides business additional levers model to remainthat allows efficient for the ability to shift production across like-product facilities and provides levers to pull as we continue to navigate through this dynamic macro environment SHORT-TERM OUTLOOK June and July sales and shipment trends indicate a resurgence in primary markets with strong demand across our customer base LEVERAGING OUR MODEL Highly variable cost model with demonstrated durability and resilience – flexible manufacturing processes and working capital INTERNAL ACTIONS Operational and financial foundation promotes adaptability – cost reduction, capacity flexibility, and synergistic opportunities executed and ongoing; majority of direct labor workforce returned to production in early May HEALTH & SAFETY Created and implemented protocol focused on team member safety – Dedication to each other, our customers and our communities Q1 2020 – COVID-19 PANDEMIC BEGINS Navigating Successfully Through Dynamic Macro Environment Q2 2020 Earnings Presentation

Q2 2020 FINANCIAL RESULTS ($ MILLIONS EXCEPT PER SHARE DATA) OPERATING CASH FLOW FROM NET SALES DILUTED EPS INCOME & MARGIN OPERATIONS (30.8%) (73.2%) (97.4%) (58.0%) $93.8 $613.2 $45.2 $1.18 $424.0 $39.4 7.4% $12.1 2.9% $0.03 Q2 2019 Q2 2020 Q2 2019 Q2 2020 Q2 2019 Q2 2020 6M 2019 6M 2020 . Decline attributable to lost . Fixed cost reduction efforts in . Highly flexible cost structure . Q2 2020 earnings disruptions production days / business Q2 along with proactive cost combined with fixed cost related to COVID-19 impact on disruption related to COVID-19 containment measures in 2019 reductions helped to partially end markets throughout April and early May helped mitigate some impact mitigate volume-loss from . Strong focus on cash from COVID-19, and to an COVID-19-related shutdowns . Revenues from leisure lifestyle management to navigate even greater extent after market (RV & Marine) declined unique COVID environment production resumed 39%, with RV down 40% and marine down 34% . Revenues from housing & industrial markets decreased 12%, with MH down 18% and industrial down 2% Q2 2020 Earnings Presentation

PERFORMANCE BY MARKET SECTORS ($ MILLIONS) Leisure Lifestyle1 Housing and Industrial1 RV MH (40%) (18%) $340.9 $109.9 $204.1 $90.3 Q2 2019 Q2 2020 Q2 2019 Q2 2020 . 48% of sales in Q2 2020 . 21% of sales in Q2 2020 . Content per Unit (TTM) – declined 2% to $3,086 from $3,135 . Content per Unit (TTM) – increased 16% to an estimated $4,529 . Content per unit experienced a small decline due to OEMs from $3,889 curtailing production, but continuing to ship finished goods . Content growth continues to be driven by acquisitions and leveraging synergies MARINE INDUSTRIAL (34%) (2%) $90.0 $59.0 $72.4 $70.6 Q2 2019 Q2 2020 Q2 2019 Q2 2020 . 14% of sales in Q2 2020 . 17% of sales in Q2 2020 . Powerboat Content per Retail Unit (TTM) – declined 13% to an . New Housing Starts declined 17% estimated $1,439 from $1,659 . 60% of revenues tied to new housing starts; our products go into . Content per unit negatively impacted by COVID-19 along with new homes 4-6 months after new housing starts dealer de-stocking efforts 1 All metrics compared to Q2 2019 unless otherwise noted Q2 2020 Earnings Presentation

BALANCE SHEET, CASH FLOW AND LIQUIDITY The strength of our cash flows, combined with our liquidity continue to provide us with the flexibility to navigate a variety of scenarios through these unprecedented times DEBT STRUCTURE AND MATURITIES NET LEVERAGE1 ($ in millions) . $550M Senior Secured Revolver, due September 2024 Total Debt Outstanding $702.5 . $100M Term Loan ($96.3M o/s at 6/28/20), pre-determined quarterly Less: Cash on Hand (125.6) installments; balance due @ maturity Net Debt $576.9 . $172.5M 1% Convertible Senior Notes, due February 2023 LTM Adj. EBITDA $249.9 . $300M 7.5% Senior Notes, October 2027 Net Debt to Adj. EBITDA 2.31x COVENANTS LIQUIDITY ($ in millions) . Consolidated Net Leverage Ratio – maximum 4.00x vs. 2.31x at 6/28/20 Total Revolver Credit Capacity $550.0 . Consolidated Fixed Charge Coverage Ratio – minimum 1.50x vs. 5.65x Less: Total Debt Outstanding (139.8) at 6/28/20 (including outstanding letters of credit) Unused Credit Capacity $410.2 LIQUIDITY Add: Cash on Hand 111.1 . Available liquidity, including cash on hand - $521.3M at 6/28/20 Total Available Liquidity $521.3 1 As defined by credit agreement Q2 2020 Earnings Presentation

CONCLUSION / TAKEAWAYS MARKET BUSINESS LEADERSHIP STRATEGIC LIQUIDITY POSITION MODEL Market leader in our Deep industry Flexible, high Disciplined cost Strong balance primary market experience and variable cost management sheet with no near- sectors; uniquely proven track record business model to balanced with term debt positioned for near- of successfully drive operational strategic growth maturities, ample and long-term shift navigating efficiency and investment liquidity and an toward outdoor economic cycles navigate through all opportunities enhanced capital activities economic structure conditions Driving Confidence in Financial Performance and Creating Long-term Shareholder Value Q2 2020 Earnings Presentation

Appendix Q2 2020 Earnings Presentation

NON-GAAP RECONCILIATIONS Reconciliation of Net Income to EBITDA to LTM Adjusted EBITDA ($ in millons) LTM 6/28/20 Net income $ 63.2 + Depreciation & amortization 67.2 + Interest Expense, net 40.3 + Income taxes 21.3 EBITDA 192.0 + Stock compensation expense 13.6 + Acquisition proforma, transaction-related expenses & other 44.3 LTM Adjusted EBITDA $ 249.9 Reconciliation of Net Leverage* ($ millions) Total debt outstanding @ 6/28/20 $ 703.7 Less: term loan payment (1.2) Total debt outstanding @ 6/30/20 702.5 Less: cash on hand @ 6/30/20 (125.6) Net debt @ 6/30/20 $ 576.9 LTM Adjusted EBITDA $ 249.9 Net Debt to Adjusted EBITDA 2.31 X *As defined by credit agreement which includes debt balance and cash balance two days following quarter end Use of Non-GAAP Financial Information Earnings before interest, taxes, depreciation and amortization (“EBITDA”), LTM Adjusted EBITDA, and Net Debt to Adjusted EBITDA are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. Q2 2020 Earnings Presentation