Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOME BANCSHARES INC | homb-8k_20200730.htm |

HOMB Retail Fireside Chat 30 July 2020

Forward Looking Statement This presentation may contain forward-looking statements regarding the Company’s plans, expectations, goals and outlook for the future. Statements in this presentation that are not historical facts should be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements of this type speak only as of the date of this presentation. By nature, forward-looking statements involve inherent risk and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward-looking statements. These factors include, but are not limited to, the following: economic conditions, credit quality, interest rates, loan demand, disruptions and uncertainties in our business and operations as a result of the ongoing coronavirus pandemic, the ability to successfully integrate new acquisitions, legislative and regulatory changes and risks associated with current and future regulations, technological changes and cybersecurity risks, competition from other financial institutions, changes in the assumptions used in making the forward-looking statements, and other factors described in reports we file with the Securities and Exchange Commission (the “SEC”), including those factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on February 26, 2020, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 8, 2020.

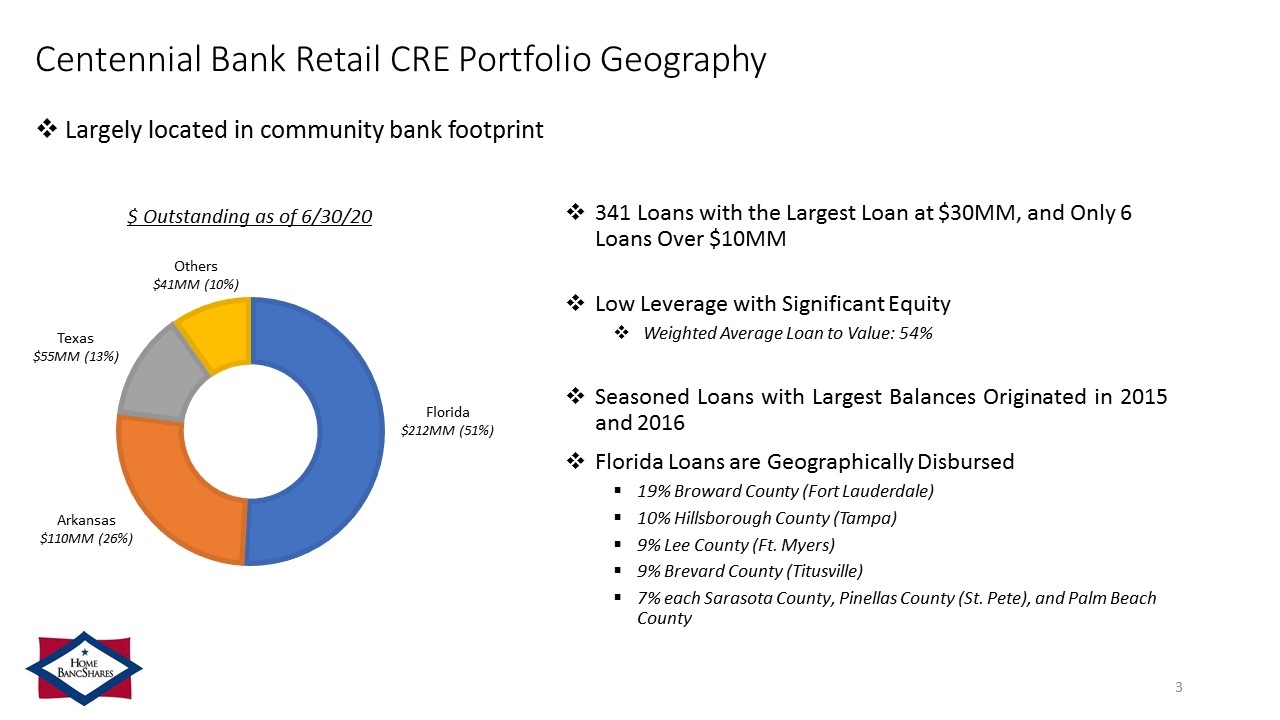

Centennial Bank Retail CRE Portfolio Geography 341 Loans with the Largest Loan at $30MM, and Only 6 Loans Over $10MM Low Leverage with Significant Equity Weighted Average Loan to Value: 54% Seasoned Loans with Largest Balances Originated in 2015 and 2016 Florida Loans are Geographically Disbursed 19% Broward County (Fort Lauderdale) 10% Hillsborough County (Tampa) 9% Lee County (Ft. Myers) 9% Brevard County (Titusville) 7% each Sarasota County, Pinellas County (St. Pete), and Palm Beach County $ Outstanding as of 6/30/20 Texas $55MM (13%) Florida $212MM (51%) Arkansas $110MM (26%) Others $41MM (10%) Largely located in community bank footprint

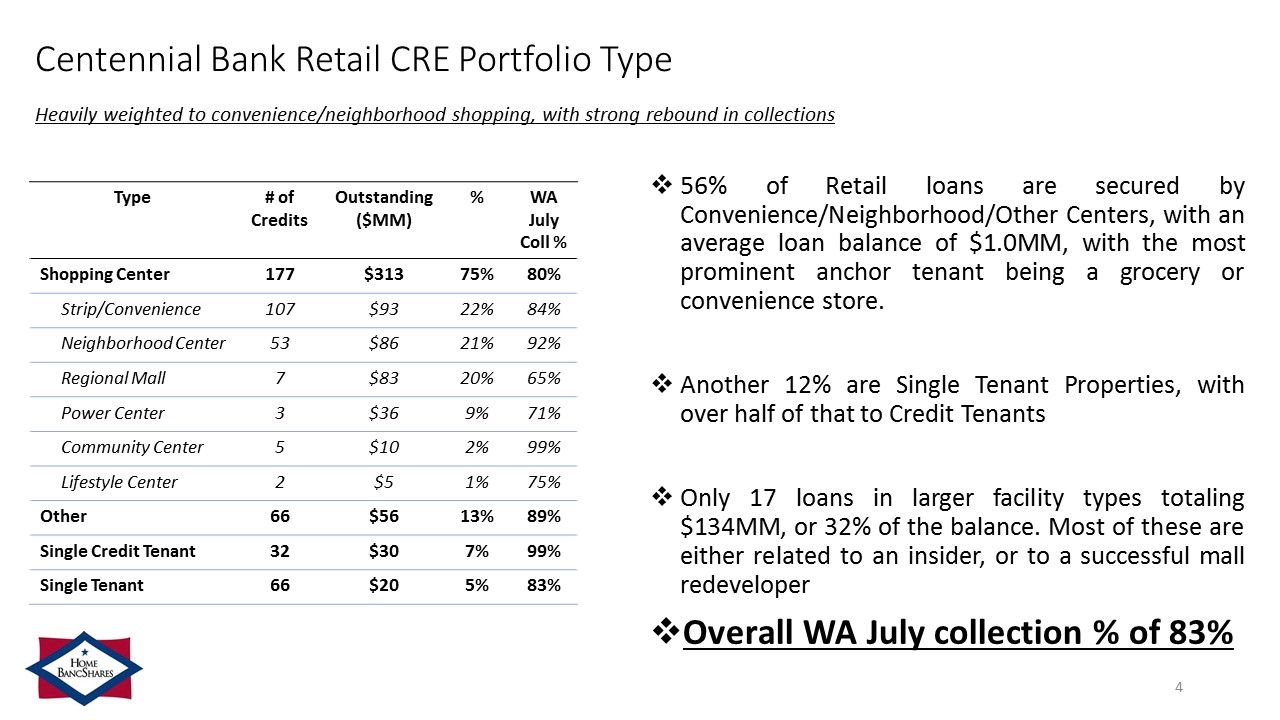

Centennial Bank Retail CRE Portfolio Type Heavily weighted to convenience/neighborhood shopping, with strong rebound in collections Type # of Credits Outstanding ($MM) % WA July Coll % Shopping Center 177 $313 75% 80% Strip/Convenience 107 $93 22% 84% Neighborhood Center 53 $86 21% 92% Regional Mall 7 $83 20% 65% Power Center 3 $36 9% 71% Community Center 5 $10 2% 99% Lifestyle Center 2 $5 1% 75% Other 66 $56 13% 89% Single Credit Tenant 32 $30 7% 99% Single Tenant 66 $20 5% 83% 56% of Retail loans are secured by Convenience/Neighborhood/Other Centers, with an average loan balance of $1.0MM, with the most prominent anchor tenant being a grocery or convenience store. Another 12% are Single Tenant Properties, with over half of that to Credit Tenants Only 17 loans in larger facility types totaling $134MM, or 32% of the balance. Most of these are either related to an insider, or to a successful mall redeveloper Overall WA July collection % of 83%

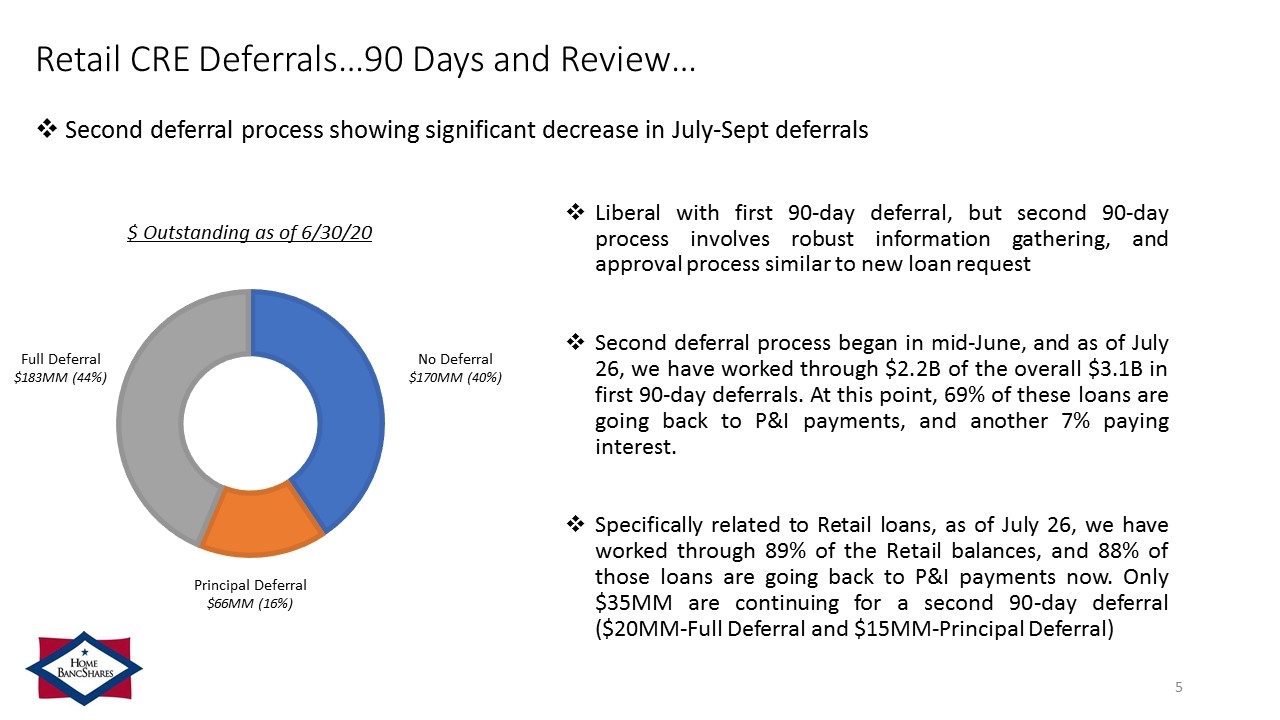

Retail CRE Deferrals…90 Days and Review… Liberal with first 90-day deferral, but second 90-day process involves robust information gathering, and approval process similar to new loan request Second deferral process began in mid-June, and as of July 26, we have worked through $2.2B of the overall $3.1B in first 90-day deferrals. At this point, 69% of these loans are going back to P&I payments, and another 7% paying interest. Specifically related to Retail loans, as of July 26, we have worked through 89% of the Retail balances, and 88% of those loans are going back to P&I payments now. Only $35MM are continuing for a second 90-day deferral ($20MM-Full Deferral and $15MM-Principal Deferral) $ Outstanding as of 6/30/20 Full Deferral $183MM (44%) No Deferral $170MM (40%) Principal Deferral $66MM (16%) Second deferral process showing significant decrease in July-Sept deferrals

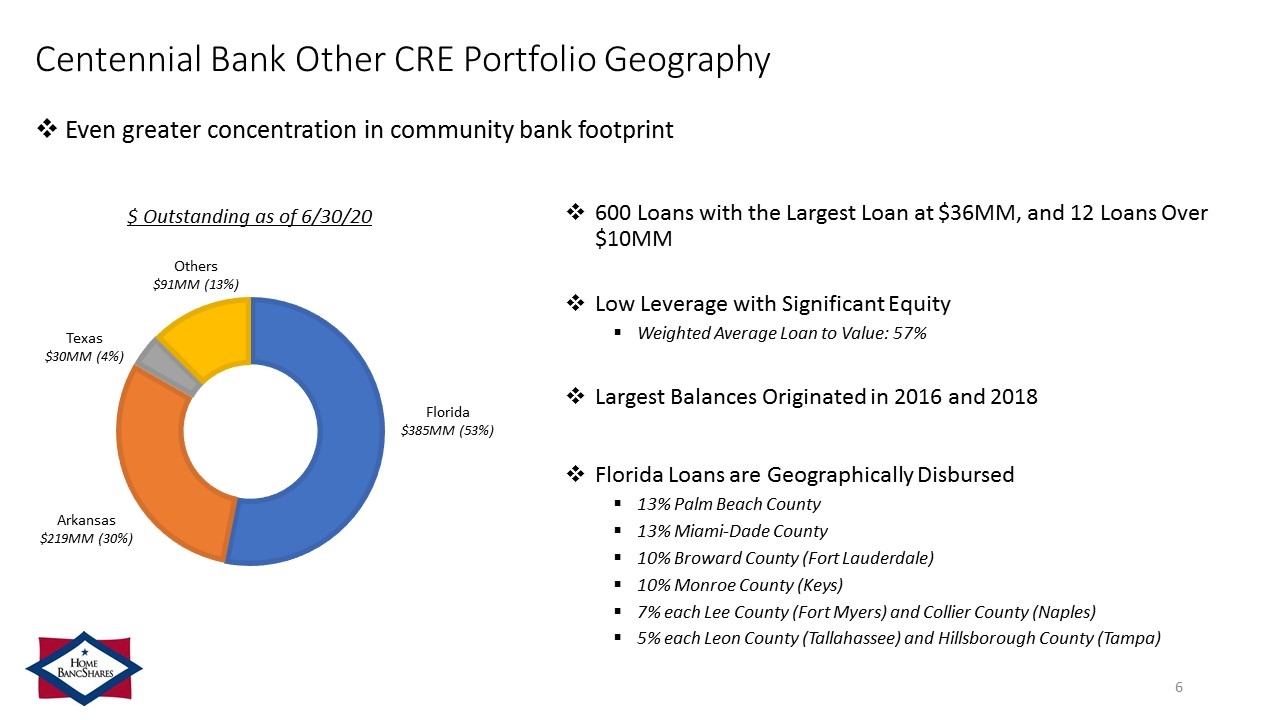

Centennial Bank Other CRE Portfolio Geography 600 Loans with the Largest Loan at $36MM, and 12 Loans Over $10MM Low Leverage with Significant Equity Weighted Average Loan to Value: 57% Largest Balances Originated in 2016 and 2018 Florida Loans are Geographically Disbursed 13% Palm Beach County 13% Miami-Dade County 10% Broward County (Fort Lauderdale) 10% Monroe County (Keys) 7% each Lee County (Fort Myers) and Collier County (Naples) 5% each Leon County (Tallahassee) and Hillsborough County (Tampa) $ Outstanding as of 6/30/20 Texas $30MM (4%) Florida $385MM (53%) Arkansas $219MM (30%) Others $91MM (13%) Even greater concentration in community bank footprint

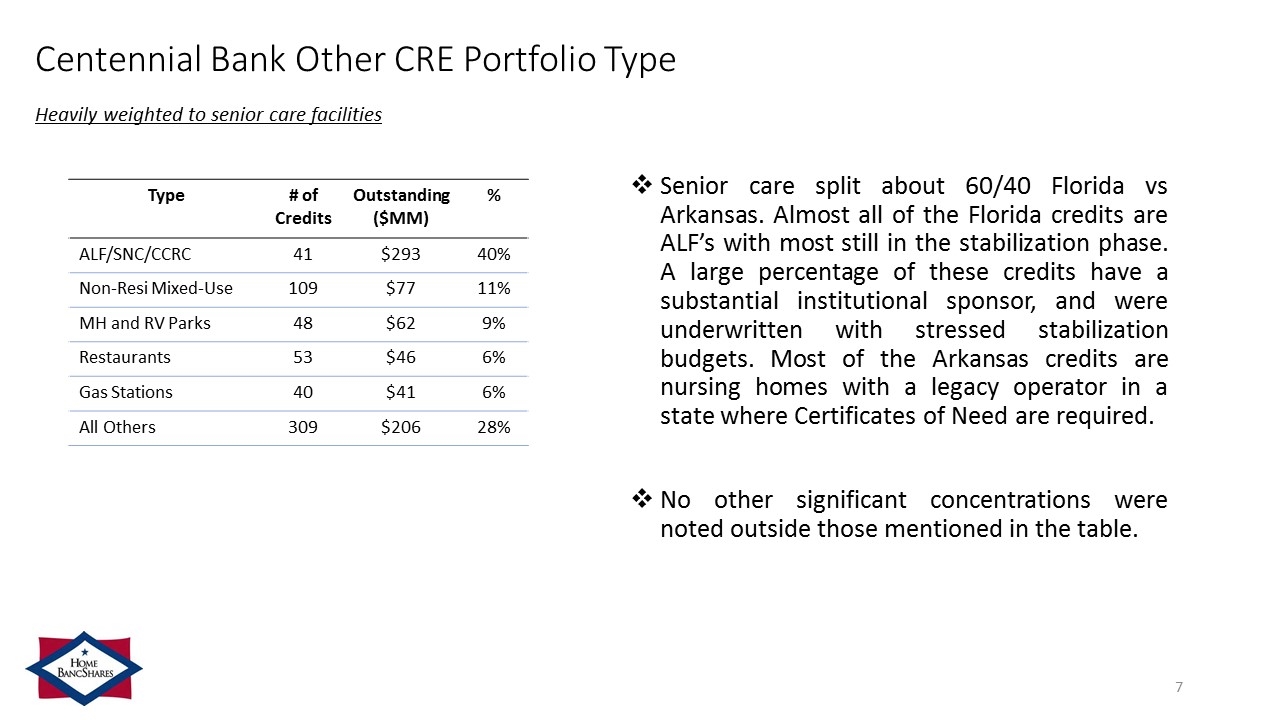

Centennial Bank Other CRE Portfolio Type Heavily weighted to senior care facilities Type # of Credits Outstanding ($MM) % ALF/SNC/CCRC 41 $293 40% Non-Resi Mixed-Use 109 $77 11% MH and RV Parks 48 $62 9% Restaurants 53 $46 6% Gas Stations 40 $41 6% All Others 309 $206 28% Senior care split about 60/40 Florida vs Arkansas. Almost all of the Florida credits are ALF’s with most still in the stabilization phase. A large percentage of these credits have a substantial institutional sponsor, and were underwritten with stressed stabilization budgets. Most of the Arkansas credits are nursing homes with a legacy operator in a state where Certificates of Need are required. No other significant concentrations were noted outside those mentioned in the table.

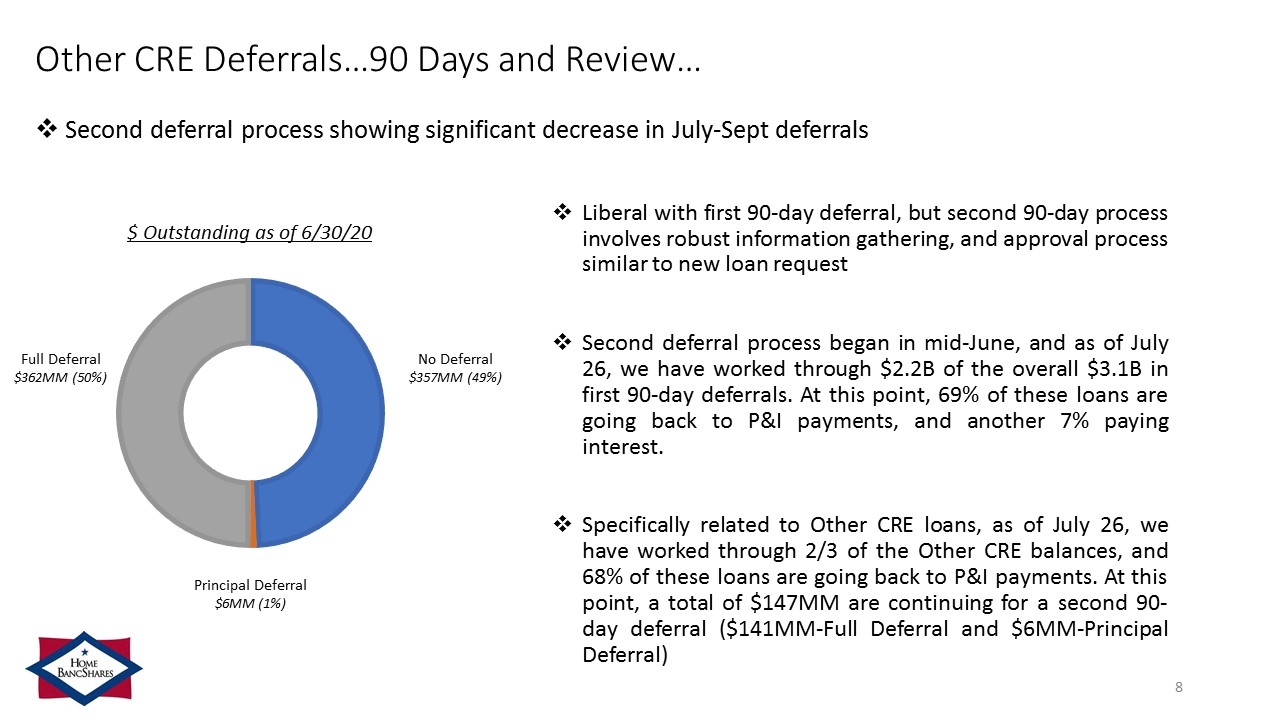

Other CRE Deferrals…90 Days and Review… Liberal with first 90-day deferral, but second 90-day process involves robust information gathering, and approval process similar to new loan request Second deferral process began in mid-June, and as of July 26, we have worked through $2.2B of the overall $3.1B in first 90-day deferrals. At this point, 69% of these loans are going back to P&I payments, and another 7% paying interest. Specifically related to Other CRE loans, as of July 26, we have worked through 2/3 of the Other CRE balances, and 68% of these loans are going back to P&I payments. At this point, a total of $147MM are continuing for a second 90-day deferral ($141MM-Full Deferral and $6MM-Principal Deferral) $ Outstanding as of 6/30/20 Full Deferral $362MM (50%) No Deferral $357MM (49%) Principal Deferral $6MM (1%) Second deferral process showing significant decrease in July-Sept deferrals

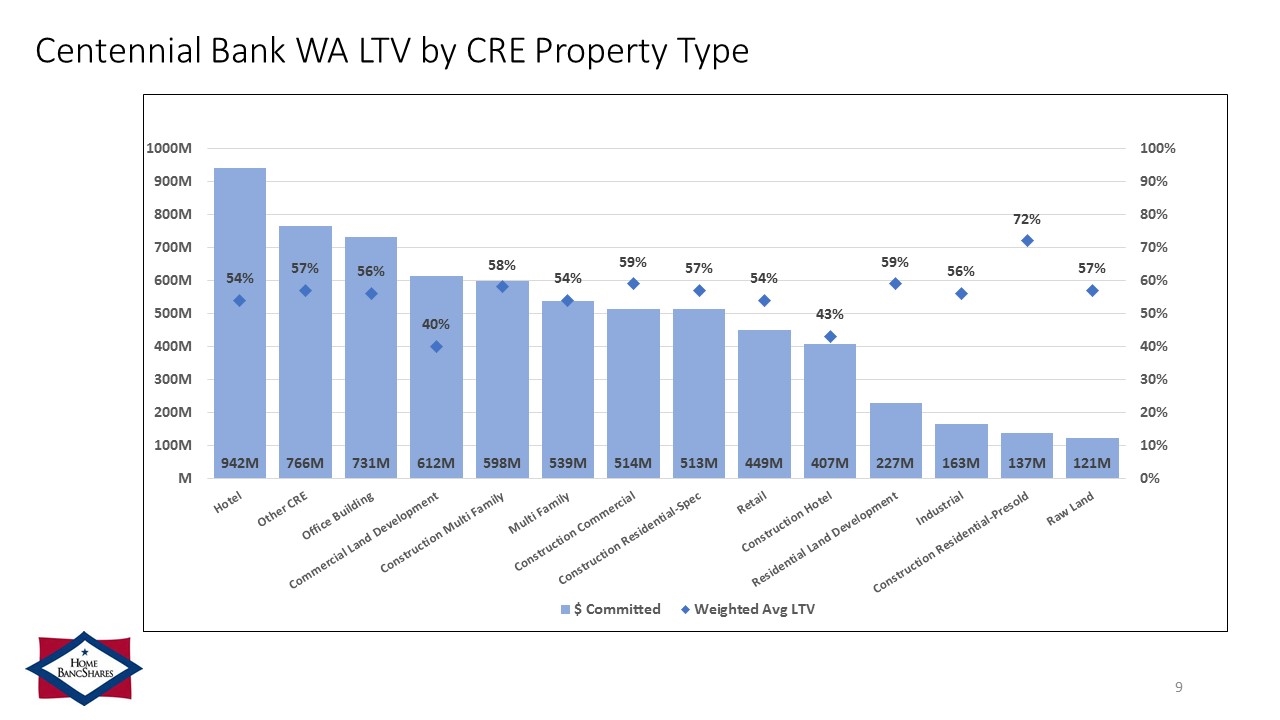

Centennial Bank WA LTV by CRE Property Type

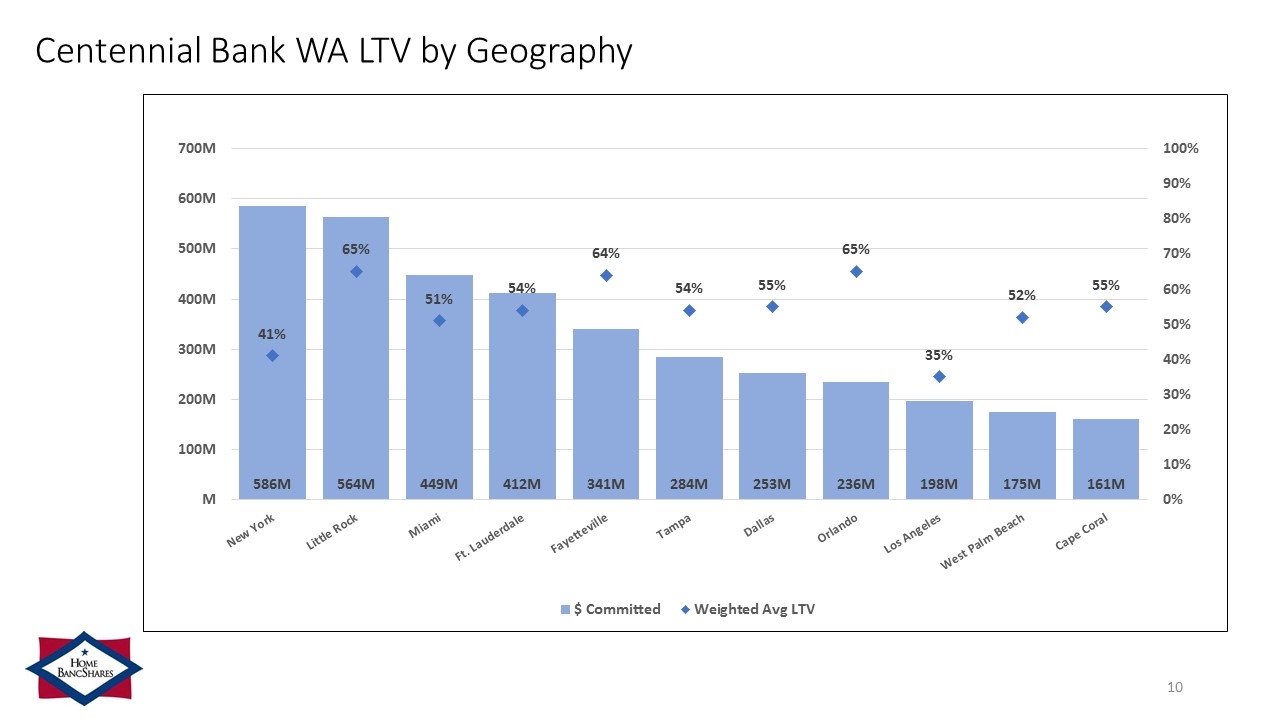

Centennial Bank WA LTV by Geography

Contact Information Corporate Headquarters Home BancShares, Inc. 719 Harkrider Street, Suite 100 P.O. Box 966 Conway, AR 72033 Financial Information Donna Townsell Director of Investor Relations (501) 328-4625 Website www.homebancshares.com

NASDAQ: HOMB | July 2020 www.homebancshares.com