Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COUSINS PROPERTIES INC | cuz-20200730.htm |

| TABLE OF CONTENTS | ||||||||

| Forward-Looking Statements | |||||

| Earnings Release | |||||

| Condensed Consolidated Balance Sheets | |||||

| Condensed Consolidated Statements of Operations | |||||

Key Performance Metrics | |||||

| Funds From Operations - Detail | |||||

Portfolio Statistics | |||||

Same Property Performance | |||||

Office Leasing Activity | |||||

| Office Lease Expirations | |||||

Top 20 Office Tenants | |||||

| Tenant Industry Diversification | |||||

| Investment Activity | |||||

| Land Inventory | |||||

Debt Schedule | |||||

| Joint Venture Information | |||||

| Non-GAAP Financial Measures - Calculations and Reconciliations | |||||

| Non-GAAP Financial Measures - Discussion | |||||

| Cousins Properties | Q2 2020 Supplemental Information | |||||||

| FORWARD-LOOKING STATEMENTS | ||||||||

Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2019 and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2020. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as the following: guidance and underlying assumptions; business and financial strategy; future debt financings; future acquisitions and dispositions of operating assets or joint venture interests; future acquisitions and dispositions of land, including ground leases; future development and redevelopment opportunities, including fee development opportunities; future issuances and repurchases of common stock; future distributions; projected capital expenditures; market and industry trends; entry into new markets; future changes in interest rates; and all statements that address operating performance, events, or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders.

Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information that is currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following: the availability and terms of capital; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions, investments, or dispositions; the potential dilutive effect of common stock or operating partnership unit issuances; the availability of buyers and pricing with respect to the disposition of assets; changes in national and local economic conditions, the real estate industry, and the commercial real estate markets in which we operate, particularly in Atlanta, Austin, Charlotte, Phoenix, Tampa, and Dallas where we have high concentrations of our lease revenues, including the impact of high unemployment, volatility in the public equity and debt markets, and international economic and other conditions; the impact of a public health crisis, including the COVID-19 pandemic, and the governmental and third party response to such a crisis, which may affect our key personnel, our tenants, and the costs of operating our assets; the impact of social distancing, shelter-in-place, border closings, travel restrictions, remote work requirements, and similar governmental and private measures taken to combat the spread of the COVID-19 pandemic on our operations and our tenants; changes to our strategy with regard to land and other non-core holdings that may require impairment losses to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, the ability to lease newly developed and/or recently acquired space, the failure of a tenant to occupy leased space, and the risk of declining leasing rates; changes in the needs of our tenants brought about by the desire for co-working arrangements, trends toward utilizing less office space per employee, and the effect of telecommuting; any adverse change in the financial condition of one or more of our tenants; volatility in interest rates and insurance rates; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); cyber security breaches; changes in senior management, changes in the Board of Directors, and the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and meet regulatory requirements; potential changes to state, local, or federal regulations applicable to our business; material changes in the rates, or the ability to pay, dividends on common shares or other securities; potential changes to the tax laws impacting REITs and real estate in general; potential changes to the tax laws impacting REITs and real estate in general; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission ("SEC") by the Company.

The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws.

| Cousins Properties | 3 | Q2 2020 Supplemental Information | ||||||

| EARNINGS RELEASE | ||||||||

COUSINS PROPERTIES REPORTS SECOND QUARTER 2020 RESULTS

Highlights

•Net income per share was $0.16.

•Funds from operations per share was $0.66.

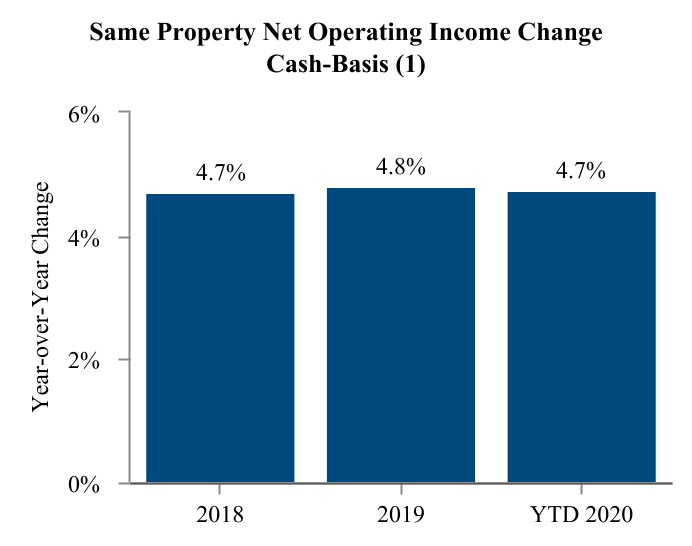

•Same property net operating income on a cash basis decreased 1.6%; adjusted for temporary rent deferrals and reduced parking income it increased 3.7%.

•Second generation net rent per square foot on a cash basis increased 20.6%.

•Executed 302,877 square feet of office leases.

•Collected 97% of rents, including 98% from office customers, in the second quarter; collected 98% of rents, including 98% from office tenants, in July.

•Executed rent deferral agreements representing 1.1% of annualized contractual rents.

•More than $1 billion of liquidity at quarter-end, representing 15.5% of total market capitalization.

•On May 4, 2020, the Company purchased a 1,550 space parking garage in Charlotte for a gross purchase price of $85.0 million.

ATLANTA (July 30, 2020) - Cousins Properties (NYSE:CUZ) today reported its results of operations for the quarter ended June 30, 2020.

"Our second quarter results were solid and consistent with the forecast we provided in April," said Colin Connolly, president and chief executive officer of Cousins Properties. "Although same-property performance is down due to temporary rent deferral agreements and reduced parking demand, the economics on new leases remain strong driven by our Sun Belt markets and trophy portfolio. Looking forward, we firmly believe compelling investment opportunities will emerge over the coming quarters that will allow us to take advantage of our best-in-class balance sheet to create significant value for our shareholders."

Financial Results

Net income available to common stockholders was $23.1 million, or $0.16 per share, for the second quarter of 2020, compared with net loss available to common stockholders of $22.4 million, or $0.20 per share (net income available to common shareholders of $0.24 per share, excluding transaction costs), for the second quarter of 2019. Net income available to common stockholders was $198.0 million, or $1.34 per share, for the six months ended June 30, 2020, compared with $12.9 million, or $0.12 per share ($0.57 per share, excluding transaction costs), for the six months ended June 30, 2019. The increase in net income available to common stockholders between the six month periods is primarily due to the sales of Hearst Tower and of the company's investment in the Gateway Village joint venture in the first quarter of 2020 and due to the acquisition costs related to the TIER merger in the second quarter 2019.

Funds From Operations ("FFO") was $98.0 million, or $0.66 per share, for the second quarter of 2020, compared with $31.9 million, or $0.28 per share ($0.71 per share, excluding transaction costs), for the second quarter of 2019. FFO was was $210.7 million, or $1.42 per share, for the six months ended June 30, 2020, compared with $116.4 million, or $1.05 per share ($1.50 per share, excluding transaction costs), for the six months ended June 30, 2019.

| Cousins Properties | 4 | Q2 2020 Supplemental Information | ||||||

| EARNINGS RELEASE | ||||||||

2020 Guidance

Due to uncertainty driven by the COVID-19 pandemic, the Company withdrew its earnings guidance in April 2020. However, at that time the Company provided financial information to assist investors as they assessed the Company’s outlook for the balance of 2020. Based on actual results to date as well as the Company’s current outlook, this previously provided information remains unchanged except for the following updates. All information covers full year 2020 results.

•The Company acquired a parking garage in Charlotte on May 4th that is anticipated to generate net operating income of $1.5 million to $2.0 million during the Company's ownership period in 2020. Stabilized annual net operating income is anticipated to be $4.5 million to $5.0 million. This acquisition was funded with cash on hand.

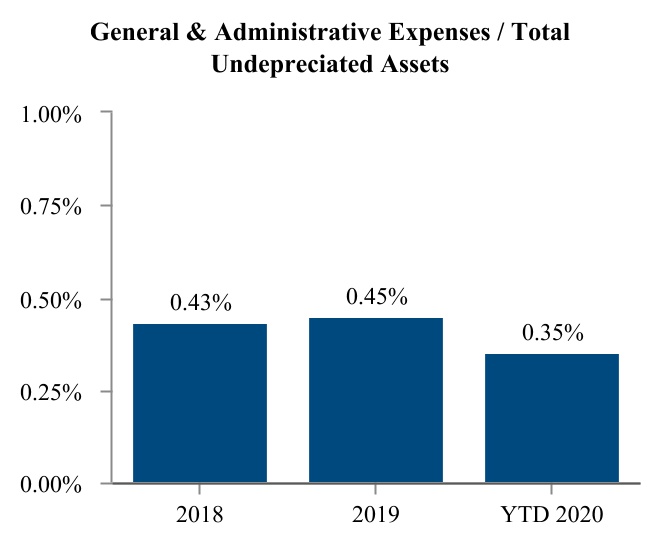

•General and administrative expenses are anticipated to decline by an additional $1 million on top of the $3 million to $5 million decline announced last quarter. The Company now anticipates full year general and administrative expenses of $27 million to $29 million, net of capitalized salaries, down 18% from its original range of $33 million to $35 million.

•A decline in parking revenue is anticipated to reduce net operating income by $5.5 million to $9.5 million compared to a prior range of $3.5 million to $9.5 million due to a revised outlook on the duration of the pandemic.

•Fee and other income is anticipated to decline by $2 million while property level net operating income is anticipated to increase by $300,000 due to the previously disclosed Parsley Energy lease amendment at Colorado Tower being accounted for as a lease modification rather than a termination.

Investor Conference Call and Webcast

The Company will conduct a conference call at 10:00 a.m. (Eastern Time) on Friday, July 31, 2020, to discuss the results of the quarter ended June 30, 2020. The number to call for this interactive teleconference is (877) 247-1056. The live webcast of this call can be accessed on the Company's website, www.cousins.com, through the “Cousins Properties Second Quarter Conference Call” link on the Investor Relations page. A replay of the conference call will be available for seven days by dialing (877) 344-7529 and entering the passcode 10146359. The playback can also be accessed on the Company's website.

Acting through its operating partnership, Cousins Properties, LP, Cousins Properties is a leading fully-integrated real estate investment trust (REIT) with extensive experience in development, acquisition, financing, management, and leasing. Based in Atlanta, the Company actively invests in top-tier urban office assets and opportunistic mixed-use properties in Sunbelt markets.

| Cousins Properties | 5 | Q2 2020 Supplemental Information | ||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||

(in thousands, except share and per share amounts)

| June 30, 2020 | December 31, 2019 | ||||||||||

| Assets: | (unaudited) | ||||||||||

| Real estate assets: | |||||||||||

| Operating properties, net of accumulated depreciation of $692,126 and $577,139 in 2020 and 2019, respectively | $ | 6,011,375 | $ | 5,669,324 | |||||||

| Projects under development | 205,376 | 410,097 | |||||||||

| Land | 97,196 | 116,860 | |||||||||

| 6,313,947 | 6,196,281 | ||||||||||

| Real estate assets and other assets held for sale, net of accumulated depreciation and amortization of $61,093 in 2019 | — | 360,582 | |||||||||

| Cash and cash equivalents | 28,255 | 15,603 | |||||||||

| Restricted cash | 1,947 | 2,005 | |||||||||

| Notes and accounts receivable | 35,078 | 23,680 | |||||||||

| Deferred rents receivable | 119,982 | 102,314 | |||||||||

| Investment in unconsolidated joint ventures | 129,857 | 133,884 | |||||||||

| Intangible assets, net | 224,066 | 257,649 | |||||||||

| Other assets | 55,316 | 59,449 | |||||||||

| Total assets | $ | 6,908,448 | $ | 7,151,447 | |||||||

| Liabilities: | |||||||||||

| Notes payable | $ | 1,939,517 | $ | 2,222,975 | |||||||

| Accounts payable and accrued expenses | 183,350 | 209,904 | |||||||||

| Deferred income | 57,199 | 52,269 | |||||||||

| Intangible liabilities, net of accumulated amortization of $66,343 and $55,798 in 2020 and 2019, respectively | 72,560 | 83,105 | |||||||||

| Other liabilities | 115,493 | 134,128 | |||||||||

| Liabilities of real estate assets held for sale, net of accumulated amortization of $7,771 in 2019 | — | 21,231 | |||||||||

| Total liabilities | 2,368,119 | 2,723,612 | |||||||||

| Commitments and contingencies | |||||||||||

| Equity: | |||||||||||

| Stockholders' investment: | |||||||||||

| Preferred stock, $1 par value, 20,000,000 shares authorized, 1,716,837 shares issued and outstanding in 2019 | — | 1,717 | |||||||||

| Common stock, $1 par value, 300,000,000 shares authorized, 151,153,042 and 149,347,382 shares issued, and 148,568,109 and 146,762,449 shares outstanding in 2020 and 2019, respectively | 151,153 | 149,347 | |||||||||

| Additional paid-in capital | 5,540,945 | 5,493,883 | |||||||||

| Treasury stock at cost, 2,584,933 shares in 2020 and 2019 | (148,473) | (148,473) | |||||||||

| Distributions in excess of cumulative net income | (1,028,289) | (1,137,200) | |||||||||

| Total stockholders' investment | 4,515,336 | 4,359,274 | |||||||||

| Nonredeemable noncontrolling interests | 24,993 | 68,561 | |||||||||

| Total equity | 4,540,329 | 4,427,835 | |||||||||

| Total liabilities and equity | $ | 6,908,448 | $ | 7,151,447 | |||||||

| Cousins Properties | 6 | Q2 2020 Supplemental Information | ||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||

(unaudited; in thousands, except per share amounts)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Rental property revenues | $ | 175,099 | $ | 134,933 | $ | 364,228 | $ | 258,798 | |||||||||||||||

| Fee income | 4,690 | 7,076 | 9,422 | 15,804 | |||||||||||||||||||

| Other | 126 | 11 | 163 | 151 | |||||||||||||||||||

| 179,915 | 142,020 | 373,813 | 274,753 | ||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Rental property operating expenses | 61,621 | 46,705 | 126,159 | 90,192 | |||||||||||||||||||

| Reimbursed expenses | 322 | 1,047 | 843 | 1,979 | |||||||||||||||||||

| General and administrative expenses | 8,543 | 8,374 | 14,195 | 19,834 | |||||||||||||||||||

| Interest expense | 13,993 | 12,059 | 29,897 | 22,879 | |||||||||||||||||||

| Depreciation and amortization | 72,868 | 50,904 | 144,482 | 96,765 | |||||||||||||||||||

| Transaction costs | 63 | 49,827 | 428 | 49,830 | |||||||||||||||||||

| Other | 552 | 624 | 1,118 | 804 | |||||||||||||||||||

| 157,962 | 169,540 | 317,122 | 282,283 | ||||||||||||||||||||

| Income from unconsolidated joint ventures | 1,715 | 3,634 | 5,140 | 6,538 | |||||||||||||||||||

| Gain (loss) on sales of investments in unconsolidated joint ventures | (231) | — | 45,999 | — | |||||||||||||||||||

| Gain (loss) on investment property transactions | (201) | 1,304 | 90,715 | 14,415 | |||||||||||||||||||

| Net income (loss) | 23,236 | (22,582) | 198,545 | 13,423 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (135) | 173 | (501) | (491) | |||||||||||||||||||

| Net income (loss) available to common stockholders | $ | 23,101 | $ | (22,409) | $ | 198,044 | $ | 12,932 | |||||||||||||||

| Net income (loss) per common share — basic and diluted | $ | 0.16 | $ | (0.20) | $ | 1.34 | $ | 0.12 | |||||||||||||||

| Weighted average shares — basic | 148,548 | 112,926 | 147,986 | 109,049 | |||||||||||||||||||

| Weighted average shares — diluted | 148,580 | 114,670 | 148,570 | 110,822 | |||||||||||||||||||

| Cousins Properties | 7 | Q2 2020 Supplemental Information | ||||||

| KEY PERFORMANCE METRICS | ||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| Property Statistics | |||||||||||||||||||||||||||||

| Consolidated Operating Properties | 23 | 24 | 33 | 33 | 34 | 34 | 32 | 32 | 32 | ||||||||||||||||||||

| Consolidated Rentable Square Feet (in thousands) | 12,203 | 12,573 | 18,372 | 18,372 | 19,599 | 19,599 | 18,249 | 18,249 | 18,249 | ||||||||||||||||||||

Unconsolidated Operating Properties | 4 | 5 | 5 | 5 | 4 | 4 | 3 | 3 | 3 | ||||||||||||||||||||

Unconsolidated Rentable Square Feet (in thousands) | 3,113 | 3,394 | 3,394 | 3,394 | 2,168 | 2,168 | 1,107 | 1,107 | 1,107 | ||||||||||||||||||||

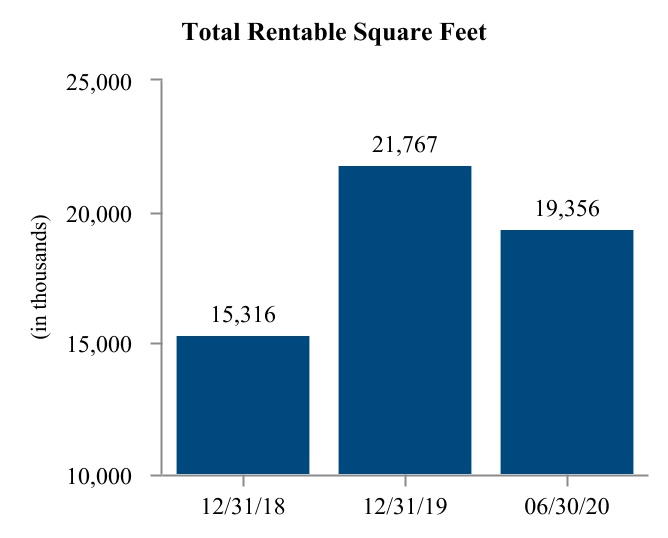

| Total Operating Properties | 27 | 29 | 38 | 38 | 38 | 38 | 35 | 35 | 35 | ||||||||||||||||||||

| Total Rentable Square Feet (in thousands) | 15,316 | 15,967 | 21,766 | 21,766 | 21,767 | 21,767 | 19,356 | 19,356 | 19,356 | ||||||||||||||||||||

| Office Leasing Activity (1) | |||||||||||||||||||||||||||||

| Net Leased during the Period (square feet in thousands) | 1,597 | 682 | 1,089 | 741 | 562 | 3,074 | 476 | 303 | 779 | ||||||||||||||||||||

| Net Effective Rent Calculation (per square foot) | |||||||||||||||||||||||||||||

| Net Rent | $31.01 | $27.86 | $29.34 | $33.66 | $31.38 | $30.43 | $34.88 | $33.54 | $34.36 | ||||||||||||||||||||

| Net Free Rent | (0.85) | (0.49) | (0.52) | (0.64) | (1.01) | (0.63) | (1.92) | (0.92) | (1.54) | ||||||||||||||||||||

Leasing Commissions | (2.41) | (1.13) | (2.34) | (2.86) | (2.84) | (2.29) | (2.68) | (3.02) | (2.82) | ||||||||||||||||||||

Tenant Improvements | (4.40) | (1.74) | (4.69) | (3.13) | (4.89) | (3.69) | (5.27) | (4.17) | (4.84) | ||||||||||||||||||||

| Leasing Costs | (7.66) | (3.36) | (7.55) | (6.63) | (8.74) | (6.61) | (9.87) | (8.11) | (9.20) | ||||||||||||||||||||

| Net Effective Rent | $23.35 | $24.50 | $21.79 | $27.03 | $22.64 | $23.82 | $25.01 | $25.43 | $25.16 | ||||||||||||||||||||

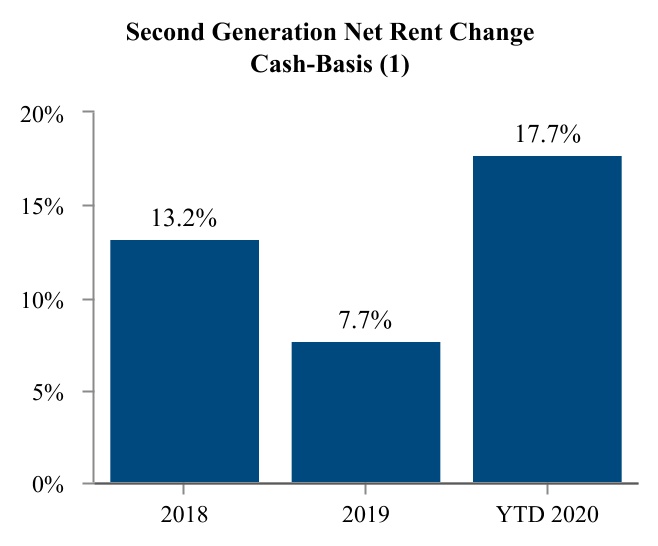

| Change in Second Generation Net Rent | 32.5 | % | 22.8 | % | 21.5 | % | 17.2 | % | 25.5 | % | 21.3 | % | 26.9 | % | 31.8 | % | 29.6 | % | |||||||||||

| Change in Cash-Basis Second Generation Net Rent | 13.2 | % | 7.1 | % | 4.9 | % | 8.1 | % | 12.6 | % | 7.7 | % | 14.3 | % | 20.6 | % | 17.7 | % | |||||||||||

| Same Property Information (2) | |||||||||||||||||||||||||||||

| Percent Leased (period end) | 94.5 | % | 94.4 | % | 93.9 | % | 93.7 | % | 94.6 | % | 94.6 | % | 94.8 | % | 94.4 | % | 94.4 | % | |||||||||||

| Weighted Average Occupancy | 91.9 | % | 92.0 | % | 91.8 | % | 90.9 | % | 91.1 | % | 91.8 | % | 91.4 | % | 91.5 | % | 91.5 | % | |||||||||||

Change in Net Operating Income (over prior year period) | 2.1 | % | 4.3 | % | 4.5 | % | 0.3 | % | 1.4 | % | 2.6 | % | 3.2 | % | (2.4) | % | 0.4 | % | |||||||||||

Change in Cash-Basis Net Operating Income (over prior year period) | 4.7 | % | 4.0 | % | 5.5 | % | 2.9 | % | 6.0 | % | 4.8 | % | 11.4 | % | (1.6) | % | 4.7 | % | |||||||||||

| Development Pipeline (3) | |||||||||||||||||||||||||||||

| Estimated Project Costs (in thousands) | $245,900 | $199,900 | $427,900 | $427,900 | $565,600 | $565,600 | $565,600 | $565,600 | $565,600 | ||||||||||||||||||||

| Estimated Project Costs/ Total Undepreciated Assets | 4.7 | % | 3.8 | % | 5.5 | % | 5.4 | % | 6.9 | % | 6.9 | % | 7.1 | % | 7.0 | % | 7.0 | % | |||||||||||

| Market Capitalization (4) | |||||||||||||||||||||||||||||

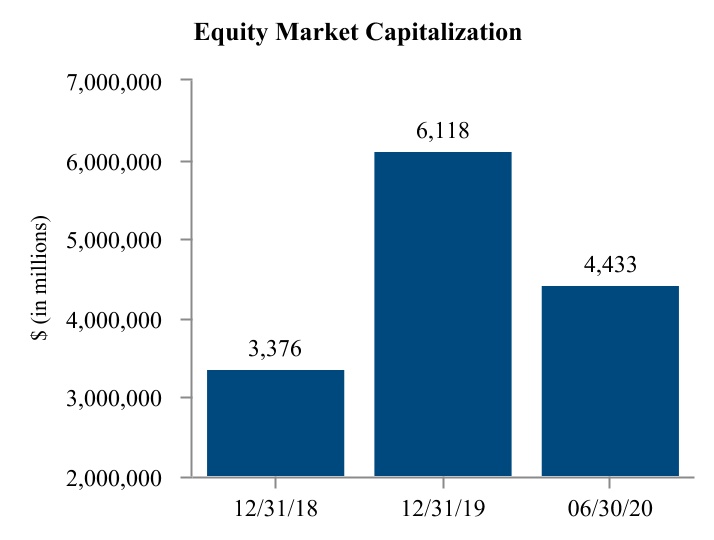

| Common Stock Price (period end) | $31.60 | $38.64 | $36.17 | $37.59 | $41.20 | $41.20 | $29.27 | $29.83 | $29.83 | ||||||||||||||||||||

| Common Stock/Units Outstanding (period end in thousands) | 106,840 | 106,890 | 148,507 | 148,506 | 148,506 | 148,506 | 148,565 | 148,593 | 148,593 | ||||||||||||||||||||

| Equity Market Capitalization (in thousands) | $3,376,144 | $4,130,230 | $5,371,498 | $5,582,341 | $6,118,447 | $6,118,447 | $4,348,498 | $4,432,529 | $4,432,529 | ||||||||||||||||||||

| Debt (in thousands) | 1,234,016 | 1,287,164 | 2,007,663 | 2,023,136 | 2,305,494 | 2,305,494 | 2,036,955 | 2,038,271 | 2,038,271 | ||||||||||||||||||||

| Total Market Capitalization (in thousands) | $4,610,152 | $5,417,403 | $7,379,161 | $7,605,477 | $8,423,941 | $8,423,941 | $6,385,453 | $6,470,800 | $6,470,800 | ||||||||||||||||||||

| Cousins Properties | 8 | Q2 2020 Supplemental Information | ||||||

| KEY PERFORMANCE METRICS | ||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| Credit Ratios (4) | |||||||||||||||||||||||||||||

| Net Debt/Total Market Capitalization | 26.5 | % | 23.4 | % | 26.8 | % | 26.2 | % | 27.1 | % | 27.1 | % | 29.8 | % | 30.9 | % | 30.9 | % | |||||||||||

| Net Debt/Total Undepreciated Assets | 24.0 | % | 24.1 | % | 25.5 | % | 25.2 | % | 27.8 | % | 27.8 | % | 24.0 | % | 24.9 | % | 24.9 | % | |||||||||||

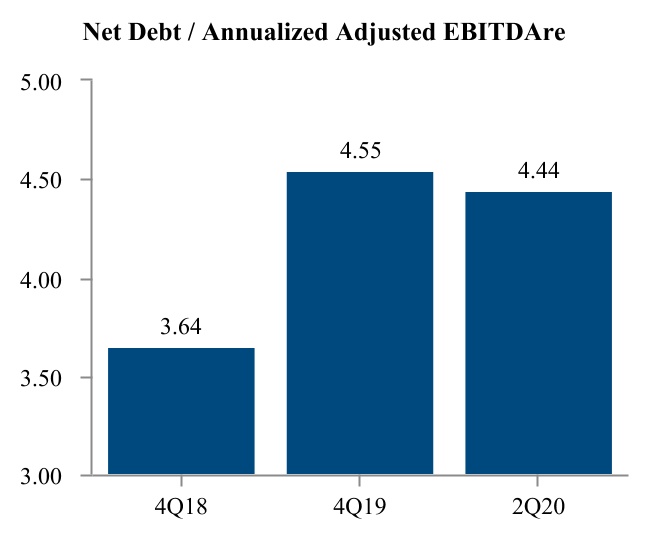

Net Debt/Annualized Adjusted EBITDAre (5) | 3.64 | 3.26 | 5.15 | 4.02 | 4.55 | 4.55 | 3.66 | 4.44 | 4.44 | ||||||||||||||||||||

Fixed Charges Coverage (Adjusted EBITDAre) | 5.46 | 6.08 | 5.58 | 6.21 | 5.91 | 5.95 | 6.22 | 5.95 | 6.09 | ||||||||||||||||||||

| Dividend Information (4) | |||||||||||||||||||||||||||||

| Common Dividend per Share | $1.04 | $0.29 | $0.29 | $0.29 | $0.29 | $1.16 | $0.30 | $0.30 | $0.60 | ||||||||||||||||||||

| Funds From Operations (FFO) Payout Ratio before Transaction Costs | 40.8 | % | 36.1 | % | 52.1 | % | 39.7 | % | 39.3 | % | 41.4 | % | 39.4 | % | 45.5 | % | 42.2 | % | |||||||||||

| Funds Available for Distribution (FAD) Payout Ratio | 61.2 | % | 56.4 | % | 131.6 | % | 53.9 | % | 60.8 | % | 67.2 | % | 59.7 | % | 77.4 | % | 67.4 | % | |||||||||||

| Operations Ratio (4) | |||||||||||||||||||||||||||||

Annualized General and Administrative Expenses/Total Undepreciated Assets | 0.43 | % | 0.87 | % | 0.43 | % | 0.30 | % | 0.55 | % | 0.45 | % | 0.28 | % | 0.43 | % | 0.35 | % | |||||||||||

| Additional Information (4) (in thousands, except per square foot amounts) | |||||||||||||||||||||||||||||

| In-Place Gross Rent (per square foot) (6) | $36.41 | $36.95 | $36.98 | $37.26 | $37.44 | $37.44 | $39.29 | $39.48 | $39.48 | ||||||||||||||||||||

Straight Line Rental Revenue | $26,017 | $8,732 | $6,068 | $6,522 | $8,123 | $29,445 | $9,895 | $11,238 | $21,133 | ||||||||||||||||||||

Above and Below Market Rents Amortization | $6,877 | $1,670 | $1,981 | $3,042 | $2,846 | $9,539 | $2,808 | $2,737 | $5,545 | ||||||||||||||||||||

Second Generation Capital Expenditures | $56,667 | $8,074 | $40,604 | $18,946 | $23,085 | $90,709 | $23,817 | $25,716 | $49,533 | ||||||||||||||||||||

(1) See Office Leasing Activity on page 20 for additional detail and explanations.

(2) Same Property Information is derived from the pool of office properties, as defined, in the period originally reported. See Same Property Performance on page 18 and Non-GAAP Financial Measures - Calculations and Reconciliations on page 37 for additional information.

(3) Cousins' share of estimated project costs. See Development Pipeline on page 26 for additional detail.

(4) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 32.

(5) Given the timing of the closing of the TIER transaction, the actual calculation of this ratio was temporarily high for the second quarter of 2019 and decreased when a full quarter of TIER operations were included in EBITDAre. Second quarter 2019 EBITDAre, annualized for the calculation, included 17 days of Legacy TIER operations while the total impact of the TIER transaction was included in net debt as of June 30, 2019.

(6) In-place gross rent equals the annualized cash basis base rent including tenant's share of estimated operating expenses, if applicable, as of the end of the period divided by occupied square feet.

| Cousins Properties | 9 | Q2 2020 Supplemental Information | ||||||

| KEY PERFORMANCE METRICS | ||||||||

(1) Office properties only.

Note: See additional information included herein for calculations, definitions, and reconciliations to GAAP financial measures.

| Cousins Properties | 10 | Q2 2020 Supplemental Information | ||||||

| FUNDS FROM OPERATIONS - SUMMARY (1) | ||||||||

| (amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| Net Operating Income | $ | 326,063 | $ | 87,731 | $ | 97,417 | $ | 120,642 | $ | 126,000 | $ | 431,790 | $ | 127,782 | $ | 117,132 | $ | 244,914 | |||||||||||

| Gain on Sales of Undepreciated Investment Properties | 3,291 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | 1,335 | — | 1,335 | ||||||||||||||||||||

| Fee Income | 10,089 | 8,728 | 7,075 | 7,495 | 5,220 | 28,518 | 4,732 | 4,689 | 9,421 | ||||||||||||||||||||

| Other Income | 3,678 | 748 | 306 | 3,671 | 3,136 | 7,861 | 2,994 | 726 | 3,720 | ||||||||||||||||||||

| Reimbursed Expenses | (3,782) | (932) | (1,047) | (1,290) | (735) | (4,004) | (521) | (322) | (843) | ||||||||||||||||||||

| General and Administrative Expenses | (22,040) | (11,460) | (8,374) | (5,852) | (11,321) | (37,007) | (5,652) | (8,543) | (14,195) | ||||||||||||||||||||

| Interest Expense | (45,886) | (12,574) | (13,692) | (16,377) | (17,058) | (59,701) | (16,554) | (14,543) | (31,097) | ||||||||||||||||||||

| Other Expenses | (1,642) | (404) | (50,699) | (1,658) | (2,286) | (55,047) | (1,188) | (1,007) | (2,195) | ||||||||||||||||||||

| Depreciation and Amortization of Non-Real Estate Assets | (1,872) | (456) | (454) | (443) | (446) | (1,799) | (207) | (173) | (380) | ||||||||||||||||||||

| FFO (1) | $ | 267,899 | $ | 84,513 | $ | 31,869 | $ | 106,209 | $ | 106,202 | $ | 328,793 | $ | 112,721 | $ | 97,959 | $ | 210,680 | |||||||||||

| TIER transaction costs | — | 3 | 49,827 | 1,048 | 1,999 | 52,877 | 365 | 63 | 428 | ||||||||||||||||||||

| FFO before TIER transaction costs | $ | 267,899 | $ | 84,516 | $ | 81,696 | $ | 107,257 | $ | 108,201 | $ | 381,670 | $ | 113,086 | $ | 98,022 | $ | 211,108 | |||||||||||

| Weighted Average Shares - Diluted | 106,868 | 106,901 | 114,670 | 148,530 | 148,534 | 129,831 | 148,561 | 148,580 | 148,570 | ||||||||||||||||||||

| FFO per Share (1) | $ | 2.51 | $ | 0.79 | $ | 0.28 | $ | 0.72 | $ | 0.72 | $ | 2.53 | $ | 0.76 | $ | 0.66 | $ | 1.42 | |||||||||||

| FFO per Share before TIER transaction costs | $ | 2.51 | $ | 0.79 | $ | 0.71 | $ | 0.72 | $ | 0.73 | $ | 2.94 | $ | 0.76 | $ | 0.66 | $ | 1.42 | |||||||||||

(1) See pages 32 and 35 for reconciliations of Funds From Operations to net income available to common shareholders.

| Cousins Properties | 11 | Q2 2020 Supplemental Information | ||||||

| FUNDS FROM OPERATIONS - DETAIL (1) | ||||||||

| (amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| Net Operating Income | |||||||||||||||||||||||||||||

| Consolidated Properties | |||||||||||||||||||||||||||||

| The Domain (2) | $ | — | $ | — | $ | 1,881 | $ | 8,926 | $ | 9,138 | $ | 19,945 | $ | 9,068 | $ | 9,475 | $ | 18,543 | |||||||||||

| Spring & 8th (2) | 21,450 | 7,218 | 7,385 | 7,392 | 7,374 | 29,369 | 7,351 | 7,255 | 14,606 | ||||||||||||||||||||

| Northpark (2) | 24,418 | 6,463 | 6,039 | 6,521 | 6,249 | 25,272 | 6,916 | 6,983 | 13,899 | ||||||||||||||||||||

| Terminus (2) (3) | — | — | — | — | 7,330 | 7,330 | 6,949 | 6,899 | 13,848 | ||||||||||||||||||||

| Corporate Center (2) | 23,946 | 6,386 | 6,785 | 6,619 | 6,694 | 26,484 | 6,157 | 5,928 | 12,085 | ||||||||||||||||||||

| Hayden Ferry (2) | 23,465 | 5,945 | 6,154 | 5,721 | 6,118 | 23,938 | 6,321 | 5,676 | 11,997 | ||||||||||||||||||||

| Bank of America Plaza | — | — | 933 | 5,103 | 4,569 | 10,605 | 5,323 | 5,028 | 10,351 | ||||||||||||||||||||

| Fifth Third Center | 19,130 | 4,735 | 4,503 | 4,408 | 4,347 | 17,993 | 4,573 | 4,791 | 9,364 | ||||||||||||||||||||

| BriarLake Plaza (2) | — | — | 852 | 4,623 | 4,742 | 10,217 | 4,681 | 4,367 | 9,048 | ||||||||||||||||||||

| One Eleven Congress | 16,218 | 4,446 | 4,515 | 4,203 | 4,215 | 17,379 | 4,396 | 4,496 | 8,892 | ||||||||||||||||||||

| Promenade | 16,502 | 4,788 | 4,708 | 4,353 | 4,510 | 18,359 | 4,506 | 3,950 | 8,456 | ||||||||||||||||||||

| 3344 Peachtree | 12,182 | 3,142 | 3,328 | 3,345 | 3,488 | 13,303 | 5,267 | 2,966 | 8,233 | ||||||||||||||||||||

| The Terrace (2) | — | — | 749 | 3,617 | 3,945 | 8,311 | 3,988 | 3,998 | 7,986 | ||||||||||||||||||||

| San Jacinto Center | 14,652 | 3,665 | 3,679 | 3,637 | 3,612 | 14,593 | 3,617 | 4,290 | 7,907 | ||||||||||||||||||||

| Burnett Plaza | — | — | 710 | 3,556 | 3,963 | 8,229 | 3,631 | 3,649 | 7,280 | ||||||||||||||||||||

| Colorado Tower | 13,773 | 3,480 | 3,483 | 3,502 | 3,526 | 13,991 | 3,350 | 3,303 | 6,653 | ||||||||||||||||||||

| Buckhead Plaza (2) | 16,851 | 4,047 | 3,968 | 3,765 | 3,299 | 15,079 | 3,617 | 2,783 | 6,400 | ||||||||||||||||||||

| NASCAR Plaza | 10,334 | 2,538 | 2,494 | 2,586 | 2,682 | 10,300 | 2,750 | 2,655 | 5,405 | ||||||||||||||||||||

| 816 Congress | 11,656 | 3,290 | 2,879 | 2,969 | 2,709 | 11,847 | 2,636 | 2,754 | 5,390 | ||||||||||||||||||||

| 3350 Peachtree | 7,633 | 2,011 | 2,345 | 2,329 | 2,272 | 8,957 | 2,450 | 2,849 | 5,299 | ||||||||||||||||||||

| Legacy Union One | — | — | 450 | 2,360 | 2,347 | 5,157 | 2,400 | 2,396 | 4,796 | ||||||||||||||||||||

| 1200 Peachtree | — | 775 | 2,318 | 2,332 | 2,266 | 7,691 | 2,332 | 2,318 | 4,650 | ||||||||||||||||||||

| Tempe Gateway | 7,934 | 2,165 | 1,757 | 1,785 | 2,043 | 7,750 | 2,084 | 1,835 | 3,919 | ||||||||||||||||||||

| 8000 Avalon | 5,432 | 1,714 | 1,916 | 1,899 | 1,879 | 7,408 | 1,759 | 1,867 | 3,626 | ||||||||||||||||||||

| 3348 Peachtree | 5,720 | 1,527 | 1,499 | 1,598 | 1,543 | 6,167 | 1,502 | 1,309 | 2,811 | ||||||||||||||||||||

| 111 West Rio | 5,477 | 1,381 | 1,380 | 1,407 | 1,391 | 5,559 | 1,388 | 1,411 | 2,799 | ||||||||||||||||||||

| Domain Point (2) | — | — | 348 | 1,571 | 1,139 | 3,058 | 1,187 | 1,435 | 2,622 | ||||||||||||||||||||

| 5950 Sherry Lane | — | — | 220 | 1,056 | 1,040 | 2,316 | 1,239 | 1,184 | 2,423 | ||||||||||||||||||||

| The Pointe | 4,815 | 1,255 | 1,235 | 1,260 | 1,339 | 5,089 | 1,192 | 1,230 | 2,422 | ||||||||||||||||||||

| Research Park V | 4,066 | 1,031 | 1,023 | 1,006 | 1,027 | 4,087 | 1,029 | 1,029 | 2,058 | ||||||||||||||||||||

| Meridian Mark Plaza | 3,849 | 1,018 | 1,163 | 1,104 | 1,085 | 4,370 | 1,067 | 846 | 1,913 | ||||||||||||||||||||

| Harborview Plaza | 1,753 | 346 | 553 | 431 | 683 | 2,013 | 795 | 840 | 1,635 | ||||||||||||||||||||

| Other (4) | 25,919 | 6,492 | 6,786 | 6,621 | 7,312 | 27,211 | 6,226 | 1,144 | 7,370 | ||||||||||||||||||||

| Subtotal - Consolidated | 297,175 | 79,858 | 88,038 | 111,605 | 119,876 | 399,377 | 121,747 | 112,939 | 234,686 | ||||||||||||||||||||

| Cousins Properties | 12 | Q1 2020 Supplemental Information | ||||||

| FUNDS FROM OPERATIONS - DETAIL (1) | ||||||||

| (amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| Unconsolidated Properties (5) | |||||||||||||||||||||||||||||

| Dimensional Place | — | 206 | 1,770 | 1,912 | 1,873 | 5,761 | 1,900 | 1,955 | 3,855 | ||||||||||||||||||||

| Carolina Square (2) | 3,823 | 1,097 | 1,053 | 1,009 | 1,208 | 4,367 | 1,255 | 1,210 | 2,465 | ||||||||||||||||||||

| Emory University Hospital Midtown | 4,024 | 1,027 | 1,036 | 1,072 | 1,104 | 4,239 | 1,078 | 962 | 2,040 | ||||||||||||||||||||

| Terminus (2) (3) | 13,501 | 3,670 | 3,662 | 3,216 | — | 10,548 | — | — | — | ||||||||||||||||||||

| Other (4) | 7,540 | 1,873 | 1,858 | 1,828 | 1,939 | 7,498 | 1,802 | 66 | 1,868 | ||||||||||||||||||||

| Subtotal - Unconsolidated | 28,888 | 7,873 | 9,379 | 9,037 | 6,124 | 32,413 | 6,035 | 4,193 | 10,228 | ||||||||||||||||||||

| Total Net Operating Income (1) | 326,063 | 87,731 | 97,417 | 120,642 | 126,000 | 431,790 | 127,782 | 117,132 | 244,914 | ||||||||||||||||||||

| Gain on Sales of Undepreciated Investment Properties | |||||||||||||||||||||||||||||

| Sales Less Cost of Sales - Consolidated | 512 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | — | — | — | ||||||||||||||||||||

| Sales Less Cost of Sales - Unconsolidated (5) | 2,779 | — | — | — | — | — | 1,335 | — | 1,335 | ||||||||||||||||||||

| Total Gain on Sales of Undepreciated Investment Properties | 3,291 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | 1,335 | — | 1,335 | ||||||||||||||||||||

| Fee Income | |||||||||||||||||||||||||||||

| Development Fees | 2,935 | 7,022 | 5,112 | 5,670 | 4,254 | 22,058 | 3,835 | 3,846 | 7,681 | ||||||||||||||||||||

| Management Fees (6) | 5,911 | 1,379 | 1,548 | 1,824 | 966 | 5,717 | 762 | 843 | 1,605 | ||||||||||||||||||||

| Leasing & Other Fees | 1,243 | 327 | 415 | 1 | — | 743 | 135 | — | 135 | ||||||||||||||||||||

| Total Fee Income | 10,089 | 8,728 | 7,075 | 7,495 | 5,220 | 28,518 | 4,732 | 4,689 | 9,421 | ||||||||||||||||||||

| Other Income | |||||||||||||||||||||||||||||

| Termination Fees | 1,548 | 520 | 190 | 3,575 | 2,942 | 7,227 | 2,844 | 539 | 3,383 | ||||||||||||||||||||

| Termination Fees - Unconsolidated (5) | — | 3 | 4 | 9 | — | 16 | 1 | 2 | 3 | ||||||||||||||||||||

| Interest and Other Income | 1,722 | 140 | 11 | 3 | 92 | 246 | 37 | 126 | 163 | ||||||||||||||||||||

| Interest and Other Income - Unconsolidated (5) | 315 | 85 | 101 | 84 | 102 | 372 | 112 | 59 | 171 | ||||||||||||||||||||

| Gain on Extinguishment of Debt | 93 | — | — | — | — | — | — | — | — | ||||||||||||||||||||

| Total Other Income | 3,678 | 748 | 306 | 3,671 | 3,136 | 7,861 | 2,994 | 726 | 3,720 | ||||||||||||||||||||

| Total Fee and Other Income | 13,767 | 9,476 | 7,381 | 11,166 | 8,356 | 36,379 | 7,726 | 5,415 | 13,141 | ||||||||||||||||||||

| Reimbursed Expenses | (3,782) | (932) | (1,047) | (1,290) | (735) | (4,004) | (521) | (322) | (843) | ||||||||||||||||||||

| General and Administrative Expenses | (22,040) | (11,460) | (8,374) | (5,852) | (11,321) | (37,007) | (5,652) | (8,543) | (14,195) | ||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Consolidated Debt | |||||||||||||||||||||||||||||

| 2019 Senior Notes, Unsecured ($275M) | — | — | (366) | (2,744) | (2,743) | (5,853) | (2,744) | (2,744) | (5,488) | ||||||||||||||||||||

| 2017 Senior Notes, Unsecured ($250M) | (9,958) | (2,490) | (2,489) | (2,490) | (2,489) | (9,958) | (2,489) | (2,490) | (4,979) | ||||||||||||||||||||

| 2019 Senior Notes, Unsecured ($250M) | — | — | (326) | (2,440) | (2,441) | (5,207) | (2,441) | (2,441) | (4,882) | ||||||||||||||||||||

| Credit Facility, Unsecured | (3,023) | (1,289) | (1,705) | (1,628) | (2,703) | (7,325) | (3,081) | (773) | (3,854) | ||||||||||||||||||||

| Term Loan, Unsecured | (8,495) | (2,422) | (2,421) | (2,302) | (2,049) | (9,194) | (1,891) | (1,190) | (3,081) | ||||||||||||||||||||

| Terminus (2) (3) | — | — | — | — | (1,540) | (1,540) | (1,526) | (1,511) | (3,037) | ||||||||||||||||||||

| 2019 Senior Notes, Unsecured ($125M) | — | — | (160) | (1,197) | (1,197) | (2,554) | (1,197) | (1,197) | (2,394) | ||||||||||||||||||||

| Fifth Third Center | (4,951) | (1,221) | (1,215) | (1,208) | (1,202) | (4,846) | (1,194) | (1,188) | (2,382) | ||||||||||||||||||||

| 2017 Senior Notes, Unsecured ($100M) | (4,145) | (1,036) | (1,037) | (1,036) | (1,036) | (4,145) | (1,036) | (1,037) | (2,073) | ||||||||||||||||||||

| Promenade | (4,360) | (1,069) | (1,060) | (1,052) | (1,043) | (4,224) | (1,034) | (1,025) | (2,059) | ||||||||||||||||||||

| Colorado Tower | (4,233) | (1,051) | (1,046) | (1,040) | (1,036) | (4,173) | (1,030) | (1,026) | (2,056) | ||||||||||||||||||||

| Cousins Properties | 13 | Q2 2020 Supplemental Information | ||||||

| FUNDS FROM OPERATIONS - DETAIL (1) | ||||||||

| (amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | 2020 1st | 2020 2nd | YTD 2020 | |||||||||||||||||||||

| 816 Congress | (3,173) | (784) | (779) | (776) | (772) | (3,111) | (768) | (763) | (1,531) | ||||||||||||||||||||

| Legacy Union One | — | — | (98) | (536) | (535) | (1,169) | (528) | (527) | (1,055) | ||||||||||||||||||||

| Other (4) | (1,994) | (473) | (473) | (469) | (468) | (1,883) | (254) | (40) | (294) | ||||||||||||||||||||

| Capitalized (7) | 4,902 | 1,015 | 1,116 | 4,218 | 4,870 | 11,219 | 5,309 | 3,959 | 9,268 | ||||||||||||||||||||

| Subtotal - Consolidated | (39,430) | (10,820) | (12,059) | (14,700) | (16,384) | (53,963) | (15,904) | (13,993) | (29,897) | ||||||||||||||||||||

| Unconsolidated Debt (5) | |||||||||||||||||||||||||||||

| Terminus (2) (3) | (3,976) | (1,038) | (905) | (961) | — | (2,904) | — | — | — | ||||||||||||||||||||

| Carolina Square (2) | (1,223) | (406) | (420) | (409) | (370) | (1,605) | (347) | (249) | (596) | ||||||||||||||||||||

| Emory University Hospital Midtown | (1,257) | (310) | (308) | (307) | (304) | (1,229) | (303) | (301) | (604) | ||||||||||||||||||||

| Subtotal - Unconsolidated | (6,456) | (1,754) | (1,633) | (1,677) | (674) | (5,738) | (650) | (550) | (1,200) | ||||||||||||||||||||

| Total Interest Expense | (45,886) | (12,574) | (13,692) | (16,377) | (17,058) | (59,701) | (16,554) | (14,543) | (31,097) | ||||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||||||||

| Severance | (60) | (23) | (23) | (84) | (24) | (154) | (51) | (17) | (68) | ||||||||||||||||||||

| Partners' Share of FFO in Consolidated Joint Ventures | (558) | (171) | (192) | (249) | (221) | (833) | (213) | (342) | (555) | ||||||||||||||||||||

| Property Taxes and Other Holding Costs | (583) | (184) | (209) | (392) | (290) | (1,075) | (356) | (380) | (736) | ||||||||||||||||||||

| Loss on Extinguishment of Debt | (85) | — | — | — | — | — | — | — | — | ||||||||||||||||||||

| Income Tax Expense | — | — | (242) | 242 | 298 | 298 | (50) | 50 | — | ||||||||||||||||||||

| Predevelopment & Other Costs | (108) | (23) | (206) | (127) | (46) | (402) | (153) | (255) | (408) | ||||||||||||||||||||

| Transaction Costs - TIER | — | (3) | (49,827) | (1,048) | (1,999) | (52,877) | (365) | (63) | (428) | ||||||||||||||||||||

| Transaction/Acquisition Costs - Other | (248) | — | — | — | (4) | (4) | — | — | — | ||||||||||||||||||||

| Total Other Expenses | (1,642) | (404) | (50,699) | (1,658) | (2,286) | (55,047) | (1,188) | (1,007) | (2,195) | ||||||||||||||||||||

| Depreciation and Amortization of Non-Real Estate Assets | (1,872) | (456) | (454) | (443) | (446) | (1,799) | (207) | (173) | (380) | ||||||||||||||||||||

| FFO (1) | $ | 267,899 | $ | 84,513 | $ | 31,869 | $ | 106,209 | $ | 106,202 | $ | 328,793 | $ | 112,721 | $ | 97,959 | $ | 210,680 | |||||||||||

| TIER transaction costs | — | 3 | 49,827 | 1,048 | 1,999 | 52,877 | 365 | 63 | 428 | ||||||||||||||||||||

| FFO before TIER transaction costs | $ | 267,899 | $ | 84,516 | $ | 81,696 | $ | 107,257 | $ | 108,201 | $ | 381,670 | $ | 113,086 | $ | 98,022 | $ | 211,108 | |||||||||||

| Weighted Average Shares - Diluted | 106,868 | 106,901 | 114,670 | 148,530 | 148,534 | 129,831 | 148,561 | 148,580 | 148,570 | ||||||||||||||||||||

| FFO per Share (1) | $ | 2.51 | $ | 0.79 | $ | 0.28 | $ | 0.72 | $ | 0.72 | $ | 2.53 | $ | 0.76 | $ | 0.66 | $ | 1.42 | |||||||||||

| FFO per Share before TIER transaction costs | $ | 2.51 | $ | 0.79 | $ | 0.71 | $ | 0.72 | $ | 0.73 | $ | 2.94 | $ | 0.76 | $ | 0.66 | $ | 1.42 | |||||||||||

| Note: Amounts may differ slightly from other schedules contained herein due to rounding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 32. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Contains multiple buildings that are grouped together for reporting purposes. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) On October 1, 2019, the Company purchased its partner's 50% interest in Terminus Office Holdings LLC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Primarily represents properties sold and loans repaid prior to March 31, 2020 that are not considered discontinued operations. The Company sold the Hearst Tower and Woodcrest operating properties and its interest in the Gateway Village unconsolidated joint venture in the first quarter of 2020. Includes preliminary operational activity at 120 West Trinity and 10000 Avalon, which are in the final stages of development. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Unconsolidated amounts include amounts recorded in unconsolidated joint ventures for the respective category multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes including these amounts in the categories indicated is meaningful to investors and analysts. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) Management Fees include reimbursement of expenses that are included in the "Reimbursed Expenses" line item. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (7) Amounts of interest expense related to consolidated debt that is capitalized to consolidated development projects and equity in unconsolidated development projects. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cousins Properties | 14 | Q2 2020 Supplemental Information | ||||||

| PORTFOLIO STATISTICS | ||||||||

| Office Properties | Rentable Square Feet | Financial Statement Presentation | Company's Ownership Interest | End of Period Leased | Weighted Average Occupancy (1) | % of Total Net Operating Income (2) | Property Level Debt ($000) (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q20 | 1Q20 | 2Q20 | 1Q20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Spring & 8th (4) | 765,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 6.2% | $ | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Northpark (4) | 1,539,000 | Consolidated | 100% | 93.3% | 93.1% | 92.2% | 88.5% | 6.0% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Terminus (4) (5) | 1,226,000 | Consolidated | 100% | 83.5% | 83.5% | 80.5% | 78.2% | 5.9% | 199,427 | |||||||||||||||||||||||||||||||||||||||||||||||

| Promenade | 777,000 | Consolidated | 100% | 90.7% | 90.5% | 90.1% | 89.6% | 3.5% | 94,176 | |||||||||||||||||||||||||||||||||||||||||||||||

| 3344 Peachtree | 484,000 | Consolidated | 100% | 97.1% | 97.1% | 86.5% | 86.4% | 2.5% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| 3350 Peachtree | 413,000 | Consolidated | 100% | 95.2% | 95.2% | 95.2% | 95.2% | 2.4% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Buckhead Plaza (4) | 667,000 | Consolidated | 100% | 74.8% | 77.5% | 75.0% | 72.6% | 2.4% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| 1200 Peachtree (5) | 370,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 2.0% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| 8000 Avalon | 229,000 | Consolidated | 90% | 97.8% | 100.0% | 99.3% | 100.0% | 1.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| 3348 Peachtree | 258,000 | Consolidated | 100% | 91.0% | 92.3% | 91.0% | 91.7% | 1.1% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Emory University Hospital Midtown | 358,000 | Unconsolidated | 50% | 99.2% | 98.3% | 97.1% | 97.7% | 0.8% | 33,568 | |||||||||||||||||||||||||||||||||||||||||||||||

| Meridian Mark Plaza | 160,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 0.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||

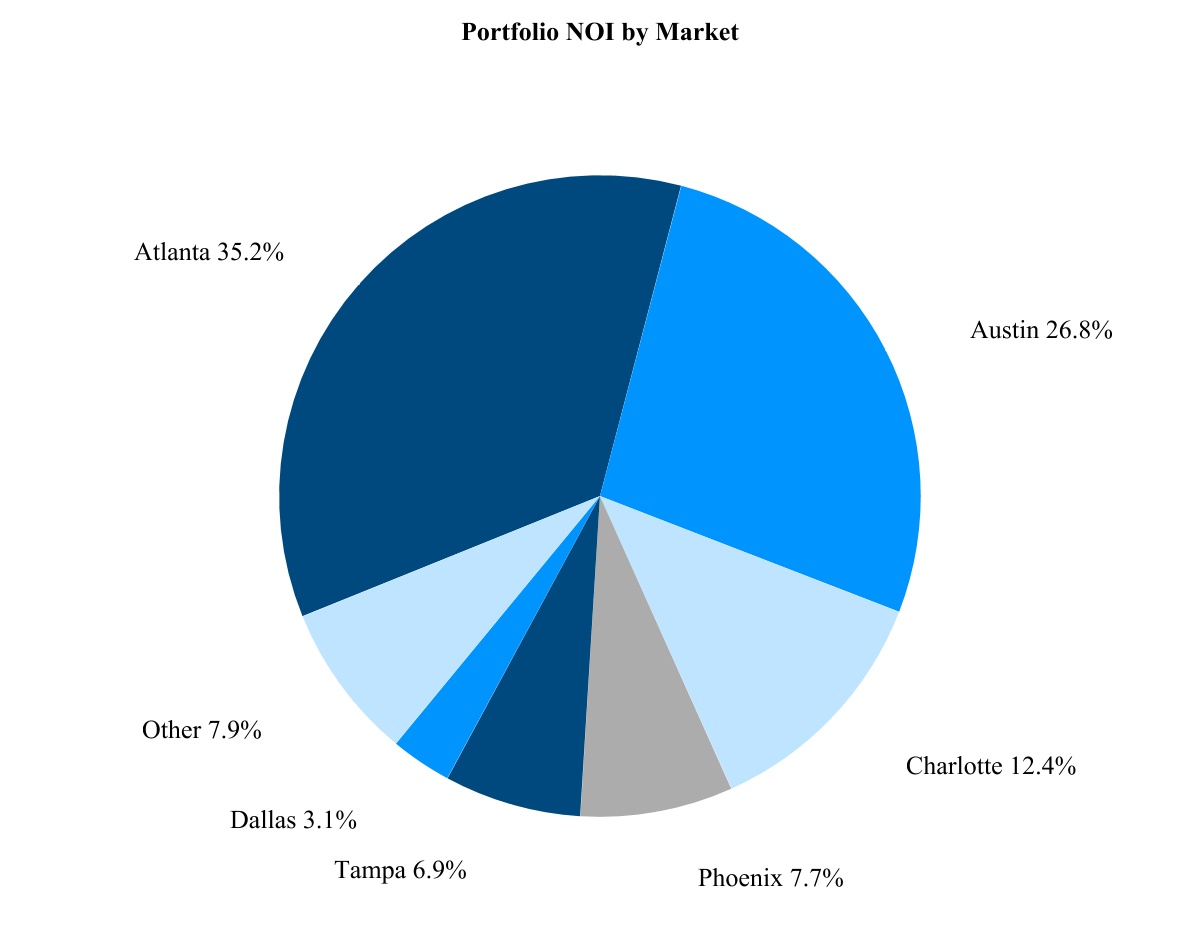

| ATLANTA | 7,246,000 | 91.4% | 91.6% | 89.8% | 88.4% | 35.2% | 327,171 | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Domain (4) (5) | 1,287,000 | Consolidated | 100% | 99.7% | 99.7% | 94.5% | 89.3% | 8.5% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| One Eleven Congress | 519,000 | Consolidated | 100% | 95.0% | 95.0% | 88.2% | 88.8% | 3.9% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| San Jacinto Center | 399,000 | Consolidated | 100% | 96.5% | 96.2% | 91.3% | 87.8% | 3.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| The Terrace (4) (5) | 619,000 | Consolidated | 100% | 88.8% | 89.9% | 86.8% | 86.6% | 3.4% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Colorado Tower | 373,000 | Consolidated | 100% | 97.8% | 97.8% | 96.1% | 98.7% | 2.8% | 115,289 | |||||||||||||||||||||||||||||||||||||||||||||||

| 816 Congress | 435,000 | Consolidated | 100% | 87.5% | 90.2% | 87.6% | 86.3% | 2.4% | 78,762 | |||||||||||||||||||||||||||||||||||||||||||||||

| Domain Point (4) (5) | 243,000 | Consolidated | 96.5% | 90.6% | 90.6% | 88.7% | 76.8% | 1.2% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Research Park V | 173,000 | Consolidated | 100% | 97.1% | 97.1% | 97.1% | 97.1% | 0.9% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| AUSTIN | 4,048,000 | 95.0% | 95.4% | 91.4% | 88.8% | 26.8% | 194,051 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Bank of America Plaza (5) | 891,000 | Consolidated | 100% | 79.9% | 85.6% | 85.2% | 90.3% | 4.3% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Fifth Third Center | 692,000 | Consolidated | 100% | 99.8% | 99.8% | 99.8% | 96.2% | 4.1% | 138,294 | |||||||||||||||||||||||||||||||||||||||||||||||

| NASCAR Plaza | 394,000 | Consolidated | 100% | 99.4% | 100.0% | 98.2% | 99.3% | 2.3% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Dimensional Place (5) | 281,000 | Unconsolidated | 50% | 95.6% | 95.6% | 94.7% | 94.7% | 1.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| CHARLOTTE | 2,258,000 | 91.1% | 93.6% | 93.0% | 94.2% | 12.4% | 138,294 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Hayden Ferry (4) | 789,000 | Consolidated | 100% | 97.8% | 97.8% | 90.3% | 93.5% | 4.9% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Tempe Gateway | 264,000 | Consolidated | 100% | 94.8% | 94.8% | 94.8% | 94.8% | 1.6% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| 111 West Rio | 225,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 1.2% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| PHOENIX | 1,278,000 | 97.6% | 97.6% | 92.9% | 94.9% | 7.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Center (4) | 1,226,000 | Consolidated | 100% | 98.0% | 97.9% | 87.9% | 93.2% | 5.1% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| The Pointe | 253,000 | Consolidated | 100% | 93.6% | 94.4% | 92.9% | 93.4% | 1.1% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Harborview Plaza | 205,000 | Consolidated | 100% | 76.3% | 80.0% | 77.6% | 79.1% | 0.7% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| TAMPA | 1,684,000 | 94.7% | 95.2% | 87.4% | 91.5% | 6.9% | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cousins Properties | 15 | Q2 2020 Supplemental Information | ||||||

| PORTFOLIO STATISTICS | ||||||||

| Office Properties | Rentable Square Feet | Financial Statement Presentation | Company's Ownership Interest | End of Period Leased | Weighted Average Occupancy (1) | % of Total Net Operating Income (2) | Property Level Debt ($000) (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q20 | 1Q20 | 2Q20 | 1Q20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legacy Union One (5) | 319,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 2.1% | 67,796 | |||||||||||||||||||||||||||||||||||||||||||||||

| 5950 Sherry Lane (5) | 197,000 | Consolidated | 100% | 93.1% | 93.1% | 89.9% | 88.7% | 1.0% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| DALLAS | 516,000 | 97.4% | 97.4% | 96.1% | 95.7% | 3.1% | 67,796 | |||||||||||||||||||||||||||||||||||||||||||||||||

| BriarLake Plaza - Houston (4) (5) | 835,000 | Consolidated | 100% | 84.1% | 89.2% | 86.2% | 88.3% | 3.8% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Burnett Plaza - Fort Worth (5) | 1,023,000 | Consolidated | 100% | 87.3% | 87.6% | 87.2% | 86.6% | 3.1% | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Carolina Square - Chapel Hill | 158,000 | Unconsolidated | 50% | 94.5% | 93.3% | 79.5% | 79.5% | 0.3% | 12,879 | |||||||||||||||||||||||||||||||||||||||||||||||

| OTHER OFFICE | 2,016,000 | 86.2% | 88.6% | 86.5% | 87.1% | 7.2% | 12,879 | |||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OFFICE | 19,046,000 | 92.5% | 93.3% | 90.3% | 89.9% | 99.3% | $ | 740,191 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other Properties | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Carolina Square Apartment - Chapel Hill (246 units) | 266,000 | Unconsolidated | 50% | 100.0% | 99.6% | 99.9% | 99.9% | 0.6% | 21,683 | |||||||||||||||||||||||||||||||||||||||||||||||

| Carolina Square Retail - Chapel Hill | 44,000 | Unconsolidated | 50% | 89.8% | 89.3% | 89.8% | 89.8% | 0.1% | 3,587 | |||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OTHER | 310,000 | 98.6% | 98.1% | 98.4% | 98.4% | 0.7% | $ | 25,270 | ||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 19,356,000 | 92.5% | 93.3% | 90.4% | 90.0% | 100.0% | $ | 765,461 | ||||||||||||||||||||||||||||||||||||||||||||||||

| See next page for footnotes | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cousins Properties | 16 | Q2 2020 Supplemental Information | ||||||

| PORTFOLIO STATISTICS | ||||||||

| (1) | Represents the weighted average occupancy of the property over the period for which the property was available for occupancy. | ||||

| (2) | The Company's share of net operating income for the six months ended June 30, 2020. | ||||

| (3) | The Company's share of property specific mortgage debt, including premiums and net of unamortized loan costs, as of June 30, 2020. | ||||

| (4) | Contains two or more buildings that are grouped together for reporting purposes. | ||||

| (5) | Not included in Same Property as of June 30, 2020. | ||||

| Cousins Properties | 17 | Q2 2020 Supplemental Information | ||||||

| SAME PROPERTY PERFORMANCE (1) | ||||||||

| ($ in thousands) | |||||||||||||||||

| Three Months Ended June 30, | |||||||||||||||||

| 2020 | 2019 | % Change | |||||||||||||||

| Rental Property Revenues (2) | $ | 110,204 | $ | 115,182 | (4.3) | % | |||||||||||

| Rental Property Operating Expenses (2) | 37,815 | 41,011 | (7.8) | % | |||||||||||||

| Same Property Net Operating Income | $ | 72,389 | $ | 74,171 | (2.4) | % | |||||||||||

| Cash-Basis Rental Property Revenues (3) | $ | 103,713 | $ | 108,018 | (4.0) | % | |||||||||||

| Cash-Basis Rental Property Operating Expenses (4) | 37,648 | 40,850 | (7.8) | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income | $ | 66,065 | $ | 67,168 | (1.6) | % | |||||||||||

| Add: Payment Deferrals (5) | 1,068 | — | 100.0 | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals (5) | $ | 67,133 | $ | 67,168 | (0.1) | % | |||||||||||

| Less: Parking Net Operating Income | (5,220) | (7,458) | (30.0) | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals and Parking (6) | $ | 61,913 | $ | 59,710 | 3.7 | % | |||||||||||

| End of Period Leased | 94.4 | % | 93.9 | % | |||||||||||||

| Weighted Average Occupancy | 91.5 | % | 92.0 | % | |||||||||||||

| Six Months Ended June 30, | |||||||||||||||||

| 2020 | 2019 | % Change | |||||||||||||||

| Rental Property Revenues (2) | $ | 225,455 | $ | 230,224 | (2.1) | % | |||||||||||

| Rental Property Operating Expenses (2) | 76,888 | 82,207 | (6.5) | % | |||||||||||||

| Same Property Net Operating Income | $ | 148,567 | $ | 148,017 | 0.4 | % | |||||||||||

| Cash-Basis Rental Property Revenues (3) | $ | 213,712 | $ | 212,850 | 0.4 | % | |||||||||||

| Cash-Basis Rental Property Operating Expenses (4) | 76,555 | 81,880 | (6.5) | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income | $ | 137,157 | $ | 130,970 | 4.7 | % | |||||||||||

| Add: Payment Deferrals (5) | 1,068 | — | 100.0 | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals (5) | $ | 138,225 | $ | 130,970 | 5.5 | % | |||||||||||

| Less: Parking Net Operating Income | (12,887) | (15,028) | (14.2) | % | |||||||||||||

| Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals and Parking (6) | $ | 125,338 | $ | 115,942 | 8.1 | % | |||||||||||

| Weighted Average Occupancy | 91.5 | % | 92.0 | % | |||||||||||||

See next page for footnotes

| Cousins Properties | 18 | Q2 2020 Supplemental Information | ||||||

| SAME PROPERTY PERFORMANCE (1) | ||||||||

| (1) | Same Properties include those office properties that were fully operational and owned by the Company for the entirety of the comparable reporting periods. See Portfolio Statistics beginning on page 15 for footnotes indicating which properties are not included in Same Property. See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 32. | ||||||||||

| (2) | Rental Property Revenues and Expenses include results for the Company and its share of unconsolidated joint ventures and exclude termination fee income. Net operating income for unconsolidated joint ventures is calculated as rental property revenues less termination fee income and rental property expenses at the joint ventures multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes that including these amounts with consolidated net operating income is meaningful to investors and analysts. | ||||||||||

| (3) | Cash-Basis Rental Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Revenues, excluding termination fee income, straight-line rents, amortization of lease inducements, and amortization of acquired above and below market rents. | ||||||||||

| (4) | Cash-Basis Rental Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. | ||||||||||

| (5) | As a result of the COVID-19 pandemic, the Company has entered into lease amendments with certain tenants to provide payment deferrals without lease extensions. Management believes that Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals provides analysts and investors with useful information related to the Company's core operations before the impact of certain lease amendments with tenants who have experienced disruptions in their business as a result of the COVID-19 pandemic and allows for comparability of the results of its operations with other real estate companies. | ||||||||||

| (6) | Cash-Basis Same Property Net Operating Income Adjusted for Payment Deferrals and Parking represents Cash-Basis Net Operating Income Adjusted for Payment Deferrals before parking net operating income and is intended to provide analysts and investors with useful information related to the Company's core operations before the impact of significant changes in physical occupancy at the Company's properties as a result of the COVID-19 pandemic, which is materially impacting parking net operating income. | ||||||||||

| Cousins Properties | 19 | Q2 2020 Supplemental Information | ||||||

| OFFICE LEASING ACTIVITY(1) | ||||||||

| Three Months Ended June 30, 2020 | Six Months Ended June 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||

| New | Renewal | Expansion | Total | New | Renewal | Expansion | Total | ||||||||||||||||||||||||||||||||||||||||

| Gross leased (square feet) | 348,574 | 980,664 | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Leases one year or less, amenity leases, percentage rent leases, storage leases, intercompany leases, and license agreements (square feet) | (45,697) | (202,004) | |||||||||||||||||||||||||||||||||||||||||||||

| Net leased (square feet) | 93,262 | 204,549 | 5,066 | 302,877 | 342,756 | 334,871 | 101,033 | 778,660 | |||||||||||||||||||||||||||||||||||||||

| Number of transactions | 6 | 10 | 2 | 18 | 20 | 27 | 10 | 57 | |||||||||||||||||||||||||||||||||||||||

| Lease term (years) (2) | 10.8 | 6.1 | 8.0 | 7.6 | 9.0 | 5.9 | 7.8 | 7.5 | |||||||||||||||||||||||||||||||||||||||

| Net Effective Rent Calculation (per square foot per year) (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net annualized rent (3) | $ | 44.72 | $ | 28.57 | $ | 28.33 | $ | 33.54 | $ | 40.81 | $ | 29.12 | $ | 29.81 | $ | 34.36 | |||||||||||||||||||||||||||||||

| Net free rent | (1.29) | (0.77) | (0.32) | (0.92) | (2.28) | (1.03) | (0.71) | (1.54) | |||||||||||||||||||||||||||||||||||||||

| Leasing commissions | (4.20) | (2.54) | (1.04) | (3.02) | (3.22) | (2.57) | (2.25) | (2.82) | |||||||||||||||||||||||||||||||||||||||

| Tenant improvements | (8.06) | (2.41) | (3.83) | (4.17) | (7.16) | (2.39) | (5.10) | (4.84) | |||||||||||||||||||||||||||||||||||||||

Leasing Costs | (13.55) | (5.72) | (5.19) | (8.11) | (12.66) | (5.99) | (8.06) | (9.20) | |||||||||||||||||||||||||||||||||||||||

| Net effective rent | $ | 31.17 | $ | 22.85 | $ | 23.14 | $ | 25.43 | $ | 28.15 | $ | 23.13 | $ | 21.75 | $ | 25.16 | |||||||||||||||||||||||||||||||

| Second generation leased square footage (4)(5) | 292,635 | 538,437 | |||||||||||||||||||||||||||||||||||||||||||||

| Increase in second generation net rent per square foot (2)(3)(4)(5) | 31.8 | % | 29.6 | % | |||||||||||||||||||||||||||||||||||||||||||

| Increase in cash-basis second generation net rent per square foot (2)(4)(5) | 20.6 | % | 17.7 | % | |||||||||||||||||||||||||||||||||||||||||||

(1) Office leasing activity is comprised of total square feet leased, unadjusted for ownership share, and excluding apartment leasing, retail leasing, and rent deferral/extension agreements related to COVID-19. | |||||||||||||||||||||||||||||||||||||||||||||||

| (2) Weighted average. | |||||||||||||||||||||||||||||||||||||||||||||||

| (3) Straight-line net rent per square foot (operating expenses deducted from gross leases) over the lease term. | |||||||||||||||||||||||||||||||||||||||||||||||

(4) Excludes leases executed for spaces that were vacant upon acquisition, new leases in development properties, and leases for spaces that have been vacant for one year or more. | |||||||||||||||||||||||||||||||||||||||||||||||

(5) Increase in net rent at the end of term paid by the prior tenant compared to net rent at the beginning of term paid by the current tenant. For early renewals, the increase in net rent at the end of term of the original lease is compared to net rent at the beginning of the extended term of the lease. | |||||||||||||||||||||||||||||||||||||||||||||||

| Cousins Properties | 20 | Q2 2020 Supplemental Information | ||||||

| OFFICE LEASE EXPIRATIONS | ||||||||

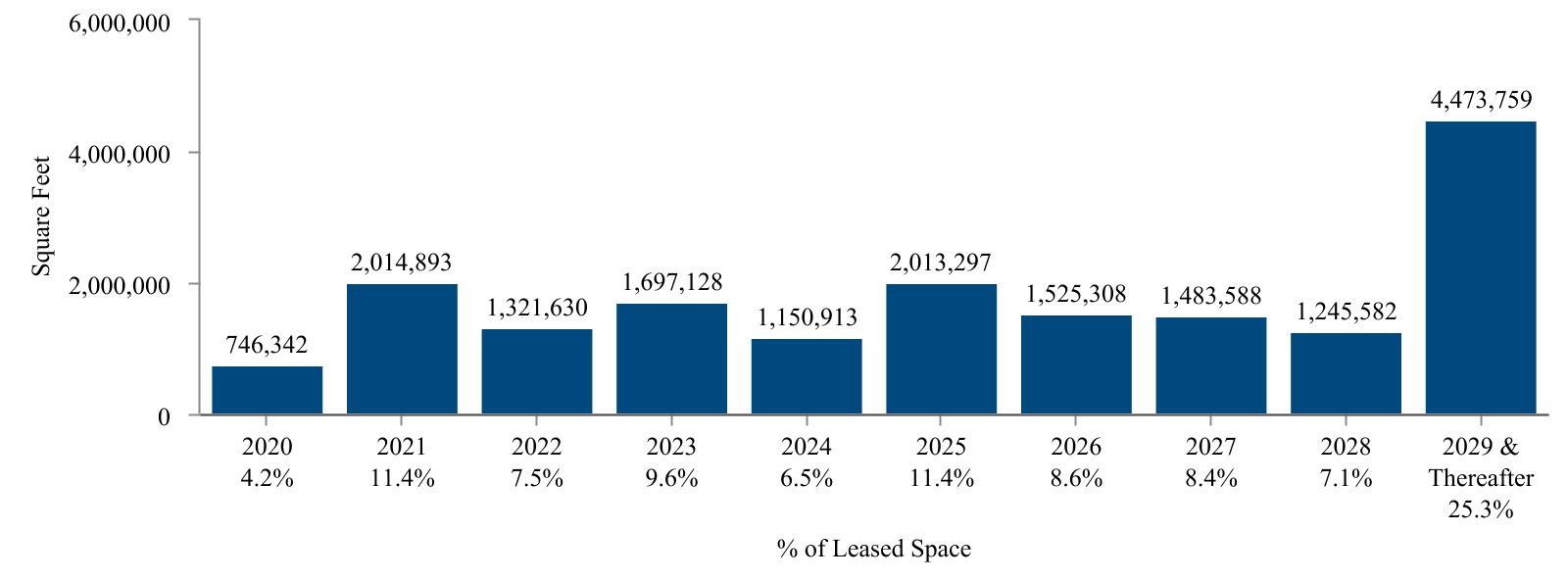

Lease Expirations by Year (1)

| Year of Expiration | Square Feet Expiring | % of Leased Space | Annual Contractual Rent (in thousands) (2) | % of Annual Contractual Rent | Annual Contractual Rent/Sq. Ft. | |||||||||||||||||||||||||||

| 2020 | 746,342 | 4.2 | % | $ | 22,829 | 2.9 | % | $ | 30.59 | |||||||||||||||||||||||

| 2021 | 2,014,893 | 11.4 | % | 75,886 | 9.6 | % | 37.66 | |||||||||||||||||||||||||

| 2022 | 1,321,630 | 7.5 | % | 55,839 | 7.0 | % | 42.25 | |||||||||||||||||||||||||

| 2023 | 1,697,128 | 9.6 | % | 71,942 | 9.1 | % | 42.39 | |||||||||||||||||||||||||

| 2024 | 1,150,913 | 6.5 | % | 47,877 | 6.0 | % | 41.60 | |||||||||||||||||||||||||

| 2025 | 2,013,297 | 11.4 | % | 89,921 | 11.3 | % | 44.66 | |||||||||||||||||||||||||

| 2026 | 1,525,308 | 8.6 | % | 70,902 | 8.9 | % | 46.48 | |||||||||||||||||||||||||

| 2027 | 1,483,588 | 8.4 | % | 62,790 | 7.9 | % | 42.32 | |||||||||||||||||||||||||

| 2028 | 1,245,582 | 7.1 | % | 56,852 | 7.2 | % | 45.64 | |||||||||||||||||||||||||

| 2029 &Thereafter | 4,473,759 | 25.3 | % | 238,758 | 30.1 | % | 53.37 | |||||||||||||||||||||||||

| Total | 17,672,440 | 100.0 | % | $ | 793,596 | 100.0 | % | $ | 44.91 | |||||||||||||||||||||||

| (1) Company's share. | |||||||||||

(2) Annual Contractual Rent is the estimated rent in the year of expiration. It includes the minimum base rent and an estimate of operating expenses, if applicable, as defined in the respective leases. | |||||||||||

| Cousins Properties | 21 | Q2 2020 Supplemental Information | ||||||

| TOP 20 OFFICE TENANTS | ||||||||

| Tenant (1) | Number of Properties Occupied | Number of Markets Occupied | Company's Share of Square Footage | Company's Share of Annualized Rent (2) | Percentage of Company's Share of Annualized Rent | Weighted Average Remaining Lease Term (Years) | |||||||||||||||||||||||||||||||||||

| 1 | NCR Corporation | 1 | 1 | 762,090 | $ | 35,576,091 | 5.3% | 13 | |||||||||||||||||||||||||||||||||

| 2 | Amazon | 4 | 3 | 430,099 | 20,258,684 | 3.0% | 5 | ||||||||||||||||||||||||||||||||||

| 3 | Expedia, Inc. | 1 | 1 | 363,751 | 17,321,799 | 2.6% | 9 | ||||||||||||||||||||||||||||||||||

| 4 | Bank of America | 2 | 1 | 574,485 | 17,076,816 | 2.5% | 3 | ||||||||||||||||||||||||||||||||||

| 5 | Facebook, Inc. | 1 | 1 | 224,400 | 11,671,065 | 1.8% | 8 | ||||||||||||||||||||||||||||||||||

| 6 | Norfolk Southern Corporation | 2 | 1 | 394,621 | 9,716,585 | 1.5% | 2 | ||||||||||||||||||||||||||||||||||

| 7 | Americredit Financial Services (dba GM Financial) | 2 | 2 | 333,782 | 9,132,537 | 1.4% | 10 | ||||||||||||||||||||||||||||||||||

| 8 | Apache Corporation | 1 | 1 | 210,012 | 9,048,341 | 1.4% | 4 | ||||||||||||||||||||||||||||||||||

| 9 | Parsley Energy, L.P. | 1 | 1 | 135,107 | 8,569,705 | 1.3% | 5 | ||||||||||||||||||||||||||||||||||

| 10 | Wells Fargo Bank, NA | 4 | 3 | 198,376 | 8,492,222 | 1.3% | 6 | ||||||||||||||||||||||||||||||||||

| 11 | Ovintiv USA Inc. (fka Encana Oil & Gas (USA) Inc.) (3) | 1 | 1 | 318,582 | 7,831,964 | 1.2% | 7 | ||||||||||||||||||||||||||||||||||

| 12 | ADP, LLC | 1 | 1 | 225,000 | 7,674,312 | 1.1% | 8 | ||||||||||||||||||||||||||||||||||

| 13 | Dimensional Fund Advisors LP | 1 | 1 | 132,434 | 6,871,718 | 1.0% | 14 | ||||||||||||||||||||||||||||||||||

| 14 | McGuirewoods LLP | 3 | 3 | 197,282 | 6,840,507 | 1.0% | 6 | ||||||||||||||||||||||||||||||||||

| 15 | Westrock Shared Services, LLC | 1 | 1 | 208,268 | 6,821,518 | 1.0% | 10 | ||||||||||||||||||||||||||||||||||

| 16 | Regus Equity Business Centers, LLC | 6 | 4 | 146,852 | 6,023,080 | 0.9% | 4 | ||||||||||||||||||||||||||||||||||

| 17 | Samsung Engineering America | 1 | 1 | 133,860 | 6,019,230 | 0.9% | 6 | ||||||||||||||||||||||||||||||||||

| 18 | Anthem | 1 | 1 | 198,834 | 5,917,076 | 0.9% | 1 | ||||||||||||||||||||||||||||||||||

| 19 | Morgan Stanley | 2 | 2 | 130,863 | 5,662,738 | 0.8% | 8 | ||||||||||||||||||||||||||||||||||

| 20 | NASCAR Media Group, LLC | 1 | 1 | 139,861 | 5,638,755 | 0.8% | 1 | ||||||||||||||||||||||||||||||||||

| Total | 5,458,559 | $ | 212,164,743 | 31.7% | 7 | ||||||||||||||||||||||||||||||||||||

| (1) | In some cases, the actual tenant may be an affiliate of the entity shown. | ||||||||||||||||||||||||||||||||||||||||

| (2) | Annualized Rent represents the annualized rent including tenant's share of estimated operating expenses, if applicable, paid by the tenant as of the date of this report. If the tenant is in a free rent period as of the date of this report, Annualized Rent represents the annualized contractual rent the tenant will pay in the first month it is required to pay rent. | ||||||||||||||||||||||||||||||||||||||||

| (3) | Ovintiv USA Inc. has multiple subleases for substantially all of its space. In the event of termination of the Ovintiv lease, such subleases would become direct leases with Cousins. | ||||||||||||||||||||||||||||||||||||||||

| Note: | This schedule includes tenants whose leases have commenced and/or who have taken occupancy. Leases that have been signed but have not commenced are excluded. | ||||||||||||||||||||||||||||||||||||||||

| Cousins Properties | 22 | Q2 2020 Supplemental Information | ||||||

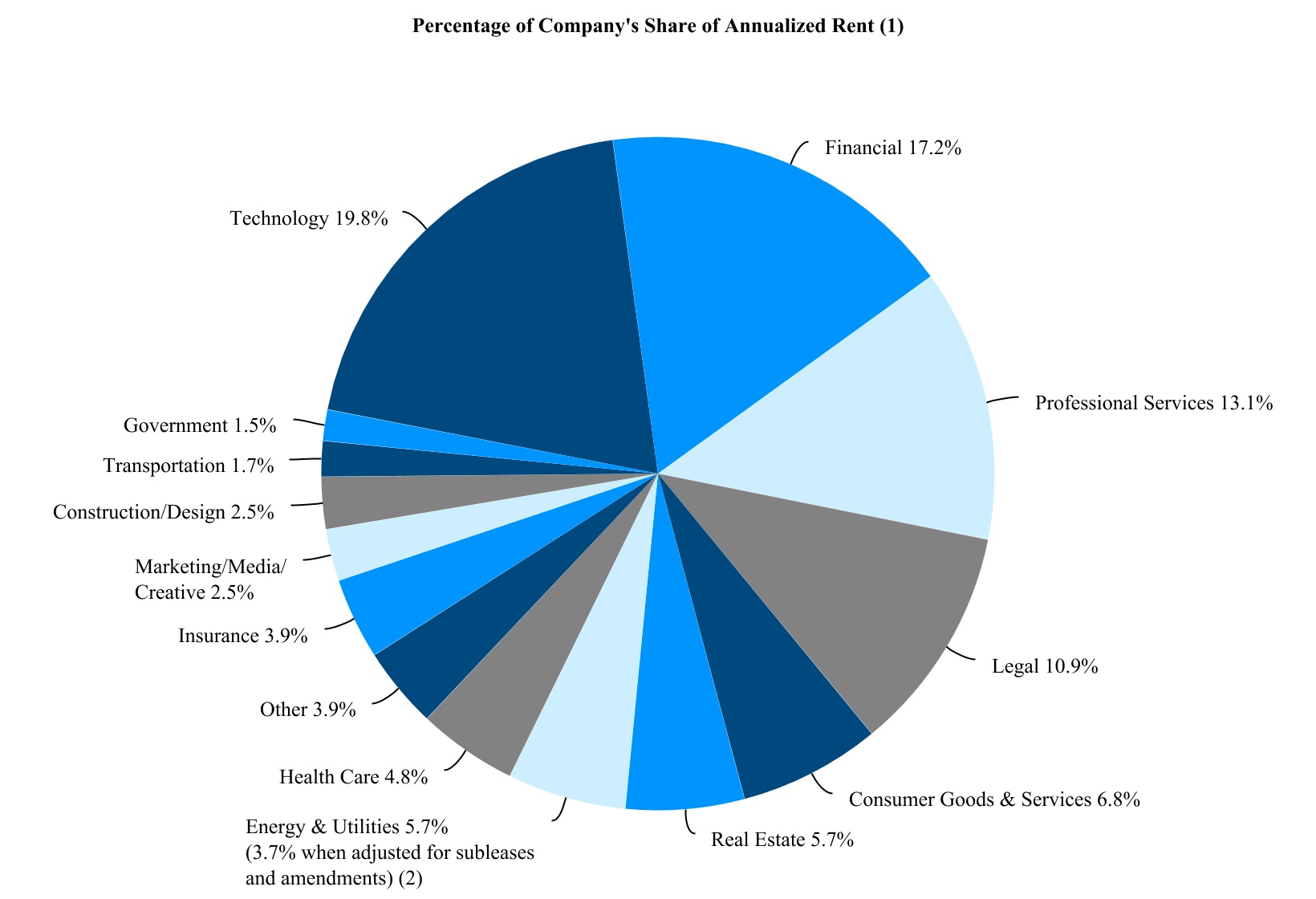

| TENANT INDUSTRY DIVERSIFICATION | ||||||||

Note: Management uses SIC codes when available, along with judgment, to determine tenant industry classification.

(1) Annualized Rent represents the annualized rent including tenant's share of estimated operating expenses, if applicable, paid by the tenant as of the date of this report. If the tenant is in a free rent period as of the date of this report, Annualized Rent represents the annualized contractual rent the tenant will pay in the first month it is required to pay full rent.

(2) Several of our Energy & Utilities tenants have entered into subleases with unaffiliated parties for large portions of their space or have executed amendments to surrender portions of their currently leased space. In the event of lease terminations, generally such subleases would become direct leases with the Company, although the lease term and rent due under such subleases may differ from the prime lease. After considering these subleases and the contractual space surrender obligations, the portion of our rent from Energy & Utilities tenants is reduced to 3.7%. Note that the chart above has not been adjusted to reflect the various industry sectors of such subtenants.

| Cousins Properties | 23 | Q2 2020 Supplemental Information | ||||||

| INVESTMENT ACTIVITY | ||||||||

Completed Property Acquisitions

| Property | Type | Market | Company's Ownership Interest | Timing | Square Feet | Gross Purchase Price ($ in thousands) (1) | ||||||||||||||||||||||||||||||||

| 2019 | ||||||||||||||||||||||||||||||||||||||

| 1200 Peachtree | Office | Atlanta | 100% | 1Q | 370,000 | $ | 82,000 | |||||||||||||||||||||||||||||||

| TIER REIT, Inc. | Office | Various | Various | 2Q | 5,799,000 | (2) | ||||||||||||||||||||||||||||||||

| Terminus (3) | Office | Atlanta | 100% | 4Q | 1,226,000 | 246,000 | ||||||||||||||||||||||||||||||||

| 2017 | ||||||||||||||||||||||||||||||||||||||

| 111 West Rio (4) | Office | Phoenix | 100% | 1Q | 225,000 | 19,600 | ||||||||||||||||||||||||||||||||

| 2016 | ||||||||||||||||||||||||||||||||||||||

| Parkway Properties | Office | Various | Various | 4Q | 8,819,000 | (5) | ||||||||||||||||||||||||||||||||

| Cousins Fund II, L.P. (6) | Office | Various | 100% | 4Q | (6) | 279,100 | ||||||||||||||||||||||||||||||||

| 16,439,000 | $ | 626,700 | ||||||||||||||||||||||||||||||||||||

Completed Property Developments

| Project | Type | Market | Company's Ownership Interest | Timing | Square Feet | Total Project Cost ($ in thousands) (1) | ||||||||||||||||||||||||||||||||

| 2019 | ||||||||||||||||||||||||||||||||||||||

| Dimensional Place | Office | Charlotte | 50% | 1Q | 281,000 | 96,000 | ||||||||||||||||||||||||||||||||

| 2018 | ||||||||||||||||||||||||||||||||||||||

| Spring & 8th | Office | Atlanta | 100% | 1Q/4Q | 765,000 | 332,500 | ||||||||||||||||||||||||||||||||

| 2017 | ||||||||||||||||||||||||||||||||||||||

| 8000 Avalon | Office | Atlanta | 90% | 2Q | 229,000 | 73,000 | ||||||||||||||||||||||||||||||||

| Carolina Square | Mixed | Chapel Hill | 50% | 3Q | 468,000 | 123,000 | ||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||

| Colorado Tower | Office | Austin | 100% | 1Q | 373,000 | 126,100 | ||||||||||||||||||||||||||||||||

| Emory Point - Phase II | Mixed | Atlanta | 75% | 3Q | 302,000 | 75,400 | ||||||||||||||||||||||||||||||||

| Research Park V | Office | Austin | 100% | 4Q | 173,000 | 45,000 | ||||||||||||||||||||||||||||||||

| 2,591,000 | $ | 871,000 | ||||||||||||||||||||||||||||||||||||

(1) Except as otherwise noted, amounts represent total purchase prices, total project cost paid by the company, and, where applicable, its joint venture partner, including certain allocated costs required by GAAP that are not incurred in a joint venture.

(2) Properties acquired in the merger with TIER REIT, Inc.

(3) Purchased outside interest of 50% in Terminus Office Holdings for $246 million before reductions for existing mortgage debt.

(4) Purchased outside interest of 25.4% in 111 West Rio.

(5) Properties acquired in the merger with Parkway Properties, Inc.

(6) Purchased the outside interest (approximately 70%) in a consolidated partnership for $279.1 million.

| Cousins Properties | 24 | Q2 2020 Supplemental Information | ||||||

| INVESTMENT ACTIVITY | ||||||||

Completed Property Dispositions

| Property | Type | Market | Company's Ownership Interest | Timing | Square Feet | Gross Sales Price ($ in thousands) (1) | ||||||||||||||||||||||||||||||||

| 2020 | ||||||||||||||||||||||||||||||||||||||

| Hearst Tower | Office | Charlotte | 100% | 1Q | 966,000 | $ | 455,500 | |||||||||||||||||||||||||||||||

| Gateway Village (2) | Office | Charlotte | 50% | 1Q | 1,061,000 | 52,200 | ||||||||||||||||||||||||||||||||

| Woodcrest | Office | Cherry Hill | 100% | 1Q | 386,000 | 25,300 | ||||||||||||||||||||||||||||||||

| 2017 | ||||||||||||||||||||||||||||||||||||||

| Emory Point I and II | Mixed | Atlanta | 75% | 2Q | 786,000 | 199,000 | ||||||||||||||||||||||||||||||||

| American Cancer Society Center | Office | Atlanta | 100% | 2Q | 996,000 | 166,000 | ||||||||||||||||||||||||||||||||

Bank of America Center, One Orlando ---Centre, and Citrus Center | Office | Orlando | 100% | 4Q | 1,038,000 | 208,100 | ||||||||||||||||||||||||||||||||

| Courvoisier Centre (3) | Office | Miami | 20% | 4Q | 343,000 | 33,900 | ||||||||||||||||||||||||||||||||

| 2016 | ||||||||||||||||||||||||||||||||||||||

| 100 North Point Center East | Office | Atlanta | 100% | 1Q | 129,000 | 22,000 | ||||||||||||||||||||||||||||||||

| Post Oak Central and Greenway Plaza (4) | Office | Houston | 100% | 4Q | 5,628,000 | — | ||||||||||||||||||||||||||||||||

| Two Liberty Place | Office | Philadelphia | 100% | 4Q | 941,000 | 219,000 | ||||||||||||||||||||||||||||||||

| 191 Peachtree | Office | Atlanta | 100% | 4Q | 1,225,000 | 267,500 | ||||||||||||||||||||||||||||||||

| Lincoln Place | Office | Miami | 100% | 4Q | 140,000 | 80,000 | ||||||||||||||||||||||||||||||||

| The Forum | Office | Atlanta | 100% | 4Q | 220,000 | 70,000 | ||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||

| 2100 Ross | Office | Dallas | 100% | 3Q | 844,000 | 131,000 | ||||||||||||||||||||||||||||||||

| 200, 333, and 555 North Point Center East | Office | Atlanta | 100% | 4Q | 411,000 | 70,300 | ||||||||||||||||||||||||||||||||

| The Points at Waterview | Office | Dallas | 100% | 4Q | 203,000 | 26,800 | ||||||||||||||||||||||||||||||||

| 15,317,000 | $ | 2,026,600 | ||||||||||||||||||||||||||||||||||||

(1) Except as otherwise noted, amounts represent total gross sales prices received by the Company and, where applicable, its joint venture partner.

(2) The Company sold its interest in the joint venture to its partner for $52.2 million. The proceeds represent a 17% internal rate of return for the Company on its invested capital, as stipulated in the partnership agreement.

(3) The Company sold its partnership interest for $12.6 million in a transaction that valued its interest in the property at $33.9 million, prior to deduction for existing mortgage debt.

(4) After the merger with Parkway Properties, Inc., these properties were spun off in a related transaction to Parkway, Inc.

| Cousins Properties | 25 | Q2 2020 Supplemental Information | ||||||

| DEVELOPMENT PIPELINE (1) | ||||||||

| Project | Type | Market | Company's Ownership Interest | Construction Start Date | Number of Square Feet /Apartment Units | Estimated Project Cost (1) (2) ($ in thousands) | Company's Share of Estimated Project Cost (2) ($ in thousands) | Project Cost Incurred to Date (2) ($ in thousands) | Company's Share of Project Cost Incurred to Date (2) ($ in thousands) | Percent Leased | Initial Revenue Recognition (3) | Estimated Stabilization (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 120 West Trinity | Mixed | Atlanta | 20 | % | 1Q17 | $ | 85,000 | $ | 17,000 | $ | 83,103 | $ | 16,621 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Office | 33,000 | 100 | % | 2Q20 | 3Q20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail | 19,000 | 12 | % | 3Q20 | 4Q20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Apartments | 330 | 43 | % | 4Q19 | 4Q20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10000 Avalon | Office | Atlanta | 90 | % | 3Q18 | 251,000 | 96,000 | 86,400 | 92,569 | 83,312 | 75 | % | 1Q20 | 1Q21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 300 Colorado (5) | Office | Austin | 50 | % | 4Q18 | 358,000 | 193,000 | 96,500 | 142,938 | 71,469 | 87 | % | 1Q21 | 1Q22 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domain 10 | Office | Austin | 100 | % | 4Q18 | 300,000 | 111,000 | 111,000 | 85,676 | 85,676 | 98 | % | 4Q20 | 3Q21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domain 12 | Office | Austin | 100 | % | 2Q18 | 320,000 | 117,000 | 117,000 | 113,441 | 113,441 | 100 | % | 2Q20 | 3Q20 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100 Mill | Office | Phoenix | 90 | % | 1Q20 | 287,000 | 153,000 | 137,700 | 38,463 | 34,617 | 44 | % | 1Q22 | 1Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 755,000 | $ | 565,600 | $ | 556,190 | $ | 405,136 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | This schedule shows projects currently under active development through the substantial completion of construction. Amounts included in the estimated project cost column are the estimated costs of the project through stabilization. Significant estimation is required to derive these costs, and the final costs may differ from these estimates. | ||||

| (2) | Estimated and incurred project costs include financing costs only on project-specific debt, and exclude certain allocated capitalized costs required by GAAP that are not incurred in a joint venture and fair value adjustments for legacy TIER projects that were recorded as a result of the Merger. | ||||

| (3) | Initial revenue recognition represents the quarter within which the Company estimates it will begin recognizing revenue under GAAP. | ||||

| (4) | Estimated stabilization is the quarter within which the Company estimates it will achieve 90% economic occupancy. Interest, taxes, and operating expenses are capitalized on the unoccupied portion of the building for the period beginning with initial occupancy until the earlier of the achievement of 90% economic occupancy or one year. | ||||

| (5) | 300 Colorado estimated project cost will be funded with a combination of $67 million of equity contributed by the joint venture partners, followed by a $126 million construction loan. | ||||

| Cousins Properties | 26 | Q2 2020 Supplemental Information | ||||||

| LAND INVENTORY | ||||||||