Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PayPal Holdings, Inc. | pypl-20200729.htm |

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) Second Quarter 2020 Results San Jose, California, July 29, 2020 Q2’20: Record performance across key operating and financial metrics • Total Payment Volume (TPV) of $222 billion, growing 29%, and 30% on an FX-neutral basis (FXN); revenue of $5.26 billion, growing 22%, and 25% FXN • GAAP EPS of $1.29, up 86% with non-GAAP EPS of $1.07, up 49% • Cash flow from operations of $2.4 billion, growing 103%, with free cash flow of $2.2 billion, growing 112% • 21.3 million Net New Active Accounts (NNAs) added; strongest quarter for NNAs in PayPal’s history FY’20: Reinstating and raising full year guidance based on strong momentum • Q3’20 revenue growth expected to be ~23%, and ~25% FXN, consistent with Q2’20 • With year-to-date revenue growth of 17%, and 19% FXN, FY’20 revenue growth now expected to be ~20%, and ~22% FXN • FY’20 GAAP EPS growth expected to be ~25% with non-GAAP EPS growth of ~25% • Approximately 70 million NNAs expected to be added to PayPal’s platform in FY’20 Q2’20 Highlights In the midst of the COVID-19 pandemic, GAAP Non-GAAP digital payments have become more YoY YoY important and essential than ever. Our USD $ Change USD $ Change record performance in the second quarter — our strongest quarter ever — reaffirms the Net Revenues $5.26B 22% $5.26B 25%* relevance of PayPal in the unfolding digital future. We’re committed to supporting our consumers and merchants as they work to Operating Income $0.95B 35% $1.49B 49% safely navigate this new reality.” Dan Schulman EPS $1.29 86% $1.07 49% President and CEO * On an FXN basis

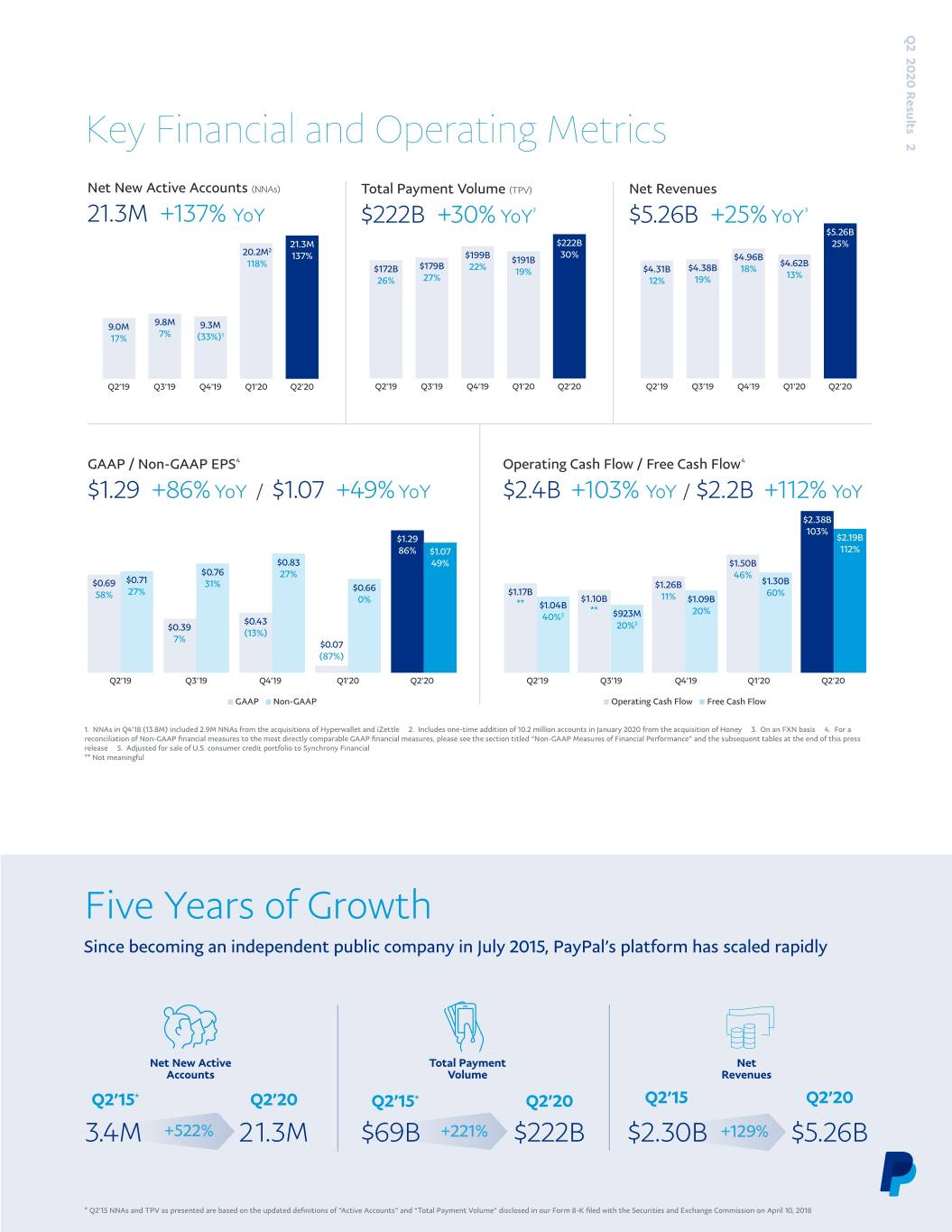

Q2 2020 Results 2 Key Financial and Operating Metrics Net New Active Accounts (NNAs) Total Payment Volume (TPV) Net Revenues 21.3M +137% YoY $222B +30% YoY 3 $5.26B +25% YoY 3 $5.26B 21.3M $222B 25% 20.2M2 137% $199B 30% $4.96B 118% $191B $4.62B $172B $179B 22% $4.31B $4.38B 18% 19% 13% 26% 27% 12% 19% 9.8M 9.0M 9.3M 7% 1 17% (33%) Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 GAAP / Non-GAAP EPS4 Operating Cash Flow / Free Cash Flow4 $1.29 +86% YoY / $1.07 +49% YoY $2.4B +103% YoY / $2.2B +112% YoY $2.38B 103% $1.29 $2.19B 86% $1.07 112% $0.83 49% $1.50B $0.76 27% 46% $0.71 $1.30B $0.69 31% $0.66 $1.26B 27% $1.17B 60% 58% 0% $1.10B 11% $1.09B ** $1.04B ** 20% 40%5 $923M $0.43 5 $0.39 20% (13%) 7% $0.07 (87%) Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 Q2’19 Q3’19 Q4’19 Q1’20 Q2’20 ■ GAAP ■ Non-GAAP ■ Operating Cash Flow ■ Free Cash Flow 1. NNAs in Q4’18 (13.8M) included 2.9M NNAs from the acquisitions of Hyperwallet and iZettle 2. Includes one-time addition of 10.2 million accounts in January 2020 from the acquisition of Honey 3. On an FXN basis 4. For a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the section titled “Non-GAAP Measures of Financial Performance” and the subsequent tables at the end of this press release 5. Adjusted for sale of U.S. consumer credit portfolio to Synchrony Financial ** Not meaningful Five Years of Growth Since becoming an independent public company in July 2015, PayPal’s platform has scaled rapidly Net New Active Total Payment Net Accounts Volume Revenues Q2’15* Q2’20 Q2’15* Q2’20 Q2’15 Q2’20 3.4M +522% 21.3M $69B +221% $222B $2.30B +129% $5.26B * Q2’15 NNAs and TPV as presented are based on the updated definitions of “Active Accounts” and “Total Payment Volume” disclosed in our Form 8-K filed with the Securities and Exchange Commission on April 10, 2018

Q2 2020 Results 3 Q2’20 Financial Highlights Strongest quarterly performance in PayPal’s history Our second quarter performance • Revenue of $5.26 billion; growing 22% on a spot basis and 25% FXN. highlights the benefits of PayPal’s • GAAP operating margin of 18.1%, expanding 170 basis points; diversification and scale, and our non-GAAP operating margin of 28.2%, expanding 504 basis points. resulting earnings power. We delivered Increased credit provisions of $117 million were recorded due to 25% revenue growth on a currency- revised macroeconomic projections. neutral basis, 49% growth in non-GAAP • GAAP EPS of $1.29, up 86%; non-GAAP EPS of $1.07, up 49%. earnings per share, and generated $2.2 • GAAP and non-GAAP EPS include an approximate $0.07 of negative impact from increased credit provisions related to billion dollars in free cash flow.” revised macroeconomic projections. John Rainey • GAAP EPS also includes a net unrealized gain of $0.58 on CFO and EVP strategic investments, driven primarily by MercadoLibre Global Customer Operations (NASDAQ: MELI). Q2’20 Operating Highlights Record growth in NNAs and strong engagement driving sustained momentum • 21.3 million NNAs added, bringing total active accounts to 346 million accounts, up 21%. • 3.7 billion payment transactions, up 26%. • $222 billion in TPV, up 29% on a spot basis and 30% FXN. • Merchant Services volume grew 28% on a spot basis and 30% FXN, and represented 91% of TPV. • Venmo processed approximately $37 billion in TPV, growing 52%. • 39.2 payment transactions per active account on a trailing twelve months basis, flat to Q2’19. Adjusting for the acquisition of Honey in January 2020, 40.7 payment transactions per active account on a trailing twelve months basis, up 4%. Balance Sheet and Liquidity Strong balance sheet growth and cash-flow generation • PayPal’s cash, cash equivalents, and investments totaled $16.2 billion as of June 30, 2020. • Accessed the public debt markets in May 2020, raising $4.0 billion in senior fixed notes at a weighted average effective interest rate of 2.26%. PayPal’s debt totaled $9.0 billion as of June 30, 2020. • PayPal generated cash flow from operations of $2.4 billion, growing 103%, and free cash flow of $2.2 billion, growing 112%. • In Q2’20, repurchased approximately 1.4 million shares of common stock, returning $220 million to stockholders.

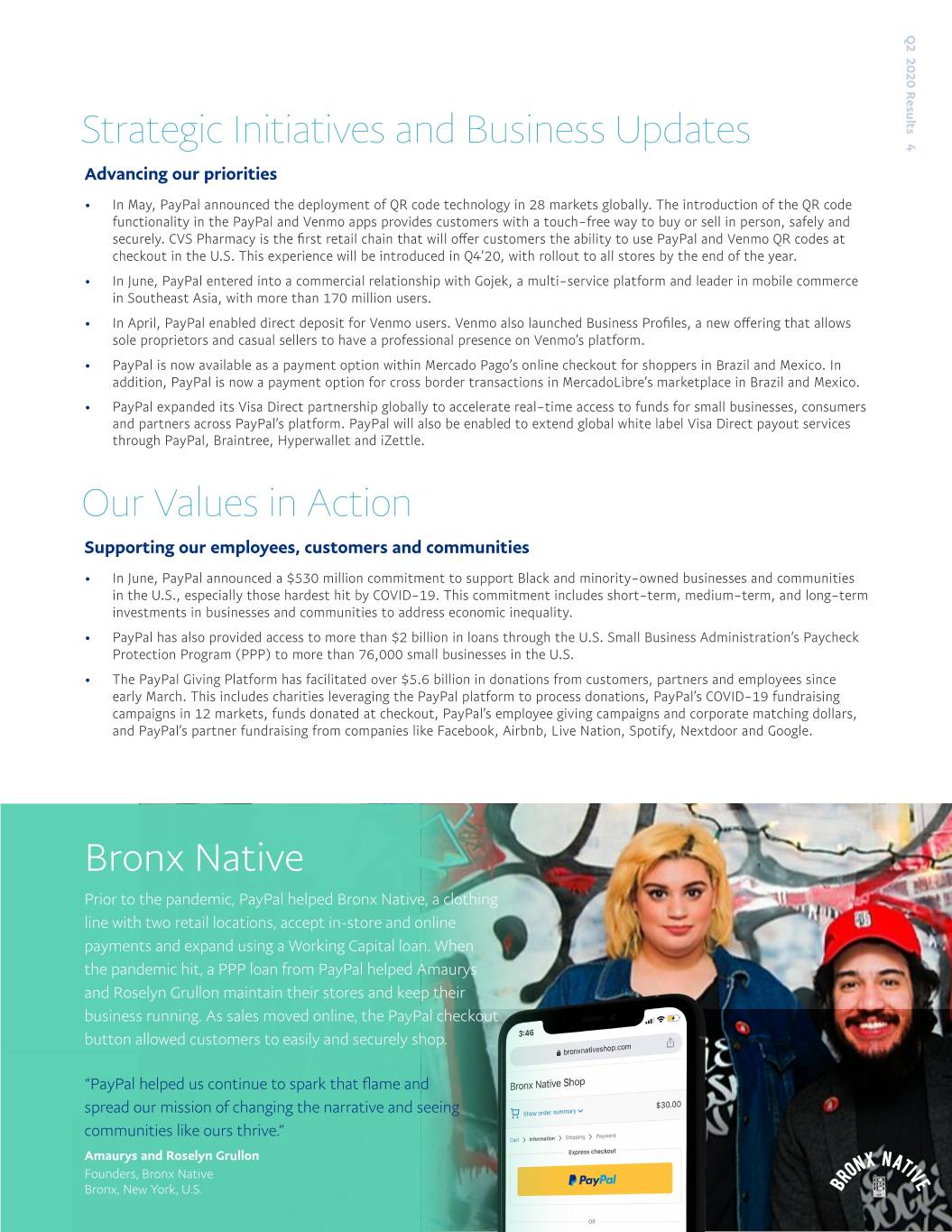

Q2 2020 Results 4 Strategic Initiatives and Business Updates Advancing our priorities • In May, PayPal announced the deployment of QR code technology in 28 markets globally. The introduction of the QR code functionality in the PayPal and Venmo apps provides customers with a touch-free way to buy or sell in person, safely and securely. CVS Pharmacy is the first retail chain that will offer customers the ability to use PayPal and Venmo QR codes at checkout in the U.S. This experience will be introduced in Q4’20, with rollout to all stores by the end of the year. • In June, PayPal entered into a commercial relationship with Gojek, a multi-service platform and leader in mobile commerce in Southeast Asia, with more than 170 million users. • In April, PayPal enabled direct deposit for Venmo users. Venmo also launched Business Profiles, a new offering that allows sole proprietors and casual sellers to have a professional presence on Venmo’s platform. • PayPal is now available as a payment option within Mercado Pago’s online checkout for shoppers in Brazil and Mexico. In addition, PayPal is now a payment option for cross border transactions in MercadoLibre’s marketplace in Brazil and Mexico. • PayPal expanded its Visa Direct partnership globally to accelerate real-time access to funds for small businesses, consumers and partners across PayPal’s platform. PayPal will also be enabled to extend global white label Visa Direct payout services through PayPal, Braintree, Hyperwallet and iZettle. Our Values in Action Supporting our employees, customers and communities • In June, PayPal announced a $530 million commitment to support Black and minority-owned businesses and communities in the U.S., especially those hardest hit by COVID-19. This commitment includes short-term, medium-term, and long-term investments in businesses and communities to address economic inequality. • PayPal has also provided access to more than $2 billion in loans through the U.S. Small Business Administration’s Paycheck Protection Program (PPP) to more than 76,000 small businesses in the U.S. • The PayPal Giving Platform has facilitated over $5.6 billion in donations from customers, partners and employees since early March. This includes charities leveraging the PayPal platform to process donations, PayPal’s COVID-19 fundraising campaigns in 12 markets, funds donated at checkout, PayPal’s employee giving campaigns and corporate matching dollars, and PayPal’s partner fundraising from companies like Facebook, Airbnb, Live Nation, Spotify, Nextdoor and Google. Bronx Native Prior to the pandemic, PayPal helped Bronx Native, a clothing line with two retail locations, accept in-store and online payments and expand using a Working Capital loan. When the pandemic hit, a PPP loan from PayPal helped Amaurys and Roselyn Grullon maintain their stores and keep their business running. As sales moved online, the PayPal checkout button allowed customers to easily and securely shop. “PayPal helped us continue to spark that flame and spread our mission of changing the narrative and seeing communities like ours thrive.” Amaurys and Roselyn Grullon Founders, Bronx Native Bronx, New York, U.S.

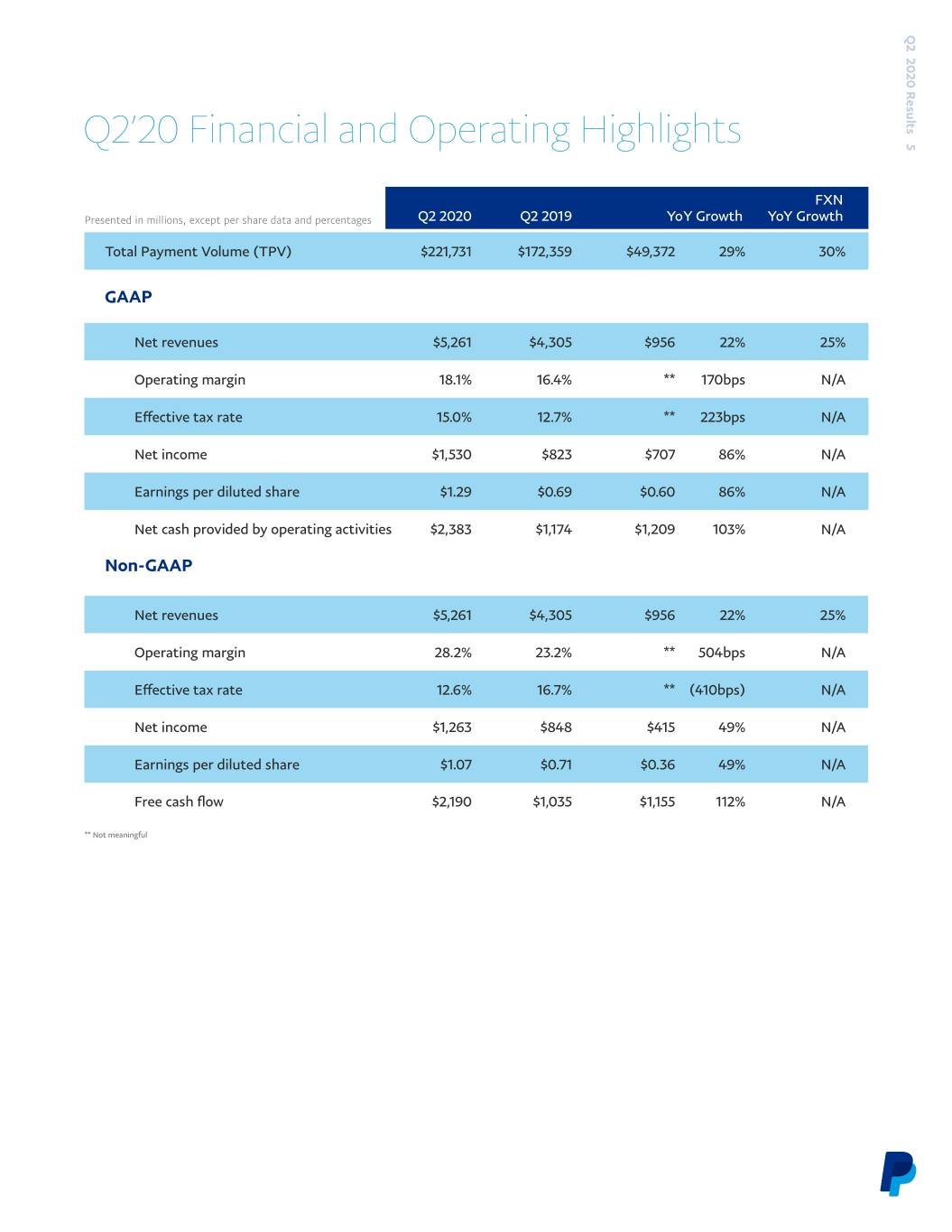

Q2 2020 Results 5 Q2’20 Financial and Operating Highlights FXN Presented in millions, except per share data and percentages Q2 2020 Q2 2019 YoY Growth YoY Growth Total Payment Volume (TPV) $221,731 $172,359 $49,372 29% 30% GAAP Net revenues $5,261 $4,305 $956 22% 25% Operating margin 18.1% 16.4% ** 170bps N/A Effective tax rate 15.0% 12.7% ** 223bps N/A Net income $1,530 $823 $707 86% N/A Earnings per diluted share $1.29 $0.69 $0.60 86% N/A Net cash provided by operating activities $2,383 $1,174 $1,209 103% N/A Non-GAAP Net revenues $5,261 $4,305 $956 22% 25% Operating margin 28.2% 23.2% ** 504bps N/A Effective tax rate 12.6% 16.7% ** (410bps) N/A Net income $1,263 $848 $415 49% N/A Earnings per diluted share $1.07 $0.71 $0.36 49% N/A Free cash flow $2,190 $1,035 $1,155 112% N/A ** Not meaningful

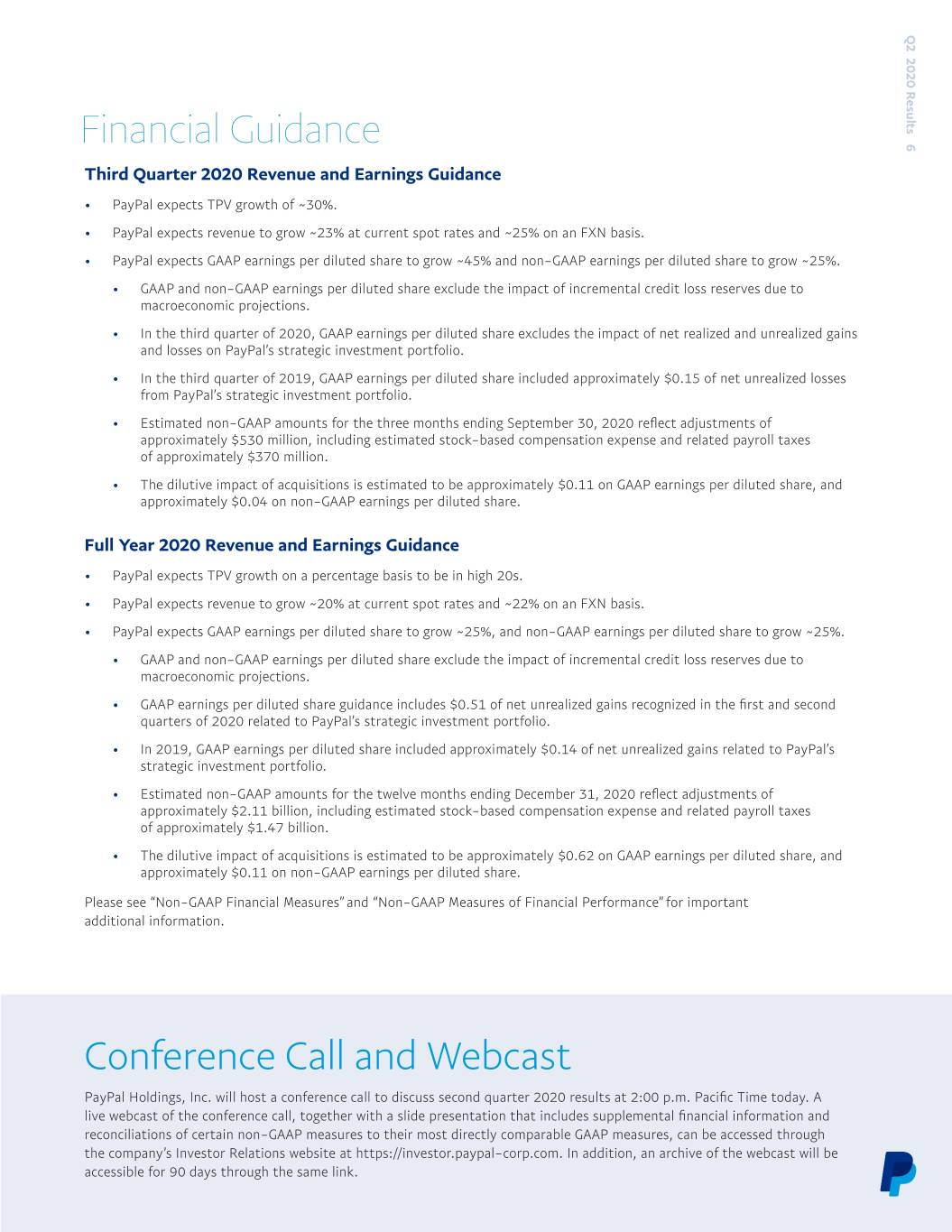

Q2 2020 Results 6 Financial Guidance Third Quarter 2020 Revenue and Earnings Guidance • PayPal expects TPV growth of ~30%. • PayPal expects revenue to grow ~23% at current spot rates and ~25% on an FXN basis. • PayPal expects GAAP earnings per diluted share to grow ~45% and non-GAAP earnings per diluted share to grow ~25%. • GAAP and non-GAAP earnings per diluted share exclude the impact of incremental credit loss reserves due to macroeconomic projections. • In the third quarter of 2020, GAAP earnings per diluted share excludes the impact of net realized and unrealized gains and losses on PayPal’s strategic investment portfolio. • In the third quarter of 2019, GAAP earnings per diluted share included approximately $0.15 of net unrealized losses from PayPal’s strategic investment portfolio. • Estimated non-GAAP amounts for the three months ending September 30, 2020 reflect adjustments of approximately $530 million, including estimated stock-based compensation expense and related payroll taxes of approximately $370 million. • The dilutive impact of acquisitions is estimated to be approximately $0.11 on GAAP earnings per diluted share, and approximately $0.04 on non-GAAP earnings per diluted share. Full Year 2020 Revenue and Earnings Guidance • PayPal expects TPV growth on a percentage basis to be in high 20s. • PayPal expects revenue to grow ~20% at current spot rates and ~22% on an FXN basis. • PayPal expects GAAP earnings per diluted share to grow ~25%, and non-GAAP earnings per diluted share to grow ~25%. • GAAP and non-GAAP earnings per diluted share exclude the impact of incremental credit loss reserves due to macroeconomic projections. • GAAP earnings per diluted share guidance includes $0.51 of net unrealized gains recognized in the first and second quarters of 2020 related to PayPal’s strategic investment portfolio. • In 2019, GAAP earnings per diluted share included approximately $0.14 of net unrealized gains related to PayPal’s strategic investment portfolio. • Estimated non-GAAP amounts for the twelve months ending December 31, 2020 reflect adjustments of approximately $2.11 billion, including estimated stock-based compensation expense and related payroll taxes of approximately $1.47 billion. • The dilutive impact of acquisitions is estimated to be approximately $0.62 on GAAP earnings per diluted share, and approximately $0.11 on non-GAAP earnings per diluted share. Please see “Non-GAAP Financial Measures” and “Non-GAAP Measures of Financial Performance” for important additional information. Conference Call and Webcast PayPal Holdings, Inc. will host a conference call to discuss second quarter 2020 results at 2:00 p.m. Pacific Time today. A live webcast of the conference call, together with a slide presentation that includes supplemental financial information and reconciliations of certain non-GAAP measures to their most directly comparable GAAP measures, can be accessed through the company’s Investor Relations website at https://investor.paypal-corp.com. In addition, an archive of the webcast will be accessible for 90 days through the same link.

Q2 2020 Results 7 Presentation All growth rates represent year-over-year comparisons, except as otherwise noted. FXN results are calculated by translating the current period local currency results by the prior period exchange rate. FXN growth rates are calculated by comparing the current period FXN results with the prior period results, excluding the impact from hedging activities. All amounts in tables are presented in U.S. dollars, rounded to the nearest millions, except as otherwise noted. As a result, certain amounts and rates may not sum or recalculate using the rounded dollar amounts provided. Non-GAAP Financial Measures This press release includes financial measures defined as “non-GAAP financial measures” by the SEC including: non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating income, non-GAAP operating margin, non-GAAP effective tax rate, free cash flow, and adjusted free cash flow. For an explanation of the foregoing non-GAAP measures, please see “Non-GAAP Measures of Financial Performance” included in this press release. These measures may be different from non- GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles (GAAP). For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, see “Non-GAAP Measures of Financial Performance,” “Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin,” “Reconciliation of GAAP Net Income to Non-GAAP Net Income, GAAP Diluted EPS to Non-GAAP Diluted EPS and GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate,” and “Reconciliation of Operating Cash Flow to Free Cash Flow and Adjusted Free Cash Flow.” Forward-Looking Statements This press release contains forward-looking statements relating to, among other things, the future results of operations, financial condition, expectations, and plans of PayPal Holdings, Inc. and its consolidated subsidiaries that reflect PayPal’s current projections and forecasts. Forward-looking statements can be identified by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “project,” “forecast,” and other similar expressions. Forward-looking statements include, but are not limited to, statements regarding projected financial results for the third quarter and full year 2020, impact and timing of acquisitions, and projected future growth of PayPal’s businesses. Forward-looking statements are based upon various estimates and assumptions, as well as information known to PayPal as of the date of this press release, and are inherently subject to numerous risks and uncertainties. Accordingly, actual results could differ materially from those predicted or implied by forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: the direct and indirect impact of the COVID-19 outbreak on PayPal’s business, financial condition and results of operations as well as the operations of PayPal’s customers, suppliers, vendors and other business partners, even after the COVID-19 outbreak has subsided; the effect of political, business, economic, market, and trade conditions, including any regional or general economic downturn or crisis and any conditions that affect payments or e-commerce growth; fluctuations in foreign currency exchange rates; the competitive, regulatory, payment card association- related and other risks specific to PayPal’s payment platform, including core PayPal, PayPal Credit, Braintree, Venmo, Xoom, iZettle, Honey, Hyperwallet and other products, especially as PayPal continues to expand geographically, introduce new products and support across technologies and payment methods and as new laws and regulations related to payments and financial services come into effect; the impact of PayPal’s customer choice initiatives, including on its funding mix and transaction expense; PayPal’s ability to successfully compete in an increasingly competitive environment for its businesses, products, and services, including competition for consumers and merchants and the increasing importance of digital and mobile payments and mobile commerce; the outcome of legal and regulatory proceedings and PayPal’s need and ability to manage regulatory, tax and litigation risks as its products and services are offered in more jurisdictions and applicable laws become more restrictive; changes to PayPal’s capital allocation or management of operating cash; uncertainty surrounding the implementation and impact of the United Kingdom’s withdrawal from the European Union; cyberattacks and security vulnerabilities in PayPal products and services that could disrupt business, reduce revenue, increase costs, harm our competitive position or our reputation, or lead to liability; the effect of management changes and business initiatives; any changes PayPal may make to its product and service offerings; the effect of any natural disasters, the COVID-19 outbreak or other business interruptions on PayPal or PayPal’s customers; PayPal’s ability to timely upgrade and develop its technology systems, infrastructure, and customer service capabilities at reasonable cost; PayPal’s ability to maintain the stability, security, and performance of its Payments Platform and Honey

Q2 2020 Results 8 Platform while adding new products and features in a timely fashion; risks that planned acquisitions will not be completed on contemplated terms, or at all, and that any businesses PayPal may acquire may not perform in accordance with its expectations; and PayPal’s ability to profitably integrate, manage, and grow businesses that have been acquired or may be acquired in the future. The forward-looking statements in this release do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. More information about factors that could adversely affect PayPal’s results of operations, financial condition and prospects, or that could cause actual results to differ from those expressed or implied in forward-looking statements is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in PayPal’s most recent annual report on Form 10-K and its subsequent quarterly reports on Form 10-Q, copies of which may be obtained by visiting PayPal’s Investor Relations website at https://investor.paypal-corp.com or the SEC’s website at www.sec.gov. All information in this release speaks as of July 29, 2020. For the reasons discussed above, you should not place undue reliance on the forward-looking statements in this press release. PayPal assumes no obligation to update such forward-looking statements. Disclosure Channels PayPal Holdings, Inc. uses its Investor Relations website (https://investor.paypal-corp.com), the PayPal Newsroom (https:// newsroom.paypal-corp.com/), PayPal Stories Blog (https://www.paypal.com/stories/us), Twitter handles (@PayPal and @ PayPalNews), LinkedIn page (https://www.linkedin.com/company/paypal), Facebook page (https://www.facebook.com/ PayPalUSA/), YouTube channel (https://www.youtube.com/paypal), Dan Schulman’s LinkedIn profile (https://www.linkedin. com/ in/dan-schulman/), John Rainey’s LinkedIn profile (www.linkedin.com/in/john-rainey-pypl), Dan Schulman’s Facebook page (https://www.facebook.com/DanSchulmanPayPal/) and Dan Schulman’s Instagram page (https://www.instagram.com/ dan_schulman/) as a means of disclosing information about the company and for complying with its disclosure obligations under Regulation FD. The information that is posted through these channels may be deemed material. Accordingly, investors should monitor these channels in addition to PayPal’s press releases, filings with the Securities and Exchange Commission (“SEC”), public conference calls, and webcasts. Investor Relations Contacts Media Relations Contacts Gabrielle Rabinovitch Amanda Miller grabinovitch@paypal.com amandacmiller@paypal.com 408.219.0563 Akila Moorthy amoorthy@paypal.com Josh Criscoe jcriscoe@paypal.com 646.667.5065 © 1999-2020 PayPal Holdings, Inc. All rights reserved. Other company and product names may be trademarks of their respective owners.

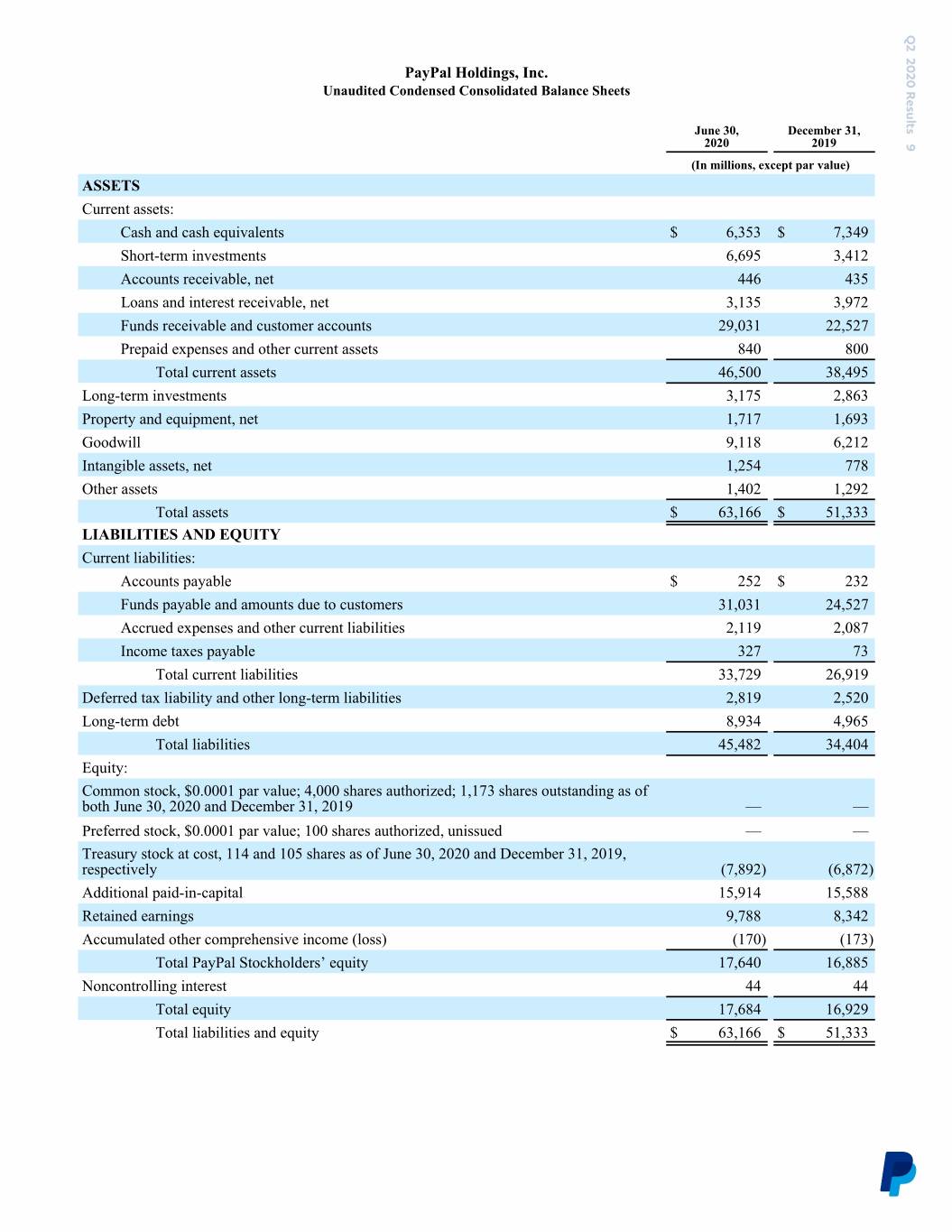

Q2 2020 Results 9 PayPal Holdings, Inc. Unaudited Condensed Consolidated Balance Sheets June 30, December 31, 2020 2019 (In millions, except par value) ASSETS Current assets: Cash and cash equivalents $ 6,353 $ 7,349 Short-term investments 6,695 3,412 Accounts receivable, net 446 435 Loans and interest receivable, net 3,135 3,972 Funds receivable and customer accounts 29,031 22,527 Prepaid expenses and other current assets 840 800 Total current assets 46,500 38,495 Long-term investments 3,175 2,863 Property and equipment, net 1,717 1,693 Goodwill 9,118 6,212 Intangible assets, net 1,254 778 Other assets 1,402 1,292 Total assets $ 63,166 $ 51,333 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 252 $ 232 Funds payable and amounts due to customers 31,031 24,527 Accrued expenses and other current liabilities 2,119 2,087 Income taxes payable 327 73 Total current liabilities 33,729 26,919 Deferred tax liability and other long-term liabilities 2,819 2,520 Long-term debt 8,934 4,965 Total liabilities 45,482 34,404 Equity: Common stock, $0.0001 par value; 4,000 shares authorized; 1,173 shares outstanding as of both June 30, 2020 and December 31, 2019 — — Preferred stock, $0.0001 par value; 100 shares authorized, unissued — — Treasury stock at cost, 114 and 105 shares as of June 30, 2020 and December 31, 2019, respectively (7,892) (6,872) Additional paid-in-capital 15,914 15,588 Retained earnings 9,788 8,342 Accumulated other comprehensive income (loss) (170) (173) Total PayPal Stockholders’ equity 17,640 16,885 Noncontrolling interest 44 44 Total equity 17,684 16,929 Total liabilities and equity $ 63,166 $ 51,333

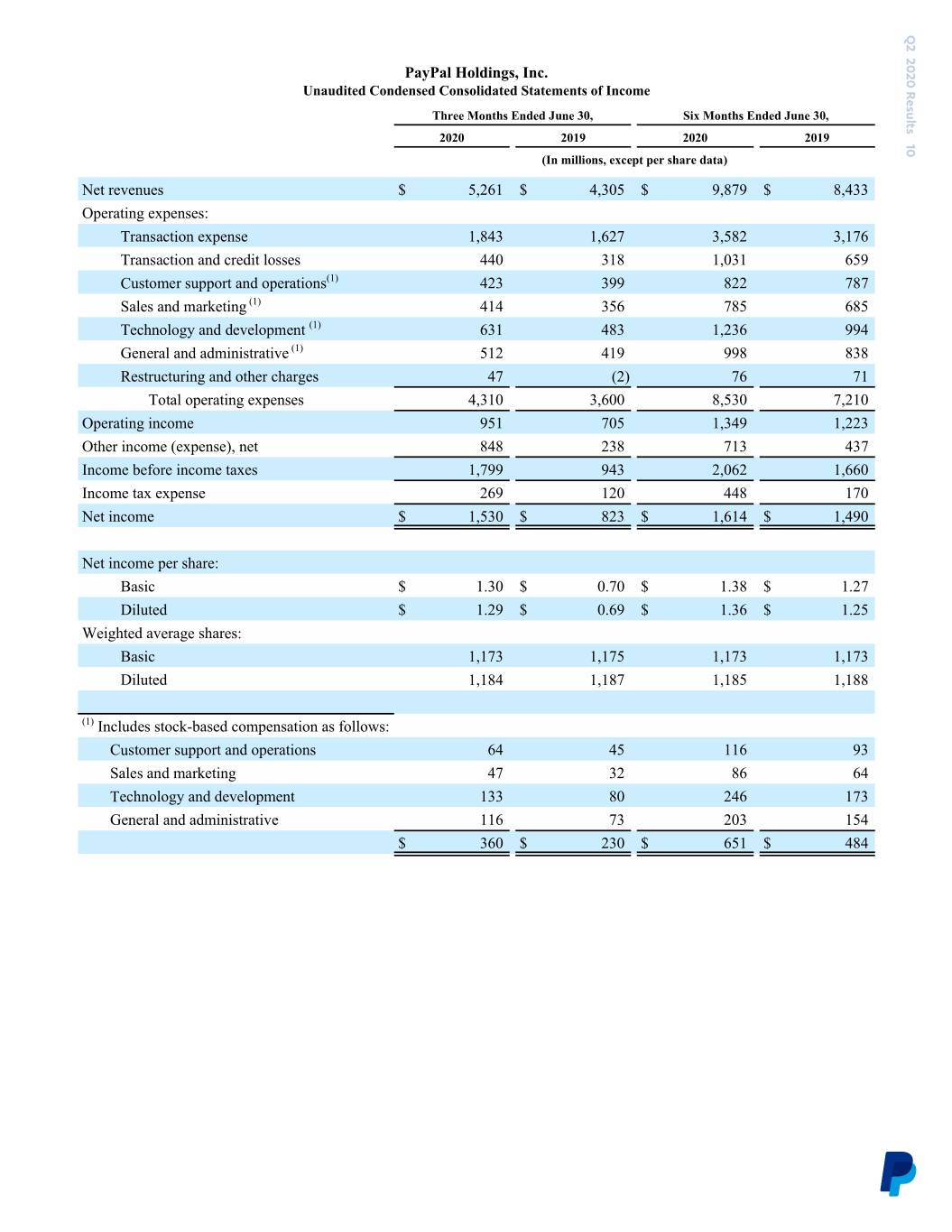

Q2 2020 Results 10 PayPal Holdings, Inc. Unaudited Condensed Consolidated Statements of Income Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 (In millions, except per share data) Net revenues $ 5,261 $ 4,305 $ 9,879 $ 8,433 Operating expenses: Transaction expense 1,843 1,627 3,582 3,176 Transaction and credit losses 440 318 1,031 659 Customer support and operations(1) 423 399 822 787 Sales and marketing (1) 414 356 785 685 Technology and development (1) 631 483 1,236 994 General and administrative (1) 512 419 998 838 Restructuring and other charges 47 (2) 76 71 Total operating expenses 4,310 3,600 8,530 7,210 Operating income 951 705 1,349 1,223 Other income (expense), net 848 238 713 437 Income before income taxes 1,799 943 2,062 1,660 Income tax expense 269 120 448 170 Net income $ 1,530 $ 823 $ 1,614 $ 1,490 Net income per share: Basic $ 1.30 $ 0.70 $ 1.38 $ 1.27 Diluted $ 1.29 $ 0.69 $ 1.36 $ 1.25 Weighted average shares: Basic 1,173 1,175 1,173 1,173 Diluted 1,184 1,187 1,185 1,188 (1) Includes stock-based compensation as follows: Customer support and operations 64 45 116 93 Sales and marketing 47 32 86 64 Technology and development 133 80 246 173 General and administrative 116 73 203 154 $ 360 $ 230 $ 651 $ 484

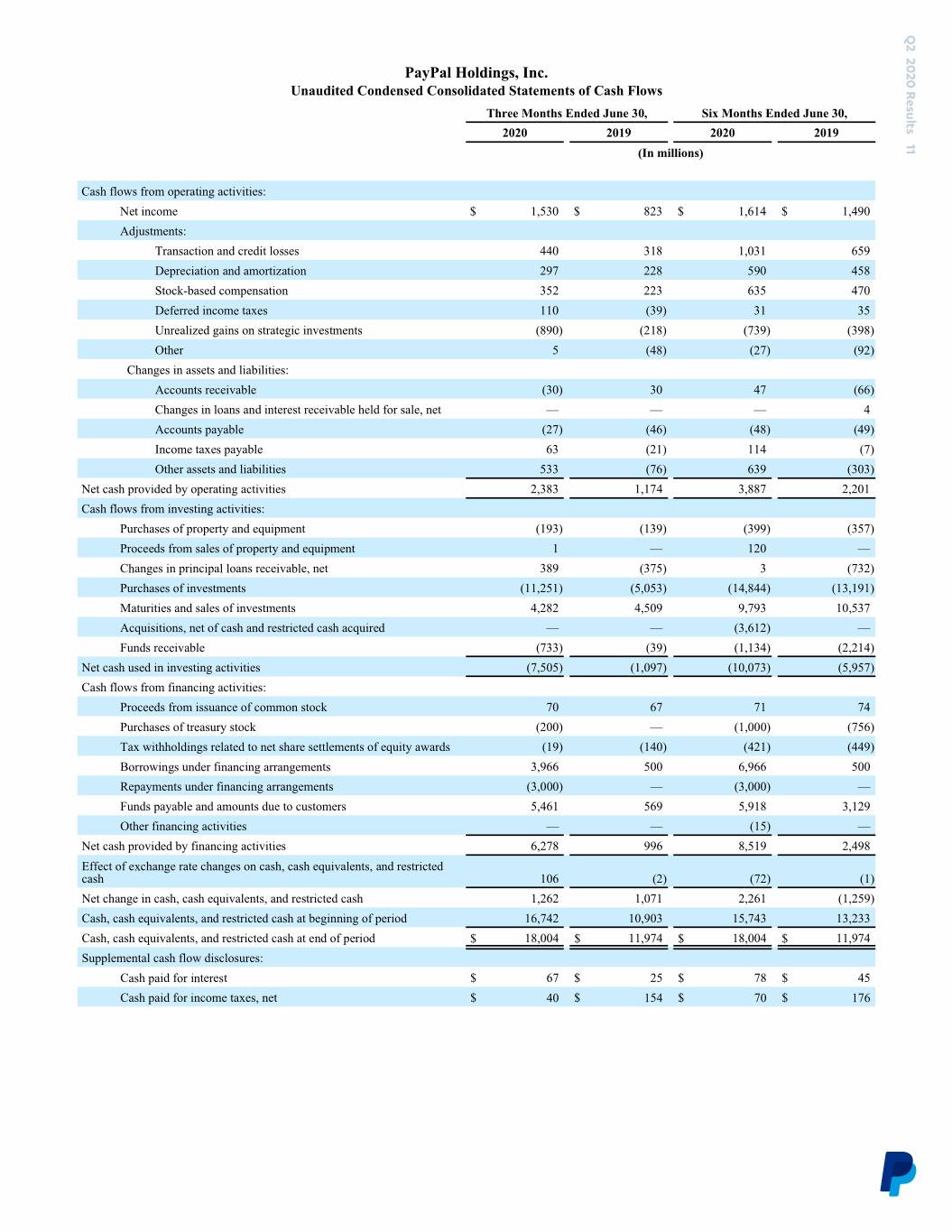

Q2 2020 Results 11 PayPal Holdings, Inc. Unaudited Condensed Consolidated Statements of Cash Flows Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 (In millions) Cash flows from operating activities: Net income $ 1,530 $ 823 $ 1,614 $ 1,490 Adjustments: Transaction and credit losses 440 318 1,031 659 Depreciation and amortization 297 228 590 458 Stock-based compensation 352 223 635 470 Deferred income taxes 110 (39) 31 35 Unrealized gains on strategic investments (890) (218) (739) (398) Other 5 (48) (27) (92) Changes in assets and liabilities: Accounts receivable (30) 30 47 (66) Changes in loans and interest receivable held for sale, net — — — 4 Accounts payable (27) (46) (48) (49) Income taxes payable 63 (21) 114 (7) Other assets and liabilities 533 (76) 639 (303) Net cash provided by operating activities 2,383 1,174 3,887 2,201 Cash flows from investing activities: Purchases of property and equipment (193) (139) (399) (357) Proceeds from sales of property and equipment 1 — 120 — Changes in principal loans receivable, net 389 (375) 3 (732) Purchases of investments (11,251) (5,053) (14,844) (13,191) Maturities and sales of investments 4,282 4,509 9,793 10,537 Acquisitions, net of cash and restricted cash acquired — — (3,612) — Funds receivable (733) (39) (1,134) (2,214) Net cash used in investing activities (7,505) (1,097) (10,073) (5,957) Cash flows from financing activities: Proceeds from issuance of common stock 70 67 71 74 Purchases of treasury stock (200) — (1,000) (756) Tax withholdings related to net share settlements of equity awards (19) (140) (421) (449) Borrowings under financing arrangements 3,966 500 6,966 500 Repayments under financing arrangements (3,000) — (3,000) — Funds payable and amounts due to customers 5,461 569 5,918 3,129 Other financing activities — — (15) — Net cash provided by financing activities 6,278 996 8,519 2,498 Effect of exchange rate changes on cash, cash equivalents, and restricted cash 106 (2) (72) (1) Net change in cash, cash equivalents, and restricted cash 1,262 1,071 2,261 (1,259) Cash, cash equivalents, and restricted cash at beginning of period 16,742 10,903 15,743 13,233 Cash, cash equivalents, and restricted cash at end of period $ 18,004 $ 11,974 $ 18,004 $ 11,974 Supplemental cash flow disclosures: Cash paid for interest $ 67 $ 25 $ 78 $ 45 Cash paid for income taxes, net $ 40 $ 154 $ 70 $ 176

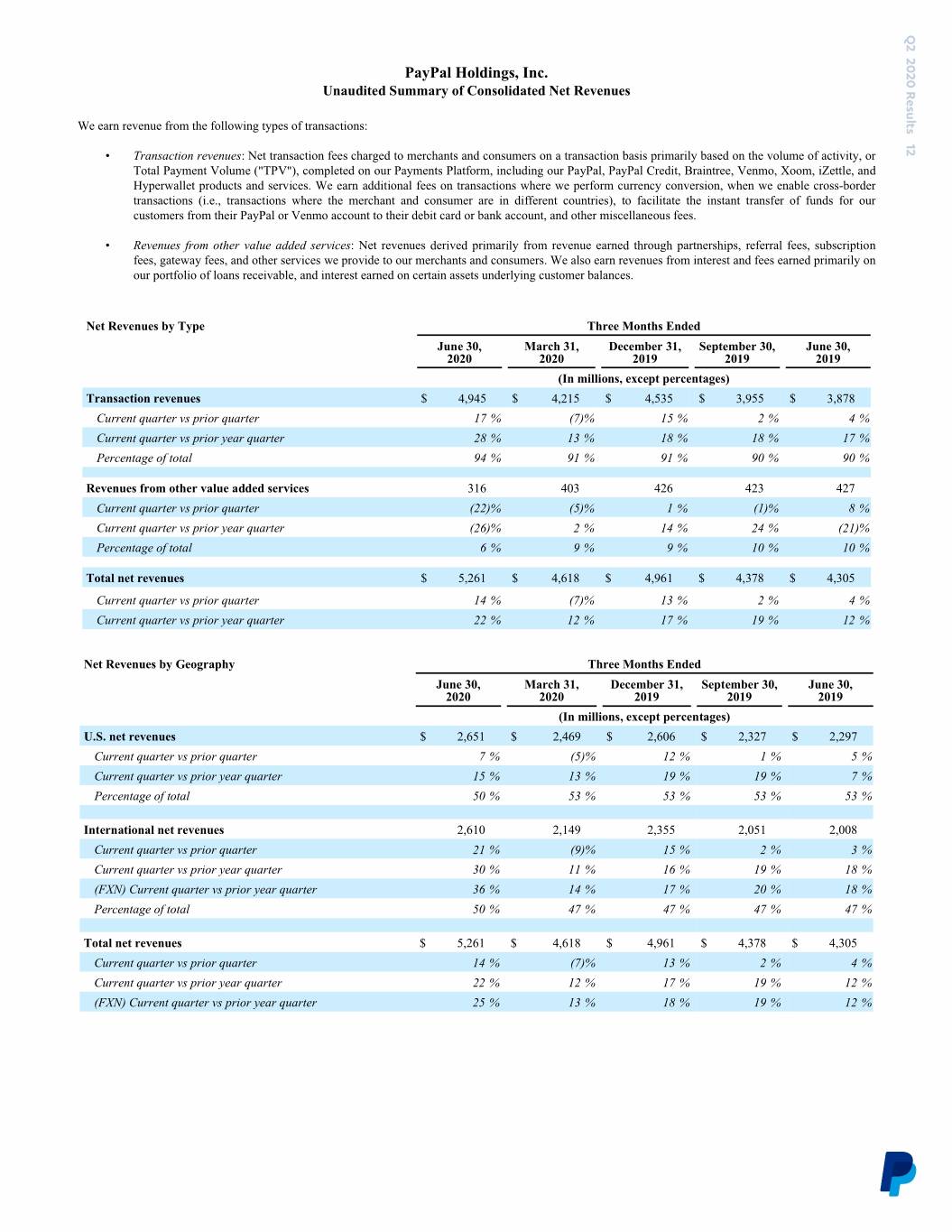

Q2 2020 Results 12 PayPal Holdings, Inc. Unaudited Summary of Consolidated Net Revenues We earn revenue from the following types of transactions: • Transaction revenues: Net transaction fees charged to merchants and consumers on a transaction basis primarily based on the volume of activity, or Total Payment Volume ("TPV"), completed on our Payments Platform, including our PayPal, PayPal Credit, Braintree, Venmo, Xoom, iZettle, and Hyperwallet products and services. We earn additional fees on transactions where we perform currency conversion, when we enable cross-border transactions (i.e., transactions where the merchant and consumer are in different countries), to facilitate the instant transfer of funds for our customers from their PayPal or Venmo account to their debit card or bank account, and other miscellaneous fees. • Revenues from other value added services: Net revenues derived primarily from revenue earned through partnerships, referral fees, subscription fees, gateway fees, and other services we provide to our merchants and consumers. We also earn revenues from interest and fees earned primarily on our portfolio of loans receivable, and interest earned on certain assets underlying customer balances. Net Revenues by Type Three Months Ended June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 (In millions, except percentages) Transaction revenues $ 4,945 $ 4,215 $ 4,535 $ 3,955 $ 3,878 Current quarter vs prior quarter 17 % (7) % 15 % 2 % 4 % Current quarter vs prior year quarter 28 % 13 % 18 % 18 % 17 % Percentage of total 94 % 91 % 91 % 90 % 90 % Revenues from other value added services 316 403 426 423 427 Current quarter vs prior quarter (22) % (5) % 1 % (1) % 8 % Current quarter vs prior year quarter (26) % 2 % 14 % 24 % (21) % Percentage of total 6 % 9 % 9 % 10 % 10 % Total net revenues $ 5,261 $ 4,618 $ 4,961 $ 4,378 $ 4,305 Current quarter vs prior quarter 14 % (7) % 13 % 2 % 4 % Current quarter vs prior year quarter 22 % 12 % 17 % 19 % 12 % Net Revenues by Geography Three Months Ended June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 (In millions, except percentages) U.S. net revenues $ 2,651 $ 2,469 $ 2,606 $ 2,327 $ 2,297 Current quarter vs prior quarter 7 % (5) % 12 % 1 % 5 % Current quarter vs prior year quarter 15 % 13 % 19 % 19 % 7 % Percentage of total 50 % 53 % 53 % 53 % 53 % International net revenues 2,610 2,149 2,355 2,051 2,008 Current quarter vs prior quarter 21 % (9) % 15 % 2 % 3 % Current quarter vs prior year quarter 30 % 11 % 16 % 19 % 18 % (FXN) Current quarter vs prior year quarter 36 % 14 % 17 % 20 % 18 % Percentage of total 50 % 47 % 47 % 47 % 47 % Total net revenues $ 5,261 $ 4,618 $ 4,961 $ 4,378 $ 4,305 Current quarter vs prior quarter 14 % (7) % 13 % 2 % 4 % Current quarter vs prior year quarter 22 % 12 % 17 % 19 % 12 % (FXN) Current quarter vs prior year quarter 25 % 13 % 18 % 19 % 12 %

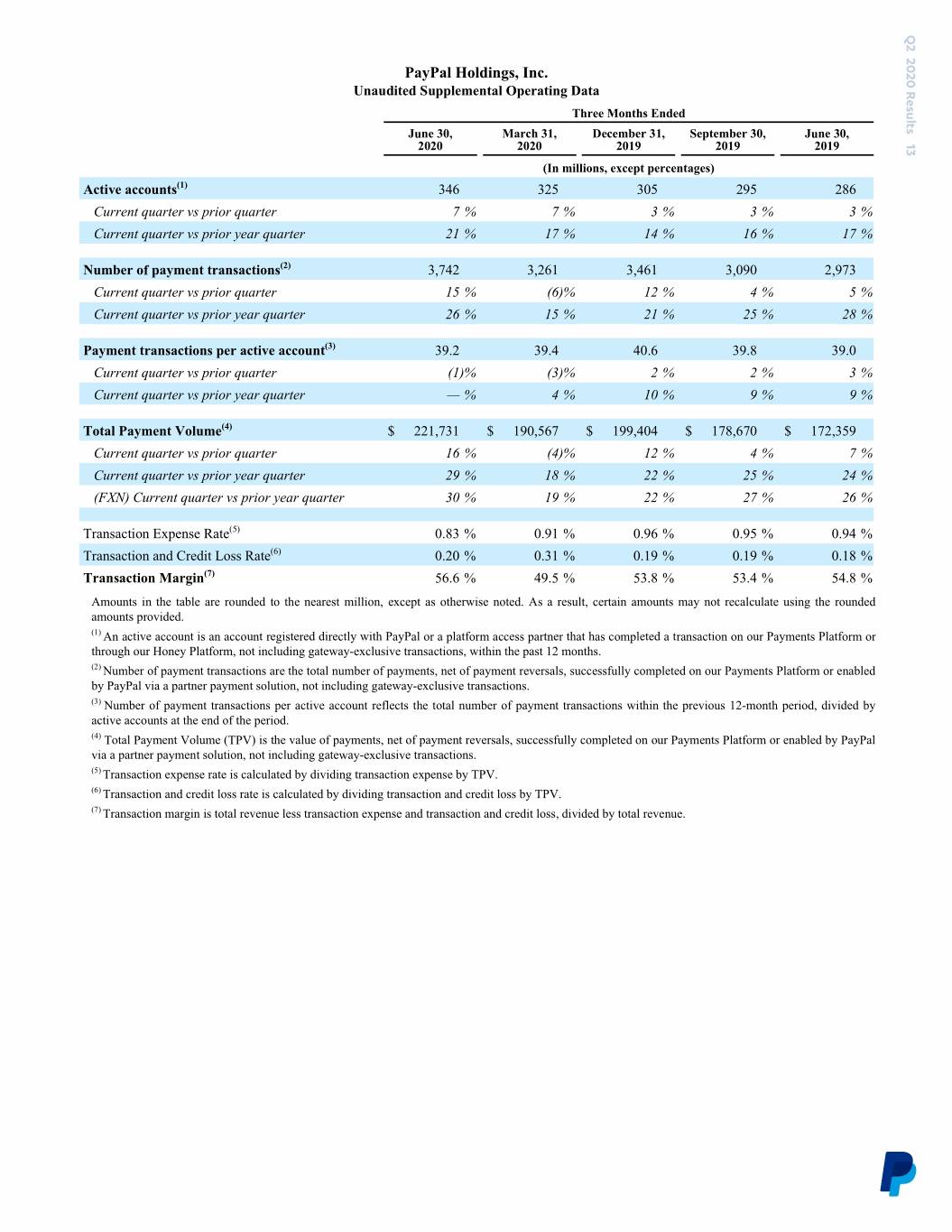

Q2 2020 Results 13 PayPal Holdings, Inc. Unaudited Supplemental Operating Data Three Months Ended June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 (In millions, except percentages) Active accounts(1) 346 325 305 295 286 Current quarter vs prior quarter 7 % 7 % 3 % 3 % 3 % Current quarter vs prior year quarter 21 % 17 % 14 % 16 % 17 % Number of payment transactions(2) 3,742 3,261 3,461 3,090 2,973 Current quarter vs prior quarter 15 % (6) % 12 % 4 % 5 % Current quarter vs prior year quarter 26 % 15 % 21 % 25 % 28 % Payment transactions per active account(3) 39.2 39.4 40.6 39.8 39.0 Current quarter vs prior quarter (1) % (3) % 2 % 2 % 3 % Current quarter vs prior year quarter — % 4 % 10 % 9 % 9 % Total Payment Volume(4) $ 221,731 $ 190,567 $ 199,404 $ 178,670 $ 172,359 Current quarter vs prior quarter 16 % (4) % 12 % 4 % 7 % Current quarter vs prior year quarter 29 % 18 % 22 % 25 % 24 % (FXN) Current quarter vs prior year quarter 30 % 19 % 22 % 27 % 26 % Transaction Expense Rate(5) 0.83 % 0.91 % 0.96 % 0.95 % 0.94 % Transaction and Credit Loss Rate(6) 0.20 % 0.31 % 0.19 % 0.19 % 0.18 % Transaction Margin(7) 56.6 % 49.5 % 53.8 % 53.4 % 54.8 % Amounts in the table are rounded to the nearest million, except as otherwise noted. As a result, certain amounts may not recalculate using the rounded amounts provided. (1) An active account is an account registered directly with PayPal or a platform access partner that has completed a transaction on our Payments Platform or through our Honey Platform, not including gateway-exclusive transactions, within the past 12 months. (2) Number of payment transactions are the total number of payments, net of payment reversals, successfully completed on our Payments Platform or enabled by PayPal via a partner payment solution, not including gateway-exclusive transactions. (3) Number of payment transactions per active account reflects the total number of payment transactions within the previous 12-month period, divided by active accounts at the end of the period. (4) Total Payment Volume (TPV) is the value of payments, net of payment reversals, successfully completed on our Payments Platform or enabled by PayPal via a partner payment solution, not including gateway-exclusive transactions. (5) Transaction expense rate is calculated by dividing transaction expense by TPV. (6) Transaction and credit loss rate is calculated by dividing transaction and credit loss by TPV. (7) Transaction margin is total revenue less transaction expense and transaction and credit loss, divided by total revenue.

Q2 2020 Results 14 PayPal Holdings, Inc. Non-GAAP Measures of Financial Performance To supplement the company’s condensed consolidated financial statements presented in accordance with generally accepted accounting principles, or GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP net income, non-GAAP diluted earnings per share, non-GAAP operating income, non-GAAP operating margin, non- GAAP effective tax rate, free cash flow, and adjusted free cash flow. These non-GAAP measures are not in accordance with, or an alternative to, measures prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. These measures should only be used to evaluate the company’s results of operations in conjunction with the corresponding GAAP measures. Reconciliation to the most directly comparable GAAP measure of all non-GAAP measures included in this press release can be found in the tables included in this press release. These non-GAAP measures are provided to enhance investors’ overall understanding of the company’s current financial performance and its prospects for the future. Specifically, the company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses, as the case may be, that may not be indicative of its core operating results and business outlook. In addition, because the company has historically reported certain non-GAAP results to investors, the company believes that the inclusion of non-GAAP measures provides consistency in the company’s financial reporting. For its internal budgeting process, and as discussed further below, the company’s management uses financial measures that do not include stock-based compensation expense, employer payroll taxes on stock-based compensation, amortization or impairment of acquired intangible assets, impairment of goodwill, restructuring-related charges, certain other gains, losses, benefits, or charges that are not indicative of the company’s core operating results, and the income taxes associated with the foregoing. In addition to the corresponding GAAP measures, the company’s management also uses the foregoing non-GAAP measures in reviewing the financial results of the company. The company excludes the following items from non-GAAP net income, non-GAAP diluted earnings per share, non-GAAP operating income, non-GAAP operating margin, and non-GAAP effective tax rate: Stock-based compensation expense and related employer payroll taxes. This consists of expenses for equity awards under our equity incentive plans. We exclude stock-based compensation expense from our non-GAAP measures primarily because they are non-cash expenses. The related employer payroll taxes are dependent on our stock price and the timing and size of exercises and vesting of equity awards, over which management has limited to no control, and as such management does not believe it correlates to the operation of our business. Amortization or impairment of acquired intangible assets, impairment of goodwill, and transaction expenses from the acquisition or disposal of a business. We incur amortization or impairment of acquired intangible assets and goodwill in connection with acquisitions and may incur significant gains or losses or transactional expenses from the acquisition or disposal of a business and therefore exclude these amounts from our non-GAAP measures. We exclude these items because management does not believe they are reflective of our ongoing operating results. Restructuring. These consist of expenses for employee severance and other exit and disposal costs. The company excludes significant restructuring charges primarily because management does not believe they are reflective of ongoing operating results. Gains and losses on strategic investments. We record gains and losses on our strategic investments related to our interest in companies over which we have limited control and visibility. We exclude such gains and losses in full because we lack control over the operations of the investee and the related gains and losses are not indicative of our ongoing operating results. Certain other significant gains, losses, benefits, or charges that are not indicative of the company’s core operating results. These are significant gains, losses, benefits, or charges during a period that are the result of isolated events or transactions which have not occurred frequently in the past and are not expected to occur regularly in the future. The company excludes these amounts from its non-GAAP results because management does not believe they are indicative of our current or ongoing operating results. Tax effect of non-GAAP adjustments. This adjustment is made to present stock-based compensation and the other amounts described above on an after-tax basis consistent with the presentation of non-GAAP net income. The company also uses free cash flow, a non-GAAP measure. Free cash flow represents operating cash flows less purchases of property and equipment. The company considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after the purchases of property, buildings, and equipment, which can then be used to, among other things, invest in the company’s business, make strategic acquisitions and investments, and repurchase stock. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in the company’s cash balance for the period. In addition to the non-GAAP measures discussed above, the company also analyzes certain measures, including net revenues and operating expenses, on an FX-neutral basis to better measure the comparability of operating results between periods. The company believes that changes in foreign currency exchange rates are not indicative of the company’s operations and evaluating growth in net revenues and operating expenses on an FX-neutral basis provides an additional meaningful and comparable assessment of these measures to both management and investors. FX-neutral results are calculated by translating the current period’s local currency results with the prior period’s exchange rate. FX-neutral growth rates are calculated by comparing the current period’s FX-neutral results by the prior period’s results, excluding the impact from hedging activities.

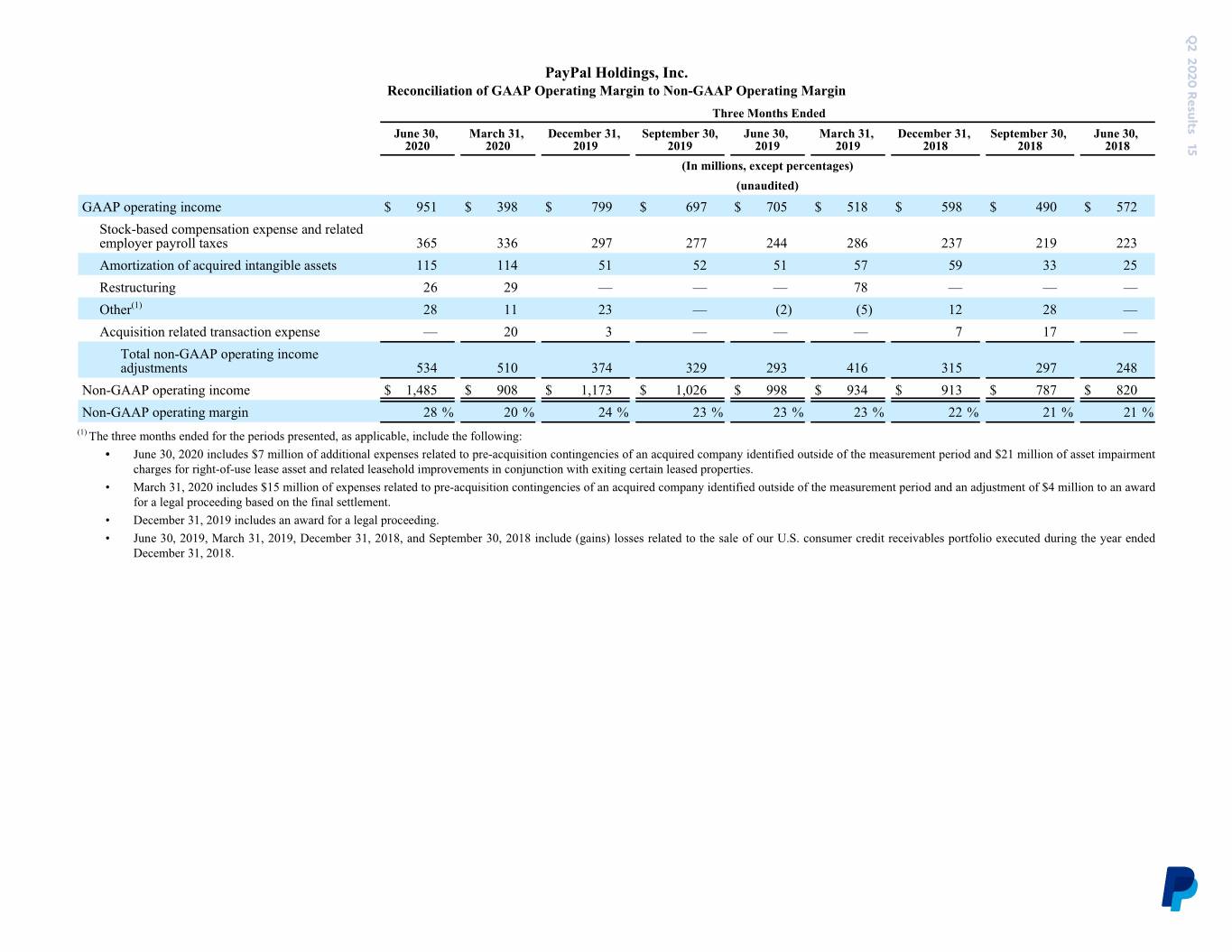

Q2 2020 Results 15 PayPal Holdings, Inc. Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin Three Months Ended June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 2019 2018 2018 2018 (In millions, except percentages) (unaudited) GAAP operating income $ 951 $ 398 $ 799 $ 697 $ 705 $ 518 $ 598 $ 490 $ 572 Stock-based compensation expense and related employer payroll taxes 365 336 297 277 244 286 237 219 223 Amortization of acquired intangible assets 115 114 51 52 51 57 59 33 25 Restructuring 26 29 — — — 78 — — — Other(1) 28 11 23 — (2) (5) 12 28 — Acquisition related transaction expense — 20 3 — — — 7 17 — Total non-GAAP operating income adjustments 534 510 374 329 293 416 315 297 248 Non-GAAP operating income $ 1,485 $ 908 $ 1,173 $ 1,026 $ 998 $ 934 $ 913 $ 787 $ 820 Non-GAAP operating margin 28 % 20 % 24 % 23 % 23 % 23 % 22 % 21 % 21 % (1) The three months ended for the periods presented, as applicable, include the following: • June 30, 2020 includes $7 million of additional expenses related to pre-acquisition contingencies of an acquired company identified outside of the measurement period and $21 million of asset impairment charges for right-of-use lease asset and related leasehold improvements in conjunction with exiting certain leased properties. • March 31, 2020 includes $15 million of expenses related to pre-acquisition contingencies of an acquired company identified outside of the measurement period and an adjustment of $4 million to an award for a legal proceeding based on the final settlement. • December 31, 2019 includes an award for a legal proceeding. • June 30, 2019, March 31, 2019, December 31, 2018, and September 30, 2018 include (gains) losses related to the sale of our U.S. consumer credit receivables portfolio executed during the year ended December 31, 2018. Q2 2020 Results 15 15 Results 2020 Q2

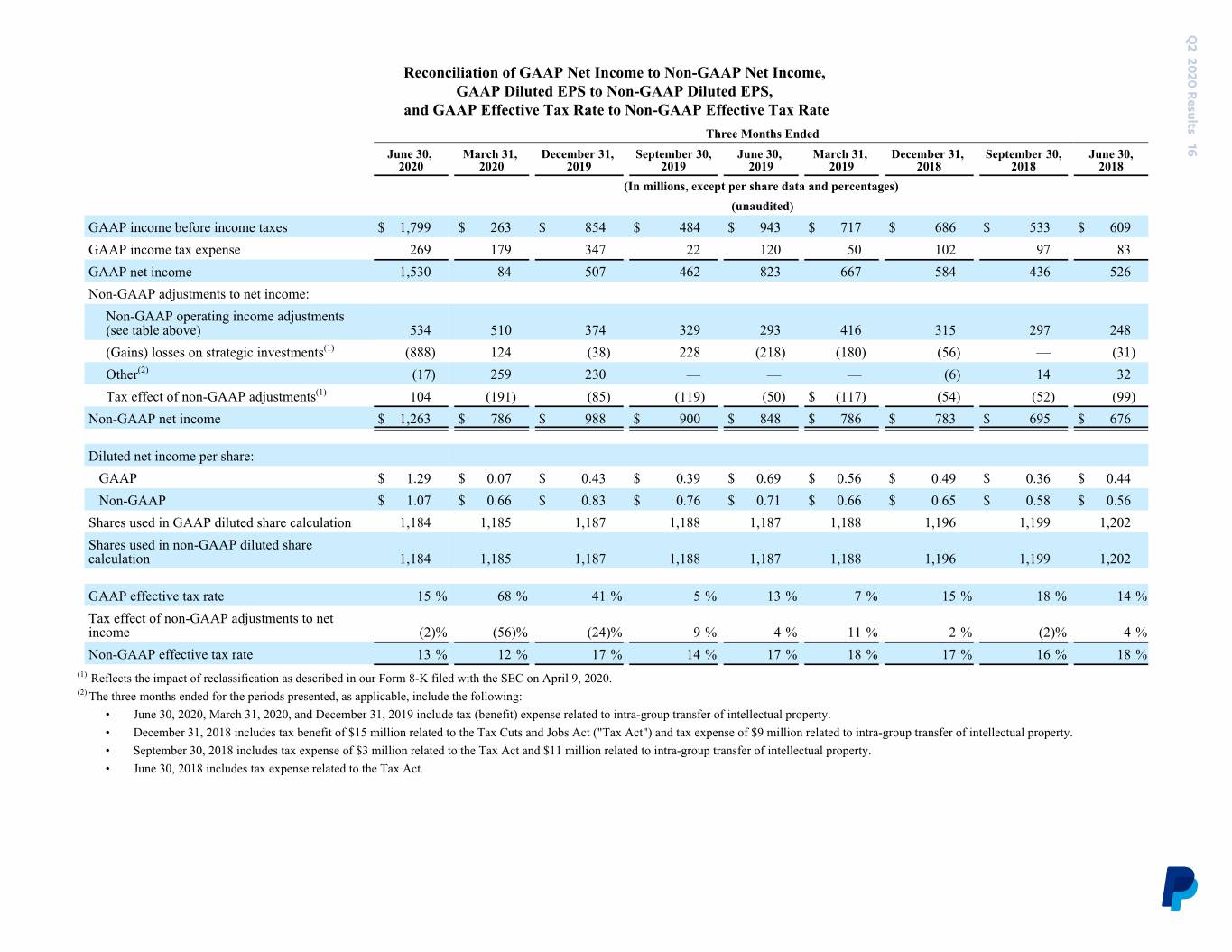

Q2 2020 Results 16 Reconciliation of GAAP Net Income to Non-GAAP Net Income, GAAP Diluted EPS to Non-GAAP Diluted EPS, and GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate Three Months Ended June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 2019 2018 2018 2018 (In millions, except per share data and percentages) (unaudited) GAAP income before income taxes $ 1,799 $ 263 $ 854 $ 484 $ 943 $ 717 $ 686 $ 533 $ 609 GAAP income tax expense 269 179 347 22 120 50 102 97 83 GAAP net income 1,530 84 507 462 823 667 584 436 526 Non-GAAP adjustments to net income: Non-GAAP operating income adjustments (see table above) 534 510 374 329 293 416 315 297 248 (Gains) losses on strategic investments(1) (888) 124 (38) 228 (218) (180) (56) — (31) Other(2) (17) 259 230 — — — (6) 14 32 Tax effect of non-GAAP adjustments(1) 104 (191) (85) (119) (50) $ (117) (54) (52) (99) Non-GAAP net income $ 1,263 $ 786 $ 988 $ 900 $ 848 $ 786 $ 783 $ 695 $ 676 Diluted net income per share: GAAP $ 1.29 $ 0.07 $ 0.43 $ 0.39 $ 0.69 $ 0.56 $ 0.49 $ 0.36 $ 0.44 Non-GAAP $ 1.07 $ 0.66 $ 0.83 $ 0.76 $ 0.71 $ 0.66 $ 0.65 $ 0.58 $ 0.56 Shares used in GAAP diluted share calculation 1,184 1,185 1,187 1,188 1,187 1,188 1,196 1,199 1,202 Shares used in non-GAAP diluted share calculation 1,184 1,185 1,187 1,188 1,187 1,188 1,196 1,199 1,202 GAAP effective tax rate 15 % 68 % 41 % 5 % 13 % 7 % 15 % 18 % 14 % Tax effect of non-GAAP adjustments to net income (2) % (56) % (24) % 9 % 4 % 11 % 2 % (2) % 4 % Non-GAAP effective tax rate 13 % 12 % 17 % 14 % 17 % 18 % 17 % 16 % 18 % (1) Reflects the impact of reclassification as described in our Form 8-K filed with the SEC on April 9, 2020. (2) The three months ended for the periods presented, as applicable, include the following: • June 30, 2020, March 31, 2020, and December 31, 2019 include tax (benefit) expense related to intra-group transfer of intellectual property. • December 31, 2018 includes tax benefit of $15 million related to the Tax Cuts and Jobs Act ("Tax Act") and tax expense of $9 million related to intra-group transfer of intellectual property. • September 30, 2018 includes tax expense of $3 million related to the Tax Act and $11 million related to intra-group transfer of intellectual property. • June 30, 2018 includes tax expense related to the Tax Act. Q2 2020 Results 16 16 Results 2020 Q2

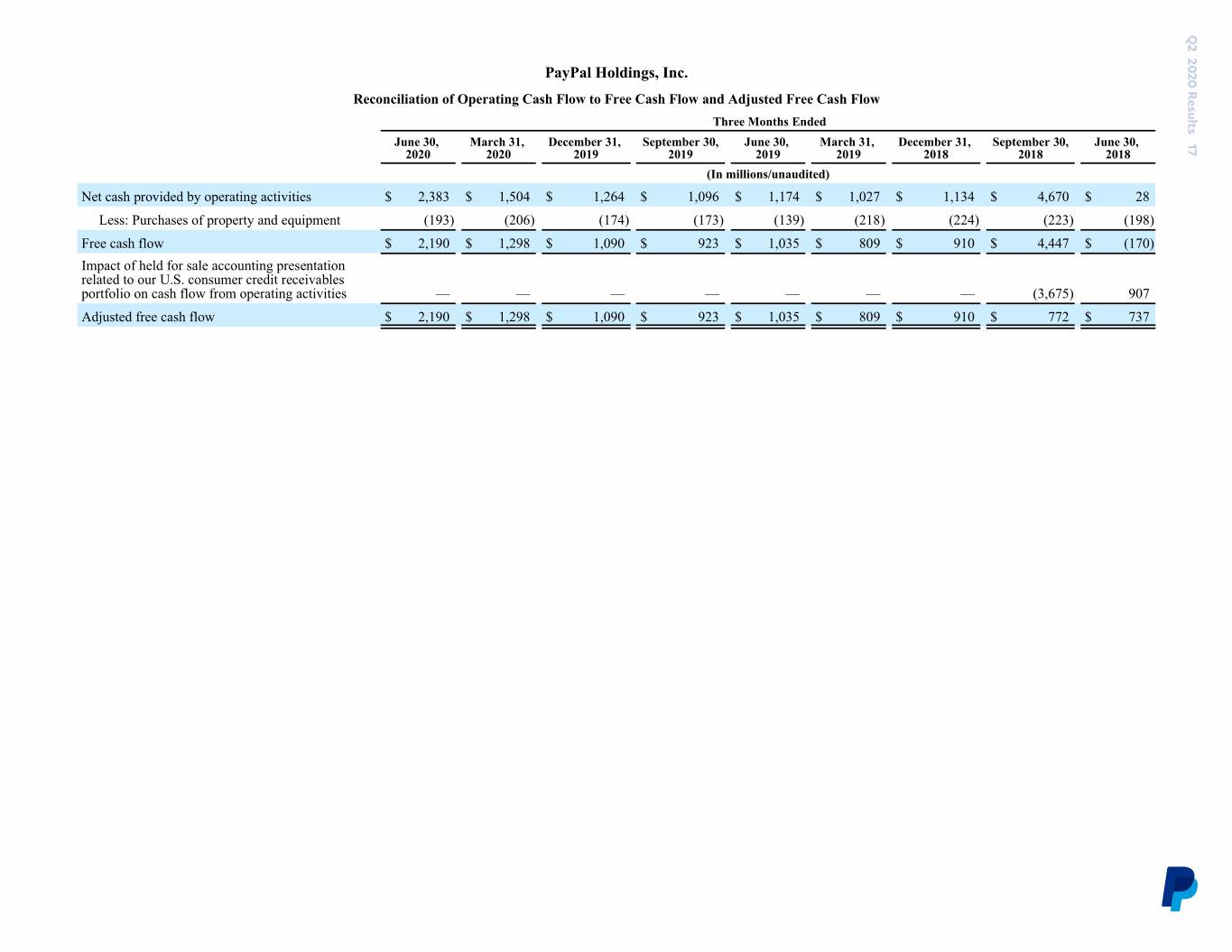

Q2 2020 Results 17 PayPal Holdings, Inc. Reconciliation of Operating Cash Flow to Free Cash Flow and Adjusted Free Cash Flow Three Months Ended June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, 2020 2020 2019 2019 2019 2019 2018 2018 2018 (In millions/unaudited) Net cash provided by operating activities $ 2,383 $ 1,504 $ 1,264 $ 1,096 $ 1,174 $ 1,027 $ 1,134 $ 4,670 $ 28 Less: Purchases of property and equipment (193) (206) (174) (173) (139) (218) (224) (223) (198) Free cash flow $ 2,190 $ 1,298 $ 1,090 $ 923 $ 1,035 $ 809 $ 910 $ 4,447 $ (170) Impact of held for sale accounting presentation related to our U.S. consumer credit receivables portfolio on cash flow from operating activities — — — — — — — (3,675) 907 Adjusted free cash flow $ 2,190 $ 1,298 $ 1,090 $ 923 $ 1,035 $ 809 $ 910 $ 772 $ 737 Q2 2020 Results 17 17 Results 2020 Q2