Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL VALLEY COMMUNITY BANCORP | cvcy-20200728.htm |

Investor Presentation 21st Annual KBW Community Bank Investor Conference July 28 - 30, 2020 Jim Ford President & CEO Dave Kinross EVP CFO James Kim EVP COO

Forward-Looking Statements Certain matters discussed in this report constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company’s current business strategy and the Company’s plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates; (3) a decline in economic conditions in the Central Valley and the Greater Sacramento Region; (4) the Company’s ability to continue its internal growth at historical rates; (5) the Company’s ability to maintain its net interest margin; (6) the decline in quality of the Company’s earning assets; (7) a decline in credit quality; (8) changes in the regulatory environment; (9) fluctuations in the real estate market; (10) changes in business conditions and inflation; (11) changes in securities markets (12) risks associated with acquisitions, relating to difficulty in integrating combined operations and related negative impact on earnings, and incurrence of substantial expenses; (13) political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, drought, pandemic diseases or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; and (14) the rapidly changing uncertainties related to the Covid-19 pandemic including, but not limited to, the potential adverse effect of the pandemic on the economy, our employees and customers, and our financial performance. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company. When the Company uses in this presentation the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “commit,” “believe,” and similar expressions, the Company intends to identify forward-looking statements. Such statements are not guarantees of performance and are subject to certain risks, uncertainties and assumptions, including those described in this presentation. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected, projected, intended, committed or believed. The future results and shareholder values of the Company may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results and values are beyond the Company’s ability to control or predict. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Central Valley Community Bancorp will undertake no obligation to revise or publically release any revision or update to the forward looking statements to reflect events or circumstances that occur after the date on which statements were made. 2

Experienced Management Team Years at Years of Executive Position CVCY Experience James M. Ford President & CEO 6 40 David A. Kinross EVP, Chief Financial Officer 14 30 James J. Kim EVP, Chief Operating Officer 3 20 Patrick J. Carman EVP, Chief Credit Officer 11 48 Ken Ramos EVP, Market Executive – South 1 31 Blaine Lauhon EVP, Market Executive – North 2 33 Teresa Gilio EVP, Chief Administrative Officer 11 38 3

Overview 20 Branches in 9 Contiguous Counties NASDAQ Symbol CVCY Market Capitalization $192 Million Institutional Ownership 46% Insider Ownership 16% Total Assets $1.91 Billion Headquarters Fresno, CA Number of Branches 20 Year Established 1980 Strategic Footprint Bakersfield to Sacramento As of June 30, 2020 4

Financial Highlights 2020 Q2 YTD 2019 2018 Total Assets $1.91 Billion $1.60 Billion $1.54 Billion Net Income $8.92 Million $21.44 Million $21.29 Million Diluted EPS $0.71 $1.59 $1.54 Net Interest Margin 4.11% 4.51% 4.44% ROAA 1.05% 1.36% 1.35% ROAE 7.92% 9.39% 10.07% Cash Dividends per share $0.22 $0.43 $0.31 Total Cost of Funds 0.11% 0.15% 0.09% NPAs to Total Assets 0.13% 0.11% 0.18% Leverage Capital Ratio 9.63% 11.38% 11.48% Common Equity Tier 1 Ratio 13.66% 14.55% 15.13% Tier 1 Risk Based Capital Ratio 14.08% 14.98% 15.59% Total Risk Based Capital Ratio 15.25% 15.79% 16.44% 5

COVID-19 Responses • Implemented Pandemic Plan mid February 2020 to address COVID-19 and escalated activities into early March 2020 • California governor enacted “shelter-in-place” for non-essential businesses on March 19, 2020 • We have successfully split our operations center into two functions that duplicate processes so that either can continue back-office processing • About 15% of our workforce is working remotely from home • Installed Plexiglas barriers in banking centers • Reduced banking center hours and utilized drive-up teller stations • Our Credit teams began monitoring clients via direct communication, checklists we deployed to aid in monitoring loans. • A loan deferral program was announced and executed beginning in Mid- March • PPP approved SBA loans totaled $211 million with net fees of $6.3 million 6

COVID-19 Responses (continued) • Implemented a 90-day loan deferral program with 290 deferrals representing $179 million in outstanding loan balances at June 30, 2020 • Added resources to the Credit Administration team to do additional targeted segment and loan analysis and reporting (LTV, DSC, Government Guarantees, etc.) • Identified higher risk segments to analyze first in addition to all loans over $750,000, representing 70% of our total loan portfolio • Evaluating and talking to all PPP Loan recipients and all Loan Deferral recipients for current liquidity, financial information and projected cash flow to develop any plans that are necessary • Increasing frequency of Problem Loan Report meetings • Focusing on both Probability of Default and Loss Given Default • Monitoring external economic conditions, i.e. unemployment rates, home sales, etc. 7

Attractive Investment Opportunity CVCY Stock Price 25 20 15 Price 10 Dividend Payout Ratio - 31.0% Dividend Yield - 2.86% 5 0 1/1/2015 1/1/2016 1/1/2017 1/1/2018 1/1/2019 1/1/2020 As of June 30, 2020 Source: NASDAQ Monthly Closing Price Data 8

Growing Franchise Average Total Assets 2,000,000 1,800,000 1,600,000 1,400,000 1,200,000 1,000,000 Thousands 1,705,964 800,000 1,577,410 1,574,089 1,491,696 1,321,007 600,000 1,222,526 400,000 200,000 0 2015 2016 2017 2018 2019 2020 Q2 YTD Note: Acquisitions of Sierra Vista Bank occurred on October 1, 2016, and Folsom Lake Bank occurred on October 1, 2017 9

Strong Net Income and NIM 25,000 4.60 4.51 4.50 4.44 4.40 20,000 4.40 4.30 15,000 4.20 4.11 4.06 Percent Thousands 4.10 21,289 21,443 10,000 4.01 4.00 15,182 14,026 10,964 3.90 5,000 8,924 3.80 0 3.70 2015 2016 2017 2018 2019 2020 Q2 YTD Net Income Net Interest Margin 10

Solid Earnings ROAA / ROAE 1.60 12.00 10.07 1.40 9.84 9.39 10.00 1.20 8.12 7.92 7.69 8.00 1.00 0.80 6.00 1.36 1.35 Percent ROAE ROAA Percent ROAA 0.60 1.15 1.05 4.00 0.90 0.94 0.40 2.00 0.20 - - 2015 2016 2017 2018 2019 2020 Q2 YTD ROAA ROAE 11

Steady Deposit Growth and Lowest Cost of Funds Average Total Deposits 1,600,000 0.15 0.16 1,400,000 0.14 1,200,000 0.11 0.12 1,000,000 0.10 0.09 0.09 0.09 0.08 800,000 0.08 1,445,543 Percent Thousands 1,284,305 1,333,754 1,295,780 600,000 0.06 1,144,231 1,065,798 400,000 0.04 200,000 0.02 0 0.00 2015 2016 2017 2018 2019 2020 Q2 YTD Avg Deposits Cost of Funds 12

Attractive Deposit Mix Total Deposits = $1.65 Billion TCDs 5% Money Market 18% Non-Interest Bearing 50% Now/Savings 27% As of June 30, 2020 13

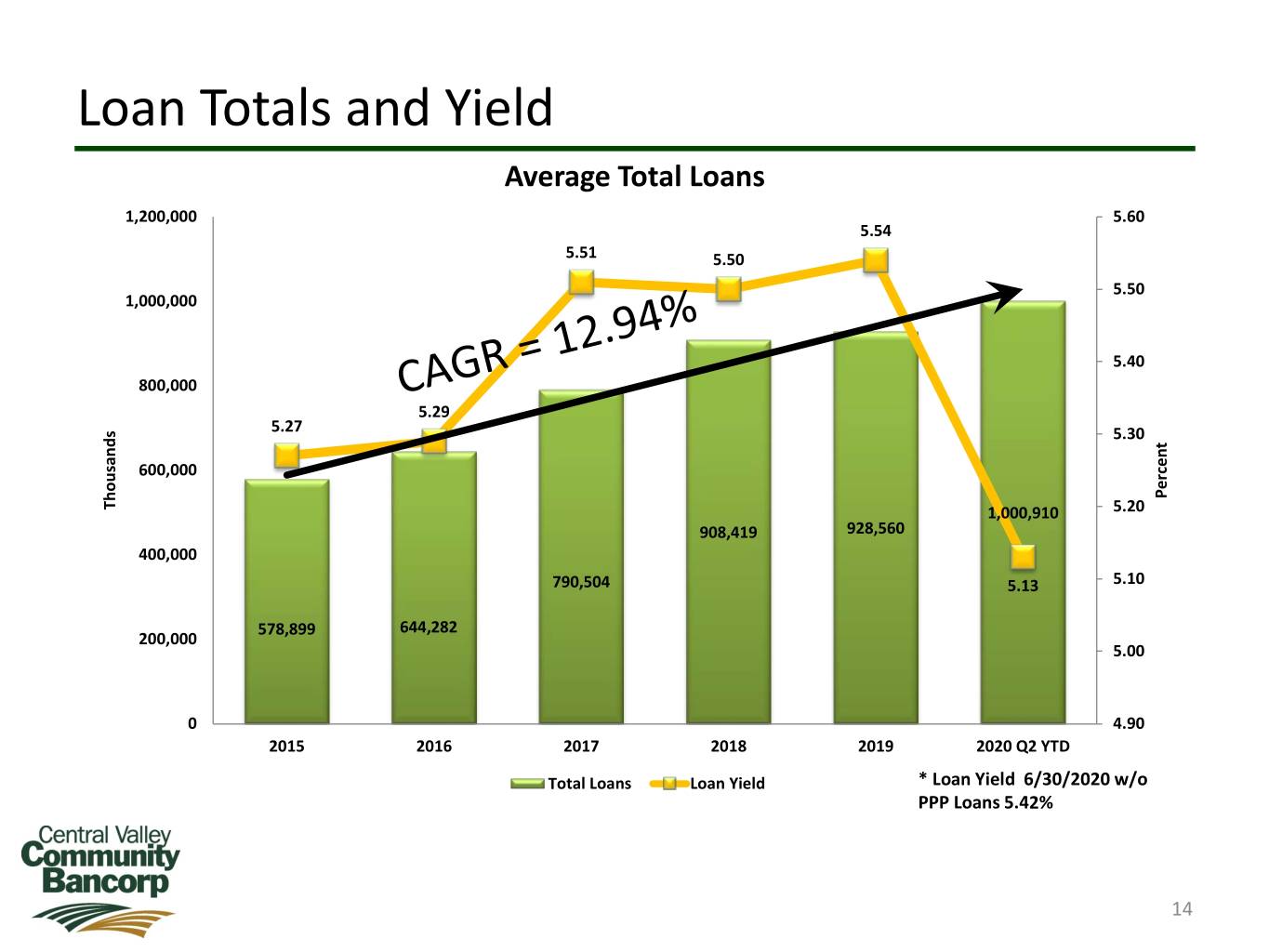

Loan Totals and Yield Average Total Loans 1,200,000 5.60 5.54 5.51 5.50 5.50 1,000,000 5.40 800,000 5.29 5.27 5.30 600,000 Percent Thousands 1,000,910 5.20 908,419 928,560 400,000 790,504 5.13 5.10 578,899 644,282 200,000 5.00 0 4.90 2015 2016 2017 2018 2019 2020 Q2 YTD Total Loans Loan Yield * Loan Yield 6/30/2020 w/o PPP Loans 5.42% 14

Well Diversified Loan Portfolio Total Loans = $1.13 Billion Consumer & Equity Loans and Installment, 4% Other Real Estate, Lines, 5% 3% Commercial & Industrial, 27% Commercial Real Estate, 28% Agriculture Production & Land, 9% R/E Construction & Owner Occupied Land, 7% Real Estate, 18% As of June 30, 2020 Excludes Deferred Loan Fees 15

Agricultural Loan Commitments Pistachios Citrus 1% 1% Cotton 2% Cherries Tree Fruit Almonds 3% 16% 19% Table Grapes Raisins 6% 7% Open Land 12% Tomatoes 11% Walnuts Row Crops 5% 3% Other 12% Wine Grapes 2% As of June 30, 2020 16

Non Performing Loans 3,500 1.80 1.61 1.60 3,000 1.40 1.23 1.24 2,500 1.20 0.97 0.99 0.97 2,000 1.00 Percent Thousands 0.80 1,500 2,945 2,740 2,542 2,413 2,406 0.60 1,000 1,693 0.40 500 0.20 0 - 2015 2016 2017 2018 2019 2020 Q2 YTD Non Performing Assets ALLL/Loans * ALLL/Loans 6/30/2020 w/o PPP and acquired loans 1.80% 17

Special Mention Loans 40,000 6.00 35,000 4.80 5.00 30,000 3.95 4.00 25,000 3.17 2.99 2.86 20,000 3.00 2.43 Percent Thousands 35,735 15,000 29,911 28,719 28,183 26,254 2.00 21,908 10,000 1.00 5,000 - - 2015 2016 2017 2018 2019 2020 Q2 YTD Special Mention Loans SM Loans/Gross Loans 18

Substandard Loans 60,000 6.54 7.00 6.00 50,000 5.55 5.31 5.00 40,000 3.59 4.00 3.43 30,000 3.09 Percent Thousands 3.00 49,464 49,998 20,000 38,672 33,838 2.00 31,764 28,394 10,000 1.00 - - 2015 2016 2017 2018 2019 2020 Q2 YTD Substandard Loans Sub Loans/Gross Loans 19

Conservative Investment Portfolio Total = $503 Million Total = $638 Million Yield = 2.91% Yield = 2.50% Effective Duration 4.00 Effective Duration 4.56 US Government Private Equity Corporate Agencies Equity US Label Fed Funds Mutual Debt 7% Private Mutual Government Mortgage Sold Funds 1% Label Fed Funds Funds Agencies and Asset 13% 2% Mortgage Sold 1% 3% Backed & Asset 6% 31% Backed Agency 8% Agency CMO, Municipal CMO, MBS MBS & & Other Securities Municipal Other Securities 37% Securities Securities 39% 27% 32% As of June 30, 2020 As of December 31, 2019 20

On the Horizon Improve Efficiencies Monitor COVID-19 Impacts on Customers and Local Economy Proactively Respond to COVID-19 Related Borrower Issues Organic Loan & Deposit Growth Invest in Team & Technology 21

Investing in Relationships 22