Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRINKS CO | bcoform8-kearnings2q20.htm |

| EX-99.1 - EXHIBIT 99.1 - BRINKS CO | ex991q22020.htm |

Exhibit 99.2 Second Quarter 2020 July 29, 2020 1

Safe Harbor Statements and Non-GAAP Results These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," “model”, "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to information regarding: potential 2020 and 2021 revenue and adjusted EBITDA results and the impact of 2020 cost actions; liquidity following the G4S acquisition; expected future payments to fund pension and UMWA obligations; 2020 cash flow and capex; and post-Covid-19 crisis tax rate. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; seasonality, pricing and other competitive industry factors; investment in information technology (“IT”) and its impact on revenue and profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions, regulatory issues (including the imposition of international sanctions, including by the U.S. government), currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including negotiations with organized labor and work stoppages; pandemics (including the ongoing Covid-19 pandemic and related impact to and restrictions on the actions of businesses and consumers, including suppliers and customers), acts of terrorism, strikes or other extraordinary events that negatively affect global or regional cash commerce; anticipated cash needs in light of our current liquidity position and the impact of Covid-19 on our liquidity; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and product or market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee and environmental liabilities in connection with former coal operations, including black lung claims; the impact of the Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public perception of our business, reputation and brand; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations. This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31,2020 and June 30, 2020, and in our other public filings with the Securities and Exchange Commission. Unless otherwise noted, the forward-looking information discussed today and included in these materials is representative as of today only and The Brink's Company undertakes no obligation to update any information contained in this document. These materials are copyrighted and may not be used without written permission from Brink's. Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix and in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website: www.brinks.com. 2

Key Messages (Non-GAAP) Second-quarter results better than expected • Strong sequential growth in operating profit, adj. EBITDA and EPS • Revenue down 10% vs 2019, down 17% organically, flat on constant currency • 8.9% operating margin • Strong revenue recovery from April low point: total company (ex. G4S) down 29% in April vs June 14%; including G4S, down 20% in April, up 3% in June Addressing investor concerns • Financial strength – expanded liquidity to ~$1.3B pro forma, amended debt covenants • G4S acquisition – 80% closed, synergies on track; cost realignment initiated • Cost structure – aggressive realignment, positioned for strong future margin improvement • Retail exposure – U.S. customers re-opening faster than expected • Cash usage – all re-opened U.S. customers accepting cash, cash-in-circulation well above pre-Covid levels Expect continued recovery in 2020 • Expect sequential growth in revenue, operating profit and adj. EBITDA • Realigned cost structure expected to drive 2020 adj. EBITDA margin improvement Positioned for strong revenue and profit growth in 2021 • Full-year impact of cost reductions, G4S acquisition and retail recovery expected to drive material revenue and margin growth • Strategy 2.0 results expected to be incremental Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 3

Our Priorities PRIORITY 1 Our people and customers • Our highest priority is the health and safety of our employees, their families and our customers • Provide “essential services” to our customers PRIORITY 2 Preserve cash and optimize profitability • Take decisive and timely action to preserve cash, maximize liquidity • Execute actions now to reduce variable and fixed costs • Cost actions to date reflected in improved 2Q results PRIORITY 3 Position Brink’s to be stronger on the other side of the crisis • Resize the business & rebuild our business model to achieve target profitability at lower revenue. Accelerate synergies and restructuring • Drive margins higher with sustainable fixed cost reductions • Complete and integrate G4S cash and G4Si acquisitions • Accelerate Strategy 2.0 development and implementation 4

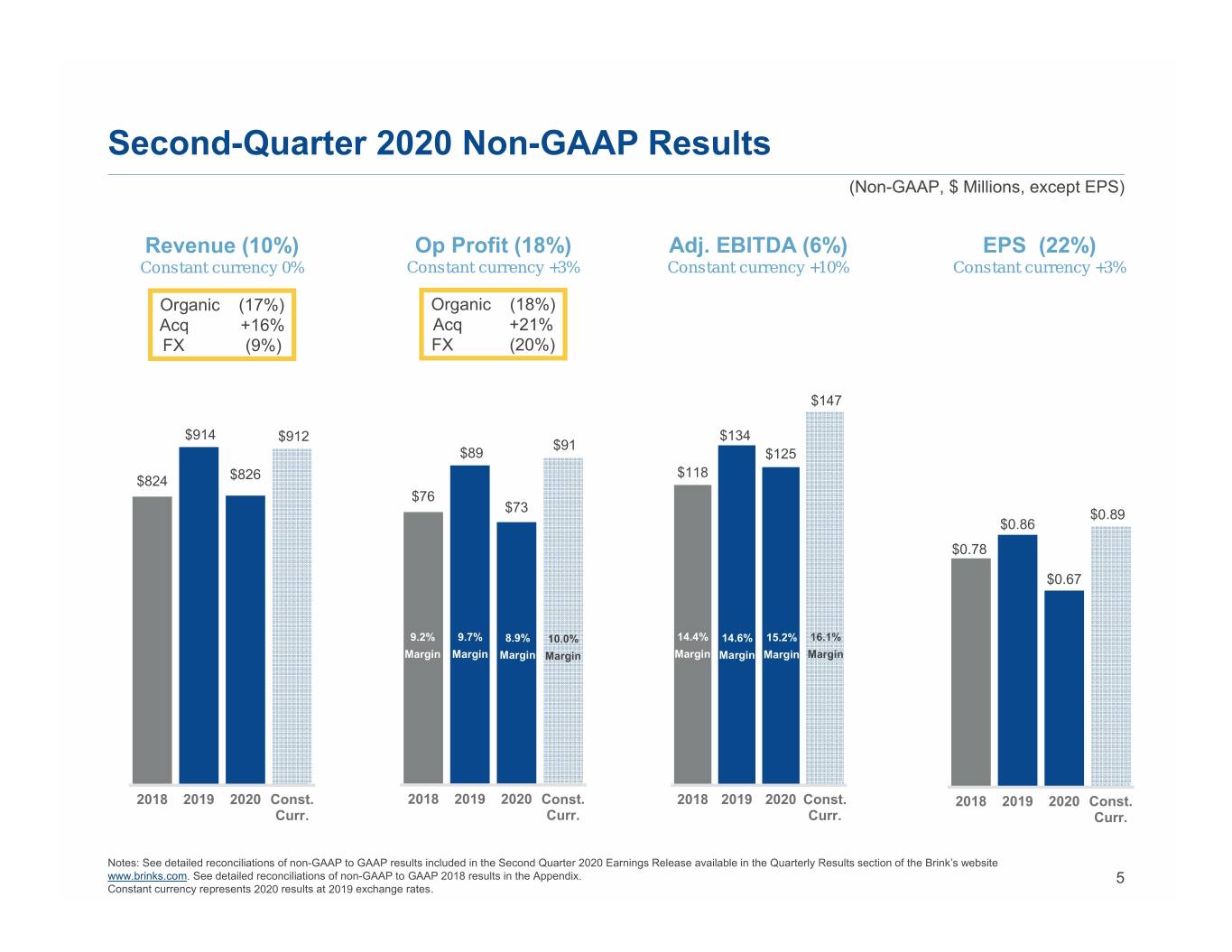

Second-Quarter 2020 Non-GAAP Results (Non-GAAP, $ Millions, except EPS) Revenue (10%) Op Profit (18%) Adj. EBITDA (6%) EPS (22%) Constant currency 0% Constant currency +3% Constant currency +10% Constant currency +3% Organic (17%) Organic (18%) Acq +16% Acq +21% FX (9%) FX (20%) $147 $914 $912 $134 $91 $89 $125 $118 $824 $826 $76 $73 $0.89 12.8% $0.86 Margin $0.78 $0.67 9.2% 9.7% 8.9% 10.0% 14.4% 14.6% 15.2% 16.1% Margin Margin Margin Margin Margin Margin Margin Margin 2018 2019 2020 Const. 2018 2019 2020 Const. 2018 2019 2020 Const. 2018 2019 2020 Const. Curr. Curr. Curr. Curr. Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2018 results in the Appendix. 5 Constant currency represents 2020 results at 2019 exchange rates.

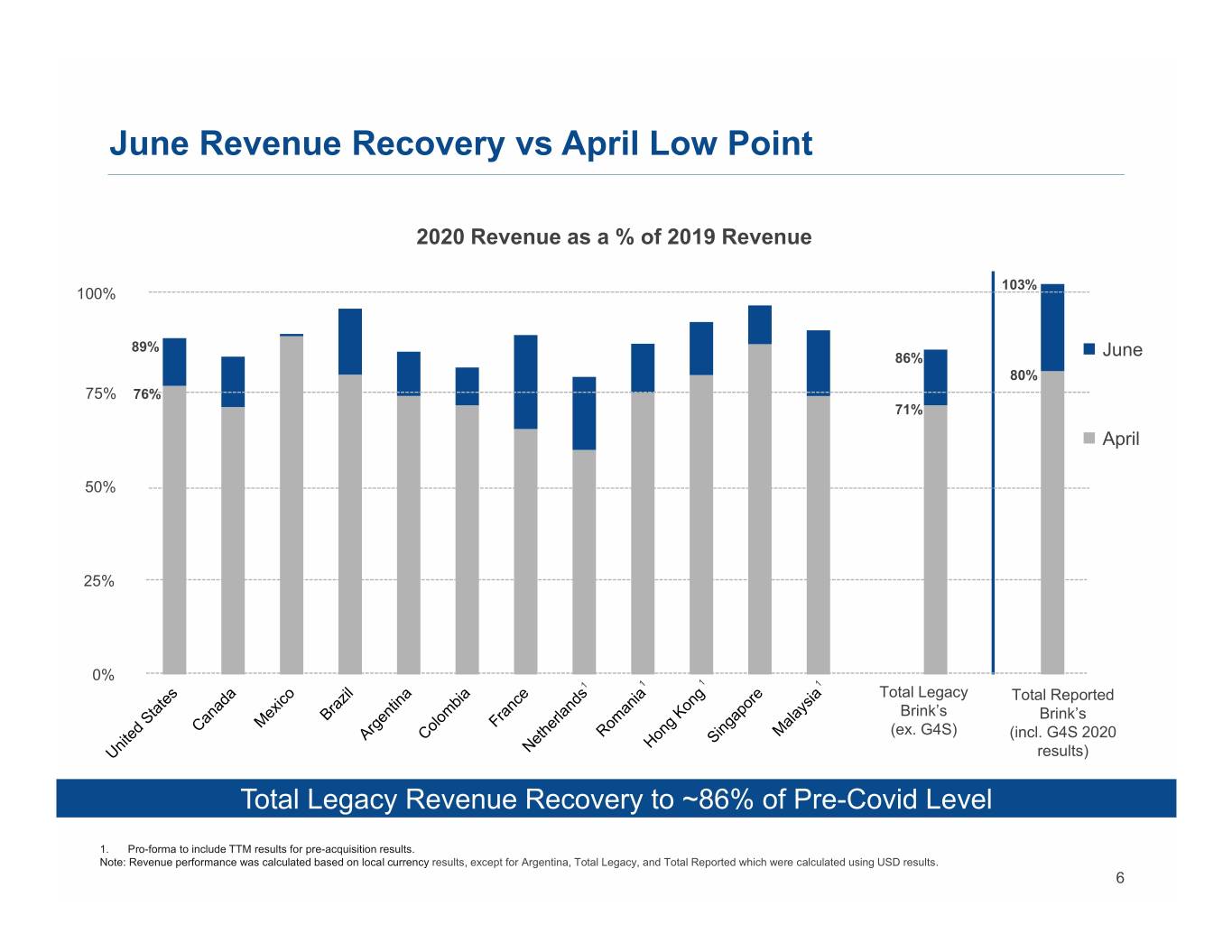

June Revenue Recovery vs April Low Point 2020 Revenue as a % of 2019 Revenue 103% 100% 89% 86% June 80% 75% 76% 71% April 50% 25% 0% Total Legacy Total Reported Brink’s Brink’s (ex. G4S) (incl. G4S 2020 results) Total Legacy Revenue Recovery to ~86% of Pre-Covid Level 1. Pro-forma to include TTM results for pre-acquisition results. Note: Revenue performance was calculated based on local currency results, except for Argentina, Total Legacy, and Total Reported which were calculated using USD results. 6

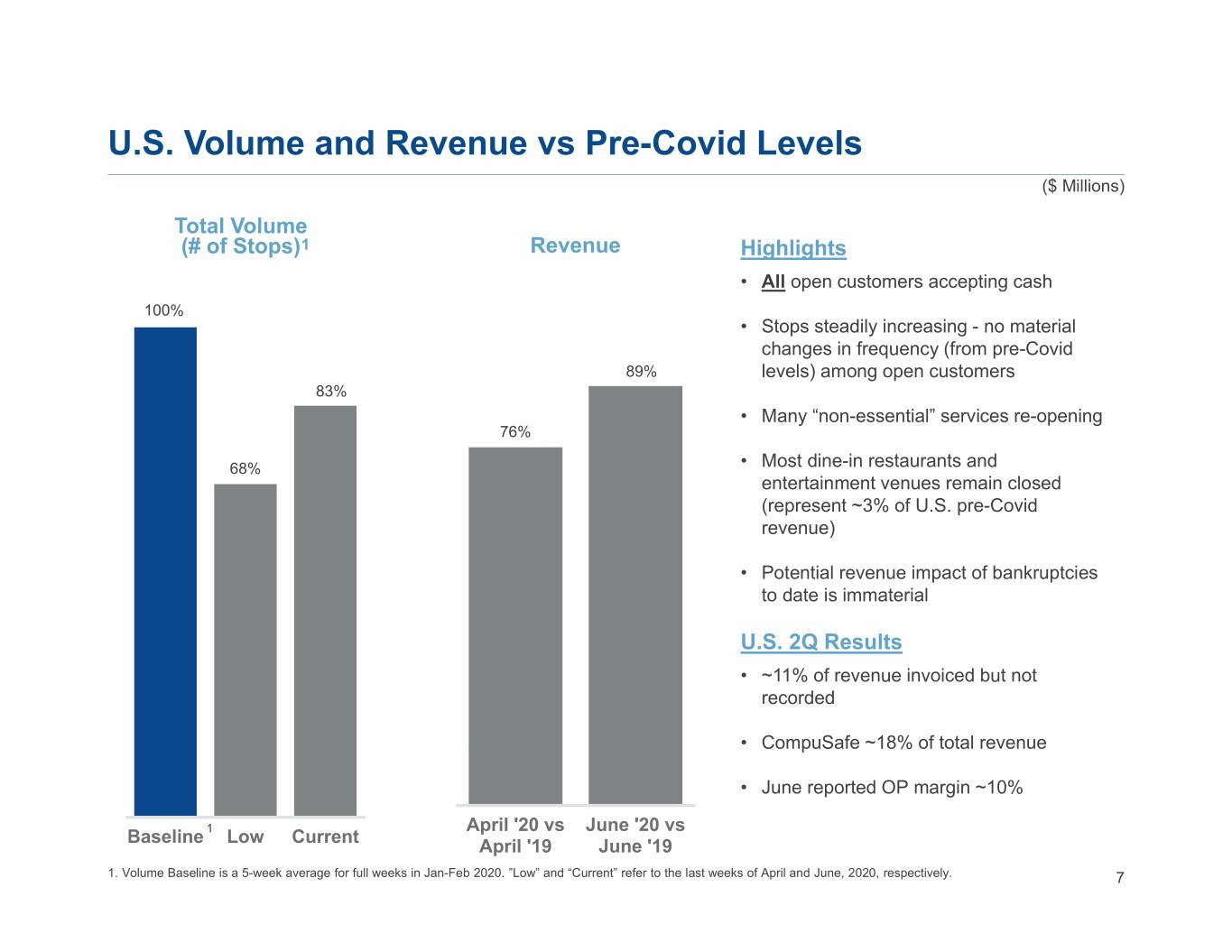

U.S. Volume and Revenue vs Pre-Covid Levels ($ Millions) Total Volume (# of Stops)1 Revenue Highlights • All open customers accepting cash 100% • Stops steadily increasing - no material changes in frequency (from pre-Covid 89% levels) among open customers 83% 10.5% • Many “non-essential” services re-opening 76% Margin 68% • Most dine-in restaurants and 8.1% entertainment venues remain closed Margin (represent ~3% of U.S. pre-Covid 8.8% revenue) Margin • Potential revenue impact of bankruptcies 5.4% Margin to date is immaterial 5.9% Margin U.S. 2Q Results • ~11% of revenue invoiced but not 10.5% recorded Margin 8.9% • CompuSafe ~18% of total revenue Margin • June reported OP margin ~10% April '20 vs June '20 vs Baseline1 Low Current April '19 June '19 1. Volume Baseline is a 5-week average for full weeks in Jan-Feb 2020. ”Low” and “Current” refer to the last weeks of April and June, 2020, respectively. 7

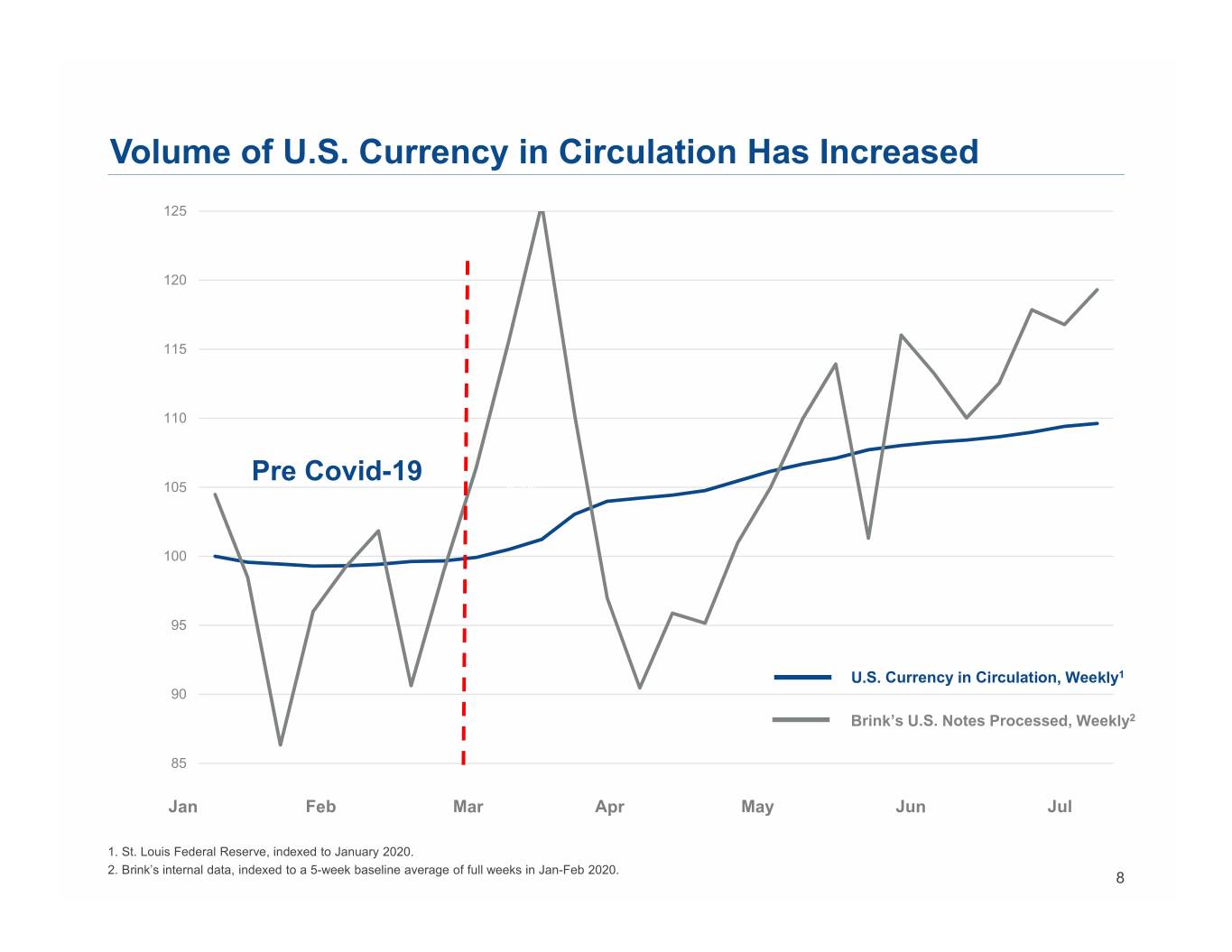

Volume of U.S. Currency in Circulation Has Increased 125 120 115 110 Pre Covid-19 105 8.1% Margin 100 95 U.S. Currency in Circulation, Weekly1 90 Brink’s U.S. Notes Processed, Weekly2 8.9% Margin 85 5.9% Jan Feb Margin Mar Apr May Jun Jul 1. St. Louis Federal Reserve, indexed to January 2020. 2. Brink’s internal data, indexed to a 5-week baseline average of full weeks in Jan-Feb 2020. 8

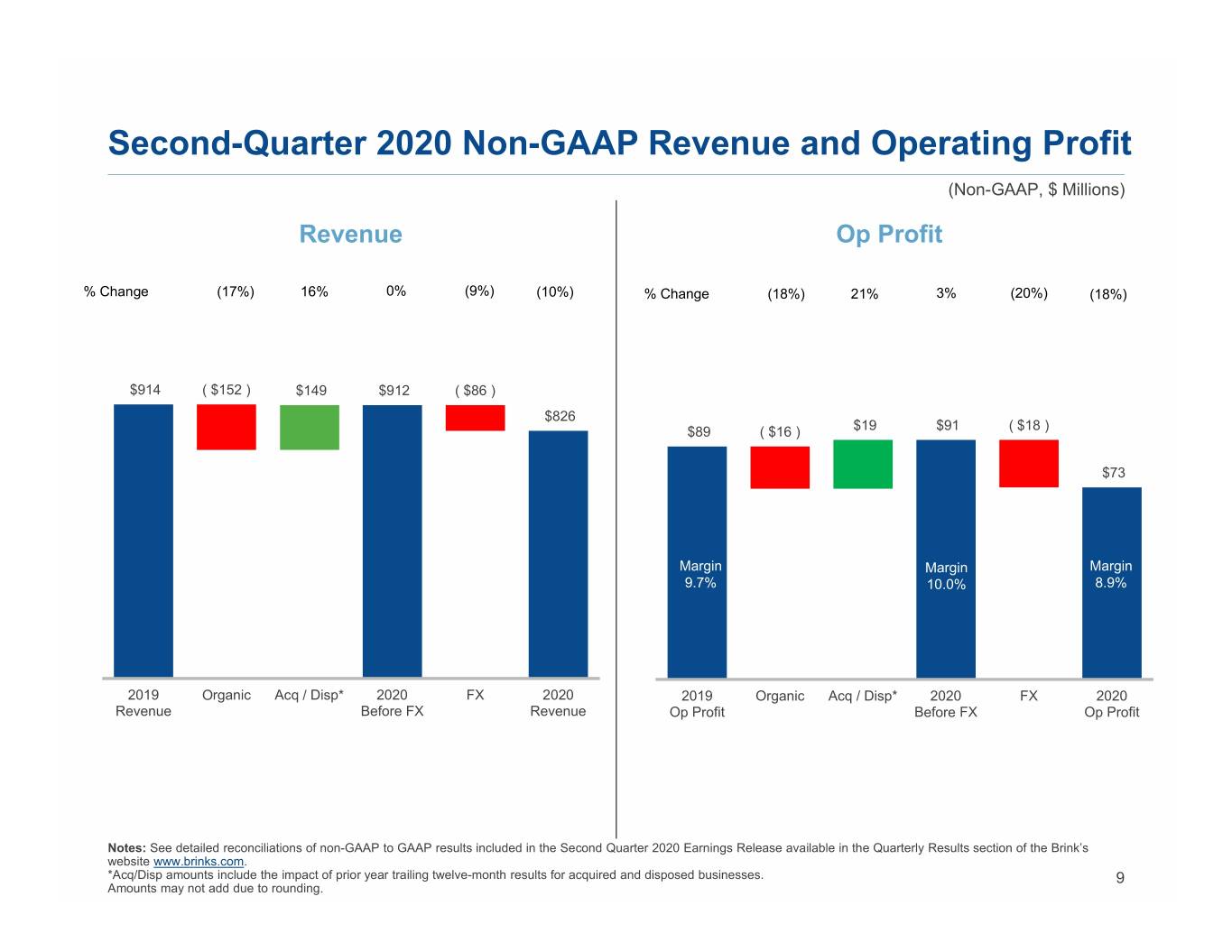

Second-Quarter 2020 Non-GAAP Revenue and Operating Profit (Non-GAAP, $ Millions) Revenue Op Profit % Change (17%) 16% 0% (9%) (10%) % Change (18%) 21% 3% (20%) (18%) $914 ( $152 ) $149 $912 ( $86 ) $826 $89 ( $16 ) $19 $91 ( $18 ) $73 Margin Margin Margin 9.7% 10.0% 8.9% 2019 Organic Acq / Disp* 2020 FX 2020 2019 Organic Acq / Disp* 2020 FX 2020 Revenue Before FX Revenue Op Profit Before FX Op Profit Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses. 9 Amounts may not add due to rounding.

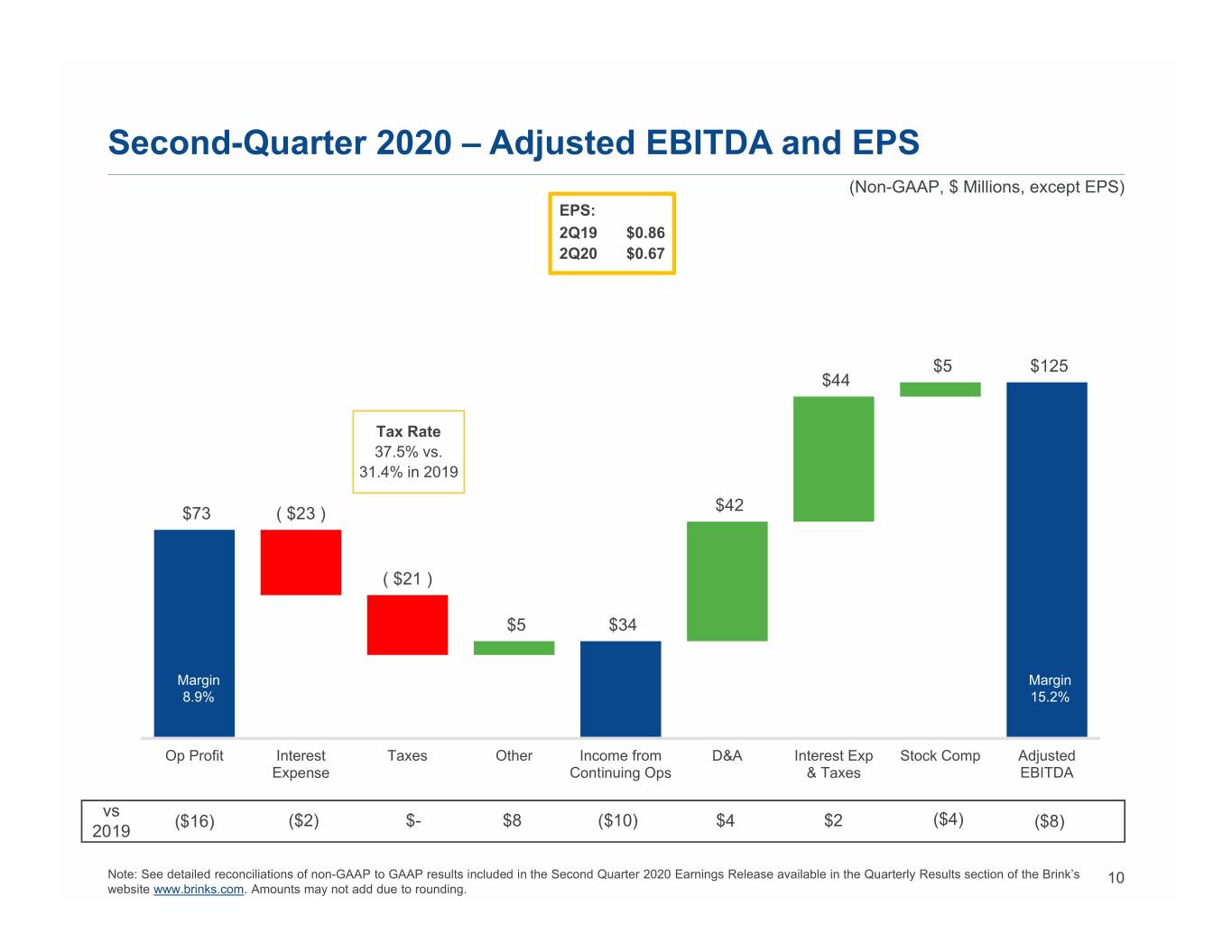

Second-Quarter 2020 – Adjusted EBITDA and EPS (Non-GAAP, $ Millions, except EPS) EPS: 2Q19 $0.86 2Q20 $0.67 $5 $125 $44 Tax Rate 37.5% vs. 31.4% in 2019 $73 ( $23 ) $42 ( $21 ) $5 $34 Margin Margin 8.9% 15.2% Op Profit Interest Taxes Other Income from D&A Interest Exp Stock Comp Adjusted Expense Continuing Ops & Taxes EBITDA vs ($16) ($2) $-$8 ($10) $4 $2 ($4) ($8) 2019 Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s 10 website www.brinks.com. Amounts may not add due to rounding.

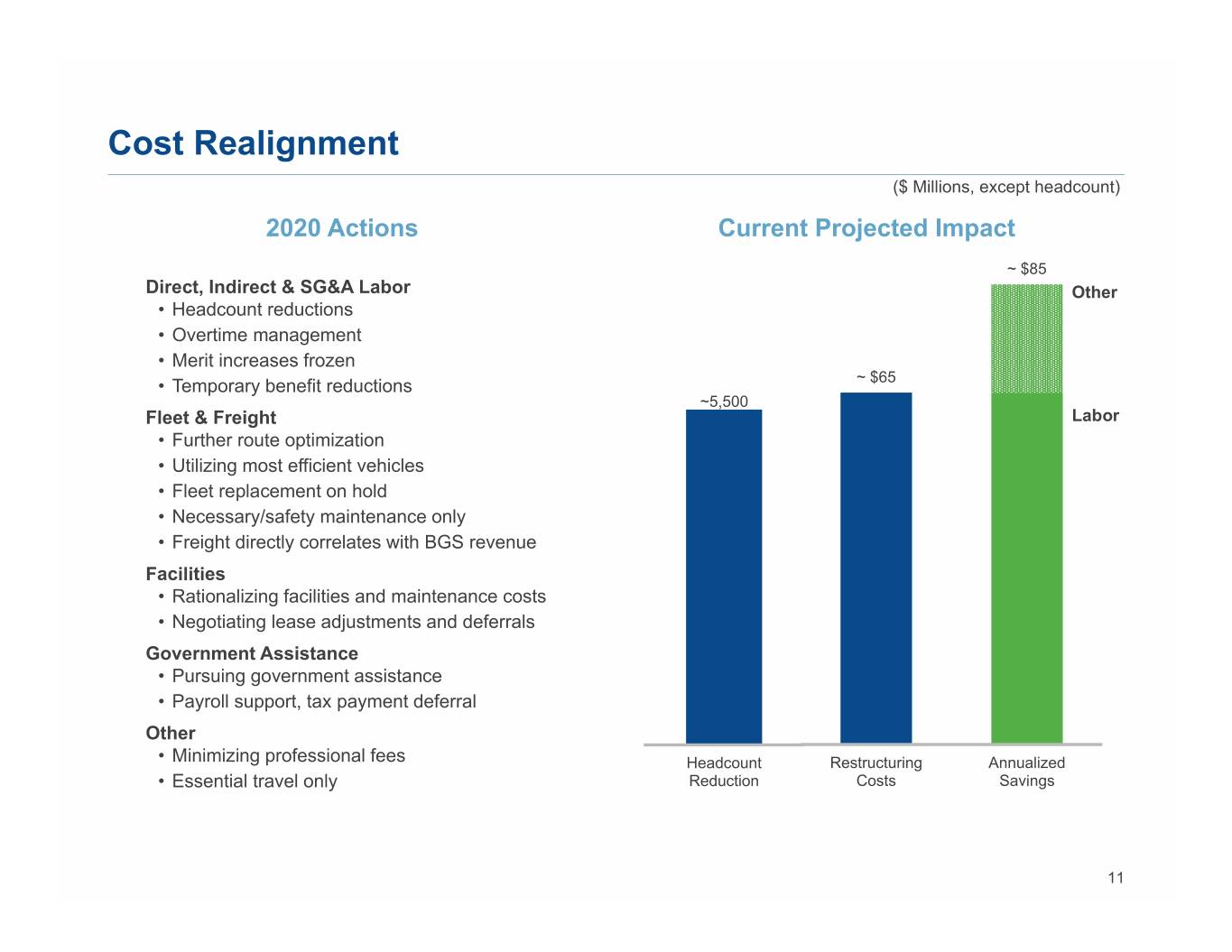

Cost Realignment ($ Millions, except headcount) 2020 Actions Current Projected Impact ~ $85 Direct, Indirect & SG&A Labor Other • Headcount reductions • Overtime management • Merit increases frozen • Temporary benefit reductions ~ $65 ~5,500 Fleet & Freight Labor • Further route optimization • Utilizing most efficient vehicles • Fleet replacement on hold • Necessary/safety maintenance only • Freight directly correlates with BGS revenue Facilities • Rationalizing facilities and maintenance costs • Negotiating lease adjustments and deferrals Government Assistance • Pursuing government assistance • Payroll support, tax payment deferral Other • Minimizing professional fees Headcount Restructuring Annualized • Essential travel only Reduction Costs Savings 11

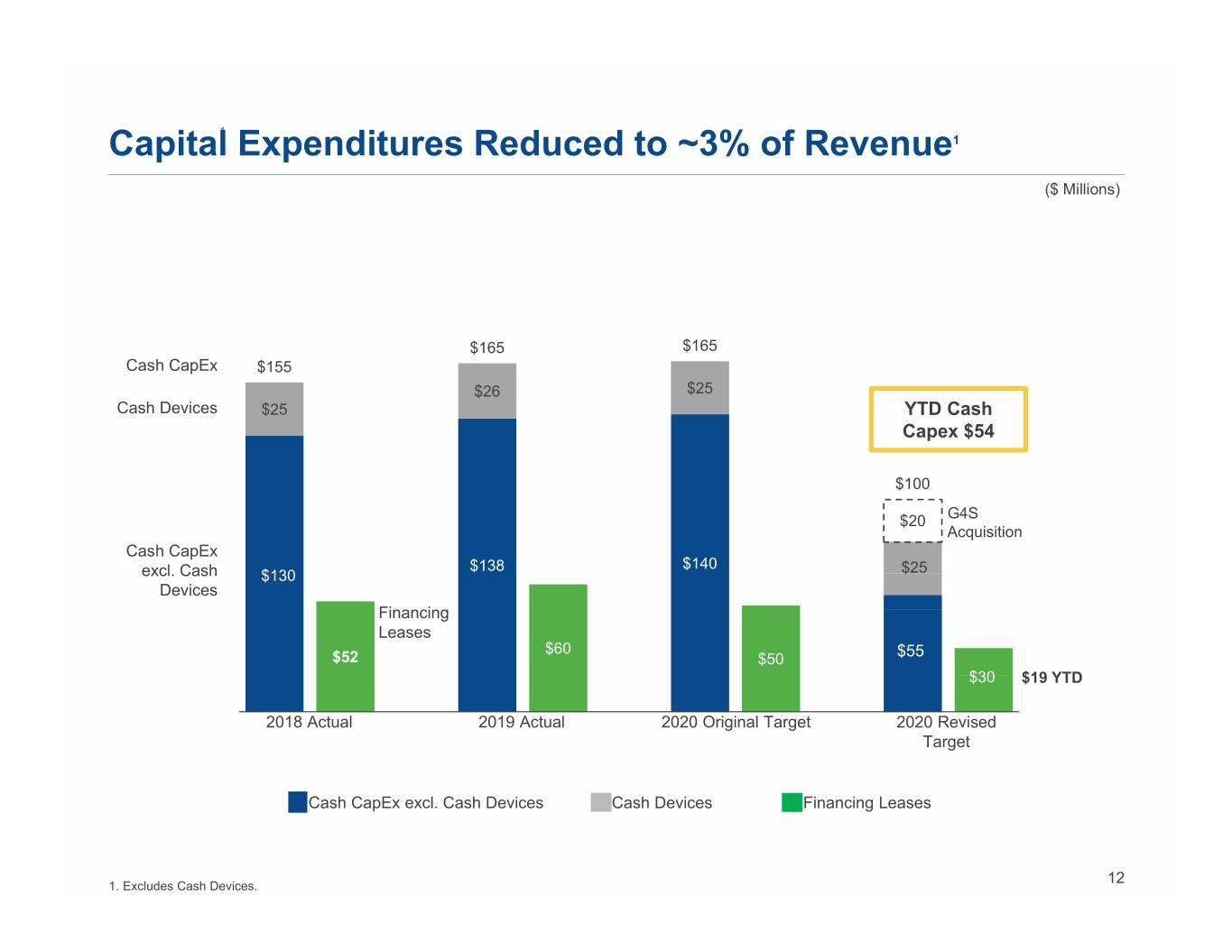

1 Capital Expenditures Reduced to ~3% of Revenue1 ($ Millions) $165 $165 Cash CapEx $155 $26 $25 Cash Devices $25 YTD Cash Capex $54 $100 $20 G4S Acquisition Cash CapEx $138 $140 $25 excl. Cash $130 Devices Financing Leases $60 $52 $50 $55 $30 $19 YTD 2018 Actual 2019 Actual 2020 Original Target 2020 Revised Target Cash CapEx excl. Cash Devices Cash Devices Financing Leases 12 1. Excludes Cash Devices.

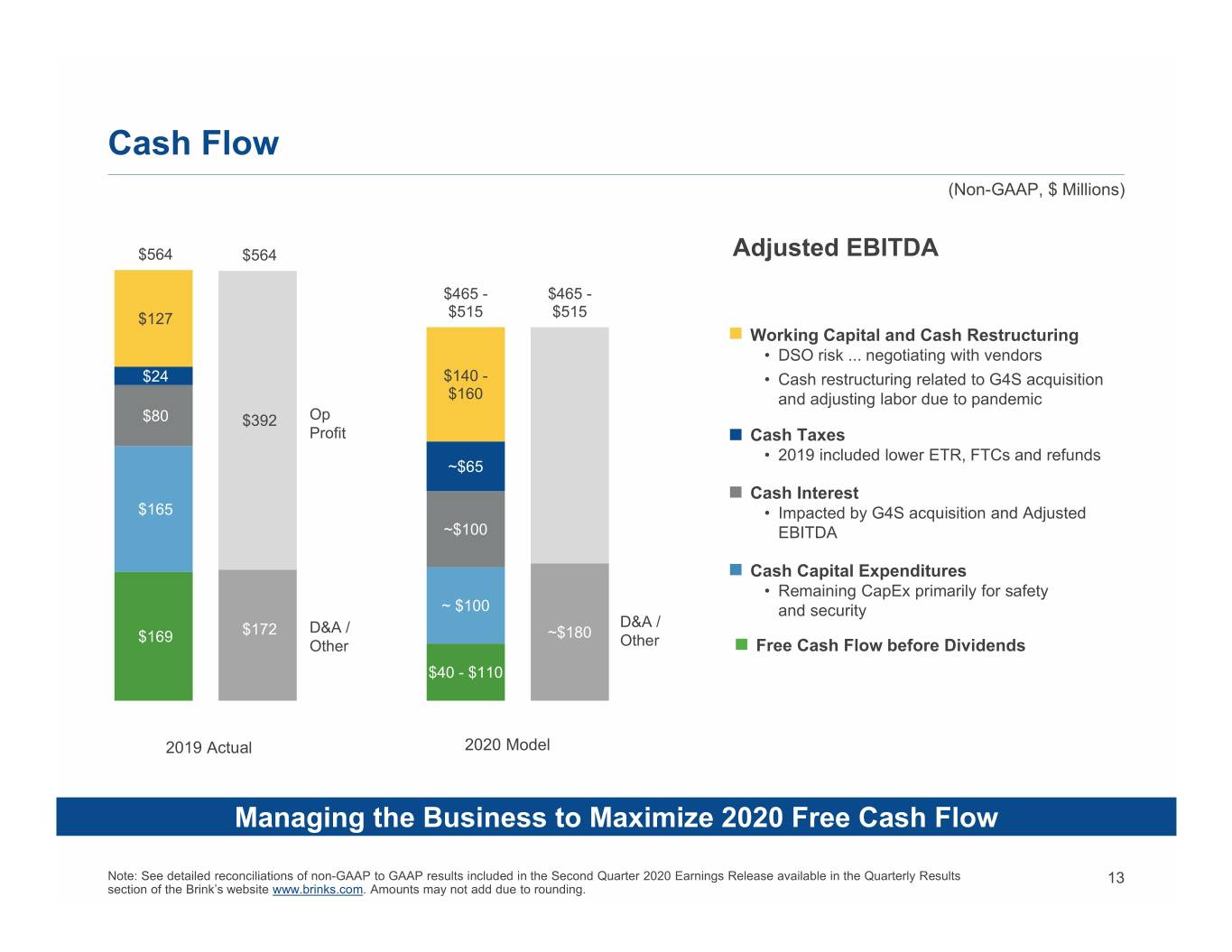

Cash Flow (Non-GAAP, $ Millions) $564 $564 Adjusted EBITDA $465 - $465 - $127 $515 $515 Working Capital and Cash Restructuring • DSO risk ... negotiating with vendors $24 $140 - • Cash restructuring related to G4S acquisition $160 and adjusting labor due to pandemic $80 $392 Op Profit Cash Taxes • 2019 included lower ETR, FTCs and refunds ~$65 Cash Interest $165 • Impacted by G4S acquisition and Adjusted ~$100 EBITDA Cash Capital Expenditures • Remaining CapEx primarily for safety ~ $100 and security D&A / D&A / $169 $172 ~$180 Other Other Free Cash Flow before Dividends $40 - $110 2019 Actual 2020 Model Managing the Business to Maximize 2020 Free Cash Flow Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results 13 section of the Brink’s website www.brinks.com. Amounts may not add due to rounding.

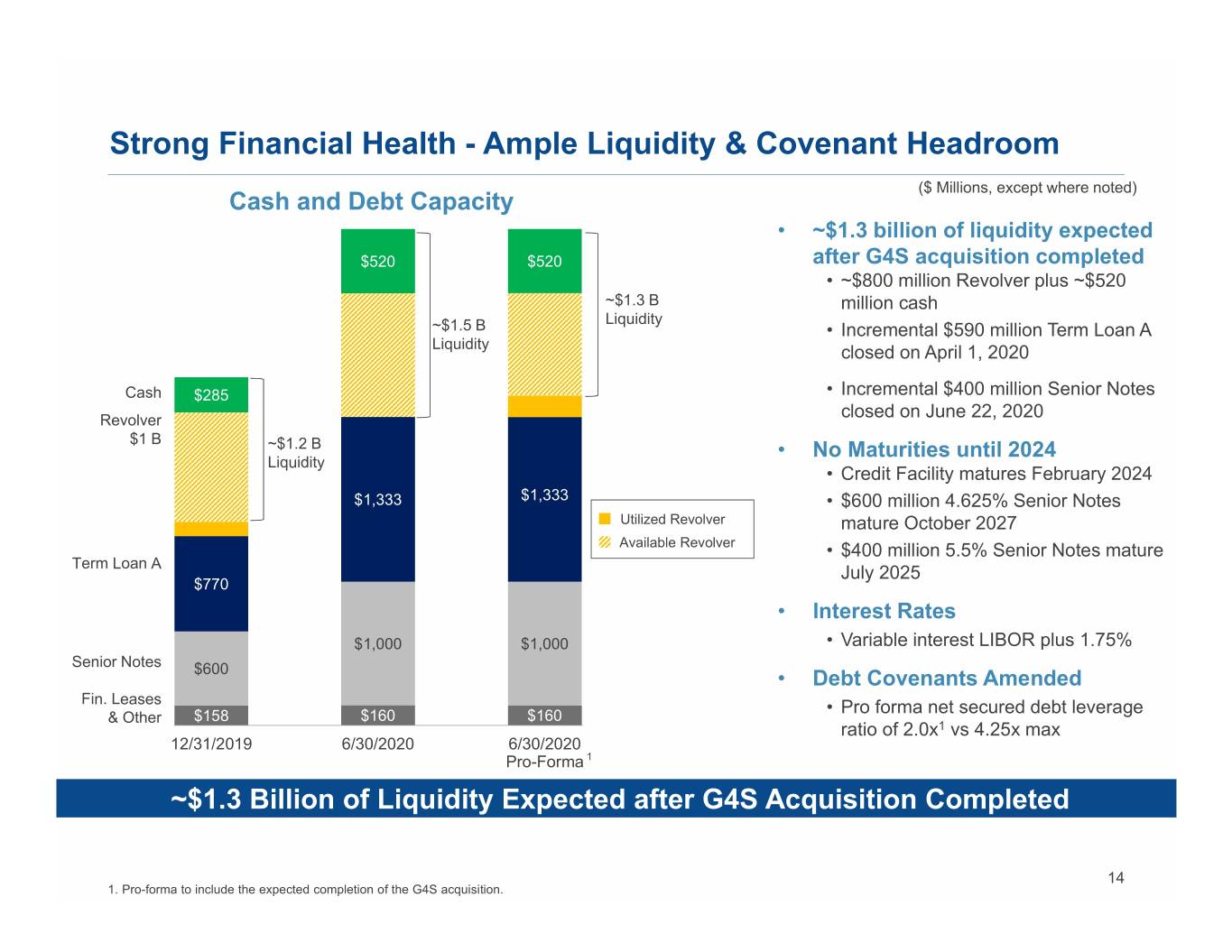

Strong Financial Health - Ample Liquidity & Covenant Headroom ($ Millions, except where noted) Cash and Debt Capacity • ~$1.3 billion of liquidity expected $520 $520 after G4S acquisition completed • ~$800 million Revolver plus ~$520 ~$1.3 B million cash Liquidity ~$1.5 B • Incremental $590 million Term Loan A Liquidity closed on April 1, 2020 Cash $285 • Incremental $400 million Senior Notes Revolver closed on June 22, 2020 $1 B ~$1.2 B • No Maturities until 2024 Liquidity • Credit Facility matures February 2024 $1,333 $1,333 • $600 million 4.625% Senior Notes Utilized Revolver mature October 2027 Available Revolver • $400 million 5.5% Senior Notes mature Term Loan A July 2025 $770 • Interest Rates $1,000 $1,000 • Variable interest LIBOR plus 1.75% Senior Notes 1 $600 • Debt Covenants Amended Fin. Leases • Pro forma net secured debt leverage & Other $158 $160 $160 ratio of 2.0x1 vs 4.25x max 12/31/2019 6/30/2020 6/30/2020 Pro-Forma 1 ~$1.3 Billion of Liquidity Expected after G4S Acquisition Completed 14 1. Pro-forma to include the expected completion of the G4S acquisition.

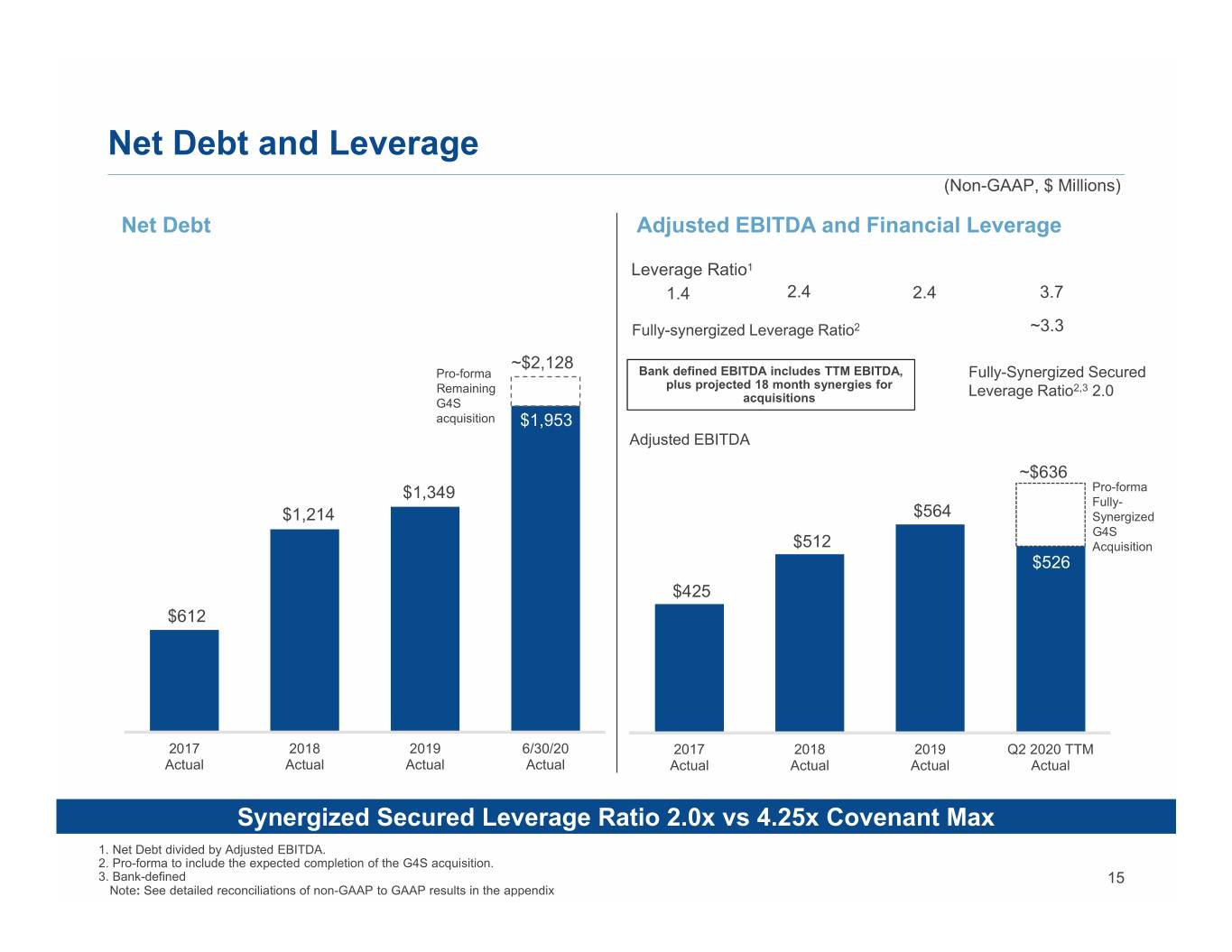

Net Debt and Leverage (Non-GAAP, $ Millions) Net Debt Adjusted EBITDA and Financial Leverage Leverage Ratio1 1.4 2.4 2.4 3.7 Fully-synergized Leverage Ratio2 ~3.3 ~$2,128 Pro-forma Bank defined EBITDA includes TTM EBITDA, Fully-Synergized Secured Remaining plus projected 18 month synergies for Leverage Ratio2,3 2.0 G4S acquisitions acquisition $1,953 Adjusted EBITDA ~$636 $1,349 Pro-forma Fully- $1,214 $564 Synergized G4S $512 Acquisition $526 $425 $612 2017 2018 2019 6/30/20 2017 2018 2019 Q2 2020 TTM Actual Actual Actual Actual Actual Actual Actual Actual Synergized Secured Leverage Ratio 2.0x vs 4.25x Covenant Max 1. Net Debt divided by Adjusted EBITDA. 2. Pro-forma to include the expected completion of the G4S acquisition. 3. Bank-defined 15 Note: See detailed reconciliations of non-GAAP to GAAP results in the appendix

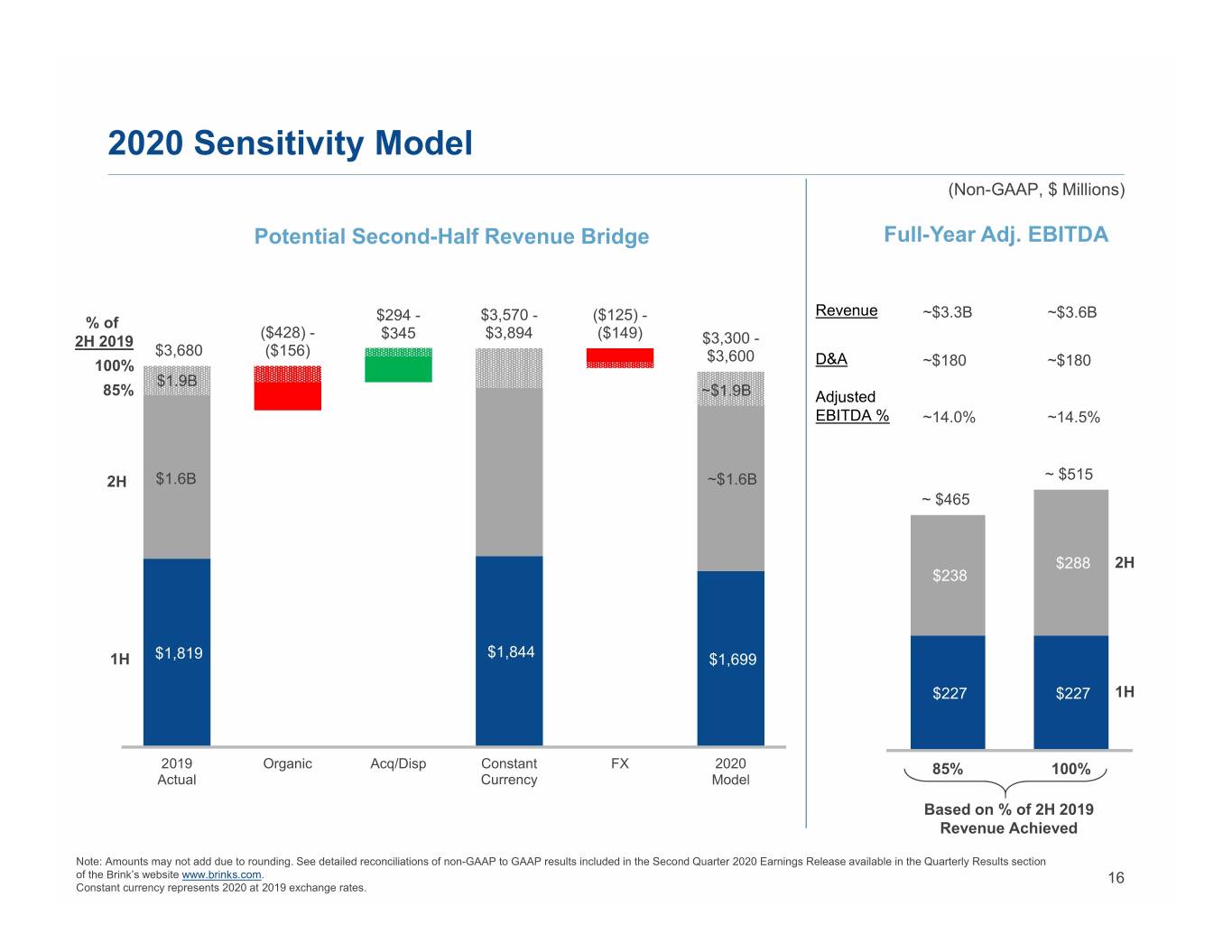

2020 Sensitivity Model (Non-GAAP, $ Millions) Potential Second-Half Revenue Bridge Full-Year Adj. EBITDA $3,570 - ($125) - Revenue ~$3.3B ~$3.6B % of $294 - ($428) - $345 $3,894 ($149) 2H 2019 $3,300 - $3,680 ($156) $3,600 100% D&A ~$180 ~$180 $1.9B 85% ~$1.9B Adjusted EBITDA % ~14.0% ~14.5% 2H $1.6B ~$1.6B ~ $515 ~ $465 $288 2H $238 1H $1,819 $1,844 $1,699 $227 $227 1H 2019 Organic Acq/Disp Constant FX 2020 85% 100% Actual Currency Model Based on % of 2H 2019 Revenue Achieved Note: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 16 Constant currency represents 2020 at 2019 exchange rates.

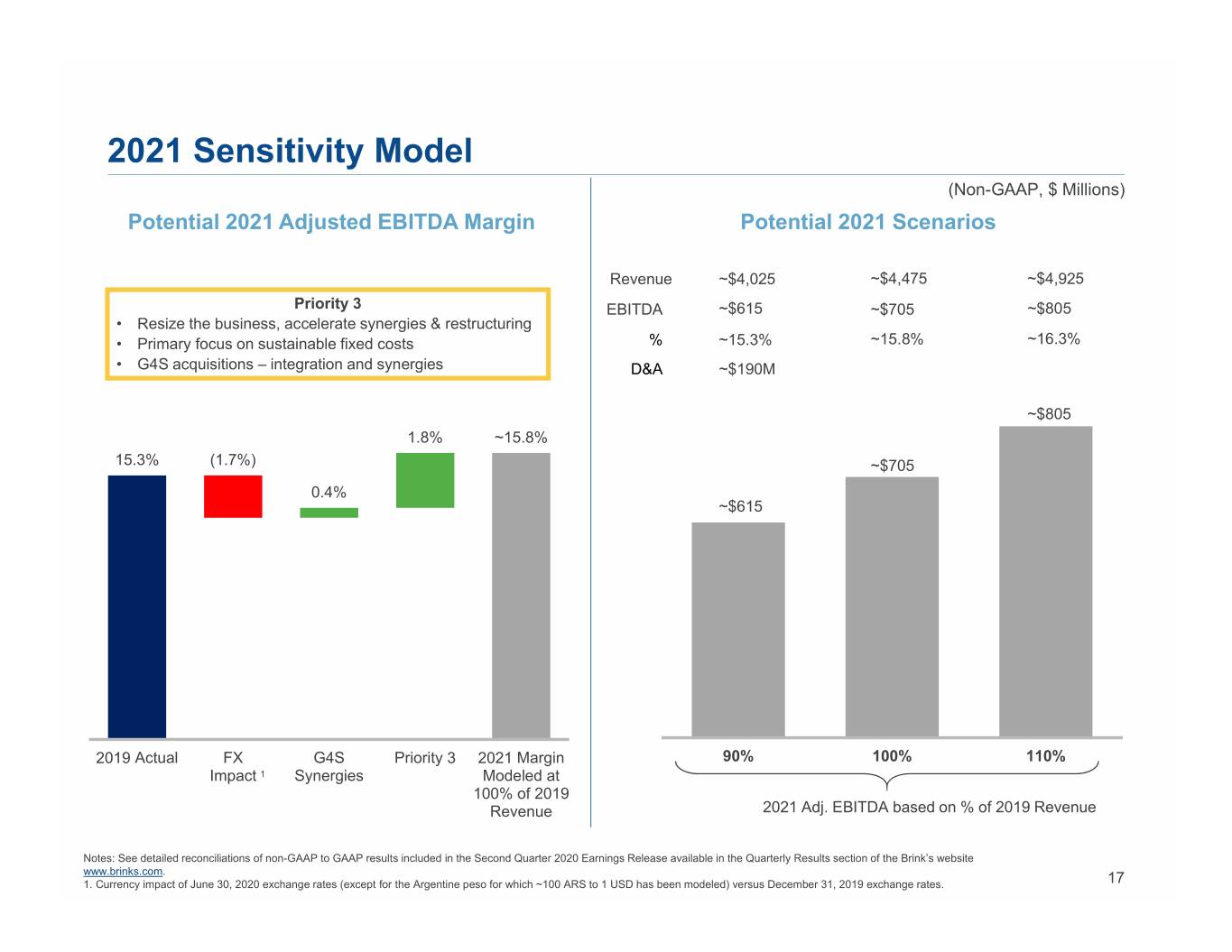

2021 Sensitivity Model (Non-GAAP, $ Millions) Potential 2021 Adjusted EBITDA Margin Potential 2021 Scenarios Revenue ~$4,025 ~$4,475 ~$4,925 Priority 3 EBITDA~$615 ~$705 ~$805 • Resize the business, accelerate synergies & restructuring • Primary focus on sustainable fixed costs % ~15.3% ~15.8% ~16.3% • G4S acquisitions – integration and synergies D&A ~$190M ~$805 1.8% ~15.8% 15.3% (1.7%) ~$705 0.4% ~$615 2019 Actual FX G4S Priority 3 2021 Margin 90% 100% 110% Impact 1 Synergies Modeled at 100% of 2019 Revenue 2021 Adj. EBITDA based on % of 2019 Revenue Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 1. Currency impact of June 30, 2020 exchange rates (except for the Argentine peso for which ~100 ARS to 1 USD has been modeled) versus December 31, 2019 exchange rates. 17

Summary and Conclusion 2020 • Encouraged by 2Q results, June revenue at 86% of 2019 level and increasing • Expect improving revenue and higher margin rate in second half • G4S acquisition performing well, on track for completion by year-end • 2020 Sensitivity Model: Revenue: $3.3B to $3.6B (85%-100% of 2H 2019 revenue) Adj. EBITDA: $465 to $515M (Margin 14.0% – 14.5%) 2021 • Expect to emerge from crisis positioned for long-term growth in revenue, earnings, margins, cash flow, higher margins and ROIC • Leverage expanded global footprint and realigned total and fixed cost structure • 2021 Sensitivity Model: Revenue $4.0B to $4.9B (90% - 110% of pro forma 2019 revenue) Adj. EBITDA: $615M to $805M (Margin 15.3% - 16.3%) • Accelerate deployment of Brink’s Strategy 2.0 (not included in sensitivity model) Brink’s Complete gaining traction; agreement for ~1,500 locations; targeting large customers (1,000+ locations) Notes: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website 18 www.brinks.com.

Appendix 19

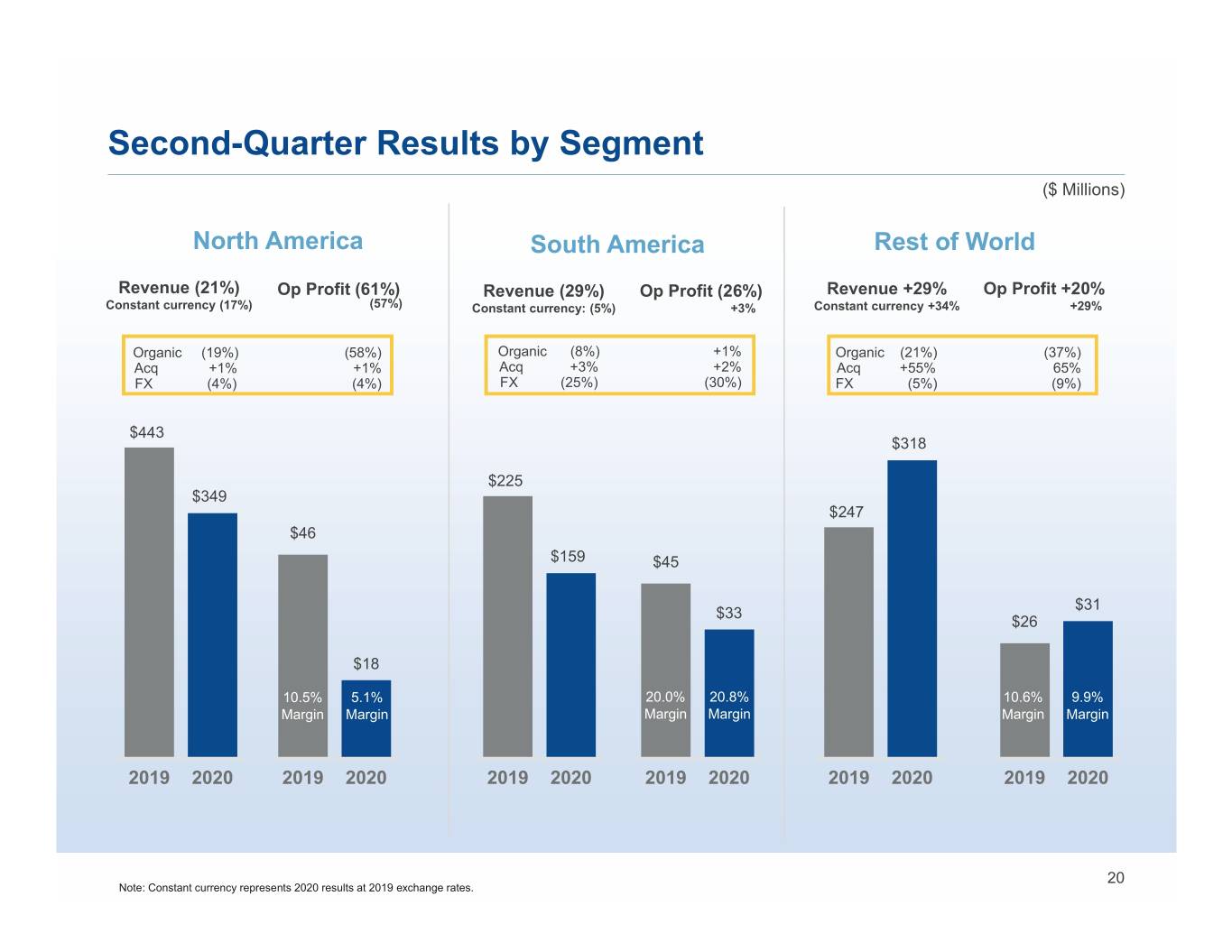

Second-Quarter Results by Segment ($ Millions) North America South America Rest of World Revenue (21%) Op Profit (61%) Revenue (29%) Op Profit (26%) Revenue +29% Op Profit +20% Constant currency (17%) (57%) Constant currency: (5%) +3% Constant currency +34% +29% Organic (19%) (58%) Organic (8%) +1% Organic (21%) (37%) Acq +1% +1% Acq +3% +2% Acq +55% 65% FX (4%) (4%) FX (25%) (30%) FX (5%) (9%) $443 $318 $225 $349 $247 $46 $159 $45 $31 $33 $26 $18 10.5% 5.1% 20.0% 20.8% 10.6% 9.9% Margin Margin Margin Margin Margin Margin 2019 2020 2019 2020 2019 2020 2019 2020 2019 2020 2019 2020 20 Note: Constant currency represents 2020 results at 2019 exchange rates.

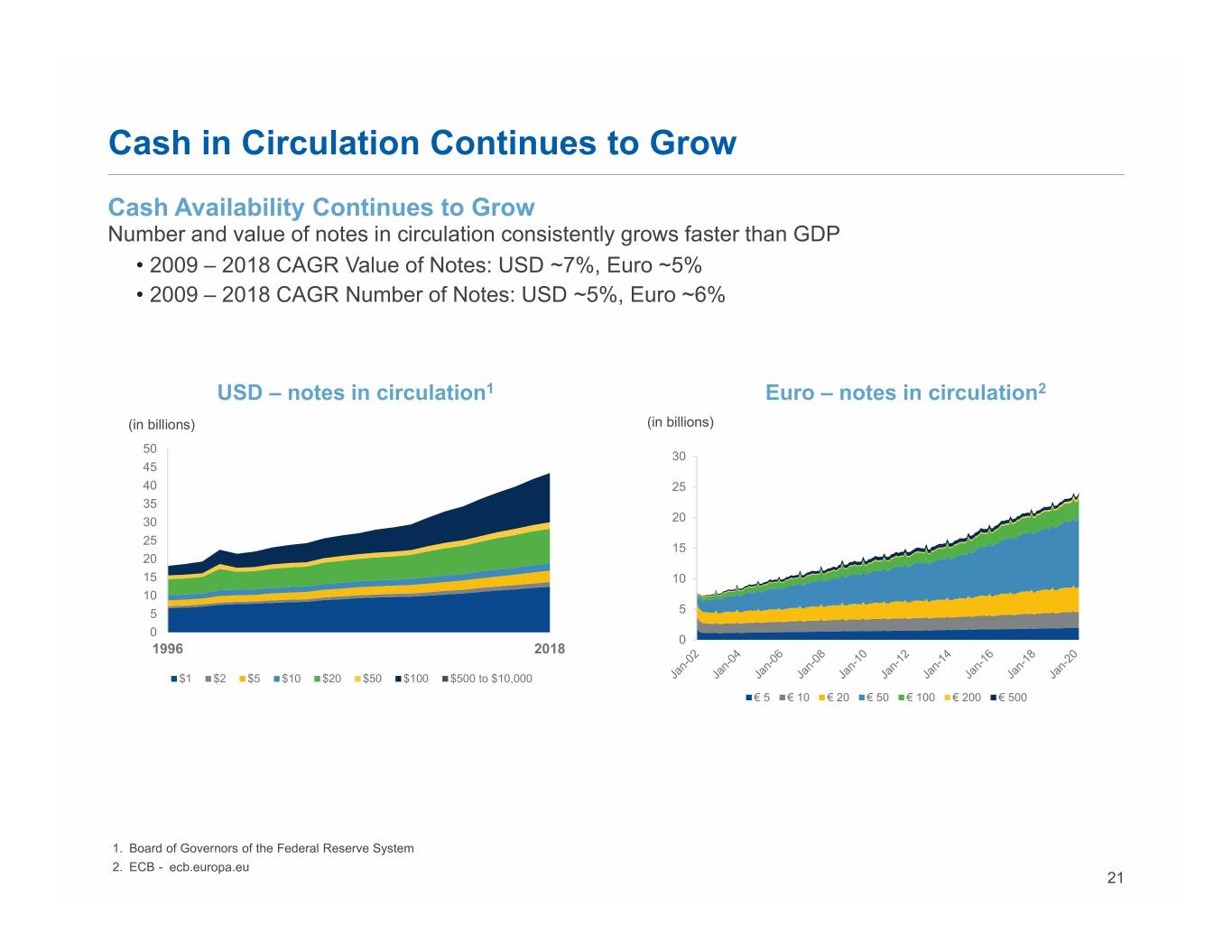

Cash in Circulation Continues to Grow Cash Availability Continues to Grow Number and value of notes in circulation consistently grows faster than GDP • 2009 – 2018 CAGR Value of Notes: USD ~7%, Euro ~5% • 2009 – 2018 CAGR Number of Notes: USD ~5%, Euro ~6% USD – notes in circulation1 Euro – notes in circulation2 (in billions) (in billions) 50 30 45 40 25 35 30 20 25 15 20 15 10 10 5 5 0 0 1996 2018 $1 $2 $5 $10 $20 $50 $100 $500 to $10,000 €5 €10 €20 €50 € 100 € 200 € 500 1. Board of Governors of the Federal Reserve System 2. ECB - ecb.europa.eu 21

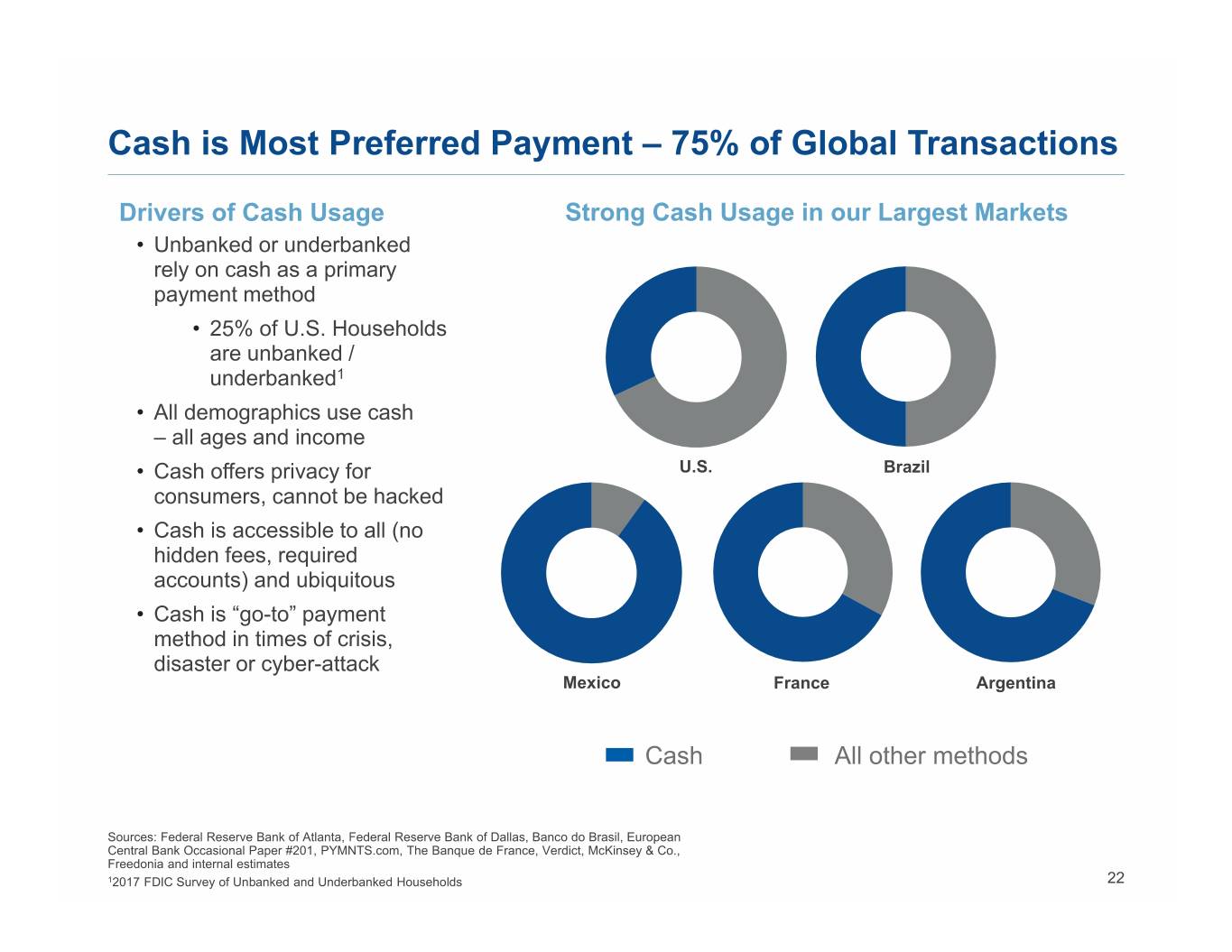

Cash is Most Preferred Payment – 75% of Global Transactions Drivers of Cash Usage Strong Cash Usage in our Largest Markets • Unbanked or underbanked rely on cash as a primary payment method • 25% of U.S. Households are unbanked / underbanked1 • All demographics use cash – all ages and income • Cash offers privacy for U.S. Brazil consumers, cannot be hacked • Cash is accessible to all (no hidden fees, required accounts) and ubiquitous • Cash is “go-to” payment method in times of crisis, disaster or cyber-attack Mexico France Argentina Cash All other methods Sources: Federal Reserve Bank of Atlanta, Federal Reserve Bank of Dallas, Banco do Brasil, European Central Bank Occasional Paper #201, PYMNTS.com, The Banque de France, Verdict, McKinsey & Co., Freedonia and internal estimates 12017 FDIC Survey of Unbanked and Underbanked Households 22

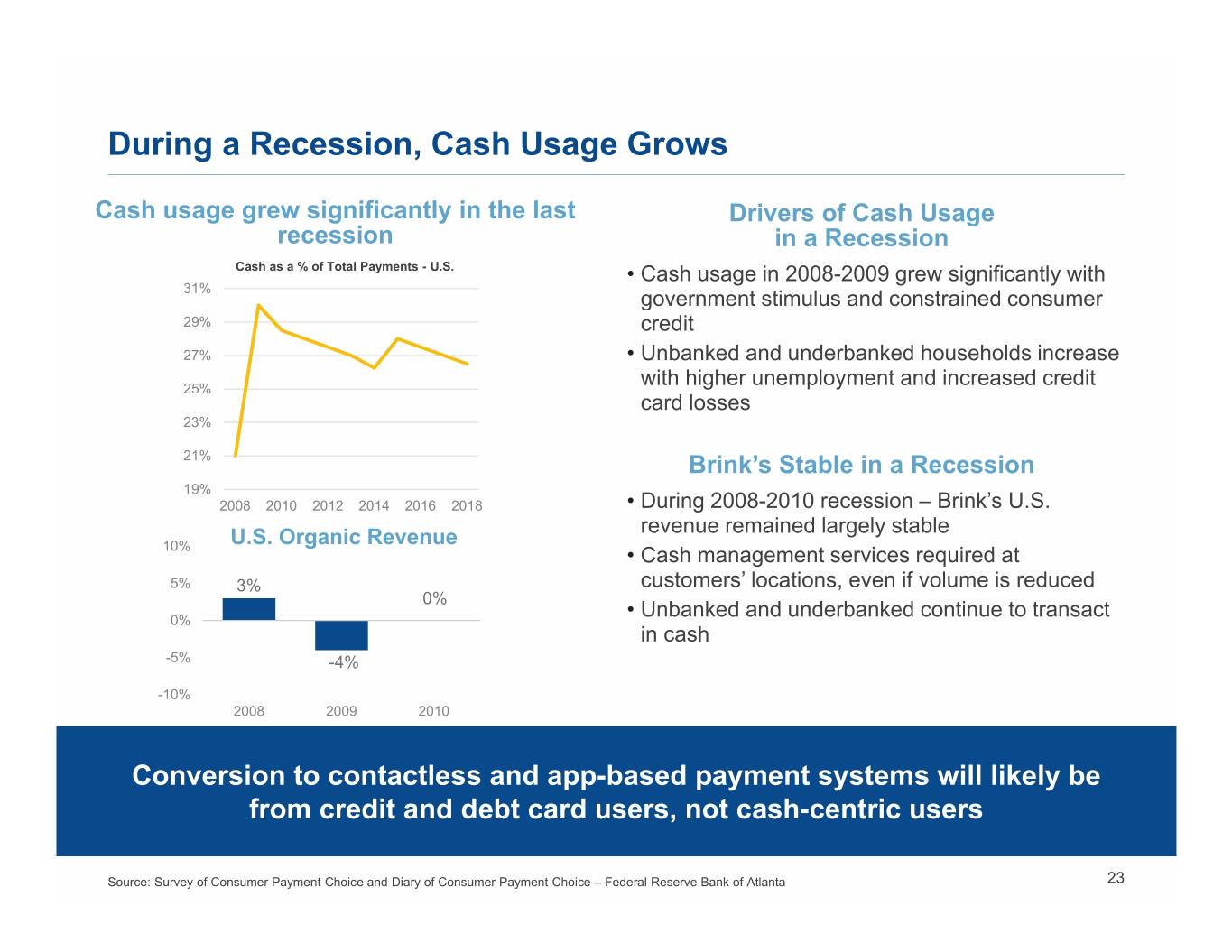

During a Recession, Cash Usage Grows Cash usage grew significantly in the last Drivers of Cash Usage recession in a Recession Cash as a % of Total Payments - U.S. • Cash usage in 2008-2009 grew significantly with 31% government stimulus and constrained consumer 29% credit 27% • Unbanked and underbanked households increase 25% with higher unemployment and increased credit card losses 23% 21% Brink’s Stable in a Recession 19% 2008 2010 2012 2014 2016 2018 • During 2008-2010 recession – Brink’s U.S. revenue remained largely stable U.S. Organic Revenue 10% • Cash management services required at 5% 3% customers’ locations, even if volume is reduced 0% 0% • Unbanked and underbanked continue to transact in cash -5% -4% -10% 2008 2009 2010 Conversion to contactless and app-based payment systems will likely be from credit and debt card users, not cash-centric users Source: Survey of Consumer Payment Choice and Diary of Consumer Payment Choice – Federal Reserve Bank of Atlanta 23

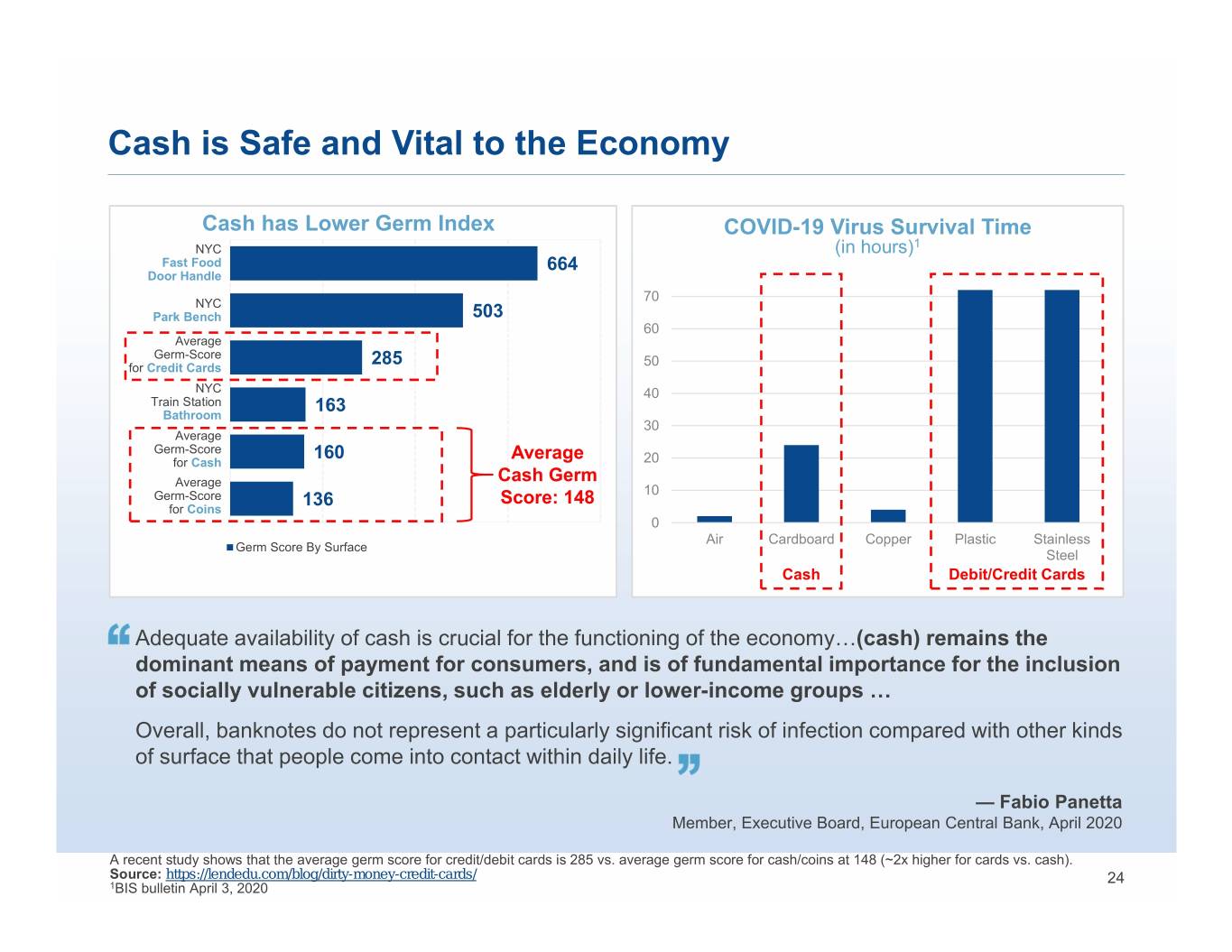

Cash is Safe and Vital to the Economy Cash has Lower Germ Index COVID-19 Virus Survival Time NYC (in hours)1 Fast Food 664 Door Handle 70 NYC Park Bench 503 60 Average Germ-Score 285 for Credit Cards 50 NYC 40 Train Station 163 Bathroom 30 Average Germ-Score 160 Average for Cash 20 Average Cash Germ Germ-Score 136 Score: 148 10 for Coins 0 Air Cardboard Copper Plastic Stainless Germ Score By Surface Steel Cash Debit/Credit Cards Adequate availability of cash is crucial for the functioning of the economy…(cash) remains the dominant means of payment for consumers, and is of fundamental importance for the inclusion of socially vulnerable citizens, such as elderly or lower-income groups … Overall, banknotes do not represent a particularly significant risk of infection compared with other kinds of surface that people come into contact within daily life. — Fabio Panetta Member, Executive Board, European Central Bank, April 2020 A recent study shows that the average germ score for credit/debit cards is 285 vs. average germ score for cash/coins at 148 (~2x higher for cards vs. cash). Source: https://lendedu.com/blog/dirty-money-credit-cards/ 24 1BIS bulletin April 3, 2020

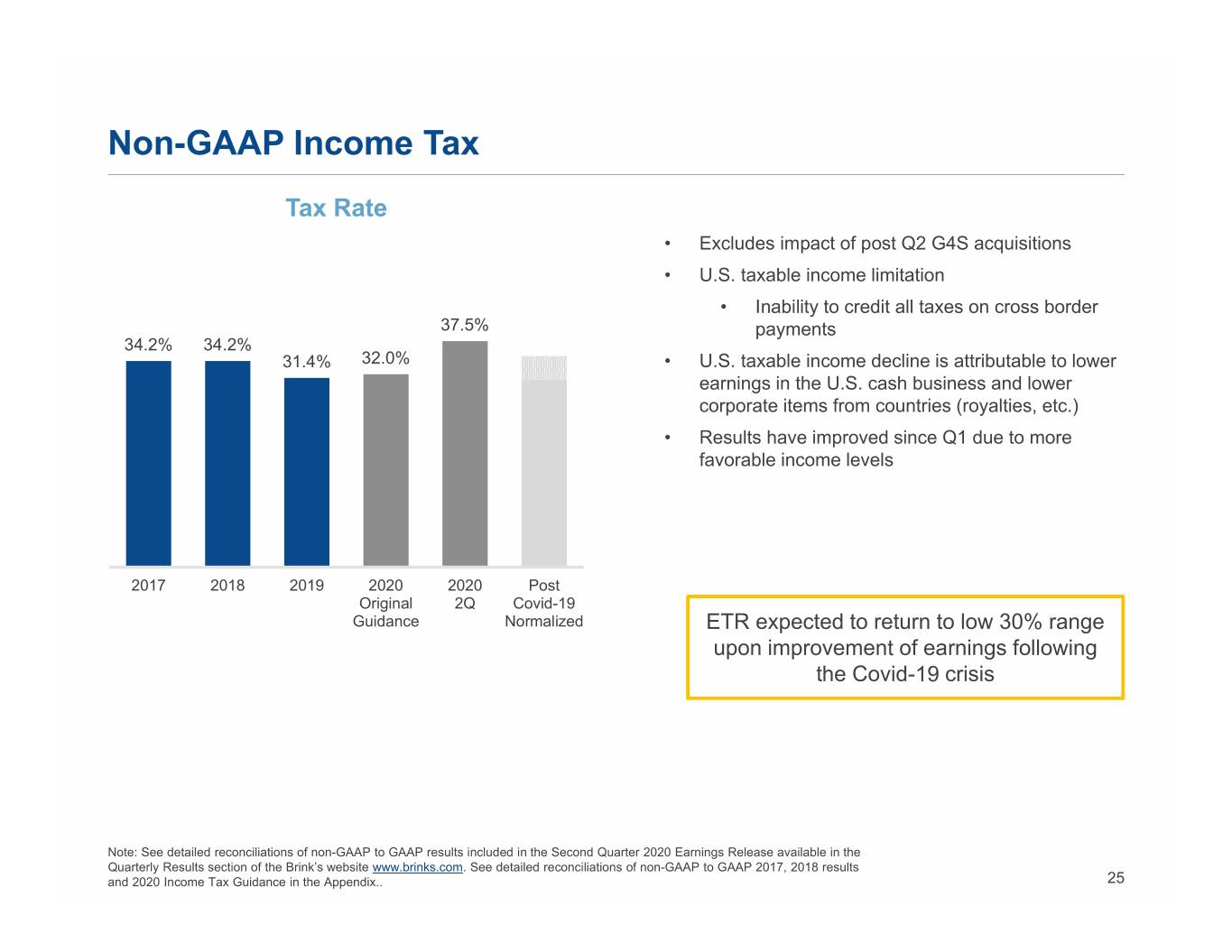

Non-GAAP Income Tax Tax Rate • Excludes impact of post Q2 G4S acquisitions • U.S. taxable income limitation • Inability to credit all taxes on cross border 37.5% payments 34.2% 34.2% 31.4% 32.0% • U.S. taxable income decline is attributable to lower earnings in the U.S. cash business and lower corporate items from countries (royalties, etc.) • Results have improved since Q1 due to more favorable income levels 2017 2018 2019 2020 2020 Post Original 2Q Covid-19 Guidance Normalized ETR expected to return to low 30% range upon improvement of earnings following the Covid-19 crisis Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2020 Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2017, 2018 results and 2020 Income Tax Guidance in the Appendix.. 25

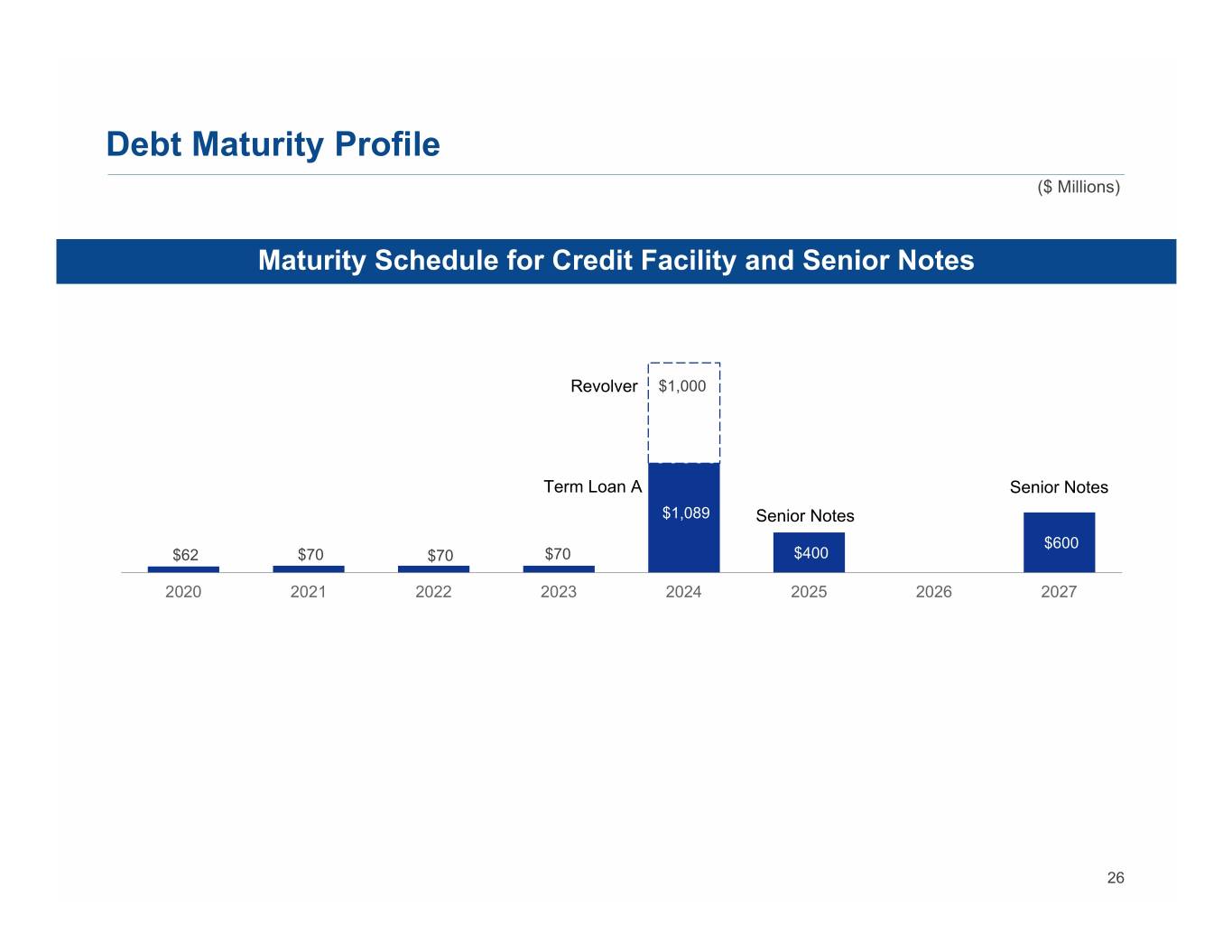

Debt Maturity Profile ($ Millions) Maturity Schedule for Credit Facility and Senior Notes Revolver $1,000 Term Loan A Senior Notes $1,089 Senior Notes $600 $62 $70 $70 $70 $400 2020 2021 2022 2023 2024 2025 2026 2027 26

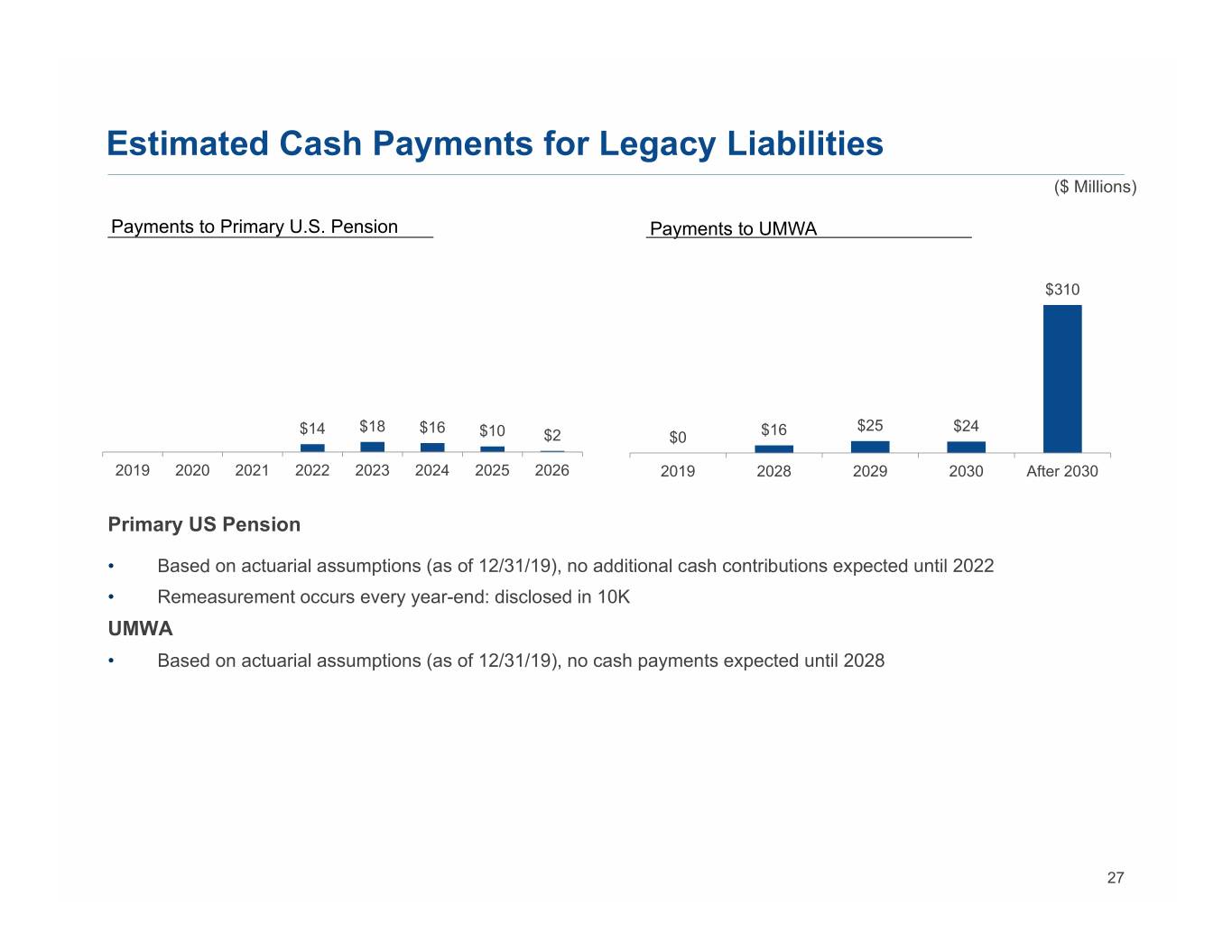

Estimated Cash Payments for Legacy Liabilities ($ Millions) Payments to Primary U.S. Pension Payments to UMWA $310 $14 $18 $16 $25 $24 $10 $2 $0 $16 2019 2020 2021 2022 2023 2024 2025 2026 2019 2028 2029 2030 After 2030 Primary US Pension • Based on actuarial assumptions (as of 12/31/19), no additional cash contributions expected until 2022 • Remeasurement occurs every year-end: disclosed in 10K UMWA • Based on actuarial assumptions (as of 12/31/19), no cash payments expected until 2028 27

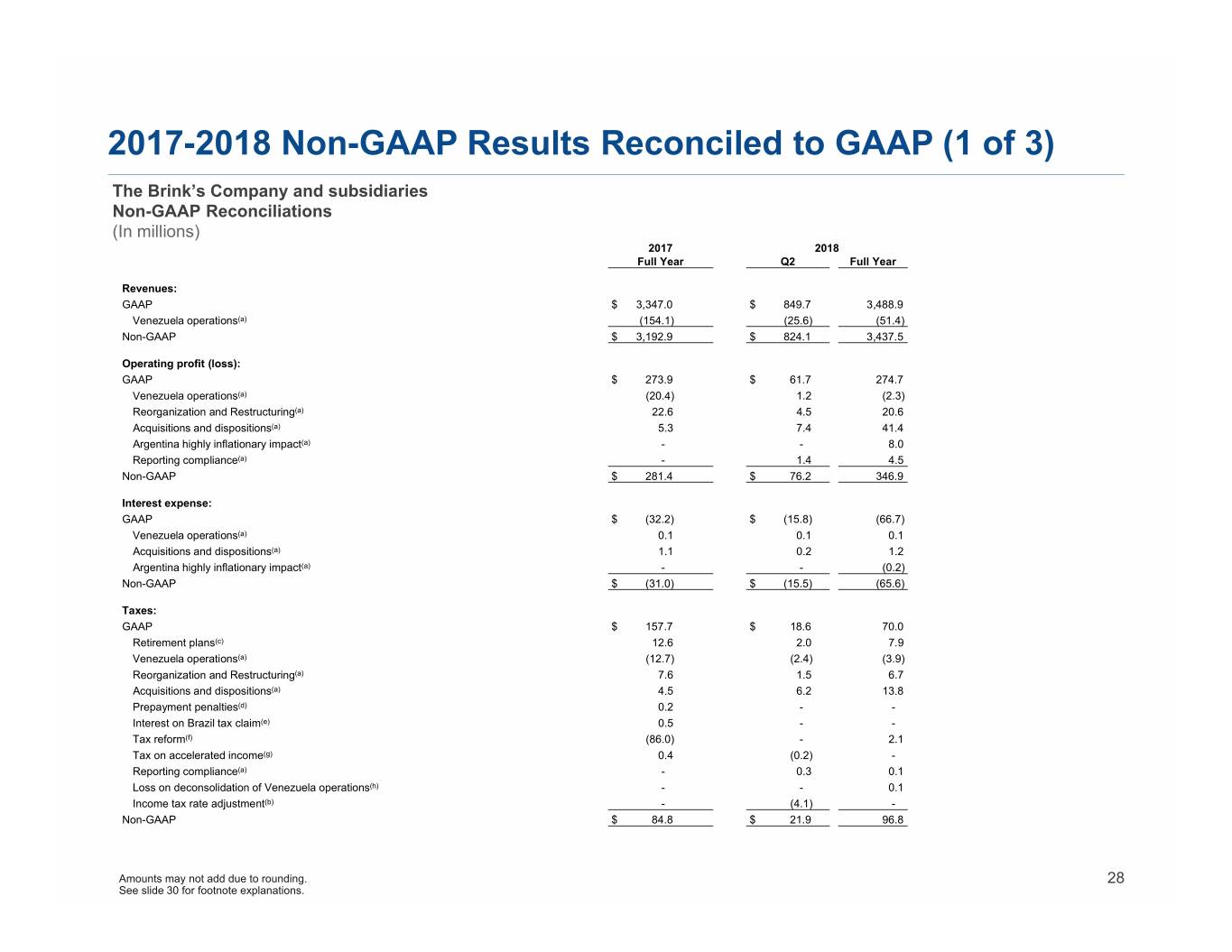

2017-2018 Non-GAAP Results Reconciled to GAAP (1 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2017 2018 Full Year Q2 Full Year Revenues: GAAP $ 3,347.0 $ 849.7 3,488.9 Venezuela operations(a) (154.1) (25.6) (51.4) Non-GAAP $ 3,192.9 $ 824.1 3,437.5 Operating profit (loss): GAAP $ 273.9 $ 61.7 274.7 Venezuela operations(a) (20.4) 1.2 (2.3) Reorganization and Restructuring(a) 22.6 4.5 20.6 Acquisitions and dispositions(a) 5.3 7.4 41.4 Argentina highly inflationary impact(a) - - 8.0 Reporting compliance(a) - 1.4 4.5 Non-GAAP $ 281.4 $ 76.2 346.9 Interest expense: GAAP $ (32.2) $ (15.8) (66.7) Venezuela operations(a) 0.1 0.1 0.1 Acquisitions and dispositions(a) 1.1 0.2 1.2 Argentina highly inflationary impact(a) --(0.2) Non-GAAP $ (31.0) $ (15.5) (65.6) Taxes: GAAP $ 157.7 $ 18.6 70.0 Retirement plans(c) 12.6 2.0 7.9 Venezuela operations(a) (12.7) (2.4) (3.9) Reorganization and Restructuring(a) 7.6 1.5 6.7 Acquisitions and dispositions(a) 4.5 6.2 13.8 Prepayment penalties(d) 0.2 - - Interest on Brazil tax claim(e) 0.5 - - Tax reform(f) (86.0) - 2.1 Tax on accelerated income(g) 0.4 (0.2) - Reporting compliance(a) - 0.3 0.1 Loss on deconsolidation of Venezuela operations(h) - - 0.1 Income tax rate adjustment(b) - (4.1) - Non-GAAP $ 84.8 $ 21.9 96.8 Amounts may not add due to rounding. 28 See slide 30 for footnote explanations.

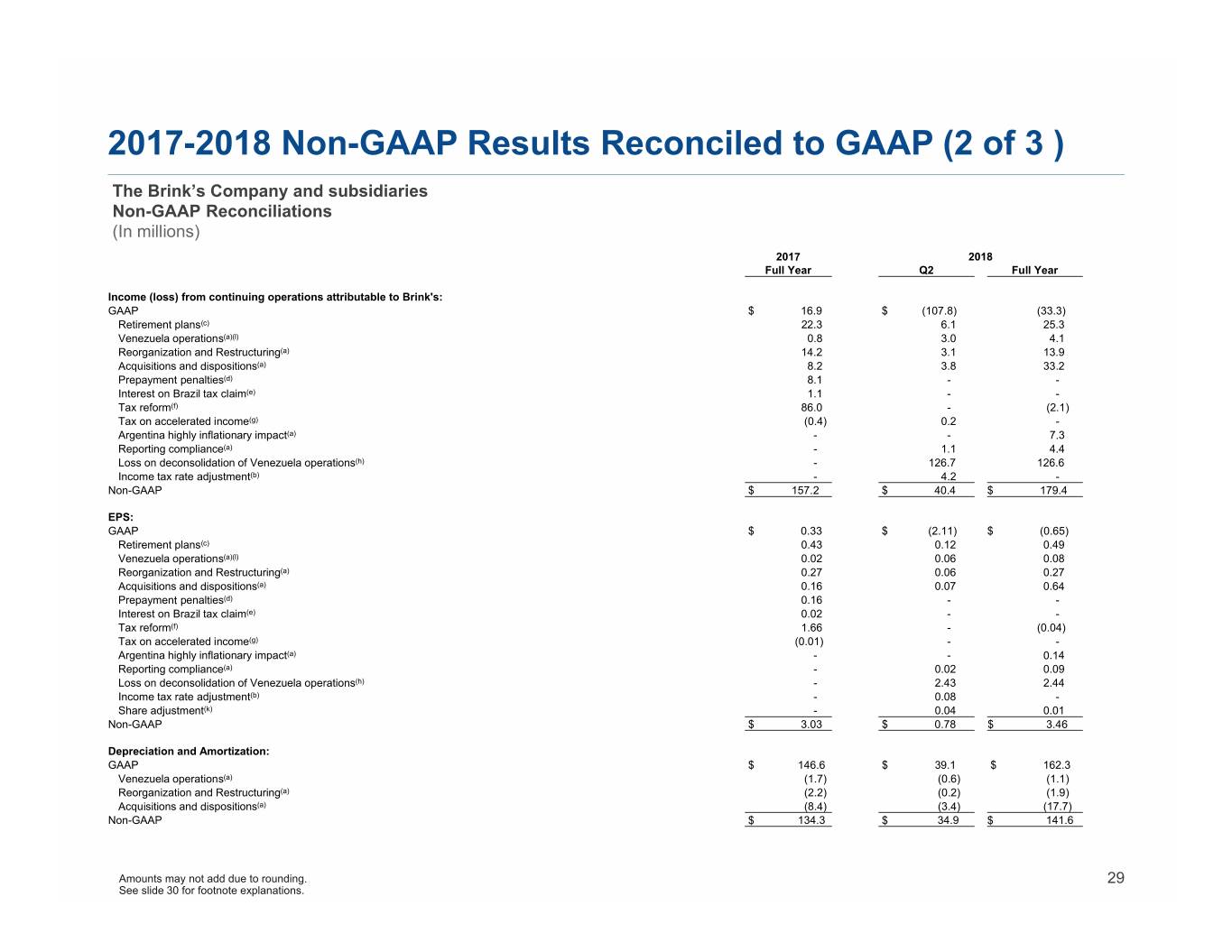

2017-2018 Non-GAAP Results Reconciled to GAAP (2 of 3 ) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2017 2018 Full Year Q2 Full Year Income (loss) from continuing operations attributable to Brink's: GAAP $ 16.9 $ (107.8) (33.3) Retirement plans(c) 22.3 6.1 25.3 Venezuela operations(a)(l) 0.8 3.0 4.1 Reorganization and Restructuring(a) 14.2 3.1 13.9 Acquisitions and dispositions(a) 8.2 3.8 33.2 Prepayment penalties(d) 8.1 - - Interest on Brazil tax claim(e) 1.1 - - Tax reform(f) 86.0 - (2.1) Tax on accelerated income(g) (0.4) 0.2 - Argentina highly inflationary impact(a) - - 7.3 Reporting compliance(a) - 1.1 4.4 Loss on deconsolidation of Venezuela operations(h) - 126.7 126.6 Income tax rate adjustment(b) -4.2 - Non-GAAP $ 157.2 $ 40.4 $ 179.4 EPS: GAAP $ 0.33 $ (2.11) $ (0.65) Retirement plans(c) 0.43 0.12 0.49 Venezuela operations(a)(l) 0.02 0.06 0.08 Reorganization and Restructuring(a) 0.27 0.06 0.27 Acquisitions and dispositions(a) 0.16 0.07 0.64 Prepayment penalties(d) 0.16 - - Interest on Brazil tax claim(e) 0.02 - - Tax reform(f) 1.66 - (0.04) Tax on accelerated income(g) (0.01) - - Argentina highly inflationary impact(a) - - 0.14 Reporting compliance(a) - 0.02 0.09 Loss on deconsolidation of Venezuela operations(h) - 2.43 2.44 Income tax rate adjustment(b) - 0.08 - Share adjustment(k) - 0.04 0.01 Non-GAAP $ 3.03 $ 0.78 $ 3.46 Depreciation and Amortization: GAAP $ 146.6 $ 39.1 $ 162.3 Venezuela operations(a) (1.7) (0.6) (1.1) Reorganization and Restructuring(a) (2.2) (0.2) (1.9) Acquisitions and dispositions(a) (8.4) (3.4) (17.7) Non-GAAP $ 134.3 $ 34.9 $ 141.6 Amounts may not add due to rounding. 29 See slide 30 for footnote explanations.

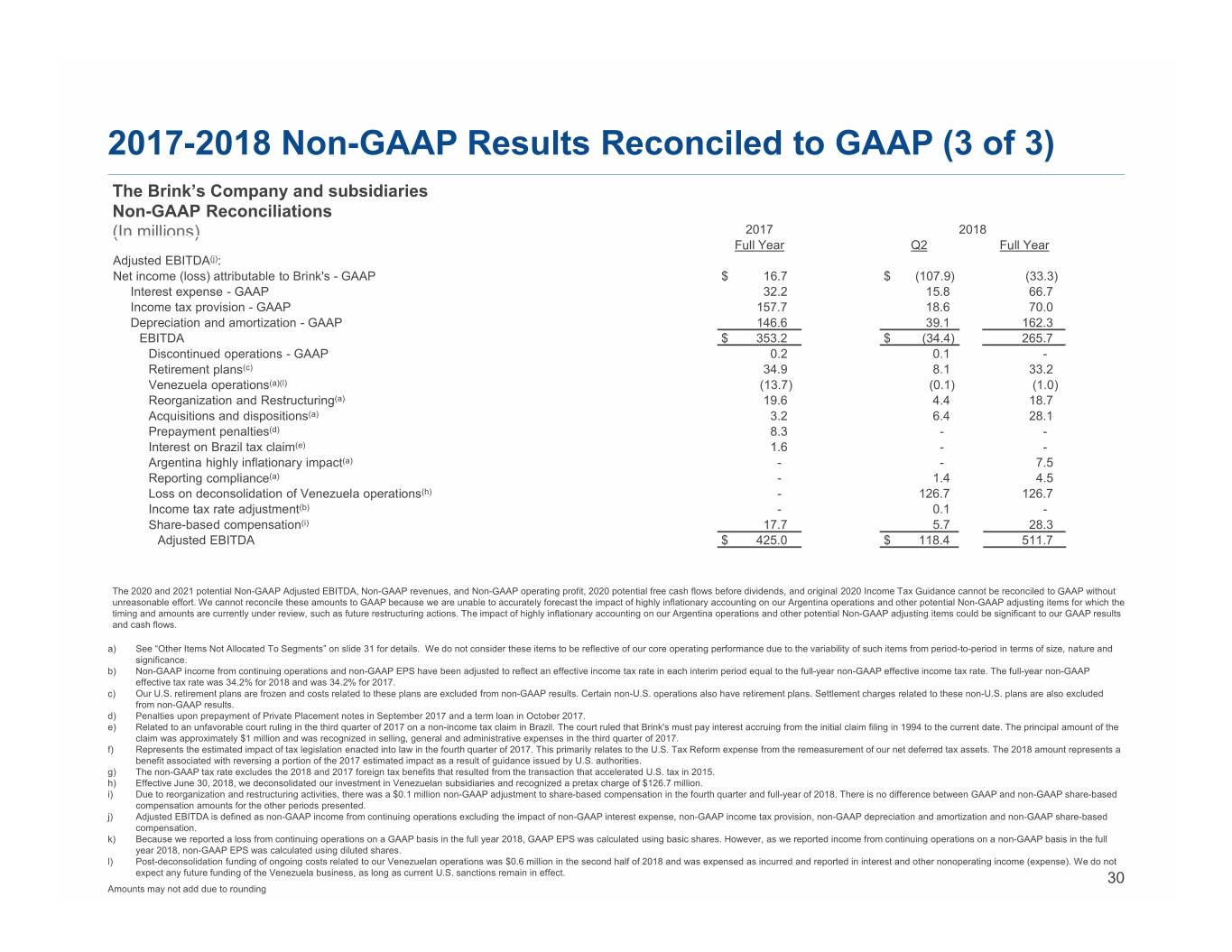

2017-2018 Non-GAAP Results Reconciled to GAAP (3 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2017 2018 Full Year Q2 Full Year Adjusted EBITDA(j): Net income (loss) attributable to Brink's - GAAP $ 16.7 $ (107.9) (33.3) Interest expense - GAAP 32.2 15.8 66.7 Income tax provision - GAAP 157.7 18.6 70.0 Depreciation and amortization - GAAP 146.6 39.1 162.3 EBITDA $ 353.2 $ (34.4) 265.7 Discontinued operations - GAAP 0.2 0.1 - Retirement plans(c) 34.9 8.1 33.2 Venezuela operations(a)(l) (13.7) (0.1) (1.0) Reorganization and Restructuring(a) 19.6 4.4 18.7 Acquisitions and dispositions(a) 3.2 6.4 28.1 Prepayment penalties(d) 8.3 - - Interest on Brazil tax claim(e) 1.6 - - Argentina highly inflationary impact(a) - - 7.5 Reporting compliance(a) - 1.4 4.5 Loss on deconsolidation of Venezuela operations(h) - 126.7 126.7 Income tax rate adjustment(b) -0.1 - Share-based compensation(i) 17.7 5.7 28.3 Adjusted EBITDA $ 425.0 $ 118.4 511.7 The 2020 and 2021 potential Non-GAAP Adjusted EBITDA, Non-GAAP revenues, and Non-GAAP operating profit, 2020 potential free cash flows before dividends, and original 2020 Income Tax Guidance cannot be reconciled to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions. The impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items could be significant to our GAAP results and cash flows. a) See “Other Items Not Allocated To Segments” on slide 31 for details. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. b) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate was 34.2% for 2018 and was 34.2% for 2017. c) Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges related to these non-U.S. plans are also excluded from non-GAAP results. d) Penalties upon prepayment of Private Placement notes in September 2017 and a term loan in October 2017. e) Related to an unfavorable court ruling in the third quarter of 2017 on a non-income tax claim in Brazil. The court ruled that Brink's must pay interest accruing from the initial claim filing in 1994 to the current date. The principal amount of the claim was approximately $1 million and was recognized in selling, general and administrative expenses in the third quarter of 2017. f) Represents the estimated impact of tax legislation enacted into law in the fourth quarter of 2017. This primarily relates to the U.S. Tax Reform expense from the remeasurement of our net deferred tax assets. The 2018 amount represents a benefit associated with reversing a portion of the 2017 estimated impact as a result of guidance issued by U.S. authorities. g) The non-GAAP tax rate excludes the 2018 and 2017 foreign tax benefits that resulted from the transaction that accelerated U.S. tax in 2015. h) Effective June 30, 2018, we deconsolidated our investment in Venezuelan subsidiaries and recognized a pretax charge of $126.7 million. i) Due to reorganization and restructuring activities, there was a $0.1 million non-GAAP adjustment to share-based compensation in the fourth quarter and full-year of 2018. There is no difference between GAAP and non-GAAP share-based compensation amounts for the other periods presented. j) Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization and non-GAAP share-based compensation. k) Because we reported a loss from continuing operations on a GAAP basis in the full year 2018, GAAP EPS was calculated using basic shares. However, as we reported income from continuing operations on a non-GAAP basis in the full year 2018, non-GAAP EPS was calculated using diluted shares. l) Post-deconsolidation funding of ongoing costs related to our Venezuelan operations was $0.6 million in the second half of 2018 and was expensed as incurred and reported in interest and other nonoperating income (expense). We do not expect any future funding of the Venezuela business, as long as current U.S. sanctions remain in effect. 30 Amounts may not add due to rounding

Non-GAAP Reconciliation – Other The Brink’s Company and subsidiaries Other Items Not Allocated to Segments (Unaudited) (In millions) Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. See below for a summary of the other items not allocated to segments. Venezuela operations Venezuela operations Prior to the deconsolidation of our Venezuelan subsidiaries effective June 30, 2018, we excluded from our segment results all of our Venezuela operating results, due to the Venezuelan government's restrictions that have prevented us from repatriating funds. As a result, the Chief Executive Officer, the Company's Chief Operating Decision maker ("CODM"), has assessed segment performance and has made resource decisions by segment excluding Venezuela operating results. Reorganization and Restructuring 2016 Restructuring In the fourth quarter of 2016, management implemented restructuring actions across our global business operations and our corporate functions. As a result of these actions, we recognized charges of $18.1 million in 2016, $17.3 million in 2017 and $13.0 million in 2018. The actions under this program were substantially completed in 2018, with cumulative pretax charges of approximately $48 million. Other Restructurings Management periodically implements restructuring actions in targeted sections of our business. As a result of these actions, we recognized charges of $4.6 million in 2017 and $7.6 million in 2018, primarily severance costs. Due to the unique circumstances around these charges, they have not been allocated to segment results and are excluded from non-GAAP results. Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the business and are special in nature are consistently excluded from non-GAAP results. These items are described below: 2018 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $17.7 million in 2018. - Integration costs in 2018 related to acquisitions in France and the U.S. were $8.1 million. - 2018 transaction costs related to business acquisitions were $6.7 million. - We incurred 2018 severance charges related to our acquisitions in Argentina, France, U.S. and Brazil of $5.0 million. - Compensation expense related to the retention of key Dunbar employees was $4.1 million in 2018. - We recognized a net gain in 2018 ($2.6 million, net of statutory employee benefit) on the sale of real estate in Mexico. 2017 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $8.4 million in 2017. - A net gain of $7.8 million was recognized in 2017 related to the sale of real estate in Mexico. - We incurred 2017 severance costs of $4.0 million related to our acquisitions in Argentina and Brazil. - Transaction costs were $2.6 million related to acquisitions of new businesses in 2017. - We recognized currency transaction gains of $1.8 million related to acquisition activity in 2017. Argentina highly inflationary impact Beginning in the third quarter of 2018, we designated Argentina's economy as highly inflationary for accounting purposes. As a result, Argentine peso- denominated monetary assets and liabilities are now remeasured at each balance sheet date to the currency exchange rate then in effect, with currency remeasurement gains and losses recognized in earnings. In addition, nonmonetary assets retain a higher historical basis when the currency is devalued. The higher historical basis results in incremental expense being recognized when the nonmonetary assets are consumed. In the second half of 2018, we recognized $8.0 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $6.2 million. These amounts are excluded from non-GAAP results. Reporting compliance Certain compliance costs (primarily third party expenses) are excluded from 2018 non-GAAP results. These costs relate to the implementation and January 1, 2019 adoption of the new lease accounting standard ($2.7 million in 2018) and the mitigation of material weaknesses ($1.8 million in 2018). 31

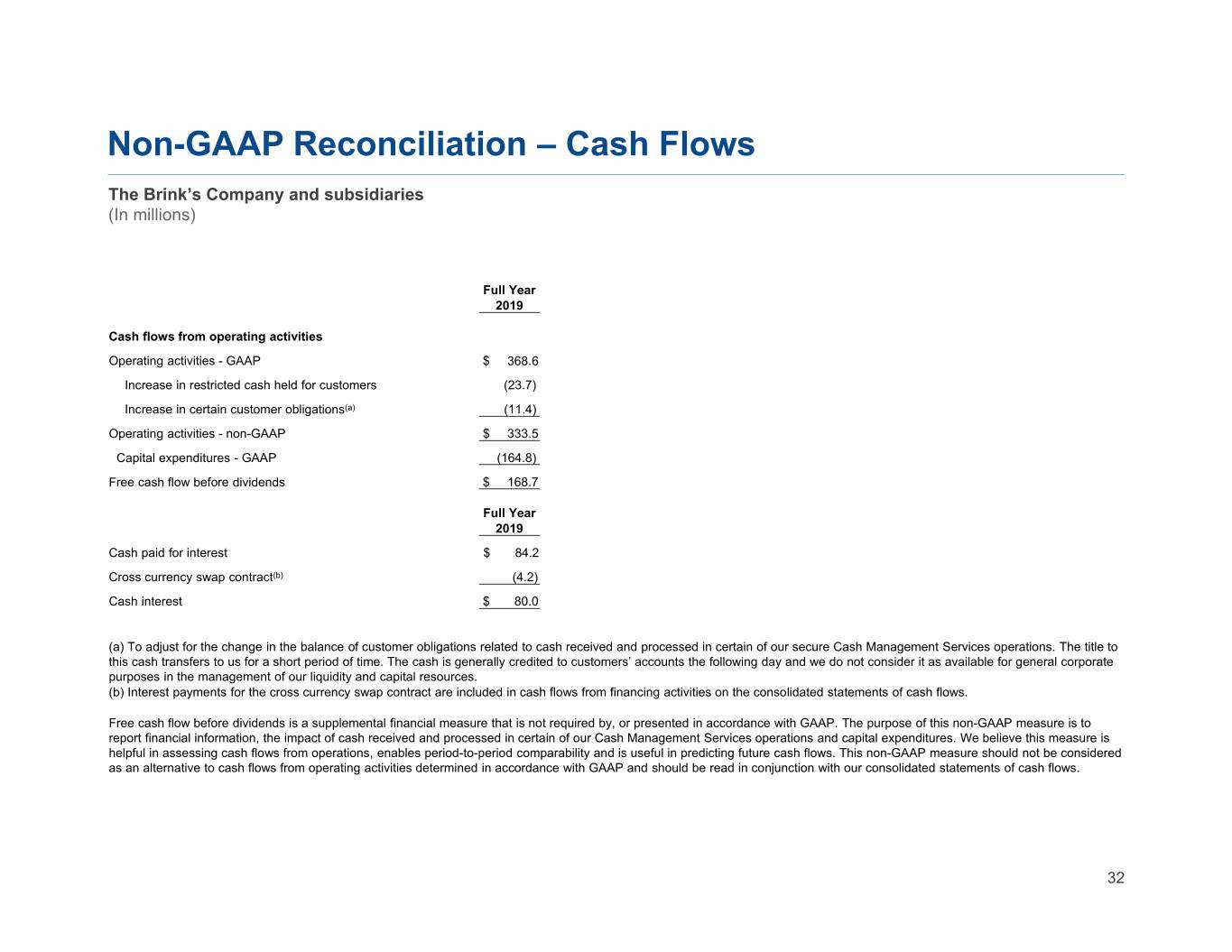

Non-GAAP Reconciliation – Cash Flows The Brink’s Company and subsidiaries (In millions) Full Year 2019 Cash flows from operating activities Operating activities - GAAP $ 368.6 Increase in restricted cash held for customers (23.7) Increase in certain customer obligations(a) (11.4) Operating activities - non-GAAP $ 333.5 Capital expenditures - GAAP (164.8) Free cash flow before dividends $ 168.7 Full Year 2019 Cash paid for interest $ 84.2 Cross currency swap contract(b) (4.2) Cash interest $ 80.0 (a) To adjust for the change in the balance of customer obligations related to cash received and processed in certain of our secure Cash Management Services operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources. (b) Interest payments for the cross currency swap contract are included in cash flows from financing activities on the consolidated statements of cash flows. Free cash flow before dividends is a supplemental financial measure that is not required by, or presented in accordance with GAAP. The purpose of this non-GAAP measure is to report financial information, the impact of cash received and processed in certain of our Cash Management Services operations and capital expenditures. We believe this measure is helpful in assessing cash flows from operations, enables period-to-period comparability and is useful in predicting future cash flows. This non-GAAP measure should not be considered as an alternative to cash flows from operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows. 32

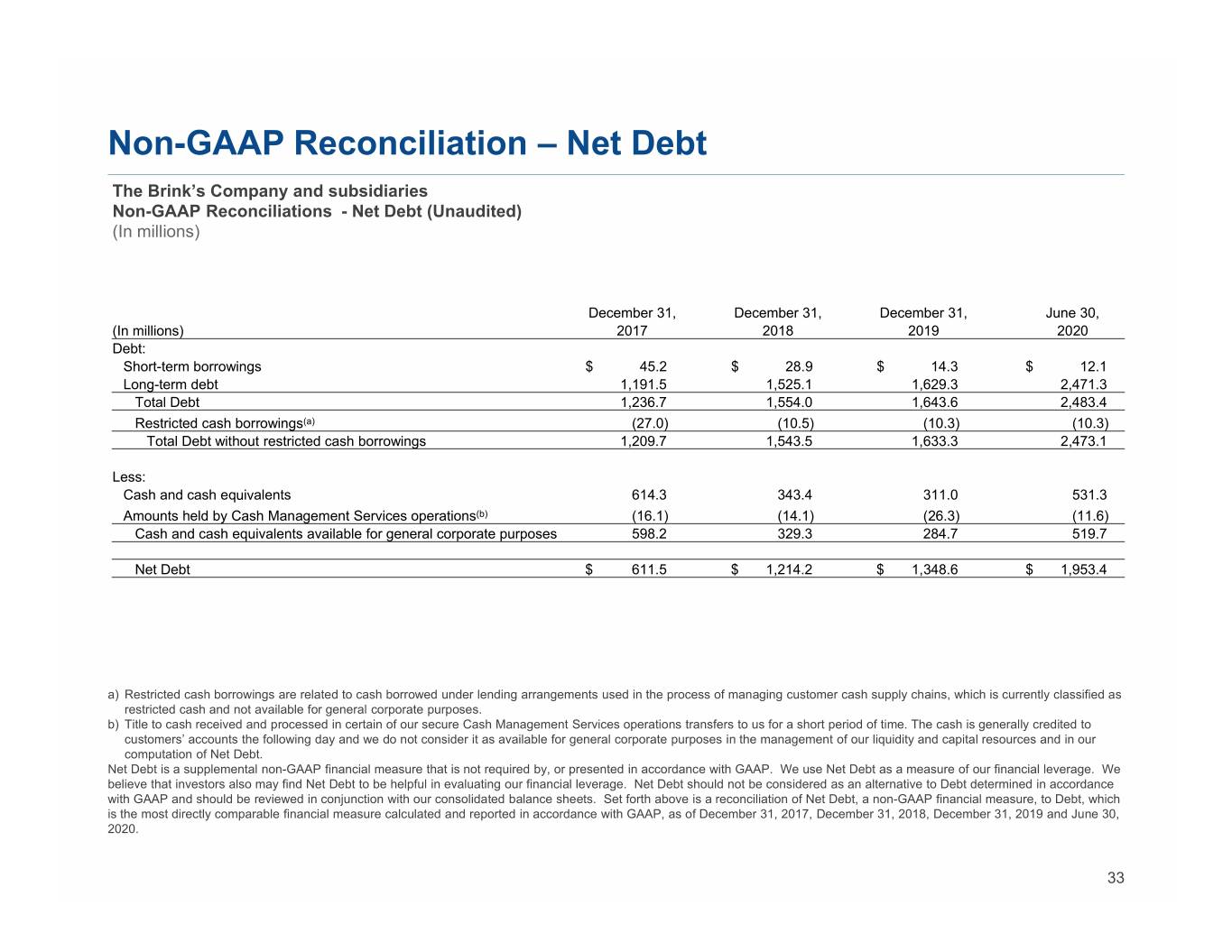

Non-GAAP Reconciliation – Net Debt The Brink’s Company and subsidiaries Non-GAAP Reconciliations - Net Debt (Unaudited) (In millions) December 31, December 31, December 31, June 30, (In millions) 2017 2018 2019 2020 Debt: Short-term borrowings $ 45.2 $ 28.9 $ 14.3 $ 12.1 Long-term debt 1,191.5 1,525.1 1,629.3 2,471.3 Total Debt 1,236.7 1,554.0 1,643.6 2,483.4 Restricted cash borrowings(a) (27.0) (10.5) (10.3) (10.3) Total Debt without restricted cash borrowings 1,209.7 1,543.5 1,633.3 2,473.1 Less: Cash and cash equivalents 614.3 343.4 311.0 531.3 Amounts held by Cash Management Services operations(b) (16.1) (14.1) (26.3) (11.6) Cash and cash equivalents available for general corporate purposes 598.2 329.3 284.7 519.7 Net Debt $ 611.5 $ 1,214.2 $ 1,348.6 $ 1,953.4 a) Restricted cash borrowings are related to cash borrowed under lending arrangements used in the process of managing customer cash supply chains, which is currently classified as restricted cash and not available for general corporate purposes. b) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in our computation of Net Debt. Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial measure calculated and reported in accordance with GAAP, as of December 31, 2017, December 31, 2018, December 31, 2019 and June 30, 2020. 33