Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Veritex Holdings, Inc. | a2q20pressrelease-quar.htm |

| EX-99.1 - EX-99.1 - Veritex Holdings, Inc. | a2020q2-exhibit991.htm |

| 8-K - 8-K - Veritex Holdings, Inc. | vbtx-20200728.htm |

V E R I T E X Investor Presentation 2nd Quarter 2020

Safe Harbor Forward-looking statements This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on various facts and derived utilizing assumptions, current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include, without limitation, statements relating to the expected payment date of Veritex Holdings, Inc.’s (“Veritex”) quarterly cash dividend, impact of certain changes in Veritex’s accounting policies, standards and interpretation, the effects of the COVID-19 pandemic and actions taken in response thereto, Veritex’s business and growth strategy, projected plans and objectives. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Veritex’s Annual Report on Form 10-K for the year ended December 31, 2019 and any updates to those risk factors set forth in Veritex’s Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Veritex does not undertake any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All forward- looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Veritex or persons acting on Veritex’s behalf may issue. This presentation also includes industry and trade association data, forecasts and information that Veritex has prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information publicly available to Veritex, which information may be specific to particular markets or geographic locations. Some data is also based on Veritex's good faith estimates, which are derived from management's knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although Veritex believes these sources are reliable, Veritex has not independently verified the information contained therein. While Veritex is not aware of any misstatements regarding the industry data presented in this presentation, Veritex's estimates involve risks and uncertainties and are subject to change based on various factors. Similarly, Veritex believes that its internal research is reliable, even though such research has not been verified by independent sources. 2

Risk Factor Update The novel coronavirus (“COVID-19”) and the impact of actions to mitigate it could have a material adverse effect our business, financial condition and results of operations, and such effects will depend on future developments, which are highly uncertain and are difficult to predict. COVID-19 has led to federal, state and local governments enacting various restrictions in an attempt to limit the spread of the virus, including the declaration of a federal National Emergency; multiple cities’ and states’ declarations of states of emergency; school and business closings; limitations on social or public gatherings and other social distancing measures, such as working remotely, travel restrictions, quarantines and shelter in place orders. Such measures have significantly contributed to rising unemployment and reductions in consumer and business spending. In response to the economic and financial effects of COVID-19, the Federal Reserve Board has sharply reduced interest rates and instituted quantitative easing measures as well as domestic and global capital market support programs. In addition, the Trump Administration, Congress, various federal agencies and state governments have taken measures to address the economic and social consequences of the pandemic, including the passage of the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, and the Main Street Lending Program. The CARES Act, among other things, provides certain measures to support individuals and businesses in maintaining solvency through monetary relief, including in the form of financing, loan forgiveness and automatic forbearance. Beginning in early April 2020, we began processing loan applications under the Paycheck Protection Program created under the CARES Act. The Federal Reserve’s Main Street Lending Program will offer deferred interest on 4-year loans to small and mid-sized businesses. Other banking regulatory agencies have encouraged lenders to extend additional loans, and the federal government is considering additional stimulus and support legislation focused on providing aid to various sectors, including small businesses. The full impact on our business activities as a result of new government and regulatory policies, programs and guidelines, as well as regulators’ reactions to such activities, remains uncertain. The economic effects of the COVID-19 outbreak have had a destabilizing effect on financial markets, key market indices and overall economic activity. The uncertainty regarding the duration of the pandemic and the resulting economic disruption has caused increased market volatility and may lead to an economic recession and/or a significant decrease in consumer confidence and business generally. The continuation of these conditions caused by the outbreak, including the impacts of the CARES Act and other federal and state measures, specifically with respect to loan forbearances, can be expected to adversely impact our businesses and results of operations and the operations of our borrowers, customers and business partners. In particular, these events can be expected to, among other things: . impair the ability of borrowers to repay outstanding loans or other obligations, resulting in increases in delinquencies; . impair the value of collateral securing loans (particularly with respect to real estate); . impair the value of our securities portfolio; . require an increase in our allowance for credit losses or unfunded commitments; . adversely affect the stability of our deposit base, or otherwise impair our liquidity; . reduce our wealth management revenues and the demand for our products and services; . create stress on our operations and systems associated with our participation in the Paycheck Protection Program as a result of high demand and volume of applications; . result in increased compliance risk as we become subject to new regulatory and other requirements associated with the Paycheck Protection Program and other new programs in which we participate; . impair the ability of loan guarantors to honor commitments; . negatively impact our regulatory capital ratios; . negatively impact the productivity and availability of key personnel and other employees necessary to conduct our business, and of third-party service providers who perform critical services for us, or otherwise cause operational failures due to changes in our normal business practices necessitated by the outbreak and related governmental actions; . increase cyber and payment fraud risk, given increased online and remote activity; and . broadly result in lost revenue and income. Prolonged measures by health or other governmental authorities encouraging or requiring significant restrictions on travel, assembly or other core business practices could further harm our business and those of our customers, in particular our small to medium sized business customers. Although we have business continuity plans and other safeguards in place, there is no assurance that they will be effective. The ultimate impact of these factors is highly uncertain at this time and we do not yet know the full extent of the impacts on our business, our operations or the global economy as a whole. However, the decline in economic conditions generally and a prolonged negative impact on small to medium sized businesses, in particular, due to COVID-19 may result in a material adverse effect to our business, financial condition and results of operations and may heighten many of our known risks described in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2019. 3

Non-GAAP Financial Measures Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain supplemental non-GAAP financial measures used in managing its business provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to assess the Company’s operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Veritex’s results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: • Tangible book value per common share; • Tangible common equity to tangible assets; • Returns on average tangible common equity; • Operating net income; • Pre-tax, pre-provision operating earnings; • Diluted operating earnings per share (“EPS”); • Operating return on average assets; • Operating return on average tangible common equity; • Operating efficiency ratio; • Operating noninterest income; and • Operating noninterest expense. Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP. 4

Q2 2020 – Positioning for Challenges Ahead • Pre-tax pre-provision operating earnings of $45.7 million – 2.11% of average assets Strong PTPP annualized Earnings • Net income of $24.0 million, or $0.48 diluted earnings per share (“EPS”) • Provision for credit losses and unfunded commitments of $19.0 million for the quarter Building • Allowance for credit losses coverage increased to 2.01% of total loans, excluding mortgage warehouse and Paycheck Protection Program (“PPP”) loans compared to Reserves 1.73% in the first quarter of 2020 • Net charge-offs of $1.8 million for the quarter, or 3 bps to average loans outstanding • Maintained strong regulatory capital metrics – total common equity tier 1 capital Capital Strong increased $24.6 million, or 13 bps to 9.66% & Growing • Declared regular quarterly dividend of $0.17 • No share repurchases during the quarter • Originated 2,116 PPP loans totaling $400.9 million, increasing our total loans to $6.6 billion, or 22.8% annualized growth Loan and • Mortgage warehouse lending (counter cyclical) increased 19.1% over 1Q20 and 121% Deposit Growth over 2Q19 • Transactional deposits grew $535.7 million, or 52.4% annualized 5

Pandemic Response

Business as “Unusual” Operational Response and Preparedness TOP 5 PRIORITIES • Dispersion of critical operational processes (IT, Wire, Deposit Operations, HR, Digital Banking, Factoring, Branches, Branch Operations, Loan operations, Information Security, Fraud, BSA). . Protection of life/safety of people • Increased monitoring focused on higher risk operations, enhanced remote access security and further restricted internet access. . Sustaining/supporting critical processes • Enhanced security around wire transfer execution. . Communicate frequently and effectively • Flexible scheduling is being provided to those that are unable to work from home. . Support remote working success • Restructured loan approval process by eliminating Executive Loan Committee meetings using already in place approval limits. . Provide seamless service to clients • Implemented a Small Business Administration (“SBA”) module to enable SBA team to offer Paycheck Protection Program (“PPP”) loans to small business clients. DFW Cases: 64,294 • 308, or 57%, of Veritex employees are working remotely Deaths: 825 Texas Cases: 341,739 3% Deaths: 4,151 33% $1.2 mm COVID exp. 64% Houston Cases: 62,162 Deaths: 593 Source: Texas Department of State Health Services as of July 22, 2020. CRA Donations Compensation Other 7

Taking Care of Clients and Communities Paycheck Protection Program (“PPP”) • As an SBA preferred lender, Veritex is participating in the CARES Act PPP loan program • Elected the fair value option to account for PPP loans for reporting purposes • Total gross fees recognized in second quarter of 2020 approximated $12.5 million • Effective yield on PPP loans was 1% in accordance with program guidelines As of June 30, 2020 ($ in millions) # of Loans $ of Loans PPP Loans Funded 2,116 $ 400.9 million Fair Value Adj. (priced at $99.5) 1 2,116 ($ 2.0 million) PPP Loans at Fair Value 2,116 $ 398.9 million Average loan approximately $189 thousand; Weighted average fee – 3.13% Loan Total PPP by Sector Origination # of Loans SBA Fee % $ Fee Funded Pool 4% 2% 6% < 150,000 $ 71,494 1,580 5.00% $ 3.6 Services 8% Real Estate $150,001 - Manufacturing $ 68,651 301 5.00% $ 3.4 $350,000 9% Distribution $350,000 - 57% Financial Services $ 146,443 205 3.00% $ 4.4 $2,000,000 Commodities 14% Government > $2,000,000 $ 114,366 30 1.00% $ 1.1 TOTAL $ 400,954 2,116 $ 12.5 8 1 Fair value price was based on a level 2 broker quote.

Credit Outlook

Loan Portfolio by Loan Type NOOCRE Outstanding: $1.8 Billion Unfunded: $127.5Million 6% Average Loan: $2.8 Million 6% WA LTV: 59% NPL: 1.10% 28% 7% C&I Outstanding: $1.6 Billion Unfunded: $685.3 Million 8% $6.6 Average Loan: $393 Thousand NPL: 1.12% 1 OOCRE Billion Outstanding: $723.8 Million 9% Unfunded: $20.5 Million Average Loan: $941 Thousand WA LTV: 62% Construction 24% NPL: 0.51% 12% Outstanding: $566.5 Million Unfunded: $630.9 Million Average Loan: $1.7 Million WA LTV: 57% NOOCRE C&I NPL: 0.13% OOCRE Construction and Land 1-4 Family Residential Mortgage Warehouse Multifamily WA % Complete: 50% Multifamily PPP Outstanding: $388.4 Million Unfunded: $10.1 Million Average Loan: $5.3 Million 1 Total loans excludes Loans Held for Sale. WA LTV: 69% NPL: 0% 10

Asset Quality Remains Stable NPAs / Total Loans + OREO Past Due 1 Trends % of Total Loans 2 ($ in millions) 1.0% 0.9% 0.9% 0.70% 0.9% 0.8% 0.60% 0.8% 0.7% 0.7% 0.50% 0.6% 0.40% 0.5% $51.4 $53.3 $43.3 0.4% 0.3% $39.4 0.30% 0.3% 0.20% 0.2% $17.0 0.10% 0.1% 0.0% 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 30-59 Past Due 60-89 Past Due 90+ Past Due NPAs NPAs/Total Loans + OREO Net Charge-off Trends 0.23% 0.18% 0.14% 0.13% 0.08% 0.05% 0.03% 0.03% 0.00% 0.00% 0.00% -0.03% 2Q19 3Q19 4Q19 1Q20 2Q20 Net Charge-offs Net Charge-off / Avg. Loans Net Charge-offs, excluding Energy / Avg. Loans 1 Past due loans exclude purchased credit deteriorated loans that are accounted for on a pooled basis and non-accrual loans. 11 2 Total loans excludes Loans Held for Sale, Mortgage Warehouse and PPP loans.

Pandemic Portfolio Review Timing – Review performed during June 2020 Phase 1 Scope – All relationships above $2 million that one or more of the following applies: • High Risk Industry • Received a Round 1 Deferment • Received a PPP loan Phase 2 Scope – All relationships above $20 million in commitments Penetration – Phase 1 and Phase 2 targeted review covered $4.9 billion, or 55.2%, of total commitments Results › 2.3% of the total committed bank $s were downgraded to Special Mention, or $203.2 million › $126.1 Million of downgrades to Special Mention were in the Hospitality portfolio › $25.4 Million of downgrades to Special Mention were in the Retail CRE portfolio › 0.3% of the total committed bank $s were downgraded to Substandard, or $31.0 Million › $3.8 Million is in the Hospitality portfolio › $17 Million relates to a student housing property that is underperforming due to COVID issues › $10 Million downgrade is related to a fuel jobber/C-Store operator who is demonstrating poor operating performance Next Steps • Reviews will be conducted quarterly as real time data is collected on borrowers performance in the portfolio 12

Loan Deferment Program Round 1: The Loan Deferment Program addresses the significant payment challenges faced by our customers caused by the COVID-19 virus. Initially 90-day deferral of principal and/or interest Round 2: The second round of the Loan Deferment Program takes a deeper dive into the reasons for the additional deferment request, the actual financial performance of the borrower and the actions being taken by the borrower outside of the deferment request. Extended 90-day deferral of principal and/or interest Round 2 Deferment Request Process Complete IF APPROVED Request Senior Credit Deferment Form Payment Due Financial Loan Servicing Deferment in Officer Reviews Sent to Borrower Date Extended Update Preps Deferment Writing (E-mail) Risk Rating for Execution Received Form 90 Days Round 1 Round 2 As of July 24, 2020 Approved Deferments Approved Expected CRE Retail $338.5 million CRE Retail $3.6 million $3.9 million CRE Hospitality $215.6 million CRE Hospitality $59.6 million $70.3 million CRE Office $201.9 million CRE Office - $7.2 million C&I $164.4 million C&I $10.2 million $31.7 million CRE Other $83.7 million CRE Other $4.3 million $19.0 million 54% CRE Warehouse $79.1 million CRE Warehouse $3.6 million $3.3 million CRE Multifamily $63.1 million CRE Multifamily - $6.2 million Residential RE $43.6 million Residential RE $4.6 million $0.3 million Construction $7.9 million Construction - $0.3 million Consumer $1.0 million Consumer - - Total $1.2 billion Total $85.9 million $142.2 million % of Total Outstanding 18.2% % of Total Outstanding 1.5% 2.5% 13 13

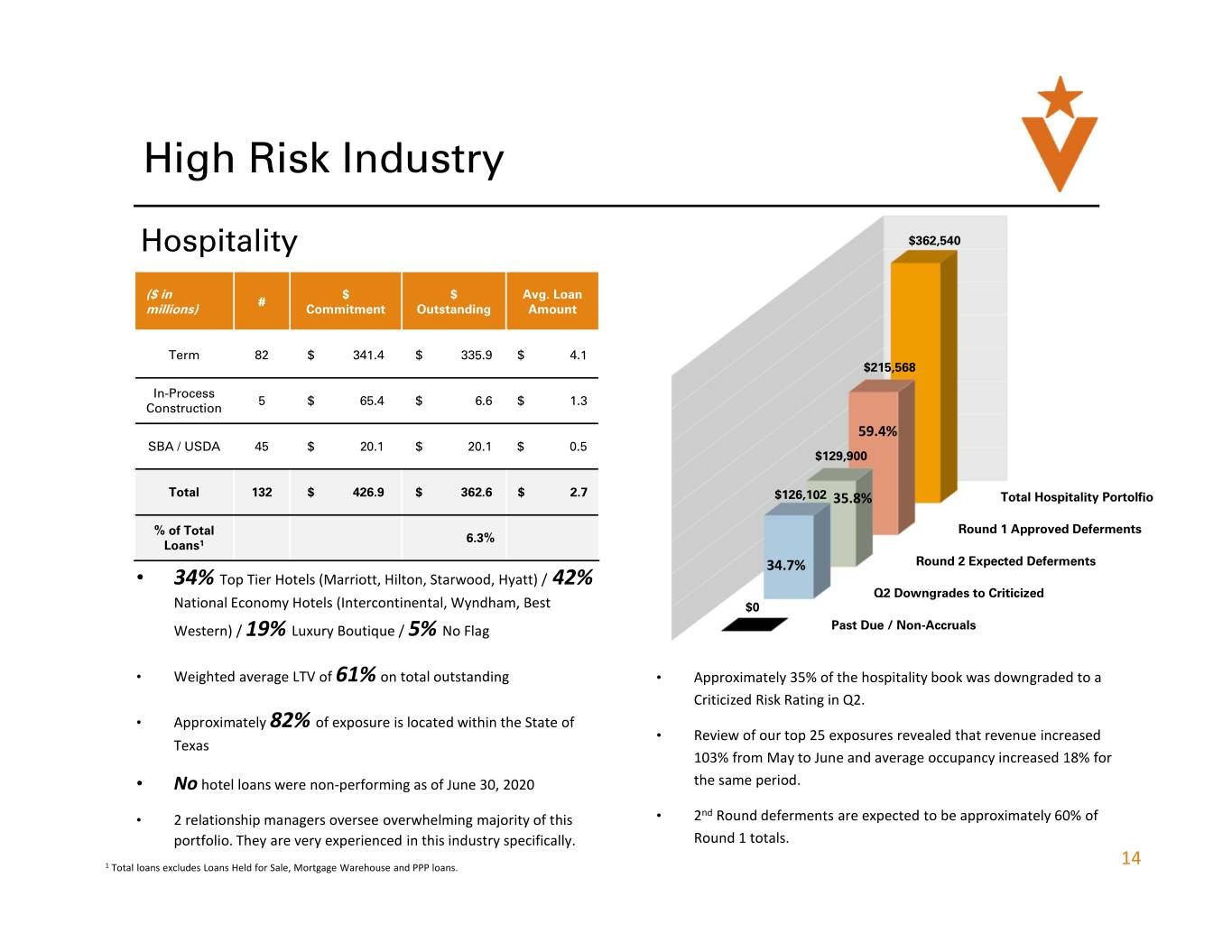

High Risk Industry Hospitality $362,540 ($ in $ $ Avg. Loan # millions) Commitment Outstanding Amount Term 82 $ 341.4 $ 335.9 $ 4.1 $215,568 In-Process 5 $ 65.4 $ 6.6 $ 1.3 Construction 59.4% SBA / USDA 45 $ 20.1 $ 20.1 $ 0.5 $129,900 Total 132 $ 426.9 $ 362.6 $ 2.7 $126,102 35.8% Total Hospitality Portolfio % of Total Round 1 Approved Deferments 6.3% Loans 1 34.7% Round 2 Expected Deferments • 34% Top Tier Hotels (Marriott, Hilton, Starwood, Hyatt) / 42% Q2 Downgrades to Criticized National Economy Hotels (Intercontinental, Wyndham, Best $0 Western) / 19% Luxury Boutique / 5% No Flag Past Due / Non-Accruals • Weighted average LTV of 61% on total outstanding • Approximately 35% of the hospitality book was downgraded to a Criticized Risk Rating in Q2. • Approximately 82% of exposure is located within the State of • Review of our top 25 exposures revealed that revenue increased Texas 103% from May to June and average occupancy increased 18% for • No hotel loans were non-performing as of June 30, 2020 the same period. nd • 2 relationship managers oversee overwhelming majority of this • 2 Round deferments are expected to be approximately 60% of portfolio. They are very experienced in this industry specifically. Round 1 totals. 1 Total loans excludes Loans Held for Sale, Mortgage Warehouse and PPP loans. 14

High Risk Industry Retail CRE ($ in $ $ Avg. Loan # millions) Commitment Outstanding Amount $462,754 NOOCRE 188 $ 411.6 $ 392.1 $ 2.1 Retail Construction 22 $ 139.2 $ 70.7 $ 3.2 Retail Total 210 $ 550.8 $ 462.8 $ 2.2 $239,194 % of Total 8.1% Loans 1 • Weighted average LTV of 55.2% on total outstanding 51.7% • Approximately 6.9% of outstanding exposure are Criticized assets Total Retail CRE Portolfio $25,418 Round 1 Aproved Deferments • 7 borrowers with loans in excess of $10 million with an 5.5% Q2 Downgrades to Criticized average LTV of 62% $7,500 Round 2 Expected Deferments • Approximately 95% of outstanding exposure is located in $4,856 the Bank’s primary market of Texas Past Due / Non-Accrual • 0.32% of retail loans were non-performing as of June 30, 2020. This was a single loan that resolved as of July 7,2020 1 Total loans excludes Loans Held for Sale, Mortgage Warehouse and PPP loans. 15

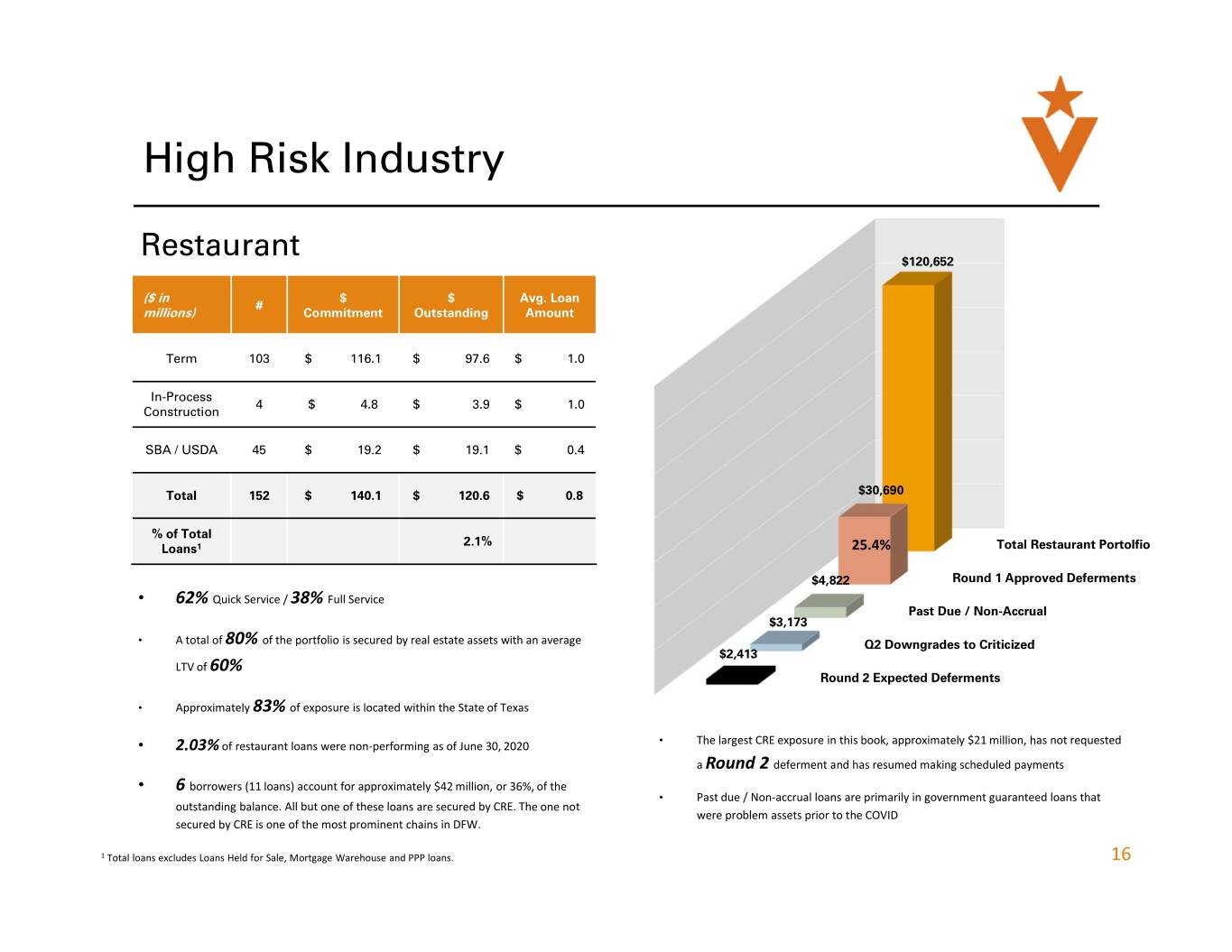

High Risk Industry Restaurant $120,652 ($ in $ $ Avg. Loan # millions) Commitment Outstanding Amount Term 103 $ 116.1 $ 97.6 $ 1.0 In-Process 4 $ 4.8 $ 3.9 $ 1.0 Construction SBA / USDA 45 $ 19.2 $ 19.1 $ 0.4 Total 152 $ 140.1 $ 120.6 $ 0.8 $30,690 % of Total 2.1% Loans 1 25.4% Total Restaurant Portolfio $4,822 Round 1 Approved Deferments • 62% Quick Service / 38% Full Service Past Due / Non-Accrual $3,173 • A total of 80% of the portfolio is secured by real estate assets with an average Q2 Downgrades to Criticized $2,413 LTV of 60% Round 2 Expected Deferments • Approximately 83% of exposure is located within the State of Texas • 2.03% of restaurant loans were non-performing as of June 30, 2020 • The largest CRE exposure in this book, approximately $21 million, has not requested a Round 2 deferment and has resumed making scheduled payments • 6 borrowers (11 loans) account for approximately $42 million, or 36%, of the • Past due / Non-accrual loans are primarily in government guaranteed loans that outstanding balance. All but one of these loans are secured by CRE. The one not were problem assets prior to the COVID secured by CRE is one of the most prominent chains in DFW. 1 Total loans excludes Loans Held for Sale, Mortgage Warehouse and PPP loans. 16

High Risk Industry Summary $5,725,414 The following portfolios are considered a High Risk Industry: › Retail CRE › Hospitality › Restaurants › Senior Housing › Healthcare › Leveraged Lending › Energy $462,754 1 19.2% / TL Total Loans ("TL") $362,540 Retail CRE (8.1% / TL) Hospitality (6.3% / TL) $120,652 Restaurant (2.1% / TL) $65,546 Senior Housing (1.1% / TL) $44,550 Healthcare (0.8% / TL) $29,007 Leveraged Lending (0.5% / TL) $14,841 Energy (0.4% / TL) 1 Total loans excludes Loans Held for Sale, Mortgage Warehouse and PPP loans. 17

CECL Update

CECL – Continuing Reserve Build June 30, 2020 January 1, 2020 March 31, 2020 June 30, 2020 Reserve % per ($ in thousands) Portfolio Pooled Loans, exc. MW and PPP Commercial $ 19,102 $ 24,814 $ 23,370 1.55% CRE 17,351 28,619 38,590 1.55% Multifamily 2,593 4,900 6,429 1.63% Construction and Land 3,180 6,172 9,084 1.49% 1-4 Family Residential 5,094 7,583 10,217 1.95% Consumer 338 323 311 2.13% Total $ 47,658 $ 72,411 $ 88,001 1.59% Specific Reserves $ 1,602 $ 5,921 $ 5,713 13.60% PCD Reserves $ 19,711 $ 22,651 $ 21,651 14.80% Allowance for Credit Loss ("ACL"), exc. MW and PPP $ 68,971 $ 100,983 $ 115,365 14.2% in Reserves ACL / Total LHFI, exc. MW and PPP 1.23% 1.73% 2.01% ACL / Total LHFI 1.16% 1.62% 1.76% Reserve for Unfunded Expected to Fund$ 1,718 $ 5,599 $ 8,398 Net Charge-offs $ 236 $ (1,554) CECL Modeling Assumptions ($ in thousands) $150,000 NPL / Reserves › Moody’s Texas unemployment and year-over-year % change in Texas GDP utilized in model $115,365 $100,983 › Forecasts feature significant recessionary estimates $100,000 followed by slow improvement $68,971 › Texas Unemployment increases from 8.2% 3Q20 $45,615 to 8.45% 2Q21 $43,600 $50,000 $33,439 › % YOY change in Texas GDP bottoms out (7.1%) in 3Q20 recovering to 7.4% by 2Q21 › Continued elevated qualitative reserves equating to a $- 4Q19 1Q20 2Q20 ending ACL mirroring Moody’s stressed W shape economic 19 recovery ACL NPLs

Capital and Financial Results

Capital Remains Strong and Continues to Build ($ in thousands) June 30, 2020 March 31, 2020 $ Change Basel III Standarized 1 CET1 capital $ 726,006 $ 701,401 $ 24,605 CET1 capital ratio 9.7% 9.5% Leverage capital $ 755,121 $ 730,461 $ 24,660 Leverage capital ratio 9.2% 9.9% Tier 1 capital $ 755,121 $ 730,461 $ 24,660 Tier 1 capital ratio 10.1% 9.9% Total capital $ 955,220 $ 918,866 $ 36,354 Total capital ratio 12.7% 12.5% Risk weighted assets $ 7,516,531 $ 7,359,811 $ 156,720 Total assets 2 $ 8,587,858 $ 8,531,624 $ 56,234 Tangible common equity / Tangible Assets 3 8.96% 8.81% Ratios as of June 30, 2020 • Dividends 12.49% 12.71% 11.29% 11.29% › On July 28, 2020, declared quarterly cash dividend of $0.17 10.29% 10.05% 9.66% per common share payable in August 2020 9.16% › Will continuously review dividend with Board of Directors throughout the COVID-19 pandemic • Stock Buyback Program › Suspended on March 16, 2020 2 Leverage Ratio Tier 1 Ratio Total Capital Ratio CET1 • Elected option to delay CECL transition impact on regulatory Bank VHI capital for 2 years, followed by a three-year transition period 1 Estimated capital measures inclusive of CECL capital transition provisions as of June 30, 2020. 2 Total assets includes PPP loans that we did not utilize the Paycheck Protection Program Liquidity Facility to fund. 21 3 Please refer to the “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non-GAAP financial measures.

Deposits – Record Growth & Improving Mix $7 • Total deposits, excluding time deposits, increased $535.7 million, or 52.0% annualizes during the second quarter of $6 2020. Loan to Deposit Ratio 2 100% $5 • Noninterest-bearing deposits totaled $1.9 billion, which comprised 31.1% of total deposits as of June 30, 2020. $4 90% • Excluding mortgage warehouse and PPP loans, the loan to deposit ratio was 93.5% at June 30, 2020. $3 • Reliance on less valuable time deposits has decreased from $2 80% 33% in 2Q19 to 25% in 2Q20. $1 • Cost of interest-bearing deposits, excluding deposit premium 70% accretion, declined 56 bps in 2Q20 to 0.86%. $- 2Q19 3Q19 4Q19 1Q20 2Q20 Certificates and other time deposits Interest-bearing Noninterest-bearing Quarterly Cost of Interest-bearing Deposits and Total Deposits 1 CD Maturity Table 1.94% 1.89% 1.65% Balance WA Rate 1.42% 3Q20 431,576 1.41% 1.47% 1.44% 4Q20 282,475 1.68% 1Q21 235,424 1.61% 1.23% 2Q21 271,539 1.20% 1.05% 0.86% 3Q21 79,820 1.83% 0.61% 4Q21 69,107 1.69% 1Q22 58,278 1.73% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q22+ 75,482 1.87% Average cost of interest-bearing deposits, excluding deposit premium accretion Total 1,503,701 1.52% Average cost of total deposits, excluding deposit premium accretion 1 Average costs of interest-bearings deposits excludes $1,355, $1,210, $740, $423 and $263 of deposit premium accretion as of 2Q19, 3Q19, 4Q19, 1Q20 and 2Q20, respectively. 22 2 Loan to Deposit Ratio excluding mortgage warehouse and PPP loans.

Robust and Stable Liquidity Debt Securities Portfolio as of June 30, 2020 Ratings Profile S&P Moody's AAA 75.2% Aaa 66.8% 5% 13% AA 0.7% Aa1 0.5% 27% 14% Portfolio Highlights Wtd. Avg. Tax Equivalent Yield 2.88% 41% % Available-for-Sale 97.0% Avg. Life 5.8 yrs Modified Duration 4.1 yrs MUN COR CMO MBS ABS $ in millions Available for Sale Portfolio Breakout Primary & Secondary Liquidity Sources Cash and Cash Equivalents $ 160,306 Market Net Unrealized Unpledged Investment Securities 1,025,743 Security Type Book Value Value Gain Corporate $ 150,923 $ 151,329 $ 406 FHLB Borrowing Availability 311,464 Municipal 114,789 122,324 7,535 Unsecured Lines of Credit 175,000 Mortgage-Backed Security 271,680 289,444 17,764 Funds Available through Fed Discount 620,503 Collateralized Mortgage Obligation 433,532 457,026 23,494 Window Asset Backed Securities 56,531 59,947 3,416 Available Paycheck Protection $ 1,027,455 $ 1,080,070 $ 52,615 Program Liquidity Facility (“PPPLF”) $ 400,954 from FRB Total as of June 30, 2020 $ 2,693,970 23

Key Financial Metrics ROAA 1 Tangible Book Value per Common Share 1 2.22% 2.26% $14.61 $14.73 $14.71 2.07% 2.11% $14.39 1.94% $14.27 1.36% 1.36% 1.43% 0.98% 0.20% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 12Q20 Reported PTPP Operating Efficiency Ratio 1 Tangible Book Value per Common Share Build $15.20 51.49% $0.04 $15.00 $0.48 $0.05 $(0.17) $(0.07) $14.80 $(0.01) $14.71 47.12% 47.61% $14.60 46.02% $14.39 47.61% $14.40 43.66% 43.67% 45.67% 45.74% $14.20 $14.00 42.36% 2Q19 3Q19 4Q19 1Q20 2Q20 Reported Operating 24 1 Please refer to the “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non-GAAP financial measures.

Net Interest Income $ in millions • Net interest income of $65.8 million, down slightly from 1Q20 $70.9 $71.4 $69.9 $67.4 $65.8 • Net interest margin of 3.31% down 36 bps compared to 1Q20 • Drivers of NIM decrease are as follows: 4.00% 3.90% 12 bps of the decline is due to lower interest rates 3.81% 9 bps of the decline is due to the impact of PPP 3.69% 3.67% 3.60% lending with a 1% yield 3.47% 6 bps of the decline is due to lower purchase 3.39% 3.31% accounting adjustments Remaining decline is primarily due to an unfavorable 3.13% mix shift • Loan yields decreased 64 bps mainly driven by 83 bps decline in 1 Mo Libor during Q2 and a flattening yield curve 2Q19 3Q19 4Q19 1Q20 2Q20 • Costs of interest bearing deposits decreased 55 bps due to Net Interest Income repricing efforts in a lower rate environment NIM 1 Adjusted NIM (Excludes All Purchase Accounting) • Strong growth in in non-time deposits at lower rates helped offset the decline in loan yields 1 Purchase accounting adjustments are primarily comprised of loan accretion and deposit premium amortization of $3.1 million and $263 thousand, respectively, in 2Q20, $ $4.4 million and $423 thousand, respectively, in 1Q20, $5.6 million and $740 thousand, respectively, in 4Q19, $4.2 million and $1.2 million, respectively, in 3Q19 and $3.6 million and $1.9 million, respectively, in 25 2Q19.

Noninterest Income/Expense (Operating) ($ in thousands) ($ in thousands) Operating Noninterest Income 1 Composition Operating Noninterest Expense 1 Composition $38,500 $18,411 $35,366 $35,545 $34,106 $33,595 $7,750 $6,940 $7,510 $2,897 $7,100 $6,559 $1,245 $2,696 $2,696 $2,696 $2,719 $2,712 $2,796 $2,615 $2,196 $2,814 $2,750 $3,994 $11,006 $4,198 $4,273 $4,014 $4,044 $8,430 $7,570 $1,443 $7,247 $6,676 $842 $138 $2,179 $81 $143 $20,019 $2,252 $1,921 $18,917 $18,870 $1,932 $142 $308 $17,459 $17,530 $845 $1,240 $3,667 $3,728 $3,642 $3,422 $2,960 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Other Salaries and employee benefits Occupany and equipment Government guaranteed loan income, net Professional and regulatory fees Includes $1.1 million in Gain on sale of mortgage loans Amortization of intangibles Loan fees COVID related expenses problem loan expenses, up Service charges and fees on deposit accounts Other from $159 thousand in 1Q20. 26 1 Please refer to the “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for a description and reconciliation of this non-GAAP financial measures.

Building to Weather the Pandemic and Capture Opportunities • Significant additions and depth added to the Senior Executive Vice President Team including: Talent Additions • Jim Recer, Chief Banking Officer • Cara McDaniel, Chief Talent Officer • Scooter Smith, Head of Private Bank • 9.66% CET1 Ratio Well Capitalized • 10.05% Tier 1 Ratio • $1.2 billion Total Capital • Continued focus on growing pre-tax, pre-provision operating return earnings which PTPP increased $6.6 million from the first quarter of 2020 to the second quarter of 2020 • PTPP ROAA above 2% 5 out of the last 6 quarters • Maintaining conservative underwriting standards Conservative • Proactive pandemic portfolio deep dive review with 55% penetration Credit Discipline • Net charge-offs, excluding energy, to average loans has averaged 0.016% for the past five quarters • Maintain focus on the community we serve including donations and outreach where most Customer and needed in our community Community • Provide constant support to customers helping navigate and respond to the most urgent Focused needs during these uncharted times • Care, concern and work flexibility with increased protocol for entire staff 27

Supplemental

Reconciliation of Non -GAAP Financial Measures 29

Reconciliation of Non -GAAP Financial Measures 30

Reconciliation of Non -GAAP Financial Measures 31

Reconciliation of Non -GAAP Financial Measures 32

Reconciliation of Non -GAAP Financial Measures As of 30-Jun-20 31-Mar-20 31-Dec-19 30-Sep-19 30-Jun-19 (Dollars in thousands, except per share data) Operating Noninterest Income Noninterest income $ 21,290 $ 7,247 $ 7,132 $ 8,430 $ 6,034 Plus: Loss (gain) on sale of securities availablefor sale, net (2,879) - 438 - 642 Operating noninterest income $ 18,411 $ 7,247 $ 7,570 $ 8,430 $ 6,676 Operating Noninterest Expense Noninterest expense $ 40,061 $ 35,545 $ 36,284 $ 34,630 $ 39,896 1 Plus: Loss (gain) on sale of disposed branch assets - - - - 359 Plus: FHLB pre-payment fees 1,561 - - - - Plus: Merger and acquisition expenses - - 918 1,035 5,431 Operating noninterest expense $ 38,500 $ 35,545 $ 35,366 $ 33,595 $ 34,106 1 Annualized ratio. Loss on sale of disposed branch assets for the three months ended June 30, 2019 is included in merger and acquisition expense within the condensed consolidated statements of income. 33

V E R I T E X