Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SS&C Technologies Holdings Inc | ssnc-ex991_7.htm |

| 8-K - 8-K - SS&C Technologies Holdings Inc | ssnc-8k_20200728.htm |

SS&C Technologies (NASDAQ:SSNC) Q2 2020 Earnings Results

Safe Harbor Statement This presentation contains forward-looking statements, as defined by federal and state securities laws, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this message including those set forth below. All statements contained in this presentation are made only as of the date of this presentation. In addition, except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation. Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. Other factors that could affect actual results, outcomes, levels of activity, performance, developments or achievements can be found under the heading “Risk Factors” in SS&C Technologies Holdings, Inc.’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. As a result, we cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished.

SS&C’s Response to the COVID-19 Pandemic Maintaining Business Continuity, Operational capabilities, and Employee Safety Supporting our Clients through this unprecedented time We have instituted safety measures including work from home, work rotations for essential functions and closing of locations following the recommendations of regulators and health organizations around the world. The primary goal is to ensure our clients’ and every SS&C employee's health and safety. 99% of our global workforce is working from home at this time. Continue to evaluate reopening and plan on reopening some locations in the next several months. We have been reaching out to our customers offering our assistance, expertise and technological resources. The challenges of COVID-19 are proving the value of our investments in worldwide resiliency. We are providing capability via technology at scale and we are meeting our deliverables. Increased inbound interest for cloud hosting and outsourced services as firms in this remote working environment look to us to provide access to production systems, and augment their staff and processing capability. SS&C Health is developing dashboards that are updated in real time related to COVID-19 product utilization and trends. Feedback from clients has been overwhelmingly positive, service levels remain very high. Proven, resilient business model 96.0% revenue retention LTM as of June 30, 2020. SS&C has high contractually recurring revenue base. Less than 3.0% of 2019 revenues were from perpetual licenses and professional services. Cash flow provided by operations was $555.7 million for the six months ended June 30, 2020, up 33.4%. Adjusted diluted earnings per share in Q2 2020 were $1.04 per share, up 14.3%.

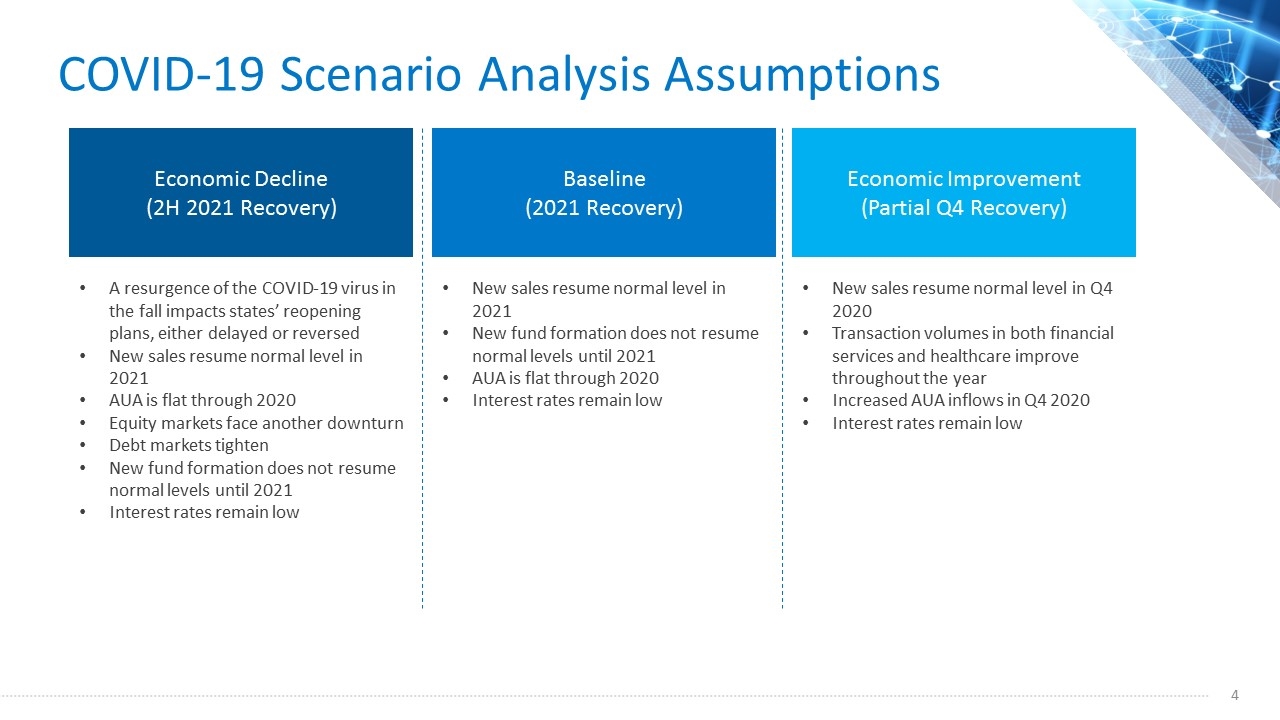

COVID-19 Scenario Analysis Assumptions Economic Decline (2H 2021 Recovery) Baseline (2021 Recovery) New sales resume normal level in Q4 2020 Transaction volumes in both financial services and healthcare improve throughout the year Increased AUA inflows in Q4 2020 Interest rates remain low New sales resume normal level in 2021 New fund formation does not resume normal levels until 2021 AUA is flat through 2020 Interest rates remain low Economic Improvement (Partial Q4 Recovery) A resurgence of the COVID-19 virus in the fall impacts states’ reopening plans, either delayed or reversed New sales resume normal level in 2021 AUA is flat through 2020 Equity markets face another downturn Debt markets tighten New fund formation does not resume normal levels until 2021 Interest rates remain low

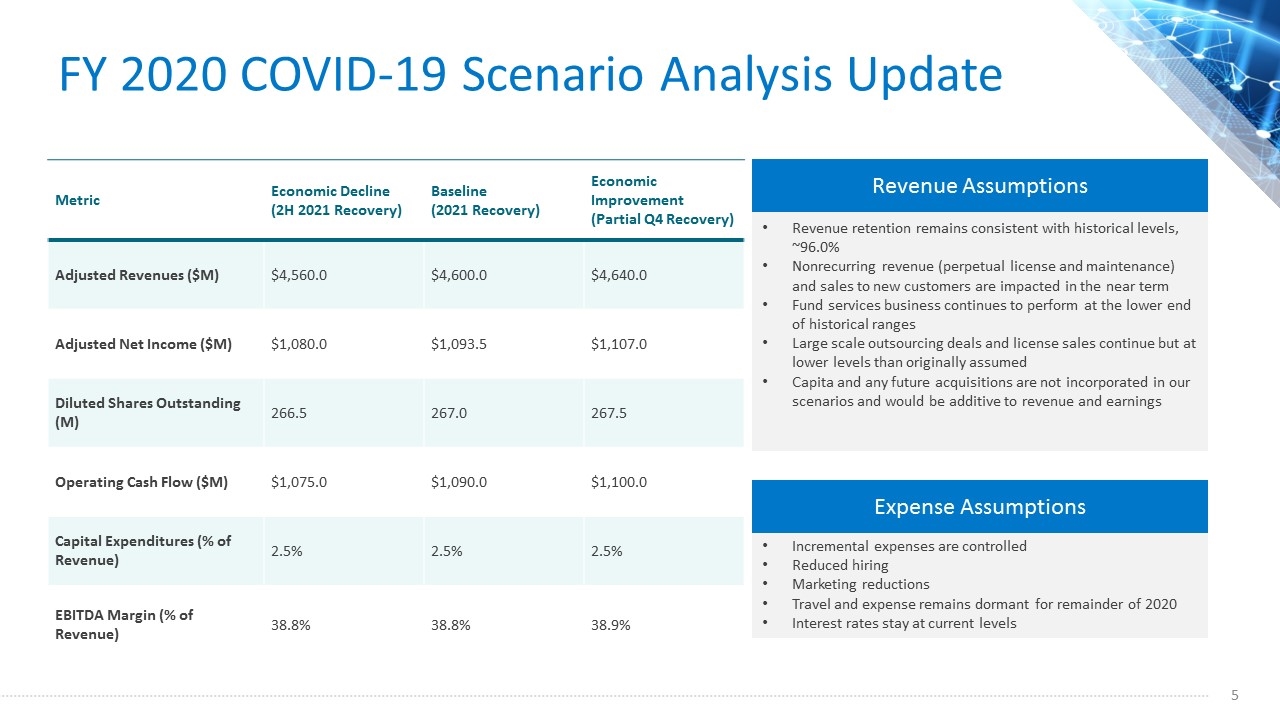

FY 2020 COVID-19 Scenario Analysis Update Metric Economic Decline (2H 2021 Recovery) Baseline (2021 Recovery) Economic Improvement (Partial Q4 Recovery) Adjusted Revenues ($M) $4,560.0 $4,600.0 $4,640.0 Adjusted Net Income ($M) $1,080.0 $1,093.5 $1,107.0 Diluted Shares Outstanding (M) 266.5 267.0 267.5 Operating Cash Flow ($M) $1,075.0 $1,090.0 $1,100.0 Capital Expenditures (% of Revenue) 2.5% 2.5% 2.5% EBITDA Margin (% of Revenue) 38.8% 38.8% 38.9% Revenue Assumptions Revenue retention remains consistent with historical levels, ~96.0% Nonrecurring revenue (perpetual license and maintenance) and sales to new customers are impacted in the near term Fund services business continues to perform at the lower end of historical ranges Large scale outsourcing deals and license sales continue but at lower levels than originally assumed Capita and any future acquisitions are not incorporated in our scenarios and would be additive to revenue and earnings Expense Assumptions Incremental expenses are controlled Reduced hiring Marketing reductions Travel and expense remains dormant for remainder of 2020 Interest rates stay at current levels

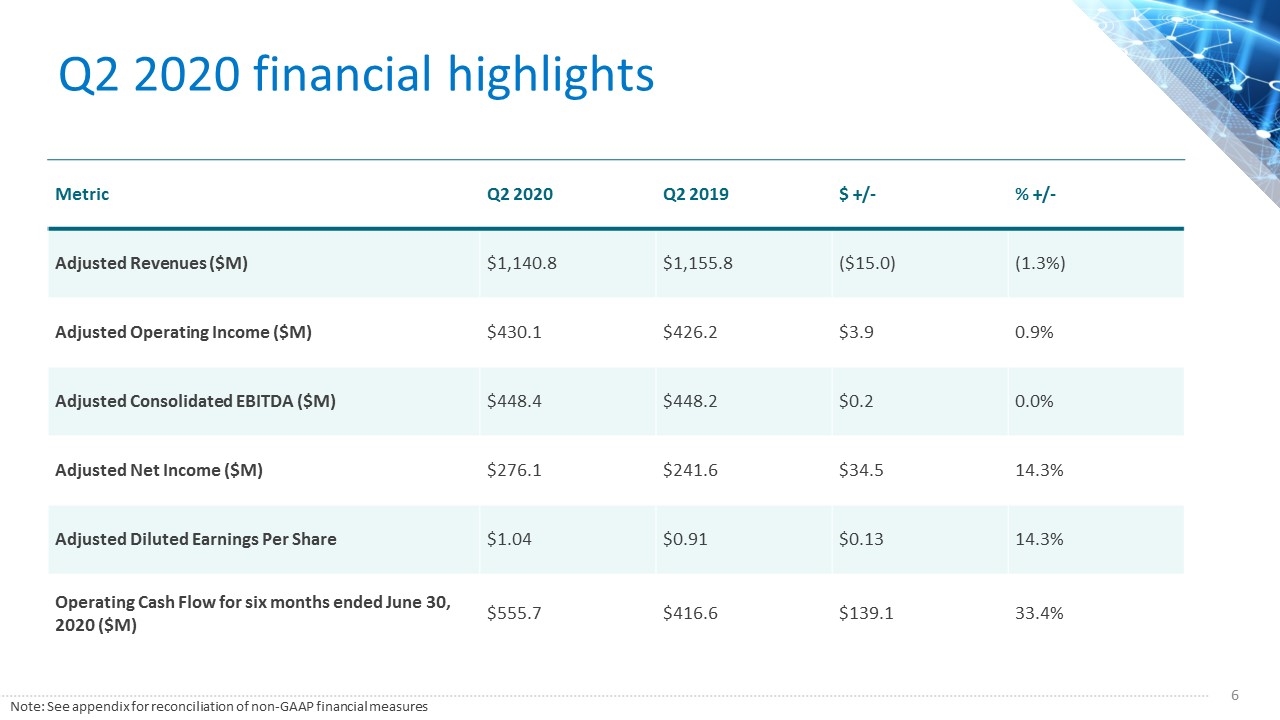

Q2 2020 financial highlights Metric Q2 2020 Q2 2019 $ +/- % +/- Adjusted Revenues ($M) $1,140.8 $1,155.8 ($15.0) (1.3%) Adjusted Operating Income ($M) $430.1 $426.2 $3.9 0.9% Adjusted Consolidated EBITDA ($M) $448.4 $448.2 $0.2 0.0% Adjusted Net Income ($M) $276.1 $241.6 $34.5 14.3% Adjusted Diluted Earnings Per Share $1.04 $0.91 $0.13 14.3% Operating Cash Flow for six months ended June 30, 2020 ($M) $555.7 $416.6 $139.1 33.4% Note: See appendix for reconciliation of non-GAAP financial measures

Operating cash flow was $555.7 M for the six months ended June 30, 2020, up $139.1 M, a 33.4% increase from $416.6 M for the prior six months Debt Pay down Paid down $2,302.3 M of net debt since our April 2018 acquisition of DST Systems Net leverage ratio is 3.60x LTM consolidated EBITDA, secured net leverage ratio is 2.53x LTM consolidated EBITDA of $1,848.2 M Shareholder Returns SS&C’s board of directors renewed the common stock repurchase program, and increased the program to $750.0 M Repurchased 0.5 M shares of common stock in Q2 2020, at an average price of $58.62 per share for $27.9 M Paid $32.1 M in dividends in Q2 2020 Acquisitions Closed the Innovest acquisition for total consideration of $120 M Debt review and capital allocation

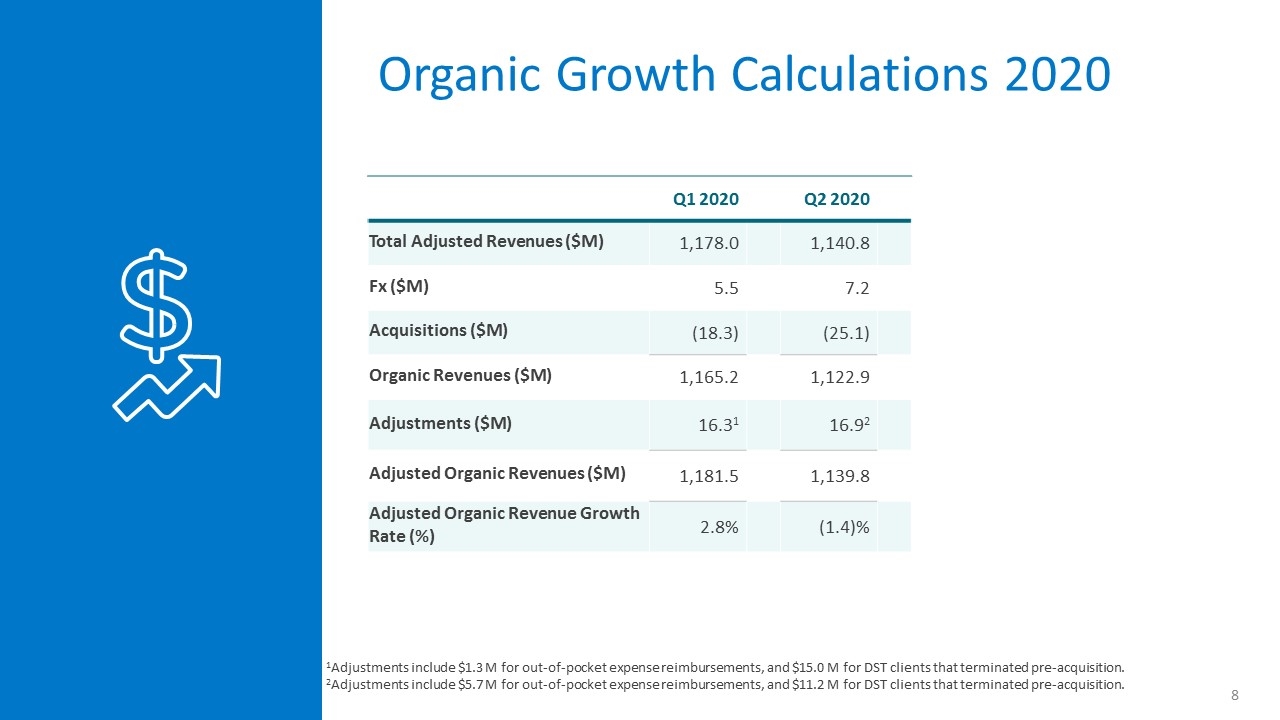

Organic Growth Calculations 2020 1Adjustments include $1.3 M for out-of-pocket expense reimbursements, and $15.0 M for DST clients that terminated pre-acquisition. 2Adjustments include $5.7 M for out-of-pocket expense reimbursements, and $11.2 M for DST clients that terminated pre-acquisition. Q1 2020 Q2 2020 Total Adjusted Revenues ($M) 1,178.0 1,140.8 Fx ($M) 5.5 7.2 Acquisitions ($M) (18.3) (25.1) Organic Revenues ($M) 1,165.2 1,122.9 Adjustments ($M) 16.31 16.92 Adjusted Organic Revenues ($M) 1,181.5 1,139.8 Adjusted Organic Revenue Growth Rate (%) 2.8% (1.4)%

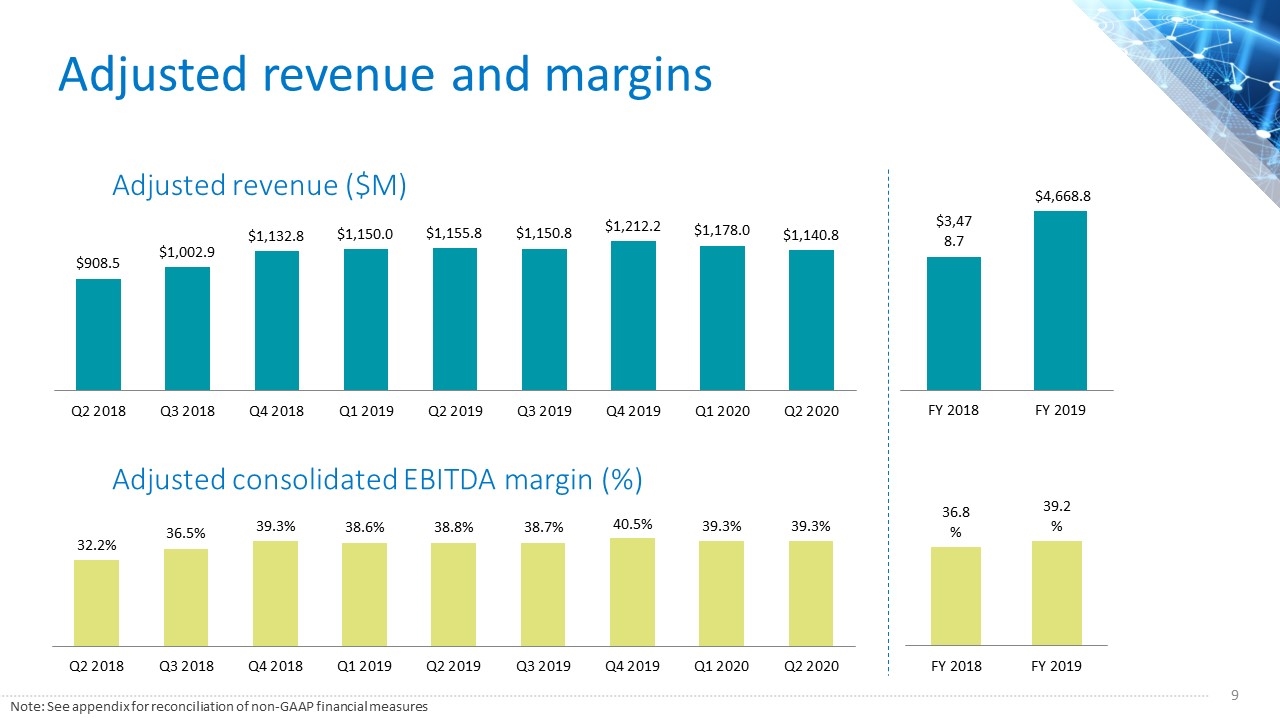

Adjusted revenue and margins Adjusted revenue ($M) Adjusted consolidated EBITDA margin (%) Note: See appendix for reconciliation of non-GAAP financial measures

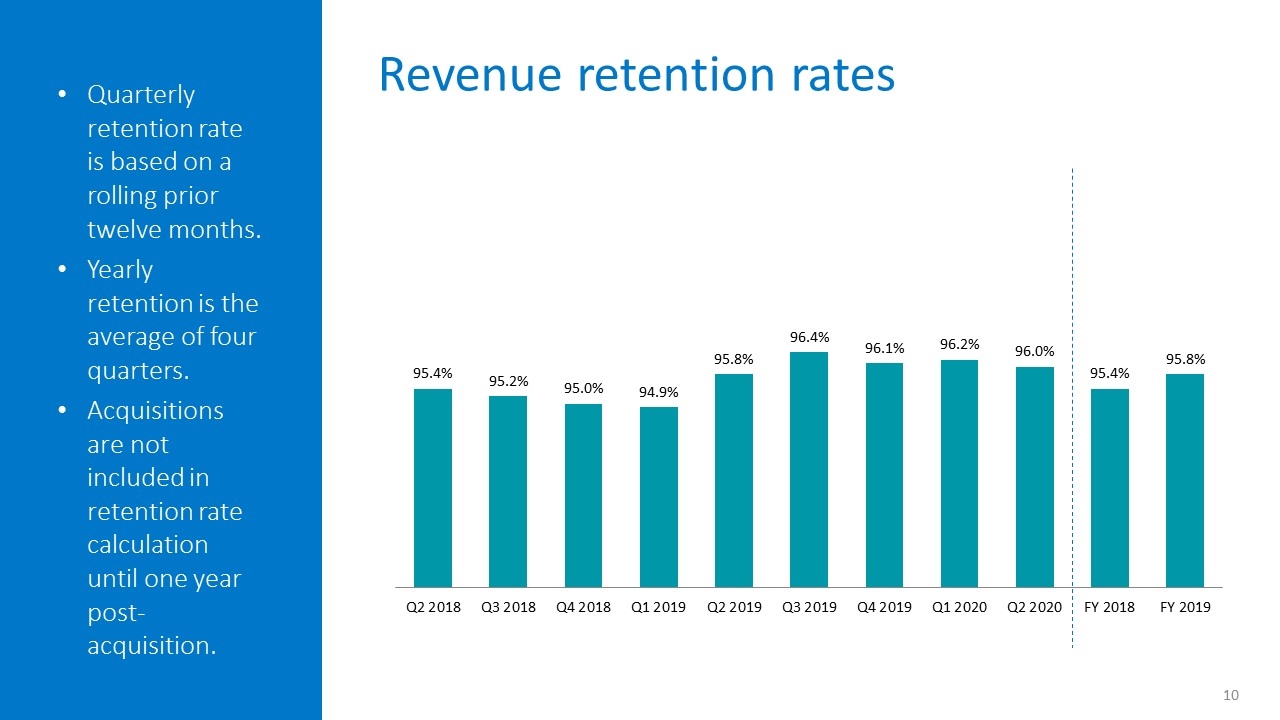

Quarterly retention rate is based on a rolling prior twelve months. Yearly retention is the average of four quarters. Acquisitions are not included in retention rate calculation until one year post-acquisition. Revenue retention rates

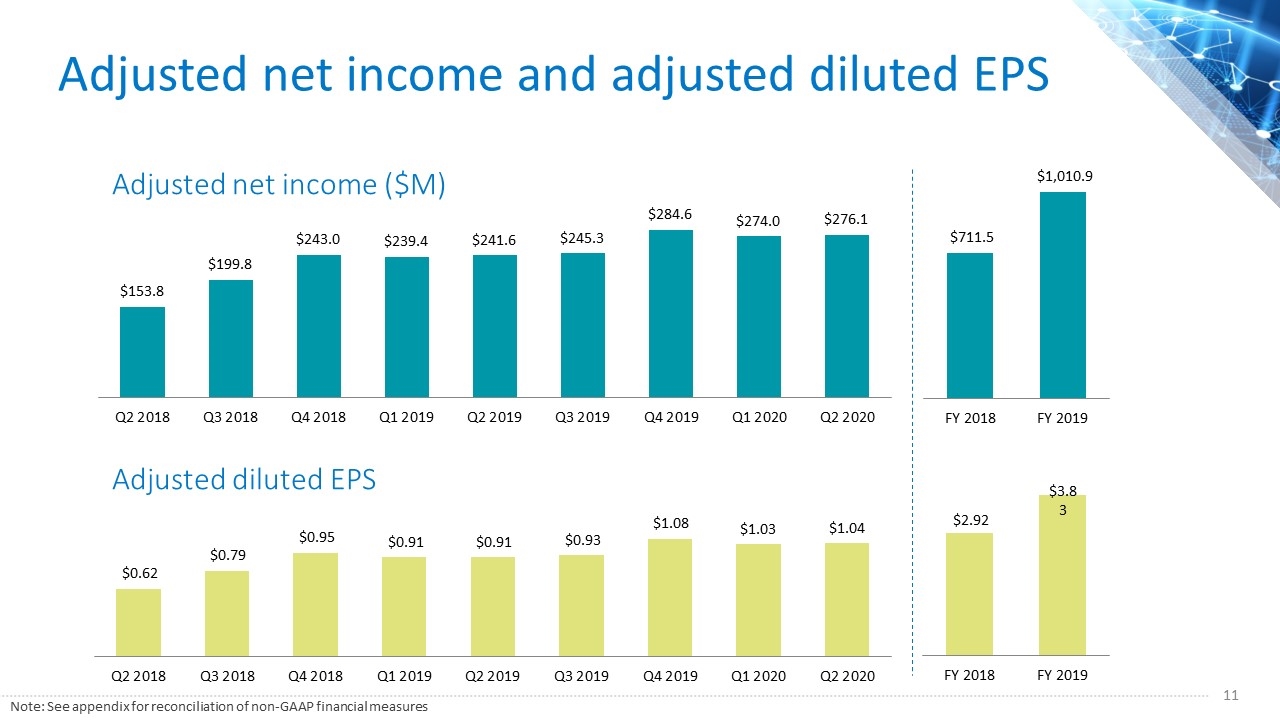

Adjusted net income and adjusted diluted EPS Adjusted net income ($M) Adjusted diluted EPS Note: See appendix for reconciliation of non-GAAP financial measures

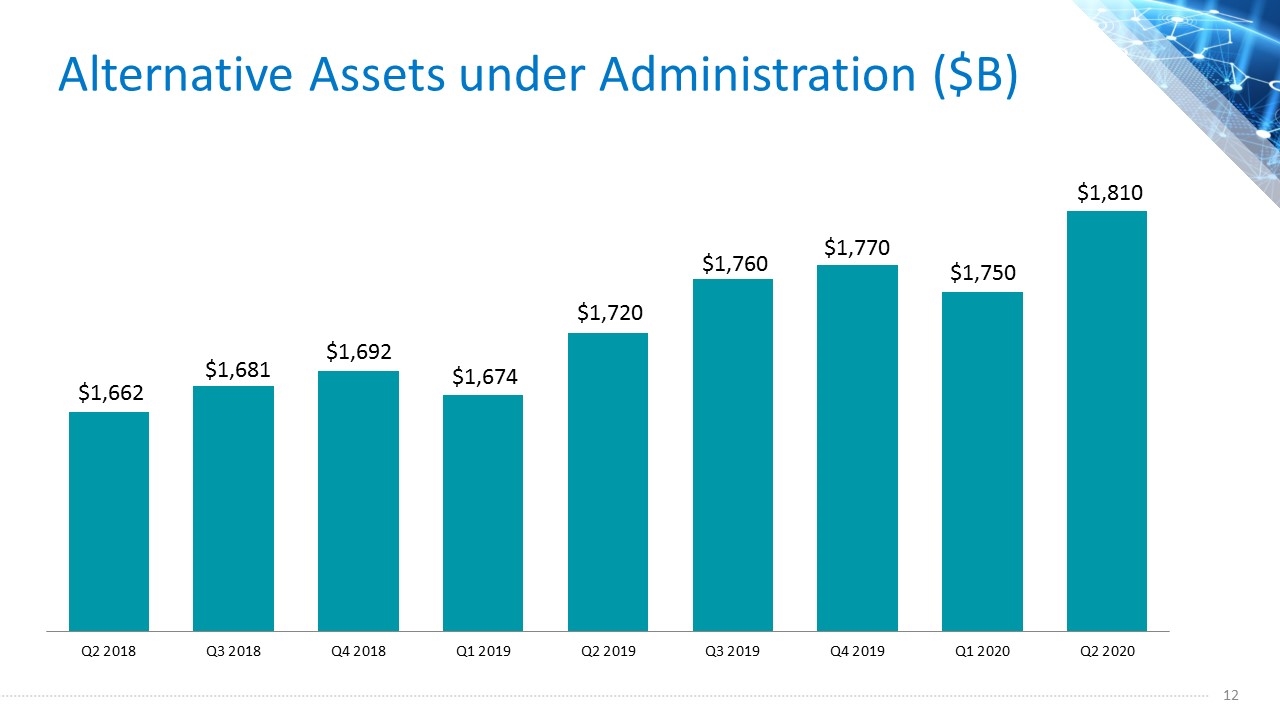

Alternative Assets under Administration ($B)

Appendix Disclosures relating to non-GAAP financial measures

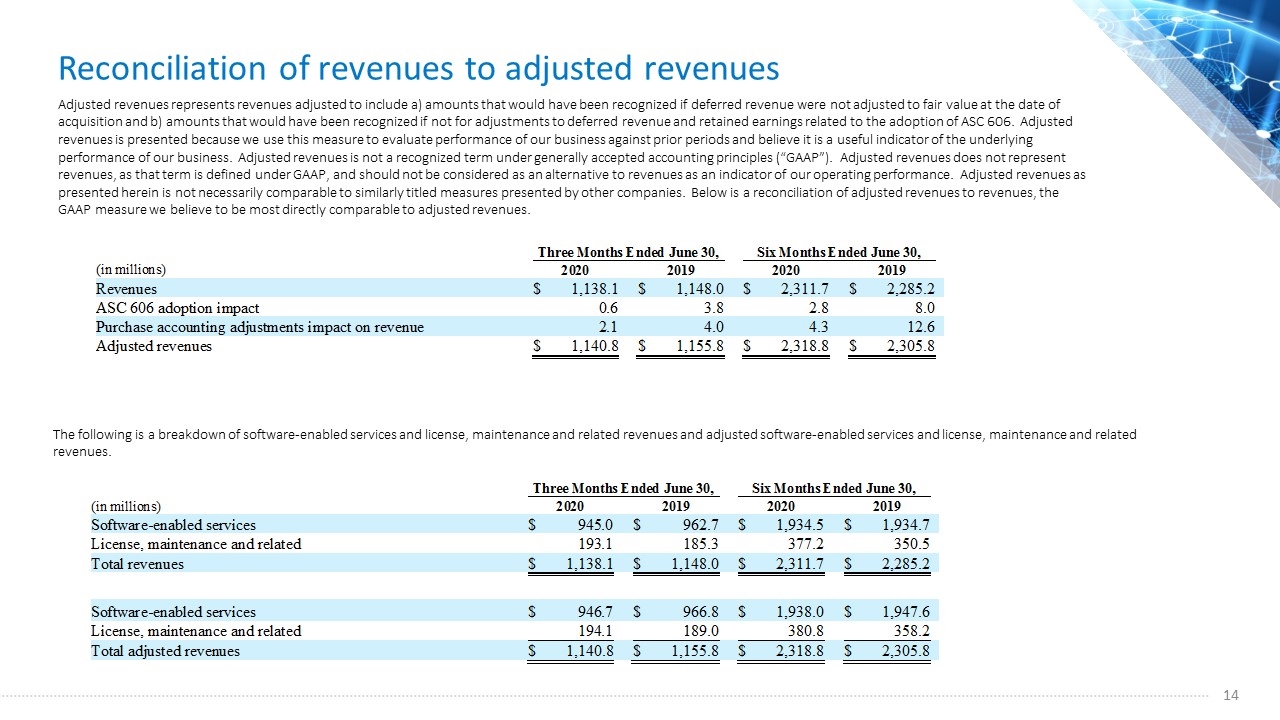

Reconciliation of revenues to adjusted revenues Adjusted revenues represents revenues adjusted to include a) amounts that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition and b) amounts that would have been recognized if not for adjustments to deferred revenue and retained earnings related to the adoption of ASC 606. Adjusted revenues is presented because we use this measure to evaluate performance of our business against prior periods and believe it is a useful indicator of the underlying performance of our business. Adjusted revenues is not a recognized term under generally accepted accounting principles (“GAAP”). Adjusted revenues does not represent revenues, as that term is defined under GAAP, and should not be considered as an alternative to revenues as an indicator of our operating performance. Adjusted revenues as presented herein is not necessarily comparable to similarly titled measures presented by other companies. Below is a reconciliation of adjusted revenues to revenues, the GAAP measure we believe to be most directly comparable to adjusted revenues. The following is a breakdown of software-enabled services and license, maintenance and related revenues and adjusted software-enabled services and license, maintenance and related revenues.

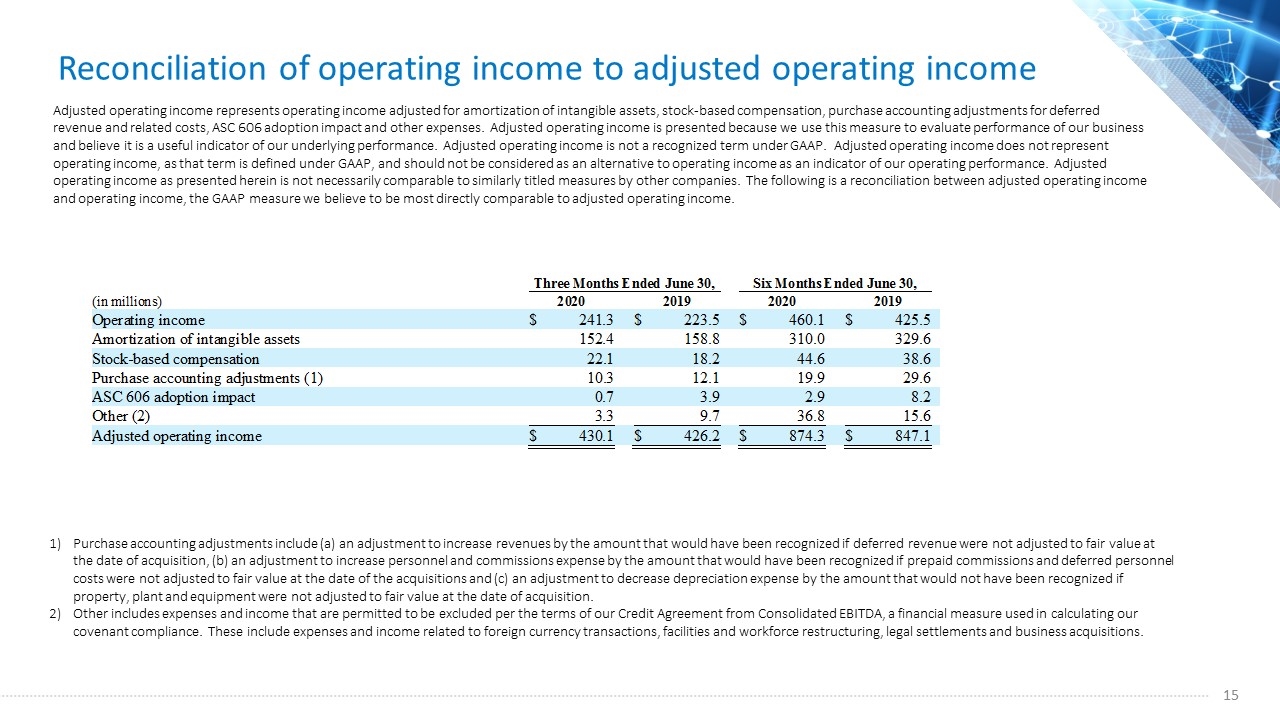

Reconciliation of operating income to adjusted operating income Adjusted operating income represents operating income adjusted for amortization of intangible assets, stock-based compensation, purchase accounting adjustments for deferred revenue and related costs, ASC 606 adoption impact and other expenses. Adjusted operating income is presented because we use this measure to evaluate performance of our business and believe it is a useful indicator of our underlying performance. Adjusted operating income is not a recognized term under GAAP. Adjusted operating income does not represent operating income, as that term is defined under GAAP, and should not be considered as an alternative to operating income as an indicator of our operating performance. Adjusted operating income as presented herein is not necessarily comparable to similarly titled measures by other companies. The following is a reconciliation between adjusted operating income and operating income, the GAAP measure we believe to be most directly comparable to adjusted operating income. Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition, (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to decrease depreciation expense by the amount that would not have been recognized if property, plant and equipment were not adjusted to fair value at the date of acquisition. Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These include expenses and income related to foreign currency transactions, facilities and workforce restructuring, legal settlements and business acquisitions.

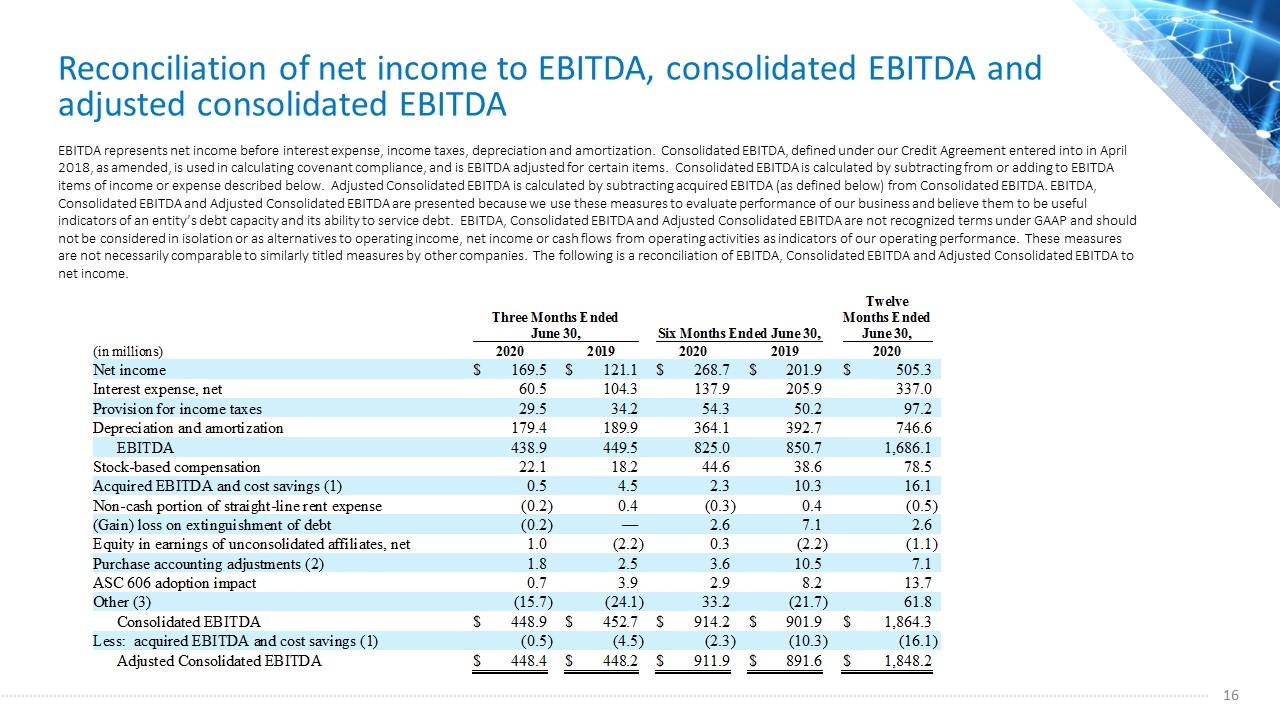

Reconciliation of net income to EBITDA, consolidated EBITDA and adjusted consolidated EBITDA EBITDA represents net income before interest expense, income taxes, depreciation and amortization. Consolidated EBITDA, defined under our Credit Agreement entered into in April 2018, as amended, is used in calculating covenant compliance, and is EBITDA adjusted for certain items. Consolidated EBITDA is calculated by subtracting from or adding to EBITDA items of income or expense described below. Adjusted Consolidated EBITDA is calculated by subtracting acquired EBITDA (as defined below) from Consolidated EBITDA. EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA are presented because we use these measures to evaluate performance of our business and believe them to be useful indicators of an entity’s debt capacity and its ability to service debt. EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA are not recognized terms under GAAP and should not be considered in isolation or as alternatives to operating income, net income or cash flows from operating activities as indicators of our operating performance. These measures are not necessarily comparable to similarly titled measures by other companies. The following is a reconciliation of EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA to net income.

Reconciliation of net income to EBITDA, consolidated EBITDA and adjusted consolidated EBITDA Acquired EBITDA reflects the EBITDA impact of significant businesses that were acquired during the period as if the acquisition occurred at the beginning of the period, as well as cost savings enacted in connection with acquisitions. Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition and (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions. Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These include expenses and income related to foreign currency transactions, investment gains and losses, facilities and workforce restructuring, legal settlements, business acquisitions and other items.

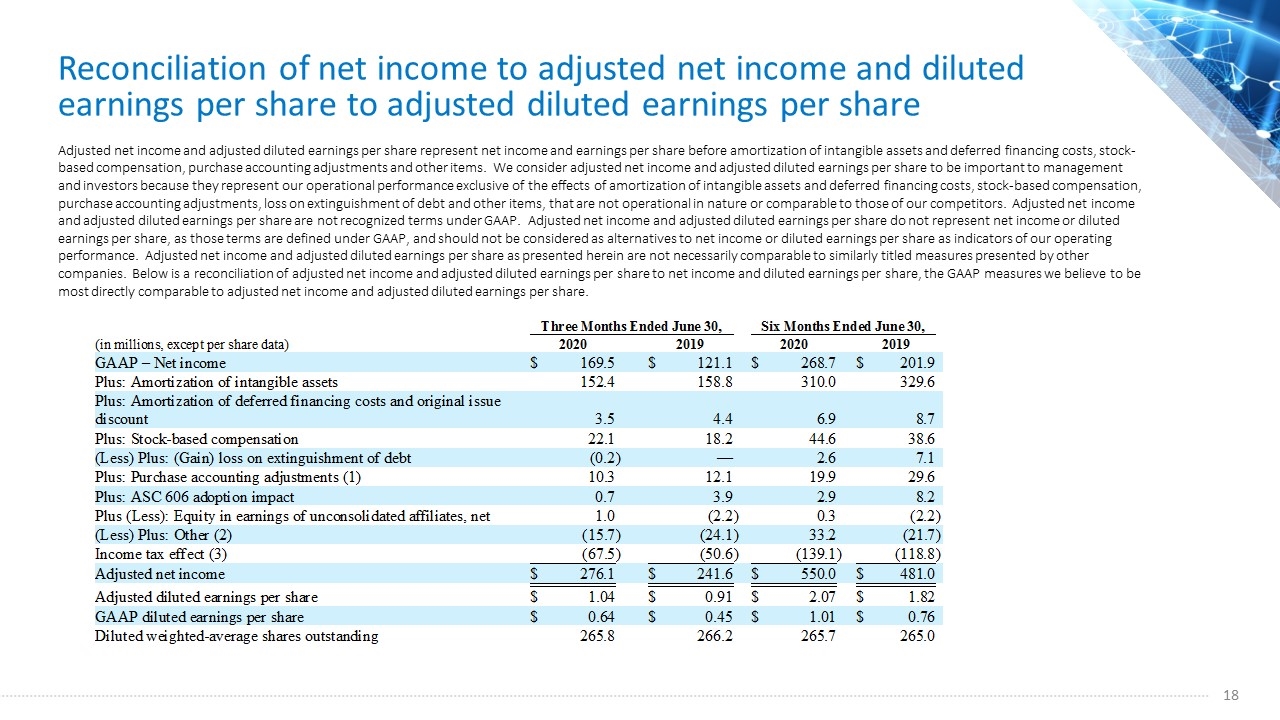

Reconciliation of net income to adjusted net income and diluted earnings per share to adjusted diluted earnings per share Adjusted net income and adjusted diluted earnings per share represent net income and earnings per share before amortization of intangible assets and deferred financing costs, stock-based compensation, purchase accounting adjustments and other items. We consider adjusted net income and adjusted diluted earnings per share to be important to management and investors because they represent our operational performance exclusive of the effects of amortization of intangible assets and deferred financing costs, stock-based compensation, purchase accounting adjustments, loss on extinguishment of debt and other items, that are not operational in nature or comparable to those of our competitors. Adjusted net income and adjusted diluted earnings per share are not recognized terms under GAAP. Adjusted net income and adjusted diluted earnings per share do not represent net income or diluted earnings per share, as those terms are defined under GAAP, and should not be considered as alternatives to net income or diluted earnings per share as indicators of our operating performance. Adjusted net income and adjusted diluted earnings per share as presented herein are not necessarily comparable to similarly titled measures presented by other companies. Below is a reconciliation of adjusted net income and adjusted diluted earnings per share to net income and diluted earnings per share, the GAAP measures we believe to be most directly comparable to adjusted net income and adjusted diluted earnings per share.

Reconciliation of net income to adjusted net income and diluted earnings per share to adjusted diluted earnings per share Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition, (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to decrease depreciation expense by the amount that would not have been recognized if property, plant and equipment were not adjusted to fair value at the date of acquisition. Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These include expenses and income related to foreign currency transactions, investment gains and losses, facilities and workforce restructuring, legal settlements, business acquisitions and other items. An estimated normalized effective tax rate of approximately 26% for the three and six months ended June 30, 2020 and 2019, respectively, has been used to adjust the provision for income taxes for the purpose of computing adjusted net income.