Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 EIX Q2 2020 CONFERENCE CALL PREPARED REMARKS DATED JULY 28, 2020 - EDISON INTERNATIONAL | eix-sceexhibit992q22020.htm |

| EX-99.1 - EXHIBIT 99.1 EDISON INTERNATIONAL PRESS RELEASE JULY 28, 2020 - EDISON INTERNATIONAL | eix-sceexhibit99x1q220.htm |

| 8-K - 8-K - EDISON INTERNATIONAL | eix-20200728.htm |

Exhibit 99.3 Second Quarter 2020 Financial Results July 28, 2020

Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs through regulated rates, including costs related to uninsured wildfire-related and mudslide-related liabilities, costs incurred to mitigate the risk of utility equipment causing future wildfires, costs incurred to implement SCE's new customer service system and costs incurred as a result of the COVID-19 pandemic; • ability of SCE to implement its Wildfire Mitigation Plan, including effectively implementing Public Safety Power Shut-Offs when appropriate; • ability to obtain sufficient insurance at a reasonable cost, including insurance relating to SCE's nuclear facilities and wildfire-related claims, and to recover the costs of such insurance or, in the event liabilities exceed insured amounts, the ability to recover uninsured losses from customers or other parties; • risks associated with California Assembly Bill 1054 (“AB 1054”) effectively mitigating the significant risk faced by California investor-owned utilities related to liability for damages arising from catastrophic wildfires where utility facilities are alleged to be a substantial cause, including SCE's ability to maintain a valid safety certification, SCE's ability to recover uninsured wildfire-related costs from the insurance fund established under AB 1054 (“Wildfire Insurance Fund”), the longevity of the Wildfire Insurance Fund, and the CPUC's interpretation of and actions under AB 1054, including their interpretation of the new prudency standard established under AB 1054; • decisions and other actions by the California Public Utilities Commission, the Federal Energy Regulatory Commission, the Nuclear Regulatory Commission and other governmental authorities, including decisions and actions related to nationwide or statewide crisis, determinations of authorized rates of return or return on equity, the recoverability of wildfire-related and mudslide-related costs, issuance of SCE's wildfire safety certification, wildfire mitigation efforts, and delays in executive, regulatory and legislative actions; • ability of Edison International or SCE to borrow funds and access bank and capital markets on reasonable terms; • risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel, delays, contractual disputes, and cost overruns; • pandemics, such as COVID-19, and other events that cause regional, statewide, national or global disruption,, which could impact, among other things, Edison International's and SCE's business, operations, cash flows, liquidity and/or financial results; • extreme weather-related incidents and other natural disasters (including earthquakes and events caused, or exacerbated, by climate change, such as wildfires), which could cause, among other things, public safety issues, property damage and operational issues; • physical security of Edison International's and SCE's critical assets and personnel and the cybersecurity of Edison International's and SCE's critical information technology systems for grid control, and business, employee and customer data; • risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure for other electricity providers such as Community Choice Aggregators (“CCA,” which are cities, counties, and certain other public agencies with the authority to generate and/or purchase electricity for their local residents and businesses) and Electric Service Providers (entities that offer electric power and ancillary services to retail customers, other than electrical corporations (like SCE) and CCAs); • risks inherent in SCE's transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), changes in the California Independent System Operator’s transmission plans, and governmental approvals; and • risks associated with the operation of transmission and distribution assets and power generating facilities, including public, contractor and employee safety issues, the risk of utility assets causing or contributing to wildfires, failure, availability, efficiency, and output of equipment and facilities, and availability and cost of spare parts. Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. July 28, 2020 1

Second Quarter Earnings Summary Q2 Q2 2020 2019 Variance SCE EPS Drivers2 Test Year 2018 GRC true-up in 20193 $ (0.20) Basic Earnings Per Share (EPS) Higher revenue 0.19 SCE $ 1.02 $ 1.28 $ (0.26) - CPUC revenue 0.14 - FERC revenue 0.05 EIX Parent & Other (0.17) (0.08) (0.09) Higher O&M (0.24) Basic EPS $ 0.85 $ 1.20 $ (0.35) Higher depreciation (0.13) Higher net financing costs (0.03) Less: Non-core Items Income taxes (0.01) Other 0.03 SCE1 $ (0.08) $ (0.38) $ 0.30 Results prior to impact from share dilution $ (0.39) EIX Parent & Other1 (0.07) — (0.07) Impact from share dilution (0.17) Total core drivers $ (0.56) Total Non-core $ (0.15) $ (0.38) $ 0.23 Non-core items1 0.30 Total $ (0.26) Core Earnings Per Share (EPS) Key EIX EPS Drivers2 SCE $ 1.10 $ 1.66 $ (0.56) EIX parent and other — Higher interest expense $ (0.04) Impact from share dilution 0.02 EIX Parent & Other (0.10) (0.08) (0.02) Total core drivers $ (0.02) 1 Core EPS $ 1.00 $ 1.58 $ (0.58) Non-core items (0.07) Total $ (0.09) 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. For comparability, 2020 core drivers are reported based on prior period weighted-average share count of 325.8 million (2020 weighted-average shares outstanding is 375.0 million) 3. Impacts of Test Year 2018 GRC true-up in 2019 aggregated separately; $(0.20) includes revenue of $0.34, O&M of $(0.06), depreciation of $(0.24), interest expense of $0.01, property and other taxes of $(0.01) and income taxes of $(0.24) Note: Diluted earnings were $0.85 and $1.20 per share for the three months ended June 30, 2020 and 2019, respectively July 28, 2020 2

SCE has strong rate base growth driven by significant electric infrastructure investment opportunities SCE forecasts deploying significant capital in …resulting in above industry average rate 2020–2023… base growth Capital Expenditures, $ in Billions Rate Base2,3, $ in Billions ~$21 billion 7.5% 2020–2023 CAGR 41.0 38.2 5.4 5.4 5.4 35.9 5.0 33.5 4.8 30.8 28.5 Wildfire1 Generation Transmission Distribution 2019 2020 2021 2022 2023 Range 2018 2019 2020 2021 2022 2023 CAGR Range Case4 (Actual) 4.8 4.9 4.9 4.8 Case4 28.5 30.8 33.3 35.1 37.0 39.2 6.6% 1. In accordance with Assembly Bill (AB) 1054, ~$1.6 billion of wildfire mitigation-related spend shall not earn an equity return 2. Morongo Transmission holds an option to invest up to $400 million in the West of Devers Transmission Project at the in-service date, estimated to be 2021. In the chart, rate base has been reduced to reflect this option. Capital forecast includes 100% of the project spend 3. Weighted-average year basis. Excludes rate base associated with ~$1.6 billion of capital referred to in footnote 1 and projects or programs not yet approved 4. For 2021–2023 capital, reflects a 10% reduction of the total capital forecast using management judgment based on experience of previously authorized amounts and potential for permitting delays and other operational considerations. For 2020 capital, reflects a 10% reduction applied only to FERC capital spending and non-GRC programs. For rate base, forecast range case reflects capital expenditure forecast range case July 28, 2020 3

GRC update: Intervenor proposals submitted; CPUC action affirms commitment to maintaining original schedule Primary intervenor reductions are focused on CalPA and TURN proposals would result in the following areas, which ignore key cost-of- rate base growth near range case forecast service principles Rate Base CAGR, 2018–2023 Wildfire mitigation: Generally support 7.5% activities, but propose lower covered conductor 6.1% 6.4% scope Wildfire insurance: Argue for partial SCE Rebuttal1 CalPA2 TURN 3 shareholder funding of premiums CalPA and TURN recommend 2021 revenue Depreciation rate: Propose lower depreciation requirement increases of 7.0% and 3.6% 2021 GRC Revenue Requirement, $ in Billions 7.5 Incentive compensation: Similar to prior GRCs, 2020 6.9 6.7 argue portion should not be recovered from Authorized ($6.4) customers SCE Rebuttal CalPA TURN 1. SCE Rebuttal rate base forecast includes CPUC GRC 2019-2020 authorized and 2021-2023 request, and latest Non-GRC and FERC estimates 2. CalPA rate base forecast assumes CPUC GRC rate base attrition year increases for 2022 and 2023 of 3.5%, consistent with CalPA’s attrition mechanism proposal 3. TURN rate base forecast assumes TURN’s CPUC GRC rate base attrition proposal of budget-based capital additions for wildfire and new service connections, 0% increase on all other capital additions July 28, 2020 4

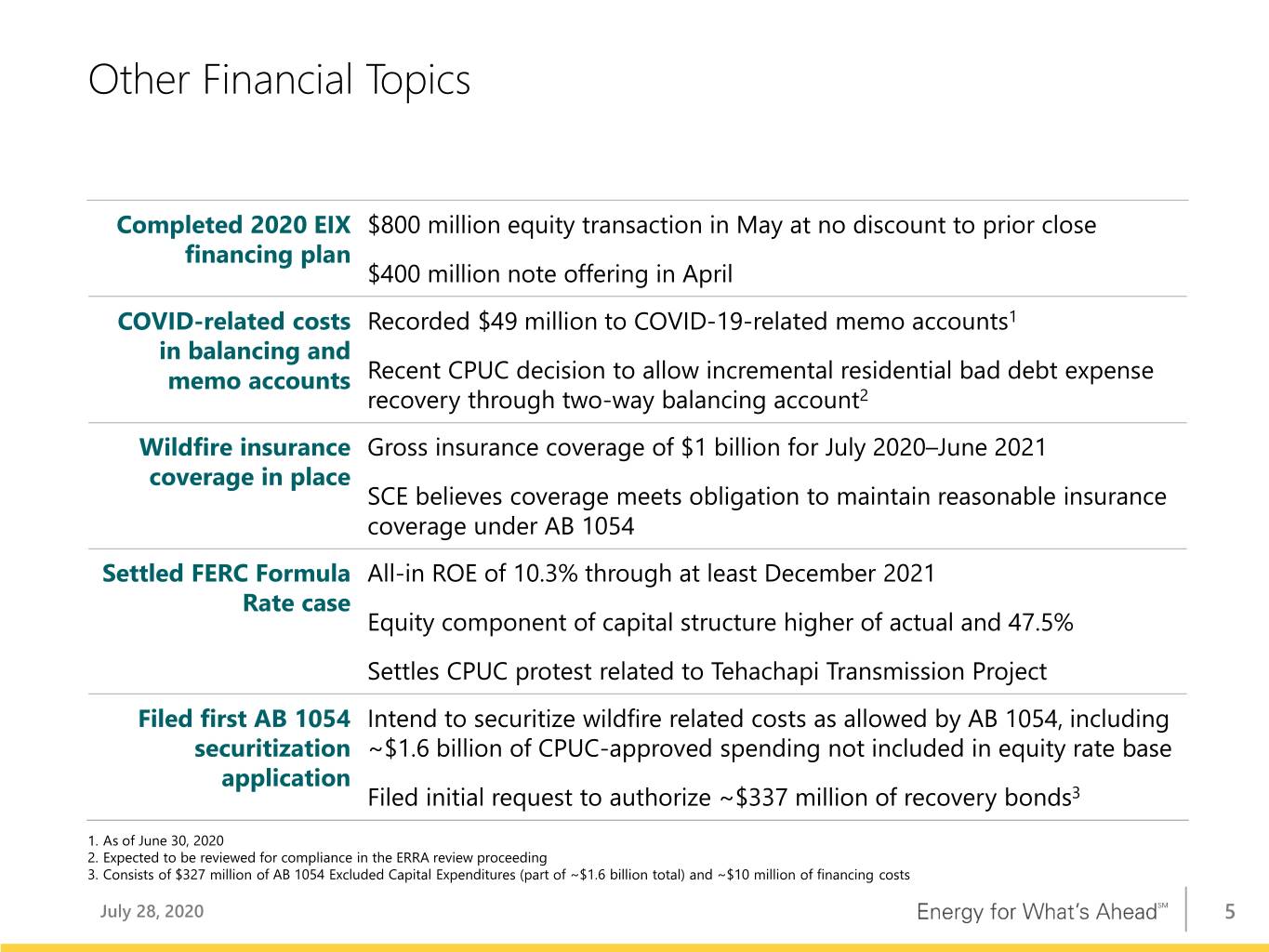

Other Financial Topics Completed 2020 EIX $800 million equity transaction in May at no discount to prior close financing plan $400 million note offering in April COVID-related costs Recorded $49 million to COVID-19-related memo accounts1 in balancing and memo accounts Recent CPUC decision to allow incremental residential bad debt expense recovery through two-way balancing account2 Wildfire insurance Gross insurance coverage of $1 billion for July 2020–June 2021 coverage in place SCE believes coverage meets obligation to maintain reasonable insurance coverage under AB 1054 Settled FERC Formula All-in ROE of 10.3% through at least December 2021 Rate case Equity component of capital structure higher of actual and 47.5% Settles CPUC protest related to Tehachapi Transmission Project Filed first AB 1054 Intend to securitize wildfire related costs as allowed by AB 1054, including securitization ~$1.6 billion of CPUC-approved spending not included in equity rate base application Filed initial request to authorize ~$337 million of recovery bonds3 1. As of June 30, 2020 2. Expected to be reviewed for compliance in the ERRA review proceeding 3. Consists of $327 million of AB 1054 Excluded Capital Expenditures (part of ~$1.6 billion total) and ~$10 million of financing costs July 28, 2020 5

EIX narrows 2020 core earnings guidance to $4.37–4.62 Midpoint of 2020 Core Earnings Per Share Guidance Range of $4.37–4.62 Building from SCE Rate Base on 2019 Weighted Average Shares $0.27 ($0.10) ($0.43) $5.20 Interest related to ($0.44) Financial, debt issued for $4.50 operating, and fund contribution: Operating other: ($0.09) expenses and $0.40 other: Previously issued Additional ($0.14) 2019 shares: Energy efficiency: disallowed ($0.31) $0.01 executive 2020 equity plan: compensation: Interest expense: Incremental ($0.13) ($0.01) ($0.29) wildfire mitigation costs not in regulatory assets: ($0.14) SCE 2020 EPS from SCE SB 901/AB 1054 EIX Parent Share Count Midpoint of EIX Rate Base Forecast Variances Impacts & Other Dilution EPS Guidance Range Note: See Earnings Per Share Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. All tax-effected information on this slide is based on our current combined statutory tax rate of approximately 28%. Totals may not foot due to rounding July 28, 2020 6

2020 EIX Core Earnings Guidance Assumptions 2020 Assumption Additional Notes CPUC Rate Base ($ in Billions) $26.9 Return on Equity (ROE) 10.30% 2020 Cost of Capital Final Decision Equity in Capital Structure 52% 2020 Cost of Capital Final Decision FERC Rate Base ($ in Billions) $6.6 ~20% of total 2020 rate base forecast ROE 10.30% 2019 Formula Rate Settlement filed with FERC1 Equity in Capital Structure 47.5% 2019 Formula Rate Settlement filed with FERC1,2 Other EIX Equity Issuances $0.9 ATM program issuances of $27 million in Q1, $800 Items ($ in Billions) million registered direct offering in May, and internal programs Weighted Average Share 2019: 339.7 Based on shares outstanding as of June 30, 2020 Count (Millions) 2020: 372.6 held constant for balance of year; subject to change for internal program issuances Wildfire Insurance Fund Excluded Amortization expense will be a non-core item Expense from core guidance 1. Settlement with intervening parties pending FERC approval 2. FERC capital structure includes charges such as the AB 1054 wildfire insurance fund contributions, wildfire-related claims associated with the 2017/2018 wildfire events, and the SONGS asset impairment July 28, 2020 7

Appendix

Ye a r -to-Date Earnings Summary YTD YTD 2020 2019 Variance SCE EPS Drivers2 Test Year 2018 GRC true-up in 20193 $ (0.20) Basic Earnings Per Share (EPS) Higher revenue 0.61 SCE $ 1.64 $ 2.18 $ (0.54) - CPUC revenue 0.51 - FERC revenue 0.10 EIX Parent & Other (0.27) (0.13) (0.14) Higher O&M (0.52) Basic EPS $ 1.37 $ 2.05 $ (0.68) Higher depreciation (0.15) Higher interest expense (0.05) Less: Non-core Items Income taxes 0.01 Other 0.03 SCE1 $ (0.20) $ (0.16) $ (0.04) Results prior to impact from share dilution $ (0.27) EIX Parent & Other1 (0.08) — (0.08) Impact from share dilution (0.23) Total core drivers $ (0.50) Total Non-core $ (0.28) $ (0.16) $ (0.12) Non-core items1 (0.04) Total $ (0.54) Core Earnings Per Share (EPS) Key EIX EPS Drivers2 EIX parent and other — Higher interest expense and SCE $ 1.84 $ 2.34 $ (0.50) corporate expenses $ (0.09) Impact from share dilution 0.03 EIX Parent & Other (0.19) (0.13) (0.06) Total core drivers $ (0.06) Core EPS $ 1.65 $ 2.21 $ (0.56) Non-core items1 (0.08) Total $ (0.14) 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. For comparability, 2020 core EPS drivers are reported based on prior period weighted-average share count of 325.8 million (2020 weighted-average shares outstanding is 366.8 million) 3. Impacts of Test Year 2018 GRC true-up in 2019 aggregated separately; $(0.20) includes revenue of $0.34, O&M of $(0.06), depreciation of $(0.24), interest expense of $0.01, property and other taxes of $(0.01) and income taxes of $(0.24) Note: Diluted earnings were $1.36 and $2.05 per share for the six months ended June 30, 2020 and 2019, respectively July 28, 2020 9

Earnings Per Share Non-GAAP Reconciliations Reconciliation of EIX Basic Earnings Per Share Guidance to EIX Core Earnings Per Share Guidance1 2020 EPS Attributable to Edison International Low High Basic EIX EPS $4.09 $4.34 Total Non-Core Items (0.28) (0.28) Core EIX EPS $4.37 $4.62 1. EPS is calculated on the assumed weighted-average share count for 2020 of 372.6 million July 28, 2020 10

Earnings Non-GAAP Reconciliations Reconciliation of EIX GAAP Earnings to EIX Core Earnings Earnings Attributable to Edison International, $ in Millions Q2 Q2 YTD YTD 2020 2019 2020 2019 SCE $381 $419 $600 $712 EIX Parent & Other (63) (27) (99) (42) Basic Earnings $318 $392 $501 $670 Non-Core Items SCE Wildfire Insurance Fund expense (60) — (120) — 2017/2018 Wildfire/Mudslide expenses (9) — (9) — Disallowed historical capital expenditures in SCE's 2018 GRC decision — (123) — (123) Sale of San Onofre nuclear fuel 37 — 37 3 Re-measurement of uncertain tax positions related to tax years 2010 – 2012 — — 18 — Re-measurement of deferred taxes — — — 69 EIX Parent & Other Goodwill impairment (25) — (25) — Re-measurement of uncertain tax positions related to tax years 2010 – 2012 — — (3) — Less: Total non-core items $(57) $(123) $(102) $(51) SCE 413 542 674 763 EIX Parent & Other (38) (27) (71) (42) Core Earnings $375 $515 $603 $721 July 28, 2020 11

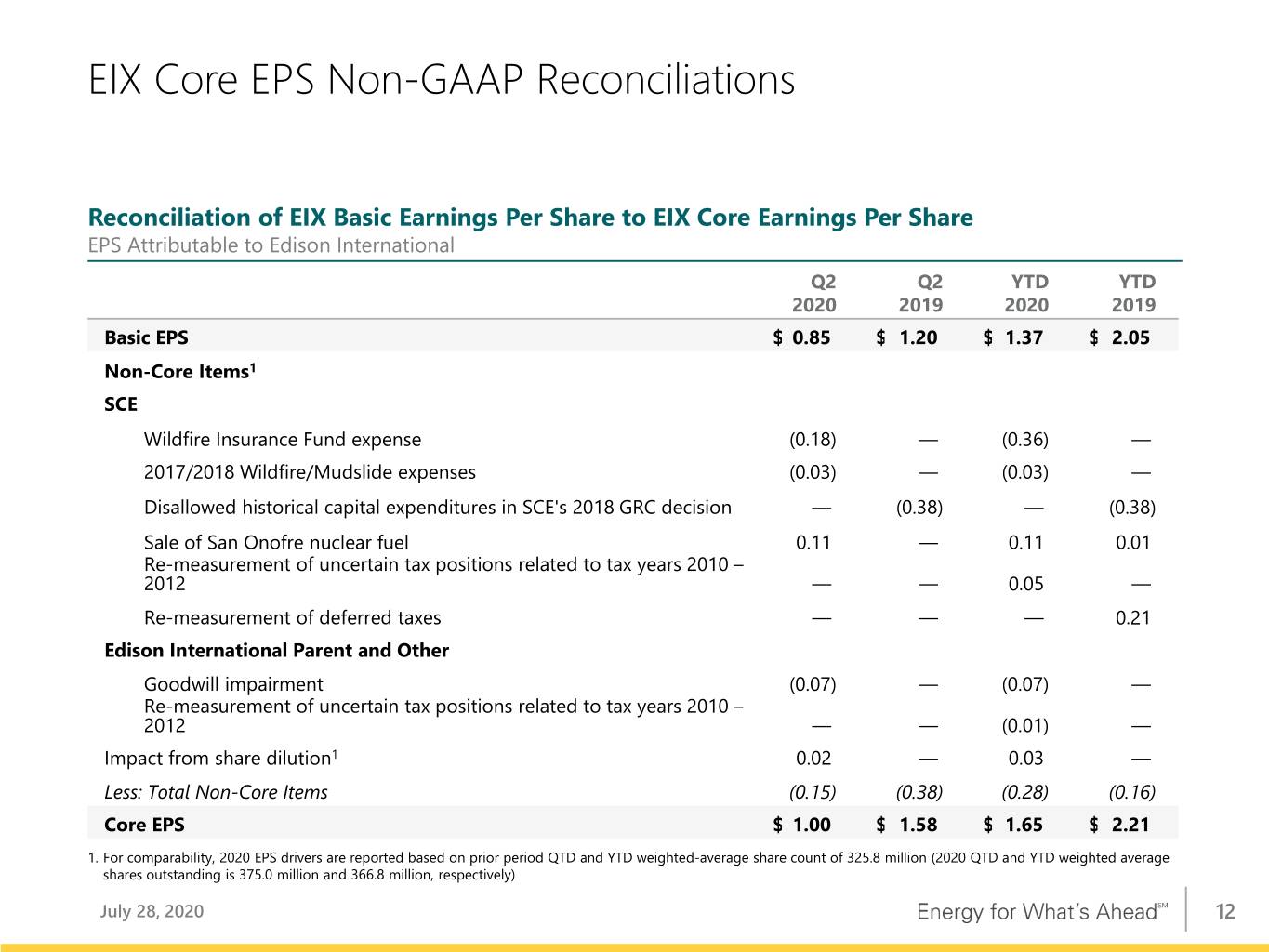

EIX Core EPS Non-GAAP Reconciliations Reconciliation of EIX Basic Earnings Per Share to EIX Core Earnings Per Share EPS Attributable to Edison International Q2 Q2 YTD YTD 2020 2019 2020 2019 Basic EPS $ 0.85 $ 1.20 $ 1.37 $ 2.05 Non-Core Items1 SCE Wildfire Insurance Fund expense (0.18) — (0.36) — 2017/2018 Wildfire/Mudslide expenses (0.03) — (0.03) — Disallowed historical capital expenditures in SCE's 2018 GRC decision — (0.38) — (0.38) Sale of San Onofre nuclear fuel 0.11 — 0.11 0.01 Re-measurement of uncertain tax positions related to tax years 2010 – 2012 — — 0.05 — Re-measurement of deferred taxes — — — 0.21 Edison International Parent and Other Goodwill impairment (0.07) — (0.07) — Re-measurement of uncertain tax positions related to tax years 2010 – 2012 — — (0.01) — Impact from share dilution1 0.02 — 0.03 — Less: Total Non-Core Items (0.15) (0.38) (0.28) (0.16) Core EPS $ 1.00 $ 1.58 $ 1.65 $ 2.21 1. For comparability, 2020 EPS drivers are reported based on prior period QTD and YTD weighted-average share count of 325.8 million (2020 QTD and YTD weighted average shares outstanding is 375.0 million and 366.8 million, respectively) July 28, 2020 12

Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings (losses) internally for financial planning and for analysis of performance. Core earnings (losses) are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the company's performance from period to period. Core earnings (losses) are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (losses) are defined as earnings attributable to Edison International shareholders less non-core items. Non-core items include income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as write downs, asset impairments and other income and expense related to changes in law, outcomes in tax, regulatory or legal proceedings, and exit activities, including sale of certain assets and other activities that are no longer continuing. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Sam Ramraj, Vice President (626) 302-2540 sam.ramraj@edisonintl.com July 28, 2020 13