Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - DTE ENERGY CO | exhibit991-06302020.htm |

| 8-K - 8-K - DTE ENERGY CO | dte-20200728.htm |

EXHIBIT 99.2 c DTE 2Q 2020 EARNINGS CONFERENCE CALL JULY 28, 2020 1

Safe harbor statement Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration,” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors impact forward-looking statements including, but not limited to, the following: the duration and impact of the COVID-19 pandemic on DTE Energy and customers, impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations and the volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power, or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in the Registrants' public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2019 Form 10-K and 2020 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

Participants Jerry Norcia – President and CEO Dave Ruud – Senior Vice President and CFO Barbara Tuckfield – Director Investor Relations 3

Focusing on our employees, customers and communities; positioned to deliver on our financial targets Employees Investors • Ensuring the health and safety of our • Reaffirming 2020 operating EPS1 guidance employees • Confirming 5% – 7% operating EPS growth Successfully implemented work from target through 2024 home for over half of our employees Engagement and safety performance • Ensuring strong balance sheet and liquidity is extraordinary position; delivering on cash and capital targets Customers • 7% dividend increase in 2020; targeting 7% • Delivering safe and reliable energy dividend increase in 20212 • Providing support to customers Significantly streamlined energy assistance payments Community • Addressing our communities’ most vital needs through philanthropy and volunteerism Providing resources to serve families’ basic needs, such as food, shelter and access to core medical services 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Subject to Board approval 4

On track to deliver in 2020 • Achieved strong 2Q results; solid year-to-date operating earnings1 across all business lines • Executing economic response plan Operational savings implemented and being realized • Reaffirming 2020 operating EPS guidance • Progressing on key deliverables in all business lines DTE Electric: received general rate case order and approval of innovative plan to keep electric rates unchanged until 2022 DTE Gas: filed settlement agreement and announced commitment to net zero greenhouse gas emissions GSP: flowing test gas on LEAP in July and full in- service August 1 P&I: finalized industrial energy services agreement Confirming 5% – 7% operating EPS target through 2024 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 5

Executing on our economic response plan; on track to achieve 2020 targets Economic impact update • Overall tracking below the $60 million impact detailed on the 1Q call Electric residential sales better than anticipated; commercial and industrial sales in-line with May start scenario COVID-19 costs tracking to plan Economic response update • On target with our economic response plan • Weather and residential sales favorability allows for potential cost pull-ahead from future years Positions us to minimize future rate impacts on customers • Non-utilities continue to track ahead of plan 6

DTE Electric: providing customers clean, reliable and affordable energy DTE Electric • Constructive regulatory approvals provide certainty to plan General rate case order issued in May supports investment plans Order issued in July delays rate case filing to 2021, maintains financial health and keeps electric base rates unchanged until 2022 Renewable energy plan order expands wind and solar power generation, improves energy efficiency and achieves carbon reduction goals • Commissioned largest wind park in Michigan, powering 64,000 homes and growing our renewable portfolio 7

DTE Gas: advancing toward net zero emissions through infrastructure investments and innovative planning DTE Gas • Announced first-of-its-kind plan to reduce greenhouse gas emissions to net zero by 2050 Partnering with suppliers and customers across the natural gas chain Reducing 6 million metric tons of greenhouse gases per year • Constructive rate case settlement filed in July supports investment plans removing regulatory uncertainty • Resumed main renewal work and on target to complete 200 miles in 2020 • Began construction of transmission system renewal project 8

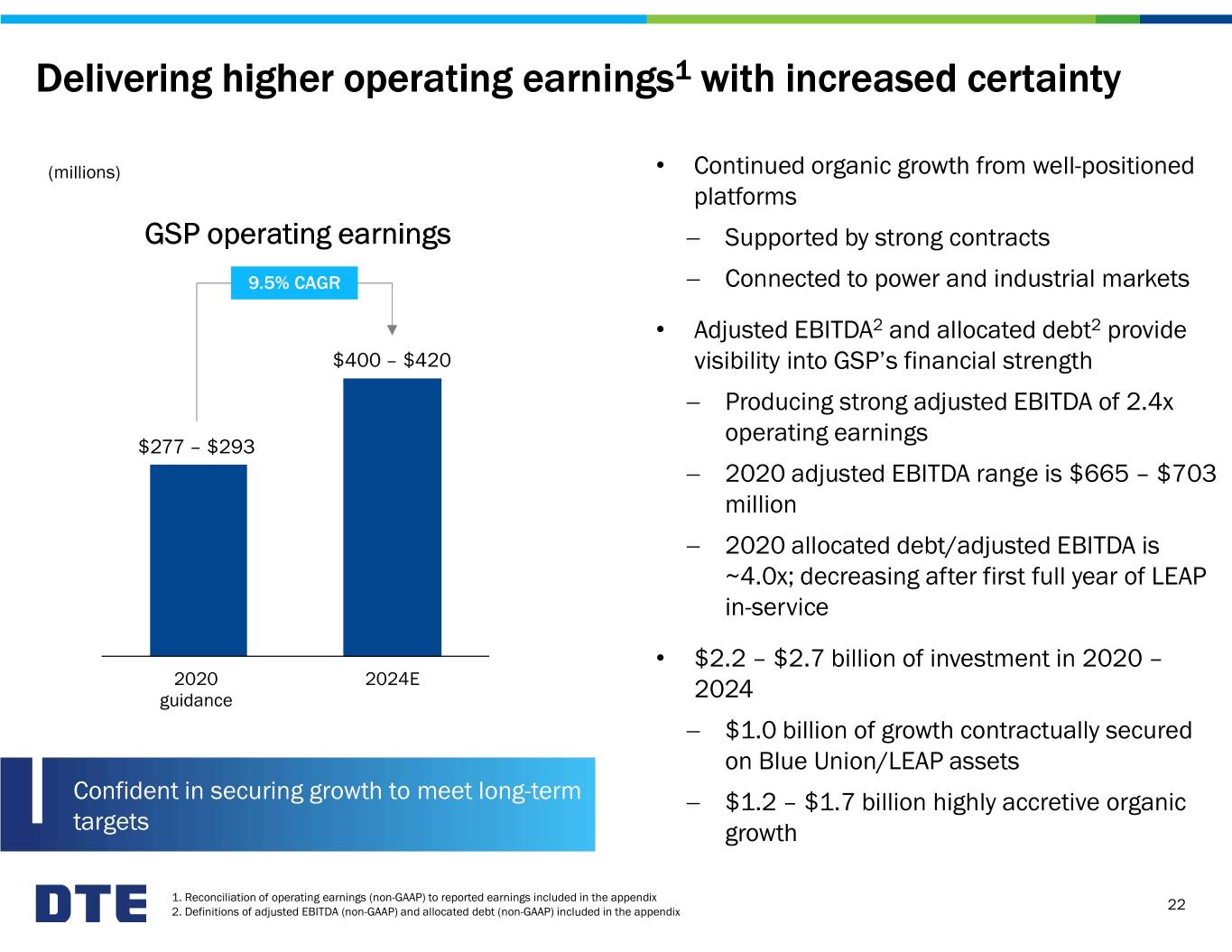

GSP: continuing to deliver successful results; well-positioned for future growth Gas Storage & Pipelines Percentage of revenue from demand-based contracts or MVCs/flowing gas • LEAP flowing test gas in July and full in- service August 1; on time and under budget • Assets are well-positioned for future 100% growth 92% 93% Located in premium natural gas basins • Adjusted EBITDA1 and allocated debt1 provide visibility into GSP’s financial Contract credit strength provisions Producing strong adjusted EBITDA of 2.4x operating earnings2 Average contract tenor (years) 10 9 10 2020 adjusted EBITDA range is $665 – $703 million Regulated Gathering Gathering 2020 allocated debt/adjusted EBITDA pipelines and pipelines storage is ~4.0x; decreasing after first full year of LEAP in-service 1. Definitions of adjusted EBITDA (non-GAAP) and allocated debt (non-GAAP) included in the appendix 2. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 9

P&I: underpinned by strong growth in RNG and industrial energy services Power & Industrial Projects • RNG and industrial energy services projects drive long-term growth Finalized cogeneration agreement in June Operationalized large Wisconsin RNG and Ford Motor projects this year • Developing high-potential investment opportunities with additional projects in late- stage development Strong project pipeline to continue executing growth strategy in RNG and industrial energy services businesses On track to originate $15 million of new operating earnings1 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 1010

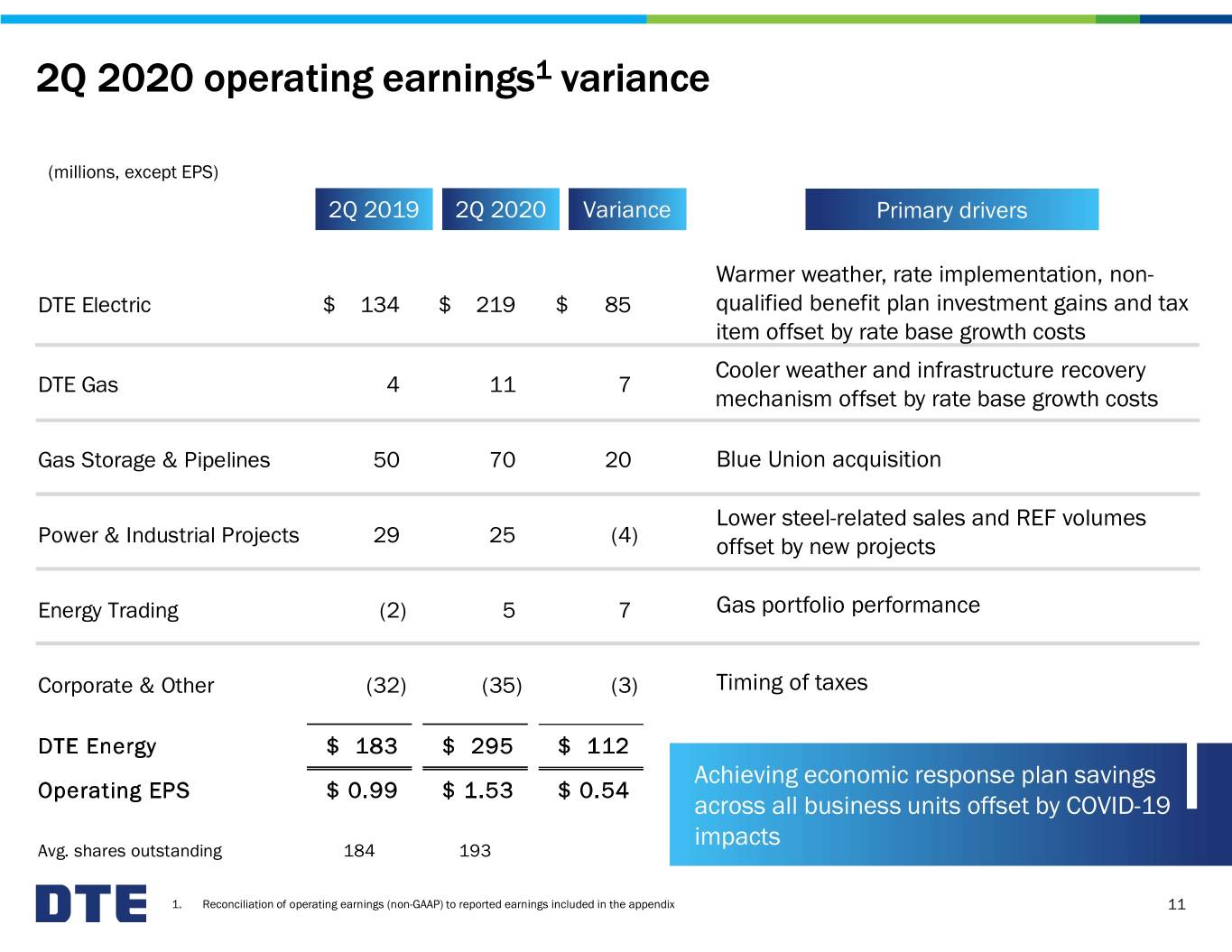

2Q 2020 operating earnings1 variance (millions, except EPS) 2Q 2019 2Q 2020 Variance Primary drivers Warmer weather, rate implementation, non- DTE Electric$ 134 $ 219 $ 85 qualified benefit plan investment gains and tax item offset by rate base growth costs Cooler weather and infrastructure recovery DTE Gas 4 11 7 mechanism offset by rate base growth costs Gas Storage & Pipelines 50 70 20 Blue Union acquisition Lower steel-related sales and REF volumes Power & Industrial Projects 29 25 (4) offset by new projects Energy Trading (2) 5 7 Gas portfolio performance Corporate & Other (32) (35) (3) Timing of taxes DTE Energy$ 183 $ 295 $ 112 Achieving economic response plan savings Operating EPS$ 0.99 $ 1.53 $ 0.54 across all business units offset by COVID-19 impacts Avg. shares outstanding 184 193 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 11

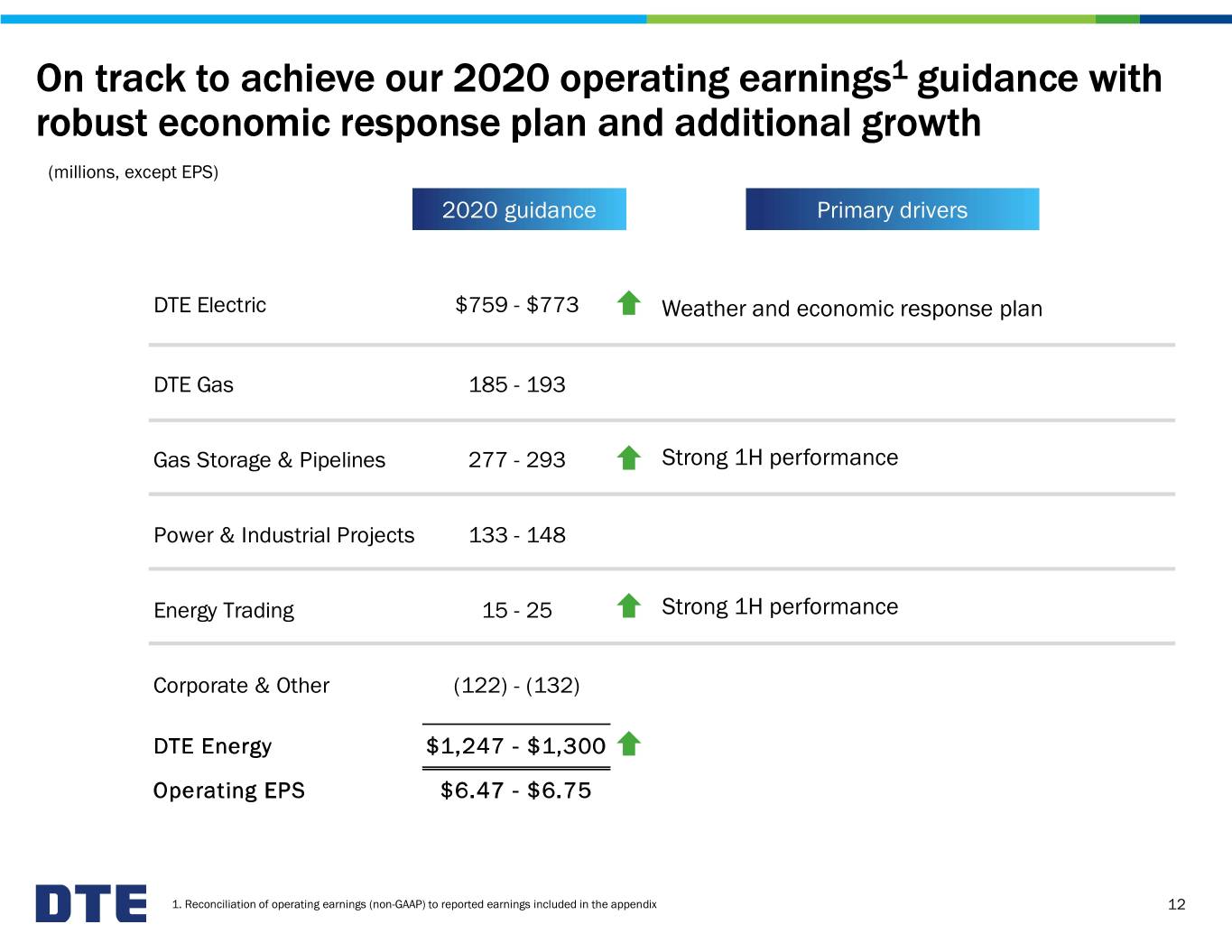

On track to achieve our 2020 operating earnings1 guidance with robust economic response plan and additional growth (millions, except EPS) 2020 guidance Primary drivers DTE Electric $759 - $773 Weather and economic response plan DTE Gas 185 - 193 Gas Storage & Pipelines 277 - 293 Strong 1H performance Power & Industrial Projects 133 - 148 Energy Trading 15 - 25 Strong 1H performance Corporate & Other (122) - (132) DTE Energy $1,247 - $1,300 Operating EPS $6.47 - $6.75 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 12

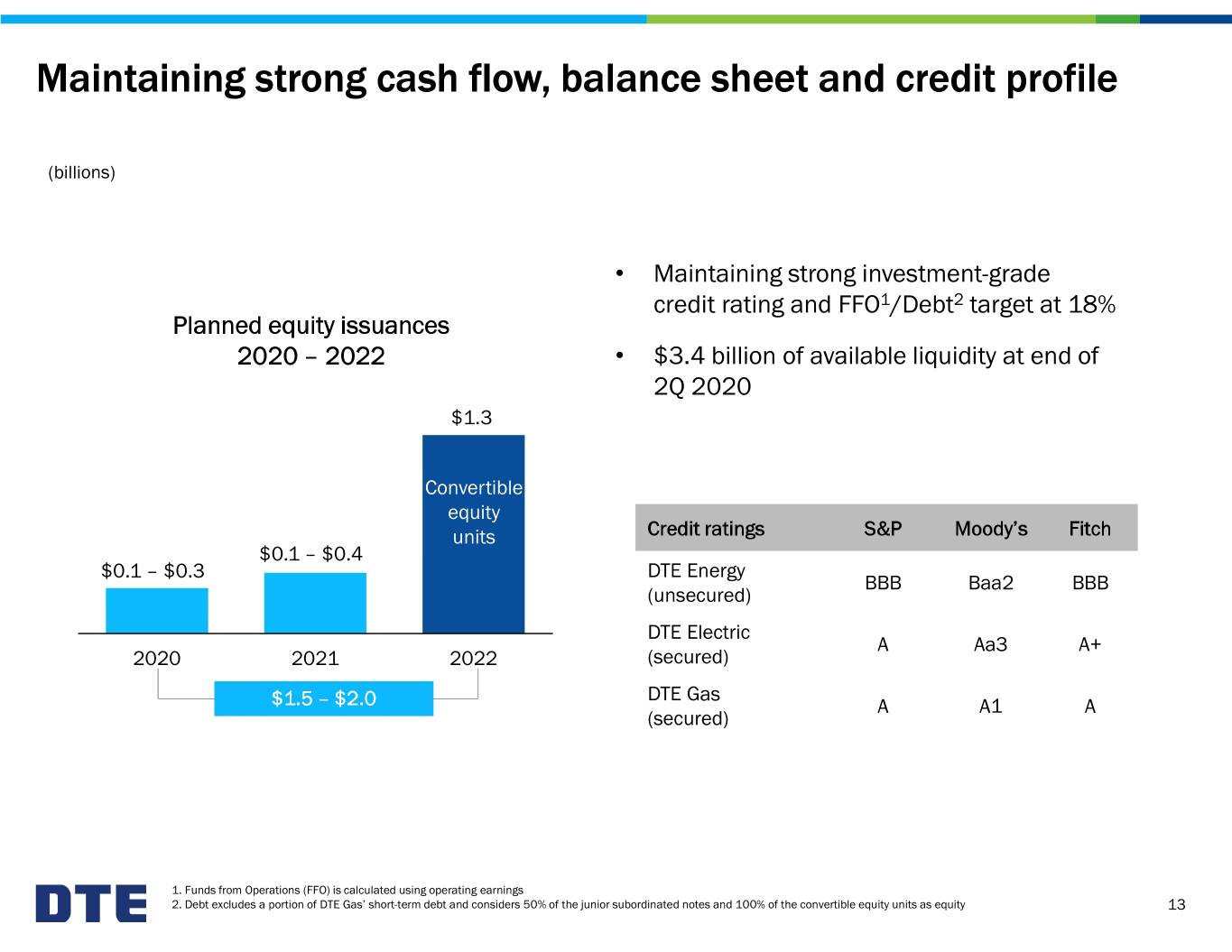

Maintaining strong cash flow, balance sheet and credit profile (billions) • Maintaining strong investment-grade credit rating and FFO1/Debt2 target at 18% Planned equity issuances 2020 – 2022 • $3.4 billion of available liquidity at end of 2Q 2020 $1.3 Convertible equity units Credit ratings S&P Moody’s Fitch $0.1 – $0.4 $0.1 – $0.3 DTE Energy BBB Baa2 BBB (unsecured) DTE Electric A Aa3 A+ 2020 2021 2022 (secured) DTE Gas $1.5 – $2.0 A A1 A (secured) 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 13

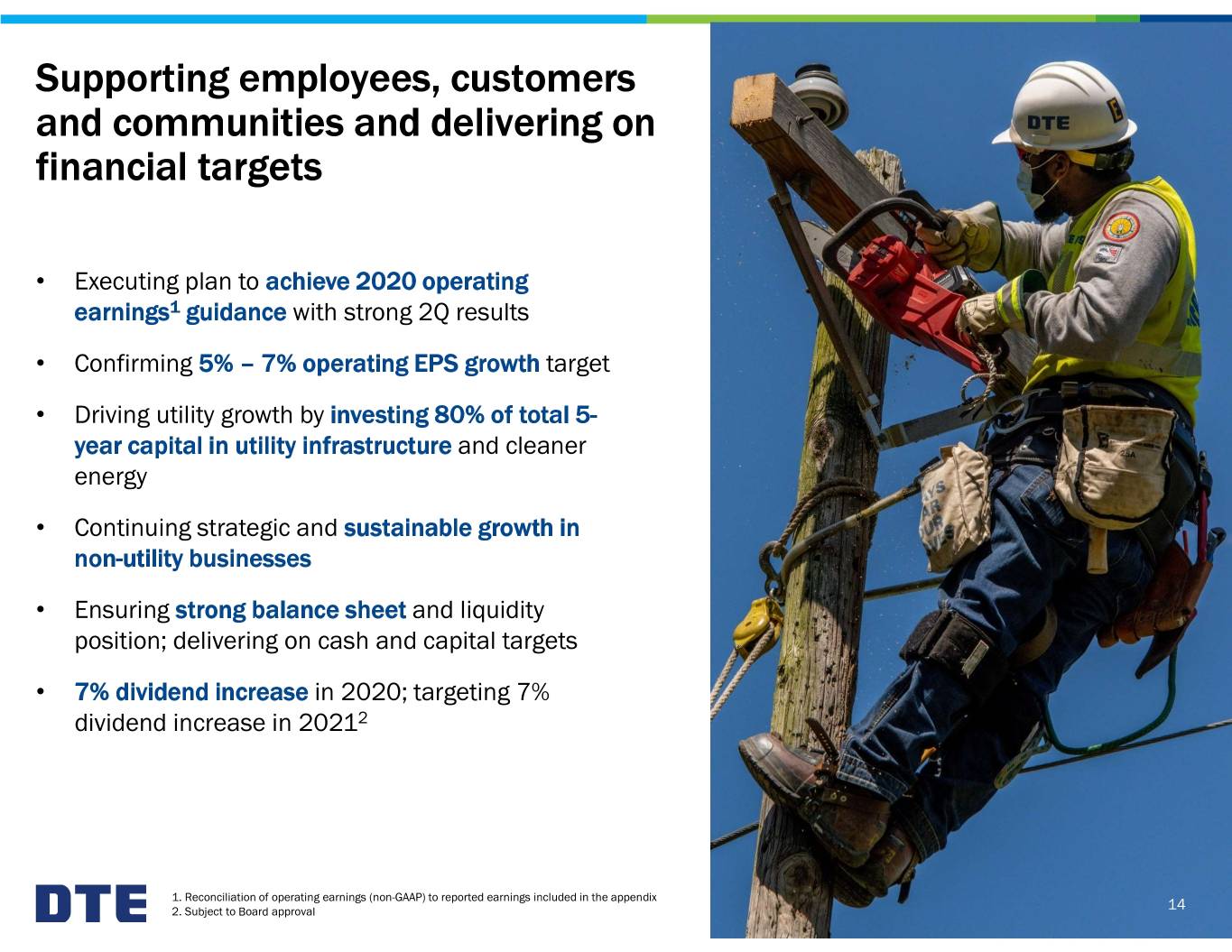

Supporting employees, customers and communities and delivering on financial targets • Executing plan to achieve 2020 operating earnings1 guidance with strong 2Q results • Confirming 5% – 7% operating EPS growth target • Driving utility growth by investing 80% of total 5- year capital in utility infrastructure and cleaner energy • Continuing strategic and sustainable growth in non-utility businesses • Ensuring strong balance sheet and liquidity position; delivering on cash and capital targets • 7% dividend increase in 2020; targeting 7% dividend increase in 20212 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Subject to Board approval 14

CONTACT US DTE Investor Relations www.dteenergy.com/investors 313.235.8030 15

Appendix 16

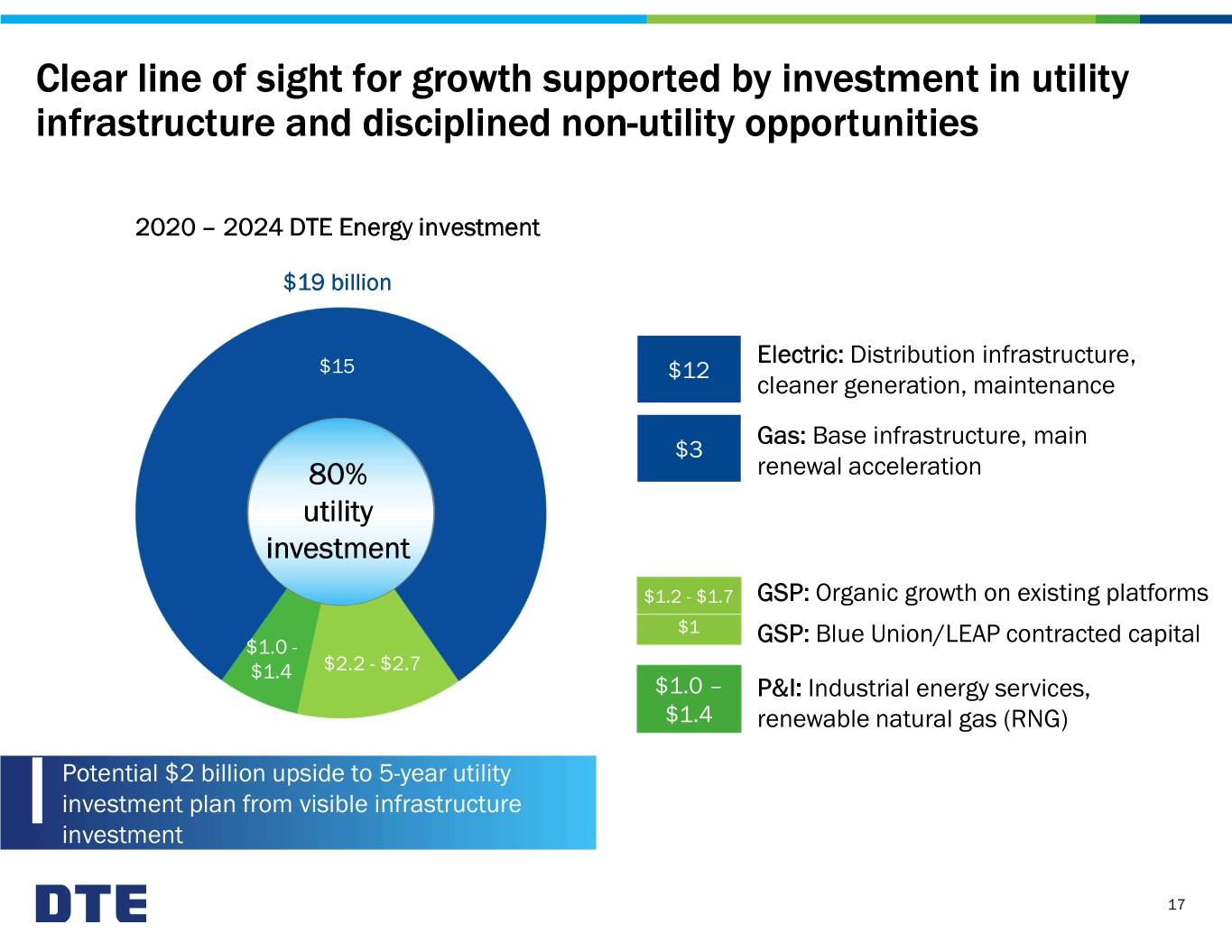

Clear line of sight for growth supported by investment in utility infrastructure and disciplined non-utility opportunities 2020 – 2024 DTE Energy investment $19 billion Electric: Distribution infrastructure, $15 $12 cleaner generation, maintenance Gas: Base infrastructure, main $3 80% renewal acceleration utility investment $1.2 - $1.7 GSP: Organic growth on existing platforms $1 GSP: Blue Union/LEAP contracted capital $1.0 - $1.4 $2.2 - $2.7 $1.0 – P&I: Industrial energy services, $1.4 renewable natural gas (RNG) Potential $2 billion upside to 5-year utility investment plan from visible infrastructure investment 17

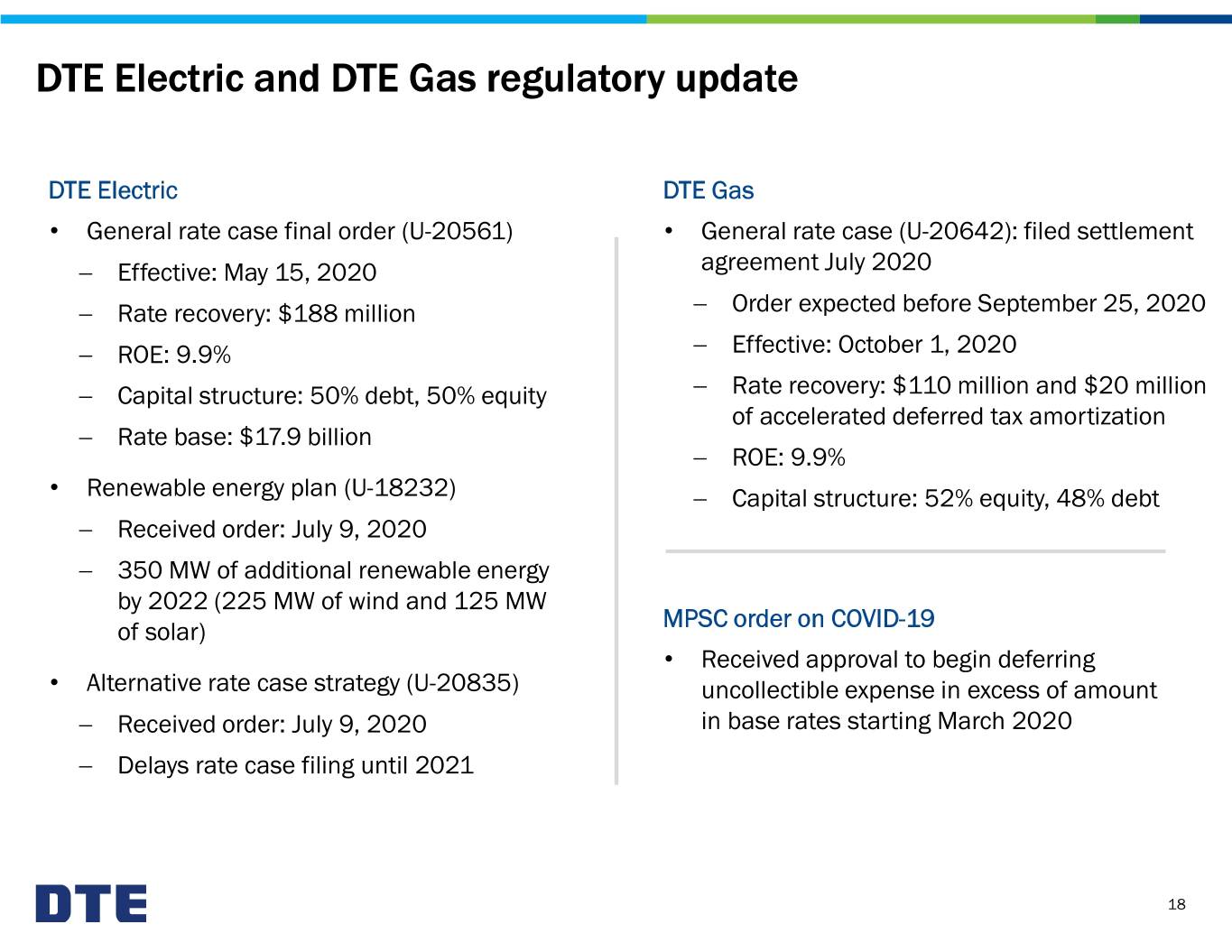

DTE Electric and DTE Gas regulatory update DTE Electric DTE Gas • General rate case final order (U-20561) • General rate case (U-20642): filed settlement Effective: May 15, 2020 agreement July 2020 Rate recovery: $188 million Order expected before September 25, 2020 ROE: 9.9% Effective: October 1, 2020 Capital structure: 50% debt, 50% equity Rate recovery: $110 million and $20 million of accelerated deferred tax amortization Rate base: $17.9 billion ROE: 9.9% • Renewable energy plan (U-18232) Capital structure: 52% equity, 48% debt Received order: July 9, 2020 350 MW of additional renewable energy by 2022 (225 MW of wind and 125 MW MPSC order on COVID-19 of solar) • Received approval to begin deferring • Alternative rate case strategy (U-20835) uncollectible expense in excess of amount Received order: July 9, 2020 in base rates starting March 2020 Delays rate case filing until 2021 18

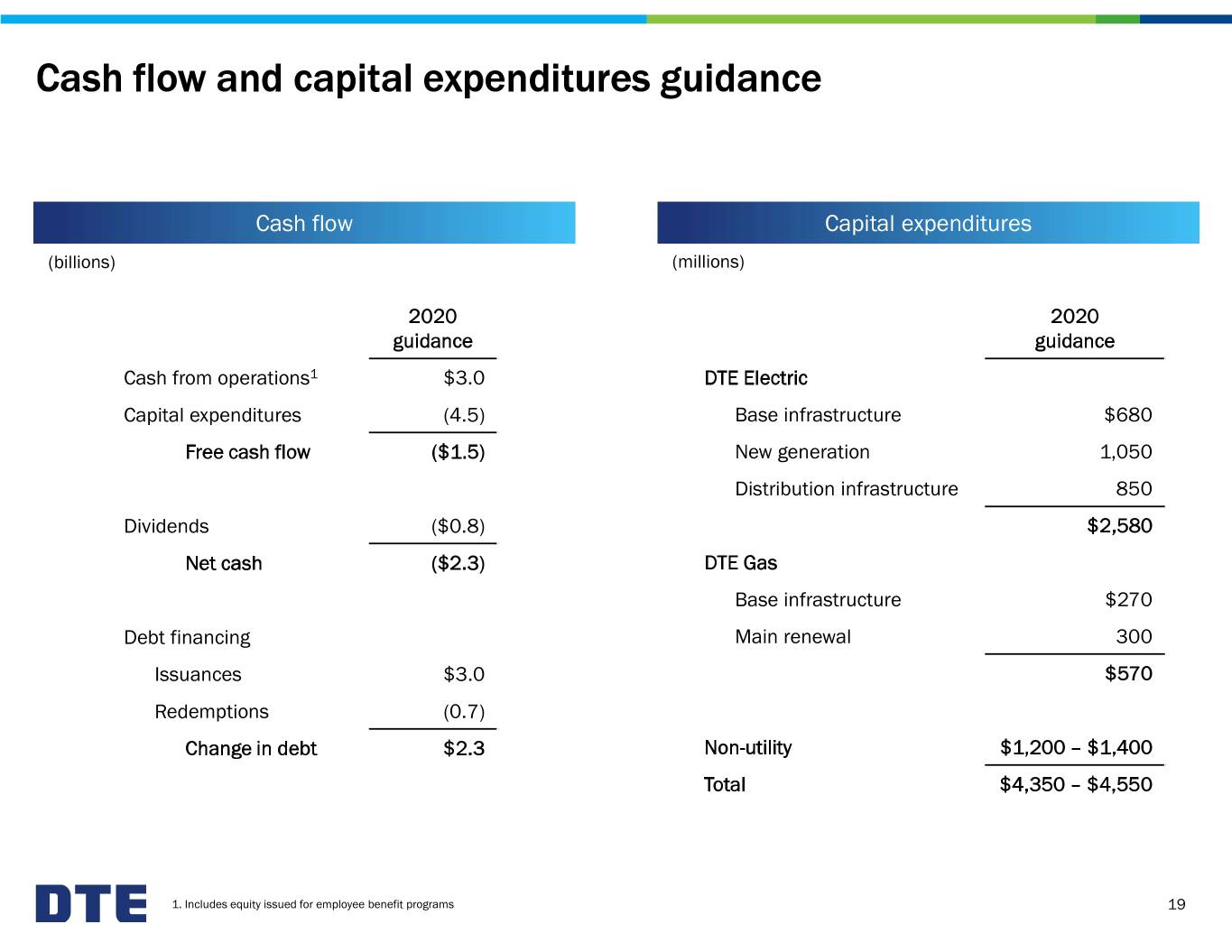

Cash flow and capital expenditures guidance Cash flow Capital expenditures (billions) (millions) 2020 2020 guidance guidance Cash from operations1 $3.0 DTE Electric Capital expenditures (4.5) Base infrastructure $680 Free cash flow ($1.5) New generation 1,050 Distribution infrastructure 850 Dividends ($0.8) $2,580 Net cash ($2.3) DTE Gas Base infrastructure $270 Debt financing Main renewal 300 Issuances $3.0 $570 Redemptions (0.7) Change in debt $2.3 Non-utility $1,200 – $1,400 Total $4,350 – $4,550 1. Includes equity issued for employee benefit programs 19

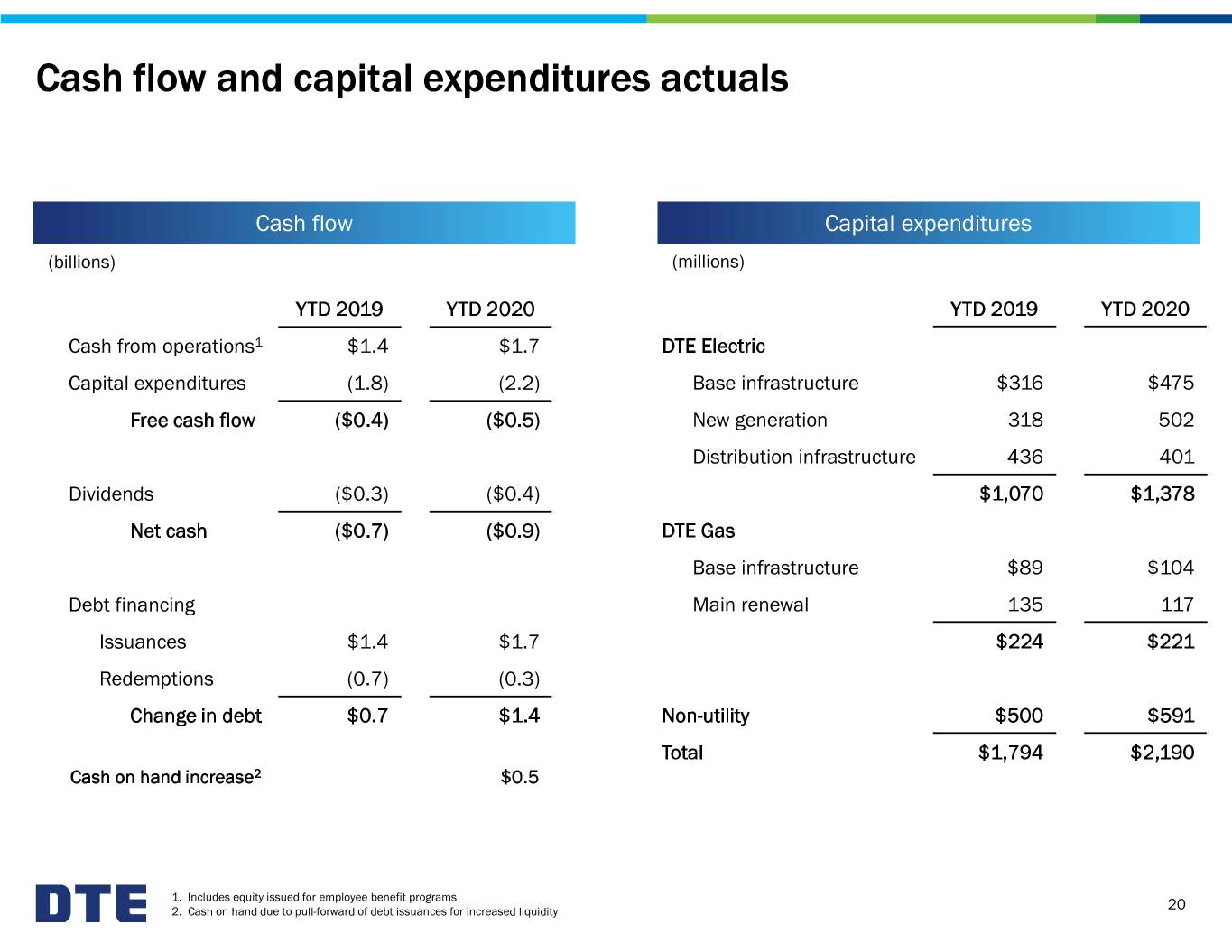

Cash flow and capital expenditures actuals Cash flow Capital expenditures (billions) (millions) YTD 2019 YTD 2020 YTD 2019 YTD 2020 Cash from operations1 $1.4 $1.7 DTE Electric Capital expenditures (1.8) (2.2) Base infrastructure $316 $475 Free cash flow ($0.4) ($0.5) New generation 318 502 Distribution infrastructure 436 401 Dividends ($0.3) ($0.4) $1,070 $1,378 Net cash ($0.7) ($0.9) DTE Gas Base infrastructure $89 $104 Debt financing Main renewal 135 117 Issuances $1.4 $1.7 $224 $221 Redemptions (0.7) (0.3) Change in debt $0.7 $1.4 Non-utility $500 $591 Total $1,794 $2,190 Cash on hand increase2 $0.5 1. Includes equity issued for employee benefit programs 2. Cash on hand due to pull-forward of debt issuances for increased liquidity 20

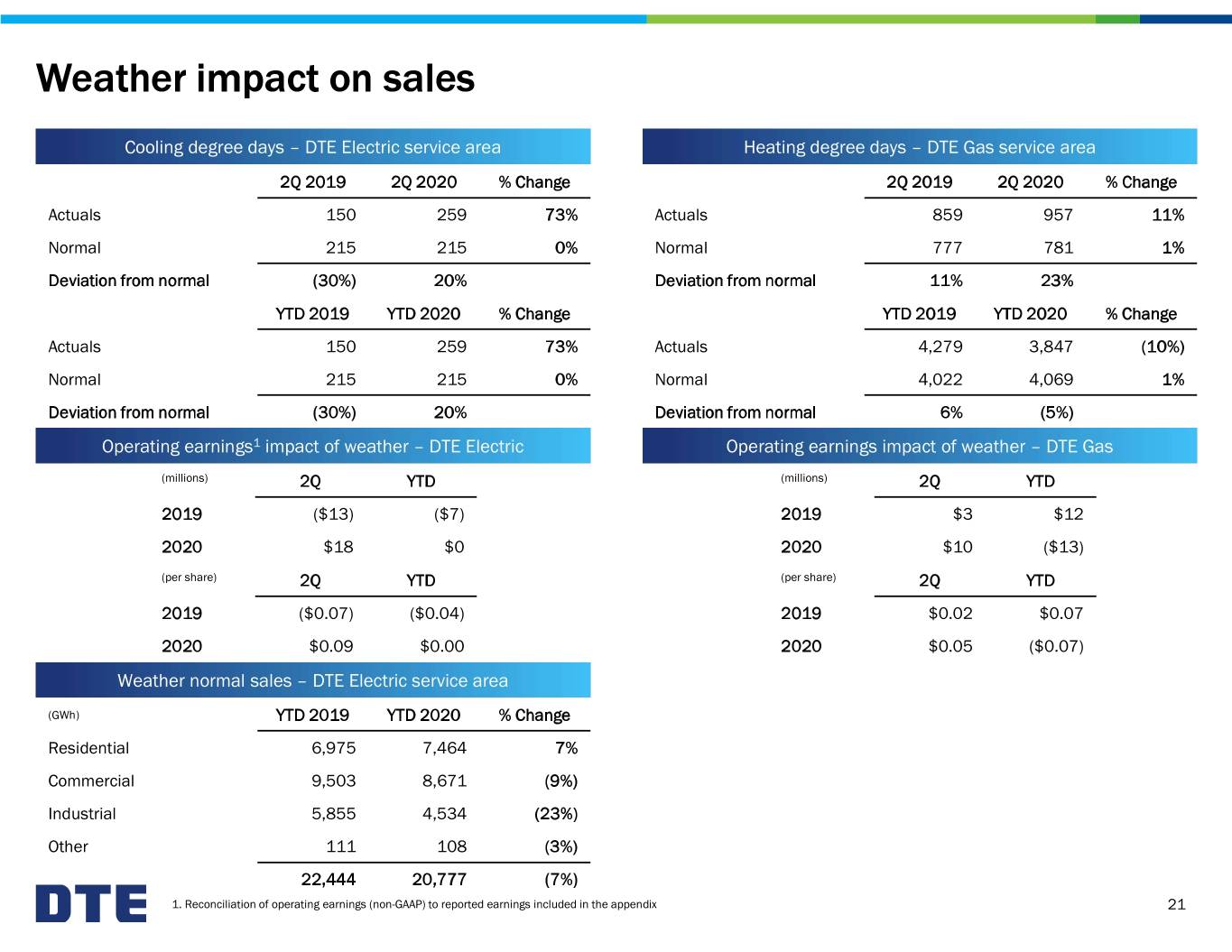

Weather impact on sales Cooling degree days – DTE Electric service area Heating degree days – DTE Gas service area 2Q 2019 2Q 2020 % Change 2Q 2019 2Q 2020 % Change Actuals 150 259 73% Actuals 859 957 11% Normal 215 215 0% Normal 777 781 1% Deviation from normal (30%) 20% Deviation from normal 11% 23% YTD 2019 YTD 2020 % Change YTD 2019 YTD 2020 % Change Actuals 150 259 73% Actuals 4,279 3,847 (10%) Normal 215 215 0% Normal 4,022 4,069 1% Deviation from normal (30%) 20% Deviation from normal 6% (5%) Operating earnings1 impact of weather – DTE Electric Operating earnings impact of weather – DTE Gas (millions) 2Q YTD (millions) 2Q YTD 2019 ($13) ($7) 2019 $3 $12 2020 $18 $0 2020 $10 ($13) (per share) 2Q YTD (per share) 2Q YTD 2019 ($0.07) ($0.04) 2019 $0.02 $0.07 2020 $0.09 $0.00 2020 $0.05 ($0.07) Weather normal sales – DTE Electric service area (GWh) YTD 2019 YTD 2020 % Change Residential 6,975 7,464 7% Commercial 9,503 8,671 (9%) Industrial 5,855 4,534 (23%) Other 111 108 (3%) 22,444 20,777 (7%) 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 21

Delivering higher operating earnings1 with increased certainty (millions) • Continued organic growth from well-positioned platforms GSP operating earnings Supported by strong contracts 9.5% CAGR Connected to power and industrial markets • Adjusted EBITDA2 and allocated debt2 provide $400 – $420 visibility into GSP’s financial strength Producing strong adjusted EBITDA of 2.4x operating earnings $277 – $293 2020 adjusted EBITDA range is $665 – $703 million 2020 allocated debt/adjusted EBITDA is ~4.0x; decreasing after first full year of LEAP in-service • $2.2 – $2.7 billion of investment in 2020 – 2020 2024E guidance 2024 $1.0 billion of growth contractually secured on Blue Union/LEAP assets Confident in securing growth to meet long-term $1.2 – $1.7 billion highly accretive organic targets growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Definitions of adjusted EBITDA (non-GAAP) and allocated debt (non-GAAP) included in the appendix 22

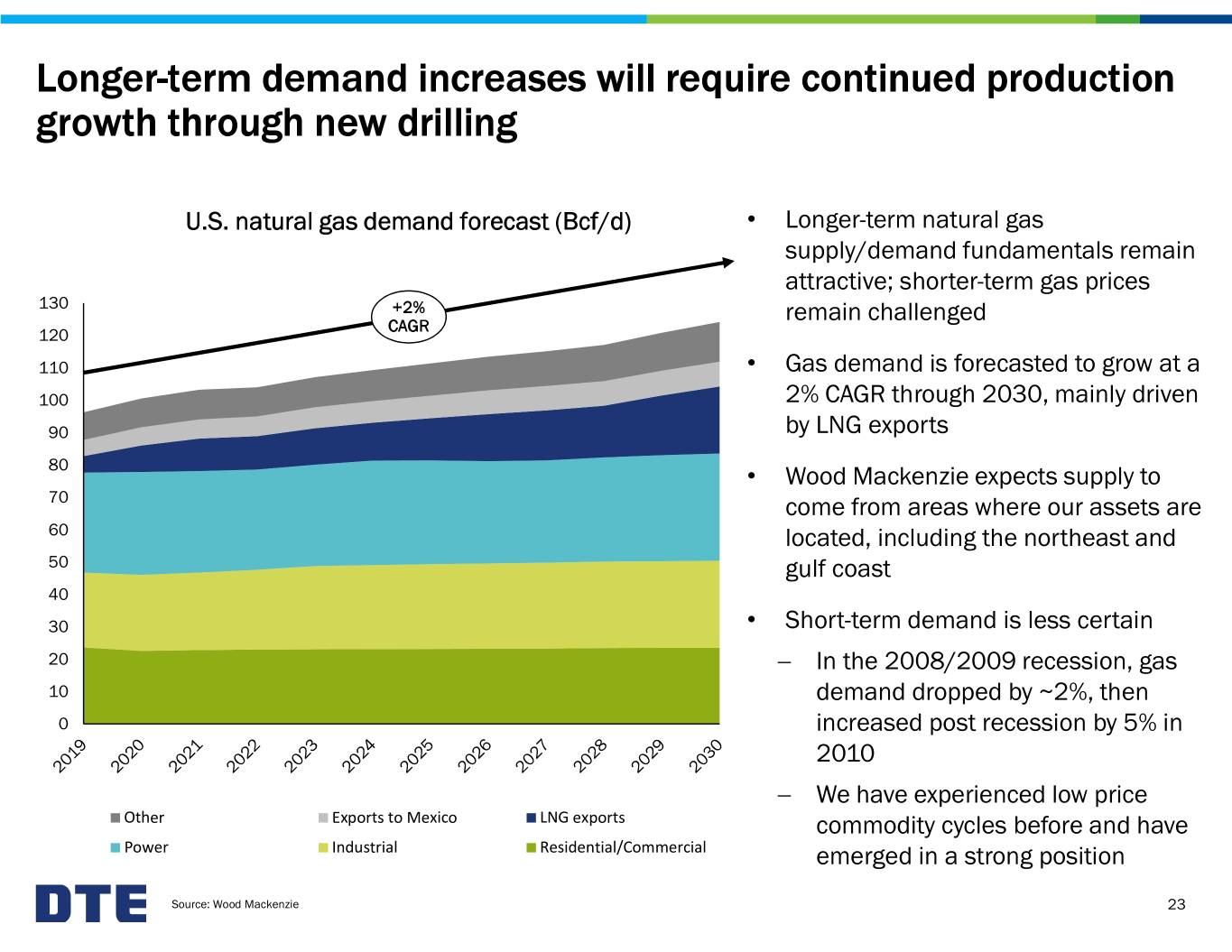

Longer-term demand increases will require continued production growth through new drilling U.S. natural gas demand forecast (Bcf/d) • Longer-term natural gas supply/demand fundamentals remain attractive; shorter-term gas prices 130 +2% remain challenged CAGR 120 110 • Gas demand is forecasted to grow at a 100 2% CAGR through 2030, mainly driven 90 by LNG exports 80 • Wood Mackenzie expects supply to 70 come from areas where our assets are 60 located, including the northeast and 50 gulf coast 40 30 • Short-term demand is less certain 20 In the 2008/2009 recession, gas 10 demand dropped by ~2%, then 0 increased post recession by 5% in 2010 We have experienced low price Other Exports to Mexico LNG exports commodity cycles before and have Power Industrial Residential/Commercial emerged in a strong position Source: Wood Mackenzie 23

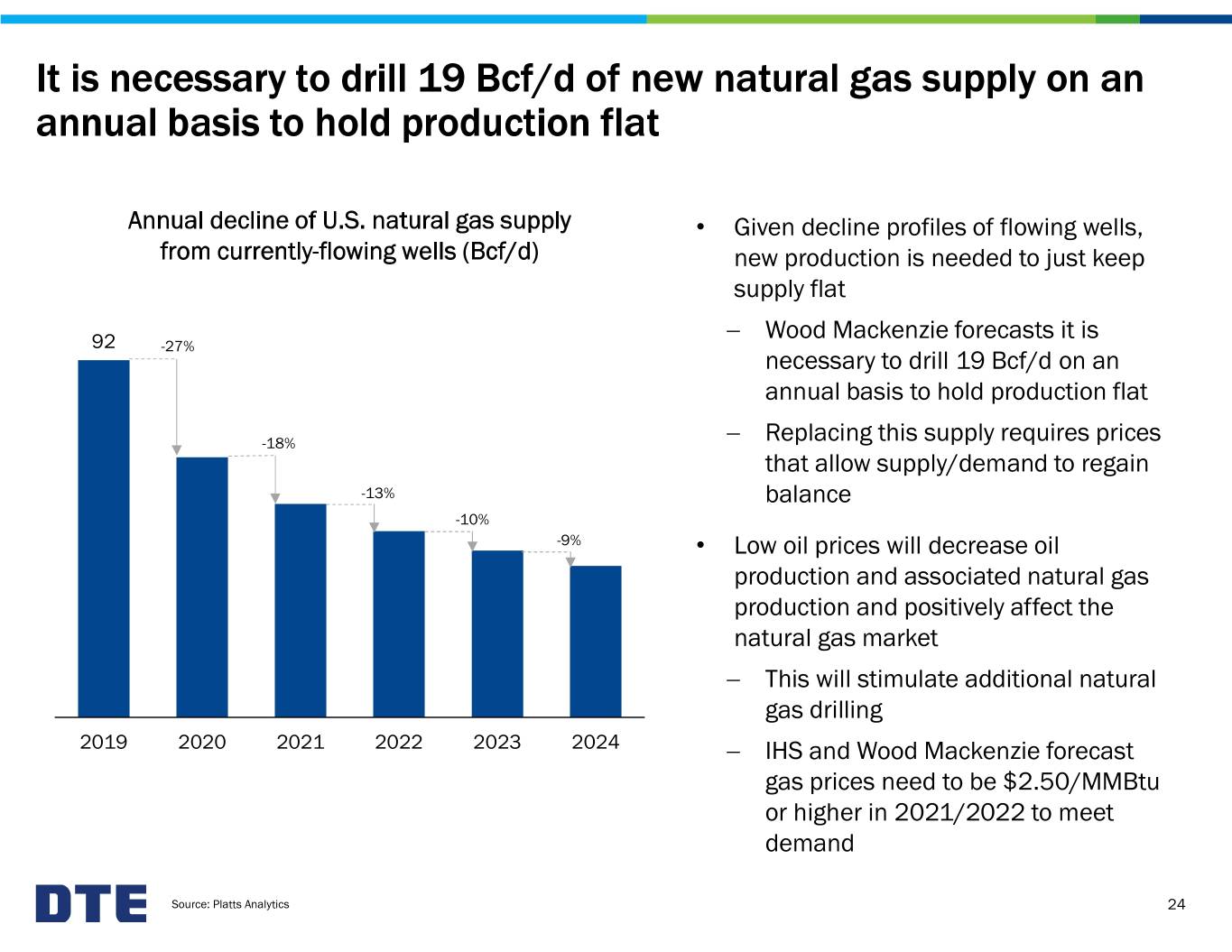

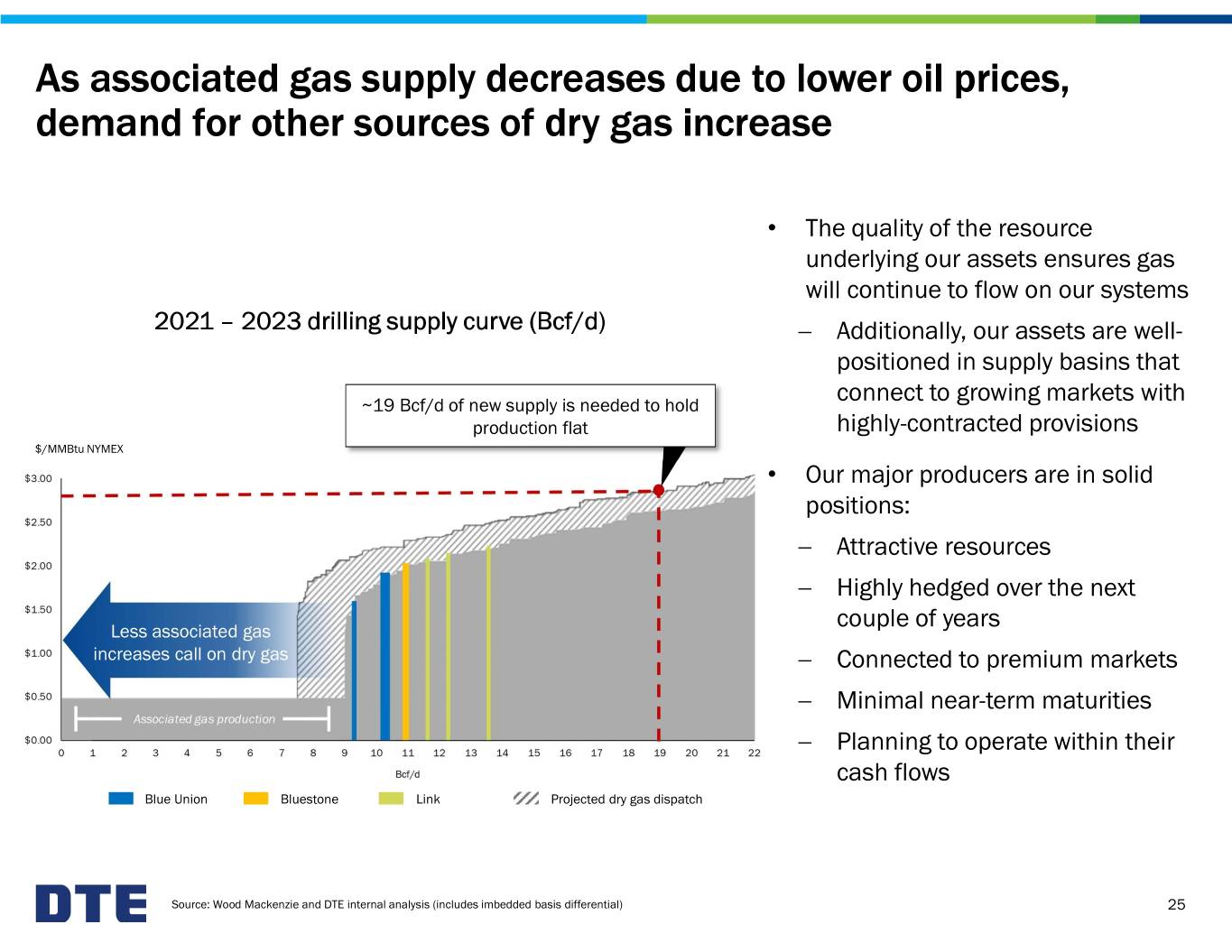

It is necessary to drill 19 Bcf/d of new natural gas supply on an annual basis to hold production flat Annual decline of U.S. natural gas supply • Given decline profiles of flowing wells, from currently-flowing wells (Bcf/d) new production is needed to just keep supply flat Wood Mackenzie forecasts it is 92 -27% necessary to drill 19 Bcf/d on an annual basis to hold production flat -18% Replacing this supply requires prices that allow supply/demand to regain -13% balance -10% -9% • Low oil prices will decrease oil production and associated natural gas production and positively affect the natural gas market This will stimulate additional natural gas drilling 2019 2020 2021 2022 2023 2024 IHS and Wood Mackenzie forecast gas prices need to be $2.50/MMBtu or higher in 2021/2022 to meet demand Source: Platts Analytics 24

As associated gas supply decreases due to lower oil prices, demand for other sources of dry gas increase • The quality of the resource underlying our assets ensures gas will continue to flow on our systems 2021 – 2023 drilling supply curve (Bcf/d) Additionally, our assets are well- positioned in supply basins that ~19 Bcf/d of new supply is needed to hold connect to growing markets with production flat highly-contracted provisions $/MMBtu NYMEX • Our major producers are in solid positions: Attractive resources Highly hedged over the next couple of years Less associated gas increases call on dry gas Connected to premium markets Minimal near-term maturities Planning to operate within their cash flows Blue Union Bluestone Link Projected dry gas dispatch Source: Wood Mackenzie and DTE internal analysis (includes imbedded basis differential) 25

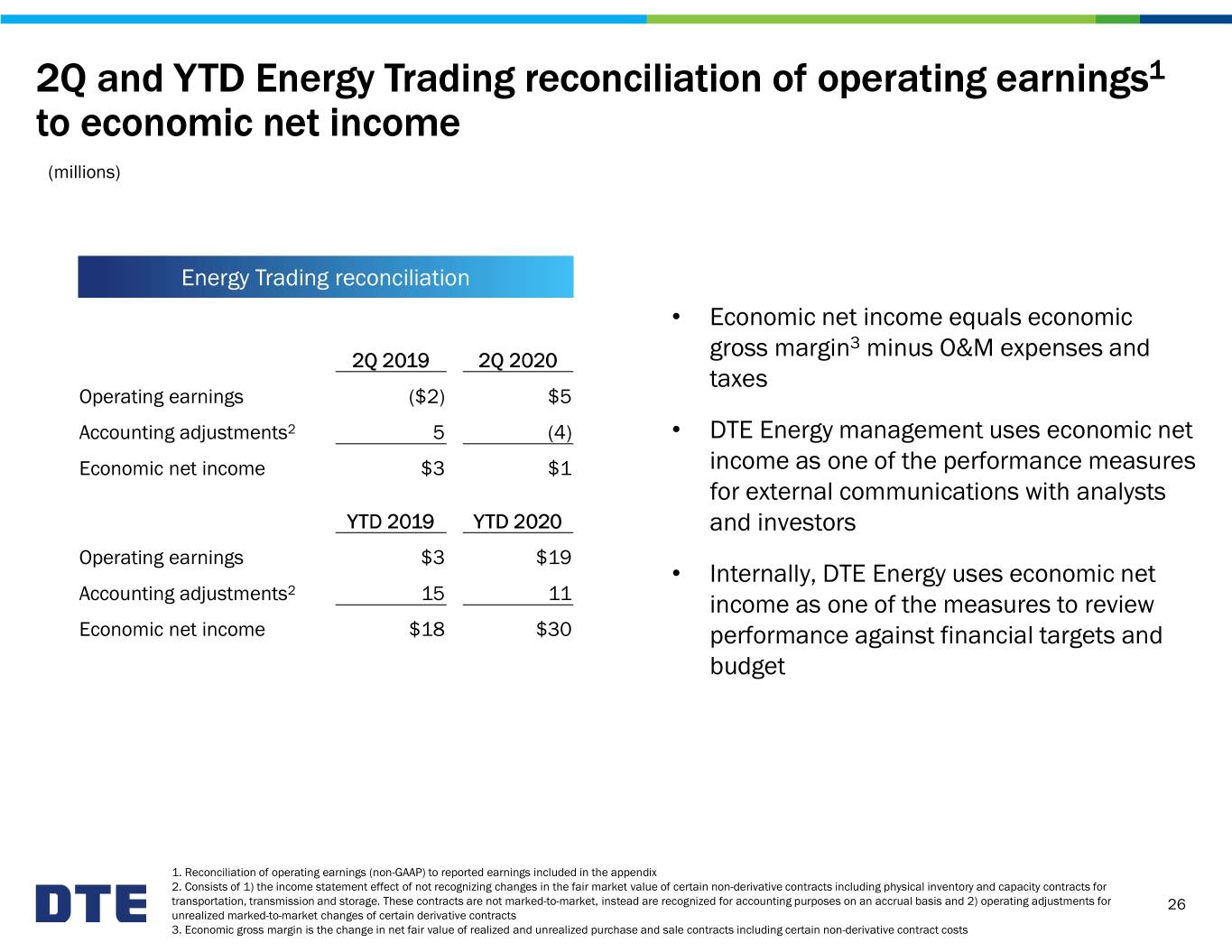

2Q and YTD Energy Trading reconciliation of operating earnings1 to economic net income (millions) Energy Trading reconciliation • Economic net income equals economic 3 2Q 2019 2Q 2020 gross margin minus O&M expenses and taxes Operating earnings ($2) $5 Accounting adjustments2 5 (4) • DTE Energy management uses economic net Economic net income $3 $1 income as one of the performance measures for external communications with analysts YTD 2019 YTD 2020 and investors Operating earnings $3 $19 • Internally, DTE Energy uses economic net 2 Accounting adjustments 15 11 income as one of the measures to review Economic net income $18 $30 performance against financial targets and budget 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not marked-to-market, instead are recognized for accounting purposes on an accrual basis and 2) operating adjustments for 26 unrealized marked-to-market changes of certain derivative contracts 3. Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs

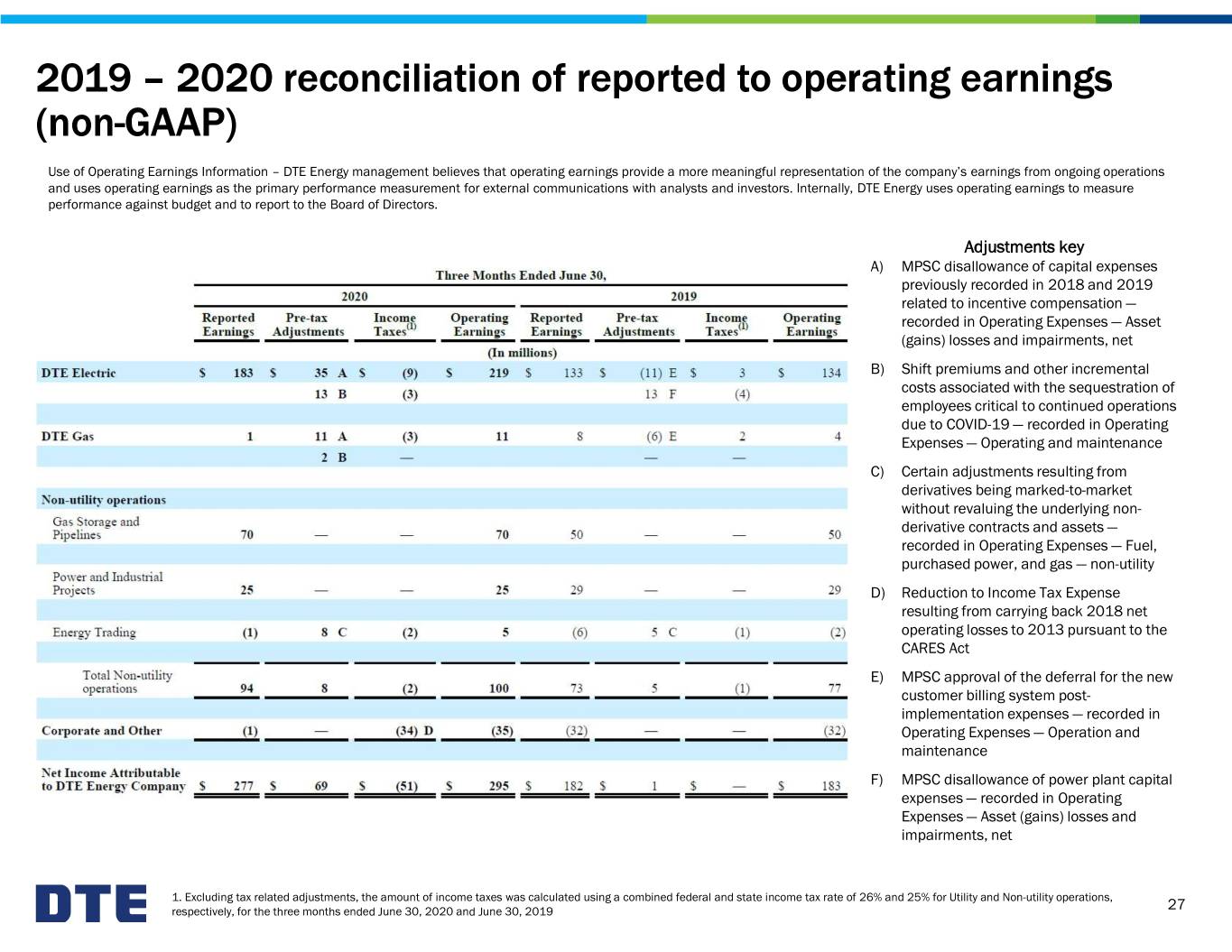

2019 – 2020 reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Adjustments key A) MPSC disallowance of capital expenses previously recorded in 2018 and 2019 related to incentive compensation — recorded in Operating Expenses — Asset (gains) losses and impairments, net B) Shift premiums and other incremental costs associated with the sequestration of employees critical to continued operations due to COVID-19 — recorded in Operating Expenses — Operating and maintenance C) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non- derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility D) Reduction to Income Tax Expense resulting from carrying back 2018 net operating losses to 2013 pursuant to the CARES Act E) MPSC approval of the deferral for the new customer billing system post- implementation expenses — recorded in Operating Expenses — Operation and maintenance F) MPSC disallowance of power plant capital expenses — recorded in Operating Expenses — Asset (gains) losses and impairments, net 1. Excluding tax related adjustments, the amount of income taxes was calculated using a combined federal and state income tax rate of 26% and 25% for Utility and Non-utility operations, respectively, for the three months ended June 30, 2020 and June 30, 2019 27

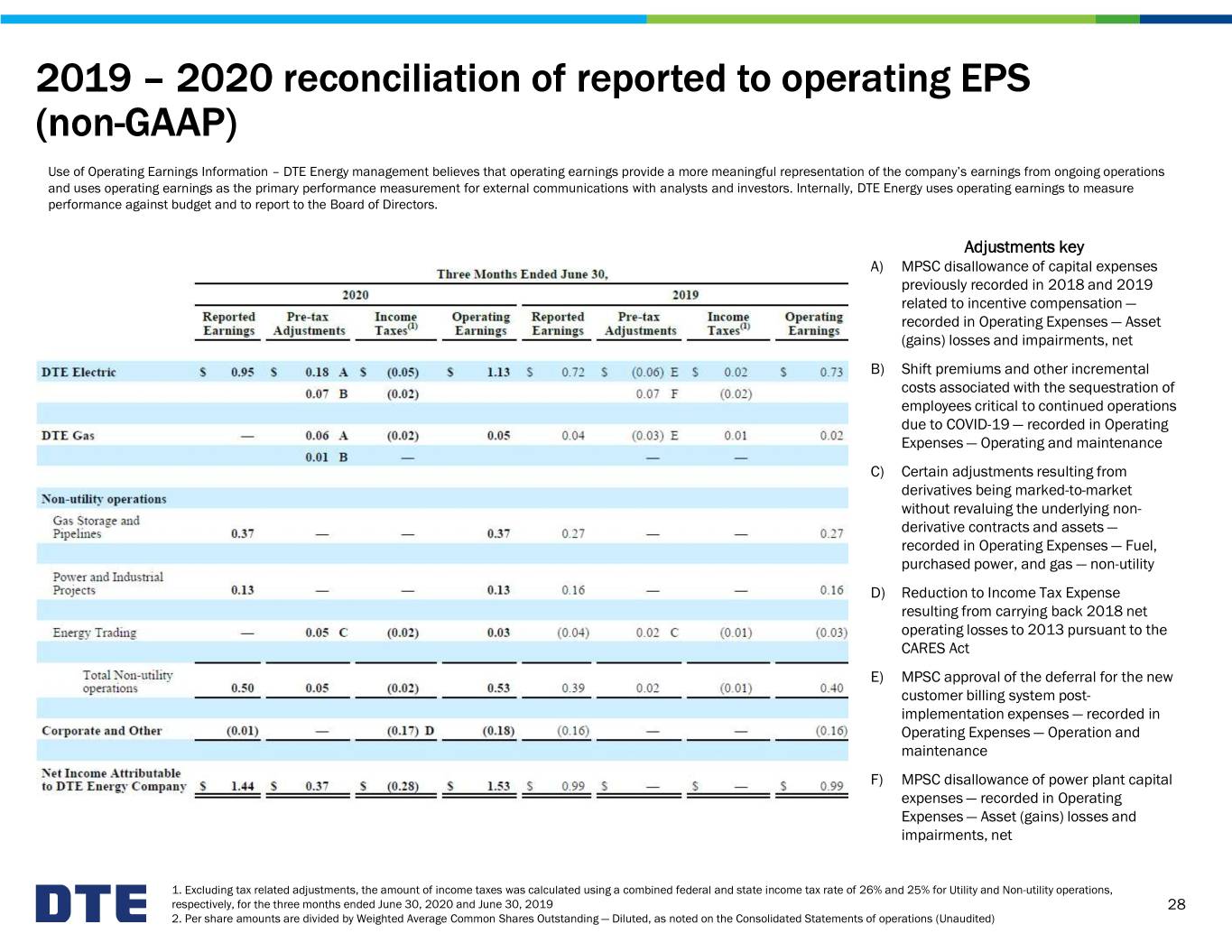

2019 – 2020 reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Adjustments key A) MPSC disallowance of capital expenses previously recorded in 2018 and 2019 related to incentive compensation — recorded in Operating Expenses — Asset (gains) losses and impairments, net B) Shift premiums and other incremental costs associated with the sequestration of employees critical to continued operations due to COVID-19 — recorded in Operating Expenses — Operating and maintenance C) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non- derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility D) Reduction to Income Tax Expense resulting from carrying back 2018 net operating losses to 2013 pursuant to the CARES Act E) MPSC approval of the deferral for the new customer billing system post- implementation expenses — recorded in Operating Expenses — Operation and maintenance F) MPSC disallowance of power plant capital expenses — recorded in Operating Expenses — Asset (gains) losses and impairments, net 1. Excluding tax related adjustments, the amount of income taxes was calculated using a combined federal and state income tax rate of 26% and 25% for Utility and Non-utility operations, respectively, for the three months ended June 30, 2020 and June 30, 2019 28 2. Per share amounts are divided by Weighted Average Common Shares Outstanding — Diluted, as noted on the Consolidated Statements of operations (Unaudited)

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 29

Adjusted EBITDA and Allocated Debt are non-GAAP measures Adjusted EBITDA is calculated using net income, the most comparable GAAP measure and adding back expenses for interest, taxes, depreciation and amortization. Adjusted EBITDA also includes an adjustment for DTE’s proportional share of joint venture net income, excluding taxes and depreciation. Allocated debt is calculated by excluding utility debt from DTE Energy debt, the most comparable GAAP measure, and allocating the residual debt. The GSP portion of the residual debt is allocated to achieve a 50/50 debt/equity structure with adjustments to accommodate off-balance sheet financing for joint venture investments. For GSP, DTE Energy management believes that Adjusted EBITDA is a meaningful disclosure to investors as it is more commonly used as the primary performance measurement for external communications with analysts and investors in the midstream industry. Allocated debt is a meaningful disclosure to provide visibility to GSP’s capital structure. Reconciliation of net income to Adjusted EBITDA as projected for full-year 2020 is not provided. We do not forecast net income as we cannot, without unreasonable efforts, estimate or predict with certainty the components of net income. These components, net of tax, may include, but are not limited to, impairments of assets and other charges, divesture costs, acquisition costs, or changes in accounting principles. All of these components could significantly impact such financial measures. At this time, management is not able to estimate the aggregate impact, if any, of these items on future period reported earnings. Accordingly, we are not able to provide a corresponding GAAP equivalent for Adjusted EBITDA. Similarly, reconciliation of DTE Energy debt to GSP allocated debt is not provided. We do not forecast debt as we cannot, without unreasonable efforts, estimate or predict it with certainty. Debt may be significantly impacted by DTE Energy’s cash flows. At this time, management is not able to estimate the aggregate impact of operating, investing, and other financing cash flows on future period debt. Accordingly, we are not able to provide a GAAP equivalent for allocated debt. 30