Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - California BanCorp | d943850dex991.htm |

| 8-K - 8-K - California BanCorp | d943850d8k.htm |

Investor Presentation Q2 2020 Steven E. Shelton President & CEO Thomas A. Sa SEVP, CFO & COO Scott Myers, SEVP, CLO Exhibit 99.2

Forward-Looking Statements During the course of the presentation and any transcript that may result, written or otherwise, California BanCorp (the “Company”) may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks. Although the Company may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized. The Company undertakes no obligation to release publicly the results of any revisions to the forward-looking statements included herein to reflect events or circumstances after today, or to reflect the occurrence of unanticipated events. The Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

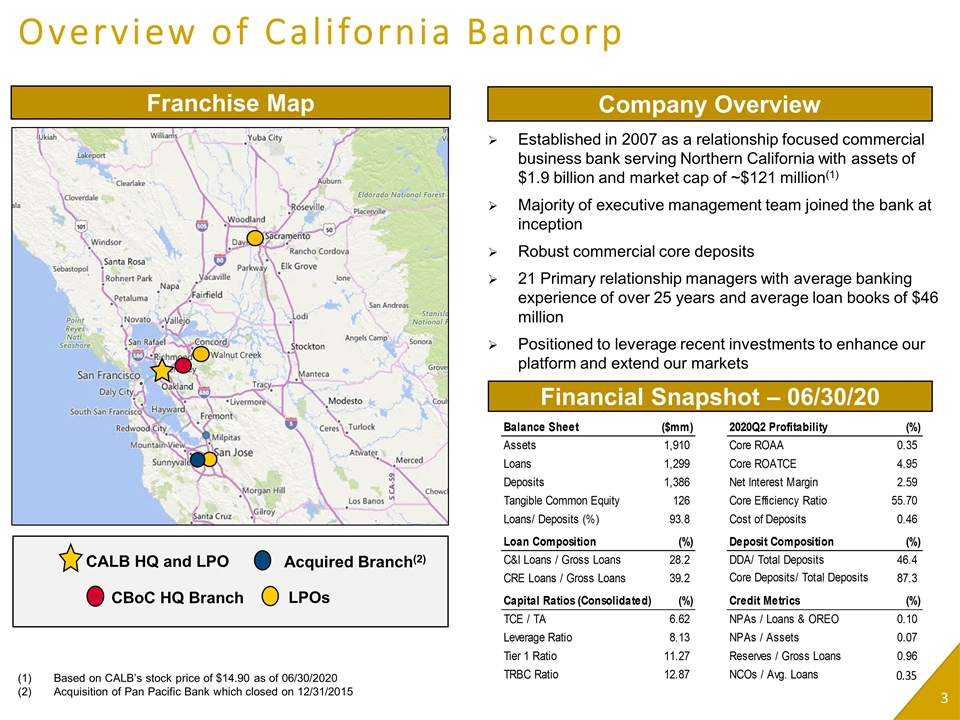

Overview of California Bancorp 3 Established in 2007 as a relationship focused commercial business bank serving Northern California with assets of $1.9 billion and market cap of ~$121 million(1) Majority of executive management team joined the bank at inception Robust commercial core deposits 21 Primary relationship managers with average banking experience of over 25 years and average loan books of $46 million Positioned to leverage recent investments to enhance our platform and extend our markets Based on CALB’s stock price of $14.90 as of 06/30/2020 Acquisition of Pan Pacific Bank which closed on 12/31/2015 Company Overview Financial Snapshot – 06/30/20 Franchise Map CALB HQ and LPO Acquired Branch(2) CBoC HQ Branch LPOs Walnut Creek

Investment Highlights Branch light, commercial focused business bank with strong middle market relationships throughout Northern California Experienced management team and seasoned C&I relationship team with strong ties to the local markets Proven organic and acquisitive growth story Quality core deposit franchise and commercial relationship strategy C&I focus provides asset sensitivity and ability to rebalance loan portfolio Disciplined underwriting standards with best in class asset quality metrics Strong earnings outlook as efficiencies from investments are realized 4 3 4

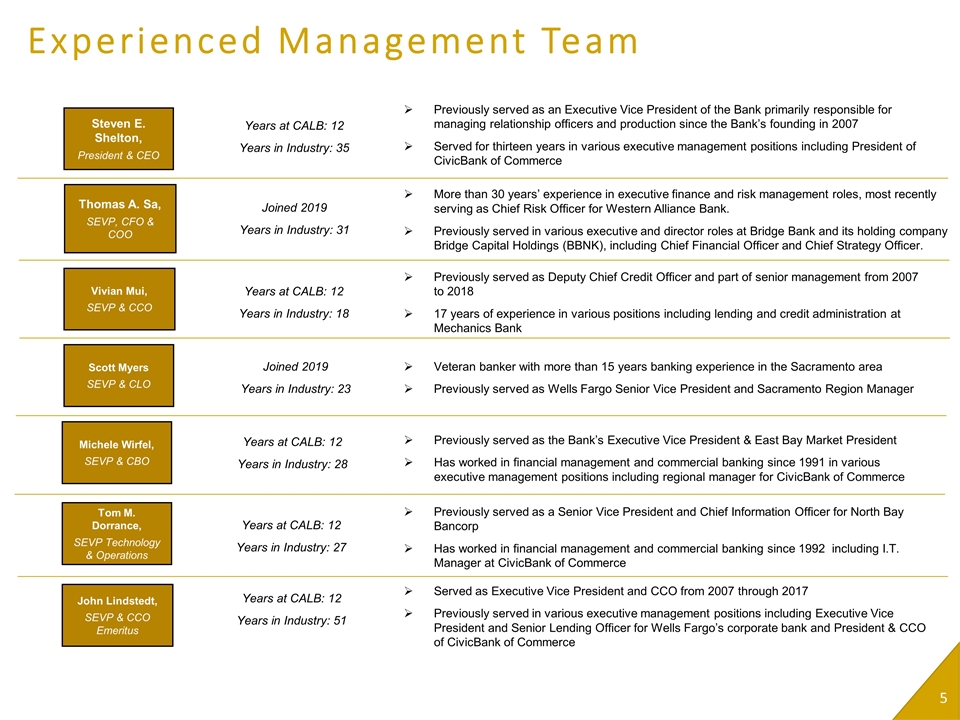

Experienced Management Team Served as Executive Vice President and CCO from 2007 through 2017 Previously served in various executive management positions including Executive Vice President and Senior Lending Officer for Wells Fargo’s corporate bank and President & CCO of CivicBank of Commerce John Lindstedt, SEVP & CCO Emeritus Tom M. Dorrance, SEVP Technology & Operations Previously served as a Senior Vice President and Chief Information Officer for North Bay Bancorp Has worked in financial management and commercial banking since 1992 including I.T. Manager at CivicBank of Commerce Michele Wirfel, SEVP & CBO Previously served as the Bank’s Executive Vice President & East Bay Market President Has worked in financial management and commercial banking since 1991 in various executive management positions including regional manager for CivicBank of Commerce Age: 84 Age: 57 Age: 51 Previously served as an Executive Vice President of the Bank primarily responsible for managing relationship officers and production since the Bank’s founding in 2007 Served for thirteen years in various executive management positions including President of CivicBank of Commerce Steven E. Shelton, President & CEO Age: 58 Years at CALB: 12 Years in Industry: 35 Years at CALB: 12 Years in Industry: 51 Years at CALB: 12 Years in Industry: 27 Years at CALB: 12 Years in Industry: 28 Veteran banker with more than 15 years banking experience in the Sacramento area Previously served as Wells Fargo Senior Vice President and Sacramento Region Manager Scott Myers SEVP & CLO Age: 49 Joined 2019 Years in Industry: 23 More than 30 years’ experience in executive finance and risk management roles, most recently serving as Chief Risk Officer for Western Alliance Bank. Previously served in various executive and director roles at Bridge Bank and its holding company Bridge Capital Holdings (BBNK), including Chief Financial Officer and Chief Strategy Officer. Thomas A. Sa, SEVP, CFO & COO Age: 57 Joined 2019 Years in Industry: 31 Previously served as Deputy Chief Credit Officer and part of senior management from 2007 to 2018 17 years of experience in various positions including lending and credit administration at Mechanics Bank Vivian Mui, SEVP & CCO Age: 40 Years at CALB: 12 Years in Industry: 18 5

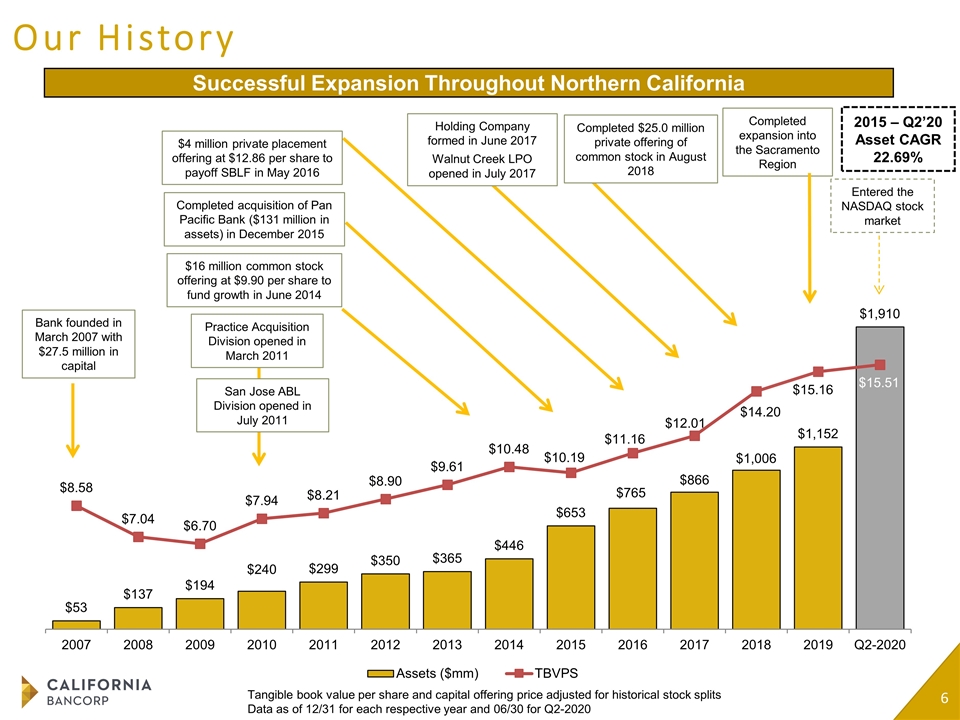

Our History Successful Expansion Throughout Northern California $16 million common stock offering at $9.90 per share to fund growth in June 2014 $4 million private placement offering at $12.86 per share to payoff SBLF in May 2016 Completed acquisition of Pan Pacific Bank ($131 million in assets) in December 2015 2015 – Q2’20 Asset CAGR 22.69% Practice Acquisition Division opened in March 2011 Tangible book value per share and capital offering price adjusted for historical stock splits Data as of 12/31 for each respective year and 06/30 for Q2-2020 Completed $25.0 million private offering of common stock in August 2018 Holding Company formed in June 2017 Walnut Creek LPO opened in July 2017 Bank founded in March 2007 with $27.5 million in capital Completed expansion into the Sacramento Region San Jose ABL Division opened in July 2011 6 Entered the NASDAQ stock market

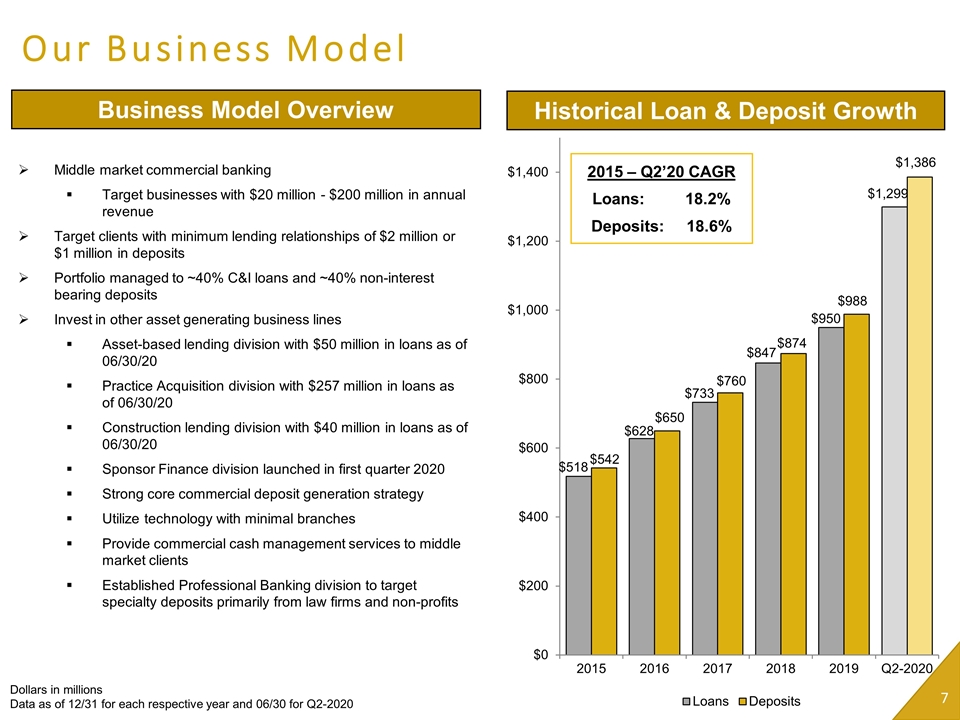

Our Business Model Historical Loan & Deposit Growth Middle market commercial banking Target businesses with $20 million - $200 million in annual revenue Target clients with minimum lending relationships of $2 million or $1 million in deposits Portfolio managed to ~40% C&I loans and ~40% non-interest bearing deposits Invest in other asset generating business lines Asset-based lending division with $50 million in loans as of 06/30/20 Practice Acquisition division with $257 million in loans as of 06/30/20 Construction lending division with $40 million in loans as of 06/30/20 Sponsor Finance division launched in first quarter 2020 Strong core commercial deposit generation strategy Utilize technology with minimal branches Provide commercial cash management services to middle market clients Established Professional Banking division to target specialty deposits primarily from law firms and non-profits Business Model Overview 2015 – Q2’20 CAGR Loans: 18.2% Deposits: 18.6% Dollars in millions Data as of 12/31 for each respective year and 06/30 for Q2-2020 7

We Serve Clients Throughout Northern California 8 ~$50 million in annual revenue $5 million revolver with $2 million outstanding $1 million equipment financing $3 million commercial real estate loan $1 million demand deposit utilizing cash management services $3 million money market accounts to hold surplus deposits Fee income driven by commercial portfolio account analysis Acquisition of Pan Pacific Bank which closed on 12/31/15. Our Middle Market Relationships Our “Typical Client” Franchise Map CALB HQ and LPO Acquired Branch(1) CBoC HQ Branch LPOs Walnut Creek

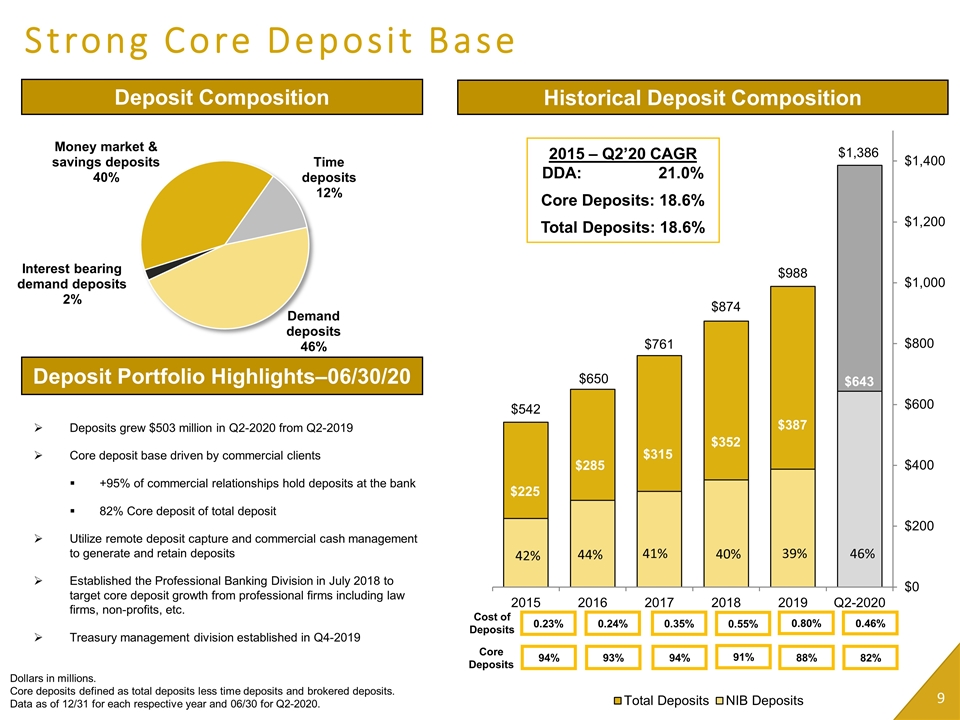

Strong Core Deposit Base 9 Deposits grew $503 million in Q2-2020 from Q2-2019 Core deposit base driven by commercial clients +95% of commercial relationships hold deposits at the bank 82% Core deposit of total deposit Utilize remote deposit capture and commercial cash management to generate and retain deposits Established the Professional Banking Division in July 2018 to target core deposit growth from professional firms including law firms, non-profits, etc. Treasury management division established in Q4-2019 Dollars in millions. Core deposits defined as total deposits less time deposits and brokered deposits. Data as of 12/31 for each respective year and 06/30 for Q2-2020. 2015 – Q2’20 CAGR DDA: 21.0% Core Deposits: 18.6% Total Deposits: 18.6% Deposit Portfolio Highlights–06/30/20 Historical Deposit Composition Deposit Composition 0.23% 0.24% 0.35% Cost of Deposits 94% 93% 94% Core Deposits 0.80% 88% 0.55% 91% 0.46% 82%

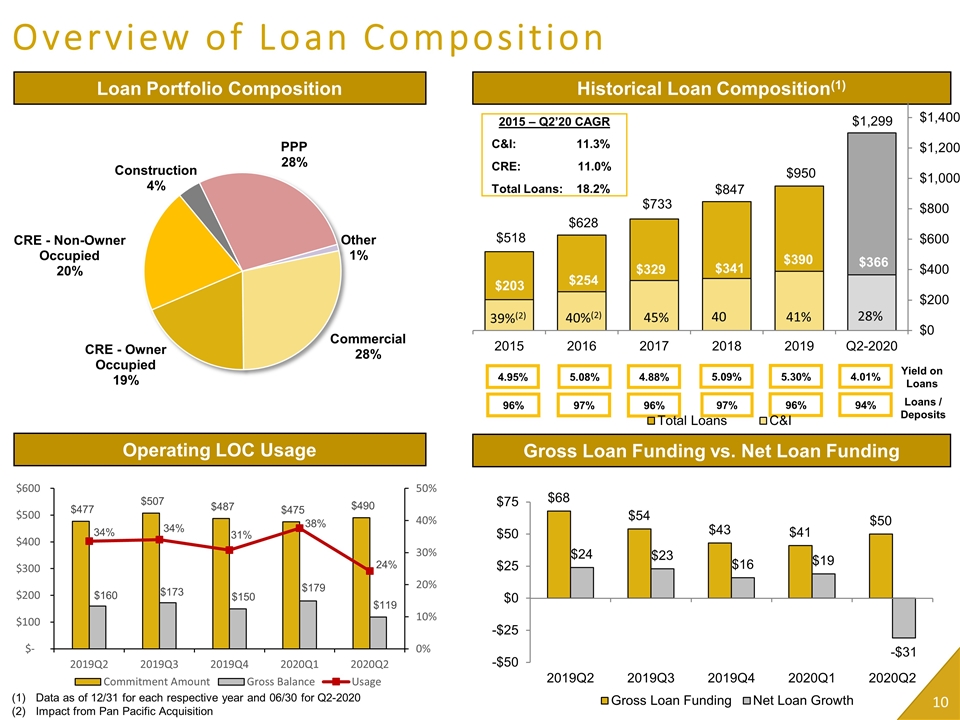

Overview of Loan Composition 10 Data as of 12/31 for each respective year and 06/30 for Q2-2020 Impact from Pan Pacific Acquisition Loan Portfolio Composition Operating LOC Usage Historical Loan Composition(1) Gross Loan Funding vs. Net Loan Funding 2015 – Q2’20 CAGR C&I: 11.3% CRE: 11.0% Total Loans: 18.2% 4.95% 5.08% 4.88% 96% 97% 96% 5.30% 96% 5.09% 97% 4.01% 94% Yield on Loans Loans / Deposits

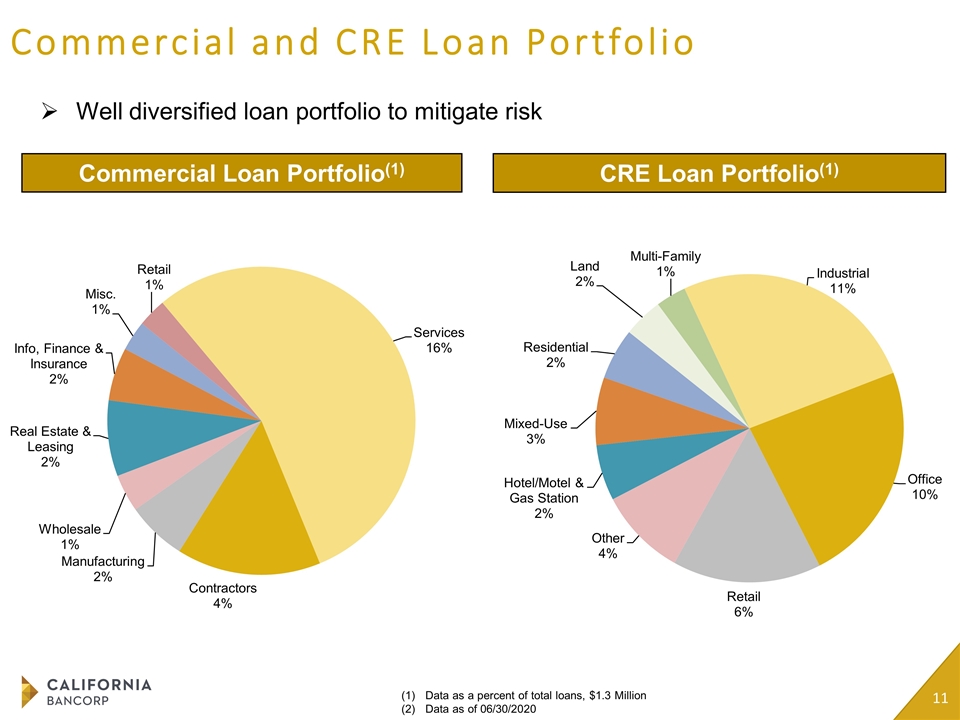

Commercial and CRE Loan Portfolio 11 Well diversified loan portfolio to mitigate risk Commercial Loan Portfolio(1) CRE Loan Portfolio(1) Data as a percent of total loans, $1.3 Million Data as of 06/30/2020

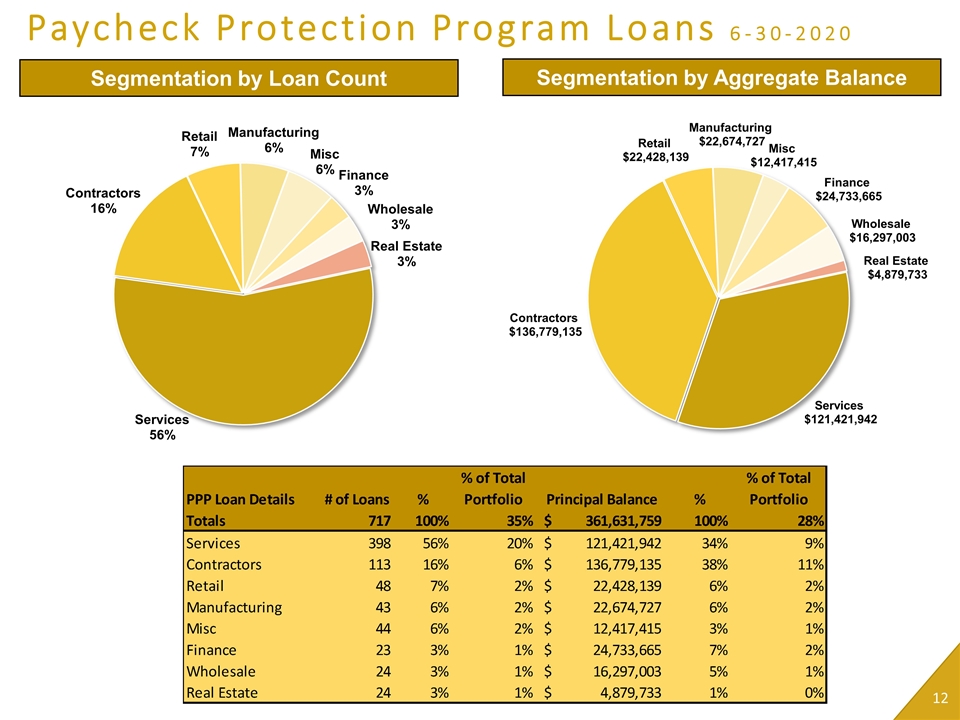

Paycheck Protection Program Loans 6-30-2020 12 As of Q2 ‘19 CALB had $621 thousand of loan discount on the acquired loans from Pan Pacific Bank Segmentation by Loan Count Segmentation by Aggregate Balance

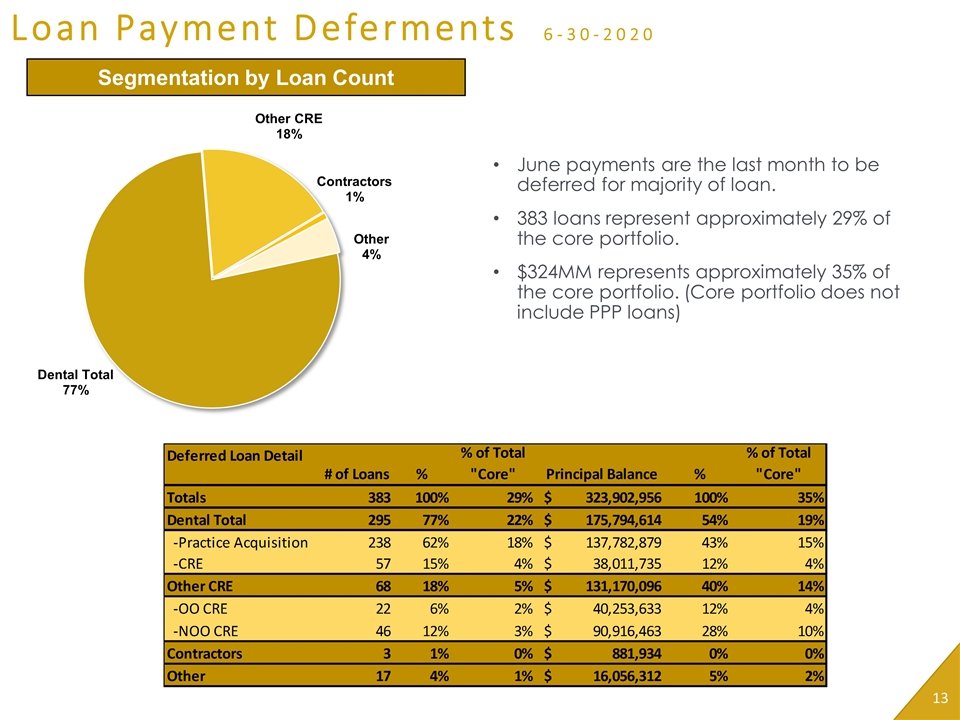

Loan Payment Deferments 6-30-2020 13 As of Q2 ‘19 CALB had $621 thousand of loan discount on the acquired loans from Pan Pacific Bank Segmentation by Loan Count June payments are the last month to be deferred for majority of loan. 383 loans represent approximately 29% of the core portfolio. $324MM represents approximately 35% of the core portfolio. (Core portfolio does not include PPP loans)

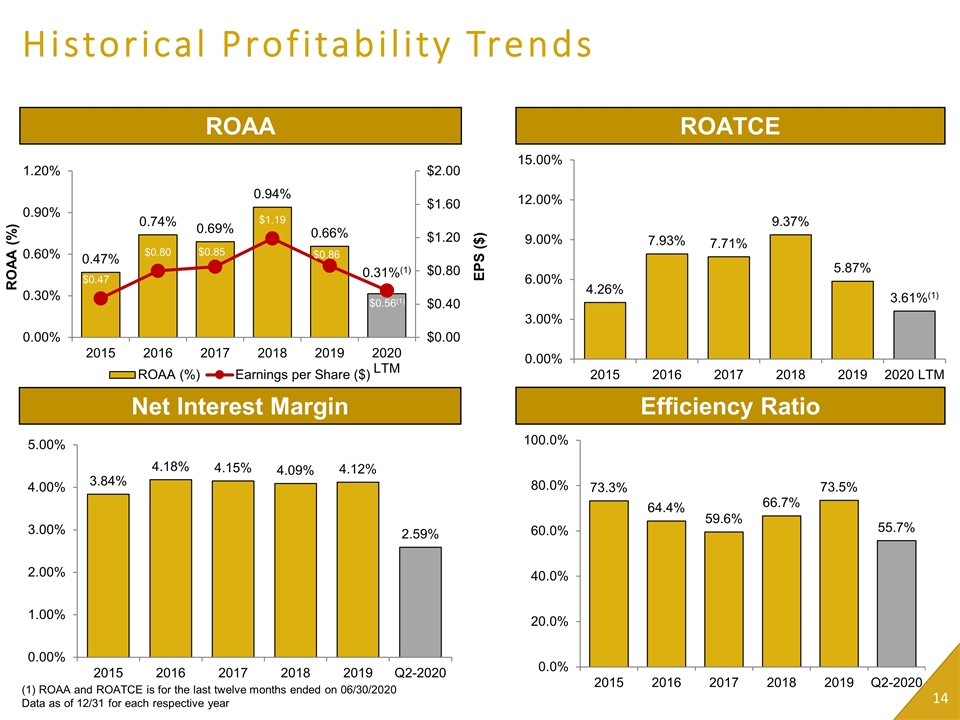

Historical Profitability Trends 14 (1) ROAA and ROATCE is for the last twelve months ended on 06/30/2020 Data as of 12/31 for each respective year ROAA ROATCE Efficiency Ratio Net Interest Margin EPS ($) ROAA (%)

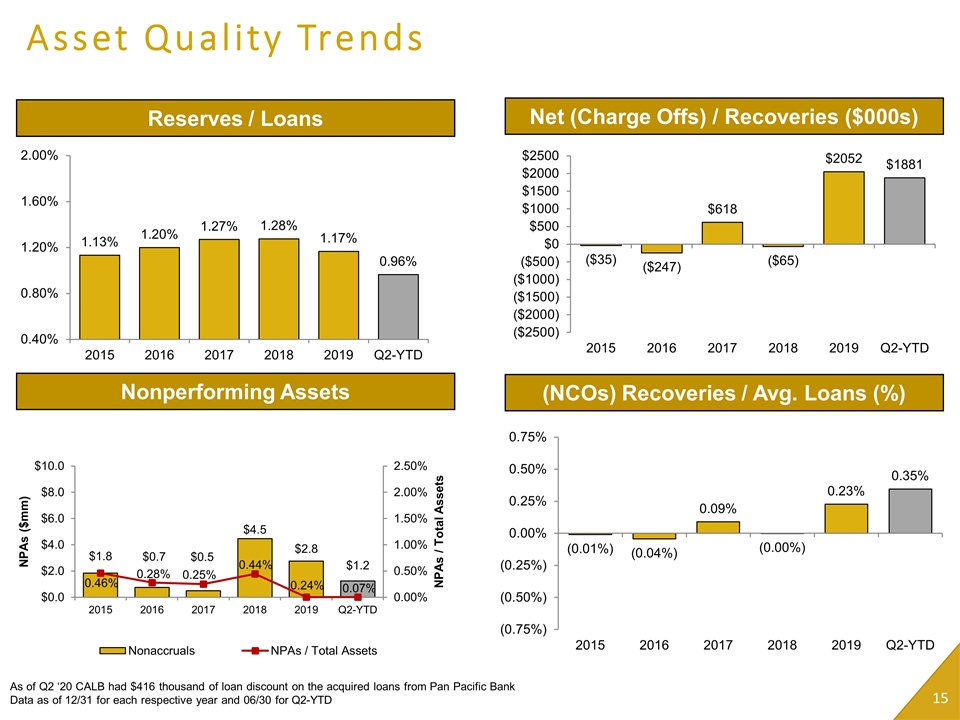

Asset Quality Trends 15 As of Q2 ‘19 CALB had $621 thousand of loan discount on the acquired loans from Pan Pacific Bank As of Q2 ‘20 CALB had $416 thousand of loan discount on the acquired loans from Pan Pacific Bank Data as of 12/31 for each respective year and 06/30 for Q2-YTD Net (Charge Offs) / Recoveries ($000s) Reserves / Loans Nonperforming Assets (NCOs) Recoveries / Avg. Loans (%)

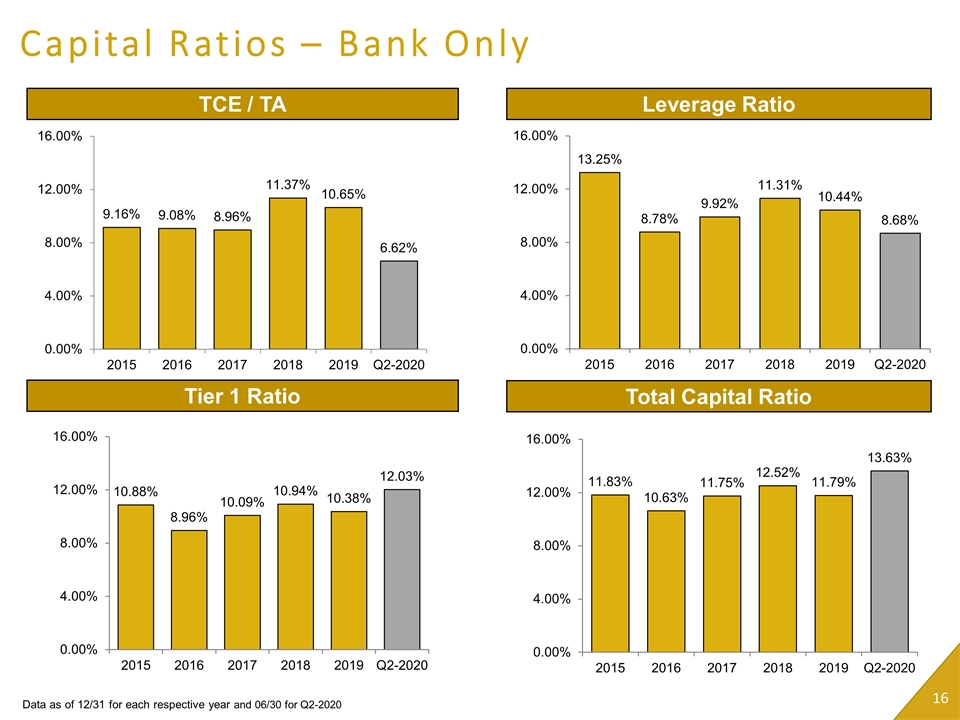

Capital Ratios – Bank Only 16 Data as of 12/31 for each respective year and 06/30 for Q2-2020 TCE / TA Leverage Ratio Total Capital Ratio Tier 1 Ratio

Summary 17

Please send questions to ir@bankcbc.com Or Call 510.457.3751 CaliforniaBankofCommerce.com