Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Silvergate Capital Corp | ex991q22020earningsrel.htm |

| 8-K - 8-K - Silvergate Capital Corp | si8-k7272020earningsre.htm |

Exhibit 99.2 Silvergate Capital Corporation 2Q20 Earnings Presentation July 27, 2020

Forward Looking Statements This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s periodic and current reports filed with the U.S. Securities and Exchange Commission. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. Further, given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated and when and how the economy may be reopened. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: the demand for our products and services may decline, making it difficult to grow assets and income; if the economy is unable to fully reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; our allowance for loan losses may increase if borrowers experience financial difficulties, which will adversely affect our net income; the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; our cyber security risks are increased as the result of an increase in the number of employees working remotely; and FDIC premiums may increase if the agency experiences additional resolution costs. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For the most current, accurate information, please refer to the investor relations section of the Company's website at https://ir.silvergatebank.com. Silvergate “Silvergate Bank” and its logos and other trademarks referred to and included in this presentation belong to us. Solely for convenience, we refer to our trademarks in this presentation without the ® or the ™ or symbols, but such references are not intended to indicate that we will not fully assert under applicable law our trademark rights. Other service marks, trademarks and trade names referred to in this presentation, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks. In this presentation, we refer to Silvergate Capital Corporation as “Silvergate” or the “Company” and to Silvergate Bank as the “Bank”. 2

2Q20 Highlights Digital Currency Platform Loan Portfolio & Credit • Record number of 2Q20 Silvergate Exchange Network, • Loan portfolio balance up 21% year-on-year and relatively or SEN transactions of 40,286 and SEN volumes of unchanged from prior quarter, with nonperforming assets $22.4 billion, up 28% and 29%, respectively, versus of $4.6 million, or 0.20% of total assets at June 30, 2020 1Q19 • Mortgage warehouse represents largest component of • Digital currency fee income of $2.4 million up 41% as loan portfolio, at 42.8% of total portfolio at June 30, 2020 compared to 1Q20 and up 119% compared to 2Q19 • Conservative credit culture evidenced by relatively low • Expanded access to SEN Leverage with approved lines loan-to-value (LTV), with a 54% LTV in commercial and of credit totaling $22.5 million versus $12.5 million in multi-family real estate loans, and 55% LTV in 1-4 family 1Q20 loans • Foreign currency offering launched in 2Q20, providing • 17% of HFI loan portfolio as of June 30, 2020 had been direct client access to transactions in EUR & CHF, with granted payment deferrals, with 27% of those modified additional currencies to be added going forward loans resuming payments by July 15, 2020, on a dollar volume basis 2Q20 Financial Highlights Other • Net income of $5.5 million as compared to $4.4 million • Beginning in 3Q20, Silvergate will no longer purchase for 1Q20 single-family real estate loans through its correspondent lending unit, but will continue to service existing loans • Diluted EPS of $0.29 per share compared to $0.23 per currently on balance sheet share for 1Q20 • Balance sheet asset focus on scalable SEN Leverage • Book value per share of $14.36 compared to $13.11 for loans and mortgage warehouse, while maintaining solid 1Q20 CRE lending platform • NIM was 3.14% compared to 2.86% for 1Q20 • Silvergate continued to operate with uninterrupted • Total risk-based capital ratio of 25.54% as of June 30, banking access for customers and majority of the 2020 Company’s employees working remotely • Tier 1 leverage ratio of 11.57% as of June 30, 2020 3

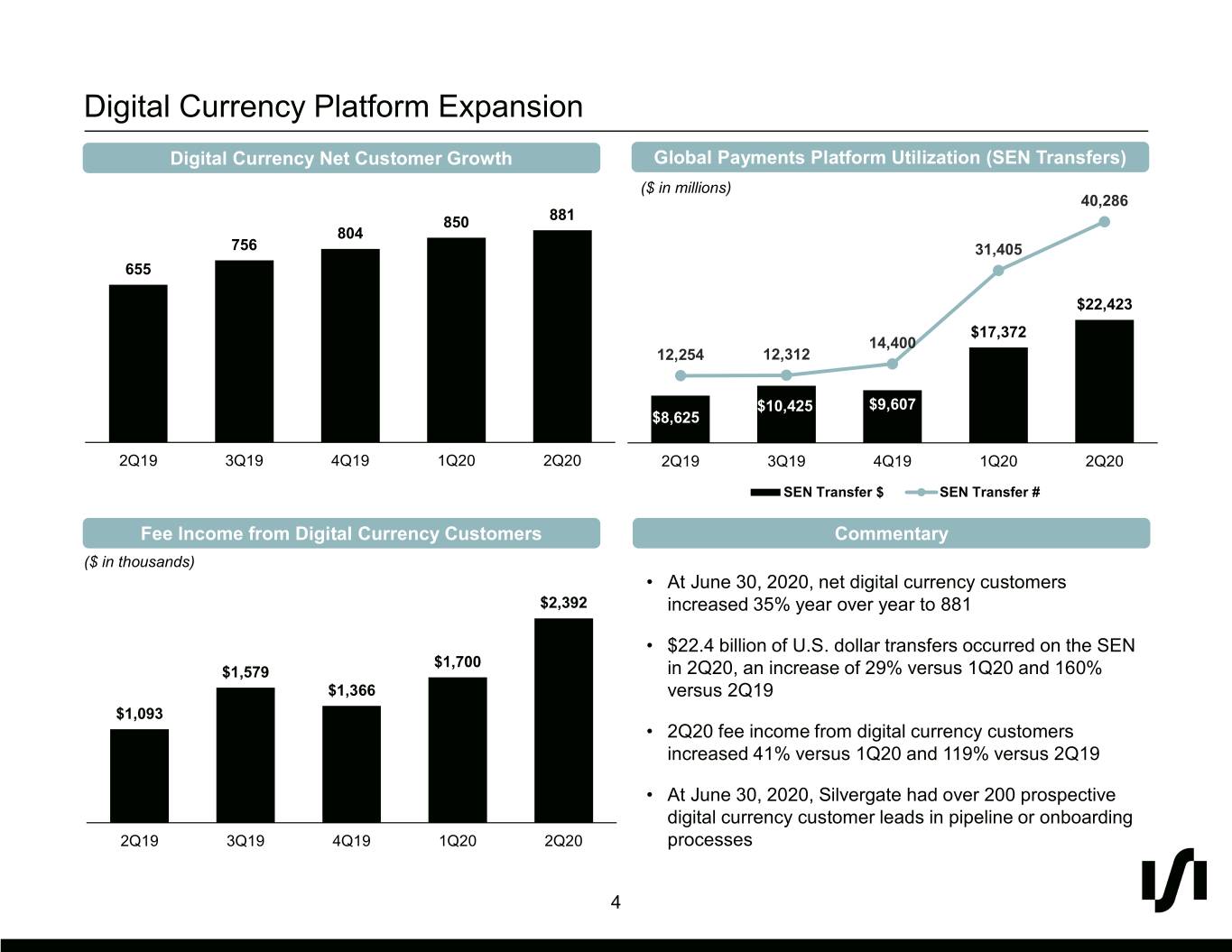

Digital Currency Platform Expansion Digital Currency Net Customer Growth Global Payments Platform Utilization (SEN Transfers) ($ in millions) 40,286 850 881 804 756 31,405 655 $22,423 $17,372 14,400 12,254 12,312 $10,425 $9,607 $8,625 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 SEN Transfer $ SEN Transfer # Fee Income from Digital Currency Customers Commentary ($ in thousands) • At June 30, 2020, net digital currency customers $2,392 increased 35% year over year to 881 • $22.4 billion of U.S. dollar transfers occurred on the SEN $1,700 $1,579 in 2Q20, an increase of 29% versus 1Q20 and 160% $1,366 versus 2Q19 $1,093 • 2Q20 fee income from digital currency customers increased 41% versus 1Q20 and 119% versus 2Q19 • At June 30, 2020, Silvergate had over 200 prospective digital currency customer leads in pipeline or onboarding 2Q19 3Q19 4Q19 1Q20 2Q20 processes 4

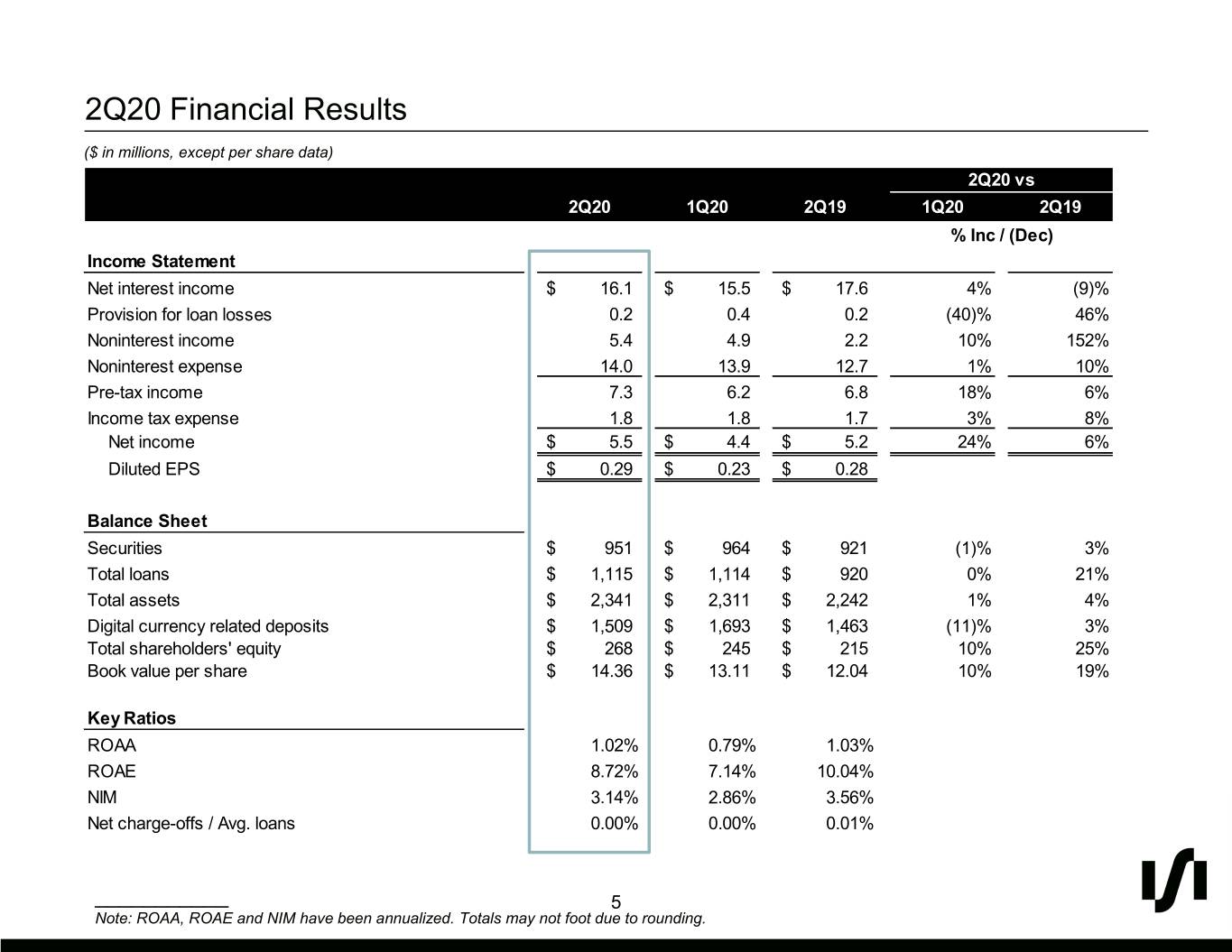

2Q20 Financial Results ($ in millions, except per share data) 2Q20 vs 2Q20 1Q20 2Q19 1Q20 2Q19 % Inc / (Dec) Income Statement Net interest income $ 16.1 $ 15.5 $ 17.6 4% (9)% Provision for loan losses 0.2 0.4 0.2 (40)% 46% Noninterest income 5.4 4.9 2.2 10% 152% Noninterest expense 14.0 13.9 12.7 1% 10% Pre-tax income 7.3 6.2 6.8 18% 6% Income tax expense 1.8 1.8 1.7 3% 8% Net income $ 5.5 $ 4.4 $ 5.2 24% 6% Diluted EPS $ 0.29 $ 0.23 $ 0.28 Balance Sheet Securities $ 951 $ 964 $ 921 (1)% 3% Total loans $ 1,115 $ 1,114 $ 920 0% 21% Total assets $ 2,341 $ 2,311 $ 2,242 1% 4% Digital currency related deposits $ 1,509 $ 1,693 $ 1,463 (11)% 3% Total shareholders' equity $ 268 $ 245 $ 215 10% 25% Book value per share $ 14.36 $ 13.11 $ 12.04 10% 19% Key Ratios ROAA 1.02% 0.79% 1.03% ROAE 8.72% 7.14% 10.04% NIM 3.14% 2.86% 3.56% Net charge-offs / Avg. loans 0.00% 0.00% 0.01% ___________ 5 Note: ROAA, ROAE and NIM have been annualized. Totals may not foot due to rounding.

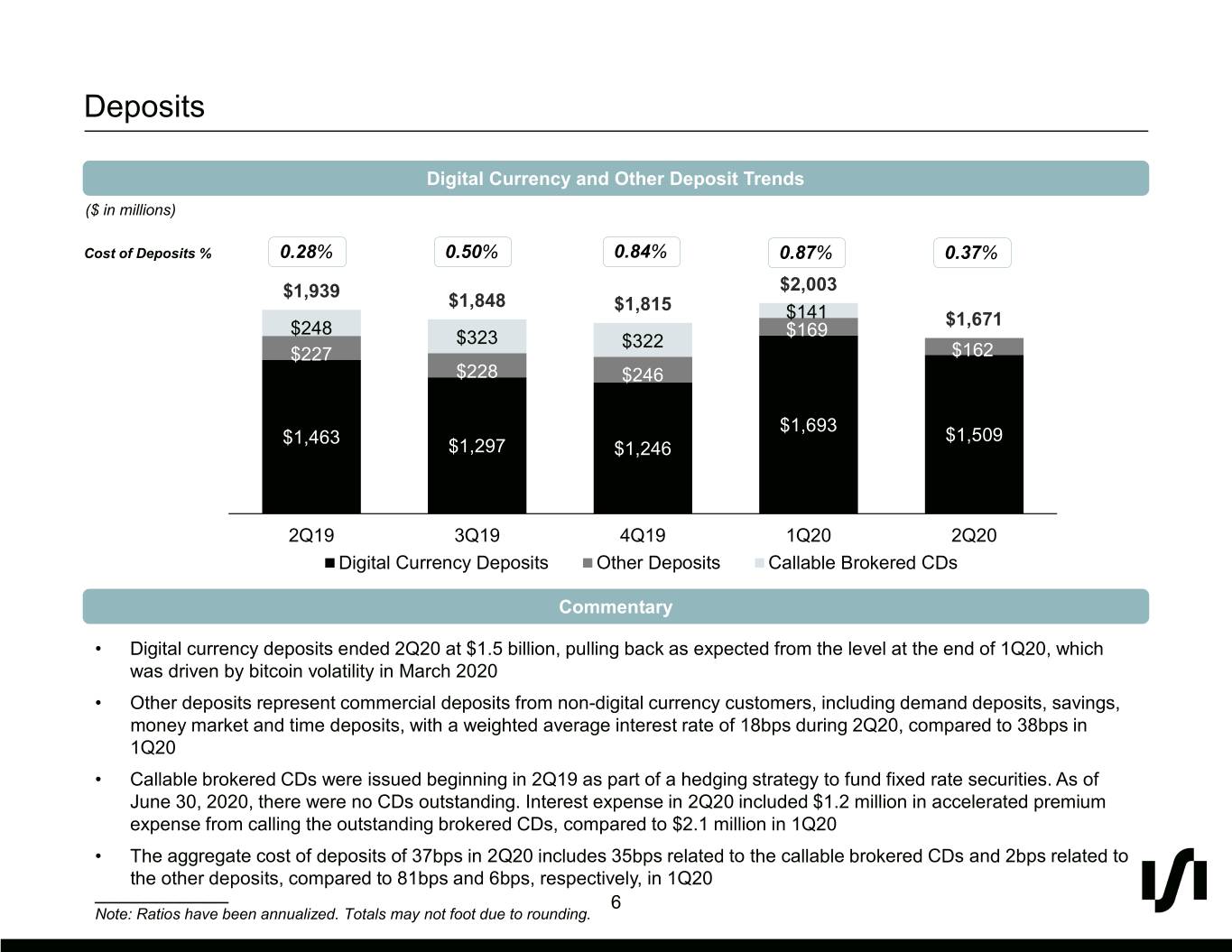

Deposits Digital Currency and Other Deposit Trends ($ in millions) Cost of Deposits % 0.28% 0.50% 0.84% 0.87% 0.37% $1,939 $2,003 $1,848 $1,815 $141 $1,671 $248 $169 $323 $322 $227 $162 $228 $246 $1,693 $1,463 $1,509 $1,297 $1,246 2Q19 3Q19 4Q19 1Q20 2Q20 Digital Currency Deposits Other Deposits Callable Brokered CDs Commentary • Digital currency deposits ended 2Q20 at $1.5 billion, pulling back as expected from the level at the end of 1Q20, which was driven by bitcoin volatility in March 2020 • Other deposits represent commercial deposits from non-digital currency customers, including demand deposits, savings, money market and time deposits, with a weighted average interest rate of 18bps during 2Q20, compared to 38bps in 1Q20 • Callable brokered CDs were issued beginning in 2Q19 as part of a hedging strategy to fund fixed rate securities. As of June 30, 2020, there were no CDs outstanding. Interest expense in 2Q20 included $1.2 million in accelerated premium expense from calling the outstanding brokered CDs, compared to $2.1 million in 1Q20 • The aggregate cost of deposits of 37bps in 2Q20 includes 35bps related to the callable brokered CDs and 2bps related to the other deposits, compared to 81bps and 6bps, respectively, in 1Q20 ___________ 6 Note: Ratios have been annualized. Totals may not foot due to rounding.

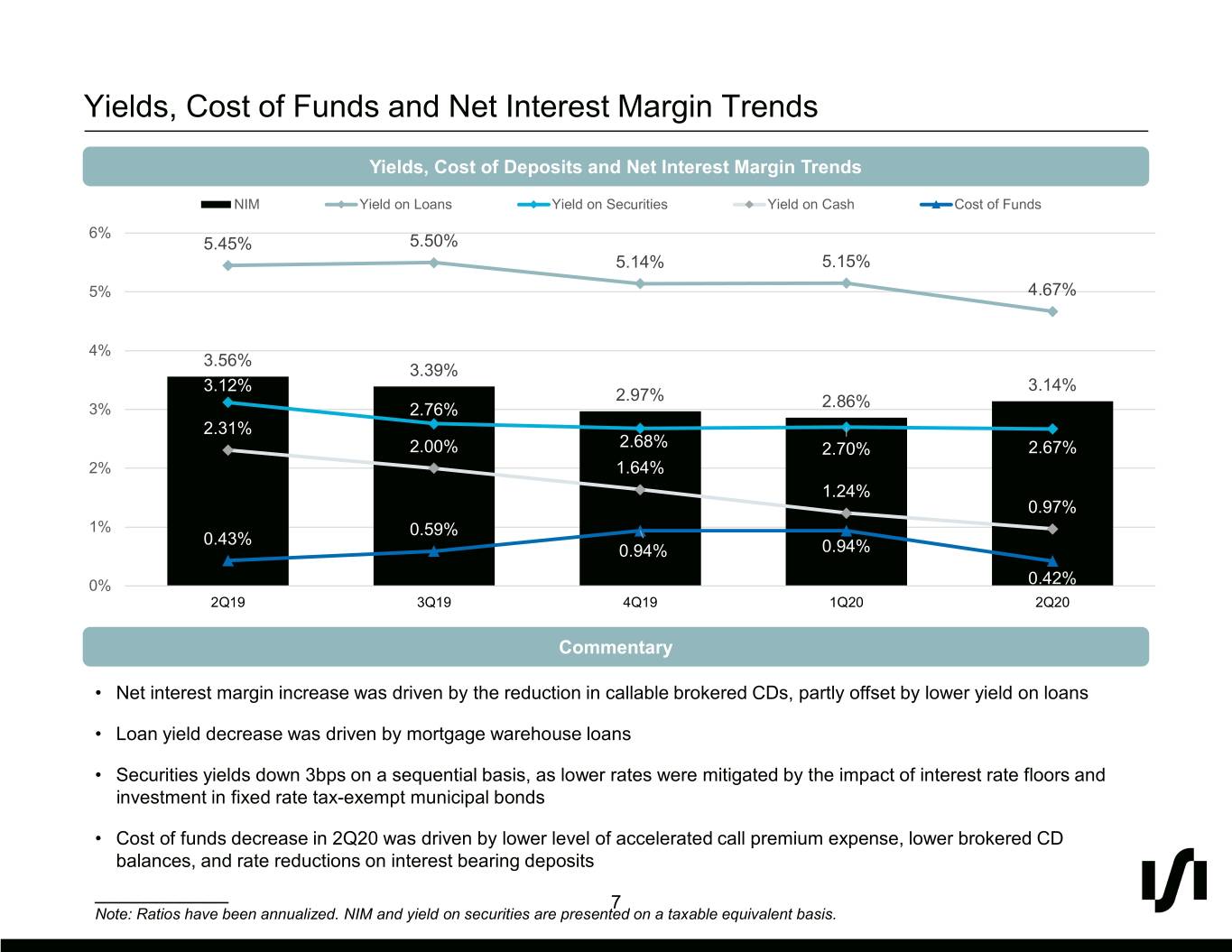

Yields, Cost of Funds and Net Interest Margin Trends Yields, Cost of Deposits and Net Interest Margin Trends NIM Yield on Loans Yield on Securities Yield on Cash Cost of Funds 6% 5.45% 5.50% 5.14% 5.15% 5% 4.67% 4% 3.56% 3.39% 3.12% 3.14% 2.97% 3% 2.76% 2.86% 2.31% 2.00% 2.68% 2.70% 2.67% 2% 1.64% 1.24% 0.97% 1% 0.59% 0.43% 0.94% 0.94% 0% 0.42% 2Q19 3Q19 4Q19 1Q20 2Q20 Commentary • Net interest margin increase was driven by the reduction in callable brokered CDs, partly offset by lower yield on loans • Loan yield decrease was driven by mortgage warehouse loans • Securities yields down 3bps on a sequential basis, as lower rates were mitigated by the impact of interest rate floors and investment in fixed rate tax-exempt municipal bonds • Cost of funds decrease in 2Q20 was driven by lower level of accelerated call premium expense, lower brokered CD balances, and rate reductions on interest bearing deposits ___________ 7 Note: Ratios have been annualized. NIM and yield on securities are presented on a taxable equivalent basis.

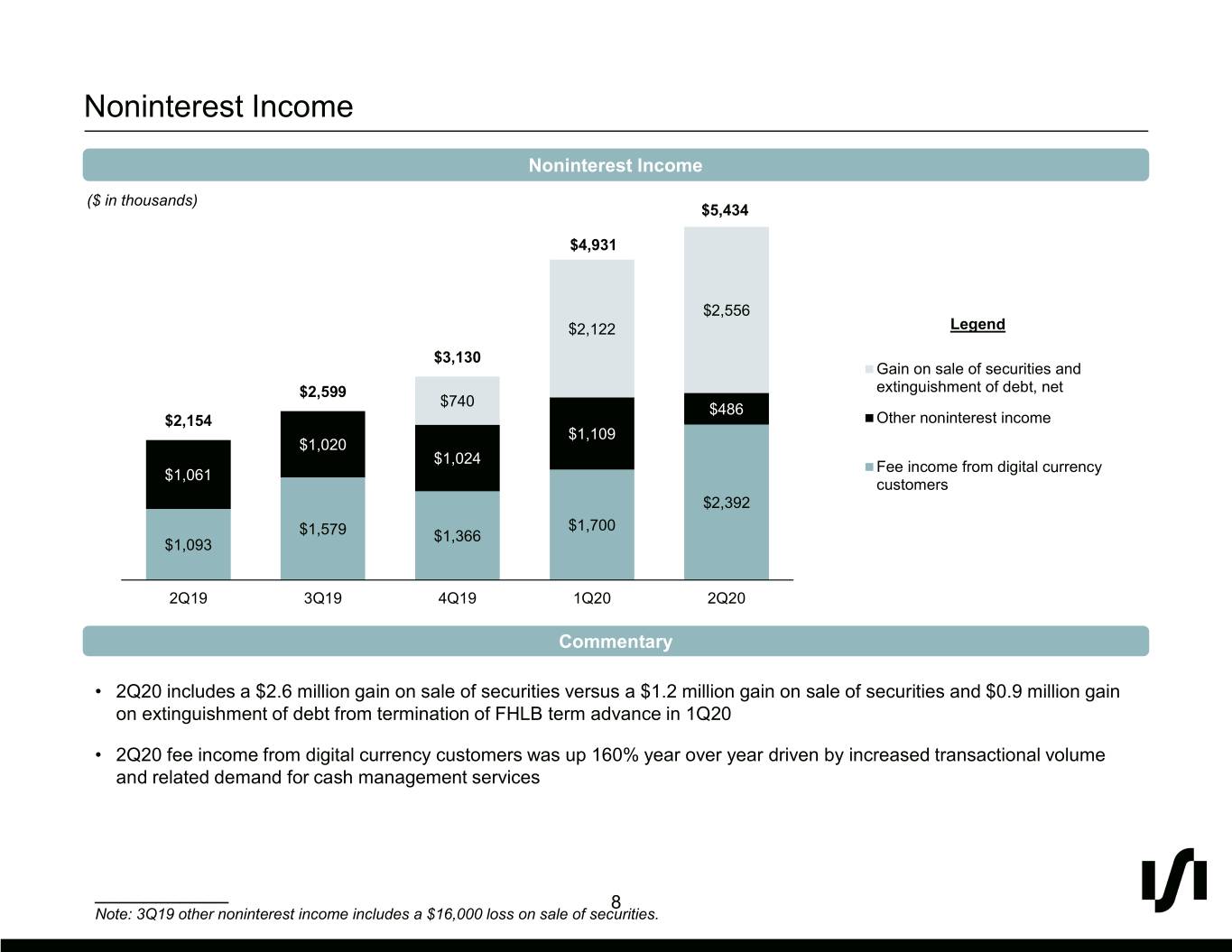

Noninterest Income Noninterest Income 6000 ($ in thousands) $5,434 $4,931 5000 $2,556 4000 $2,122 Legend $3,130 Gain on sale of securities and 3000 $2,599 extinguishment of debt, net $740 $486 $2,154 Other noninterest income $1,109 2000 $1,020 $1,024 Fee income from digital currency $1,061 customers $2,392 1000 $1,700 $1,579 $1,366 $1,093 0 2Q19 3Q19 4Q19 1Q20 2Q20 Commentary • 2Q20 includes a $2.6 million gain on sale of securities versus a $1.2 million gain on sale of securities and $0.9 million gain on extinguishment of debt from termination of FHLB term advance in 1Q20 • 2Q20 fee income from digital currency customers was up 160% year over year driven by increased transactional volume and related demand for cash management services ___________ 8 Note: 3Q19 other noninterest income includes a $16,000 loss on sale of securities.

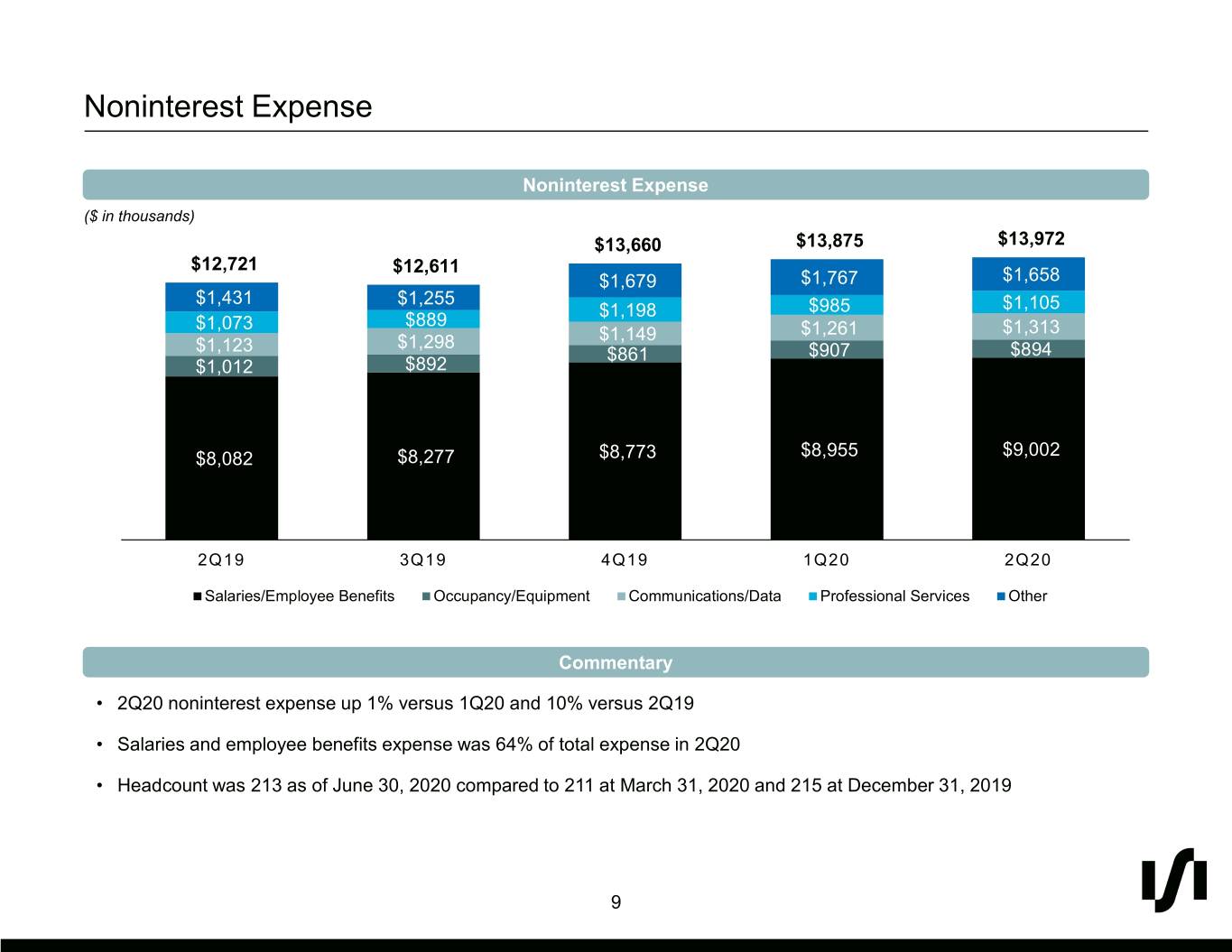

Noninterest Expense Noninterest Expense ($ in thousands) $13,660 $13,875 $13,972 $12,721 $12,611 $1,679 $1,767 $1,658 $1,431 $1,255 $1,198 $985 $1,105 $1,073 $889 $1,261 $1,313 $1,298 $1,149 $1,123 $861 $907 $894 $1,012 $892 $8,082 $8,277 $8,773 $8,955 $9,002 2Q19 3Q19 4Q19 1Q20 2Q20 Salaries/Employee Benefits Occupancy/Equipment Communications/Data Professional Services Other Commentary • 2Q20 noninterest expense up 1% versus 1Q20 and 10% versus 2Q19 • Salaries and employee benefits expense was 64% of total expense in 2Q20 • Headcount was 213 as of June 30, 2020 compared to 211 at March 31, 2020 and 215 at December 31, 2019 9

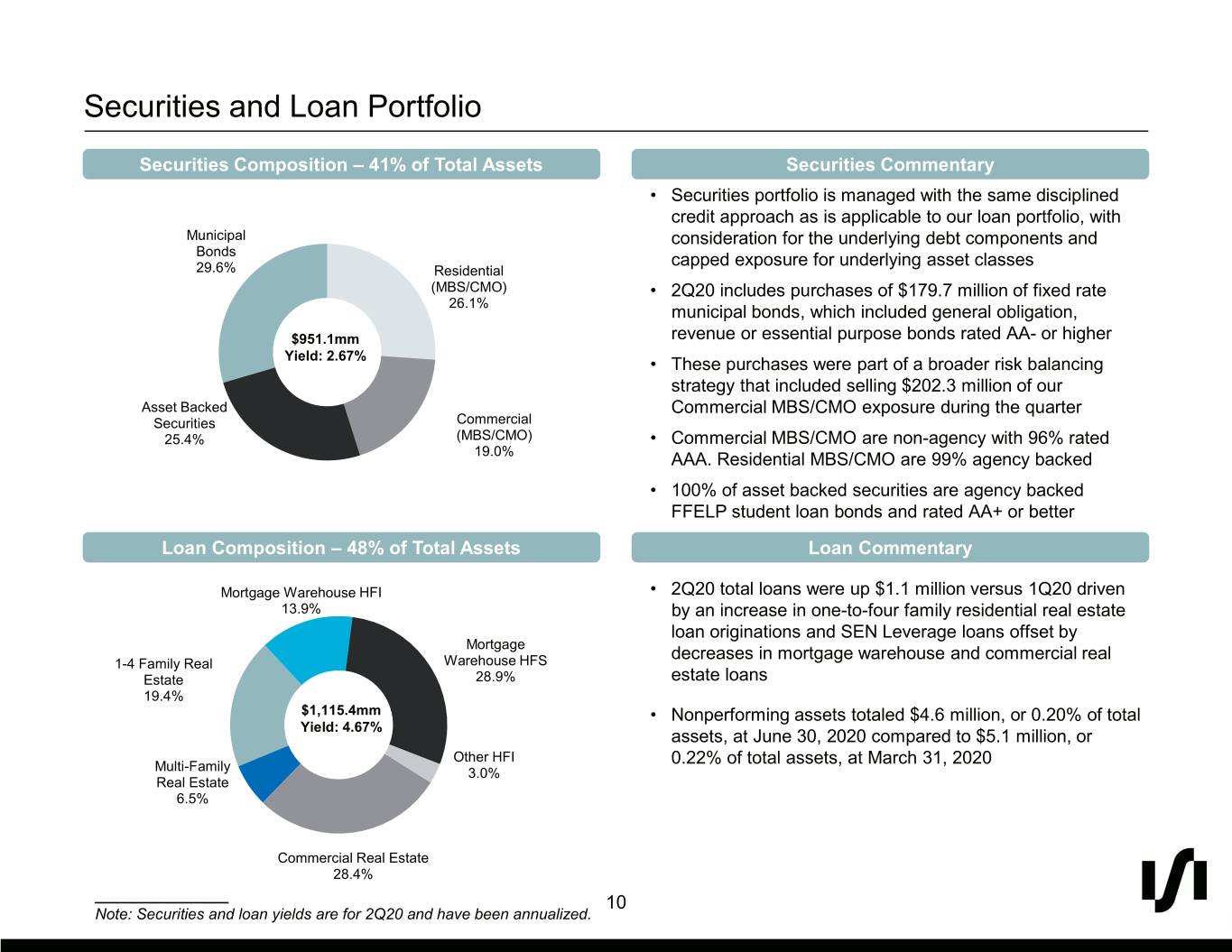

Securities and Loan Portfolio Securities Composition – 41% of Total Assets Securities Commentary • Securities portfolio is managed with the same disciplined credit approach as is applicable to our loan portfolio, with Municipal consideration for the underlying debt components and Bonds capped exposure for underlying asset classes 29.6% Residential (MBS/CMO) • 2Q20 includes purchases of $179.7 million of fixed rate 26.1% municipal bonds, which included general obligation, $951.1mm revenue or essential purpose bonds rated AA- or higher Yield: 2.67% • These purchases were part of a broader risk balancing strategy that included selling $202.3 million of our Asset Backed Commercial MBS/CMO exposure during the quarter Securities Commercial 25.4% (MBS/CMO) • Commercial MBS/CMO are non-agency with 96% rated 19.0% AAA. Residential MBS/CMO are 99% agency backed • 100% of asset backed securities are agency backed FFELP student loan bonds and rated AA+ or better Loan Composition – 48% of Total Assets Loan Commentary Mortgage Warehouse HFI • 2Q20 total loans were up $1.1 million versus 1Q20 driven 13.9% by an increase in one-to-four family residential real estate loan originations and SEN Leverage loans offset by Mortgage decreases in mortgage warehouse and commercial real 1-4 Family Real Warehouse HFS Estate 28.9% estate loans 19.4% $1,115.4mm • Nonperforming assets totaled $4.6 million, or 0.20% of total Yield: 4.67% assets, at June 30, 2020 compared to $5.1 million, or Other HFI 0.22% of total assets, at March 31, 2020 Multi-Family 3.0% Real Estate 6.5% Commercial Real Estate 28.4% ___________ 10 Note: Securities and loan yields are for 2Q20 and have been annualized.

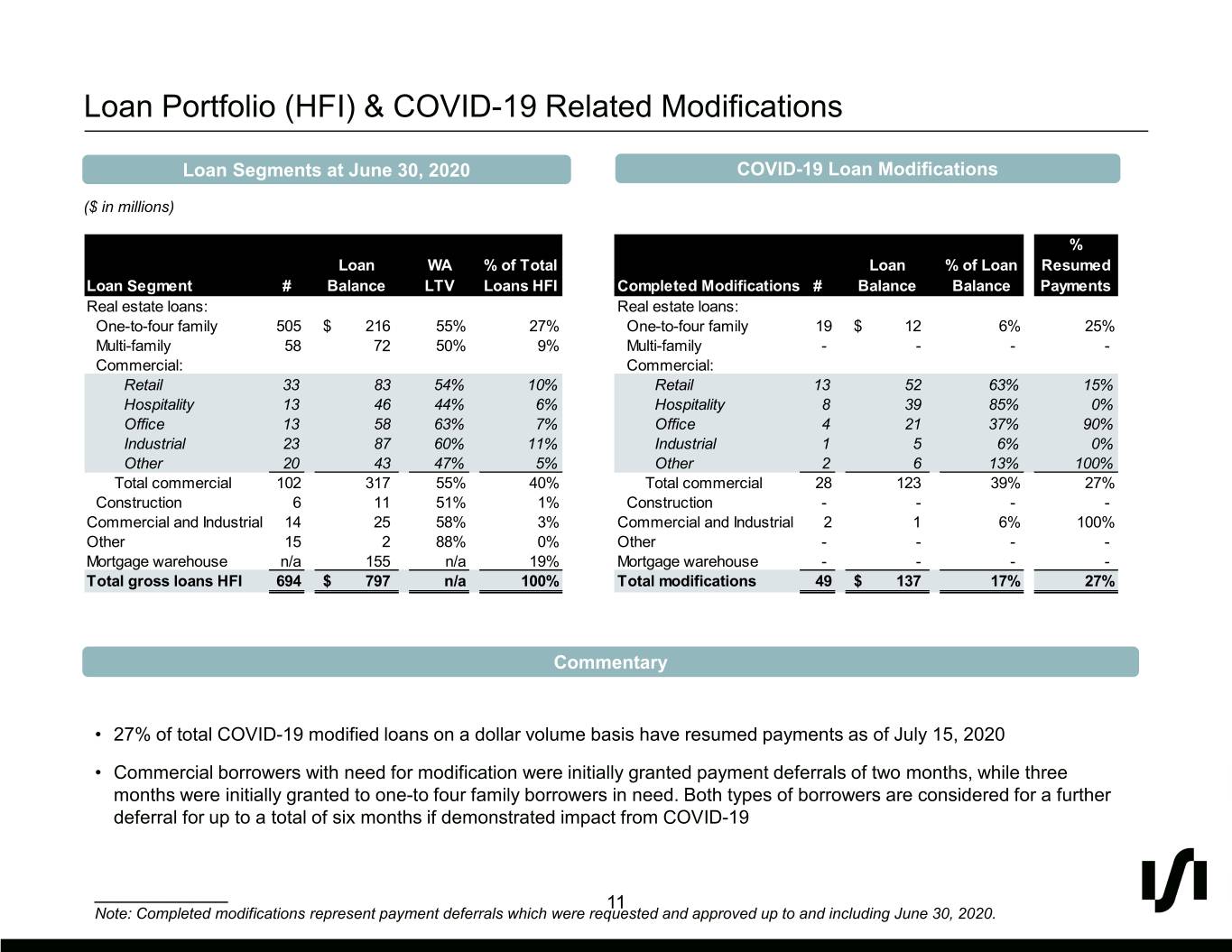

Loan Portfolio (HFI) & COVID-19 Related Modifications Loan Segments at June 30, 2020 COVID-19 Loan Modifications ($ in millions) % Loan WA % of Total Loan % of Loan Resumed Loan Segment # Balance LTV Loans HFI Completed Modifications # Balance Balance Payme nts Real estate loans: Real estate loans: One-to-four family 505 $ 216 55% 27% One-to-four family 19 $ 12 6% 25% Multi-family 58 72 50% 9% Multi-family - - - - Commercial: Commercial: Retail 33 83 54% 10% Retail 13 52 63% 15% Hospitality 13 46 44% 6% Hospitality 8 39 85% 0% Office 13 58 63% 7% Office 4 21 37% 90% Industrial 23 87 60% 11% Industrial 1 5 6% 0% Other 20 43 47% 5% Other 2 6 13% 100% Total commercial 102 317 55% 40% Total commercial 28 123 39% 27% Construction 6 11 51% 1% Construction - - - - Commercial and Industrial 14 25 58% 3% Commercial and Industrial 2 1 6% 100% Other 15 2 88% 0% Other - - - - Mortgage warehouse n/a 155 n/a 19% Mortgage warehouse - - - - Total gross loans HFI 694 $ 797 n/a 100% Total modifications 49 $ 137 17% 27% Commentary • 27% of total COVID-19 modified loans on a dollar volume basis have resumed payments as of July 15, 2020 • Commercial borrowers with need for modification were initially granted payment deferrals of two months, while three months were initially granted to one-to four family borrowers in need. Both types of borrowers are considered for a further deferral for up to a total of six months if demonstrated impact from COVID-19 ___________ 11 Note: Completed modifications represent payment deferrals which were requested and approved up to and including June 30, 2020.

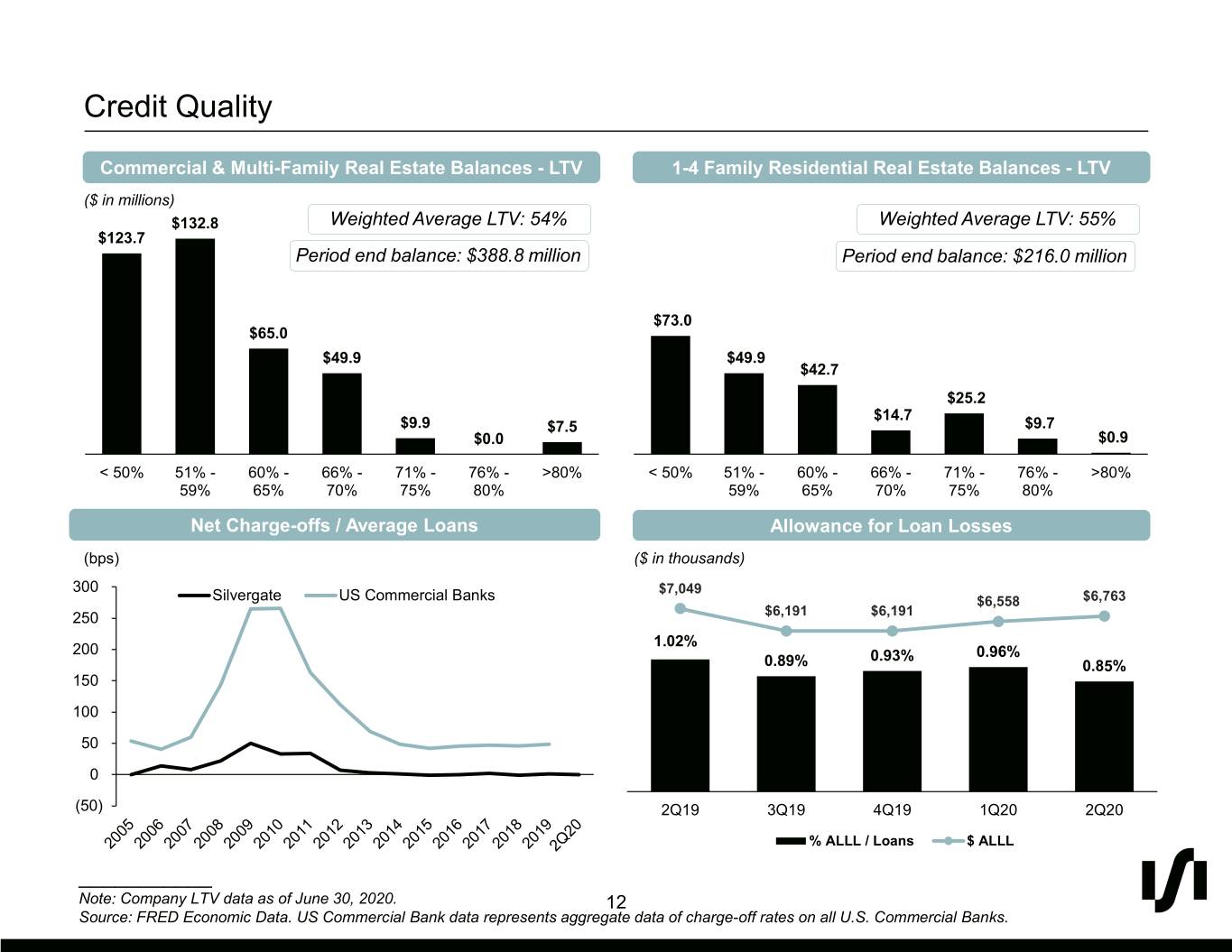

Credit Quality Commercial & Multi-Family Real Estate Balances - LTV 1-4 Family Residential Real Estate Balances - LTV ($ in millions) $132.8 Weighted Average LTV: 54% Weighted Average LTV: 55% $123.7 Period end balance: $388.8 million Period end balance: $216.0 million $73.0 $65.0 $49.9 $49.9 $42.7 $25.2 $14.7 $9.9 $7.5 $9.7 $0.0 $0.9 < 50% 51% - 60% - 66% - 71% - 76% - >80% < 50% 51% - 60% - 66% - 71% - 76% - >80% 59% 65% 70% 75% 80% 59% 65% 70% 75% 80% Net Charge-offs / Average Loans Allowance for Loan Losses (bps) ($ in thousands) 300 $7,049 Silvergate US Commercial Banks $6,558 $6,763 250 $6,191 $6,191 1.02% 200 0.93% 0.96% 0.89% 0.85% 150 100 50 0 (50) 2Q19 3Q19 4Q19 1Q20 2Q20 % ALLL / Loans $ ALLL ___________ Note: Company LTV data as of June 30, 2020. 12 Source: FRED Economic Data. US Commercial Bank data represents aggregate data of charge-off rates on all U.S. Commercial Banks.

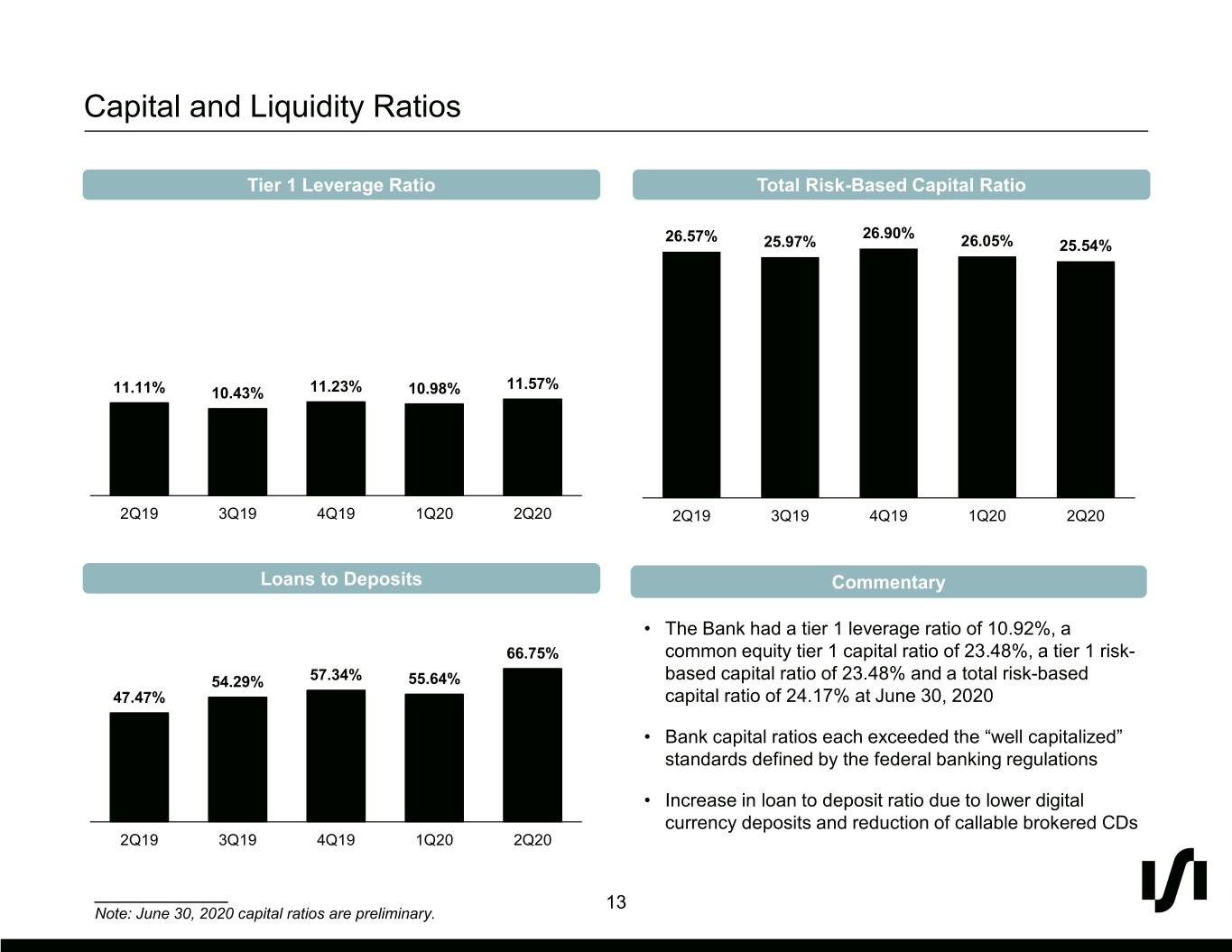

Capital and Liquidity Ratios Tier 1 Leverage Ratio Total Risk-Based Capital Ratio 26.57% 26.90% 25.97% 26.05% 25.54% 11.57% 11.11% 10.43% 11.23% 10.98% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Loans to Deposits Commentary • The Bank had a tier 1 leverage ratio of 10.92%, a 66.75% common equity tier 1 capital ratio of 23.48%, a tier 1 risk- 54.29% 57.34% 55.64% based capital ratio of 23.48% and a total risk-based 47.47% capital ratio of 24.17% at June 30, 2020 • Bank capital ratios each exceeded the “well capitalized” standards defined by the federal banking regulations • Increase in loan to deposit ratio due to lower digital currency deposits and reduction of callable brokered CDs 2Q19 3Q19 4Q19 1Q20 2Q20 ___________ 13 Note: June 30, 2020 capital ratios are preliminary.

Appendix

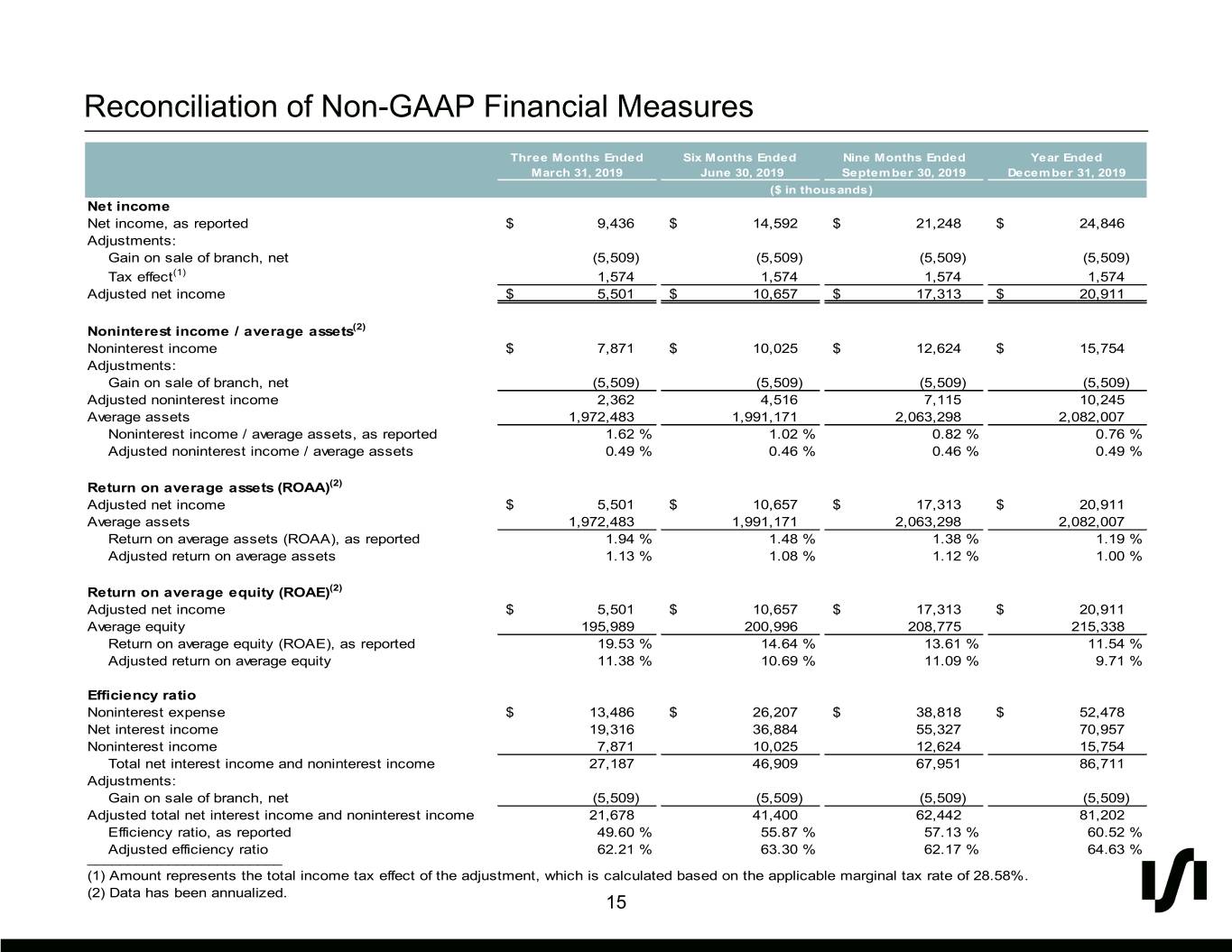

Reconciliation of Non-GAAP Financial Measures Three Months Ended Six Months Ended Nine Months Ended Year Ended March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 ($ in thousands) Net income Net income, as reported $ 9,436 $ 14,592 $ 21,248 $ 24,846 Adjustments: Gain on sale of branch, net (5,509) (5,509) (5,509) (5,509) Tax effect(1) 1,574 1,574 1,574 1,574 Adjusted net income $ 5,501 $ 10,657 $ 17,313 $ 20,911 Noninterest income / average assets(2) Noninterest income $ 7,871 $ 10,025 $ 12,624 $ 15,754 Adjustments: Gain on sale of branch, net (5,509) (5,509) (5,509) (5,509) Adjusted noninterest income 2,362 4,516 7,115 10,245 Average assets 1,972,483 1,991,171 2,063,298 2,082,007 Noninterest income / average assets, as reported 1.62 % 1.02 % 0.82 % 0.76 % Adjusted noninterest income / average assets 0.49 % 0.46 % 0.46 % 0.49 % Return on average assets (ROAA)(2) Adjusted net income $ 5,501 $ 10,657 $ 17,313 $ 20,911 Average assets 1,972,483 1,991,171 2,063,298 2,082,007 Return on average assets (ROAA), as reported 1.94 % 1.48 % 1.38 % 1.19 % Adjusted return on average assets 1.13 % 1.08 % 1.12 % 1.00 % Return on average equity (ROAE)(2) Adjusted net income $ 5,501 $ 10,657 $ 17,313 $ 20,911 Average equity 195,989 200,996 208,775 215,338 Return on average equity (ROAE), as reported 19.53 % 14.64 % 13.61 % 11.54 % Adjusted return on average equity 11.38 % 10.69 % 11.09 % 9.71 % Efficiency ratio Noninterest expense $ 13,486 $ 26,207 $ 38,818 $ 52,478 Net interest income 19,316 36,884 55,327 70,957 Noninterest income 7,871 10,025 12,624 15,754 Total net interest income and noninterest income 27,187 46,909 67,951 86,711 Adjustments: Gain on sale of branch, net (5,509) (5,509) (5,509) (5,509) Adjusted total net interest income and noninterest income 21,678 41,400 62,442 81,202 Efficiency ratio, as reported 49.60 % 55.87 % 57.13 % 60.52 % Adjusted efficiency ratio 62.21 % 63.30 % 62.17 % 64.63 % ________________________ (1) Amount represents the total income tax effect of the adjustment, which is calculated based on the applicable marginal tax rate of 28.58%. (2) Data has been annualized. 15