Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BrightSphere Investment Group Inc. | form8-kxbhmsannounceme.htm |

| EX-2.1 - EXHIBIT 2.1 PURCHASE A - BrightSphere Investment Group Inc. | ex21-bhmsequitypurchas.htm |

Contact: Elie Sugarman ir@bsig.com (617) 369-7300 BrightSphere Investment Group Inc. Announces Divestiture of Affiliates Barrow, Hanley, Mewhinney & Strauss and Copper Rock Capital Partners - Approximately $335 million of expected after-tax proceeds from the divestitures enabling us to reduce debt and repurchase shares, which could generate double digit accretion to 2021 ENI per share, while also allowing us to further support affiliate growth by seeding new strategies - Improved organic growth profile as pro forma business has historically generated positive net flows - Valuation received underscores high intrinsic value of the company’s businesses relative to the company’s current trading levels BOSTON, MA – BrightSphere Investment Group Inc. (NYSE: BSIG) today announced that it has entered into definitive agreements to sell its interests in affiliates Barrow, Hanley, Mewhinney & Strauss, LLC (“Barrow Hanley”) and Copper Rock Capital Partners, LLC (“Copper Rock”). BrightSphere has entered into a definitive agreement to sell its 75.1% ownership interest in Barrow Hanley to Perpetual Limited (ASX: PPT), an Australian publicly listed financial services company, for $319 million. In addition, Perpetual Limited will redeem BrightSphere’s seed capital investments in Barrow Hanley strategies at closing, which had a market value of approximately $44 million as of June 30, 2020. BrightSphere anticipates utilizing a portion of its deferred tax assets to off-set cash taxes associated with the transaction, resulting in total expected after-tax proceeds of approximately $320 million including the seed capital. As of June 30, 2020, Barrow Hanley, a value oriented investment manager with a 40-year track record, had assets under management of $44 billion and estimated year to date GAAP net income attributed to controlling shareholders and Adjusted EBITDA of $17 million and $20 million, respectively1. The transaction is subject to customary regulatory approvals and closing conditions and is anticipated to close in the fourth quarter of 2020. Separately, BrightSphere has agreed to sell its equity interests in Copper Rock to Spouting Rock Asset Management LLC and Copper Rock management. BrightSphere anticipates total after-tax proceeds from this transaction of approximately $15 million, including seed capital but excluding upside sharing arrangements. 1 See our investor presentation, Brightsphere Announces Divestiture of Two Affiliates – Barrow, Hanley, Mewhinney & Strauss, LLC and Copper Rock Capital Partners, dated July 26, 2020, for a reconciliation of Adjusted EBITDA to U.S. GAAP net income attributable to controlling interests for the six months ended June 30, 2020.

Suren Rana, BrightSphere’s President and Chief Executive Officer said, “Following the transactions, our pro forma business will be much more focused on our diversified quantitative and secondary private market strategies and will have a history of consistently generating positive net flows.” “Additionally, these transactions highlight the high intrinsic value embedded in our businesses relative to our stock’s current trading levels. Proceeds from these transactions will allow us to pay down debt and return capital to shareholders through repurchases, which could result in double digit accretion to 2021 ENI per share while also providing capital to support the continued growth of our remaining affiliates by seeding new strategies.” “Finally, I would like to thank our talented teams at Barrow Hanley and Copper Rock for their contributions to our business all these years by relentlessly serving their clients. They are landing in synergistic homes committed to their continued progress and we wish them well in their future initiatives.” Morgan Stanley acted as exclusive financial advisor to BrightSphere in connection with the sale of Barrow Hanley. Ropes & Gray LLP served as the legal advisor. BrightSphere will host a conference call to discuss the transaction at 11:00 A.M. Eastern Time on July 27, 2020. Participants may dial (844) 445-4807 (domestic) or (647) 253-8636 (international) and use the conference ID 1158056. In addition, a copy of the presentation slides to be presented on the conference call are also available at ir.bsig.com. A replay of the call will be available beginning approximately one hour after its conclusion either on BrightSphere’s website, at ir.bsig.com or by dialing (800) 585-8367 (domestic) or (416) 621-4642 (international) conference ID 1158056. About BrightSphere BrightSphere is a diversified, global asset management company with approximately $162 billion of assets under management as of March 31, 2020. Through its world-class investment management Affiliates, BrightSphere offers sophisticated investors access to a wide array of leading quantitative and solutions-based, private and public market alternative, and liquid alpha strategies designed to meet a range of risk and return objectives. For more information, please visit BrightSphere’s website at www.bsig.com. Information that may be important to investors will be routinely posted on our website. Forward Looking Statements This press release includes forward-looking statements, including those related to the after-tax proceeds from our disposition of Barrow Hanley, the expected closing date of the transaction, Barrow Hanley’s financial results for the six months ended June 30, 2020, our liquidity and use of capital resources, including share repurchases and expected ENI per share accretion, and the performance of our Affiliates. The words or phrases “expect,” “anticipate,” “estimate,” and other similar expressions are intended to identify such forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Such

statements are subject to various known and unknown risks and uncertainties and readers should be cautioned that any forward-looking information provided by or on behalf of the Company is not a guarantee of future performance. Actual results may differ materially from those in forward-looking information as a result of various factors, some of which are beyond the Company’s control, including, but not limited to, those discussed in the Company’s most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 2, 2020, Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on May 11, 2020, and subsequent SEC filings, including risks related to the disruption caused by the COVID-19 pandemic, which has and is expected to continue to materially affect our business, financial condition, results of operations and cash flows for an extended period of time, as well as those related to the expected closing of the transaction, the timing of such closing and the satisfaction of necessary closing conditions. Due to such risks and uncertainties and other factors, the Company cautions each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this press release and the Company undertakes no obligations to update any forward looking statement to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures This communication contains non-GAAP financial measures. Reconciliations of GAAP to non- GAAP financial measures are included in the Appendix of this communication. Adjusted EBITDA is defined as economic net income before interest, income taxes, depreciation and amortization. The Company notes that its calculation of Adjusted EBITDA may not be consistent with Adjusted EBITDA as calculated by other companies. The Company believes Adjusted EBITDA is a useful liquidity metric because it indicates the Company’s ability to make further investments in its business, service debt and meet working capital requirements. BSIG 2020031

BrightSphere Announces Divestiture of Two Affiliates – Barrow, Hanley, Mewhinney & Strauss, LLC and Copper Rock Capital Partners July 26, 2020

Forward-Looking Statements This presentation includes forward-looking statements, including those related to the after-tax proceeds from our disposition of Barrow Hanley, the expected closing date of the transaction, Barrow Hanley’s financial results for the six months ended June 30, 2020, our liquidity and use of capital resources, including share repurchases and expected ENI per share accretion, and the performance of our Affiliates. The words or phrases “expect,” “anticipate,” “estimate,” and other similar expressions are intended to identify such forward- looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Such statements are subject to various known and unknown risks and uncertainties and readers should be cautioned that any forward- looking information provided by or on behalf of the Company is not a guarantee of future performance. Actual results may differ materially from those in forward-looking information as a result of various factors, some of which are beyond the Company’s control, including, but not limited to, those discussed in the Company’s most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 2, 2020, Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on May 11, 2020, and subsequent SEC filings, including risks related to the disruption caused by the COVID-19 pandemic, which has and is expected to continue to materially affect our business, financial condition, results of operations and cash flows for an extended period of time, as well as those related to the expected closing of the transaction, the timing of such closing and the satisfaction of necessary closing conditions. Due to such risks and uncertainties and other factors, the Company cautions each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this presentation and the Company undertakes no obligations to update any forward looking statement to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures This communication contains non-GAAP financial measures. Reconciliations of GAAP to non-GAAP financial measures are included in the Appendix of this communication. Adjusted EBITDA is defined as economic net income before interest, income taxes, depreciation and amortization. The Company notes that its calculation of Adjusted EBITDA may not be consistent with Adjusted EBITDA as calculated by other companies. The Company believes Adjusted EBITDA is a useful liquidity metric because it indicates the Company’s ability to make further investments in its business, service debt and meet working capital requirements. 2

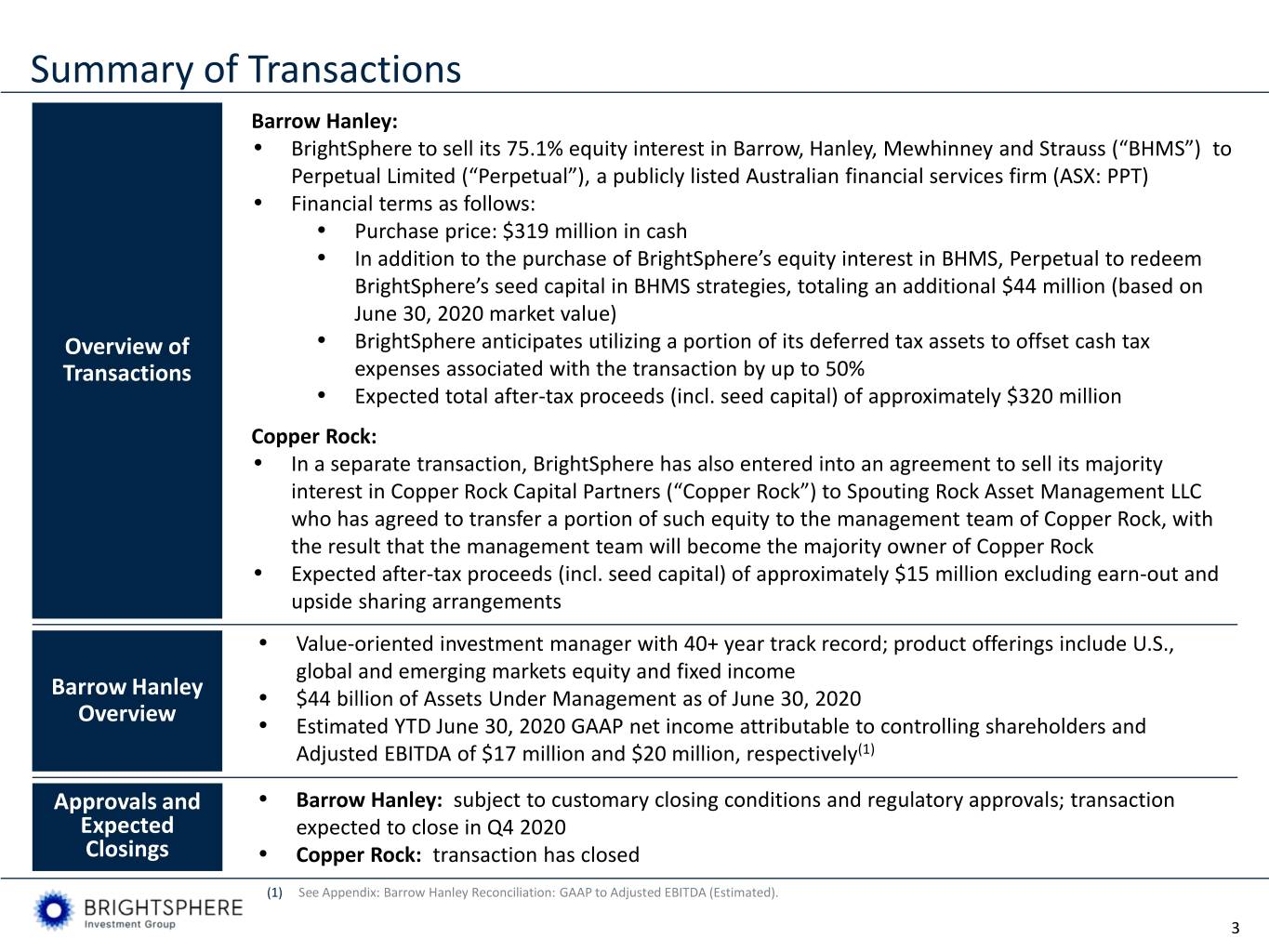

Summary of Transactions Barrow Hanley: • BrightSphere to sell its 75.1% equity interest in Barrow, Hanley, Mewhinney and Strauss (“BHMS”) to Perpetual Limited (“Perpetual”), a publicly listed Australian financial services firm (ASX: PPT) • Financial terms as follows: • Purchase price: $319 million in cash • In addition to the purchase of BrightSphere’s equity interest in BHMS, Perpetual to redeem BrightSphere’s seed capital in BHMS strategies, totaling an additional $44 million (based on June 30, 2020 market value) Overview of • BrightSphere anticipates utilizing a portion of its deferred tax assets to offset cash tax Transactions expenses associated with the transaction by up to 50% • Expected total after-tax proceeds (incl. seed capital) of approximately $320 million Copper Rock: • In a separate transaction, BrightSphere has also entered into an agreement to sell its majority interest in Copper Rock Capital Partners (“Copper Rock”) to Spouting Rock Asset Management LLC who has agreed to transfer a portion of such equity to the management team of Copper Rock, with the result that the management team will become the majority owner of Copper Rock • Expected after-tax proceeds (incl. seed capital) of approximately $15 million excluding earn-out and upside sharing arrangements • Value-oriented investment manager with 40+ year track record; product offerings include U.S., global and emerging markets equity and fixed income Barrow Hanley • $44 billion of Assets Under Management as of June 30, 2020 Overview • Estimated YTD June 30, 2020 GAAP net income attributable to controlling shareholders and Adjusted EBITDA of $17 million and $20 million, respectively(1) Approvals and • Barrow Hanley: subject to customary closing conditions and regulatory approvals; transaction Expected expected to close in Q4 2020 Closings • Copper Rock: transaction has closed (1) See Appendix: Barrow Hanley Reconciliation: GAAP to Adjusted EBITDA (Estimated). 3

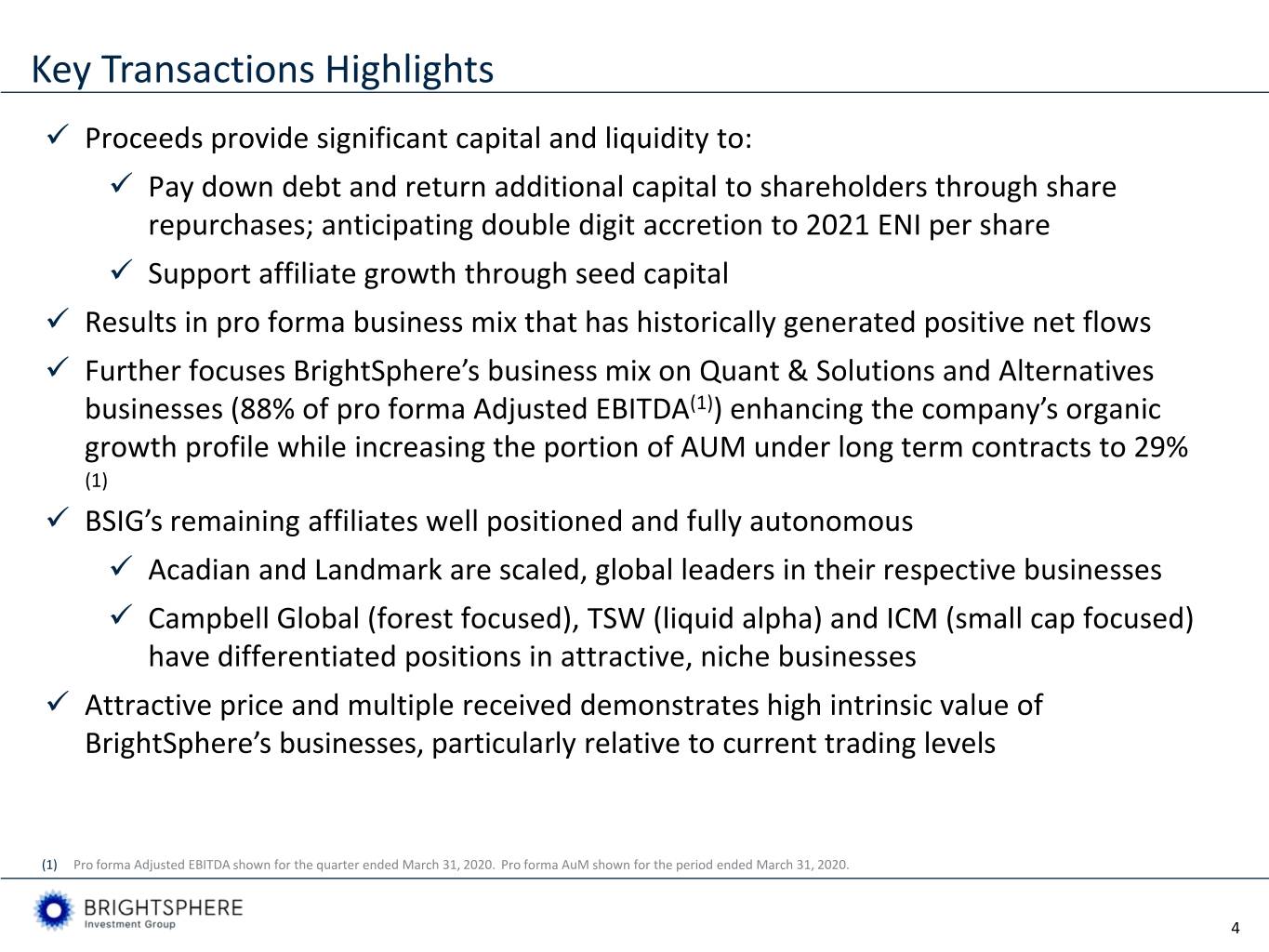

Key Transactions Highlights Proceeds provide significant capital and liquidity to: Pay down debt and return additional capital to shareholders through share repurchases; anticipating double digit accretion to 2021 ENI per share Support affiliate growth through seed capital Results in pro forma business mix that has historically generated positive net flows Further focuses BrightSphere’s business mix on Quant & Solutions and Alternatives businesses (88% of pro forma Adjusted EBITDA(1)) enhancing the company’s organic growth profile while increasing the portion of AUM under long term contracts to 29% (1) BSIG’s remaining affiliates well positioned and fully autonomous Acadian and Landmark are scaled, global leaders in their respective businesses Campbell Global (forest focused), TSW (liquid alpha) and ICM (small cap focused) have differentiated positions in attractive, niche businesses Attractive price and multiple received demonstrates high intrinsic value of BrightSphere’s businesses, particularly relative to current trading levels (1) Pro forma Adjusted EBITDA shown for the quarter ended March 31, 2020. Pro forma AuM shown for the period ended March 31, 2020. 4

Pro Forma Business Mix Positioned to Generate Organic Growth Quant & Solutions (1) Alternatives (1) Liquid Alpha (1) • Highly scalable offerings with • Diverse secondaries private • Demonstrated long-term alpha substantial capacity and growing market strategies in private generation across diverse, long- global demand equity, real estate and real assets only international and domestic • Leveraging data and technology • Predominately private market, public securities strategies in computational factor-based with selected differentiated liquid including equities and fixed investment process strategies income • Versatile, highly-tailored, • More than 90% of revenue • Strong performance over market outcome-driven investing to comprising management fees cycles driven by consistent achieve client-specific goals from long-term committed investment discipline • Ongoing product innovation capital • Expansion into in-demand, higher responds to evolving client needs • Long-dated investment periods fee offerings support healthy operating margins • Multi-Asset Class capability provide long-term committed meeting increased demand for assets • Disciplined adherence to broad-based, bespoke • Growing global investor base and investment processes across investment solutions substantial capacity market cycles (1) Certain smaller Acadian strategies are included in Alternatives and certain TSW strategies are included in Quant & Solutions where the classification is more appropriate. 5

Pro Forma Business’ Net Client Cash Flows Have Been Strong $12.0b $10.6b $10.0b $8.0b $7.2b $6.0b $4.0b $1.9b $2.0b $1.5b $0.0b 2017 2018 2019 YTD Mar-20 % of BoP AUM(1) 9% 5% 1% 4% (1) Beginning of period AuM figures exclude Heitman for 2017 and 2018. Pro Forma excludes historical net client cash flows from Barrow Hanley and Copper Rock. YTD % of BoP AuM shown on an annualized basis. 6

More Attractive Pro Forma Business Mix – by Earnings Metric (1) ENI Revenue Economic Net Income (2) Adjusted EBITDA (2) Alternatives Alternatives Alternatives 18% 23% 17% Quant & Solutions Quant & 48% Solutions Quant & Liquid Alpha Liquid Alpha 53% Solutions BrightSphere 27% 29% 56% Liquid Alpha 29% Alternatives Alternatives 22% Alternatives 29% 20% Liquid Alpha Quant & Liquid Alpha 12% Pro Forma Pro Solutions 13% Quant & Quant & Liquid Alpha 59% Solutions 12% Solutions 65% 68% Note: See our quarterly report on Form 10-Q for the quarterly period ended March 31, 2020 for additional information on the Company’s calculation of economic net income and adjusted EBITDA. (1) All figures shown are for the quarter ended March 31, 2020. Pro forma figures give effect to the dispositions of Barrow Hanley and Copper Rock. (2) Figures represent percentage of segment economic net income and adjusted EBITDA, and excludes economic net income and adjusted EBITDA of head office and other costs classified as ‘other’ as reflected in the segment reporting in the company’s Form 10-Q. 7

More Attractive Pro Forma Business Mix – by AUM (1) By Segment By Asset Class By Client Location Alternatives Alternatives Other Australia 15% 15% 7% 4% Fixed Asia Quant & Income 6% Solutions 8% 49% Europe 10% BrightSphere Liquid Alpha 36% Equity USA 77% 73% Alternatives Alternatives Australia Other 20% 20% 5% 7% Asia Fixed 6% Income 2% Liquid Alpha Europe 14% 12% Pro Forma Pro Quant & Solutions USA 66% Equity 70% 78% (1) AUM as of Q1 2020. Pro forma figures give effect to the dispositions of Barrow Hanley and Copper Rock. 8

Appendix

Barrow Hanley Reconciliation: GAAP to Adjusted EBITDA (Estimated) $ in millions YTD Period Ended June 30, 2020(1) U.S. GAAP net income attributable to controlling interests $17 Non-cash key employee-owned equity and profit interest revaluations (2) ($3) Interest income ($0) Interest expense $0 Depreciation and amortization $0 Income tax expense $6 Adjusted EBITDA $20 Note: See our quarterly report on Form 10-Q for the quarterly period ended March 31, 2020 for additional information on the Company’s calculation of economic net income and adjusted EBITDA. (1) This financial data is preliminary and may change. It has been prepared by, and is the responsibility of the Company’s management. KPMG LLP, the Company’s independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial data, nor have any other independent accountants. There can be no assurance that the Company’s actual results for this period will not differ from the preliminary financial data and such changes could be material. Investors should not place undue reliance on the limited preliminary information being provided herein. (2) Represents non-cash expenses reflecting changes in the value of Affiliate equity and profit interests held by Affiliate key employees. 10