Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANK OF HAWAII CORP | boh2q2020erex991072720.htm |

| 8-K - 8-K - BANK OF HAWAII CORP | boh-20200727.htm |

Bank of Hawaii Corporation Second Quarter 2020 Financial Results July 27, 2020

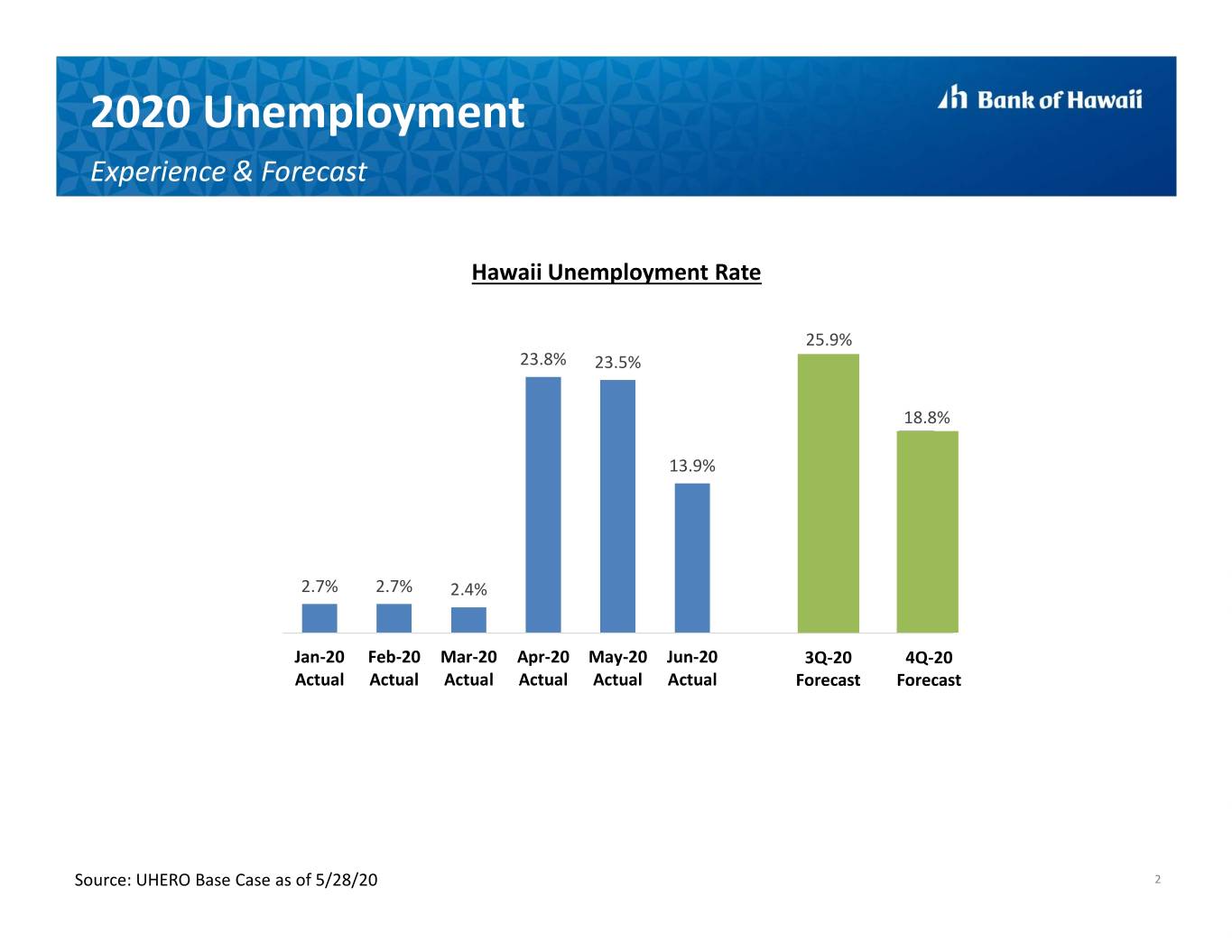

2020 Unemployment Experience & Forecast Hawaii Unemployment Rate 25.9% 23.8% 23.5% 18.8% 13.9% 2.7% 2.7% 2.4% Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 3Q-20 4Q-20 Actual Actual Actual Actual Actual Actual Forecast Forecast Source: UHERO Base Case as of 5/28/20 2

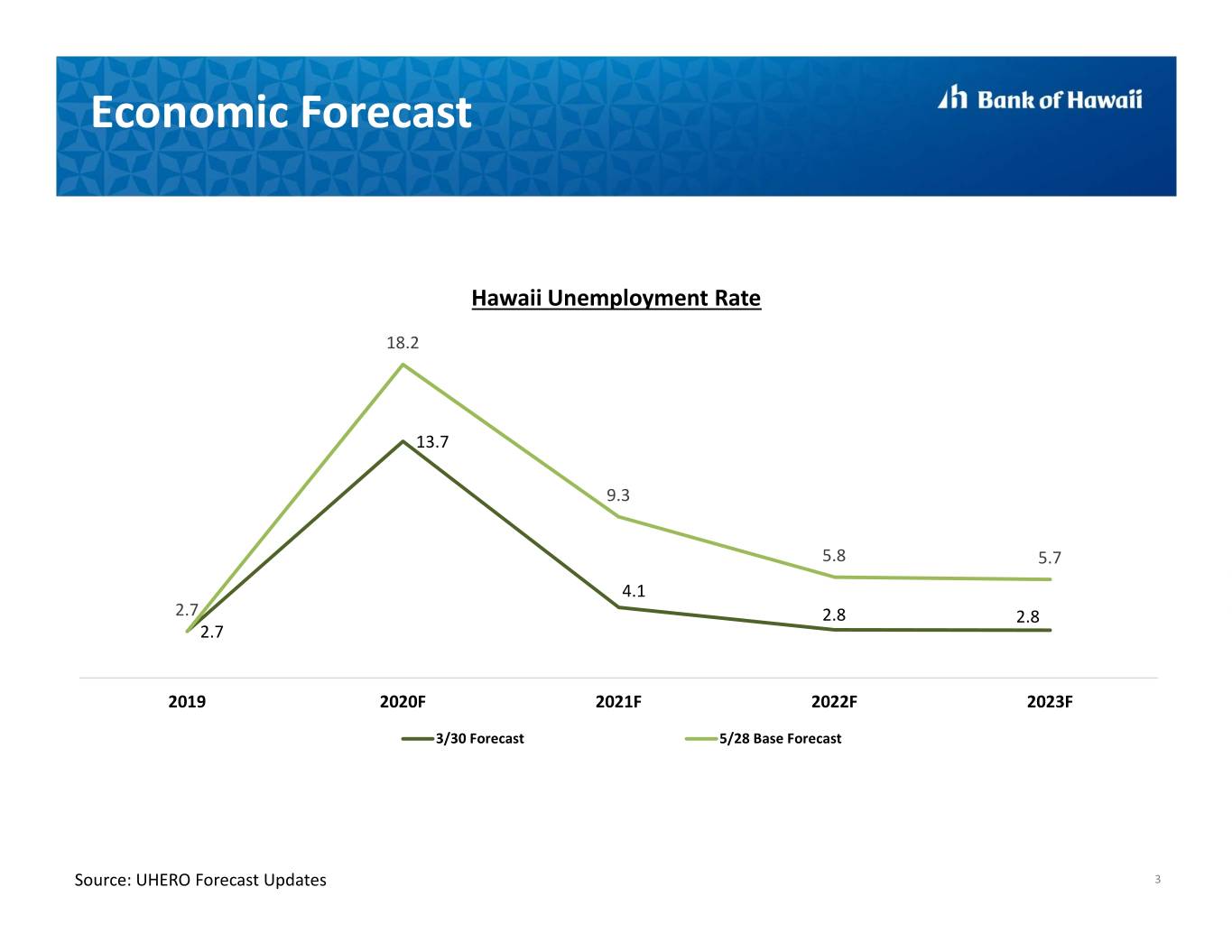

Economic Forecast Hawaii Unemployment Rate 18.2 13.7 9.3 5.8 5.7 4.1 2.7 2.8 2.8 2.7 2019 2020F 2021F 2022F 2023F 3/30 Forecast 5/28 Base Forecast Source: UHERO Forecast Updates 3

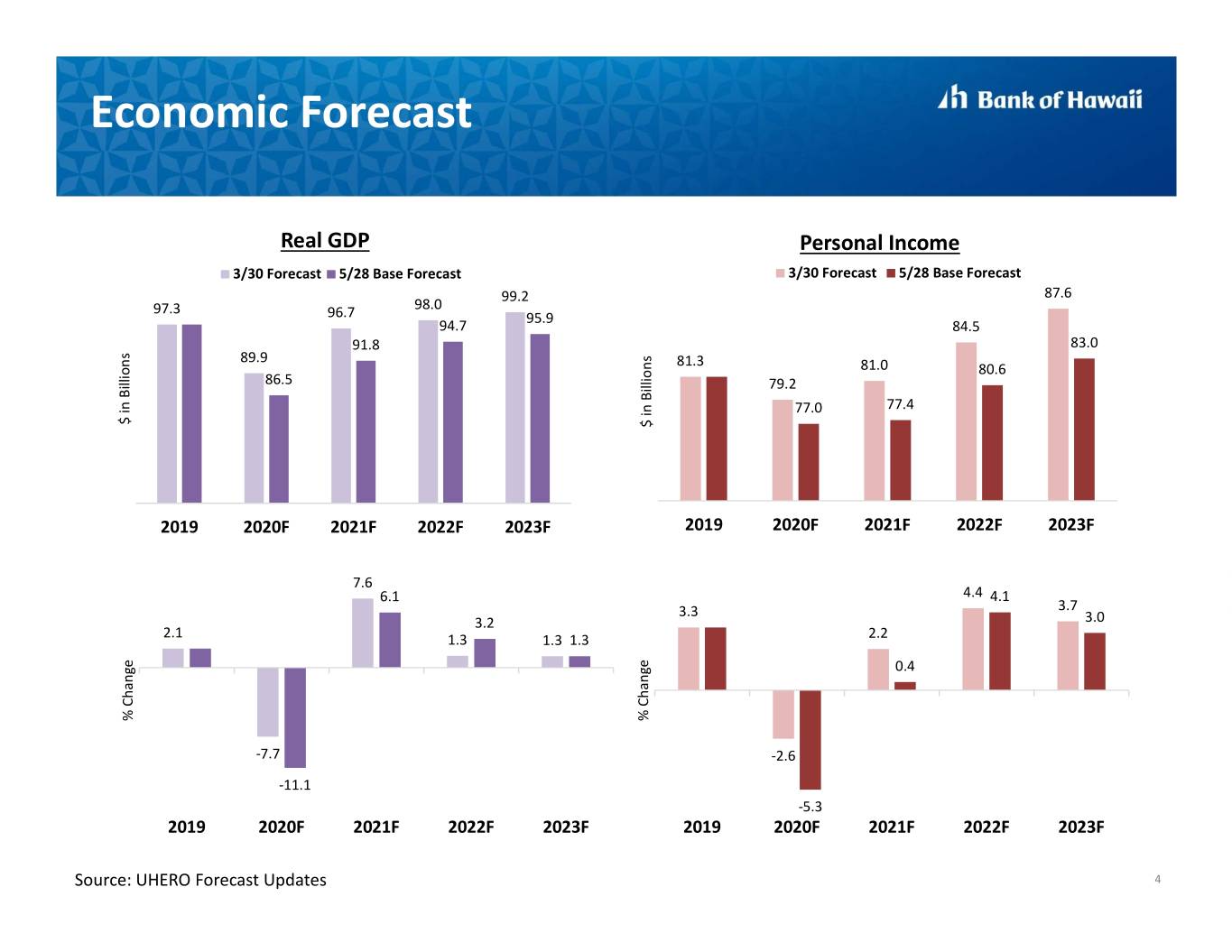

Economic Forecast Real GDP Personal Income 3/30 Forecast 5/28 Base Forecast 3/30 Forecast 5/28 Base Forecast 99.2 87.6 97.3 98.0 96.7 95.9 94.7 84.5 91.8 83.0 89.9 81.3 81.0 80.6 86.5 79.2 77.0 77.4 $ in$ Billions $ in$ Billions 2019 2020F 2021F 2022F 2023F 2019 2020F 2021F 2022F 2023F 7.6 6.1 4.4 4.1 3.3 3.7 3.2 3.0 2.1 1.3 1.3 1.3 2.2 0.4 % % Change % Change -7.7 -2.6 -11.1 -5.3 2019 2020F 2021F 2022F 2023F 2019 2020F 2021F 2022F 2023F Source: UHERO Forecast Updates 4

Well Positioned • Strong Credit Metrics • Continued Stable Loan Growth • Strong Core Deposit Growth • Well Managed Funding Costs • Strong Liquidity • Solid Capital Levels 5

Credit Overview

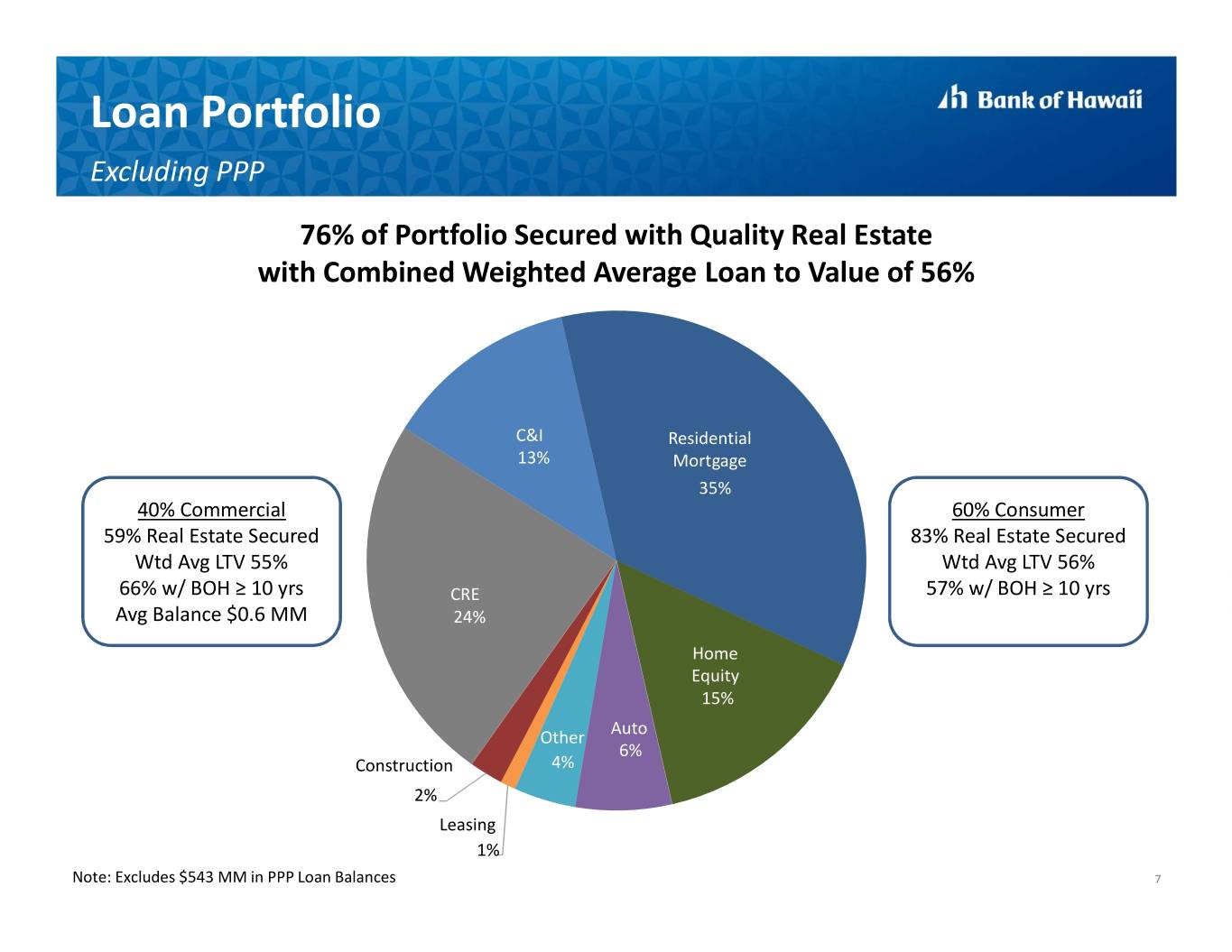

Loan Portfolio Excluding PPP 76% of Portfolio Secured with Quality Real Estate with Combined Weighted Average Loan to Value of 56% C&I Residential 13% Mortgage 35% 40% Commercial 60% Consumer 59% Real Estate Secured 83% Real Estate Secured Wtd Avg LTV 55% Wtd Avg LTV 56% 66% w/ BOH ≥ 10 yrs CRE 57% w/ BOH ≥ 10 yrs Avg Balance $0.6 MM 24% Home Equity 15% Other Auto 6% Construction 4% 2% Leasing 1% Note: Excludes $543 MM in PPP Loan Balances 7

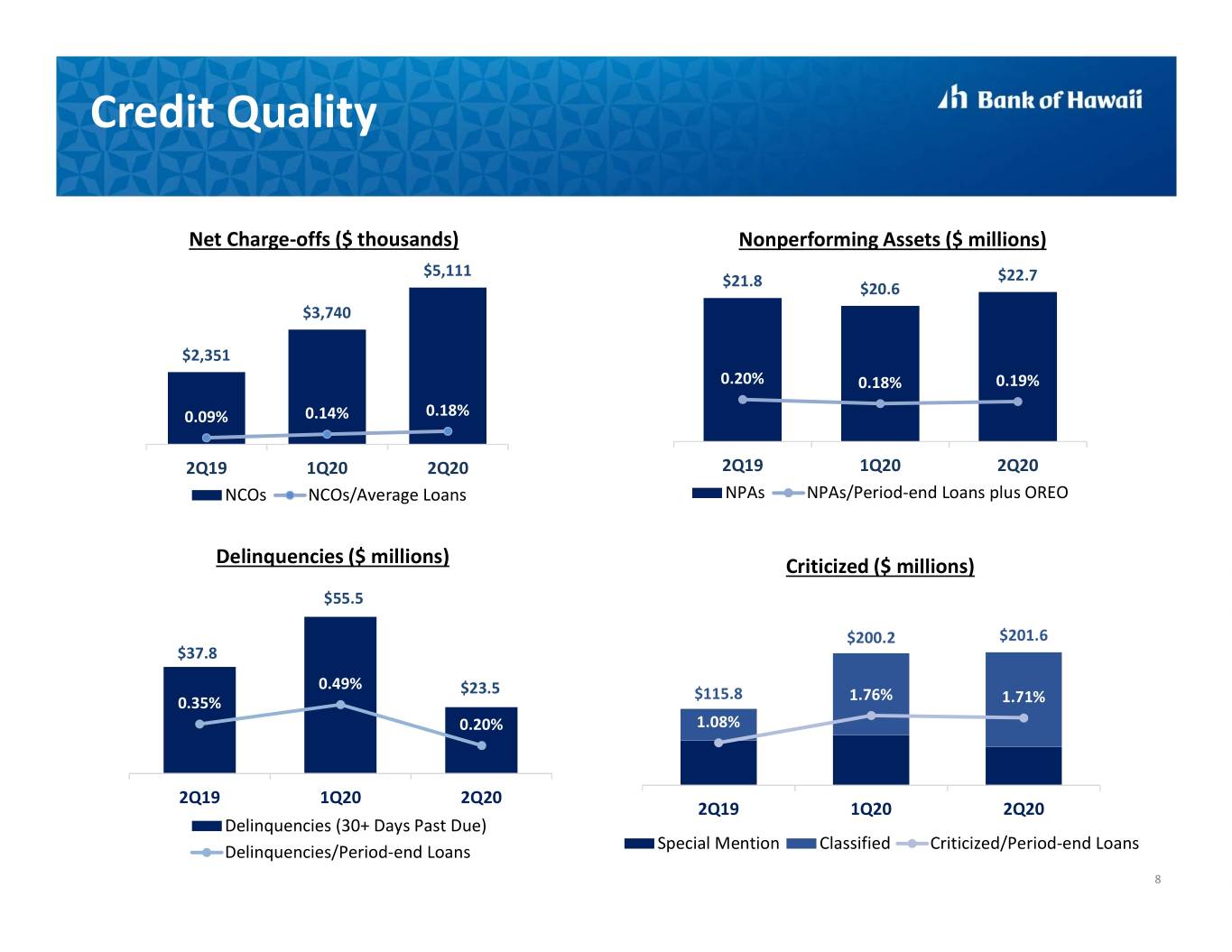

Credit Quality 1.00% Net Charge-offs ($ thousands) $30.0 Nonperforming Assets ($ millions) $6, 000 2.50% 0.80% $5,111 $25.0 $21.8 $22.7 $5, 000 2.00% $20.6 $20.0 0.60% $4, 000 $3,740 1.50% $15.0 $3, 000 $2,351 0.40% 1.00% $10.0 $2, 000 0.20% 0.18% 0.19% 0.20% 0.50% $5.0 $1, 000 0.09% 0.14% 0.18% $0.0 0.00% $0 0.00% 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20 NCOs NCOs/Average Loans NPAs NPAs/Period-end Loans plus OREO Delinquencies ($ millions) $70.0 1.40% Criticized ($ millions) 300 5.00% 4.80%4.85%4.90%4.95% $60.0 $55.5 1.20% 4.65%4.70%4.75% 4.45%4.50%4.55%4.60% 4.25%4.30%4.35%4.40% 4.05%4.10%4.15%4.20% $50.0 1.00% 3.95%4.00% $201.6 3.75%3.80%3.85%3.90% $200.2 3.55%3.60%3.65%3.70% 200 3.35%3.40%3.45%3.50% $40.0 $37.8 0.80% 3.25%3.30% 3.05%3.10%3.15%3.20% 2.85%2.90%2.95%3.00% 2.65%2.70%2.75%2.80% $30.0 0.49% 0.60% 2.50%2.55%2.60% $23.5 2.30%2.35%2.40%2.45% $115.8 1.76% 1.71% 2.10%2.15%2.20%2.25% 0.35% 1.90%1.95%2.00%2.05% $20.0 0.40% 1.80%1.85% 100 1.60%1.65%1.70%1.75% 0.20% 1.08% 1.40%1.45%1.50%1.55% 1.20%1.25%1.30%1.35% $10.0 0.20% 1.10%1.15% 0.90%0.95%1.00%1.05% 0.70%0.75%0.80%0.85% 0.50%0.55%0.60%0.65% $0.0 0.00% 0.40%0.45% 0.20%0.25%0.30%0.35% 0 0.00%0.05%0.10%0.15% 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20 Delinquencies (30+ Days Past Due) Delinquencies/Period-end Loans Special Mention Classified Criticized/Period-end Loans 8

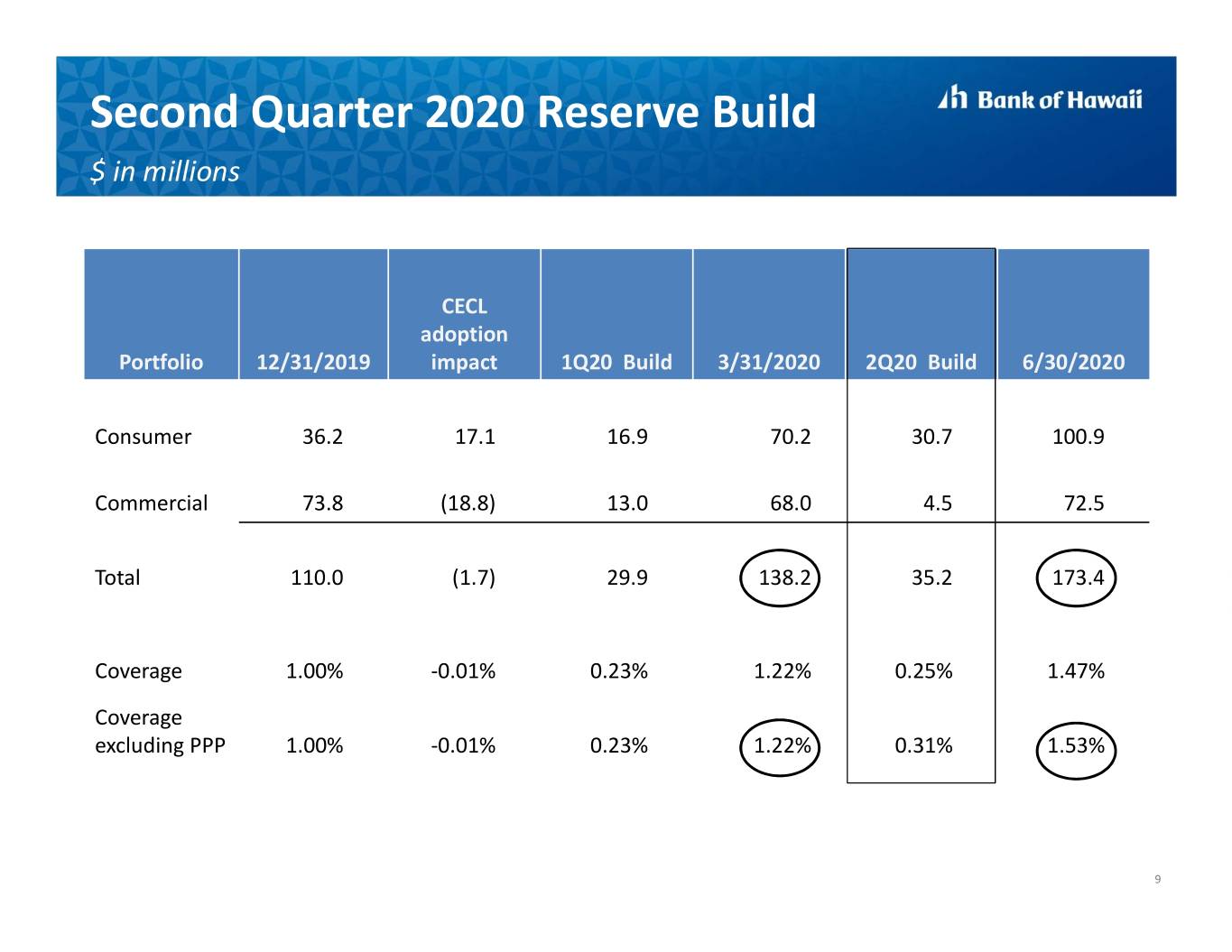

Second Quarter 2020 Reserve Build $ in millions CECL adoption Portfolio 12/31/2019 impact 1Q20 Build 3/31/2020 2Q20 Build 6/30/2020 Consumer 36.2 17.1 16.9 70.2 30.7 100.9 Commercial 73.8 (18.8) 13.0 68.0 4.5 72.5 Total 110.0 (1.7) 29.9 138.2 35.2 173.4 Coverage 1.00% -0.01% 0.23% 1.22% 0.25% 1.47% Coverage excluding PPP 1.00% -0.01% 0.23% 1.22% 0.31% 1.53% 9

Customer Relief Update $1.9 B (16%) Deferrals & Extensions as of 2Q20 Total Modifications Consumer Commercial 12% Outstandings 21% Outstandings Consumer 7% Forbearance Principal 8% 17% Commercial Extension 9% 4% Interest 1% P&I 3% No Modification No Modification No Modification 88% 79% 84% 10

Customer Relief Update • 17,300 Accounts as of June 30th • Deceleration in Activity Since Peak in April Weekly Payment Deferrals Granted $250 $600 $500 $200 $400 $150 $300 millions $100 millions $200 $50 $100 $0 $0 New Consumer New Commercial 11

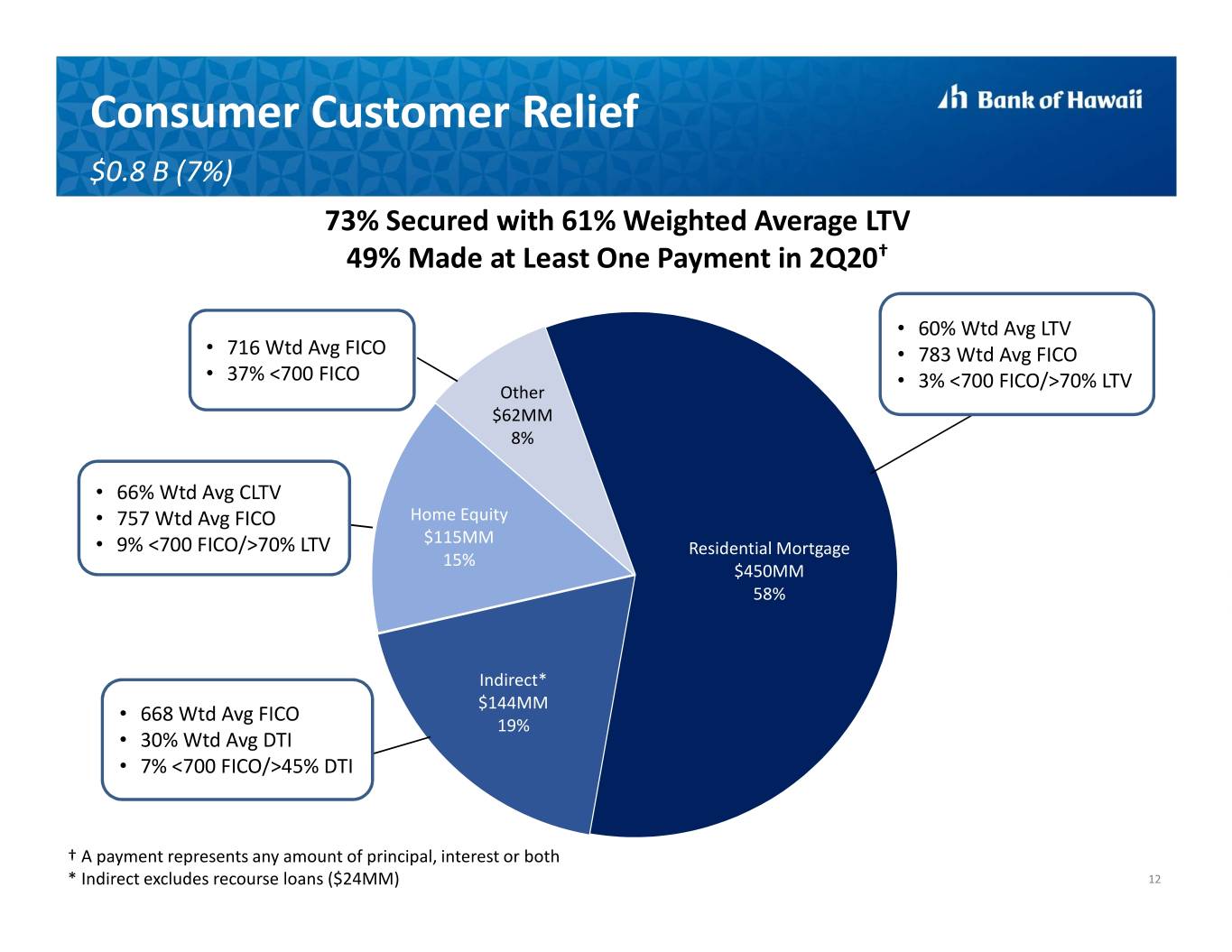

Consumer Customer Relief $0.8 B (7%) 73% Secured with 61% Weighted Average LTV 49% Made at Least One Payment in 2Q20† • 60% Wtd Avg LTV • 716 Wtd Avg FICO • 783 Wtd Avg FICO • 37% <700 FICO • 3% <700 FICO/>70% LTV Other $62MM 8% • 66% Wtd Avg CLTV • 757 Wtd Avg FICO Home Equity $115MM • 9% <700 FICO/>70% LTV Residential Mortgage 15% $450MM 58% Indirect* $144MM • 668 Wtd Avg FICO 19% • 30% Wtd Avg DTI • 7% <700 FICO/>45% DTI † A payment represents any amount of principal, interest or both * Indirect excludes recourse loans ($24MM) 12

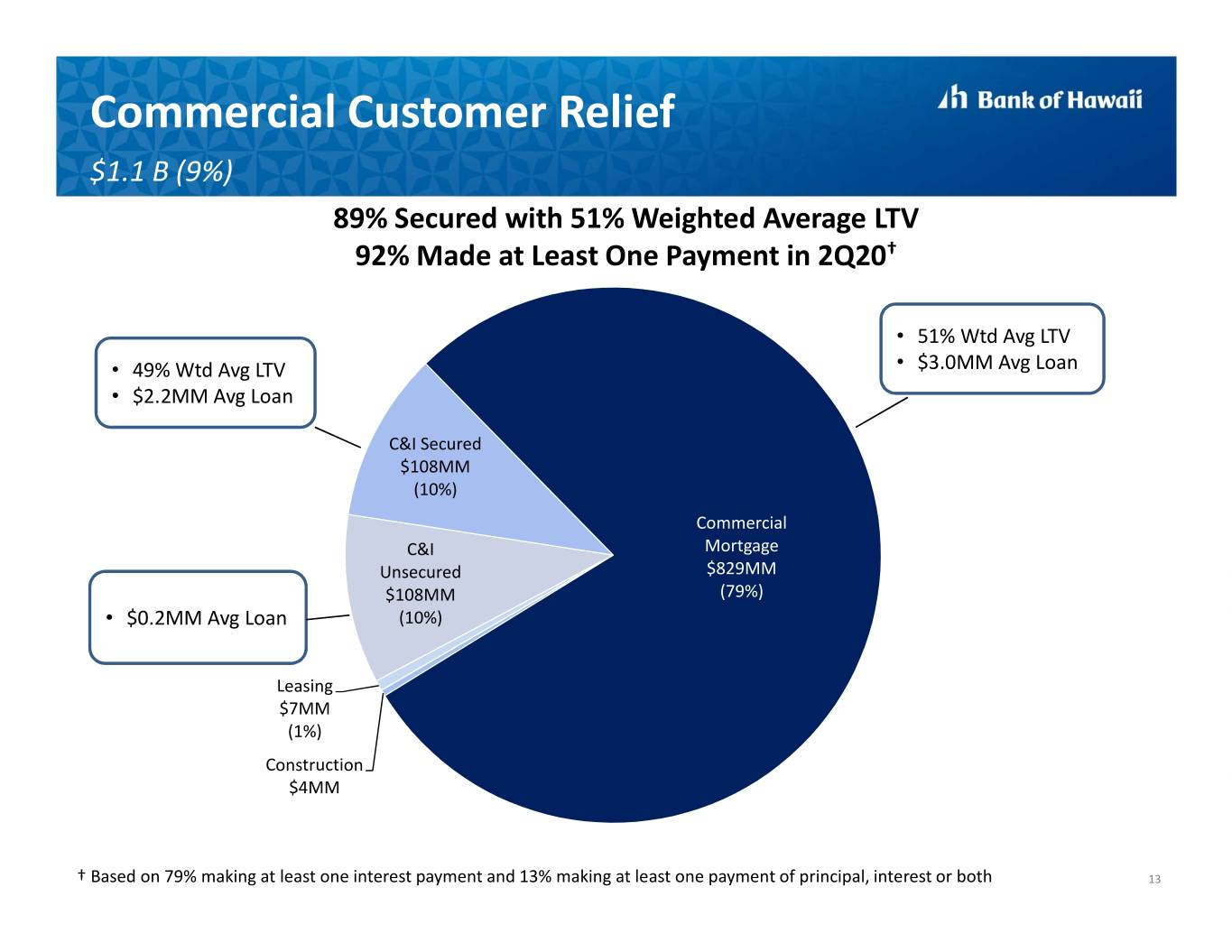

Commercial Customer Relief $1.1 B (9%) 89% Secured with 51% Weighted Average LTV 92% Made at Least One Payment in 2Q20† • 51% Wtd Avg LTV • 49% Wtd Avg LTV • $3.0MM Avg Loan • $2.2MM Avg Loan C&I Secured $108MM (10%) Commercial C&I Mortgage Unsecured $829MM $108MM (79%) • $0.2MM Avg Loan (10%) Leasing $7MM (1%) Construction $4MM † Based on 79% making at least one interest payment and 13% making at least one payment of principal, interest or both 13

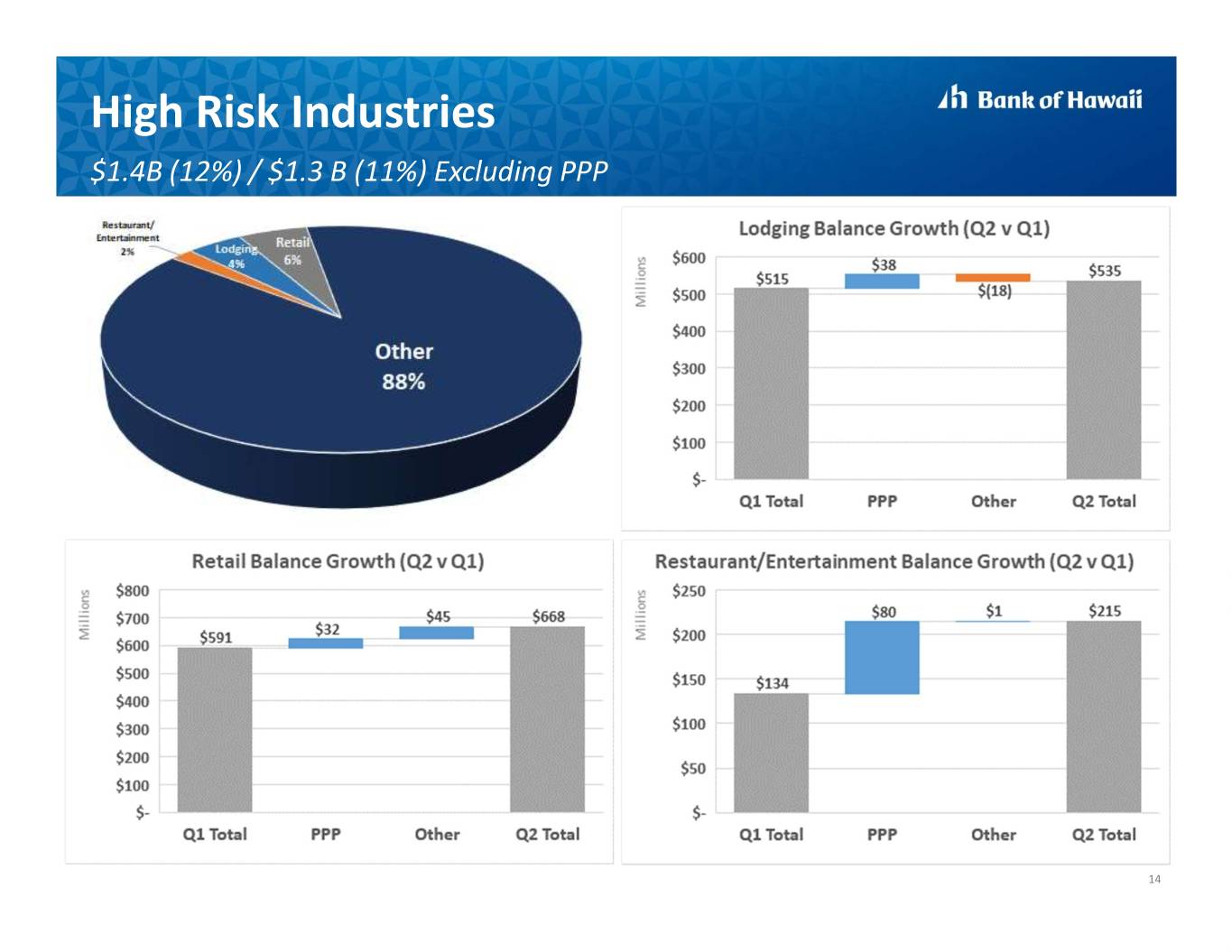

High Risk Industries $1.4B (12%) / $1.3 B (11%) Excluding PPP Lodging` retail lodging retail all others 14

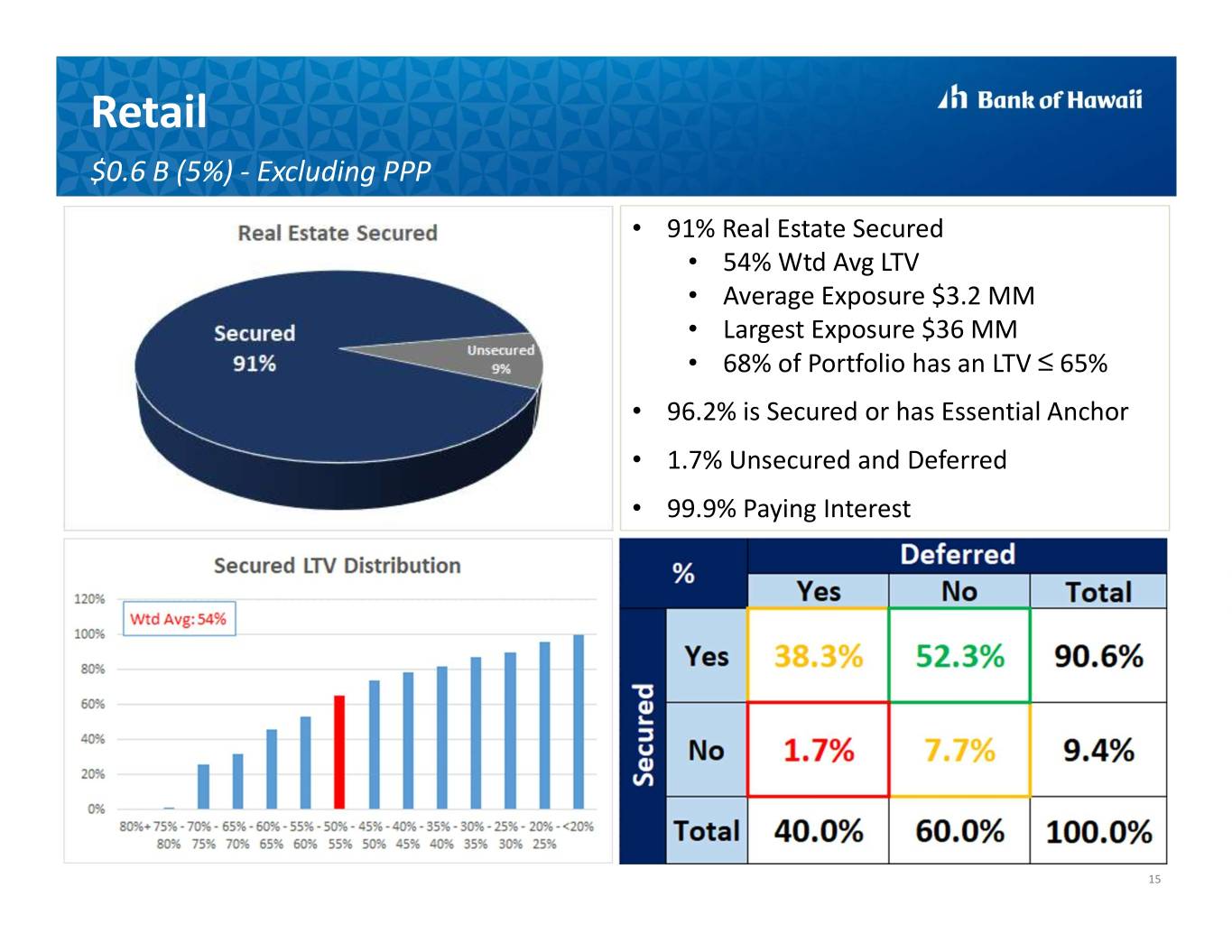

Retail $0.6 B (5%) - Excluding PPP • 91% Real Estate Secured • 54% Wtd Avg LTV • Average Exposure $3.2 MM • Largest Exposure $36 MM • 68% of Portfolio has an LTV ≤ 65% • 96.2% is Secured or has Essential Anchor • 1.7% Unsecured and Deferred • 99.9% Paying Interest 15

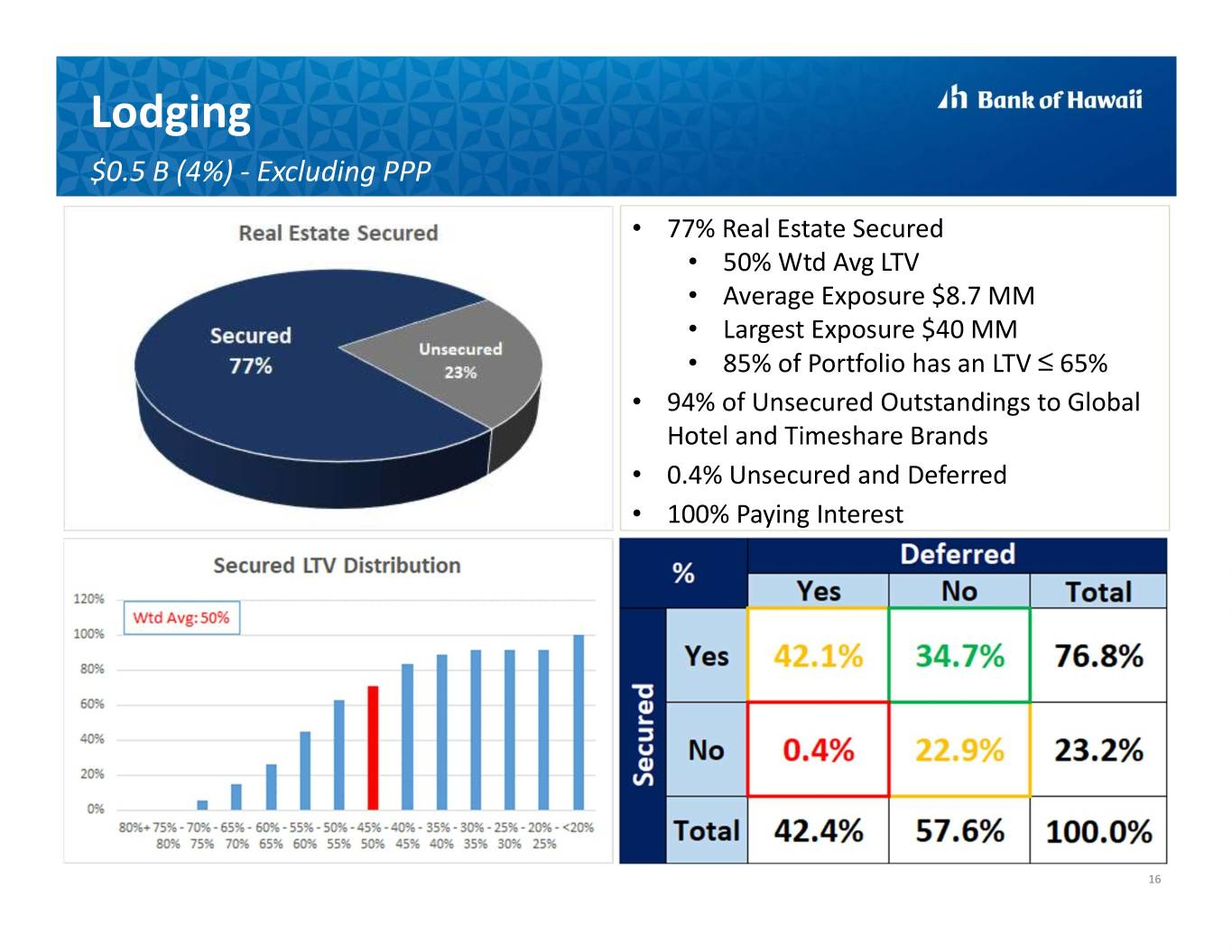

Lodging $0.5 B (4%) - Excluding PPP • 77% Real Estate Secured • 50% Wtd Avg LTV • Average Exposure $8.7 MM • Largest Exposure $40 MM • 85% of Portfolio has an LTV ≤ 65% • 94% of Unsecured Outstandings to Global Hotel and Timeshare Brands • 0.4% Unsecured and Deferred • 100% Paying Interest 16

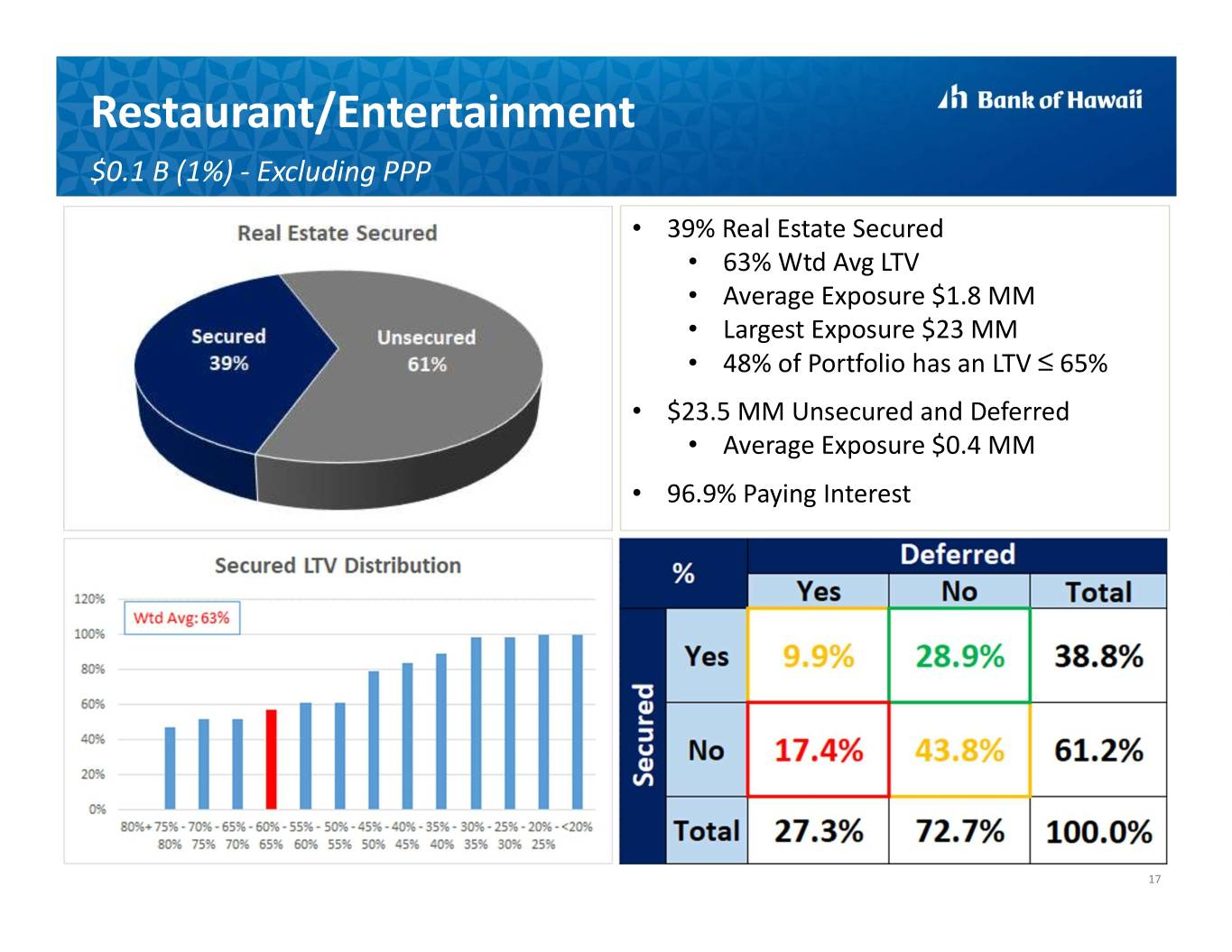

Restaurant/Entertainment $0.1 B (1%) - Excluding PPP • 39% Real Estate Secured • 63% Wtd Avg LTV • Average Exposure $1.8 MM • Largest Exposure $23 MM • 48% of Portfolio has an LTV ≤ 65% • $23.5 MM Unsecured and Deferred • Average Exposure $0.4 MM • 96.9% Paying Interest 17

Financial Overview

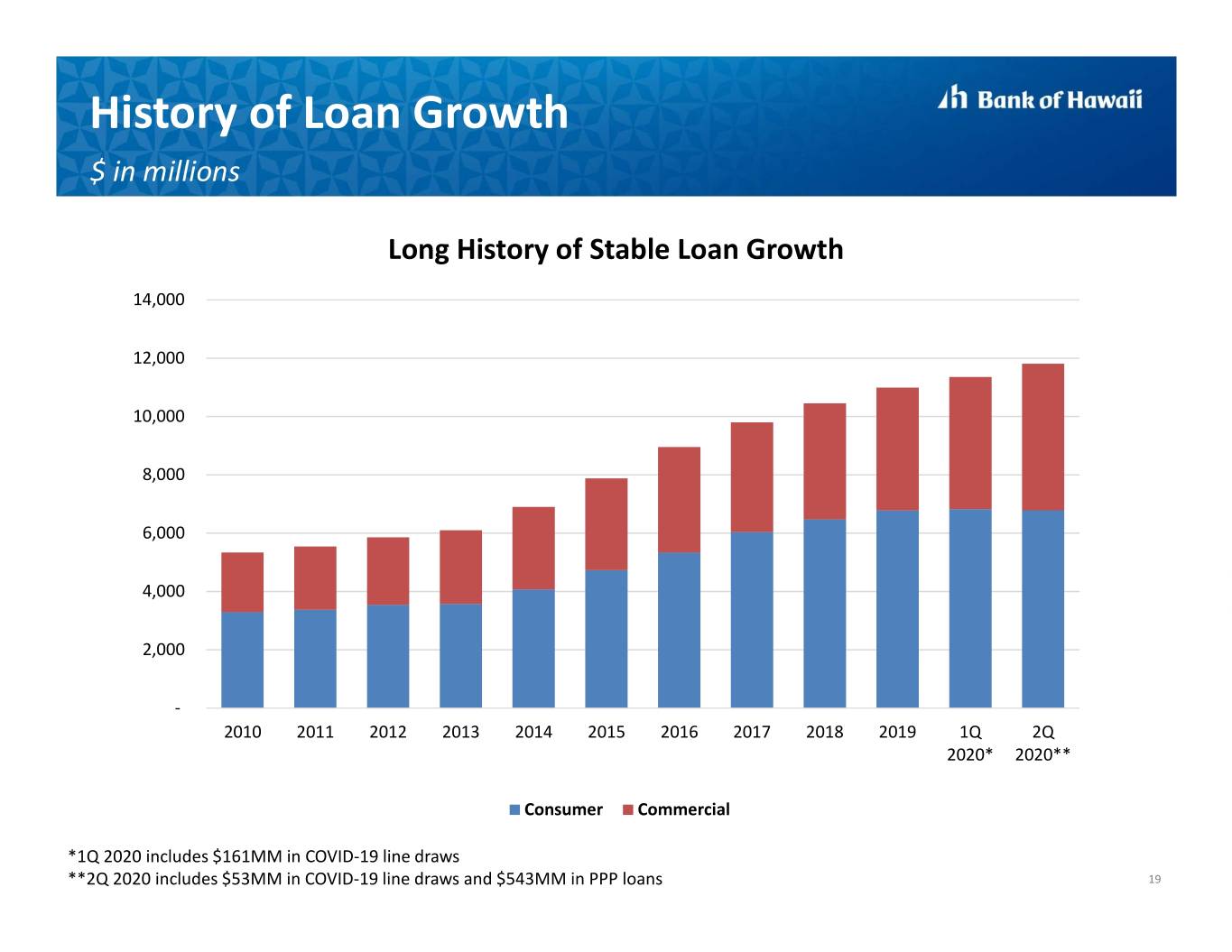

History of Loan Growth $ in millions Long History of Stable Loan Growth 14,000 12,000 10,000 8,000 6,000 4,000 2,000 - 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 2Q 2020* 2020** Consumer Commercial *1Q 2020 includes $161MM in COVID-19 line draws **2Q 2020 includes $53MM in COVID-19 line draws and $543MM in PPP loans 19

Second Quarter 2020 Loan Growth $ in millions Loan Growth in Q2 Driven by PPP Loans 543 (107) 11,805 61 (101) 56 11,353 1Q Total Loans Commercial Mortgage Other PPP COVID Line 2Q Total Loans Consumer Paydowns 20

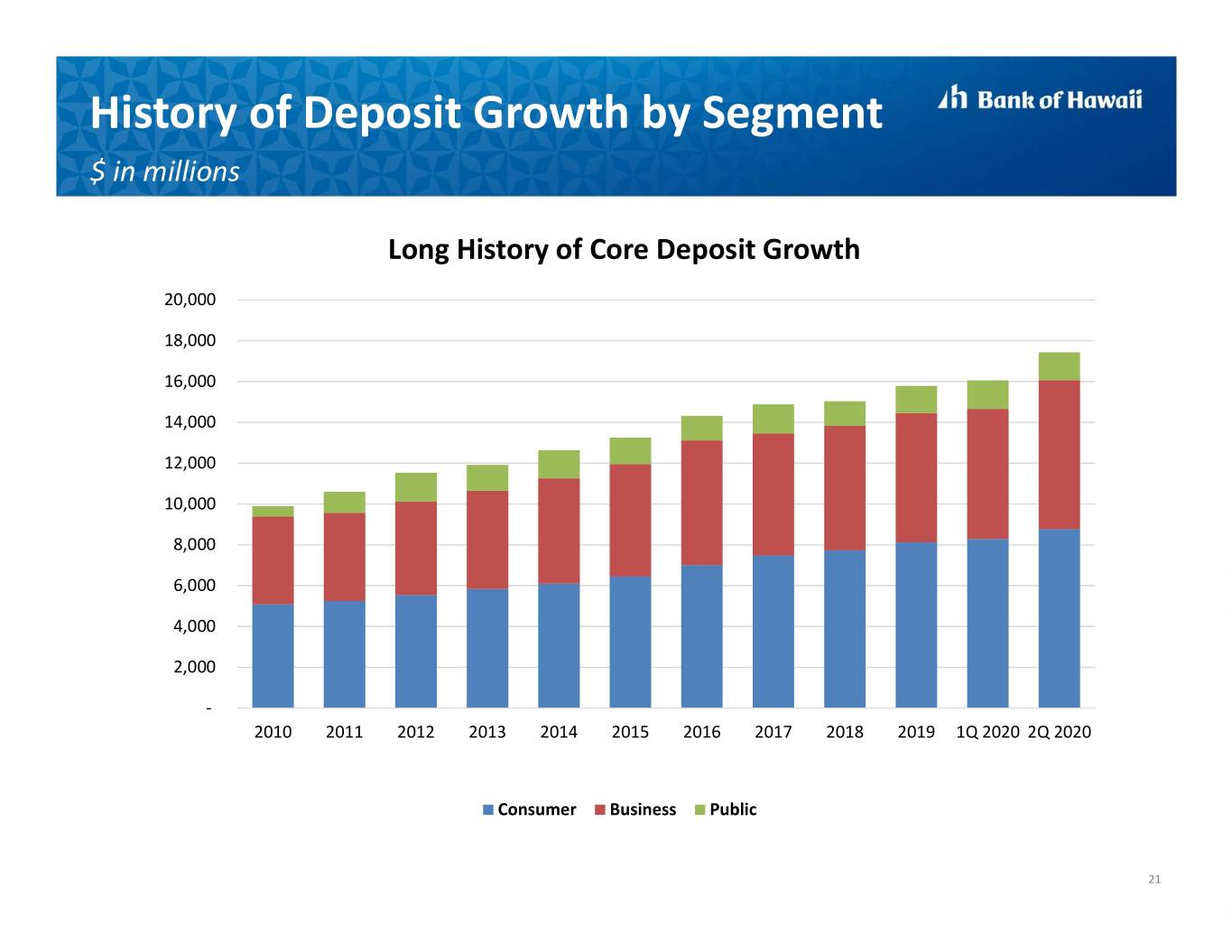

History of Deposit Growth by Segment $ in millions Long History of Core Deposit Growth 20,000 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 - 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 20202Q 2020 Consumer Business Public 21

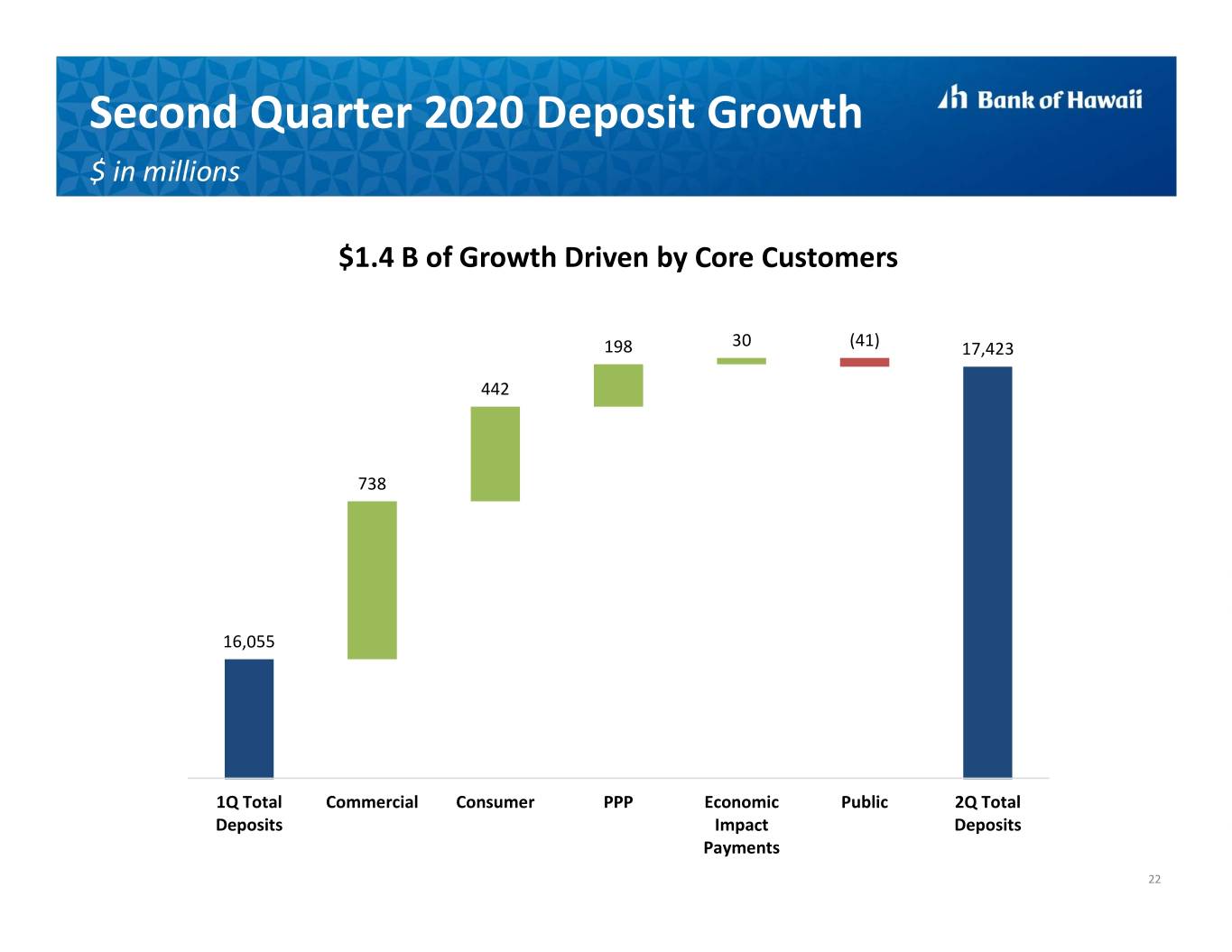

Second Quarter 2020 Deposit Growth $ in millions $1.4 B of Growth Driven by Core Customers 198 30 (41) 17,423 442 738 16,055 1Q Total Commercial Consumer PPP Economic Public 2Q Total Deposits Impact Deposits Payments 22

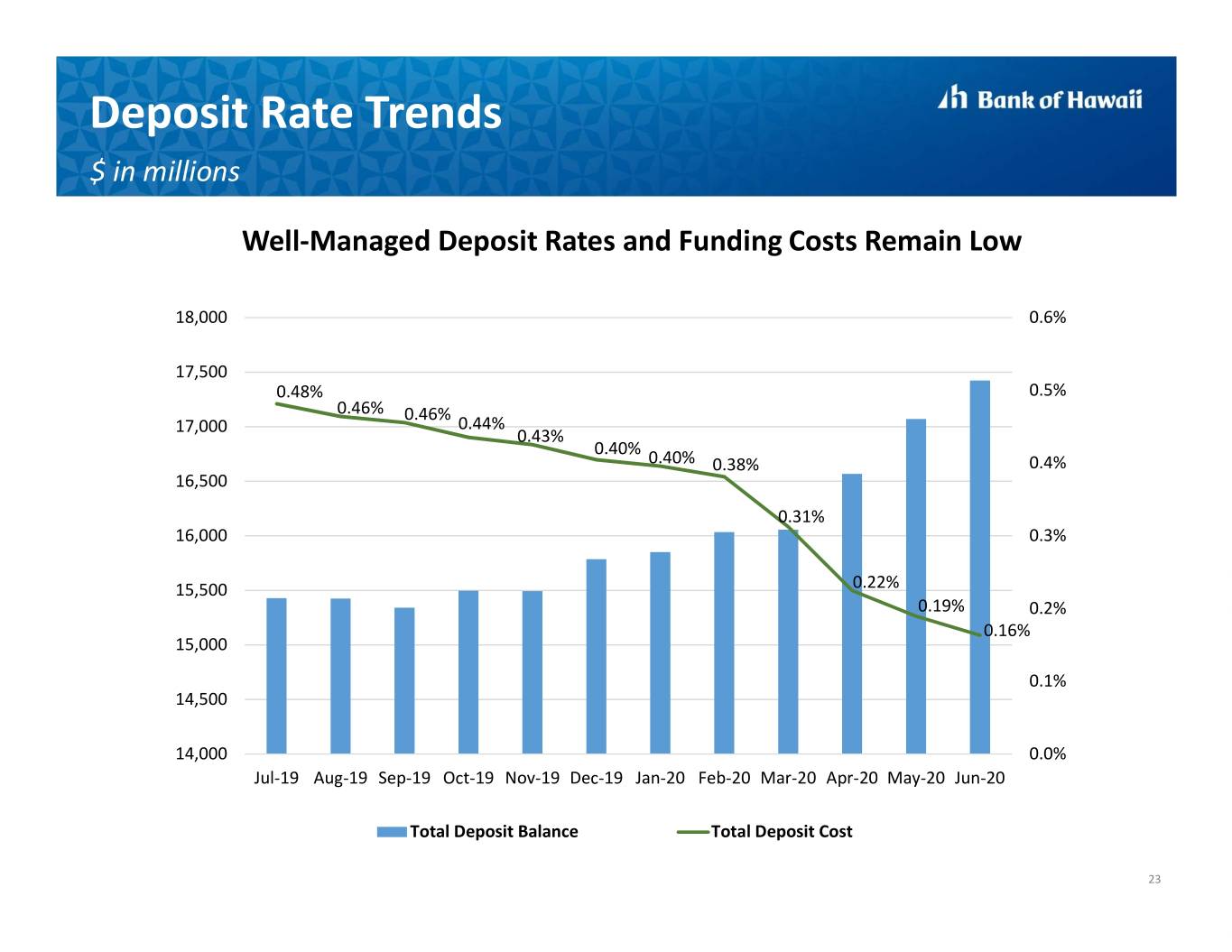

Deposit Rate Trends $ in millions Well-Managed Deposit Rates and Funding Costs Remain Low 18,000 0.6% 17,500 0.48% 0.5% 0.46% 0.46% 17,000 0.44% 0.43% 0.40% 0.40% 0.38% 0.4% 16,500 0.31% 16,000 0.3% 15,500 0.22% 0.19% 0.2% 0.16% 15,000 0.1% 14,500 14,000 0.0% Jul-19 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Total Deposit Balance Total Deposit Cost 23

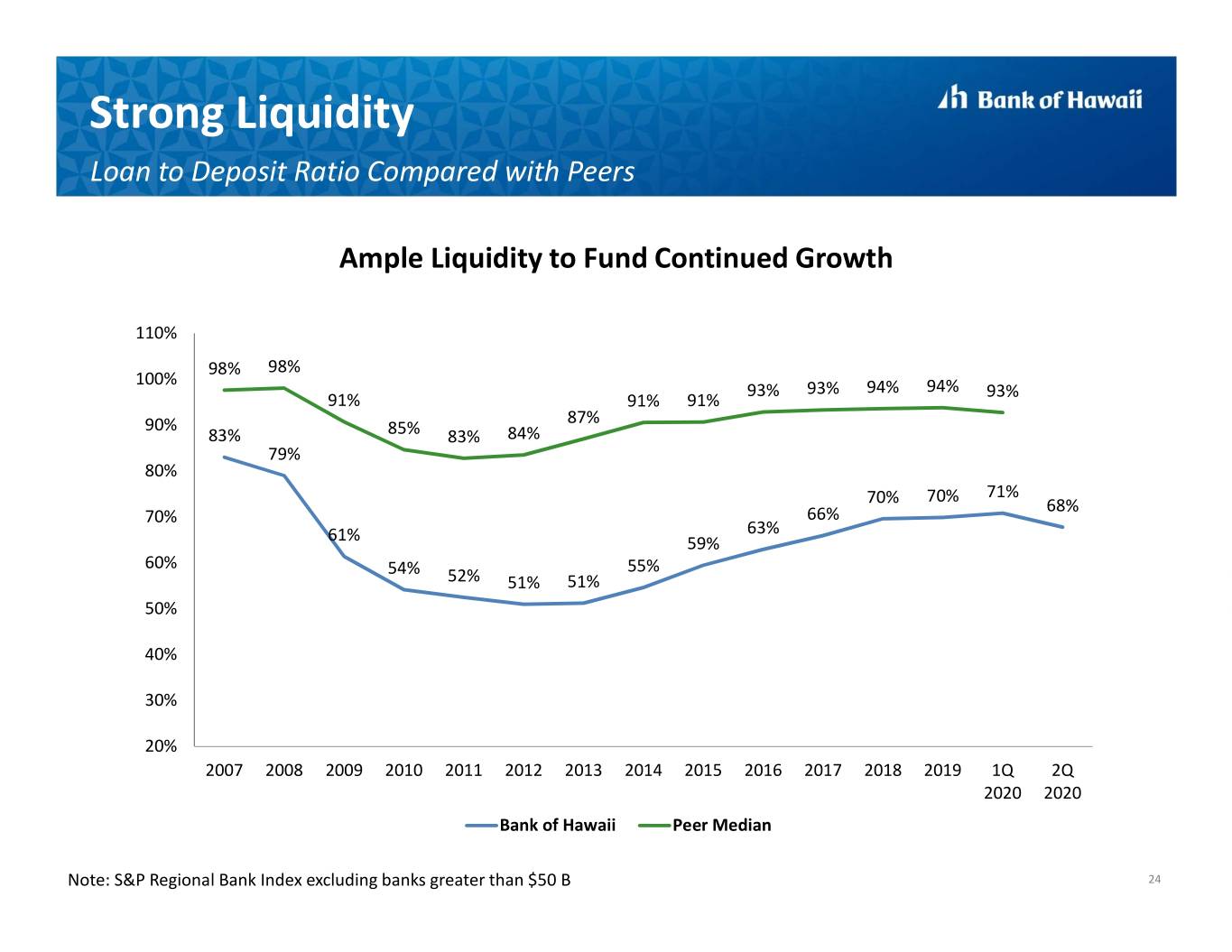

Strong Liquidity Loan to Deposit Ratio Compared with Peers Ample Liquidity to Fund Continued Growth 110% 98% 98% 100% 93% 93% 94% 94% 93% 91% 91% 91% 90% 87% 83% 85% 83% 84% 79% 80% 70% 71% 70% 68% 70% 66% 63% 61% 59% 60% 54% 55% 52% 51% 51% 50% 40% 30% 20% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 2Q 2020 2020 Bank of Hawaii Peer Median Note: S&P Regional Bank Index excluding banks greater than $50 B 24

Investment Portfolio & Duration $ in millions Total Investment Portfolio 8,000 AFS HTM Premium Amortization 12 6,003 10 6,000 5,610 5,685 7.5 8 5.8 6.2 4,000 6 2,960 3,004 3,277 4 2,000 2 2,650 2,681 2,726 0 - 2Q 2019 1Q 2020 2Q 2020 Duration 2Q 2019 1Q 2020 2Q 2020 3.54 3.18 3.11 3.28 2.92 2.76 2.83 2.72 2.90 Total AFS HTM Total AFS HTM Total AFS HTM 25

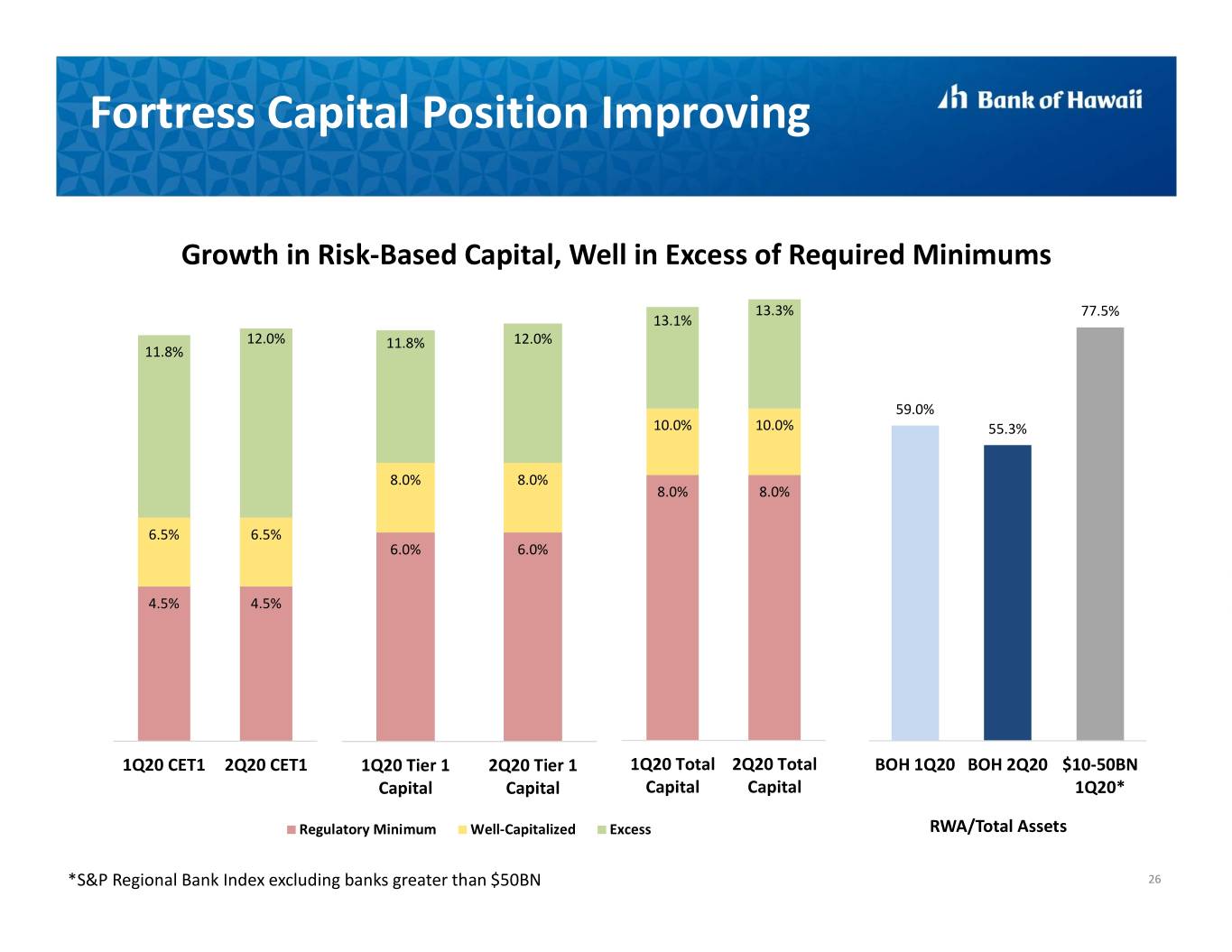

Fortress Capital Position Improving Growth in Risk-Based Capital, Well in Excess of Required Minimums 13.3% 77.5% 13.1% 12.0% 11.8% 12.0% 11.8% 59.0% 10.0% 10.0% 55.3% 8.0% 8.0% 8.0% 8.0% 6.5% 6.5% 6.0% 6.0% 4.5% 4.5% 1Q20 CET1 2Q20 CET1 1Q20 Tier 1 2Q20 Tier 1 1Q20 Total 2Q20 Total BOH 1Q20 BOH 2Q20 $10-50BN Capital Capital Capital Capital 1Q20* Regulatory Minimum Well-Capitalized Excess RWA/Total Assets *S&P Regional Bank Index excluding banks greater than $50BN 26

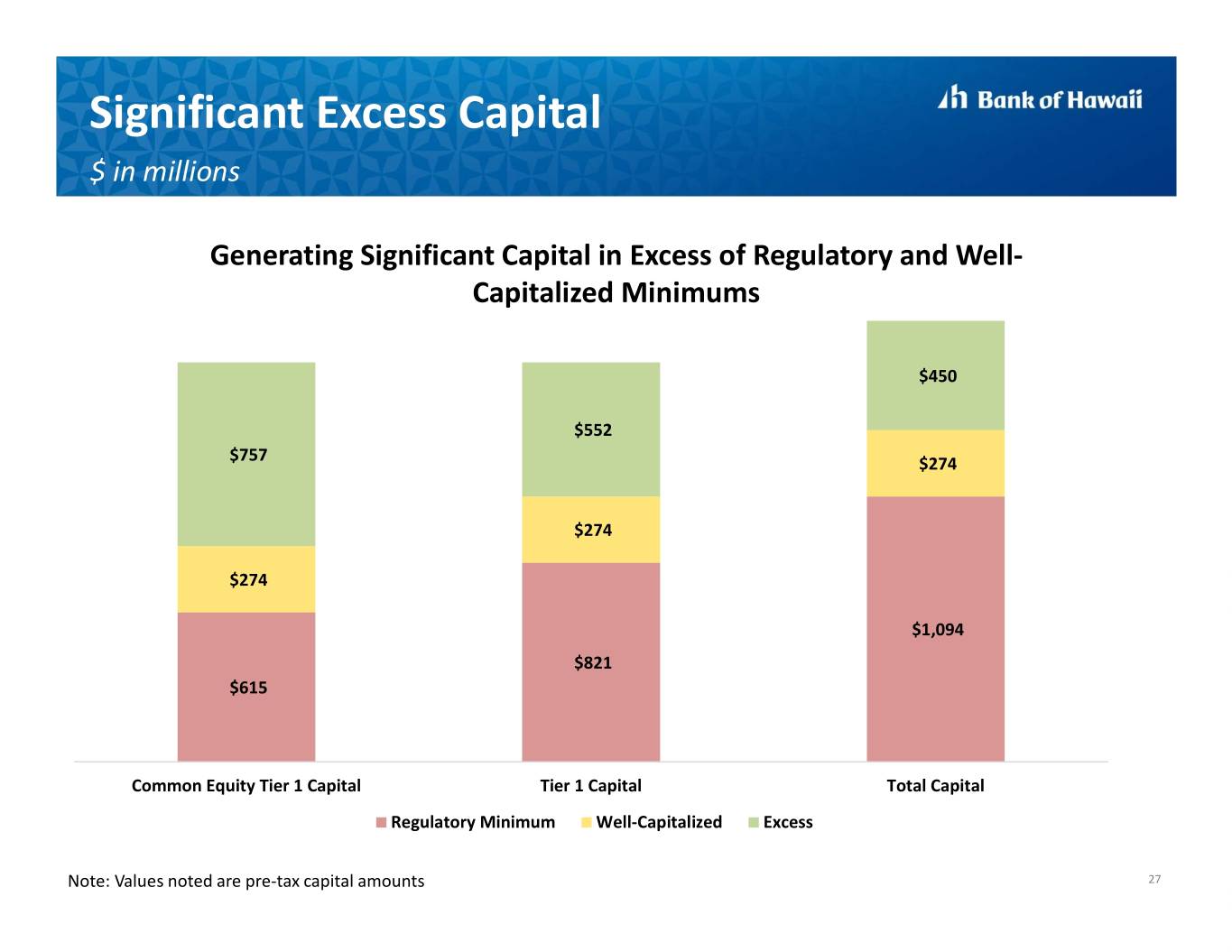

Significant Excess Capital $ in millions Generating Significant Capital in Excess of Regulatory and Well- Capitalized Minimums $450 $552 $757 $274 $274 $274 $1,094 $821 $615 Common Equity Tier 1 Capital Tier 1 Capital Total Capital Regulatory Minimum Well-Capitalized Excess Note: Values noted are pre-tax capital amounts 27

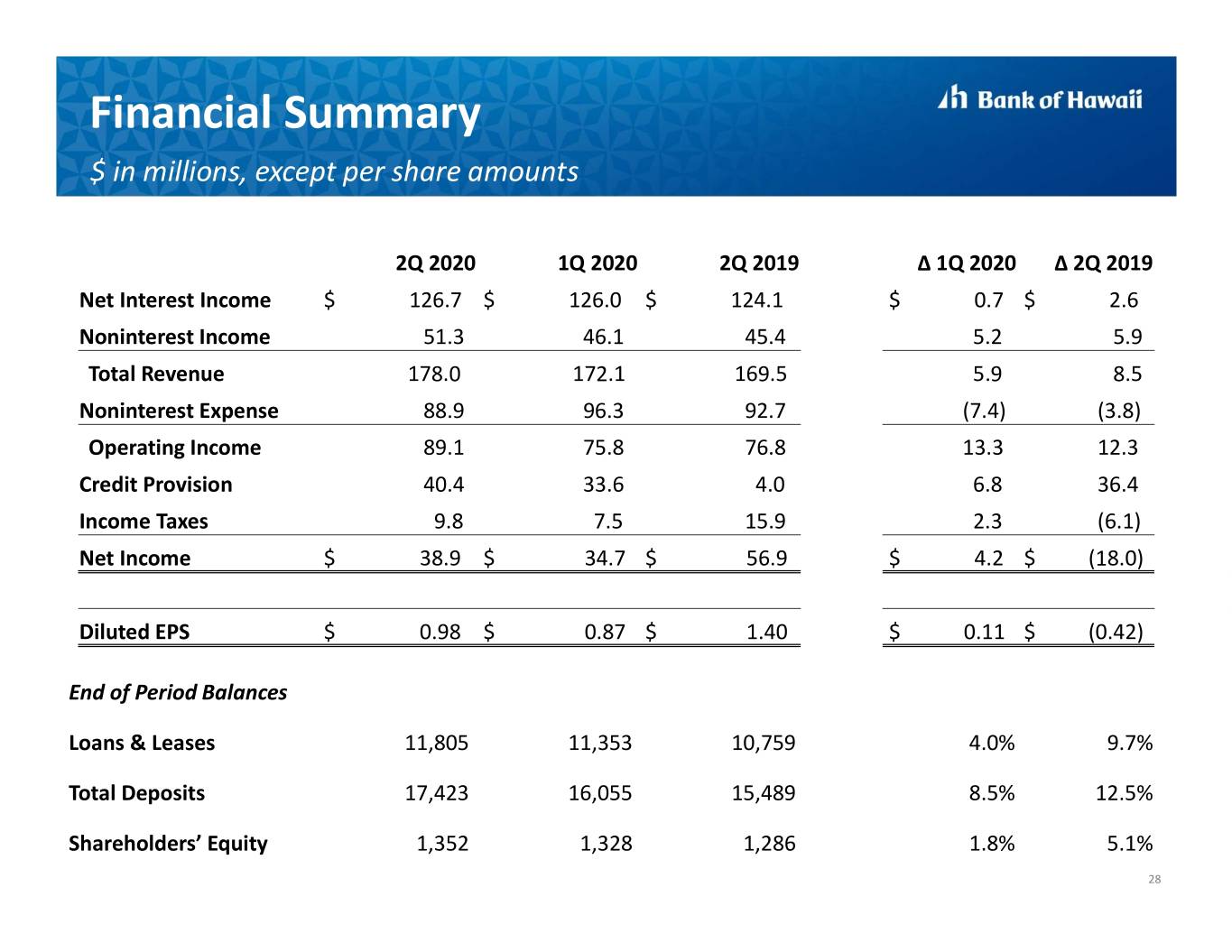

Financial Summary $ in millions, except per share amounts 2Q 2020 1Q 2020 2Q 2019 ∆ 1Q 2020 ∆ 2Q 2019 Net Interest Income $ 126.7 $ 126.0 $ 124.1 $ 0.7 $ 2.6 Noninterest Income 51.3 46.1 45.4 5.2 5.9 Total Revenue 178.0 172.1 169.5 5.9 8.5 Noninterest Expense 88.9 96.3 92.7 (7.4) (3.8) Operating Income 89.1 75.8 76.8 13.3 12.3 Credit Provision 40.4 33.6 4.0 6.8 36.4 Income Taxes 9.8 7.5 15.9 2.3 (6.1) Net Income $ 38.9 $ 34.7 $ 56.9 $ 4.2 $ (18.0) Diluted EPS $ 0.98 $ 0.87 $ 1.40 $ 0.11 $ (0.42) End of Period Balances Loans & Leases 11,805 11,353 10,759 4.0% 9.7% Total Deposits 17,423 16,055 15,489 8.5% 12.5% Shareholders’ Equity 1,352 1,328 1,286 1.8% 5.1% 28

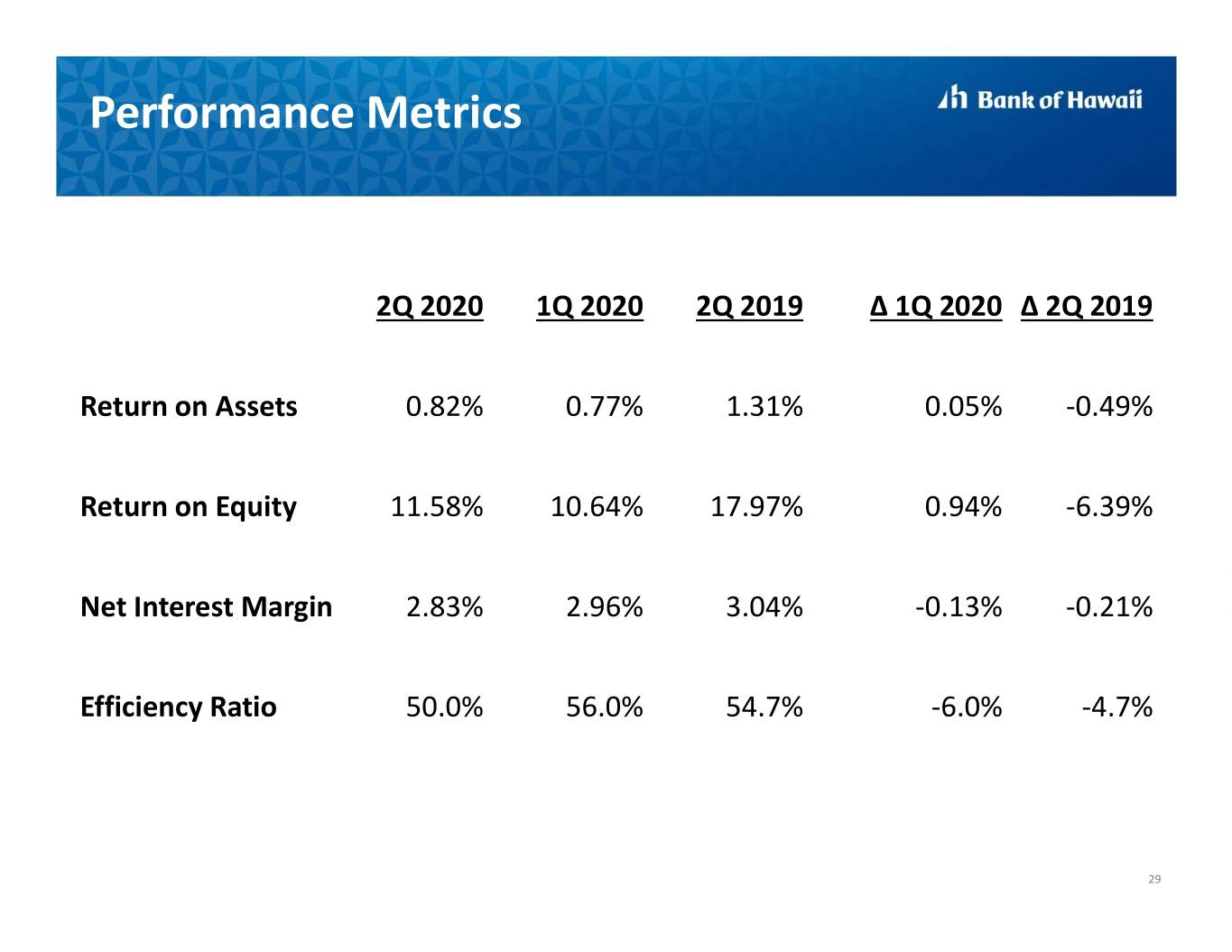

Performance Metrics 2Q 2020 1Q 2020 2Q 2019 ∆ 1Q 2020 ∆ 2Q 2019 Return on Assets 0.82% 0.77% 1.31% 0.05% -0.49% Return on Equity 11.58% 10.64% 17.97% 0.94% -6.39% Net Interest Margin 2.83% 2.96% 3.04% -0.13% -0.21% Efficiency Ratio 50.0% 56.0% 54.7% -6.0% -4.7% 29

Bank of Hawaii Corporation Second Quarter 2020 Financial Results July 27, 2020

APPENDIX

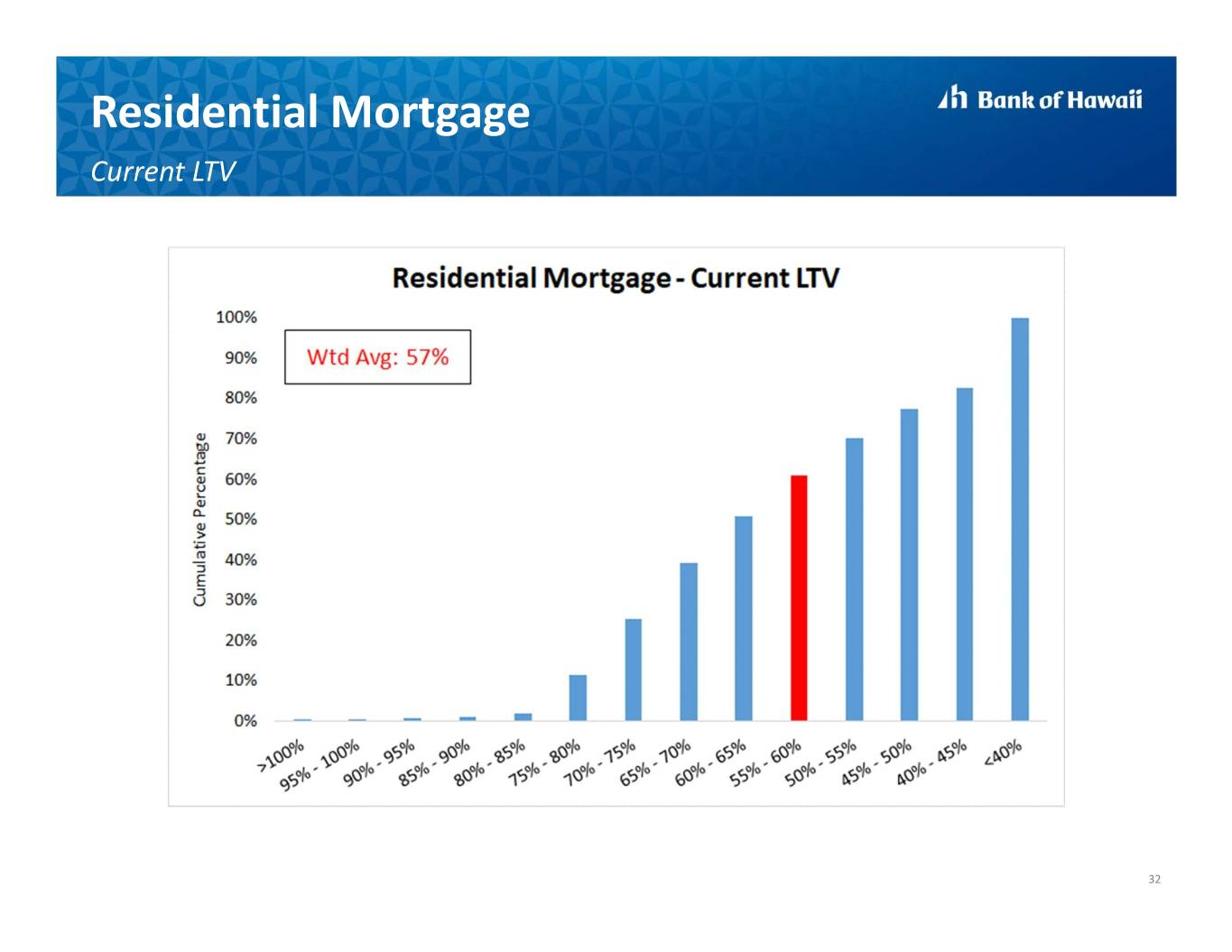

Residential Mortgage Current LTV 32

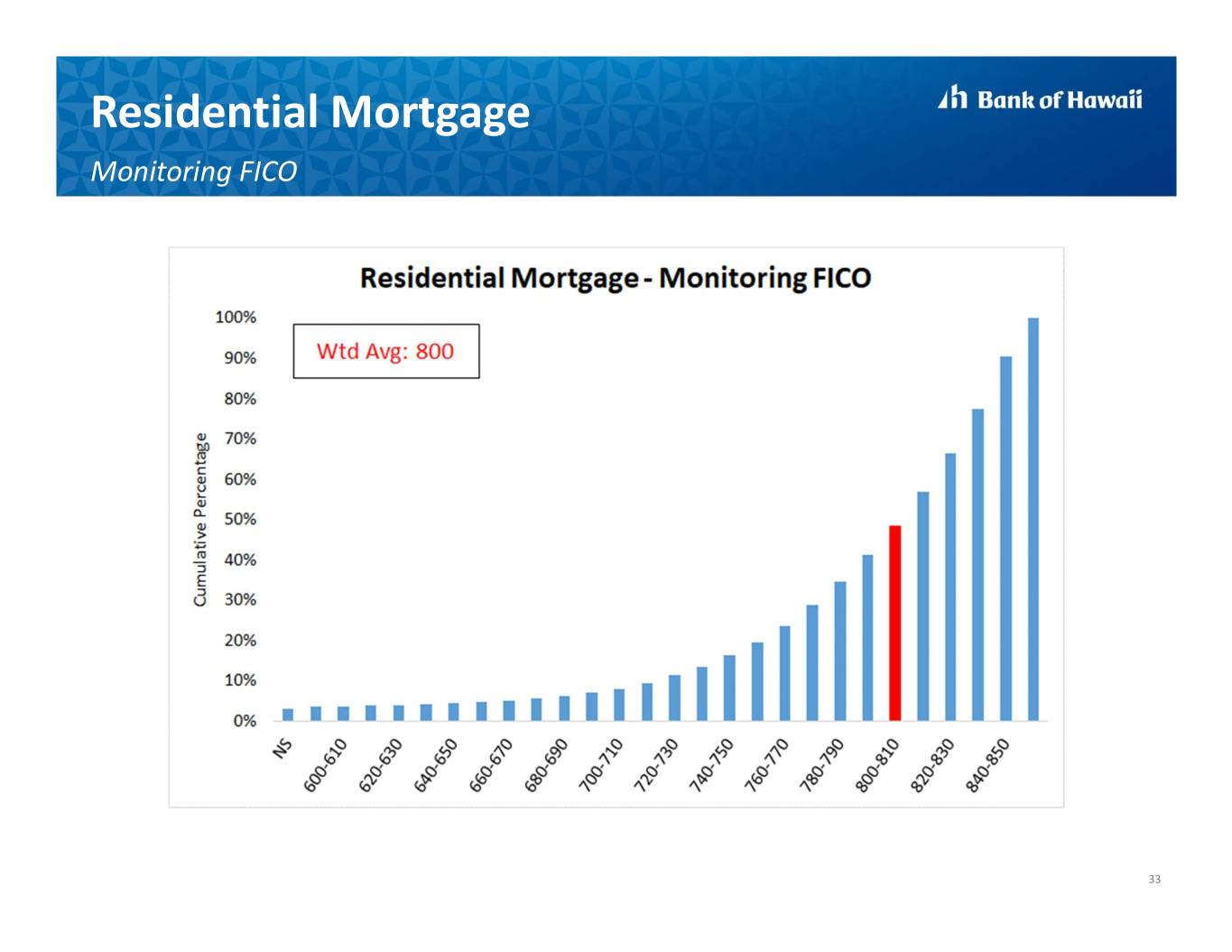

Residential Mortgage Monitoring FICO 33

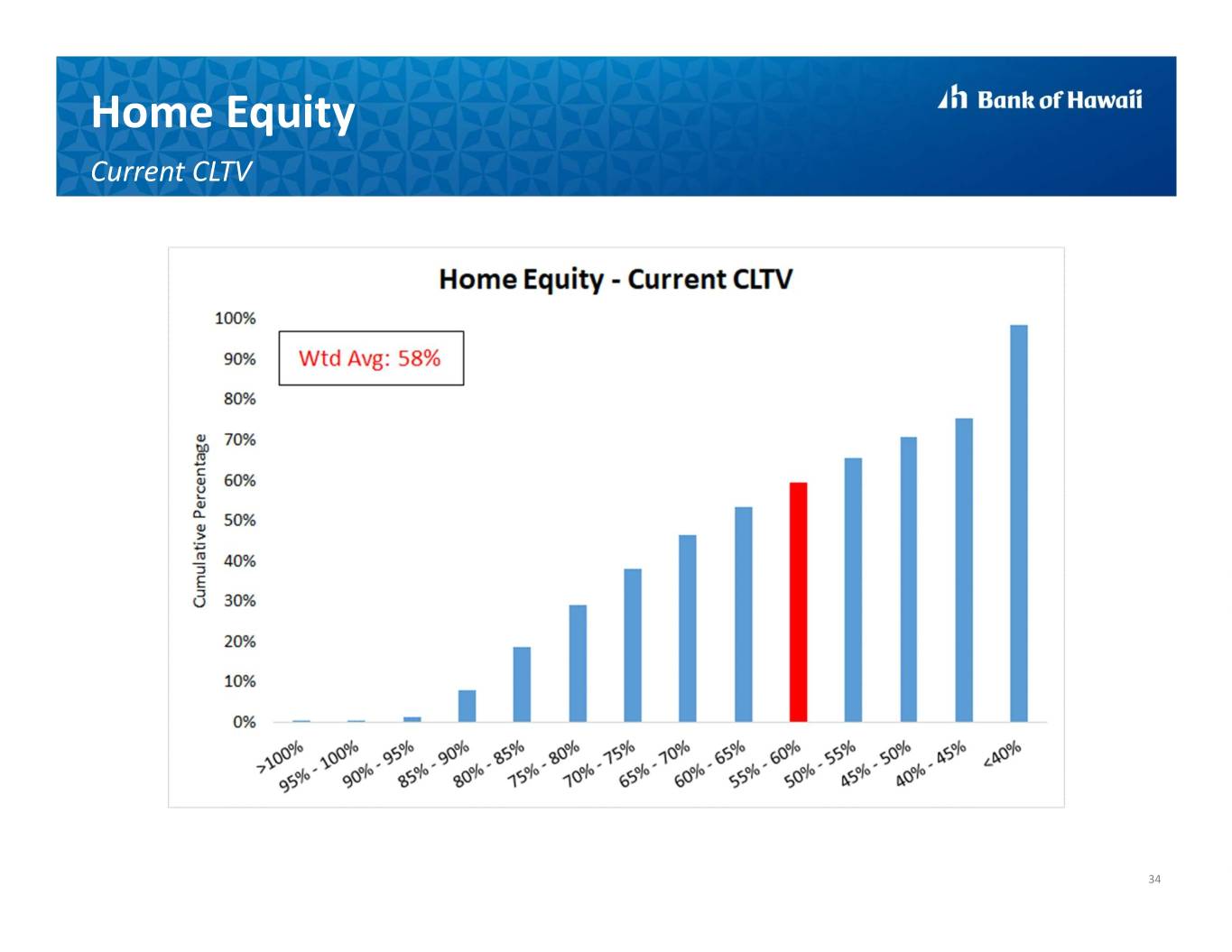

Home Equity Current CLTV 34

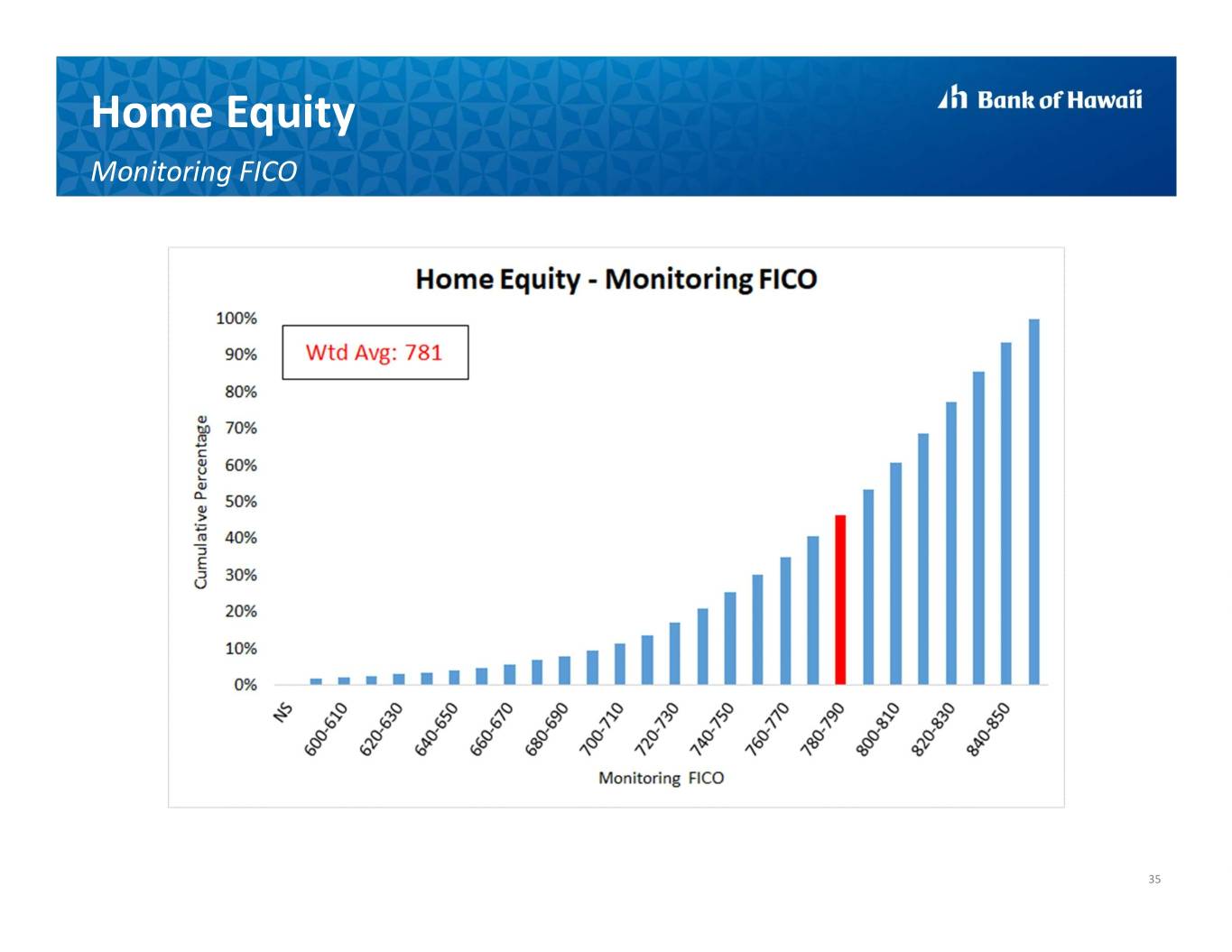

Home Equity Monitoring FICO 35

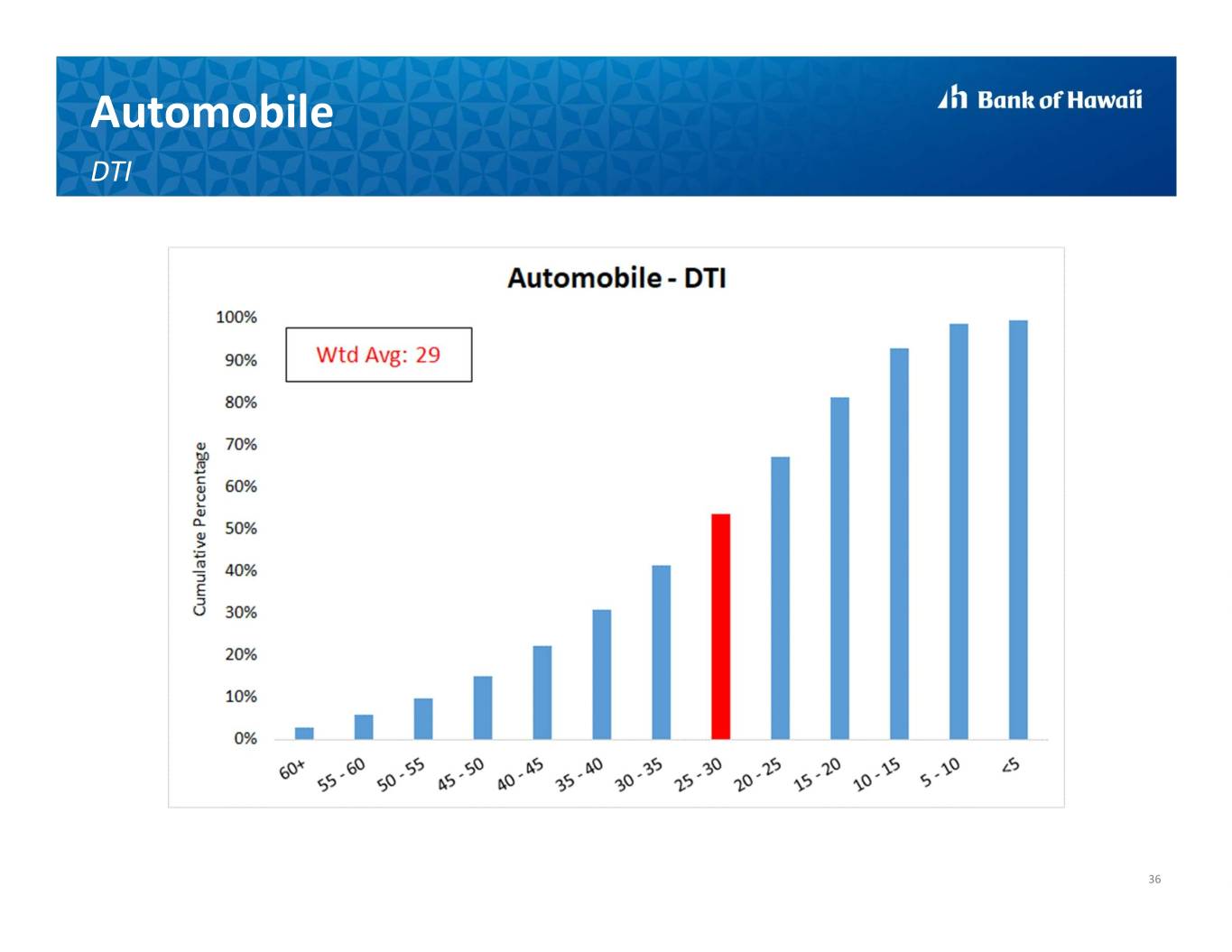

Automobile DTI 36

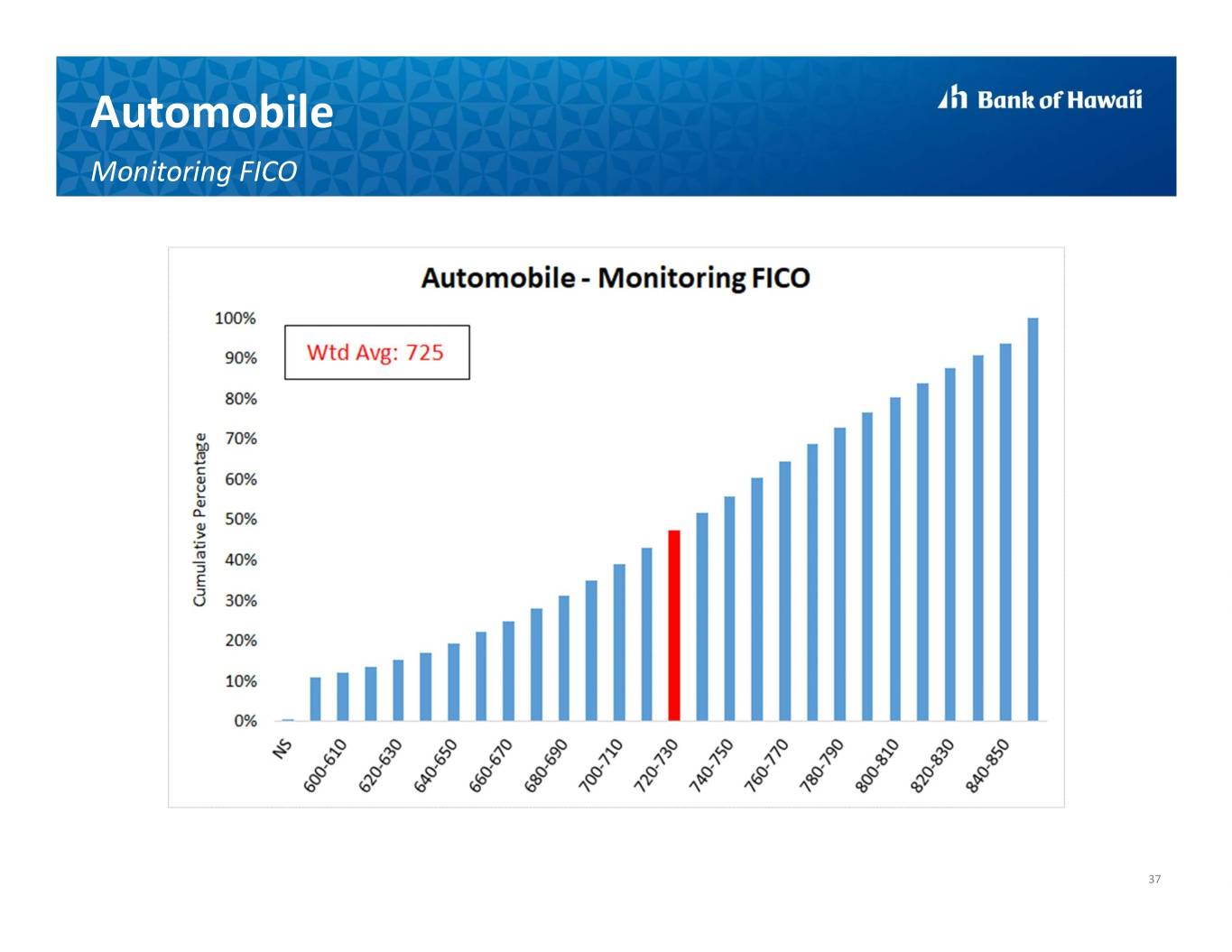

Automobile Monitoring FICO 37

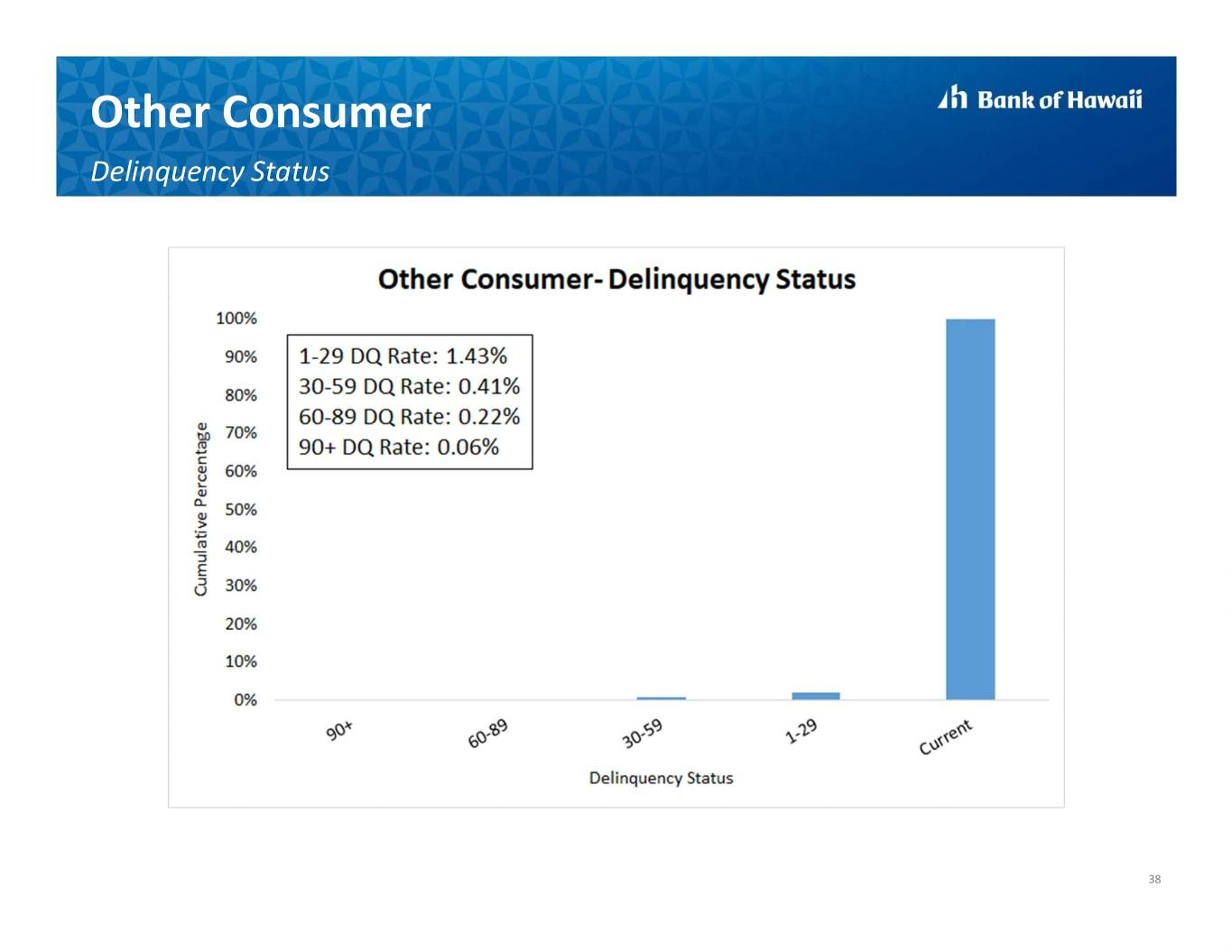

Other Consumer Delinquency Status 38

Other Consumer Monitoring FICO 39

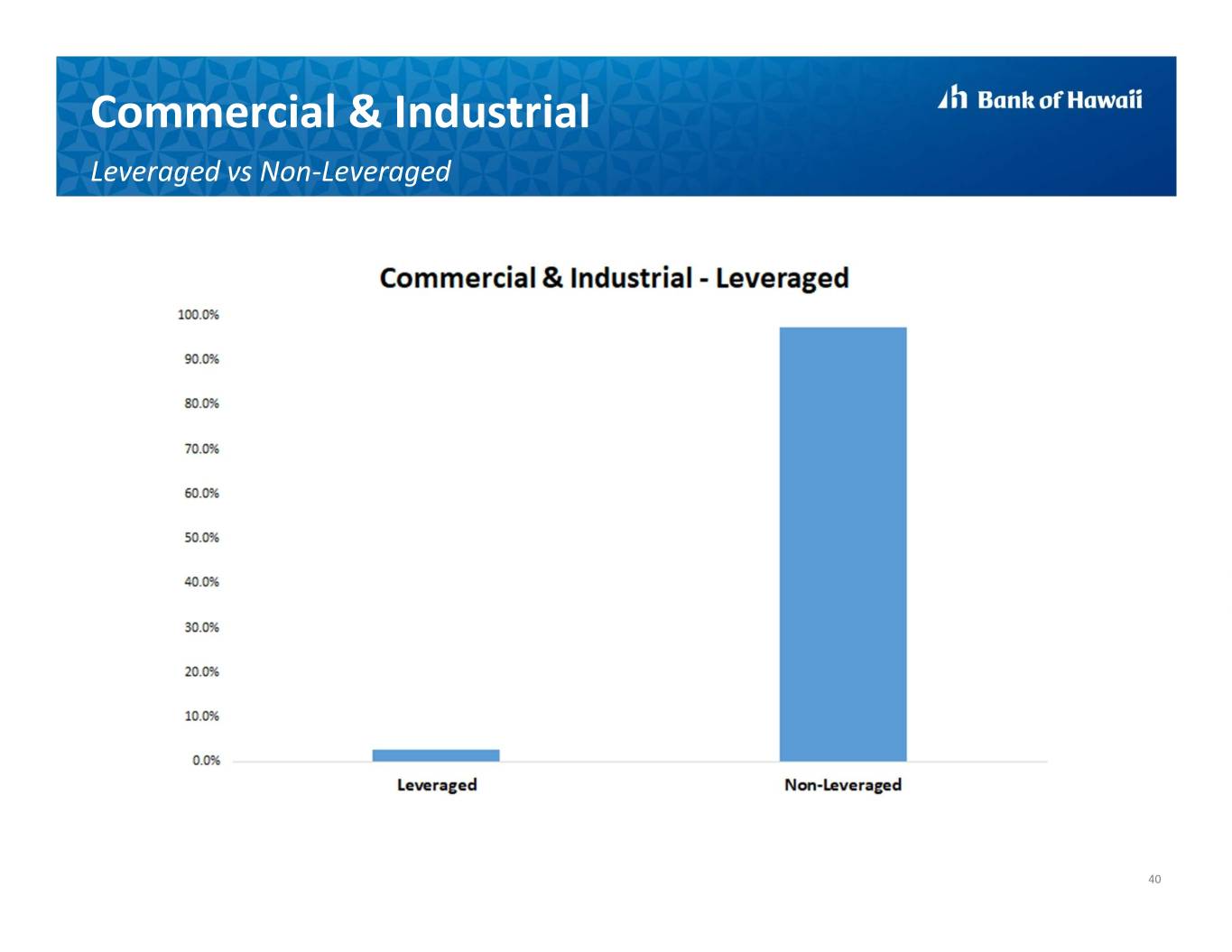

Commercial & Industrial Leveraged vs Non-Leveraged 40

Commercial Mortgage Current LTV 41

Commercial Mortgage Detail Current LTV 42

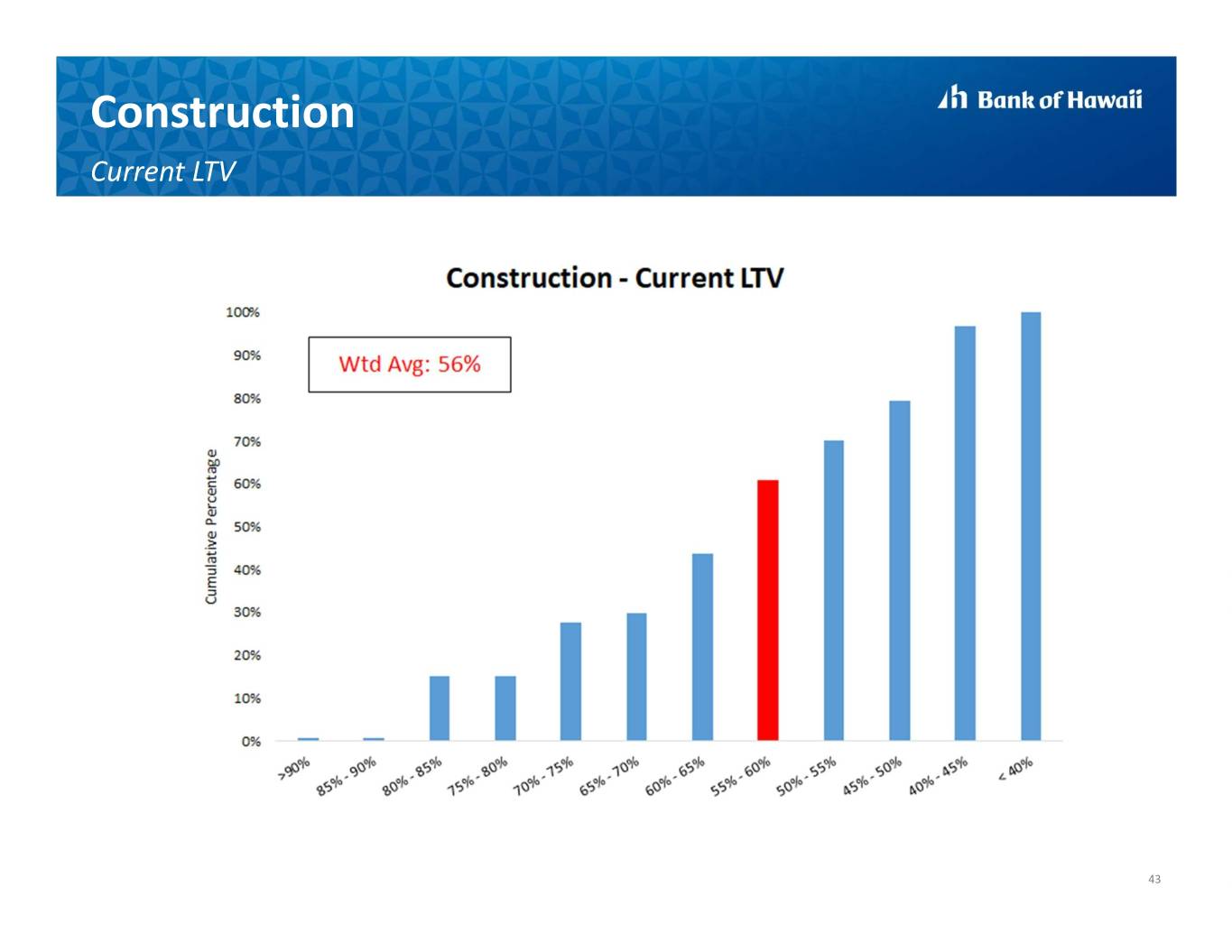

Construction Current LTV 43

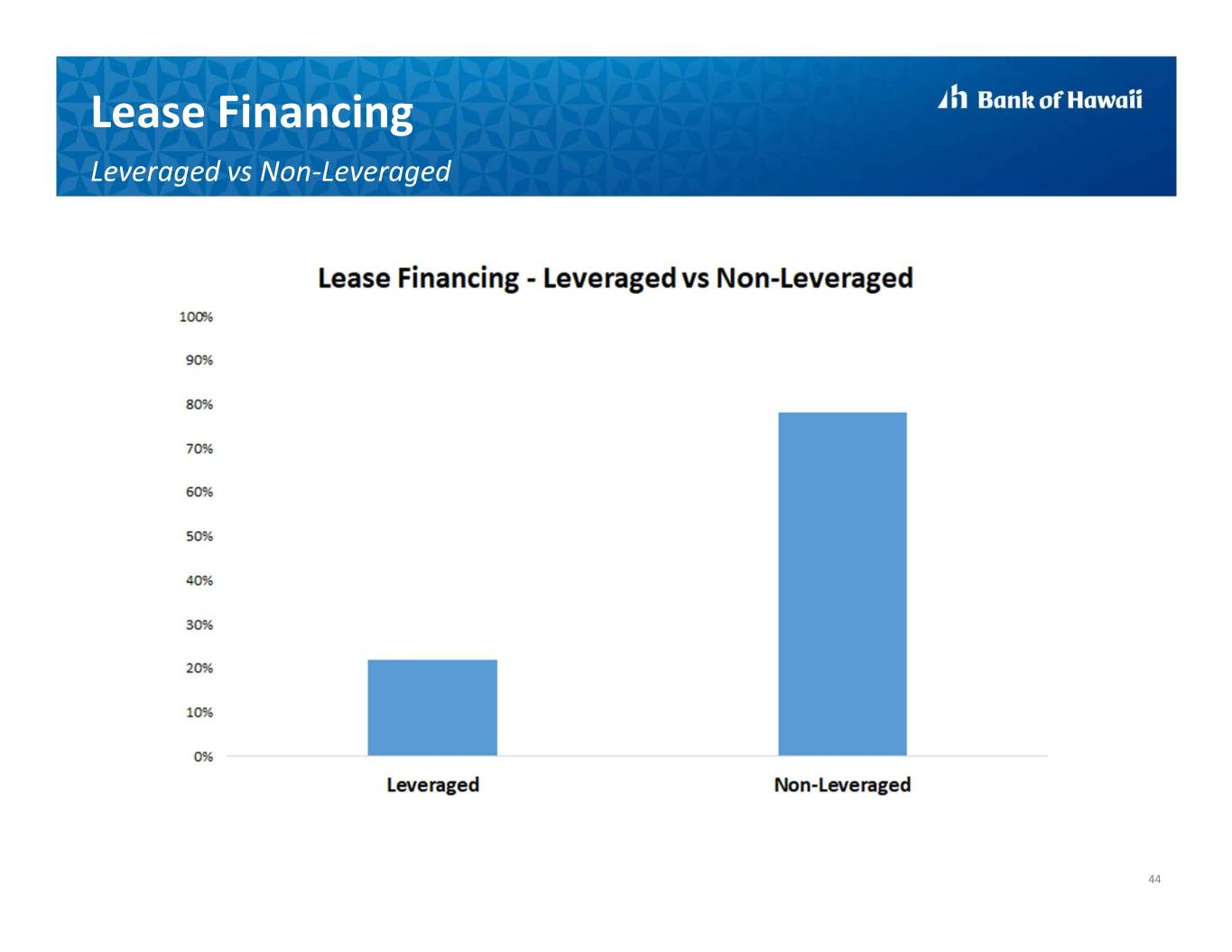

Lease Financing Leveraged vs Non-Leveraged 44

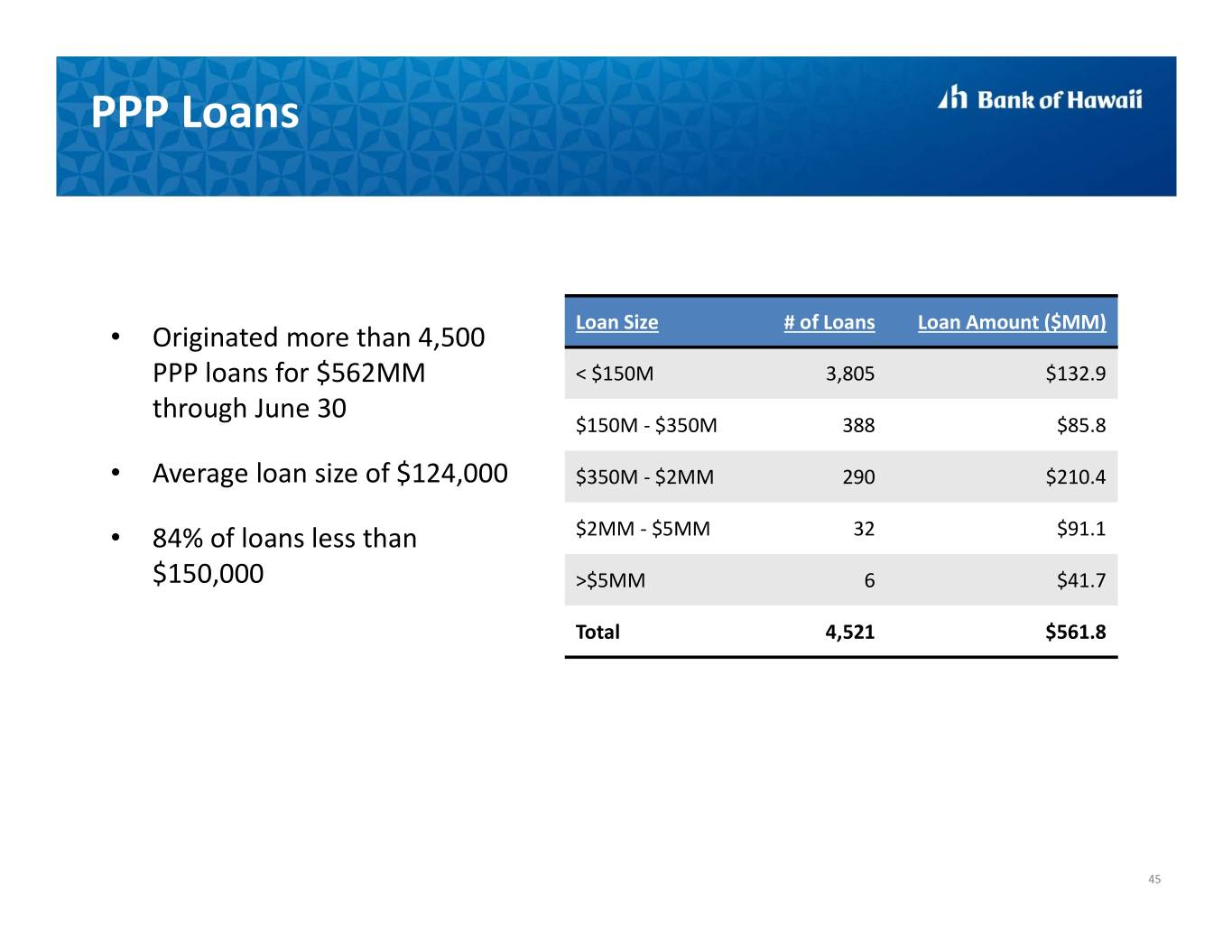

PPP Loans Loan Size # of Loans Loan Amount ($MM) • Originated more than 4,500 PPP loans for $562MM < $150M 3,805 $132.9 through June 30 $150M - $350M 388 $85.8 • Average loan size of $124,000 $350M - $2MM 290 $210.4 • 84% of loans less than $2MM - $5MM 32 $91.1 $150,000 >$5MM 6 $41.7 Total 4,521 $561.8 45

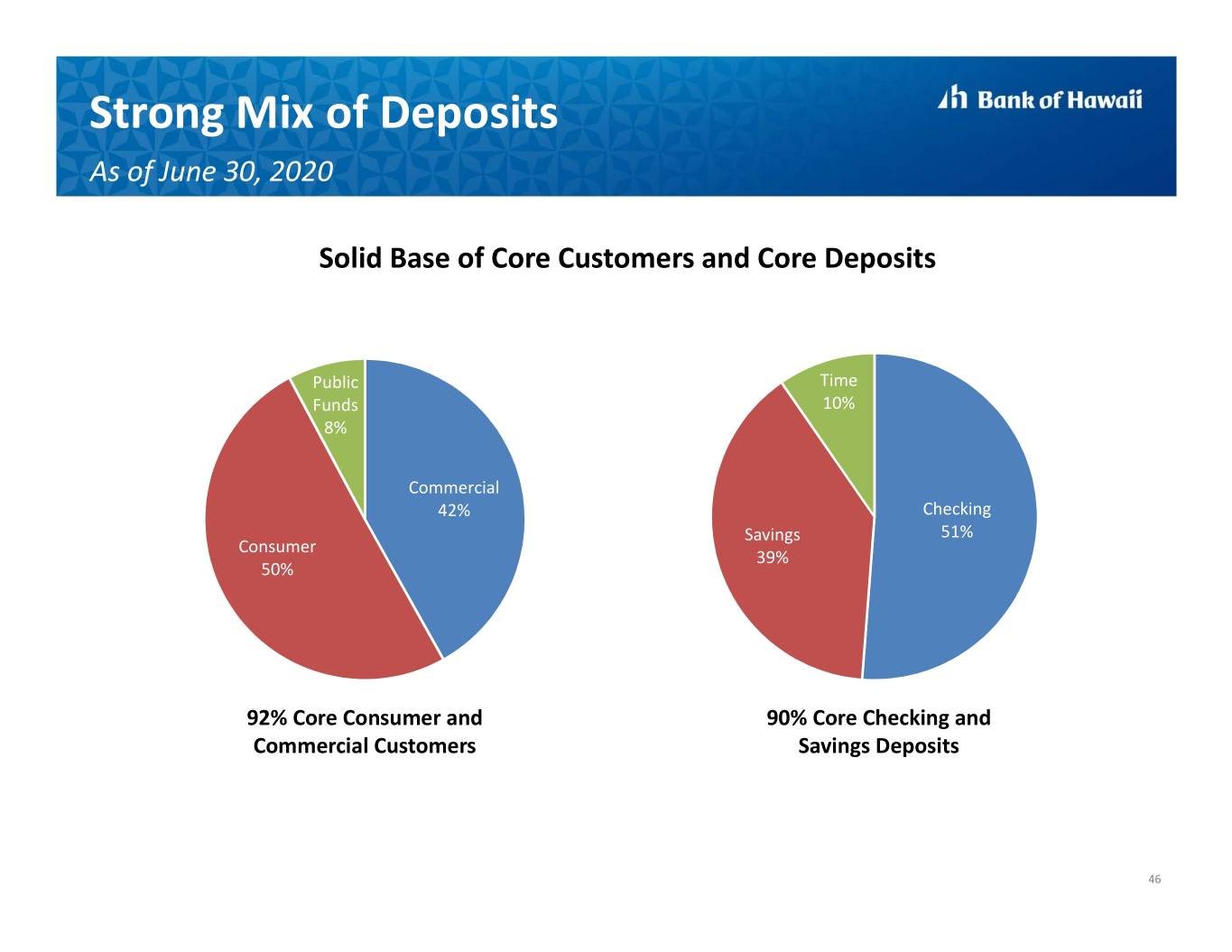

Strong Mix of Deposits As of June 30, 2020 Solid Base of Core Customers and Core Deposits Public Time Funds 10% 8% Commercial 42% Checking Savings 51% Consumer 39% 50% 92% Core Consumer and 90% Core Checking and Commercial Customers Savings Deposits 46

Conservative Investment Portfolio As of June 30, 2020 Investment Securities Portfolio Consists of High-Quality Securities. Sector Muni 2% Corp 3% • 95% AAA-rated, 100% A-rated or higher • Highly liquid and pledgeable Government / Agency 95% • Secure and reliable cash flows Moody’s Rating Cash Flow AA A 2% 3% Bullets 8% AAA Monthly Payments 95% 92% 47

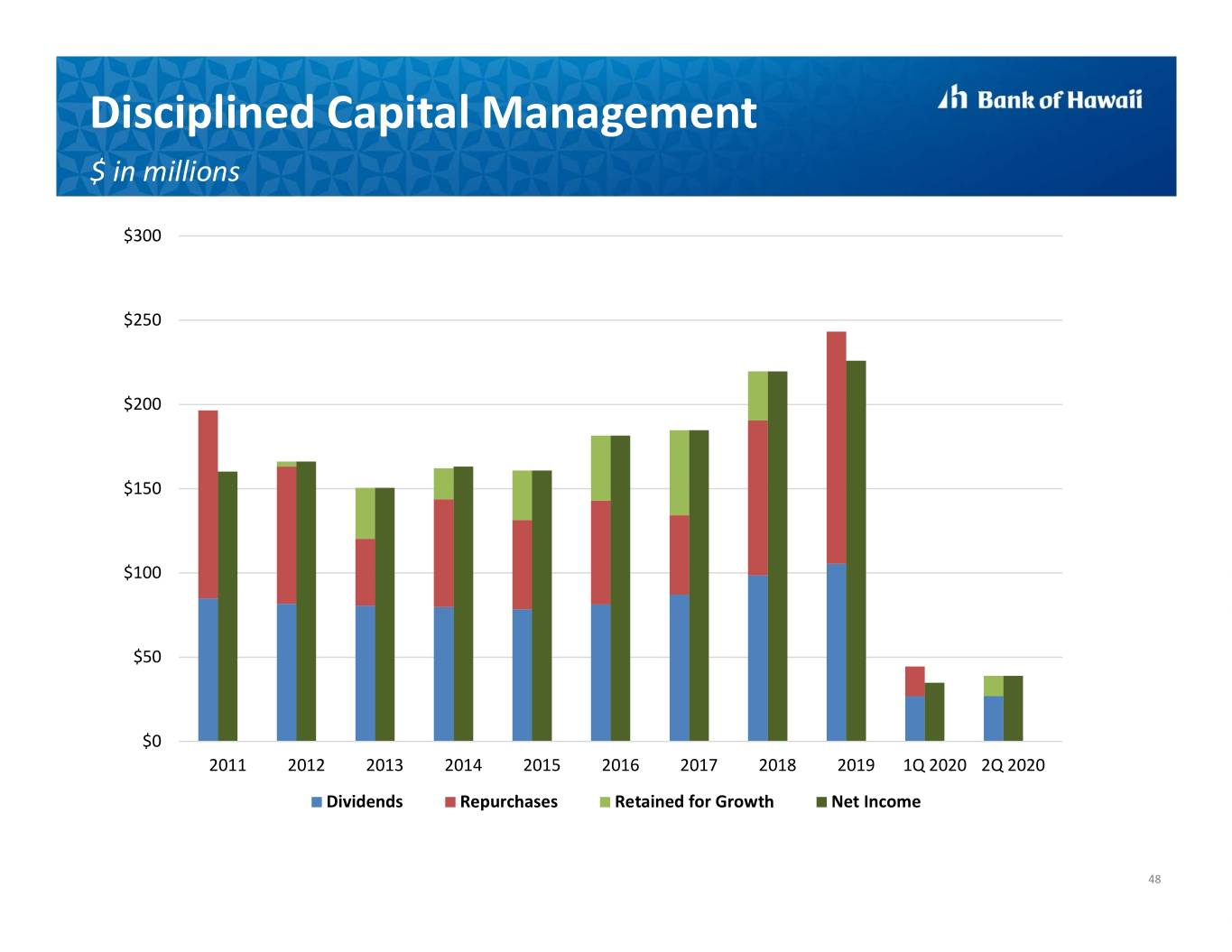

Disciplined Capital Management $ in millions $300 $250 $200 $150 $100 $50 $0 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 2020 2Q 2020 Dividends Repurchases Retained for Growth Net Income 48

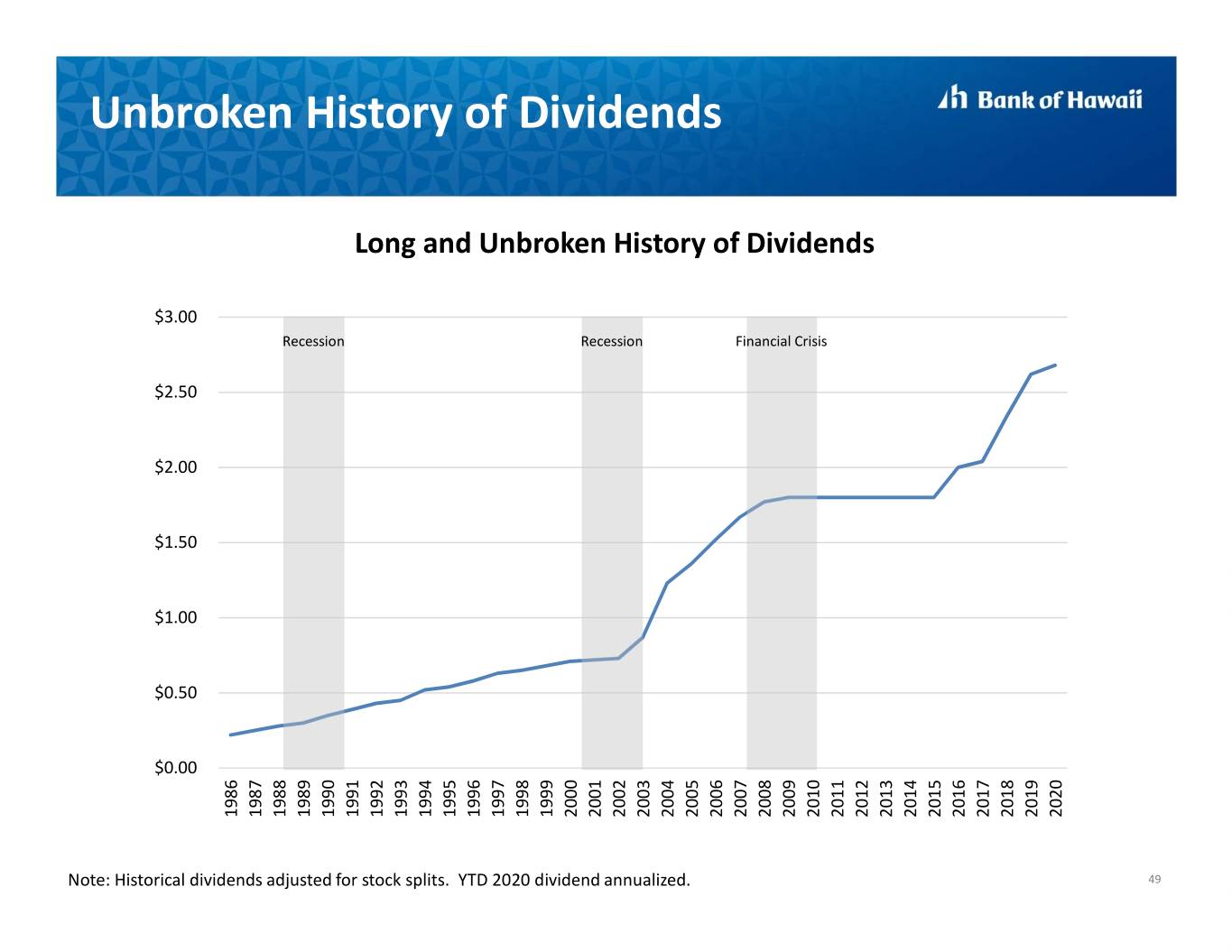

Note: Historical dividends adjusted for stock splits. YTD 2020 dividend dividend annualized. 2020 YTD HistoricalNote: dividends adjusted for stocksplits. Unbroken HistoryDividendsof $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 1986 1987 1988 Recession 1989 1990 1991 and UnbrokenLong History of Dividends 1992 1993 1994 1995 1996 1997 1998 1999 2000 Recession 2001 2002 2003 2004 2005 2006 2007 CrisisFinancial 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 49

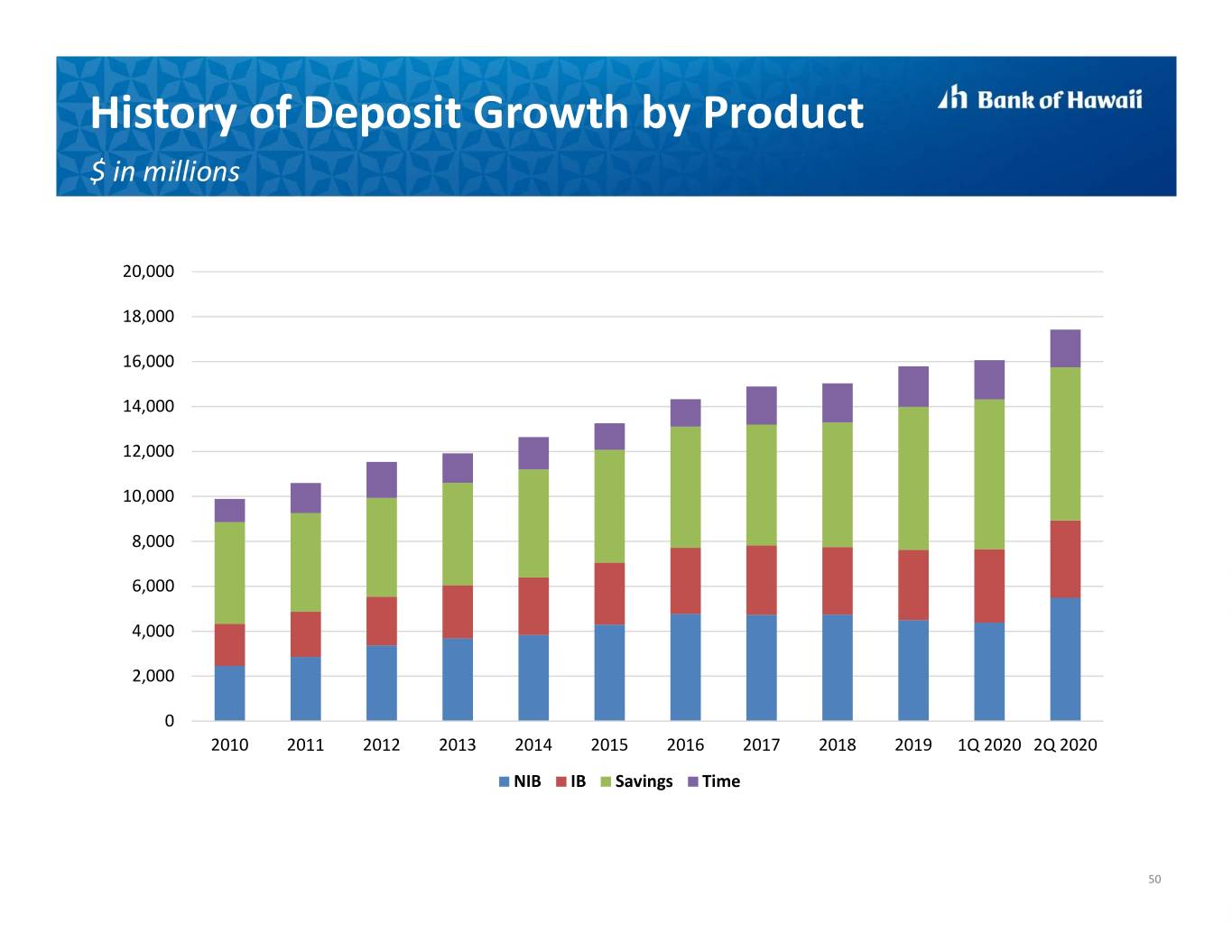

History of Deposit Growth by Product $ in millions 20,000 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 2020 2Q 2020 NIB IB Savings Time 50