Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Reliant Bancorp, Inc. | a52254205ex99_1.htm |

| 8-K - RELIANT BANCORP, INC. 8-K - Reliant Bancorp, Inc. | a52254205.htm |

Exhibit 99.2

Q2 2020 Earnings Presentation July 24, 2020

Safe Harbor Statements Forward-Looking StatementsAll statements, other than statements of historical

fact, included in this presentation and any oral statements made regarding the subject matter of this presentation that address activities, events, or developments that Reliant Bancorp, Inc. (“Reliant” or the “Company”) expects, believes, or

anticipates will or may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s response to the coronavirus (COVID-19) pandemic, the Transactions (as defined below) being accretive to the

Company’s earnings in 2021, and the Company’s strategy for 2020. The words “believe,” “anticipate,” “expect,” “may,” “will,” “assume,” “should,” “predict,” “could,” “would,” “intend,” “targets,” “estimates,” “projects,” “plans,” and

“potential,” and other similar words and expressions of the future, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking, including statements

about the Company’s future financial and operating results and the Company’s plans, objectives, and intentions. All forward-looking statements are subject to risks, uncertainties, and other factors that may cause the actual results,

performance, or achievements of the Company to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties, and other factors include, among others: (1) the

global health and economic crisis precipitated by the coronavirus (COVID-19) pandemic, (2) actions taken by governments, businesses, and individuals in response to the coronavirus (COVID-19) pandemic, (3) the pace of recovery when the

coronavirus (COVID-19) pandemic subsides, (4) the possible recurrence of the coronavirus (COVID-19), (5) changes in political conditions or the legislative or regulatory environment, including governmental initiatives affecting the financial

services industry, including without limitation the Coronavirus Aid, Relief, and Economic Security (or CARES) Act, (6) the possibility that our asset quality could decline or that we experience greater loan losses than anticipated, (7)

increased levels of other real estate, primarily as a result of foreclosures, (8) the impact of liquidity needs on our results of operations and financial condition, (9) competition from financial institutions and other financial service

providers, (10) the effect of interest rate increases on the cost of deposits, (11) unanticipated weakness in loan demand or loan pricing, (12) greater than anticipated adverse conditions in the national economy or local economies in which we

operate, including Middle Tennessee, (13) lack of strategic growth opportunities or our failure to execute on available opportunities, (14) deterioration in the financial condition of borrowers resulting in significant increases in loan losses

and provisions for those losses, (15) economic crises and associated credit issues in industries most impacted by the coronavirus (COVID-19) pandemic, including the restaurant, hospitality, and retail sectors, (16) the ability to grow and

retain low-cost core deposits and retain large, uninsured deposits, (17) our ability to effectively manage problem credits, (18) our ability to successfully implement efficiency initiatives on time and with the results projected, (19) our

ability to successfully develop and market new products and technology, (20) the impact of negative developments in the financial industry and United States and global capital and credit markets, (21) our ability to retain the services of key

personnel, (22) our ability to adapt to technological changes, (23) risks associated with litigation, including the applicability of insurance coverage, (24) the vulnerability of the network and online banking portals of Reliant Bank (the

“Bank”), and the systems of parties with whom the Company and the Bank contract, to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss, and other security breaches and

interruptions, (25) changes in state and federal laws, rules, regulations, or policies applicable to banks or bank or financial holding companies, including regulatory or legislative developments, (26) adverse results (including costs, fines,

reputational harm, and/or other negative effects) from current or future litigation, regulatory examinations, or other legal and/or regulatory actions, (27) the risk that expected cost savings and revenue synergies from (a) the merger of the

Company and Tennessee Community Bank Holdings, Inc. (“TCB Holdings”) (the “TCB Holdings Transaction”) or (b) the merger of the Company and First Advantage Bancorp (“FABK”) (the “FABK Transaction” and, together with the TCB Holdings Transaction,

collectively, the “Transactions”), may not be realized or may take longer than anticipated to be realized, (28) the effect of the Transactions on our customer, supplier, or employee relationships and operating results (including without

limitation difficulties in maintaining relationships with employees and customers), as well as on the market price of the Company’s common stock, (29) the risk that the businesses and operations of TCB Holdings and its subsidiaries and of FABK

and its subsidiaries cannot be successfully integrated with the business and operations of the Company and its subsidiaries or that integration will be more costly or difficult than expected, (30) the amount of costs, fees, expenses, and

charges related to the Transactions, including those arising as a result of unexpected factors or events, (31) reputational risk associated with and the reaction of our customers, suppliers, employees, or other business partners to the

Transactions, (32) the risk associated with Company management’s attention being diverted away from the day-to-day business and operations of the Company to the integration of the Transactions, and (33) general competitive, economic, political,

and market conditions, including economic conditions in the local markets where we operate. Additional factors which could affect the forward-looking statements can be found in the Company’s annual report on Form 10-K, quarterly reports on Form

10-Q, and current reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at http://www.sec.gov. The Company believes the forward-looking statements contained herein are reasonable;

however, many of such risks, uncertainties, and other factors are beyond the Company’s ability to control or predict and undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak

only as of the date that they are made. Therefore, the Company can give no assurance that its future results will be as estimated. The Company does not intend to, and disclaims any obligation to, update or revise any forward-looking

statement. Non-GAAP Financial MeasuresThis presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and, therefore, are considered non-GAAP financial

measures. Members of the Company’s management use these non-GAAP financial measures in their analysis of the Company’s performance, financial condition, and efficiency of operations. Management of the Company believes that these non-GAAP

financial measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods, and demonstrate the effects of significant gains and charges in the current period. Management of the Company also

believes that investors find these non-GAAP financial measures useful as they assist investors in understanding underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed

herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the non-GAAP financial measures discussed herein are

calculated may differ from the manner in which measures with similar names are calculated by other companies. You should understand how other companies calculate their financial measures similar to, or with names similar to, the non-GAAP

financial measures we have discussed herein when comparing such non-GAAP financial measures. 1 The non-GAAP financial measures contained in this presentation include, without limitation, adjusted net income, adjusted return on average assets

(adjusted ROAA), average tangible common equity, adjusted return on average tangible common equity (adjusted ROATCE), adjusted (quarterly) earnings per share, adjusted return on average equity (adjusted ROAE), adjusted net interest rate spread,

adjusted net interest margin, tangible assets, tangible common equity, tangible book value per share (TBVPS), tangible common equity to tangible assets (TCE/TA), return on average tangible common equity (ROATCE), adjusted non-interest expense,

adjusted pre-tax, pre-provision income, real income, adjusted efficiency ratio, and allowance for loan losses plus unamortized loan accretion to total loans.

Pandemic - Our Response to COVID-19 EmployeesEnsuring Health and Safety of our Team

Members CommunitiesHelping the Communities we Serve PromiseMeet needs through actions tailored after the bank’s core values MissionMaintain Banking ServicesPreserve Capital Control Expenses CommunitiesHelping the Communities we

Serve CommunitiesHelping the Communities we Serve Remain focused on delivering the bank’s promise to grow a community of friends - one relationship at a time, as we provide essential services to our neighbors and partner with local

non-profits to serve our communitiesDeployed and continue monitoring federal guidelines for effective protocol, including social distancing, to prevent the spread of the virusImplemented enhanced cleaning procedures with sterilization and

provided protective gear, including hand sanitizer, masks, plexi-shields in customer facing areas and infrared thermometersAdjusted our business model to implement telework for employees whose job functions can be executed remotely, including

virtual meetings using teleconferencing, Teams, Zoom and Go To Meeting Delivering service at all branches via drive thru facilities and lobby visits by appointment. ATMs are continually replenished and accessible at all locations. Remote ATM

access is also available at over 32,000 surcharge-free ATMs nationwide through the MoneyPass® networkSuspended share repurchase program during 2020Suspended new capital projectsReviewing branch networkSuspended non-essential business

travelLimited non-essential discretionary expenditures As we continue to navigate this unprecedented time, our commitment and focus on Reliant’s mission remains unchanged — to inspire and empower our employees, deliver exceptional customer

experiences and give back to our communities through involvement and outreach. This duty includes taking quick action to preserve capital and liquidity and aggressively manage and control unwarranted expenses. Our employees and customers

depend on us to do the right things, so we tailored our action plan after the bank’s values with a special focus on communication, which is provided via email, internal and external website blogs and virtual CEO Townhall meetings. Each of these

channels are used to provide bank updates and aid options as they become available. 2

Pandemic - Our Response to COVID-19 (Cont’d) EmployeesEnsuring Health and Safety of our Team

Members CommunitiesHelping the Communities we Serve CommunitiesHelping the Communities we Serve CommunitiesHelping the Communities we Serve Reinvented employee training modules for virtual deliveryExtended coverage of

First Stop Health Benefit to all employees – even those not enrolled in Reliant’s group medical plan to provide virtual medical advice and assistanceEmployees with symptoms or who may have been exposed to the virus are asked to stay home – with

full payGifted $500 bonus to each non-executive employee, in appreciation of the continued efforts to ensure we maintain servicing to our customers and communities during the unprecedented pandemic As a trusted financial advisor, we continue

to extend credit and are working directly with our customers impacted by the COVID-19 pandemic to defer payments, modify loan and repayment terms, assist with overdraft/late fees, provide flexibility with early CD withdrawals and otherwise

provide assistance. Promise (cont’d)Meet needs through actions tailored after the bank’s core values We are serving as a participating lender with SBA’s Paycheck Protection Program (PPP) giving our small business customers access to critical

funds. To date, Reliant’s PPP stats reflect: 891 active PPP borrowers$83,220,482 in PPP loans$3,295,755 in PPP loan FeesHardship relief available to Reliant credit card holders, with late fees waived from April 3 - June 30, with ability to

defer payments for up to three months. Trusted AdvisorWorking directly with those impacted by COVID-19 pandemic and providing financial support 24/7 Mobile App Online Banking/Bill Pay 24/7 ATMs Tap-To Pay 24/7 Telephone Banking Debit

& Credit Cards 3

Pandemic - Our Response to COVID-19 (Cont’d) EmployeesEnsuring Health and Safety of our Team

Members CommunitiesHelping the Communities we Serve CommunitiesHelping the Communities we Serve CommunitiesHelping the Communities we Serve We have increased efforts to educate customers about digital and alternative

options that allow them to bank remotely, including: Trusted Advisor (cont.)Working directly with those impacted by COVID-19 pandemic and providing financial support 24/7 Mobile App Online Banking/Bill Pay 24/7 ATMs Tap-To-Pay 24/7

Telephone Banking Debit & Credit Cards Increased access, education and awareness have resulted in growth in digital channel usage by clients: Mobile Deposits 36.6% Q2 2019* vs Q2 2020** Total Dollars $9,987,467 vs

$13,640,650 Online Transfers 53% Q2 2019* vs Q2 2020** Total Dollars $389,255,454 vs $595,477,186 ATM Deposits 65.3% Q2 2019* vs Q2 2020** Total Dollars $1,864,314 vs $3,081,314 Online Transfers 26.2% Q2 2019* vs Q2

2020** Total Items 97,792 vs 123,363 Mobile Deposits 20.3% Q2 2019* vs Q2 2020** Total Items 14,054 vs 16,912 Branch Transactions 28.1% Q2 2019* vs Q2 2020** Total Items 709,025 vs 509,783 * 2019 Includes figures for

Reliant Bank, Community Bank & Trust and First Advantage Bank.** 2020 Includes figures from the combined bank. 4

Financial Highlights & Results Quarterly Highlights for Q2 2020 Financial Results Note: Core

figures exclude mortgage subsidiary financials and one-time merger expensesAdjusted for merger expensesNon-GAAP figures. Refer to appendix for “reconciliation of non-GAAP financial measures”Gross figureBank segment excludes RMV

results. (3) (2) (2) (1) (1) (1) (1) (2) (2) (2) (2) (2) (2) (2) 5 Reported EPS for the second quarter of 2020 was $0.48 per diluted common share on net income of $7.9 million. Second quarter 2020 net income was impacted by,

among other items, $5.2 million of purchase accounting accretion ($0.23 increase to EPS) and $2.6 million of merger expense ($0.12 decrease to EPS).Pre-tax, pre-provision income (excluding merger costs) was $15.2 million for the second quarter

of 2020. Real income was $12.2 million or $0.74 per common diluted share for the second quarter of 2020.Net interest margin increased 97 bps from March 31, 2020 to 4.58% at June 30, 2020, helping generate record-level net interest income of

$30.0 million. When $5.2 million of purchase accounting accretion and tax credits are excluded, adjusted net interest margin is 3.70%, up 26 bps from March 31, 2020.Loan provision expense for the second quarter of 2020 was $3.0 million, all of

which can be attributed to increased risk factors related to the COVID-19 pandemic. A loan fair value mark of $21.8 million was recorded for the loan portfolio purchased from First Advantage Bank. Allowance for loan loss and unamortized

purchase loan discounts comprised 1.73% of gross loans held for investment at June 30, 2020.Core deposits totaled approximately $2.0 billion at June 30, 2020, an increase of $715.9 million since March 31, 2020, from both acquisition and organic

growth, helping reduce cost of funds to 91 basis points, a 39-bps decline from the linked quarter.Bank-segment non-interest expense was $16.4 million for the second quarter of 2020, an increase of $4.0 million from the first quarter of 2020.

The increase was primarily due to the addition of former First Advantage Bank employees and facilities and approximately $811 thousand of restructuring and non-recurring miscellaneous charges. (2) (2) (2) (2) (4) (1) (2) (1) (2) (1)

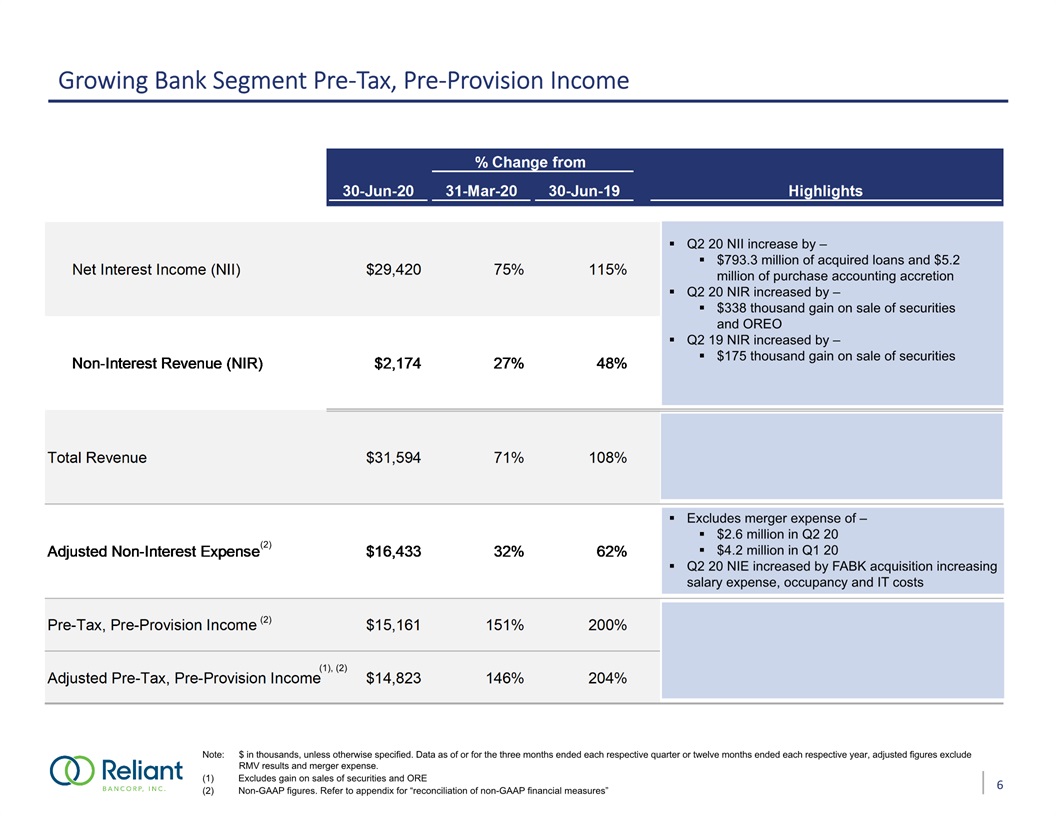

Growing Bank Segment Pre-Tax, Pre-Provision Income Q4 19 NII impacted by 1.1 million gain on

sale of securities$166 thousand gain on sale of OREQ1 19 NII impacted by$131 thousand gain on sale of securities Note: $ in thousands, unless otherwise specified. Data as of or for the three months ended each respective quarter or twelve

months ended each respective year, adjusted figures exclude RMV results and merger expense. Excludes gain on sales of securities and ORENon-GAAP figures. Refer to appendix for “reconciliation of non-GAAP financial measures” (2) 6 Q2 20 NII

increase by –$793.3 million of acquired loans and $5.2 million of purchase accounting accretionQ2 20 NIR increased by –$338 thousand gain on sale of securities and OREOQ2 19 NIR increased by –$175 thousand gain on sale of securities Excludes

merger expense of –$2.6 million in Q2 20$4.2 million in Q1 20Q2 20 NIE increased by FABK acquisition increasing salary expense, occupancy and IT costs (2) (1), (2)

Growing, Profitable Bank Segment Bank Segment Net Income(1),(2),(3) Source: Company

documentsNote: $ in millions, unless otherwise specified; Data as of or for the three months ended each respective quarter or twelve months ended each respective year. Bank segment results exclude RMV results. Please note, RMV results are

included in consolidated financial results, with any loss netted out as non-controlling interest in subsidiary.Does not include merger expense. Refer to appendix for “reconciliation of non-GAAP financial measures.”Non-GAAP figure. Refer to

appendix for “reconciliation of non-GAAP financial measures.” Bank Segment Net Interest Income(1),(2) Bank Segment Non-Interest Expense(1),(2),(3) Adj. NIM(3): Adjusted Efficiency(1) (3): 7 Adjustments due to merger

expenses

Recent Acquisitions to Grow Franchise and Expand Presence in Middle Tennessee Announced on September 16,

2019; Closed on January 1, 2020Assets: $253 millionHeadquarters: Ashland City, TN Five branches in the Nashville MSA Announced on October 23, 2019; Closed on April 1, 2020Assets: $738 millionHeadquarters: Clarksville, TN Five branches in

Montgomery County, TN; Three branches in the Nashville MSA Entry into Cheatham County, TN with the #1 deposit market share and strengthens existing footprint in Robertson County, TNSome of the lowest cost deposits in the regionSizeable

reductions in noninterest expense coupled with increased capital base to further support borrower demand Extended footprint into the attractive Clarksville MSA with #2 deposit market share and 15.4% of depositsVibrant Williamson County, TN

position improves to #5 with 8.5% deposit market share Added highly profitable manufactured housing lending business (8.9% of total loan portfolio at June 30, 2020) Modeled EPS accretion in 2021 of ~12.5%Cost savings tracking better than

expected4 of the 5 acquired branches have been retainedRealizing deposit growth – not runoff and strong retention of loan portfolio Modeled EPS accretion in 2021 of >17%Cost savings on track with strong employee retention6 of the 8 acquired

branches have been retainedSignificant customer retention – both loans and deposits Overview Strategic Rationale Transaction Considerations and Updates Successful integration of two accretive and attractive

acquisitions 8 (1) (1) (1) (1) Financial data based on FDIC Summary of Deposits report as of June 30, 2019. (1) (1)

Diverse Deposit Portfolio Mix Cost of IB Deposits: Cost of Funds: Note: $ in millions, unless

otherwise specified. Data as of or for the three months ended each respective quarter or twelve months ended each respective year. Reflects consolidated numbers for Reliant Bancorp, Inc. Wholesale and Other Purchased Funds 0.49% 0.73%

1.15% 1.67% 1.71% 1.37% 0.99% 0.40% 0.61% 0.96% 1.42% 1.45% 1.12% 0.79% 0.43% 0.66% 1.07% 1.48% 1.52% 1.30% 0.91% Total Deposits CAGR: 40.8% % of Total Deposits: Wt. Avg. Cost: Wt. Avg.

Duration (Months): 2.34% 2.10% 1.85% 1.13% 0.37% 3.0 2.2 2.0 2.0 3.9 Cost of Total Deposits: 9

Balancing Growth and Profitability Coupon + Fees: Loan Portfolio(1) Notes:$ in millions,

unless otherwise specified. Data as of or for the three months ended each respective quarter or twelve months ended each respective year. Does not include loans held for sale.Increase in Consumer & Other loans at June 30, 2020 due to

acquisition of $177.0 million of Manufactured Housing – Chattel loans from First Advantage Bank. CAGR: 42.7% Loan Yields 10 (2)

Well Capitalized and Strong Liquidity Position Source: Company documents, SNL FinancialNote: Data as of

or for the three months ended each respective quarter; Chart and table reflect numbers for Reliant Bank (excludes holding company)Estimated figures only as regulatory Call Report has not been finalized Non-GAAP figure. Refer to appendix for

“reconciliation of non-GAAP financial measures”.Cash balance adjusted by transit items.Net of current advances. (1) (2) 11 (4) (3)

Delivering Shareholder Value Reported and Adjusted Quarterly Diluted EPS(1) Tangible Book Value per

Share(1) Reported and Adjusted ROAA(1) Reported and Adjusted ROATCE(1) Source: Company documentsNote: Data as of or for the three months ended each respective quarter. (1) Non-GAAP figures. Refer to appendix for “reconciliation of non-GAAP

financial measures”. 12 Reported Metrics Adjustments due to merger expenses

Disciplined Credit Culture Allowance for Loan Loss + Purchase Discounts(1) Net Charge-Offs (Recoveries)

/ Average Loans(2) Non-Performing Assets / Total Assets Source: Company documentsNote: Data as of or for the three months ended each respective quarter.Non-GAAP figure. Refer to appendix for “reconciliation of non-GAAP financial

measures.”Data has been annualized 13

Reconciliation of Reserves Reserves / Loans (%) (Reserves + Discount) / Loans (%) Note: Data as of

3/31/2020 and as of the three months ended 6/30/2020, respectively(1) Assumes partial amortization of existing acquired loan discount $3.0 mm $(58.5) mm $(646.6) mm $3.0 mm $(58.5) mm $646.6 mm $21.8 mm Reflects Acquired Loan

Discount A B C D E F G H I J K L M N (1) (1) 14

Diversified Lending Platform C&D Portfolio Commercial Real Estate Portfolio Source: S&P Global

Market Intelligence, Company documentsNote: $ in millions, unless otherwise specified. Data as of or for the three months ended each respective quarter. Outstanding balance as a % of Total Capital 15

Hospitality Portfolio – Granular Portfolio with Conservative Credit Profile Source: Company

documentsNote: Data as of or for the three months ended June 30, 2020 (1) Represents committed loan amount. Local vs. National(1) Term vs. Construction(1) Portfolio Highlights Hotel Flags(1) 5.79% of Total Portfolio(1)Portfolio totals as

of Q2 ’20: Term: $101.1 million, 27 borrowers with an average loan size of $3.7 millionConstruction: 5 projects totaling $45.7 million with $7.7 million fundedPrimarily limited-service national franchisesStrong LTVs and DSCRsWeighted average

LTV – 58.14% Weighted average DSCR – 2.26xNo nonperforming loans in segment; 0.0% charge-offs in 2019Average seasoning of 58 monthsAll secured by first liens on real estate and FFE (Pre-Covid-19) 16

Restaurant Portfolio – Diversified with Low Average Loan Size Source: Company documentsNote: Data as of

or for the three months ended June 30, 2020(1) Represents committed loan amount.(2) Other Includes, without limitation, Dairy Queen, Gigi’s Cupcakes, Captain D’s, Jet’s Pizza, Zaxbys, Wendy’s and Starbucks Total $93.7 million Total $124.4

million Portfolio Statistics Burger King Local vs. National(1) Secured by Real Estate(1) Portfolio Highlights Brands(1) 5.21% of Total Portfolio(1)Outstanding balances as of Q2 ’20: $96.3 millionQuick-Service (QSR) national franchises:

83.1 million 86% of total Dine-in Facilities: $16.5 million 14% of totalMajority of borrowers have been with Reliant for 5+ yearsWeighted average DSCR: 1.65x No nonperforming loans in segment; 0.0% charge-offs in 202039% of outstanding loans

secured by real estate DSCR and ‘Other’ brand numbers under progress Show % of total Show % of total TBU TBU – Restaurant Data 17 (2)

Retail CRE Portfolio Source: Company documentsNote: Data as of or for the three months ended June 30,

2020 Represents committed loan amounts. Total $93.7 million Total $124.4 million Portfolio Statistics Burger King Non Owner-Occupied by Property Type(1) Non Owner-Occupied vs. Construction(1) Portfolio Highlights Construction by

Property Type(1) No past dues in categories at 6/30/2020No charge-offs in categories in 2019 or YTD 2020All loans in categories are Pass-ratedRetail Anchored Tenants (Primarily Publix, CVS, Large National Retailers) Avg. Loan Size - $3.5

million Committed Balance - $28.3 millionAvg. DSC – 1.42xAvg. LTV – 56.36%Retail Non-Anchored Tenants - 107 CustomersAvg. Loan Size - $1.1 million Committed Balance - $134.6 millionAvg. DSC – 2.03xAvg. LTV – 64.68%Retail Single Credit Tenant

(Largest Concentration – Dollar General, AT&T)Committed Balance - $40.4 million Avg. DSC – 1.37xAvg. LTV – 62.35% DSCR and ‘Other’ brand numbers under progress Show % of total Show % of total TBU TBU – Restaurant Data 18

Providing Relief to Customers - Loan Modifications Q4 19 NII impacted by 1.1 million gain on sale of

securities$166 thousand gain on sale of OREQ1 19 NII impacted by$131 thousand gain on sale of securities Initial Mod Request through May 31, 2020 Second Mod Request – July 17, 2020 Modifications % of Total Modifications % of

Total C&I $34,851 1.54% $6,095 0.26% Church / Consumer / Medical 24,809 1.10% - - CRE 291,232 12.90% 1,916 0.08% Hospitality 96,047 4.25% 15,993 0.69% Multifamily 14,757 0.65% - - Restaurant

54,067 2.39% - - Manufactured Housing 14,887 0.66% - - Total Modifications $530,650 23.50% $24,004 1.04% Portfolio total $2,258,390(1) $2,317,324(2) ($ in thousands) Source: Company information(1)

As of March 31, 2020 – Reliant and FABK combined on a proforma basis.As of June 30, 2020, The Information presented reflects second loan modifications granted on or before July 17, 2020. Management anticipates additional loan modification

requests will be received, and the actual numbers of second loan modifications granted may be higher than the numbers as presented in this performance measure. 19 (3)

Our Strategy for 2020 COVID-19 response:Focus on employees, customers and communitiesPrudently monitor

credit environment and capital ratiosCapital preservation – share repurchase suspended, ongoing evaluation of dividendsRigorous review of non-interest expenseReview branch networkPursue coveted M&A opportunitiesOn-going focus on organic

earning-asset generation and improved funding mixFully integrate Community Bank & Trust and First Advantage Bank acquisitions and leverage presence in new marketsHire selectively to prepare for future growthBuild out and optimize digital

channelAlign management structure for $3-5 billion company 20

Appendix

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Adjusted Net Income, Adjusted Return

on Average Assets, Average Tangible Common Equity, Adjusted Return on Average Tangible Common Equity, Adjusted Earnings Per Share and Adjusted Return on Average Equity 21

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Adjusted Net Interest Spread and

Adjusted Net Interest Margin 22

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Tangible Common Equity to Tangible

Assets, Tangible Book Value per Share and Return on Average Tangible Common Equity 23

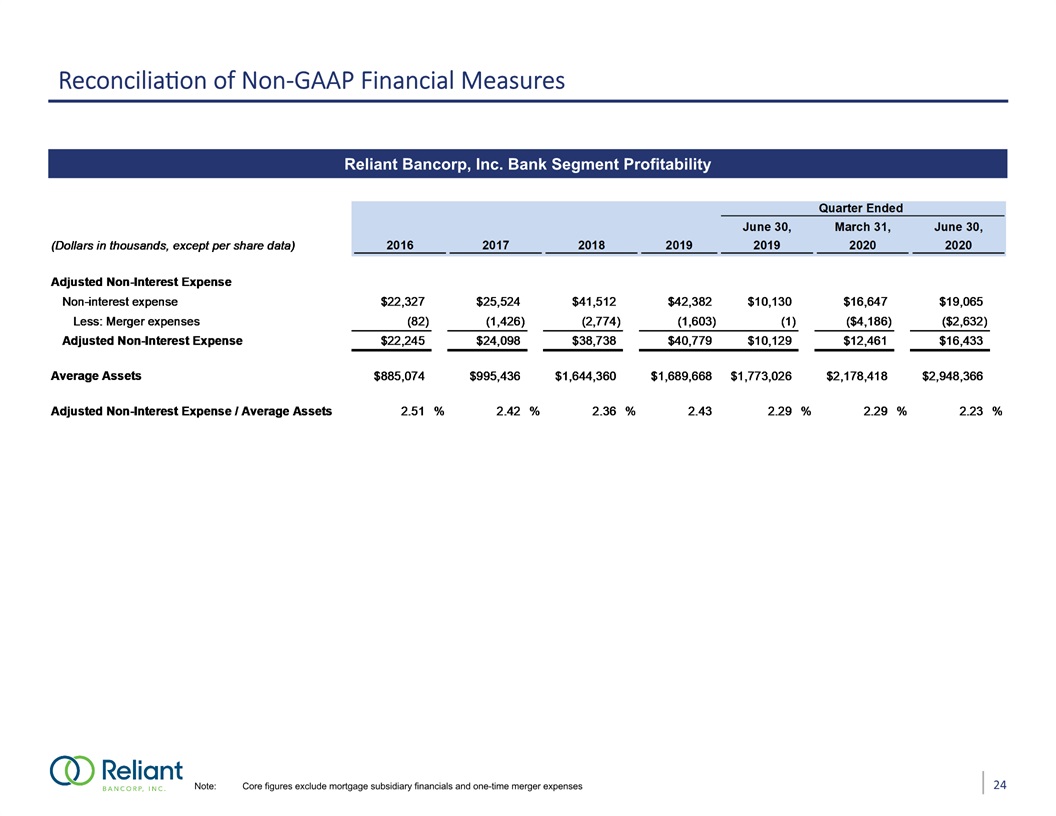

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Bank Segment Profitability Note:

Core figures exclude mortgage subsidiary financials and one-time merger expenses 24

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Bank Segment Pre-tax Pre-Provision

Net Income and Real Income Note: Core figures exclude mortgage subsidiary financials and one-time merger expenses 25

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Adjusted Efficiency Ratio Note:

Adjusted figures exclude RMV results and merger expense. 26

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. ALLL + Unamortized Loan

Accretion 27