Attached files

| file | filename |

|---|---|

| 8-K - 8-K 2ND QTR 2020 EARNINGS PRESENTATION - FIRST MERCHANTS CORP | frme-20200723.htm |

2Q 2020 | Earnings Highlights | July 23, 2020

Forward Looking Statement This presentation contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward- looking statements include, but are not limited to, statements relating to First Merchants’ goals, intentions and expectations; statements regarding the First Merchants’ business plan and growth strategies; statements regarding the asset quality of First Merchants’ loan and investment portfolios; and estimates of First Merchants’ risks and future costs and benefits. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the effects of a pandemic or other unforeseeable event; the ability of First Merchants to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like First Merchants’ affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity, credit and interest rate risks associated with the First Merchants’ business; and other risks and factors identified in each of First Merchants’ filings with the Securities and Exchange Commission. First Merchants undertakes no obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this presentation or press release. In addition, the company’s past results of operations do not necessarily indicate its anticipated future results. NON-GAAP FINANCIAL MEASURES These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, First Merchants Corporation has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

Michael C. Rechin President Chief Executive Officer

2nd Quarter 2020 Highlights . Earnings Per Share of $.62; Net Income of $33.0 Million; ROA 0.97% Earnings . Pre-Tax Pre-Provision Income of $59.1 Million . PTPP ROA 1.73%; PTPP ROE 13.18% . Total Assets of $13.8 Billion; Grew by 28.7% over 2Q 2019 Assets . Total Loans Grew approximately $900 Million from PPP Volume . Allowance & Fair Value Marks totaling 1.62% of Loans Asset Quality . $21.9 Million Provision; Allowance increased by 49.0% over 2Q 2019 . Deposit Costs Declined by 50 bps from 4Q 2019 to 47 bps Deposits . Anticipate Additional Interest Rate and Expense Reductions Linked to CD Volume and Maturities . Tangible Common Equity to Assets of 9.31% Capital . $23.04 TBV Per Share, 9.7% Increase over 2Q 2019 4

Response to COVID-19 . SBA Paycheck Protection Program institution with more than 5,000 applications and greater than $900 Million funded to businesses (FMB is, and has been, a preferred SBA Lender) CARES Act . Prepared for forgiveness phase with internal and external resources . Main Street Approved Lender . Less than $1.25 Billion in Commercial Loan modifications or ~12% of the portfolio COVID-19 Loan . Robust process for 2nd request modifications Modifications . No 2nd request modifications at the end of the quarter with limited interest thus far . Ample liquidity with Loan to Deposit Ratio of 84.8% Liquidity . Deposit Growth of $1.1 Billion or 11% over 1Q 2020 . Cash and Investment Securities total $3.4 Billion; increasing 15% over 1Q 2020 5

Response to Our Stakeholders . Protection of Clients and Employees is our priority . All Banking Center lobbies are open and serving clients Client & . Modifications and protective barriers in place to protect Employees and Clients Employee . “Safe” environment includes masked employees with appointments encouraged Support . Enhanced mobile and online services, such as increased mobile deposit limits, to allow more transactions to be completed outside the branch . Leveraged digital banking, call center and banking centers to provide uninterrupted customer service . “Return to Office” framework flexes to our environment . $1 Million in donations distributed to non profits within our communities aiding COVID-19 relief efforts Community . $1.4 Billion pledged within the Community Benefits Agreement to provide multi-year Support support through credit, philanthropy and banking center access . Director of Corporate Social Responsibility named to combine and expand efforts throughout market 6

Our Franchise ILLINOIS MICHIGAN Restore Illinois Plan Phase 4 of 5 MI Safe Start Plan Phase 2-4 of 6 Unemployment1 April 2020 16.4% Unemployment1 June 2020 14.6% April 2020 22.7% June 2020 14.8% OHIO INDIANA Responsible Restart Ohio Back on Track Indiana Plan Levels 1-3 Phase 4.5 of 5 Unemployment1 1 Unemployment April 2020 16.8% April 2020 16.9% June 2020 10.9% June 2020 11.2% 1US Bureau of Labor Statistics 7

Mark K. Hardwick Executive Vice President Chief Financial Officer and Chief Operating Officer

Total Assets ($ in Millions) 2018 2019 Q1-’20 Q2-’20 1. Investments $1,633 $2,596 $2,698 $2,789 2. Loans 7,229 8,468 8,612 9,2991 3. Allowance (81) (80) (99) (121) 4. Goodwill & Intangibles 470 579 577 576 5. BOLI 225 288 290 291 6. Other 409 606 616 985 7. Total Assets $9,885 $12,457 $12,694 $13,819 1 1 Includes $883 million of SBA Paycheck Protection Program loans 9

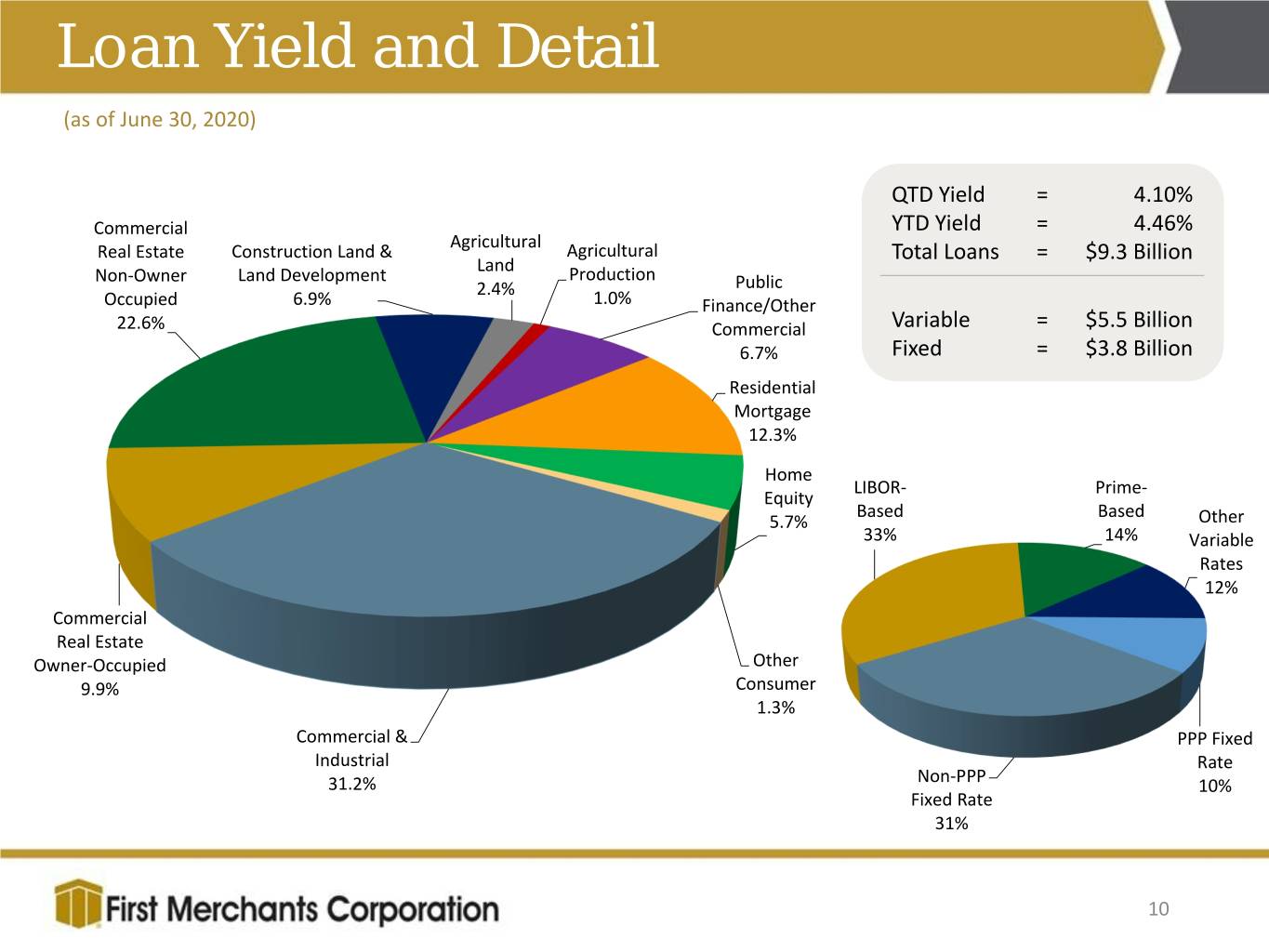

Loan Yield and Detail (as of June 30, 2020) QTD Yield = 4.10% Commercial YTD Yield = 4.46% Agricultural Real Estate Construction Land & Agricultural Total Loans = $9.3 Billion Land Non-Owner Land Development Production 2.4% Public Occupied 6.9% 1.0% Finance/Other 22.6% Commercial Variable = $5.5 Billion 6.7% Fixed = $3.8 Billion Residential Mortgage 12.3% Home LIBOR- Prime- Equity Based Based 5.7% Other 33% 14% Variable Rates 12% Commercial Real Estate Owner-Occupied Other 9.9% Consumer 1.3% Commercial & PPP Fixed Industrial Rate Non-PPP 31.2% 10% Fixed Rate 31% 10

Investment Portfolio (as of June 30, 2020) $2.8 Billion Portfolio Tax-Exempt Mortgage-Backed Modified duration of 4.7 years Municipals Securities Tax equivalent yield of 3.02% 51% 35% Net unrealized gain of $139.1 Million Corporate Obligations U. S. Collateralized 1% Agencies Mortgage 2% Obligations 11% 11

Total Liabilities and Capital ($ in Millions) 2018 2019 Q1-’20 Q2-’20 1. Customer Non-Maturity Deposits $6,268 $8,147 $8,256 $9,567 2. Customer Time Deposits 1,241 1,478 1,411 1,276 3. Brokered Deposits 246 215 203 123 Total Deposits 7,755 9,840 9,870 10,966 4. Borrowings 538 599 716 754 5. Other Liabilities 51 98 206 177 6. Hybrid Capital 133 134 124 113 7. Common Equity 1,408 1,786 1,778 1,809 8. Total Liabilities and Capital $9,885 $12,457 $12,694 $13,819 12

Deposit Detail (as of June 30, 2020) QTD Cost = 0.47% Certificates & Certificates & Time Time Deposits YTD Cost = 0.67% Deposits <$100,000 >$100,000 Total Deposits = $11.0 Billion Savings 6% Brokered 6% Deposits Deposits 30% 1% Demand Deposits 57% 13

Capital Ratios Total Risk-Based Capital Ratio (Target = 12.50%) Common Equity Tier 1 Capital Ratio (Target = 10.00%) Tangible Common Equity Ratio (TCE) (Target = 9.00%) 15.00% 14.71% 14.61% 14.56% 14.25% 14.37% 14.29% 14.18% 14.00% 13.81% 13.80% 13.00% 12.12% 11.98% 12.05% 12.14% 12.13% 11.84% 12.00% 11.64% 11.58% 11.21% 11.00% 10.16% 10.14% 10.07% 9.97% 9.95% 9.91% 9.93% without 10.00% 9.55% PPP Loans 9.36% 9.31% 9.00% 8.00% 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 14

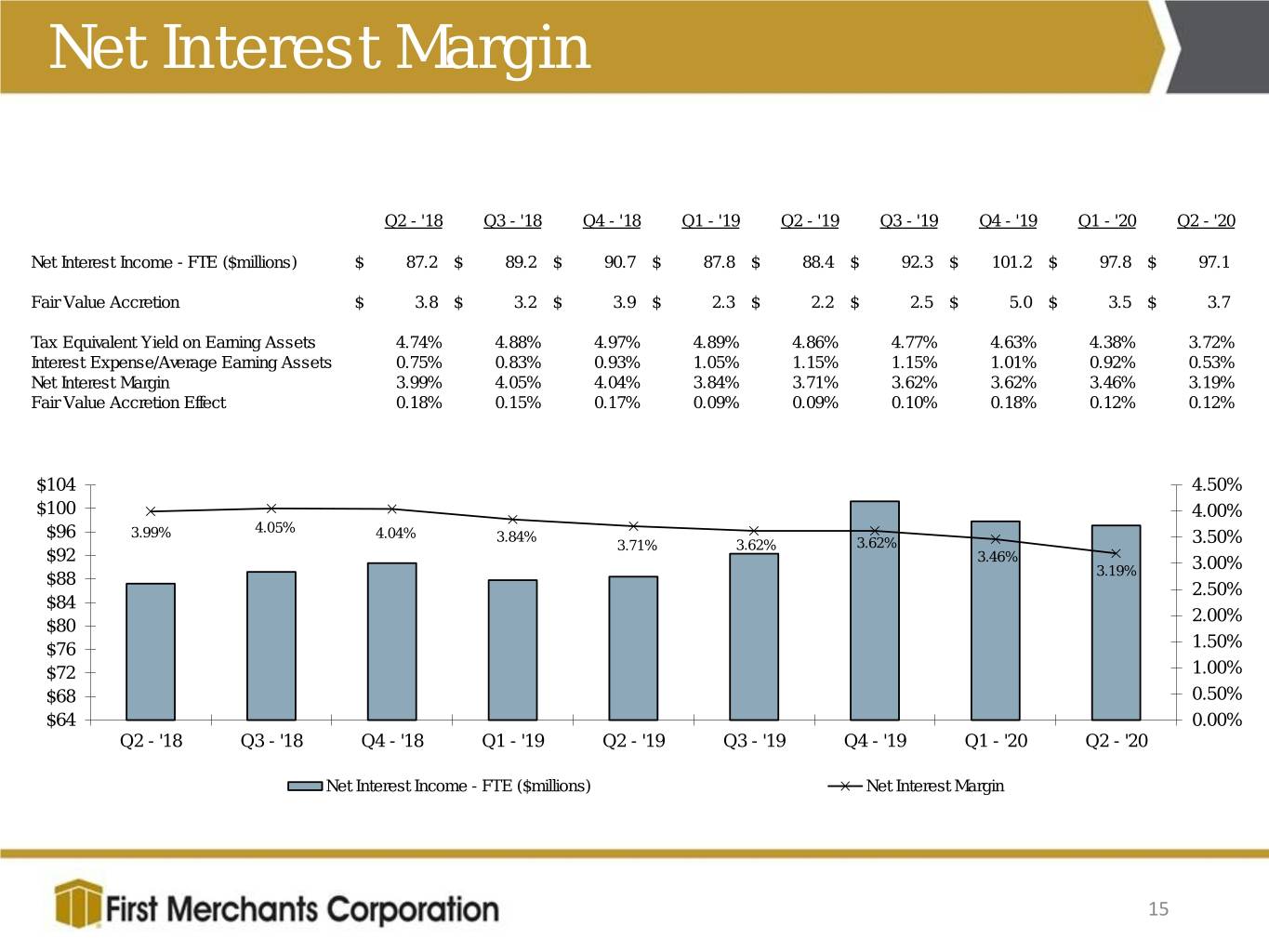

Net Interest Margin Q2 - '18 Q3 - '18 Q4 - '18 Q1 - '19 Q2 - '19 Q3 - '19 Q4 - '19 Q1 - '20 Q2 - '20 Net Interest Income - FTE ($millions) $ 87.2 $ 89.2 $ 90.7 $ 87.8 $ 88.4 $ 92.3 $ 101.2 $ 97.8 $ 97.1 Fair Value Accretion $ 3.8 $ 3.2 $ 3.9 $ 2.3 $ 2.2 $ 2.5 $ 5.0 $ 3.5 $ 3.7 Tax Equivalent Yield on Earning Assets 4.74% 4.88% 4.97% 4.89% 4.86% 4.77% 4.63% 4.38% 3.72% Interest Expense/Average Earning Assets 0.75% 0.83% 0.93% 1.05% 1.15% 1.15% 1.01% 0.92% 0.53% Net Interest Margin 3.99% 4.05% 4.04% 3.84% 3.71% 3.62% 3.62% 3.46% 3.19% Fair Value Accretion Effect 0.18% 0.15% 0.17% 0.09% 0.09% 0.10% 0.18% 0.12% 0.12% $104 4.50% $100 4.00% 4.05% $96 3.99% 4.04% 3.84% 3.71% 3.62% 3.62% 3.50% $92 3.46% 3.00% $88 3.19% 2.50% $84 2.00% $80 $76 1.50% $72 1.00% $68 0.50% $64 0.00% Q2 - '18 Q3 - '18 Q4 - '18 Q1 - '19 Q2 - '19 Q3 - '19 Q4 - '19 Q1 - '20 Q2 - '20 Net Interest Income - FTE ($millions) Net Interest Margin 15

Non-Interest Income ($ in Millions) 2018 2019 Q1-’20 Q2-’20 1. Service Charges on Deposit Accounts $ 21.0 $23.0 $ 6.0 $ 4.3 2. Wealth Management Fees 14.9 17.6 6.0 5.6 3. Card Payment Fees 18.0 20.2 5.9 6.1 4. Gains on Sales of Mortgage Loans 7.0 7.9 3.4 3.7 5. Derivative Hedge Fees 2.5 5.4 1.9 1.1 6. Other Customer Fees 1.9 1.7 0.4 0.3 7. Cash Surrender Value of Life Ins 4.2 4.5 1.4 1.3 8. Gains on Sales of Securities 4.3 4.4 4.6 3.1 9. Other 2.7 2.0 0.2 1.0 10. Total Non-Interest Income $76.5 $86.7 $29.8 $26.5 16

Non-Interest Expense ($ in Millions) 2018 2019 Q1-’20 Q2-’20 1. Salary & Benefits $131.7 $144.0 $39.2 $35.7 2. Premises & Equipment 32.7 35.8 10.2 9.9 3. Intangible Asset Amortization 6.7 6.0 1.5 1.5 4. Professional & Other Outside Services 8.2 15.4 2.3 1.6 5. OREO/Credit-Related Expense 1.5 2.4 0.5 0.7 6. FDIC Expense 2.9 0.7 1.5 1.5 7. Outside Data Processing 13.2 16.5 4.2 2.6 8. Marketing 4.7 6.7 1.4 2.1 9. Other 18.4 19.3 5.3 4.4 10. Total Non-Interest Expense $220.0 $246.8 1 $66.1 $60.0 1Includes acquisition-related expenses of $13.7 million 17

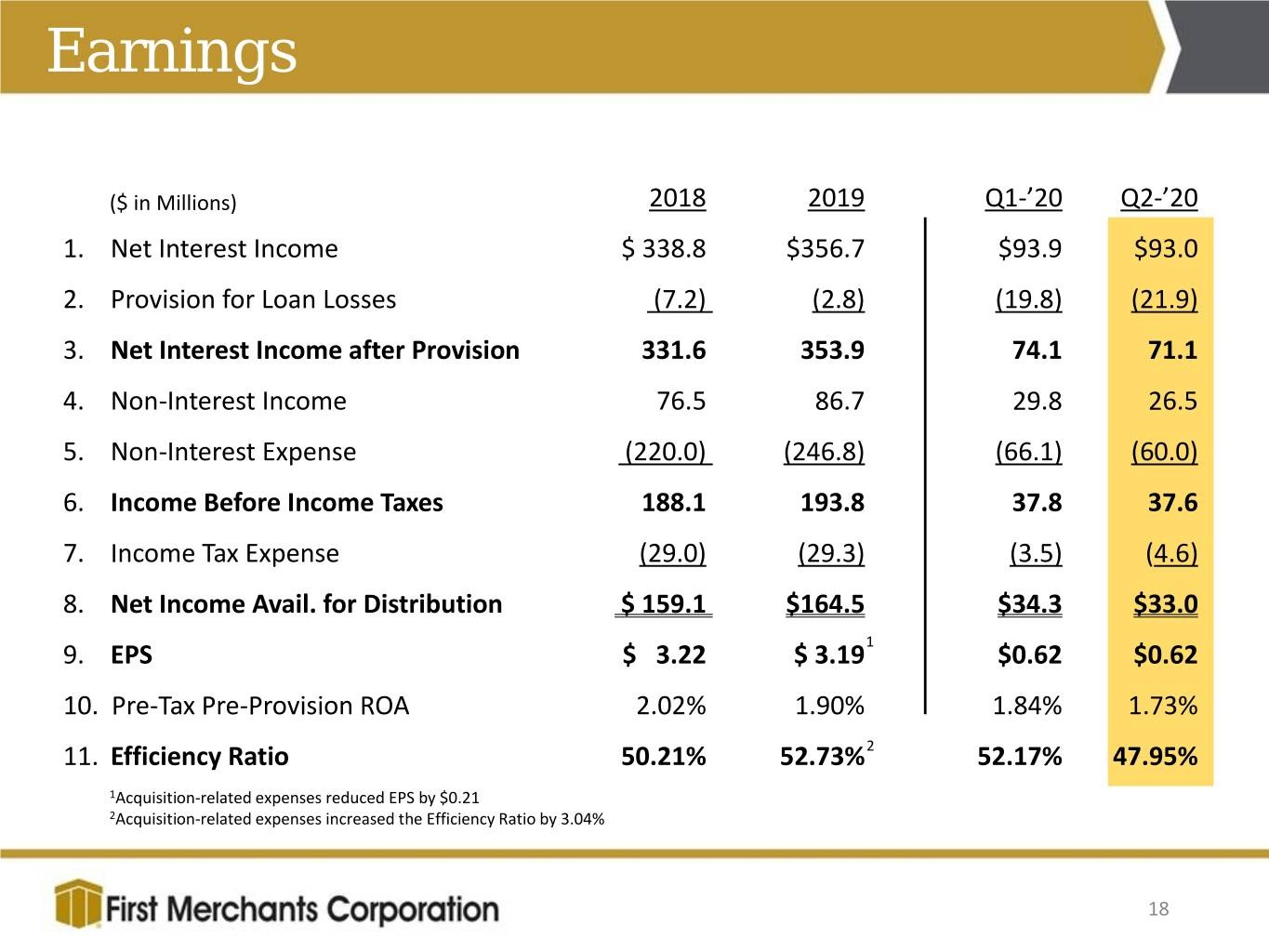

Earnings ($ in Millions) 2018 2019 Q1-’20 Q2-’20 1. Net Interest Income $ 338.8 $356.7 $93.9 $93.0 2. Provision for Loan Losses (7.2) (2.8) (19.8) (21.9) 3. Net Interest Income after Provision 331.6 353.9 74.1 71.1 4. Non-Interest Income 76.5 86.7 29.8 26.5 5. Non-Interest Expense (220.0) (246.8) (66.1) (60.0) 6. Income Before Income Taxes 188.1 193.8 37.8 37.6 7. Income Tax Expense (29.0) (29.3) (3.5) (4.6) 8. Net Income Avail. for Distribution $ 159.1 $164.5 $34.3 $33.0 9. EPS $ 3.22 $ 3.191 $0.62 $0.62 10. Pre-Tax Pre-Provision ROA 2.02% 1.90% 1.84% 1.73% 11. Efficiency Ratio 50.21% 52.73%2 52.17% 47.95% 1Acquisition-related expenses reduced EPS by $0.21 2Acquisition-related expenses increased the Efficiency Ratio by 3.04% 18

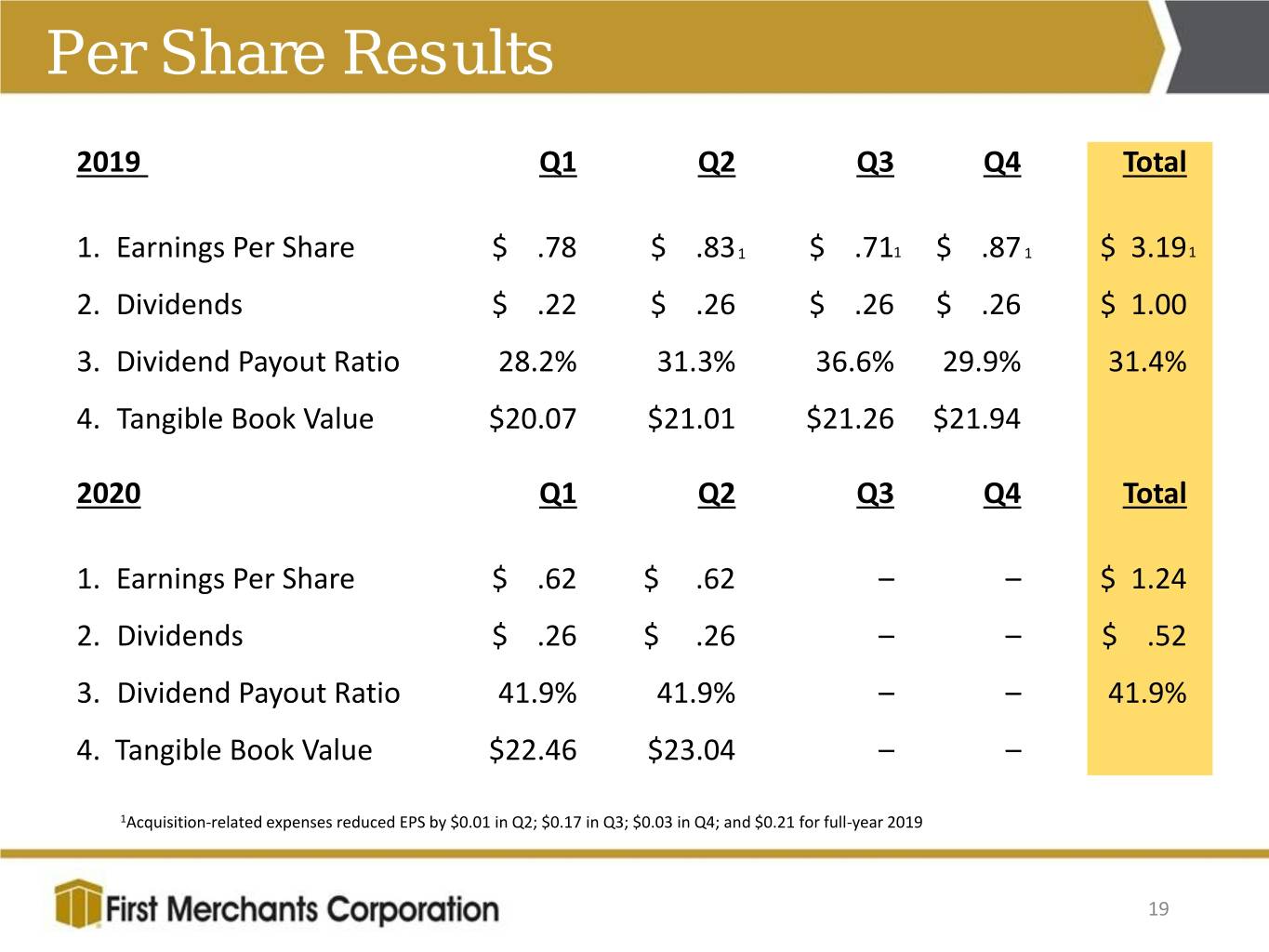

Per Share Results 2019 Q1 Q2 Q3 Q4 Total 1. Earnings Per Share $ .78 $ .83 1 $ .711 $ .87 1 $ 3.191 2. Dividends $ .22 $ .26 $ .26 $ .26 $ 1.00 3. Dividend Payout Ratio 28.2% 31.3% 36.6% 29.9% 31.4% 4. Tangible Book Value $20.07 $21.01 $21.26 $21.94 2020 Q1 Q2 Q3 Q4 Total 1. Earnings Per Share $ .62 $ .62 – – $ 1.24 2. Dividends $ .26 $ .26 – – $ .52 3. Dividend Payout Ratio 41.9% 41.9% – – 41.9% 4. Tangible Book Value $22.46 $23.04 – – 1Acquisition-related expenses reduced EPS by $0.01 in Q2; $0.17 in Q3; $0.03 in Q4; and $0.21 for full-year 2019 19

Dividends and Tangible Book Value Quarterly Dividends Tangible Book Value .26 .26 0.26 $23.04 0.24 $21.94 .22 0.22 $19.12 0.20 .18 $16.96 0.18 $15.85 .15 $14.68 0.16 .14 $13.65 0.14 $12.17 $10.95 0.12 .11 $9.21 $9.64 0.10 .08 0.08 0.06 .05 0.04 .03 0.02 .01 0.00 3.77% Forward Dividend Yield Compound Annual Growth Rate of 10.13% 20

Michele M. Kawiecki Senior Vice President Director of Finance

ALLL and Fair Value Summary ($ in Millions) Q3-'19 Q4-'19 Q1-'20 Q2-'20 1 Beginning Allowance for Loan Losses (ALLL) $ 81.3 $ 80.6 $ 80.3 $ 99.5 2 Less: Net Charge-offs (Recoveries) 1.3 0.8 0.6 0.2 3 Add: Provision Expense 0.6 0.5 19.8 21.9 4 Ending Allowance for Loan Losses (ALLL) $ 80.6 $ 80.3 $ 99.5 $ 121.1 5 Specific Reserves $ 2.3 $ 0.7 $ 0.6 $ 13.0 6 ALLL/Non-Accrual Loans 354.5% 503.4% 635.5% 241.7% 7 ALLL/Non-Purchased Loans 1.16% 1.11% 1.33% 1.46% 8 ALLL/Loans 0.97% 0.95% 1.15% 1.30% 9 Fair Value Adjustment (FVA) $ 41.3 $ 36.6 $ 33.1 $ 29.3 10 Total ALLL plus FVA 121.9 116.9 132.5 150.4 11 Purchased Loans plus FVA 1,410.3 1,271.2 1,155.1 1,039.4 12 FVA/Purchased Loans plus FVA 2.93% 2.88% 2.86% 2.82% 100% 90% 80% 70% 60% 62.1% Cumulative Loan Income 50% 16.1% Cumulative Offset Charge-Offs 40% Remaining Fair Value 21.8% Adjustment 30% 20% 10% 0% 22

Loan Loss Coverage & Capital Strength ALLL ALLL/Loans ALLL/Loans - PPP Loans Allowance for Loan Losses - 12/31/19 $ 80.3 0.95% Q1-'20 increase in ALLL $ 19.2 Allowance for Loan Losses - 3/31/20 $ 99.5 1.15% Q2-'20 increase in ALLL $ 21.6 Allowance for Loan Losses - 6/30/20 $ 121.1 1.30% 1.44% CECL Day 1 Adoption Impact* $ 52.2 Allowance for Loan Losses with CECL Day 1 Impact $ 173.3 1.86% 2.06% *CECL has not been adopted and is included for illustrative purposes only. The impact assumes retrospective measurement back to January 1, 2020 and reflects the range disclosed in the 12/31/19 Form 10-K. Adoption impact would also include $18.5 million in reserve for unfunded commitments recorded in Other Liabilities. Total Risk Based Capital Ratio with CECL Adoption 13.68% (Stated – 14.18%) Excess Capital Post-CECL allowance + excess 3.18% $316 million capital provides $500 million in of excess capital reserves without considering future earnings or remaining fair value marks Well Capitalized 10.50% 23

John J. Martin Executive Vice President Chief Credit Officer

Loan Portfolio Trends Portfolio Trending – Q2-’20 25

Loan Portfolio Portfolio – Q2-’20 Geography By State COVID Modifications by Loan Type $ Millions $ with # with Mods Mods % of $ Commercial & Industrial $ 163 681 6.3% Sponsor Finance 12 4 3.7% CRE Owner Occupied 266 435 29.1% Construction & Land Development 36 21 5.6% CRE Non-Owner Occupied 544 422 25.9% Agriculture 2 11 0.7% Residential Mortgage 95 645 8.3% Home Equity 3 66 0.6% Other Consumer 3 263 2.5% Total Loans $ 1,124 2,548 12.1% 26

COVID-19 Loan Modifications by Industry Loan Balances by Industry Loan Balances and Mod Requests Manufacturing Public Administration Other Administrative Services Agriculture Wholesale Trade Retail Trade Senior Living Hotels Professional Service Medical Restaurant & Food Service Construction Finance & Insurance Specialty Trade Other Service Transportation & Warehouse Religious Organizations Private Banking/Private… Dental Mining & Utilities Veterinary Loan Balance Mod Requests 27

Payroll Protection Loans Payroll Protection Summary Payroll Protection Distribution $907.5 million in loans to 5,078 borrowers $26.9 million in deferred fees on PPP loans PPP Loan Balances # PPP Loans $158.0 Average loan size of ~$178,000 Manufacturing 386 $103.4 Professional Service 551 Initial focus on existing customers $92.5 Other Admin Services 432 $83.8 Specialty Trade 362 $62.8 Construction 227 $55.5 Retail Trade 512 $48.8 Wholesale Trade 188 Geographic $46.4 Tranportation & Warehouse 226 $38.0 Restaurant 361 $37.2 Medical 227 $29.1 Other Service 413 $28.2 Investment CRE 234 $19.3 Religious Org 231 $19.1 Agriculture 210 $ By State $19.1 Dental 179 $19.0 Finance & Insurance 168 $47.3 Other Sectors Combined 171 28

Commercial & Industrial Portfolio C & I(1) Concentration by NAICS C & I Line Utilization C&I utilization dropped in Q2 reducing loan balances by $138 million Geographic C&I Loans (1) Includes C&I, Sponsor Finance and OOCRE 29

Sponsor and Leveraged Lending Sponsor Finance Leveraged Loans Private Equity Firms in the Midwest and Borrowers where: Southeast acquiring companies with less Greater than 3X Senior Funded than $10 million in EBITDA. Debt/EBITDA Senior Secured, Amortizing Term Loans and Greater than 4X Total Funded Debt/EBITDA Revolving Lines of Credit Includes Sponsor Finance Portfolio 39 Borrowers, $325.8MM Outstanding and $425.9MM Committed Includes Middle Market Relationships Includes Shared National Credits of generally BBB- or better Term A/B Total Leveraged Loans $ Millions Q2 ' 20 Q2 '20 % of Total $ Loans % Bal with Type of Leveraged Loan Balance Commitment Loans Mods Mods Sponsor Finance $ 243 $ 299 3.2% $ 12 4.9% Middle Market Relationships 147 181 1.9% 13 8.8% Shared National Credits 114 141 1.5% 0 0.0% Total Leveraged Loans $ 504 $ 621 6.7% $ 25 5.0% 30

Investment Real Estate IRE Portfolio – Q2-’20 $ Millions % of Total Average % Loans $ Loans with Investment Real Estate Q2 - '20 Loans Loan Size with Mods Mods Multi-family $ 682 7.3% $ 1.3 15.3% $ 104.4 Commercial Real Estate 1,416 15.2% 1.1 31.1% 439.6 $ 2,098 22.6% $ 1.1 25.9% $ 544.0 Loans by Geography Loans by Top Metros TN Q2 '20 % Total KY 2.8% Other 3.3% States 10.1% Metro Areas Balance Inv. RE Indianapolis, IN $ 328 15.6% MI 7.5% Columbus, OH 188 9.0% By IN 46.6% Chicago, IL 184 8.8% IL State 10.5% Northwest Indiana 149 7.1% OH Fort Wayne, IN 137 6.5% 19.1% Detroit, MI 69 3.3% 31

COVID Sensitive Industries Hotel $ Millions % Total Avg loan $ Loans % Bal with Q2 '20 Loans # Loans size Mods Mods Hotel Hotel (includes hotel/motel and other accomodations) $ 197 2.1% 139 $ 1.42 $ 157 79.9% Retail $ Millions % Total Avg loan $ Loans % Bal with Q2 '20 Loans # Loans size Mods Mods Retail Retail - real estate secured $ 431 4.6% 697 $ 0.62 $ 167 38.7% Retail Trade - non real estate secured 145 1.6% 1,388 0.10 3 2.1% Total $ 576 6.2% 2,085 0.28 $ 170 29.5% 32

COVID Sensitive Industries Restaurants and Food Service $ Millions % Total Avg $ Loans % Bal with Q2 '20 Loans # Loans loan size Mods Mods Restaurants Restaurants - real estate secured $ 98 1.1% 252 $ 0.39 $ 40 40.8% Restaurants - non RE secured 96 1.0% 580 0.17 9 9.4% Total $ 194 2.1% 832 0.23 $ 49 25.3% Senior Living $ Millions % Total Avg $ Loans % Bal with Senior Q2 '20 Loans # Loans loan size Mods Mods Skilled Nursing Facilities $ 169 1.8% 28 $ 6.04 $ - 0.0% Living Assisted Living Facility and other 118 1.3% 42 2.81 16 13.6% Total $ 287 70 $ 4.10 $ 16 5.6% 33

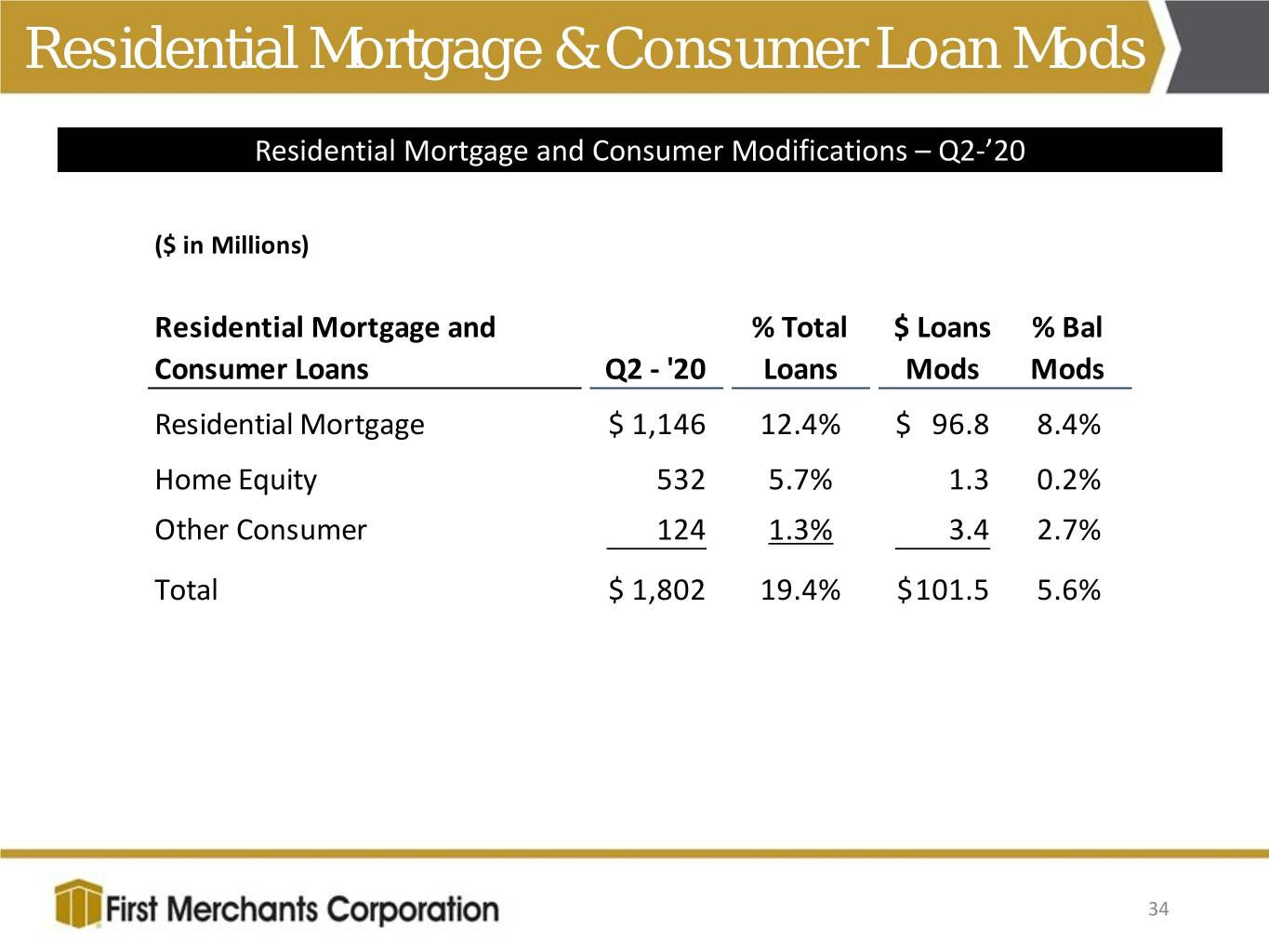

Residential Mortgage & Consumer Loan Mods Residential Mortgage and Consumer Modifications – Q2-’20 ($ in Millions) Residential Mortgage and % Total $ Loans % Bal Consumer Loans Q2 - '20 Loans Mods Mods Residential Mortgage $ 1,146 12.4% $ 96.8 8.4% Home Equity 532 5.7% 1.3 0.2% Other Consumer 124 1.3% 3.4 2.7% Total $ 1,802 19.4% $ 101.5 5.6% 34

Mortgage Lending Gain On Sale 2Q Gain On Sale up 9.25% over Q1 to $3.7 million Offering extended locks with minimal impact on gain sale economics Taking 15 year fixed rate fully salable on Pipeline balance sheet at yield favorable to Pipeline strong with dollars up 45% at the end comparable MBS of the 2nd quarter Year over Year $200 $180 Purchase & Refinance $160 $175 $140 Strong refinance demand has allowed for small price premium to market $120 $100 $121 The jumbo market for existing home $80 purchases remains strong in our Columbus $60 and Indianapolis markets. Placing 7/1 and $40 10/1 jumbo mortgages on balance sheet $20 $0 $ Millions 6/30/2019 6/30/2020 35

Asset Quality Summary Asset Quality – Q2-’20 Change ($ in Millions) Linked Quarter 2018 2019 Q1-'20 Q2-'20 $ % 1. Non-Accrual Loans $ 26.1 $ 16.0 $ 15.6 $ 50.1 $ 34.5 221.2% 2. Other Real Estate 2.2 7.5 8.0 7.4 (0.6) (7.5%) 3. Renegotiated Loans 1.1 0.8 0.7 1.1 0.4 57.1% 4. 90+ Days Delinquent Loans 1.9 0.1 0.3 5.0 4.7 1,566.7% 5. Total NPAs & 90+ Days Delinquent $ 31.3 $ 24.4 $ 24.6 $ 63.6 $ 39.0 158.5% 6. Total NPAs & 90+ Days/Loans & ORE 0.4% 0.3% 0.3% 0.7% 7. Classified Loans $167.4 $200.1 $ 207.0 $ 239.6 $ 32.6 15.7% 8. Classified Loans/Total Loans 2.3% 2.4% 2.4% 2.6% 36

Non-Performing Asset Reconciliation ($ in Millions) Q3-'19MBT Q4-'19 Q1-'20 Q2-'20 1. Beginning Balance NPAs & 90+ Days Delinquent $ 27.6 $ 30.5 $ 24.4 $ 24.6 Non-Accrual 2. Add: New Non-Accruals 7.5 2.3 2.8 35.6 3. Less: To Accrual/Payoff/Renegotiated (2.1) (6.9) (1.2) (0.6) 4. Less: To OREO (6.4) (0.8) (0.7) - 5. Less: Charge-offs (1.9) (1.3) (1.3) (0.5) 6. Increase / (Decrease): Non-Accrual Loans (2.9) (6.7) (0.4) 34.5 Other Real Estate Owned (ORE) 7. Add: New ORE Properties 6.5 0.8 0.7 - 8. Less: ORE Sold (0.4) (0.3) (0.2) (0.3) 9. Less: ORE Losses (write-downs) (0.1) (0.1) - (0.3) 10. Increase / (Decrease): ORE 6.0 0.4 0.5 (0.6) 11. Increase / (Decrease): 90+ Days Delinquent (0.1) - 0.2 4.7 12. Increase / (Decrease): Renegotiated Loans (0.1) 0.2 (0.1) 0.4 13. Total NPAs & 90+ Days Delinquent Change 2.9 (6.1) 0.2 39.0 14. Ending Balance NPAs & 90+ Days Delinquent $ 30.5 $ 24.4 $ 24.6 $ 63.6 37

Credit Response to COVID-19 . Proactively engage customers to chart path forward . Use of modifications to bridge and strategize Loan Portfolio . Maintaining existing underwriting standards while recognizing the impact of pandemic . Opportunistic portfolio growth to well positioned borrowers . Net Charge-offs remain low this quarter at $230,000 . Beginning credit cycle with stronger credit profile and enhanced processes Asset Quality . Working with borrowers to resolve issues in COVID sensitive industries . Limited interest thus far in 2nd modifications – none booked Q2 . Robust process in place for 2nd modification requests - eye towards next actions Approach . PPP forgiveness planning underway in anticipation of guidance . Experienced workout staff with special asset process from last recession 38

Michael C. Rechin President Chief Executive Officer

First Merchants… Strong & Stable Looking Forward… Industry leading profitability, Return on Assets, and Efficiency Ratios Pre-Tax Pre-Provision Earnings strength of $59.1 Million TCE of nearly 10% excluding effect of PPP Loans Diversified loan portfolio, long-term consistent asset quality and underwriting Allowance for Loan Losses & Fair Value Marks total approximately 1.62% of loans 85% loan-to-deposit ratio produces excess liquidity Corporate Social Responsibility investment fortifies our communities staying power Accelerate our delivery channel change Well positioned for this challenge . . . and for the future “Compelling value proposition” 40

First Merchants Corporation common stock is traded on the NASDAQ Global Select Market under the symbol FRME Additional information can be found at www.firstmerchants.com Investor Inquiries: Nicole Weaver, Investor Relations 765.521.7619 nweaver@firstmerchants.com 41

Appendix

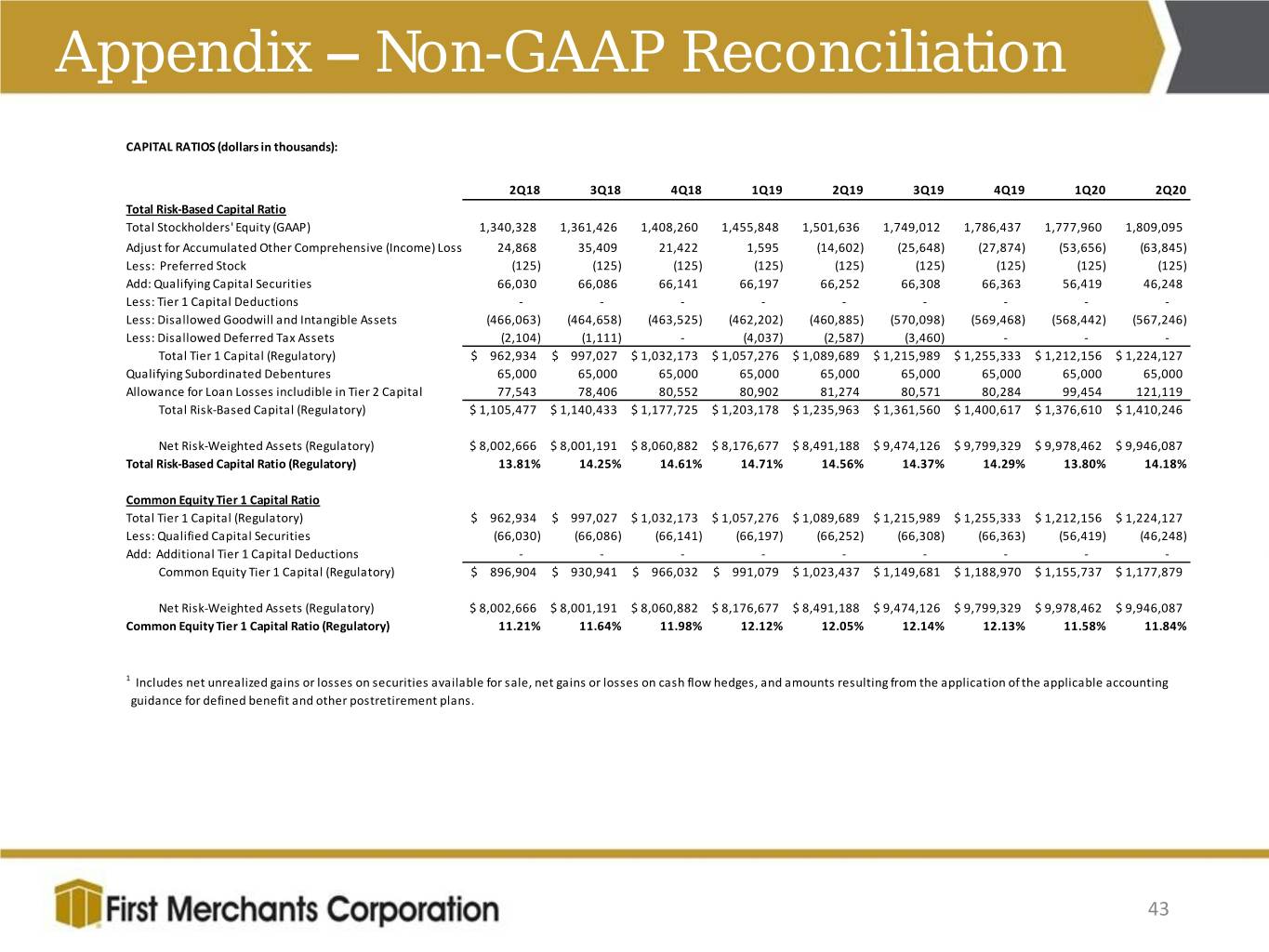

Appendix – Non-GAAP Reconciliation CAPITAL RATIOS (dollars in thousands): 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Total Risk-Based Capital Ratio Total Stockholders' Equity (GAAP) 1,340,328 1,361,426 1,408,260 1,455,848 1,501,636 1,749,012 1,786,437 1,777,960 1,809,095 Adjust for Accumulated Other Comprehensive (Income) Loss 1 24,868 35,409 21,422 1,595 (14,602) (25,648) (27,874) (53,656) (63,845) Less: Preferred Stock (125) (125) (125) (125) (125) (125) (125) (125) (125) Add: Qualifying Capital Securities 66,030 66,086 66,141 66,197 66,252 66,308 66,363 56,419 46,248 Less: Tier 1 Capital Deductions - - - - - - - - - Less: Disallowed Goodwill and Intangible Assets (466,063) (464,658) (463,525) (462,202) (460,885) (570,098) (569,468) (568,442) (567,246) Less: Disallowed Deferred Tax Assets (2,104) (1,111) - (4,037) (2,587) (3,460) - - - Total Tier 1 Capital (Regulatory) $ 962,934 $ 997,027 $ 1,032,173 $ 1,057,276 $ 1,089,689 $ 1,215,989 $ 1,255,333 $ 1,212,156 $ 1,224,127 Qualifying Subordinated Debentures 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000 Allowance for Loan Losses includible in Tier 2 Capital 77,543 78,406 80,552 80,902 81,274 80,571 80,284 99,454 121,119 Total Risk-Based Capital (Regulatory) $ 1,105,477 $ 1,140,433 $ 1,177,725 $ 1,203,178 $ 1,235,963 $ 1,361,560 $ 1,400,617 $ 1,376,610 $ 1,410,246 Net Risk-Weighted Assets (Regulatory) $ 8,002,666 $ 8,001,191 $ 8,060,882 $ 8,176,677 $ 8,491,188 $ 9,474,126 $ 9,799,329 $ 9,978,462 $ 9,946,087 Total Risk-Based Capital Ratio (Regulatory) 13.81% 14.25% 14.61% 14.71% 14.56% 14.37% 14.29% 13.80% 14.18% Common Equity Tier 1 Capital Ratio Total Tier 1 Capital (Regulatory) $ 962,934 $ 997,027 $ 1,032,173 $ 1,057,276 $ 1,089,689 $ 1,215,989 $ 1,255,333 $ 1,212,156 $ 1,224,127 Less: Qualified Capital Securities (66,030) (66,086) (66,141) (66,197) (66,252) (66,308) (66,363) (56,419) (46,248) Add: Additional Tier 1 Capital Deductions - - - - - - - - - Common Equity Tier 1 Capital (Regulatory) $ 896,904 $ 930,941 $ 966,032 $ 991,079 $ 1,023,437 $ 1,149,681 $ 1,188,970 $ 1,155,737 $ 1,177,879 Net Risk-Weighted Assets (Regulatory) $ 8,002,666 $ 8,001,191 $ 8,060,882 $ 8,176,677 $ 8,491,188 $ 9,474,126 $ 9,799,329 $ 9,978,462 $ 9,946,087 Common Equity Tier 1 Capital Ratio (Regulatory) 11.21% 11.64% 11.98% 12.12% 12.05% 12.14% 12.13% 11.58% 11.84% 1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans. 43

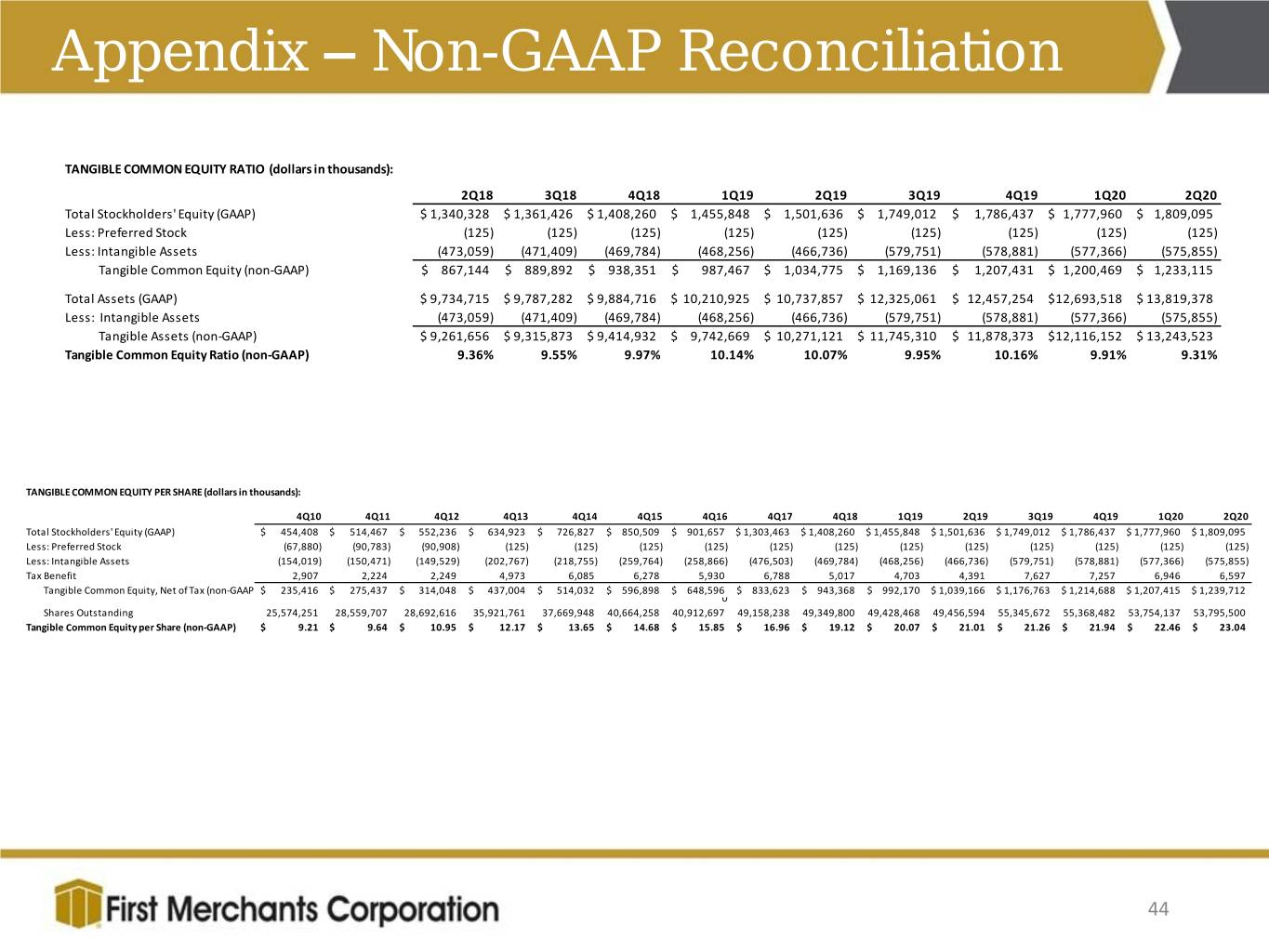

Appendix – Non-GAAP Reconciliation TANGIBLE COMMON EQUITY RATIO (dollars in thousands): 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Total Stockholders' Equity (GAAP) $ 1,340,328 $ 1,361,426 $ 1,408,260 $ 1,455,848 $ 1,501,636 $ 1,749,012 $ 1,786,437 $ 1,777,960 $ 1,809,095 Less: Preferred Stock (125) (125) (125) (125) (125) (125) (125) (125) (125) Less: Intangible Assets (473,059) (471,409) (469,784) (468,256) (466,736) (579,751) (578,881) (577,366) (575,855) Tangible Common Equity (non-GAAP) $ 867,144 $ 889,892 $ 938,351 $ 987,467 $ 1,034,775 $ 1,169,136 $ 1,207,431 $ 1,200,469 $ 1,233,115 Total Assets (GAAP) $ 9,734,715 $ 9,787,282 $ 9,884,716 $ 10,210,925 $ 10,737,857 $ 12,325,061 $ 12,457,254 $12,693,518 $ 13,819,378 Less: Intangible Assets (473,059) (471,409) (469,784) (468,256) (466,736) (579,751) (578,881) (577,366) (575,855) Tangible Assets (non-GAAP) $ 9,261,656 $ 9,315,873 $ 9,414,932 $ 9,742,669 $ 10,271,121 $ 11,745,310 $ 11,878,373 $12,116,152 $ 13,243,523 Tangible Common Equity Ratio (non-GAAP) 9.36% 9.55% 9.97% 10.14% 10.07% 9.95% 10.16% 9.91% 9.31% TANGIBLE COMMON EQUITY PER SHARE (dollars in thousands): 4Q10 4Q11 4Q12 4Q13 4Q14 4Q15 4Q16 4Q17 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Total Stockholders' Equity (GAAP) $ 454,408 $ 514,467 $ 552,236 $ 634,923 $ 726,827 $ 850,509 $ 901,657 $ 1,303,463 $ 1,408,260 $ 1,455,848 $ 1,501,636 $ 1,749,012 $ 1,786,437 $ 1,777,960 $ 1,809,095 Less: Preferred Stock (67,880) (90,783) (90,908) (125) (125) (125) (125) (125) (125) (125) (125) (125) (125) (125) (125) Less: Intangible Assets (154,019) (150,471) (149,529) (202,767) (218,755) (259,764) (258,866) (476,503) (469,784) (468,256) (466,736) (579,751) (578,881) (577,366) (575,855) Tax Benefit 2,907 2,224 2,249 4,973 6,085 6,278 5,930 6,788 5,017 4,703 4,391 7,627 7,257 6,946 6,597 Tangible Common Equity, Net of Tax (non-GAAP) $ 235,416 $ 275,437 $ 314,048 $ 437,004 $ 514,032 $ 596,898 $ 648,596 $ 833,623 $ 943,368 $ 992,170 $ 1,039,166 $ 1,176,763 $ 1,214,688 $ 1,207,415 $ 1,239,712 0 Shares Outstanding 25,574,251 28,559,707 28,692,616 35,921,761 37,669,948 40,664,258 40,912,697 49,158,238 49,349,800 49,428,468 49,456,594 55,345,672 55,368,482 53,754,137 53,795,500 Tangible Common Equity per Share (non-GAAP) $ 9.21 $ 9.64 $ 10.95 $ 12.17 $ 13.65 $ 14.68 $ 15.85 $ 16.96 $ 19.12 $ 20.07 $ 21.01 $ 21.26 $ 21.94 $ 22.46 $ 23.04 44

Appendix – Non-GAAP Reconciliation EFFICIENCY RATIO (dollars in thousands): 2018 2019 1Q20 2Q20 Non Interest Expense (GAAP) $ 219,951 $ 246,763 $ 66,171 $ 59,989 Less: Intangible Asset Amortization (6,719) (5,994) (1,514) (1,511) Less: OREO and Foreclosure Expenses (1,470) (2,428) (505) (684) Adjusted Non Interest Expense (non-GAAP) 211,762 238,341 64,152 57,794 Net Interest Income (GAAP) 338,857 356,660 93,877 93,018 Plus: Fully Taxable Equivalent Adjustment 10,732 13,085 3,894 4,088 Net Interest Income on a Fully Taxable Equivalent Basis (non-GAAP) 349,589 369,745 97,771 97,106 Non Interest Income (GAAP) 76,459 86,688 29,799 26,481 Less: Investment Securities Gains (Losses) (4,269) (4,415) (4,612) (3,068) Adjusted Non Interest Income (non-GAAP) 72,190 82,273 25,187 23,413 Adjusted Revenue (non-GAAP) 421,779 452,018 122,958 120,519 Efficiency Ratio (non-GAAP) 50.21% 52.73% 52.17% 47.95% FORWARD DIVIDEND YIELD 2Q20 Most recent quarter's dividend per share $ 0.26 Most recent quarter's dividend per share - Annualized $ 1.04 Stock Price at 6/30/20 $ 27.57 Forward Dividend Yield 3.77% 45

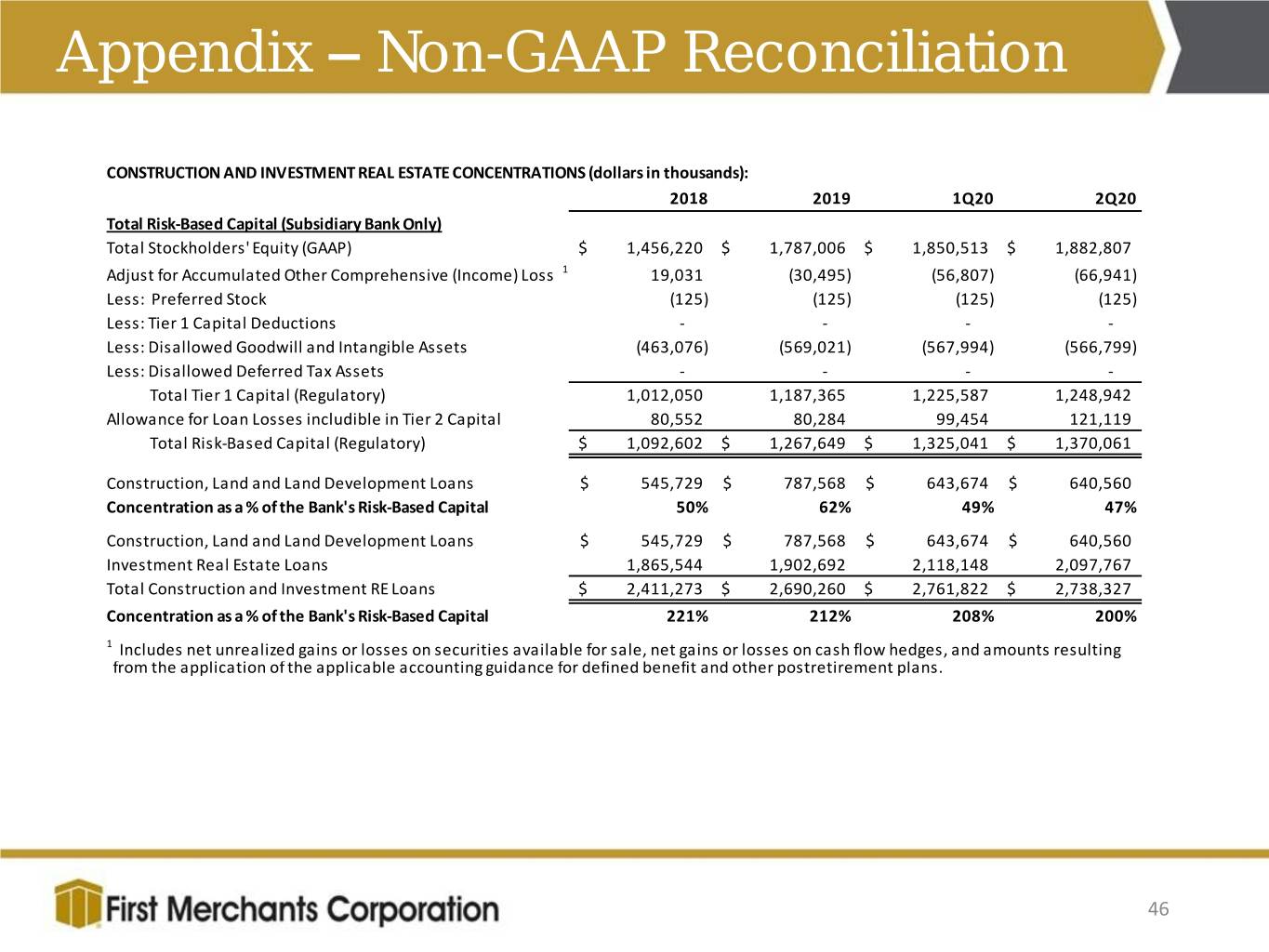

Appendix – Non-GAAP Reconciliation CONSTRUCTION AND INVESTMENT REAL ESTATE CONCENTRATIONS (dollars in thousands): 2018 2019 1Q20 2Q20 Total Risk-Based Capital (Subsidiary Bank Only) Total Stockholders' Equity (GAAP) $ 1,456,220 $ 1,787,006 $ 1,850,513 $ 1,882,807 Adjust for Accumulated Other Comprehensive (Income) Loss 1 19,031 (30,495) (56,807) (66,941) Less: Preferred Stock (125) (125) (125) (125) Less: Tier 1 Capital Deductions - - - - Less: Disallowed Goodwill and Intangible Assets (463,076) (569,021) (567,994) (566,799) Less: Disallowed Deferred Tax Assets - - - - Total Tier 1 Capital (Regulatory) 1,012,050 1,187,365 1,225,587 1,248,942 Allowance for Loan Losses includible in Tier 2 Capital 80,552 80,284 99,454 121,119 Total Risk-Based Capital (Regulatory) $ 1,092,602 $ 1,267,649 $ 1,325,041 $ 1,370,061 Construction, Land and Land Development Loans $ 545,729 $ 787,568 $ 643,674 $ 640,560 Concentration as a % of the Bank's Risk-Based Capital 50% 62% 49% 47% Construction, Land and Land Development Loans $ 545,729 $ 787,568 $ 643,674 $ 640,560 Investment Real Estate Loans 1,865,544 1,902,692 2,118,148 2,097,767 Total Construction and Investment RE Loans $ 2,411,273 $ 2,690,260 $ 2,761,822 $ 2,738,327 Concentration as a % of the Bank's Risk-Based Capital 221% 212% 208% 200% 1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans. 46