Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CROSSFIRST BANKSHARES, INC. | q22020crossfirst8kform.htm |

| EX-99.1 - EX-99.1 - CROSSFIRST BANKSHARES, INC. | exhibit991q22020.htm |

NASDAQ: CFB | July 23th, 2020

FORWARD-LOOKING STATEMENTS. The financial results in this presentation reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. This presentation and oral statements made during this meeting contain forward-looking statements. These forward- looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as "may," "might," "should," "could," "predict," "potential," "believe," "expect," "continue," "will," "anticipate," "seek," "estimate," "intend," "plan," "strive," "projection," "goal," "target," "outlook," "aim," "would," "annualized" and "outlook," or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: risks relating to the COVID-19 pandemic; risks related to general business and economic conditions and any regulatory responses to such conditions; our ability to effectively execute our growth strategy and manage our growth, including identifying and consummating suitable mergers and acquisitions; the geographic concentration of our markets; fluctuation of the fair value of our investment securities due to factors outside our control; our ability to successfully manage our credit risk and the sufficiency of our allowance; regulatory restrictions on our ability to grow due to our concentration in commercial real estate lending; our ability to attract, hire and retain qualified management personnel; interest rate fluctuations; our ability to raise or maintain sufficient capital; competition from banks, credit unions and other financial services providers; the effectiveness of our risk management framework in mitigating risks and losses; our ability to maintain effective internal control over financial reporting; our ability to keep pace with technological changes; system failures and interruptions, cyber-attacks and security breaches; employee error, fraudulent activity by employees or clients and inaccurate or incomplete information about our clients and counterparties; our ability to maintain our reputation; costs and effects of litigation, investigations or similar matters; risk exposure from transactions with financial counterparties; severe weather, acts of god, acts of war or terrorism; compliance with governmental and regulatory requirements; changes in the laws, rules, regulations, interpretations or policies relating to financial institutions, accounting, tax, trade, monetary and fiscal matters; compliance with requirements associated with being a public company; level of coverage of our business by securities analysts; and future equity issuances. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward- looking statement, whether as a result of new information, future developments or otherwise, except as required by law. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP measures. These non-GAAP measures, as calculated by CrossFirst, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included at the end of this presentation. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

st Mike Maddox – President, CEO of CrossFirst Bankshares (effective June 1 ) and Director of CrossFirst Other Senior Executives • Joined CrossFirst in 2008 after serving as Kansas City regional president for Intrust Bank • Practicing lawyer for more than six years before joining Intrust Bank • Graduate School of Banking at the University of Wisconsin - Madison Amy Fauss Chief Operating Officer of CrossFirst Bank 28+ years of banking experience David O’Toole – CFO, Chief Investment Officer and Director of CrossFirst Joined CrossFirst in 2009 • More than 40 years of experience in banking, accounting, valuation and investment banking • Founding shareholder and director of CrossFirst Bank and became CFO in 2008 Tom Robinson • Co-founder and managing partner of a national bank consulting and accounting firm Chief Risk Officer of CrossFirst • Served on numerous boards of directors of banks and private companies, including the Continental Airlines, 35+ years of banking experience Joined CrossFirst in 2011 Inc. travel agency advisory board Randy Rapp – Chief Credit Officer of CrossFirst Bank Aisha Reynolds General Counsel of CrossFirst and • More than 30 years of experience in banking, primarily as a credit analyst, commercial relationship manager CrossFirst Bank and credit officer 13+ years of experience • Joined CrossFirst in April 2019 after serving as Executive Vice President and Chief Credit Officer of Texas Joined CrossFirst in 2018 Capital Bank, National Association from May 2015 until March 2019 • Mr. Rapp joined Texas Capital Bank in 2000 Steve Peterson Matt Needham – Managing Director of Strategy and Investor Relations of CrossFirst Chief Banking Officer of CrossFirst 21+ years of experience • More than 15 years experience in banking, strategy, accounting and investment banking, five with CrossFirst Joined CrossFirst in 2011 • Deep experience in capital markets including valuation, mergers, acquisitions and divestitures • Provided assurance and advisory services with Ernst & Young • Former Deputy Bank Commissioner in Kansas and has served on several bank boards • MBA Wake Forest University, obtained CFA designation and CPA, Graduate School of Banking at the University of Colorado George F. Jones Jr. – Vice Chairman (effective June 1st) and Director of CrossFirst • Joined CrossFirst in 2016 after a short retirement from Texas Capital Bancshares, Inc. (TCBI) • As former CEO of CrossFirst Bankshares, led CrossFirst through its initial public offering in 2019 • Founding executive of TCBI in 1998 • Led TCBI through 50 consecutive profitable quarters and growth to $12 billion in assets 3

Delivering Long Term Value for CrossFirst Shareholders Capital Enhance Diversification Optimization Exceptional ROATCE, EPS of Loan & Deliver Strong through Reputation for Growth, & Deposit Credit Quality Organic Quality & Efficiency Portfolio Growth & M&A Service CrossFirst Strategic Approach: 1. Supporting our clients, employees, and communities through the COVID-19 Pandemic 2. Maintain a branch-lite business model with strategically placed locations 3. Focus on our core markets; grow organically using the relationship banking model 4. Execute on our high-tech, high-touch banking strategy; leverage technology for enhanced service 5. Attract, retain, and develop the highest level of talent 6. Improve profitability and efficiency for the organization; optimize excess capital to deliver shareholder returns 7. Serve businesses, business owners, professionals and their networks in extraordinary ways 8. Employ effective enterprise risk management 4

$50 25 Consecutive Quarters of Operating (1) $45 Revenue Growth $43.8 $40.3 $39.4 $40 $39.0 $36.5 $35.3 $35 $33.6 $30.0 $30 $27.6 $24.8 $25 $22.3 $19.6 $20 $18.8 $17.3 $15.9 $15.1 $15 $13.7 $12.8 $11.7 $11.8 $10.9 $10.2 $9.2 $10 $8.5 $7.6 $5 $- Note: Dollars in charts are in millions. (1) Defined as net-interest income + non-interest income 5

1. Comprehensive COVID-19 response plan to support our clients, employees, and communities 2. Strong capital position and liquidity provides CrossFirst with financial flexibility to give customers relief and continue to invest for the long term in the business 3. Closely monitoring and engaging clients to mitigate risks and impact from COVID-19 especially customer modifications & energy portfolio 4. Branch-lite business model and technology strategy provides CrossFirst an advantage for strong business continuity through the pandemic 5. Strong reserve build of total loan loss reserves / loans of 1.61% including a quarterly provision of $21 million 6. Stress testing of capital and credit scenarios show CrossFirst as well capitalized under several extreme scenarios 7. Return to work planning remains flexible with safety of employees, clients and other stakeholders as the highest priority 8. Positioned for long term growth after the market stabilizes 6 6

• $5.5 billion(1) asset banking operation founded in 2007 • Branch-lite structure operating 8 branches in key markets (2) along the I-35 corridor (1) (1) • 3rd largest bank headquartered in the Kansas City MSA (1) (1) • High-growth commercial banking franchise with 364 full time equivalent employees (1) (1) • High quality people, strong culture & relationship-oriented business model • Serving businesses, business owners, professionals and their personal networks • Core focus on improving profitability & operating (Number of Locations) efficiency Financial Performance For Six Months Ended 6/30/20 (2) Balance Sheet Performance (Year-to-Date) Asset Quality Metrics Assets: $5,462 ROAA: (0.14)% NPAs / Assets: 0.74% Gross Loans:( 3) $4,413 ROACE: (1.15)% NCOs / Avg. Loans: (4) 1.01% Deposits: $4,304 Efficiency Ratio: 63.29% Reserves / Loans: 1.61% (4) CET 1 Capital: 11.99% NIM(FTE): 3.22% Reserves / NPLs: 189% Total Risk-Based Capital: 13.27% Net Income (loss): ($3.5) Classified Loans / Capital + ALLL 34.9% (1) As of June 30, 2020. (2) Dollars are in millions. 7 (3) Net of unearned income (4) YTD Interim Periods Annualized

Commentary SBA / PPP Applications Existing Customers New Customers Totals # of Applications • CFB is a strong supporter of local 886 298 1,184 businesses and communities we Approved serve $ Loans Funded $290 $79 $369 (Dollars in millions) • Preferred SBA lender • Weighted average fee rate of approximately 2.4%, excluding fee impact to yield Loans Approved by Industry Loans Approved by Market (Based on $ Funded) (Based on $ Funded) • Total average loan size of $312 thousand Other Services & Construction 10% Business Support Kansas City 17% Medical/ 53% • Management is working to Healthcare expedite the forgiveness process 16% Hotel & Dallas of the PPP loans Restaurants 12% 12% Professional Services Wichita 19% 17% Oklahoma City Tulsa & Energy 7% Other Small Businesses 11% 26% Note: Information as of July 7, 2020 8

Nonperforming Assets / Assets Commentary on NPA’s 1.5% ▪ Increase in NPAs stem primarily from the risk rating grade migration of energy credits and 0.97% 1.00% 0.97% negative impacts caused by the 1.0% COVID-19 pandemic 0.74% 0.59% 0.5% 0.43% 0.27% 0.20% 0.18% 0.08% 0.0% 2014 2015 2016 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Commentary Charge-Offs ▪ $1.3 million in net charge-offs for Q2 2020; includes a $1 million charge-off to energy loan Net Charge-Offs / Average Loans(1) ▪ $19.4 million in net charge-offs 2.1% 2.00% for Q1 2020 which primarily 1.8% included $17.9 million for the large previously disclosed NPA 1.5% ▪ In Q4 2019, $5.5 million of net 1.2% charge-offs, included a $5 million partial charge-off of the 0.9% 0.53% 0.58% previously disclosed loan 0.6% 0.44% 0.31% ▪ In Q3 2019 the Company had net 0.3% 0.11% 0.12% charge-offs of $4.7 million from 0.02% 0.04% 0.07% two legacy NPAs, one C&I and 0.0% one Energy 2014 2015 2016 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 9 (1) Ratio is annualized.

Modifications by Type Migration of Credit by Risk Weighting (As of June 30, 2020) (in $millions) $5,000 $4,429 $4,500 $237 16% $4,011 $3,862 $105 $170 $4,000 $3,639 $87 $3,476 $85 $48 $79 $3,500 $88 $48 Loan 37% $57 $3,000 Modifications $2,500 of $709 million 24% $2,000 $4,022 $3,827 $3,506 $3,727 $1,500 $3,331 6% $1,000 17% $500 $0 Interest Only - 90 Days Interest Only - 90+ Days Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Payment Deferral - 90+ Days Payment Deferral - 90 Days Other % Substandard 3% 2% 2% 3% 5% & Doubtful ➢ Three Main Categories of Modifications: 33% Hotels, Pass Special Mention Substandard & Doubtful Restaurants, and Entertainment; 29% Real Estate Rental; and 16% Health Care ➢ Majority of the increase in “Substandard & Doubtful” loans ➢ ~90% of the modifications remained in Pass risk resulted from the Energy portfolio reassessment in Q2 2020 rating ➢ Majority of the modified loans that migrated in risk 10 rating were from the Retail CRE and Hotel portfolios 10

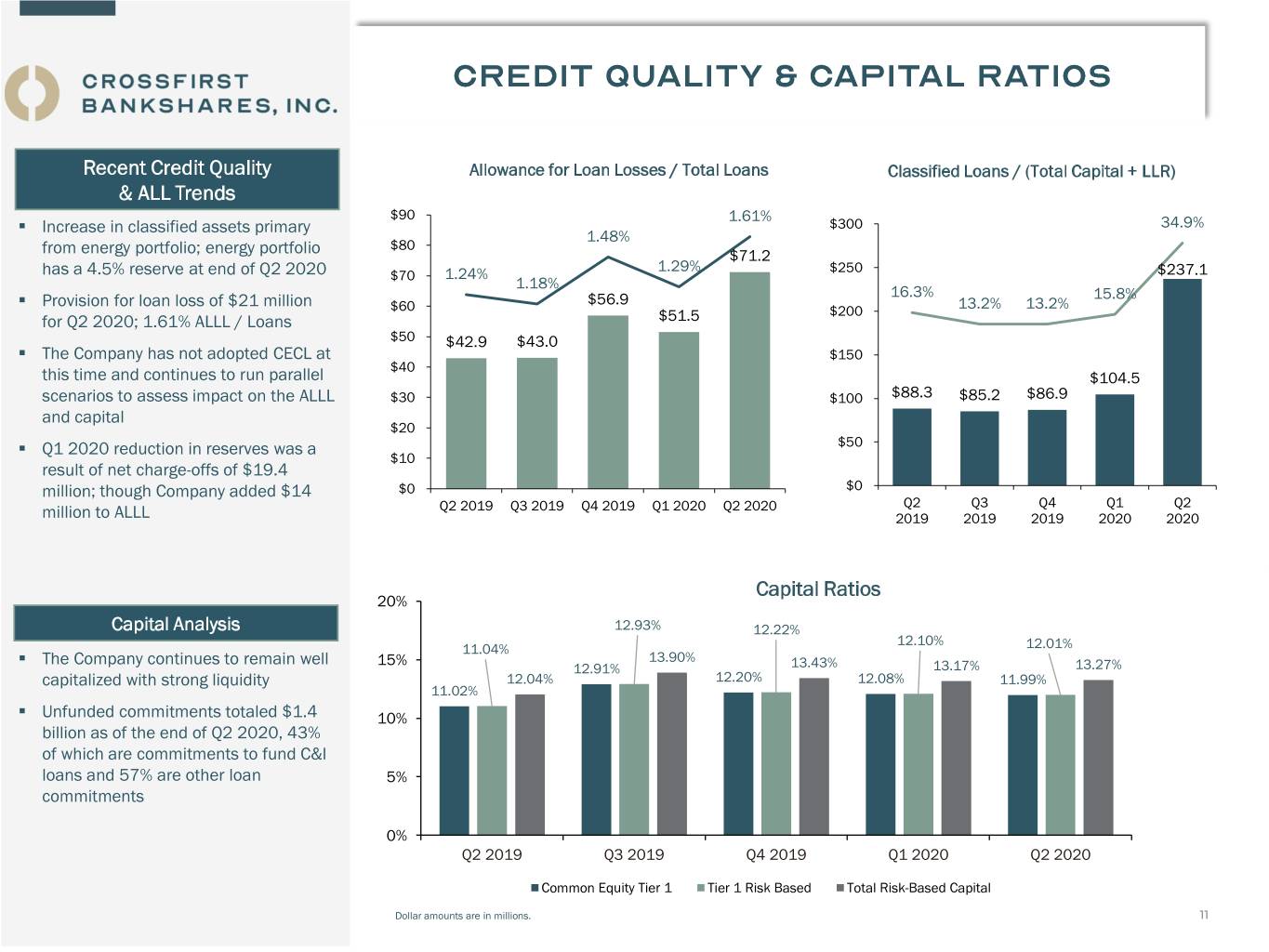

Recent Credit Quality Allowance for Loan Losses / Total Loans Classified Loans / (Total Capital + LLR) & ALL Trends $90 1.61% ▪ Increase in classified assets primary $300 34.9% 40.0% 1.48% from energy portfolio; energy portfolio $80 35.0% $71.2 30.0% has a 4.5% reserve at end of Q2 2020 1.29% $250 $237.1 1.24% 25.0% $70 1.18% 16.3% ▪ Provision for loan loss of $21 million $56.9 15.8% 20.0% $60 $200 13.2% 13.2% for Q2 2020; 1.61% ALLL / Loans $51.5 15.0% $50 $42.9 $43.0 10.0% ▪ The Company has not adopted CECL at $150 5.0% $40 this time and continues to run parallel $104.5 0.0% scenarios to assess impact on the ALLL $30 $100 $88.3 $85.2 $86.9 -5.0% and capital -10.0% $20 -15.0% $50 ▪ Q1 2020 reduction in reserves was a -20.0% $10 result of net charge-offs of $19.4 -25.0% -30.0% million; though Company added $14 $0 0.00% $0 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 Q3 Q4 Q1 Q2 million to ALLL 2019 2019 2019 2020 2020 Capital Ratios 20% Capital Analysis 12.93% 12.22% 12.10% 11.04% 12.01% ▪ The Company continues to remain well 15% 13.90% 12.91% 13.43% 13.17% 13.27% capitalized with strong liquidity 12.04% 12.20% 12.08% 11.99% 11.02% ▪ Unfunded commitments totaled $1.4 10% billion as of the end of Q2 2020, 43% of which are commitments to fund C&I loans and 57% are other loan 5% commitments 0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Common Equity Tier 1 Tier 1 Risk Based Total Risk-Based Capital Dollar amounts are in millions. 11

14% Q2 2020 CET1 Ratio Stress Test Details1 Results & Assumptions 12% 11.6% 10.3% ➢ CFB has well capitalized balance sheet with $581 million of CET1 regulatory capital or a ~12% CET1 ratio 10% 8.3% 5.1% 3.8% ▪ $242 million of excess capital over the Company’s 8% policy level & $71 million in available allowance 7% Bank 1.8% for loan losses Policy Limit6% 2.0% 2.0% 2.0% ➢ Regulatory Threshold of 6.5% not breached in severe 4% Pandemic Scenario 2% 4.5% 4.5% 4.5% Scenarios Considered: 0% ➢ Federal Reserve Board (FRB) & Oxford COVID-19 FRB Baseline Oxford COVID- 19 Severe Pandemic Baseline Scenarios with macro-economic risk factors Baseline ➢ Darling Consulting Group (DCG) Pandemic Scenario After Tax 0.4% 1.7% 3.7% Loss Sensitivity % created from a combination of Oxford, FRB & DCG data ($ million) $20 $80 $180 Key Assumptions: Regulatory Minimum Capital Conservation Buffer Excess Capital ➢ Scenarios assumes no loan loss utilization ➢ Expected loss rates over 13 quarters are immediately (in millions) FRB Oxford Severe Pandemic deducted from the capital ratios Allowance $71 $71 $71 ➢ Does not include the impact of future ongoing earnings Remaining or balance sheet changes $222 $162 $62 Excess Capital Excess Capital & ALLL after $293 $233 $133 Stress Test 12 12 Note 1: This analysis is not an expected loss model or forecast, it is solely an illustration of the Company’s ability to absorb economic stress to capital

Commentary Yield on Loans and Cost of Total Deposits 6% 5.70% 5.34% 5.52% 5.01% 4.89% ▪ Continued to grow core deposits 4.62% 4.60% 4.61% and maintained wholesale 4% funding levels ▪ Continued to maintain Margin 1.89% 1.98% 2% 1.44% (FTE) in Q2 2020 of 3.19%, 1.11% 0.88% 0.91% 0.87% 0.99% compared to 3.24% in Q1 2020 despite significant rate cuts 0% 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 ▪ Company continued to shorten Yield on Loans Cost of Total Deposits the duration of deposits and move deposit costs down to Net Interest Margin – Fully Tax Equivalent capture economics associated with FOMC rate cuts 4% 3.40% 3.40% 3.39% 3.40% 3.27% 3.24% 3.31% 3.22% ▪ Loan to deposit ratio increased 3% from 100.8 to 102.5 QoQ, as loans grew from PPP; the wholesale funding mix changed 2% to include more FHLB advances 1% 0% 2014 2015 2016 2017 2018 2019 YTD YTD 2019 2020 13

Investment Portfolio Breakout as of June 30, 2020(1) Commentary ▪ At the end of Q2 2020, the portfolio’s duration was approximately 4.2 years and the fully taxable equivalent (FTE) yield MBS (Fixed) Municipal - 20.6% for Q2 2020 declined to 3.07% Tax- Exempt 63.4% Total: ~$700 (1) ▪ ~$35 million of MBS and CMO million prepayments were accelerated due to lower rates CMO (Fixed) ▪ $15 million of securities were 13.7% purchased in Q2 2020 to replace Other Municipal - Taxable prepayments with an average FTE 0.5% 1.8% yield of 2.24% Average Yield on Securities – Fully Tax Equivalent ▪ During Q2 2020, $13.7 million of 5% municipals were sold to manage 3.85% credit exposure resulting in $322 4% 3.69% 3.72% 3.63% 3.62% 3.35% 3.51% thousand in realized profits 3.15% ▪ The marketable securities 3% portfolio has substantial unrealized gains of approximately 2% $33 million as of June 30, 2020 1% ▪ Portfolio primarily comprised of low risk, investment grade 0% securities 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 14 (1) Based on approximate fair value.

Operating Revenue(1) Commentary $180 ▪ Our balance sheet growth, $150.2 YTD ‘19 – YTD ‘20 combined with a relatively $160 Growth: 17.2% $140 stable net interest margin, has $116.5 historically enabled robust $120 $100 operating revenue growth $78.5 $84.1 $80 $71.8 $57.5 $60 $44.6 ▪ Core earnings power of the $40 $33.0 Company continues to increase $20 $0 ▪ 25th consecutive quarter of operating revenue growth ▪ Pretax, pre-provision profit(2) continues to grow and also Earnings Performance includes a one-time, non-cash charge of $7.4 million for $70 $62.5 goodwill impairment in Q2 $60 $50 $40 $30.7 $28.5 $27.2 $30.9 ▪ Year-to-date income impacted $30 $16.9 $19.6 $18.8 by $14 million in first quarter $20 $14.1 $16.4 $8.4 $10.3 and $21 million in second $10 $4.1 $7.5 $5.8 quarter for provisioning as a $0 result of economic uncertainty, ($10) ($3.5) and migration of Energy credits (2) Note: Dollars in charts are in millions. Net Income Pretax, Pre-Provision Profit (1) Defined as net-interest income + non-interest income. (2) Represents a Non-GAAP financial measure, see Non-GAAP reconciliation slides at the end of the presentation for more detail. In 15 addition, pre-tax net profits may also be found presented in the supplemental information

Commentary Return on Average Assets / Non-GAAP ROAA(1) ▪ CrossFirst’s branch-lite model is 1.00% 0.88% an efficient and scalable 0.83% 0.80% infrastructure to support 0.63% 0.56% 0.56% additional efficiency 0.60% 0.53% 0.41% ▪ Core efficiency performance is 0.40% 0.24% trending down consistent with 0.15% management’s initiatives 0.20% 0.00% ▪ Quarterly ROAA significantly impacted by COVID-19 -0.20% -0.14% provisioning in 2020 to $35 2014 2015 2016 2017 2018 2019 YTD 2019 Non-GAAP YTD YTD 2020 Non-GAAP YTD million YTD 2019 2020 ▪ One-time $7.4 million goodwill impairment in Q2 impacted ROAA Efficiency Ratio / Non-GAAP Core Efficiency Ratio (FTE)(1) and Efficiency Ratios 100% 90% 79.10% 80% 74.68% 73.64% 68.48% 70.64% 70% 62.11% 63.29% 58.37% 60.71% 60% 53.61% 50% 40% 30% 20% 10% 0% 2014 2015 2016 2017 2018 2019 YTD 2019 Non-GAAP YTD YTD 2020 Non-GAAP YTD 2019 2020 16 (1) Represents a non-GAAP financial measure, see non-GAAP reconciliation slides in the supplemental information for more detail

17

Industry Total Exposure (1) % of Gross Loans(1) Energy Oil (excludes Natural Gas) $251 6.2% Retail Commercial Real Estate $198 4.9% Hotel & Lodging $167 4.1% Healthcare C&I $142 3.5% Entertainment & Recreation(2) $100 2.5% Restaurant(3) $61 1.5% Industry categories selected based on the following criteria: • Lower consumption from COVID-19 pandemic compounded with high production and inventory supplies from ongoing political disputes • Implementation of travel, entertainment, and restaurant restrictions • Cancellation of all events and large gatherings • Cessation of revenue due to business being considered “nonessential” (1) Loan values recorded on balance sheet in millions as of June 30, 2020; excludes PPP loans (2) Includes Native American Gaming, Parking Lots and Garages (3) Restaurant information includes both C&I and CRE exposure 18

Energy Portfolio Dynamics Energy by Composition 6/30/2020 ($ millions) ▪ Typically only lend as a senior secured # % Unfunded Average Avg % Outstanding lender in single bank transactions and Loans Total Commitments Size Hedged as a cash flow lender Oil 42 $251 64% $21 $6 48% ▪ Exploration & Production lending only Natural 14 $139 36% $13 $10 52% on proven and producing reserves Gas Other ▪ As of June 30, 2020, CrossFirst does 2 $0 0% $37 $1 0% not have any shale, oil field services, or Sources mid-stream energy company loans Total 58 $390 100% $71 $7 50% (1) ▪ Collateral base is predominately comprised of properties with sufficient Energy Credit Classifications Energy Exposure by State production history to establish reliable 100% 4% LA 4% production trends; long-life assets 3% MI 6% OH 15% KY 2% 90% OK 24% ▪ 2020 portfolio(1) hedges 28% KS 8% 80% IN 2% ▪ 48% of Oil exposure hedged at Substandard IL 3% & Doubtful $49.16 / barrel 70% AK 1% 18% PA 1% ▪ 52% Natural Gas hedged at 60% WY 1% UT 2% $2.08 / MMBtu WV 5% TX 26% 50% Special 93% ▪ $17.4 million of Reserves are allocated Mention Energy Commitments by Basin 40% to Energy, representing 4.5% of the Appalachian total energy portfolio 30% 13 Other 20% 54% Basins Pass20% 20% Permian ▪ Customers continue to actively Illinois 15% manage operating expenses 3% 10% Tuscaloosa 4% 0% Western Anadarko Q1 2020 Q2 2020 Anadarko Antrim 13% Data as of 6/30/20 5% 5% Arkoma Multiple (1) Weighted Average 7% 8% 19

Loan Mix by Type ($4.4bn) (1) C&I Loan Breakdown by Type ($1.3bn) Professional & Credit Related Technical Services Misc. Financial Activities 4% Financial Vehicles Owner Occupied 4% Management 2% Real Estate Other Motor Vehicle & 3% SBA PPP 6% 1% Parts Dealers Aircraft Education 8% 4% Residential Real Commercial & 5% 2% Other Estate Industrial 8% Restaurants 16% 29% 5% Energy Engineering & 9% Contracting 5% Rental & Leasing Health Care Services 11% Construction & 5% Land Development Security Services Real Estate 15% Commercial Real 6% Business Activity Manufacturing Recreation Estate Loans to 8% 7% 7% 24% Individuals 6% CRE Loan Portfolio by Segment ($1.7bn)(2) CRE Loans by Geography ($1.7bn)(2) Medical Self Storage Raw Land 3% 2% 4% Land TX C-Store Development 46% Other 2% 2% 5% Senior Living Multi-Family 6% 23% KS Hotel 12% 10% Remaining 1-4 Family Res Retail States Construction OK 12% 12% 12% 10% KY Industrial 2%FL AZ MO Office 2% CO (excludes Self- 11% 2% 5% 7% Storage) 10% Note: Data as of June 30, 2020. 20 (1) Shown as a percentage of bank capital. (2) CRE as defined by regulators (including construction and development).

Compound Annual Growth Rates Total Assets $5,462 Since Since $4,931 2007 2012 Total Assets 55.2% 35.3% $4,107 $2,961 $2,133 $1,574 $1,220 $847 $565 $311 $355 $22 $77 $155 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q2 2020 2007 2010 2012 2014 Established with Acquired Leawood, Expansion into Expansion into 2017 2019 initial presence in KS-based Wichita and Energy Lending Expansion into Enterprise CrossFirst Kansas City Leawood Oklahoma City Value Lending, Relational Bankshares, Inc. Bancshares markets Tribal Nations Lending Initial Public Offering (~$72.5mm in and Relational High at $14.50; Nasdaq Total Assets) Volume Builder Lending listed: CFB 2013 2008 Expansion into Tulsa market Formed through acquisition of Tulsa CrossFirst National Bancshares, Inc. 2016 2018 2020 Bankshares, Inc. (~$160mm in Total Assets) George F. Jones George F. Jones Mike Maddox Jr. joins as Vice Jr. named CEO of named CEO of Chairman to CrossFirst CrossFirst expand into Dallas Bankshares, Inc. Bankshares, Inc. market Dollars in chart are in millions. 21

Gross Loans (Net of Unearned Income) Commentary $5,000 $4,413 $3,852 ▪ Loan growth has been primarily $4,000 $3,467 all organic and historically been $3,061 very strong $3,000 $1,996 ▪ Loan growth, excluding PPP $2,000 loans, was a modest 1.2% $1,297 $785 $993 compared to the previous quarter $1,000 ▪ Diversification remains a core $0 tenet 2014 2015 2016 2017 2018 2019 Q2 2019 Q2 2020 ▪ Loan yields have trended downward due to the declining Gross Loans by Type rate environment $4,700 $4,429 Q2 2020 Gross Loan Composition $4,011 $4,200 $3,862 $369 $43 $46 $3,476 $3,639 $45 $3,700 $44 $399 $504 $536 $46 $365 $3,200 $359 $625 $662 Construction & Land $628 Residential Real $463 $528 Development $2,700 Estate 15% 12% $2,200 $1,024 $1,085 $968 $993 $1,141 SBA/ Consumer PPP $1,700 1% $386 $396 $409 $399 $390 8% $1,200 $700 $1,254 $1,313 $1,357 $1,355 $1,285 $200 -$300 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Commercial Real Commercial & Energy Industrial Loan Estate 5.66% 5.53% 5.21% 4.98% 4.28% 9% 29% Yield 26% Commercial & Industrial Energy Commercial Real Estate Construction & Land Development Residential Real Estate Consumer SBA/ PPP 22 Dollars in charts are in millions. Amounts shown are as of the end of the period.

Commentary Total Deposits $5,000 ▪ CrossFirst has generated $4,500 $4,304 $3,924 significant growth in core $4,000 $3,584 deposits and maintained $3,500 $3,208 $3,000 wholesale funding to support $2,303 the PPP and securities portfolio $2,500 $2,000 $1,694 $1,295 $1,500 ▪ Company continued to shorten $962 time deposit portfolio which $1,000 typically lags in a declining rate $500 environment $0 2014 2015 2016 2017 2018 2019 Q2 2019 Q2 2020 Deposit Mix by Type $4,304 $4,250 $3,924 $3,973 $745 Q2 2020 Deposit Composition $3,750 $3,584 $3,658 $710 $724 $3,250 $416 $766 $753 $379 $530 Time Deposits Time Deposits $2,750 $469 < $100,000 ≥ $100,000 $535 10% $2,250 17% $1,994 $1,765 $1,750 $1,903 $1,634 $1,776 $1,250 $399 DDA $750 $538 18% $137 $146 $259 $750 Savings $250 $512 $514 $522 $567 & MMA -$250 46% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Transaction Deposits Cost of 9% 1.99% 1.94% 1.70% 1.46% 0.79% Deposits Non-interest bearing deposits Transaction Deposits Savings & MMA Time Deposits < $100,000 Time Deposits ≥ $100,000 23 Dollars are in millions and amounts shown are as of the end of the period.

As of and for the Year Ended As of and for the Six Months Ended (Dollars thousands, except per share data) December 31, June 30, 2015 2016 2017 2018 2019 2019 2020 Income Statement Data Interest income $54,116 $69,069 $97,816 $156,880 $216,218 $105,509 $105,462 Interest expense 11,849 15,016 22,998 46,512 74,774 37,030 26,077 Net interest income 42,267 54,053 74,818 110,368 141,444 68,479 79,385 Provision for loan losses 5,975 6,500 12,000 13,500 29,900 5,700 34,950 Non-interest income 2,365 3,407 3,679 6,083 8,715 3,317 4,729 Non-interest expense 30,562 40,587 62,089 85,755 87,648 44,591 53,233 Income before taxes 8,095 10,373 4,408 17,196 32,611 21,505 (4,069) Income tax expense (benefit) 626 62 (1,441) (2,394) 4,138 2,716 (570) Net income (loss) 7,469 10,311 5,849 19,590 28,473 18,789 (3,499) Preferred stock dividends 2,066 2,100 2,100 2,100 175 175 0 Net income available to common stockholders 5,403 8,211 3,749 17,490 28,298 18,614 (3,499) Non-GAAP core operating income(1) 7,469 10,311 9,716 19,940 27,427 17,743 3,898 Balance Sheet Data Cash and cash equivalents $79,418 $155,972 $130,820 $216,541 $187,320 $141,373 $194,371 Available-for-sale securities 460,542 593,012 703,581 663,678 741,634 704,776 700,083 Gross loans (net of unearned income) 992,726 1,296,886 1,996,029 3,060,747 3,852,244 3,467,204 4,413,224 Allowance for loan losses (15,526) (20,786) (26,091) (37,826) (56,896) (42,852) (71,185) Goodwill and other intangibles 8,100 7,998 7,897 7,796 7,694 7,745 247 Total assets 1,574,346 2,133,106 2,961,118 4,107,215 4,931,233 4,473,182 5,462,254 Non-interest-bearing deposits 123,430 198,088 290,906 484,284 521,826 511,837 750,333 Total deposits 1,294,812 1,694,301 2,303,364 3,208,097 3,923,759 3,584,136 4,304,143 Borrowings and repurchase agreements 112,430 216,709 357,837 388,391 373,664 364,246 500,498 Trust preferred securities, net of fair value adj. 792 819 850 884 921 902 942 Preferred Stock, liquidation value 30,000 30,000 30,000 30,000 0 0 0 Total Stockholders' Equity 160,004 214,837 287,147 490,336 601,644 499,195 608,092 Tangible Stockholders' Equity(1) 121,904 176,839 249,250 452,540 593,950 491,450 607,845 Share and Per Share Data: Basic earnings per share $0.29 $0.39 $0.12 $0.48 $0.59 $0.41 ($0.07) Diluted earnings per share 0.28 0.39 0.12 0.47 0.58 0.40 (0.07) Book value per share 6.61 7.34 8.38 10.21 11.58 11.00 11.66 Tangible book value per share(1) 6.20 7.02 8.12 10.04 11.43 10.83 11.65 Wtd. avg. common shares out. - basic 18,640,678 20,820,784 30,086,530 36,422,612 47,679,184 45,165,248 52,088,239 Wtd. avg. common shares out. - diluted 19,378,290 21,305,874 30,963,424 37,492,567 48,576,135 46,159,825 52,586,209 Shares outstanding at end of period 19,661,718 25,194,872 30,686,256 45,074,322 51,969,203 45,367,641 52,167,573 Historic share counts and per share figures reflect 2:1 stock split effected on 12/21/18. 24 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides at the end of this presentation for additional detail.

As of and for the Year Ended As of and for the Six Months Ended December 31, June 30, 2015 2016 2017 2018 2019 2019 2020 Selected Ratios: Return on average assets 0.53% 0.56% 0.24% 0.56% 0.63% 0.88% (0.14%) Non-GAAP core operating return on average assets(1) 0.53 0.56 0.40 0.57 0.61 0.83 0.15 Return on average common equity(1) 4.60 5.51 1.53 5.34 5.38 7.87 (1.15) Non-GAAP core operating return on average 4.60 5.51 3.11 5.45 5.18 7.43 1.28 common equity(1) Yield on earning assets - tax equivalent(2) 4.14 4.08 4.37 4.77 5.04 5.21 4.25 Yield on securities - tax equivalent(2) 3.72 3.63 3.85 3.62 3.35 3.51 3.15 Yield on loans 4.62 4.60 4.89 5.34 5.52 5.70 4.61 Cost of interest-bearing deposits 1.01 0.96 1.12 1.71 2.21 2.31 1.31 Cost of funds 0.94 0.91 1.06 1.49 1,90 1.97 1.15 Cost of total deposits 0.91 0.87 0.99 1.44 1.89 1.98 1.11 Net interest margin - tax equivalent(2) 3.27 3.24 3.40 3.39 3.31 3.40 3.22 Non-interest expense to average assets 2.17 2.21 2.53 2.45 1.95 2.10 2.01 Efficiency ratio(3) 68.48 70.64 79.10 73.64 58.37 62.11 63.29 Non-GAAP core operating efficiency ratio FTE(1)(3) 64.66 66.04 72.33 67.68 57.25 60.71 53.61 Non-interest-bearing deposits to total deposits 9.53 11.69 12.63 15.10 13.30 14.28 17.43 Loans to deposits 76.67 76.54 86.66 95.41 98.18 96.74 102.53 Credit Quality Ratios: Allowance for loans losses to total loans 1.56% 1.60% 1.30% 1.23% 1.48% 1.24% 1.61% Non-performing assets to total assets 0.08 0.20 0.18 0.43 0.97 1.18 0.74 Non-performing loans to total loans 0.12 0.33 0.27 0.58 1.15 1.45 0.86 Allowance for loans losses to non-performing loans 1,336.38 493.14 481.68 212.30 128.54 85.22 188.55 Net charge-offs to average loans 0.04 0.11 0.44 0.07 0.31 0.04 1.01 Capital Ratios: Total stockholders' equity to total assets 10.16% 10.07% 9.70% 11.94% 12.20% 11.16% 11.13% Common equity tier 1 capital ratio 8.50 9.78 8.62 11.75 12.20 11.02 11.99 Tier 1 risk-based capital ratio 10.70 11.38 9.70 12.53 12.22 11.04 12.01 Total risk-based capital ratio 11.82 12.51 10.65 13.51 13.43 12.04 13.27 Tier 1 leverage ratio 9.72 10.48 9.71 12.43 12.06 10.87 10.75 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides at the end of this presentation or press release for additional detail. (2) Tax-exempt income is calculated on a tax equivalent basis. Tax-exempt income includes municipal securities, which is exempt from federal taxation. A tax rate of 21% is used for fiscal year 2018 and after and a tax rate of 35% is used for fiscal years 2017 and prior. (3) Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. 25

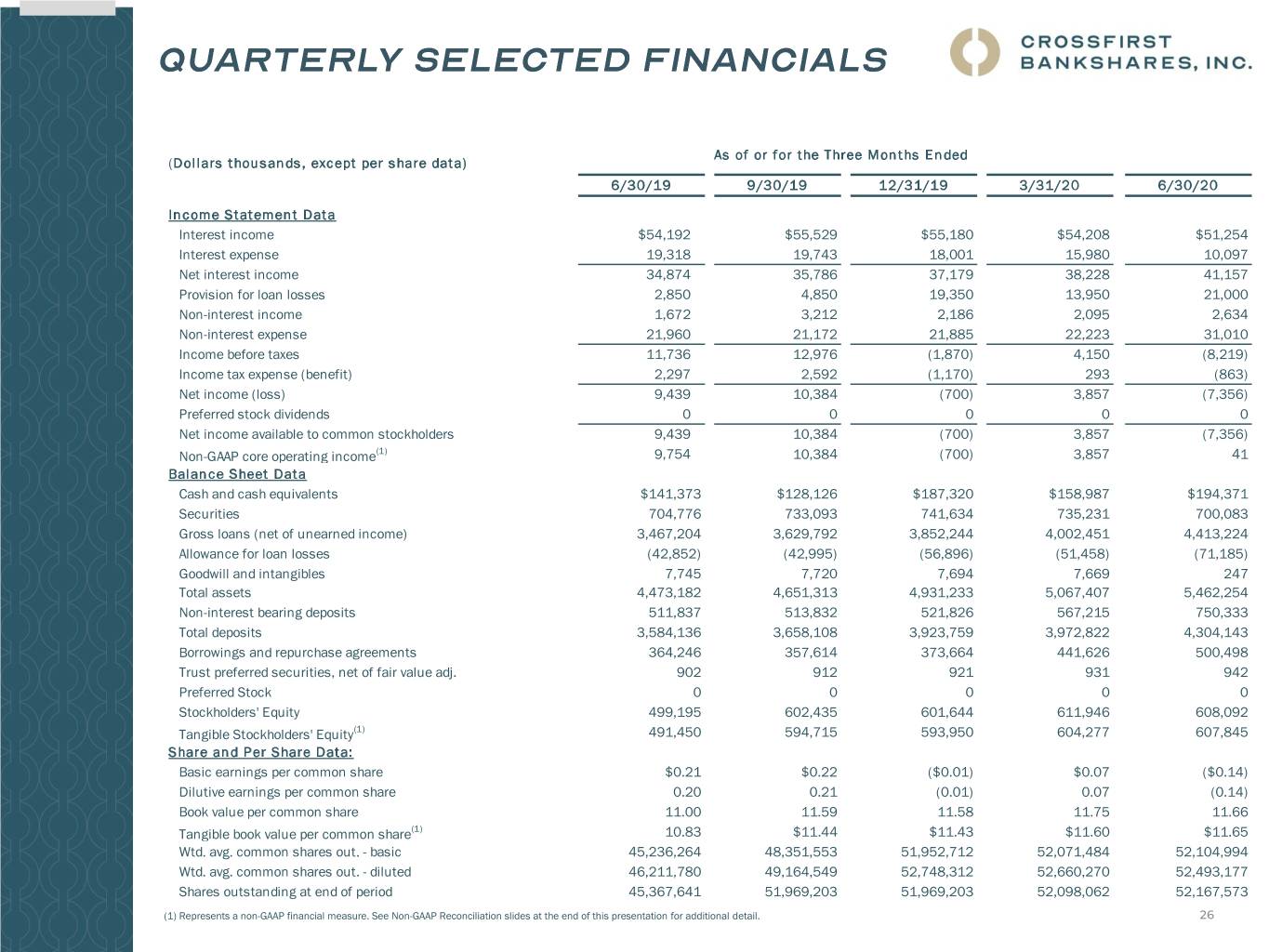

As of or for the Three Months Ended (Dollars thousands, except per share data) 6/30/19 9/30/19 12/31/19 3/31/20 6/30/20 Income Statement Data Interest income $54,192 $55,529 $55,180 $54,208 $51,254 Interest expense 19,318 19,743 18,001 15,980 10,097 Net interest income 34,874 35,786 37,179 38,228 41,157 Provision for loan losses 2,850 4,850 19,350 13,950 21,000 Non-interest income 1,672 3,212 2,186 2,095 2,634 Non-interest expense 21,960 21,172 21,885 22,223 31,010 Income before taxes 11,736 12,976 (1,870) 4,150 (8,219) Income tax expense (benefit) 2,297 2,592 (1,170) 293 (863) Net income (loss) 9,439 10,384 (700) 3,857 (7,356) Preferred stock dividends 0 0 0 0 0 Net income available to common stockholders 9,439 10,384 (700) 3,857 (7,356) Non-GAAP core operating income(1) 9,754 10,384 (700) 3,857 41 Balance Sheet Data Cash and cash equivalents $141,373 $128,126 $187,320 $158,987 $194,371 Securities 704,776 733,093 741,634 735,231 700,083 Gross loans (net of unearned income) 3,467,204 3,629,792 3,852,244 4,002,451 4,413,224 Allowance for loan losses (42,852) (42,995) (56,896) (51,458) (71,185) Goodwill and intangibles 7,745 7,720 7,694 7,669 247 Total assets 4,473,182 4,651,313 4,931,233 5,067,407 5,462,254 Non-interest bearing deposits 511,837 513,832 521,826 567,215 750,333 Total deposits 3,584,136 3,658,108 3,923,759 3,972,822 4,304,143 Borrowings and repurchase agreements 364,246 357,614 373,664 441,626 500,498 Trust preferred securities, net of fair value adj. 902 912 921 931 942 Preferred Stock 0 0 0 0 0 Stockholders' Equity 499,195 602,435 601,644 611,946 608,092 Tangible Stockholders' Equity(1) 491,450 594,715 593,950 604,277 607,845 Share and Per Share Data: Basic earnings per common share $0.21 $0.22 ($0.01) $0.07 ($0.14) Dilutive earnings per common share 0.20 0.21 (0.01) 0.07 (0.14) Book value per common share 11.00 11.59 11.58 11.75 11.66 Tangible book value per common share(1) 10.83 $11.44 $11.43 $11.60 $11.65 Wtd. avg. common shares out. - basic 45,236,264 48,351,553 51,952,712 52,071,484 52,104,994 Wtd. avg. common shares out. - diluted 46,211,780 49,164,549 52,748,312 52,660,270 52,493,177 Shares outstanding at end of period 45,367,641 51,969,203 51,969,203 52,098,062 52,167,573 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides at the end of this presentation for additional detail. 26

CrossFirst Bankshares, Inc Quarterly Financials As of or for the Three Months Ended 6/30/19 9/30/19 12/31/19 3/31/20 6/30/20 Selected Ratios: - - - - Return on average assets(1) 0.86% 0.89% (0.06%) 0.31% (0.54%) - - - - Non-GAAP core operating return on average assets(1)(2) 0.89 0.89 (0.06) 0.31 - Return on average common equity - 7.78 - 7.58 - (0.46) - 2.53 (4.84) Yield on earning assets - 5.12 - 4.94 - 4.71 - 4.52 3.91 - - - - Yield on earning assets - tax equivalent(3) 5.18 5.00 4.76 4.57 3.96 Yield on securities - 3.08 - 2.85 - 2.86 - 2.85 2.70 - - - - Yield on securities - tax equivalent(3) 3.42 3.19 3.22 3.21 3.07 Yield on loans - 5.66 - 5.53 - 5.21 - 4.98 4.28 Costs of interest bearing liabilities - 2.29 - 2.24 - 1.96 - 1.70 1.01 Cost of interest-bearing deposits - 2.33 - 2.26 - 1.97 - 1.69 0.95 Cost of funds - 1.99 - 1.94 - 1.71 - 1.49 0.85 Cost of Deposits - 1.99 - 1.94 - 1.70 - 1.46 0.79 Cost of other borrowings - 1.93 - 1.95 - 1.86 - 1.72 1.35 - - - - Net interest margin - tax equivalent(3) 3.35 3.24 3.23 3.24 3.19 Noninterest expense to average assets - 2.00 - 1.82 - 1.81 - 1.80 2.21 - - - - Efficiency ratio(4) 60.09 54.29 55.60 55.11 70.81 - - - - Non-GAAP core operating efficiency ratio (FTE) (2)(4) 58.43 53.43 54.66 54.18 53.09 Noninterest bearing deposits to total deposits - 14.28 - 14.05 - 13.30 - 14.28 17.43 Loans to deposits - 96.74 - 99.23 - 98.18 - 100.75 102.53 Credit Quality Ratios: Allowance for loans losses to total loans 1.24% 1.18% 1.48% 1.29% 1.61% Nonperforming assets to total assets 1.18 1.00 0.97 0.59 0.74 Nonperforming loans to total loans 1.45 1.22 1.15 0.66 0.86 Allowance for loans losses to nonperforming loans 85.20 97.12 128.54 195.99 188.55 Net charge-offs to average loans(1) 0.00 0.53 0.58 2.00 0.12 Capital Ratios: Total stockholders' equity to total assets - 11.16% - 12.95% - 12.20% - 12.08% 11.13% Common equity tier 1 capital ratio - 11.02 - 12.91 - 12.20 - 12.08 11.99 Tier 1 risk-based capital ratio - 11.04 - 12.93 - 12.22 - 12.10 12.01 Total risk-based capital ratio - 12.04 - 13.90 - 13.43 - 13.17 13.27 Tier 1 leverage ratio - 10.87 - 12.57 - 12.06 - 11.81 10.75 (1) Interim periods are annualized (2) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides at the end of this presentation for additional detail. 27 (3) Tax-exempt income is calculated on a tax equivalent basis. Tax-exempt income includes municipal securities, which is exempt from federal taxation. A tax rate of 21% is used for 2018, 2019 & 2020. (4) Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income

As of or for the Year Ended As of or for the Six Months Ended (Dollars in thousands) December 31, June 30, 2014 2015 2016 2017 2018 2019 2019 2020 Non-GAAP Core Operating Income: Net Income (loss) $4,143 $7,469 $10,311 $5,849 $19,590 $28,473 $18,789 ($3,499) Add: restructuring charges 0 0 0 0 4,733 0 0 0 Less: Tax effect(1) 0 0 0 0 1,381 0 0 0 Restructuring charges, net of tax 0 0 0 0 3,352 0 0 0 Add: fixed asset impairments 0 0 0 1,903 171 424 424 0 Less: Tax effect(2) 0 0 0 737 44 109 109 0 Fixed asset impairments, net of tax 0 0 0 1,166 127 315 315 0 Add: Goodwill Impairment(3) 0 0 0 0 0 0 0 7,397 Add: State tax credit(3) 0 0 0 0 (3,129) (1,361) (1,361) 0 Add: 2017 Tax Cut and Jobs Act(3) 0 0 0 2,701 0 0 0 0 Non-GAAP core operating income $4,143 $7,469 $10,311 $9,716 $19,940 $27,427 $17,743 $3,898 Non-GAAP Core Operating Return on Average Assets: Net Income (loss) $4,143 $7,469 $10,311 $5,849 $19,590 $28,473 $18,789 ($3,499) Non-GAAP core operating income 4,143 7,469 10,311 9,716 19,940 27,427 17,743 3,898 Average Assets 1,003,991 1,410,447 1,839,563 2,452,797 3,494,655 4,499,764 4,285,768 5,209,810 GAAP return on average assets 0.41% 0.53% 0.56% 0.24% 0.56% 0.63% 0.88% (0.14%) Non-GAAP core operating return on average assets 0.41% 0.53% 0.56% 0.40% 0.57% 0.61% 0.83% 0.15% Non-GAAP Core Operating Return on Average Equity: Net Income $4,143 $7,469 $10,311 $5,849 $19,590 $28,473 $18,789 ($3,499) Non-GAAP core operating income 4,143 7,469 10,311 9,716 19,940 27,427 17,743 3,898 Less: Preferred stock dividends 1,485 2,066 2,100 2,100 2,100 175 175 0 Net Income available to common stockholders 2,658 5,403 8,211 3,749 17,490 28,298 18,614 (3,499) Non-GAAP core operating income 2,658 5,403 8,211 7,616 17,840 27,252 17,568 3,898 available to common stockholders Average common equity 86,273 117,343 149,132 245,193 327,446 526,225 476,749 612,208 Tangible Assets 8,201 8,152 8,050 7,949 7,847 7,746 7,772 7,629 Average Tangible Equity 78,072 109,191 141,082 237,244 319,599 518,479 468,977 604,579 GAAP return on average common equity 3.08% 4.60% 5.51% 1.53% 5.34% 5.38% 7.87% (1.15%) Non-GAAP core return on average tangible common 3.08% 4.95% 5.82% 3.21% 5.58% 5.26% 7.55% 1.30% equity Non-GAAP Core Operating Efficiency Ratio: Non-interest expense $24,640 $30,562 $40,587 $62,089 $85,755 $87,648 $44,591 $53,233 Less: goodwill impairment 0 0 0 0 4,733 0 0 7,397 Non-GAAP non-interest expense (numerator) 24,640 30,562 40,587 62,089 81,022 87,648 44,591 45,836 Net interest income 31,090 42,267 54,053 74,818 110,368 141,444 68,479 79,385 Tax-equivalent interest income 1,712 2,637 4,001 5,439 3,099 2,522 1,229 1,380 Non-interest income 1,904 2,365 3,407 3,679 6,083 8,715 3,317 4,729 Add: fixed asset impairments 0 0 0 1,903 171 424 424 0 Non-GAAP Operating revenue (denominator) 34,706 47,269 61,461 85,839 119,721 153,105 73,449 85,494 GAAP efficiency ratio 74.68% 68.48% 70.64% 79.10% 73.64% 58.37% 62.11% 63.29% Non-GAAP core operating efficiency ratio (FTE) 71.00% 64.66% 66.04% 72.33% 67.68% 57.25% 60.71% 53.61% (1) Represents the tax impact of the adjustments above at a tax rate of 25.73%, plus a permanent tax benefit associated with stock-based grants that were exercised prior to our former CEO’s departure. 28 (2) Represents the tax impact of the adjustments above at a tax rate of 25.73% for fiscal years 2018 and after; 38.73% for fiscal years prior to 2018. (3) No tax effect associated with the 2017 Tax Act adjustment or state tax credit or the goodwill impairment.

As of or for the Three Months Ended (Dollars in thousands) June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 June 30, 2020 Non-GAAP Core Operating Income: Net Income (loss) $9,439 $10,384 ($700) $3,857 ($7,356) Add: restructuring charges 0 0 0 0 0 Less: Tax effect(1) 0 0 0 0 0 Restructuring charges, net of tax 0 0 0 0 0 Add: fixed asset impairments 424 0 0 0 0 Less: Tax effect(2) 109 0 0 0 0 Fixed asset impairments, net of tax 315 0 0 0 0 Add: Goodwill Impairment(3) 0 0 0 0 7,397 Add: State tax credit(3) 0 0 0 0 0 Add: 2017 Tax Cut and Jobs Act Non-GAAP core operating income $9,754 $10,384 ($700) $3,857 $41 Non-GAAP Core Operating Return on Average Assets: Net Income (loss) $9,439 $10,384 ($700) $3,857 ($7,356) Non-GAAP core operating income 9,754 10,384 (700) 3,857 41 Average Assets 4,402,002 4,610,958 4,809,579 4,975,531 5,441,513 GAAP return on average assets(4) 0.86% 0.89% (0.06%) 0.31% (0.54%) Non-GAAP core operating return on average assets(4) 0.89% 0.89% (0.06%) 0.31% 0.00% Non-GAAP Core Operating Efficiency Ratio: Non-interest expense $21,960 $21,172 $21,885 $22,223 $31,010 Less: Goodwill Impairment $0 $0 $0 $0 $7,397 Less: restructuring charges 0 0 0 0 0 Non-GAAP non-interest expense (numerator) 21,960 21,172 21,885 22,223 23,613 Net interest income 34,874 35,786 37,179 38,228 41,157 Tax-equivalent interest income 612 624 670 695 685 Non-interest income 1,672 3,212 2,186 2,095 2,634 Add: fixed asset impairments 424 0 0 0 0 Non-GAAP operating revenue (denominator) 37,582 39,622 40,035 41,018 44,476 GAAP efficiency ratio 60.09% 54.29% 55.60% 55.11% 70.81% Non-GAAP core operating efficiency ratio (FTE) 58.43% 53.43% 54.66% 54.18% 53.09% (1) Represents the tax impact of the adjustments above at a tax rate of 25.73%, plus a permanent tax benefit associated with stock-based grants that were exercised prior to our former CEO’s departure. (2) Represents the tax impact of the adjustments above at a tax rate of 25.73%. (3) No tax effect associated with the state tax credit or the goodwill impairment (4) Interim periods are annualized. 29

As of or for the Year Ended As of or for the Six Months Ended (Dollars in thousands, except per share data) December 31, June 30, 2014 2015 2016 2017 2018 2019 2019 2020 Non-GAAP Pre-Tax Pre-Provision Profit Income before Taxes (loss) 4,439 8,095 10,373 4,408 17,196 32,611 21,505 (4,069) Provision for Credit loss 3,915 5,975 6,500 12,000 13,500 29,900 5,700 34,950 Non-GAAP Pre-Tax Pre-Provision Profit 8,354 14,070 16,873 16,408 30,696 62,511 27,205 30,881 Average Assets 1,003,991 1,410,447 1,839,563 2,452,797 3,494,655 4,499,764 4,285,768 5,209,810 Non-GAAP Pre-Tax Pre-Provision Return on 0.83% 1.00% 0.92% 0.67% 0.88% 1.39% 1.28% 1.19% Average Assets Tangible Stockholders' Equity: Stockholders' equity $137,098 $160,004 $214,837 $287,147 $490,336 $601,644 $499,195 $608,092 Less: goodwill and intangible assets 8,201 8,100 7,998 7,897 7,796 7,694 7,745 247 Less: preferred stock 28,614 30,000 30,000 30,000 30,000 0 0 0 Tangible Stockholders' Equity $100,283 $121,904 $176,839 $249,250 $452,540 $593,950 $491,450 $607,845 Shares outstanding at end of period 17,908,862 19,661,718 25,194,872 30,686,256 45,074,322 51,969,203 45,367,641 52,167,573 Book value per common share $6.06 $6.61 $7.34 $8.38 $10.21 $11.58 $11.00 $11.66 Tangible book value per common share $5.60 $6.20 $7.02 $8.12 $10.04 $11.43 $10.83 $11.65 As of or for the Three Months Ended (Dollars in thousands, except per share data) 6/30/19 9/30/19 12/31/19 3/31/20 6/30/20 Non GAAP Pre-Tax Pre-Provision Profit Income before Taxes 11,736 12,976 (1,870) 4,150 (8,219) Provision for Credit loss 2,850 4,850 19,350 13,950 21,000 Non-GAAP Pre-Tax Pre-Provision Profit 14,586 17,826 17,480 18,100 12,781 Average Assets 4,402,002 4,610,958 4,809,579 4,975,531 5,441,513 Non-GAAP Pre-Tax Pre-Provision Return on Average 1.33% 1.53% 1.44% 1.46% 0.94% Assets Tangible Stockholders' Equity: Stockholders' equity $499,195 $602,435 $601,644 $611,946 $608,092 Less: goodwill and intangible assets 7,745 7,720 7,694 7,669 247 Less: preferred stock 0 0 0 0 0 Tangible Stockholders' Equity $491,450 $594,715 $593,950 $604,277 $607,845 Shares outstanding at end of period 45,367,641 51,969,203 51,969,203 52,098,062 52,167,573 Book value per common share $11.00 $11.59 $11.58 $11.75 $11.66 Tangible book value per common share $10.83 $11.44 $11.43 $11.60 $11.65 30